Deck 7: Markets, Prices, Supply, and Demand

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 7: Markets, Prices, Supply, and Demand

1

The household real budget constraint shows that household real consumption is equal to household real income plus household real saving.

False

2

Real profit equals real output plus spending on capital and labour inputs.

False

3

The market clearing approach assumes that:

A)people are able to affect prices that influence their decisions.

B)prices adjust to clear markets.

C)firms are able to affect prices that influence their decisions.

D)all of the above.

A)people are able to affect prices that influence their decisions.

B)prices adjust to clear markets.

C)firms are able to affect prices that influence their decisions.

D)all of the above.

prices adjust to clear markets.

4

In the goods market in the model of this chapter households can buy:

A)bonds.

B)goods to increase their stock of capital.

C)labour services.

D)all of the above.

A)bonds.

B)goods to increase their stock of capital.

C)labour services.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

The labour market clears when:

A)the real wage causes LS = LD.

B)the real wage causes LS to be minimized.

C)the marginal product of labour is zero.

D)the real wage causes LS to be as large as possible.

A)the real wage causes LS = LD.

B)the real wage causes LS to be minimized.

C)the marginal product of labour is zero.

D)the real wage causes LS to be as large as possible.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

The real wage is:

A)hourly earning after taxes.

B)wages plus fringe benefits.

C)the value of a worker's time in goods received.

D)the price level divided by the nominal wage rate.

A)hourly earning after taxes.

B)wages plus fringe benefits.

C)the value of a worker's time in goods received.

D)the price level divided by the nominal wage rate.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Money in the model of this chapter is held because:

A)for its own sake.

B)to trade fairly soon for something else.

C)to earn interest.

D)all of the above.

A)for its own sake.

B)to trade fairly soon for something else.

C)to earn interest.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

In the model of this chapter prices like the real wage adjust to clear markets like the labour market.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

In the rental market in the model of this chapter, households buy and sell:

A)real estate.

B)consumer durables like cars.

C)the use of capital for one period.

D)all of the above.

A)real estate.

B)consumer durables like cars.

C)the use of capital for one period.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

A bond that is traded in the bond market in the model of this chapter is piece of paper that:

A)is the lenders claim to the amount owed by the borrower.

B)is the borrowers claim to the amount owed by the lender.

C)is the lenders claim to ownership in the company.

D)assures the person is who they say they are.

A)is the lenders claim to the amount owed by the borrower.

B)is the borrowers claim to the amount owed by the lender.

C)is the lenders claim to ownership in the company.

D)assures the person is who they say they are.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

The market clearing approach assumes that:

A)people are not able to affect prices that influence their decisions.

B)prices change very slowly.

C)firms are able to affect prices that influence their decisions.

D)all of the above.

A)people are not able to affect prices that influence their decisions.

B)prices change very slowly.

C)firms are able to affect prices that influence their decisions.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

The goods market the price, P, is:

A)the price level.

B)the rental price of goods.

C)the price of a particular good.

D)the interest rate.

A)the price level.

B)the rental price of goods.

C)the price of a particular good.

D)the interest rate.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

Money in the model of this chapter is:

A)gold.

B)a medium of exchange.

C)interest earning.

D)all of the above.

A)gold.

B)a medium of exchange.

C)interest earning.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

If a household has ¥2,000 in money and the price level is 10, then the real value of its money is:

A)¥10.

B)¥20,000.

C)200 goods.

D)1,900 goods.

A)¥10.

B)¥20,000.

C)200 goods.

D)1,900 goods.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

The market clearing approach assumes that:

A)people are able to affect prices that influence their decisions.

B)prices change very slowly.

C)firms are not able to affect prices that influence their decisions.

D)all of the above.

A)people are able to affect prices that influence their decisions.

B)prices change very slowly.

C)firms are not able to affect prices that influence their decisions.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

Bond holdings and interest income are zero for the whole economy.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

In the model of this chapter the nominal rate of return on capital, (R/P) -  is greater than the nominal return on bonds, i, because capital is viewed by households as more risky than bonds.

is greater than the nominal return on bonds, i, because capital is viewed by households as more risky than bonds.

is greater than the nominal return on bonds, i, because capital is viewed by households as more risky than bonds.

is greater than the nominal return on bonds, i, because capital is viewed by households as more risky than bonds.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

The market clearing approach assumes that:

A)people are not able to affect prices that influence their decisions.

B)prices adjust to clear markets.

C)firms are not able to affect prices that influence their decisions.

D)all of the above.

A)people are not able to affect prices that influence their decisions.

B)prices adjust to clear markets.

C)firms are not able to affect prices that influence their decisions.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

If the nominal wage rate is £10 per hour and the price level is 2, then the real wage a worker earns is:

A)five units of goods per hour.

B)eight units of goods per hour.

C)twenty units of goods per hour.

D)one-fifth unit of goods per hour.

A)five units of goods per hour.

B)eight units of goods per hour.

C)twenty units of goods per hour.

D)one-fifth unit of goods per hour.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

One unit of money in the model of this chapter has a purchasing power of:

A)the price level time that one unit, P.

B)the price level over the interest rate, (P/i).

C)the interest rate, i.

D)one over the price level, (1/P)

A)the price level time that one unit, P.

B)the price level over the interest rate, (P/i).

C)the interest rate, i.

D)one over the price level, (1/P)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

According to the household nominal budget constraint, PC+  B+P•

B+P•  K =

K =  + wL + i(B + PK), households can use their income to:

+ wL + i(B + PK), households can use their income to:

A)purchase consumption goods.

B)acquire more bonds.

C)purchase capital goods.

D)all of the above.

B+P•

B+P•  K =

K =  + wL + i(B + PK), households can use their income to:

+ wL + i(B + PK), households can use their income to:A)purchase consumption goods.

B)acquire more bonds.

C)purchase capital goods.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

In the market clearing model, for the whole economy interest income is:

A)bonds minus the interest rate.

B)zero.

C)the interest rate divided by bonds.

D)bonds divided by the interest rate.

A)bonds minus the interest rate.

B)zero.

C)the interest rate divided by bonds.

D)bonds divided by the interest rate.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

The maturity of a bond is:

A)the amount of interest paid each period.

B)the amount borrowed.

C)the amount of interest paid over the term of the bond.

D)the time at which the lender must be paid back.

A)the amount of interest paid each period.

B)the amount borrowed.

C)the amount of interest paid over the term of the bond.

D)the time at which the lender must be paid back.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

According to the household nominal budget constraint, PC+  B+P•

B+P•  K =

K =  + wL + i(B + PK), households can use their income to:

+ wL + i(B + PK), households can use their income to:

A)hire more workers.

B)acquire more money.

C)purchase capital goods.

D)all of the above.

B+P•

B+P•  K =

K =  + wL + i(B + PK), households can use their income to:

+ wL + i(B + PK), households can use their income to:A)hire more workers.

B)acquire more money.

C)purchase capital goods.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

Interest income is:

A)positive for net bond holders.

B)zero for the whole economy.

C)negative for net bond issuers.

D)all of the above.

A)positive for net bond holders.

B)zero for the whole economy.

C)negative for net bond issuers.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

Individual household nominal income includes:

A)nominal interest income, iB.

B)nominal net rental income, [(R/P) -![<strong>Individual household nominal income includes:</strong> A)nominal interest income, iB. B)nominal net rental income, [(R/P) - PK]•PK. C)nominal wage income, wL. D)all of the above.](https://d2lvgg3v3hfg70.cloudfront.net/TB8790/11eb7ff0_af79_1aab_8992_f3025cbfe36f_TB8790_11.jpg) PK]•PK.

PK]•PK.

C)nominal wage income, wL.

D)all of the above.

A)nominal interest income, iB.

B)nominal net rental income, [(R/P) -

![<strong>Individual household nominal income includes:</strong> A)nominal interest income, iB. B)nominal net rental income, [(R/P) - PK]•PK. C)nominal wage income, wL. D)all of the above.](https://d2lvgg3v3hfg70.cloudfront.net/TB8790/11eb7ff0_af79_1aab_8992_f3025cbfe36f_TB8790_11.jpg) PK]•PK.

PK]•PK.C)nominal wage income, wL.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

If the principal of a bond is €1000, it matures in a year and the interest rate is 6%, then at the end of the year the lender will receive:

A)€1000.

B)€1060.

C)€60.

D)€940.

A)€1000.

B)€1060.

C)€60.

D)€940.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

If the principal of a bond is €100, it matures in a year and the interest rate is 4%, then at the interest payment on this bond will be:

A)€100.

B)€96.

C)€4.

D)€400.

A)€100.

B)€96.

C)€4.

D)€400.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

The rental price of capital is:

A)a dollar (euro, etc.) amount per unit of capital.

B)a real interest rate.

C)a nominal interest rate

D)profit.

A)a dollar (euro, etc.) amount per unit of capital.

B)a real interest rate.

C)a nominal interest rate

D)profit.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

If a household this week produces 20 of its product at a cost of 50 cents each, sells them for €1, works 40 hours at £10 per hour, must pay £10 in interest owed on its borrowing and rents out 10 units of capital at £100 for the week, the household's, nominal income is:

A)£1,440 this week.

B)£1,400 this week.

C)£1,420 this week.

D)none of the above.

A)£1,440 this week.

B)£1,400 this week.

C)£1,420 this week.

D)none of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

The profit in the model is:

A)output - (wages times labour hired + the rental price times capital rented).

B)(price times output) divided by (wages times labour hired + the rental price times capital rented).

C)(price times output) - (wages times labour hired + the rental price times capital rented).

D)(wages times labour hired + the rental price times capital rented) - (price times output).

A)output - (wages times labour hired + the rental price times capital rented).

B)(price times output) divided by (wages times labour hired + the rental price times capital rented).

C)(price times output) - (wages times labour hired + the rental price times capital rented).

D)(wages times labour hired + the rental price times capital rented) - (price times output).

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

According to the household nominal budget constraint, PC+  B+P•

B+P•  K =

K =  + wL + i(B + PK), households can use their income to:

+ wL + i(B + PK), households can use their income to:

A)purchase consumption goods.

B)hire more workers.

C)acquire more money.

D)all of the above.

B+P•

B+P•  K =

K =  + wL + i(B + PK), households can use their income to:

+ wL + i(B + PK), households can use their income to:A)purchase consumption goods.

B)hire more workers.

C)acquire more money.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

The rate of return from owning capital is:

A)the rental price of capital, R.

B)the value of depreciation, PK.

PK.

C)the net nominal rental income, (R/P)•PK - PK.

PK.

D)the real rental price less depreciation, (R/P) - .

.

A)the rental price of capital, R.

B)the value of depreciation,

PK.

PK.C)the net nominal rental income, (R/P)•PK -

PK.

PK.D)the real rental price less depreciation, (R/P) -

.

.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

If the rental price of a capital good is £100 and the price level is 25, then when renting the capital the owner's real earnings are:

A)4 units of output per period.

B)2,500 units of output per period.

C)seventy five units of output per period.

D)one-fourth unit of output per period.

A)4 units of output per period.

B)2,500 units of output per period.

C)seventy five units of output per period.

D)one-fourth unit of output per period.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

According to the household nominal budget constraint, PC+  B+P•

B+P•  K =

K =  + wL + i(B + PK), households can use their income to:

+ wL + i(B + PK), households can use their income to:

A)acquire more money.

B)acquire more bonds.

C)pay more wages.

D)all of the above.

B+P•

B+P•  K =

K =  + wL + i(B + PK), households can use their income to:

+ wL + i(B + PK), households can use their income to:A)acquire more money.

B)acquire more bonds.

C)pay more wages.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

In the model the nominal interest rate equals the nominal net return on capital, i = (R/P) -  , because:

, because:

A)other than rates of return bonds and capital look the same to households as assets.

B)capital is riskier than bonds.

C)bonds are riskier than capital.

D)bonds are zero in the aggregate.

, because:

, because:A)other than rates of return bonds and capital look the same to households as assets.

B)capital is riskier than bonds.

C)bonds are riskier than capital.

D)bonds are zero in the aggregate.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

The principal of a bond is:

A)the amount of interest paid each period.

B)the initial amount borrowed.

C)the amount of interest paid over the term of the bond.

D)the total amount to be paid back including the amount borrow and the amount of interest paid over the term of the bond.

A)the amount of interest paid each period.

B)the initial amount borrowed.

C)the amount of interest paid over the term of the bond.

D)the total amount to be paid back including the amount borrow and the amount of interest paid over the term of the bond.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

In the model the nominal interest rate equals the nominal net return on capital, i = (R/P) -  , because:

, because:

A)bonds are zero in the aggregate.

B)capital is riskier than bonds.

C)bonds are riskier than capital.

D)if bonds offered a higher return than capital households would hold no capital.

, because:

, because:A)bonds are zero in the aggregate.

B)capital is riskier than bonds.

C)bonds are riskier than capital.

D)if bonds offered a higher return than capital households would hold no capital.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

Over all household's bonds, B, must total zero because:

A)there are no bonds in the model.

B)for every dollar loaned a dollar is borrowed in the bond market.

C)bonds are not important in the model.

D)bonds are illegal in most economies.

A)there are no bonds in the model.

B)for every dollar loaned a dollar is borrowed in the bond market.

C)bonds are not important in the model.

D)bonds are illegal in most economies.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

The household real budget constraint C + (  B/P) +

B/P) +  K = (

K = (  /P)+ (w/P)•L + i•((B/P) + K). shows that in our model:

/P)+ (w/P)•L + i•((B/P) + K). shows that in our model:

A)households get income only from labour.

B)households can spend their income on consumption or acquiring more capital and bonds.

C)households can spend their income only on consumption.

D)households view bonds as riskier than capital.

B/P) +

B/P) +  K = (

K = (  /P)+ (w/P)•L + i•((B/P) + K). shows that in our model:

/P)+ (w/P)•L + i•((B/P) + K). shows that in our model:A)households get income only from labour.

B)households can spend their income on consumption or acquiring more capital and bonds.

C)households can spend their income only on consumption.

D)households view bonds as riskier than capital.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

In the market clearing model, nominal saving is:

A)always zero.

B)nominal income less nominal consumption.

C)nominal income - depreciation of capital.

D)all of the above.

A)always zero.

B)nominal income less nominal consumption.

C)nominal income - depreciation of capital.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

To maximize profit a firm should hire labour:

A)until it can produce no more of its product.

B)until the marginal product of labour begins to fall.

C)until the marginal product of labour equal the real wage rate.

D)until the marginal product of labour is zero.

A)until it can produce no more of its product.

B)until the marginal product of labour begins to fall.

C)until the marginal product of labour equal the real wage rate.

D)until the marginal product of labour is zero.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

In the market clearing model, nominal saving is:

A)the change in money + the change in bonds + the change in the nominal value of capital.

B)nominal income plus nominal saving.

C)always zero.

D)all of the above.

A)the change in money + the change in bonds + the change in the nominal value of capital.

B)nominal income plus nominal saving.

C)always zero.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

In the model why does the return on bonds, i, equal the return on capital, (R/P) -  ?

?

?

?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

Real saving is:

A) + wL + i(B + PK) - PC.

+ wL + i(B + PK) - PC.

B)output plus consumption.

C)( /P) + (w/P)L + i((B/P) + K) - C.

/P) + (w/P)L + i((B/P) + K) - C.

D)all of the above.

A)

+ wL + i(B + PK) - PC.

+ wL + i(B + PK) - PC.B)output plus consumption.

C)(

/P) + (w/P)L + i((B/P) + K) - C.

/P) + (w/P)L + i((B/P) + K) - C.D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

In the market clearing model, nominal saving is:

A)the change in money + the change in bonds.

B)nominal income plus nominal consumption.

C) + wL + i(B + PK) - PC.

+ wL + i(B + PK) - PC.

D)all of the above.

A)the change in money + the change in bonds.

B)nominal income plus nominal consumption.

C)

+ wL + i(B + PK) - PC.

+ wL + i(B + PK) - PC.D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

In the market clearing model, the demand for capital and labour come from:

A)the tastes of people.

B)rental and labour markets.

C)the objective of profit maximizing.

D)all of the above.

A)the tastes of people.

B)rental and labour markets.

C)the objective of profit maximizing.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

How is profit calculated in the model?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

To maximize profit a firm should hire capital:

A)until it can produce no more of its product.

B)until the marginal product of labour begins to fall.

C)until the marginal product of capital equal the real rental price of capital.

D)until the marginal product of capital is zero.

A)until it can produce no more of its product.

B)until the marginal product of labour begins to fall.

C)until the marginal product of capital equal the real rental price of capital.

D)until the marginal product of capital is zero.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

What causes the labour and capital markets to clear in the model of this chapter?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

In the market clearing model:

A)households can owe pay interest.

B)households can earn interest.

C)for the whole economy interest income is zero.

D)all of the above.

A)households can owe pay interest.

B)households can earn interest.

C)for the whole economy interest income is zero.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

In the market clearing model, nominal saving is:

A)the change in money + the change in bonds + the change in the nominal value of capital.

B)nominal income less nominal consumption.

C) + wL + i(B + PK) - PC.

+ wL + i(B + PK) - PC.

D)all of the above.

A)the change in money + the change in bonds + the change in the nominal value of capital.

B)nominal income less nominal consumption.

C)

+ wL + i(B + PK) - PC.

+ wL + i(B + PK) - PC.D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

An investment in the model of this chapter is:

A)the purchase of a bond.

B)the purchase of ownership in a firm.

C)the purchase of a capital good used for production.

D)all of the above.

A)the purchase of a bond.

B)the purchase of ownership in a firm.

C)the purchase of a capital good used for production.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

What is the household real budget constraint and what does it tell us?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

What is real profit in the model of this chapter?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

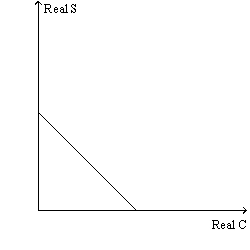

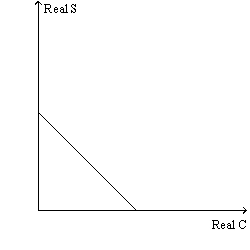

Figure 6.1

In Figure 6.1 an increase in real income is shown by:

A)a shift of the curve up and to the right.

B)rotating the curve out the real consumption axis.

C)a shift of the curve inward and to the left.

D)rotating the curve up the real saving axis.

In Figure 6.1 an increase in real income is shown by:

A)a shift of the curve up and to the right.

B)rotating the curve out the real consumption axis.

C)a shift of the curve inward and to the left.

D)rotating the curve up the real saving axis.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

The household real budget constraint C + (  B/P) +

B/P) +  K = (

K = (  /P) + (w/P)•L + i•((B/P) + K). shows that in our model:

/P) + (w/P)•L + i•((B/P) + K). shows that in our model:

A)households get income only from labour.

B)households can spend their income only on consumption.

C)households get income from profits from production, labour and interest on bonds and capital.

D)households view bonds as riskier than capital.

B/P) +

B/P) +  K = (

K = (  /P) + (w/P)•L + i•((B/P) + K). shows that in our model:

/P) + (w/P)•L + i•((B/P) + K). shows that in our model:A)households get income only from labour.

B)households can spend their income only on consumption.

C)households get income from profits from production, labour and interest on bonds and capital.

D)households view bonds as riskier than capital.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

The household's budget constraint shows that:

A)sources of fund = uses of funds.

B)profits are the largest part of income

C)labour income is the largest part of income.

D)consumption is the largest part of spending.

A)sources of fund = uses of funds.

B)profits are the largest part of income

C)labour income is the largest part of income.

D)consumption is the largest part of spending.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

In the market clearing model, depreciation,  , is:

, is:

A)the rate at which capital disappears.

B)the rate at which money loses value.

C)the rate at which bonds lose value.

D)all of the above.

, is:

, is:A)the rate at which capital disappears.

B)the rate at which money loses value.

C)the rate at which bonds lose value.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

In the market for capital services:

A)the supply of capital adjusts to create market clearing.

B)the real rental price of capital adjusts to create market clearing.

C)the demand for capital adjusts to create market clearing.

D)all of the above.

A)the supply of capital adjusts to create market clearing.

B)the real rental price of capital adjusts to create market clearing.

C)the demand for capital adjusts to create market clearing.

D)all of the above.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck