Deck 17: Pricing in Retailing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/23

Play

Full screen (f)

Deck 17: Pricing in Retailing

1

A floor tile retailer wants to receive a 35 percent markup (at retail) for all merchandise. If one style of tile retails for $11 per tile, what is the maximum that the retailer would be willing to pay for a tile

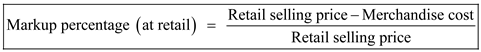

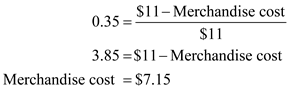

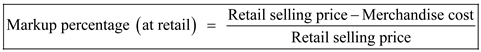

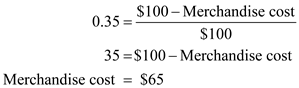

Markup pricing:

Markup pricing is set by retailers for per unit merchandise cost additions, retail expenses (operational), and the profit desired. Markup is the difference between costs of merchandise and the sale price.

It is given that the floor tile retailer receives 35% markup (retail) merchandise and one style of tile retails $11 per tile.

Hence, the merchandise cost that the retailer would be willing to pay per tile is

Hence, the merchandise cost that the retailer would be willing to pay per tile is

.

.

Markup pricing is set by retailers for per unit merchandise cost additions, retail expenses (operational), and the profit desired. Markup is the difference between costs of merchandise and the sale price.

It is given that the floor tile retailer receives 35% markup (retail) merchandise and one style of tile retails $11 per tile.

Hence, the merchandise cost that the retailer would be willing to pay per tile is

Hence, the merchandise cost that the retailer would be willing to pay per tile is .

. 2

What policies would you set for eBay in deciding which products and sellers are to be listed at the Web site

Case summary:

E is operating online marketplace in which the third party buyers and sellers transact in a wide variety of products, clothing, automobiles, electronics, collectibles, and other merchandise. The company hopes that acquisition is the bottom line from 2012 though the pressure is negative on short term operating profits. Conversion rate is the major focus of E as it seeks to increase sellers' success in conversion of sold items. G checkout and credit card limits E's ability to increase revenues and commission on P transactions with a particular rate. Growth segment will continue E's focus on small medium business as well as sole proprietorship. The gross profit is expected to grow in future level off 20% sales in 2018. Competition and mix of transactions offset each other. The company expects gross profit margin of 30 to 31 percentage in 2018.

Policies set by E:

Product based policies:

• Knockoff sales

• Counterfeit sales of goods

• Recall of goods sold

• Inappropriate sale of goods

Seller based strategies that ban sales:

• Improper placement of goods

• Customer rating is low

• Unacceptable offers

E is operating online marketplace in which the third party buyers and sellers transact in a wide variety of products, clothing, automobiles, electronics, collectibles, and other merchandise. The company hopes that acquisition is the bottom line from 2012 though the pressure is negative on short term operating profits. Conversion rate is the major focus of E as it seeks to increase sellers' success in conversion of sold items. G checkout and credit card limits E's ability to increase revenues and commission on P transactions with a particular rate. Growth segment will continue E's focus on small medium business as well as sole proprietorship. The gross profit is expected to grow in future level off 20% sales in 2018. Competition and mix of transactions offset each other. The company expects gross profit margin of 30 to 31 percentage in 2018.

Policies set by E:

Product based policies:

• Knockoff sales

• Counterfeit sales of goods

• Recall of goods sold

• Inappropriate sale of goods

Seller based strategies that ban sales:

• Improper placement of goods

• Customer rating is low

• Unacceptable offers

3

A car dealer purchases multiple-disk CD players for $100 each and desires a 35 percent markup (at retail). What retail price should be charged

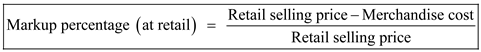

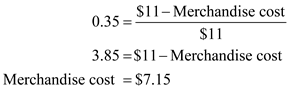

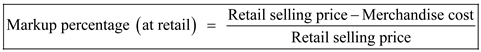

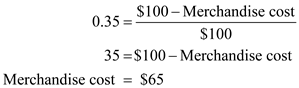

Markup pricing:

Markup pricing is set by retailers for per unit merchandise cost additions, retail expenses (operational), and the profit desired. Markup is the difference between costs of merchandise and the sale price.

It is given that the multiple disk and compact disk players receive 35% markup (retail) merchandise and $100 each.

Hence, the merchandise cost is

Hence, the merchandise cost is

that the retailer would be willing to pay per compact disk player.

that the retailer would be willing to pay per compact disk player.

Markup pricing is set by retailers for per unit merchandise cost additions, retail expenses (operational), and the profit desired. Markup is the difference between costs of merchandise and the sale price.

It is given that the multiple disk and compact disk players receive 35% markup (retail) merchandise and $100 each.

Hence, the merchandise cost is

Hence, the merchandise cost is  that the retailer would be willing to pay per compact disk player.

that the retailer would be willing to pay per compact disk player. 4

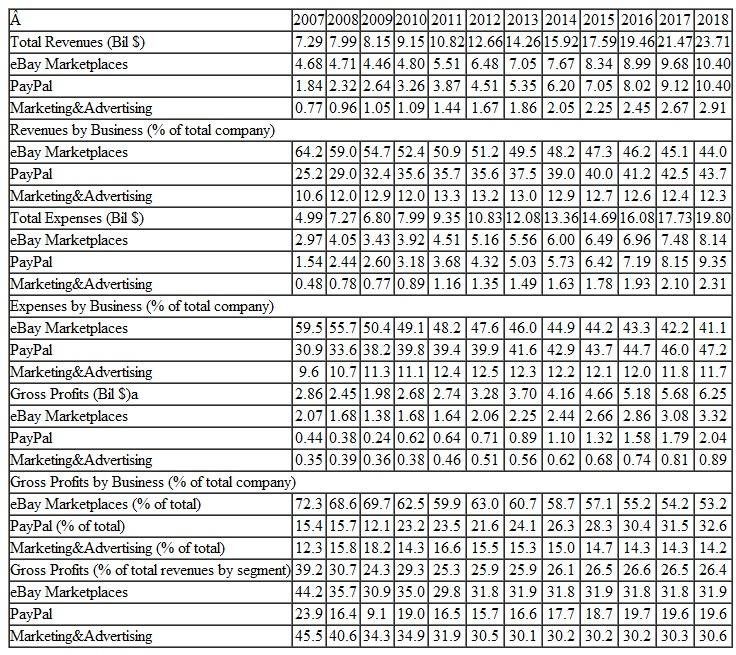

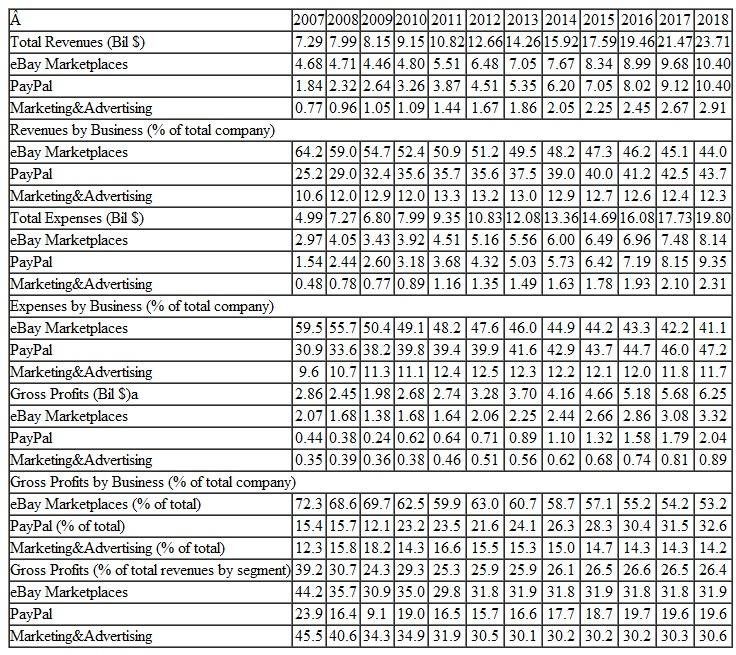

Evaluate the data in Table 1.

Table 1 A Financial Summary for eBay

Table 1 A Financial Summary for eBay

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

5

A gift store charges $25.00 for a ceramic figurine; its cost is $14.00. What is the markup percentage (at cost and at retail)

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

6

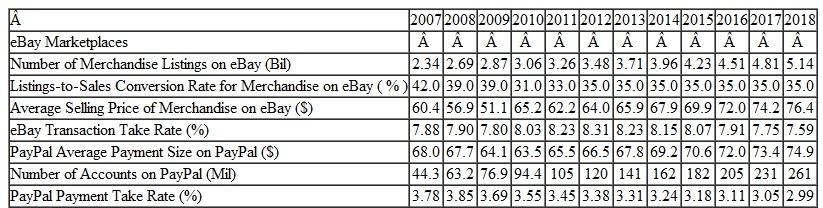

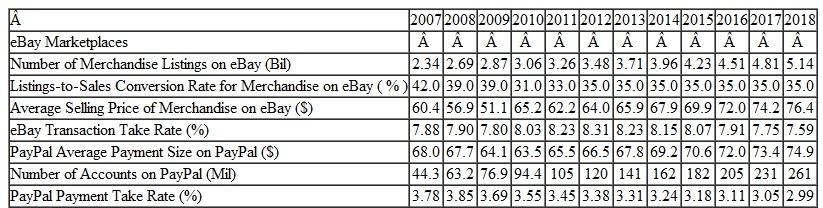

Evaluate the data in Table 2.

Table 2 A Closer Look at eBay Marketplaces and PayPal

Table 2 A Closer Look at eBay Marketplaces and PayPal

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

7

A firm has planned operating expenses of $200,000, a profit goal of $130,000, and planned reductions of $35,000, and it expects sales of $700,000. Compute the initial markup percentage.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

8

At the end of the year, the retailer in Question 8 determines that actual operating expenses are $160,000, actual profit is $120,000, and actual sales are $650,000. What is the maintained markup percentage Explain the difference in your answers to Questions 8 and 9.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

9

What are the pros and cons of everyday low pricing to a retailer To a manufacturer

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

10

Under what circumstances do you think unbundled pricing is a good idea A poor idea Why

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

11

A retailer buys items for $65. At an original retail price of $89, it expects to sell 1,000 units.

a. If the price is marked down to $79, how many units must the retailer sell to earn the same total gross profit it would attain with an $89 price

b. If the price is marked up to $99, how many units must the retailer sell to earn the same total gross profit it would attain with an $89 price

a. If the price is marked down to $79, how many units must the retailer sell to earn the same total gross profit it would attain with an $89 price

b. If the price is marked up to $99, how many units must the retailer sell to earn the same total gross profit it would attain with an $89 price

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

12

Case 1: Making McDonald's Recession-Resistant

As its chief executive likes to say, McDonald's (www.mcdonalds.com) is "recession-resistant" as opposed to "recession-proof." Nonetheless, the retailer has outperformed many other retailers during the recent tough economic times. The nation's leading fast-food chain has even managed to report comparable store sales growth in many quarters-due to the strong growth in its McCafé beverages, its new fruit-and-maple oatmeal, expanded sales of healthier foods, and its everyday value pricing menu.

Both the McCafé line of beverages and the fruit-and-maple oatmeal were developed to bolster McDonald's weakest meal-breakfast. In May 2009, McDonald's launched its McCafé beverages as an addition to its traditional coffee segment. According to Ashlee Yingling, a company spokesperson: "It continues to evolve as we look at espresso-based drinks." Additional coffee products may make McDonald's a destination retailer of coffees, which Dunkin' Donuts (www.dunkindonuts.com) has accomplished.

McDonald's, which is best known for its burgers, milk shakes, and French fries, is now also featuring healthier foods. Although mostly perceived as a breakfast item, McDonald's fruit-and-maple oatmeal is available all day long. And unlike other products that have been criticized as being unhealthy, the fruit-and-maple oatmeal is available with or without brown sugar, provides the equivalent of two servings of whole grain, and comprises 20 percent of the daily requirements for fiber. The fruit-and-maple oatmeal was developed in association with the Whole Grains Council.

While McDonald's has had salads on its menu since 2003 and snack wraps since 2006, today it also offers small food portions, grilled versus fried alternatives, and a "made for you" platform in which consumers can order any item on the menu to their liking (such as a burger without cheese or oatmeal without brown sugar). Yingling says: "It's not about categorizing it as 'healthier,' it's about providing options customers feel good about eating."

Instead of offering a constant stream of promotions (such as buy a burger and fries and get a free soda) and price reductions, McDonald's is more committed to providing everyday value to its customers. The use of everyday value pricing reduces advertising costs, makes sales forecasting more predictable, avoids excessive peaks and valleys in sales, and is not reliant on a franchisee's joining each promotion.

McDonald's product-planning process seeks to eliminate duplication between existing and new products. Thus, the Big N' Tasty burger was eliminated after the Angus Third Pounder was developed. Similarly, the Mac Snack Wrap was discontinued once the Angus Snack Wrap was commercialized. As Ashlee Yingling notes: "It's just about realizing the similarities in menu items, then a decision has to be made about keeping both or not-but it is not a decision that we take lightly." The introduction of five new products in a year does not mean that five existing products need to be eliminated.

Some retail analysts are concerned that McDonald's stream of new products will reduce its ability to quickly deliver hot-and-tasty foods. Yingling counters this criticism by stating that all of the chain's new products must meet the criteria of being served within 1½ minutes of a customer's initial order.

Questions

1. Evaluate the appropriateness of the McCafé line of coffees and the fruit-and-maple oatmeal to McDonald's overall merchandising strategy.

2. Discuss the pros and cons of McDonald's use of an everyday value pricing strategy versus a constant stream of promotions.

3. Describe the pitfalls associated with McDonald's having too many products.

4. Develop a system for McDonald's to use to eliminate duplication among new and existing products.

As its chief executive likes to say, McDonald's (www.mcdonalds.com) is "recession-resistant" as opposed to "recession-proof." Nonetheless, the retailer has outperformed many other retailers during the recent tough economic times. The nation's leading fast-food chain has even managed to report comparable store sales growth in many quarters-due to the strong growth in its McCafé beverages, its new fruit-and-maple oatmeal, expanded sales of healthier foods, and its everyday value pricing menu.

Both the McCafé line of beverages and the fruit-and-maple oatmeal were developed to bolster McDonald's weakest meal-breakfast. In May 2009, McDonald's launched its McCafé beverages as an addition to its traditional coffee segment. According to Ashlee Yingling, a company spokesperson: "It continues to evolve as we look at espresso-based drinks." Additional coffee products may make McDonald's a destination retailer of coffees, which Dunkin' Donuts (www.dunkindonuts.com) has accomplished.

McDonald's, which is best known for its burgers, milk shakes, and French fries, is now also featuring healthier foods. Although mostly perceived as a breakfast item, McDonald's fruit-and-maple oatmeal is available all day long. And unlike other products that have been criticized as being unhealthy, the fruit-and-maple oatmeal is available with or without brown sugar, provides the equivalent of two servings of whole grain, and comprises 20 percent of the daily requirements for fiber. The fruit-and-maple oatmeal was developed in association with the Whole Grains Council.

While McDonald's has had salads on its menu since 2003 and snack wraps since 2006, today it also offers small food portions, grilled versus fried alternatives, and a "made for you" platform in which consumers can order any item on the menu to their liking (such as a burger without cheese or oatmeal without brown sugar). Yingling says: "It's not about categorizing it as 'healthier,' it's about providing options customers feel good about eating."

Instead of offering a constant stream of promotions (such as buy a burger and fries and get a free soda) and price reductions, McDonald's is more committed to providing everyday value to its customers. The use of everyday value pricing reduces advertising costs, makes sales forecasting more predictable, avoids excessive peaks and valleys in sales, and is not reliant on a franchisee's joining each promotion.

McDonald's product-planning process seeks to eliminate duplication between existing and new products. Thus, the Big N' Tasty burger was eliminated after the Angus Third Pounder was developed. Similarly, the Mac Snack Wrap was discontinued once the Angus Snack Wrap was commercialized. As Ashlee Yingling notes: "It's just about realizing the similarities in menu items, then a decision has to be made about keeping both or not-but it is not a decision that we take lightly." The introduction of five new products in a year does not mean that five existing products need to be eliminated.

Some retail analysts are concerned that McDonald's stream of new products will reduce its ability to quickly deliver hot-and-tasty foods. Yingling counters this criticism by stating that all of the chain's new products must meet the criteria of being served within 1½ minutes of a customer's initial order.

Questions

1. Evaluate the appropriateness of the McCafé line of coffees and the fruit-and-maple oatmeal to McDonald's overall merchandising strategy.

2. Discuss the pros and cons of McDonald's use of an everyday value pricing strategy versus a constant stream of promotions.

3. Describe the pitfalls associated with McDonald's having too many products.

4. Develop a system for McDonald's to use to eliminate duplication among new and existing products.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

13

What can any retailer learn from this case

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

14

Case 2: The Merchandising of Private Brands

At one point, product planning decisions by retailers for their private-label brands was a simple process. The retailers simply contracted with national brand manufacturers or with a private-label producer to make a special private-label product version. The retailers then placed the private-label brand on their store shelves. Now, retailers are much more involved with planning the specifications of their private-label products, with designing distinctive logos and labels, and with even managing "good, better, and best" versions of their private-label brands.

Many retail analysts agree that retailers need to develop a strong product-placement strategy for their private-label products so that consumers can more easily locate these items in the store. According to one consumer packaged goods executive: "While innovation is important, the fundamentals of having the right products in stock-in sight and in the right locations with the right message to offer-are key to driving shopper loyalty."

To add to today's complexity in the placement of private-label products, many retailers offer different levels of quality (such as premium products and organics) within a single private-label brand. As a result, promotions for each version need to stress price-based appeals for low-cost private-label goods and a private label's unique characteristics for upscale product categories (such as more chocolate chips than a national brand for a premium chocolate chip cookie or the use of organic ingredients for soup).

Product-placement decisions also need to reflect shelf-height decisions. Duane Reade (www.duanereade.com), a New York-based drugstore chain, places its premium cookies at eye level (the most preferred space), its value-oriented private-label brand of cookies below eye level, and the national brands of cookies at the poorest locations on its store shelves.

The traditional shelf location for private-label brands has been to the right of national brands on the same shelf. This accomplishes several objectives. It enables shoppers to compare price and quantity levels between different types of brands. In many cases, shoppers may elect to buy the private label based on its low cost, similar ingredients, or larger package size as compared with the national brand. The strategy also gives shoppers a better idea of the comprehensive selection available for a store's private labels. Some retailers use endcaps (end-of-aisle displays) for their private labels. These locations have more visibility and greater store traffic than mid-aisle displays. Some retailers give premium space to new national brands based on slotting fees paid by the national brands for preferred product placement.

In addition to shelf placement, merchandising programs for private labels need to engage shoppers. Trader Joe's (www.traderjoes.com) offers sampling stations where employees prepare light snacks using their private-label goods. These snacks are generally easy to prepare, and they stimulate the sales of multiple private-label ingredients to follow the recipes.

Retailers need to be aware of merchandising pitfalls associated with private labels. One common error is not to view the private label as a real brand. Retailers falling victim to this problem area may not give the private label prominent shelf placement or they may fail to make the brand easy to locate. Another merchandising pitfall is for retailers to promote their private-label brands solely on the basis of price.

Questions

1. What factors are behind the shift to an increased role of retailers in the development and promotion of private labels

2. Provide examples of how a retailer can offer different versions of its private-label chicken soup.

3. What is the impact of a retailer's offering multiple versions of a private label on a manufacturer's brand strategy

4. Develop a merchandising program for a new private-label line of healthy snacks at a specialty food store chain.

At one point, product planning decisions by retailers for their private-label brands was a simple process. The retailers simply contracted with national brand manufacturers or with a private-label producer to make a special private-label product version. The retailers then placed the private-label brand on their store shelves. Now, retailers are much more involved with planning the specifications of their private-label products, with designing distinctive logos and labels, and with even managing "good, better, and best" versions of their private-label brands.

Many retail analysts agree that retailers need to develop a strong product-placement strategy for their private-label products so that consumers can more easily locate these items in the store. According to one consumer packaged goods executive: "While innovation is important, the fundamentals of having the right products in stock-in sight and in the right locations with the right message to offer-are key to driving shopper loyalty."

To add to today's complexity in the placement of private-label products, many retailers offer different levels of quality (such as premium products and organics) within a single private-label brand. As a result, promotions for each version need to stress price-based appeals for low-cost private-label goods and a private label's unique characteristics for upscale product categories (such as more chocolate chips than a national brand for a premium chocolate chip cookie or the use of organic ingredients for soup).

Product-placement decisions also need to reflect shelf-height decisions. Duane Reade (www.duanereade.com), a New York-based drugstore chain, places its premium cookies at eye level (the most preferred space), its value-oriented private-label brand of cookies below eye level, and the national brands of cookies at the poorest locations on its store shelves.

The traditional shelf location for private-label brands has been to the right of national brands on the same shelf. This accomplishes several objectives. It enables shoppers to compare price and quantity levels between different types of brands. In many cases, shoppers may elect to buy the private label based on its low cost, similar ingredients, or larger package size as compared with the national brand. The strategy also gives shoppers a better idea of the comprehensive selection available for a store's private labels. Some retailers use endcaps (end-of-aisle displays) for their private labels. These locations have more visibility and greater store traffic than mid-aisle displays. Some retailers give premium space to new national brands based on slotting fees paid by the national brands for preferred product placement.

In addition to shelf placement, merchandising programs for private labels need to engage shoppers. Trader Joe's (www.traderjoes.com) offers sampling stations where employees prepare light snacks using their private-label goods. These snacks are generally easy to prepare, and they stimulate the sales of multiple private-label ingredients to follow the recipes.

Retailers need to be aware of merchandising pitfalls associated with private labels. One common error is not to view the private label as a real brand. Retailers falling victim to this problem area may not give the private label prominent shelf placement or they may fail to make the brand easy to locate. Another merchandising pitfall is for retailers to promote their private-label brands solely on the basis of price.

Questions

1. What factors are behind the shift to an increased role of retailers in the development and promotion of private labels

2. Provide examples of how a retailer can offer different versions of its private-label chicken soup.

3. What is the impact of a retailer's offering multiple versions of a private label on a manufacturer's brand strategy

4. Develop a merchandising program for a new private-label line of healthy snacks at a specialty food store chain.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

15

Describe and analyze eBay's overall merchandising strategy.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

16

Why is it important for retailers to understand the concept of price elasticity even if they are unable to compute it

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

17

Case 3: Destocking as a Strategy

Due to the recent weak economic environment, many retailers have been reluctant to order too many goods, fearing that they will not sell. Among the economic indicators that most concern retailers' stocking approach are high unemployment levels, high foreclosure rates in the housing market, fluctuations in the stock market, and gasoline price levels that deter shopping. As a result of these concerns, some retailers would rather risk lost sales due to stockouts than have to heavily mark down goods that were ordered in too large quantities. Analysts attribute this low-inventory strategy to retailers' remembering the 2008-2009 recession peak when too many retailers were burdened with high inventories.

To reduce inventory risk, some retailers have begun to carefully evaluate such tactics as their "back-to-school" sales. For a number of retailers, this is the second most critical season (after Christmas) in terms of sales. Other retailers have added alternate suppliers to serve as backups in the case of high demand levels. Macy's (www.macys.com) has effectively reduced inventory requirements by working with suppliers to get more store-ready merchandise that does not require distribution centers operated by the retailer. Macy's has also lowered its inventory-holding costs by combining store and online inventories in one facility, instead of maintaining separate warehouses for each channel. These changes resulted in Macy's saving $5 million in 2010 alone.

These shifts in inventory planning are reflected in the retail business inventory-to-sales ratio, which was at 1.33 as of mid-2011, the lowest for this time period since 1992. As a vice-president for the National Retail Federation says: "With rising gas prices and challenges in the labor and housing markets, consumer spending has slowed and retailers have adjusted their inventory levels accordingly."

The inventory-to-sales ratios for manufacturers and wholesalers have shown similar declines. This indicates that these supply chain members are not necessarily holding excess inventories for rapid delivery to retailers with low stock on hand, which is opposite to what the retailers are assuming.

The downside of having too little inventory on hand-a negative impact on revenue-was experienced by Wal-Mart when that retailer reduced inventory selections as a means of lessening inventory-holding costs and improving supply-chain efficiency. Unfortunately, Wal-Mart's sales performance suffered when customers found that their favorite brands were no longer stocked. Another potential problem associated with low inventories is the difficulty in dealing with supply-chain disruptions, such as the 2011 earthquake in Japan.

Sharen Turney, the chief executive of Victoria's Secret (www.victoriassecret.com), understands the need to weigh the benefits of minimizing inventory-holding costs against the possibility of lost sales. Turney says that Victoria's Secret is seeking a "balanced approach between managing the business with optimism and staying conservative on our inventory and expense plans."

In addition to lost sales, too little inventory is typically associated with the need for frequent ordering, the need for emergency shipments, high ordering costs, and less ability to receive quantity discounts. In contrast, too high an inventory is normally associated with high holding costs, the need for markdowns to clear out unsold inventory, and too much dated merchandise.

Questions

1. List five tactics that retailers can use to reduce their inventory levels while keeping the chance of stockouts low.

2. Discuss the supply-chain implications of retailers having low inventory-to-sales ratios if the inventory-to-sales ratios of manufacturers and wholesalers are high.

3. What are the dangers of frequent small orders and the use of emergency shipments as a means of reducing inventory requirements

4. How could Wal-Mart have foreseen and avoided the negative impact on revenues of pruning its merchandise selection

Due to the recent weak economic environment, many retailers have been reluctant to order too many goods, fearing that they will not sell. Among the economic indicators that most concern retailers' stocking approach are high unemployment levels, high foreclosure rates in the housing market, fluctuations in the stock market, and gasoline price levels that deter shopping. As a result of these concerns, some retailers would rather risk lost sales due to stockouts than have to heavily mark down goods that were ordered in too large quantities. Analysts attribute this low-inventory strategy to retailers' remembering the 2008-2009 recession peak when too many retailers were burdened with high inventories.

To reduce inventory risk, some retailers have begun to carefully evaluate such tactics as their "back-to-school" sales. For a number of retailers, this is the second most critical season (after Christmas) in terms of sales. Other retailers have added alternate suppliers to serve as backups in the case of high demand levels. Macy's (www.macys.com) has effectively reduced inventory requirements by working with suppliers to get more store-ready merchandise that does not require distribution centers operated by the retailer. Macy's has also lowered its inventory-holding costs by combining store and online inventories in one facility, instead of maintaining separate warehouses for each channel. These changes resulted in Macy's saving $5 million in 2010 alone.

These shifts in inventory planning are reflected in the retail business inventory-to-sales ratio, which was at 1.33 as of mid-2011, the lowest for this time period since 1992. As a vice-president for the National Retail Federation says: "With rising gas prices and challenges in the labor and housing markets, consumer spending has slowed and retailers have adjusted their inventory levels accordingly."

The inventory-to-sales ratios for manufacturers and wholesalers have shown similar declines. This indicates that these supply chain members are not necessarily holding excess inventories for rapid delivery to retailers with low stock on hand, which is opposite to what the retailers are assuming.

The downside of having too little inventory on hand-a negative impact on revenue-was experienced by Wal-Mart when that retailer reduced inventory selections as a means of lessening inventory-holding costs and improving supply-chain efficiency. Unfortunately, Wal-Mart's sales performance suffered when customers found that their favorite brands were no longer stocked. Another potential problem associated with low inventories is the difficulty in dealing with supply-chain disruptions, such as the 2011 earthquake in Japan.

Sharen Turney, the chief executive of Victoria's Secret (www.victoriassecret.com), understands the need to weigh the benefits of minimizing inventory-holding costs against the possibility of lost sales. Turney says that Victoria's Secret is seeking a "balanced approach between managing the business with optimism and staying conservative on our inventory and expense plans."

In addition to lost sales, too little inventory is typically associated with the need for frequent ordering, the need for emergency shipments, high ordering costs, and less ability to receive quantity discounts. In contrast, too high an inventory is normally associated with high holding costs, the need for markdowns to clear out unsold inventory, and too much dated merchandise.

Questions

1. List five tactics that retailers can use to reduce their inventory levels while keeping the chance of stockouts low.

2. Discuss the supply-chain implications of retailers having low inventory-to-sales ratios if the inventory-to-sales ratios of manufacturers and wholesalers are high.

3. What are the dangers of frequent small orders and the use of emergency shipments as a means of reducing inventory requirements

4. How could Wal-Mart have foreseen and avoided the negative impact on revenues of pruning its merchandise selection

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

18

Comment on each of the following from the perspective of a small retailer:

a. Horizontal price fixing.

b. Vertical price fixing.

c. Price discrimination.

d. Minimum-price laws.

e. Unit pricing.

a. Horizontal price fixing.

b. Vertical price fixing.

c. Price discrimination.

d. Minimum-price laws.

e. Unit pricing.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

19

Discuss the pros and cons of eBay's huge product assortment to eBay.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

20

Give an example of a price strategy that integrates demand, cost, and competitive criteria.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

21

Case 4: Cheap Chic from Forever 21

Forever 21 (www.forever21.com) is a retailer that operates various store brands. It generates $3 billion a year in sales, has more than 480 stores, and employs 35,000 people. Forever 21 has grown so quickly that it opened 100 stores in 2010; and during one two-week period in 2011, Forever 21 opened three stores. In the past several years, Forever 21 has increased its square footage of store space from 1 million square feet to 10 million square feet, and from one private-label brand to six such brands. Even with this expansion, Forever 21 has been profitable. Its overall growth has been accomplished with no advertising, almost no marketing effort, and infrequent efforts of the chain's management to introduce themselves to their customers.

Early in their career as merchants, Do Won and Jin Sook Chang, the founders of Forever 21, began to order only small quantities of each style they offered for sale. To reduce their inventory risk and minimize markdowns, they planned to quickly reorder fast-selling clothing and discontinue styles that did not sell well. According to one research analyst: "A typical Forever 21 has inventory turnover of 20 percent per week, about two times the level of apparel manufacturers."

Forever 21 has been quick to capitalize on location opportunities generated by store closings and bankruptcies of other retailers. These include locations that were abandoned by Sears, Saks, Circuit City, Dillards, and Mervyn's. In addition, Forever 21 has locations on Fifth Avenue in New York City, on London's Oxford Street, and in Tokyo's Shibuya district.

Forever 21's growth has not been controversy-free. Even though the owners of the chain have never been found guilty of copyright infringement in court, between 2006 and 2010, about 50 designer brands-including Diane von Furstenberg, Anna Sui, and Anthropologie-individually sued Forever 21. While U.S. copyright law protects original prints and graphics (as opposed to the design itself), these three firms won out-of-court settlements against Forever 21 (the results of this litigation are confidential).

In commenting on the Anthropologie case, a U.S. District Court judge said: "We note the extraordinary litigating history of this company, which raises the most serious questions as to whether it is a business that is predicated in large measure on the systematic infringement of competitors' intellectual property." Similarly, a copyright law expert stated: "Illegal copying has been incorporated into their business model. But it's not necessarily a terrible result for designers who do receive payment."

Another designer who received payment from Forever 21 was Virginia Johnson. The original Johnson skirt was sold for $175; Forever 21's clone was priced at less than $18. In this instance, Forever 21 paid $9,000 (22.5 percent of sales) for a licensing agreement.

Another criticism of Forever 21 involves its history of using suppliers that underpay their workers. As one attorney who successfully sued Forever 21 concluded: "Forever 21 is not a victim of the industry. They create and demand these conditions. They squeeze their suppliers and make it necessary for them to get things done as quickly and as cheaply as possible, no matter what the cost to the workers."

Questions

1. Comment on the statement that Forever 21 "began to order only small quantities of each style offered for sale. They figured that they could quickly reorder fast selling clothing and drop styles that did not sell well to minimize their inventory risk."

2. Legal issues aside, evaluate Forever 21's strategy of making low-cost versions of successful designs by famous designers.

3. What do you recommend that Forever 21 should do in the future to avoid the controversies cited in this case

4. From a merchandising perspective, what are the pros and cons of Forever 21's fast-growth strategy

Forever 21 (www.forever21.com) is a retailer that operates various store brands. It generates $3 billion a year in sales, has more than 480 stores, and employs 35,000 people. Forever 21 has grown so quickly that it opened 100 stores in 2010; and during one two-week period in 2011, Forever 21 opened three stores. In the past several years, Forever 21 has increased its square footage of store space from 1 million square feet to 10 million square feet, and from one private-label brand to six such brands. Even with this expansion, Forever 21 has been profitable. Its overall growth has been accomplished with no advertising, almost no marketing effort, and infrequent efforts of the chain's management to introduce themselves to their customers.

Early in their career as merchants, Do Won and Jin Sook Chang, the founders of Forever 21, began to order only small quantities of each style they offered for sale. To reduce their inventory risk and minimize markdowns, they planned to quickly reorder fast-selling clothing and discontinue styles that did not sell well. According to one research analyst: "A typical Forever 21 has inventory turnover of 20 percent per week, about two times the level of apparel manufacturers."

Forever 21 has been quick to capitalize on location opportunities generated by store closings and bankruptcies of other retailers. These include locations that were abandoned by Sears, Saks, Circuit City, Dillards, and Mervyn's. In addition, Forever 21 has locations on Fifth Avenue in New York City, on London's Oxford Street, and in Tokyo's Shibuya district.

Forever 21's growth has not been controversy-free. Even though the owners of the chain have never been found guilty of copyright infringement in court, between 2006 and 2010, about 50 designer brands-including Diane von Furstenberg, Anna Sui, and Anthropologie-individually sued Forever 21. While U.S. copyright law protects original prints and graphics (as opposed to the design itself), these three firms won out-of-court settlements against Forever 21 (the results of this litigation are confidential).

In commenting on the Anthropologie case, a U.S. District Court judge said: "We note the extraordinary litigating history of this company, which raises the most serious questions as to whether it is a business that is predicated in large measure on the systematic infringement of competitors' intellectual property." Similarly, a copyright law expert stated: "Illegal copying has been incorporated into their business model. But it's not necessarily a terrible result for designers who do receive payment."

Another designer who received payment from Forever 21 was Virginia Johnson. The original Johnson skirt was sold for $175; Forever 21's clone was priced at less than $18. In this instance, Forever 21 paid $9,000 (22.5 percent of sales) for a licensing agreement.

Another criticism of Forever 21 involves its history of using suppliers that underpay their workers. As one attorney who successfully sued Forever 21 concluded: "Forever 21 is not a victim of the industry. They create and demand these conditions. They squeeze their suppliers and make it necessary for them to get things done as quickly and as cheaply as possible, no matter what the cost to the workers."

Questions

1. Comment on the statement that Forever 21 "began to order only small quantities of each style offered for sale. They figured that they could quickly reorder fast selling clothing and drop styles that did not sell well to minimize their inventory risk."

2. Legal issues aside, evaluate Forever 21's strategy of making low-cost versions of successful designs by famous designers.

3. What do you recommend that Forever 21 should do in the future to avoid the controversies cited in this case

4. From a merchandising perspective, what are the pros and cons of Forever 21's fast-growth strategy

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

22

Explain why markups are usually computed as a percentage of selling price rather than of cost.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

23

Today, eBay offers products in two ways: through auctions and through set prices. Comment on this approach.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck