Deck 9: Mortgage Mayhem

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/41

Play

Full screen (f)

Deck 9: Mortgage Mayhem

1

Fill in the blank with information and concepts from this chapter.

The housing boom, like most booms, was fueled by easy ___________.

The housing boom, like most booms, was fueled by easy ___________.

Easy Credit

The housing boom was stimulated by easy credit option, similar to reason for occurrence of most booms in past. To help the individuals in buying an affordable home for living, the Federal National Mortgage Association and Federal Home Mortgage Corporation was started by the Congress of Country U.

Hence, the correct answer is

.

.

The housing boom was stimulated by easy credit option, similar to reason for occurrence of most booms in past. To help the individuals in buying an affordable home for living, the Federal National Mortgage Association and Federal Home Mortgage Corporation was started by the Congress of Country U.

Hence, the correct answer is

.

. 2

The SEC Complaint alleges that the description of Countrywide's loans in its 10-K filings was misleading in which of the following ways? (a) Its description of prime nonconforming and nonprime loans was insufficient.

(b) It did not disclose the extent of the exceptions to its underwriting guidelines.

(c) It did not disclose that its prime nonconforming category included pay-option ARM loans, including such loans with reduced documentation.

(d) All of the above.

(b) It did not disclose the extent of the exceptions to its underwriting guidelines.

(c) It did not disclose that its prime nonconforming category included pay-option ARM loans, including such loans with reduced documentation.

(d) All of the above.

SEC Compliant

The Securities and Exchange Commission (SEC)of Country U complaint suspected that the Countrywide's report of its loans in its 10-K filings was deceptive in the following manners.

• In periodic filings, explanations for "prime non-conforming" and "non-prime" loans were not disclose to the investors, about the kind of loans comes under these category.

• 10-K filings did not expose the level of the changes to its underwriting guidelines.

• 10-K filings did not reveal that its "prime non-conforming" loan grouping consist of pay-option ARM loans with reduced documentation.

Option a, b, and c, are included in the above explanation for SEC's complaint. "Option d" includes all the above options.

Hence, the correct answer is

.

.

The Securities and Exchange Commission (SEC)of Country U complaint suspected that the Countrywide's report of its loans in its 10-K filings was deceptive in the following manners.

• In periodic filings, explanations for "prime non-conforming" and "non-prime" loans were not disclose to the investors, about the kind of loans comes under these category.

• 10-K filings did not expose the level of the changes to its underwriting guidelines.

• 10-K filings did not reveal that its "prime non-conforming" loan grouping consist of pay-option ARM loans with reduced documentation.

Option a, b, and c, are included in the above explanation for SEC's complaint. "Option d" includes all the above options.

Hence, the correct answer is

.

. 3

Fill in the blank with information and concepts from this chapter.

The process in which many loans are pooled together and interests in these pooled loans are sold to investors is known as ___________.

The process in which many loans are pooled together and interests in these pooled loans are sold to investors is known as ___________.

Mortgage

Mortgage is a debt for the company which is secured by fixed assets. The company has to pay the mortgage with interest.

Securitization refers to the process in which loans are accelerated and pooled together in large quantities and sell the interests on these loans to investors in the form of securities.

Therefore, the correct answer is

.

.

Mortgage is a debt for the company which is secured by fixed assets. The company has to pay the mortgage with interest.

Securitization refers to the process in which loans are accelerated and pooled together in large quantities and sell the interests on these loans to investors in the form of securities.

Therefore, the correct answer is

.

. 4

Why is an increase in accumulated negative amortization from one year to the next a signal that a decrease in earnings may follow? (a) This shows that there may have been an increase in a high-risk portion of a lender's loan portfolio.

(b) A loan loss may follow because once the unpaid interest on a pay-option ARM loan reaches a certain percentage of principal borrowed, the loan repayment resets to a higher amount to cover the interest payments, and borrowers may be unable to pay the subsequent higher monthly payment after the payment resets and they may default.

(c) Accumulated negative amortization represents interest that will be earned in future periods but has been paid in the current period.

(d) Both (a) and (b) are correct.

(b) A loan loss may follow because once the unpaid interest on a pay-option ARM loan reaches a certain percentage of principal borrowed, the loan repayment resets to a higher amount to cover the interest payments, and borrowers may be unable to pay the subsequent higher monthly payment after the payment resets and they may default.

(c) Accumulated negative amortization represents interest that will be earned in future periods but has been paid in the current period.

(d) Both (a) and (b) are correct.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

5

Fill in the blank with information and concepts from this chapter.

An MBS is a financial ___________ that gives the owner a partial interest in a pool of mortgage loans.

An MBS is a financial ___________ that gives the owner a partial interest in a pool of mortgage loans.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following attributes of loans is not an indication of an increased risk of repayment default? (a) Conforming to GSE underwriting standards.

(b) Having a loan-to-value ratio of 95 percent or higher.

(c) Having reduced documentation or no documentation.

(d) Being a stated income loan.

(b) Having a loan-to-value ratio of 95 percent or higher.

(c) Having reduced documentation or no documentation.

(d) Being a stated income loan.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

7

Fill in the blank with information and concepts from this chapter.

In 1970, ___________ issued the first MBSs in the United States when it sold securities backed by its FHA and VA loans.

In 1970, ___________ issued the first MBSs in the United States when it sold securities backed by its FHA and VA loans.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

8

Discuss the role of the government spon-sored-enterprises (GSEs) in the funding and issuance of mortgage loans.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

9

CASE STUDY

TierOne Bank

• Read extracts from the SEC Complaint filed on September 25, 2012, against TierOne Bank.

• Examine extracts from TierOne?s Financial Statements (10-Ks) for 2005-2008. According to the December 31, 2007, 10-K, "TierOne Corporation ('Company') is a Wisconsin corporation headquartered in Lincoln, Nebraska. TierOne Corporation is the holding company for TierOne Bank ('Bank')" (p. 5).

• Respond to the following Case Study Questions.

Required

a. Underestimation of allowance for loan losses: In the text, Signal #2 is "Allowance for Loan Losses Not Growing in Proportion to the Increase in Troubled Loans." Read the extracts from TierOne's financial statements and notes to its financial statements for the years 2005-2008. Explain whether you can identify the signal that TierOne's allowance for loan losses may allegedly have been understated. Show supporting calculations for your answer.

b. Underestimation of allowance for loan losses: In the text, Signal #3 is "Allowance for Loan Losses Not Increasing Significantly as House Prices Fall." Reread the discussion of Signal #3 in the text, as well as extracts from the SEC Complaint against TierOne. Search online for articles published in late 2008 about falling house prices. Explain how Signal #3 could have alerted users of TierOne?s financial statements that its allowance for loan losses at December 2008 may allegedly have been understated.

Extracts from Complaint against TierOne Bank*

Civil Action No. 12-cv-00343 Filed September 25, 2012 10

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF NEBRASKA

Omaha Division

SECURITIES AND EXCHANGE

COMMISSION

PARAGRAPHS 3 and 7:

3. TierOne was a century-old thrift bank that had historically focused on residential and agricultural loans in the Nebraska/Iowa/Kansas region. Beginning in about 2004, TierOne expanded into riskier types of lending in high-growth geographic regions such as Las Vegas, Florida, and Arizona. By the second half of 2008, as a result of the financial crisis and accompanying crash in real estate markets, TierOne was experiencing a significant rise in high-risk problem loans.

7. The full extent of TierOne's loan-related losses did not become publicly known until late 2009, after OTS required TierOne to obtain new appraisals for its impaired loans. TierOne ultimately disclosed over $130 million of additional loan losses. Had TierOne recorded these additional loss provisions in the proper quarters, it would have missed the OTS-required capital ratios as of the end of December 31, 2008, and for each quarter thereafter. Following the announcements of the additional loss provisions, TierOne's stock price dropped more than 70 percent. TierOne eventually filed for bankruptcy shortly after the bank was shut down by OTS in June 2010.

PARAGRAPHS 24?29

24. Generally Accepted Accounting Principles, or "GAAP," provides that a loan becomes "impaired" when it is probable that the bank will be unable to collect all amounts due under the original loan agreement. In addition, TierOne?s written lending policy stated that a loan greater than 90 days past due should be considered impaired. 25. Under GAAP, TierOne was required to assess probable losses associated with its impaired loans and record those losses in its allowance for loan and lease losses ("ALLL"). GAAP permits the impairment to be measured using the fair value of the underlying collateral if the loan is collateral dependent, which is the method that was typically utilized by TierOne.

26. Any increase in ALLL (a balance sheet item) must be accompanied by the recording of a provision for loan losses (an income statement item), thereby increasing reported loss and further eroding the bank?s capital, which, in turn, negatively impacted the bank's ability to meet the OTS-required elevated capital ratios.

27. Some of TierOne's real estate loans were eventually foreclosed upon and the underlying collateral became the property of the bank, or OREO. GAAP required TierOne to carry OREO on its books at the lower of the property?s book value or fair value, less costs to sell the property.

28. Thus, a key consideration under GAAP regarding the existence and magnitude of losses for impaired loans or OREO is the fair value of the collateral or OREO property. A recent appraisal performed by an independent and certified real estate appraiser is normally the best evidence of a property?s fair value. In the absence of a current appraisal, all relevant and current information known at the time must be used. This information includes: the most recent evidence of market declines, broker price opinions ("BPO"), recent comparable sales, internal determinations of value, current project status and offers to purchase or sell.

29. In this case, TierOne intentionally delayed the process of obtaining current appraisals for properties that had declined in value, relying instead on inaccurate data and assumptions.

PARAGRAPHS 60?62

60. In August 2009, OTS directed TierOne to obtain updated appraisals. The new appraisals revealed the actual values of TierOne's collateral for impaired loans and OREO. On October 14, 2009, TierOne filed a Form 8-K reporting an additional $13.9 million in loan loss provisions for the second quarter of 2009. TierOne also announced that it intended to restate its second quarter 2009 financial statements, and that the bank?s capital ratios would fall below the levels required by OTS. In the days following this news, TierOne's stock price fell over 17 percent, from approximately $3.27 per share to $2.69 per share.

61. The situation worsened as more OTS-mandated appraisals came in. On November 10, 2009, TierOne filed another Form 8-K reporting an additional loan loss provision of $120.2 million for the third quarter of 2009. TierOne?s stock price dropped a further 54 percent over the next three trading days, from approximately $1.71 per share to $0.78 per share.

62. TierOne was shut down by OTS on June 4, 2010, and filed for bankruptcy later that month.

TierOne Bank

• Read extracts from the SEC Complaint filed on September 25, 2012, against TierOne Bank.

• Examine extracts from TierOne?s Financial Statements (10-Ks) for 2005-2008. According to the December 31, 2007, 10-K, "TierOne Corporation ('Company') is a Wisconsin corporation headquartered in Lincoln, Nebraska. TierOne Corporation is the holding company for TierOne Bank ('Bank')" (p. 5).

• Respond to the following Case Study Questions.

Required

a. Underestimation of allowance for loan losses: In the text, Signal #2 is "Allowance for Loan Losses Not Growing in Proportion to the Increase in Troubled Loans." Read the extracts from TierOne's financial statements and notes to its financial statements for the years 2005-2008. Explain whether you can identify the signal that TierOne's allowance for loan losses may allegedly have been understated. Show supporting calculations for your answer.

b. Underestimation of allowance for loan losses: In the text, Signal #3 is "Allowance for Loan Losses Not Increasing Significantly as House Prices Fall." Reread the discussion of Signal #3 in the text, as well as extracts from the SEC Complaint against TierOne. Search online for articles published in late 2008 about falling house prices. Explain how Signal #3 could have alerted users of TierOne?s financial statements that its allowance for loan losses at December 2008 may allegedly have been understated.

Extracts from Complaint against TierOne Bank*

Civil Action No. 12-cv-00343 Filed September 25, 2012 10

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF NEBRASKA

Omaha Division

SECURITIES AND EXCHANGE

COMMISSION

PARAGRAPHS 3 and 7:

3. TierOne was a century-old thrift bank that had historically focused on residential and agricultural loans in the Nebraska/Iowa/Kansas region. Beginning in about 2004, TierOne expanded into riskier types of lending in high-growth geographic regions such as Las Vegas, Florida, and Arizona. By the second half of 2008, as a result of the financial crisis and accompanying crash in real estate markets, TierOne was experiencing a significant rise in high-risk problem loans.

7. The full extent of TierOne's loan-related losses did not become publicly known until late 2009, after OTS required TierOne to obtain new appraisals for its impaired loans. TierOne ultimately disclosed over $130 million of additional loan losses. Had TierOne recorded these additional loss provisions in the proper quarters, it would have missed the OTS-required capital ratios as of the end of December 31, 2008, and for each quarter thereafter. Following the announcements of the additional loss provisions, TierOne's stock price dropped more than 70 percent. TierOne eventually filed for bankruptcy shortly after the bank was shut down by OTS in June 2010.

PARAGRAPHS 24?29

24. Generally Accepted Accounting Principles, or "GAAP," provides that a loan becomes "impaired" when it is probable that the bank will be unable to collect all amounts due under the original loan agreement. In addition, TierOne?s written lending policy stated that a loan greater than 90 days past due should be considered impaired. 25. Under GAAP, TierOne was required to assess probable losses associated with its impaired loans and record those losses in its allowance for loan and lease losses ("ALLL"). GAAP permits the impairment to be measured using the fair value of the underlying collateral if the loan is collateral dependent, which is the method that was typically utilized by TierOne.

26. Any increase in ALLL (a balance sheet item) must be accompanied by the recording of a provision for loan losses (an income statement item), thereby increasing reported loss and further eroding the bank?s capital, which, in turn, negatively impacted the bank's ability to meet the OTS-required elevated capital ratios.

27. Some of TierOne's real estate loans were eventually foreclosed upon and the underlying collateral became the property of the bank, or OREO. GAAP required TierOne to carry OREO on its books at the lower of the property?s book value or fair value, less costs to sell the property.

28. Thus, a key consideration under GAAP regarding the existence and magnitude of losses for impaired loans or OREO is the fair value of the collateral or OREO property. A recent appraisal performed by an independent and certified real estate appraiser is normally the best evidence of a property?s fair value. In the absence of a current appraisal, all relevant and current information known at the time must be used. This information includes: the most recent evidence of market declines, broker price opinions ("BPO"), recent comparable sales, internal determinations of value, current project status and offers to purchase or sell.

29. In this case, TierOne intentionally delayed the process of obtaining current appraisals for properties that had declined in value, relying instead on inaccurate data and assumptions.

PARAGRAPHS 60?62

60. In August 2009, OTS directed TierOne to obtain updated appraisals. The new appraisals revealed the actual values of TierOne's collateral for impaired loans and OREO. On October 14, 2009, TierOne filed a Form 8-K reporting an additional $13.9 million in loan loss provisions for the second quarter of 2009. TierOne also announced that it intended to restate its second quarter 2009 financial statements, and that the bank?s capital ratios would fall below the levels required by OTS. In the days following this news, TierOne's stock price fell over 17 percent, from approximately $3.27 per share to $2.69 per share.

61. The situation worsened as more OTS-mandated appraisals came in. On November 10, 2009, TierOne filed another Form 8-K reporting an additional loan loss provision of $120.2 million for the third quarter of 2009. TierOne?s stock price dropped a further 54 percent over the next three trading days, from approximately $1.71 per share to $0.78 per share.

62. TierOne was shut down by OTS on June 4, 2010, and filed for bankruptcy later that month.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

10

Fill in the blank with information and concepts from this chapter.

Before the passage of the Secondary Mortgage Market Enhancement Act of 1984, there were regulations that prohibited ___________ investors from investing in mortgage-backed securities that were not backed by GSEs.

Before the passage of the Secondary Mortgage Market Enhancement Act of 1984, there were regulations that prohibited ___________ investors from investing in mortgage-backed securities that were not backed by GSEs.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

11

Describe the role of tranching in the granting of easy credit that fueled the housing bubble.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

12

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

Leveraged transactions are frequent catalysts in boom-bust cycles.

Leveraged transactions are frequent catalysts in boom-bust cycles.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

13

Fill in the blank with information and concepts from this chapter.

Loans that adhered to strict underwriting criteria that were required for the loans to be sold to the GSEs were known as "GSE ___________ loans."

Loans that adhered to strict underwriting criteria that were required for the loans to be sold to the GSEs were known as "GSE ___________ loans."

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

14

As the mortgage industry evolved from making loans that conformed to GSE standards to making and selling subprime loans, what were some of the changes in underwriting standards that occurred?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

15

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

The housing boom was caused by mortgage lenders demanding large down payments from home buyers.

The housing boom was caused by mortgage lenders demanding large down payments from home buyers.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

16

Fill in the blank with information and concepts from this chapter.

Tranching is a process of carving up or separating a pool of mortgages into different classes of securities that absorb different ___________ losses.

Tranching is a process of carving up or separating a pool of mortgages into different classes of securities that absorb different ___________ losses.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

17

What is meant by negative amortization?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

18

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

Fannie Mae and Freddie Mac were established to accelerate the funding and issue of mortgage loans.

Fannie Mae and Freddie Mac were established to accelerate the funding and issue of mortgage loans.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

19

Fill in the blank with information and concepts from this chapter.

The Glass-Steagall Act of 1933 ___________ commercial banking from investment banking to prevent consumers' deposits from being used in risky investment banking activities such as trading in securities.

The Glass-Steagall Act of 1933 ___________ commercial banking from investment banking to prevent consumers' deposits from being used in risky investment banking activities such as trading in securities.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

20

Explain the "reset" clause in the pay-option ARM loan agreement.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

21

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

Pooling a number of loans and selling interests in those loans to investors as securities is known as tranching.

Pooling a number of loans and selling interests in those loans to investors as securities is known as tranching.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

22

Fill in the blank with information and concepts from this chapter.

A credit-default swap is a financial instrument that gives the holder the right to be paid if the borrowers of the specified loans ___________.

A credit-default swap is a financial instrument that gives the holder the right to be paid if the borrowers of the specified loans ___________.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

23

What were the main risks of pay-option ARM loans?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

24

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

As a result of the process of tranching, a ratings agency could give a higher credit rating to a class of securities carved from a pool of loans than would be given to other classes of securities carved from the same pool of loans.

As a result of the process of tranching, a ratings agency could give a higher credit rating to a class of securities carved from a pool of loans than would be given to other classes of securities carved from the same pool of loans.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

25

It is likely that a price bubble exists when: (a) The price of an asset increases sharply.

(b) The earnings related to an asset increase sharply.

(c) An asset's price and its earnings increase sharply.

(d) An asset's price increases faster than its earnings.

(b) The earnings related to an asset increase sharply.

(c) An asset's price and its earnings increase sharply.

(d) An asset's price increases faster than its earnings.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

26

How were credit-default swaps expected to act as hedges against the risk of investing in mortgage-backed securities.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

27

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

The term underwriting standards refers to the credit risk standards that lenders require to be met before they will grant a loan to a borrower.

The term underwriting standards refers to the credit risk standards that lenders require to be met before they will grant a loan to a borrower.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

28

The 1968 Charter Act facilitated the granting of mortgage loans by: (a) Establishing the Federal National Mortgage Association to buy up mortgages that were guaranteed by the Federal Housing Administration (Fannie Mae).

(b) Expanding the mandate of Fannie Mae to include the purchase of mortgages that were not government-guaranteed.

(c) Establishing the Federal Home Mortgage Corporation, or Freddie Mac.

(d) Ending regulations that prohibited institutional investors from investing in mortgage-backed securities that were not backed by GSEs.

(b) Expanding the mandate of Fannie Mae to include the purchase of mortgages that were not government-guaranteed.

(c) Establishing the Federal Home Mortgage Corporation, or Freddie Mac.

(d) Ending regulations that prohibited institutional investors from investing in mortgage-backed securities that were not backed by GSEs.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

29

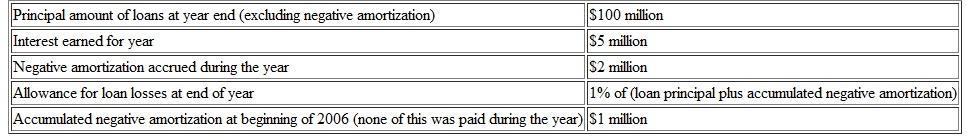

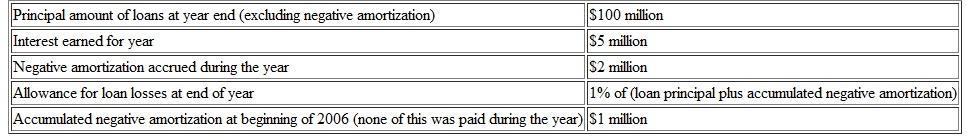

Murky Mortgage Corp. is a mortgage lender. The following information relates to Murky Mortgage's portfolio of loans held for investment at December 31, 2006:

What is the amount of loans held for investment net of allowance for loan losses on the balance sheet at December 31, 2006?

What is the amount of loans held for investment net of allowance for loan losses on the balance sheet at December 31, 2006?

What is the amount of loans held for investment net of allowance for loan losses on the balance sheet at December 31, 2006?

What is the amount of loans held for investment net of allowance for loan losses on the balance sheet at December 31, 2006?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

30

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

The Glass-Steagall Act of 1933 had separated commercial banking from investment banking, which prevented commercial banks from trading in securities.

The Glass-Steagall Act of 1933 had separated commercial banking from investment banking, which prevented commercial banks from trading in securities.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

31

The Secondary Mortgage Market Enhancement Act of 1984: (a) Allowed the GSEs (Fannie Mae and Freddie Mac) to sell MBSs (mortgage-backed securities) backed by FHA and VA loans.

(b) Allowed institutional investors such as pension funds and insurance companies to invest in non-GSE guaranteed mortgage-backed securities on the condition that they received appropriate ratings from the ratings agencies.

(c) Stipulated that securities that were backed by a pool of loans had to be categorized into different tranches, or classes, that absorbed different default losses.

(d) Repealed or ended the regulations that had required the separation of investment banking from commercial banking.

(b) Allowed institutional investors such as pension funds and insurance companies to invest in non-GSE guaranteed mortgage-backed securities on the condition that they received appropriate ratings from the ratings agencies.

(c) Stipulated that securities that were backed by a pool of loans had to be categorized into different tranches, or classes, that absorbed different default losses.

(d) Repealed or ended the regulations that had required the separation of investment banking from commercial banking.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

32

One of the loans included in Sloppy Mortgage Corporation's loans at January 1, 2006, was a pay-option ARM loan of $900,000 taken out on January 1, 2006, when the value of the house was $900,000. The interest earned (or accrued) on this loan for the year was $54,000. The principal repayments during the year amounted to $30,000 ($2,500 per month). The borrower opted to pay principal plus only $1,500 interest per month. The borrower remained current on these repayments for all 12 months of 2006.

On January 1, 2007, the repayment reset to $7,500 per month, and the borrower immediately informed the lender that no future payments would be made on the loan. The house immediately went into foreclosure, and the house quickly sold for $700,000.

What is the amount of the loss that Sloppy Mortgage must recognize in its income statement in 2007 if it has no allowance for loan losses in respect of this loan?

On January 1, 2007, the repayment reset to $7,500 per month, and the borrower immediately informed the lender that no future payments would be made on the loan. The house immediately went into foreclosure, and the house quickly sold for $700,000.

What is the amount of the loss that Sloppy Mortgage must recognize in its income statement in 2007 if it has no allowance for loan losses in respect of this loan?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

33

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

A credit-default swap is a derivative financial instrument that gives only the original lender of the underlying loan the right to payment if the borrower defaults on repayments.

A credit-default swap is a derivative financial instrument that gives only the original lender of the underlying loan the right to payment if the borrower defaults on repayments.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

34

A credit-default swap: (a) Is a form of derivative financial instrument.

(b) Is a financial instrument that gives the holder of the instrument the right to receive payment from the writer of the instrument if investments in specified loans suffer defaults or losses.

(c) Could give the holder of the instrument the right to payment on the default of a specified loan even if the holder of the instrument did not have a direct investment in the loan.

(d) All of the above.

(b) Is a financial instrument that gives the holder of the instrument the right to receive payment from the writer of the instrument if investments in specified loans suffer defaults or losses.

(c) Could give the holder of the instrument the right to payment on the default of a specified loan even if the holder of the instrument did not have a direct investment in the loan.

(d) All of the above.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

35

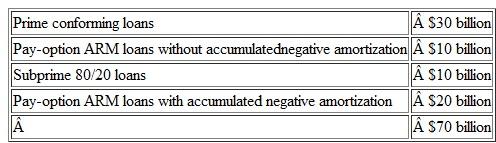

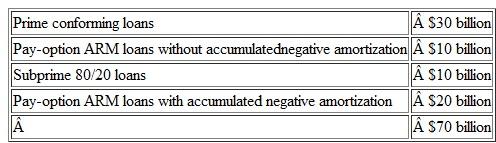

Moldy Mortgage Corp. has a loan portfolio with the following loans at December 31, 2013:

Moldy Mortgage wants to have an allowance for loan losses comprised of the following:

Moldy Mortgage wants to have an allowance for loan losses comprised of the following:

0.1 percent of prime conforming loans

6.0 percent of subprime 80/20 loans

0.5 percent of pay-option ARM loans without negative amortization

10 percent of pay-option ARM loans with accumulated negative amortization.

Compute the required balance for the allowance for loan losses at December 31, 2013.

Moldy Mortgage wants to have an allowance for loan losses comprised of the following:

Moldy Mortgage wants to have an allowance for loan losses comprised of the following:0.1 percent of prime conforming loans

6.0 percent of subprime 80/20 loans

0.5 percent of pay-option ARM loans without negative amortization

10 percent of pay-option ARM loans with accumulated negative amortization.

Compute the required balance for the allowance for loan losses at December 31, 2013.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

36

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

The 80/20 loan is a mortgage loan whereby the borrower takes out a loan for 80 percent of the purchase price and a second loan for 20 percent of the purchase price, leaving the borrower with no equity in the house at the time of the loan.

The 80/20 loan is a mortgage loan whereby the borrower takes out a loan for 80 percent of the purchase price and a second loan for 20 percent of the purchase price, leaving the borrower with no equity in the house at the time of the loan.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

37

The Commodities Futures Modernization Act of 2000 and the repeal of the Glass-Steagall Act in 1999: (a) Effectively ended the separation of commercial banking from investment banking.

(b) Ended the prevention of commercial banks from trading in securities.

(c) Excluded the regulation of derivative financial instruments by the Commodities Futures Trading Commission.

(d) All of the above.

(b) Ended the prevention of commercial banks from trading in securities.

(c) Excluded the regulation of derivative financial instruments by the Commodities Futures Trading Commission.

(d) All of the above.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

38

Answer the following question with T for true or F for false for more practice with key terms and concepts from this chapter.

Although the SEC Complaint (June 4, 2009) alleged that Countrywide's description of prime nonconforming and nonprime loans in its 10-K filings was misleading, Countrywide's 10-K filings did reveal that its delinquencies on its pay-option ARM loans were increasing much more rapidly than its allowance for loan losses on all of its loans held for investment.

Although the SEC Complaint (June 4, 2009) alleged that Countrywide's description of prime nonconforming and nonprime loans in its 10-K filings was misleading, Countrywide's 10-K filings did reveal that its delinquencies on its pay-option ARM loans were increasing much more rapidly than its allowance for loan losses on all of its loans held for investment.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

39

Which one of the following statements regarding pay-option ARM loans is not correct? (a) Some borrowers of pay-option ARM loans choose to make monthly payments that are not large enough to cover the interest that accrues on the loans each month.

(b) If a borrower chooses to make monthly payments that do not cover the monthly interest on the loan, the difference between the interest that accrues and the interest that is paid is accrued and added to the loan amount as an asset on the balance sheet.

(c) With pay-option loans, the difference between the interest that accrues each month and the lower amount that borrowers choose to pay is known and reported in financial statements as the "loan delinquency amount."

(d) "Accumulated negative amortization" refers to the accumulated shortfall between the interest that has accrued on a loan and the amount of interest that a borrower has paid.

(b) If a borrower chooses to make monthly payments that do not cover the monthly interest on the loan, the difference between the interest that accrues and the interest that is paid is accrued and added to the loan amount as an asset on the balance sheet.

(c) With pay-option loans, the difference between the interest that accrues each month and the lower amount that borrowers choose to pay is known and reported in financial statements as the "loan delinquency amount."

(d) "Accumulated negative amortization" refers to the accumulated shortfall between the interest that has accrued on a loan and the amount of interest that a borrower has paid.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

40

Fill in the blank with information and concepts from this chapter.

A bubble refers to an inflated price for an asset that is not supported by the ___________ of the asset.

A bubble refers to an inflated price for an asset that is not supported by the ___________ of the asset.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

41

Which one of the following statements does not describe the transformation in Countrywide's reported loan portfolio? (a) In 2004, conventional conforming loans dropped to 38.2 percent.

(b) Subprime loans increased from 2004 to 2006.

(c) By 2006, 31.9% percent of Countrywide's loan originations were conforming.

(d) By 2006, 10.2 percent of Countrywide's loans were home equity loans.

(b) Subprime loans increased from 2004 to 2006.

(c) By 2006, 31.9% percent of Countrywide's loan originations were conforming.

(d) By 2006, 10.2 percent of Countrywide's loans were home equity loans.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck