Deck 32: Money, Banking, and Financial Institutions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/17

Play

Full screen (f)

Deck 32: Money, Banking, and Financial Institutions

1

Suppose the assets of the SilverBank are $100,000 higher than on the previous day and its net worth is up $20,000. By how much and in what direction must its liabilities have changed from the day before

Remember that a balance sheet must satisfy the following equation:

Thus, if the assets of the bank went up by $100,000, this must mean that liabilities plus net worth also went up by $100,000. Since we are given that net worth went up by $20,000, we have:

Thus, if the assets of the bank went up by $100,000, this must mean that liabilities plus net worth also went up by $100,000. Since we are given that net worth went up by $20,000, we have:

This means that liabilities must have increased by $80,000.

This means that liabilities must have increased by $80,000.

Thus, if the assets of the bank went up by $100,000, this must mean that liabilities plus net worth also went up by $100,000. Since we are given that net worth went up by $20,000, we have:

Thus, if the assets of the bank went up by $100,000, this must mean that liabilities plus net worth also went up by $100,000. Since we are given that net worth went up by $20,000, we have: This means that liabilities must have increased by $80,000.

This means that liabilities must have increased by $80,000. 2

What is the difference between an asset and a liability on a bank's balance sheet How does net worth relate to each Why must a balance sheet always balance What are the major assets and claims on a commercial bank's balance sheet

An Asset and a Liability are on different sides of a bank's balance sheet. Assets are things that are owned by the bank or owed to the bank, and liabilities are claims of non-owners of the bank against the firm's assets. In other words, liabilities are what the bank owes to people who do not own the bank.

Assets, liabilities, and net worth are related through the simple expression:

.

.

This expression simply says that the assets of a bank must equal to what it owes to non-owners plus what it owes to owners, or the net worth. The net worth, in other words, is just the difference between a bank's assets and its liabilities. This is how much the bank is worth, in a sense.

A balance sheet must balance because of the expression listed above (

), which says that every dollar increase in assets must be offset by a dollar increase in liabilities and net worth. By definition, the net worth of a bank is the difference between the assets and liabilities, therefore, liabilities plus net worth must always equal a bank's assets.

), which says that every dollar increase in assets must be offset by a dollar increase in liabilities and net worth. By definition, the net worth of a bank is the difference between the assets and liabilities, therefore, liabilities plus net worth must always equal a bank's assets.

Assets of a bank include vault cash (the cash that a bank holds in its vault) and property, while the main claims on a bank include its stock shares (the money that came from people investing in the bank) and its checkable deposits (people putting money into the bank). Checkable deposits are claims on the bank because someone who deposits money into the bank is essence "lending" to the bank. The bank is expected to pay back the depositor whenever he or she demands it.

Assets, liabilities, and net worth are related through the simple expression:

.

.This expression simply says that the assets of a bank must equal to what it owes to non-owners plus what it owes to owners, or the net worth. The net worth, in other words, is just the difference between a bank's assets and its liabilities. This is how much the bank is worth, in a sense.

A balance sheet must balance because of the expression listed above (

), which says that every dollar increase in assets must be offset by a dollar increase in liabilities and net worth. By definition, the net worth of a bank is the difference between the assets and liabilities, therefore, liabilities plus net worth must always equal a bank's assets.

), which says that every dollar increase in assets must be offset by a dollar increase in liabilities and net worth. By definition, the net worth of a bank is the difference between the assets and liabilities, therefore, liabilities plus net worth must always equal a bank's assets.Assets of a bank include vault cash (the cash that a bank holds in its vault) and property, while the main claims on a bank include its stock shares (the money that came from people investing in the bank) and its checkable deposits (people putting money into the bank). Checkable deposits are claims on the bank because someone who deposits money into the bank is essence "lending" to the bank. The bank is expected to pay back the depositor whenever he or she demands it.

3

Suppose that Serendipity Bank has excess reserves of $8000 and checkable deposits of $150,000. If the reserve ratio iS20 percent, what is the size of the bank's actual reserves

Required Reserve= 20/100 of $150,000= $30,000

National Bank of Commerce has $8000 excess reserve,

Actual Reserve= Required Reserve + Excess Reserve

= $30,000 + $8,000

= $38,000

The National Bank of Commerce has $38,000 actual reserves.

National Bank of Commerce has $8000 excess reserve,

Actual Reserve= Required Reserve + Excess Reserve

= $30,000 + $8,000

= $38,000

The National Bank of Commerce has $38,000 actual reserves.

4

Explain why merchants accepted gold receipts as a means of payment even though the receipts were issued by goldsmiths, not the government. What risk did goldsmiths introduce into the payments system by issuingin the form of gold receipts

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

5

Third National Bank has reserves of $20,000 and checkable deposits of $100,000. The reserve ratio iS20 percent. Households deposit $5000 in currency into the bank and that currency is added to reserves. What level of excess reserves does the bank now have

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

6

Why is the banking system in the United States referred to as a fractional reserve bank system What is the role of deposit insurance in a fractional reserve system

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

7

Suppose again that Third National Bank has reserves of $20,000 and checkable deposits of $100,000. The reserve ratio iS20 percent. The bank now sells $5000 in securities to the Federal Reserve Bank in its district, receiving a $5000 increase in reserves in return. What level of excess reserves does the bank now have By what amount does your answer differ (yes, it does!) from the answer to problem 3

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

8

Why does the Federal Reserve require commercial banks to have reserves Explain why reserves are an asset to commercial banks but a liability to the Federal Reserve Banks. What are excess reserves How do you calculate the amount of excess reserves held by a bank What is the significance of excess reserves

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

9

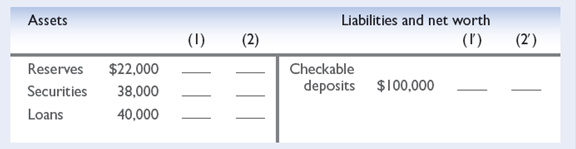

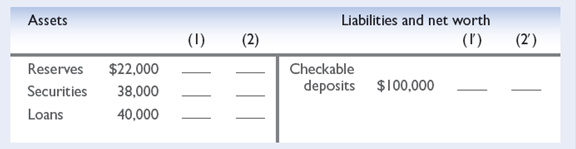

The balance sheet at the top of the next page is for Big Bucks Bank. The reserve ratio iS20 percent.

a. What is the maximum amount of newthat Big Bucks Bank can make Show in columnS1 anD1 how the bank's balance sheet will appear after the bank has lent this additional amount.

b. By how much has the supply of money changed

c. How will the bank's balance sheet appear after checks drawn for the entire amount of the newhave been cleared against the bank Show the new balance sheet in columnS2 anD2 .

d. Answer questions a, b, and c on the assumption that the reserve ratio iS15 percent.

a. What is the maximum amount of newthat Big Bucks Bank can make Show in columnS1 anD1 how the bank's balance sheet will appear after the bank has lent this additional amount.

b. By how much has the supply of money changed

c. How will the bank's balance sheet appear after checks drawn for the entire amount of the newhave been cleared against the bank Show the new balance sheet in columnS2 anD2 .

d. Answer questions a, b, and c on the assumption that the reserve ratio iS15 percent.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

10

"Whenever currency is deposited in a commercial bank, cash goes out of circulation and, as a result, the supply of money is reduced." Do you agree Explain why or why not.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

11

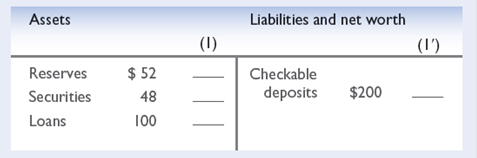

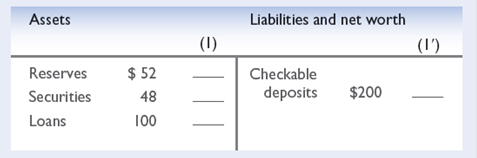

Suppose the simplified consolidated balance sheet shown below is for the entire commercial banking system and that all figures are in billions of dollars. The reserve ratio iS25 percent.

a. What is the amount of excess reserves in this commercial banking system What is the maximum amount the banking system might lend Show in columnS1 anD1 how the consolidated balance sheet wouldafter this amount has been lent. What is the size of the monetary multiplier

b. Answer the questions in part a assuming the reserve ratio iS20 percent. What is the resulting difference in the amount that the commercial banking system can lend

a. What is the amount of excess reserves in this commercial banking system What is the maximum amount the banking system might lend Show in columnS1 anD1 how the consolidated balance sheet wouldafter this amount has been lent. What is the size of the monetary multiplier

b. Answer the questions in part a assuming the reserve ratio iS20 percent. What is the resulting difference in the amount that the commercial banking system can lend

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

12

"When a commercial bank makesit creates money; whenare repaid, money is destroyed." Explain.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

13

If the required reserve ratio iS10 percent, what is the monetary multiplier If the monetary multiplier is 4, what is the required reserve ratio

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose that Mountain Star Bank discovers that its reserves will temporarily fall slightly below those legally required. How might it temporarily remedy this situation through the Federal funds market Now assume Mountain Star finds that its reserves will be substantially and permanently deficient. What remedy is available to this bank (Hint: Recall your answer to question 6.)

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

15

Explain why a single commercial bank can safely lend only an amount equal to its excess reserves but the commercial banking system as a whole can lend by a multiple of its excess reserves. What is the monetary multiplier, and how does it relate to the reserve ratio

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

16

How would a decrease in the reserve requirement affect the (a) size of the money multiplier, (b) amount of excess reserves in the banking system, and (c) extent to which the system could expand the money supply through the creation of checkable deposits via

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

17

LAST WORD Explain how the bank panics of 1930-1933 produced a decline in the nation's money supply. Why are such panics highly unlikely today

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck