Deck 8: Tall Tales

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/41

Play

Full screen (f)

Deck 8: Tall Tales

1

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

One of the signals of the improper use and disclosure of related-party transactions is references in the notes to the financial statements that indicate the intermingling of a company's assets or liabilities with those of its major shareholders, officers, or directors.

One of the signals of the improper use and disclosure of related-party transactions is references in the notes to the financial statements that indicate the intermingling of a company's assets or liabilities with those of its major shareholders, officers, or directors.

Financial Disclosures

Financial disclosure refers to all material, significant and relevant information concerning the reporting organization that is essential to understand the financial statements of the organization. They are either provided on the face of the financial statement or as notes to the financial statements as supporting schedules.

A disclosures note in the financial statements indicates that, company is doing transactions with "foremost shareholders, officers or directors" of the business. Hence, the given statement is true.

Therefore, the correct answer is

.

.

Financial disclosure refers to all material, significant and relevant information concerning the reporting organization that is essential to understand the financial statements of the organization. They are either provided on the face of the financial statement or as notes to the financial statements as supporting schedules.

A disclosures note in the financial statements indicates that, company is doing transactions with "foremost shareholders, officers or directors" of the business. Hence, the given statement is true.

Therefore, the correct answer is

.

. 2

Edison Schools is presented in the chapter as an example of: (a) Failure to disclose related-party transactions.

(b) Inadequate disclosures in its Management Discussion and Analysis (MD A).

(c) Improper accounting for payments in violation of the Foreign Corrupt Practices Act.

(d) Inappropriate accounting for round-trip transactions.

(b) Inadequate disclosures in its Management Discussion and Analysis (MD A).

(c) Improper accounting for payments in violation of the Foreign Corrupt Practices Act.

(d) Inappropriate accounting for round-trip transactions.

Financial Disclosures

Financial disclosure refers to all material, significant and relevant information concerning the reporting organization that is essential to understand the financial statements of the organization. They are either provided on the face of the financial statement or as notes to the financial statements as supporting schedules.

a.A Corporation is presented in this chapter mainly as an example of " failure to disclose related-party transactions ". Hence, it is an incorrect option.

b.E School is presented in this chapter mainly as an example of " inadequate disclosure in its MD A (Management Discussion and Analysis)". Hence, it is the correct option.

c.B Corporation is presented in this chapter mainly as an example of " improper accounting for foreign payments in violation of the FCPA (Foreign Corrupt Practices Act)". Hence, it is an incorrect option.

d.K Incorporation is presented in this chapter mainly as an example of " inappropriate accounting for round-trip transactions ". Hence, it is an incorrect option.

Therefore, the correct answer is

.

.

Financial disclosure refers to all material, significant and relevant information concerning the reporting organization that is essential to understand the financial statements of the organization. They are either provided on the face of the financial statement or as notes to the financial statements as supporting schedules.

a.A Corporation is presented in this chapter mainly as an example of " failure to disclose related-party transactions ". Hence, it is an incorrect option.

b.E School is presented in this chapter mainly as an example of " inadequate disclosure in its MD A (Management Discussion and Analysis)". Hence, it is the correct option.

c.B Corporation is presented in this chapter mainly as an example of " improper accounting for foreign payments in violation of the FCPA (Foreign Corrupt Practices Act)". Hence, it is an incorrect option.

d.K Incorporation is presented in this chapter mainly as an example of " inappropriate accounting for round-trip transactions ". Hence, it is an incorrect option.

Therefore, the correct answer is

.

. 3

Rhodes Co. manages a school for the Old England School District. In year 1, Rhodes Co.'s first year of operating the school, the school earned per pupil fees of $100,000. Rhodes is responsible for teacher salaries and is considered to be the primary obligor for the salaries. However, the school district paid the teachers' salaries of $70,000 and paid Rhodes the net amount of $30,000 in respect of year 1 operations. Rhodes incurred other administrative expenses of $10,000 for the year (ignoring taxes), which it paid itself.

Required

a. What is the amount of revenue that Rhodes should report in its income statement for year 1 in accordance with EITF 01-14?

b. What is the amount of Rhodes Co.'s net income for year 1?

Required

a. What is the amount of revenue that Rhodes should report in its income statement for year 1 in accordance with EITF 01-14?

b. What is the amount of Rhodes Co.'s net income for year 1?

Revenues

Revenue: The income or earnings received by a company for the goods and services delivered, are known as revenues.

a.Income statement: This is the financial statement of a company which shows all the revenues earned, and expenses incurred by the company over a period of time.

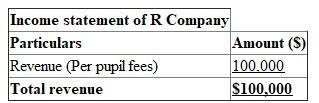

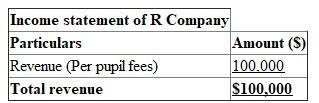

Determine the amount of revenue reported by R in his income statement:

Hence, the revenue reported by R in his income statement is

Hence, the revenue reported by R in his income statement is

.

.

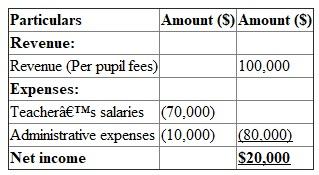

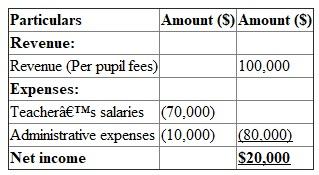

b.Net income : The net income is the excess of revenues over expenses after adjusting for depreciation and taxes.

Determine the amount of net income of R Company for year 1:

Hence, the amount of net income of R Company for year 1 is

Hence, the amount of net income of R Company for year 1 is

.

.

Revenue: The income or earnings received by a company for the goods and services delivered, are known as revenues.

a.Income statement: This is the financial statement of a company which shows all the revenues earned, and expenses incurred by the company over a period of time.

Determine the amount of revenue reported by R in his income statement:

Hence, the revenue reported by R in his income statement is

Hence, the revenue reported by R in his income statement is .

.b.Net income : The net income is the excess of revenues over expenses after adjusting for depreciation and taxes.

Determine the amount of net income of R Company for year 1:

Hence, the amount of net income of R Company for year 1 is

Hence, the amount of net income of R Company for year 1 is .

. 4

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

BellSouth is presented in the text as an example of the improper disclosure of non-GAAP information.

BellSouth is presented in the text as an example of the improper disclosure of non-GAAP information.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following correctly describes the SEC's finding against Edison? (a) Edison's revenue recognition practices did not contravene GAAP, but failed to present an accurate picture of the issuer's financial condition.

(b) Edison's recognition practices contravened GAAP.

(c) Since the issuance of the guidance of EITF 01-14 in 2002, if a company is the primary obligor for an expense, it must report revenue net of expenses that are deducted from those revenues before payment is made to the entity.

(d) The net income reported by Edison in its income statement was incorrect.

(b) Edison's recognition practices contravened GAAP.

(c) Since the issuance of the guidance of EITF 01-14 in 2002, if a company is the primary obligor for an expense, it must report revenue net of expenses that are deducted from those revenues before payment is made to the entity.

(d) The net income reported by Edison in its income statement was incorrect.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

6

Ruby Company manages the daily operations for the human resources department of Jade Company. In terms of the contract, Ruby receives a fee of $100 per year for each employee on Jade's payroll, less the salary of Jade's bookkeeper, who works full-time on human resource matters. Jade is the "primary obligor" for the bookkeeper's salary.

Last year, Jade had 1,000 employees on its payroll and the bookkeeper's salary (which was paid by Jade) was $40,000. Ruby's other administrative expenses were $10,000.

Required

a. What is the amount of revenue that Ruby Company should report on its income statement for last year in terms of EITF 01-14?

b. What was Ruby's operating income for last year (ignoring taxes)?

Last year, Jade had 1,000 employees on its payroll and the bookkeeper's salary (which was paid by Jade) was $40,000. Ruby's other administrative expenses were $10,000.

Required

a. What is the amount of revenue that Ruby Company should report on its income statement for last year in terms of EITF 01-14?

b. What was Ruby's operating income for last year (ignoring taxes)?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

7

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

BellSouth properly recorded and disclosed improper payments in its books and records.

BellSouth properly recorded and disclosed improper payments in its books and records.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not true regarding the SECs allegations against Adelphia? (a) The company concealed rampant selfdealing by the family that founded and controlled Adelphia.

(b) The company falsified operations statistics.

(c) The company improperly accounted for foreign payments in violation of the Foreign Corrupt Practices Act.

(d) The company excluded liabilities from its consolidated financial statements.

(b) The company falsified operations statistics.

(c) The company improperly accounted for foreign payments in violation of the Foreign Corrupt Practices Act.

(d) The company excluded liabilities from its consolidated financial statements.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

9

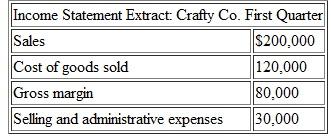

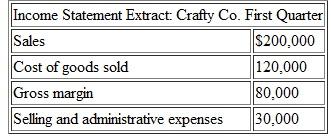

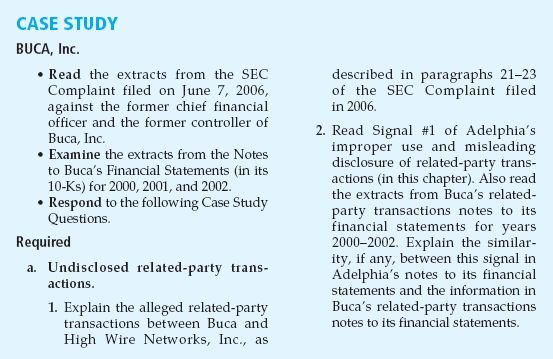

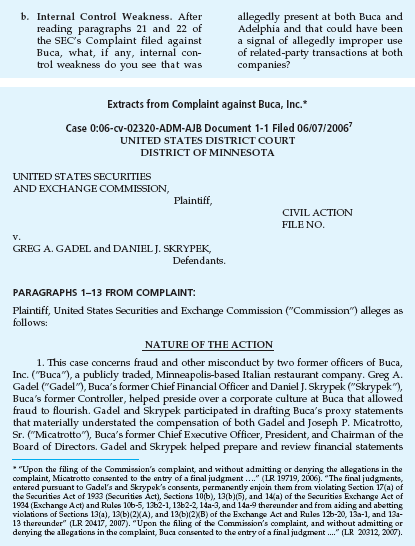

Crafty Company manufactures and sells printers. On the last day of the first quarter of the year, Crafty contrives with Tricky Company to sell 100 printers to Tricky Company for $1,000 each. In terms of Crafty's agreement with Tricky, Tricky will sell those 100 printers back to Crafty at the same price of $1,000 each in the second quarter of the year. The cost of each printer that Crafty manufactures is $600. Crafty allocates the full cost of the printers that it purchases from Tricky to inventory.

Examine the following extract from Crafty's income statement, excluding the contrived round-trip transaction:

Assume that Crafty Company goes ahead with the contrived round-trip transaction with Tricky Company. Prepare Crafty's income statement for the first quarter with the round-trip transaction included. Ignore taxes.

Assume that Crafty Company goes ahead with the contrived round-trip transaction with Tricky Company. Prepare Crafty's income statement for the first quarter with the round-trip transaction included. Ignore taxes.

Examine the following extract from Crafty's income statement, excluding the contrived round-trip transaction:

Assume that Crafty Company goes ahead with the contrived round-trip transaction with Tricky Company. Prepare Crafty's income statement for the first quarter with the round-trip transaction included. Ignore taxes.

Assume that Crafty Company goes ahead with the contrived round-trip transaction with Tricky Company. Prepare Crafty's income statement for the first quarter with the round-trip transaction included. Ignore taxes.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

10

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

Krispy Kreme's internally appointed independent investigation into its business practices concluded that the company's accounting errors were intentional.

Krispy Kreme's internally appointed independent investigation into its business practices concluded that the company's accounting errors were intentional.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

11

In the text, Signal #1 of improper use of related-party transactions states that any disclosures in the notes to the financial statements that the company is doing transactions with any major shareholder, officer, or director of the company should alert the reader to the fact that these transactions could be used to: (a) Hide the company's debt.

(b) Overstate the company's earnings.

(c) Loot the company's assets.

(d) All of the above.

(b) Overstate the company's earnings.

(c) Loot the company's assets.

(d) All of the above.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

12

Greasy Patties Corporation, a hamburger chain, has 100 stores. In its tenth year of operating, its total sales for year 10 amounted to $100 million. During year 11, Greasy Patties Corporation decides that it would be beneficial to report increased sales for the year, and it opens 50 new stores in year 11. However, the stores competed with each other for sales and same-store sales for old stores decreased by 10 percent in year 11 compared to year 10. The total sales for the new stores that opened in year 11 amounted to $30 million.

Required

How much did total sales for Greasy Patties Corporation increase in year 11 over year 10 in dollars and in percentage?

Required

How much did total sales for Greasy Patties Corporation increase in year 11 over year 10 in dollars and in percentage?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

13

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

In the recording of Krispy Kreme's round- trip transactions, equipment sales were made to a franchisee shortly before the reacquisition of the franchise and the sales price of the equipment was deducted from the reacquisition cost of the franchise.

In the recording of Krispy Kreme's round- trip transactions, equipment sales were made to a franchisee shortly before the reacquisition of the franchise and the sales price of the equipment was deducted from the reacquisition cost of the franchise.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

14

Adelphia's overstatement of its number of cable subscribers in its 10-K reports: (a) Is an example of a revenue recognition practice that contravenes GAAP.

(b) Caused it to overstate its earnings.

(c) Is an example of the failure to properly disclose related-party transactions.

(d) Is an example of the improper use of non-GAAP measures.

(b) Caused it to overstate its earnings.

(c) Is an example of the failure to properly disclose related-party transactions.

(d) Is an example of the improper use of non-GAAP measures.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

15

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

Krispy Kreme also failed to accrue the full amount of incentive compensation expense in accordance with the company's incentive plan.

Krispy Kreme also failed to accrue the full amount of incentive compensation expense in accordance with the company's incentive plan.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

16

According to the SEC, BellSouth's improper accounting for foreign payments in contravention of the Foreign Corrupt Practices Act (FCPA) included all of the following, except: (a) The use of fabricated invoices at Telcel.

(b) Breaking a foreign country's law that prohibited foreign companies from holding a majority of the stock in a tele-communications company.

(c) The failure to keep accurate records.

(d) Incorrectly describing payments to a lobbyist as consulting services.

(b) Breaking a foreign country's law that prohibited foreign companies from holding a majority of the stock in a tele-communications company.

(c) The failure to keep accurate records.

(d) Incorrectly describing payments to a lobbyist as consulting services.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

17

Fill in the blank with information and concepts from this chapter.

In the case of Edison Schools, Inc., its inadequate disclosure did not affect the amount of net it ____________ reported.

In the case of Edison Schools, Inc., its inadequate disclosure did not affect the amount of net it ____________ reported.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

18

The Foreign Corrupt Practices Act is enforced by: (a) The Department of Justice.

(b) The Securities and Exchange Commission.

(c) The Financial Accounting Standards Board.

(d) Both (a) and (b).

(b) The Securities and Exchange Commission.

(c) The Financial Accounting Standards Board.

(d) Both (a) and (b).

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

19

Fill in the blank with information and concepts from this chapter.

Edison's practice was to report the gross amount of the fee per student as its ____________ in its income statement.

Edison's practice was to report the gross amount of the fee per student as its ____________ in its income statement.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

20

Krispy Kreme is presented in the text as an example of: (a) Improper accounting for related-party transactions.

(b) Improper disclosure of non-GAAP financial measures.

(c) Improper disclosure in its Management Discussion and Analysis.

(d) Improper accounting for round-trip transactions.

(b) Improper disclosure of non-GAAP financial measures.

(c) Improper disclosure in its Management Discussion and Analysis.

(d) Improper accounting for round-trip transactions.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

21

Fill in the blank with information and concepts from this chapter.

In the ____________ case, the issue was that it did not accurately and completely describe the realities of its operations in its MD A.

In the ____________ case, the issue was that it did not accurately and completely describe the realities of its operations in its MD A.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following regarding Krispy Kreme's round-trip transactions is not correct? (a) Krispy Kreme engaged in contrived equipment sales to franchisees.

(b) The transactions inflated franchise reacquisition purchase prices.

(c) The transactions resulted in the reporting of overstated net income.

(d) The transactions overstated expenses in the income statement.

(b) The transactions inflated franchise reacquisition purchase prices.

(c) The transactions resulted in the reporting of overstated net income.

(d) The transactions overstated expenses in the income statement.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

23

Fill in the blank with information and concepts from this chapter.

The disclosure of related-party transactions should alert the user of financial statements that the transactions could be used to the ____________ company's debt, or to its earnings, or to ____________ loot the company's assets.

The disclosure of related-party transactions should alert the user of financial statements that the transactions could be used to the ____________ company's debt, or to its earnings, or to ____________ loot the company's assets.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

24

Krispy Kreme's internal investigation revealed each of the following accounting errors except : (a) The misallocation of compensation expenses to franchise reacquisition costs.

(b) The creation of cookie-jar reserves to release into profit in later periods.

(c) The recording of early shipments of equipment sales to franchisees.

(d) The failure to record the full amount of incentive compensation.

(b) The creation of cookie-jar reserves to release into profit in later periods.

(c) The recording of early shipments of equipment sales to franchisees.

(d) The failure to record the full amount of incentive compensation.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

25

Fill in the blank with information and concepts from this chapter.

According to the SEC, Adelphia purchased land from members of the Rigas family in terms of a contract in which a clause stated that the ____________ rights to the land would revert back to the owner after 20 years.

According to the SEC, Adelphia purchased land from members of the Rigas family in terms of a contract in which a clause stated that the ____________ rights to the land would revert back to the owner after 20 years.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

26

Is the intermingling of a company's assets with those of a major shareholder, director, or company officer illegal? Is it unethical? Or is it both illegal and unethical? Explain your answer.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

27

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

28

Fill in the blank with information and concepts from this chapter.

The strength of the FCPA legislation lies in the requirement that companies keep accurate ____________ and records.

The strength of the FCPA legislation lies in the requirement that companies keep accurate ____________ and records.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

29

Discuss the improper accounting practices at Adelphia that were similar to the improper accounting practices at Enron. Use specific examples from each company.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

30

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

The Management Discussion and Analysis (MD A) section in the SEC filings of publicly traded companies discusses the issuer's financial condition and results of operations to enhance investor understanding of financial statements.

The Management Discussion and Analysis (MD A) section in the SEC filings of publicly traded companies discusses the issuer's financial condition and results of operations to enhance investor understanding of financial statements.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

31

Fill in the blank with information and concepts from this chapter.

According to the SEC, Telcel recorded a disbursement in its books and records based on ____________ invoices.

According to the SEC, Telcel recorded a disbursement in its books and records based on ____________ invoices.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

32

In the case of Edison Schools, explain why the SEC issued an AAER even though it did not find that Edison's revenue recognition practices did not contravene GAAP.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

33

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

According to the SEC's AAER 1555, Edison disclosed the existence and amount of its District-Paid Expenses, but did not properly offset them from revenues.

According to the SEC's AAER 1555, Edison disclosed the existence and amount of its District-Paid Expenses, but did not properly offset them from revenues.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

34

Fill in the blank with information and concepts from this chapter.

The SOX Report defined round-trip transactions as transactions that involve simultaneous pre- ____________ sales trans actions, often of the same product, to create a false impression of business activity and revenue.

The SOX Report defined round-trip transactions as transactions that involve simultaneous pre- ____________ sales trans actions, often of the same product, to create a false impression of business activity and revenue.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

35

Explain how Adelphia misreported non-GAAP information.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

36

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

Technical compliance with GAAP in the financial statements will insulate an issuer of financial statements from enforcement actions by the SEC.

Technical compliance with GAAP in the financial statements will insulate an issuer of financial statements from enforcement actions by the SEC.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

37

Fill in the blank with information and concepts from this chapter.

An increase in the intangible asset described as "franchise acquisition rights" could be a signal that too many ____________ have been sold in the past.

An increase in the intangible asset described as "franchise acquisition rights" could be a signal that too many ____________ have been sold in the past.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

38

Explain why an action can be taken against an issuer of financial statements in terms of the Foreign Corrupt Practices Act in respect of a suspicious payment without proving that the payment was for an illegal activity.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

39

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

According to the SEC, Adelphia's improper reporting included inaccurate non-GAAP information.

According to the SEC, Adelphia's improper reporting included inaccurate non-GAAP information.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

40

Fill in the blank with information and concepts from this chapter.

Another signal that a company has sold too many franchises is when the growth in total company sales is a much greater percentage than the percentage growth in ____________ - ____________ sales.

Another signal that a company has sold too many franchises is when the growth in total company sales is a much greater percentage than the percentage growth in ____________ - ____________ sales.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

41

Explain what is meant by a "round-trip transaction."

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck