Deck 9: Market Failure and Externalities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/18

Play

Full screen (f)

Deck 9: Market Failure and Externalities

1

BARRIERS TO ENTRY Complete each of the following sentences:

a. A U.S. _______ awards inventors the exclusive right to production for 20 years.

b. Patents and licenses are examples of government-imposed ______ that prevent entry into an industry.

c. When economies of scale make it possible for a single firm to satisfy market demand at a lower cost per unit than could two or more firms, the single firm is considered a _______.

d. A potential barrier to entry is a firm's control of a(n) ______ critical to production in the industry.

a. A U.S. _______ awards inventors the exclusive right to production for 20 years.

b. Patents and licenses are examples of government-imposed ______ that prevent entry into an industry.

c. When economies of scale make it possible for a single firm to satisfy market demand at a lower cost per unit than could two or more firms, the single firm is considered a _______.

d. A potential barrier to entry is a firm's control of a(n) ______ critical to production in the industry.

a.Patent right:

Patent is a kind of intellectual property rights, given by the government to the inventor for a particular period of time. In U.S., patent right is given for 20 years. Patent rights legally protect the patentee from others reproducing, using, selling, and distributing the patented invention to others without his/her permission.

b.Legal restriction:

Patent is a kind of intellectual property rights, given by the government to impose legal restrictions that prevent entry in to an industry.

c.Monopoly:

Natural monopoly:

Natural monopoly refers to the firm that has entire market share and produces at lower cost of production. If there is a competition, then it leads to increase in the cost of production. Natural monopoly can be achieved through public ownership and public regulation that regulates the price of monopoly firm.

Since the firm controls 100% market and has lower unit cost, it is considered as n atural monopoly.

d.Barrier entry:

Barriers to entry refers that an existing firm restricts the new firm to enter the business through controls such as essential or non reproducible resource , low cost of production, and low price.

Patent is a kind of intellectual property rights, given by the government to the inventor for a particular period of time. In U.S., patent right is given for 20 years. Patent rights legally protect the patentee from others reproducing, using, selling, and distributing the patented invention to others without his/her permission.

b.Legal restriction:

Patent is a kind of intellectual property rights, given by the government to impose legal restrictions that prevent entry in to an industry.

c.Monopoly:

Natural monopoly:

Natural monopoly refers to the firm that has entire market share and produces at lower cost of production. If there is a competition, then it leads to increase in the cost of production. Natural monopoly can be achieved through public ownership and public regulation that regulates the price of monopoly firm.

Since the firm controls 100% market and has lower unit cost, it is considered as n atural monopoly.

d.Barrier entry:

Barriers to entry refers that an existing firm restricts the new firm to enter the business through controls such as essential or non reproducible resource , low cost of production, and low price.

2

BARRIERS TO ENTRY Explain how economies of scale can be a barrier to entry.

Economies of scale:

Economies of scale refer to a fall in the cost of production due to an increase in the level of output production.

Economies of scale provide barrier to entry :

When a firm's cost of production decreases throughout its production process in the long-run, then it enjoys the economies of scale. The economies of scale may occur even when the firm run in profits by investing on the labor, for advertising and other machinery. Mostly, the economies of scale provide barrier to entry to the small firms. Some examples are given below:

- With the increase in demand for the skilled workers, the existing firms enjoy economies of scale thereby, increasing its production. Therefore, this demand for the skilled labor is the entry barrier for the small companies to enter into the new market.

- The advertising costs in the electronic media involved would make the firm run in profits by reaching more customers within less time. And eventually leads to economies of scale. But, this would make the new companies frighten, with the increasing costs of advertising per second pulse, to invest huge amount of capital.

The new firms also cannot enter the market, since its cost of production is higher than the low-cost firms. Hence, economies of scale provide barrier to entry.

Economies of scale refer to a fall in the cost of production due to an increase in the level of output production.

Economies of scale provide barrier to entry :

When a firm's cost of production decreases throughout its production process in the long-run, then it enjoys the economies of scale. The economies of scale may occur even when the firm run in profits by investing on the labor, for advertising and other machinery. Mostly, the economies of scale provide barrier to entry to the small firms. Some examples are given below:

- With the increase in demand for the skilled workers, the existing firms enjoy economies of scale thereby, increasing its production. Therefore, this demand for the skilled labor is the entry barrier for the small companies to enter into the new market.

- The advertising costs in the electronic media involved would make the firm run in profits by reaching more customers within less time. And eventually leads to economies of scale. But, this would make the new companies frighten, with the increasing costs of advertising per second pulse, to invest huge amount of capital.

The new firms also cannot enter the market, since its cost of production is higher than the low-cost firms. Hence, economies of scale provide barrier to entry.

3

Case Study: Is a Diamond Forever?

How did the De Beers cartel try to maintain control of the price in the diamond market? How was this control undermined?

How did the De Beers cartel try to maintain control of the price in the diamond market? How was this control undermined?

Cartel:

Cartel refers to the situation where the producers join together and act as a single firm to maintain a higher price.Maintaining the price:

The DB Company controlled the supply of rough diamond throughout the world. When there is a higher supply, then DB Company buys the excess supply of the rough diamond from the market with the intention to maintain the higher price for the diamond. Since the DB Company controls the supply of rough diamond, it is able to fix and maintain the higher price.Losing the control:

DB Company maintains the higher price by controlling the supply of essential resource of rough diamond. When the new firms from different countries supply the rough diamond in large quantities, then the ability of DB Company's control over the supply of rough diamond would weaken. Hence, DB Company lost the ability to maintain the higher price.

Cartel refers to the situation where the producers join together and act as a single firm to maintain a higher price.Maintaining the price:

The DB Company controlled the supply of rough diamond throughout the world. When there is a higher supply, then DB Company buys the excess supply of the rough diamond from the market with the intention to maintain the higher price for the diamond. Since the DB Company controls the supply of rough diamond, it is able to fix and maintain the higher price.Losing the control:

DB Company maintains the higher price by controlling the supply of essential resource of rough diamond. When the new firms from different countries supply the rough diamond in large quantities, then the ability of DB Company's control over the supply of rough diamond would weaken. Hence, DB Company lost the ability to maintain the higher price.

4

REVENUE FOR THE MONOPOLIST How does the demand curve faced by a monopolist differ from the demand curve faced by a perfectly competitive firm?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

5

REVENUE FOR THE MONOPOLIST Why is it impossible for a profit-maximizing monopolist to choose any price and any quantity it wishes?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

6

REVENUE SCHEDULES Explain why the marginal revenue curve for a monopolist lies below its demand curve, rather than coinciding with the demand curve, as is the case for a perfectly competitive firm. When is it ever possible for a monopolist's marginal revenue curve to coincide with its demand curve?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

7

REVENUE CURVES Why would a monopoly firm never knowingly produce on the inelastic portion of its demand curve?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

8

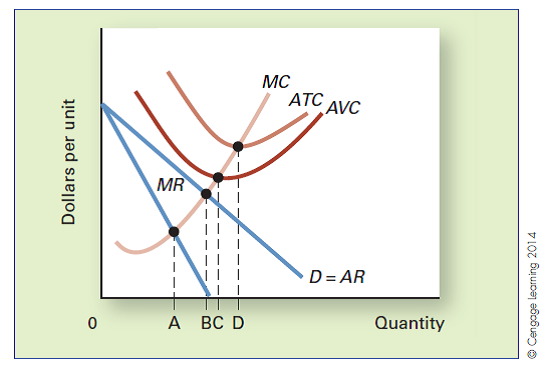

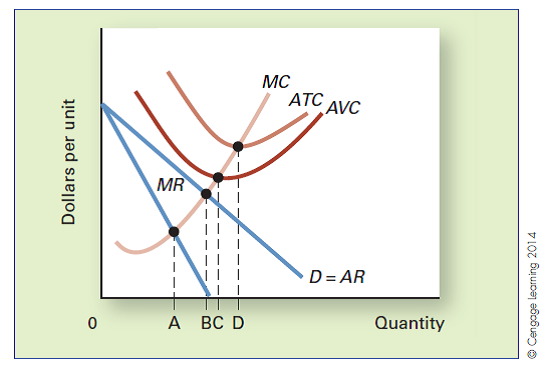

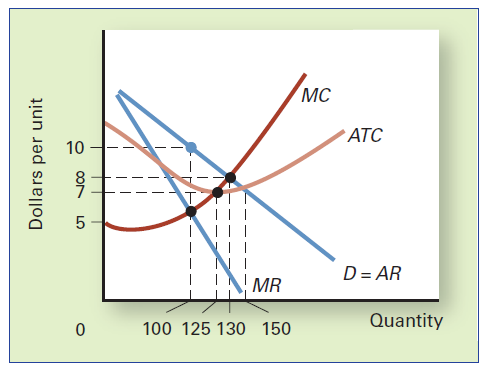

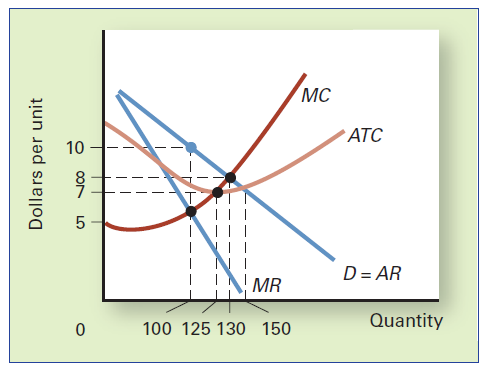

PROFIT MAXIMIZATION Review the following graph showing the short-run situation of a monopolist. What output level does the firm choose in the short run? Why?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

9

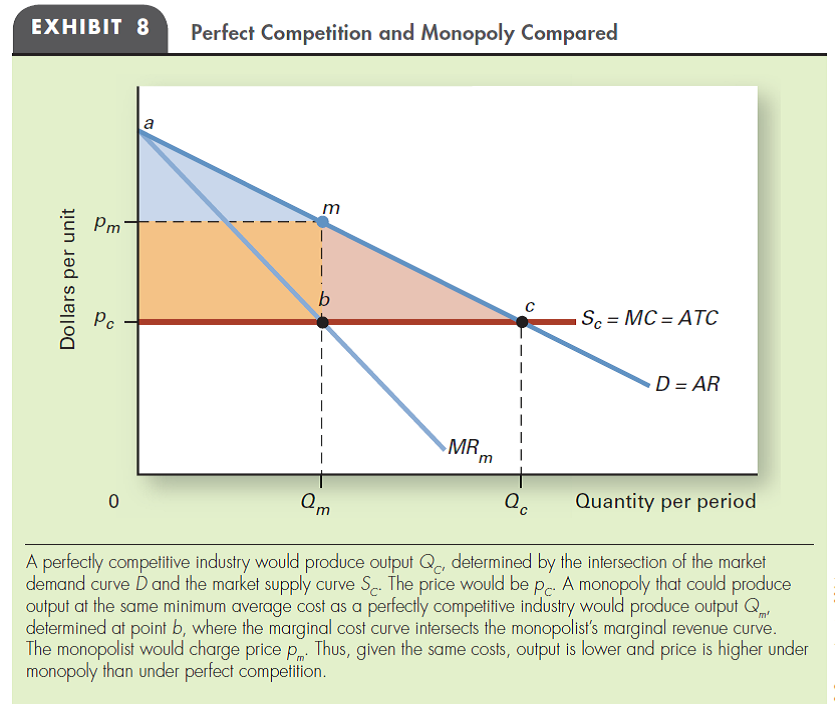

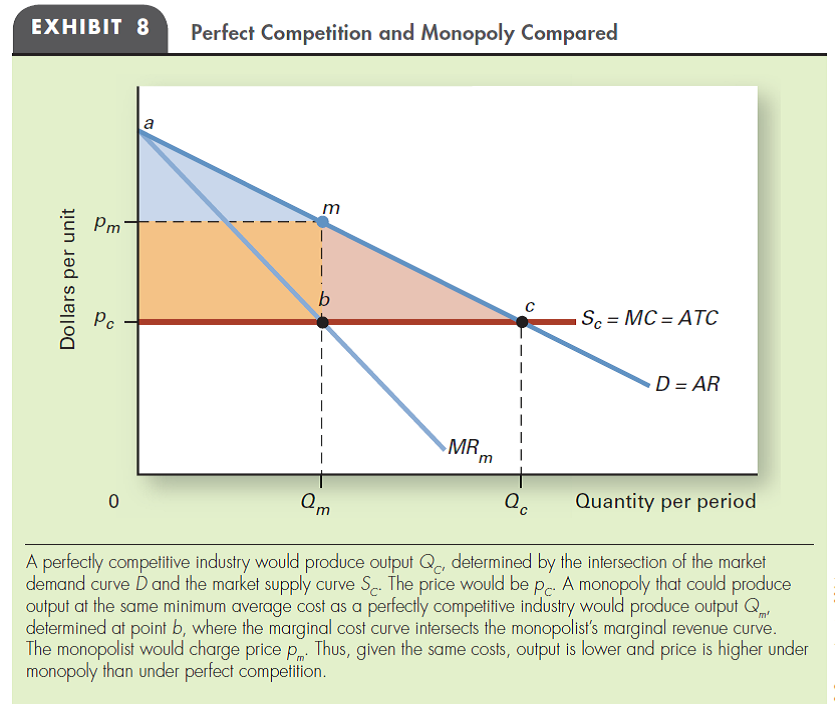

ALLOCATIVE AND DISTRIBUTIVE EFFECTS Why is society worse off under monopoly than under perfect competition, even if both market structures face the same constant long-run average cost curve?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

10

WELFARE COST OF MONOPOLY Explain why the welfare loss of a monopoly may be smaller or larger than the loss shown in Exhibit 8 in this chapter.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

11

Case Study: The Mail Monopoly Can the U.S. Postal Service be considered a monopoly in first-class mail? Why or why not? What has happened to the price elasticity of demand for first class mail in recent years?

Reference Case Study:

Public Policy

The Mail Monopoly The U.S. Post Office was granted a monopoly in 1775 and has operated under federal protection ever since. In 1971, Congress converted the Post Office Department into a semi-independent agency called the U.S. Postal Service, or USPS, which had total revenue of about $70 billion in 2009. Because of the national recession, revenue in 2009 was down 9 percent from 2008 and about the same as in 2006. More than 650,000 employees at 37,000 post offices deliver an average of 177 billion pieces of mail a year to 144 million home and business addresses. This amounts to about 40 percent of the world's total mail delivery. USPS pays no taxes and is exempt from local zoning laws. It has a legal monopoly in delivering regular, first-class letters and has the exclusive right to use the space inside your mailbox. Other delivery services such as FedEx or UPS cannot deliver to mail boxes or post office boxes.

The USPS monopoly has suffered in recent years because of rising costs and growing competition from new technologies. The price of a first-class stamp climbed from 6 cents in 1970 to 44 cents by 2010-a growth rate twice that of inflation. Long distance phone service, one possible substitute for first-class mail, is much cheaper today than in 1970. New technologies such as email, ecards, online bill-payment, text messaging, and social-networking sites also displace USPS delivery services (email messages now greatly outnumber first-class letters). Because its monopoly applies only to regular first-class mail, USPS has lost chunks of other business to private firms offering lower rates and better service. The United Parcel Service (UPS), for example, is more mechanized and more containerized than the USPS and thus has lower costs and less breakage. The USPS has tried to emulate UPS but with only limited success. After Hurricane Katrina, it took seven months to reopen the USPS processing and distribution center in New Orleans. Rivals UPS, FedEx, and DHL all restored service within three weeks.

When the Postal Service raised third-class ("junk" mail) rates, businesses substituted other forms of advertising, including cable TV, telemarketing, and the Internet. UPS and other rivals now account for most ground-shipped packages. Even USPS's first-class monopoly is being threatened, because FedEx and others have captured 90 percent of the overnight mail business. Thus, USPS is losing business because of competition from overnight mail and from new technologies.

USPS has been fighting back, trying to leverage its monopoly power while increasing efficiency. On the electronic front, USPS tried to offer online postage purchases, online bill-paying service, and online document transmission service. But these new products were scrapped as failures. Changing technology and competition have been eroding USPS's government granted monopoly. USPS lost about $4 billion in 2009 and said that without drastic changes, losses would total $238 billion over the next decade. Even a legal monopoly can lose money. Proposed changes include postage increases and dropping Saturday delivery.

Reference Case Study:

Public Policy

The Mail Monopoly The U.S. Post Office was granted a monopoly in 1775 and has operated under federal protection ever since. In 1971, Congress converted the Post Office Department into a semi-independent agency called the U.S. Postal Service, or USPS, which had total revenue of about $70 billion in 2009. Because of the national recession, revenue in 2009 was down 9 percent from 2008 and about the same as in 2006. More than 650,000 employees at 37,000 post offices deliver an average of 177 billion pieces of mail a year to 144 million home and business addresses. This amounts to about 40 percent of the world's total mail delivery. USPS pays no taxes and is exempt from local zoning laws. It has a legal monopoly in delivering regular, first-class letters and has the exclusive right to use the space inside your mailbox. Other delivery services such as FedEx or UPS cannot deliver to mail boxes or post office boxes.

The USPS monopoly has suffered in recent years because of rising costs and growing competition from new technologies. The price of a first-class stamp climbed from 6 cents in 1970 to 44 cents by 2010-a growth rate twice that of inflation. Long distance phone service, one possible substitute for first-class mail, is much cheaper today than in 1970. New technologies such as email, ecards, online bill-payment, text messaging, and social-networking sites also displace USPS delivery services (email messages now greatly outnumber first-class letters). Because its monopoly applies only to regular first-class mail, USPS has lost chunks of other business to private firms offering lower rates and better service. The United Parcel Service (UPS), for example, is more mechanized and more containerized than the USPS and thus has lower costs and less breakage. The USPS has tried to emulate UPS but with only limited success. After Hurricane Katrina, it took seven months to reopen the USPS processing and distribution center in New Orleans. Rivals UPS, FedEx, and DHL all restored service within three weeks.

When the Postal Service raised third-class ("junk" mail) rates, businesses substituted other forms of advertising, including cable TV, telemarketing, and the Internet. UPS and other rivals now account for most ground-shipped packages. Even USPS's first-class monopoly is being threatened, because FedEx and others have captured 90 percent of the overnight mail business. Thus, USPS is losing business because of competition from overnight mail and from new technologies.

USPS has been fighting back, trying to leverage its monopoly power while increasing efficiency. On the electronic front, USPS tried to offer online postage purchases, online bill-paying service, and online document transmission service. But these new products were scrapped as failures. Changing technology and competition have been eroding USPS's government granted monopoly. USPS lost about $4 billion in 2009 and said that without drastic changes, losses would total $238 billion over the next decade. Even a legal monopoly can lose money. Proposed changes include postage increases and dropping Saturday delivery.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

12

CONDITIONS FOR PRICE DISCRIMINATION List three conditions that must be met for a monopolist to price discriminate successfully?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

13

PRICE DISCRIMINATION Explain how it may be profitable for South Korean manufacturers to sell new autos at a lower price in the United States than in South Korea, even with transportation costs included.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

14

PERFECT PRICE DISCRIMINATION Why is the perfectly discriminating monopolist's marginal revenue curve identical to the demand curve it faces?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

15

SHORT-RUN PROFIT MAXIMIZATION Answer the following questions on the basis of the monopolist's situation illustrated in the graph below.

a. At what output rate and price does the monopolist operate?

b. In equilibrium, approximately what is the firm's total cost and its total revenue?

c. What is the firm's economic profit or loss in equilibrium?

a. At what output rate and price does the monopolist operate?

b. In equilibrium, approximately what is the firm's total cost and its total revenue?

c. What is the firm's economic profit or loss in equilibrium?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

16

MONOPOLY Suppose that a certain manufacturer has a monopoly on the sorority and fraternity ring business (a constant-cost industry) because it has persuaded the "Greeks" to give it exclusive rights to their insignia.

a. Using demand and cost curves, draw a diagram depicting the firm's profit-maximizing price and output level.

b. Why is marginal revenue less than price for this firm?

c. On your diagram, show the deadweight loss that occurs because the output level is determined by a monopoly rather than by a competitive market.

d. What would happen to price and output if the Greeks decided to charge the manufacturer a royalty fee of $3 per ring?

a. Using demand and cost curves, draw a diagram depicting the firm's profit-maximizing price and output level.

b. Why is marginal revenue less than price for this firm?

c. On your diagram, show the deadweight loss that occurs because the output level is determined by a monopoly rather than by a competitive market.

d. What would happen to price and output if the Greeks decided to charge the manufacturer a royalty fee of $3 per ring?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

17

Login to www.cengagebrain.com and access the Global Economic Watch to do this exercise.

Global Economic Watch Go to the Global Economic Crisis Resource Center. Select Global Issues in Context. In the Basic Search box at the top of the page, enter the phrase "Google monopoly." On the Results page, go to the Global Viewpoints section. Click on the link for the February 19, 2010, article "Is Google Gaining a Monopoly on the World's Information?" Does Google enjoy a barrier to entry? What is the source of that barrier, if any?

Global Economic Watch Go to the Global Economic Crisis Resource Center. Select Global Issues in Context. In the Basic Search box at the top of the page, enter the phrase "Google monopoly." On the Results page, go to the Global Viewpoints section. Click on the link for the February 19, 2010, article "Is Google Gaining a Monopoly on the World's Information?" Does Google enjoy a barrier to entry? What is the source of that barrier, if any?

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

18

Login to www.cengagebrain.com and access the Global Economic Watch to do this exercise.

Global Economic Watch Go to the Global Economic Crisis Resource Center. Select Global Issues in Context. In the Basic Search box at the top of the page, enter the term "price discrimination." Write a paragraph about one example of an organization practicing price discrimination.

Global Economic Watch Go to the Global Economic Crisis Resource Center. Select Global Issues in Context. In the Basic Search box at the top of the page, enter the term "price discrimination." Write a paragraph about one example of an organization practicing price discrimination.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck