Deck 10: Project Cash-Flow Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 10: Project Cash-Flow Analysis

1

Identify which of the following costs are fixed and which are variable:

(a) Wages paid to temporary workers

(b) Property taxes on a factory building

(c) Property taxes on an administrative building

(d) Sales commission

(e) Electricity for machinery and equipment in a plant

(f) Heat and air conditioning for a plant

(g) Salaries paid to design engineers

(h) Regular maintenance on machinery and equipment

(i) Basic raw materials used in production

(j) Factory fire insurance

(a) Wages paid to temporary workers

(b) Property taxes on a factory building

(c) Property taxes on an administrative building

(d) Sales commission

(e) Electricity for machinery and equipment in a plant

(f) Heat and air conditioning for a plant

(g) Salaries paid to design engineers

(h) Regular maintenance on machinery and equipment

(i) Basic raw materials used in production

(j) Factory fire insurance

Fixed and Variable Costs:

Fixed costs refer to the costs that change over time but remain fixed to the quantity of production for a relevant time period. Hence fixed costs are time reliable and not depend on the levels of goods and services produced by a company.

Variable costs refer to the costs that vary depending on production volume of a company. Variable costs rise as production increases and fall as production decreases

a.Since a company tends to increase its production with minimum expenses will prefer temporary workers rather than permanent workers. Temporary workers will be paid less comparatively than permanent workers and this creates the variable costs in a company's budget. Hence, wages paid to temporary workers is a variable cost.

b.Whether a particular cost is a fixed or variable cost is based on how it reacts to the change in the business. Property taxes on factory building are a kind of overhead costs which is an indirect manufacturing expense of a company. Hence the property taxes on factory building are a fixed overhead cost as it is not charged directly in the finished goods.

c.Whether a particular cost is a fixed or variable cost is based on how it reacts to the change in the business. Hence, property tax on administrative building is a fixed cost.

d.Sales commission refers to the amount received by an individual from the sales apart from his regular salary income. Hence, sales commission to a sales person comes under variable cost of a company as variable cost does not change with the changes in the level of activity but affected by the changes in the particular activity.

e.

Company's overhead expenses include costs such as electricity for machinery and equipment in a plant is a variable cost. These costs are identified when there is a change in the volume of production in a company.

f.

Since heat and air-conditioning for a plant comes under company's overhead costs which are quite predictable and remains unchanged is termed as fixed cost.

g.

Since salaries paid to the design engineers are quite predictable and remains unchanged during a volume of production is termed as fixed cost.

h.

Regular maintenance on machinery and equipment is a kind of semi-variable fixed cost, which varies continuously but not at the direct proportion of volume of production changes. Hence, regular maintenance on machinery and equipment is a fixed cost.

i.

Since basic raw materials used in production varies in proportion to the change in volume of production is known as a variable cost.

j.

Since factory fire insurance are quite predictable and remains unchanged during a volume of production is termed as a fixed cost.

Fixed costs refer to the costs that change over time but remain fixed to the quantity of production for a relevant time period. Hence fixed costs are time reliable and not depend on the levels of goods and services produced by a company.

Variable costs refer to the costs that vary depending on production volume of a company. Variable costs rise as production increases and fall as production decreases

a.Since a company tends to increase its production with minimum expenses will prefer temporary workers rather than permanent workers. Temporary workers will be paid less comparatively than permanent workers and this creates the variable costs in a company's budget. Hence, wages paid to temporary workers is a variable cost.

b.Whether a particular cost is a fixed or variable cost is based on how it reacts to the change in the business. Property taxes on factory building are a kind of overhead costs which is an indirect manufacturing expense of a company. Hence the property taxes on factory building are a fixed overhead cost as it is not charged directly in the finished goods.

c.Whether a particular cost is a fixed or variable cost is based on how it reacts to the change in the business. Hence, property tax on administrative building is a fixed cost.

d.Sales commission refers to the amount received by an individual from the sales apart from his regular salary income. Hence, sales commission to a sales person comes under variable cost of a company as variable cost does not change with the changes in the level of activity but affected by the changes in the particular activity.

e.

Company's overhead expenses include costs such as electricity for machinery and equipment in a plant is a variable cost. These costs are identified when there is a change in the volume of production in a company.

f.

Since heat and air-conditioning for a plant comes under company's overhead costs which are quite predictable and remains unchanged is termed as fixed cost.

g.

Since salaries paid to the design engineers are quite predictable and remains unchanged during a volume of production is termed as fixed cost.

h.

Regular maintenance on machinery and equipment is a kind of semi-variable fixed cost, which varies continuously but not at the direct proportion of volume of production changes. Hence, regular maintenance on machinery and equipment is a fixed cost.

i.

Since basic raw materials used in production varies in proportion to the change in volume of production is known as a variable cost.

j.

Since factory fire insurance are quite predictable and remains unchanged during a volume of production is termed as a fixed cost.

2

J J Electric Company expects to have taxable income of $320,000 from its regular business over the next two years. The company is considering a new residential wiring project for a proposed apartment complex during year 0. This two-year project requires purchase of new equipment for $30,000. The equipment falls into the MACRS five-year class. The equipment will be sold after two years for $12,000. The project will bring in additional revenue of $100,000 each year, but it is expected to incur an additional operating cost of $40,000 each year. What is the income tax rate to use in year 1 for this project evaluation? (a) 39%

(b) 34%

(c) 33.77%

(d) 35.39%

(b) 34%

(c) 33.77%

(d) 35.39%

Given information:

• Taxable income (TI) is $320,000.

• Revenue (R) is $100,000.

• Operating cost (C) per year is $40,000.

• Time period (N) is 2 years.

Tax rate for first year:

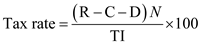

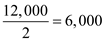

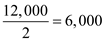

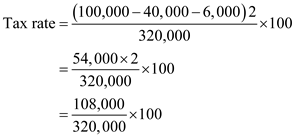

Tax rate can be calculated by using the following formula: …… (1)Salvage value after 2 year is $12,000. Hence, the depreciation (D) per year is

…… (1)Salvage value after 2 year is $12,000. Hence, the depreciation (D) per year is  .

.

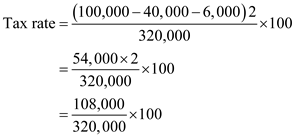

Substitute the respective values in Equation (1) to calculate the tax rate.

The tax rate is

The tax rate is  percent. Hence, option c is correct.

percent. Hence, option c is correct.

• Taxable income (TI) is $320,000.

• Revenue (R) is $100,000.

• Operating cost (C) per year is $40,000.

• Time period (N) is 2 years.

Tax rate for first year:

Tax rate can be calculated by using the following formula:

…… (1)Salvage value after 2 year is $12,000. Hence, the depreciation (D) per year is

…… (1)Salvage value after 2 year is $12,000. Hence, the depreciation (D) per year is  .

. Substitute the respective values in Equation (1) to calculate the tax rate.

The tax rate is

The tax rate is  percent. Hence, option c is correct.

percent. Hence, option c is correct. 3

Classify the following costs into either being product cost or period cost:

(a) Raw material costs

(b) Income taxes paid

(c) Interest expenses on borrowed funds

(d) Wages incurred in producing products

(e) Fire insurance premium paid on factory buildings

(f) Electric bill for the warehouse operation

(g) Salary paid for engineers

(h) Material handling cost related to production

(i) Salary paid for plant manager

(j) Leasing expense for forklift trucks in warehouse operation

(k) Mortgage payments on factory buildings

(a) Raw material costs

(b) Income taxes paid

(c) Interest expenses on borrowed funds

(d) Wages incurred in producing products

(e) Fire insurance premium paid on factory buildings

(f) Electric bill for the warehouse operation

(g) Salary paid for engineers

(h) Material handling cost related to production

(i) Salary paid for plant manager

(j) Leasing expense for forklift trucks in warehouse operation

(k) Mortgage payments on factory buildings

Product and period cost:

Product costs refer to all the cost included while manufacturing or purchasing a product, such as raw materials purchased and manufacturing overhead costs.

Period cost refers to all the cost that is not included while manufacturing or purchasing a product. Sales commission, office rent, administrative and selling cost are few examples of period costs.

Examples of product and period costs:

a.Since the purchase of raw materials includes in the cost of manufacturing or producing a product is a product cost.

b.Since income taxes paid is not included while manufacturing a product and seen as an administrative cost is refers to a period cost.

c.Since interest expenses on borrowed funds is not included while manufacturing a product and comes under selling cost is refers to a period cost.

d.Since the wages incurred in producing products includes in the cost of manufacturing or producing a product is a product cost.

e.

Since fire insurance premium paid on factory buildings is not included while manufacturing a product and seen as an administrative cost is refers to a period cost.

f.

Since electricity bill for the warehouse operation is not included while manufacturing a product and comes under selling cost is refers to a period cost.

g.

Since the salary paid for engineers is not included while manufacturing a product and seen as an administrative cost is refers to a period cost.

h.

Since the material handling cost related to production includes in the cost of manufacturing or producing a product is a product cost.

i.

Since salary paid for the plant manager is not included while manufacturing a product and seen as a marketing cost is refers to a period cost.

j.

Since leasing expense for fork-lift trucks in warehouse operation is not included while manufacturing a product and comes under selling or marketing cost is refers to a period cost.

k.

Since mortgage payments on factory buildings is not included while manufacturing a product and comes under selling or marketing cost is refers to a period cost.

Product costs refer to all the cost included while manufacturing or purchasing a product, such as raw materials purchased and manufacturing overhead costs.

Period cost refers to all the cost that is not included while manufacturing or purchasing a product. Sales commission, office rent, administrative and selling cost are few examples of period costs.

Examples of product and period costs:

a.Since the purchase of raw materials includes in the cost of manufacturing or producing a product is a product cost.

b.Since income taxes paid is not included while manufacturing a product and seen as an administrative cost is refers to a period cost.

c.Since interest expenses on borrowed funds is not included while manufacturing a product and comes under selling cost is refers to a period cost.

d.Since the wages incurred in producing products includes in the cost of manufacturing or producing a product is a product cost.

e.

Since fire insurance premium paid on factory buildings is not included while manufacturing a product and seen as an administrative cost is refers to a period cost.

f.

Since electricity bill for the warehouse operation is not included while manufacturing a product and comes under selling cost is refers to a period cost.

g.

Since the salary paid for engineers is not included while manufacturing a product and seen as an administrative cost is refers to a period cost.

h.

Since the material handling cost related to production includes in the cost of manufacturing or producing a product is a product cost.

i.

Since salary paid for the plant manager is not included while manufacturing a product and seen as a marketing cost is refers to a period cost.

j.

Since leasing expense for fork-lift trucks in warehouse operation is not included while manufacturing a product and comes under selling or marketing cost is refers to a period cost.

k.

Since mortgage payments on factory buildings is not included while manufacturing a product and comes under selling or marketing cost is refers to a period cost.

4

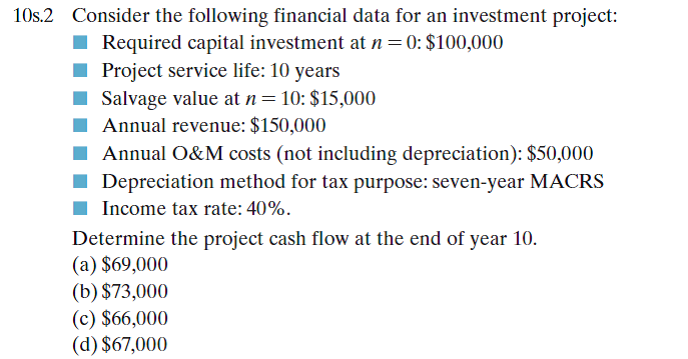

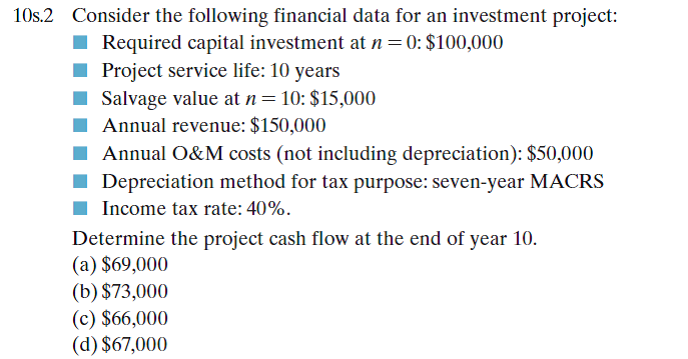

Consider the following financial data for an investment project: Required capital investment at n = 0: $100,000

Project service life: 10 years

Salvage value at n = 10: $15,000

Annual revenue: $150,000

Annual O M costs (not including depreciation): $50,000

Depreciation method for tax purpose: seven-year MACRS

Income tax rate: 40%.

Determine the project cash flow at the end of year 10.

(a) $69,000

(b) $73,000

(c) $66,000

(d) $67,000

Project service life: 10 years

Salvage value at n = 10: $15,000

Annual revenue: $150,000

Annual O M costs (not including depreciation): $50,000

Depreciation method for tax purpose: seven-year MACRS

Income tax rate: 40%.

Determine the project cash flow at the end of year 10.

(a) $69,000

(b) $73,000

(c) $66,000

(d) $67,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

Some commonly known costs associated with manufacturing operations are listed below:

(a) Paint shop superintendent's salary

(b) Labor costs in assembling a product

(c) Rent on a factory building

(d) Radio-frequency identification (RFID) units embedded in the final product during shipping

(e) Depreciation on machinery

(f) Lubricants used for machines

(g) CPU chips used in notebook production

(h) Paint used in automobile production

(i) Janitorial and custodial salaries

(j) Coffee beans used in packaging roasted coffee

(k) Sugar used in icecream production

(l) Electricity for operation of machines

(m) Electricity for heating and cooling the factory building

(n) Glue used in electronic board production

Classify each cost as being either variable or fixed with respect to volume or level of activity.

(a) Paint shop superintendent's salary

(b) Labor costs in assembling a product

(c) Rent on a factory building

(d) Radio-frequency identification (RFID) units embedded in the final product during shipping

(e) Depreciation on machinery

(f) Lubricants used for machines

(g) CPU chips used in notebook production

(h) Paint used in automobile production

(i) Janitorial and custodial salaries

(j) Coffee beans used in packaging roasted coffee

(k) Sugar used in icecream production

(l) Electricity for operation of machines

(m) Electricity for heating and cooling the factory building

(n) Glue used in electronic board production

Classify each cost as being either variable or fixed with respect to volume or level of activity.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

Suppose that in Problem 10s.2, the firm borrowed the entire capital investment at 10% interest over 10 years. If the required principal and interest payments in year 10 are Principal payment: $14,795

Interest payment: $1,480,

What would be the net cash flow at the end of year 10?

(a) $46,725

(b) $63,000

(c) $62,112

(d) $53,317

Interest payment: $1,480,

What would be the net cash flow at the end of year 10?

(a) $46,725

(b) $63,000

(c) $62,112

(d) $53,317

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

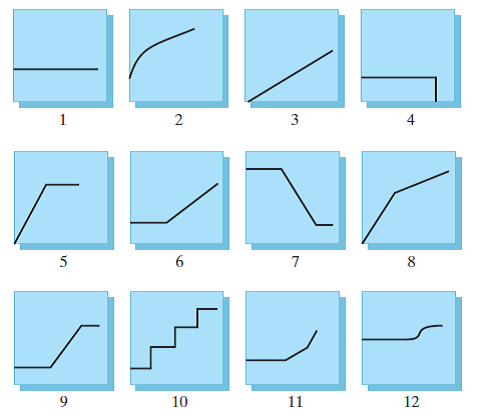

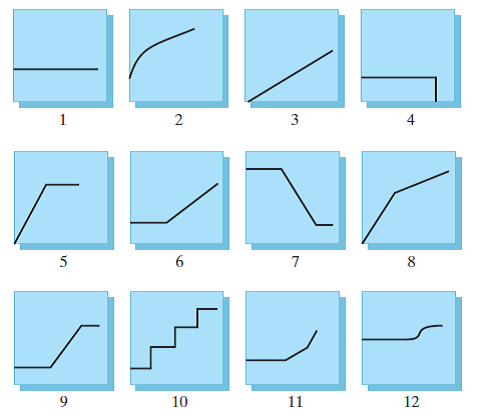

The accompanying figures depict a number of cost behavior patterns that might be found in a company's cost structure. The vertical axis on each graph represents total cost, and the horizontal axis on each graph represents level of activity (volume). For each of the given situations, identify the graph that illustrates the cost pattern involved. Any graph may be used more than once. (Adapted originally from the CPA exam; also found in R. H. Garrison and E. W. Noreen, Managerial Accounting, 9th edition, Irwin, 2009.)

(a) Electricity bill-a flat-rate fixed charge plus a variable cost after a certain number of kilowatt-hours are used.

(b) City water bill, which is computed as follows:

First 1,000,000 gallons $1,000 flat, or less

Next 10,000 gallons $0.003 per gallon used

Next 10,000 gallons $0.006 per gallon used

Next 10,000 gallons $0.009 per gallon used

(c) Depreciation of equipment, where the amount is computed by the straight-line method. When the depreciation rate was established, it was anticipated that the obsolescence factor would be greater than the wear-and-tear factor.

(d) Rent on a factory building donated by the city, where the agreement calls for a fixed-fee payment unless 200,000 labor-hours or more are worked, in which case no rent need be paid.

(e) Cost of raw materials, where the cost decreases by 5 cents per unit for each of the first 100 units purchased after which it remains constant at $2.50 per unit.

(f) Salaries of maintenance workers, where one maintenance worker is needed for every 1,000 machine hours or less (that is, 0 to 1,000 hours require one maintenance worker, 1,001 to 2,000 hours require two maintenance workers, etc.).

(g) Cost of raw materials used.

(h) Rent on a factory building donated by the county, where the agreement calls for rent of $100,000 less $1 for each direct labor-hour worked in excess of 200,000 hours, but a minimum rental payment of $20,000 must be paid.

(i) Use of a machine under a lease, where a minimum charge of $1,000 is paid for up to 400 hours of machine time. After 400 hours of machine time, an additional charge of $2 per hour is paid up to a maximum charge of $2,000 per period.

(a) Electricity bill-a flat-rate fixed charge plus a variable cost after a certain number of kilowatt-hours are used.

(b) City water bill, which is computed as follows:

First 1,000,000 gallons $1,000 flat, or less

Next 10,000 gallons $0.003 per gallon used

Next 10,000 gallons $0.006 per gallon used

Next 10,000 gallons $0.009 per gallon used

(c) Depreciation of equipment, where the amount is computed by the straight-line method. When the depreciation rate was established, it was anticipated that the obsolescence factor would be greater than the wear-and-tear factor.

(d) Rent on a factory building donated by the city, where the agreement calls for a fixed-fee payment unless 200,000 labor-hours or more are worked, in which case no rent need be paid.

(e) Cost of raw materials, where the cost decreases by 5 cents per unit for each of the first 100 units purchased after which it remains constant at $2.50 per unit.

(f) Salaries of maintenance workers, where one maintenance worker is needed for every 1,000 machine hours or less (that is, 0 to 1,000 hours require one maintenance worker, 1,001 to 2,000 hours require two maintenance workers, etc.).

(g) Cost of raw materials used.

(h) Rent on a factory building donated by the county, where the agreement calls for rent of $100,000 less $1 for each direct labor-hour worked in excess of 200,000 hours, but a minimum rental payment of $20,000 must be paid.

(i) Use of a machine under a lease, where a minimum charge of $1,000 is paid for up to 400 hours of machine time. After 400 hours of machine time, an additional charge of $2 per hour is paid up to a maximum charge of $2,000 per period.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

A new absorption chiller system costs $360,000 and will save $52,500 in each of the next 12 years. The asset is classified as a seven-year MACRS property for depreciation purpose. The expected salvage value is $20,000. The firm pays taxes at a combined rate of 40% and has an MARR of 12%. What is the net present worth of the system? (a) $46,725

(b) $63,739

(c) $62,112

(d) $53,317

(b) $63,739

(c) $62,112

(d) $53,317

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose that a company expects the following financial results from a project during its first year operation:

Sales revenue: $300,000

Variable costs: $100,000

Fixed costs: $50,000

Total unit produced and sold: 10,000 units

(a) Compute the contribution margin percentage.

(b) Compute the break-even point in units sold.

Sales revenue: $300,000

Variable costs: $100,000

Fixed costs: $50,000

Total unit produced and sold: 10,000 units

(a) Compute the contribution margin percentage.

(b) Compute the break-even point in units sold.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

A corporation is considering purchasing a machine that costs $120,000 and will save $ X per year after taxes. The cost of operating the machine, including maintenance and depreciation, is $20,000 per year after taxes. The machine will be needed for four years after which it will have a zero salvage value. If the firm wants a 14% rate of return after taxes, what is the minimum after-tax annual savings that must be generated to realize a 14% rate of return after taxes? (a) $50,000

(b) $61,184

(c) $91,974

(d) $101,974

(b) $61,184

(c) $91,974

(d) $101,974

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

Suppose ADI Corporation's break-even sales volume is $500,000 with fixed costs of $250,000.

(a) Compute the contribution margin percentage.

(b) Compute the selling price if variable costs are $15 per unit.

(a) Compute the contribution margin percentage.

(b) Compute the selling price if variable costs are $15 per unit.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

12

A corporation is considering purchasing a machine that will save $200,000 per year before taxes. The cost of operating the machine, including maintenance, is $80,000 per year. The machine costing $150,000 will be needed for five years, after which it will have a salvage value of $25,000. A straight-line depreciation with no half-year convention applies (i.e., 20% each year). If the firm wants 15% rate of return after taxes, what is the net present value of the cash flows generated from this machine? The firm's income tax rate is 40%. (a) $137,306

(b) $218,313

(c) $199,460

(d) $375,000

(b) $218,313

(c) $199,460

(d) $375,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

13

Given the following information, answer the questions:

The ratio of variable cost per unit divided by selling price per unit equals 0.3.

Fixed costs amount to $60,000.

(a) Draw the cost-volume-profit diagram.

(b) What is the break-even point?

(c) What effect would an 8% decrease in selling price have on the break-even point from part (b)?

The ratio of variable cost per unit divided by selling price per unit equals 0.3.

Fixed costs amount to $60,000.

(a) Draw the cost-volume-profit diagram.

(b) What is the break-even point?

(c) What effect would an 8% decrease in selling price have on the break-even point from part (b)?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

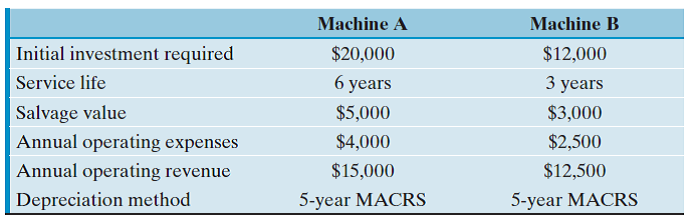

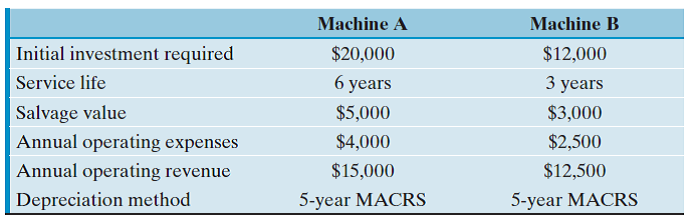

A firm is trying to choose between two machines to manufacture a new line of office furniture. The financial data for each machine have been compiled as follows:

The firm's marginal tax rate is 40% and uses a 15% discount rate to value the projects. Also, assume that the required service period is indefinite.

The firm's marginal tax rate is 40% and uses a 15% discount rate to value the projects. Also, assume that the required service period is indefinite.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

The Austin Electric Company has three product lines of surge protectors commonly used in PC and other electronic devices-A, B, and C-having a contribution margin of $3, $2, and $1, respectively. The president foresees sales of 200,000 units in the coming period, consisting of 20,000 units of A, 100,000 units of B, and 80,000 units of C. The company's fixed costs for the period are $255,000.

(a) What is the company's break-even point in units, assuming that the given sales mix is maintained?

(b) If the mix is maintained, what is the total contribution margin when 200,000 units are sold? What is operating income?

(c) What would be operating income if 20,000 units of A, 80,000 units of B, and 100,000 units of C were sold? What is the new break-even point in units if these relationships persist in the next period?

(a) What is the company's break-even point in units, assuming that the given sales mix is maintained?

(b) If the mix is maintained, what is the total contribution margin when 200,000 units are sold? What is operating income?

(c) What would be operating income if 20,000 units of A, 80,000 units of B, and 100,000 units of C were sold? What is the new break-even point in units if these relationships persist in the next period?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

What is the internal rate of return (after tax) of machine A? (a) 28%

(b) 39%

(c) 35%

(d) 43%

(b) 39%

(c) 35%

(d) 43%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

Buffalo Environmental Service expects to generate a taxable income of $350,000 from its regular business in 2012. The company is also considering a new venture: cleaning up oil spills made by fishing boats in lakes. This new venture is expected to generate an additional taxable income of $180,000.

(a) Determine the firm's marginal tax rates before and after the venture.

(b) Determine the firm's average tax rates before and after the venture.

(a) Determine the firm's marginal tax rates before and after the venture.

(b) Determine the firm's average tax rates before and after the venture.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

What is the net present worth of machine B after tax over 3 years? (a) $6,394

(b) $6,233

(c) $5,562

(d) $7,070

(b) $6,233

(c) $5,562

(d) $7,070

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

Scottsdale Print Shop expects to have an annual taxable income of $300,000 from its regular business over the next two years. The company is also considering the proposed acquisition of a new printing machine to expand current business to offer in its product catalog. The machine's installed price is $105,000. The machine falls into the MACRS five-year class, and it will have an estimated salvage value of $30,000 at the end of six years. The machine is expected to generate additional before-tax revenue of $120,000 per year.

(a) Determine the company's annual marginal (incremental) tax rates over the next two years with the proposed investment in the printing machine.

(b) Determine the company's annual average tax rates over the next two years with the machine.

(a) Determine the company's annual marginal (incremental) tax rates over the next two years with the proposed investment in the printing machine.

(b) Determine the company's annual average tax rates over the next two years with the machine.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

Using the replacement chain method (machine B can be replaced with an identical machine at the end of year 3), determine which project should be adopted after tax. (a) Machine A.

(b) Machine B.

(c) Either machine.

(d) Neither machine.

(b) Machine B.

(c) Either machine.

(d) Neither machine.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

Delta Electric Company expects to have an annual taxable income of $500,000 from its residential accounts over the next two years. The company is also bidding on a two-year wiring service job for a large apartment complex. This commercial service requires the purchase of a new truck equipped with wire-pulling tools at a cost of $50,000. The equipment falls into the MACRS five-year class and will be retained for future use (instead of being sold) after two years, indicating no gain or loss on this property. The project will bring in additional annual revenue of $200,000, but it is expected to incur additional annual operating costs of $100,000. Compute the marginal tax rates applicable to the project's operating profits for the next two years.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

10s)11 Phoenix Construction Ltd. is considering the acquisition of a new 18-wheeler. The truck's base price is $80,000, and it will cost another $20,000 to modify it for special use by the company.

This truck falls into the MACRS five-year class.

It will be sold after three years (project life) for $30,000.

The truck purchase will have no effect on revenues, but it is expected to save the firm $45,000 per year in before-tax operating costs, mainly in leasing expenses.

The firm's marginal tax rate (federal plus state) is 40%, and its MARR is 15%.

What is the net present worth of this acquisition?

(a) -$45,158 (loss)

(b) $532

(c) $1,677

(d) $2,742

This truck falls into the MACRS five-year class.

It will be sold after three years (project life) for $30,000.

The truck purchase will have no effect on revenues, but it is expected to save the firm $45,000 per year in before-tax operating costs, mainly in leasing expenses.

The firm's marginal tax rate (federal plus state) is 40%, and its MARR is 15%.

What is the net present worth of this acquisition?

(a) -$45,158 (loss)

(b) $532

(c) $1,677

(d) $2,742

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

A small manufacturing company has an estimated annual taxable income of $195,000. Due to an increase in business, the company is considering purchasing a new machine that will generate additional (before-tax) annual revenue of $80,000 over the next five years. The new machine requires an investment of $100,000, which will be depreciated under the five-year MACRS method.

(a) What is the increment in income tax caused by the purchase of the new machine in tax year 1?

(b) What is the incremental tax rate associated with the purchase of the new equipment in year 1?

(a) What is the increment in income tax caused by the purchase of the new machine in tax year 1?

(b) What is the incremental tax rate associated with the purchase of the new equipment in year 1?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

A special purpose machine tool set would cost $20,000. The tool set will be financed by a $10,000 bank loan repayable in two equal annual installments at 10% compounded annually. The tool is expected to provide annual savings (material) of $30,000 for two years and is to be depreciated by the three-year MACRS method. This special machine tool will require annual O M costs in the amount of $5,000. The salvage value at the end of two years is expected to be $8,000. Suppose that it is expected a 6% annual inflation during the project period. Assuming a marginal tax rate of 40% and an MARR of 20% (inflation adjusted), what is the net present worth of this project? (a) $16,301

(b) $24,558

(c) $23,607

(d) $18,562

(b) $24,558

(c) $23,607

(d) $18,562

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

Simon Machine Tools Company is considering the purchase of a new set of machine tools to process special orders over the next three years. The following financial information is available:

Without the project, the company expects to have a taxable income of $400,000 each year from its regular business over the next three years.

This three-year project requires the purchase of a new set of machine tools at a cost of $50,000. The equipment falls into the MACRS three-year class. The tools will be sold at the end of the project life for $10,000. The project will bring in additional annual revenue of $90,000, but it is expected to incur additional annual operating costs of $25,000.

(a) What are the additional taxable incomes (from undertaking the project) during years 1 through 3, respectively?

(b) What are the additional income taxes (from undertaking the new orders) during years 1 through 3, respectively?

Without the project, the company expects to have a taxable income of $400,000 each year from its regular business over the next three years.

This three-year project requires the purchase of a new set of machine tools at a cost of $50,000. The equipment falls into the MACRS three-year class. The tools will be sold at the end of the project life for $10,000. The project will bring in additional annual revenue of $90,000, but it is expected to incur additional annual operating costs of $25,000.

(a) What are the additional taxable incomes (from undertaking the project) during years 1 through 3, respectively?

(b) What are the additional income taxes (from undertaking the new orders) during years 1 through 3, respectively?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

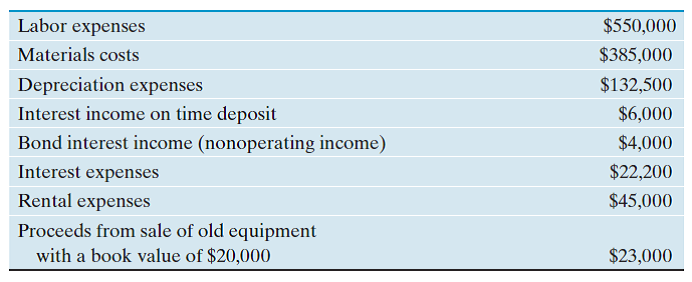

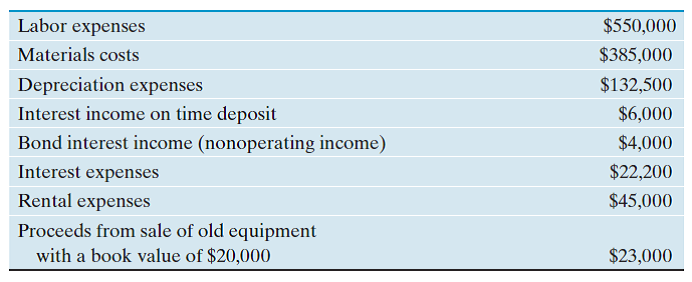

Jackson Heating Air Company had sales revenue of $2,250,000 from operations during tax-year 1. Here are some operating data on the company for that year:

(a) What is Jackson's taxable gains?

(b) What is Jackson's taxable income?

(c) What are Jackson's marginal and average tax rates?

(d) What is Jackson's net cash flow after tax?

(a) What is Jackson's taxable gains?

(b) What is Jackson's taxable income?

(c) What are Jackson's marginal and average tax rates?

(d) What is Jackson's net cash flow after tax?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

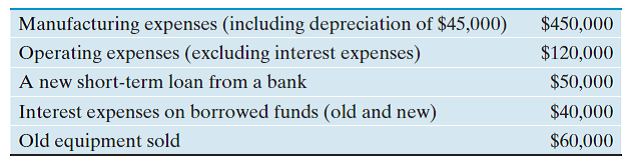

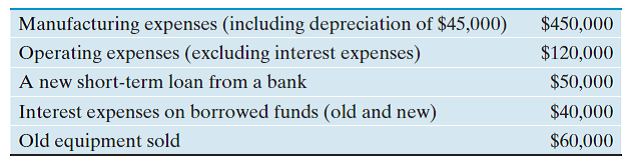

In 2012, Elway Aerospace Company had gross revenues of $1,200,000 from operations. The following financial transactions were posted during the year:

The old equipment had a book value of $75,000 at the time of sale.

(a) What is Elway's income tax liability?

(b) What is Elway's operating income?

(c) What is the net cash flow?

The old equipment had a book value of $75,000 at the time of sale.

(a) What is Elway's income tax liability?

(b) What is Elway's operating income?

(c) What is the net cash flow?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

An asset in the five-year MACRS property class cost $100,000 and has a zero estimated salvage value after six years of use. The asset will generate annual revenues of $300,000 and will require $100,000 in annual labor costs and $50,000 in annual material expenses. There are no other revenues and expenses. Assume a tax rate of 40%.

(a) Compute the after-tax cash flows over the project life.

(b) Compute the NPW at MARR = 12%. Is this investment acceptable?

(c) Compute the IRR for this project.

(a) Compute the after-tax cash flows over the project life.

(b) Compute the NPW at MARR = 12%. Is this investment acceptable?

(c) Compute the IRR for this project.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

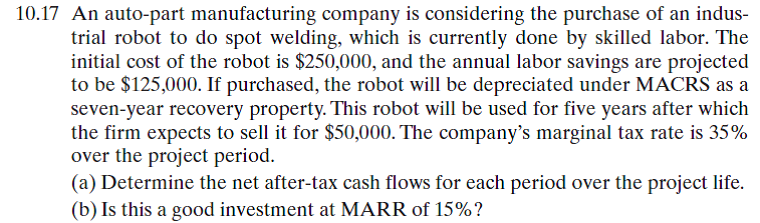

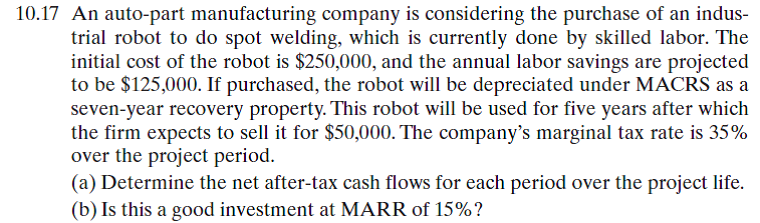

29

An auto-part manufacturing company is considering the purchase of an industrial robot to do spot welding, which is currently done by skilled labor. The initial cost of the robot is $250,000, and the annual labor savings are projected to be $125,000. If purchased, the robot will be depreciated under MACRS as a seven-year recovery property. This robot will be used for five years after which the firm expects to sell it for $50,000. The company's marginal tax rate is 35% over the project period.

(a) Determine the net after-tax cash flows for each period over the project life.

(b) Is this a good investment at MARR of 15%?

(a) Determine the net after-tax cash flows for each period over the project life.

(b) Is this a good investment at MARR of 15%?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

You are considering purchasing a new injection molding machine. This machine will have an estimated service life of 10 years with a negligible after-tax salvage value. Its annual net after-tax operating cash flows are estimated to be $60,000. If you expect a 15% rate of return on investment, what would be the maximum amount that you should spend to purchase the injection molding machine?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

A facilities engineer is considering a $50,000 investment in an energy management system (EMS). The system is expected to save $10,000 annually in utility bills for N years. After N years, the EMS will have a zero salvage value. In an after-tax analysis, how many years would N need to be in order for the engineer's company to earn a 10% return on the investment? Assume MACRS depreciation with a three-year class life and a 35% tax rate.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

A corporation is considering a proposal for the purchase of a machine that will save $130,000 per year before taxes. The cost of operating the machine, including maintenance, is $20,000 per year. The machine will be needed for five years after which it will have a zero salvage value. MACRS depreciation will be used, assuming a three-year class life. The marginal income-tax rate is 40%. If the firm wants 12% IRR after taxes, how much can it afford to pay for this machine?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

Atlanta Capital Leasing Company (ACLC) leases tractors to construction companies. The firm wants to set a three-year lease payment schedule for a tractor purchased at $53,000 from the equipment manufacturer. The asset is classified as a five-year MACRS property. The tractor is expected to have a salvage value of $22,000 at the end of three years of rental. ACLC will require the lessee to make a security deposit of $1,500 that is refundable at the end of the lease term. ACLC's marginal tax rate is 35%. If ACLC wants an after-tax return of 10%, what lease payment schedule should be set?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

You are interested in purchasing a machine that will save $200,000 per year before taxes. The cost of operating the machine, including maintenance, is $80,000 per year. The machine, which costs $150,000, will be needed for five years after which it will have a salvage value of $25,000. The machine would qualify for a 7-year MACRS property. What is the net present value of the cash flows generated from this machine at 15%? The firm's income tax rate is 40%.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

Peachtree Construction Company, a highway contractor, is considering the purchase of a new trench excavator that costs $300,000 and can dig a 3-foot-wide trench at the rate of 16 feet per hour. The contractor gets paid according to the usage of the equipment, $100 per hour. The expected average annual usage is 500 hours, and maintenance and operating costs will be $10 per hour. The contractor will depreciate the equipment by using a five-year MACRS, units-of-production method. At the end of five years, the excavator will be sold for $100,000.

(a) Assuming that the contractor's marginal tax rate is 35% per year, determine the annual after-tax cash flow.

(b) Is this a good investment if the contractor requires 15% return on investment?

(a) Assuming that the contractor's marginal tax rate is 35% per year, determine the annual after-tax cash flow.

(b) Is this a good investment if the contractor requires 15% return on investment?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

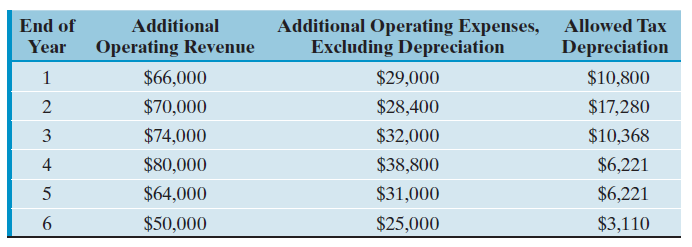

Tucson Solar Company builds residential solar homes. Because of an anticipated increase in business volume, the company is considering the acquisition of a loader at a cost of $54,000. This acquisition cost includes delivery charges and applicable taxes. The firm has estimated that if the loader is acquired, the following additional revenues and operating expenses (excluding depreciation) should be expected:

The projected revenue is assumed to be in cash in the year indicated, and all the additional operating expenses are expected to be paid in the year in which they are incurred. The estimated salvage value for the loader at the end of the sixth year is $8,000. The firm's incremental (marginal) tax rate is 35%.

(a) What is the after-tax cash flow if the loader is acquired?

(b) What is the equivalent annual cash flow the firm can expect by owning and operating this loader at an interest rate of 12%?

The projected revenue is assumed to be in cash in the year indicated, and all the additional operating expenses are expected to be paid in the year in which they are incurred. The estimated salvage value for the loader at the end of the sixth year is $8,000. The firm's incremental (marginal) tax rate is 35%.

(a) What is the after-tax cash flow if the loader is acquired?

(b) What is the equivalent annual cash flow the firm can expect by owning and operating this loader at an interest rate of 12%?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

An automaker is considering installing a three-dimensional (3-D) computerized styling system at a cost of $180,000 (including hardware and software). With the 3-D computer modeling system, designers will have the ability to view their design from many angles and to fully account for the space required for the engine and passengers. The digital information used to create the computer model can be revised in consultation with engineers, and the data can be used to run milling machines that make physical models quickly and precisely. The automaker expects to decrease turnaround time by 35% for new automobile models (from configuration to final design). The expected saving is $350,000 per year. The training and operating and maintenance cost for the new system is expected to be $80,000 per year. The system has a five-year useful life and can be depreciated as a five-year MACRS class. The system will have an estimated salvage value of $5,000. The automaker's marginal tax rate is 40%.

(a) Determine the annual cash flows for this investment.

(b) What is the return on investment for this project? The firm's MARR is 12%.

(a) Determine the annual cash flows for this investment.

(b) What is the return on investment for this project? The firm's MARR is 12%.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

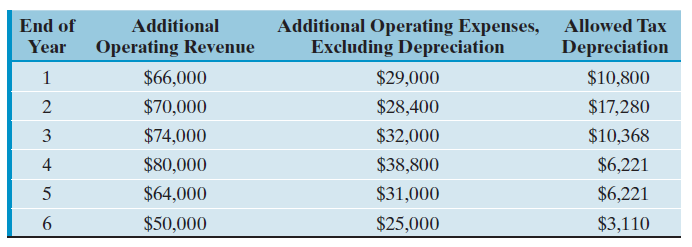

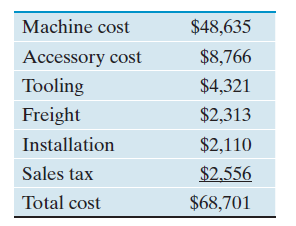

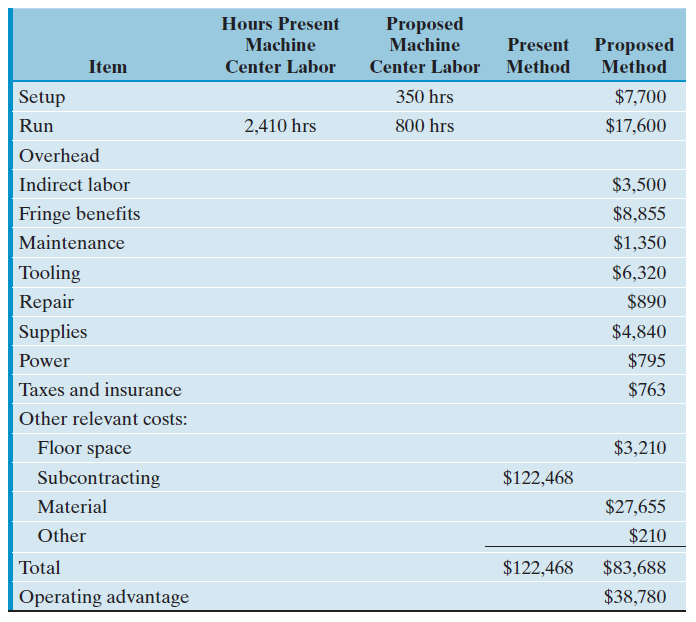

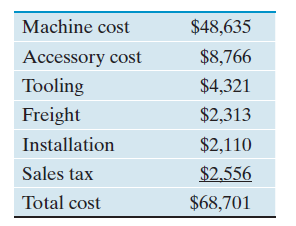

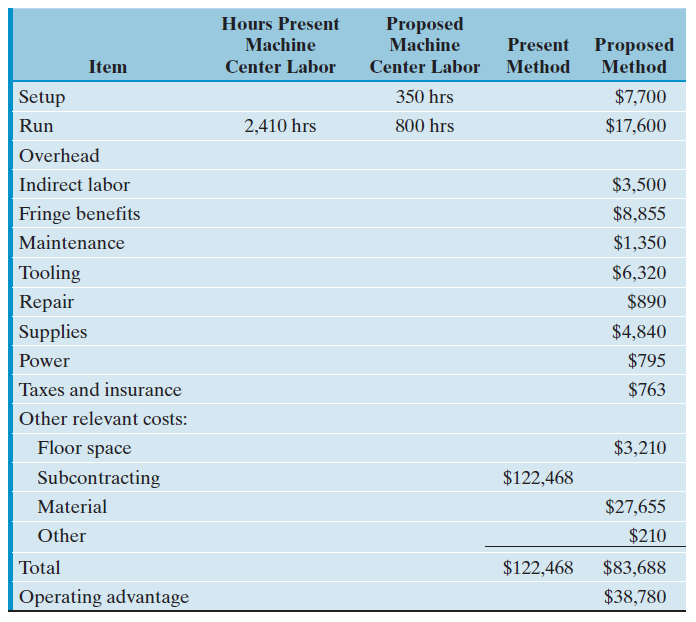

The Manufacturing Division of Ohio Vending Machine Company is considering its Toledo plant's request for a half-inch-capacity automatic screw-cutting machine to be included in the division's 2013 capital budget:

Name of project: Mazda Automatic Screw Machine

Project cost: $68,701

Purpose of project: To reduce the cost of some of the parts that are now being subcontracted by this plant, to cut down on inventory by shortening lead time, and to better control the quality of the parts. The proposed equipment includes the following cost basis:

Anticipated savings: as shown in the accompanying table.

Tax depreciation method: seven-year MACRS.

Marginal tax rate: 40%.

MARR: 15%.

(a) Determine the net after-tax cash flows over the project life of six years. Assume a salvage value of $3,500.

(b) Is this project acceptable based on the PW criterion?

(c) Determine the IRR for this investment.

Name of project: Mazda Automatic Screw Machine

Project cost: $68,701

Purpose of project: To reduce the cost of some of the parts that are now being subcontracted by this plant, to cut down on inventory by shortening lead time, and to better control the quality of the parts. The proposed equipment includes the following cost basis:

Anticipated savings: as shown in the accompanying table.

Tax depreciation method: seven-year MACRS.

Marginal tax rate: 40%.

MARR: 15%.

(a) Determine the net after-tax cash flows over the project life of six years. Assume a salvage value of $3,500.

(b) Is this project acceptable based on the PW criterion?

(c) Determine the IRR for this investment.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

Reconsider Problem 10.17. Suppose that the project requires a $30,000 investment in working capital at the beginning of the project and the entire amount will be recovered at the end of project life. How does this investment in working capital change the net cash flows series?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

Reconsider Problem 10.23. Suppose that the purchase also requires an investment in working capital in the amount of $50,000, which will be recovered in full at the end of year 5. Determine the net present worth of the project.

10.23 Peachtree Construction Company, a highway contractor, is considering the purchase of a new trench excavator that costs $300,000 and can dig a 3-foot-wide trench at the rate of 16 feet per hour. The contractor gets paid according to the usage of the equipment, $100 per hour. The expected average annual usage is 500 hours, and maintenance and operating costs will be $10 per hour. The contractor will depreciate the equipment by using a five-year MACRS, units-of-production method. At the end of five years, the excavator will be sold for $100,000.

(a) Assuming that the contractor's marginal tax rate is 35% per year, determine the annual after-tax cash flow.

(b) Is this a good investment if the contractor requires 15% return on investment?

10.23 Peachtree Construction Company, a highway contractor, is considering the purchase of a new trench excavator that costs $300,000 and can dig a 3-foot-wide trench at the rate of 16 feet per hour. The contractor gets paid according to the usage of the equipment, $100 per hour. The expected average annual usage is 500 hours, and maintenance and operating costs will be $10 per hour. The contractor will depreciate the equipment by using a five-year MACRS, units-of-production method. At the end of five years, the excavator will be sold for $100,000.

(a) Assuming that the contractor's marginal tax rate is 35% per year, determine the annual after-tax cash flow.

(b) Is this a good investment if the contractor requires 15% return on investment?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

Consider a project with an initial investment of $300,000, which must be financed at an interest rate of 12% per year. Assuming that the required repayment period is six years, determine the repayment schedule by identifying the principal as well as the interest payments for each of the following repayment methods:

(a) Equal repayment of the principal: $50,000 principal payment each year

(b) Equal repayment of the interest: $36,000 interest payment each year

(c) Equal annual installments: $72,968 each year

(a) Equal repayment of the principal: $50,000 principal payment each year

(b) Equal repayment of the interest: $36,000 interest payment each year

(c) Equal annual installments: $72,968 each year

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

A special-purpose machine tool set would cost $30,000. The entire capital expenditure ($30,000) is to be borrowed with the stipulation that it be repaid by two equal end-of-year payments at 12% compounded annually. The tool is expected to provide annual savings (in material) of $45,000 for two years and is to be depreciated by the MACRS three-year recovery period. This special machine tool will require annual O M costs in the amount of $12,000. The salvage value at the end of two years is expected to be $9,000. Assuming a marginal tax rate of 40% and MARR of 15%, what is the net present worth of this project?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

The Balas Manufacturing Company is considering buying an overhead pulley system. The new system has a purchase price of $150,000, an estimated useful life and MACRS class life of five years, and an estimated salvage value of $10,000. The system is expected to enable the company to economize on electric power usage, labor, and repair costs, as well as to reduce the number of defective products made. A total annual savings of $95,000 will be realized if the new pulley system is installed. The company is in the 35% marginal tax bracket. The initial investment will be financed with 40% equity and 60% debt. The before-tax debt interest rate, which combines both short-term and long-term financing, is 12% with the loan to be repaid in equal annual installments over the project life.

(a) Determine the after-tax cash flows.

(b) Evaluate this investment project by using an MARR of 20%.

(c) Evaluate this investment project on the basis of the IRR criterion.

(a) Determine the after-tax cash flows.

(b) Evaluate this investment project by using an MARR of 20%.

(c) Evaluate this investment project on the basis of the IRR criterion.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

A toy manufacturer is considering the installation of a new process machine for its toy manufacturing facility. The machine costs $350,000 installed, will generate additional revenues of $120,000 per year, and will save $50,000 per year in labor and material costs. The machine will be financed by a $250,000 bank loan repayable in three equal annual principal installments plus 9% interest on the outstanding balance. The machine will be depreciated by seven-year MACRS. The useful life of this process machine is 10 years at which time it will be sold for $20,000. The combined marginal tax rate is 40%.

(a) Find the year-by-year after-tax cash flow for the project.

(b) Compute the IRR for this investment.

(c) At MARR = 18%, is this project economically justifiable?

(a) Find the year-by-year after-tax cash flow for the project.

(b) Compute the IRR for this investment.

(c) At MARR = 18%, is this project economically justifiable?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

Consider the following financial information about a retooling project at a computer manufacturing company:

The project costs $2 million and has a five-year service life.

The project can be classified as a seven-year property under the MACRS rule.

At the end of the fifth year, any assets held for the project will be sold. The expected salvage value will be about 10% of the initial project cost.

The firm will finance 40% of the project money from an outside financial institution at an interest rate of 10%. The firm is required to repay the loan with five equal annual payments.

The firm's incremental (marginal) tax rate on this investment is 35%.

The firm's MARR is 18%.

Use this financial information to complete the following tasks:

(a) Determine the after-tax cash flows.

(b) Compute the annual equivalent cost for this project.

The project costs $2 million and has a five-year service life.

The project can be classified as a seven-year property under the MACRS rule.

At the end of the fifth year, any assets held for the project will be sold. The expected salvage value will be about 10% of the initial project cost.

The firm will finance 40% of the project money from an outside financial institution at an interest rate of 10%. The firm is required to repay the loan with five equal annual payments.

The firm's incremental (marginal) tax rate on this investment is 35%.

The firm's MARR is 18%.

Use this financial information to complete the following tasks:

(a) Determine the after-tax cash flows.

(b) Compute the annual equivalent cost for this project.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

A manufacturing company is considering the acquisition of a new injection-molding machine at a cost of $110,000. Because of a rapid change in product mix, the need for this particular machine is expected to last only eight years after which time the machine is expected to have a salvage value of $10,000. The annual operating cost is estimated to be $8,000. The addition of this machine to the current production facility is expected to generate annual revenue of $60,000. The firm has only $70,000 available from its equity funds, so it must borrow the additional $40,000 required at an interest rate of 10% per year with repayment of principal and interest in eight equal annual amounts. The applicable marginal income tax rate for the firm is 40%. Assume that the asset qualifies for a seven-year MACRS property classification.

(a) Determine the after-tax cash flows.

(b) Determine the NPW of this project at MARR = 14%.

(a) Determine the after-tax cash flows.

(b) Determine the NPW of this project at MARR = 14%.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

Suppose an asset has a purchase cost of $15,000, a life of five years, a salvage value of $3,000 at the end of five years, and a net annual before-tax revenue of $7,500. The firm's marginal tax rate is 35%. The asset will be depreciated by five-year MACRS.

(a) Determine the cash flow after taxes, assuming that the purchase cost will be entirely financed by the equity funds.

(b) Rework part (a), assuming that the entire investment would be financed by a bank loan at an interest rate of 9%.

(c) Given a choice between paying the purchase cost up front from the firm's equity and using the financing method of part (b), show calculations to justify which is the better choice at an interest rate of 9%.

(a) Determine the cash flow after taxes, assuming that the purchase cost will be entirely financed by the equity funds.

(b) Rework part (a), assuming that the entire investment would be financed by a bank loan at an interest rate of 9%.

(c) Given a choice between paying the purchase cost up front from the firm's equity and using the financing method of part (b), show calculations to justify which is the better choice at an interest rate of 9%.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

A construction company is considering the proposed acquisition of a new earthmover. The purchase price is $100,000, and an additional $25,000 is required to modify the equipment for special use by the company. The equipment falls into the MACRS five-year classification (tax life), and it will be sold after five years (project life) for $50,000. Purchase of the earthmover will have no effect on revenues, but it is expected to save the firm $60,000 per year in before-tax operating costs-mainly labor. The firm's marginal tax rate is 40%. Assume that the initial investment is to be financed by a bank loan at an interest rate of 10% payable annually. Determine the after-tax cash flows and the worth of investment for this project if the firm's MARR is known to be 12%.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

A leading regional airline that is now carrying 54% of all the passengers that pass through the Southeast is considering the possibility of adding a new long-range aircraft to its fleet. The aircraft being considered for purchase is the Boeing 717-200, which is quoted at $35 million per unit. Boeing requires a 10% down payment at the time of delivery, and the balance is to be paid over a 10-year period at an interest rate of 9% compounded annually. The actual payment schedule calls for making only interest payments over the 10-year period, with the original principal amount to be paid off at the end of the 10th year. The airline expects to generate $40 million per year by adding this aircraft to its current fleet but also estimates an operating and maintenance cost of $30 million per year. The aircraft is expected to have a 15-year service life with a salvage value of 15% of the original purchase price. If the airline purchases the aircraft, it will be depreciated by the seven-year MACRS property classification. The firm's combined federal and state marginal tax rate is 38%, and its MARR is 18%.

(a) Determine the cash flow associated with the debt financing.

(b) Is this project acceptable?

(a) Determine the cash flow associated with the debt financing.

(b) Is this project acceptable?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

The headquarters building, Building A, owned by a rapidly growing company, is not large enough for current needs. A search for enlarged quarters revealed two new alternatives that would provide sufficient room, enough parking, and the desired appearance and location; or the company could remodel its existing building to create more usable space. The company's three options are as follows:

Option 1: Lease Building B for $144,000 per year.

Option 2: Purchase Building C for $800,000, including a $150,000 cost for land.

Option 3: Remodel Building A.

It is believed that land values will not decrease over the ownership period, but the value of all structures will decline to 10% of the purchase price in 30 years. Annual property tax payments are expected to be 5% of the purchase price. The present headquarters building is already paid for and is now valued at $300,000. The land it is on is appraised at $60,000. The structure can be remodeled at a cost of $300,000 to make it comparable with the other alternatives. However, the remodeled Building A will occupy part of the existing parking lot. An adjacent, privately owned parking lot can be leased for 30 years under an agreement that the first year's rental of $9,000 will increase by $500 each year. The annual property taxes on the remodeled property will again be 5% of the present valuation plus the cost to remodel. The study period for the comparison is 30 years, and the desired rate of return on investments is 12%. Assume that the firm's marginal tax rate is 40% and the new building (C) and remodeled structure will be depreciated under MACRS at a real-property recovery period of 39 years. If the annual upkeep costs are the same for all three alternatives, which one is preferable?

Option 1: Lease Building B for $144,000 per year.

Option 2: Purchase Building C for $800,000, including a $150,000 cost for land.

Option 3: Remodel Building A.

It is believed that land values will not decrease over the ownership period, but the value of all structures will decline to 10% of the purchase price in 30 years. Annual property tax payments are expected to be 5% of the purchase price. The present headquarters building is already paid for and is now valued at $300,000. The land it is on is appraised at $60,000. The structure can be remodeled at a cost of $300,000 to make it comparable with the other alternatives. However, the remodeled Building A will occupy part of the existing parking lot. An adjacent, privately owned parking lot can be leased for 30 years under an agreement that the first year's rental of $9,000 will increase by $500 each year. The annual property taxes on the remodeled property will again be 5% of the present valuation plus the cost to remodel. The study period for the comparison is 30 years, and the desired rate of return on investments is 12%. Assume that the firm's marginal tax rate is 40% and the new building (C) and remodeled structure will be depreciated under MACRS at a real-property recovery period of 39 years. If the annual upkeep costs are the same for all three alternatives, which one is preferable?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

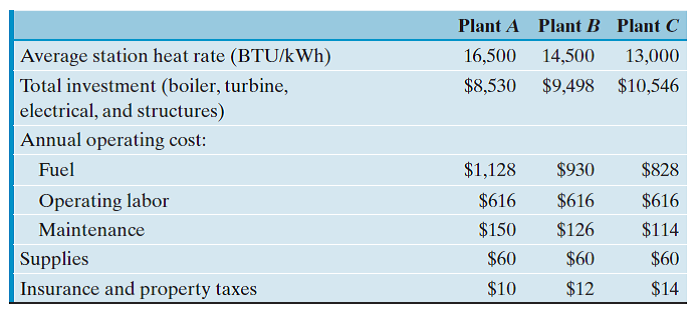

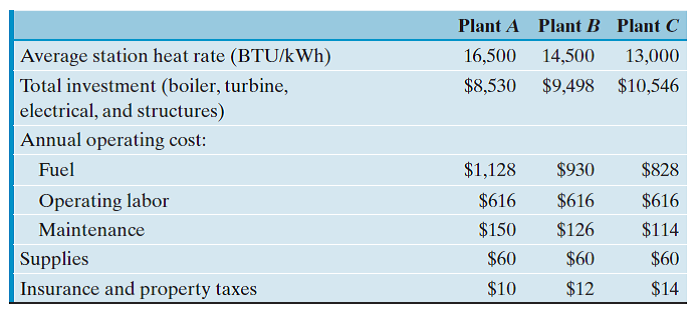

An international manufacturer of prepared food items needs 50,000,000 kWh of electrical energy a year with a maximum demand of 10,000 kW. The local utility presently charges $0.085 per kWh, a rate considered high throughout the industry. Because the firm's power consumption is so large, its engineers are considering installing a 10,000-kW steam-turbine plant. Three types of plant have been proposed as shown in the following table ($ units in thousands):

The service life of each plant is expected to be 20 years. The plant investment will be subject to a 20-year MACRS property classification. The expected salvage value of the plant at the end of its useful life is about 10% of the original investment. The firm's MARR is known to be 12%. The firm's marginal income-tax rate is 39%.

(a) Determine the unit power cost ($/kWh) for each plant.

(b) Which plant would provide the most economical power?

The service life of each plant is expected to be 20 years. The plant investment will be subject to a 20-year MACRS property classification. The expected salvage value of the plant at the end of its useful life is about 10% of the original investment. The firm's MARR is known to be 12%. The firm's marginal income-tax rate is 39%.

(a) Determine the unit power cost ($/kWh) for each plant.

(b) Which plant would provide the most economical power?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

H H Machine Systems Inc. needs to acquire a new lift truck for transporting final products to their warehouse. One alternative is to purchase the lift truck for $40,000, which will be financed by a bank loan at an interest rate of 12%. The loan must be repaid in four equal installments payable at the end of each year. Under the borrow-to-purchase arrangement, H H would have to maintain the truck at an annual cost of $1,200, payable at year-end. Alternatively, H H could lease the truck on a four-year contract for a lease payment of $11,000 per year. Each annual lease payment must be made at the beginning of each year. The truck would be maintained by the lessor. The truck falls into the five-year MACRS classification, and it has a salvage value of $10,000, which is the expected market value after four years, at which time H H plans to replace the truck, regardless of whether the company leases or buys. H H has a marginal tax rate of 40% and an MARR of 15%.

(a) What is H H's cost of leasing in present worth?

(b) What is H H's cost of owning in present worth?

(c) Should the truck be leased or purchased?

(a) What is H H's cost of leasing in present worth?

(b) What is H H's cost of owning in present worth?

(c) Should the truck be leased or purchased?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

Janet Wigandt, an electrical engineer for Instrument Control, Inc. (ICI), has been asked to perform a lease-buy analysis on a new pin-inserting machine for ICI's PC-board manufacturing operation. The details of the two options are as follows:

Buy option: The equipment costs $120,000. To purchase it, ICI could obtain a term loan for the full amount at 10% interest with four equal annual installments (end-of-year payments). The machine falls into a five-year MACRS property classification. Annual revenues of $200,000 and annual operating costs of $40,000 are anticipated. The machine requires annual maintenance at a cost of $10,000. Because technology is changing rapidly in pin-inserting machinery, the salvage value of the machine is expected to be only $20,000.

Lease option: BLI is willing to write a four-year operating lease on the equipment for payments of $44,000 at the beginning of each year. Under this operating-lease arrangement, BLI will maintain the asset, so the annual maintenance cost of $10,000 will be saved. ICI's marginal tax rate is 40%, and its MARR is 15% during the analysis period.

(a) What is ICI's present-worth (incremental) cost of owning the equipment?

(b) What is ICI's present-worth (incremental) cost of leasing the equipment?

(c) Should ICI buy or lease the equipment?

Buy option: The equipment costs $120,000. To purchase it, ICI could obtain a term loan for the full amount at 10% interest with four equal annual installments (end-of-year payments). The machine falls into a five-year MACRS property classification. Annual revenues of $200,000 and annual operating costs of $40,000 are anticipated. The machine requires annual maintenance at a cost of $10,000. Because technology is changing rapidly in pin-inserting machinery, the salvage value of the machine is expected to be only $20,000.

Lease option: BLI is willing to write a four-year operating lease on the equipment for payments of $44,000 at the beginning of each year. Under this operating-lease arrangement, BLI will maintain the asset, so the annual maintenance cost of $10,000 will be saved. ICI's marginal tax rate is 40%, and its MARR is 15% during the analysis period.

(a) What is ICI's present-worth (incremental) cost of owning the equipment?

(b) What is ICI's present-worth (incremental) cost of leasing the equipment?

(c) Should ICI buy or lease the equipment?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

Oregon Machinery Company (OMC) has decided to acquire a screw machine. One alternative is to lease the machine on a three-year contract for a lease payment of $22,000 per year with payments to be made at the beginning of each year. The lease would include maintenance. The second alternative is to purchase the machine outright for $97,000, financing the investment with a bank loan for the net purchase price and amortizing the loan over a three-year period at an interest rate of 12% per year (annual payment = $40, 386).

Under the borrow-to-purchase arrangement, the company would have to maintain the machine at an annual cost of $6,000, payable at year-end. The machine falls into the seven-year MACRS classification, and it has a salvage value of $45,000, which is the expected market value at the end of year 3. After three years, the company plans to replace the machine regardless of whether it leases or buys. The tax rate is 40%, and the MARR is 15%.

(a) What is OMC's PW cost of leasing?

(b) What is OMC's PW cost of owning?

(c) From the financing analyses in parts (a) and (b), what are the advantages and disadvantages of leasing and owning?

Under the borrow-to-purchase arrangement, the company would have to maintain the machine at an annual cost of $6,000, payable at year-end. The machine falls into the seven-year MACRS classification, and it has a salvage value of $45,000, which is the expected market value at the end of year 3. After three years, the company plans to replace the machine regardless of whether it leases or buys. The tax rate is 40%, and the MARR is 15%.

(a) What is OMC's PW cost of leasing?

(b) What is OMC's PW cost of owning?

(c) From the financing analyses in parts (a) and (b), what are the advantages and disadvantages of leasing and owning?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

Gentry Machines, Inc., has just received a special job order from one of its clients.

The following financial data on the order have been collected:

This two-year project requires the purchase of a special-purpose piece of equipment for $55,000. The equipment falls into the MACRS five-year class.

The machine will be sold at the end of two years for $27,000 (today's dollars).

The project will bring in an additional annual revenue of $114,000 (actual dollars), but it is expected to incur an additional annual operating cost of $53,800 (today's dollars).

To purchase the equipment, the firm expects to borrow $50,000 at 10% over a two-year period (equal annual payments of $28,810 in actual dollars). The remaining $5,000 will be taken from the firm's retained earnings.

The firm expects a general inflation of 5% per year during the project period. The firm's marginal tax rate is 40%, and its market interest rate is 18%.

(a) Compute the after-tax cash flows in actual dollars.

(b) What is the equivalent present worth of this amount at time 0?

The following financial data on the order have been collected:

This two-year project requires the purchase of a special-purpose piece of equipment for $55,000. The equipment falls into the MACRS five-year class.

The machine will be sold at the end of two years for $27,000 (today's dollars).

The project will bring in an additional annual revenue of $114,000 (actual dollars), but it is expected to incur an additional annual operating cost of $53,800 (today's dollars).

To purchase the equipment, the firm expects to borrow $50,000 at 10% over a two-year period (equal annual payments of $28,810 in actual dollars). The remaining $5,000 will be taken from the firm's retained earnings.

The firm expects a general inflation of 5% per year during the project period. The firm's marginal tax rate is 40%, and its market interest rate is 18%.

(a) Compute the after-tax cash flows in actual dollars.

(b) What is the equivalent present worth of this amount at time 0?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

Hugh Health Product Corporation is considering the purchase of a computer to control plant packaging for a spectrum of health products. The following data have been collected:

First cost = $130,000 to be borrowed at 9% interest, where only interest is paid each year and the principal is due in a lump sum at the end of year 2.

Economic service life = six years.

Estimated selling price in year-0 dollars = $20,000.

Depreciation method = five-year MACRS property.

Marginal income-tax rate = 40% (remains constant).

Annual revenue = $155,000 (today's dollars).

Annual expense (not including depreciation and interest) = $88,000 (today's dollars).

Market interest rate = 18%.

(a) An average general inflation rate of 5%, affecting all revenues, expenses, and the salvage value, is expected during the project period. Determine the cash flows in actual dollars.

(b) Compute the net present worth of the project under inflation.

(c) Compute the net-present-worth loss (or gain) due to inflation.

(d) Compute the present-worth loss (or gain) due to borrowing.

First cost = $130,000 to be borrowed at 9% interest, where only interest is paid each year and the principal is due in a lump sum at the end of year 2.

Economic service life = six years.

Estimated selling price in year-0 dollars = $20,000.

Depreciation method = five-year MACRS property.

Marginal income-tax rate = 40% (remains constant).

Annual revenue = $155,000 (today's dollars).

Annual expense (not including depreciation and interest) = $88,000 (today's dollars).

Market interest rate = 18%.

(a) An average general inflation rate of 5%, affecting all revenues, expenses, and the salvage value, is expected during the project period. Determine the cash flows in actual dollars.

(b) Compute the net present worth of the project under inflation.

(c) Compute the net-present-worth loss (or gain) due to inflation.

(d) Compute the present-worth loss (or gain) due to borrowing.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

57

J. F. Manning Metal Company is considering the purchase of a new milling machine during year 0. The machine's base price is $135,000, and it will cost another $15,000 to modify the machine for special use by the firm, resulting in a $150,000 cost base for depreciation. The machine falls into the MACRS seven-year property class. The machine will be sold after three years for $80,000 (actual dollars). Use of the machine will require an increase in net working capital (inventory) of $10,000 at the beginning of the project year. The machine will have no effect on revenues, but it is expected to save the firm $80,000 (today's dollars) per year in before-tax operating costs-mainly labor. The firm's marginal tax rate is 40%, and this rate is expected to remain unchanged over the project's duration. However, the company expects that the labor cost will increase at an annual rate of 5% and that the working-capital requirement will grow at an annual rate of 8% caused by inflation. The selling price of the milling machine is not affected by inflation. The general inflation rate is estimated to be 6% per year over the project period. The firm's market interest rate is 20%.

(a) Determine the project cash flows in actual dollars.

(b) Determine the project cash flows in constant (time-zero) dollars.

(c) Is this project acceptable?

(a) Determine the project cash flows in actual dollars.

(b) Determine the project cash flows in constant (time-zero) dollars.

(c) Is this project acceptable?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58