hapter 12 Special Property Transactions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/65

Play

Full screen (f)

hapter 12 Special Property Transactions

1

What is the difference between a deferred gain and an excluded gain ?

Difference between deferred and excluded gain:

1. Deferred Gain:

Deferred gain is the gain which is realized after the sale or dispose of property. This would be a gain which is recognized in future.2. Excluded Gain:

Excluded gain is the gain which is realized at the exchange and recognized as gain when the exchange has taken place.

1. Deferred Gain:

Deferred gain is the gain which is realized after the sale or dispose of property. This would be a gain which is recognized in future.2. Excluded Gain:

Excluded gain is the gain which is realized at the exchange and recognized as gain when the exchange has taken place.

2

Explain the constructive ownership rules and how they relate to related-party transactions.

Related party loss is a loss arising from transaction of sale or transfer of a capital asset between related parties which is not deductible by related party seller.

Related party transaction includes transactions of a taxpayer with following parties: -

• Corporation in which he is a majority holder, directly or indirectly (more than 50% ownership)• Partnership firm in which he is a majority partner (more than 50% ownership)• Spouse

• Sister/Brother

• Parents

• Children

• Ancestors/Descendent

However, related party transaction doesn't include transaction with nephew / niece, cousin, uncle / aunt.

While considering if a party is related to the taxpayer, constructive ownership rule also applies.

Constructive Ownership rule assumes that a taxpayer constructively owns the stock held by anyone or any entity under his control.

Following are the examples of constructive ownership:

• Shareholders of a corporation are assumed to be proportionately holding the shares held by the corporation.

• Partners of a partnership are assumed to be proportionately holding the shares held by the partnership.

• A taxpayer is assumed to be holding any stock held by his/her family members.

Related party transaction includes transactions of a taxpayer with following parties: -

• Corporation in which he is a majority holder, directly or indirectly (more than 50% ownership)• Partnership firm in which he is a majority partner (more than 50% ownership)• Spouse

• Sister/Brother

• Parents

• Children

• Ancestors/Descendent

However, related party transaction doesn't include transaction with nephew / niece, cousin, uncle / aunt.

While considering if a party is related to the taxpayer, constructive ownership rule also applies.

Constructive Ownership rule assumes that a taxpayer constructively owns the stock held by anyone or any entity under his control.

Following are the examples of constructive ownership:

• Shareholders of a corporation are assumed to be proportionately holding the shares held by the corporation.

• Partners of a partnership are assumed to be proportionately holding the shares held by the partnership.

• A taxpayer is assumed to be holding any stock held by his/her family members.

3

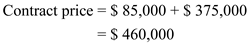

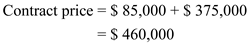

On July 1, 2010, Andrea sold land held for investment to Taylor. Andrea's land had a $300,000 basis and was subject to a $150,000 mortgage. Under the contractual agreement, Taylor will pay Andrea $85,000 on the date of the sale, will assume the mortgage, and will give Andrea a note for $375,000 (plus interest at the federal rate) due the following year. What is the contract price of sale? a. $460,000.

B) $525,000.

C) $610,000.

D) $760,000.

B) $525,000.

C) $610,000.

D) $760,000.

A person may be required to sell a property at a place and need to buy the same kind of property at another place. It can be seen as a kind of exchange a person makes. To avoid the tax burden or defer the tax for the future in this situation, the IRC has formed some provisions to provide relief to the person. One of those relief provided is:

Installment sales:

Installment sales are a remedy provided to the buyer to make the payment for buying the property in installments. It is done to decrease the burden of hefty payment at a time. It also adds to the benefit of the receiver of the payment, that the tax payment is spread in other words deferred throughout installments. In order to entitle for the above provision of installment sales, at least installment must be received subsequent the year of sales, that is, must involve at least two payments in two different years. The installment sales cover three particulars: (1) interest payment (ii) return of the adjusted basis (iii) gain on the sale. The interest income and gain on the sale must not be mixed and should be reported separately. The return of adjusted basis and gain on the sales for each installment made is estimated using the percentage of gross profit.

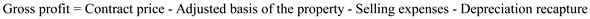

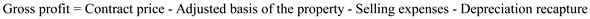

The gross profit is calculated as:

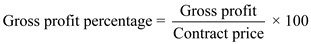

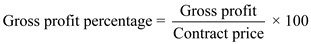

The percentage of gross profit is estimated as:

The percentage of gross profit is estimated as:

It can be seen that the interest charges do not affect the gross profit percentage.

It can be seen that the interest charges do not affect the gross profit percentage.

The contract price is the selling price, but if the buyer has admitted to assuming any obligations that are to be paid, then the selling price is subtracted by the amount of the obligations assumed to get the contract price.From the amount received in every installment, the interest element is separately dealt, and from the remaining amount after deducting the interest element, the gain is calculated using the gross profit percentage, and it is considered as the income. The remaining amount after deducting the gross profit and interest element from the installment received is the return on the basis.

Calculation of contract price:

The contract price includes the payment made in cash and the amount of note.Hence, the correct option is (a).

The contract price includes the payment made in cash and the amount of note.Hence, the correct option is (a).

Installment sales:

Installment sales are a remedy provided to the buyer to make the payment for buying the property in installments. It is done to decrease the burden of hefty payment at a time. It also adds to the benefit of the receiver of the payment, that the tax payment is spread in other words deferred throughout installments. In order to entitle for the above provision of installment sales, at least installment must be received subsequent the year of sales, that is, must involve at least two payments in two different years. The installment sales cover three particulars: (1) interest payment (ii) return of the adjusted basis (iii) gain on the sale. The interest income and gain on the sale must not be mixed and should be reported separately. The return of adjusted basis and gain on the sales for each installment made is estimated using the percentage of gross profit.

The gross profit is calculated as:

The percentage of gross profit is estimated as:

The percentage of gross profit is estimated as: It can be seen that the interest charges do not affect the gross profit percentage.

It can be seen that the interest charges do not affect the gross profit percentage. The contract price is the selling price, but if the buyer has admitted to assuming any obligations that are to be paid, then the selling price is subtracted by the amount of the obligations assumed to get the contract price.From the amount received in every installment, the interest element is separately dealt, and from the remaining amount after deducting the interest element, the gain is calculated using the gross profit percentage, and it is considered as the income. The remaining amount after deducting the gross profit and interest element from the installment received is the return on the basis.

Calculation of contract price:

The contract price includes the payment made in cash and the amount of note.Hence, the correct option is (a).

The contract price includes the payment made in cash and the amount of note.Hence, the correct option is (a). 4

Indicate whether the property acquired qualifies as replacement property for each of the following involuntary conversions:

a. The Harts' personal residence is destroyed by a hurricane. They decide not to acquire a replacement residence but to invest the insurance proceeds in a house that they rent to tenants.

b. Faiqa's personal residence is condemned. She uses the proceeds to invest in another personal residence.

c. Tonya owns a storage warehouse used for business purposes. A flood destroys the building, and she decides to use the insurance proceeds to rebuild the warehouse in another state.

d. Ramona owns an apartment building that is destroyed by a flood. She uses the insurance proceeds to build an apartment building nearby, which is out of the flood zone.

a. The Harts' personal residence is destroyed by a hurricane. They decide not to acquire a replacement residence but to invest the insurance proceeds in a house that they rent to tenants.

b. Faiqa's personal residence is condemned. She uses the proceeds to invest in another personal residence.

c. Tonya owns a storage warehouse used for business purposes. A flood destroys the building, and she decides to use the insurance proceeds to rebuild the warehouse in another state.

d. Ramona owns an apartment building that is destroyed by a flood. She uses the insurance proceeds to build an apartment building nearby, which is out of the flood zone.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

5

How is the basis calculated in a like-kind exchange? How does the receipt of boot affect the basis of the asset received? How does the giving of boot affect the basis of the asset received?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

6

What is a wash sale, and why are losses from wash sales disallowed?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is correct with regard to installment sales? a. The contract price is generally the amount of cash the seller will receive.

B) Sales by a taxpayer who is a dealer in the item sold are not eligible for installment sale treatment.

C) The installment method cannot be used to report gain from the sale of stock or securities that are traded on an established securities market.

D) All of the above are correct.

B) Sales by a taxpayer who is a dealer in the item sold are not eligible for installment sale treatment.

C) The installment method cannot be used to report gain from the sale of stock or securities that are traded on an established securities market.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

8

Jessica's office building is destroyed by fire on November 15, 2010. The adjusted basis of the building is $410,000. She receives insurance proceeds of $550,000 on December 12, 2010.

a. Calculate her realized and recognized gain or loss for the replacement property if she acquires an office building in December 2010 for $550,000.

b. Calculate her realized and recognized gain or loss for the replacement property if she acquires an office building in December 2010 for $495,000.

c. What is her basis for the replacement property in (a) and in (b)?

d. Calculate Jessica's realized and recognized gain or loss if she does not invest in replacement property.

a. Calculate her realized and recognized gain or loss for the replacement property if she acquires an office building in December 2010 for $550,000.

b. Calculate her realized and recognized gain or loss for the replacement property if she acquires an office building in December 2010 for $495,000.

c. What is her basis for the replacement property in (a) and in (b)?

d. Calculate Jessica's realized and recognized gain or loss if she does not invest in replacement property.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

9

Often, when assets are exchanged, liabilities are assumed in the exchange. How does the assumption of liabilities in a like-kind exchange affect the gain or loss recognized? How does it affect the basis of an asset received in a like-kind exchange?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

10

For an exchange to qualify as a nontaxable exchange, what criteria must be present? a. There must be an exchange.

B) The property transferred and received must be held for use in a trade or business or for investment.

C) The property exchanged must be like-kind.

D) All of these must be present.

B) The property transferred and received must be held for use in a trade or business or for investment.

C) The property exchanged must be like-kind.

D) All of these must be present.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

11

A taxpayer who sells her personal residence in 2010 may exclude some or all of the gain on the sale if the residence was owned and lived in for a. At least four years before the sale date.

B) Any two years of a five-year period before the sale.

C) Any of the last four years of an eight-year period before the sale.

D) At least one year prior to the sale date.

B) Any two years of a five-year period before the sale.

C) Any of the last four years of an eight-year period before the sale.

D) At least one year prior to the sale date.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

12

Reid's personal residence is condemned on September 12, 2010, as part of a plan to add two lanes to the existing highway. His adjusted basis is $300,000. He receives condemnation proceeds of $340,000 on September 30, 2010. He purchases another personal residence for $325,000 on October 15, 2010. What are Reid's realized and recognized gain or loss?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

13

What are the special provisions for like-kind exchanges between related-parties? Why are these special provisions included in the IRC?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

14

24) For the asset received in a like-kind exchange, how is the holding period of the new asset determined? a. According to the date the new asset is received.

B) According to the date the old asset is given away.

C) According to the holding period of the old asset.

D) None of the above apply.

B) According to the date the old asset is given away.

C) According to the holding period of the old asset.

D) None of the above apply.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

15

Marcus purchased Vinnie and Marie's personal residence for $225,000 cash and the assumption of their $100,000 mortgage. Vinnie and Marie bought the house six years ago for $275,000 and have used it as a primary residence. What amount of gain should Vinnie and Marie recognize on the sale of their personal residence? a. $0.

B) $50,000.

C) $100,000.

D) $225,000.

B) $50,000.

C) $100,000.

D) $225,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

16

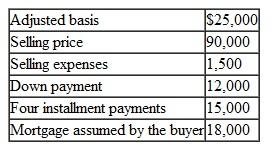

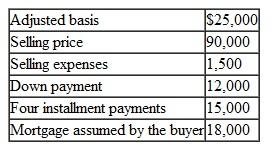

Pedro sells investment land on September 1, 2010. Information pertaining to the sale follows:

Each installment payment is due on September 1 of 2011, 2012, 2013, and 2014 (ignore interest). Determine the tax consequences in 2010, 2011, 2012, 2013, and 2014.

Each installment payment is due on September 1 of 2011, 2012, 2013, and 2014 (ignore interest). Determine the tax consequences in 2010, 2011, 2012, 2013, and 2014.

Each installment payment is due on September 1 of 2011, 2012, 2013, and 2014 (ignore interest). Determine the tax consequences in 2010, 2011, 2012, 2013, and 2014.

Each installment payment is due on September 1 of 2011, 2012, 2013, and 2014 (ignore interest). Determine the tax consequences in 2010, 2011, 2012, 2013, and 2014.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

17

Must both parties in a potential like-kind exchange agree to the exchange? If not, how can the transaction be structured to defer any gain?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following exchanges qualifies as like-kind property? a. Partnership interest for partnership interest.

B) Inventory for equipment.

C) Investment land for an apartment building.

D) Business- use delivery truck for business-use van.

B) Inventory for equipment.

C) Investment land for an apartment building.

D) Business- use delivery truck for business-use van.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

19

Daniel, who is single, purchased a house on May 15, 1987, for $115,000. During the years he owned the house, he installed a swimming pool at a cost of $24,000 and replaced the driveway at a cost of $12,000. On April 28, 2010, Daniel sold the house for $470,000. He paid a realtor commission of $28,000 and legal fees of $1,000 connected with the sale of the house. What is Daniel's recognized gain on the sale of the house? a. $0.

B) $ 40,000.

C) $290,000.

D) $319,000.

B) $ 40,000.

C) $290,000.

D) $319,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

20

Virginia is an accountant for a global CPA firm. She is being temporarily transferred from the Raleigh, North Carolina, office to Tokyo. She will leave Raleigh on October 7, 2010, and will be out of the country for four years. She sells her personal residence on September 30, 2010 for $250,000 (her adjusted basis is $190,000). Upon her return to the United States in 2014, she purchases a new residence in Los Angeles for $220,000, where she will continue working for the same firm.

a. What are Virginia's realized and recognized gain or loss?

b. What is Virginia's basis in the new residence?

a. What are Virginia's realized and recognized gain or loss?

b. What is Virginia's basis in the new residence?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

21

What is an involuntary conversion?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

22

Eric exchanged equipment used in his land-clearing business with Geoff for upgraded equipment. Eric exchanged the equipment with a $75,000 FMV and $45,000 basis along with $15,000 cash. Geoff's basis in his equipment is $60,000, and the FMV is $90,000. Which of the following statements is correct? a. Geoff must recognize a gain of $15,000 on the exchange.

B) Geoff must recognize a gain of $5,000 on the exchange.

C) Neither Eric nor Geoff must recognize a gain.

D) Eric must recognize a gain of $15,000 on the exchange.

B) Geoff must recognize a gain of $5,000 on the exchange.

C) Neither Eric nor Geoff must recognize a gain.

D) Eric must recognize a gain of $15,000 on the exchange.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

23

All of the following relationships are considered related parties except a. A corporation and a taxpayer whose spouse of the taxpayer owns 80% of the corporation's stock.

B) A trust and a taxpayer who is the grantor of the trust.

C) A corporation and a taxpayer who owns 20% of the corporation's stock.

D) A partnership and a taxpayer who is a two-thirds partner.

B) A trust and a taxpayer who is the grantor of the trust.

C) A corporation and a taxpayer who owns 20% of the corporation's stock.

D) A partnership and a taxpayer who is a two-thirds partner.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

24

On February 1, 2010, a 39-year-old widow buys a new residence for $150,000. Three months later, she sells her old residence for $310,000 (adjusted basis of $120,000). Selling expenses totaled $21,000. She lived in the old house for 15 years.

a. What are the widow's realized and recognized gain or loss?

b. What is her basis in the new residence?

a. What are the widow's realized and recognized gain or loss?

b. What is her basis in the new residence?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

25

When an involuntary conversion occurs and the taxpayer receives insurance proceeds, what must the taxpayer do to guarantee that no gain is recognized?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

26

Ava exchanges a machine used in her business with Gail for another machine. The basis of Ava's old machine is $50,000, the FMV is $66,000, and she gives Gail cash of $14,000. Gail's basis in her machine is $70,000, and the FMV is $80,000. What is Ava's adjusted basis in the new machine she receives? a. $50,000.

B) $64,000.

C) $66,000.

D) $80,000.

B) $64,000.

C) $66,000.

D) $80,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

27

On June 1, 2010, Nigel sells land (basis $55,000) to his son Ted for $40,000, the land's fair market value on the date of the sale. On September 21, 2010, Ted sells the land to an unrelated party. Which of the following statements is correct? a. If Ted sells the land for $35,000, he has a $20,000 recognized loss on the sale.

B) If Ted sells the land for $65,000, he has a $25,000 recognized gain on the sale.

C) If Ted sells the land for $45,000, he has a $5,000 recognized gain on the sale.

D) If Ted sells the land for $57,000, he has a $2,000 recognized gain on the sale.

B) If Ted sells the land for $65,000, he has a $25,000 recognized gain on the sale.

C) If Ted sells the land for $45,000, he has a $5,000 recognized gain on the sale.

D) If Ted sells the land for $57,000, he has a $2,000 recognized gain on the sale.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

28

Dominique is a manager for a regional bank. He is being relocated several states away to act as a temporary manager while a new branch is interviewing for a permanent manager. He will leave on May 1, 2010, and will be at the new location for less than one year. He sells his personal residence on April 15, 2010, for $123,000 (adjusted basis $95,000). Upon completion of the assignment, he purchases a new residence for $200,000.

a. What are Dominique's realized and recognized gain or loss?

b. What is Dominique's basis in the new residence?

c. Assume that Dominique is transferred out of state and sells his new residence for $230,000 60 days later( he is single). What are his realized and recognized gain?

a. What are Dominique's realized and recognized gain or loss?

b. What is Dominique's basis in the new residence?

c. Assume that Dominique is transferred out of state and sells his new residence for $230,000 60 days later( he is single). What are his realized and recognized gain?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

29

When faced with an involuntary conversion, does the taxpayer have an unlimited amount of time to replace the converted property? Explain.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

30

Janel exchanges a building she uses in her rental business for a building owned by Russel that she will use in her rental business. The adjusted basis of Janel's building is $160,000, and the fair market value is $250,000. The adjusted basis of Russel's building is $80,000, and the fair market value is $250,000. Which of the following statements is correct? a. Janel's recognized gain is $0, and her basis for the building received is $160,000.

B) Janel's recognized gain is $90,000, and her basis for the building received is $160,000.

C) Janel's recognized gain is $0, and her basis for the building received is $250,000.

D) Janel's recognized gain is $90,000, and her basis for the building received is $250,000.

B) Janel's recognized gain is $90,000, and her basis for the building received is $160,000.

C) Janel's recognized gain is $0, and her basis for the building received is $250,000.

D) Janel's recognized gain is $90,000, and her basis for the building received is $250,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

31

Bryce owns 200 shares of Basic Company stock that he purchased for $8,000 three years ago. On December 28, 2010, Bryce sold 100 shares of the stock for $2,500. On January 3, 2011, Bryce repurchased 50 shares for $1,100. How much of the loss can Bryce deduct in 2010? a. $0.

B) $ 750.

C) $4,400.

C) $5,500.

B) $ 750.

C) $4,400.

C) $5,500.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

32

Crystal owns 150 shares of Carson, Inc., stock that has an adjusted basis of $100,000. On December 18, 2010, she sells the 150 shares for FMV ($88,000). On January 7, 2011, she purchases 200 shares of Carson stock for $127,500.

a. What are Crystal's realized and recognized gain or loss on the sale of the 150 shares sold on December 18, 2010?

b. What is Crystal's adjusted basis for the 200 shares purchased on January 7, 2011?

c. How would your answers in (a) and (b) change if she purchased only 100 shares for $98,000 in January?

a. What are Crystal's realized and recognized gain or loss on the sale of the 150 shares sold on December 18, 2010?

b. What is Crystal's adjusted basis for the 200 shares purchased on January 7, 2011?

c. How would your answers in (a) and (b) change if she purchased only 100 shares for $98,000 in January?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

33

How are the basis and holding period of the replacement property in an involuntary conversion determined? Explain.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

34

Jason exchanged office furniture (seven-year life) for other furniture (seven-year life). The old furniture had an adjusted basis of $14,000, and the new furniture had a FMV of $22,000. Jason also paid $5,000 cash in the exchange. What are the recognized gain or loss and the basis of the furniture? a. $0 and $14,000

B) $0 and $19,000

C) $ 6,000 and $14,000

D) ($8,000) and $9,000

B) $0 and $19,000

C) $ 6,000 and $14,000

D) ($8,000) and $9,000

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

35

Carlton holds undeveloped land for investment. His adjusted basis in the land is $200,000, and the FMV is $325,000. On November 1, 2010, he exchanges this land for land owned by his son, who is 31 years old. The appraised value of his son's land is $320,000 with a basis of $310,000.

a. Calculate Carlton's realized and recognized gain or loss from the exchange with his son and on Carlton's subsequent sale of the land to a real estate agent on July 19, 2011, for $375,000.

b. Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July 19, 2011. Calculate Carlton's basis for the land on November 1, 2010, and July 19, 2011.

c. What could Carlton do to avoid any recognition of gain associated with the first exchange prior to his sale of the land?

a. Calculate Carlton's realized and recognized gain or loss from the exchange with his son and on Carlton's subsequent sale of the land to a real estate agent on July 19, 2011, for $375,000.

b. Calculate Carlton's realized and recognized gain or loss from the exchange with his son if Carlton does not sell the land received from his son, but his son sells the land received from Carlton on July 19, 2011. Calculate Carlton's basis for the land on November 1, 2010, and July 19, 2011.

c. What could Carlton do to avoid any recognition of gain associated with the first exchange prior to his sale of the land?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

36

On January 1, 2009, Myron sells stock that has a $50,000 FMV on the date of the sale (basis $75,000) to his son Vernon for $50,000. On October 21, 2010, Vernon sells the stock to an unrelated party. In each of the following, determine the tax consequences of these transactions to Myron and Vernon:

a. Vernon sells the stock for $40,000.

b. Vernon sells the stock for $80,000.

c. Vernon sells the stock for $65,000.

a. Vernon sells the stock for $40,000.

b. Vernon sells the stock for $80,000.

c. Vernon sells the stock for $65,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

37

What information must be reported to the IRS concerning an involuntary conversion?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

38

Gretel exchanges a warehouse with an adjusted basis of $150,000 and fair market value of $160,000 for a mini-storage building with a fair market value of $100,000 and $60,000 cash. What are the recognized gain or loss and the basis of the mini-storage building? a. $0 gain and $150,000 basis.

B) $10,000 gain and $100,000 basis.

C) $10,000 gain and $150,000 basis.

D) ($10,000) loss and $160,000 basis.

B) $10,000 gain and $100,000 basis.

C) $10,000 gain and $150,000 basis.

D) ($10,000) loss and $160,000 basis.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

39

Elaine exchanges a van that is used exclusively for business purposes for another van that also is to be used exclusively for business. The adjusted basis for the old van is $18,000, and its FMV is $14,500.

a. Calculate Elaine's recognized gain or loss on the exchange.

b. Calculate Elaine's basis for the van she receives.

a. Calculate Elaine's recognized gain or loss on the exchange.

b. Calculate Elaine's basis for the van she receives.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

40

Harold owns 130 shares of stock in Becker Corporation. His adjusted basis for the stock is $210,000. On December 15, 2010, he sells the stock for $180,000. He purchases 200 shares of Becker Corporation stock on January 12, 2011, for $195,000.

a. What are Harold's realized and recognized gain or loss on the sale?

b. What is Harold's adjusted basis for the 200 shares purchased on January 12, 2011?

c. How would your answers in (a) and (b) change if he purchased only 100 shares for $95,000 in January?

a. What are Harold's realized and recognized gain or loss on the sale?

b. What is Harold's adjusted basis for the 200 shares purchased on January 12, 2011?

c. How would your answers in (a) and (b) change if he purchased only 100 shares for $95,000 in January?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

41

Can the exchange of personal-use property qualify as a like-kind exchange? Why or why not?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

42

How is income reported from an installment sale? What are the components of the payments received in an installment sale, and how is the gross profit percentage calculated?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

43

What tax form is completed to elect deferral of gain on an involuntary conversion? a. No form is required.

B) Form 4797.

C) Form 4562.

D) Form 1040, Schedule D.

B) Form 4797.

C) Form 4562.

D) Form 1040, Schedule D.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

44

What is the basis of the new property in each of the following situations? Is any gain recognized in the following transactions?

a. Rental house with an adjusted basis of $100,000 exchanged for personal-use river cottage with a FMV of $130,000.

b. General Motors common stock with an adjusted basis of $19,000 exchanged for Quaker Oats common stock with a FMV of $14,000.

c. Land and building with an adjusted basis of $25,000 used as a furniture repair shop exchanged for land and a building with a FMV of $52,000 used as a car dealership.

d. An office building with an adjusted basis of $22,000 exchanged for a heavy-duty truck with a FMV of $28,000. Both properties are held 100% for business purposes.

e. A residential rental property held for investment with an adjusted basis of $230,000 exchanged for a warehouse to be held for investment with a FMV of $180,000.

a. Rental house with an adjusted basis of $100,000 exchanged for personal-use river cottage with a FMV of $130,000.

b. General Motors common stock with an adjusted basis of $19,000 exchanged for Quaker Oats common stock with a FMV of $14,000.

c. Land and building with an adjusted basis of $25,000 used as a furniture repair shop exchanged for land and a building with a FMV of $52,000 used as a car dealership.

d. An office building with an adjusted basis of $22,000 exchanged for a heavy-duty truck with a FMV of $28,000. Both properties are held 100% for business purposes.

e. A residential rental property held for investment with an adjusted basis of $230,000 exchanged for a warehouse to be held for investment with a FMV of $180,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

45

Lewis owns 200 shares of stock in Modlin Corporation. His adjusted basis for the stock is $180,000. On December 15, 2010, he sells the stock for $170,000. He purchases 200 shares of Modlin Corporation stock on January 8, 2011, for $170,000.

a. What are Lewis's realized and recognized gain or loss on the sale?

b. What is Lewis's adjusted basis for the 200 shares purchased on January 8, 2011?

c. How would your answers in (a) and (b) change if he purchased only 100 shares for $105,000 in January?

d. What tax treatment is Lewis trying to achieve?

a. What are Lewis's realized and recognized gain or loss on the sale?

b. What is Lewis's adjusted basis for the 200 shares purchased on January 8, 2011?

c. How would your answers in (a) and (b) change if he purchased only 100 shares for $105,000 in January?

d. What tax treatment is Lewis trying to achieve?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

46

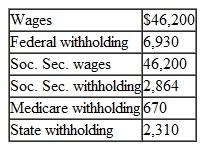

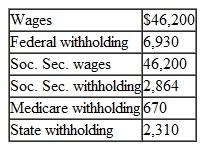

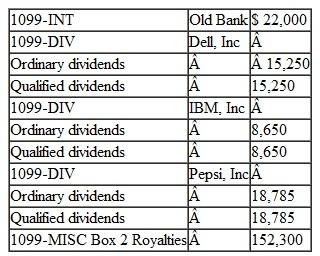

Wendy O'Neil (SSN 412-34-5670), who is single, worked full-time as the director at a local charity. She resides at 1501 Front Street, Highland, AZ 98765. For the year, she had the following reported on her W-2:

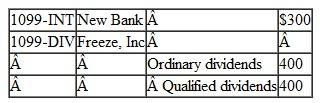

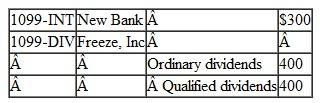

Other information follows:

Other information follows:

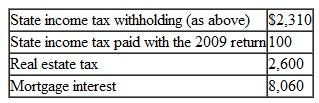

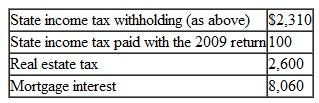

Wendy had the following itemized deductions:

Wendy had the following itemized deductions:

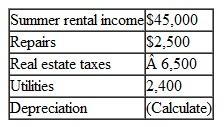

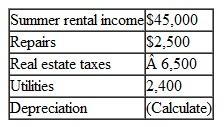

Wendy inherited a beach house in North Carolina (rental only) on October 4, 2009 from her father. The FMV at the father's death was $850,000. He had purchased the house 20 years earlier for $100,000.

Wendy inherited a beach house in North Carolina (rental only) on October 4, 2009 from her father. The FMV at the father's death was $850,000. He had purchased the house 20 years earlier for $100,000.

On November 12, 2010, Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Blvd., Hot Town, Arizona. She received rental property with a FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2011.

On November 12, 2010, Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Blvd., Hot Town, Arizona. She received rental property with a FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2011.

Prepare Form 1040 for Wendy for 2011. You will also need Form 1040, Schedule A, Schedule B, Schedule D, Schedule E, Schedule M, Form 4562, and Form 8824

Other information follows:

Other information follows: Wendy had the following itemized deductions:

Wendy had the following itemized deductions: Wendy inherited a beach house in North Carolina (rental only) on October 4, 2009 from her father. The FMV at the father's death was $850,000. He had purchased the house 20 years earlier for $100,000.

Wendy inherited a beach house in North Carolina (rental only) on October 4, 2009 from her father. The FMV at the father's death was $850,000. He had purchased the house 20 years earlier for $100,000. On November 12, 2010, Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Blvd., Hot Town, Arizona. She received rental property with a FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2011.

On November 12, 2010, Wendy properly conducted a like-kind exchange for rental real estate located at 128 Lake Blvd., Hot Town, Arizona. She received rental property with a FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2011.Prepare Form 1040 for Wendy for 2011. You will also need Form 1040, Schedule A, Schedule B, Schedule D, Schedule E, Schedule M, Form 4562, and Form 8824

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

47

Discuss the rules concerning the sale of a personal residence. Include in your discussion, the specifics regarding the ownership test and the use test.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

48

In order to build a new road, the city of Oxford annexed 20 acres of Michael's farmland with a FMV of $30,000 and basis of $18,000. In return, Michael received 50 acres of similar land, which was appraised at $45,000. In this involuntary conversion, what gain or loss should Michael recognize, and what is his basis in the new land? a. $0 gain and $18,000 basis.

B) $0 gain and $27,000 basis.

C) $12,000 gain and $30,000 basis.

D) $27,000 gain and $45,000 basis.

B) $0 gain and $27,000 basis.

C) $12,000 gain and $30,000 basis.

D) $27,000 gain and $45,000 basis.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

49

Viktor exchanges stock (adjusted basis $18,000, FMV $25,000) and real estate (adjusted basis $18,000, FMV $44,000) held for investment for other real estate to be held for investment. The real estate acquired in the exchange has a FMV of $67,000.

a. What are Viktor's realized and recognized gain or loss?

b. What is the basis of the acquired real estate?

a. What are Viktor's realized and recognized gain or loss?

b. What is the basis of the acquired real estate?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

50

What types of properties do not qualify for like-kind exchange treatment?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

51

Is a taxpayer allowed to take the §121 exclusion for a vacation home that was never rented? Explain.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

52

A warehouse with an adjusted basis of $125,000 was destroyed by a tornado on April 15, 2010. On June 15, 2010, the insurance company paid the owner $195,000. The owner reinvested $170,000 in another warehouse. What is the basis of the new warehouse if nonrecognition of gain from an involuntary conversion is elected? a. $100,000.

B) $125,000.

C) $170,000.

D) $195,000.

B) $125,000.

C) $170,000.

D) $195,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

53

LaRhonda owns an office building that has an adjusted basis of $45,000. The building is subject to a mortgage of $20,000. She transfers the building to Miguel in exchange for $15,000 cash and a warehouse with a FMV of $50,000. Miguel assumes the mortgage on the building.

a. What are LaRhonda's realized and recognized gain or loss?

b. What is her basis in the newly acquired warehouse?

a. What are LaRhonda's realized and recognized gain or loss?

b. What is her basis in the newly acquired warehouse?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

54

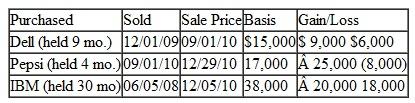

Dave (SSN 412-34-5670) and Alicia (SSN412-34-5671) Stanley are married and retired at age 50. The couple's income consists of rental property, stock investments, and royalties from an invention. They sold their large house that they had purchased six years ago for $580,000 on October 18, 2010, for $1 million. They now live in a condo at 101 Magnolia Lane, Suite 15, High Park, Florida 12345.

The rental property is an apartment complex (building cost $1.5 million and purchased January 5, 2010) with 30 units that rent for $27,000 per month and are at 90% occupancy.

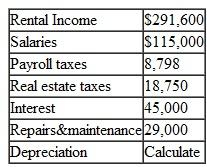

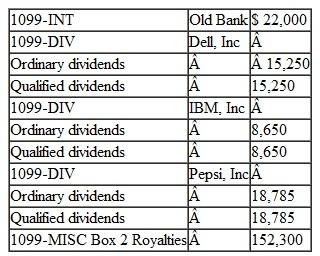

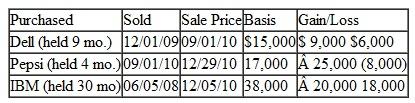

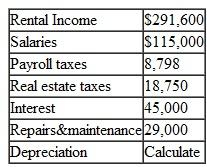

The following is also for the year:

The following is also for the year:

On January 3, 2011, Dave repurchased the exact number of shares he sold on 12/29/11.

On January 3, 2011, Dave repurchased the exact number of shares he sold on 12/29/11.

The Stanleys' paid $13,000 each quarter (4 payments) in federal estimated income taxes.

Prepare Form 1040 for the Stanleys. You will need Form 1040, Schedule B, Schedule D, Schedule E, Schedule M, and Form 4562.

The rental property is an apartment complex (building cost $1.5 million and purchased January 5, 2010) with 30 units that rent for $27,000 per month and are at 90% occupancy.

The following is also for the year:

The following is also for the year:

On January 3, 2011, Dave repurchased the exact number of shares he sold on 12/29/11.

On January 3, 2011, Dave repurchased the exact number of shares he sold on 12/29/11.The Stanleys' paid $13,000 each quarter (4 payments) in federal estimated income taxes.

Prepare Form 1040 for the Stanleys. You will need Form 1040, Schedule B, Schedule D, Schedule E, Schedule M, and Form 4562.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

55

If a taxpayer moves within two years after moving into a new home and uses the exclusion on his former home, is any gain taxable on the sale of the new home? Under what conditions can some of the exclusion be used?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

56

A warehouse with an adjusted basis of $250,000 was destroyed by a tornado on April 15, 2010. On June 15, 2010, the insurance company paid the owner $395,000. The owner reinvested $470,000 in a new warehouse. What is the basis of the new warehouse if nonrecognition of gain from an involuntary conversion is elected? a. $105,000.

B) $250,000.

C) $325,000.

D) $395,000.

B) $250,000.

C) $325,000.

D) $395,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

57

Kim owns equipment that is used exclusively in her business. The equipment has an adjusted basis of $8,500 (FMV $5,000). Kim transfers the equipment and $2,000 cash to David for a computer (also used for business purposes) that has a FMV of $7,000.

a. What is Kim's recognized gain or loss on the exchange?

b. What is Kim's adjusted basis in the computer?

a. What is Kim's recognized gain or loss on the exchange?

b. What is Kim's adjusted basis in the computer?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

58

Discuss the characteristics of what is considered a like-kind asset. Must the asset received in a like-kind exchange be an exact duplicate of the asset given? Explain.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

59

What happens in the following circumstances if a wife, prior to marriage, uses the exclusion on the sale of a residence and subsequently (after marriage) sells a second residence within two years?

a. The new husband sells a residence;

b. The new husband dies within two years and the wife sells the residence;

a. The new husband sells a residence;

b. The new husband dies within two years and the wife sells the residence;

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

60

Kyla owns a convenience store with an adjusted basis of $215,000 that was destroyed by a flood on August 15, 2010. Kyla received a check for $275,000 from her insurance company on January 10, 2010, compensating her for the damage to her store. What is the latest date on which Kyla can buy replacement property to avoid recognition of any realized gain? a. August 15, 2012.

B) December 31, 2012.

C) January 10, 2013.

D) December 31, 2014.

B) December 31, 2012.

C) January 10, 2013.

D) December 31, 2014.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

61

Joshua owns undeveloped land that has an adjusted basis of $45,000. He exchanges it for other undeveloped land with a FMV of $70,000.

a. What are his realized and recognized gain or loss on the exchange?

b. What is his basis in the acquired land?

a. What are his realized and recognized gain or loss on the exchange?

b. What is his basis in the acquired land?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

62

What is boot ? How does the receipt of boot affect a like-kind exchange?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

63

What is a related-party loss, and why is it disallowed?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

64

On June 15, 2010, Allen sold land held for investment to Stan for $50,000 and an installment note of $250,000 payable in five equal annual installments beginning on June 15, 2011, plus interest at 10%. Allen's basis in the land is $150,000. What amount of gain is recognized in 2010 under the installment method? a. $0.

B) $25,000.

C) $50,000.

D)$150,000.

B) $25,000.

C) $50,000.

D)$150,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

65

Patti's garage (used to store business property) is destroyed by a fire. She decides not to replace it and uses the insurance proceeds to invest in her business. The garage had an adjusted basis of $50,000.

a. If the insurance proceeds total $20,000, what is Patti's recognized gain or loss?

b. If the insurance proceeds total $60,000, what is Patti's recognized gain or loss?

a. If the insurance proceeds total $20,000, what is Patti's recognized gain or loss?

b. If the insurance proceeds total $60,000, what is Patti's recognized gain or loss?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck