Deck 11: Stockholders Equity

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/91

Play

Full screen (f)

Deck 11: Stockholders Equity

1

Finding Financial Information

Refer to the financial statements of The Home Depot in Appendix A at the end of this book, or download the annual report from the Cases section of the text's Web site at www.mhhe.com/phillips4e.

Required:

1. As of January 30, 2011, how many shares of common stock were authorized How many shares were issued' How many shares were held in treasury

a. 10,000,000,000; 1,716,000,000:99,000,000

b. 10,000,000,000; 1,722,000,000; 18,000,000

c. Unlimited: 1,623,000,000; 18,000,000

d. 10,000,000,000; 1,722,000,000; 99,000,000

2. According to the Retained Earnings column in the Statement of Stockholders' Equity, what was the total dollar amount of cash dividends declared during the year ended January 30, 2011

a. $1,521,000,000

b. $1,525,000,000

c. $1,569,000,000

d. $2,608,000,000

3. According to the income statement, how has The Home Depot's net earnings and basic earnings per share changed over the past three years

a. Both net earnings and EPS increased.

b. Net earnings increased and EPS decreased.

c. Net earnings decreased and EPS increased.

d. Both net earnings and EPS decreased.

Refer to the financial statements of The Home Depot in Appendix A at the end of this book, or download the annual report from the Cases section of the text's Web site at www.mhhe.com/phillips4e.

Required:

1. As of January 30, 2011, how many shares of common stock were authorized How many shares were issued' How many shares were held in treasury

a. 10,000,000,000; 1,716,000,000:99,000,000

b. 10,000,000,000; 1,722,000,000; 18,000,000

c. Unlimited: 1,623,000,000; 18,000,000

d. 10,000,000,000; 1,722,000,000; 99,000,000

2. According to the Retained Earnings column in the Statement of Stockholders' Equity, what was the total dollar amount of cash dividends declared during the year ended January 30, 2011

a. $1,521,000,000

b. $1,525,000,000

c. $1,569,000,000

d. $2,608,000,000

3. According to the income statement, how has The Home Depot's net earnings and basic earnings per share changed over the past three years

a. Both net earnings and EPS increased.

b. Net earnings increased and EPS decreased.

c. Net earnings decreased and EPS increased.

d. Both net earnings and EPS decreased.

1.

Option

is correct.

is correct.

The company has 10,000,000,000 authorized shares, 1,722,000,000 issued shares, and 99,000,000 treasury shares.

Authorized shares: This is total number of shares the company is authorized to issue.

Issue shares: Shares offer to the public are issued shares.

Treasury shares: The shares which are repurchased by the company are treasury shares.

All the other options are incorrect, because the annual report of the company of 30/01/2011 reflects figures as in option d.

2.

Option

is correct.

is correct.

The amount of cash dividends to shareholders of the company during the period is $1,569,000,000.

All the other options are incorrect, because the annual report of the company of 30/01/2011 reflects figures as option 'c'.

3.

Option

is correct.

is correct.

Net earnings and EPS both are increased over the last few years. The net earnings and EPS of the company for the year ended 30/01/2011 are $3,338 million and $2.03 respectively.

Earnings per share

: This is the net income per outstanding share. Net income should be divided by outstanding number of shares to get EPS.

: This is the net income per outstanding share. Net income should be divided by outstanding number of shares to get EPS.

Net income or net earnings is the excess amount of revenues over expenses. Outstanding shares are number of shares issued by the company and paid up, excluding treasury stocks.

All the other options are incorrect, because the annual report of the company of 30/01/2011 reflects figures as option 'a'.

Option

is correct.

is correct. The company has 10,000,000,000 authorized shares, 1,722,000,000 issued shares, and 99,000,000 treasury shares.

Authorized shares: This is total number of shares the company is authorized to issue.

Issue shares: Shares offer to the public are issued shares.

Treasury shares: The shares which are repurchased by the company are treasury shares.

All the other options are incorrect, because the annual report of the company of 30/01/2011 reflects figures as in option d.

2.

Option

is correct.

is correct. The amount of cash dividends to shareholders of the company during the period is $1,569,000,000.

All the other options are incorrect, because the annual report of the company of 30/01/2011 reflects figures as option 'c'.

3.

Option

is correct.

is correct. Net earnings and EPS both are increased over the last few years. The net earnings and EPS of the company for the year ended 30/01/2011 are $3,338 million and $2.03 respectively.

Earnings per share

: This is the net income per outstanding share. Net income should be divided by outstanding number of shares to get EPS.

: This is the net income per outstanding share. Net income should be divided by outstanding number of shares to get EPS.Net income or net earnings is the excess amount of revenues over expenses. Outstanding shares are number of shares issued by the company and paid up, excluding treasury stocks.

All the other options are incorrect, because the annual report of the company of 30/01/2011 reflects figures as option 'a'.

2

Just prior to filing for bankruptcy protection in 2009, General Motors asked its bondholders to exchange their investment in GM's bonds for GM stock. The bondholders rejected this proposal. Why might GM have proposed this exchange Why might the bondholders have rejected it

The company has proposed the exchange of the investment because it would reduce the secured liability of the company that the company would be liable to pay at any cost. If the bond holders convert their bonds into the stock then the company's risk of paying the bond holders would be eliminated and the company would no more be liable to pay the money to bondholders.

The bondholders have rejected the proposal because the acceptance of proposal would result in the loss of their money. If they become the stockholder of the company then the company would no more be liable to pay their money. The right to receive the money for the bonds will be lost.

The bondholders have rejected the proposal because the acceptance of proposal would result in the loss of their money. If they become the stockholder of the company then the company would no more be liable to pay their money. The right to receive the money for the bonds will be lost.

3

Differentiate between common stock and preferred stock.

Common stock is the basic voting stock that is issued by a corporation. It gives the right to vote and share in the profitability of the business through dividends. The rate of dividend is not fixed in common stock.

Preferred stock is that stock that has specified rights over common stock and typically has a fixed dividend rate. There is an option to convert into common stock and also there is an option to participate into voting rights.

Preferred stock is that stock that has specified rights over common stock and typically has a fixed dividend rate. There is an option to convert into common stock and also there is an option to participate into voting rights.

4

Recording Stockholders' Equity Transactions

The annual report for Malibu Beachwear reported the following transactions affecting stockholders' equity:

a. Purchased $3.5 million in treasury stock.

b. Declared and paid cash dividends in the amount of $254.2 million.

c. Issued 100 percent common stock dividend involving 222.5 million additional shares with a total par value of $556.3 million.

Required:

1. Indicate the effect (increase, decrease, or no effect) of each of these transactions on total assets, liabilities, and stockholders' equity.

2. Prepare journal entries to record each of these transactions.

The annual report for Malibu Beachwear reported the following transactions affecting stockholders' equity:

a. Purchased $3.5 million in treasury stock.

b. Declared and paid cash dividends in the amount of $254.2 million.

c. Issued 100 percent common stock dividend involving 222.5 million additional shares with a total par value of $556.3 million.

Required:

1. Indicate the effect (increase, decrease, or no effect) of each of these transactions on total assets, liabilities, and stockholders' equity.

2. Prepare journal entries to record each of these transactions.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

5

Define stock dividend. How does a stock dividend differ from a cash dividend

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

6

(Supplement 11A) Comparing Stockholders' Equity Sections for Alternative Forms of Organization

Assume for each of the following independent cases that the annual accounting period ends on December 31, 2013, and that the total of all revenue accounts was $150,000 and the total of all expense accounts was $130,000.

Case A : Assume that the business is a sole proprietorship owned by Proprietor A. Prior to the closing entries, the Capital account reflected a credit balance of $50,000 and the Drawings account showed a balance of $8,000.

Case B : Assume that the business is a partnership owned by Partner A and Partner B. Prior to the closing entries, the owners' equity accounts reflected the following balances: A, Capital, $40,000; B, Capital, $58,000; A, Drawings, $5,000; and B, Drawings, $9,000. Profits and losses arc divided equally.

Case C : Assume that the business is a corporation. Prior to the closing entries, the stockholders' equity accounts showed the following: Capital Stock, par $ 10, authorized 30,000 shares, outstanding 15,000 shares; Additional Paid-In Capital, $5,000; Retained Earnings, 565.0C00.

Required:

1. Give all the closing entries required at December 31, 2013. for each of the separate cases.

2. Show how the equity section of the balance sheet would appear at December 31, 2013, for each case. Show computations.

Assume for each of the following independent cases that the annual accounting period ends on December 31, 2013, and that the total of all revenue accounts was $150,000 and the total of all expense accounts was $130,000.

Case A : Assume that the business is a sole proprietorship owned by Proprietor A. Prior to the closing entries, the Capital account reflected a credit balance of $50,000 and the Drawings account showed a balance of $8,000.

Case B : Assume that the business is a partnership owned by Partner A and Partner B. Prior to the closing entries, the owners' equity accounts reflected the following balances: A, Capital, $40,000; B, Capital, $58,000; A, Drawings, $5,000; and B, Drawings, $9,000. Profits and losses arc divided equally.

Case C : Assume that the business is a corporation. Prior to the closing entries, the stockholders' equity accounts showed the following: Capital Stock, par $ 10, authorized 30,000 shares, outstanding 15,000 shares; Additional Paid-In Capital, $5,000; Retained Earnings, 565.0C00.

Required:

1. Give all the closing entries required at December 31, 2013. for each of the separate cases.

2. Show how the equity section of the balance sheet would appear at December 31, 2013, for each case. Show computations.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

7

Wiki Art Gallery (WAG)

Access the Wiki Art Gallery (WAG) instructional case in Connect, and read the case in sufficient depth to answer the following questions.

1. Is there any evidence that Rob failed to follow generally accepted accounting principles when preparing WAG's 2011 and 2010 financial statements

a. Yes, dividends should have increased rather than decreased from 2010 to 2011.

b. Yes, as a public company, WAG is required to report its price/earnings ratio.

c. Yes, dividends should not be reported on the income statement.

d. No, there were no violations of generally accepted accounting principles.

2. Stephen and Rob agreed to base their agreement on an "earnings multiplier." Which of the following is an alternative name for this concept

a. Earnings per share (EPS) ratio.

b. Return on equity (ROE) ratio.

c. Price/earnings (P/E) ratio.

d. None of the above.

Access the Wiki Art Gallery (WAG) instructional case in Connect, and read the case in sufficient depth to answer the following questions.

1. Is there any evidence that Rob failed to follow generally accepted accounting principles when preparing WAG's 2011 and 2010 financial statements

a. Yes, dividends should have increased rather than decreased from 2010 to 2011.

b. Yes, as a public company, WAG is required to report its price/earnings ratio.

c. Yes, dividends should not be reported on the income statement.

d. No, there were no violations of generally accepted accounting principles.

2. Stephen and Rob agreed to base their agreement on an "earnings multiplier." Which of the following is an alternative name for this concept

a. Earnings per share (EPS) ratio.

b. Return on equity (ROE) ratio.

c. Price/earnings (P/E) ratio.

d. None of the above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

8

Internet-Based Team Research: Examining an Annual Report

As a team, select an industry to analyze. Using your Web browser, each team member should access the annual report or 10-K for one publicly traded company in the industry, with each member selecting a different company. (See S1-3 in Chapter 1 for a description of possible resources for these tasks.)

Required:

1. On an individual basis, each team member should write a short report that incorporates the following:

a. Has the company declared cash or stock dividends during the past three years

b. What is the trend in the company's EPS over the past three years

c. Compute and analyze the return on equity ratio over the past two years.

2. Then, as a team, write a short report comparing and contrasting your companies using these attributes. Discuss any patterns across the companies that you as a team observe. Provide potential explanations for any differences discovered.

As a team, select an industry to analyze. Using your Web browser, each team member should access the annual report or 10-K for one publicly traded company in the industry, with each member selecting a different company. (See S1-3 in Chapter 1 for a description of possible resources for these tasks.)

Required:

1. On an individual basis, each team member should write a short report that incorporates the following:

a. Has the company declared cash or stock dividends during the past three years

b. What is the trend in the company's EPS over the past three years

c. Compute and analyze the return on equity ratio over the past two years.

2. Then, as a team, write a short report comparing and contrasting your companies using these attributes. Discuss any patterns across the companies that you as a team observe. Provide potential explanations for any differences discovered.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

9

Ethical Decision Making: A Mini-Case

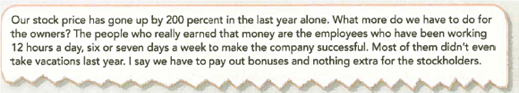

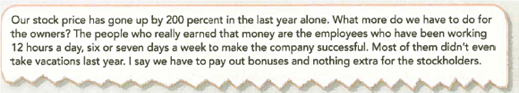

You are the president of a very successful Internet company that has had a remarkably profitable year. You have determined that the company has more than $10 million in cash generated by operating activities not needed in the business. You are thinking about paying it out to stockholders as a special dividend. You discuss the idea with your vice president, who reacts angrily to your suggestion:

As president, you know that you are hired by the board of directors, which is elected by the stockholders.

Required:

What is your responsibility to both groups To which group would you give the $10 million Why

You are the president of a very successful Internet company that has had a remarkably profitable year. You have determined that the company has more than $10 million in cash generated by operating activities not needed in the business. You are thinking about paying it out to stockholders as a special dividend. You discuss the idea with your vice president, who reacts angrily to your suggestion:

As president, you know that you are hired by the board of directors, which is elected by the stockholders.

Required:

What is your responsibility to both groups To which group would you give the $10 million Why

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

10

When treasury stock is purchased with cash, what is the impact on the balance sheet equation

A) No change: the reduction of the asset cash is offset with the addition of the asset treasury stock.

B) Assets decrease and stockholders' equity increases.

C) Assets increase and stockholders' equity decreases.

D) Assets decrease and stockholders' equity decreases.

A) No change: the reduction of the asset cash is offset with the addition of the asset treasury stock.

B) Assets decrease and stockholders' equity increases.

C) Assets increase and stockholders' equity decreases.

D) Assets decrease and stockholders' equity decreases.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

11

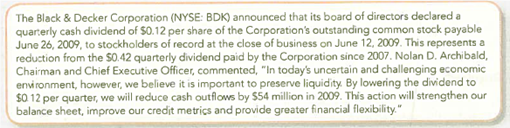

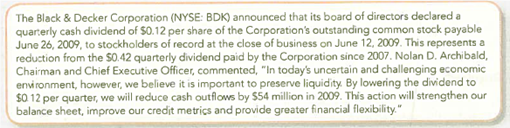

Accounting for Dividends during the Credit Crisis

Black Decker is a leading global manufacturer and marketer of power tools, hardware, and home improvement products. A press release on April 30, 2009, contained the following announcement:

At the time of the press release, Black Decker had 150,000,000 shares authorized and 60 million outstanding. The par value for the company's stock is $.50 per share.

Required:

1. Prepare journal entries as appropriate for each of the three dates mentioned above.

2. Explain how a dividend cut from $0.42 to $0.12 will strengthen the company's balance sheet.

Black Decker is a leading global manufacturer and marketer of power tools, hardware, and home improvement products. A press release on April 30, 2009, contained the following announcement:

At the time of the press release, Black Decker had 150,000,000 shares authorized and 60 million outstanding. The par value for the company's stock is $.50 per share.

Required:

1. Prepare journal entries as appropriate for each of the three dates mentioned above.

2. Explain how a dividend cut from $0.42 to $0.12 will strengthen the company's balance sheet.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

12

You work for a public company that has relied heavily on debt financing in the past and is now considering a preferred stock issuance to reduce its debt-to-assets ratio. Debt to-assets is one of the key ratios in your company's loan covenants. Should the preferred stock have a fixed annual dividend rate, or a dividend that is determined yearly In what way might this decision be affected by IFRS

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

13

Recording Stock Dividends

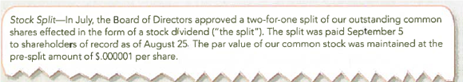

Activision Blizzard, Inc., reported the following in the notes to its financial statements.

Required:

1. Describe the effects that this transaction would have had on the company's financial statements. Assume that 600 million shares were outstanding at the time of the transaction, trading at a stock price of $33.

TIP : Although the financial statements refer to a stock split, the transaction actually involved a 100% stock dividend. Large stock dividends, such as a 100% dividend, are recorded at par value.

2. Why might the board of directors have decided to declare a stock dividend rather than a stock split

Activision Blizzard, Inc., reported the following in the notes to its financial statements.

Required:

1. Describe the effects that this transaction would have had on the company's financial statements. Assume that 600 million shares were outstanding at the time of the transaction, trading at a stock price of $33.

TIP : Although the financial statements refer to a stock split, the transaction actually involved a 100% stock dividend. Large stock dividends, such as a 100% dividend, are recorded at par value.

2. Why might the board of directors have decided to declare a stock dividend rather than a stock split

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

14

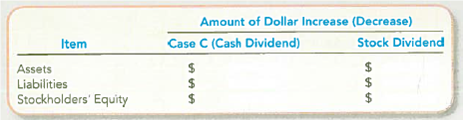

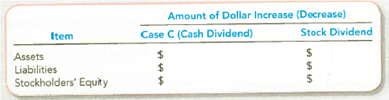

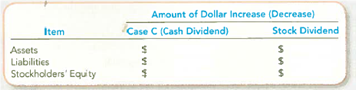

Comparing Stock and Cash Dividends

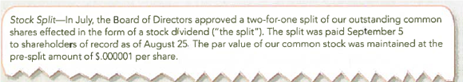

Tower Corp. had the following stock outstanding and Retained Earnings at December 31, 2012:

On December 31, 2012, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. No dividends were declared during 2010 or 2011. Three independent cases are assumed:

Case A : The preferred stock is noncumulative; the total amount of 2012 dividends would be $12,600.

Case B : The preferred stock is cumulative; the total amount of 2012 dividends would be $14,400. Dividends were not in arrears prior to 2010.

Case C : Same as Case B, except the total dividends are $66,000.

Required:

1. Compute the amount of 2012 dividends, in total and per share, that would be payable to each class of stockholders for each case. Show computations.

TIP : Preferred stockholders with cumulative dividends are to be paid dividends for any prior years (in arrears) and for the current year, before common stockholders are paid.

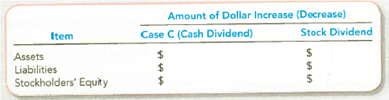

2. Complete the following schedule, which compares case C to a 100 percent common stock dividend issued when the stock price is $24.

Tower Corp. had the following stock outstanding and Retained Earnings at December 31, 2012:

On December 31, 2012, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. No dividends were declared during 2010 or 2011. Three independent cases are assumed:

Case A : The preferred stock is noncumulative; the total amount of 2012 dividends would be $12,600.

Case B : The preferred stock is cumulative; the total amount of 2012 dividends would be $14,400. Dividends were not in arrears prior to 2010.

Case C : Same as Case B, except the total dividends are $66,000.

Required:

1. Compute the amount of 2012 dividends, in total and per share, that would be payable to each class of stockholders for each case. Show computations.

TIP : Preferred stockholders with cumulative dividends are to be paid dividends for any prior years (in arrears) and for the current year, before common stockholders are paid.

2. Complete the following schedule, which compares case C to a 100 percent common stock dividend issued when the stock price is $24.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

15

Recording and Reporting Stockholders' Equity Transactions

Ava School of Learning obtained a charter at the start of 2013 that authorized 50,000 shares of no-par common stock and 20,000 shares of preferred stock, par value $10. During 2013, the following selected transactions occurred:

a. Collected $40 cash per share from four individuals and issued 5,000 shares of common stock to each.

b. Issued 6,000 shares of common stock to an outside investor at $40 cash per share.

c. Issued 8,000 shares of preferred stock at $20 cash per share.

Required:

1. Give the journal entries indicated for each of these transactions.

2. Prepare the stockholders' equity section of the balance sheet at December 31, 2013. At the end of 2013, the accounts reflected net income of $36,000. No dividends were declared.

Ava School of Learning obtained a charter at the start of 2013 that authorized 50,000 shares of no-par common stock and 20,000 shares of preferred stock, par value $10. During 2013, the following selected transactions occurred:

a. Collected $40 cash per share from four individuals and issued 5,000 shares of common stock to each.

b. Issued 6,000 shares of common stock to an outside investor at $40 cash per share.

c. Issued 8,000 shares of preferred stock at $20 cash per share.

Required:

1. Give the journal entries indicated for each of these transactions.

2. Prepare the stockholders' equity section of the balance sheet at December 31, 2013. At the end of 2013, the accounts reflected net income of $36,000. No dividends were declared.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

16

Recording Dividends

On May 20, 2013, the board of directors for Auction.com declared a cash dividend of 50 cents per share payable to stockholders of record on June 14. The dividends will be paid on July 14-The company has 500,000 shares of stock outstanding. Prepare any necessary journal entries for each date.

On May 20, 2013, the board of directors for Auction.com declared a cash dividend of 50 cents per share payable to stockholders of record on June 14. The dividends will be paid on July 14-The company has 500,000 shares of stock outstanding. Prepare any necessary journal entries for each date.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

17

Calculating and Interpreting Earnings per Share (EPS) and Return on Equity (ROE)

Academy Driving School reported the following amount in its financial statements:

Calculate 2013 EPS and ROE. Another driving school in the same city reported a higher net income ($45,000) in 2013, yet its EPS and ROE ratios were lower than those for the Academy Driving School. Explain how this apparent inconsistency could occur.

Academy Driving School reported the following amount in its financial statements:

Calculate 2013 EPS and ROE. Another driving school in the same city reported a higher net income ($45,000) in 2013, yet its EPS and ROE ratios were lower than those for the Academy Driving School. Explain how this apparent inconsistency could occur.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

18

Reporting Stockholders' Equity and Determining Dividend Policy

Incentive Corporation was organized in 2012 to operate a financial consulting business. The charter authorized the following capital stock: common stock, par value $4 per share, 12,000 shares. During the first year, the following selected transactions were completed:

a. Issued 6,000 shares of common stock for cash at $20 per share.

b. Issued 2,000 shares of common stock for cash at $23 per share.

Required:

1. Show the effects of each transaction on the accounting equation.

2. Give the journal entry required for each of these transactions.

3. Prepare the stockholders' equity section as it should be reported on the 2012 year-end balance sheet. At year-end, the accounts reflected a profit of $100.

4. Incentive Corporation has $30,000 in the company's bank account. Should the company declare cash dividends at this time Explain.

Incentive Corporation was organized in 2012 to operate a financial consulting business. The charter authorized the following capital stock: common stock, par value $4 per share, 12,000 shares. During the first year, the following selected transactions were completed:

a. Issued 6,000 shares of common stock for cash at $20 per share.

b. Issued 2,000 shares of common stock for cash at $23 per share.

Required:

1. Show the effects of each transaction on the accounting equation.

2. Give the journal entry required for each of these transactions.

3. Prepare the stockholders' equity section as it should be reported on the 2012 year-end balance sheet. At year-end, the accounts reflected a profit of $100.

4. Incentive Corporation has $30,000 in the company's bank account. Should the company declare cash dividends at this time Explain.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

19

Reporting the Stockholders Equity Section of the Balance Sheet

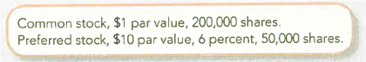

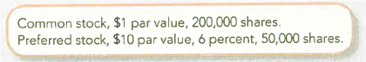

Shelby Corporation was organized in January 2013 to operate an air conditioning sales and service business. The charter issued by the stare authorized the following capital stock:

During January and February 2013, the following stock transactions were completed:

a. Collected $400,000 cash and issued 20,000 shares of common stock.

b. Issued 15,000 shares of preferred stock at $30 per share; collected in cash.

Net income for 2013 was $50,000; cash dividends declared and paid at year-end were $10,000.

Required:

Prepare the stockholders' equity section of the balance sheet at December 31, 2013.

Shelby Corporation was organized in January 2013 to operate an air conditioning sales and service business. The charter issued by the stare authorized the following capital stock:

During January and February 2013, the following stock transactions were completed:

a. Collected $400,000 cash and issued 20,000 shares of common stock.

b. Issued 15,000 shares of preferred stock at $30 per share; collected in cash.

Net income for 2013 was $50,000; cash dividends declared and paid at year-end were $10,000.

Required:

Prepare the stockholders' equity section of the balance sheet at December 31, 2013.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

20

A journal entry is not recorded on what date

A) date of declaration

B) date of record

C) date of payment

D) A journal entry is recorded on all of these dates.

A) date of declaration

B) date of record

C) date of payment

D) A journal entry is recorded on all of these dates.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

21

Define treasury stock. Why do corporations acquire treasury stock

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

22

What are the primary reasons for issuing a stock dividend

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

23

Which statement regarding treasury stock is false

A) Treasury stock is considered to be issued but not outstanding.

B) Treasury stock has no voting, dividend, or liquidation rights.

C) Treasury stock reduces total stockholders' equity on the balance sheet.

D) None of the above are false.

A) Treasury stock is considered to be issued but not outstanding.

B) Treasury stock has no voting, dividend, or liquidation rights.

C) Treasury stock reduces total stockholders' equity on the balance sheet.

D) None of the above are false.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is ordered from the largest number of shares to the smallest number of shares

A) Shares authorized, shares issued, shares outstanding.

B) Shares issued, shares outstanding, shares authorized.

C) Shares outstanding, shares issued, shares authorized.

D) Shares in treasury, shares outstanding, shares issued.

A) Shares authorized, shares issued, shares outstanding.

B) Shares issued, shares outstanding, shares authorized.

C) Shares outstanding, shares issued, shares authorized.

D) Shares in treasury, shares outstanding, shares issued.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

25

Comparing Common Stock and Preferred Stock

Your parents have just retired and have asked you for some financial advice. They have decided to invest $100,000 in a company very similar to National Beverage Corp. The company has issued both common and preferred stock. Which type of stock would you recommend What factors are relevant to this recommendation

Your parents have just retired and have asked you for some financial advice. They have decided to invest $100,000 in a company very similar to National Beverage Corp. The company has issued both common and preferred stock. Which type of stock would you recommend What factors are relevant to this recommendation

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

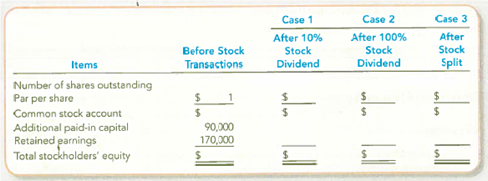

26

Computing Dividends on Preferred Stock and Analyzing Differences

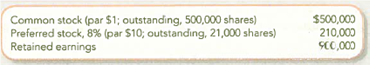

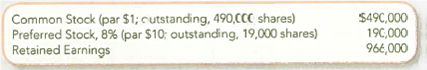

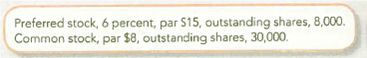

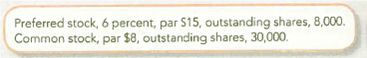

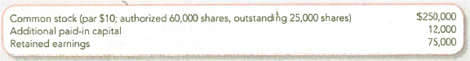

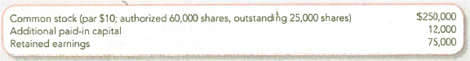

The records of Hoffman Company reflected the following balances in the stockholders' equity accounts at December 31, 2012:

On January 1, 2013, the board of directors was considering the distribution of a $62,000 cash dividend. No dividends were paid during 2011 and 2012.

Required:

1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions:

a. The preferred stock is noncumulative.

b. The preferred stock is cumulative.

2. Briefly explain why the dividends per share of common stock were less for the second assumption.

3. What factors would cause a more favorable dividend for the common stockholders

The records of Hoffman Company reflected the following balances in the stockholders' equity accounts at December 31, 2012:

On January 1, 2013, the board of directors was considering the distribution of a $62,000 cash dividend. No dividends were paid during 2011 and 2012.

Required:

1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions:

a. The preferred stock is noncumulative.

b. The preferred stock is cumulative.

2. Briefly explain why the dividends per share of common stock were less for the second assumption.

3. What factors would cause a more favorable dividend for the common stockholders

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

27

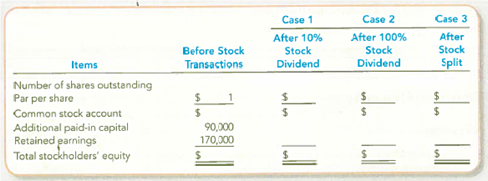

Comparing Stock Dividends and Splits

On July 1, 2013, Jones Corporation had the following capital structure:

Required:

Complete the following table based on three independent cases involving stock transactions:

Case 1: The board of directors declared and issued a 10 percent stock dividend when the stock price was $8 per share.

Case 2: The board of directors declared and issued a 100 percent stock dividend when the stock price was $8 per share.

Case 3: The board of directors voted a 2-for-l stock split. The stock price prior to the split was $8 per share.

On July 1, 2013, Jones Corporation had the following capital structure:

Required:

Complete the following table based on three independent cases involving stock transactions:

Case 1: The board of directors declared and issued a 10 percent stock dividend when the stock price was $8 per share.

Case 2: The board of directors declared and issued a 100 percent stock dividend when the stock price was $8 per share.

Case 3: The board of directors voted a 2-for-l stock split. The stock price prior to the split was $8 per share.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

28

Computing the Number of Issued Shares

Face 2 Face Corporation reports 100 outstanding shares, 500 authorized shares, and 50 shares of treasury stock. How many shares are issued

Face 2 Face Corporation reports 100 outstanding shares, 500 authorized shares, and 50 shares of treasury stock. How many shares are issued

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

29

Analyzing and Recording the Issuance of Common Stock

To expand operations, Aragon Consulting issued 1,000 shares of previously unissued common stock with a par value of $1. The price for the stock was $50 per share. Analyze the accounting equation effects and record the journal entry for the stock issuance. Would your answer be different if the par value were $2 per share If so, analyze the accounting equation effects and record the journal entry for the stock issuance with a par value of $2.

To expand operations, Aragon Consulting issued 1,000 shares of previously unissued common stock with a par value of $1. The price for the stock was $50 per share. Analyze the accounting equation effects and record the journal entry for the stock issuance. Would your answer be different if the par value were $2 per share If so, analyze the accounting equation effects and record the journal entry for the stock issuance with a par value of $2.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

30

Explain the distinction between par value and no-par value capital stock.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

31

In what situation does total stockholders' equity decrease

A) When a cash dividend is declared.

B) When a stock dividend is declared.

C) When a stock split is announced.

D) None of the above.

A) When a cash dividend is declared.

B) When a stock dividend is declared.

C) When a stock split is announced.

D) None of the above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

32

Inferring Financial Information Using the P/E Ratio

In 2012, Rec Room Sports reported earnings per share of $8.50 when its stock price was $212.50. In 2013, its earnings increased by 20 percent. If the P/E ratio remains constant, what is likely to be the price of the stock Explain

In 2012, Rec Room Sports reported earnings per share of $8.50 when its stock price was $212.50. In 2013, its earnings increased by 20 percent. If the P/E ratio remains constant, what is likely to be the price of the stock Explain

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

33

Recording Cash Dividends

National Chocolate Corp. produces chocolate bars and snacks under the brand names Blast and Soothe. A press release contained the following information:

Required:

1. Prepare any journal entries that National Chocolate Corp. should make as the result of information in the preceding report.

2. What two requirements would the board of directors have considered before making the dividend decisions

National Chocolate Corp. produces chocolate bars and snacks under the brand names Blast and Soothe. A press release contained the following information:

Required:

1. Prepare any journal entries that National Chocolate Corp. should make as the result of information in the preceding report.

2. What two requirements would the board of directors have considered before making the dividend decisions

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

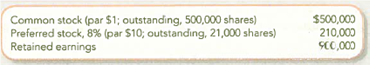

34

Comparing Stock and Cash Dividends

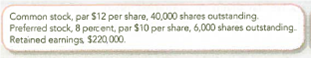

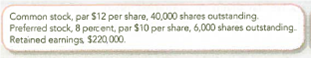

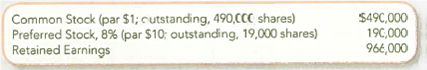

Ritz Company had the following stock outstanding and Retained Earnings at December 31, 2013:

On December 31, 2013, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. No dividends were declared during 2011 or 2012. Three independent cases are assumed:

Case A : The preferred stock is noncumulative; the total amount of 2013 dividends would be $30,000.

Case B : The preferred stock is cumulative; the total amount of 2013 dividends would be $30,000. Dividends were not in arrears prior to 2011.

Case C: Same as Case B, except the amount is $75,000.

Required:

1. Compute the amount of dividends, in total and per share, payable to each class of stockholders for each case. Show computations. Round per-share amounts to two decimal places.

2. Complete the following schedule, which compares case C to a 100 percent stock dividend on the outstanding common shares when the stock price was $50.

Ritz Company had the following stock outstanding and Retained Earnings at December 31, 2013:

On December 31, 2013, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. No dividends were declared during 2011 or 2012. Three independent cases are assumed:

Case A : The preferred stock is noncumulative; the total amount of 2013 dividends would be $30,000.

Case B : The preferred stock is cumulative; the total amount of 2013 dividends would be $30,000. Dividends were not in arrears prior to 2011.

Case C: Same as Case B, except the amount is $75,000.

Required:

1. Compute the amount of dividends, in total and per share, payable to each class of stockholders for each case. Show computations. Round per-share amounts to two decimal places.

2. Complete the following schedule, which compares case C to a 100 percent stock dividend on the outstanding common shares when the stock price was $50.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

35

Critical Thinking: Making a Decision as an investor

You have retired after a long and successful career as a business executive and now spend a good portion of your time managing your retirement portfolio. You are considering three basic investment alternatives. You can invest in (1) corporate bonds paying 7 percent interest, (2) conservative stocks that pay substantial dividends (typically 5 percent c# the stock price every year), and (3) growth-oriented technology stocks that pay no dividends.

Required:

Analyze each of these alternatives and select one. Justify your selection.

You have retired after a long and successful career as a business executive and now spend a good portion of your time managing your retirement portfolio. You are considering three basic investment alternatives. You can invest in (1) corporate bonds paying 7 percent interest, (2) conservative stocks that pay substantial dividends (typically 5 percent c# the stock price every year), and (3) growth-oriented technology stocks that pay no dividends.

Required:

Analyze each of these alternatives and select one. Justify your selection.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

36

Determining the Impact of a Stock Dividend

Sturdy Stone Tools, Inc., announced a 100 percent stock dividend. Determine the impact (increase, decrease, no change) of this dividend on the following:

1. Total assets.

2. Total liabilities.

3. Common stock.

4. Total stockholders' equity.

5. Market value per share of common stock.

Sturdy Stone Tools, Inc., announced a 100 percent stock dividend. Determine the impact (increase, decrease, no change) of this dividend on the following:

1. Total assets.

2. Total liabilities.

3. Common stock.

4. Total stockholders' equity.

5. Market value per share of common stock.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

37

Your company has been very profitable and expects continued financial success. Its stock price has reached a point where the company needs to make it more affordable. Would you recommend a stock dividend or a stock split Why

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

38

Accounting for Equity Financing

Nicole has been financing Nicole's Getaway Spa (NGS) using equity financing. Currently NGS has authorized 100,000 no-par preferred shares and 200,000 $2 par common shares. Outstanding shares include 50,000 preferred shares and 40,000 common shares.

Recently the following transactions have taken place.

a. NGS issues 1,000 preferred shares for $12 a share.

b. NGS repurchases 1,000 common shares for $11 a share.

c. On November 12, 2014, the board of directors declared a $0.10 cash dividend on each outstanding preferred share.

d. The dividend is paid December 20, 2014.

Required:

1. Prepare the journal entries needed for each of the transactions.

2. If you were a common shareholder concerned about your voting rights, would you prefer Nicole to issue additional common shares or additional preferred shares Why

3. Describe the overall effect of each transaction on the assets, liabilities, and shareholders' equity of the company. (Use + for increase, for decrease, and NE for no effect.)

4. How would each transaction affect the ROE ratio

Nicole has been financing Nicole's Getaway Spa (NGS) using equity financing. Currently NGS has authorized 100,000 no-par preferred shares and 200,000 $2 par common shares. Outstanding shares include 50,000 preferred shares and 40,000 common shares.

Recently the following transactions have taken place.

a. NGS issues 1,000 preferred shares for $12 a share.

b. NGS repurchases 1,000 common shares for $11 a share.

c. On November 12, 2014, the board of directors declared a $0.10 cash dividend on each outstanding preferred share.

d. The dividend is paid December 20, 2014.

Required:

1. Prepare the journal entries needed for each of the transactions.

2. If you were a common shareholder concerned about your voting rights, would you prefer Nicole to issue additional common shares or additional preferred shares Why

3. Describe the overall effect of each transaction on the assets, liabilities, and shareholders' equity of the company. (Use + for increase, for decrease, and NE for no effect.)

4. How would each transaction affect the ROE ratio

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

39

Recording Cash and Stock Dividends

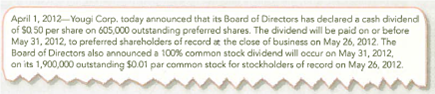

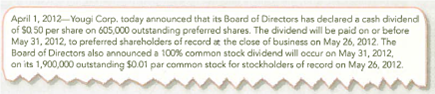

Yougi Corp. is an animation studio operating in South Florida. A recent press release contained the following information:

Required:

1. Prepare any journal entries that Yougi Corp. should make as the result of information in the preceding report.

2. What two requirements would the board of directors have considered before making the dividend decision

Yougi Corp. is an animation studio operating in South Florida. A recent press release contained the following information:

Required:

1. Prepare any journal entries that Yougi Corp. should make as the result of information in the preceding report.

2. What two requirements would the board of directors have considered before making the dividend decision

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

40

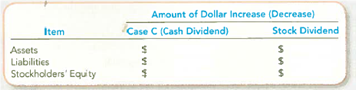

Comparing Stock and Cash Dividends

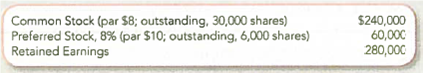

Carlos Company had the following stock outstanding and Retained Earnings at December 31, 2013

On December 31, 2013, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. Nodividends were declared during 2011 or 2012. Three independent cases are assumed:

Case A : The preferred stock is noncumulative; rhe rotal amount of 2013 dividends would be $24,000.

Case B : The preferred stock is cumulative; the total amount of 2013 dividends would be $24,000. Dividends were not in arrears prior to 2011.

Case C : Same as Case B, except: the amount is $67,000.

Required:

1. Compute the amount of 2013 dividends, in total and per share, payable to each class of stockholders for each case. Show computations. Round per-share amounts to two decimal places.

2. Complete the following schedule, which compares case C to a 100 percent stock dividend on the outstanding common shares when the stock price was $45.

Carlos Company had the following stock outstanding and Retained Earnings at December 31, 2013

On December 31, 2013, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. Nodividends were declared during 2011 or 2012. Three independent cases are assumed:

Case A : The preferred stock is noncumulative; rhe rotal amount of 2013 dividends would be $24,000.

Case B : The preferred stock is cumulative; the total amount of 2013 dividends would be $24,000. Dividends were not in arrears prior to 2011.

Case C : Same as Case B, except: the amount is $67,000.

Required:

1. Compute the amount of 2013 dividends, in total and per share, payable to each class of stockholders for each case. Show computations. Round per-share amounts to two decimal places.

2. Complete the following schedule, which compares case C to a 100 percent stock dividend on the outstanding common shares when the stock price was $45.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

41

Finding Amounts Missing from the Stockholders' Equity Section

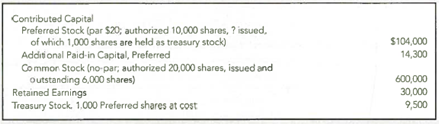

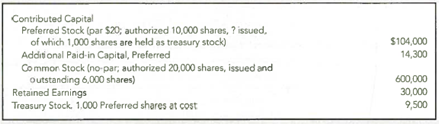

The stockholders' equity section on the December 31, 2012, balance sheet of Chemfast Corporation reported the following amounts:

Assume that no shares of treasury stock have been sold in the past.

Required:

Complete the following statements and show your computations.

1. The number of shares of preferred stock issued was _________.

2. The number -of shares of preferred stock outstanding was _________.

3. The average issue price of the preferred stock was $ _________ per share.

4. The average issue price of the common stock was $ _________.

5. The treasury stock transaction increased (decreased) stockholders' equity by _______.

6. The treasury stock cost $ ______ per share.

7. Total stockholders' equity is $ ______.

The stockholders' equity section on the December 31, 2012, balance sheet of Chemfast Corporation reported the following amounts:

Assume that no shares of treasury stock have been sold in the past.

Required:

Complete the following statements and show your computations.

1. The number of shares of preferred stock issued was _________.

2. The number -of shares of preferred stock outstanding was _________.

3. The average issue price of the preferred stock was $ _________ per share.

4. The average issue price of the common stock was $ _________.

5. The treasury stock transaction increased (decreased) stockholders' equity by _______.

6. The treasury stock cost $ ______ per share.

7. Total stockholders' equity is $ ______.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

42

How is treasury stock reported on the balance sheet How is the "gain or loss" on reissued treasury stock reported on the financial statements

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

43

Determining the Impact of Cash and Stock Dividends

Superior Corporation has the following capital stock outstanding:

On October 1, 2013, the board of directors declared a full preferred stock dividend, payable on December 20. 2013. On December 20, 2013, the market prices were preferred stock, $40, and common stock, $32.

Required:

Indicate the direction and amount of change in total assets liabilities, and stockholders' equity as a result of: ( a ) declaration of the cash dividend on October 1, ( b ) payment of the cash dividend on December 20, and (c) a 100 percent common stock dividend on December 20.

Superior Corporation has the following capital stock outstanding:

On October 1, 2013, the board of directors declared a full preferred stock dividend, payable on December 20. 2013. On December 20, 2013, the market prices were preferred stock, $40, and common stock, $32.

Required:

Indicate the direction and amount of change in total assets liabilities, and stockholders' equity as a result of: ( a ) declaration of the cash dividend on October 1, ( b ) payment of the cash dividend on December 20, and (c) a 100 percent common stock dividend on December 20.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

44

Financial Reporting of Write-off, Depreciation, Bond Issuance and Common Stock Issuance, Purchase, Reissuance, and Cash Dividends (Chapters 8, 9, 10 and 11)

American Laser, Inc., reported the following account balances on January 1, 2013.

The company entered into the following transactions during 2013.

Required:

1. Analyze the effects of each transaction on total assets, liabilities, and stockholders' equity.

2. Prepare journal entries to record each transaction.

3. Prepare the noncurrent liabilities and stockholders' equity sections of the balance sheet at December 31, 2013. At the end of 2013, the adjusted net income was $20,000.

American Laser, Inc., reported the following account balances on January 1, 2013.

The company entered into the following transactions during 2013.

Required:

1. Analyze the effects of each transaction on total assets, liabilities, and stockholders' equity.

2. Prepare journal entries to record each transaction.

3. Prepare the noncurrent liabilities and stockholders' equity sections of the balance sheet at December 31, 2013. At the end of 2013, the adjusted net income was $20,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

45

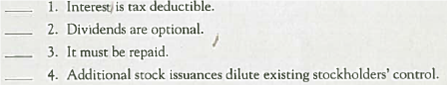

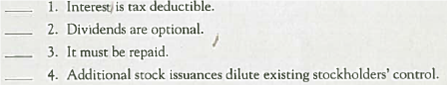

What are the relative advantages of equity versus debt financing

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

46

Explain each of the following terms: (a) authorized capital stock, (b) issued capital stock, and (c) outstanding capital stock.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following transactions will increase the return on equity

A) Declare and issue a stock dividend.

B) Split the stock 2-for-1.

C) Repurchase the company's stock.

D) None of the above.

A) Declare and issue a stock dividend.

B) Split the stock 2-for-1.

C) Repurchase the company's stock.

D) None of the above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

48

Recording the Payment of Dividends and Preparing a Statement of Retained Earnings

The 2012 annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $100,000 in 2012. It also declared and paid dividends on common stock in the amount of $2 per share. During 2012, Sneer had 1 million common shares authorized; 300,000 shares had been issued; and 100,000 shares were in treasury stock. The balance in Retained Earning; was $800,000 on December 31, 2011, and 2012 Net Income was $300,000.

Required:

1. Prepare journal entries to record the declaration, and payment, of dividends on ( a ) preferred and ( b ) common stock.

2. Using the information given above, prepare a statement of retained earnings for the year ended December 31, 2013.

The 2012 annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $100,000 in 2012. It also declared and paid dividends on common stock in the amount of $2 per share. During 2012, Sneer had 1 million common shares authorized; 300,000 shares had been issued; and 100,000 shares were in treasury stock. The balance in Retained Earning; was $800,000 on December 31, 2011, and 2012 Net Income was $300,000.

Required:

1. Prepare journal entries to record the declaration, and payment, of dividends on ( a ) preferred and ( b ) common stock.

2. Using the information given above, prepare a statement of retained earnings for the year ended December 31, 2013.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

49

(Supplement 11A) Comparing Owner's Equity to Stockholders' Equity

On January' 2, Daniel Harrison contributed $20,000 to start his business. At the end of the year, the business had generated $30,000 in sales revenues, incurred $18,000 in operating expenses, and distributed $5,000 for Daniel to use to pay some personal expenses. Prepare ( a ) a statement of owner's equity, assuming this is a sole proprietorship, ( b ) the owner's equity section of the balance sheet, assuming this is a sole proprietorship, and ( c ) the stockholder's equity section of the balance sheet, assuming this is a corporation with no-par value stock.

On January' 2, Daniel Harrison contributed $20,000 to start his business. At the end of the year, the business had generated $30,000 in sales revenues, incurred $18,000 in operating expenses, and distributed $5,000 for Daniel to use to pay some personal expenses. Prepare ( a ) a statement of owner's equity, assuming this is a sole proprietorship, ( b ) the owner's equity section of the balance sheet, assuming this is a sole proprietorship, and ( c ) the stockholder's equity section of the balance sheet, assuming this is a corporation with no-par value stock.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

50

Analyzing Accounting Equation Effects, Recording Journal Entries, and Preparing a Partial Balance Sheet Involving Stock Issuance, Purchase, and Reissuance Transactions

Worldwide Company obtained a charter from the state in January 2013, which authorized 200,000 shares of common stock, $10 par value. During the first year, the company earned $38,200 and the following selected transactions occurred in the order given:

a. Issued 60,000 shares of the common stock at $ 12 cash per share.

b. Reacquired 2,000 shares at $15 cash per share from stockholders.

c. Reissued 1,000 of the shares of the treasury stock purchased in transaction (b) two months later at $18 cash per share.

Required:

1. Indicate the effects of each transaction on the accounting equation.

2. Prepare journal entries to record each transaction.

3. Prepare the stockholders' equity section of the balance sheet at December 31, 2013.

TIP : Because this is the first year of operations, Retained Earnings has a zero balance at the beginning of the year.

Worldwide Company obtained a charter from the state in January 2013, which authorized 200,000 shares of common stock, $10 par value. During the first year, the company earned $38,200 and the following selected transactions occurred in the order given:

a. Issued 60,000 shares of the common stock at $ 12 cash per share.

b. Reacquired 2,000 shares at $15 cash per share from stockholders.

c. Reissued 1,000 of the shares of the treasury stock purchased in transaction (b) two months later at $18 cash per share.

Required:

1. Indicate the effects of each transaction on the accounting equation.

2. Prepare journal entries to record each transaction.

3. Prepare the stockholders' equity section of the balance sheet at December 31, 2013.

TIP : Because this is the first year of operations, Retained Earnings has a zero balance at the beginning of the year.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

51

Comparing Financial Information

Refer to the financial statements of The Home Depot in Appendix A and Lowe's in Appendix B at the end of this book, or download the annual reports from the Cases section of the text's Web site at www.mhhe.com/phillips4e.

Required:

1. Did Lowe's have more or fewer authorized shares of common stock than The Home Depot at the beginning of February 2011

2. From the Retained Earnings column in the statement of stockholders' equity, what total amount of cash dividends did Lowe's declare during the year ended January 28, 2011 Compared to The Home Depot, is Lowe's policy on dividends better, worse, or just different

3. How have Lowe's net earnings changed over the past three years How has the company's basic earnings per share changed over the past three years According to financial statement note 11, were the changes in EPS caused only by changes in Lowe's net earnings

Refer to the financial statements of The Home Depot in Appendix A and Lowe's in Appendix B at the end of this book, or download the annual reports from the Cases section of the text's Web site at www.mhhe.com/phillips4e.

Required:

1. Did Lowe's have more or fewer authorized shares of common stock than The Home Depot at the beginning of February 2011

2. From the Retained Earnings column in the statement of stockholders' equity, what total amount of cash dividends did Lowe's declare during the year ended January 28, 2011 Compared to The Home Depot, is Lowe's policy on dividends better, worse, or just different

3. How have Lowe's net earnings changed over the past three years How has the company's basic earnings per share changed over the past three years According to financial statement note 11, were the changes in EPS caused only by changes in Lowe's net earnings

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

52

Ethical Decision Making: A Real-Life Example

Activision became a public company with an initial public offering of stock on June 9, 1983, at $12 per share. In June 2002, Activision issued 7.5 million additional shares to the public at approximately $33 per share in a seasoned new issue. In October 2002, when its stock was trading at about $22 per share, Activision executives announced that the company would spend up to $150 million to reacquire stock from investors. On January 8, 2003, The Wall Street Journal reported that several analysts were criticizing Activision's executives because the company had issued the shares to the public at a high price ($33) and then were offering to reacquire them at the going stock market price, which was considerably lower than the issue price in 2002.

Required:

1. Do you think it was inappropriate for Activision to offer to reacquire the stock at a lower stock price in October 2002

2. Would your answer to question 1 be different if Activision had not issued additional stock in June 2002

3. The above Wall Street Journal article also reported that, in December 2002, Activision executives had purchased, for their own personal investment portfolios, 530,000 shares of stock in the company at the then-current price of $13.32 per share. If you were an investor, how would you feel about executives buying stock in their own company

4. Would your answer to question 3 be different if you also learned that the executives had disposed of nearly 2.5 million shares of Activision stock earlier in the year, when the price was at least $26.08 per share

Activision became a public company with an initial public offering of stock on June 9, 1983, at $12 per share. In June 2002, Activision issued 7.5 million additional shares to the public at approximately $33 per share in a seasoned new issue. In October 2002, when its stock was trading at about $22 per share, Activision executives announced that the company would spend up to $150 million to reacquire stock from investors. On January 8, 2003, The Wall Street Journal reported that several analysts were criticizing Activision's executives because the company had issued the shares to the public at a high price ($33) and then were offering to reacquire them at the going stock market price, which was considerably lower than the issue price in 2002.

Required:

1. Do you think it was inappropriate for Activision to offer to reacquire the stock at a lower stock price in October 2002

2. Would your answer to question 1 be different if Activision had not issued additional stock in June 2002

3. The above Wall Street Journal article also reported that, in December 2002, Activision executives had purchased, for their own personal investment portfolios, 530,000 shares of stock in the company at the then-current price of $13.32 per share. If you were an investor, how would you feel about executives buying stock in their own company

4. Would your answer to question 3 be different if you also learned that the executives had disposed of nearly 2.5 million shares of Activision stock earlier in the year, when the price was at least $26.08 per share

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

53

Determining the Effects of Stock Issuance and Treasury Stock Transactions

Trans Union Corporation issued 5,000 shares for $50 per share in the current year, and it issued 10.000 shares for $37 per share in the following year. The year after that, the company reacquired 20.000 shares of its own stock for $45 per share. Determine the impact (increase, decrease, or no change) of each of these transactions on the following classifications:

1. Total assets.

2. Total liabilities.

3. Total stockholders' equity.

4. Net income.

Trans Union Corporation issued 5,000 shares for $50 per share in the current year, and it issued 10.000 shares for $37 per share in the following year. The year after that, the company reacquired 20.000 shares of its own stock for $45 per share. Determine the impact (increase, decrease, or no change) of each of these transactions on the following classifications:

1. Total assets.

2. Total liabilities.

3. Total stockholders' equity.

4. Net income.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

54

Determining the Impact of a Stock Split

Complete the requirements of Ml 1-10 assuming that the company announced a 2-for-l stock split.

Complete the requirements of Ml 1-10 assuming that the company announced a 2-for-l stock split.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

55

Identify and explain the three important dates with respect to dividends.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

56

Computing Shares Outstanding

The 2010 annual report for Fortune Brands , the seller of Pinnacle golf balls and MasterLock padlocks, disclosed that 750 million shares of common stock have been authorized. At the end of 2009, 150 million shares had been issued and the number of shares in treasury stock was 84 million. During 2010, 2 million common shares were reissued from treasury, and 1 million common shares were purchased for treasury stock.

Required:

Determine the number of common shares (a) issued, (b) in treasury, and (c) outstanding at the end of 2010.

The 2010 annual report for Fortune Brands , the seller of Pinnacle golf balls and MasterLock padlocks, disclosed that 750 million shares of common stock have been authorized. At the end of 2009, 150 million shares had been issued and the number of shares in treasury stock was 84 million. During 2010, 2 million common shares were reissued from treasury, and 1 million common shares were purchased for treasury stock.

Required:

Determine the number of common shares (a) issued, (b) in treasury, and (c) outstanding at the end of 2010.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

57

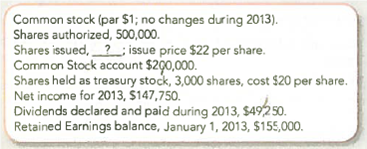

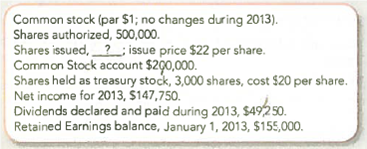

Finding Missing Amounts

At December 31, 2013, the records of Nortech Corporation provided the following selected and incomplete data:

Required:

1. Complete the following:

Shares authorized _________.

Shares issued __________.

Shares outstanding ___________.

TIP : To determine the number of shares issued, divide the balance in the Common Stock account by the par value per share.

2. The balance in Additional Paid-in Capital would be $ _______.

3. Earnings per share is $ ______.

4. Dividends paid per share of common stock is $ ________.

5. Treasury stock should be reported in the stockholders' equity section of the balance sheet in the amount of $ ________.

6. Assume that the board of directors approved a 2-for-l stock split. After the stock split, the par value per share will be $ _______.

7. Disregard the stock split (assumed above). Assume instead that a 100 percent stock dividend was declared and issued after the treasury stock had been acquired, when the market price of the common stock was $21. Give any journal entry that should be made.

At December 31, 2013, the records of Nortech Corporation provided the following selected and incomplete data:

Required:

1. Complete the following:

Shares authorized _________.

Shares issued __________.

Shares outstanding ___________.

TIP : To determine the number of shares issued, divide the balance in the Common Stock account by the par value per share.

2. The balance in Additional Paid-in Capital would be $ _______.

3. Earnings per share is $ ______.

4. Dividends paid per share of common stock is $ ________.

5. Treasury stock should be reported in the stockholders' equity section of the balance sheet in the amount of $ ________.

6. Assume that the board of directors approved a 2-for-l stock split. After the stock split, the par value per share will be $ _______.

7. Disregard the stock split (assumed above). Assume instead that a 100 percent stock dividend was declared and issued after the treasury stock had been acquired, when the market price of the common stock was $21. Give any journal entry that should be made.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

58

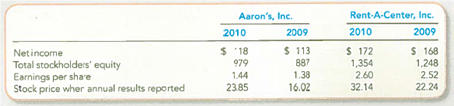

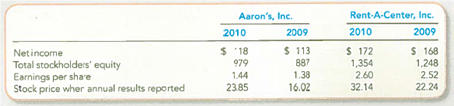

Computing and interpreting Return on Equity (ROE) and Price/Earnings (P/E) Ratios

Aaron's, Int., and Rent-A-Center, Inc. , are two publicly traded rental companies. They reported the following in their 2010 financial statements (in millions of dollars, except per share amounts and stock prices):

Required:

1. Compute the 2010 ROE for each company. Express ROE as a percentage rounded to one decimal place. Which company appears to generate greater returns on stockholders' equity in 2010

TIP : Remember that the bottom of the ROE ratio uses the average stockholders' equity.

2. Compute the 2010 P/E ratio for each company (rounded to one decimal place). Do investors appear to value one company more than the other Explain.

Aaron's, Int., and Rent-A-Center, Inc. , are two publicly traded rental companies. They reported the following in their 2010 financial statements (in millions of dollars, except per share amounts and stock prices):

Required:

1. Compute the 2010 ROE for each company. Express ROE as a percentage rounded to one decimal place. Which company appears to generate greater returns on stockholders' equity in 2010

TIP : Remember that the bottom of the ROE ratio uses the average stockholders' equity.

2. Compute the 2010 P/E ratio for each company (rounded to one decimal place). Do investors appear to value one company more than the other Explain.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

59

What are the usual characteristics of preferred stock

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

60

What are the two basic requirements to support the declaration of a cash dividend What are the effects of a cash dividend on assets and stockholders' equity

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

61

Journalizing Cash Dividends and Stock Dividends

Bogscraft Company has outstanding 60,000 shares of $ 10 par value common stock and 25,000 shares of $20 par value preferred stock (8 percent). On February 1, 2013, the board of directors voted in favor of an 8 percent cash dividend on the preferred stock. The cash dividends are to be paid on March 15, 2013. A 100 percent stock dividend on the common stock occurred on June 30, 2011, when the common stock price was $30 per share.

Required:

Prepare journal entries to record the events on ( a ) February 1, ( b ) March 15, and ( c ) June 30.

Bogscraft Company has outstanding 60,000 shares of $ 10 par value common stock and 25,000 shares of $20 par value preferred stock (8 percent). On February 1, 2013, the board of directors voted in favor of an 8 percent cash dividend on the preferred stock. The cash dividends are to be paid on March 15, 2013. A 100 percent stock dividend on the common stock occurred on June 30, 2011, when the common stock price was $30 per share.

Required:

Prepare journal entries to record the events on ( a ) February 1, ( b ) March 15, and ( c ) June 30.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

62

Which feature is not applicable to common stock ownership

A) Right to receive dividends before preferred stock shareholders.

B) Right to vote on appointment of external auditor.

C) Right to receive residual assets of the company should it cease operations.

D) All of the above are applicable to common stock ownership.

A) Right to receive dividends before preferred stock shareholders.

B) Right to vote on appointment of external auditor.

C) Right to receive residual assets of the company should it cease operations.

D) All of the above are applicable to common stock ownership.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

63

Preparing the Stockholders' Equity Section of the Balance Sheet

North Wind Aviation received its charter during January' 2013. The charter authorized the following capital stock:

During 2013, the following transactions occurred in the order given:

a. Issued a total of 40,000 shares of the common stock for $15 per share.

b. Issued 10,000 shares of the preferred stock at $16 per share.

c. Issued 3,000 shares of the common stock at $20 per share and 1,000 shares of the preferred stock at $16.

d. Net income for the first year was $48,000.

Required:

Prepare the stockholders' equity section of the balance sheet at December 31, 2013.

North Wind Aviation received its charter during January' 2013. The charter authorized the following capital stock:

During 2013, the following transactions occurred in the order given:

a. Issued a total of 40,000 shares of the common stock for $15 per share.

b. Issued 10,000 shares of the preferred stock at $16 per share.

c. Issued 3,000 shares of the common stock at $20 per share and 1,000 shares of the preferred stock at $16.

d. Net income for the first year was $48,000.

Required:

Prepare the stockholders' equity section of the balance sheet at December 31, 2013.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

64

Determining the Effects of the Issuance of Common and Preferred Stock

Inside Incorporated was issued a charter or^ January 15, 2013, that authorized the following capital stock:

During 2013, the following selected transactions were completed in the order given:

a. Issued 20,000 shares of the $6 par common stock at $18 cash per share.

b. Issued 3,000 shares of preferred stock at $22 cash per share.

c. At the end of 2013, the accounts showed net income of $38,000.

Required: