Deck 16: Jones Iron Works

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/7

Play

Full screen (f)

Deck 16: Jones Iron Works

1

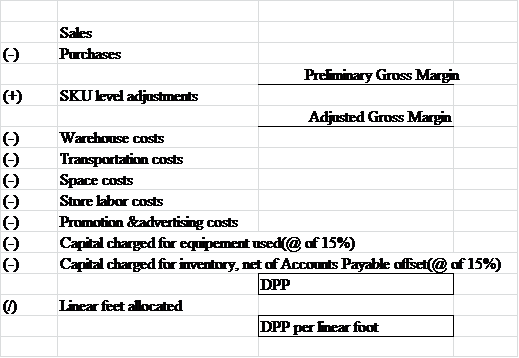

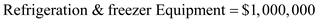

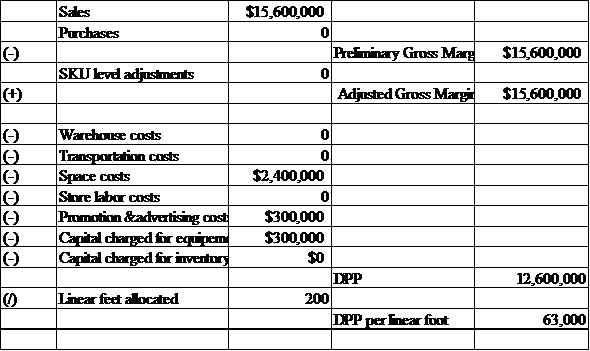

Calculate the annual DPP per "linear foot" of shelf space for Store #5 as a whole.

Direct Product Profit (DPP):

Direct product profit is defined as an accounting method for measuring the profitability of the product and the profitability of the shelf space.

By extracting the information:

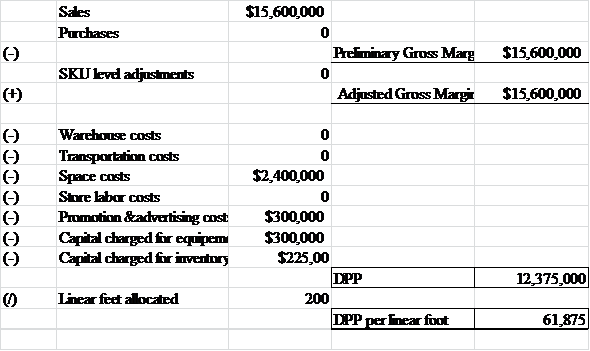

Calculate the annual DPP per linear foot for store #5 as a whole:

Calculate the annual DPP per linear foot for store #5 as a whole:

Methodology:

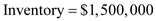

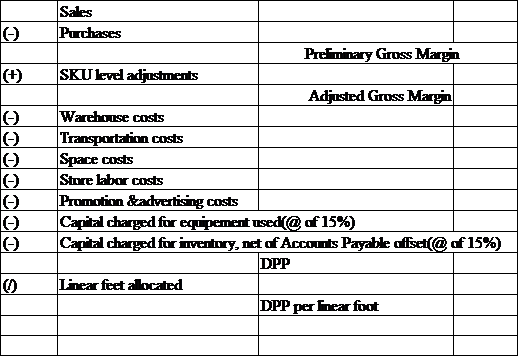

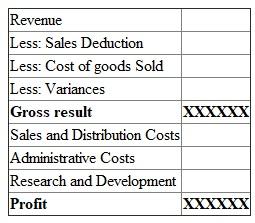

The DPP approach is designed as follows:

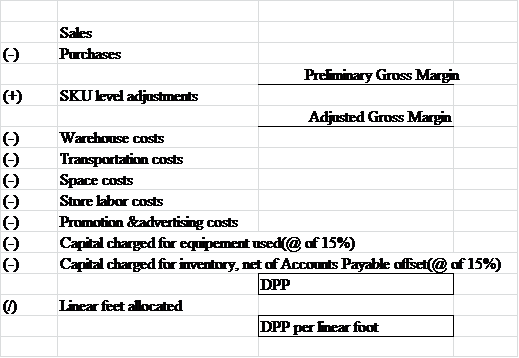

Substitute:

Substitute:

Here,

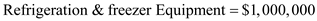

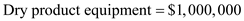

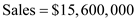

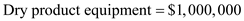

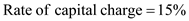

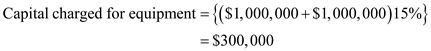

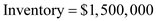

Sale is $15,600,000, space costs is $2,400,000, advertising promotion is $300,000, refrigeration freezer equipment is $1,000,000, dry product equipment is $1,000,000, inventory is $1,500,000, and the rate of capital charged is 15%.

Assumptions:

The warehouse and transportation cost are assumed to be zero as the amount is included in cost of goods sold but the allocation is not given.

Working notes:

Working notes:

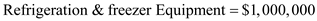

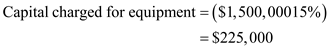

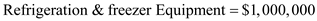

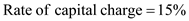

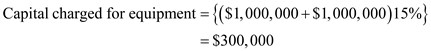

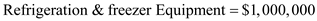

Calculation of capital charge for equipment:

Given:

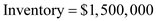

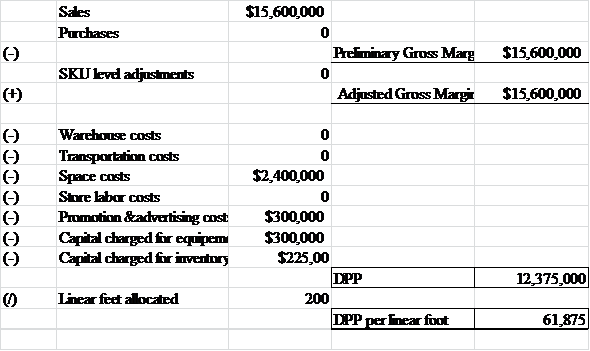

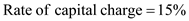

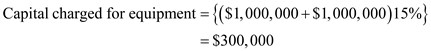

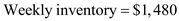

Calculation of Capital charge for inventory:

Calculation of Capital charge for inventory:

Given:

Direct product profit is defined as an accounting method for measuring the profitability of the product and the profitability of the shelf space.

By extracting the information:

Calculate the annual DPP per linear foot for store #5 as a whole:

Calculate the annual DPP per linear foot for store #5 as a whole: Methodology:

The DPP approach is designed as follows:

Substitute:

Substitute: Here,

Sale is $15,600,000, space costs is $2,400,000, advertising promotion is $300,000, refrigeration freezer equipment is $1,000,000, dry product equipment is $1,000,000, inventory is $1,500,000, and the rate of capital charged is 15%.

Assumptions:

The warehouse and transportation cost are assumed to be zero as the amount is included in cost of goods sold but the allocation is not given.

Working notes:

Working notes: Calculation of capital charge for equipment:

Given:

Calculation of Capital charge for inventory:

Calculation of Capital charge for inventory: Given:

2

Calculate the annual DPP per "linear foot" for Bread for Store #5.

Direct Product Profit (DPP):

Direct product profit is defined as an accounting method for measuring the profitability of the product and the profitability of the shelf space.

By extracting the information:

Dry product equipment $1,000,000

Dry product equipment $1,000,000

Inventory charged is ignored because the few days' supply on hand is offset by the 10 days' accounts payable float.

For bread SKU level gross margin, transportation, labor and warehouse costs are zero.

Calculate the annual DPP per linear foot for Bread for store #5:

Methodology:

The DPP approach is designed as follows:

Substitute:

Substitute:

Here,

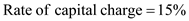

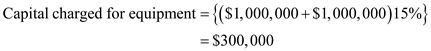

Sale is $15,600,000, space cost is $2,400,000, advertising promotion is $300,000, refrigeration freezer Equipment is $1,000,000, dry product equipment is $1,000,000, and the rate of capital charged is 15%.

Working notes:

Working notes:

Calculation of capital charge for equipment:

Given:

Dry product equipment $1,000,000

Dry product equipment $1,000,000

Direct product profit is defined as an accounting method for measuring the profitability of the product and the profitability of the shelf space.

By extracting the information:

Dry product equipment $1,000,000

Dry product equipment $1,000,000Inventory charged is ignored because the few days' supply on hand is offset by the 10 days' accounts payable float.

For bread SKU level gross margin, transportation, labor and warehouse costs are zero.

Calculate the annual DPP per linear foot for Bread for store #5:

Methodology:

The DPP approach is designed as follows:

Substitute:

Substitute: Here,

Sale is $15,600,000, space cost is $2,400,000, advertising promotion is $300,000, refrigeration freezer Equipment is $1,000,000, dry product equipment is $1,000,000, and the rate of capital charged is 15%.

Working notes:

Working notes: Calculation of capital charge for equipment:

Given:

Dry product equipment $1,000,000

Dry product equipment $1,000,000

3

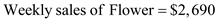

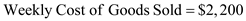

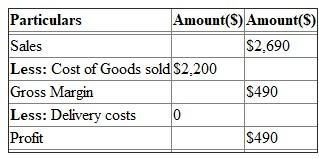

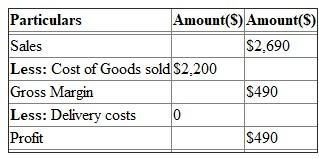

Calculate the weekly profit impact to Flowers Bakery of the proposed change in delivery to Store #5.

Calculate the weekly profit impact to Flowers Bakery of the proposed change in delivery to Store #5:

The profit is calculated through cost sales method, which compares cost to corresponding revenue. The profit is calculated as follows:

By extracting the information:

By extracting the information:

Calculate the weekly profit:

Calculate the weekly profit:

The profit is calculated through cost sales method, which compares cost to corresponding revenue. The profit is calculated as follows:

By extracting the information:

By extracting the information:

Calculate the weekly profit:

Calculate the weekly profit:

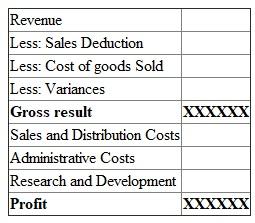

4

Calculate the weekly profit impact to Store #5 of the proposal from Flowers.

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

5

Calculate the annual DPP per "linear foot," after the switch in delivery mode by Flowers for each of the 12 bread SKUs ( day old is the 12 th SKU ).

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

6

One key issue in profit per unit of shelf space is the efficiency of package design. A loaf of bread at 4" × 5" × 9.6" is not an efficient package size when shelves are 24" deep. Assume the bread loaf could be changed to 4" × 4" × 12" (same bread volume per loaf). Calculate the impact on annual Profit for Store #5. Make all your assumptions explicit.

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

7

What managerial insights emerge from your answers to questions 1 through 6 regarding the Bread category in Store #5 What are your recommendations to the store manager

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck