Deck 8: Consumption, Saving, and Investment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 8: Consumption, Saving, and Investment

1

Real income is:

A)wL + i(B+K)

B)(w/P)L + i((B/P)+ K)

C)(w/P)L + i((B/P)+(K/P))

D)(w/P)L + i(B+ K)

A)wL + i(B+K)

B)(w/P)L + i((B/P)+ K)

C)(w/P)L + i((B/P)+(K/P))

D)(w/P)L + i(B+ K)

(w/P)L + i((B/P)+ K)

2

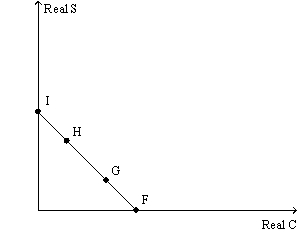

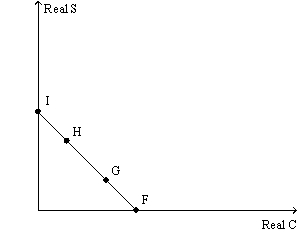

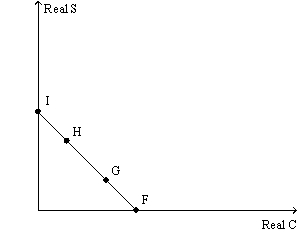

Figure 7.1

In Figure 7.1 if the household opts to consume all its income it will be at point:

A)F

B)G

C)H

D)I

In Figure 7.1 if the household opts to consume all its income it will be at point:

A)F

B)G

C)H

D)I

F

3

Real household saving is:

A) B +

B +  K

K

B) B + (

B + (  K/P)

K/P)

C)( B/P) +

B/P) +  K

K

D)( B/P) + (

B/P) + (  K/P)

K/P)

A)

B +

B +  K

KB)

B + (

B + (  K/P)

K/P)C)(

B/P) +

B/P) +  K

KD)(

B/P) + (

B/P) + (  K/P)

K/P)(  B/P) +

B/P) +  K

K

B/P) +

B/P) +  K

K 4

Real profit is zero when:

A)the interest rate is zero.

B)the depreciation rate is high.

C)the labour and capital markets clear.

D)the labour and capital markets do not clear.

A)the interest rate is zero.

B)the depreciation rate is high.

C)the labour and capital markets clear.

D)the labour and capital markets do not clear.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

The household's year one budget constraint is:

A)real assets at the end of year zero plus real income in year one less consumption in year one equals real assets at the end of year one.

B)real income in year one less real assets at the end of year zero less consumption in year one equals real assets at the end of year one.

C)real assets at the end of year zero plus real income in year one plus consumption in year one equals real assets at the end of year one.

D)real income in year one plus consumption in year one less real assets at the end of year zero equals real assets at the end of year one.

A)real assets at the end of year zero plus real income in year one less consumption in year one equals real assets at the end of year one.

B)real income in year one less real assets at the end of year zero less consumption in year one equals real assets at the end of year one.

C)real assets at the end of year zero plus real income in year one plus consumption in year one equals real assets at the end of year one.

D)real income in year one plus consumption in year one less real assets at the end of year zero equals real assets at the end of year one.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

In the one period budget constraint sources of funds include:

A)labour income.

B)income from capital.

C)income from bonds.

D)all of the above.

A)labour income.

B)income from capital.

C)income from bonds.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

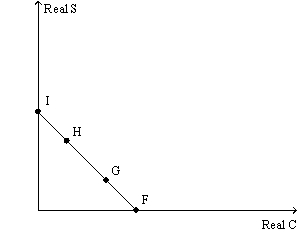

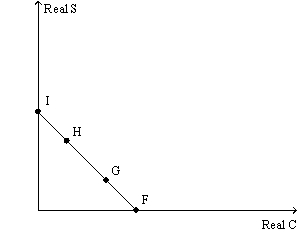

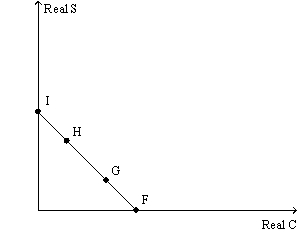

Figure 7.1

In Figure 7.1 if the household moves from point F to point H on its budget, it would be:

A)saving and consuming more.

B)saving less and consuming more.

C)saving more and consuming less.

D)saving and consuming less.

In Figure 7.1 if the household moves from point F to point H on its budget, it would be:

A)saving and consuming more.

B)saving less and consuming more.

C)saving more and consuming less.

D)saving and consuming less.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

If wages rise by €10 per worker just this period, we would expect to see consumption rise by much less than €10 this period.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

In the one period budget constraint sources of funds include:

A)capital gains.

B)income from capital.

C)income from rising prices.

D)all of the above.

A)capital gains.

B)income from capital.

C)income from rising prices.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

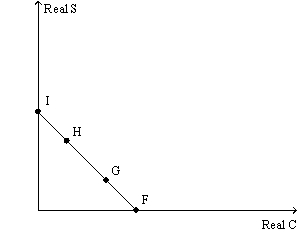

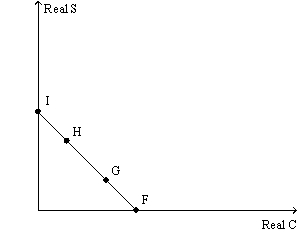

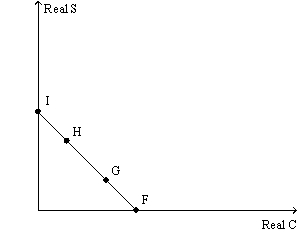

Figure 7.1

In Figure 7.1 if the household moves from point H to point G on its budget, it would be:

A)saving and consuming more.

B)saving less and consuming more.

C)saving more and consuming less.

D)saving and consuming less.

In Figure 7.1 if the household moves from point H to point G on its budget, it would be:

A)saving and consuming more.

B)saving less and consuming more.

C)saving more and consuming less.

D)saving and consuming less.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

Figure 7.1

In Figure 7.1 if the household decides to save all of its income, it would be at point:

A)F

B)G

C)H

D)I

In Figure 7.1 if the household decides to save all of its income, it would be at point:

A)F

B)G

C)H

D)I

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

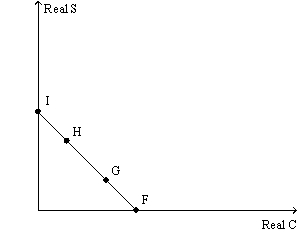

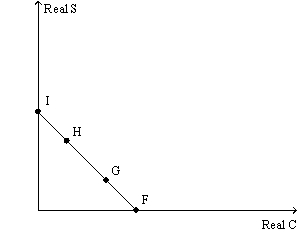

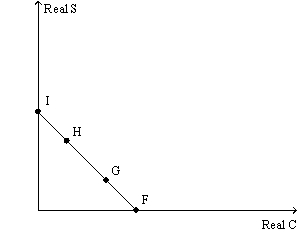

Figure 7.1

In Figure 7.1 if the household moves from point I to point H on its budget, it would be:

A)saving and consuming more.

B)saving less and consuming more.

C)saving more and consuming less.

D)saving and consuming less.

In Figure 7.1 if the household moves from point I to point H on its budget, it would be:

A)saving and consuming more.

B)saving less and consuming more.

C)saving more and consuming less.

D)saving and consuming less.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

€100 a year from now is equal in worth to €100 today.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

When the labour and capital markets clear:

A)depreciation is zero.

B)real profit is zero.

C)a dollar today is worth more than a dollar in the future.

D)all of the above.

A)depreciation is zero.

B)real profit is zero.

C)a dollar today is worth more than a dollar in the future.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

In the one period budget constraint sources of funds include:

A)labour income.

B)interests bearing money.

C)capital gains.

D)all of the above.

A)labour income.

B)interests bearing money.

C)capital gains.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

Figure 7.1

In Figure 7.1 if the household moves from point G to point H on its budget, it would be:

A)saving and consuming more.

B)saving less and consuming more.

C)saving more and consuming less.

D)saving and consuming less.

In Figure 7.1 if the household moves from point G to point H on its budget, it would be:

A)saving and consuming more.

B)saving less and consuming more.

C)saving more and consuming less.

D)saving and consuming less.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

A discount factor is used to deflate nominal consumption to real consumption.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

If the value of initial assets increases, then a household will change consumption or present value of asset at the end of period 2 due to an income effect.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

The aggregate household budget constraint is consumption plus net investment is real GDP less depreciation.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

Real saving in year one is:

A)real bonds plus capital in year 1 minus real bonds and capital in year 0.

B)bonds plus capital plus money period 1.

C)bonds plus capital in period 1.

D)interest times the sum of bonds plus capital in period 1.

A)real bonds plus capital in year 1 minus real bonds and capital in year 0.

B)bonds plus capital plus money period 1.

C)bonds plus capital in period 1.

D)interest times the sum of bonds plus capital in period 1.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

An income effect is the response of households to changes in the present value of:

A)relative prices.

B)sources of funds.

C)uses of funds.

D)assets at the end of year two.

A)relative prices.

B)sources of funds.

C)uses of funds.

D)assets at the end of year two.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

An increase in the interest rate:

A)makes future consumption cheaper.

B)decreases future income.

C)makes present consumption cheaper.

D)all of the above.

A)makes future consumption cheaper.

B)decreases future income.

C)makes present consumption cheaper.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

In the one period budget constraint the uses of funds include:

A)payment of transfers.

B)purchases of capital goods.

C)payment of wages.

D)all of the above.

A)payment of transfers.

B)purchases of capital goods.

C)payment of wages.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

The measure used to reduce future consumption to today's values is called:

A)an implicit deflator.

B)a discount factor.

C)an escalator.

D)a future value.

A)an implicit deflator.

B)a discount factor.

C)an escalator.

D)a future value.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

Utility in economics is:

A)a product with a derived demand like electricity.

B)usefulness.

C)satisfaction or happiness.

D)all of the above.

A)a product with a derived demand like electricity.

B)usefulness.

C)satisfaction or happiness.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

In the one period budget constraint the uses of funds include:

A)purchases of consumption goods.

B)purchases of capital goods.

C)purchases of bonds.

D)all of the above.

A)purchases of consumption goods.

B)purchases of capital goods.

C)purchases of bonds.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

An increase in the interest rate:

A)makes consumption in period two relatively more expensive compared to consumption in period one.

B)does not change relative cost of consuming in either period.

C)makes consumption in period two relatively cheaper compared consumption in period one.

D)discourages savings in each period.

A)makes consumption in period two relatively more expensive compared to consumption in period one.

B)does not change relative cost of consuming in either period.

C)makes consumption in period two relatively cheaper compared consumption in period one.

D)discourages savings in each period.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

An increase in the interest rate:

A)makes future consumption cheaper.

B)increases future income.

C)makes present consumption more expensive.

D)all of the above.

A)makes future consumption cheaper.

B)increases future income.

C)makes present consumption more expensive.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

If a household consumes one less unit in period 1, they can consume:

A)on more unit in period two.

B)(1 + i) more units in period two.

C)one less unit in period two.

D)no more in period two.

A)on more unit in period two.

B)(1 + i) more units in period two.

C)one less unit in period two.

D)no more in period two.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

The present value of sources of funds is:

A)the value of initial assets plus the present value of wage income plus the present value of assets at the end of year two.

B)the value of initial assets plus the present value of assets at the end of year two.

C)the present value of wage income plus the present value of assets at the end of year two.

D)the value of initial assets plus the present value of wage income.

A)the value of initial assets plus the present value of wage income plus the present value of assets at the end of year two.

B)the value of initial assets plus the present value of assets at the end of year two.

C)the present value of wage income plus the present value of assets at the end of year two.

D)the value of initial assets plus the present value of wage income.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

In the one period budget constraint sources of funds include:

A)capital gains.

B)inflation.

C)income from bonds.

D)all of the above.

A)capital gains.

B)inflation.

C)income from bonds.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

If the interest rate is greater than zero, then the concept of present value is that a dollar today:

A)is worth more than a dollar a year from now.

B)is worth less than a dollar a year from now.

C)will be worthless a year from now.

D)is worth the same as a year from now.

A)is worth more than a dollar a year from now.

B)is worth less than a dollar a year from now.

C)will be worthless a year from now.

D)is worth the same as a year from now.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

In the one period budget constraint the uses of funds include:

A)purchases of consumption goods.

B)payment of wages.

C)payment profits.

D)all of the above.

A)purchases of consumption goods.

B)payment of wages.

C)payment profits.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

When a discount factor is multiplied times a future period variable it creates a:

A)future value.

B)a present value.

C)a real variable.

D)a nominal variable.

A)future value.

B)a present value.

C)a real variable.

D)a nominal variable.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

In the one period budget constraint the uses of funds include:

A)payment of transfers.

B)payment of wages.

C)purchases of bonds.

D)all of the above.

A)payment of transfers.

B)payment of wages.

C)purchases of bonds.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

A yen today is worth more than a yen a year from now as long as:

A)the interest rate is negative.

B)the interest rate is positive.

C)the depreciation rate is negative.

D)the depreciation rate is positive.

A)the interest rate is negative.

B)the interest rate is positive.

C)the depreciation rate is negative.

D)the depreciation rate is positive.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

Utility in economics:

A)used to mean happiness.

B)used to mean satisfaction.

C)is what a person gets from a good.

D)all of the above.

A)used to mean happiness.

B)used to mean satisfaction.

C)is what a person gets from a good.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

An increase in the interest rate can cause an income effect by:

A)making future consumption cheaper.

B)changing real income in year two.

C)making present consumption cheaper.

D)all of the above.

A)making future consumption cheaper.

B)changing real income in year two.

C)making present consumption cheaper.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

An increase in the interest rate:

A)makes future consumption more expensive.

B)decreases future income.

C)makes present consumption more expensive.

D)all of the above.

A)makes future consumption more expensive.

B)decreases future income.

C)makes present consumption more expensive.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

If the present value of assets at the end of year two is constant, an increase in the present value of sources of funds must cause:

A)consumption in periods one and two to rise.

B)consumption in periods one and two to fall.

C)consumption to rise in period one and fall in period two.

D)consumption to fall in period one and rise in period two.

A)consumption in periods one and two to rise.

B)consumption in periods one and two to fall.

C)consumption to rise in period one and fall in period two.

D)consumption to fall in period one and rise in period two.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

Show the relationship between the household budget constraint and net national product.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

If the household budget constraint is aggregated over all household, it shows that:

A)consumption plus net investment equal net national product.

B)consumption plus net investment equals real GDP less depreciation.

C)C + K = Y -

K = Y -  K

K

D)all of the above.

A)consumption plus net investment equal net national product.

B)consumption plus net investment equals real GDP less depreciation.

C)C +

K = Y -

K = Y -  K

KD)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

In the multi-year budget constraint the present value of consumption equals the value of initial assets plus the:

A)present value of savings.

B)present value of final assets.

C)present value of wage incomes.

D)the present value of time.

A)present value of savings.

B)present value of final assets.

C)present value of wage incomes.

D)the present value of time.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

The marginal propensity to consume out of a temporary change in income is approximately:

A)1

B)0.5

C)0

D)none of the above.

A)1

B)0.5

C)0

D)none of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

The marginal propensity to save out of a permanent change in income is approximately:

A)1

B)0.5

C)0

D)none of the above.

A)1

B)0.5

C)0

D)none of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

An intertemporal substitution effect is caused by a change in:

A)a price from one period to another.

B)wealth.

C)income.

D)all of the above.

A)a price from one period to another.

B)wealth.

C)income.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

The marginal propensity to save out of a temporary change in income is approximately:

A)1

B)0.5

C)0

D)none of the above.

A)1

B)0.5

C)0

D)none of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

What are the effects of an increase in the interest rate on the choice of consumption over time?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

If the household budget constraint is aggregated over all household, it shows that:

A)consumption less net investment equal net national product.

B)consumption plus net investment equals real GDP less depreciation.

C)C - K = Y +

K = Y +  K

K

D)all of the above.

A)consumption less net investment equal net national product.

B)consumption plus net investment equals real GDP less depreciation.

C)C -

K = Y +

K = Y +  K

KD)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

An increase in the interest rate:

A)makes future consumption more expensive.

B)increases future income.

C)makes present consumption cheaper.

D)all of the above.

A)makes future consumption more expensive.

B)increases future income.

C)makes present consumption cheaper.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

Derive the household's two period real budget constraint.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

If a worker gets a promotion that doubles their salary, with the increase in salary we would expect them to:

A)save most of it.

B)reject it.

C)consume most of it.

D)consume half of it and save half of it.

A)save most of it.

B)reject it.

C)consume most of it.

D)consume half of it and save half of it.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

The marginal propensity to consume out of a permanent change in income is approximately:

A)1

B)0.5

C)0

D)none of the above.

A)1

B)0.5

C)0

D)none of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

If the household budget constraint is aggregated over all household, it shows that:

A)consumption plus net investment equal net national product.

B)consumption less net investment equals real GDP less depreciation.

C)C - K = Y +

K = Y +  K.

K.

D)all of the above.

A)consumption plus net investment equal net national product.

B)consumption less net investment equals real GDP less depreciation.

C)C -

K = Y +

K = Y +  K.

K.D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

If a worker receives a onetime bonus we would expect them to:

A)save most of it.

B)refuse it.

C)consume most of it.

D)consume half and save half of it.

A)save most of it.

B)refuse it.

C)consume most of it.

D)consume half and save half of it.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

What is an intertemporal substitution effect and what can cause one?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

If a worker receives a bonus every Christmas, we would expect them to:

A)save most of it.

B)reject it.

C)consume most of it.

D)consume half of it and save half of it.

A)save most of it.

B)reject it.

C)consume most of it.

D)consume half of it and save half of it.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

If a person wins €500 in a scratch-off lottery game, we would expect them to:

A)save most of it.

B)refuse it.

C)consume most of it.

D)consume half and save half of it.

A)save most of it.

B)refuse it.

C)consume most of it.

D)consume half and save half of it.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

If the household budget constraint is aggregated over all household, it shows that:

A)profit is zero.

B)PC+ B+P•

B+P•  K =

K =  + wL + i(B + PK),

+ wL + i(B + PK),

C)C + K = Y -

K = Y -  K

K

D)all of the above.

A)profit is zero.

B)PC+

B+P•

B+P•  K =

K =  + wL + i(B + PK),

+ wL + i(B + PK),C)C +

K = Y -

K = Y -  K

KD)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

What is an income effect and what can cause one?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck