Deck 10: Developing Project Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/42

Play

Full screen (f)

Deck 10: Developing Project Cash Flows

1

A firm is considering purchasing a machine that costs $65,000. It will be used for six years, and the salvage value at that time is expected to be zero. The machine will save $35,000 per year in labor, but it will incur $12,000 in operating and maintenance costs each year. The machine will be depreciated according to five-year MACRS. The firm's tax rate is 40%, and its after-tax MARR is 15%. Should the machine be purchased?

Capital investment is one of the crucial decisions in a business. Fixed assets are capital asset. Investment in fixed asset is considered here. Initially lump sum money is employed to buy the asset. Then asset renders service during its lifetime. Revenue is earned and cash flows are generated. Firm has to decide whether investment is justified or not.

Different techniques are available for taking such decisions. They are known as capital budgeting technique. Most of the techniques are using cash flow figures for taking decisions. Thus calculation of correct cash flow is very crucial.

Different techniques are available for taking such decisions. They are known as capital budgeting techniques. Most of the techniques are using cash flow figures for taking decisions. Thus calculation of correct cash flow is very crucial.

The problem requires initial investment of $65,000 to buy a machine. It has 6 years life. Resale value of machine after 6 years is zero. So, entire $65,000 will be depreciated during 6 years.

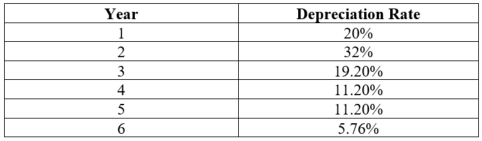

Depreciation is the value lost for using machine in production. In tax rule, modified accelerated cost recovery system (MACRS) is used for each group.

Further the method has assumed that capital asset will provide maximum service in initial years. So, high rate of depreciation is recommended. It is 200% of normal rate for asset life below 15 years. This rate is 150% for life of 15 years or more.

The problem is related with purchase of machine. Cost price is $65,000. Salvage value recoverable from machine after six years life is zero. So, entire $65,000 is depreciable.

Machine is depreciable for 5 years life span. So, in each year equal percentage will be recovered.

At the start of year zero, depreciable value of asset is 100% of initial cost. Divide it by 5 years. It is

. Since life is less than 15 years, take 2005 of normal rate. It is

. Since life is less than 15 years, take 2005 of normal rate. It is

. So in first year, depreciation rate is 40%.

. So in first year, depreciation rate is 40%.

However MACRS assumes that machine is introduced at the middle of year 1. So 50% first year depreciation rate will be applicable. It is

. Therefore, full 100% will be recovered in 6 years.

. Therefore, full 100% will be recovered in 6 years.

After charging 20% depreciation in year 1, leftover book value of machine is

. For 2 nd year, depreciation rate applicable will be 40% of 80% book value. It is

. For 2 nd year, depreciation rate applicable will be 40% of 80% book value. It is

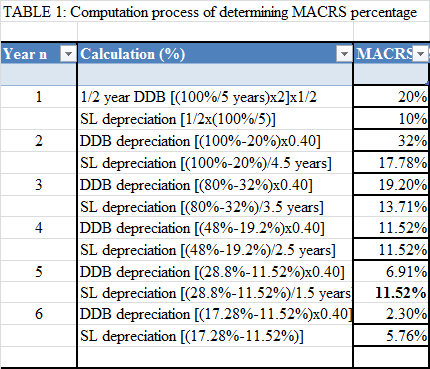

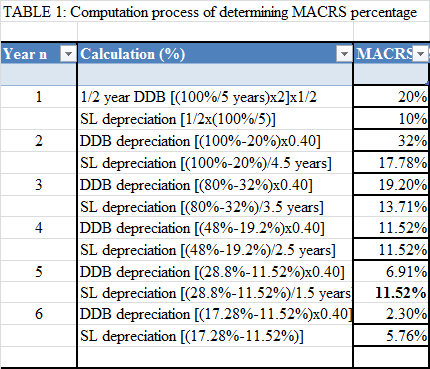

In this manner, calculate MACRS for remaining years. Remember MACRS rate cannot be less than straight line rate. It is a rate which is ascertained by dividing book value using number of year's life left. So, calculation of MACRS is shown in the table below:

In this manner, calculate MACRS for remaining years. Remember MACRS rate cannot be less than straight line rate. It is a rate which is ascertained by dividing book value using number of year's life left. So, calculation of MACRS is shown in the table below:

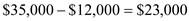

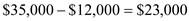

Now consider cash flow from machine. Actual life of the machine is 6 years. In each year, it will save labor cost of $35,000. Also annual operating and maintenance cost is $12,000. So net cash inflow is

Now consider cash flow from machine. Actual life of the machine is 6 years. In each year, it will save labor cost of $35,000. Also annual operating and maintenance cost is $12,000. So net cash inflow is

. It is revenue before tax.

. It is revenue before tax.

From the above figure, deduct depreciation. You will get taxable net income. Now deduct tax to get net income after tax. Finally add back depreciation. It is needed to ascertain cash flow. Note that depreciation is a book entry. No cash is paid. So after add back, you will get annual cash flow.

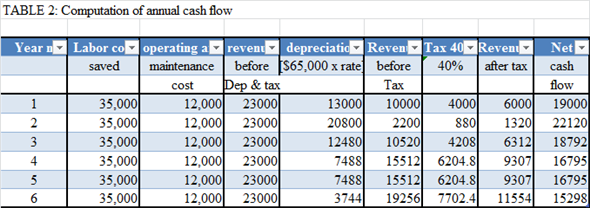

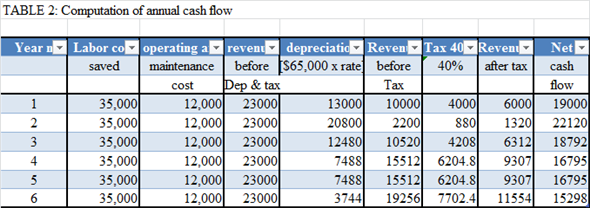

Finally apply net present worth concept to judge acceptability of project. Procedures are-

Finally apply net present worth concept to judge acceptability of project. Procedures are-

1. Consider annual cash flow.

2. Calculate annual discounting factor of each year. It is present value of one dollar receivable in future. Formula is

. Here 'r' is discounting rate. It is minimum rate of return required to be earned for survival. Future cash flow period is 'n'.

. Here 'r' is discounting rate. It is minimum rate of return required to be earned for survival. Future cash flow period is 'n'.

3. Multiply annual net cash flow by the corresponding discounting factor. It will give present value of yearly net cash flow.

4. Add all annual present value calculated in step 3 to get gross present worth.

5. Finally deduct initial investment to get net present worth. If net present worth is positive, then project is accepted.

Here discounting rate is 15%. So net present worth calculation is made and following table is prepared.

Since net present worth is positive, project is

Since net present worth is positive, project is

Machine should be purchased.

Machine should be purchased.

Different techniques are available for taking such decisions. They are known as capital budgeting technique. Most of the techniques are using cash flow figures for taking decisions. Thus calculation of correct cash flow is very crucial.

Different techniques are available for taking such decisions. They are known as capital budgeting techniques. Most of the techniques are using cash flow figures for taking decisions. Thus calculation of correct cash flow is very crucial.

The problem requires initial investment of $65,000 to buy a machine. It has 6 years life. Resale value of machine after 6 years is zero. So, entire $65,000 will be depreciated during 6 years.

Depreciation is the value lost for using machine in production. In tax rule, modified accelerated cost recovery system (MACRS) is used for each group.

Further the method has assumed that capital asset will provide maximum service in initial years. So, high rate of depreciation is recommended. It is 200% of normal rate for asset life below 15 years. This rate is 150% for life of 15 years or more.

The problem is related with purchase of machine. Cost price is $65,000. Salvage value recoverable from machine after six years life is zero. So, entire $65,000 is depreciable.

Machine is depreciable for 5 years life span. So, in each year equal percentage will be recovered.

At the start of year zero, depreciable value of asset is 100% of initial cost. Divide it by 5 years. It is

. Since life is less than 15 years, take 2005 of normal rate. It is

. Since life is less than 15 years, take 2005 of normal rate. It is  . So in first year, depreciation rate is 40%.

. So in first year, depreciation rate is 40%.However MACRS assumes that machine is introduced at the middle of year 1. So 50% first year depreciation rate will be applicable. It is

. Therefore, full 100% will be recovered in 6 years.

. Therefore, full 100% will be recovered in 6 years.After charging 20% depreciation in year 1, leftover book value of machine is

. For 2 nd year, depreciation rate applicable will be 40% of 80% book value. It is

. For 2 nd year, depreciation rate applicable will be 40% of 80% book value. It is  In this manner, calculate MACRS for remaining years. Remember MACRS rate cannot be less than straight line rate. It is a rate which is ascertained by dividing book value using number of year's life left. So, calculation of MACRS is shown in the table below:

In this manner, calculate MACRS for remaining years. Remember MACRS rate cannot be less than straight line rate. It is a rate which is ascertained by dividing book value using number of year's life left. So, calculation of MACRS is shown in the table below:  Now consider cash flow from machine. Actual life of the machine is 6 years. In each year, it will save labor cost of $35,000. Also annual operating and maintenance cost is $12,000. So net cash inflow is

Now consider cash flow from machine. Actual life of the machine is 6 years. In each year, it will save labor cost of $35,000. Also annual operating and maintenance cost is $12,000. So net cash inflow is  . It is revenue before tax.

. It is revenue before tax.From the above figure, deduct depreciation. You will get taxable net income. Now deduct tax to get net income after tax. Finally add back depreciation. It is needed to ascertain cash flow. Note that depreciation is a book entry. No cash is paid. So after add back, you will get annual cash flow.

Finally apply net present worth concept to judge acceptability of project. Procedures are-

Finally apply net present worth concept to judge acceptability of project. Procedures are-1. Consider annual cash flow.

2. Calculate annual discounting factor of each year. It is present value of one dollar receivable in future. Formula is

. Here 'r' is discounting rate. It is minimum rate of return required to be earned for survival. Future cash flow period is 'n'.

. Here 'r' is discounting rate. It is minimum rate of return required to be earned for survival. Future cash flow period is 'n'.3. Multiply annual net cash flow by the corresponding discounting factor. It will give present value of yearly net cash flow.

4. Add all annual present value calculated in step 3 to get gross present worth.

5. Finally deduct initial investment to get net present worth. If net present worth is positive, then project is accepted.

Here discounting rate is 15%. So net present worth calculation is made and following table is prepared.

Since net present worth is positive, project is

Since net present worth is positive, project is  Machine should be purchased.

Machine should be purchased. 2

Let's reconsider Problem. Carrier Corporation, a market leader of air conditioning units, is gearing up to push new energy-efficient systems in the wake of the energy bill passed by Congress. Carrier Corporation says it has invested $8 million in developing new heat exchangers- -a major component in air-conditioners-that use less energy and are about 20% smaller and 30% lighter than current energy saving versions. Carrier's current energy-efficient models are almost double the size of its regular central air-conditioning units. The company speculates this model's bulk may have been a deterrent for homeowners. The new air conditioners are expected to hit the market in the second quarter of 2016. Cooling efficiency is measured by a standard called SEER: Seasonal Energy Efficiency Ratio. It's similar to the gas mileage system used on cars-the higher the number, the more money you save. Older systems had SEER numbers as low as 8; the new Carrier systems are rated at 18! (Federal standards will require a minimum SEER of 13 from January 2006). Translated into operating costs, this means that for every $100 you used to spend on electricity for cooling, you now can spend just $39.

Problem

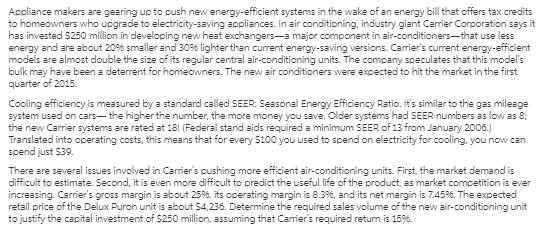

Appliance makers are gearing up to push new energy-efficient systems in the wake of an energy bill that offers tax credits to homeowners who upgrade to electricity-saving appliances. In air conditioning, industry giant Carrier Corporation says it has invested $250 million in developing new heat exchangers-a major component in air-conditioners-that use less energy and are about 20% smaller and 30% lighter than current energy-saving versions. Carrier's current energy-efficient models are almost double the size of its regular central air-conditioning units. The company speculates that this model's bulk may have been a deterrent for homeowners. The new air conditioners were expected to hit the market in the first quarter of 2015.

Cooling efficiency is measured by a standard called SEER: Seasonal Energy Efficiency Ratio. It's similar to the gas mileage system used on cars- the higher the number, the more money you save. Older systems had SEER numbers as low as 8; the new Carrier systems are rated at 18! (Federal stand aids required a minimum SEER of 13 from January 2006.) Translated into operating costs, this means that for every $100 you used to spend on electricity for cooling, you now can spend just $39.

There are several issues involved in Carrier's pushing more efficient air-conditioning units. First, the market demand is difficult to estimate. Second, it is even more difficult to predict the useful life of the product, as market competition is ever increasing. Carrier's gross margin is about 25%. its operating margin is 8.3%, and its net margin is 7.45%. The expected retail price of the Delux Puron unit is about $4,236. Determine the required sales volume of the new air-conditioning unit to justify the capital investment of $250 million, assuming that Carrier's required return is 15%.

There are several issues involved in pushing more-efficient air-conditioning unit by Carrier.

First, the size of market demand is difficult to estimate. Second, it is even more difficult to predict the useful product life as market competition is ever increasing. Carrier's marketing department has plans to target sales of the new air-conditioning units to the larger office complexes, and if they are successful there, then the units could be marketed to a wide variety of businesses, including schools, hospitals, and eventually even to households.

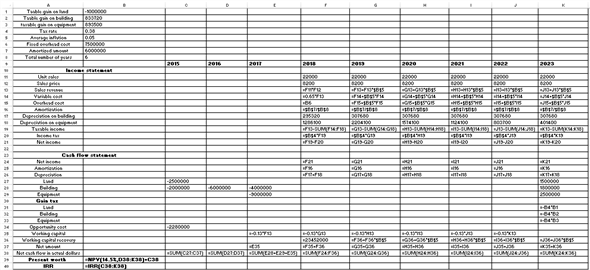

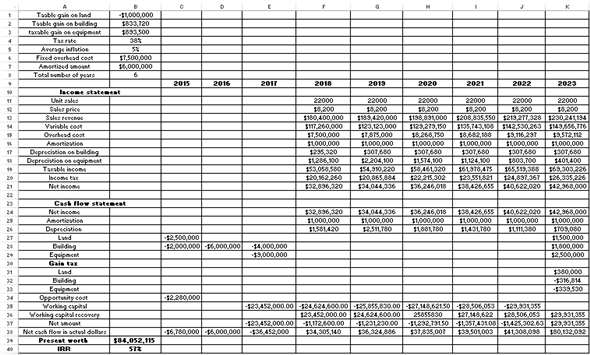

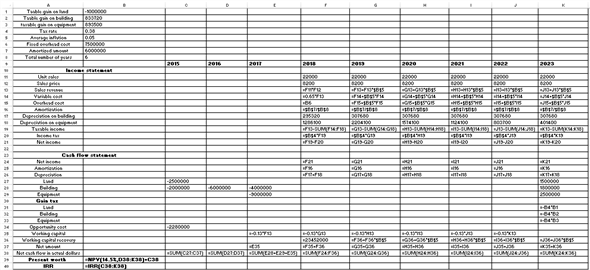

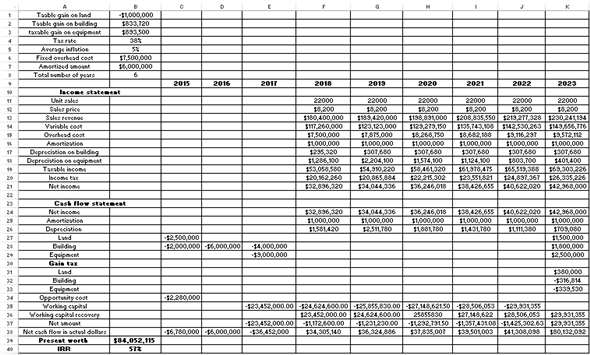

The marketing vice president believes that annual sales would be 22,000 units if the units were priced at $8,200 each. The engineering department has estimated that the firm would need a new manufacturing plant; this plant could be built and made ready for production in 2 years, once the "go" decision is made. The plant would require a 25-acre site, and Carrier currently has an option to purchase a suitable tract of land for $2.5 million. Building construction would begin in early 2014 and continue through 2015. The building, which would fall into MACRS 39-year class, would cost an estimated $12 million, and a $2 million payment would be due to the contractor on March 31, 2014, another $6 million on March 31, 2015 and remaining balance of $4 million payable on March 31, 2016.

The necessary manufacturing equipment would be installed late in 2015 and would be paid for on March 31, 2016. The equipment, which would fall into the MACRS 7-year class, would have a cost of $8.5 million, including transportation, plus another $500,000 for installation. To date, the company has spent $8 million on research and development associated with the new technology. The company already expensed $2 million of the R D costs, and the remaining $6 million has been capitalized and will be amortized over the life of the project. However, if Carrier decides not to go forward with the project, the capitalized R D expenditures could be written off as expenses on March 31, 2016.

The project would also require an initial investment in net working capital equal to 13% of the estimated sales in the first year. The initial working capital investment would be made on March 31. 2016, and on March 31 of each following year, the net working capital would be increased by an amount equal to 13% of any sales increase expected during the coming year. The project's estimated economic life is 6 years (not counting the construction period). At that time, the land is expected to have a market value of $1.5 million, the building a value of $1.8 million, and the equipment a value of $2.5 million.

The production department has estimated that variable manufacturing costs would total 65% of dollar sales, and that fixed overhead costs, excluding depreciation, would be $7.5 million for the first year of operations. Sales prices and fixed overhead costs, other than depreciation and amortization, are projected to increase with inflation, which is expected to average 5% per year over the 6-year life of the project. (Note that the first year's sales would be $8,200 × 22,000 units = $180.4 million. The second year's sales would be 5% higher than $180.4 million, and so forth.)

Carrier's marginal combined tax rate is 38%; its weighted average cost of capital is 14.5% (meaning that their inflation-adjusted minimum attractive rate of return is 14.5% after tax); and the company's policy, for capital budgeting purposes, is to assume that cash flows occur at the end of each fiscal year (for Carrier, it is March 31). Since the plant would begin operations on April 1, 2016, the first operating cash flows would thus occur on March 31, 2017.

Questions:

1. Determine how you would treat the R D expenditures.

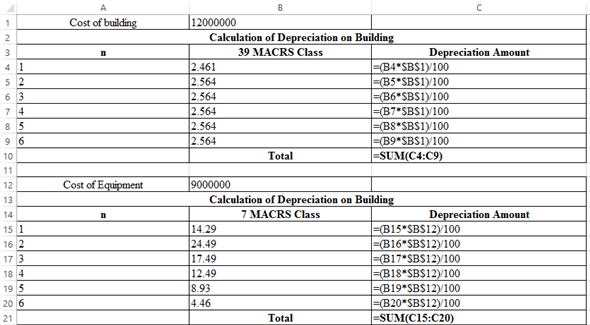

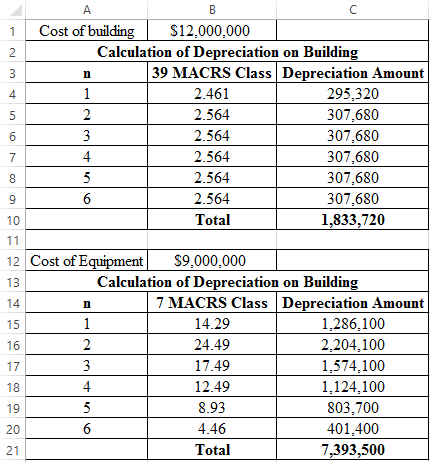

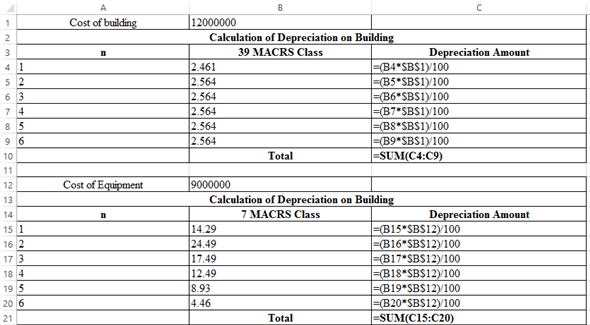

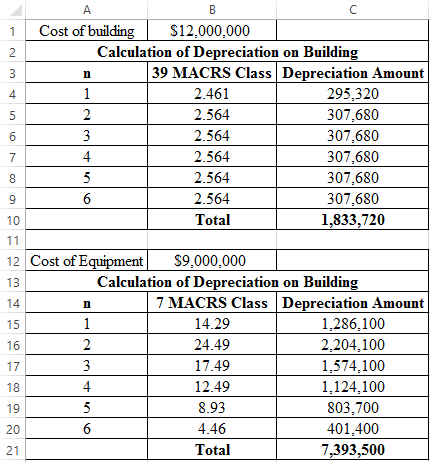

2. Determine the depreciation schedules for all assets.

3. Determine the taxable gains for each asset at the time of disposal (March 31, 2022).

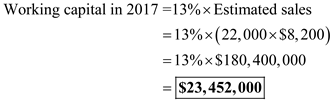

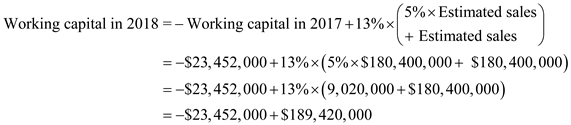

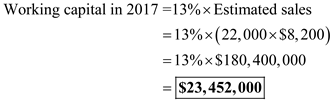

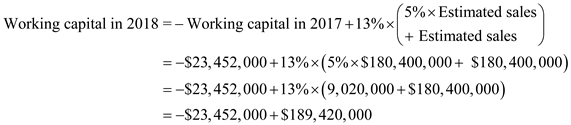

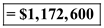

4. Determine the amount of working capital requirement in each operating period.

5. Develop the project cash flows over the life of investment using an Excel spreadsheet.

Justify the investment based on (1) net present worth criteria and (2) internal rate of return.

Problem

Appliance makers are gearing up to push new energy-efficient systems in the wake of an energy bill that offers tax credits to homeowners who upgrade to electricity-saving appliances. In air conditioning, industry giant Carrier Corporation says it has invested $250 million in developing new heat exchangers-a major component in air-conditioners-that use less energy and are about 20% smaller and 30% lighter than current energy-saving versions. Carrier's current energy-efficient models are almost double the size of its regular central air-conditioning units. The company speculates that this model's bulk may have been a deterrent for homeowners. The new air conditioners were expected to hit the market in the first quarter of 2015.

Cooling efficiency is measured by a standard called SEER: Seasonal Energy Efficiency Ratio. It's similar to the gas mileage system used on cars- the higher the number, the more money you save. Older systems had SEER numbers as low as 8; the new Carrier systems are rated at 18! (Federal stand aids required a minimum SEER of 13 from January 2006.) Translated into operating costs, this means that for every $100 you used to spend on electricity for cooling, you now can spend just $39.

There are several issues involved in Carrier's pushing more efficient air-conditioning units. First, the market demand is difficult to estimate. Second, it is even more difficult to predict the useful life of the product, as market competition is ever increasing. Carrier's gross margin is about 25%. its operating margin is 8.3%, and its net margin is 7.45%. The expected retail price of the Delux Puron unit is about $4,236. Determine the required sales volume of the new air-conditioning unit to justify the capital investment of $250 million, assuming that Carrier's required return is 15%.

There are several issues involved in pushing more-efficient air-conditioning unit by Carrier.

First, the size of market demand is difficult to estimate. Second, it is even more difficult to predict the useful product life as market competition is ever increasing. Carrier's marketing department has plans to target sales of the new air-conditioning units to the larger office complexes, and if they are successful there, then the units could be marketed to a wide variety of businesses, including schools, hospitals, and eventually even to households.

The marketing vice president believes that annual sales would be 22,000 units if the units were priced at $8,200 each. The engineering department has estimated that the firm would need a new manufacturing plant; this plant could be built and made ready for production in 2 years, once the "go" decision is made. The plant would require a 25-acre site, and Carrier currently has an option to purchase a suitable tract of land for $2.5 million. Building construction would begin in early 2014 and continue through 2015. The building, which would fall into MACRS 39-year class, would cost an estimated $12 million, and a $2 million payment would be due to the contractor on March 31, 2014, another $6 million on March 31, 2015 and remaining balance of $4 million payable on March 31, 2016.

The necessary manufacturing equipment would be installed late in 2015 and would be paid for on March 31, 2016. The equipment, which would fall into the MACRS 7-year class, would have a cost of $8.5 million, including transportation, plus another $500,000 for installation. To date, the company has spent $8 million on research and development associated with the new technology. The company already expensed $2 million of the R D costs, and the remaining $6 million has been capitalized and will be amortized over the life of the project. However, if Carrier decides not to go forward with the project, the capitalized R D expenditures could be written off as expenses on March 31, 2016.

The project would also require an initial investment in net working capital equal to 13% of the estimated sales in the first year. The initial working capital investment would be made on March 31. 2016, and on March 31 of each following year, the net working capital would be increased by an amount equal to 13% of any sales increase expected during the coming year. The project's estimated economic life is 6 years (not counting the construction period). At that time, the land is expected to have a market value of $1.5 million, the building a value of $1.8 million, and the equipment a value of $2.5 million.

The production department has estimated that variable manufacturing costs would total 65% of dollar sales, and that fixed overhead costs, excluding depreciation, would be $7.5 million for the first year of operations. Sales prices and fixed overhead costs, other than depreciation and amortization, are projected to increase with inflation, which is expected to average 5% per year over the 6-year life of the project. (Note that the first year's sales would be $8,200 × 22,000 units = $180.4 million. The second year's sales would be 5% higher than $180.4 million, and so forth.)

Carrier's marginal combined tax rate is 38%; its weighted average cost of capital is 14.5% (meaning that their inflation-adjusted minimum attractive rate of return is 14.5% after tax); and the company's policy, for capital budgeting purposes, is to assume that cash flows occur at the end of each fiscal year (for Carrier, it is March 31). Since the plant would begin operations on April 1, 2016, the first operating cash flows would thus occur on March 31, 2017.

Questions:

1. Determine how you would treat the R D expenditures.

2. Determine the depreciation schedules for all assets.

3. Determine the taxable gains for each asset at the time of disposal (March 31, 2022).

4. Determine the amount of working capital requirement in each operating period.

5. Develop the project cash flows over the life of investment using an Excel spreadsheet.

Justify the investment based on (1) net present worth criteria and (2) internal rate of return.

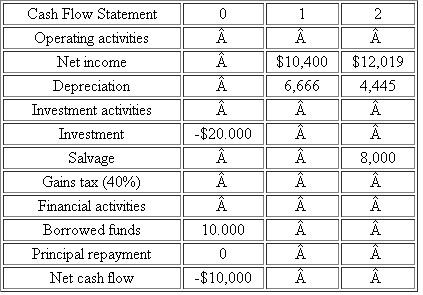

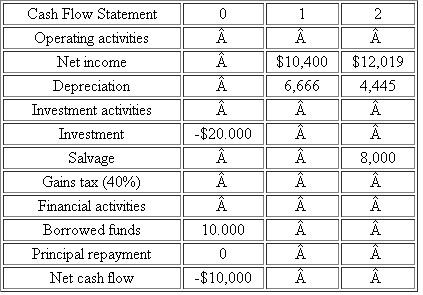

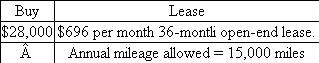

Options of Buy or borrow and lease: The manager has to decide whether to borrow funds for the fixed asset or to purchase it from market or it can be taken on lease. While taking this decision, the important aspects which are required to be considered are the total value and the life span, in case of purchase. On the other hand, the rental payments and the production level at the end of the period are considered in case of lease.

Net Cash Flows: The net cash flows are defined as the difference between the cash inflows and outflows of a company at a particular period of time.

In the present case, the company, CC had the fixed overhead cost of $7.5 million with the MACRS 7 year class.

1.

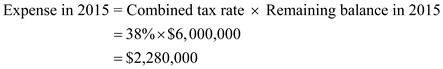

It is needed to determine the treat the R D expenditures. It can be seen under two situations:

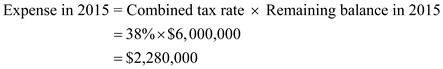

Situation 1: When the firm decides not to follow the project, then the expense in 2015 would be calculated as done below:

This amount will be written off and considered as the tax savings.

This amount will be written off and considered as the tax savings.

Situation 2: When the firm decides to follow the project, it would incur the opportunity cost of

.

.

2.

It is required to determine the depreciation schedules of the assets.

The land would have no depreciation. Building would fall under the depreciation class of 39- MACRS property and Equipment would fall under the depreciation class of 7- MACRS property.

3.

It is required to determine the taxable gains for each assets.

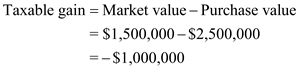

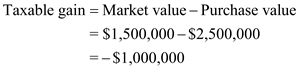

For the land asset , the taxable gain would be calculated as done below:

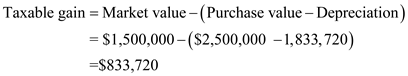

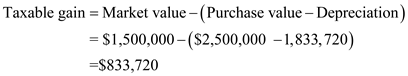

For the building asset , the taxable gain would be calculated as done below:

For the building asset , the taxable gain would be calculated as done below:

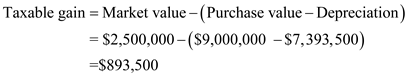

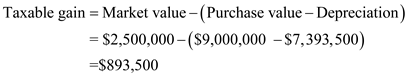

For the Equipment asset , the taxable gain would be calculated as done below:

For the Equipment asset , the taxable gain would be calculated as done below:

Working notes for the calculation of Depreciation on building and equipment are given below:

Working notes for the calculation of Depreciation on building and equipment are given below:

The corresponding values are:

The corresponding values are:

4.

4.

It is required to determine the amount of working capital requirement in each period. For the year 2017, it can be calculated with the formula given below:

For the year 2018, it can be calculated with the formula given below:

For the year 2018, it can be calculated with the formula given below:

5.

5.

It is needed to find the project cash flow by determining the Net present worth criteria and IRR in the excel file.

It can be calculated with the appropriate formula in the spreadsheet given below:

The corresponding values are:

The corresponding values are:

Hence, the calculated present worth is

Hence, the calculated present worth is

.

.

Net Cash Flows: The net cash flows are defined as the difference between the cash inflows and outflows of a company at a particular period of time.

In the present case, the company, CC had the fixed overhead cost of $7.5 million with the MACRS 7 year class.

1.

It is needed to determine the treat the R D expenditures. It can be seen under two situations:

Situation 1: When the firm decides not to follow the project, then the expense in 2015 would be calculated as done below:

This amount will be written off and considered as the tax savings.

This amount will be written off and considered as the tax savings.Situation 2: When the firm decides to follow the project, it would incur the opportunity cost of

.

.2.

It is required to determine the depreciation schedules of the assets.

The land would have no depreciation. Building would fall under the depreciation class of 39- MACRS property and Equipment would fall under the depreciation class of 7- MACRS property.

3.

It is required to determine the taxable gains for each assets.

For the land asset , the taxable gain would be calculated as done below:

For the building asset , the taxable gain would be calculated as done below:

For the building asset , the taxable gain would be calculated as done below: For the Equipment asset , the taxable gain would be calculated as done below:

For the Equipment asset , the taxable gain would be calculated as done below: Working notes for the calculation of Depreciation on building and equipment are given below:

Working notes for the calculation of Depreciation on building and equipment are given below:  The corresponding values are:

The corresponding values are: 4.

4. It is required to determine the amount of working capital requirement in each period. For the year 2017, it can be calculated with the formula given below:

For the year 2018, it can be calculated with the formula given below:

For the year 2018, it can be calculated with the formula given below:

5.

5. It is needed to find the project cash flow by determining the Net present worth criteria and IRR in the excel file.

It can be calculated with the appropriate formula in the spreadsheet given below:

The corresponding values are:

The corresponding values are: Hence, the calculated present worth is

Hence, the calculated present worth is .

. 3

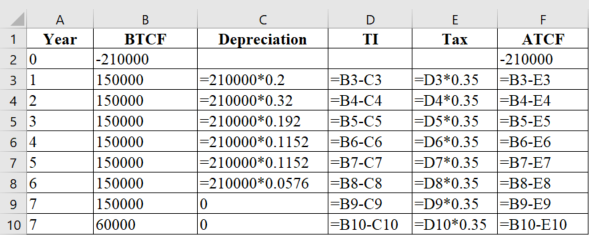

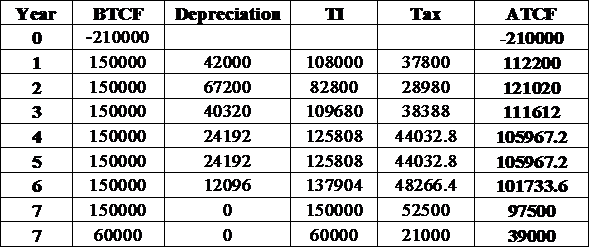

An automobile-manufacturing company is considering purchasing an industrial robot to do spot welding, which is currently done by skilled labor. The initial cost of the robot is $210,000, and the annual labor savings arc projected to be $150,000 If purchased, the robot will be depreciated under MACRS as a five-year recovery property. The robot will be used for seven years, at the end of which time, the firm expects to sell it for $60,000. The company's marginal tax rate is 35% over the project period. Determine the net after-tax cash flows for each period over the project life. Assume MARR = 15%.

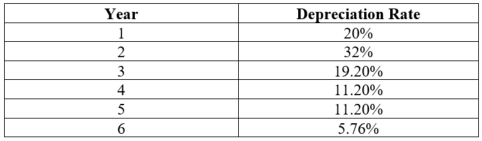

It is given that the initial cost of the robot is $210,000 and it will help in saving $150,000 to the firm. The robot will be depreciated under MACRS as a five-year property. The useful life of the robot is 7 years and the salvage value of the robot is $60,000. The marginal tax rate is 35% per year and the MARR is 15%.

BTCF is the before tax cash flow. It shows the amount that the firm earns before paying any taxes.

Depreciation is the amount of loss in value the tool due to wear and tear. MACRS depreciation is calculated on the original value of machine.

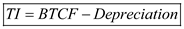

The table below shows the rate of depreciation under MACRS:

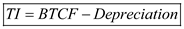

Taxable income is calculated by deducting the amount of depreciation from the before tax cash flow.

Taxable income is calculated by deducting the amount of depreciation from the before tax cash flow.

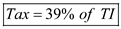

Tax is the amount of tax that must be paid. The combined income tax rate is 39%.

Tax is the amount of tax that must be paid. The combined income tax rate is 39%.

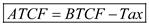

After-tax cash flow is the cash flow of the firm after deducting the taxes from the before-tax cash flow.

After-tax cash flow is the cash flow of the firm after deducting the taxes from the before-tax cash flow.

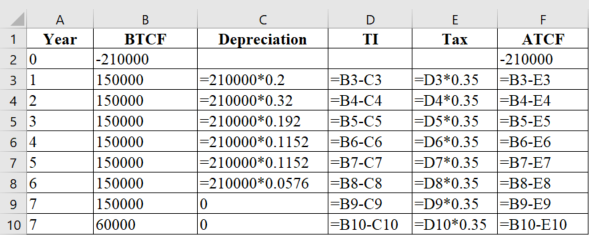

Following is the screenshot of the formulae used in calculation of depreciation, taxable income and after-tax cash flow:

Following is the screenshot of the formulae used in calculation of depreciation, taxable income and after-tax cash flow:

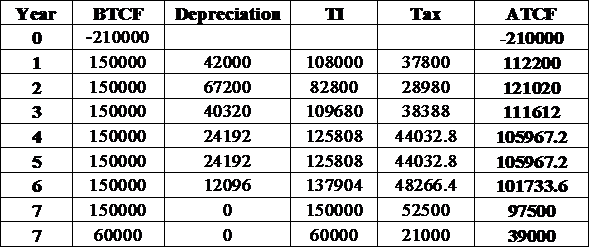

The result image is as follows:

The result image is as follows:

The last column in the table is the salvage value of the robot. Following is the formula to calculate the after-tax salvage value:

The last column in the table is the salvage value of the robot. Following is the formula to calculate the after-tax salvage value:

Thus, the after-tax salvage value of the robot is $39,000.

Thus, the after-tax salvage value of the robot is $39,000.

BTCF is the before tax cash flow. It shows the amount that the firm earns before paying any taxes.

Depreciation is the amount of loss in value the tool due to wear and tear. MACRS depreciation is calculated on the original value of machine.

The table below shows the rate of depreciation under MACRS:

Taxable income is calculated by deducting the amount of depreciation from the before tax cash flow.

Taxable income is calculated by deducting the amount of depreciation from the before tax cash flow. Tax is the amount of tax that must be paid. The combined income tax rate is 39%.

Tax is the amount of tax that must be paid. The combined income tax rate is 39%. After-tax cash flow is the cash flow of the firm after deducting the taxes from the before-tax cash flow.

After-tax cash flow is the cash flow of the firm after deducting the taxes from the before-tax cash flow. Following is the screenshot of the formulae used in calculation of depreciation, taxable income and after-tax cash flow:

Following is the screenshot of the formulae used in calculation of depreciation, taxable income and after-tax cash flow: The result image is as follows:

The result image is as follows: The last column in the table is the salvage value of the robot. Following is the formula to calculate the after-tax salvage value:

The last column in the table is the salvage value of the robot. Following is the formula to calculate the after-tax salvage value: Thus, the after-tax salvage value of the robot is $39,000.

Thus, the after-tax salvage value of the robot is $39,000. 4

As Boeing and other aircraft manufactures are planning to use more aluminum lithium alloys for their future aircrafts, the American Aluminum Company is considering making a major investment of $150 million ($5 million for land, $45 million for buildings, and $100 million for manufacturing equipment and facilities) to develop a stronger, lighter material called aluminum lithium that will make aircraft sturdier and more fuel-efficient. Aluminum lithium, which has been sold commercially for only a few years as an alternative to composite materials, will likely be the material of choice for the next generation of commercial and military aircraft because it is so much lighter than conventional aluminum alloys, which use a combination of copper, nickel, and magnesium to harden aluminium. Another advantage of aluminum lithium is that it is cheaper than composites. The firm predicts that aluminum lithium will account for about 5% of the structural weight of the average commercial aircraft within five years and 10% within 10 years. The proposed plant, which has an estimated service life of 12 years, would have a capacity of about 10 million pounds of aluminum lithium, although domestic consumption of the material is expected to be only 3 million pounds during the first four years, 5 million for the next three years, and 8 million for the remaining life of the plant. Aluminum lithium costs $12 a pound to produce, and the firm would expect to sell it at $17 a pound. The buildings will be depreciated according to the 39-year MACRS real property class, with the buildings placed in service on July 1 of the first year. All manufacturing equipment and facilities will be classified as seven-year MACRS properties.

At the end of the project life, the land will be worth $8 million, the buildings $30 million, and the equipment $10 million. Assuming that the firm's marginal tax rate is 40% and its capital gains tax rate is 35%, determine the following:

(a) The net after-tax cash flows.

(b) The IRR for this investment.

(c) Whether the project is acceptable if the firm's MARR is 15%.

At the end of the project life, the land will be worth $8 million, the buildings $30 million, and the equipment $10 million. Assuming that the firm's marginal tax rate is 40% and its capital gains tax rate is 35%, determine the following:

(a) The net after-tax cash flows.

(b) The IRR for this investment.

(c) Whether the project is acceptable if the firm's MARR is 15%.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

5

You are considering constructing a luxury apartment building project that requires an investment of $15,500,000, which comprises $12,000,000 for the building and $3,500,000 for land. The building has 50 units. You expect the maintenance cost for the apartment building to be $350,000 the first year and $400,000 the second year, after which it will continue to increase by $50,000 in subsequent years. The cost to hire a manager for the building is estimated to be $85,000 per year. After five years of operation, the apartment building can be sold for $17,000,000. What is the annual rent per apartment unit that will provide a return on investment of 15% after tax? Assume that the building will remain fully occupied during the five years. Assume also that your tax rate is 35%. The building will be depreciated according to 39-year MACRS and will be placed in service in January during the first year of ownership and sold in December during the fifth year of ownership.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

6

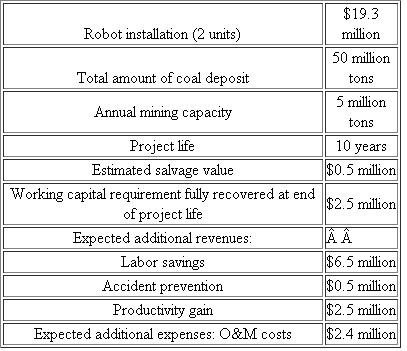

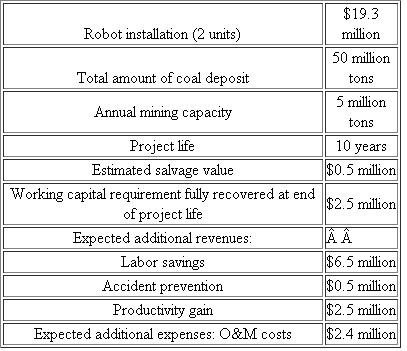

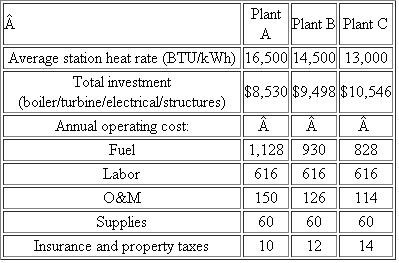

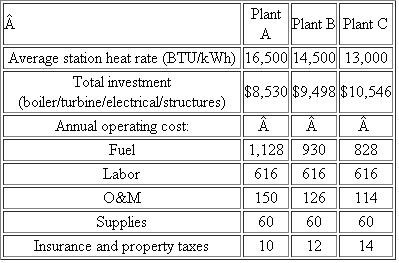

Morgantown Mining Company is considering a new mining method a!, its Blacksville mine. The method, called longwall mining, is carried out by a robot. Coal is removed by the robot-not by tunneling like a worm through an apple, which leaves more of the target coal than is removed-but rather by methodically shuttling back and forth across the width of the deposit and devouring nearly everything. The method can extract about 75% of the available coal, compared with 50% for conventional mining, which is done largely with machines that dig tunnels. Moreover, the coal can be recovered far more inexpensively. Currently, at Blacksville alone, the company mines 5 million tons a year with 2,200 workers. By installing two longwall robot machines, the company can mine 5 million tons with only 860 workers. (A robot miner can dig more than 6 tons a minute.) Despite the loss of employment, the United Mine Workers union generally favors longwall mines for two reasons: The union officials are quoted as saying, (1) "It would be far better to have highly productive operations that were able to pay our folks good wages and benefits than to have 2,200 shovelers living in poverty," and (2) "Longwall mines are inherently safer in their design." The company projects the financial data given in Table upon installation of the longwall mining.

(a) Estimate the firm's net after-tax cash flows over the project life if the firm uses the unit-production method to depreciate assets. The firm's marginal tax rate is 40%.

(a) Estimate the firm's net after-tax cash flows over the project life if the firm uses the unit-production method to depreciate assets. The firm's marginal tax rate is 40%.

(b) Estimate the firm's net after-tax cash flows if the firm chooses to depreciate the robots on the basis of MACRS (seven-year properly classification).

(a) Estimate the firm's net after-tax cash flows over the project life if the firm uses the unit-production method to depreciate assets. The firm's marginal tax rate is 40%.

(a) Estimate the firm's net after-tax cash flows over the project life if the firm uses the unit-production method to depreciate assets. The firm's marginal tax rate is 40%.(b) Estimate the firm's net after-tax cash flows if the firm chooses to depreciate the robots on the basis of MACRS (seven-year properly classification).

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

7

A local delivery company has purchased a delivery truck for $15,000. The truck will be depreciated under MACRS as five-year property. The truck's market value (salvage value) is expected to decrease by $2,500 per year. It is expected that the purchase of the truck will increase its revenue by $10,000 annually. The O M costs are expected to be $3,000 per year. The firm is in the 40% tax bracket, and its MARR is 15%. If the company plans to keep the truck for only two years, what would be the equivalent present worth?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

8

National Parts, Inc., an auto-parts manufacturer, is considering purchasing a rapid prototyping system to reduce prototyping time for form, fit, and function applications in automobile parts manufacturing. An outside consultant has been called in to estimate the initial hardware requirement and installation costs. He suggests the following:

• Prototyping equipment: $187,000

• Posturing apparatus: $10,000

• Software: $15,000

• Maintenance: $36,000 per year by the equipment manufacturer

• Resin: Annual liquid polymer consumption of 400 gallons at $350 per gallon

• Site preparation: Some facility changes are required for the installation of the rapid prototyping system (e.g., certain liquid resins contain a toxic substance, so the work area must be well ventilated).

The expected life of the system is six years with an estimated salvage value of $30,000. The proposed system is classified as a five-year MACRS property. A group of computer consultants must be hired to develop customized software to run on the system. Software development costs will be $20,000 and can be expensed during the first lax year. The new system will reduce prototype development time by 75% and material waste (resin) by 25%. This reduction in development time and material waste will save the firm $314,000 and $35,000 annually, respectively.

The firm's expected marginal tax rate over the next six years will be 40%. The firm's interest rate is 20%.

(a) Assuming that the entire initial investment will be financed from the firm's retained earnings (equity financing), determine the after-tax cash flows over the life of the investment. Compute the NPW of this investment.

(b) Assuming that the entire initial investment will be financed through a local bank at an interest rate of 13% compounded annually, determine the net after-tax cash flows for the project. Compute the NPW of the investment.

(c) Suppose that a financial lease is available for the prototype system at $62,560 per year, payable at the beginning of each year. Compute the NPW of the investment with lease financing.

(d) Select the best financing option based on the rate of return on incremental investment

• Prototyping equipment: $187,000

• Posturing apparatus: $10,000

• Software: $15,000

• Maintenance: $36,000 per year by the equipment manufacturer

• Resin: Annual liquid polymer consumption of 400 gallons at $350 per gallon

• Site preparation: Some facility changes are required for the installation of the rapid prototyping system (e.g., certain liquid resins contain a toxic substance, so the work area must be well ventilated).

The expected life of the system is six years with an estimated salvage value of $30,000. The proposed system is classified as a five-year MACRS property. A group of computer consultants must be hired to develop customized software to run on the system. Software development costs will be $20,000 and can be expensed during the first lax year. The new system will reduce prototype development time by 75% and material waste (resin) by 25%. This reduction in development time and material waste will save the firm $314,000 and $35,000 annually, respectively.

The firm's expected marginal tax rate over the next six years will be 40%. The firm's interest rate is 20%.

(a) Assuming that the entire initial investment will be financed from the firm's retained earnings (equity financing), determine the after-tax cash flows over the life of the investment. Compute the NPW of this investment.

(b) Assuming that the entire initial investment will be financed through a local bank at an interest rate of 13% compounded annually, determine the net after-tax cash flows for the project. Compute the NPW of the investment.

(c) Suppose that a financial lease is available for the prototype system at $62,560 per year, payable at the beginning of each year. Compute the NPW of the investment with lease financing.

(d) Select the best financing option based on the rate of return on incremental investment

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

9

A Los Angeles company is planning to market an answering device for people working alone who want the prestige that comes with having a secretary, but who cannot afford one. The device, called Tele-Receptionist, is similar to a voice-mail system. It uses digital-recording technology to create the illusion that a person is operating the switchboard at a busy office The company purchased a 40 000-ft 2 -building and converted it to an assembly plant for $600,000 ($100,000 worth of land and $500,000 worth of building). Installation of the assembly equipment, worth $500,000, was completed on December 31. The plant will begin operation on January 1. The company expects to have a gross annual income of $2,500,000 over the next five years. Annual manufacturing costs and all other operating expenses (excluding depreciation) are projected to be $1,280,000. For depreciation purposes, the assembly-plant building will be classified as a 39-year real property and the assembly equipment as a seven-year MACRS property. The properly value of the land and the building at the end of year 5 would appreciate as much as 15% over the initial purchase cost. The residual value of the assembly equipment is estimated to be about $50,000 at the end of year 5. The firm's marginal tax rate is expected to be about 40% over the project period. Determine the project's after-tax cash flows over the period of five years.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

10

National Office Automation, Inc. (NOAI) is a leading developer of imaging systems, controllers, and related accessories. The company's product line consists of systems for desktop publishing, automatic identification, advanced imaging, and office information markets. The firm's manufacturing plant in Ann Arbor, Michigan, consists of eight different functions: cable assembly, board assembly, mechanical assembly, controller integration, printer integration, production repair, customer repair, and shipping. The process to be considered is the transportation of pallets loaded with eight packaged desktop printers from printer integration to the shipping department. Several alternatives for minimizing operating and maintenance costs have been examined. The two most feasible alternatives are the following.

• Option 1: Use gas-powered lift trucks to transport pallets of packaged printers from printer integration to shipping. The truck also can be used to return printers that must be reworked. The trucks can be leased at a cost of $5,465 per year. With a maintenance contract costing $6,317 per year, the dealer will maintain the trucks. A fuel cost of $1,660 per year is expected. The truck requires a driver for each of the three shifts at a total cost of $58,653 per year for labor. It is estimated that transportation by truck would cause damages to material and equipment totaling $10,000 per year.

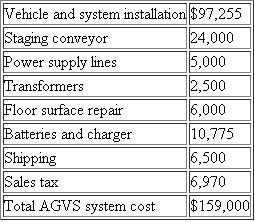

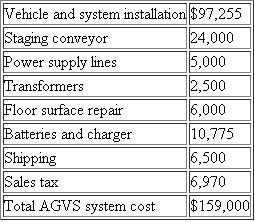

• Option 2 : Install an automatic guided vehicle system (AGVS) to transport pallets of packaged printers from printer integration to shipping and to return products that require rework. The AGVS, using an electrically powered cart and embedded wire-guidance system, would do the same job that the truck currently does, but without drivers. The total investment costs, including installation, are itemized as in Table.

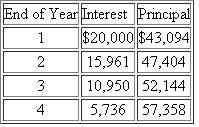

NOAI could obtain a term loan for the full investment amount ($159,000) at a 10% interest rate. The loan would be amortized over five years with payments made at the end of each year. The AGVS falls into the seven-year MACRS classification, and it has an estimated service life of 10 years and no salvage value. If the AGVS is installed, a maintenance contract would be obtained at a cost of $20,000, payable at the beginning of each year. The firm's marginal tax rate is 35% and its MARR is 15%.

NOAI could obtain a term loan for the full investment amount ($159,000) at a 10% interest rate. The loan would be amortized over five years with payments made at the end of each year. The AGVS falls into the seven-year MACRS classification, and it has an estimated service life of 10 years and no salvage value. If the AGVS is installed, a maintenance contract would be obtained at a cost of $20,000, payable at the beginning of each year. The firm's marginal tax rate is 35% and its MARR is 15%.

(a) Determine the net cash flows for each alternative over 10 years.

(b) Compute the incremental cash flows (option 2-option 1) and determine the rate of return on this incremental investment.

(c) Determine the best course of action based on the rate-of-return criterion.

• Option 1: Use gas-powered lift trucks to transport pallets of packaged printers from printer integration to shipping. The truck also can be used to return printers that must be reworked. The trucks can be leased at a cost of $5,465 per year. With a maintenance contract costing $6,317 per year, the dealer will maintain the trucks. A fuel cost of $1,660 per year is expected. The truck requires a driver for each of the three shifts at a total cost of $58,653 per year for labor. It is estimated that transportation by truck would cause damages to material and equipment totaling $10,000 per year.

• Option 2 : Install an automatic guided vehicle system (AGVS) to transport pallets of packaged printers from printer integration to shipping and to return products that require rework. The AGVS, using an electrically powered cart and embedded wire-guidance system, would do the same job that the truck currently does, but without drivers. The total investment costs, including installation, are itemized as in Table.

NOAI could obtain a term loan for the full investment amount ($159,000) at a 10% interest rate. The loan would be amortized over five years with payments made at the end of each year. The AGVS falls into the seven-year MACRS classification, and it has an estimated service life of 10 years and no salvage value. If the AGVS is installed, a maintenance contract would be obtained at a cost of $20,000, payable at the beginning of each year. The firm's marginal tax rate is 35% and its MARR is 15%.

NOAI could obtain a term loan for the full investment amount ($159,000) at a 10% interest rate. The loan would be amortized over five years with payments made at the end of each year. The AGVS falls into the seven-year MACRS classification, and it has an estimated service life of 10 years and no salvage value. If the AGVS is installed, a maintenance contract would be obtained at a cost of $20,000, payable at the beginning of each year. The firm's marginal tax rate is 35% and its MARR is 15%.(a) Determine the net cash flows for each alternative over 10 years.

(b) Compute the incremental cash flows (option 2-option 1) and determine the rate of return on this incremental investment.

(c) Determine the best course of action based on the rate-of-return criterion.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

11

A highway contractor is considering buying a new trench excavator that costs $250,000 and can dig a 3-foot-wide trench at the rate of 16 feet per hour. With the machine adequately maintained, its production rate will remain constant for the first 1,200 hours of operation and then decrease by 2 feet per hour for each additional 400 hours thereafter. The expected average annual use is 400 hours, and maintenance and operating costs will be $50 per hour. The contractor will depreciate the equipment in accordance with a five-year MACRS. At the end of five years, the excavator will be sold for $60,000. Assuming that the contractor's marginal tax rate is 35% per year, determine the annual after-tax cash flow.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

12

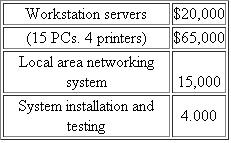

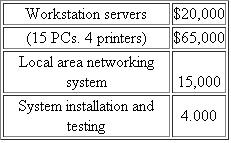

A small children's clothing manufacturer is considering an investment to computerize its management information system for material requirement planning, piece-goods coupon printing, and invoice and payroll services. An outside consultant has been retained to estimate the initial hardware requirement and installation costs. He suggests the following:

The expected life of the computer system is five years with no expected salvage value. The proposed system is classified as a five-year properly under the MACRS depreciation system. A group of computer consultants needs to be hired to develop various customized software packages to run on the system. Software development costs will be $20,000 and can be expensed during the first tax year. The new system will eliminate two clerks, whose combined annual payroll expenses are $72,000. Additional annual expenses to run this computerized system arc expected to be $15,000. Borrowing is not considered an option for this investment, nor is a tax credit available for the system. The firm's expected marginal tax rate over the next six years will be 35%. The firm's interest rate is 13%. Compute the after-tax cash flows over the life of the investment.

The expected life of the computer system is five years with no expected salvage value. The proposed system is classified as a five-year properly under the MACRS depreciation system. A group of computer consultants needs to be hired to develop various customized software packages to run on the system. Software development costs will be $20,000 and can be expensed during the first tax year. The new system will eliminate two clerks, whose combined annual payroll expenses are $72,000. Additional annual expenses to run this computerized system arc expected to be $15,000. Borrowing is not considered an option for this investment, nor is a tax credit available for the system. The firm's expected marginal tax rate over the next six years will be 35%. The firm's interest rate is 13%. Compute the after-tax cash flows over the life of the investment.

The expected life of the computer system is five years with no expected salvage value. The proposed system is classified as a five-year properly under the MACRS depreciation system. A group of computer consultants needs to be hired to develop various customized software packages to run on the system. Software development costs will be $20,000 and can be expensed during the first tax year. The new system will eliminate two clerks, whose combined annual payroll expenses are $72,000. Additional annual expenses to run this computerized system arc expected to be $15,000. Borrowing is not considered an option for this investment, nor is a tax credit available for the system. The firm's expected marginal tax rate over the next six years will be 35%. The firm's interest rate is 13%. Compute the after-tax cash flows over the life of the investment.

The expected life of the computer system is five years with no expected salvage value. The proposed system is classified as a five-year properly under the MACRS depreciation system. A group of computer consultants needs to be hired to develop various customized software packages to run on the system. Software development costs will be $20,000 and can be expensed during the first tax year. The new system will eliminate two clerks, whose combined annual payroll expenses are $72,000. Additional annual expenses to run this computerized system arc expected to be $15,000. Borrowing is not considered an option for this investment, nor is a tax credit available for the system. The firm's expected marginal tax rate over the next six years will be 35%. The firm's interest rate is 13%. Compute the after-tax cash flows over the life of the investment.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

13

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

14

An asset in the five-year MACRS property class costs $150,000 and has a zero estimated salvage value after six years of use. The asset will generate annual revenues of $320,000 and will require $80,000 in annual labor and $50,000 in annual material expenses. There are no other revenues and expenses. Assume a tax rate of 40%.

(a) Compute the after-tax cash flows over the project life.

(b) Compute the NPW at MARR = 12%. Is the investment acceptable?

(a) Compute the after-tax cash flows over the project life.

(b) Compute the NPW at MARR = 12%. Is the investment acceptable?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

15

An automaker is considering installing a three-dimensional (3-D) computerized car-styling system at a cost of $230,000 (including hardware and software). With the 3-D computer modeling system, designers will have the ability to view their design from many angles and to fully account for the space required for the engine and passengers. The digital information used to create the computer model can be revised in consultation with engineers, and the data can be used to run milling machines that make physical models quickly and precisely.

The automaker expects to decrease the turnaround time for designing a new automobile model (from configuration to final design) by 22%. The expected savings in dollars is $250,000 per year. The training and operating maintenance cost for the new system is expected to be $50,000 per year. The system has a five-year useful life and can be depreciated according to the five-year MACRS class. The system will have an estimated salvage value of $5,000. The automaker's marginal tax rate is 40%. Determine the annual cash flows for this investment. What is the return on investment for the project?

The automaker expects to decrease the turnaround time for designing a new automobile model (from configuration to final design) by 22%. The expected savings in dollars is $250,000 per year. The training and operating maintenance cost for the new system is expected to be $50,000 per year. The system has a five-year useful life and can be depreciated according to the five-year MACRS class. The system will have an estimated salvage value of $5,000. The automaker's marginal tax rate is 40%. Determine the annual cash flows for this investment. What is the return on investment for the project?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

16

A facilities engineer is considering a $55,000 investment in an energy management system (EMS). The system is expected to save $14,000 annually in utility bills for N years. After N years, the EMS will have a zero salvage value. In an after-tax analysis, what would N need to be in order for the investment to earn a 12% return? Assume MACRS depreciation with a three-year class life and a 35% tax rate.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

17

A corporation is considering purchasing a machine that will save.$150,000 per year before taxes. The cost of operating the machine (including maintenance) is $30,000 per year. The machine will be needed for five years, after which it will have a zero salvage value. MACRS depreciation will be used, assuming a three-year class life. The marginal income tax rate is 40%. If the firm wants 15% return on investment after taxes, how much can it afford to pay for this machine?.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

18

The Newport Company is planning to expand its current spindle product line. The required machinery would cost $520,000. The building that will house the new production facility would cost $1.5 million. The land would cost $350,000, and $250,000 working capital would be required. The product is expected to result in additional sales of $775,000 per year for 10 years, at which time the land can be sold for $500,000, the building for $800,000, and the equipment for $50,000. All of the working capital will be recovered. The annual disbursements for labor, materials, and all other expenses are estimated to be $465,000. The firm's income tax rate is 40%, and any capital gains will be taxed at 35%. The building will be depreciated according to a 39-year property class. The manufacturing facility will be classified as a seven-year MACRS. The firm's MARR is known to be 15% after taxes.

(a) Determine the projected net after-tax cash flows from this investment. Is the expansion justified?

(b) Compare the IRR of this project with that of a situation with no working capital.

(a) Determine the projected net after-tax cash flows from this investment. Is the expansion justified?

(b) Compare the IRR of this project with that of a situation with no working capital.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

19

An industrial engineer proposed the purchase of RFID Fixed-Asset Tracking System for the company's warehouse and weave rooms. The engineer fell that the purchase would provide a better system of locating cartons in the warehouse by recording the locations of the cartons and storing the data in the computer. The estimated investment, annual operating and maintenance costs, and expected annual savings are as follows.

• Cost of equipment and installation: $85,500

• Project life 6 years

• Expected salvage value: $5,000

• Investment in working capital (fully recoverable at the end of the project life): $15,000

• Expected annual savings on labor and materials: $65,800

• Expected annual expenses: $9,150

• Depreciation method: five-year MACRS

The firm's marginal tax rate is 35%.

(a) Determine the net after-tax cash flows over the project life.

(b) Compute the IRR for this investment.

(c) At MARR = 18% , is the project acceptable?

• Cost of equipment and installation: $85,500

• Project life 6 years

• Expected salvage value: $5,000

• Investment in working capital (fully recoverable at the end of the project life): $15,000

• Expected annual savings on labor and materials: $65,800

• Expected annual expenses: $9,150

• Depreciation method: five-year MACRS

The firm's marginal tax rate is 35%.

(a) Determine the net after-tax cash flows over the project life.

(b) Compute the IRR for this investment.

(c) At MARR = 18% , is the project acceptable?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

20

The Delaware Chemical Corporation is considering investing in a new composite material. R D engineers are investigating exotic metal-ceramic and ceramic-ceramic composites to develop materials that will withstand high temperatures, such as those to be encountered in the next generation of jet fighter engines. The company expects a three-year R D period before these new materials can be applied to commercial products.

The following financial information is presented for management review.

• R D cost: $5 million over a three-year period: $0.5 million at the beginning of year 1; $2.5 million at the beginning of year 2; and $2 million at the beginning of year 3. For tax purposes, these R D expenditures will be expensed rather than amortized.

• Capital investment: $5 million at the beginning of year 4. This investment consists of $2 million in a building and $3 million in plant equipment. The company already owns a piece of land as the building site.

• Depreciation method: The building (39-year real property class with the asset placed in service in January) and plant equipment (seven-year MACRS recovery class).

• Project life: 10 years after a three-year R D period.

• Salvage value: 10% of the initial capital investment for the equipment and 50% for the building (at the end of the project life).

• Total sales : $50 million (at the end of year 4), with an annual sales growth rate of 10% per year (compound growth) during the next five years (year 5 through year 9) and -10% (negative compound growth) per year for the remaining project life.

• Out of-pocket expenditures: 80% of annual sales.

• Working capital: 10% of annual sales (considered as an investment at the beginning of each production year and investments fully recovered at the end of the project life).

• Marginal tax rate: 40%.

(a) Determine the net after-tax cash flows over the project life.

(b) Determine the IRR for this investment.

(c) Determine the equivalent annual worth for the investment at MARR = 20%.

The following financial information is presented for management review.

• R D cost: $5 million over a three-year period: $0.5 million at the beginning of year 1; $2.5 million at the beginning of year 2; and $2 million at the beginning of year 3. For tax purposes, these R D expenditures will be expensed rather than amortized.

• Capital investment: $5 million at the beginning of year 4. This investment consists of $2 million in a building and $3 million in plant equipment. The company already owns a piece of land as the building site.

• Depreciation method: The building (39-year real property class with the asset placed in service in January) and plant equipment (seven-year MACRS recovery class).

• Project life: 10 years after a three-year R D period.

• Salvage value: 10% of the initial capital investment for the equipment and 50% for the building (at the end of the project life).

• Total sales : $50 million (at the end of year 4), with an annual sales growth rate of 10% per year (compound growth) during the next five years (year 5 through year 9) and -10% (negative compound growth) per year for the remaining project life.

• Out of-pocket expenditures: 80% of annual sales.

• Working capital: 10% of annual sales (considered as an investment at the beginning of each production year and investments fully recovered at the end of the project life).

• Marginal tax rate: 40%.

(a) Determine the net after-tax cash flows over the project life.

(b) Determine the IRR for this investment.

(c) Determine the equivalent annual worth for the investment at MARR = 20%.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

21

Refer Problem to the data in Problem If the firm expects to borrow the initial investment ($15,500,000) at 10% over five years (paying back the loan in equal annual payments of $4,088,861), determine the project's net cash flows.

Problem

You are considering constructing a luxury apartment building project that requires an investment of $15,500,000, which comprises $12,000,000 for the building and $3,500,000 for land. The building has 50 units. You expect the maintenance cost for the apartment building to be $350,000 the first year and $400,000 the second year, after which it will continue to increase by $50,000 in subsequent years. The cost to hire a manager for the building is estimated to be $85,000 per year. After five years of operation, the apartment building can be sold for $17,000,000. What is the annual rent per apartment unit that will provide a return on investment of 15% after tax? Assume that the building will remain fully occupied during the five years. Assume also that your tax rate is 35%. The building will be depreciated according to 39-year MACRS and will be placed in service in January during the first year of ownership and sold in December during the fifth year of ownership.

Problem

You are considering constructing a luxury apartment building project that requires an investment of $15,500,000, which comprises $12,000,000 for the building and $3,500,000 for land. The building has 50 units. You expect the maintenance cost for the apartment building to be $350,000 the first year and $400,000 the second year, after which it will continue to increase by $50,000 in subsequent years. The cost to hire a manager for the building is estimated to be $85,000 per year. After five years of operation, the apartment building can be sold for $17,000,000. What is the annual rent per apartment unit that will provide a return on investment of 15% after tax? Assume that the building will remain fully occupied during the five years. Assume also that your tax rate is 35%. The building will be depreciated according to 39-year MACRS and will be placed in service in January during the first year of ownership and sold in December during the fifth year of ownership.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

22

In Problem to finance the industrial robot, the company will borrow the entire amount from a local bank, and the loan will be paid off at the rate of $30,000 per year, plus 10% on the unpaid balance. Determine the net after-tax cash flows over the project life.

Problem

An automobile-manufacturing company is considering purchasing an industrial robot to do spot welding, which is currently done by skilled labor. The initial cost of the robot is $210,000, and the annual labor savings arc projected to be $150,000 If purchased, the robot will be depreciated under MACRS as a five-year recovery property. The robot will be used for seven years, at the end of which time, the firm expects to sell it for $60,000. The company's marginal tax rate is 35% over the project period. Determine the net after-tax cash flows for each period over the project life. Assume MARR = 15%

Problem

An automobile-manufacturing company is considering purchasing an industrial robot to do spot welding, which is currently done by skilled labor. The initial cost of the robot is $210,000, and the annual labor savings arc projected to be $150,000 If purchased, the robot will be depreciated under MACRS as a five-year recovery property. The robot will be used for seven years, at the end of which time, the firm expects to sell it for $60,000. The company's marginal tax rate is 35% over the project period. Determine the net after-tax cash flows for each period over the project life. Assume MARR = 15%

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

23

Refer to the financial data in Problem. Suppose that 50% of the initial investment of $230,000 will be borrowed from a local bank at an interest rate of 11 % over five years (to be paid off in five equal annual payments). Recompute the after tax cash flow.

Problem

An automaker is considering installing a three-dimensional (3-D) computerized car-styling system at a cost of $230,000 (including hardware and software). With the 3-D computer modeling system, designers will have the ability to view their design from many angles and to fully account for the space required for the engine and passengers. The digital information used to create the computer model can be revised in consultation with engineers, and the data can be used to run milling machines that make physical models quickly and precisely.

The automaker expects to decrease the turnaround time for designing a new automobile model (from configuration to final design) by 22%. The expected savings in dollars is $250,000 per year. The training and operating maintenance cost for the new system is expected to be $50,000 per year. The system has a five-year useful life and can be depreciated according to the five-year MACRS class. The system will have an estimated salvage value of $5,000. The automaker's marginal tax rate is 40%. Determine the annual cash flows for this investment. What is the return on investment for the project?

Problem

An automaker is considering installing a three-dimensional (3-D) computerized car-styling system at a cost of $230,000 (including hardware and software). With the 3-D computer modeling system, designers will have the ability to view their design from many angles and to fully account for the space required for the engine and passengers. The digital information used to create the computer model can be revised in consultation with engineers, and the data can be used to run milling machines that make physical models quickly and precisely.

The automaker expects to decrease the turnaround time for designing a new automobile model (from configuration to final design) by 22%. The expected savings in dollars is $250,000 per year. The training and operating maintenance cost for the new system is expected to be $50,000 per year. The system has a five-year useful life and can be depreciated according to the five-year MACRS class. The system will have an estimated salvage value of $5,000. The automaker's marginal tax rate is 40%. Determine the annual cash flows for this investment. What is the return on investment for the project?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

24

A special-purpose machine tool set would cost $20,000. The tool set will be financed by a $10,000 bank loan repayable in two equal annual installments at 10% compounded annually. The tool is expected to provide annual (material) savings of $30.000 for two years and is to be depreciated by the MACRS three-year recovery period The tool will require annual O M costs in the amount of $5,000. The salvage value at the end of the two years is expected to be $8,000. Assuming a marginal tax rate of 40% and MARR of 15%, what is the net present worth of this project? You may use Table as a worksheet for your calculation.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

25

The A.M.I. Company is considering installing a new process machine for the firm's manufacturing facility. The machine costs $220,000 installed, will generate additional revenues of $85,000 per year, and will save $65,000 per year in labor and material costs. The machine will be financed by a $120,000 bank loan repayable in three equal annual principal installments, plus 9% interest on the outstanding balance. The machine will be depreciated using seven-year MACRS. The useful life of the machine is 10 years, after which it will be sold for $20,000. The combined marginal tax rate is 40%.

(a) Find the year-by-year after-tax cash flow for the project.

(b) Compute the IRR for this investment.

(c) At MARR = 18%, is the project economically justifiable?

(a) Find the year-by-year after-tax cash flow for the project.

(b) Compute the IRR for this investment.

(c) At MARR = 18%, is the project economically justifiable?

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

26

Consider the following financial information about a retooling project at a computer manufacturing company:

• The project costs $2.5 million and has a five-year service life.

• The retooling project can be classified as seven-year properly under die MACRS rule

• At the end of the fifth year, any assets held for the project will be sold. The expected salvage value will be about 10% of the initial project cost.

• The firm will finance 40% of the project money from an outside financial institution at an interest rate of 10%. The firm is required to repay the loan with five equal annual payments.

• The firm's incremental (marginal) tax rate on the investment is 35%.

• The firm's MARR is 18%.

With the preceding financial information,

(a) Determine the after-tax cash flows.

(b) Compute the annual equivalent worth for this project.

• The project costs $2.5 million and has a five-year service life.

• The retooling project can be classified as seven-year properly under die MACRS rule

• At the end of the fifth year, any assets held for the project will be sold. The expected salvage value will be about 10% of the initial project cost.

• The firm will finance 40% of the project money from an outside financial institution at an interest rate of 10%. The firm is required to repay the loan with five equal annual payments.

• The firm's incremental (marginal) tax rate on the investment is 35%.

• The firm's MARR is 18%.

With the preceding financial information,

(a) Determine the after-tax cash flows.

(b) Compute the annual equivalent worth for this project.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

27

A fully automatic chucker and bar machine is to be purchased for $45,000. The money will be borrowed with the stipulation that it be repaid with six equal end-of-year payments at 12% compounded annually. The machine is expected to provide annual revenue of $13,000 for six years and is to be depreciated by the MACRS seven-year recovery period. The salvage value at the end of six years is expected to be $4,000. Assume a marginal tax rate of 35% and a MARR of 15%.

(a) Determine the after-tax cash flow for this asset over six years.

(b) Determine whether the project is acceptable on the basis of the IRR criterion.

(a) Determine the after-tax cash flow for this asset over six years.

(b) Determine whether the project is acceptable on the basis of the IRR criterion.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

28