Deck 15: Corporate Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/63

Play

Full screen (f)

Deck 15: Corporate Taxation

1

Explain the rules pertaining to the deductibility of charitable contributions for a C corporation.

A C-corporation includes sole proprietorships, partnerships, regular corporations. It gets the designation C as the tax laws pertaining to them are provided by Subchapter C of the Internal Revenue Code.C-corporations are allowed to deduct charitable contributions, if made to eligible charitable entities. The deduction is lower of charitable contribution or 10% of taxable income arrived before considering the below items:

• Amount contributed to charitable organization

• Deduction for dividend received (DRD)• Net operating loss carryback

• Capital loss carryback

Any amount of charitable contribution remaining after the permissible limit can be carried forward for 5 years and will be aggregated in charitable contributions for that year before computing the above-mentioned permissible limit. The deduction for unabsorbed charitable contributions of prior years is deducted first in future years.

Example 1:

In the year 2019, Frederick corporation has a taxable income of $56,000 before considering charitable contributions, DRD, Net operating loss carryback and capital loss carryback.Charitable contributions during the year amounted to $15,000.

1. Compute the maximum deduction for charitable contribution permissible in the year 2019.

2. Compute the charitable contribution to be carried forward.Solution:

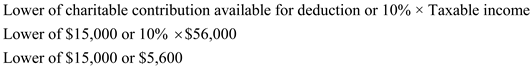

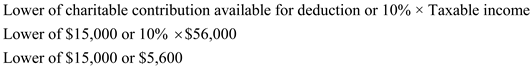

1. The maximum deduction for charitable contribution permissible in the year 2019 will be lower of charitable contribution or 10% of taxable income before considering charitable contributions, DRD, Net operating loss carryback and capital loss carryback. Therefore, permissible deduction amount is $5,600 which is calculated as:

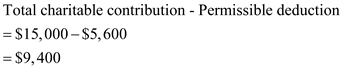

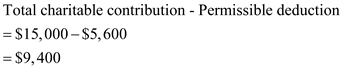

2. Charitable contribution to be carried forward:

2. Charitable contribution to be carried forward:

This amount can be carried forward up to the year 2024.

This amount can be carried forward up to the year 2024.

Example 2: Continuing example 1, suppose taxable income in year 2020 is $103,000 before considering charitable contributions, DRD, Net operating loss carryback and capital loss carryback. The charitable contribution made during the year are $13,000.

1. Compute the maximum deduction for charitable contribution permissible in the year 2020.

2. Compute the charitable contribution of year 2019 to be deducted.3. Compute the charitable contribution to be carried forward.Solution:

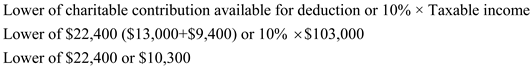

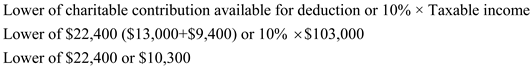

1. The maximum deduction for charitable contribution permissible in the year 2019 will be lower of charitable contribution or 10% of taxable income before considering charitable contributions, DRD, Net operating loss carryback and capital loss carryback. Therefore, permissible deduction amount is $10,300 which is calculated as:

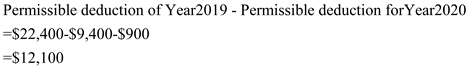

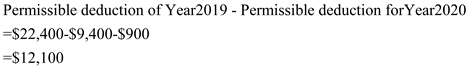

2. Out of $10,300 to be deducted, first unabsorbed charitable contribution of prior year that is $9,400 will be adjusted. Therefore, amount of charitable contribution of current year allowed as deduction is $900 ($10,300-$9,400).

2. Out of $10,300 to be deducted, first unabsorbed charitable contribution of prior year that is $9,400 will be adjusted. Therefore, amount of charitable contribution of current year allowed as deduction is $900 ($10,300-$9,400).

3. Charitable contribution to be carried forward:

Since, the unallowed deduction of year 2019 is adjusted in year 2020, the remaining unallowed deduction pertains to year 2020 and can be carried forward up to year 2025.

Since, the unallowed deduction of year 2019 is adjusted in year 2020, the remaining unallowed deduction pertains to year 2020 and can be carried forward up to year 2025.

• Amount contributed to charitable organization

• Deduction for dividend received (DRD)• Net operating loss carryback

• Capital loss carryback

Any amount of charitable contribution remaining after the permissible limit can be carried forward for 5 years and will be aggregated in charitable contributions for that year before computing the above-mentioned permissible limit. The deduction for unabsorbed charitable contributions of prior years is deducted first in future years.

Example 1:

In the year 2019, Frederick corporation has a taxable income of $56,000 before considering charitable contributions, DRD, Net operating loss carryback and capital loss carryback.Charitable contributions during the year amounted to $15,000.

1. Compute the maximum deduction for charitable contribution permissible in the year 2019.

2. Compute the charitable contribution to be carried forward.Solution:

1. The maximum deduction for charitable contribution permissible in the year 2019 will be lower of charitable contribution or 10% of taxable income before considering charitable contributions, DRD, Net operating loss carryback and capital loss carryback. Therefore, permissible deduction amount is $5,600 which is calculated as:

2. Charitable contribution to be carried forward:

2. Charitable contribution to be carried forward: This amount can be carried forward up to the year 2024.

This amount can be carried forward up to the year 2024.Example 2: Continuing example 1, suppose taxable income in year 2020 is $103,000 before considering charitable contributions, DRD, Net operating loss carryback and capital loss carryback. The charitable contribution made during the year are $13,000.

1. Compute the maximum deduction for charitable contribution permissible in the year 2020.

2. Compute the charitable contribution of year 2019 to be deducted.3. Compute the charitable contribution to be carried forward.Solution:

1. The maximum deduction for charitable contribution permissible in the year 2019 will be lower of charitable contribution or 10% of taxable income before considering charitable contributions, DRD, Net operating loss carryback and capital loss carryback. Therefore, permissible deduction amount is $10,300 which is calculated as:

2. Out of $10,300 to be deducted, first unabsorbed charitable contribution of prior year that is $9,400 will be adjusted. Therefore, amount of charitable contribution of current year allowed as deduction is $900 ($10,300-$9,400).

2. Out of $10,300 to be deducted, first unabsorbed charitable contribution of prior year that is $9,400 will be adjusted. Therefore, amount of charitable contribution of current year allowed as deduction is $900 ($10,300-$9,400).3. Charitable contribution to be carried forward:

Since, the unallowed deduction of year 2019 is adjusted in year 2020, the remaining unallowed deduction pertains to year 2020 and can be carried forward up to year 2025.

Since, the unallowed deduction of year 2019 is adjusted in year 2020, the remaining unallowed deduction pertains to year 2020 and can be carried forward up to year 2025. 2

25) Which of the following statements is correct? a. A calendar year corporation must file its tax return no later than April 15 unless it requests an extension.

B) A corporation is a legal entity that is taxed on its taxable income.

C) Corporations choose their tax year in their first year of operation and can elect to change it in their third year of operation.

D) Large corporations without inventory can choose to use either the cash or accrual method of accounting.

B) A corporation is a legal entity that is taxed on its taxable income.

C) Corporations choose their tax year in their first year of operation and can elect to change it in their third year of operation.

D) Large corporations without inventory can choose to use either the cash or accrual method of accounting.

A corporation is an operation of business that is run by individual or group of individual. A corporation must prepare their financial statements and file their taxation return regularly.

a. A calendar year corporation must file its tax return no later than April 15 unless it requests an extension.

This option is incorrect because a calendar year corporation must file its tax return no later than March 15.

b. A corporation is a legal entity that is taxed on its taxable income.This option is correct because a corporation is a legal entity which can be taxed on its taxable income.

c. Corporation choose their tax year in their first year of operation and can elect to change it in their third year of operation.

This option is incorrect because a corporation can choose to file their first tax return without approval of IRS later for changing they need to take approval from IRS.

d. Large Corporation without inventory can choose to use either the cash or accrual method of accounting.This option is incorrect because large corporation must use accrual method of accounting whether the corporation is inventory based or without inventory.

Hence option B is correct because this statement is correct out of all the options.

a. A calendar year corporation must file its tax return no later than April 15 unless it requests an extension.

This option is incorrect because a calendar year corporation must file its tax return no later than March 15.

b. A corporation is a legal entity that is taxed on its taxable income.This option is correct because a corporation is a legal entity which can be taxed on its taxable income.

c. Corporation choose their tax year in their first year of operation and can elect to change it in their third year of operation.

This option is incorrect because a corporation can choose to file their first tax return without approval of IRS later for changing they need to take approval from IRS.

d. Large Corporation without inventory can choose to use either the cash or accrual method of accounting.This option is incorrect because large corporation must use accrual method of accounting whether the corporation is inventory based or without inventory.

Hence option B is correct because this statement is correct out of all the options.

3

Which of the following items increase basis for a stockholder of a Subchapter S corporation? a. Capital contributions.

B) Charitable contributions.

C) Net losses.

D) Distributions from the corporation.

B) Charitable contributions.

C) Net losses.

D) Distributions from the corporation.

Income of S Corporation similar to partnership is taxed in the hands of shareholder but not in the hands of corporation. It is a separate legal entity like any other corporation but for tax purpose it is not treated separate and the income earned by it is charged to its shareholders in their proportionate ratio.

A shareholder's basis in the stock is increased by the following items:

Net income

Separately stated income items

Capital contributions

Loans from the shareholder to the corporation

A shareholder's basis in the stock is decreased by the following items

Net losses

Separately stated expense items like charitable Contribution

Distributions from the corporation at fair market value

Option a. Capital Contributions.

A shareholder's basis in the stock is increased by the following items:

Net income

Separately stated income items

Capital contributions

Loans from the shareholder to the corporation

A shareholder's basis in the stock is decreased by the following items

Net losses

Separately stated expense items like charitable Contribution

Distributions from the corporation at fair market value

Option a. Capital Contributions.

4

Determine the amount of (1) taxable dividend, (2) nontaxable distribution, and (3) capital gain, for the distributions made in each of the following cases:

a. Corporate E P of $10,000, shareholder stock basis of $12,000, distribution of $6,000.

b. Corporate E P of $7,500, shareholder stock basis of $7,000, distribution of $6,500.

c. Corporate E P of $16,000, shareholder stock basis of $5,000, distribution of $17,000.

d. Corporate E P of $14,000, shareholder stock basis of $11,000, distribution of $26,000.

a. Corporate E P of $10,000, shareholder stock basis of $12,000, distribution of $6,000.

b. Corporate E P of $7,500, shareholder stock basis of $7,000, distribution of $6,500.

c. Corporate E P of $16,000, shareholder stock basis of $5,000, distribution of $17,000.

d. Corporate E P of $14,000, shareholder stock basis of $11,000, distribution of $26,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

5

Explain the difference between organizational expenses and start-up expenditures. In what circumstances are they deductible?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

6

A corporation has a fiscal year-end of June. If the corporation does not receive an automatic extension of time to file its return, the return will be due on the 15 th of: a. August.

B) September.

C) October.

D) November.

B) September.

C) October.

D) November.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is incorrect? a. An S corporation can own stock of a C corporation.

B) A C corporation can own stock of an S corporation.

C) An S corporation can be a partner in a partnership.

D) An estate can own stock of an S corporation.

B) A C corporation can own stock of an S corporation.

C) An S corporation can be a partner in a partnership.

D) An estate can own stock of an S corporation.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

8

Go to the IRS Web page (www.irs.gov) and print page 5 of a Form 1120. Complete Schedule M-1 for each of the following cases:

a. Corporate financial statement net income of $52,000 including tax expense of $15,000, charitable contributions of $3,000, and depreciation expense of $37,000. Depreciation expense for tax purposes is $46,000.

b. Corporate financial statement net income of $139,000 including tax expense of $68,000, charitable contributions of $28,000, depreciation expense of $103,000, and travel and entertainment expenses of $31,000. Depreciation expense for tax purposes is $145,000.

c. Corporate financial statement net income of $226,000 including tax expense of $111,000, charitable contributions of $16,000, municipal bond interest of $19,000, travel and entertainment expenses of 41,000, capital gains of $6,000, and depreciation expense of $142,000. Depreciation expense for tax purposes is $131,000 and the corporation has a $7,000 charitable contribution carryforward for the current year.

a. Corporate financial statement net income of $52,000 including tax expense of $15,000, charitable contributions of $3,000, and depreciation expense of $37,000. Depreciation expense for tax purposes is $46,000.

b. Corporate financial statement net income of $139,000 including tax expense of $68,000, charitable contributions of $28,000, depreciation expense of $103,000, and travel and entertainment expenses of $31,000. Depreciation expense for tax purposes is $145,000.

c. Corporate financial statement net income of $226,000 including tax expense of $111,000, charitable contributions of $16,000, municipal bond interest of $19,000, travel and entertainment expenses of 41,000, capital gains of $6,000, and depreciation expense of $142,000. Depreciation expense for tax purposes is $131,000 and the corporation has a $7,000 charitable contribution carryforward for the current year.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

9

Why does the marginal tax rate vary up and down for taxable incomes over $100,000?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

10

Two individuals form a corporation and own all of its stock. One individual contributes cash, and the other contributes property encumbered by a mortgage. The new corporation assumes the mortgage. Which of the following statements is true with respect to the individual who contributes the property? a. Because the 80% test is met, no gain or loss will be recognized.

B) Gain is recognized to the extent of relief of liability.

C) Gain is recognized to the extent of relief of liability in excess of the basis of property contributed.

D) Gain is recognized to the extent the fair market value of the stock exceeds the basis of the property contributed.

B) Gain is recognized to the extent of relief of liability.

C) Gain is recognized to the extent of relief of liability in excess of the basis of property contributed.

D) Gain is recognized to the extent the fair market value of the stock exceeds the basis of the property contributed.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

11

Which, if any, of the following statements concerning the shareholders of a Subchapter S corporation is correct? a. Shareholders are taxed on their proportionate share of earnings that are distributed.

B) Shareholders are taxed on the distributions from the corporation.

C) Shareholders are taxed on their proportionate share of earnings whether or not distributed.

D) None of these statements are correct.

B) Shareholders are taxed on the distributions from the corporation.

C) Shareholders are taxed on their proportionate share of earnings whether or not distributed.

D) None of these statements are correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

12

A corporation has regular taxable income of $370,000 and a regular tax liability of $125,800. It has positive tax preference items totaling $310,000. You have determined that the corporation is subject to alternative minimum tax because it has average annual gross receipts of $9,000,000. Determine the amount of AMT owed by the corporation, if any.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

13

On what dates are estimated payments due for a calendar year corporation? What are the dates for a corporation with a fiscal year ending July 31?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

14

Tameka and Janelle form a corporation in which each will own 50% of the stock. Tameka contributes $50,000 in cash. Janelle contributes property with a basis of $30,000 and a FMV of $60,000. She receives $10,000 of inventory from the corporation. Which of the following statements is true? a. Janelle will report a gain of $10,000.

B) Janelle will report a gain of $30,000.

C) Tameka will report a gain of $10,000.

D) Neither Tameka nor Janelle will report a gain or loss as a result of these transactions.

B) Janelle will report a gain of $30,000.

C) Tameka will report a gain of $10,000.

D) Neither Tameka nor Janelle will report a gain or loss as a result of these transactions.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

15

Chen received a $10,000 dividend from a Subchapter C corporation. He also owns a 50% interest in a Subchapter S corporation that reported $100,000 of taxable income. He received a distribution of $20,000 from the Subchapter S corporation. How much income will Chen report as a result of these events? a. $30,000.

B) $40,000.

C) $60,000.

D) $80,000.

B) $40,000.

C) $60,000.

D) $80,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

16

Refer to Problem 54. Determine the amount of taxable income and separately stated items in each case, assuming the corporation was a Subchapter S corporation.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

17

Explain the rules associated with the carryback and carryforward of net operating losses.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

18

Svetlana forms a corporation in which she is the sole shareholder. She contributes a vehicle with a basis of $15,000 and a FMV of $8,000 in exchange for stock. She also contributes cash of $2,000. Svetlana will recognize: a. A $5,000 loss.

B) A $7,000 loss.

C) A $10,000 loss.

D) Neither a gain nor loss.

B) A $7,000 loss.

C) A $10,000 loss.

D) Neither a gain nor loss.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

19

When a corporation is formed, the transferor may report a gain in certain cases. What are the instances in which a gain would be reported? In these cases, what is the basis of the stock held by the transferor?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

20

Refer to Problem 58. Determine the amount of taxable income and separately stated items in each case, assuming the corporation was a Subchapter S corporation. Ignore any carryforward items.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

21

A corporation may make a distribution to its shareholders. Depending on the circumstances, in the hands of the shareholder, the distribution can be classified as a dividend, a tax-free distribution or a capital gain. Explain the circumstances in which each classification can occur.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

22

Annabelle forms a corporation in which she is the sole shareholder. She transfers $20,000 cash plus land with a $100,000 adjusted basis and a $160,000 FMV in exchange for all the stock of the corporation. The corporation assumes the $140,000 mortgage on the land. What is her basis in the stock, and what is the gain she must report (if any)? a. No gain; stock basis is $120,000.

B) Gain of $20,000; stock basis is $120,000.

C) No gain; stock basis is $100,000.

D) Gain of $20,000; stock basis is zero.

B) Gain of $20,000; stock basis is $120,000.

C) No gain; stock basis is $100,000.

D) Gain of $20,000; stock basis is zero.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

23

An individual contributes property with a FMV in excess of basis to a corporation in exchange for stock. The property is subject to a mortgage. In each of the following instances, determine the basis of the stock in the hands of the shareholder and the basis of the property contributed in the hands of the corporation. Assume that the 80% rule is met.

a. The property is subject to a mortgage that is less than basis and the corporation assumes the mortgage.

b. The property is subject to a mortgage that is more than basis and the corporation assumes the mortgage.

a. The property is subject to a mortgage that is less than basis and the corporation assumes the mortgage.

b. The property is subject to a mortgage that is more than basis and the corporation assumes the mortgage.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

24

Explain the circumstances in which a corporation can use the accrual basis or the cash basis of accounting.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

25

In what circumstances does a corporation record a gain related to a distribution to a shareholder?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

26

Mountain Company owns 10% of Valley Company. Both are domestic corporations. Valley pays a $60,000 dividend to Mountain. What amount of dividend income will be included in the taxable income of Mountain Company? a. $6,000.

B) $12,000.

C) $18,000.

D) $60,000.

B) $12,000.

C) $18,000.

D) $60,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

27

Determine the basis of stock in the hands of the shareholder in each of the following instances. Assume that the 80% rule is met in all cases.

a. Contribution of property with a basis of $1,000 and a FMV of $1,400.

b. Contribution of property with a basis of $3,000 and a FMV of $3,800. The stockholder also received $500 cash from the corporation as part of the stock transaction.

c. Contribution of property with a basis of $8,200 and a FMV of $12,500. The stockholder also received property with a FMV of $1,700 from the corporation as part of the stock transaction.

d. Contribution of a building with a FMV of $200,000, a mortgage (assumed by the corporation) of $100,000, and a basis of $125,000.

e. Contribution of a building with a FMV of $1,700,000, a mortgage (assumed by the corporation) of $1,000,000, and a basis of $635,000.

a. Contribution of property with a basis of $1,000 and a FMV of $1,400.

b. Contribution of property with a basis of $3,000 and a FMV of $3,800. The stockholder also received $500 cash from the corporation as part of the stock transaction.

c. Contribution of property with a basis of $8,200 and a FMV of $12,500. The stockholder also received property with a FMV of $1,700 from the corporation as part of the stock transaction.

d. Contribution of a building with a FMV of $200,000, a mortgage (assumed by the corporation) of $100,000, and a basis of $125,000.

e. Contribution of a building with a FMV of $1,700,000, a mortgage (assumed by the corporation) of $1,000,000, and a basis of $635,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

28

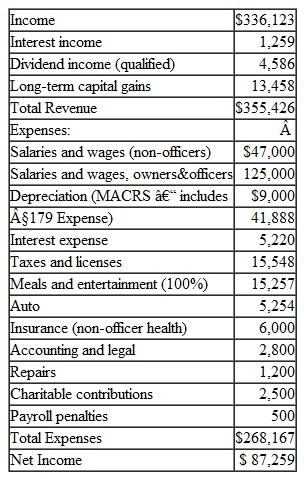

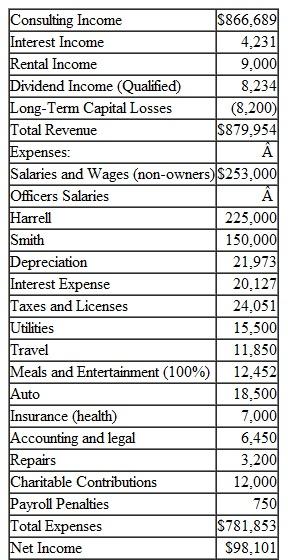

Phil Williams and Liz Johnson are 60% and 40% shareholders, respectively, in WJ Corporation, a Subchapter S corporation. The corporation had the following activity during the year:

During the year, the corporation made a distribution of $20,000, in total, to its shareholders.

During the year, the corporation made a distribution of $20,000, in total, to its shareholders.

Complete page 1, Schedule K, and Schedule M-1 of Form 1120S

******Insert TRP 1 solutions here. Three files ******

During the year, the corporation made a distribution of $20,000, in total, to its shareholders.

During the year, the corporation made a distribution of $20,000, in total, to its shareholders.Complete page 1, Schedule K, and Schedule M-1 of Form 1120S

******Insert TRP 1 solutions here. Three files ******

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

29

What is Schedule M-1, and what is its purpose?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

30

For Subchapter C corporations, which of the following statements is true? a. Capital losses can be carried back 3 years and then carried forward 5 years.

B) Corporations can elect to forego the carryback period for capital losses and only carry the losses forward.

C) Capital losses can be carried back 2 years and then carried forward 20 years.

D) Capital losses are permitted up to $3,000 per year.

B) Corporations can elect to forego the carryback period for capital losses and only carry the losses forward.

C) Capital losses can be carried back 2 years and then carried forward 20 years.

D) Capital losses are permitted up to $3,000 per year.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

31

Using the information from Problem 47, determine the basis of the property contributed in the hands of the corporation in each instance. Assume that the 80% rule is met in all cases.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

32

When must a corporate tax return be filed? Can a corporation receive an extension of time to file a return and, if so, what is the length of the extension?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

33

What is Schedule L, and what is its purpose?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is false? a. A corporation with average sales in excess of $5,000,000 must use the accrual method of accounting.

B) The charitable contributions of a corporation may be limited.

C) A corporation may be entitled to a deduction for dividends received from other domestic corporations.

D) Passive loss rules apply to corporations.

B) The charitable contributions of a corporation may be limited.

C) A corporation may be entitled to a deduction for dividends received from other domestic corporations.

D) Passive loss rules apply to corporations.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

35

Explain the operation of the dividends received deduction.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

36

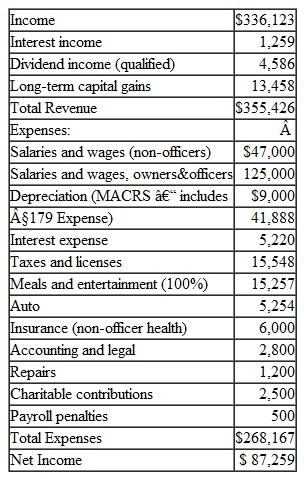

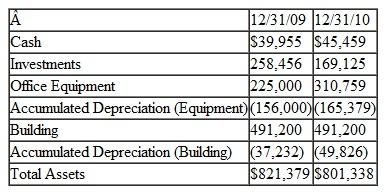

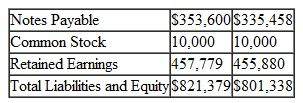

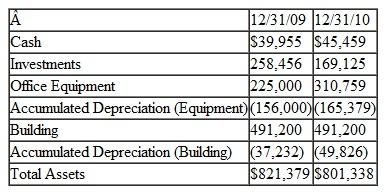

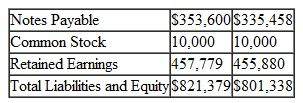

Harrell and Smith, Inc. 204 Ambulance Street, Anywhere, CA 92345, is a corporation (EIN 57-1234567) formed on January 1, 2007. Information concerning the corporation and its two shareholders follows. Harell and Smith uses the tax/cash basis accounting, did not pay dividends in excess of earnings and profits, has no foreign shareholders, is not publicly traded, and has no NOL carrybacks.

Bruce Harrell (SSN 412-34-5670), 1018 Lexington Downs, Anywhere, CA 92345 is a 60% shareholder. Della Smith (SSN 412-34-5671), 4564 Yates Rd., Anywhere, CA 92345, is a 40% shareholder. Bruce received a dividend of $60,000, and Della received a dividend of $40,000. Both of these dividends are in addition to their salaries.

Harrell and Smith Fuels, Inc.

Comparative Balance Sheet

As of December 31, 2009 and December 31, 2010

Assets:

Liabilities and Equity:

Liabilities and Equity:

Harrell and Smith Fuels, Inc.

Harrell and Smith Fuels, Inc.

Income Statement

For the Year Ending December 31, 2010

Required: Prepare Form 1120 pages 1-5 for Harrell and Smith, Inc. Schedule D, and Form 4562 can be omitted (the information given is not sufficient to complete these forms).

Required: Prepare Form 1120 pages 1-5 for Harrell and Smith, Inc. Schedule D, and Form 4562 can be omitted (the information given is not sufficient to complete these forms).

***** Insert Form 1120, 5 pages here **********

Bruce Harrell (SSN 412-34-5670), 1018 Lexington Downs, Anywhere, CA 92345 is a 60% shareholder. Della Smith (SSN 412-34-5671), 4564 Yates Rd., Anywhere, CA 92345, is a 40% shareholder. Bruce received a dividend of $60,000, and Della received a dividend of $40,000. Both of these dividends are in addition to their salaries.

Harrell and Smith Fuels, Inc.

Comparative Balance Sheet

As of December 31, 2009 and December 31, 2010

Assets:

Liabilities and Equity:

Liabilities and Equity:  Harrell and Smith Fuels, Inc.

Harrell and Smith Fuels, Inc.Income Statement

For the Year Ending December 31, 2010

Required: Prepare Form 1120 pages 1-5 for Harrell and Smith, Inc. Schedule D, and Form 4562 can be omitted (the information given is not sufficient to complete these forms).

Required: Prepare Form 1120 pages 1-5 for Harrell and Smith, Inc. Schedule D, and Form 4562 can be omitted (the information given is not sufficient to complete these forms).***** Insert Form 1120, 5 pages here **********

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

37

For purposes of the corporate alternative minimum tax, explain the application of the AMT exemption amount and its phaseout.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

38

A calendar year corporate taxpayer must make its final estimated tax payment on the 15 th of which month? a. November.

B) December.

C) January.

D) February.

B) December.

C) January.

D) February.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

39

Determine the amount of dividends received deduction in each of the following instances. In all cases, the net income figure includes the full dividend.

a. Dividend of $10,000 from a 45% owned corporation; taxable income before DRD of $50,000.

b. Dividend of $19,000 from a 15% owned corporation; taxable income before DRD of $75,000.

c. Dividend of $22,000 from a 60% owned corporation; taxable income before DRD of $11,000.

d. Dividend of $8,000 from a 10% owned corporation; taxable income before DRD of $7,000.

a. Dividend of $10,000 from a 45% owned corporation; taxable income before DRD of $50,000.

b. Dividend of $19,000 from a 15% owned corporation; taxable income before DRD of $75,000.

c. Dividend of $22,000 from a 60% owned corporation; taxable income before DRD of $11,000.

d. Dividend of $8,000 from a 10% owned corporation; taxable income before DRD of $7,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

40

Without regard to any extensions of time to file, when is the income tax return due for a corporation with a May 31 year-end? An August 31 year-end? A February 28 year-end?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

41

Under what circumstances can a parent-subsidiary group file a consolidated income tax return?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

42

Which, if any, of the following statements concerning the shareholders of a Subchapter C corporation is correct? a. Shareholders are taxed on their proportionate share of earnings and profits as they are earned.

B) Shareholders are taxed on distributions from corporate earnings and profits.

C) Shareholders are never taxed on earnings and profits or distributions from the corporation.

D) None of these statements are correct.

B) Shareholders are taxed on distributions from corporate earnings and profits.

C) Shareholders are never taxed on earnings and profits or distributions from the corporation.

D) None of these statements are correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

43

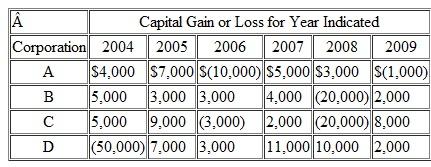

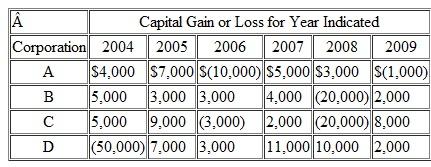

For each of the following cases, determine the amount of capital gain or loss to report in each year (after taking into account any applicable carrybacks) and the capital loss carryforward to 2010, if any. Assume that 2004 is the first year of operation for each corporation.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

44

Explain the 80% rule as it pertains to the formation of a corporation.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

45

Why might a parent-subsidiary group choose to file, or not to file, a consolidated income tax return?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

46

Parker Company has earnings and profits of $8,000. It distributes capital gain property with a basis of $2,000 and FMV of $9,000 to Gertrude Parker, its sole shareholder. Gertrude has a basis of $10,000 in her stock. Which of the following statements is true with respect to this transaction? a. Gertrude will report dividend income of $2,000 and a capital gain of $7,000.

B) Gertrude will report dividend income of $8,000.

C) Gertrude will report dividend income of $8,000 and a nontaxable distribution of $1,000.

D) Gertrude will report dividend income of $9,000.

B) Gertrude will report dividend income of $8,000.

C) Gertrude will report dividend income of $8,000 and a nontaxable distribution of $1,000.

D) Gertrude will report dividend income of $9,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

47

Determine the deductible charitable contribution in each of the following instances.

a. Charitable contribution of $4,000 and taxable income before charitable contribution of $50,000.

b. Charitable contribution of $8,000 and taxable income before charitable contribution of $50,000.

c. Charitable contribution of $4,800 and taxable income before charitable contribution of $50,000. Taxable income includes a net operating loss carryforward of $5,000.

d. Charitable contribution of $4,800 and taxable income before charitable contribution of $40,000. Taxable income includes a capital loss carryback of $5,000.

a. Charitable contribution of $4,000 and taxable income before charitable contribution of $50,000.

b. Charitable contribution of $8,000 and taxable income before charitable contribution of $50,000.

c. Charitable contribution of $4,800 and taxable income before charitable contribution of $50,000. Taxable income includes a net operating loss carryforward of $5,000.

d. Charitable contribution of $4,800 and taxable income before charitable contribution of $40,000. Taxable income includes a capital loss carryback of $5,000.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

48

In what instances could a gain be recorded associated with the issuance of stock upon formation of a corporation? Assume that the 80% test is met.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

49

What are the two tests used to determine whether a group of corporations is a brother-sister group?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is a negative adjustment on Schedule M-1? a. Federal income tax.

B) Charitable contributions in excess of the 10% limit.

C) Depreciation for books in excess of depreciation for taxes.

D) Tax-exempt interest income.

B) Charitable contributions in excess of the 10% limit.

C) Depreciation for books in excess of depreciation for taxes.

D) Tax-exempt interest income.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

51

Determine the amount of tax liability in each of the following cases.

a. Taxable income of $45,200.

b. Taxable income of $450,200.

c. Taxable income of $4,500,200.

d. Taxable income of $14,500,200.

e. Taxable income of $45,000,200.

a. Taxable income of $45,200.

b. Taxable income of $450,200.

c. Taxable income of $4,500,200.

d. Taxable income of $14,500,200.

e. Taxable income of $45,000,200.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

52

An individual contributes property with a fair market value in excess of basis to a corporation in exchange for stock. What is the basis of the stock in the hands of the shareholder, and what is the basis of the property contributed in the hands of the corporation?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

53

What criteria must a corporation meet to appropriately elect Subchapter S status?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is a positive adjustment on Schedule M-1? a. Excess of capital losses over capital gains.

B) Excess of capital gains over capital losses.

C) Charitable contribution carryover to the current year.

D) Depreciation for taxes in excess of depreciation for books.

B) Excess of capital gains over capital losses.

C) Charitable contribution carryover to the current year.

D) Depreciation for taxes in excess of depreciation for books.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

55

Determine taxable income in each of the following instances. Assume that the corporation is a C corporation and that book income is before any income tax expense.

a. Book income of $50,000 including capital gains of $2,000, a charitable contribution of $1,000, and travel and entertainment expenses of $3,000.

b. Book income of $92,000 including capital losses of $3,000, a charitable contribution of $12,000, and travel and entertainment expenses of $3,000.

c. Book income of $76,000 including municipal bond interest of $2,000, a charitable contribution of $5,000, and dividends of $3,000 from a 10% owned domestic corporation. The corporation also has an $8,000 charitable contribution carryover.

d. Book income of $129,000 including municipal bond interest of $2,000, a charitable contribution of $5,000, and dividends of $7,000 from a 70% owned domestic corporation. The corporation has a capital loss carryover of $6,000 and a capital gain of $2,500 in the current year.

a. Book income of $50,000 including capital gains of $2,000, a charitable contribution of $1,000, and travel and entertainment expenses of $3,000.

b. Book income of $92,000 including capital losses of $3,000, a charitable contribution of $12,000, and travel and entertainment expenses of $3,000.

c. Book income of $76,000 including municipal bond interest of $2,000, a charitable contribution of $5,000, and dividends of $3,000 from a 10% owned domestic corporation. The corporation also has an $8,000 charitable contribution carryover.

d. Book income of $129,000 including municipal bond interest of $2,000, a charitable contribution of $5,000, and dividends of $7,000 from a 70% owned domestic corporation. The corporation has a capital loss carryover of $6,000 and a capital gain of $2,500 in the current year.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

56

What is the dividends received deduction? What is its purpose?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

57

A calendar year corporation properly files a Subchapter S election on January 10, 2010. On what date is the election effective? What if the election were filed on June 1, 2010?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

58

Banana Company is widely held. It owns 85% of Strawberry Corporation. Two individuals hold the remaining 15%. Which of the following statements is true? a. Banana and Strawberry must file a consolidated tax return.

B) Banana and Strawberry can elect to file a consolidated tax return.

C) Banana and Strawberry can file a consolidated tax return if the other owners of Strawberry agree.

D) Banana and Strawberry are brother-sister corporations.

B) Banana and Strawberry can elect to file a consolidated tax return.

C) Banana and Strawberry can file a consolidated tax return if the other owners of Strawberry agree.

D) Banana and Strawberry are brother-sister corporations.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

59

Using the information from Problem 54, calculate the amount of tax liability in each instance.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

60

Explain the rules associated with capital loss carrybacks and carryforwards.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

61

The Subchapter S status of a calendar year corporation is statutorily terminated on August 12, 2010. The Subchapter S status is deemed to be terminated on what date? What is the answer if the status were voluntarily revoked on that date?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

62

What missing dollar amounts are correct in the following sentence? The AMT exemption is $_____ for corporations with AMT income of $______ or less. a. $40,000; $150,000.

B) $40,000; $310,000.

C) $150,000; $310,000.

D) The question cannot be answered with the information given.

B) $40,000; $310,000.

C) $150,000; $310,000.

D) The question cannot be answered with the information given.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

63

LMNO Corporation was formed in 2003. It reported net income (loss) over the 2003 through 2009 tax years, before accounting for any net operating losses, as follows:

2003 $ (4,000)

2004 $ 19,000

2005 $ 23,000

2006 $ (31,000)

2007 $ 11,000

2008 $ ( 8,000)

2009 $ 3,000

a. Determine annual taxable income after accounting for any net operating losses for 2003 to 2009, assuming the corporation does not waive the carryback period. Also determine any NOL carryforward to 2010.

b. Determine annual taxable income after accounting for any net operating losses for 2003 to 2009, assuming the corporation waives the carryback period. Also determine any NOL carryforward to 2010.

2003 $ (4,000)

2004 $ 19,000

2005 $ 23,000

2006 $ (31,000)

2007 $ 11,000

2008 $ ( 8,000)

2009 $ 3,000

a. Determine annual taxable income after accounting for any net operating losses for 2003 to 2009, assuming the corporation does not waive the carryback period. Also determine any NOL carryforward to 2010.

b. Determine annual taxable income after accounting for any net operating losses for 2003 to 2009, assuming the corporation waives the carryback period. Also determine any NOL carryforward to 2010.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck