Deck 5: Accounting for Merchandising Businesses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

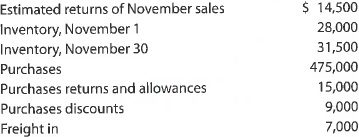

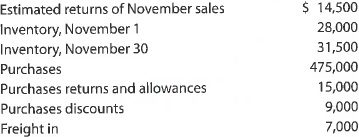

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/84

Play

Full screen (f)

Deck 5: Accounting for Merchandising Businesses

1

What distinguishes a merchandising business from a service business?

A merchandising business differs from a service business in multiple ways. First, merchandising involves the buying and selling of goods while a service business involves providing services to customers for a fee.

Second, the income statement for a merchandising business deducts the cost of the goods from the sales to determine gross profit. After that it then deducts operating expenses to determine net income. A service business only deducts operating expenses from fees earned. There is no cost of goods sold for them.

Second, the income statement for a merchandising business deducts the cost of the goods from the sales to determine gross profit. After that it then deducts operating expenses to determine net income. A service business only deducts operating expenses from fees earned. There is no cost of goods sold for them.

2

Purchase-related transactions

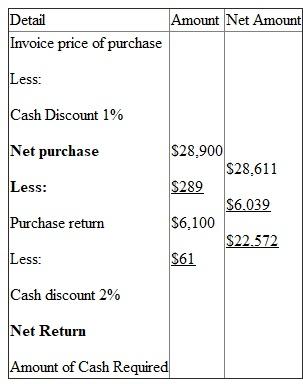

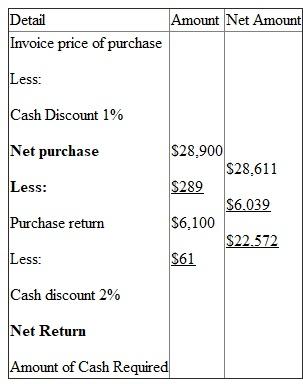

The Stationery Company purchased merchandise on account from a supplier for $28,900, terms 1/10, n/30. The Stationery Company returned $6,100 of the merchandise and received full credit.

A. What is the amount of cash required for the payment?

B. Under a perpetual inventory system, what account is credited by The Stationery Company to record the return?

The Stationery Company purchased merchandise on account from a supplier for $28,900, terms 1/10, n/30. The Stationery Company returned $6,100 of the merchandise and received full credit.

A. What is the amount of cash required for the payment?

B. Under a perpetual inventory system, what account is credited by The Stationery Company to record the return?

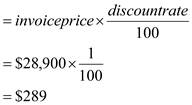

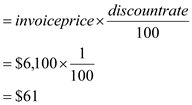

Requirement (a):

The amount of cash required is calculated by deducting the amount of return of merchandise from the amount of purchase. The amount of cash required will be calculated as under:

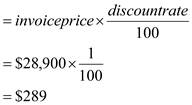

Discount on purchase

Discount on purchase

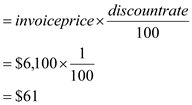

Discount on purchase return

Discount on purchase return

Requirement b:

Requirement b:

The merchandise inventory account will be credited to show the return by the Stationery Co and Account payable account will be debited.

The amount of cash required is calculated by deducting the amount of return of merchandise from the amount of purchase. The amount of cash required will be calculated as under:

Discount on purchase

Discount on purchase  Discount on purchase return

Discount on purchase return  Requirement b:

Requirement b: The merchandise inventory account will be credited to show the return by the Stationery Co and Account payable account will be debited.

3

What is the nature of (a) a credit memo issued by the seller of merchandise, (b) a debit memo issued by the buyer of merchandise?

Memos:

(a) A credit memo is issued to a customer during a return or allowance of goods and it authorizes a credit (decrease) to the buyer's account receivable.

(b) A debit memo informs the seller of the amount the buyer proposes to debit to the account payable due the seller. The buyer sends this to the seller.

(a) A credit memo is issued to a customer during a return or allowance of goods and it authorizes a credit (decrease) to the buyer's account receivable.

(b) A debit memo informs the seller of the amount the buyer proposes to debit to the account payable due the seller. The buyer sends this to the seller.

4

Assume that Audio Outfitter Inc. in Discussion Question 9 experienced an abnormal inventory shrinkage of $98,600. Audio Outfitter Inc. has decided to record the abnormal inventory shrinkage so that it would be disclosed separately on the income statement. What account would be debited for the abnormal inventory shrinkage?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

5

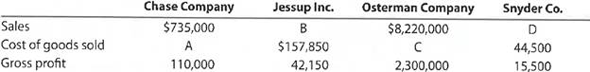

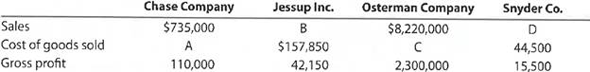

Determining amounts for items omitted from income statement

One item is omitted in each of the following four lists of income statement data. Determine the amounts of the missing items, identifying them by letter.

One item is omitted in each of the following four lists of income statement data. Determine the amounts of the missing items, identifying them by letter.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

6

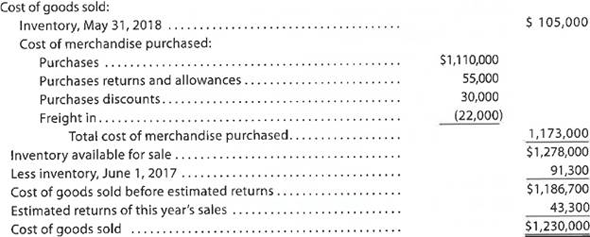

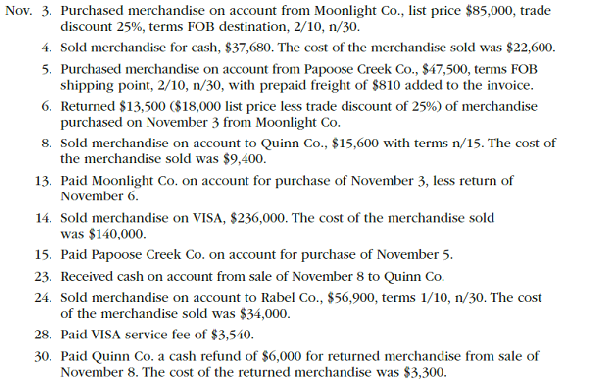

Cost of goods sold

Identify the errors in the following schedule of the cost of goods sold for the year ended May 31, 2018:

Identify the errors in the following schedule of the cost of goods sold for the year ended May 31, 2018:

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

7

Determining gross profit?

During the current year, merchandise is sold for $11,750,000. The cost of the goods sold is $7,050,000.

A. What is the amount of the gross profit?

B. Compute the gross profit percentage (gross profit divided by sales).

C. Will the income statement always report a net income? Explain.

During the current year, merchandise is sold for $11,750,000. The cost of the goods sold is $7,050,000.

A. What is the amount of the gross profit?

B. Compute the gross profit percentage (gross profit divided by sales).

C. Will the income statement always report a net income? Explain.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

8

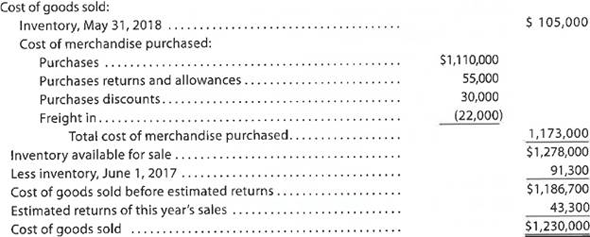

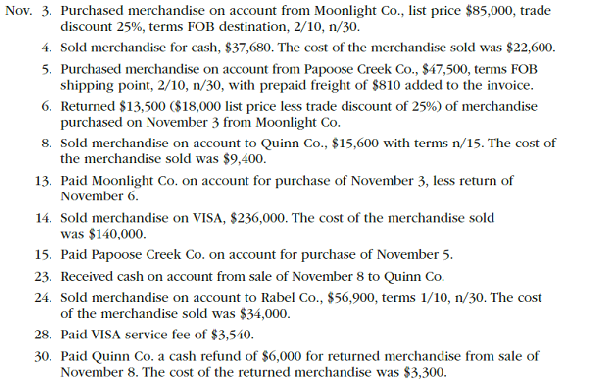

Sales-related and purchase-related transactions using perpetual inventory system

The following were selected from among the transactions completed by Babcock Company during November of the current year:

Instructions

Journalize the transactions.

The following were selected from among the transactions completed by Babcock Company during November of the current year:

Instructions

Journalize the transactions.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

9

Purchase-related transactions

Warwick's Co., a women's clothing store, purchased $75,000 of merchandise from a supplier on account, terms FOB destination, 2/10, n/30. Warwick's returned $9,000 of the merchandise, receiving a credit memo, and then paid the amount due within the discount period. Journalize Warwick's entries to record (a) the purchase, (b) the merchandise return, and (c) the payment.

Warwick's Co., a women's clothing store, purchased $75,000 of merchandise from a supplier on account, terms FOB destination, 2/10, n/30. Warwick's returned $9,000 of the merchandise, receiving a credit memo, and then paid the amount due within the discount period. Journalize Warwick's entries to record (a) the purchase, (b) the merchandise return, and (c) the payment.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

10

Customer return and refund

On December 28, Silverman Enterprises sold $18,500 of merchandise to Beasley Co. with terms 2/10, n/30. The cost of the goods sold was $11,200. On December 31, Silverman prepared its adjusting entries, yearly financial statements, and closing entries. On January 3, Silverman issued Beasley a credit memo for returned merchandise. The returned merchandise originally cost Silverman $2,350 and was billed (invoiced) for $4,000 with terms 2/10, n/30. (A) Journalize the entries by Silverman Enterprises to record the December 28 sale. Beasley paid the balance due on January 7. (B) Journalize the entries by Silverman Enterprises to record the merchandise returned January 3. (C) Journalize the entry to record the receipt of the amount due by Beasley Co. on January 7.

On December 28, Silverman Enterprises sold $18,500 of merchandise to Beasley Co. with terms 2/10, n/30. The cost of the goods sold was $11,200. On December 31, Silverman prepared its adjusting entries, yearly financial statements, and closing entries. On January 3, Silverman issued Beasley a credit memo for returned merchandise. The returned merchandise originally cost Silverman $2,350 and was billed (invoiced) for $4,000 with terms 2/10, n/30. (A) Journalize the entries by Silverman Enterprises to record the December 28 sale. Beasley paid the balance due on January 7. (B) Journalize the entries by Silverman Enterprises to record the merchandise returned January 3. (C) Journalize the entry to record the receipt of the amount due by Beasley Co. on January 7.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

11

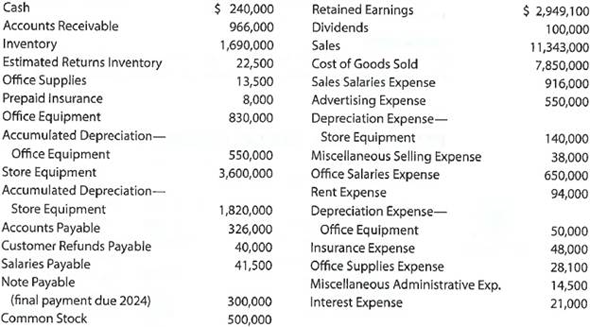

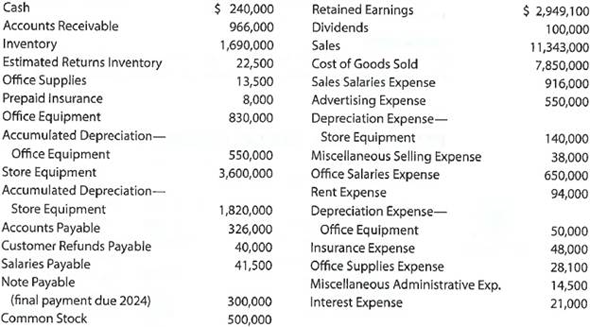

Multiple-step income statement

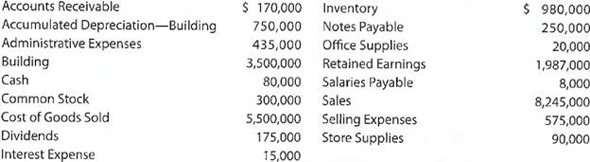

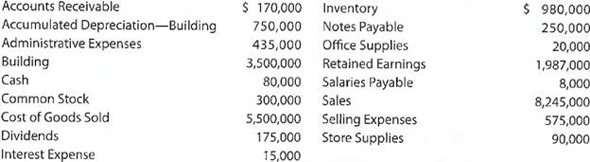

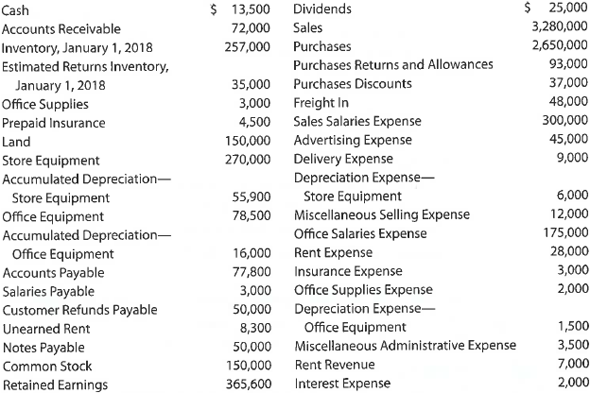

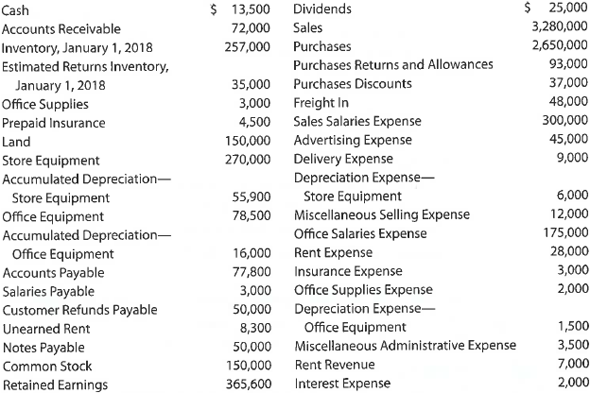

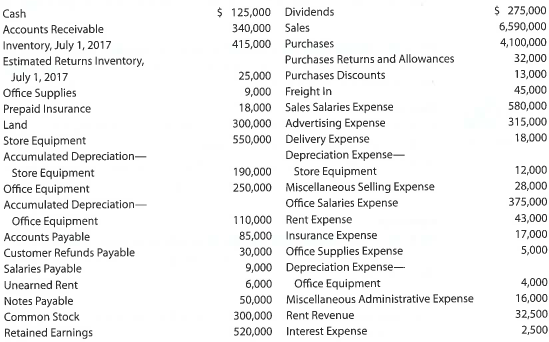

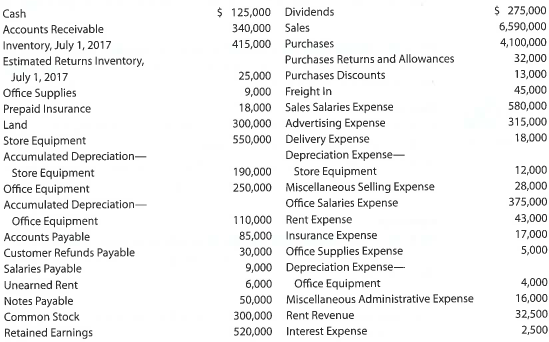

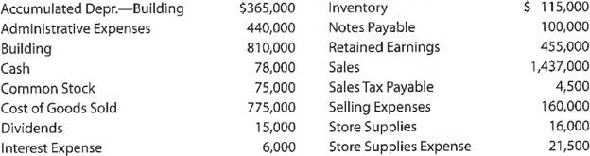

On March 31, 2018, the balances of the accounts appearing in the ledger of Royal Furnishings Company, a furniture wholesaler, are as follows:

A. Prepare a multiple-step income statement for the year ended March 31, 2018.

B. Compare the major advantages and disadvantages of the multiple-step and single-step forms of income statements.

On March 31, 2018, the balances of the accounts appearing in the ledger of Royal Furnishings Company, a furniture wholesaler, are as follows:

A. Prepare a multiple-step income statement for the year ended March 31, 2018.

B. Compare the major advantages and disadvantages of the multiple-step and single-step forms of income statements.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

12

Closing entries using periodic inventory system

United Rug Company is a small rug retailer owned and operated by Pat Kirwan. After the accounts have been adjusted on December 31, the following selected account balances were taken from the ledger:

The estimated cost of merchandise returns from December sales is $20,000. Journalize the closing entries.

United Rug Company is a small rug retailer owned and operated by Pat Kirwan. After the accounts have been adjusted on December 31, the following selected account balances were taken from the ledger:

The estimated cost of merchandise returns from December sales is $20,000. Journalize the closing entries.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

13

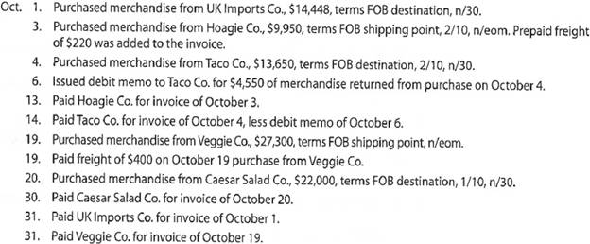

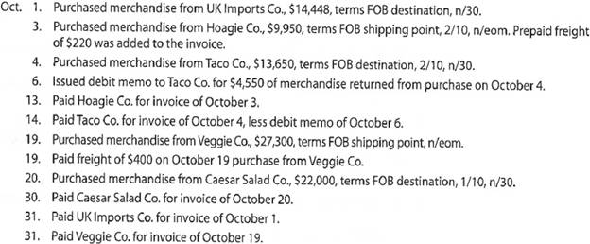

Purchase-related transactions using perpetual inventory system

The following selected transactions were completed by Capers Company during October of the current year:

Instructions

Journalize the entries to record the transactions of Capers Company for October.

The following selected transactions were completed by Capers Company during October of the current year:

Instructions

Journalize the entries to record the transactions of Capers Company for October.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

14

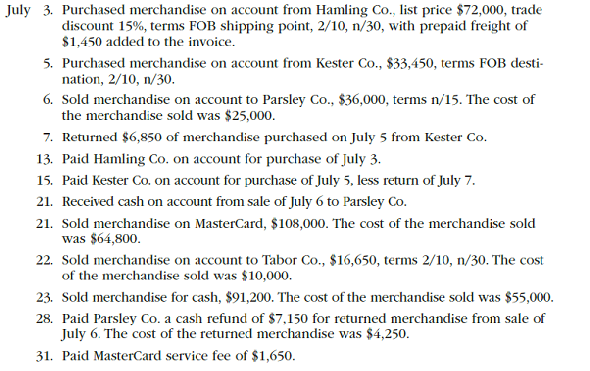

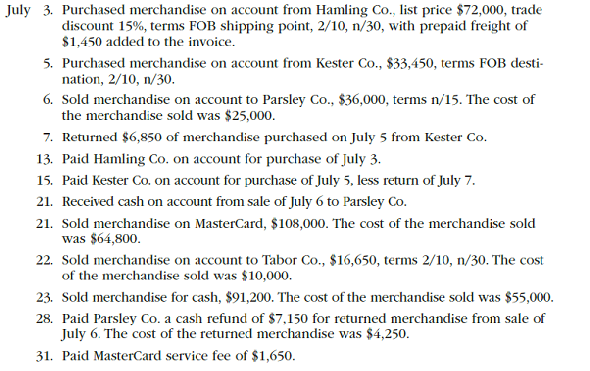

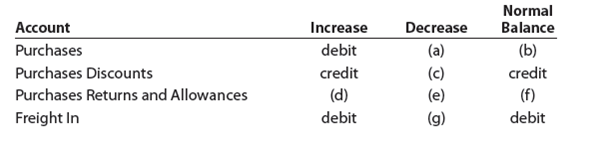

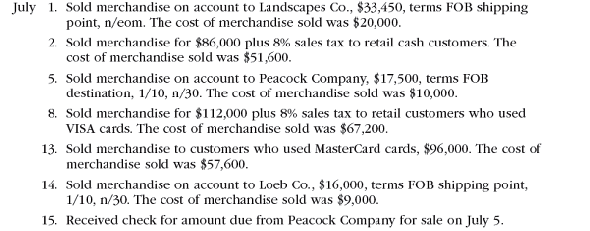

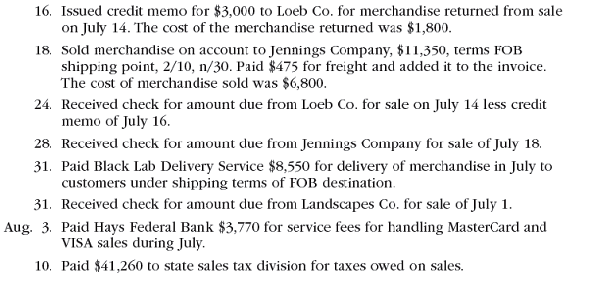

Sales-related and purchase-related transactions using perpetual inventory system

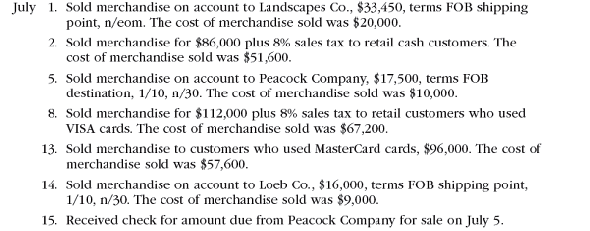

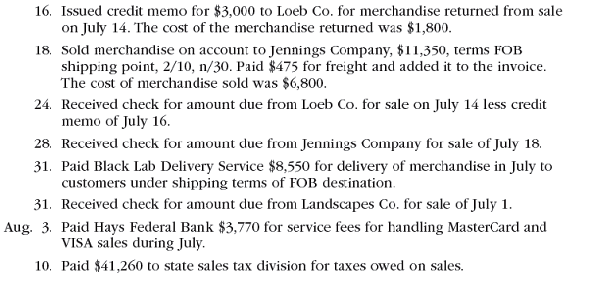

The following were selected from among the transactions completed by Essex Company during July of the current year:

Instructions

Journalize the transactions.

The following were selected from among the transactions completed by Essex Company during July of the current year:

Instructions

Journalize the transactions.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

15

Single-step income statement and balance sheet

Selected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2018, are presented in Problem 5-5A.

Instructions

1. Prepare a single-step income statement in the format shown in Exhibit 12.

2. Prepare a retained earnings statement.

3. Prepare balance sheet, assuming that the current portion of the note payable is $50,000.

4. Prepare closing entries as of May 31, 2018.

Selected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2018, are presented in Problem 5-5A.

Instructions

1. Prepare a single-step income statement in the format shown in Exhibit 12.

2. Prepare a retained earnings statement.

3. Prepare balance sheet, assuming that the current portion of the note payable is $50,000.

4. Prepare closing entries as of May 31, 2018.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

16

Periodic inventory accounts, multiple-step income statement, closing entries

On December 31, 2018, the balances of the accounts appearing in the ledger of Wyman Company are as follows:

Instructions

1. Does Wyman Company use a periodic or perpetual inventory system? Explain.

2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2018. The inventory as of December 31, 2018, was $305,000. The estimated cost of customer returns inventory for December 31, 2018, is estimated to increase to $40,000.

3. Prepare the closing entries for Wyman Company as of December 31, 2018.

4. What would be the net income if the perpetual inventory system had been used?

On December 31, 2018, the balances of the accounts appearing in the ledger of Wyman Company are as follows:

Instructions

1. Does Wyman Company use a periodic or perpetual inventory system? Explain.

2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2018. The inventory as of December 31, 2018, was $305,000. The estimated cost of customer returns inventory for December 31, 2018, is estimated to increase to $40,000.

3. Prepare the closing entries for Wyman Company as of December 31, 2018.

4. What would be the net income if the perpetual inventory system had been used?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

17

Multiple-step income statement

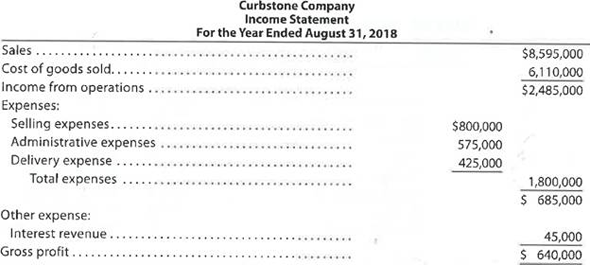

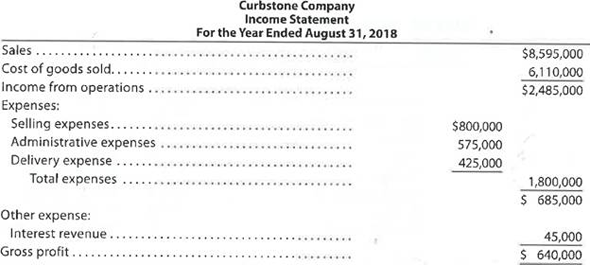

The following income statement for Curbstone Company was prepared for the year ended August 31, 2018:

A. Identify the errors in the income statement.

B. Prepare a corrected income statement.

The following income statement for Curbstone Company was prepared for the year ended August 31, 2018:

A. Identify the errors in the income statement.

B. Prepare a corrected income statement.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

18

Purchase-related transactions using perpetual inventory system

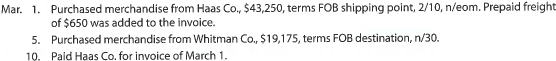

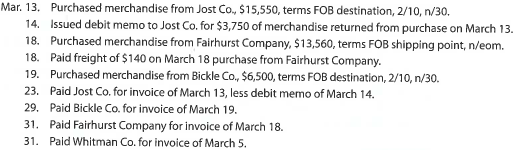

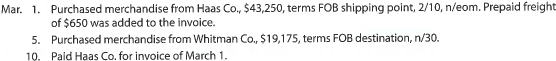

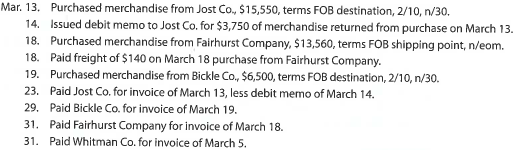

The following selected transactions were completed by Niles Co. during March of the current year:

Instructions

Journalize the entries to record the transactions of Niles Co. for March.

The following selected transactions were completed by Niles Co. during March of the current year:

Instructions

Journalize the entries to record the transactions of Niles Co. for March.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

19

Communication

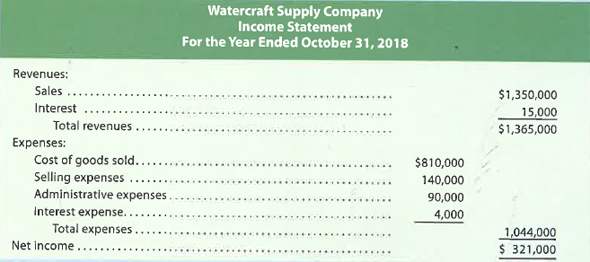

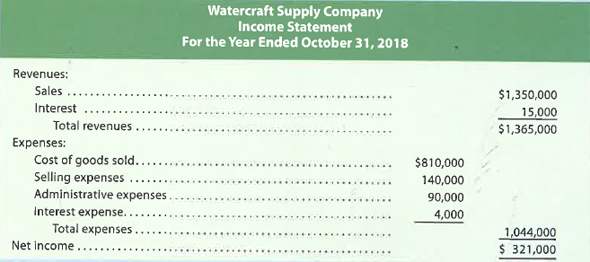

Suzi Nomro operates Watercraft Supply Company, an online boat parts distributorship that is in its third year of operation. The following income statement was prepared for the year ended October 31, 2018.

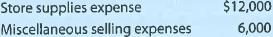

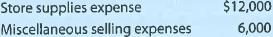

Suzi is considering a proposal to increase net income by offering sales discounts of 2/15, n/30 and by shipping all merchandise FOB shipping point. Currently, no sales discounts are allowed and merchandise is shipped FOB destination. It is estimated that the new terms will increase sales by 10%. The ratio of the cost of goods solds to sales is expected to be 60%. All selling and administrative expenses are expected to remain unchanged, except for store supplies and miscellaneous selling expenses, which are expected to increase proportionately with increased sales. The amounts of these items for the year ended October 31, 2018, were as follows:

The interest revenue and expense items will remain unchanged. The shipment of all merchandise FOB shipping point will eliminate all delivery expenses, which for the year ended October 31, 2018, were $12,000.

Write a brief memo to Suzi discussing the potential benefits and limitations of this proposal. Include a determination of the net income that Watercraft Supply could generate next year, under the new proposal, assuming that all sales are collected within the discount period.

Suzi Nomro operates Watercraft Supply Company, an online boat parts distributorship that is in its third year of operation. The following income statement was prepared for the year ended October 31, 2018.

Suzi is considering a proposal to increase net income by offering sales discounts of 2/15, n/30 and by shipping all merchandise FOB shipping point. Currently, no sales discounts are allowed and merchandise is shipped FOB destination. It is estimated that the new terms will increase sales by 10%. The ratio of the cost of goods solds to sales is expected to be 60%. All selling and administrative expenses are expected to remain unchanged, except for store supplies and miscellaneous selling expenses, which are expected to increase proportionately with increased sales. The amounts of these items for the year ended October 31, 2018, were as follows:

The interest revenue and expense items will remain unchanged. The shipment of all merchandise FOB shipping point will eliminate all delivery expenses, which for the year ended October 31, 2018, were $12,000.

Write a brief memo to Suzi discussing the potential benefits and limitations of this proposal. Include a determination of the net income that Watercraft Supply could generate next year, under the new proposal, assuming that all sales are collected within the discount period.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

20

Single-step income statement and balance sheet

Selected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 2018, are presented in Problem 5-5B.

Instructions

1. Prepare a single-step income statement in the format shown in Exhibit 12.

2. Prepare a retained earnings statement.

3. Prepare a balance sheet, assuming that the current portion of the note payable is $7,000.

4. Prepare closing entries as of June 30, 2018.

Selected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 2018, are presented in Problem 5-5B.

Instructions

1. Prepare a single-step income statement in the format shown in Exhibit 12.

2. Prepare a retained earnings statement.

3. Prepare a balance sheet, assuming that the current portion of the note payable is $7,000.

4. Prepare closing entries as of June 30, 2018.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

21

Periodic inventory accounts, multiple-step income statement, closing entries

On June 30, 2018, the balances of the accounts appearing in the ledger of Simkins Company are as follows:

Instructions

1. Does Simkins Company use a periodic or perpetual inventory system? Explain.

2. Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2018. The inventory as of June 30, 2018, was $508,000. The estimated cost of customer returns inventory for June 30, 2018 is estimated to increase to $33,000.

3. Prepare the closing entries for Simkins Company as of June 30, 2018.

4. What would be the net income if the perpetual inventory system had been used?

On June 30, 2018, the balances of the accounts appearing in the ledger of Simkins Company are as follows:

Instructions

1. Does Simkins Company use a periodic or perpetual inventory system? Explain.

2. Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2018. The inventory as of June 30, 2018, was $508,000. The estimated cost of customer returns inventory for June 30, 2018 is estimated to increase to $33,000.

3. Prepare the closing entries for Simkins Company as of June 30, 2018.

4. What would be the net income if the perpetual inventory system had been used?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

22

Single-step income statement

Summary operating data for Custom Wire Tubing Company during the year ended April 30, 2018, are as follows: cost of goods sold, $6,100,000; administrative expenses, $740,000; interest expense, $25,000; rent revenue, $60,000; sales, $9,332,500; and selling expenses, $1,250,000. Prepare a single-step income statement.

Summary operating data for Custom Wire Tubing Company during the year ended April 30, 2018, are as follows: cost of goods sold, $6,100,000; administrative expenses, $740,000; interest expense, $25,000; rent revenue, $60,000; sales, $9,332,500; and selling expenses, $1,250,000. Prepare a single-step income statement.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

23

Ethics in Action

Margie Johnson is a staff accountant at ToolEx Company, a manufacturer of tools and equipment. The company is under pressure from investors to increase earnings, and the president of the company expects the accounting department to "make this happen." Margie's boss, who has been a mentor to her, is concerned that if earnings do not increase, he will be terminated.

Shortly after the end of the fiscal year, the company performs a physical count of the inventory. When Margie compares the physical count to the balance in the inventory account, she finds a significant amount of inventory shrinkage. The amount is so large that it will result in a significant drop in earnings this period. Margie's boss asks her not to make the adjusting entry for shrinkage this period. He assures her that they will get "caught up" on shrinkage in the next period, after the pressure is off to reach this period's earnings goal. Margie's boss asks her to do this as a personal favor to him.

What should Margie do in this situation? Why?

Margie Johnson is a staff accountant at ToolEx Company, a manufacturer of tools and equipment. The company is under pressure from investors to increase earnings, and the president of the company expects the accounting department to "make this happen." Margie's boss, who has been a mentor to her, is concerned that if earnings do not increase, he will be terminated.

Shortly after the end of the fiscal year, the company performs a physical count of the inventory. When Margie compares the physical count to the balance in the inventory account, she finds a significant amount of inventory shrinkage. The amount is so large that it will result in a significant drop in earnings this period. Margie's boss asks her not to make the adjusting entry for shrinkage this period. He assures her that they will get "caught up" on shrinkage in the next period, after the pressure is off to reach this period's earnings goal. Margie's boss asks her to do this as a personal favor to him.

What should Margie do in this situation? Why?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

24

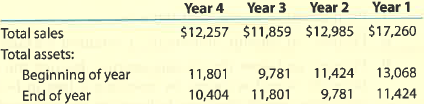

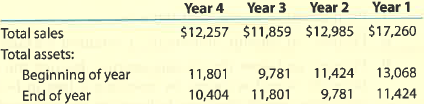

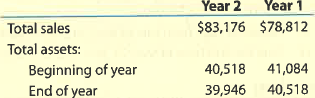

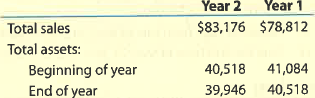

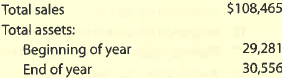

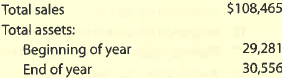

C. Penney: Asset turnover ratio

J. C. Penney Company, Inc. is a large general merchandise retailer in the United States. The following data were obtained from its financial statements for four recent years:

A. Compute the asset turnover ratio for each year. (Round to two decimal places).

B. Plot the asset turnover ratio on a line chart with the year on the horizontal axis.

C. Interpret the trend in this ratio over the four years.

J. C. Penney Company, Inc. is a large general merchandise retailer in the United States. The following data were obtained from its financial statements for four recent years:

A. Compute the asset turnover ratio for each year. (Round to two decimal places).

B. Plot the asset turnover ratio on a line chart with the year on the horizontal axis.

C. Interpret the trend in this ratio over the four years.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

25

Who bears the freight when the terms of sale are (a) FOB shipping point, (b) FOB destination?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

26

Sales-related transactions

After the amount due on a sale of $28,000, terms 2/10, n/eom, is received from a customer within the discount period, the seller consents to the return of the entire shipment for a cash refund. The cost of the merchandise returned was $16,800. (a) What is the amount of the refund owed to the customer? (b) Journalize the entries made by the seller to record the return and the refund.

After the amount due on a sale of $28,000, terms 2/10, n/eom, is received from a customer within the discount period, the seller consents to the return of the entire shipment for a cash refund. The cost of the merchandise returned was $16,800. (a) What is the amount of the refund owed to the customer? (b) Journalize the entries made by the seller to record the return and the refund.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

27

Adjusting entry for customer refunds, allowances, and returns

Scott Company had sales of $12,350,000 and related cost of goods sold of $7,500,000. Scott provides customers a refund for any returned or damaged merchandise. At the end of the year, Scott estimates that customers will request refunds for 0.8% of sales and estimates that merchandise costing $48,000 will be returned. Journalize the adjusting entries on December 31 to record the expected customer returns.

Scott Company had sales of $12,350,000 and related cost of goods sold of $7,500,000. Scott provides customers a refund for any returned or damaged merchandise. At the end of the year, Scott estimates that customers will request refunds for 0.8% of sales and estimates that merchandise costing $48,000 will be returned. Journalize the adjusting entries on December 31 to record the expected customer returns.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

28

Home Depot: Asset turnover ratio

The Home Depot reported the following data (in millions) in its recent financial statements:

A. Determine the asset turnover ratio for Home Depot for Year 2 and Year 1. (Round to two decimal places).

B. What conclusions can be drawn from these ratios concerning the trend in the ability of Home Depot to effectively use its assets to generate sales?

The Home Depot reported the following data (in millions) in its recent financial statements:

A. Determine the asset turnover ratio for Home Depot for Year 2 and Year 1. (Round to two decimal places).

B. What conclusions can be drawn from these ratios concerning the trend in the ability of Home Depot to effectively use its assets to generate sales?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

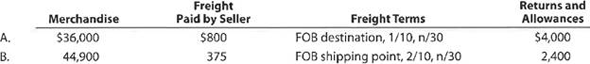

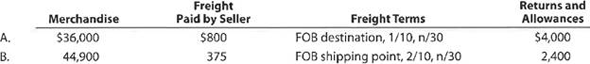

29

Freight terms

Determine the amount to be paid in full settlement of each of two invoices, (A) and (B), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period.

Determine the amount to be paid in full settlement of each of two invoices, (A) and (B), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

30

Purchase-related transactions

Journalize entries for the following related transactions of Lilly Heating Air Company:

A. Purchased $36,000 of merchandise from Schell Co. on account, terms 1/10, n/30.

B. Paid the amount owed on the invoice within the discount period.

C. Discovered that $9,000 of the merchandise purchased in (A) was defective and returned items, receiving credit.

D. Purchased $5,000 of merchandise from Schell Co. on account, terms n/30.

E. Received a refund from Schell Co. for return in (C) less the purchase in (D).

Journalize entries for the following related transactions of Lilly Heating Air Company:

A. Purchased $36,000 of merchandise from Schell Co. on account, terms 1/10, n/30.

B. Paid the amount owed on the invoice within the discount period.

C. Discovered that $9,000 of the merchandise purchased in (A) was defective and returned items, receiving credit.

D. Purchased $5,000 of merchandise from Schell Co. on account, terms n/30.

E. Received a refund from Schell Co. for return in (C) less the purchase in (D).

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

31

Sales-related transactions

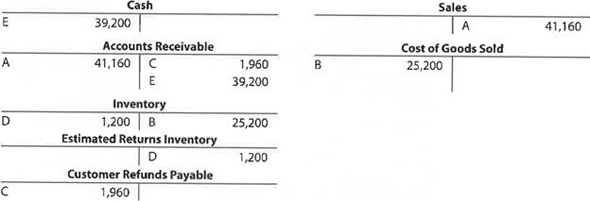

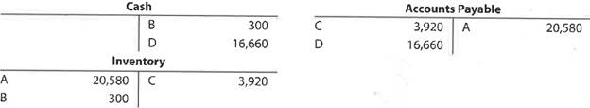

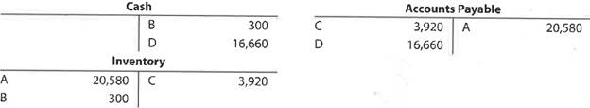

The debits and credits for five related transactions, A through E, are presented in the following T accounts. Describe each transaction.

The debits and credits for five related transactions, A through E, are presented in the following T accounts. Describe each transaction.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

32

Adjusting entry for customer refunds, allowances, and returns

Statz Company had sales of $1,800,000 and related cost of goods sold of $1,150,000 for its first year of operations ending December 31. Statz provides customers a refund for any returned or damaged merchandise. At the end of the year, Statz estimates that customers will request refunds for 1.5% of sales and estimates that merchandise costing $16,000 will be returned. Assume that on February 3 of the following year, Buck Co. returned merchandise with a selling price of $5,000 for a cash refund. The returned merchandise originally cost Statz $3,100. (A) Journalize the adjusting entries on December 31 to record the expected customer returns. (B) Journalize the entries to record the returned merchandise and cash refund to Buck Co. on February 3.

Statz Company had sales of $1,800,000 and related cost of goods sold of $1,150,000 for its first year of operations ending December 31. Statz provides customers a refund for any returned or damaged merchandise. At the end of the year, Statz estimates that customers will request refunds for 1.5% of sales and estimates that merchandise costing $16,000 will be returned. Assume that on February 3 of the following year, Buck Co. returned merchandise with a selling price of $5,000 for a cash refund. The returned merchandise originally cost Statz $3,100. (A) Journalize the adjusting entries on December 31 to record the expected customer returns. (B) Journalize the entries to record the returned merchandise and cash refund to Buck Co. on February 3.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

33

Purchases transactions

Hoffman Company purchased merchandise on account from a supplier for $65,000, terms 1/10, n/30. Hoffman returned $7,500 of the merchandise and received full credit.

A. If Hoffman Company pays the invoice within the discount period, what is the amount of cash required for the payment?

B. What account is debited by Hoffman Company to record the return?

Hoffman Company purchased merchandise on account from a supplier for $65,000, terms 1/10, n/30. Hoffman returned $7,500 of the merchandise and received full credit.

A. If Hoffman Company pays the invoice within the discount period, what is the amount of cash required for the payment?

B. What account is debited by Hoffman Company to record the return?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

34

What is the meaning of (a) 1/15, n/60; (b) n/30; (c) n/eom?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

35

Purchase-related transactions using periodic inventory system

Selected transactions for Capers Company during October of the current year are listed in Problem 6-1A.

Instructions

Journalize the entries to record the transactions of Capers Company for October using the periodic inventory system.

Selected transactions for Capers Company during October of the current year are listed in Problem 6-1A.

Instructions

Journalize the entries to record the transactions of Capers Company for October using the periodic inventory system.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

36

Sales-related transactions

Sayers Co. sold merchandise on account to a customer for $80,000 terms 2/10, n/30. The cost of the goods sold was $58,000. Journalize Sayers' entries to record (A) the sale, (B) the receipt of payment within the discount period, and (C) the receipt of payment beyond the discount period of ten days.

Sayers Co. sold merchandise on account to a customer for $80,000 terms 2/10, n/30. The cost of the goods sold was $58,000. Journalize Sayers' entries to record (A) the sale, (B) the receipt of payment within the discount period, and (C) the receipt of payment beyond the discount period of ten days.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

37

Adjusting entry for inventory shrinkage

Omega Tire Co.'s perpetual inventory records indicate that $3,145,000 of merchandise should be on hand on August 31. The physical inventory indicates that $3,113,500 of merchandise is actually on hand. Journalize the adjusting entry for the inventory shrinkage for Omega Tire Co. for the fiscal year ended August 31.

Omega Tire Co.'s perpetual inventory records indicate that $3,145,000 of merchandise should be on hand on August 31. The physical inventory indicates that $3,113,500 of merchandise is actually on hand. Journalize the adjusting entry for the inventory shrinkage for Omega Tire Co. for the fiscal year ended August 31.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

38

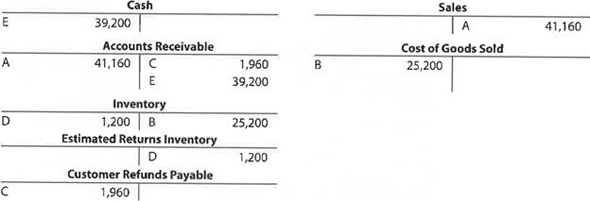

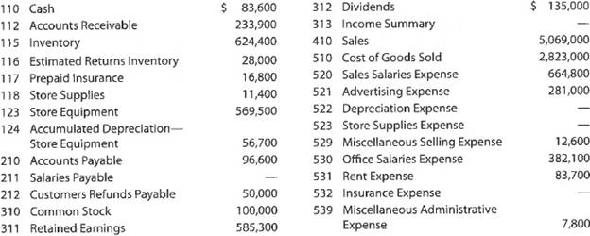

Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1, 2018 (unless otherwise indicated), are as follows:

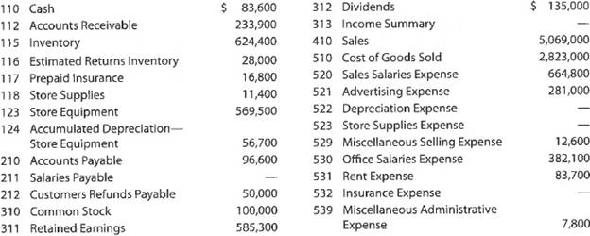

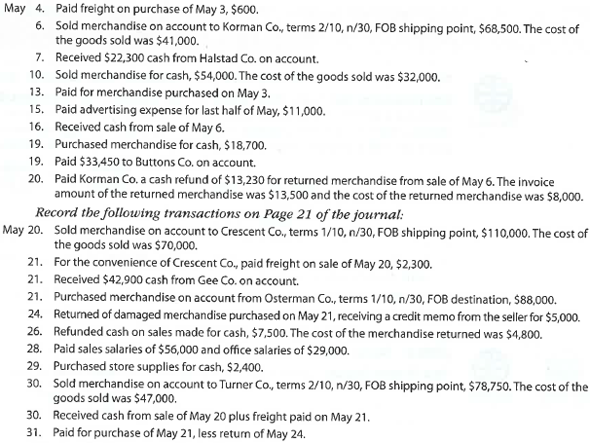

During May, the last month of the fiscal year, the following transactions were completed:

Instructions

1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark

in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal.

in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal.

2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers.

3. Prepare an unadjusted trial balance.

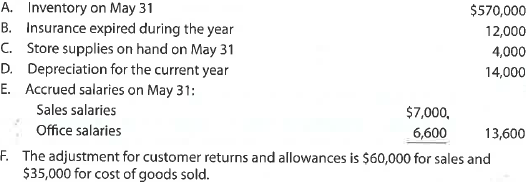

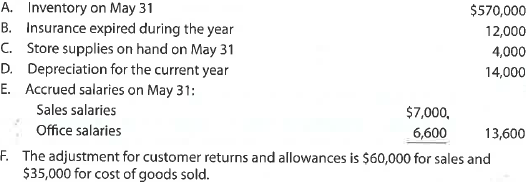

4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6).

5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet.

6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal.

7. Prepare an adjusted trial balance.

8. Prepare an income statement, a retained earnings statement, and a balance sheet.

9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account.

10. Prepare a post-closing trial balance.

During May, the last month of the fiscal year, the following transactions were completed:

Instructions

1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark

in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal.

in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal.2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers.

3. Prepare an unadjusted trial balance.

4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6).

5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet.

6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal.

7. Prepare an adjusted trial balance.

8. Prepare an income statement, a retained earnings statement, and a balance sheet.

9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account.

10. Prepare a post-closing trial balance.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

39

Purchase-related transactions

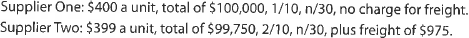

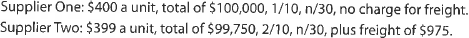

A retailer is considering the purchase of 250 units of a specific item from either of two suppliers. Their offers are as follows:

Which of the two offers, Supplier One or Supplier Two, yields the lower price?

A retailer is considering the purchase of 250 units of a specific item from either of two suppliers. Their offers are as follows:

Which of the two offers, Supplier One or Supplier Two, yields the lower price?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

40

Purchase-related transactions using periodic inventory system

Selected transactions for Niles Co. during March of the current year are listed in Problem 6-1B.

Instructions

Journalize the entries to record the transactions of Niles Co. for March using the periodic inventory system.

Selected transactions for Niles Co. during March of the current year are listed in Problem 6-1B.

Instructions

Journalize the entries to record the transactions of Niles Co. for March using the periodic inventory system.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

41

Determining amounts to be paid on invoices

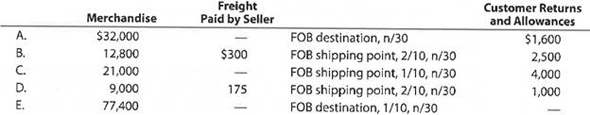

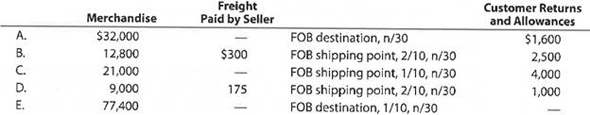

Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period:

Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period:

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

42

Closing the accounts of a merchandiser

From the following list, identify the accounts that should be closed to Income Summary at the end of the fiscal year under a perpetual inventory system: (A) Accounts Payable, (B) Advertising Expense, (C) Cost of Goods Sold, (D) Dividends, (E) Inventory, (F) Sales, (G) Supplies, (H) Supplies Expense, (I) Wages Payable.

From the following list, identify the accounts that should be closed to Income Summary at the end of the fiscal year under a perpetual inventory system: (A) Accounts Payable, (B) Advertising Expense, (C) Cost of Goods Sold, (D) Dividends, (E) Inventory, (F) Sales, (G) Supplies, (H) Supplies Expense, (I) Wages Payable.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

43

Can a business earn a gross profit but incur a net loss? Explain.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

44

Sales-related and purchase-related transactions for seller and buyer using perpetual inventory system

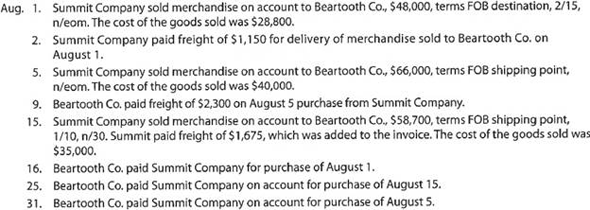

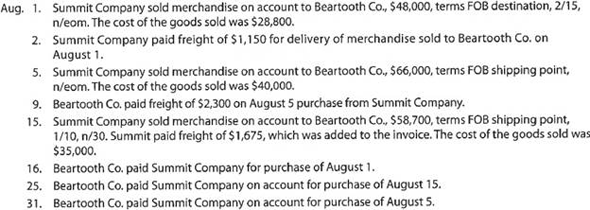

The following selected transactions were completed during August between Summit Company and Beartooth Co.:

Instructions

Journalize the August transactions for (1) Summit Company and (2) Beartooth Co.

The following selected transactions were completed during August between Summit Company and Beartooth Co.:

Instructions

Journalize the August transactions for (1) Summit Company and (2) Beartooth Co.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

45

Name four accounts that would normally appear in the chart of accounts of a merchandising business but would not appear in the chart of accounts of a service business.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

46

Sales-related transactions

Showcase Co., a furniture wholesaler, sells merchandise to Balboa Co. on account, $254,500, terms n/30. The cost of the merchandise sold is $152,700. Showcase Co. issues a credit memo for $30,000 for merchandise returned prior to Balboa Co. paying the original invoice. The cost of the merchandise returned is $17,500. Journalize Showcase Co.'s entries for (a) the sale, including the cost of the merchandise sold; (b) the credit memo, including the cost of the returned merchandise; and (c) the receipt of the check for the amount due from Balboa Co.

Showcase Co., a furniture wholesaler, sells merchandise to Balboa Co. on account, $254,500, terms n/30. The cost of the merchandise sold is $152,700. Showcase Co. issues a credit memo for $30,000 for merchandise returned prior to Balboa Co. paying the original invoice. The cost of the merchandise returned is $17,500. Journalize Showcase Co.'s entries for (a) the sale, including the cost of the merchandise sold; (b) the credit memo, including the cost of the returned merchandise; and (c) the receipt of the check for the amount due from Balboa Co.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

47

Closing entries; net income

Based on the data presented in Exercise 5-24, journalize the closing entries.

Based on the data presented in Exercise 5-24, journalize the closing entries.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

48

Determining cost of goods sold

For a recent year, Best Buy reported sales of $42,410 million. Its gross profit was $9,690 million. What was the amount of Best Buy's cost of goods sold?

For a recent year, Best Buy reported sales of $42,410 million. Its gross profit was $9,690 million. What was the amount of Best Buy's cost of goods sold?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

49

Sales-related and purchase-related transactions for seller and buyer using perpetual inventory system

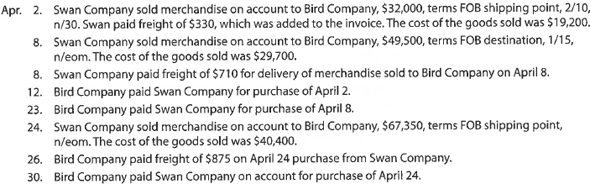

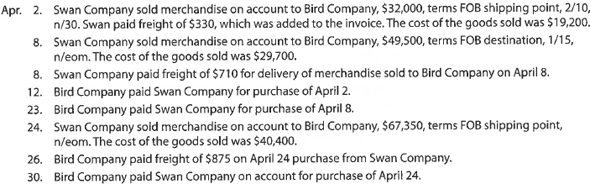

The following selected transactions were completed during April between Swan Company and Bird Company:

Instructions

Journalize the April transactions for (1) Swan Company and (2) Bird Company.

The following selected transactions were completed during April between Swan Company and Bird Company:

Instructions

Journalize the April transactions for (1) Swan Company and (2) Bird Company.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

50

Sales-related transactions, including the use of credit cards

Journalize the entries for the following transactions:

A. Sold merchandise for cash, $25,000. The cost of the goods sold was $17,500.

B. Sold merchandise on account, $98,000. The cost of the goods sold was $58,800.

C. Sold merchandise to customers who used MasterCard and VISA, $475,000. The cost of the goods sold was $280,000.

D. Sold merchandise to customers who used American Express, $63,000. The cost of the goods sold was $39,000.

E. Received an invoice from National Clearing House Credit Co. for $13,450 representing a service fee paid for processing MasterCard, VISA, and American Express sales.

Journalize the entries for the following transactions:

A. Sold merchandise for cash, $25,000. The cost of the goods sold was $17,500.

B. Sold merchandise on account, $98,000. The cost of the goods sold was $58,800.

C. Sold merchandise to customers who used MasterCard and VISA, $475,000. The cost of the goods sold was $280,000.

D. Sold merchandise to customers who used American Express, $63,000. The cost of the goods sold was $39,000.

E. Received an invoice from National Clearing House Credit Co. for $13,450 representing a service fee paid for processing MasterCard, VISA, and American Express sales.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

51

Purchase-related transactions

Based on the data presented in Exercise 6-14, journalize Balboa Co.'s entries for (a) the purchase, (b) the return of the merchandise for credit, and (c) the payment of the invoice.

Based on the data presented in Exercise 6-14, journalize Balboa Co.'s entries for (a) the purchase, (b) the return of the merchandise for credit, and (c) the payment of the invoice.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

52

Closing entries

On July 31, the close of the fiscal year, the balances of the accounts appearing in the ledger of Serbian Interiors Company, a furniture wholesaler, are as follows:

Prepare the July 31 closing entries for Serbian Interiors Company.

On July 31, the close of the fiscal year, the balances of the accounts appearing in the ledger of Serbian Interiors Company, a furniture wholesaler, are as follows:

Prepare the July 31 closing entries for Serbian Interiors Company.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

53

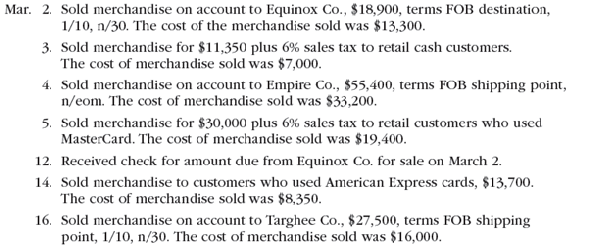

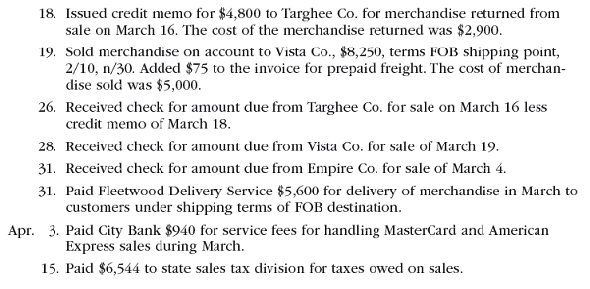

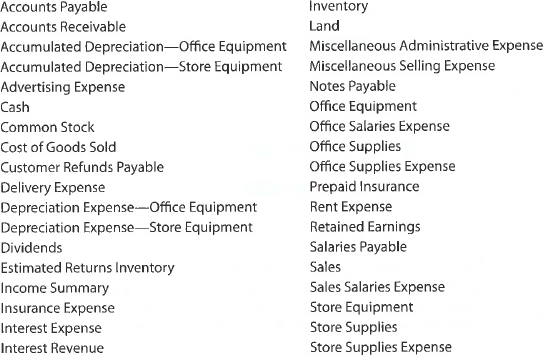

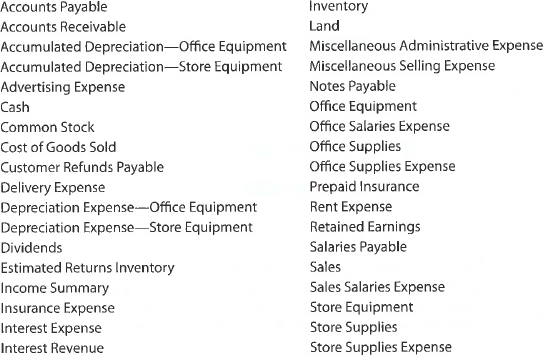

Sales-related transactions using perpetual inventory system

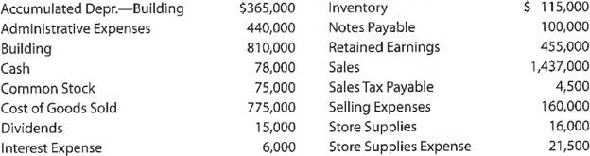

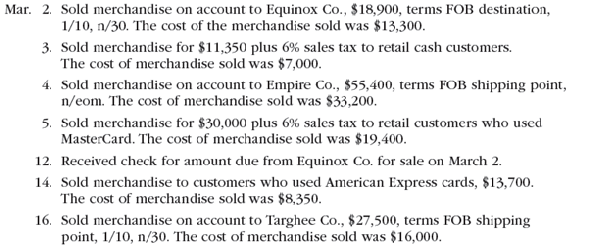

The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to wholesalers and occasionally to retail customers:

Instructions

Journalize the entries to record the transactions of Amsterdam Supply Co.

The following selected transactions were completed by Amsterdam Supply Co., which sells office supplies primarily to wholesalers and occasionally to retail customers:

Instructions

Journalize the entries to record the transactions of Amsterdam Supply Co.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

54

Transactions for buyer and seller

Shore Co. sold merchandise to Blue Star Co. on account, $112,000, terms FOB shipping point, 2/10, n/30. The cost of the goods sold is $67,200. Shore paid freight of $1,800. Journalize the entries for Shore and Blue Star for the sale, purchase, and payment of amount due.

Shore Co. sold merchandise to Blue Star Co. on account, $112,000, terms FOB shipping point, 2/10, n/30. The cost of the goods sold is $67,200. Shore paid freight of $1,800. Journalize the entries for Shore and Blue Star for the sale, purchase, and payment of amount due.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

55

Sales-related and purchase-related transactions using periodic inventory system

Selected transactions for Babcock Company during November of the current year are listed in Problem 6-3A.

Instructions

Journalize the entries to record the transactions of Babcock Company for November using the periodic inventory system.

Selected transactions for Babcock Company during November of the current year are listed in Problem 6-3A.

Instructions

Journalize the entries to record the transactions of Babcock Company for November using the periodic inventory system.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

56

Chart of accounts

Monet Paints Co. is a newly organized business with a list of accounts arranged in alphabetical order, as follows:

Construct a chart of accounts, assigning account numbers and arranging the accounts in balance sheet and income statement order, as illustrated in Exhibit 10. Each account number is three digits: the first digit is to indicate the major classification (1 for assets, and so on); the second digit is to indicate the subclassification (11 for current assets, and so on); and the third digit is to identify the specific account (110 for Cash, 112 for Accounts Receivable, 114 for Inventory, 115 for Estimated Returns Inventory, and so on).

Monet Paints Co. is a newly organized business with a list of accounts arranged in alphabetical order, as follows:

Construct a chart of accounts, assigning account numbers and arranging the accounts in balance sheet and income statement order, as illustrated in Exhibit 10. Each account number is three digits: the first digit is to indicate the major classification (1 for assets, and so on); the second digit is to indicate the subclassification (11 for current assets, and so on); and the third digit is to identify the specific account (110 for Cash, 112 for Accounts Receivable, 114 for Inventory, 115 for Estimated Returns Inventory, and so on).

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

57

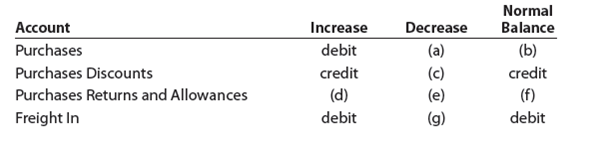

Rules of debit and credit for periodic inventory accounts

Complete the following table by indicating for (a) through (g) whether the proper answer is debit or credit:

Complete the following table by indicating for (a) through (g) whether the proper answer is debit or credit:

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

58

Sales-related transactions using perpetual inventory system

The following selected transactions were completed by Green Lawn Supplies Co., which sells irrigation supplies primarily to wholesalers and occasionally to retail customers:

Instructions

Journalize the entries to record the transactions of Green Lawn Supplies Co.

The following selected transactions were completed by Green Lawn Supplies Co., which sells irrigation supplies primarily to wholesalers and occasionally to retail customers:

Instructions

Journalize the entries to record the transactions of Green Lawn Supplies Co.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

59

How are sales to customers using MasterCard and VISA recorded?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

60

Sales-related and purchase-related transactions using periodic inventory system

Selected transactions for Essex Company during July of the current year are listed in Problem 6-3B.

Instructions

Journalize the entries to record the transactions of Essex Company for July using the periodic inventory system.

Selected transactions for Essex Company during July of the current year are listed in Problem 6-3B.

Instructions

Journalize the entries to record the transactions of Essex Company for July using the periodic inventory system.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

61

Sales tax

A sale of merchandise on account for $36,000 is subject to an 8% sales tax. (a) Should the sales tax be recorded at the time of sale or when payment is received? (b) What is the amount recorded as sales? (c) What is the amount debited to Accounts Receivable? (d) What is the title of the account to which the $2,880 ($36,000 × 8%) is credited?

A sale of merchandise on account for $36,000 is subject to an 8% sales tax. (a) Should the sales tax be recorded at the time of sale or when payment is received? (b) What is the amount recorded as sales? (c) What is the amount debited to Accounts Receivable? (d) What is the title of the account to which the $2,880 ($36,000 × 8%) is credited?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

62

Journal entries using the periodic inventory system

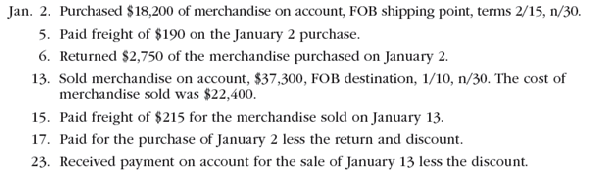

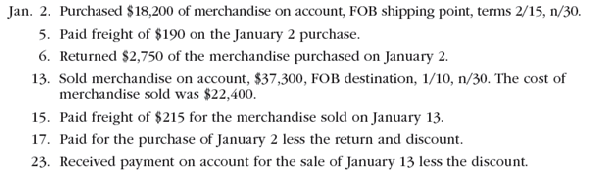

The following selected transactions were completed by Air Systems Company during January of the current year. Air Systems Company uses the periodic inventory system.

Journalize the entries to record the transactions of Air Systems Company.

The following selected transactions were completed by Air Systems Company during January of the current year. Air Systems Company uses the periodic inventory system.

Journalize the entries to record the transactions of Air Systems Company.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

63

Team Activity

In teams, select a public company that interests you. Obtain the company's most recent annual report on Form 10-K. The Form 10-K is a company's annually required filing with the Securities and Exchange Commission (SEC). It includes the company's financial statements and accompanying notes. The Form 10-K can be obtained either (A) from the investor relations section of the company's Web site or (B) by using the company search feature of the SEC's EDGAR database service found at www.sec.gov/edgar/searchedgar/companysearch.html.

1. Based on the information in the company's most recent annual report, determine each of the following for all the years presented:

A. Gross profit

B. Gross profit rate (Gross profitf ÷ Sales)

C. Income from operations

D. Percentage change in income from operations

E. Net income

F. Percentage change in net income

2. Based solely on your responses to item 1, has the company's performance improved, remained constant, or deteriorated over the periods presented? Briefly explain your answer.

In teams, select a public company that interests you. Obtain the company's most recent annual report on Form 10-K. The Form 10-K is a company's annually required filing with the Securities and Exchange Commission (SEC). It includes the company's financial statements and accompanying notes. The Form 10-K can be obtained either (A) from the investor relations section of the company's Web site or (B) by using the company search feature of the SEC's EDGAR database service found at www.sec.gov/edgar/searchedgar/companysearch.html.

1. Based on the information in the company's most recent annual report, determine each of the following for all the years presented:

A. Gross profit

B. Gross profit rate (Gross profitf ÷ Sales)

C. Income from operations

D. Percentage change in income from operations

E. Net income

F. Percentage change in net income

2. Based solely on your responses to item 1, has the company's performance improved, remained constant, or deteriorated over the periods presented? Briefly explain your answer.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

64

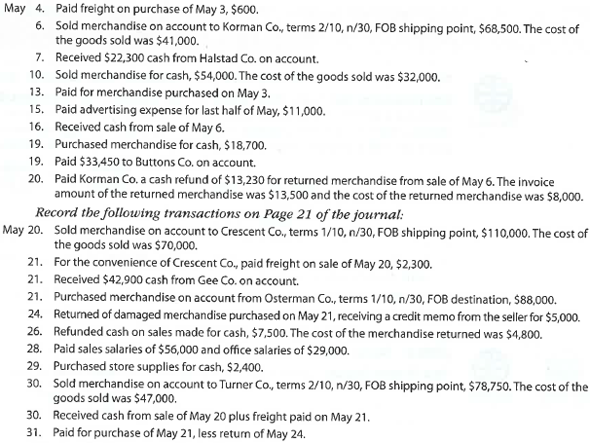

Purchase-related transactions

The debits and credits from four related transactions, A through D, are presented in the following T accounts. Describe each transaction.

The debits and credits from four related transactions, A through D, are presented in the following T accounts. Describe each transaction.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

65

Audio Outfitter Inc., which uses a perpetual inventory system, experienced a normal inventory shrinkage of $13,675. What accounts would be debited and credited to record the adjustment for the inventory shrinkage at the end of the accounting period?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

66

Sales tax transactions

Journalize the entries to record the following selected transactions:

A. Sold $640,000 of merchandise on account, subject to a sales tax of 7%. The cost of the goods sold was $385,000.

B. Paid $61,750 to the state sales tax department for taxes collected.

Journalize the entries to record the following selected transactions:

A. Sold $640,000 of merchandise on account, subject to a sales tax of 7%. The cost of the goods sold was $385,000.

B. Paid $61,750 to the state sales tax department for taxes collected.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

67

Identify items missing in determining cost of goods sold

For (A) through (E), identify the items designated by X and Y.

A. Purchases ? (X + Y) = Net purchases

B. Net purchases + X = Cost of inventory purchased

C. Inventory (beginning) + Cost of inventory purchased = X

D. Inventory available for sale ? X = Cost of inventory before estimated returns

E. Cost of goods sold before estimated returns ? X = Cost of goods sold

For (A) through (E), identify the items designated by X and Y.

A. Purchases ? (X + Y) = Net purchases

B. Net purchases + X = Cost of inventory purchased

C. Inventory (beginning) + Cost of inventory purchased = X

D. Inventory available for sale ? X = Cost of inventory before estimated returns

E. Cost of goods sold before estimated returns ? X = Cost of goods sold

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

68

Kroger: Asset turnover ratio

The Kroger Company, a national supermarket chain, reported the following data (in millions) in its financial statements for a recent year:

A. Compute the asset turnover ratio. (Round to two decimal places.)

B. Tiffany Co. is a large North American retailer of jewelry. Tiffany's asset turnover ratio is 0.92. Why would Tiffany's asset turnover ratio be lower than that of Kroger?

The Kroger Company, a national supermarket chain, reported the following data (in millions) in its financial statements for a recent year:

A. Compute the asset turnover ratio. (Round to two decimal places.)

B. Tiffany Co. is a large North American retailer of jewelry. Tiffany's asset turnover ratio is 0.92. Why would Tiffany's asset turnover ratio be lower than that of Kroger?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

69

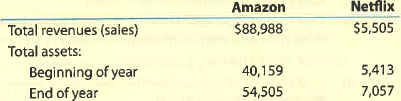

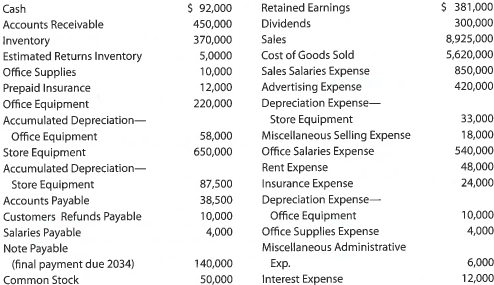

Multiple-step income statement and balance sheet

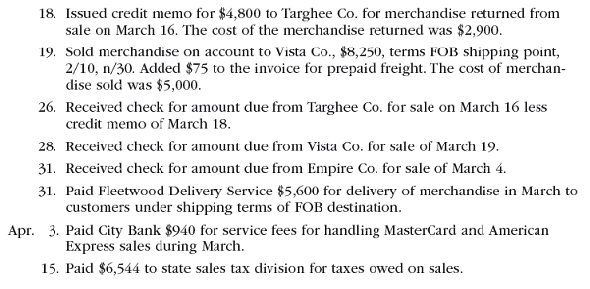

The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2018:

Instructions

1. Prepare a multiple-step income statement.

2. Prepare a retained earnings statement.

3. Prepare a balance sheet, assuming that the current portion of the note payable is $50,000.

4. Briefly explain how multiple-step and single-step income statements differ.

The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 2018:

Instructions

1. Prepare a multiple-step income statement.

2. Prepare a retained earnings statement.

3. Prepare a balance sheet, assuming that the current portion of the note payable is $50,000.

4. Briefly explain how multiple-step and single-step income statements differ.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

70

Customer refund

Senger Company sold merchandise of $15,500, terms 2/10, n/30, to Burris Inc. on April 23. Burris paid Senger for the merchandise on May 2. On May 12, Senger paid Burris $650 for costs incurred by Burris to repair defective merchandise. (A) Journalize the entry by Senger Company to record the customer refund to Burris Inc. (B) Assume that instead of paying Burris cash, Senger issued a credit memo to Burris to be used against Burris's outstanding account receivable balance. Journalize the entry by Senger Company to record the issuance of the credit memo.

Senger Company sold merchandise of $15,500, terms 2/10, n/30, to Burris Inc. on April 23. Burris paid Senger for the merchandise on May 2. On May 12, Senger paid Burris $650 for costs incurred by Burris to repair defective merchandise. (A) Journalize the entry by Senger Company to record the customer refund to Burris Inc. (B) Assume that instead of paying Burris cash, Senger issued a credit memo to Burris to be used against Burris's outstanding account receivable balance. Journalize the entry by Senger Company to record the issuance of the credit memo.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

71

Normal balances of merchandise accounts

What is the normal balance of the following accounts: (a) Cost of Merchandise Sold, (b) Customer Refunds Payable, (c) Delivery Expense, (d) Estimated Returns Inventory, (e) Merchandise Inventory, (f) Sales, (g) Sales Tax Payable.

What is the normal balance of the following accounts: (a) Cost of Merchandise Sold, (b) Customer Refunds Payable, (c) Delivery Expense, (d) Estimated Returns Inventory, (e) Merchandise Inventory, (f) Sales, (g) Sales Tax Payable.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

72

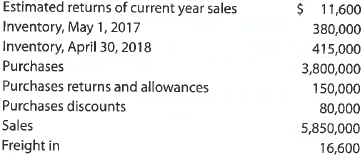

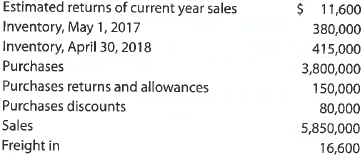

Cost of goods sold and related items

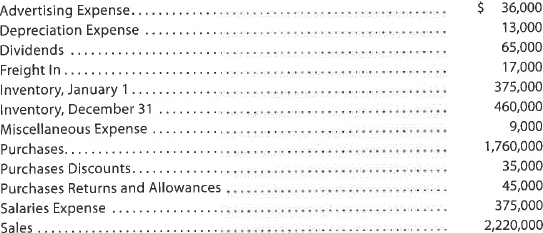

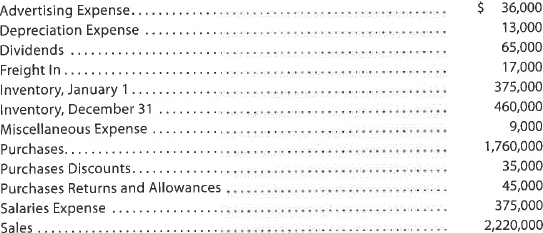

The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2018:

A. Prepare the cost of goods sold section of the income statement for the year ended April 30, 2018, using the periodic inventory system.

B. Determine the gross profit to be reported on the income statement for the year ended April 30, 2018.

C. Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?

The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2018:

A. Prepare the cost of goods sold section of the income statement for the year ended April 30, 2018, using the periodic inventory system.

B. Determine the gross profit to be reported on the income statement for the year ended April 30, 2018.

C. Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

73

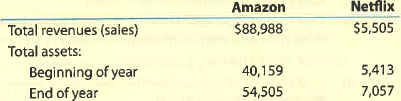

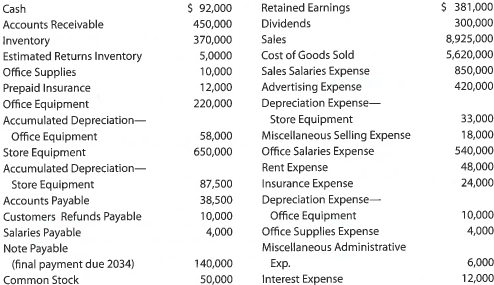

Continuing Company Analysis-Amazon: Asset turnover ratio

Amazon.com, Inc. is one of the largest Internet retailers in the world. Netflix, Inc. provides digital streaming and DVD rentals in the United States. Amazon and Netflix compete in streaming and digital services, however Amazon also sells many other products through the Internet. The sales and total assets (in millions) from recent financial statements were reported as follows for both companies:

A. Based on your knowledge of each company, identify three major assets used by each company in generating revenue.

B. Compute the asset turnover ratio for each company. (Round to two decimal places).

C. Which company generates sales from total assets more efficiently?

Amazon.com, Inc. is one of the largest Internet retailers in the world. Netflix, Inc. provides digital streaming and DVD rentals in the United States. Amazon and Netflix compete in streaming and digital services, however Amazon also sells many other products through the Internet. The sales and total assets (in millions) from recent financial statements were reported as follows for both companies:

A. Based on your knowledge of each company, identify three major assets used by each company in generating revenue.

B. Compute the asset turnover ratio for each company. (Round to two decimal places).

C. Which company generates sales from total assets more efficiently?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

74

Sales transactions?

Journalize the following merchandise transactions:

A. Sold merchandise on account, $92,500 with terms 1/10, n/30. The cost of the goods sold was $55,500.

B. Received payment less the discount.

C. Refunded $750 to customer for defective merchandise that was not returned.

Journalize the following merchandise transactions:

A. Sold merchandise on account, $92,500 with terms 1/10, n/30. The cost of the goods sold was $55,500.

B. Received payment less the discount.

C. Refunded $750 to customer for defective merchandise that was not returned.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

75

Multiple-step income statement and balance sheet

The following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 2018:

Instructions

1. Prepare a multiple-step income statement.

2. Prepare a retained earnings statement.

3. Prepare a balance sheet, assuming that the current portion of the note payable is $7,000.

4. Briefly explain how multiple-step and single-step income statements differ.

The following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 2018:

Instructions

1. Prepare a multiple-step income statement.

2. Prepare a retained earnings statement.

3. Prepare a balance sheet, assuming that the current portion of the note payable is $7,000.

4. Briefly explain how multiple-step and single-step income statements differ.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

76

Sales-related and purchase-related transactions for buyer and seller using periodic inventory system

Selected transactions during August between Summit Company and Beartooth Co. are listed in Problem 5-4A.

Instructions

Journalize the entries to record the transactions for (1) Summit Company and (2) Beartooth Co., assuming that both companies use the periodic inventory system.

Selected transactions during August between Summit Company and Beartooth Co. are listed in Problem 5-4A.

Instructions

Journalize the entries to record the transactions for (1) Summit Company and (2) Beartooth Co., assuming that both companies use the periodic inventory system.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

77

Income statement and accounts for merchandiser

For the fiscal year, sales were $46,680,000 and the cost of goods sold was $28,000,000.

A. What was the amount of gross profit?

B. If total operating expenses were $5,000,000 could you determine net income?

C. Is Customer Refunds Payable an asset, liability, or stockholders' equity account and what is its normal balance?

D. Is Estimated Returns Inventory an asset, liability, or stockholders' equity account and what is its normal balance?

For the fiscal year, sales were $46,680,000 and the cost of goods sold was $28,000,000.

A. What was the amount of gross profit?

B. If total operating expenses were $5,000,000 could you determine net income?

C. Is Customer Refunds Payable an asset, liability, or stockholders' equity account and what is its normal balance?

D. Is Estimated Returns Inventory an asset, liability, or stockholders' equity account and what is its normal balance?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

78

Cost of goods sold

Based on the following data, determine the cost of goods sold for November:

Based on the following data, determine the cost of goods sold for November:

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

79

Gross profit

During the current year, merchandise is sold for $18,300 cash and $295,700 on account. The cost of the goods sold is $188,000. What is the amount of the gross profit?

During the current year, merchandise is sold for $18,300 cash and $295,700 on account. The cost of the goods sold is $188,000. What is the amount of the gross profit?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

80

The credit period during which the buyer of merchandise is allowed to pay usually begins with what date?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck