Deck 16: Personal Selling and Sales Promotion

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/31

Play

Full screen (f)

Deck 16: Personal Selling and Sales Promotion

1

In what ways are traditional specialty stores and off-price retailers similar? How do they differ?

Similarity between off price retailers and speciality stores are:

Both, the retailers offer higher discounts than departmental stores throughout the year especially during of seasons to attract customers and increase sales.

Both, the off price retailer and traditional speciality retailer make bulk purchase from suppliers to make it cost effective.

Difference between off price retailers and speciality stores are:

Traditional speciality stores have a very narrow range of product mix with vas product lines. And off-price stores purchase manufacturer's production of off season, overruns, seconds and returns that run at cheap prices and discounted rates to consumers.

An annual membership is required in off price retailing. Services at off price are lower and selection of off price stores is unpredictable.

Traditional speciality retailers carry varied depth in any category of product whereas off price retailers offer selective national brands.

Both, the retailers offer higher discounts than departmental stores throughout the year especially during of seasons to attract customers and increase sales.

Both, the off price retailer and traditional speciality retailer make bulk purchase from suppliers to make it cost effective.

Difference between off price retailers and speciality stores are:

Traditional speciality stores have a very narrow range of product mix with vas product lines. And off-price stores purchase manufacturer's production of off season, overruns, seconds and returns that run at cheap prices and discounted rates to consumers.

An annual membership is required in off price retailing. Services at off price are lower and selection of off price stores is unpredictable.

Traditional speciality retailers carry varied depth in any category of product whereas off price retailers offer selective national brands.

2

Why are manufacturers' sales offices and branches classified as wholesalers? Which independent wholesalers are replaced by manufacturers' sales branches? By sales offices?

Sales branches act as intermediaries that sell products to the sales force, and provide them with support services.

Sales offices owned by manufacturers provide services related to the agents.

These are classified as wholesalers because these are mainly set up to reach the customers by performing the wholesaling functions effectively. The consumers usually include retailers, business buyers, and other wholesalers.

Manufacturers' sales branches and offices is the wholesaling services provided by sellers or buyers themselves replacing independent wholesalers.

Sales offices owned by manufacturers provide services related to the agents.

These are classified as wholesalers because these are mainly set up to reach the customers by performing the wholesaling functions effectively. The consumers usually include retailers, business buyers, and other wholesalers.

Manufacturers' sales branches and offices is the wholesaling services provided by sellers or buyers themselves replacing independent wholesalers.

3

Distribution decisions in the marketing plan entail the movement of your product from the producer until it reaches the final consumer. An understanding of how and where your customer prefers to purchase products is critical to the development of the marketing plan. As you apply the information in this chapter to your plan, focus on the following issues:

Discuss how the characteristics of the retail establishment, such as location and store image, have an impact on the consumer's perception of your product.

The information obtained from these questions should assist you in developing various aspects of your marketing plan found in the "Interactive Marketing Plan" exercise at www.cengagebrain.com.

Discuss how the characteristics of the retail establishment, such as location and store image, have an impact on the consumer's perception of your product.

The information obtained from these questions should assist you in developing various aspects of your marketing plan found in the "Interactive Marketing Plan" exercise at www.cengagebrain.com.

The characteristics of the product have direct impact on the consumer's perception regarding the product as the customer focuses mainly on the characteristics of the product. There are certain factors that change the perception regarding the product.

Those factors are as follows:

• Design and methodology of the product.

• Practical consequences of the product.

• Uniqueness of the product in terms of technology, customer convenience and market type and place.

• Price of the product.

• Purpose of the product.

Moreover, a customer can form perception about a product on the basis of the objectives of the product, owners, as well as company. The goodwill of the company also matters a lot.

Variation and additional characteristics attract customers a lot. Perception may also be formed by comparing the product from the competitor's product.

Those factors are as follows:

• Design and methodology of the product.

• Practical consequences of the product.

• Uniqueness of the product in terms of technology, customer convenience and market type and place.

• Price of the product.

• Purpose of the product.

Moreover, a customer can form perception about a product on the basis of the objectives of the product, owners, as well as company. The goodwill of the company also matters a lot.

Variation and additional characteristics attract customers a lot. Perception may also be formed by comparing the product from the competitor's product.

4

Juanita wants to open a small retail store that specializes in high-quality, high-priced children's clothing. What types of competitors should she be concerned about in this competitive retail environment? Why?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

5

GameStop Plays to Win The Super Mario Bros. and Iron Man games fly off the shelves when GameStop pulls out all the stops in its video game marketing. Based in Grapevine, Texas, GameStop rings up $9 billion in annual sales as a specialty retailer of new and used video game hardware and software. Its 6,600 stores in 17 countries stock popular video game consoles and accessories from Sony, Microsoft, and Nintendo, plus thousands of games. Each 1,400-square-foot store is packed with an ever-changing merchandise assortment, some items purchased new from manufacturers or distributors and some taken as trade-ins from customers.

Founded in 1996, Game- Stop went through several names and mergers as it refined its retailing model and kicked off an aggressive expansion strategy that continues today, with the opening of 400 new stores every year. Its network of brick-and- mortar stores is complemented by an e-commerce site where customers can click to browse inventory, buy games and gear to be shipped to their homes, download free or paid games, and register for online game tournaments.

Highly Seasonal, Highly Competitive

GameStop's business is both highly seasonal and highly competitive. Approximately 40 percent of its sales are made during the last three months of the year. In the United States, it must contend with the marketing muscle of giant discounters, such as Walmart and Target, toy stores like Toys"R"Us, and national electronics chains like Best Buy, as well as specialty stores, catalog merchants, and online retailers of all sizes. Outside the United States, GameStop also competes with multinational hypermarket retailers like Carrefour.

The company targets three customer segments: enthusiasts, casual gamers, and seasonal gift givers. In addition, some customers are value-oriented and prefer to buy used products, including older consoles and games that are no longer available as new items.

Used Games for Sale

One of GameStop's competitive advantages is its trade-in policy. Customers can bring in their games, consoles, and accessories and receive a store credit toward the purchase of other merchandise. Trade-ins must be in working condition and must include the original box and the instruction manual. GameStop's refurbishment centers in North America, Australia, and Europe test all trade-ins, fi x defects when necessary, repackage the products, and ship them to stores for retail sale. Not only do trade-ins stimulate store traffic, but sales of used products result in a higher gross margin than sales of new products. Used games account for about one-fourth of GameStop's revenue and as much as 45 percent of its profits. The company recently began allowing trade-ins of non-game mobile devices, such as iPads and iPods, another way to bring customers into its stores.

The profit potential in used games has drawn competition for GameStop. The convenience store chain 7-Eleven has entered this market, selling used games through a partnership with the wholesaler Game Trading Technologies. Toys"R"Us also offers some used games and consoles and invites trade-ins, in person and by mail. Amazon. com allows game trade-ins by mail and serves as a virtual storefront for used video games sold by consumers and businesses, in addition to retailing new games and consoles.

The Right Merchandise in the Right Location

GameStop chooses store locations based on a number of factors, including demographic trends, visibility to pedestrians and vehicular traffic, and parking availability. It prefers to put stores in power shopping centers and malls that draw a high volume of customers. It also checks out the competitive situation in each area before making a final decision. Store atmospherics are designed to appeal to game players and include equipment where customers can sample games and watch videos of game clips before making a purchase.

Over the years, GameStop has developed a sophisticated information system for analyzing historic trends in store sales so it can project future demand for current and new products. This is especially important for satisfying the needs of enthusiasts, who may buy elsewhere if GameStop doesn't have the latest game or console in stock immediately after its release.

To help predict demand, GameStop invites customers to preorder new items for pick up at their local stores on or after the release date. It also tracks customer requests and monitors media coverage in advance of new-product introductions. During a busy period of new-game introductions, GameStop may have more than 1,000 new games in stock and ready for purchase. Because new games and equipment can make older products obsolete, GameStop has negotiated deals with its primary suppliers to allow returns in such instances.

Thanks to its marketing information system, GameStop knows exactly which products sell in each of its stores and what inventory is available in its distribution centers. The system automatically reorders merchandise as it sells and schedules twice-weekly shipments to replenish stock, so store shelves are never empty. On the other hand, daily analysis of inventory positions and frequent restocking allows GameStop to tailor the merchandise mix for each store while avoiding the expense of carrying too much safety stock in each store.

For high efficiency, GameStop supplies replenishment stock to U.S. stores from its 400,000-square-foot distribution center in Grapevine, Texas. Its 260,000-square-foot center in Louisville, Kentucky, is dedicated to receiving, sorting, and shipping hot new games and consoles to its stores nationwide. The company uses centrally located distribution centers to restock stores in other countries.

The Digital Dilemma

Despite GameStop's considerable investment in brick-and-mortar retailing, it sees great value in maintaining a strong online retailing presence. Game enthusiasts tend to be heavy Internet users, and GameStop wants to be where they like to be. Its website has a feature of interest to all of the targeted segments: a "wish list" where enthusiasts and casual gamers can itemize the products they would most like to receive (from gift-givers). GameStop also offers a weekly e-newsletter with exclusive discounts and advance notice of sales, tournaments, midnight openings for new releases, and other events.

Game consoles are increasingly Internet-ready and many players already play games on their personal computers, so digital game downloads are a must for GameStop. Its e-commerce site sells downloadable versions of popular games and offers hundreds of free games, some downloadable and some that play in the user's Web browser. The company tested a Facebook storefront, thinking it would appeal to its 4 million "fans," but quickly closed the "store" down because online buying is so convenient on the GameStop website.

Digital downloads pose a dilemma. GameStop's executives have been monitoring the situation in the music industry, where downloads have cut into retailers' sales of actual CDs. However, digital music fi les are relatively small, compared with digital game fi les. This means buyers would have to have a very speedy broadband Internet connection to get a game downloaded in a reasonable length of time. Still, GameStop recently began accepting in-store preorders for new digitally downloadable games, accepting trade-ins as credit toward the purchase price. "This is a great illustration of how the digital distribution model and in-store experience really complement one another," explains a GameStop official.

How does GameStop create time, place, possession, and form utility for customers who want to buy used video games?

Founded in 1996, Game- Stop went through several names and mergers as it refined its retailing model and kicked off an aggressive expansion strategy that continues today, with the opening of 400 new stores every year. Its network of brick-and- mortar stores is complemented by an e-commerce site where customers can click to browse inventory, buy games and gear to be shipped to their homes, download free or paid games, and register for online game tournaments.

Highly Seasonal, Highly Competitive

GameStop's business is both highly seasonal and highly competitive. Approximately 40 percent of its sales are made during the last three months of the year. In the United States, it must contend with the marketing muscle of giant discounters, such as Walmart and Target, toy stores like Toys"R"Us, and national electronics chains like Best Buy, as well as specialty stores, catalog merchants, and online retailers of all sizes. Outside the United States, GameStop also competes with multinational hypermarket retailers like Carrefour.

The company targets three customer segments: enthusiasts, casual gamers, and seasonal gift givers. In addition, some customers are value-oriented and prefer to buy used products, including older consoles and games that are no longer available as new items.

Used Games for Sale

One of GameStop's competitive advantages is its trade-in policy. Customers can bring in their games, consoles, and accessories and receive a store credit toward the purchase of other merchandise. Trade-ins must be in working condition and must include the original box and the instruction manual. GameStop's refurbishment centers in North America, Australia, and Europe test all trade-ins, fi x defects when necessary, repackage the products, and ship them to stores for retail sale. Not only do trade-ins stimulate store traffic, but sales of used products result in a higher gross margin than sales of new products. Used games account for about one-fourth of GameStop's revenue and as much as 45 percent of its profits. The company recently began allowing trade-ins of non-game mobile devices, such as iPads and iPods, another way to bring customers into its stores.

The profit potential in used games has drawn competition for GameStop. The convenience store chain 7-Eleven has entered this market, selling used games through a partnership with the wholesaler Game Trading Technologies. Toys"R"Us also offers some used games and consoles and invites trade-ins, in person and by mail. Amazon. com allows game trade-ins by mail and serves as a virtual storefront for used video games sold by consumers and businesses, in addition to retailing new games and consoles.

The Right Merchandise in the Right Location

GameStop chooses store locations based on a number of factors, including demographic trends, visibility to pedestrians and vehicular traffic, and parking availability. It prefers to put stores in power shopping centers and malls that draw a high volume of customers. It also checks out the competitive situation in each area before making a final decision. Store atmospherics are designed to appeal to game players and include equipment where customers can sample games and watch videos of game clips before making a purchase.

Over the years, GameStop has developed a sophisticated information system for analyzing historic trends in store sales so it can project future demand for current and new products. This is especially important for satisfying the needs of enthusiasts, who may buy elsewhere if GameStop doesn't have the latest game or console in stock immediately after its release.

To help predict demand, GameStop invites customers to preorder new items for pick up at their local stores on or after the release date. It also tracks customer requests and monitors media coverage in advance of new-product introductions. During a busy period of new-game introductions, GameStop may have more than 1,000 new games in stock and ready for purchase. Because new games and equipment can make older products obsolete, GameStop has negotiated deals with its primary suppliers to allow returns in such instances.

Thanks to its marketing information system, GameStop knows exactly which products sell in each of its stores and what inventory is available in its distribution centers. The system automatically reorders merchandise as it sells and schedules twice-weekly shipments to replenish stock, so store shelves are never empty. On the other hand, daily analysis of inventory positions and frequent restocking allows GameStop to tailor the merchandise mix for each store while avoiding the expense of carrying too much safety stock in each store.

For high efficiency, GameStop supplies replenishment stock to U.S. stores from its 400,000-square-foot distribution center in Grapevine, Texas. Its 260,000-square-foot center in Louisville, Kentucky, is dedicated to receiving, sorting, and shipping hot new games and consoles to its stores nationwide. The company uses centrally located distribution centers to restock stores in other countries.

The Digital Dilemma

Despite GameStop's considerable investment in brick-and-mortar retailing, it sees great value in maintaining a strong online retailing presence. Game enthusiasts tend to be heavy Internet users, and GameStop wants to be where they like to be. Its website has a feature of interest to all of the targeted segments: a "wish list" where enthusiasts and casual gamers can itemize the products they would most like to receive (from gift-givers). GameStop also offers a weekly e-newsletter with exclusive discounts and advance notice of sales, tournaments, midnight openings for new releases, and other events.

Game consoles are increasingly Internet-ready and many players already play games on their personal computers, so digital game downloads are a must for GameStop. Its e-commerce site sells downloadable versions of popular games and offers hundreds of free games, some downloadable and some that play in the user's Web browser. The company tested a Facebook storefront, thinking it would appeal to its 4 million "fans," but quickly closed the "store" down because online buying is so convenient on the GameStop website.

Digital downloads pose a dilemma. GameStop's executives have been monitoring the situation in the music industry, where downloads have cut into retailers' sales of actual CDs. However, digital music fi les are relatively small, compared with digital game fi les. This means buyers would have to have a very speedy broadband Internet connection to get a game downloaded in a reasonable length of time. Still, GameStop recently began accepting in-store preorders for new digitally downloadable games, accepting trade-ins as credit toward the purchase price. "This is a great illustration of how the digital distribution model and in-store experience really complement one another," explains a GameStop official.

How does GameStop create time, place, possession, and form utility for customers who want to buy used video games?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

6

What value is added to a product by retailers? What value is added by retailers for producers and ultimate consumers?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

7

L.Bean: Open 24/7, Click or Brick

L.L.Bean, based in Freeport, Maine, began life as a one product firm selling by mail in 1912. Founder Leon Leonwood Bean designed and tested every product he sold, starting with the now-iconic rubber-soled Bean Boot. Today, the catalog business that L.L.Bean began is still going strong, along with 30 U.S. stores and a thriving online retail operation. In addition, L.L.Bean is expanding its retail presence in

Japan and China, where customers are particularly drawn to brand names that represent quality and a distinct personality. The company's outdoorsy image and innovative products, combined with a century-old reputation for standing behind every item, have made its stores popular shopping destinations around the world and around the Web.

Although the award-winning L.L.Bean catalog swelled in size during the 1980s and 1990s, it has slimmed down over the years as the online store has grown. Now, using sophisticated marketing database systems, L.L.Bean manages and updates the mailing lists and customer preferences for its catalogs. For targeting purposes, L.L.Bean creates 50 different catalogs that are mailed to selected customers across the United States and in 160 countries worldwide. The company's computer modeling tools indicate which customers are interested in which products so they receive only the specialized catalogs they desire. Still, says the vice president of stores, "what we find is most customers want some sort of touch point," whether they buy online, in a store, by mail, or by phone.

The company's flagship retail store in Freeport, Maine, like its online counterpart, is open 24 hours a day, 7 days a week, throughout the year. Even on major holidays like Thanksgiving and Christmas, when most other stores are closed, the flagship store is open for business. It stocks extra merchandise and hires additional employees for busy buying periods, as does the online store. Day or night, rain or shine, customers can walk the aisles of the gigantic Freeport store to browse an assortment of clothing and footwear for men, women, and children; try out camping gear and other sporting goods; buy home goods like blankets; and check out pet supplies. Every week, the store offers hands-on demonstrations and how-to seminars to educate customers about its products. Customers can pause for a cup of coffee or sit down to a full meal at the in-store café. Thanks to the store's enormous size and entertaining extras, it has become a tourist attraction as well as the centerpiece of L.L.Bean's retail empire.

L.L.Bean's online store continues to grow in popularity. In fact, online orders recently surpassed mail and phone orders, a first in the company's history, and the company also offers a mobile app for anytime, anywhere access via cell phone. The web-based store is busy year-round, but especially during the Christmas shopping season, when it receives a virtual blizzard of orders-as many as 120,000 orders in a day. Unlike the physical stores, which have limited space to hold and display inventory for shoppers to buy in person, the online store can offer every product in every size and color. Customers can order via the Web and have purchases sent to their home or office address or shipped to a local L.L.Bean store for pickup. This latter option is particularly convenient for customers who prefer to pay with cash rather than credit or debit cards.

At the start of L.L.Bean's second century, its dedication to customer satisfaction is as strong as when Leon Leonwood Bean began his mail-order business so many decades ago. "We want to keep... the customer happy and keep that customer coming back to L.L.Bean over and over," explains the vice president of e-commerce.

What type(s) of location do you think would be most appropriate for future L.L.Bean stores, and why?

L.L.Bean, based in Freeport, Maine, began life as a one product firm selling by mail in 1912. Founder Leon Leonwood Bean designed and tested every product he sold, starting with the now-iconic rubber-soled Bean Boot. Today, the catalog business that L.L.Bean began is still going strong, along with 30 U.S. stores and a thriving online retail operation. In addition, L.L.Bean is expanding its retail presence in

Japan and China, where customers are particularly drawn to brand names that represent quality and a distinct personality. The company's outdoorsy image and innovative products, combined with a century-old reputation for standing behind every item, have made its stores popular shopping destinations around the world and around the Web.

Although the award-winning L.L.Bean catalog swelled in size during the 1980s and 1990s, it has slimmed down over the years as the online store has grown. Now, using sophisticated marketing database systems, L.L.Bean manages and updates the mailing lists and customer preferences for its catalogs. For targeting purposes, L.L.Bean creates 50 different catalogs that are mailed to selected customers across the United States and in 160 countries worldwide. The company's computer modeling tools indicate which customers are interested in which products so they receive only the specialized catalogs they desire. Still, says the vice president of stores, "what we find is most customers want some sort of touch point," whether they buy online, in a store, by mail, or by phone.

The company's flagship retail store in Freeport, Maine, like its online counterpart, is open 24 hours a day, 7 days a week, throughout the year. Even on major holidays like Thanksgiving and Christmas, when most other stores are closed, the flagship store is open for business. It stocks extra merchandise and hires additional employees for busy buying periods, as does the online store. Day or night, rain or shine, customers can walk the aisles of the gigantic Freeport store to browse an assortment of clothing and footwear for men, women, and children; try out camping gear and other sporting goods; buy home goods like blankets; and check out pet supplies. Every week, the store offers hands-on demonstrations and how-to seminars to educate customers about its products. Customers can pause for a cup of coffee or sit down to a full meal at the in-store café. Thanks to the store's enormous size and entertaining extras, it has become a tourist attraction as well as the centerpiece of L.L.Bean's retail empire.

L.L.Bean's online store continues to grow in popularity. In fact, online orders recently surpassed mail and phone orders, a first in the company's history, and the company also offers a mobile app for anytime, anywhere access via cell phone. The web-based store is busy year-round, but especially during the Christmas shopping season, when it receives a virtual blizzard of orders-as many as 120,000 orders in a day. Unlike the physical stores, which have limited space to hold and display inventory for shoppers to buy in person, the online store can offer every product in every size and color. Customers can order via the Web and have purchases sent to their home or office address or shipped to a local L.L.Bean store for pickup. This latter option is particularly convenient for customers who prefer to pay with cash rather than credit or debit cards.

At the start of L.L.Bean's second century, its dedication to customer satisfaction is as strong as when Leon Leonwood Bean began his mail-order business so many decades ago. "We want to keep... the customer happy and keep that customer coming back to L.L.Bean over and over," explains the vice president of e-commerce.

What type(s) of location do you think would be most appropriate for future L.L.Bean stores, and why?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

8

Distribution decisions in the marketing plan entail the movement of your product from the producer until it reaches the final consumer. An understanding of how and where your customer prefers to purchase products is critical to the development of the marketing plan. As you apply the information in this chapter to your plan, focus on the following issues:

Considering your product's attributes and your target market's (or markets') buying behavior, will your product likely be sold to the ultimate customer or to another member of the marketing channel?

The information obtained from these questions should assist you in developing various aspects of your marketing plan found in the "Interactive Marketing Plan" exercise at www.cengagebrain.com.

Considering your product's attributes and your target market's (or markets') buying behavior, will your product likely be sold to the ultimate customer or to another member of the marketing channel?

The information obtained from these questions should assist you in developing various aspects of your marketing plan found in the "Interactive Marketing Plan" exercise at www.cengagebrain.com.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

9

Contact a local retailer you patronize, and ask the store manager to describe the store's relationship with one of its wholesalers. Using your text as a guide, identify the distribution activities performed by the wholesaler. Are any of these activities shared by both the retailer and the wholesaler? How do these activities benefit the retailer? How do they benefit you as a consumer?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

10

Walmart

Walmart provides a website where customers can shop for products, search for a nearby store, and even preorder new products. The website lets browsers see what is on sale and view company information. Access Walmart's company website at www.walmart.com.

How does Walmart attempt to position itself on its website?

Walmart provides a website where customers can shop for products, search for a nearby store, and even preorder new products. The website lets browsers see what is on sale and view company information. Access Walmart's company website at www.walmart.com.

How does Walmart attempt to position itself on its website?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

11

What major issues should be considered when determining a retail site location?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

12

GameStop Plays to Win The Super Mario Bros. and Iron Man games fly off the shelves when GameStop pulls out all the stops in its video game marketing. Based in Grapevine, Texas, GameStop rings up $9 billion in annual sales as a specialty retailer of new and used video game hardware and software. Its 6,600 stores in 17 countries stock popular video game consoles and accessories from Sony, Microsoft, and Nintendo, plus thousands of games. Each 1,400-square-foot store is packed with an ever-changing merchandise assortment, some items purchased new from manufacturers or distributors and some taken as trade-ins from customers.

Founded in 1996, Game- Stop went through several names and mergers as it refined its retailing model and kicked off an aggressive expansion strategy that continues today, with the opening of 400 new stores every year. Its network of brick-and- mortar stores is complemented by an e-commerce site where customers can click to browse inventory, buy games and gear to be shipped to their homes, download free or paid games, and register for online game tournaments.

Highly Seasonal, Highly Competitive

GameStop's business is both highly seasonal and highly competitive. Approximately 40 percent of its sales are made during the last three months of the year. In the United States, it must contend with the marketing muscle of giant discounters, such as Walmart and Target, toy stores like Toys"R"Us, and national electronics chains like Best Buy, as well as specialty stores, catalog merchants, and online retailers of all sizes. Outside the United States, GameStop also competes with multinational hypermarket retailers like Carrefour.

The company targets three customer segments: enthusiasts, casual gamers, and seasonal gift givers. In addition, some customers are value-oriented and prefer to buy used products, including older consoles and games that are no longer available as new items.

Used Games for Sale

One of GameStop's competitive advantages is its trade-in policy. Customers can bring in their games, consoles, and accessories and receive a store credit toward the purchase of other merchandise. Trade-ins must be in working condition and must include the original box and the instruction manual. GameStop's refurbishment centers in North America, Australia, and Europe test all trade-ins, fi x defects when necessary, repackage the products, and ship them to stores for retail sale. Not only do trade-ins stimulate store traffic, but sales of used products result in a higher gross margin than sales of new products. Used games account for about one-fourth of GameStop's revenue and as much as 45 percent of its profits. The company recently began allowing trade-ins of non-game mobile devices, such as iPads and iPods, another way to bring customers into its stores.

The profit potential in used games has drawn competition for GameStop. The convenience store chain 7-Eleven has entered this market, selling used games through a partnership with the wholesaler Game Trading Technologies. Toys"R"Us also offers some used games and consoles and invites trade-ins, in person and by mail. Amazon. com allows game trade-ins by mail and serves as a virtual storefront for used video games sold by consumers and businesses, in addition to retailing new games and consoles.

The Right Merchandise in the Right Location

GameStop chooses store locations based on a number of factors, including demographic trends, visibility to pedestrians and vehicular traffic, and parking availability. It prefers to put stores in power shopping centers and malls that draw a high volume of customers. It also checks out the competitive situation in each area before making a final decision. Store atmospherics are designed to appeal to game players and include equipment where customers can sample games and watch videos of game clips before making a purchase.

Over the years, GameStop has developed a sophisticated information system for analyzing historic trends in store sales so it can project future demand for current and new products. This is especially important for satisfying the needs of enthusiasts, who may buy elsewhere if GameStop doesn't have the latest game or console in stock immediately after its release.

To help predict demand, GameStop invites customers to preorder new items for pick up at their local stores on or after the release date. It also tracks customer requests and monitors media coverage in advance of new-product introductions. During a busy period of new-game introductions, GameStop may have more than 1,000 new games in stock and ready for purchase. Because new games and equipment can make older products obsolete, GameStop has negotiated deals with its primary suppliers to allow returns in such instances.

Thanks to its marketing information system, GameStop knows exactly which products sell in each of its stores and what inventory is available in its distribution centers. The system automatically reorders merchandise as it sells and schedules twice-weekly shipments to replenish stock, so store shelves are never empty. On the other hand, daily analysis of inventory positions and frequent restocking allows GameStop to tailor the merchandise mix for each store while avoiding the expense of carrying too much safety stock in each store.

For high efficiency, GameStop supplies replenishment stock to U.S. stores from its 400,000-square-foot distribution center in Grapevine, Texas. Its 260,000-square-foot center in Louisville, Kentucky, is dedicated to receiving, sorting, and shipping hot new games and consoles to its stores nationwide. The company uses centrally located distribution centers to restock stores in other countries.

The Digital Dilemma

Despite GameStop's considerable investment in brick-and-mortar retailing, it sees great value in maintaining a strong online retailing presence. Game enthusiasts tend to be heavy Internet users, and GameStop wants to be where they like to be. Its website has a feature of interest to all of the targeted segments: a "wish list" where enthusiasts and casual gamers can itemize the products they would most like to receive (from gift-givers). GameStop also offers a weekly e-newsletter with exclusive discounts and advance notice of sales, tournaments, midnight openings for new releases, and other events.

Game consoles are increasingly Internet-ready and many players already play games on their personal computers, so digital game downloads are a must for GameStop. Its e-commerce site sells downloadable versions of popular games and offers hundreds of free games, some downloadable and some that play in the user's Web browser. The company tested a Facebook storefront, thinking it would appeal to its 4 million "fans," but quickly closed the "store" down because online buying is so convenient on the GameStop website.

Digital downloads pose a dilemma. GameStop's executives have been monitoring the situation in the music industry, where downloads have cut into retailers' sales of actual CDs. However, digital music fi les are relatively small, compared with digital game fi les. This means buyers would have to have a very speedy broadband Internet connection to get a game downloaded in a reasonable length of time. Still, GameStop recently began accepting in-store preorders for new digitally downloadable games, accepting trade-ins as credit toward the purchase price. "This is a great illustration of how the digital distribution model and in-store experience really complement one another," explains a GameStop official.

What role does physical distribution play in GameStop's retailing strategy?

Founded in 1996, Game- Stop went through several names and mergers as it refined its retailing model and kicked off an aggressive expansion strategy that continues today, with the opening of 400 new stores every year. Its network of brick-and- mortar stores is complemented by an e-commerce site where customers can click to browse inventory, buy games and gear to be shipped to their homes, download free or paid games, and register for online game tournaments.

Highly Seasonal, Highly Competitive

GameStop's business is both highly seasonal and highly competitive. Approximately 40 percent of its sales are made during the last three months of the year. In the United States, it must contend with the marketing muscle of giant discounters, such as Walmart and Target, toy stores like Toys"R"Us, and national electronics chains like Best Buy, as well as specialty stores, catalog merchants, and online retailers of all sizes. Outside the United States, GameStop also competes with multinational hypermarket retailers like Carrefour.

The company targets three customer segments: enthusiasts, casual gamers, and seasonal gift givers. In addition, some customers are value-oriented and prefer to buy used products, including older consoles and games that are no longer available as new items.

Used Games for Sale

One of GameStop's competitive advantages is its trade-in policy. Customers can bring in their games, consoles, and accessories and receive a store credit toward the purchase of other merchandise. Trade-ins must be in working condition and must include the original box and the instruction manual. GameStop's refurbishment centers in North America, Australia, and Europe test all trade-ins, fi x defects when necessary, repackage the products, and ship them to stores for retail sale. Not only do trade-ins stimulate store traffic, but sales of used products result in a higher gross margin than sales of new products. Used games account for about one-fourth of GameStop's revenue and as much as 45 percent of its profits. The company recently began allowing trade-ins of non-game mobile devices, such as iPads and iPods, another way to bring customers into its stores.

The profit potential in used games has drawn competition for GameStop. The convenience store chain 7-Eleven has entered this market, selling used games through a partnership with the wholesaler Game Trading Technologies. Toys"R"Us also offers some used games and consoles and invites trade-ins, in person and by mail. Amazon. com allows game trade-ins by mail and serves as a virtual storefront for used video games sold by consumers and businesses, in addition to retailing new games and consoles.

The Right Merchandise in the Right Location

GameStop chooses store locations based on a number of factors, including demographic trends, visibility to pedestrians and vehicular traffic, and parking availability. It prefers to put stores in power shopping centers and malls that draw a high volume of customers. It also checks out the competitive situation in each area before making a final decision. Store atmospherics are designed to appeal to game players and include equipment where customers can sample games and watch videos of game clips before making a purchase.

Over the years, GameStop has developed a sophisticated information system for analyzing historic trends in store sales so it can project future demand for current and new products. This is especially important for satisfying the needs of enthusiasts, who may buy elsewhere if GameStop doesn't have the latest game or console in stock immediately after its release.

To help predict demand, GameStop invites customers to preorder new items for pick up at their local stores on or after the release date. It also tracks customer requests and monitors media coverage in advance of new-product introductions. During a busy period of new-game introductions, GameStop may have more than 1,000 new games in stock and ready for purchase. Because new games and equipment can make older products obsolete, GameStop has negotiated deals with its primary suppliers to allow returns in such instances.

Thanks to its marketing information system, GameStop knows exactly which products sell in each of its stores and what inventory is available in its distribution centers. The system automatically reorders merchandise as it sells and schedules twice-weekly shipments to replenish stock, so store shelves are never empty. On the other hand, daily analysis of inventory positions and frequent restocking allows GameStop to tailor the merchandise mix for each store while avoiding the expense of carrying too much safety stock in each store.

For high efficiency, GameStop supplies replenishment stock to U.S. stores from its 400,000-square-foot distribution center in Grapevine, Texas. Its 260,000-square-foot center in Louisville, Kentucky, is dedicated to receiving, sorting, and shipping hot new games and consoles to its stores nationwide. The company uses centrally located distribution centers to restock stores in other countries.

The Digital Dilemma

Despite GameStop's considerable investment in brick-and-mortar retailing, it sees great value in maintaining a strong online retailing presence. Game enthusiasts tend to be heavy Internet users, and GameStop wants to be where they like to be. Its website has a feature of interest to all of the targeted segments: a "wish list" where enthusiasts and casual gamers can itemize the products they would most like to receive (from gift-givers). GameStop also offers a weekly e-newsletter with exclusive discounts and advance notice of sales, tournaments, midnight openings for new releases, and other events.

Game consoles are increasingly Internet-ready and many players already play games on their personal computers, so digital game downloads are a must for GameStop. Its e-commerce site sells downloadable versions of popular games and offers hundreds of free games, some downloadable and some that play in the user's Web browser. The company tested a Facebook storefront, thinking it would appeal to its 4 million "fans," but quickly closed the "store" down because online buying is so convenient on the GameStop website.

Digital downloads pose a dilemma. GameStop's executives have been monitoring the situation in the music industry, where downloads have cut into retailers' sales of actual CDs. However, digital music fi les are relatively small, compared with digital game fi les. This means buyers would have to have a very speedy broadband Internet connection to get a game downloaded in a reasonable length of time. Still, GameStop recently began accepting in-store preorders for new digitally downloadable games, accepting trade-ins as credit toward the purchase price. "This is a great illustration of how the digital distribution model and in-store experience really complement one another," explains a GameStop official.

What role does physical distribution play in GameStop's retailing strategy?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

13

Distribution decisions in the marketing plan entail the movement of your product from the producer until it reaches the final consumer. An understanding of how and where your customer prefers to purchase products is critical to the development of the marketing plan. As you apply the information in this chapter to your plan, focus on the following issues:

Are direct-marketing or direct-selling methods appropriate for your product and target market?

The information obtained from these questions should assist you in developing various aspects of your marketing plan found in the "Interactive Marketing Plan" exercise at www.cengagebrain.com.

Are direct-marketing or direct-selling methods appropriate for your product and target market?

The information obtained from these questions should assist you in developing various aspects of your marketing plan found in the "Interactive Marketing Plan" exercise at www.cengagebrain.com.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

14

L.Bean: Open 24/7, Click or Brick

L.L.Bean, based in Freeport, Maine, began life as a one product firm selling by mail in 1912. Founder Leon Leonwood Bean designed and tested every product he sold, starting with the now-iconic rubber-soled Bean Boot. Today, the catalog business that L.L.Bean began is still going strong, along with 30 U.S. stores and a thriving online retail operation. In addition, L.L.Bean is expanding its retail presence in

Japan and China, where customers are particularly drawn to brand names that represent quality and a distinct personality. The company's outdoorsy image and innovative products, combined with a century-old reputation for standing behind every item, have made its stores popular shopping destinations around the world and around the Web.

Although the award-winning L.L.Bean catalog swelled in size during the 1980s and 1990s, it has slimmed down over the years as the online store has grown. Now, using sophisticated marketing database systems, L.L.Bean manages and updates the mailing lists and customer preferences for its catalogs. For targeting purposes, L.L.Bean creates 50 different catalogs that are mailed to selected customers across the United States and in 160 countries worldwide. The company's computer modeling tools indicate which customers are interested in which products so they receive only the specialized catalogs they desire. Still, says the vice president of stores, "what we find is most customers want some sort of touch point," whether they buy online, in a store, by mail, or by phone.

The company's flagship retail store in Freeport, Maine, like its online counterpart, is open 24 hours a day, 7 days a week, throughout the year. Even on major holidays like Thanksgiving and Christmas, when most other stores are closed, the flagship store is open for business. It stocks extra merchandise and hires additional employees for busy buying periods, as does the online store. Day or night, rain or shine, customers can walk the aisles of the gigantic Freeport store to browse an assortment of clothing and footwear for men, women, and children; try out camping gear and other sporting goods; buy home goods like blankets; and check out pet supplies. Every week, the store offers hands-on demonstrations and how-to seminars to educate customers about its products. Customers can pause for a cup of coffee or sit down to a full meal at the in-store café. Thanks to the store's enormous size and entertaining extras, it has become a tourist attraction as well as the centerpiece of L.L.Bean's retail empire.

L.L.Bean's online store continues to grow in popularity. In fact, online orders recently surpassed mail and phone orders, a first in the company's history, and the company also offers a mobile app for anytime, anywhere access via cell phone. The web-based store is busy year-round, but especially during the Christmas shopping season, when it receives a virtual blizzard of orders-as many as 120,000 orders in a day. Unlike the physical stores, which have limited space to hold and display inventory for shoppers to buy in person, the online store can offer every product in every size and color. Customers can order via the Web and have purchases sent to their home or office address or shipped to a local L.L.Bean store for pickup. This latter option is particularly convenient for customers who prefer to pay with cash rather than credit or debit cards.

At the start of L.L.Bean's second century, its dedication to customer satisfaction is as strong as when Leon Leonwood Bean began his mail-order business so many decades ago. "We want to keep... the customer happy and keep that customer coming back to L.L.Bean over and over," explains the vice president of e-commerce.

What forms of direct marketing does L.L.Bean employ? Which additional forms of direct marketing should L.L.Bean consider using?

L.L.Bean, based in Freeport, Maine, began life as a one product firm selling by mail in 1912. Founder Leon Leonwood Bean designed and tested every product he sold, starting with the now-iconic rubber-soled Bean Boot. Today, the catalog business that L.L.Bean began is still going strong, along with 30 U.S. stores and a thriving online retail operation. In addition, L.L.Bean is expanding its retail presence in

Japan and China, where customers are particularly drawn to brand names that represent quality and a distinct personality. The company's outdoorsy image and innovative products, combined with a century-old reputation for standing behind every item, have made its stores popular shopping destinations around the world and around the Web.

Although the award-winning L.L.Bean catalog swelled in size during the 1980s and 1990s, it has slimmed down over the years as the online store has grown. Now, using sophisticated marketing database systems, L.L.Bean manages and updates the mailing lists and customer preferences for its catalogs. For targeting purposes, L.L.Bean creates 50 different catalogs that are mailed to selected customers across the United States and in 160 countries worldwide. The company's computer modeling tools indicate which customers are interested in which products so they receive only the specialized catalogs they desire. Still, says the vice president of stores, "what we find is most customers want some sort of touch point," whether they buy online, in a store, by mail, or by phone.

The company's flagship retail store in Freeport, Maine, like its online counterpart, is open 24 hours a day, 7 days a week, throughout the year. Even on major holidays like Thanksgiving and Christmas, when most other stores are closed, the flagship store is open for business. It stocks extra merchandise and hires additional employees for busy buying periods, as does the online store. Day or night, rain or shine, customers can walk the aisles of the gigantic Freeport store to browse an assortment of clothing and footwear for men, women, and children; try out camping gear and other sporting goods; buy home goods like blankets; and check out pet supplies. Every week, the store offers hands-on demonstrations and how-to seminars to educate customers about its products. Customers can pause for a cup of coffee or sit down to a full meal at the in-store café. Thanks to the store's enormous size and entertaining extras, it has become a tourist attraction as well as the centerpiece of L.L.Bean's retail empire.

L.L.Bean's online store continues to grow in popularity. In fact, online orders recently surpassed mail and phone orders, a first in the company's history, and the company also offers a mobile app for anytime, anywhere access via cell phone. The web-based store is busy year-round, but especially during the Christmas shopping season, when it receives a virtual blizzard of orders-as many as 120,000 orders in a day. Unlike the physical stores, which have limited space to hold and display inventory for shoppers to buy in person, the online store can offer every product in every size and color. Customers can order via the Web and have purchases sent to their home or office address or shipped to a local L.L.Bean store for pickup. This latter option is particularly convenient for customers who prefer to pay with cash rather than credit or debit cards.

At the start of L.L.Bean's second century, its dedication to customer satisfaction is as strong as when Leon Leonwood Bean began his mail-order business so many decades ago. "We want to keep... the customer happy and keep that customer coming back to L.L.Bean over and over," explains the vice president of e-commerce.

What forms of direct marketing does L.L.Bean employ? Which additional forms of direct marketing should L.L.Bean consider using?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

15

GameStop Plays to Win The Super Mario Bros. and Iron Man games fly off the shelves when GameStop pulls out all the stops in its video game marketing. Based in Grapevine, Texas, GameStop rings up $9 billion in annual sales as a specialty retailer of new and used video game hardware and software. Its 6,600 stores in 17 countries stock popular video game consoles and accessories from Sony, Microsoft, and Nintendo, plus thousands of games. Each 1,400-square-foot store is packed with an ever-changing merchandise assortment, some items purchased new from manufacturers or distributors and some taken as trade-ins from customers.

Founded in 1996, Game- Stop went through several names and mergers as it refined its retailing model and kicked off an aggressive expansion strategy that continues today, with the opening of 400 new stores every year. Its network of brick-and- mortar stores is complemented by an e-commerce site where customers can click to browse inventory, buy games and gear to be shipped to their homes, download free or paid games, and register for online game tournaments.

Highly Seasonal, Highly Competitive

GameStop's business is both highly seasonal and highly competitive. Approximately 40 percent of its sales are made during the last three months of the year. In the United States, it must contend with the marketing muscle of giant discounters, such as Walmart and Target, toy stores like Toys"R"Us, and national electronics chains like Best Buy, as well as specialty stores, catalog merchants, and online retailers of all sizes. Outside the United States, GameStop also competes with multinational hypermarket retailers like Carrefour.

The company targets three customer segments: enthusiasts, casual gamers, and seasonal gift givers. In addition, some customers are value-oriented and prefer to buy used products, including older consoles and games that are no longer available as new items.

Used Games for Sale

One of GameStop's competitive advantages is its trade-in policy. Customers can bring in their games, consoles, and accessories and receive a store credit toward the purchase of other merchandise. Trade-ins must be in working condition and must include the original box and the instruction manual. GameStop's refurbishment centers in North America, Australia, and Europe test all trade-ins, fi x defects when necessary, repackage the products, and ship them to stores for retail sale. Not only do trade-ins stimulate store traffic, but sales of used products result in a higher gross margin than sales of new products. Used games account for about one-fourth of GameStop's revenue and as much as 45 percent of its profits. The company recently began allowing trade-ins of non-game mobile devices, such as iPads and iPods, another way to bring customers into its stores.

The profit potential in used games has drawn competition for GameStop. The convenience store chain 7-Eleven has entered this market, selling used games through a partnership with the wholesaler Game Trading Technologies. Toys"R"Us also offers some used games and consoles and invites trade-ins, in person and by mail. Amazon. com allows game trade-ins by mail and serves as a virtual storefront for used video games sold by consumers and businesses, in addition to retailing new games and consoles.

The Right Merchandise in the Right Location

GameStop chooses store locations based on a number of factors, including demographic trends, visibility to pedestrians and vehicular traffic, and parking availability. It prefers to put stores in power shopping centers and malls that draw a high volume of customers. It also checks out the competitive situation in each area before making a final decision. Store atmospherics are designed to appeal to game players and include equipment where customers can sample games and watch videos of game clips before making a purchase.

Over the years, GameStop has developed a sophisticated information system for analyzing historic trends in store sales so it can project future demand for current and new products. This is especially important for satisfying the needs of enthusiasts, who may buy elsewhere if GameStop doesn't have the latest game or console in stock immediately after its release.

To help predict demand, GameStop invites customers to preorder new items for pick up at their local stores on or after the release date. It also tracks customer requests and monitors media coverage in advance of new-product introductions. During a busy period of new-game introductions, GameStop may have more than 1,000 new games in stock and ready for purchase. Because new games and equipment can make older products obsolete, GameStop has negotiated deals with its primary suppliers to allow returns in such instances.

Thanks to its marketing information system, GameStop knows exactly which products sell in each of its stores and what inventory is available in its distribution centers. The system automatically reorders merchandise as it sells and schedules twice-weekly shipments to replenish stock, so store shelves are never empty. On the other hand, daily analysis of inventory positions and frequent restocking allows GameStop to tailor the merchandise mix for each store while avoiding the expense of carrying too much safety stock in each store.

For high efficiency, GameStop supplies replenishment stock to U.S. stores from its 400,000-square-foot distribution center in Grapevine, Texas. Its 260,000-square-foot center in Louisville, Kentucky, is dedicated to receiving, sorting, and shipping hot new games and consoles to its stores nationwide. The company uses centrally located distribution centers to restock stores in other countries.

The Digital Dilemma

Despite GameStop's considerable investment in brick-and-mortar retailing, it sees great value in maintaining a strong online retailing presence. Game enthusiasts tend to be heavy Internet users, and GameStop wants to be where they like to be. Its website has a feature of interest to all of the targeted segments: a "wish list" where enthusiasts and casual gamers can itemize the products they would most like to receive (from gift-givers). GameStop also offers a weekly e-newsletter with exclusive discounts and advance notice of sales, tournaments, midnight openings for new releases, and other events.

Game consoles are increasingly Internet-ready and many players already play games on their personal computers, so digital game downloads are a must for GameStop. Its e-commerce site sells downloadable versions of popular games and offers hundreds of free games, some downloadable and some that play in the user's Web browser. The company tested a Facebook storefront, thinking it would appeal to its 4 million "fans," but quickly closed the "store" down because online buying is so convenient on the GameStop website.

Digital downloads pose a dilemma. GameStop's executives have been monitoring the situation in the music industry, where downloads have cut into retailers' sales of actual CDs. However, digital music fi les are relatively small, compared with digital game fi les. This means buyers would have to have a very speedy broadband Internet connection to get a game downloaded in a reasonable length of time. Still, GameStop recently began accepting in-store preorders for new digitally downloadable games, accepting trade-ins as credit toward the purchase price. "This is a great illustration of how the digital distribution model and in-store experience really complement one another," explains a GameStop official.

Do you think GameStop should market used video games via vending machines placed on college campuses? Why or why not?

Founded in 1996, Game- Stop went through several names and mergers as it refined its retailing model and kicked off an aggressive expansion strategy that continues today, with the opening of 400 new stores every year. Its network of brick-and- mortar stores is complemented by an e-commerce site where customers can click to browse inventory, buy games and gear to be shipped to their homes, download free or paid games, and register for online game tournaments.

Highly Seasonal, Highly Competitive

GameStop's business is both highly seasonal and highly competitive. Approximately 40 percent of its sales are made during the last three months of the year. In the United States, it must contend with the marketing muscle of giant discounters, such as Walmart and Target, toy stores like Toys"R"Us, and national electronics chains like Best Buy, as well as specialty stores, catalog merchants, and online retailers of all sizes. Outside the United States, GameStop also competes with multinational hypermarket retailers like Carrefour.

The company targets three customer segments: enthusiasts, casual gamers, and seasonal gift givers. In addition, some customers are value-oriented and prefer to buy used products, including older consoles and games that are no longer available as new items.

Used Games for Sale

One of GameStop's competitive advantages is its trade-in policy. Customers can bring in their games, consoles, and accessories and receive a store credit toward the purchase of other merchandise. Trade-ins must be in working condition and must include the original box and the instruction manual. GameStop's refurbishment centers in North America, Australia, and Europe test all trade-ins, fi x defects when necessary, repackage the products, and ship them to stores for retail sale. Not only do trade-ins stimulate store traffic, but sales of used products result in a higher gross margin than sales of new products. Used games account for about one-fourth of GameStop's revenue and as much as 45 percent of its profits. The company recently began allowing trade-ins of non-game mobile devices, such as iPads and iPods, another way to bring customers into its stores.

The profit potential in used games has drawn competition for GameStop. The convenience store chain 7-Eleven has entered this market, selling used games through a partnership with the wholesaler Game Trading Technologies. Toys"R"Us also offers some used games and consoles and invites trade-ins, in person and by mail. Amazon. com allows game trade-ins by mail and serves as a virtual storefront for used video games sold by consumers and businesses, in addition to retailing new games and consoles.

The Right Merchandise in the Right Location

GameStop chooses store locations based on a number of factors, including demographic trends, visibility to pedestrians and vehicular traffic, and parking availability. It prefers to put stores in power shopping centers and malls that draw a high volume of customers. It also checks out the competitive situation in each area before making a final decision. Store atmospherics are designed to appeal to game players and include equipment where customers can sample games and watch videos of game clips before making a purchase.

Over the years, GameStop has developed a sophisticated information system for analyzing historic trends in store sales so it can project future demand for current and new products. This is especially important for satisfying the needs of enthusiasts, who may buy elsewhere if GameStop doesn't have the latest game or console in stock immediately after its release.

To help predict demand, GameStop invites customers to preorder new items for pick up at their local stores on or after the release date. It also tracks customer requests and monitors media coverage in advance of new-product introductions. During a busy period of new-game introductions, GameStop may have more than 1,000 new games in stock and ready for purchase. Because new games and equipment can make older products obsolete, GameStop has negotiated deals with its primary suppliers to allow returns in such instances.

Thanks to its marketing information system, GameStop knows exactly which products sell in each of its stores and what inventory is available in its distribution centers. The system automatically reorders merchandise as it sells and schedules twice-weekly shipments to replenish stock, so store shelves are never empty. On the other hand, daily analysis of inventory positions and frequent restocking allows GameStop to tailor the merchandise mix for each store while avoiding the expense of carrying too much safety stock in each store.

For high efficiency, GameStop supplies replenishment stock to U.S. stores from its 400,000-square-foot distribution center in Grapevine, Texas. Its 260,000-square-foot center in Louisville, Kentucky, is dedicated to receiving, sorting, and shipping hot new games and consoles to its stores nationwide. The company uses centrally located distribution centers to restock stores in other countries.

The Digital Dilemma

Despite GameStop's considerable investment in brick-and-mortar retailing, it sees great value in maintaining a strong online retailing presence. Game enthusiasts tend to be heavy Internet users, and GameStop wants to be where they like to be. Its website has a feature of interest to all of the targeted segments: a "wish list" where enthusiasts and casual gamers can itemize the products they would most like to receive (from gift-givers). GameStop also offers a weekly e-newsletter with exclusive discounts and advance notice of sales, tournaments, midnight openings for new releases, and other events.

Game consoles are increasingly Internet-ready and many players already play games on their personal computers, so digital game downloads are a must for GameStop. Its e-commerce site sells downloadable versions of popular games and offers hundreds of free games, some downloadable and some that play in the user's Web browser. The company tested a Facebook storefront, thinking it would appeal to its 4 million "fans," but quickly closed the "store" down because online buying is so convenient on the GameStop website.

Digital downloads pose a dilemma. GameStop's executives have been monitoring the situation in the music industry, where downloads have cut into retailers' sales of actual CDs. However, digital music fi les are relatively small, compared with digital game fi les. This means buyers would have to have a very speedy broadband Internet connection to get a game downloaded in a reasonable length of time. Still, GameStop recently began accepting in-store preorders for new digitally downloadable games, accepting trade-ins as credit toward the purchase price. "This is a great illustration of how the digital distribution model and in-store experience really complement one another," explains a GameStop official.

Do you think GameStop should market used video games via vending machines placed on college campuses? Why or why not?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

16

Location of retail outlets is an issue in strategic planning. What initial steps would you recommend to Juanita (see Application Question 1) when she considers a location for her store?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

17

Describe the three major types of traditional shopping centers. Give an example of each type in your area.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

18

What are the major differences between discount stores and department stores?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

19

Distribution decisions in the marketing plan entail the movement of your product from the producer until it reaches the final consumer. An understanding of how and where your customer prefers to purchase products is critical to the development of the marketing plan. As you apply the information in this chapter to your plan, focus on the following issues:

If your product will be sold to another member in the marketing channel, discuss whether a merchant wholesaler, agent, or broker is most suitable as your channel customer.

The information obtained from these questions should assist you in developing various aspects of your marketing plan found in the "Interactive Marketing Plan" exercise at www.cengagebrain.com.

If your product will be sold to another member in the marketing channel, discuss whether a merchant wholesaler, agent, or broker is most suitable as your channel customer.

The information obtained from these questions should assist you in developing various aspects of your marketing plan found in the "Interactive Marketing Plan" exercise at www.cengagebrain.com.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

20

Distribution decisions in the marketing plan entail the movement of your product from the producer until it reaches the final consumer. An understanding of how and where your customer prefers to purchase products is critical to the development of the marketing plan. As you apply the information in this chapter to your plan, focus on the following issues:

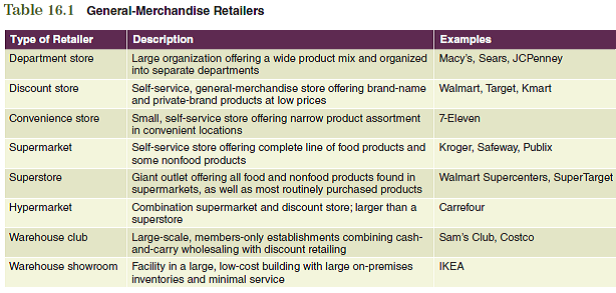

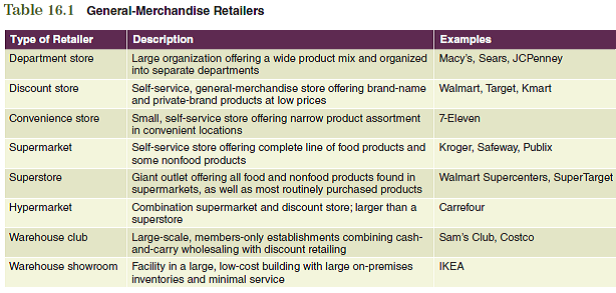

If your product will be sold to the ultimate customer, what type of retailing establishment is most suitable to your product? Consider the product's characteristics and your target market's buying behavior. Refer to Table 16.1 for retailer types.

The information obtained from these questions should assist you in developing various aspects of your marketing plan found in the "Interactive Marketing Plan" exercise at www.cengagebrain.com.

If your product will be sold to the ultimate customer, what type of retailing establishment is most suitable to your product? Consider the product's characteristics and your target market's buying behavior. Refer to Table 16.1 for retailer types.

The information obtained from these questions should assist you in developing various aspects of your marketing plan found in the "Interactive Marketing Plan" exercise at www.cengagebrain.com.

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

21

Discuss the major factors that help to determine a retail store's image. How does atmosphere add value to products sold in a store?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

22

Walmart

Walmart provides a website where customers can shop for products, search for a nearby store, and even preorder new products. The website lets browsers see what is on sale and view company information. Access Walmart's company website at www.walmart.com.

Compare the atmospherics of Walmart's website to the atmospherics of a traditional Walmart store. Are they consistent? If not, should they be?

Walmart provides a website where customers can shop for products, search for a nearby store, and even preorder new products. The website lets browsers see what is on sale and view company information. Access Walmart's company website at www.walmart.com.

Compare the atmospherics of Walmart's website to the atmospherics of a traditional Walmart store. Are they consistent? If not, should they be?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

23

How is door-to-door selling a form of retailing? Some consumers believe that direct-response orders bypass the retailer. Is this true?

Unlock Deck

Unlock for access to all 31 flashcards in this deck.

Unlock Deck

k this deck

24

GameStop Plays to Win The Super Mario Bros. and Iron Man games fly off the shelves when GameStop pulls out all the stops in its video game marketing. Based in Grapevine, Texas, GameStop rings up $9 billion in annual sales as a specialty retailer of new and used video game hardware and software. Its 6,600 stores in 17 countries stock popular video game consoles and accessories from Sony, Microsoft, and Nintendo, plus thousands of games. Each 1,400-square-foot store is packed with an ever-changing merchandise assortment, some items purchased new from manufacturers or distributors and some taken as trade-ins from customers.

Founded in 1996, Game- Stop went through several names and mergers as it refined its retailing model and kicked off an aggressive expansion strategy that continues today, with the opening of 400 new stores every year. Its network of brick-and- mortar stores is complemented by an e-commerce site where customers can click to browse inventory, buy games and gear to be shipped to their homes, download free or paid games, and register for online game tournaments.

Highly Seasonal, Highly Competitive

GameStop's business is both highly seasonal and highly competitive. Approximately 40 percent of its sales are made during the last three months of the year. In the United States, it must contend with the marketing muscle of giant discounters, such as Walmart and Target, toy stores like Toys"R"Us, and national electronics chains like Best Buy, as well as specialty stores, catalog merchants, and online retailers of all sizes. Outside the United States, GameStop also competes with multinational hypermarket retailers like Carrefour.

The company targets three customer segments: enthusiasts, casual gamers, and seasonal gift givers. In addition, some customers are value-oriented and prefer to buy used products, including older consoles and games that are no longer available as new items.

Used Games for Sale

One of GameStop's competitive advantages is its trade-in policy. Customers can bring in their games, consoles, and accessories and receive a store credit toward the purchase of other merchandise. Trade-ins must be in working condition and must include the original box and the instruction manual. GameStop's refurbishment centers in North America, Australia, and Europe test all trade-ins, fi x defects when necessary, repackage the products, and ship them to stores for retail sale. Not only do trade-ins stimulate store traffic, but sales of used products result in a higher gross margin than sales of new products. Used games account for about one-fourth of GameStop's revenue and as much as 45 percent of its profits. The company recently began allowing trade-ins of non-game mobile devices, such as iPads and iPods, another way to bring customers into its stores.