Deck 9: Financial Planning and Analysis: the Master Budget

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/45

Play

Full screen (f)

Deck 9: Financial Planning and Analysis: the Master Budget

1

Explain how a budget facilitates communication and coordination.

Budget as a tool for communication and co-ordination:

Every organization tries to be effective in achieving its goals. This required all the members of the organization to work together. For this purposes each employee and each manager must be aware of the plans made of other manager. The budgeting process helps in making this possible as it consolidates the plans of each manager.

In this context coordination and communication play an important role.

In other words, the budget facilitates 'coordination' and 'communication'.

The budget facilitates;

-Coordination can be attained by means of consolidation of all the potential factors of the blue print (budget).

-'Communication' by making all the members of the organization i.e., managers and employees understand and accept the objectives of the organization.

Every organization tries to be effective in achieving its goals. This required all the members of the organization to work together. For this purposes each employee and each manager must be aware of the plans made of other manager. The budgeting process helps in making this possible as it consolidates the plans of each manager.

In this context coordination and communication play an important role.

In other words, the budget facilitates 'coordination' and 'communication'.

The budget facilitates;

-Coordination can be attained by means of consolidation of all the potential factors of the blue print (budget).

-'Communication' by making all the members of the organization i.e., managers and employees understand and accept the objectives of the organization.

2

Use an example to explain how a budget could be used to allocate resources in a university.

The main sources of income for university are from fees receipts, exam fees, interest on investments etc., and the expenses are salary and general expenses of each department in the university, expenses on co-curricular activities, rent of building bank charges etc.

1. Using budget, the university can estimate the cash inflow and outflow for the budget period. Cash requirement can be estimated.

2. Budget is a useful tool for a university to calculate its estimated expenditure and compare the actual activity.

3. Using budget, university can improve the cost effectiveness and cost reduction as prediction of the inflation rate, the interest rate and tuition level can be incorporated in the budgets.

1. Using budget, the university can estimate the cash inflow and outflow for the budget period. Cash requirement can be estimated.

2. Budget is a useful tool for a university to calculate its estimated expenditure and compare the actual activity.

3. Using budget, university can improve the cost effectiveness and cost reduction as prediction of the inflation rate, the interest rate and tuition level can be incorporated in the budgets.

3

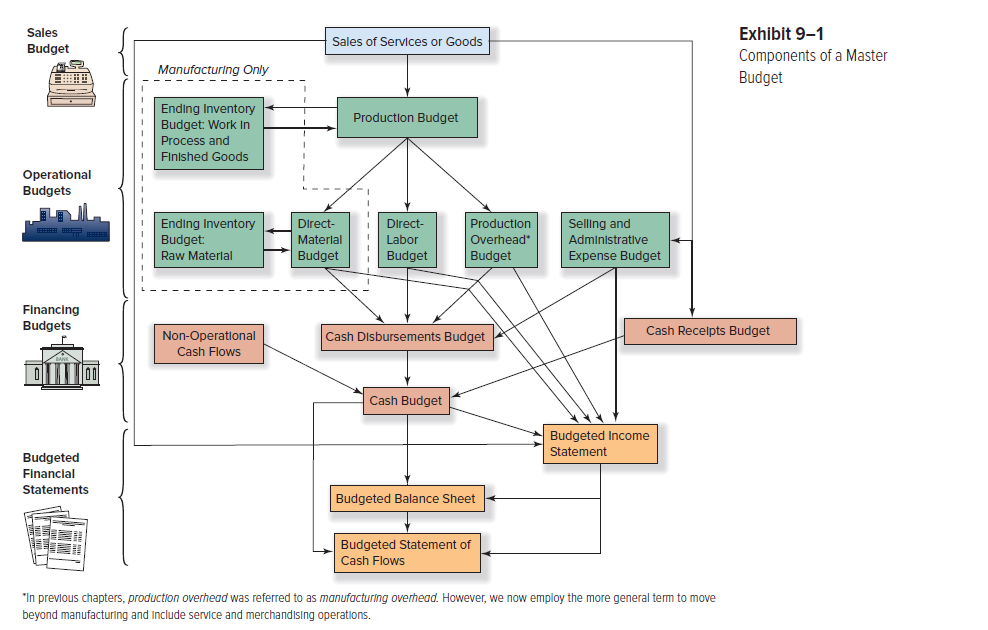

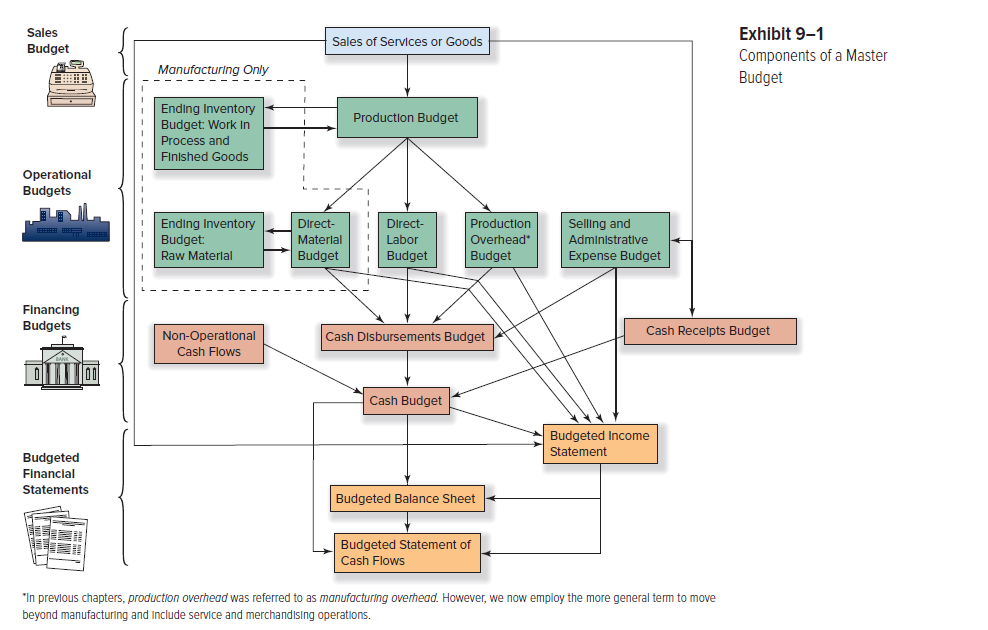

Explain what a master budget is, and list five of its parts.

Master budget:

A 'Master Budget' is a comprehensive set of budgets covering all phases of an organization operation for a specific period of time, generally one financial year.

It is a comprehensive expression of management's operating and financial plans for a future period which are summarized into a set of financial statements.

The master budget takes into account the following decisions:

a) Operating decision - concerned with the use of scarce resources; and

b) Financial decision - concerned with how to procure funds to acquire the scarce resources stated in the operating decisions.

Parts of the master budget are as follows:

1) Budgeted balance sheet

2) Budgeted income statement

3) Budgeted cash flows

4) Cash budget

5) Operational budgets like Direct Material Budget, Direct Labor Budget, and Overhead Budget etc.

A 'Master Budget' is a comprehensive set of budgets covering all phases of an organization operation for a specific period of time, generally one financial year.

It is a comprehensive expression of management's operating and financial plans for a future period which are summarized into a set of financial statements.

The master budget takes into account the following decisions:

a) Operating decision - concerned with the use of scarce resources; and

b) Financial decision - concerned with how to procure funds to acquire the scarce resources stated in the operating decisions.

Parts of the master budget are as follows:

1) Budgeted balance sheet

2) Budgeted income statement

3) Budgeted cash flows

4) Cash budget

5) Operational budgets like Direct Material Budget, Direct Labor Budget, and Overhead Budget etc.

4

Draw a flowchart similar to the one in Exhibit 9-1 for a service station. The service station provides automotive maintenance services in addition to selling gasoline and related products.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

5

Give an example of how general economic trends would affect sales forecasting in the airline industry.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

6

How does activity-based budgeting explain the logic of budgeting?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

7

How does e-budgeting make use of the Internet?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

8

Give three examples of how the City of Boston could use a budget for planning purposes.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

9

Describe the role of a budget director.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

10

What is the purpose of a budget manual?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

11

How can a company's board of directors use the budget to influence the future direction of the firm?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

12

Discuss the importance of predictions and assumptions in the budgeting process.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

13

Define the term budgetary slack, and briefly describe a problem it can cause.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

14

How can an organization help to reduce the problems caused by budgetary slack?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

15

Why is participative budgeting often an effective management tool?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

16

Discuss this comment by a small-town bank president: "Budgeting is a waste of time. I've been running this business for 40 years. I don't need to plan."

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

17

List the steps you would go through in developing a budget to meet your college expenses.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

18

Briefly describe three issues that create special challenges for multinational firms in preparing their budgets.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

19

What are the primary differences in budgeting between manufacturing and nonmanufacturing firms?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

20

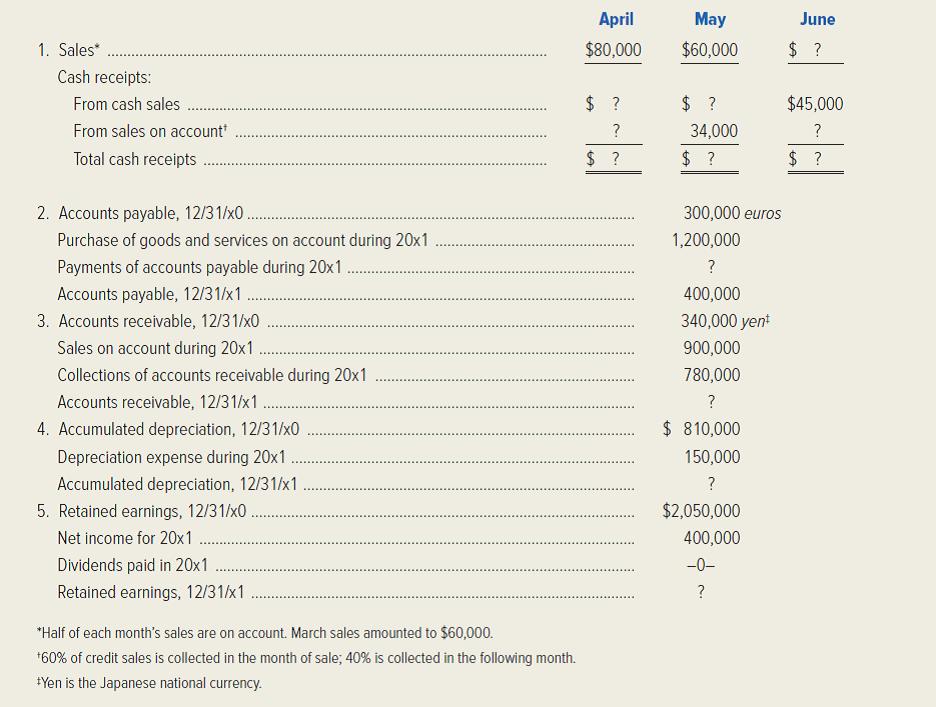

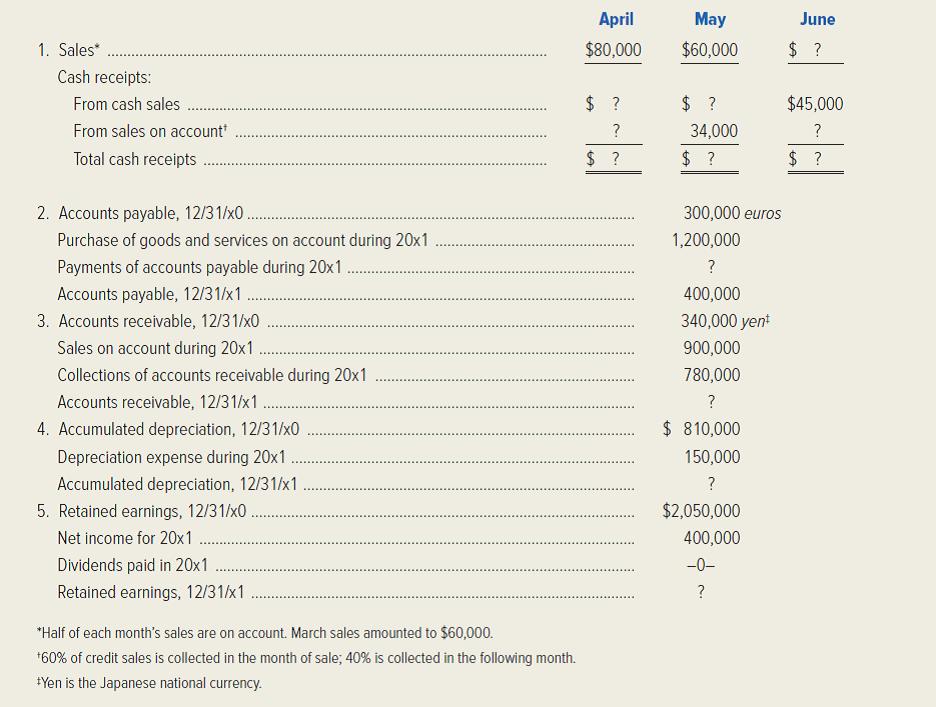

Fill in the missing amounts in the following schedules.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

21

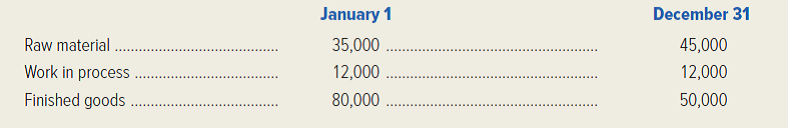

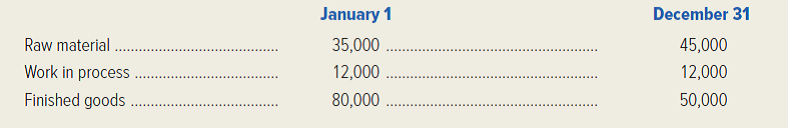

Bodin Company budgets on an annual basis. The following beginning and ending inventory levels (in units) are plannned for the year 20x1. Two units of raw material are required to produce each unit of finished product.

Required:

1. If Bodin Company plans to sell 480,000 units during the year, compute the number of units the firm would have to manufacture during the year.

2. If 500,000 finished units were to be manufactured by Bodin Company during the year, determine the amount of raw material to be purchased.

(CMA, adapted)

Required:

1. If Bodin Company plans to sell 480,000 units during the year, compute the number of units the firm would have to manufacture during the year.

2. If 500,000 finished units were to be manufactured by Bodin Company during the year, determine the amount of raw material to be purchased.

(CMA, adapted)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

22

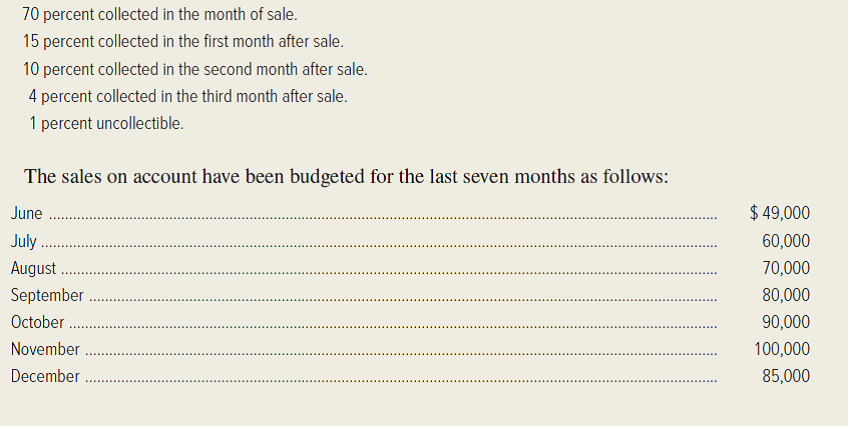

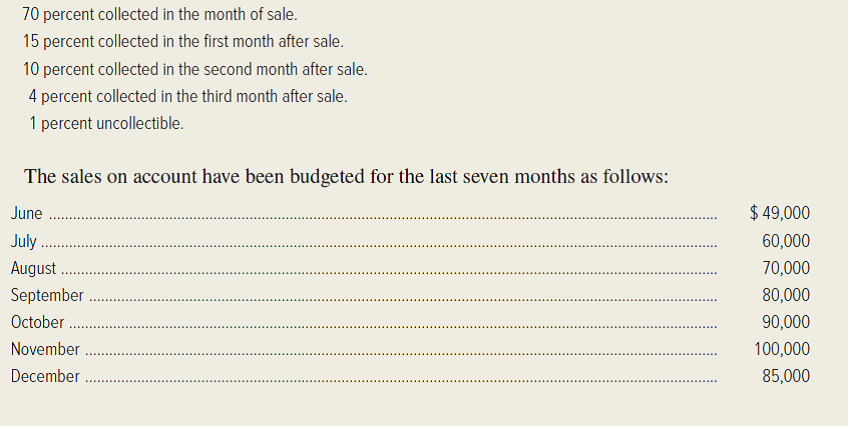

Coyote Loco, Inc., a distributor of salsa, has the following historical collection pattern for its credit sales.

Required:

1. Compute the estimated total cash collections during October from credit sales.

2. Compute the estimated total cash collections during the fourth quarter from sales made on account during the fourth quarter.

3. Build a spreadsheet: Construct an Excel spreadsheet to solve both of the preceding requirements. Show how the solution will change if the following information changes: sales in June and July were $50,000 and $65,000, respectively.

(CMA, adapted)

Required:

1. Compute the estimated total cash collections during October from credit sales.

2. Compute the estimated total cash collections during the fourth quarter from sales made on account during the fourth quarter.

3. Build a spreadsheet: Construct an Excel spreadsheet to solve both of the preceding requirements. Show how the solution will change if the following information changes: sales in June and July were $50,000 and $65,000, respectively.

(CMA, adapted)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

23

Greener Grass Fertilizer Company plans to sell 200,000 units of finished product in July and anticipates a growth rate in sales of 5 percent per month. The desired monthly ending inventory in units of finished product is 80 percent of the next month's estimated sales. There are 160,000 finished units in inventory on June 30. Each unit of finished product requires four pounds of raw material at a cost of $1.15 per pound. There are 700,000 pounds of raw material in inventory on June 30.

Required:

1. Compute the company's total required production in units of finished product for the entire three-month period ending September 30.

2. Independent of your answer to requirement (1), assume the company plans to produce 600,000 units of finished product in the three-month period ending September 30, and to have raw-material inventory on hand at the end of the three-month period equal to 25 percent of the use in that period. Compute the total estimated cost of raw-material purchases for the entire three-month period ending September 30.

(CMA, adapted)

Required:

1. Compute the company's total required production in units of finished product for the entire three-month period ending September 30.

2. Independent of your answer to requirement (1), assume the company plans to produce 600,000 units of finished product in the three-month period ending September 30, and to have raw-material inventory on hand at the end of the three-month period equal to 25 percent of the use in that period. Compute the total estimated cost of raw-material purchases for the entire three-month period ending September 30.

(CMA, adapted)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

24

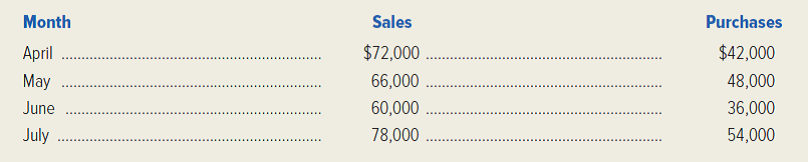

The following information is from Tejas WindowTint's financial records.

Collections from customers are normally 70 percent in the month of sale, 20 percent in the month following the sale, and 9 percent in the second month following the sale. The balance is expected to be uncollectible. All purchases are on account. Management takes full advantage of the 2 percent discount allowed on purchases paid for by the tenth of the following month. Purchases for August are budgeted at $60,000, and sales for August are forecasted at $66,000. Cash disbursements for expenses are expected to be $14,400 for the month of August. The company's cash balance on August 1 was $22,000.

Required: Prepare the following schedules.

1. Expected cash collections during August.

2. Expected cash disbursements during August.

3. Expected cash balance on August 31.

Collections from customers are normally 70 percent in the month of sale, 20 percent in the month following the sale, and 9 percent in the second month following the sale. The balance is expected to be uncollectible. All purchases are on account. Management takes full advantage of the 2 percent discount allowed on purchases paid for by the tenth of the following month. Purchases for August are budgeted at $60,000, and sales for August are forecasted at $66,000. Cash disbursements for expenses are expected to be $14,400 for the month of August. The company's cash balance on August 1 was $22,000.

Required: Prepare the following schedules.

1. Expected cash collections during August.

2. Expected cash disbursements during August.

3. Expected cash balance on August 31.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

25

Tanya Williams is the new accounts manager at East Bank of Mississippi. She has just been asked to project how many new bank accounts she will generate during 20x2. The economy of the county in which the bank operates has been growing, and the bank has experienced a 10 percent increase in its number of bank accounts over each of the past five years. In 20x1, the bank had 10,000 accounts.

The new accounts manager is paid a salary plus a bonus of $15 for every new account she generates above the budgeted amount. Thus, if the annual budget calls for 500 new accounts, and 540 new accounts are obtained, Williams's bonus will be $600 (40 × $15).

Williams believes the economy of the county will continue to grow at the same rate in 20x2 as it has in recent years. She has decided to submit a budgetary projection of 700 new accounts for 20x2.

Required: Your consulting firm has been hired by the bank president to make recommendations for improving its operations. Write a memorandum to the president defining and explaining the negative consequences of budgetary slack. Also discuss the bank's bonus system for the new accounts manager and how the bonus program tends to encourage budgetary slack.

The new accounts manager is paid a salary plus a bonus of $15 for every new account she generates above the budgeted amount. Thus, if the annual budget calls for 500 new accounts, and 540 new accounts are obtained, Williams's bonus will be $600 (40 × $15).

Williams believes the economy of the county will continue to grow at the same rate in 20x2 as it has in recent years. She has decided to submit a budgetary projection of 700 new accounts for 20x2.

Required: Your consulting firm has been hired by the bank president to make recommendations for improving its operations. Write a memorandum to the president defining and explaining the negative consequences of budgetary slack. Also discuss the bank's bonus system for the new accounts manager and how the bonus program tends to encourage budgetary slack.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

26

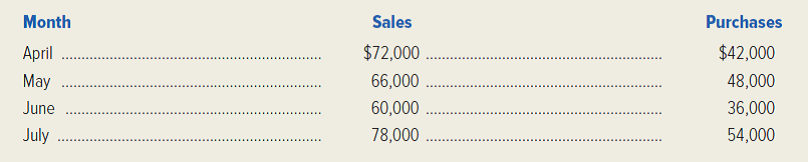

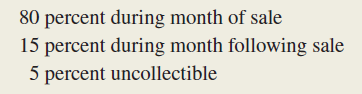

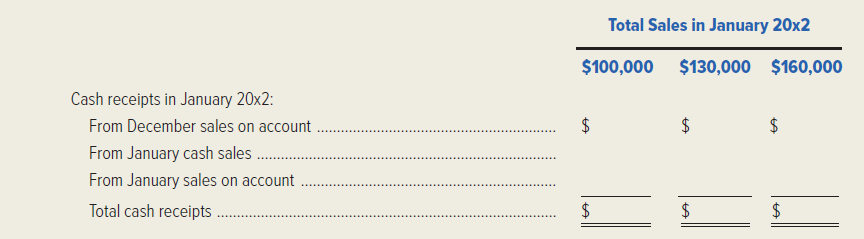

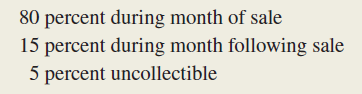

Sound Investments, Inc. is a large retailer of stereo equipment. The controller is about to prepare the budget for the first quarter of 20x2. Past experience has indicated that 75 percent of the store's sales are cash sales. The collection experience for the sales on account is as follows:

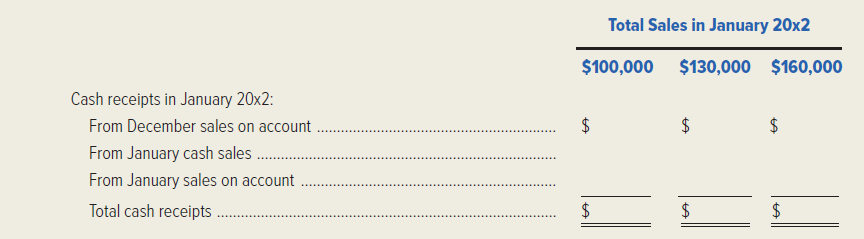

The total sales for December 20x1 are expected to be $190,000. The controller feels that sales in January 20x2 could range from $100,000 to $160,000.

Required:

1. Demonstrate how financial planning can be used to project cash receipts in January of 20x2 for three different levels of January sales. Use the following columnar format.

2. How could the controller of Sound Investments, Inc. use this financial planning approach to help in planning operations for January?

The total sales for December 20x1 are expected to be $190,000. The controller feels that sales in January 20x2 could range from $100,000 to $160,000.

Required:

1. Demonstrate how financial planning can be used to project cash receipts in January of 20x2 for three different levels of January sales. Use the following columnar format.

2. How could the controller of Sound Investments, Inc. use this financial planning approach to help in planning operations for January?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

27

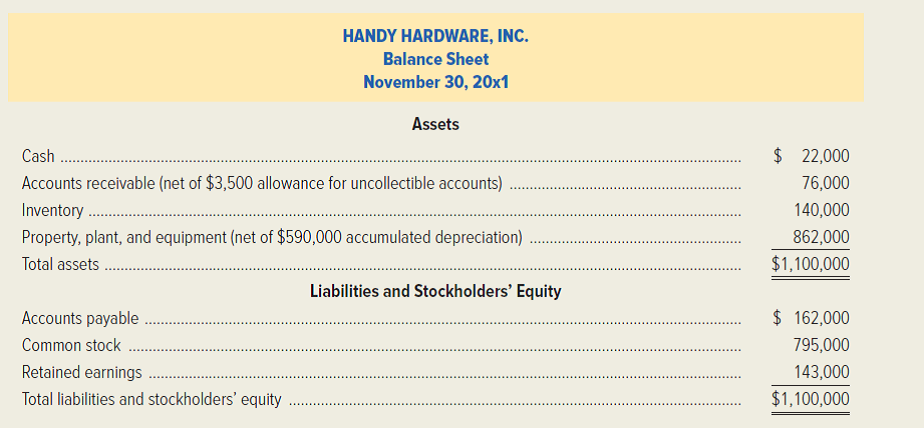

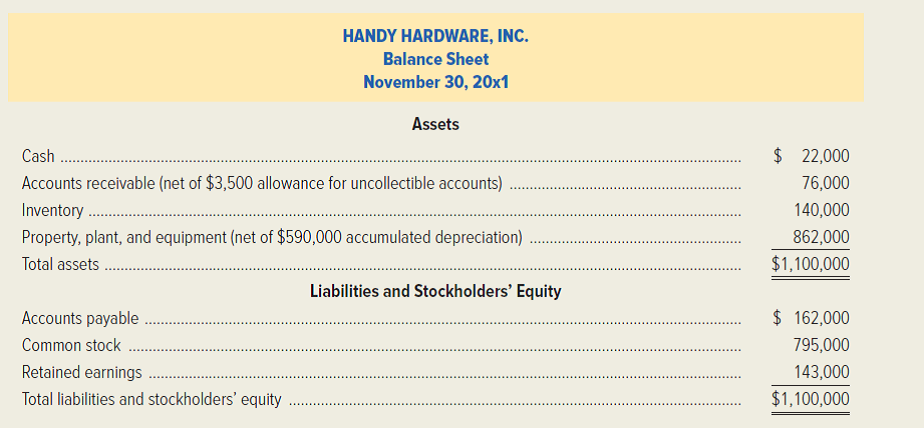

Handy Hardware is a retail hardware store. Information about the store's operations follows.

• November 20x1 sales amounted to $200,000.

• Sales are budgeted at $220,000 for December 20x1 and $200,000 for January 20x2.

• Collections are expected to be 60 percent in the month of sale and 38 percent in the month following the sale. Two percent of sales are expected to be uncollectible. Bad debts expense is recognized monthly.

• The store's gross margin is 25 percent of its sales revenue.

• A total of 80 percent of the merchandise for resale is purchased in the month prior to the month of sale, and 20 percent is purchased in the month of sale. Payment for merchandise is made in the month following the purchase.

• Other monthly expenses paid in cash amount to $22,600.

• Annual depreciation is $216,000.

The company's balance sheet as of November 30, 20x1, is as follows:

Required: Compute the following amounts.

1. The budgeted cash collections for December 20x1.

2. The budgeted income (loss) before income taxes for December 20x1.

3. The projected balance in accounts payable on December 31, 20x1.

(CMA, adapted)

• November 20x1 sales amounted to $200,000.

• Sales are budgeted at $220,000 for December 20x1 and $200,000 for January 20x2.

• Collections are expected to be 60 percent in the month of sale and 38 percent in the month following the sale. Two percent of sales are expected to be uncollectible. Bad debts expense is recognized monthly.

• The store's gross margin is 25 percent of its sales revenue.

• A total of 80 percent of the merchandise for resale is purchased in the month prior to the month of sale, and 20 percent is purchased in the month of sale. Payment for merchandise is made in the month following the purchase.

• Other monthly expenses paid in cash amount to $22,600.

• Annual depreciation is $216,000.

The company's balance sheet as of November 30, 20x1, is as follows:

Required: Compute the following amounts.

1. The budgeted cash collections for December 20x1.

2. The budgeted income (loss) before income taxes for December 20x1.

3. The projected balance in accounts payable on December 31, 20x1.

(CMA, adapted)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

28

Metropolitan Dental Associates is a large dental practice in Chicago. The firm's controller is preparing the budget for the next year. The controller projects a total of 48,000 office visits, to be evenly distributed throughout the year. Eighty percent of the visits will be half-hour appointments, and the remainder will be one-hour visits. The average rates for professional dental services are $40 for half-hour appointments and $70 for one-hour office visits. Ninety percent of each month's professional service revenue is collected during the month when services are rendered, and the remainder is collected the month following service. Uncollectible billings are negligible. Metropolitan's dental associates earn $60 per hour.

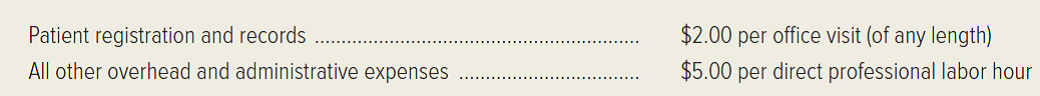

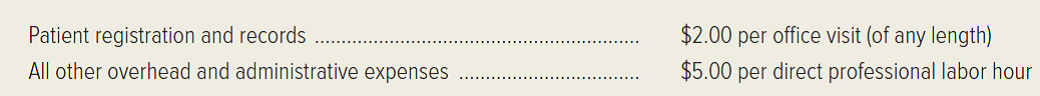

Metropolitan uses activity-based budgeting to budget office overhead and administrative expenses. Two cost drivers are used: office visits and direct professional labor. The cost-driver rates are as follows:

Required: Prepare the following budget schedules.

1. Direct-professional-labor budget for the month of June.

2. Cash collections during June for professional services rendered during May and June.

3. Overhead and administrative expense budget for the month of June.

4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following information changes: a total of 54,000 office visits are expected for the year and 70 percent of the office visits are half-hour appointments.

Metropolitan uses activity-based budgeting to budget office overhead and administrative expenses. Two cost drivers are used: office visits and direct professional labor. The cost-driver rates are as follows:

Required: Prepare the following budget schedules.

1. Direct-professional-labor budget for the month of June.

2. Cash collections during June for professional services rendered during May and June.

3. Overhead and administrative expense budget for the month of June.

4. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following information changes: a total of 54,000 office visits are expected for the year and 70 percent of the office visits are half-hour appointments.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

29

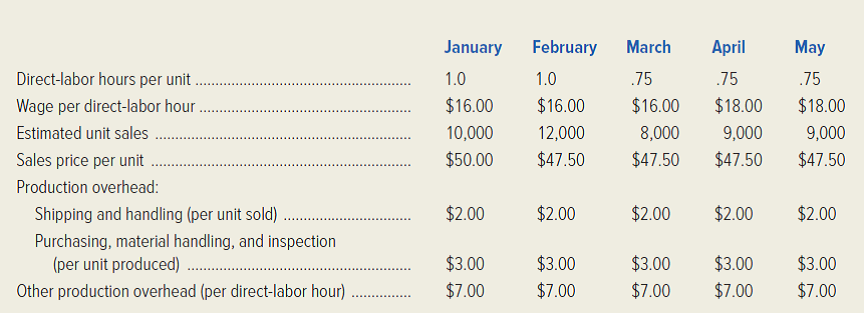

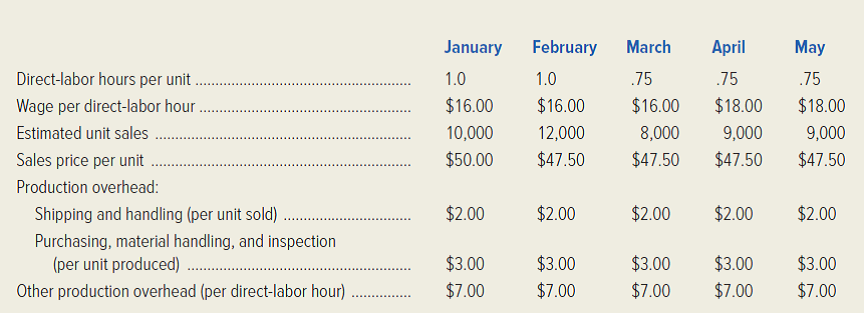

Spiffy Shades Corporation manufactures artistic frames for sunglasses. Talia Demarest, controller, is responsible for preparing the company's master budget. In compiling the budget data for 20x1, Demarest has learned that new automated production equipment will be installed on March 1. This will reduce the direct labor per frame from 1 hour to.75 hour.

Labor-related costs include pension contributions of $.50 per hour, workers' compensation insurance of $.20 per hour, employee medical insurance of $.80 per hour, and employer contributions to Social Security equal to 7 percent of direct-labor wages. The cost of employee benefits paid by the company on its employees is treated as a direct-labor cost. Spiffy Shades Corporation has a labor contract that calls for a wage increase to $18.00 per hour on April 1, 20x1. Management expects to have 16,000 frames on hand at December 31, 20x0, and has a policy of carrying an end-of-month inventory of 100 percent of the following month's sales plus 50 percent of the second following month's sales.

These and other data compiled by Demarest are summarized in the following table.

Required:

1. Prepare a production budget and a direct-labor budget for Spiffy Shades Corporation by month and for the first quarter of 20x1. Both budgets may be combined in one schedule. The direct-labor budget should include direct-labor hours and show the detail for each direct-labor cost category.

2. For each item used in the firm's production budget and direct-labor budget, identify the other components of the master budget (except for financial statement budgets) that also would, directly or indirectly, use these data.

3. Prepare a production overhead budget for each month and for the first quarter.

(CMA, adapted)

Labor-related costs include pension contributions of $.50 per hour, workers' compensation insurance of $.20 per hour, employee medical insurance of $.80 per hour, and employer contributions to Social Security equal to 7 percent of direct-labor wages. The cost of employee benefits paid by the company on its employees is treated as a direct-labor cost. Spiffy Shades Corporation has a labor contract that calls for a wage increase to $18.00 per hour on April 1, 20x1. Management expects to have 16,000 frames on hand at December 31, 20x0, and has a policy of carrying an end-of-month inventory of 100 percent of the following month's sales plus 50 percent of the second following month's sales.

These and other data compiled by Demarest are summarized in the following table.

Required:

1. Prepare a production budget and a direct-labor budget for Spiffy Shades Corporation by month and for the first quarter of 20x1. Both budgets may be combined in one schedule. The direct-labor budget should include direct-labor hours and show the detail for each direct-labor cost category.

2. For each item used in the firm's production budget and direct-labor budget, identify the other components of the master budget (except for financial statement budgets) that also would, directly or indirectly, use these data.

3. Prepare a production overhead budget for each month and for the first quarter.

(CMA, adapted)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

30

Western State University (WSU) is preparing its master budget for the upcoming academic year. Currently, 8,000 students are enrolled on campus; however, the admissions office is forecasting a 5 percent growth in the student body despite a tuition hike to $75 per credit hour. The following additional information has been gathered from an examination of university records and conversations with university officials:

• WSU is planning to award 120 tuition-free scholarships.

• The average class has 25 students, and the typical student takes 15 credit hours each semester. Each class is three credit hours.

• WSU's faculty members are evaluated on the basis of teaching, research, and university and community service. Each faculty member teaches five classes during the academic year.

Required:

1. Prepare a tuition revenue budget for the upcoming academic year.

2. Determine the number of faculty members needed to cover classes.

3. Assume there is a shortage of full-time faculty members. List at least five actions that WSU might take to accommodate the growing student body.

4. You have been requested by the university's administrative vice president (AVP) to construct budgets for other areas of operation (e.g., the library, grounds, dormitories, and maintenance). The AVP noted: "The most important resource of the university is its faculty. Now that you know the number of faculty needed, you can prepare the other budgets. Faculty members are indeed the key driver-without them we don't operate." Does the administrative vice president really understand the linkages within the budgeting process? Explain.

• WSU is planning to award 120 tuition-free scholarships.

• The average class has 25 students, and the typical student takes 15 credit hours each semester. Each class is three credit hours.

• WSU's faculty members are evaluated on the basis of teaching, research, and university and community service. Each faculty member teaches five classes during the academic year.

Required:

1. Prepare a tuition revenue budget for the upcoming academic year.

2. Determine the number of faculty members needed to cover classes.

3. Assume there is a shortage of full-time faculty members. List at least five actions that WSU might take to accommodate the growing student body.

4. You have been requested by the university's administrative vice president (AVP) to construct budgets for other areas of operation (e.g., the library, grounds, dormitories, and maintenance). The AVP noted: "The most important resource of the university is its faculty. Now that you know the number of faculty needed, you can prepare the other budgets. Faculty members are indeed the key driver-without them we don't operate." Does the administrative vice president really understand the linkages within the budgeting process? Explain.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

31

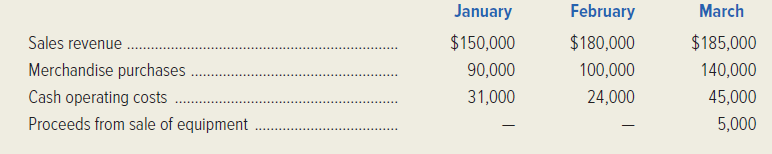

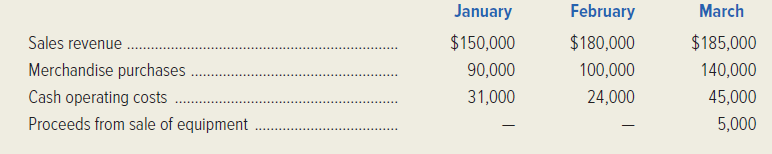

Mary and Kay, Inc., a distributor of cosmetics throughout Florida, is in the process of assembling a cash budget for the first quarter of 20x1. The following information has been extracted from the company's accounting records:

• All sales are on account. Sixty percent of customer accounts are collected in the month of sale; 35 percent are collected in the following month. Uncollectibles amounting to 5 percent of sales are anticipated, and management believes that only 20 percent of the accounts outstanding on December 31, 20x0, will be recovered and that the recovery will be in January 20x1.

• Seventy percent of the merchandise purchases are paid for in the month of purchase; the remaining 30 percent are paid for in the month after acquisition.

• The December 31, 20x0, balance sheet disclosed the following selected figures: cash, $20,000; accounts receivable, $55,000; and accounts payable, $22,000.

• Mary and Kay, Inc. maintains a $20,000 minimum cash balance at all times. Financing is available (and retired) in $1,000 multiples at an 8 percent interest rate, with borrowings taking place at the beginning of the month and repayments occurring at the end of the month. Interest is paid at the time of repaying principal and computed on the portion of principal repaid at that time.

• Additional data:

Required:

1. Prepare a schedule that discloses the firm's total cash collections for January through March.

2. Prepare a schedule that discloses the firm's total cash disbursements for January through March.

3. Prepare a schedule that summarizes the firm's financing cash flows for January through March. The schedule should present the following information in the order cited: Beginning cash balance, total receipts (from requirement (1)), total payments (from requirement (2)), the cash excess (deficiency) before financing, borrowing needed to maintain minimum balance, loan principal repaid, loan interest paid, and ending cash balance.

• All sales are on account. Sixty percent of customer accounts are collected in the month of sale; 35 percent are collected in the following month. Uncollectibles amounting to 5 percent of sales are anticipated, and management believes that only 20 percent of the accounts outstanding on December 31, 20x0, will be recovered and that the recovery will be in January 20x1.

• Seventy percent of the merchandise purchases are paid for in the month of purchase; the remaining 30 percent are paid for in the month after acquisition.

• The December 31, 20x0, balance sheet disclosed the following selected figures: cash, $20,000; accounts receivable, $55,000; and accounts payable, $22,000.

• Mary and Kay, Inc. maintains a $20,000 minimum cash balance at all times. Financing is available (and retired) in $1,000 multiples at an 8 percent interest rate, with borrowings taking place at the beginning of the month and repayments occurring at the end of the month. Interest is paid at the time of repaying principal and computed on the portion of principal repaid at that time.

• Additional data:

Required:

1. Prepare a schedule that discloses the firm's total cash collections for January through March.

2. Prepare a schedule that discloses the firm's total cash disbursements for January through March.

3. Prepare a schedule that summarizes the firm's financing cash flows for January through March. The schedule should present the following information in the order cited: Beginning cash balance, total receipts (from requirement (1)), total payments (from requirement (2)), the cash excess (deficiency) before financing, borrowing needed to maintain minimum balance, loan principal repaid, loan interest paid, and ending cash balance.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

32

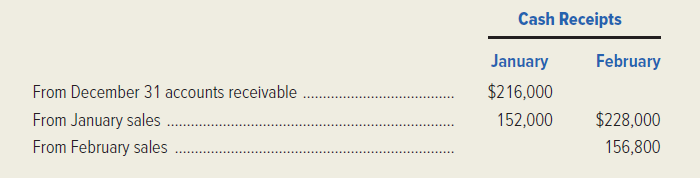

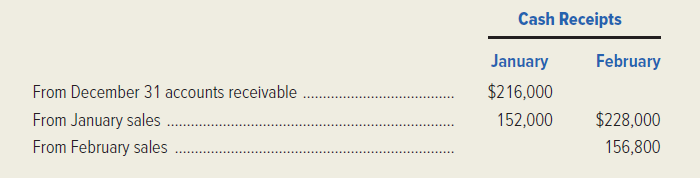

Badlands, Inc. manufactures a household fan that sells for $40 per unit. All sales are on account, with 40 percent of sales collected in the month of sale and 60 percent collected in the following month. The data that follow were extracted from the company's accounting records.

• Badlands maintains a minimum cash balance of $30,000. Total payments in January 20x1 are budgeted at $390,000.

• A schedule of cash collections for January and February of 20x1 revealed the following receipts for the period:

• March 20x1 sales are expected to total 10,000 units.

• Finished-goods inventories are maintained at 20 percent of the following month's sales.

• The December 31, 20x0, balance sheet revealed the following selected figures: cash, $45,000; accounts receivable, $216,000; and finished goods, $44,700.

Required:

1. Determine the number of units that Badlands sold in December 20x0.

2. Compute the sales revenue for March 20x1.

3. Compute the total sales revenue to be reported on Badlands' budgeted income statement for the first quarter of 20x1.

4. Determine the accounts receivable balance to be reported on the March 31, 20x1, budgeted balance sheet.

5. Calculate the number of units in the December 31, 20x0, finished-goods inventory.

6. Calculate the number of units of finished goods to be manufactured in January 20x1.

7. Calculate the financing required in January, if any, to maintain the firm's minimum cash balance.

• Badlands maintains a minimum cash balance of $30,000. Total payments in January 20x1 are budgeted at $390,000.

• A schedule of cash collections for January and February of 20x1 revealed the following receipts for the period:

• March 20x1 sales are expected to total 10,000 units.

• Finished-goods inventories are maintained at 20 percent of the following month's sales.

• The December 31, 20x0, balance sheet revealed the following selected figures: cash, $45,000; accounts receivable, $216,000; and finished goods, $44,700.

Required:

1. Determine the number of units that Badlands sold in December 20x0.

2. Compute the sales revenue for March 20x1.

3. Compute the total sales revenue to be reported on Badlands' budgeted income statement for the first quarter of 20x1.

4. Determine the accounts receivable balance to be reported on the March 31, 20x1, budgeted balance sheet.

5. Calculate the number of units in the December 31, 20x0, finished-goods inventory.

6. Calculate the number of units of finished goods to be manufactured in January 20x1.

7. Calculate the financing required in January, if any, to maintain the firm's minimum cash balance.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

33

Alpha-Tech, a rapidly growing distributor of electronic components, is formulating its plans for 20x5. Carol Jones, the firm's marketing director, has completed the following sales forecast.

Phillip Smith, an accountant in the Planning and Budgeting Department, is responsible for preparing the cash flow projection. The following information will be used in preparing the cash flow projection.

• Alpha-Tech's excellent record in accounts receivable collection is expected to continue. Sixty percent of billings are collected the month after the sale, and the remaining 40 percent two months after.

• The purchase of electronic components is Alpha-Tech's largest expenditure, and each month's cost of goods sold is estimated to be 40 percent of sales. Seventy percent of the parts are received by Alpha-Tech one month prior to sale, and 30 percent are received during the month of sale.

• Historically, 75 percent of accounts payable has been paid one month after receipt of the purchased components, and the remaining 25 percent has been paid two months after receipt.

• Hourly wages and fringe benefits, estimated to be 30 percent of the current month's sales, are paid in the month incurred.

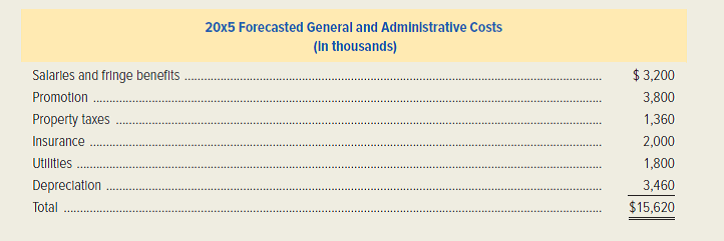

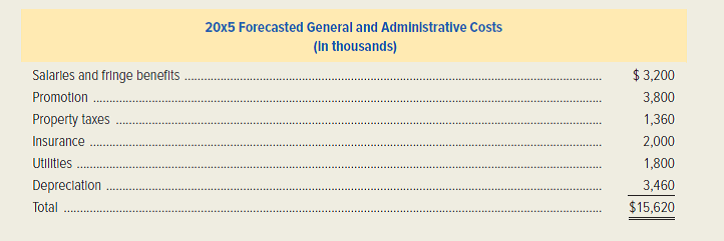

• General and administrative expenses are projected to be $15,620,000 for the year. The breakdown of these expenses is presented in the following schedule. All cash expenditures are paid uniformly throughout the year, except the property taxes, which are paid in four equal installments at the end of each quarter.

• Income-tax payments are made at the beginning of each calendar quarter based on the income of the prior quarter. Alpha-Tech is subject to an income-tax rate of 40 percent. Alpha-Tech's operating income for the first quarter of 20x5 is projected to be $3,200,000. The company pays 100 percent of the estimated tax payment.

• Alpha-Tech maintains a minimum cash balance of $500,000. If the cash balance is less than $500,000 at the end of each month, the company borrows amounts necessary to maintain this balance. All amounts borrowed are repaid out of the subsequent positive cash flow. The projected April 1, 20x5, opening balance is $500,000.

• Alpha-Tech has no short-term debt as of April 1, 20x5.

• Alpha-Tech uses a calendar year for both financial reporting and tax purposes.

Required:

1. Prepare a cash budget for Alpha-Tech by month for the second quarter of 20x5. For simplicity, ignore any interest expense associated with borrowing.

2. Discuss why cash budgeting is important for Alpha-Tech.

(CMA, adapted)

Phillip Smith, an accountant in the Planning and Budgeting Department, is responsible for preparing the cash flow projection. The following information will be used in preparing the cash flow projection.

• Alpha-Tech's excellent record in accounts receivable collection is expected to continue. Sixty percent of billings are collected the month after the sale, and the remaining 40 percent two months after.

• The purchase of electronic components is Alpha-Tech's largest expenditure, and each month's cost of goods sold is estimated to be 40 percent of sales. Seventy percent of the parts are received by Alpha-Tech one month prior to sale, and 30 percent are received during the month of sale.

• Historically, 75 percent of accounts payable has been paid one month after receipt of the purchased components, and the remaining 25 percent has been paid two months after receipt.

• Hourly wages and fringe benefits, estimated to be 30 percent of the current month's sales, are paid in the month incurred.

• General and administrative expenses are projected to be $15,620,000 for the year. The breakdown of these expenses is presented in the following schedule. All cash expenditures are paid uniformly throughout the year, except the property taxes, which are paid in four equal installments at the end of each quarter.

• Income-tax payments are made at the beginning of each calendar quarter based on the income of the prior quarter. Alpha-Tech is subject to an income-tax rate of 40 percent. Alpha-Tech's operating income for the first quarter of 20x5 is projected to be $3,200,000. The company pays 100 percent of the estimated tax payment.

• Alpha-Tech maintains a minimum cash balance of $500,000. If the cash balance is less than $500,000 at the end of each month, the company borrows amounts necessary to maintain this balance. All amounts borrowed are repaid out of the subsequent positive cash flow. The projected April 1, 20x5, opening balance is $500,000.

• Alpha-Tech has no short-term debt as of April 1, 20x5.

• Alpha-Tech uses a calendar year for both financial reporting and tax purposes.

Required:

1. Prepare a cash budget for Alpha-Tech by month for the second quarter of 20x5. For simplicity, ignore any interest expense associated with borrowing.

2. Discuss why cash budgeting is important for Alpha-Tech.

(CMA, adapted)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

34

Tulsa Chemical Company (TCC) produces and distributes industrial chemicals, TCC's earnings increased sharply in 20x1, and bonuses were paid to the management staff for the first time in several years. Bonuses are based in part on the amount by which reported income exceeds budgeted income.

Jim Kern, vice president of finance, was pleased with TCC's 20x1 earnings and thought that the pressure to show financial results would ease. However, Ellen North, TCC's president, told Kern that she saw no reason why the 20x2 bonuses should not be double those of 20x1. As a result, Kern felt pressure to increase reported income in order to exceed budgeted income by an even greater amount. This would assure increased bonuses.

Kern met with Bill Keller of Pristeel, Inc., a primary vendor of TCC's manufacturing supplies and equipment. Kern and Keller have been close business contacts for many years. Kern asked Keller to identify all of TCC's purchases of perishable supplies as equipment on Pristeel's sales invoices. The reason Kern gave for his request was that TCC's president had imposed stringent budget constraints on operating expenses but not on capital expenditures. Kern planned to capitalize the purchase of perishable supplies, and include them with the Equipment account on the balance sheet. In this way Kern could defer the expense recognition for these items to a later year. This procedure would increase reported earnings, leading to increased bonuses. Keller agreed to do as Kern had asked.

While analyzing the second quarter financial statements, Gary Wood, TCC's controller, noticed a large decrease in supplies expense from one year ago. Wood reviewed the Supplies Expense account and noticed that only equipment and no supplies had been purchased from Pristeel, a major source for supplies. Wood, who reports to Kern, immediately brought this to Kern's attention.

Kern told Wood of North's high expectations and of the arrangement made with Keller of Pristeel. Wood told Kern that his action was an improper accounting treatment for the supplies purchased from Pristeel. Wood requested that he be allowed to correct the accounts and urged that the arrangement with Pristeel be discontinued. Kern refused the request and told Wood not to become involved in the arrangement with Pristeel.

After clarifying the situation in a confidential discussion with an objective and qualified peer within TCC, Wood arranged to meet with North, TCC's president. At the meeting, Wood disclosed the arrangement Kern had made with Pristeel.

Required:

1. Explain why the use of alternative accounting methods to manipulate reported earnings is unethical.

2. Is Gary Wood, TCC's controller, correct in saying that the supplies purchased from Pristeel, Inc. were accounted for improperly? Explain your answer.

3. Assuming that Jim Kern's arrangement with Pristeel, Inc. was in violation of the standards of ethical professional practice for managerial accountants, discuss whether the actions of Wood were appropriate or inappropriate. (The guidelines for Resolution of Ethical Conflict are given in Chapter 1.)

(CMA, adapted)

Jim Kern, vice president of finance, was pleased with TCC's 20x1 earnings and thought that the pressure to show financial results would ease. However, Ellen North, TCC's president, told Kern that she saw no reason why the 20x2 bonuses should not be double those of 20x1. As a result, Kern felt pressure to increase reported income in order to exceed budgeted income by an even greater amount. This would assure increased bonuses.

Kern met with Bill Keller of Pristeel, Inc., a primary vendor of TCC's manufacturing supplies and equipment. Kern and Keller have been close business contacts for many years. Kern asked Keller to identify all of TCC's purchases of perishable supplies as equipment on Pristeel's sales invoices. The reason Kern gave for his request was that TCC's president had imposed stringent budget constraints on operating expenses but not on capital expenditures. Kern planned to capitalize the purchase of perishable supplies, and include them with the Equipment account on the balance sheet. In this way Kern could defer the expense recognition for these items to a later year. This procedure would increase reported earnings, leading to increased bonuses. Keller agreed to do as Kern had asked.

While analyzing the second quarter financial statements, Gary Wood, TCC's controller, noticed a large decrease in supplies expense from one year ago. Wood reviewed the Supplies Expense account and noticed that only equipment and no supplies had been purchased from Pristeel, a major source for supplies. Wood, who reports to Kern, immediately brought this to Kern's attention.

Kern told Wood of North's high expectations and of the arrangement made with Keller of Pristeel. Wood told Kern that his action was an improper accounting treatment for the supplies purchased from Pristeel. Wood requested that he be allowed to correct the accounts and urged that the arrangement with Pristeel be discontinued. Kern refused the request and told Wood not to become involved in the arrangement with Pristeel.

After clarifying the situation in a confidential discussion with an objective and qualified peer within TCC, Wood arranged to meet with North, TCC's president. At the meeting, Wood disclosed the arrangement Kern had made with Pristeel.

Required:

1. Explain why the use of alternative accounting methods to manipulate reported earnings is unethical.

2. Is Gary Wood, TCC's controller, correct in saying that the supplies purchased from Pristeel, Inc. were accounted for improperly? Explain your answer.

3. Assuming that Jim Kern's arrangement with Pristeel, Inc. was in violation of the standards of ethical professional practice for managerial accountants, discuss whether the actions of Wood were appropriate or inappropriate. (The guidelines for Resolution of Ethical Conflict are given in Chapter 1.)

(CMA, adapted)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

35

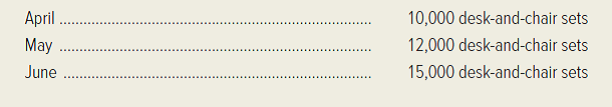

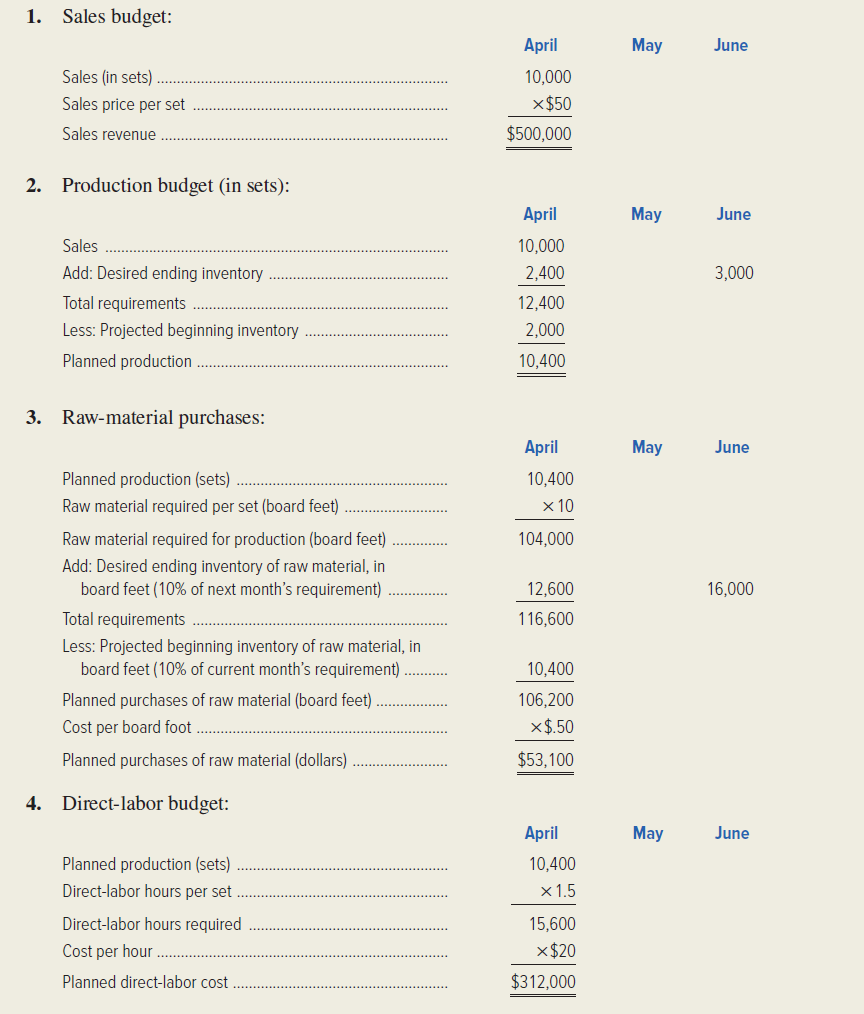

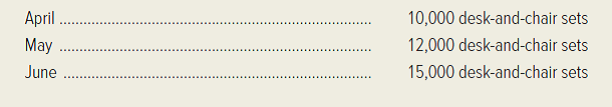

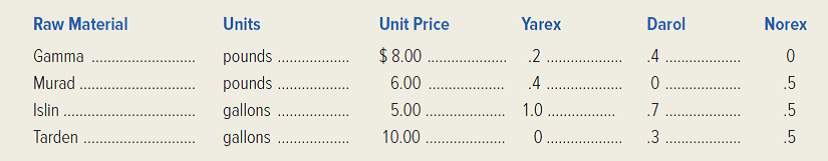

Scholastic Furniture, Inc. manufactures a variety of desks, chairs, tables, and shelf units that are sold to public school systems throughout the Midwest. The controller of the company's Desk Division is currently preparing a budget for the second quarter of the year. The following sales forecast has been made by the division's sales manager.

Each desk-and-chair set requires 10 board feet of pine planks and 1.5 hours of direct labor. Each set sells for $50. Pine planks cost $.50 per board foot, and the division ends each month with enough wood to cover 10 percent of the next month's production requirements. The division incurs a cost of $20 per hour for direct-labor wages and fringe benefits. The division ends each month with enough finished-goods inventory to cover 20 percent of the next month's sales.

Required: Complete the following budget schedules.

5. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following information changes: each set sells for $55 and the direct-labor cost per hour is $21.

Each desk-and-chair set requires 10 board feet of pine planks and 1.5 hours of direct labor. Each set sells for $50. Pine planks cost $.50 per board foot, and the division ends each month with enough wood to cover 10 percent of the next month's production requirements. The division incurs a cost of $20 per hour for direct-labor wages and fringe benefits. The division ends each month with enough finished-goods inventory to cover 20 percent of the next month's sales.

Required: Complete the following budget schedules.

5. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following information changes: each set sells for $55 and the direct-labor cost per hour is $21.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

36

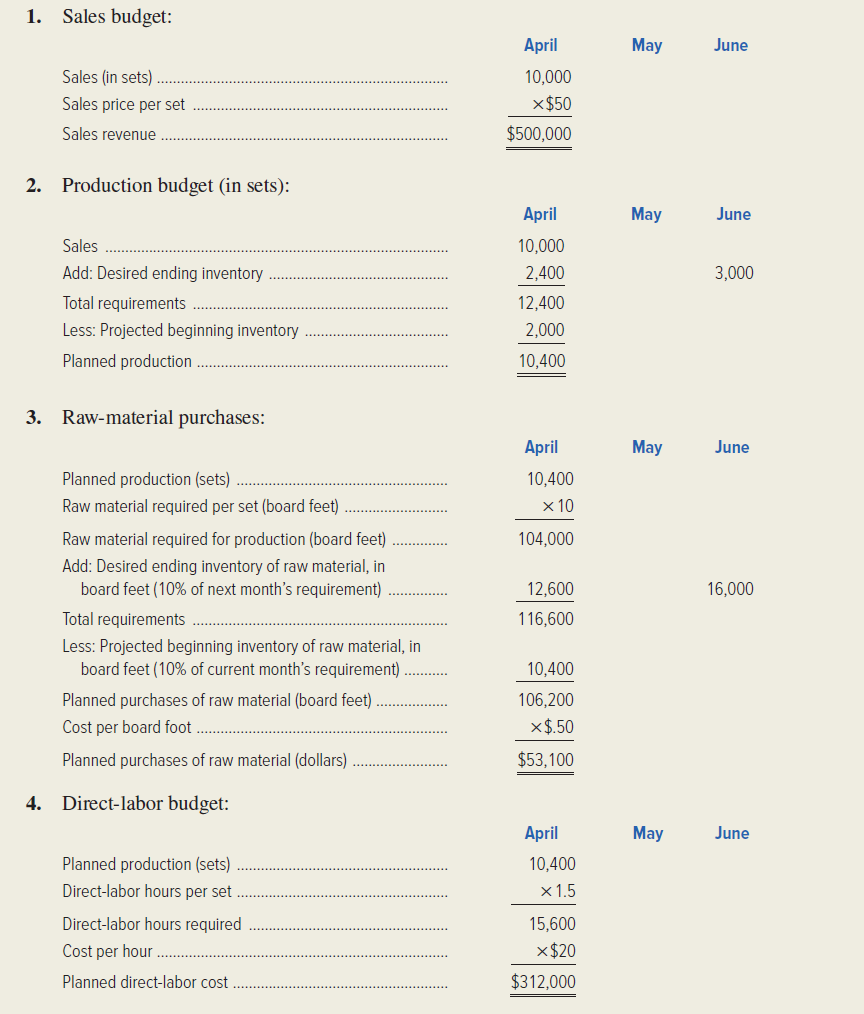

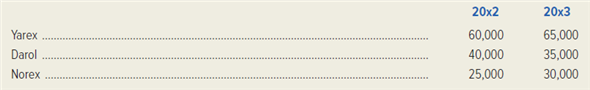

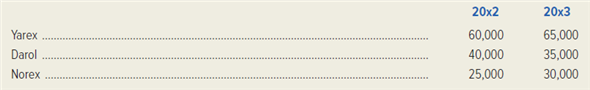

Empire Chemical Company produces three products using three different continuous processes. The products are Yarex, Darol, and Norex. Projected sales in gallons for the three products for the years 20x2 and 20x3 are as follows:

• Inventories are planned for each product so that the projected finished-goods inventory at the beginning of each year is equal to 8 percent of that year's projected sales.

• Because of the continuous nature of Empire's processes, work-in-process inventory for each of the products remains constant throughout the year.

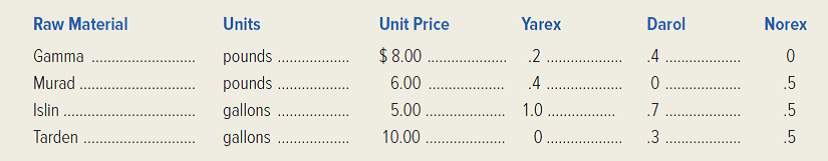

• The raw-material requirements of the three products are shown in the following chart.

• Raw-material inventories are planned so that each raw material's projected inventory at the beginning of a year is equal to 10 percent of the previous year's usage of that raw material.

The conversion requirements in hours per gallon for the three products are Yarex,.07 hour; Darol,.10 hour; and Norex,.16 hour. The conversion cost of $20 per hour is considered 100 percent variable.

Required:

1. Determine Empire Chemical Company's production budget (in gallons) for the three products for 20x2.

2. Determine Empire Chemical Company's conversion cost budget for 20x2.

3. Assuming the 20x1 usage of Islin is 100,000 gallons, determine the company's raw-material purchases budget (in dollars) for Islin for 20x2.

4. Assume that for 20x2 production, Empire Chemical Company could replace the raw material Islin with the raw material Philin. The usage of Philin would be the same as the usage of Islin. However, Philin would cost 20 percent more than Islin and would cut production times on all three products by 10 percent. Determine whether management should use Philin or Islin for the 20x2 production, supporting your decision with appropriate calculations. For this requirement, ignore any impact of beginning and ending inventory balances.

(CMA, adapted)

• Inventories are planned for each product so that the projected finished-goods inventory at the beginning of each year is equal to 8 percent of that year's projected sales.

• Because of the continuous nature of Empire's processes, work-in-process inventory for each of the products remains constant throughout the year.

• The raw-material requirements of the three products are shown in the following chart.

• Raw-material inventories are planned so that each raw material's projected inventory at the beginning of a year is equal to 10 percent of the previous year's usage of that raw material.

The conversion requirements in hours per gallon for the three products are Yarex,.07 hour; Darol,.10 hour; and Norex,.16 hour. The conversion cost of $20 per hour is considered 100 percent variable.

Required:

1. Determine Empire Chemical Company's production budget (in gallons) for the three products for 20x2.

2. Determine Empire Chemical Company's conversion cost budget for 20x2.

3. Assuming the 20x1 usage of Islin is 100,000 gallons, determine the company's raw-material purchases budget (in dollars) for Islin for 20x2.

4. Assume that for 20x2 production, Empire Chemical Company could replace the raw material Islin with the raw material Philin. The usage of Philin would be the same as the usage of Islin. However, Philin would cost 20 percent more than Islin and would cut production times on all three products by 10 percent. Determine whether management should use Philin or Islin for the 20x2 production, supporting your decision with appropriate calculations. For this requirement, ignore any impact of beginning and ending inventory balances.

(CMA, adapted)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

37

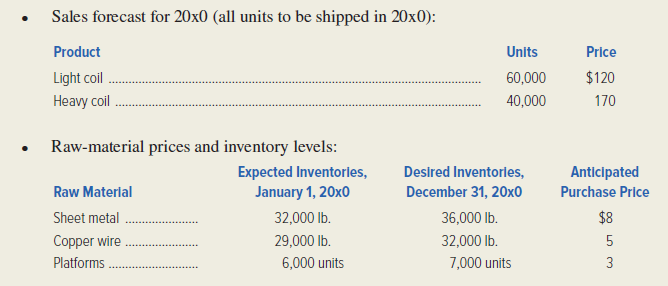

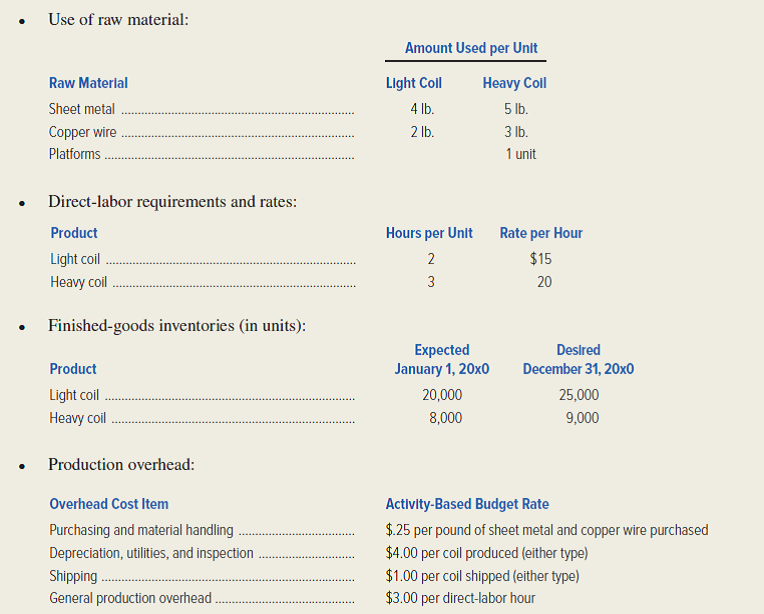

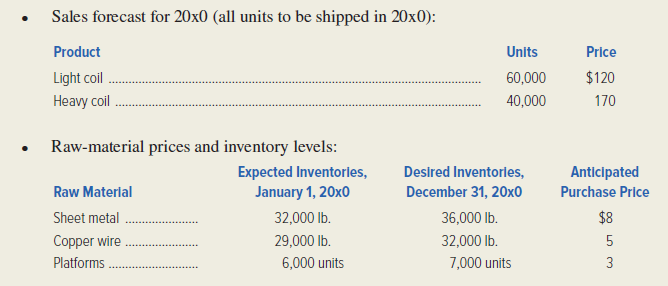

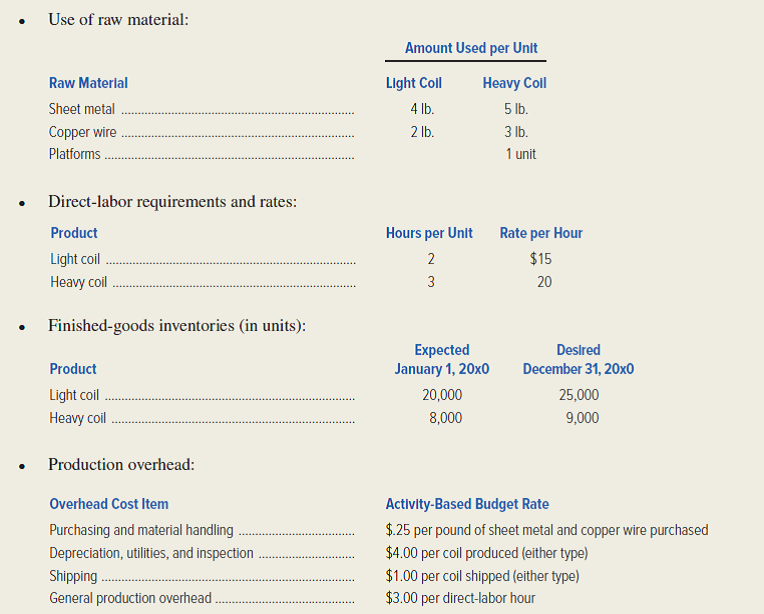

Vista Electronics, Inc. manufactures two different types of coils used in electric motors. In the fall of the current year, Erica Becker, the controller, compiled the following data.

Required: Prepare the following budgets for 20x0.

1. Sales budget (in dollars).

2. Production budget (in units).

3. Raw-material purchases budget (in quantities).

4. Raw-material purchases budget (in dollars).

5. Direct-labor budget (in dollars).

6. Production-overhead budget (in dollars).

(CPA, adapted)

Required: Prepare the following budgets for 20x0.

1. Sales budget (in dollars).

2. Production budget (in units).

3. Raw-material purchases budget (in quantities).

4. Raw-material purchases budget (in dollars).

5. Direct-labor budget (in dollars).

6. Production-overhead budget (in dollars).

(CPA, adapted)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

38

United Security Systems, Inc. (USSI) manufactures and sells security systems. The company started by installing photoelectric security systems in offices and has expanded into the private-home market. USSI has a basic security system that has been developed into three standard products, each of which can be adapted to meet the specific needs of customers. The manufacturing operation is moderate in size, as the bulk of the component manufacturing is completed by independent contractors. The security systems are approximately 85 percent complete when received from contractors and require only final assembly in the USSI plant. Each product passes through at least one of three assembly operations.

USSI operates in a rapidly growing community. There is evidence that a great deal of new commercial construction will take place in the near future, and management has decided to pursue this new market. In order to be competitive, the firm will have to expand its operations.

In view of the expected increase in business, Sandra Feldman, the controller, believes that USSI should implement a complete budgeting system. Feldman has decided to make a formal presentation to the company's president explaining the benefits of a budgeting system and outlining the budget schedules and reports that would be necessary.

Required:

1. Explain the benefits that USSI would gain from implementing a budgeting system.

2. If Sandra Feldman develops a master budget:

a. Identify, in order, the schedules that will have to be prepared.

b. Identify the subsequent schedules that would be based on the schedules identified above. Use the following format for your answer.

USSI operates in a rapidly growing community. There is evidence that a great deal of new commercial construction will take place in the near future, and management has decided to pursue this new market. In order to be competitive, the firm will have to expand its operations.

In view of the expected increase in business, Sandra Feldman, the controller, believes that USSI should implement a complete budgeting system. Feldman has decided to make a formal presentation to the company's president explaining the benefits of a budgeting system and outlining the budget schedules and reports that would be necessary.

Required:

1. Explain the benefits that USSI would gain from implementing a budgeting system.

2. If Sandra Feldman develops a master budget:

a. Identify, in order, the schedules that will have to be prepared.

b. Identify the subsequent schedules that would be based on the schedules identified above. Use the following format for your answer.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

39

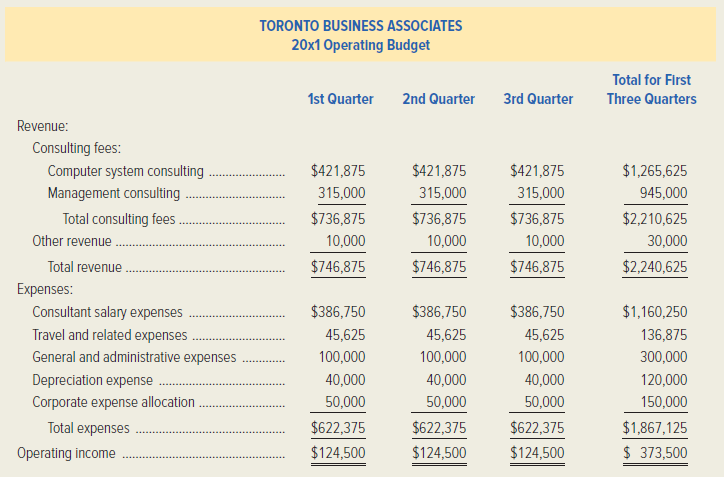

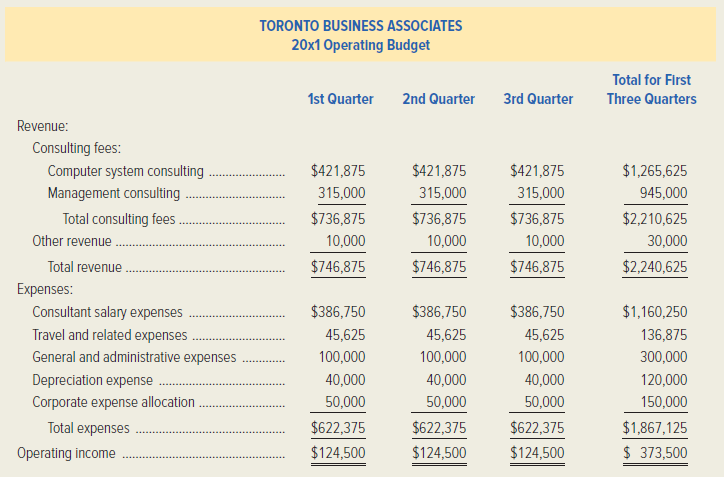

Toronto Business Associates, a division of Maple Leaf Services Corporation, offers management and computer consulting services to clients throughout Canada and the northwestern United States. The division specializes in website development and other Internet applications. The corporate management at Maple Leaf Services is pleased with the performance of Toronto Business Associates for the first nine months of the current year and has recommended that the division manager, Richard Howell, submit a revised forecast for the remaining quarter, as the division has exceeded the annual plan year-to-date by 20 percent of operating income. An unexpected increase in billed hour volume over the original plan is the main reason for this increase in income. The original operating budget for the first three quarters for Toronto Business Associates follows.

Howell will reflect the following information in his revised forecast for the fourth quarter.

• Toronto Business Associates currently has 25 consultants on staff: 10 for management consulting and 15 for computer systems consulting. Three additional management consultants have been hired to start work at the beginning of the fourth quarter in order to meet the increased client demand.

• The hourly billing rate for consulting revenue will remain at $90 per hour for each management consultant and $75 per hour for each computer consultant. However, due to the favorable increase in billing hour volume when compared to the plan, the hours for each consultant will be increased by 50 hours per quarter.

• The budgeted annual salaries and actual annual salaries, paid monthly, are the same: $50,000 for a management consultant and $46,000 for a computer consultant. Corporate management has approved a merit increase of 10 percent at the beginning of the fourth quarter for all 25 existing consultants, while the new consultants will be compensated at the planned rate.

• The planned salary expense includes a provision for employee fringe benefits amounting to 30 percent of the annual salaries. However, the improvement of some corporatewide employee programs will increase the fringe benefits to 40 percent.

• The original plan assumes a fixed hourly rate for travel and other related expenses for each billing hour of consulting. These are expenses that are not reimbursed by the client, and the previously determined hourly rate has proven to be adequate to cover these costs.

• Other revenue is derived from temporary rentals and interest income and remains unchanged for the fourth quarter.

• General and administrative expenses have been favorable at 7 percent below the plan; this 7 percent savings on fourth quarter expenses will be reflected in the revised plan.

• Depreciation of office equipment and personal computers will stay constant at the projected straight-line rate.

• Due to the favorable experience for the first three quarters and the division's increased ability to absorb costs, the corporate management at Maple Leaf Services has increased the corporate expense allocation by 50 percent.

Required:

1. Prepare a revised operating budget for the fourth quarter for Toronto Business Associates that Richard Howell will present to corporate management.

2. Discuss the reasons why an organization would prepare a revised operating budget.

(CMA, adapted)

Howell will reflect the following information in his revised forecast for the fourth quarter.

• Toronto Business Associates currently has 25 consultants on staff: 10 for management consulting and 15 for computer systems consulting. Three additional management consultants have been hired to start work at the beginning of the fourth quarter in order to meet the increased client demand.

• The hourly billing rate for consulting revenue will remain at $90 per hour for each management consultant and $75 per hour for each computer consultant. However, due to the favorable increase in billing hour volume when compared to the plan, the hours for each consultant will be increased by 50 hours per quarter.

• The budgeted annual salaries and actual annual salaries, paid monthly, are the same: $50,000 for a management consultant and $46,000 for a computer consultant. Corporate management has approved a merit increase of 10 percent at the beginning of the fourth quarter for all 25 existing consultants, while the new consultants will be compensated at the planned rate.

• The planned salary expense includes a provision for employee fringe benefits amounting to 30 percent of the annual salaries. However, the improvement of some corporatewide employee programs will increase the fringe benefits to 40 percent.

• The original plan assumes a fixed hourly rate for travel and other related expenses for each billing hour of consulting. These are expenses that are not reimbursed by the client, and the previously determined hourly rate has proven to be adequate to cover these costs.

• Other revenue is derived from temporary rentals and interest income and remains unchanged for the fourth quarter.

• General and administrative expenses have been favorable at 7 percent below the plan; this 7 percent savings on fourth quarter expenses will be reflected in the revised plan.

• Depreciation of office equipment and personal computers will stay constant at the projected straight-line rate.

• Due to the favorable experience for the first three quarters and the division's increased ability to absorb costs, the corporate management at Maple Leaf Services has increased the corporate expense allocation by 50 percent.

Required:

1. Prepare a revised operating budget for the fourth quarter for Toronto Business Associates that Richard Howell will present to corporate management.

2. Discuss the reasons why an organization would prepare a revised operating budget.

(CMA, adapted)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

40

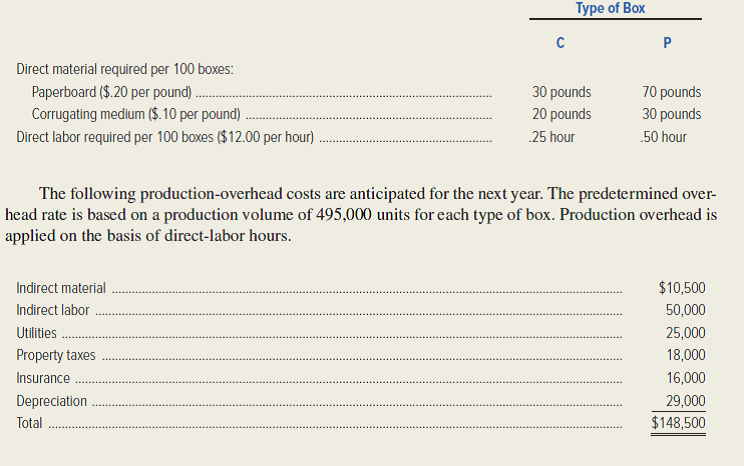

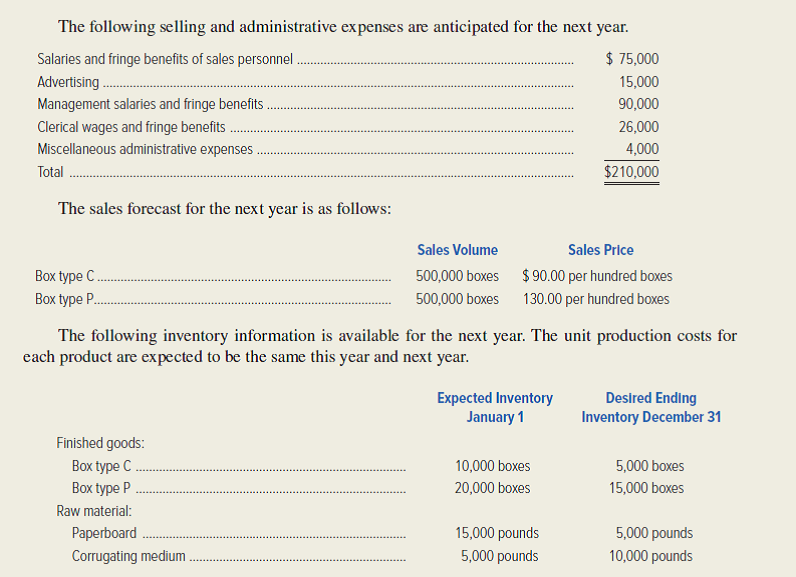

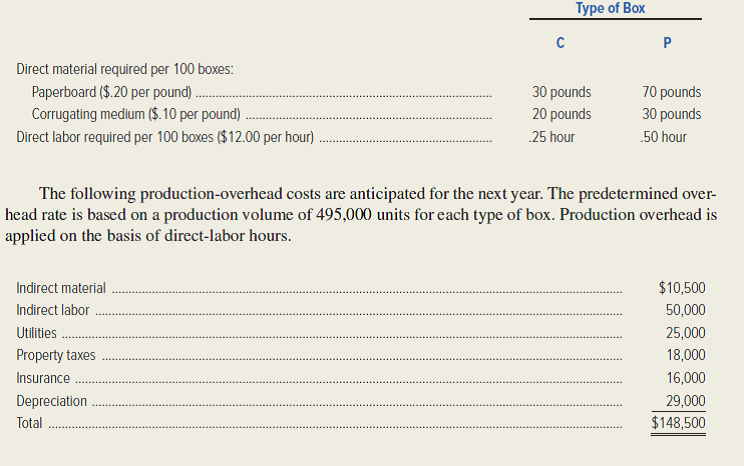

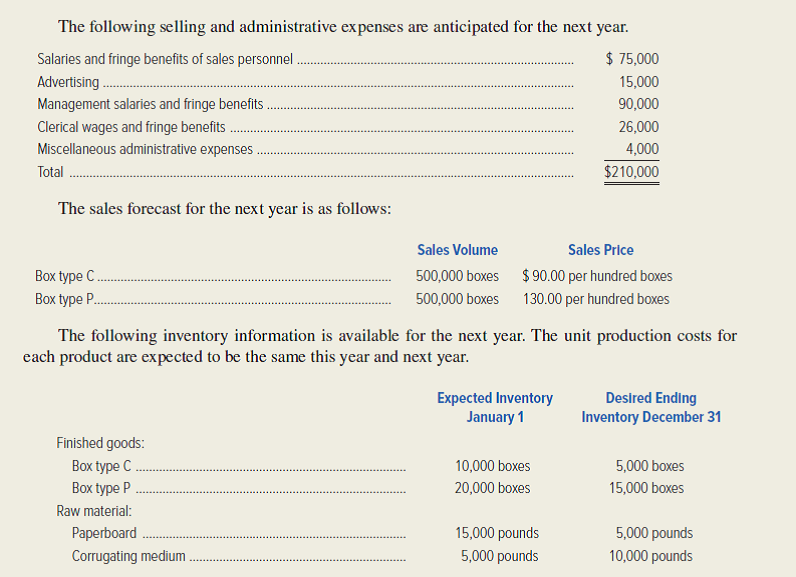

FreshPak Corporation manufactures two types of cardboard boxes used in shipping canned food, fruit, and vegetables. The canned food box (type C) and the perishable food box (type P) have the following material and labor requirements.

Required: Prepare a master budget for FreshPak Corporation for the next year. Assume an income tax rate of 40 percent. Include the following schedules.

1. Sales budget.

2. Production budget.

3. Direct-material budget.

4. Direct-labor budget.

5. Production-overhead budget.

6. Selling and administrative expense budget.

7. Budgeted income statement. ( Hint: To determine cost of goods sold, first compute the production cost per unit for each type of box. Include applied production overhead in the cost.)

Required: Prepare a master budget for FreshPak Corporation for the next year. Assume an income tax rate of 40 percent. Include the following schedules.

1. Sales budget.

2. Production budget.

3. Direct-material budget.

4. Direct-labor budget.

5. Production-overhead budget.

6. Selling and administrative expense budget.

7. Budgeted income statement. ( Hint: To determine cost of goods sold, first compute the production cost per unit for each type of box. Include applied production overhead in the cost.)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

41

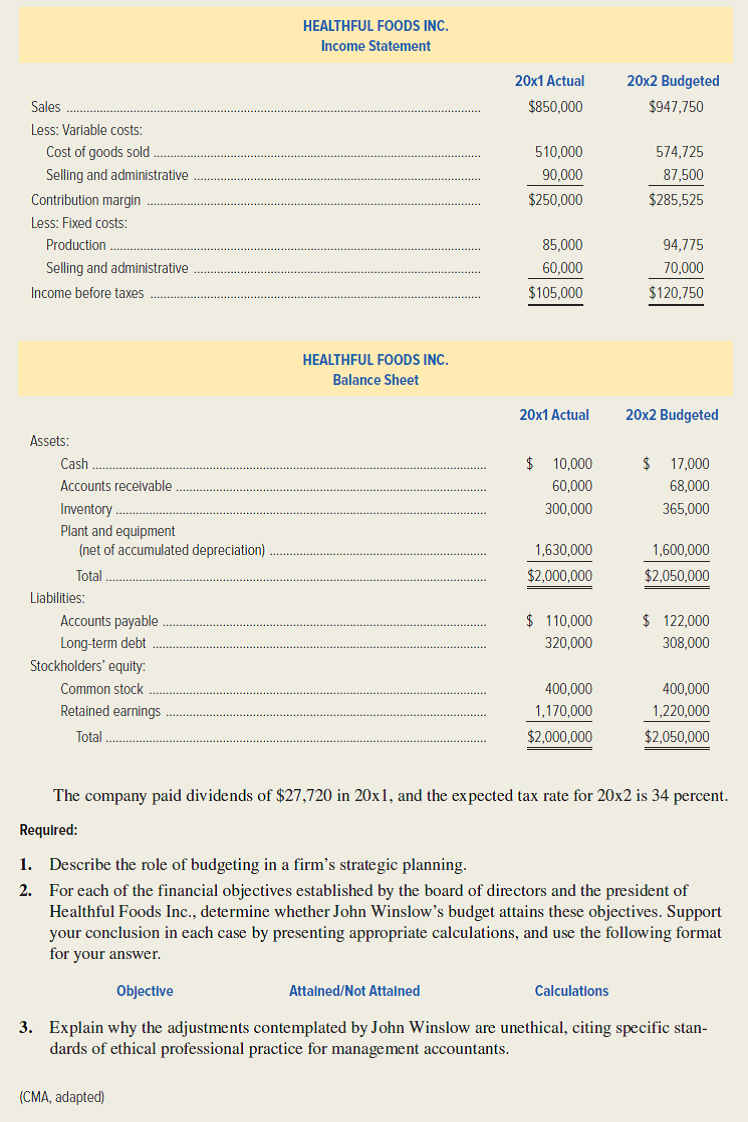

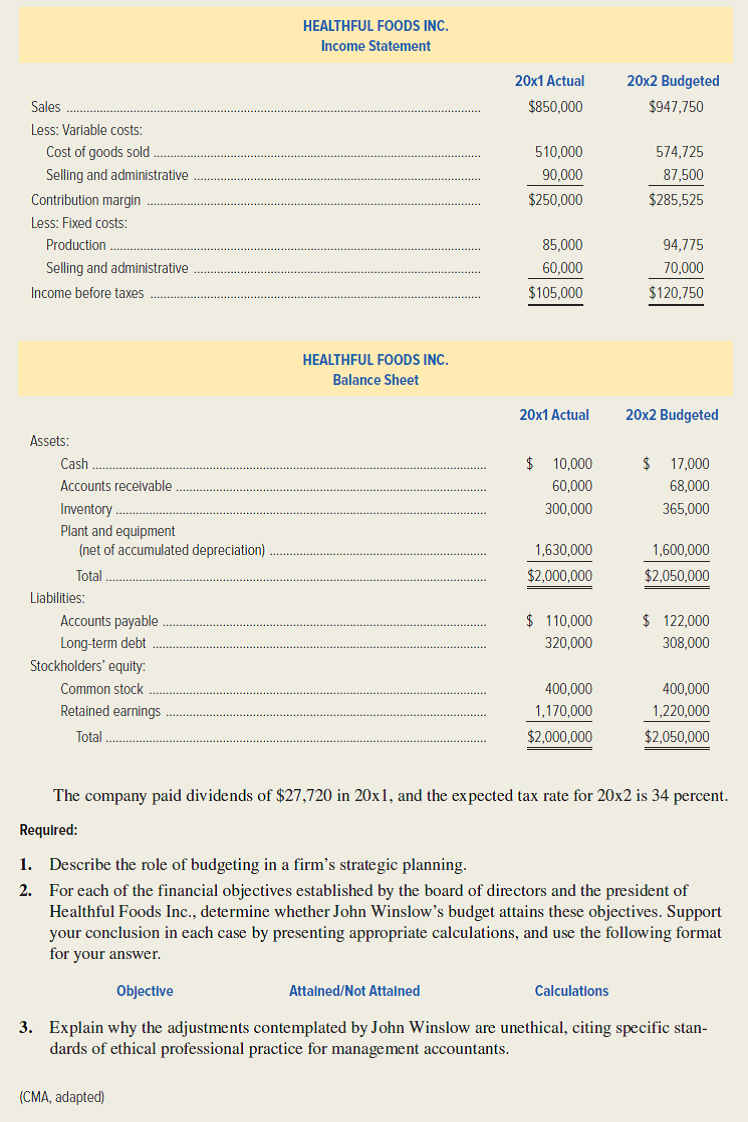

Healthful Foods Inc., a manufacturer of breakfast cereals and snack bars, has experienced several years of steady growth in sales, profits, and dividends while maintaining a relatively low level of debt. The board of directors has adopted a long-run strategy to maximize the value of the shareholders' investment. In order to achieve this goal, the board of directors established the following five-year financial objectives.

• Increase sales by 12 percent per year.

• Increase income before taxes by 15 percent per year.

• Maintain long-term debt at a maximum of 16 percent of assets.

These financial objectives have been attained for the past three years. At the beginning of last year, the president of Healthful Foods, Andrea Donis, added a fourth financial objective of maintaining cost of goods sold at a maximum of 70 percent of sales. This goal also was attained last year. The budgeting process at Healthful Foods is to be directed toward attaining these goals for the forthcoming year, a difficult task with the economy in a prolonged recession. In addition, the increased emphasis on eating healthful foods has driven up the price of ingredients used by the company significantly faster than the expected rate of inflation. John Winslow, cost accountant at Healthful Foods, has responsibility for preparation of the profit plan for next year. Winslow assured Donis that he could present a budget that achieved all of the financial objectives. Winslow believed that he could overestimate the ending inventory and reclassify fruit and grain inspection costs as administrative rather than production costs to attain the desired objective. The actual statements for 20x1 and the budgeted statements for 20x2 that Winslow prepared are as follows:

• Increase sales by 12 percent per year.

• Increase income before taxes by 15 percent per year.

• Maintain long-term debt at a maximum of 16 percent of assets.

These financial objectives have been attained for the past three years. At the beginning of last year, the president of Healthful Foods, Andrea Donis, added a fourth financial objective of maintaining cost of goods sold at a maximum of 70 percent of sales. This goal also was attained last year. The budgeting process at Healthful Foods is to be directed toward attaining these goals for the forthcoming year, a difficult task with the economy in a prolonged recession. In addition, the increased emphasis on eating healthful foods has driven up the price of ingredients used by the company significantly faster than the expected rate of inflation. John Winslow, cost accountant at Healthful Foods, has responsibility for preparation of the profit plan for next year. Winslow assured Donis that he could present a budget that achieved all of the financial objectives. Winslow believed that he could overestimate the ending inventory and reclassify fruit and grain inspection costs as administrative rather than production costs to attain the desired objective. The actual statements for 20x1 and the budgeted statements for 20x2 that Winslow prepared are as follows:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

42

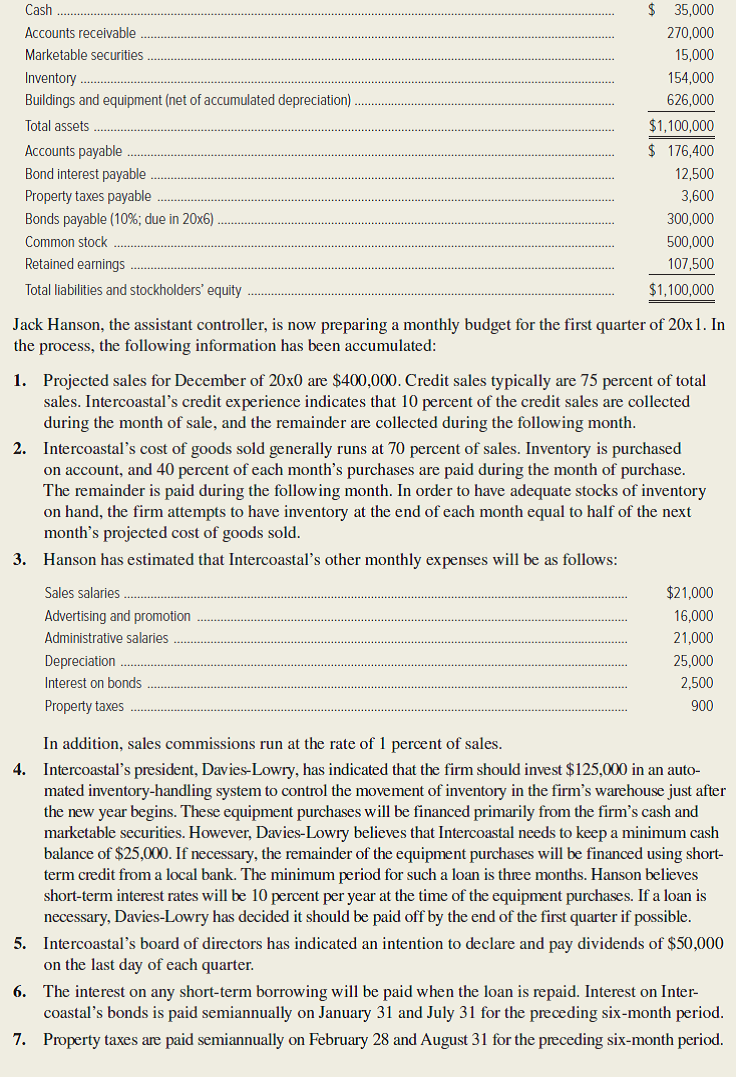

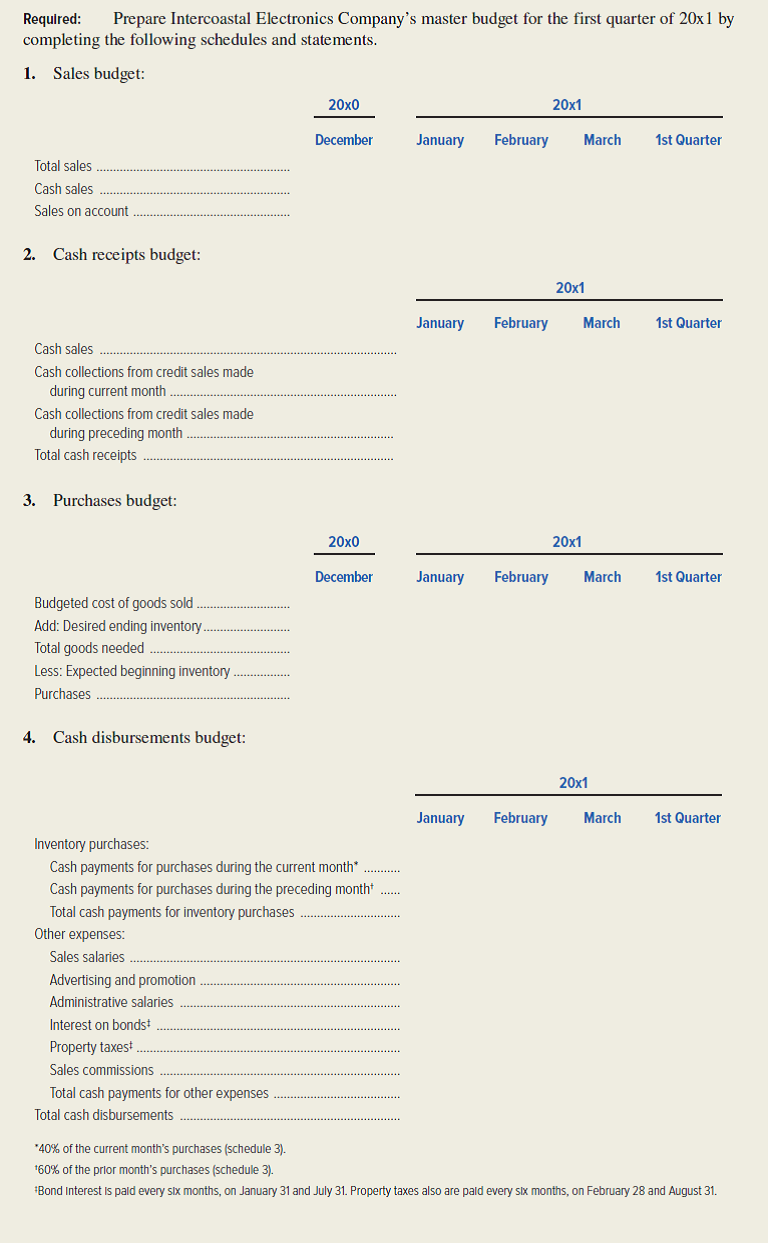

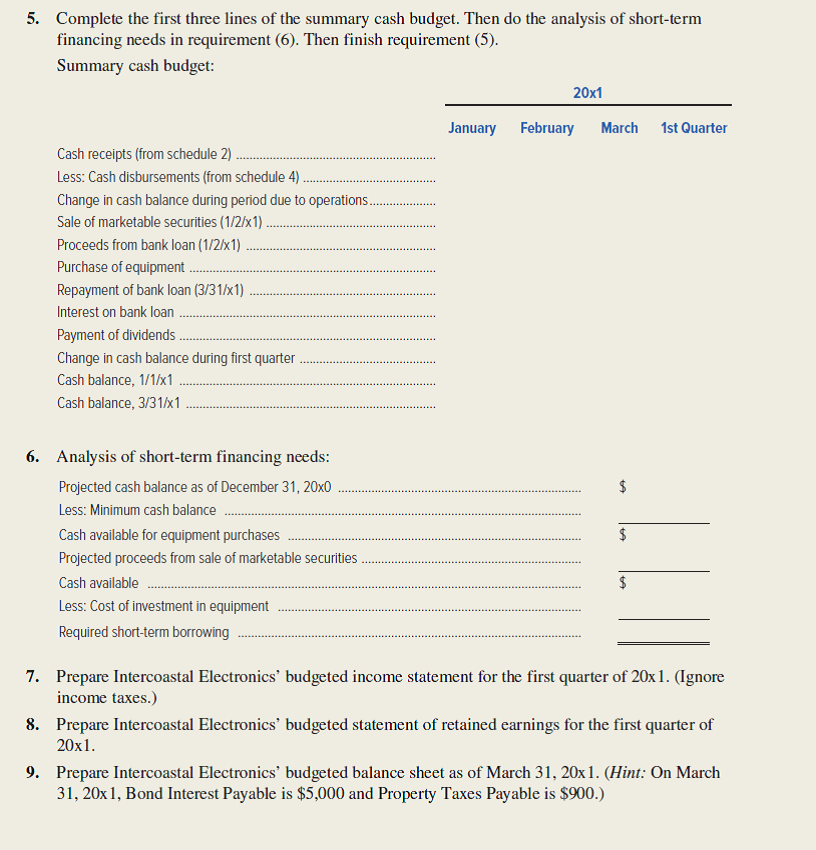

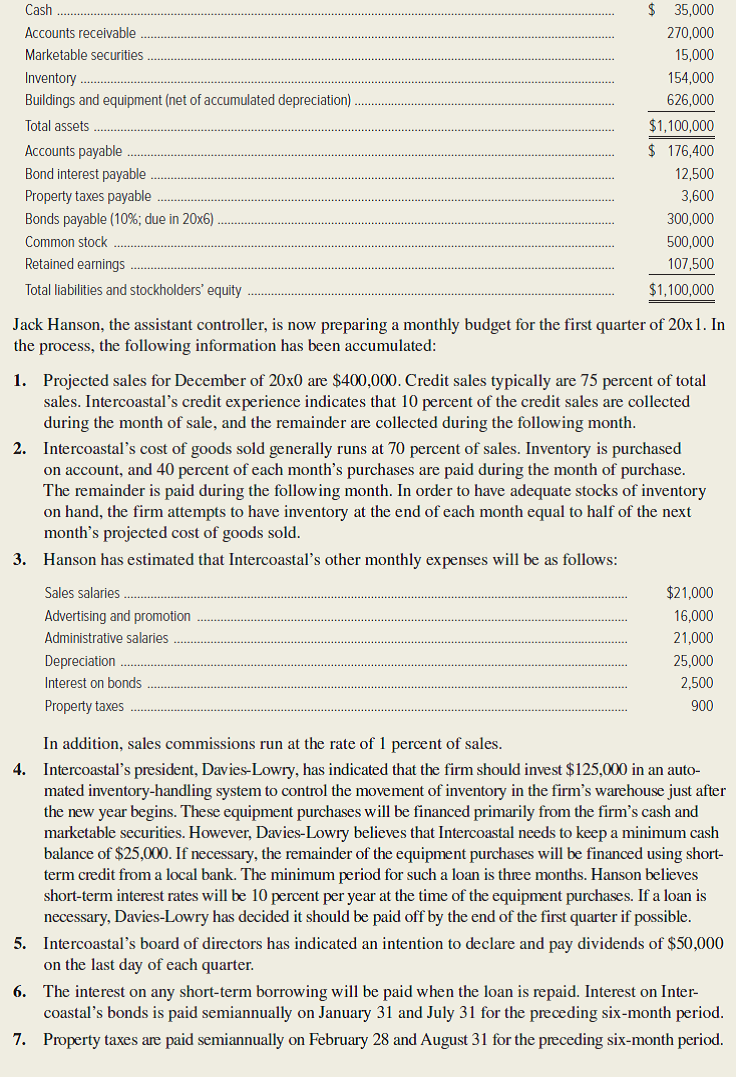

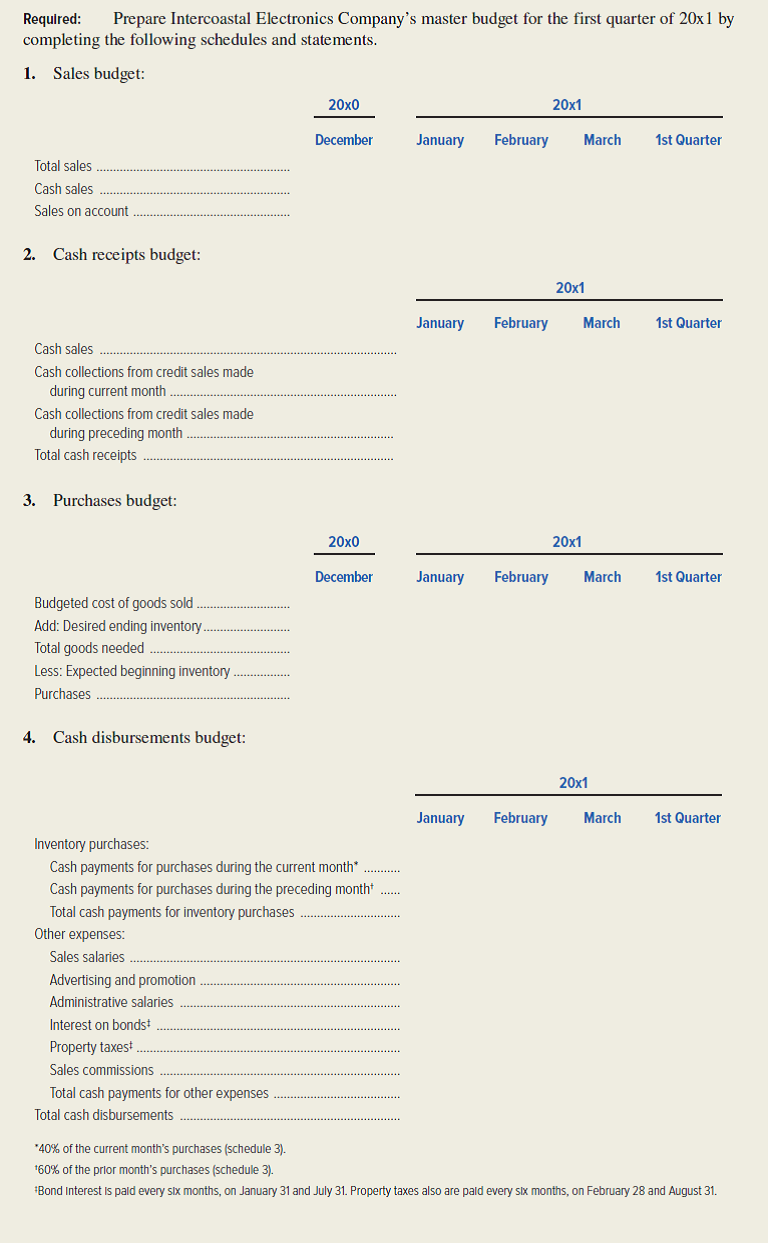

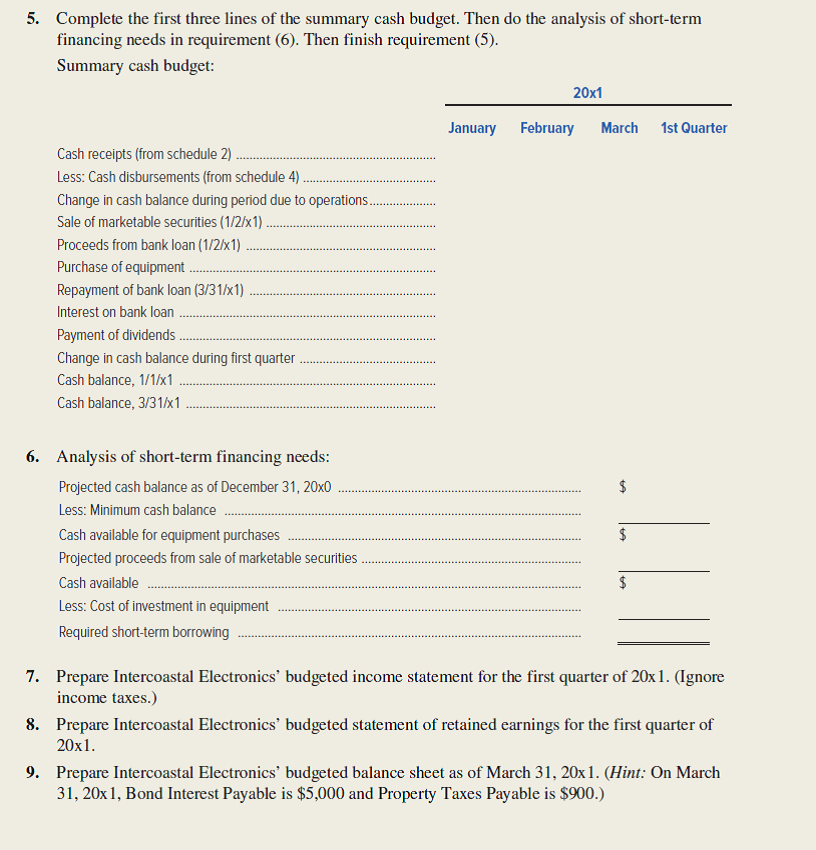

"We really need to get this new material-handling equipment in operation just after the new year begins. I hope we can finance it largely with cash and marketable securities, but if necessary we can get a shortterm loan down at MetroBank." This statement by Beth Davies-Lowry, president of Intercoastal Electronics Company, concluded a meeting she had called with the firm's top management. Intercoastal is a small, rapidly growing wholesaler of consumer electronic products. The firm's main product lines are small kitchen appliances and power tools. Marcia Wilcox, Intercoastal's General Manager of Marketing, has recently completed a sales forecast. She believes the company's sales during the first quarter of 20x1 will increase by 10 percent each month over the previous month's sales. Then Wilcox expects sales to remain constant for several months. Intercoastal's projected balance sheet as of December 31, 20x0, is as follows:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

43

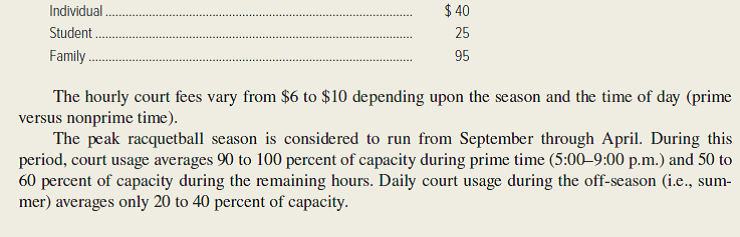

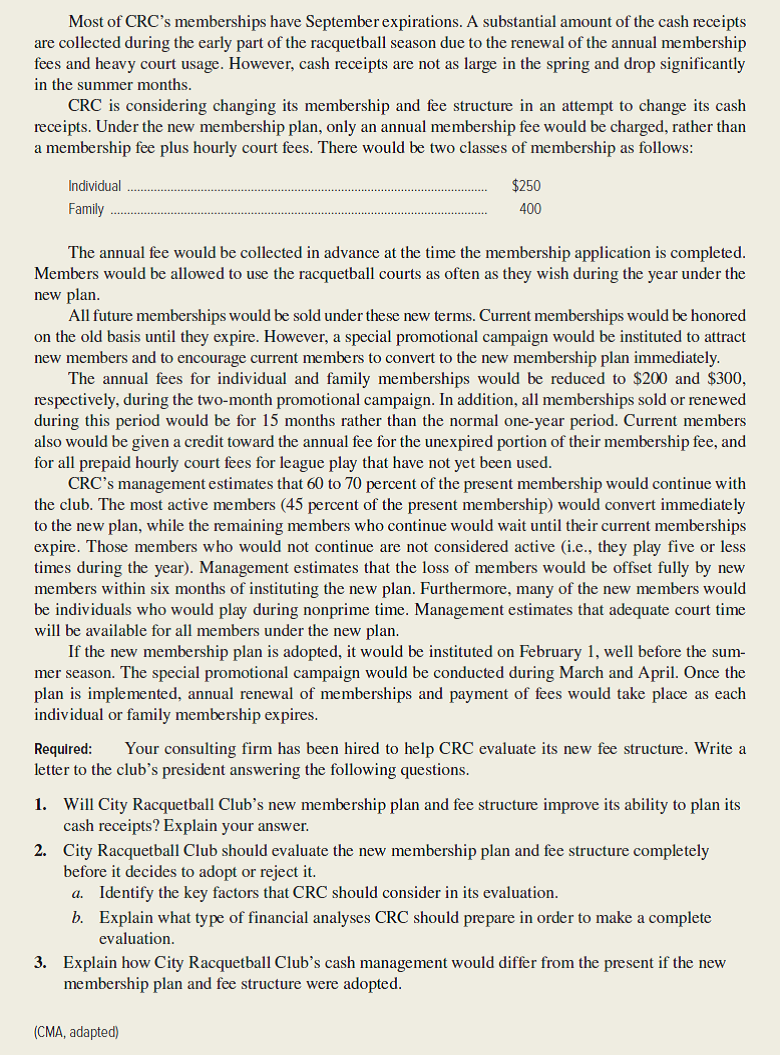

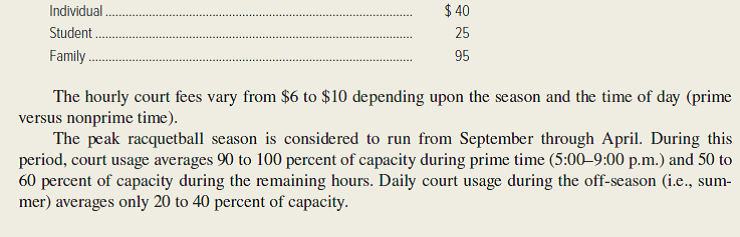

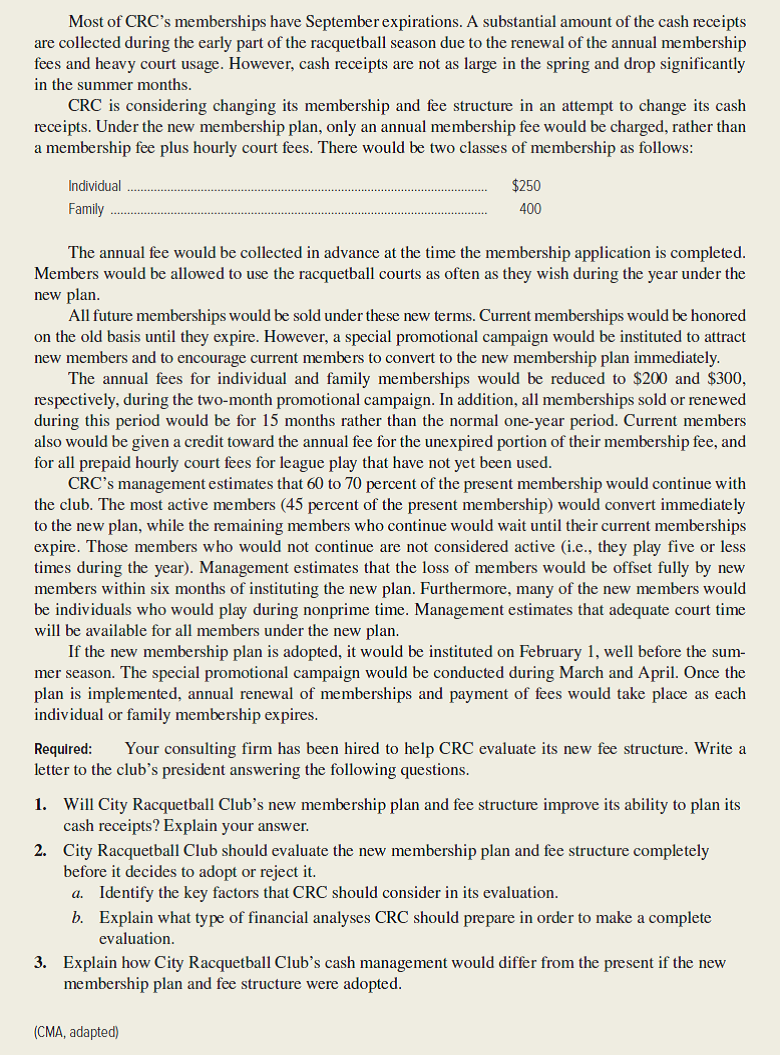

City Racquetball Club (CRC) offers racquetball and other physical fitness facilities to its members. There are four of these clubs in the metropolitan area. Each club has between 1,800 and 2,500 members. Revenue is derived from annual membership fees and hourly court fees. The annual membership fees are as follows:

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

44

Patricia Eklund, controller in the division of social services for the state, recognizes the importance of the budgetary process for planning, control, and motivational purposes. She believes that a properly implemented participative budgetary process for planning purposes and an evaluation procedure will motivate the managers to improve productivity within their particular departments. Based upon this philosophy, Eklund has implemented the following budgetary procedures.

• An appropriation target figure is given to each department manager. This amount is the maximum funding that each department can expect to receive in the next year.

• Department managers develop their individual budgets within the following spending constraints as directed by the controller's staff.

o Expenditure requests cannot exceed the appropriation target.

o All fixed expenditures should be included in the budget. Fixed expenditures would include such items as contracts and salaries at current levels.

o All government projects directed by higher authority should be included in the budget in their entirety.

• The controller's staff consolidates the budget requests from the various departments into a master budget submission for the entire division.

• Upon final budget approval by the legislature, the controller's staff allocates the appropriation to the various departments on instructions from the division manager. However, a specified percentage of each department's appropriation is held back in anticipation of potential budget cuts and special funding needs. The amount and use of this contingency fund is left to the discretion of the division manager.

• Each department is allowed to adjust its budget when necessary to operate within the reduced appropriation level. However, as stated in the original directive, specific projects authorized by higher authority must remain intact.

• The final budget is used as the basis of control. Excessive expenditures by account for each department are highlighted on a monthly basis. Department managers are expected to account for all expenditures over budget. Fiscal responsibility is an important factor in the overall performance evaluation of department managers.

Eklund believes her policy of allowing the department managers to participate in the budgetary process and then holding them accountable for their performance is essential, especially during times of limited resources. She further believes that the department managers will be positively motivated to increase the efficiency and effectiveness of their departments because they have provided input into the initial budgetary process and are required to justify any unfavorable performances.

Required:

1. Describe several operational and behavioral benefits that are generally attributed to a participative budgetary process.

2. Identify at least four deficiencies in Patricia Eklund's participative policy for planning and performance evaluation purposes. For each deficiency identified, recommend how it can be corrected.

(CMA, adapted)

• An appropriation target figure is given to each department manager. This amount is the maximum funding that each department can expect to receive in the next year.

• Department managers develop their individual budgets within the following spending constraints as directed by the controller's staff.

o Expenditure requests cannot exceed the appropriation target.

o All fixed expenditures should be included in the budget. Fixed expenditures would include such items as contracts and salaries at current levels.

o All government projects directed by higher authority should be included in the budget in their entirety.

• The controller's staff consolidates the budget requests from the various departments into a master budget submission for the entire division.

• Upon final budget approval by the legislature, the controller's staff allocates the appropriation to the various departments on instructions from the division manager. However, a specified percentage of each department's appropriation is held back in anticipation of potential budget cuts and special funding needs. The amount and use of this contingency fund is left to the discretion of the division manager.

• Each department is allowed to adjust its budget when necessary to operate within the reduced appropriation level. However, as stated in the original directive, specific projects authorized by higher authority must remain intact.

• The final budget is used as the basis of control. Excessive expenditures by account for each department are highlighted on a monthly basis. Department managers are expected to account for all expenditures over budget. Fiscal responsibility is an important factor in the overall performance evaluation of department managers.

Eklund believes her policy of allowing the department managers to participate in the budgetary process and then holding them accountable for their performance is essential, especially during times of limited resources. She further believes that the department managers will be positively motivated to increase the efficiency and effectiveness of their departments because they have provided input into the initial budgetary process and are required to justify any unfavorable performances.

Required:

1. Describe several operational and behavioral benefits that are generally attributed to a participative budgetary process.

2. Identify at least four deficiencies in Patricia Eklund's participative policy for planning and performance evaluation purposes. For each deficiency identified, recommend how it can be corrected.

(CMA, adapted)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

45

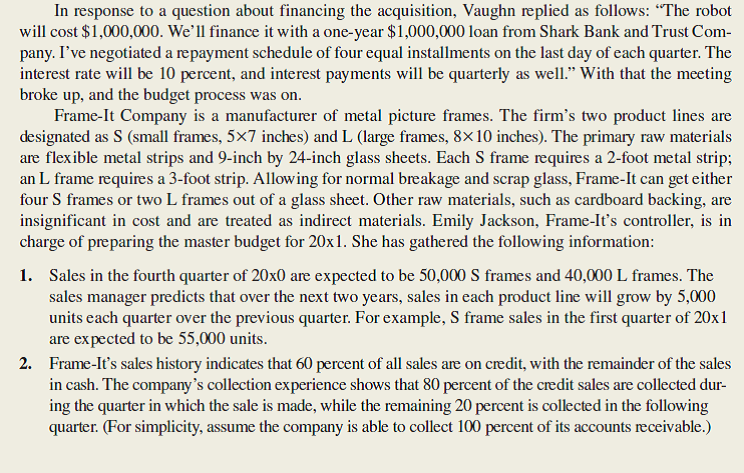

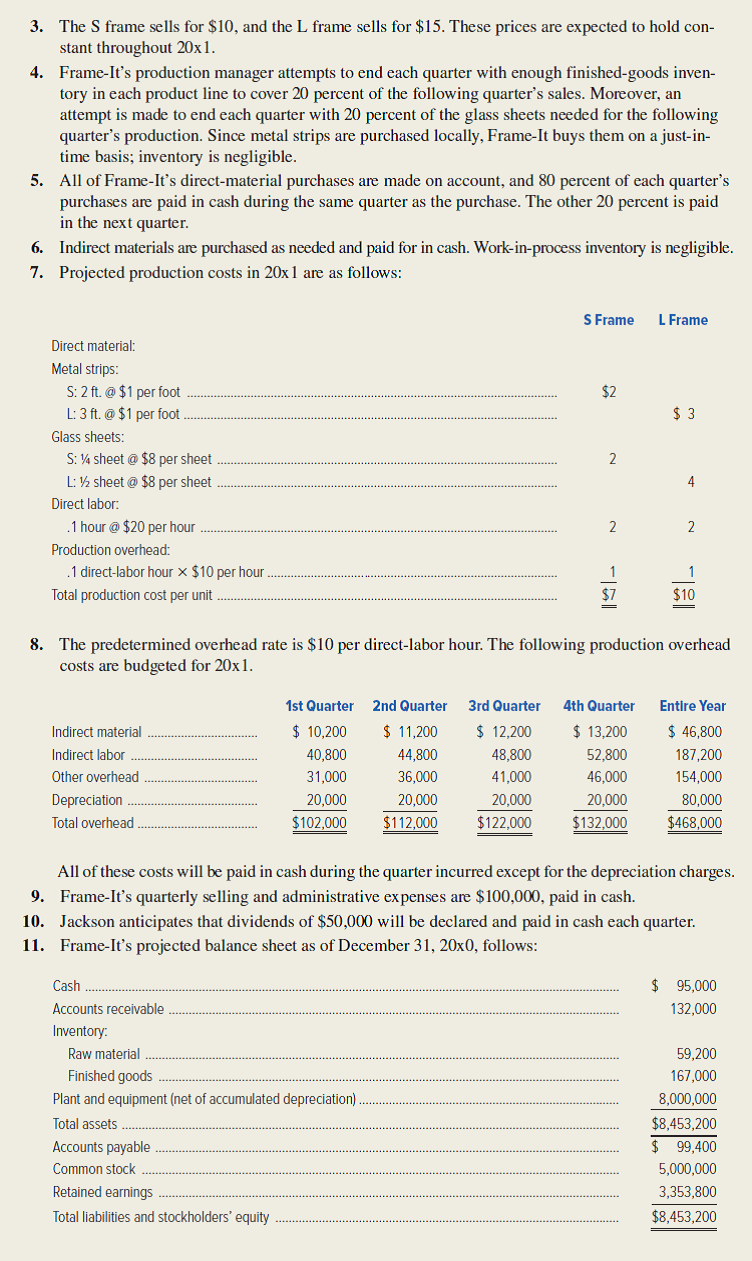

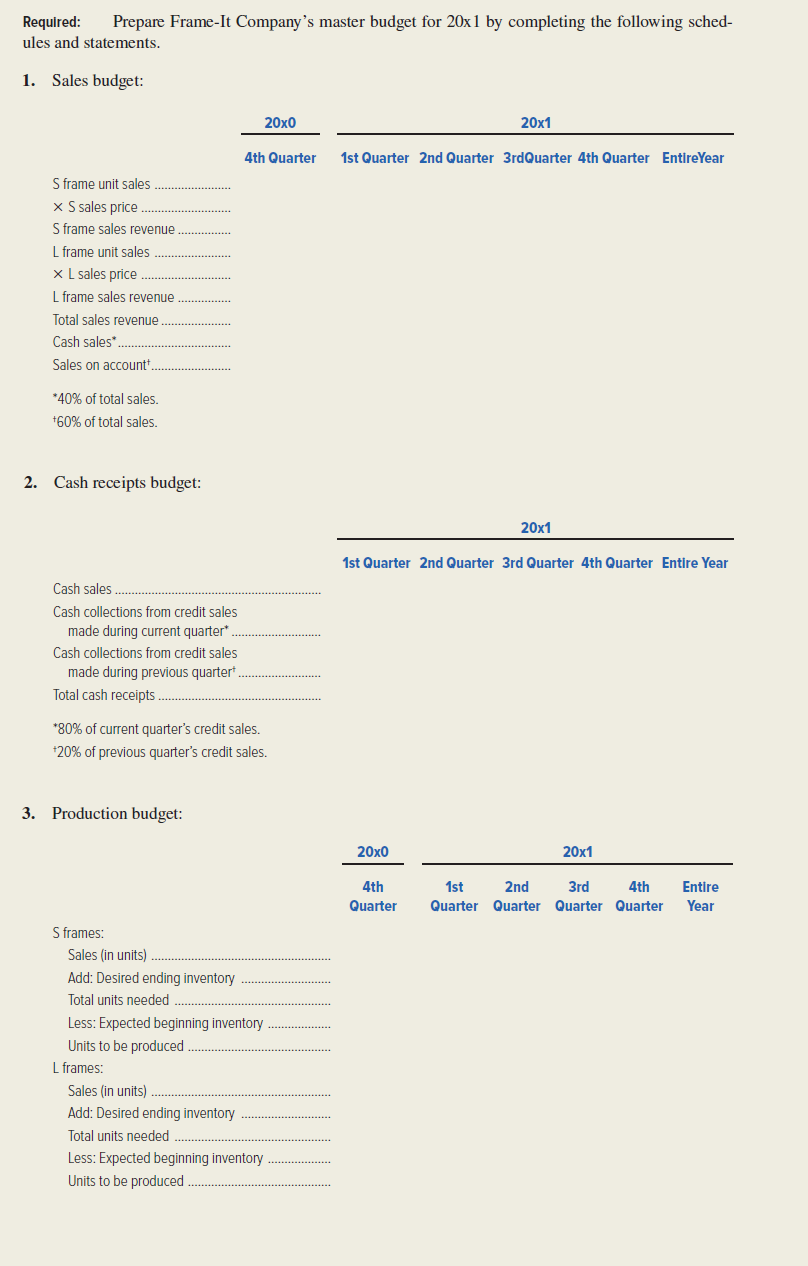

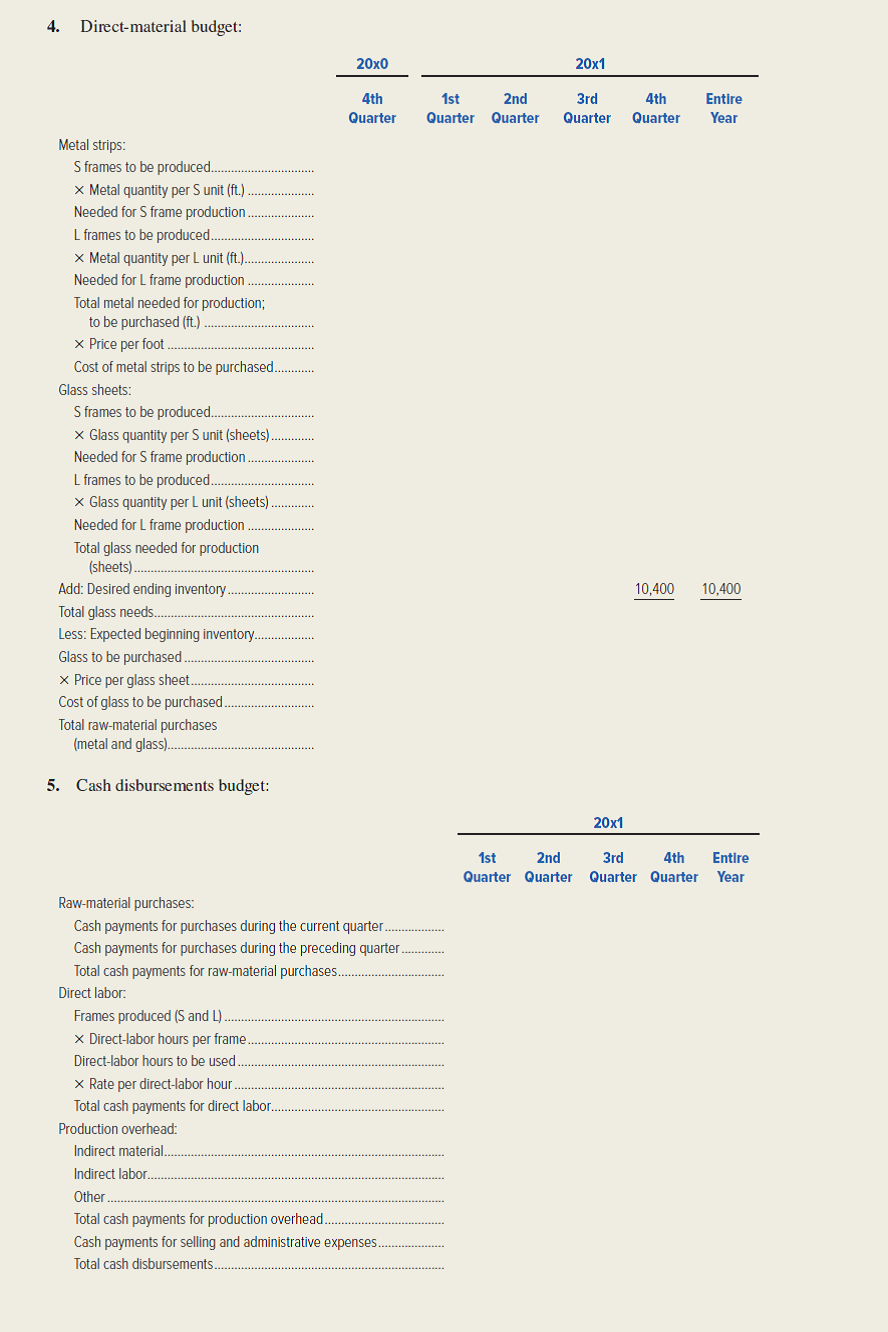

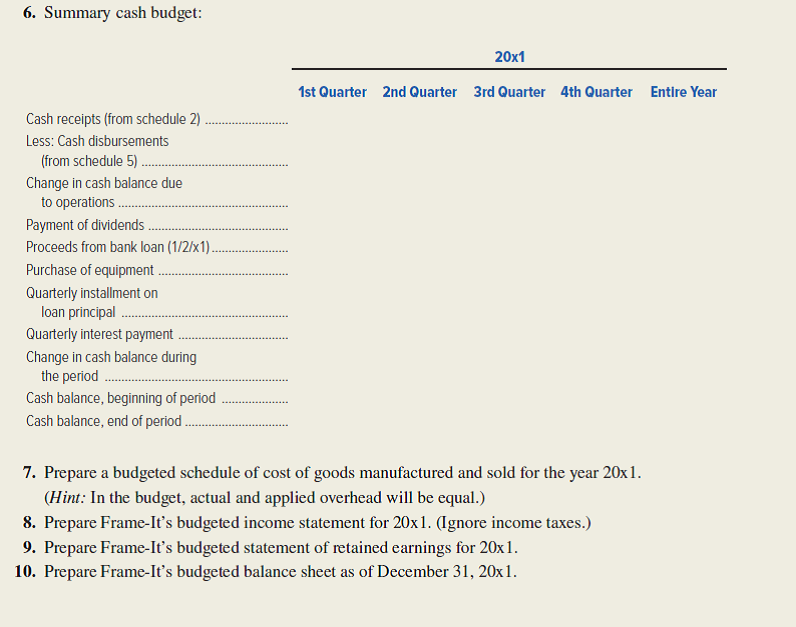

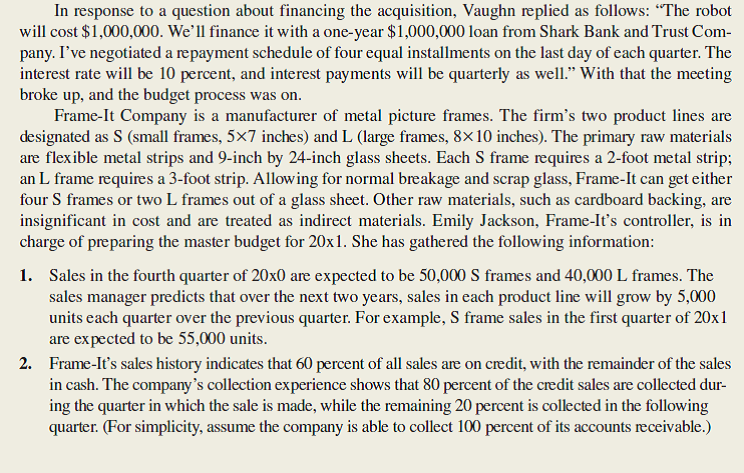

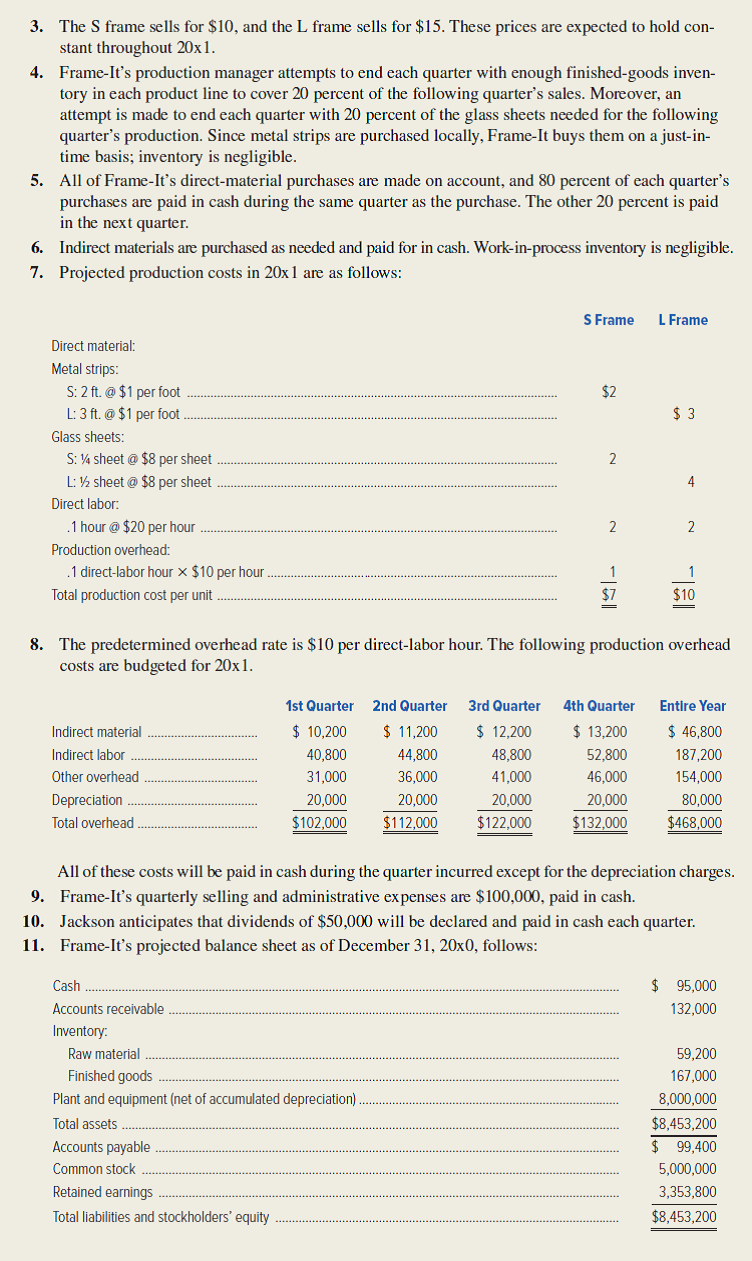

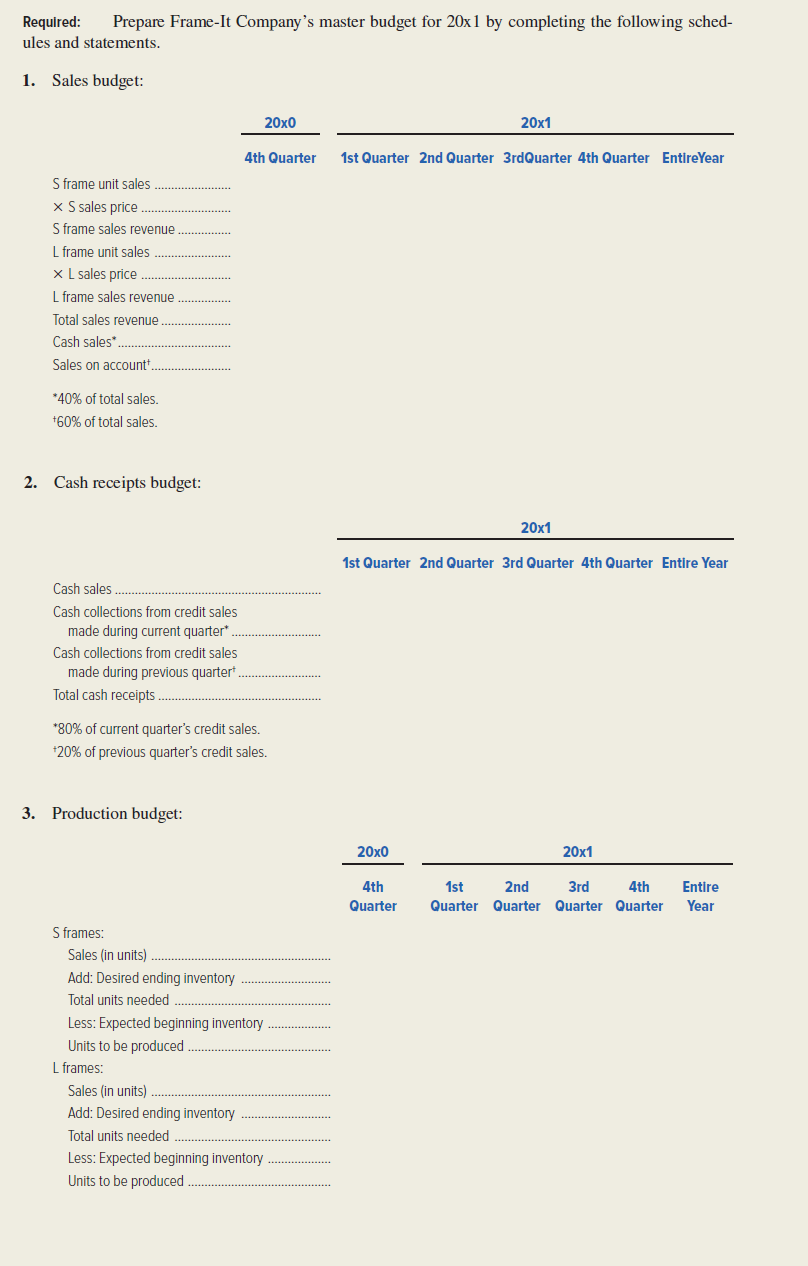

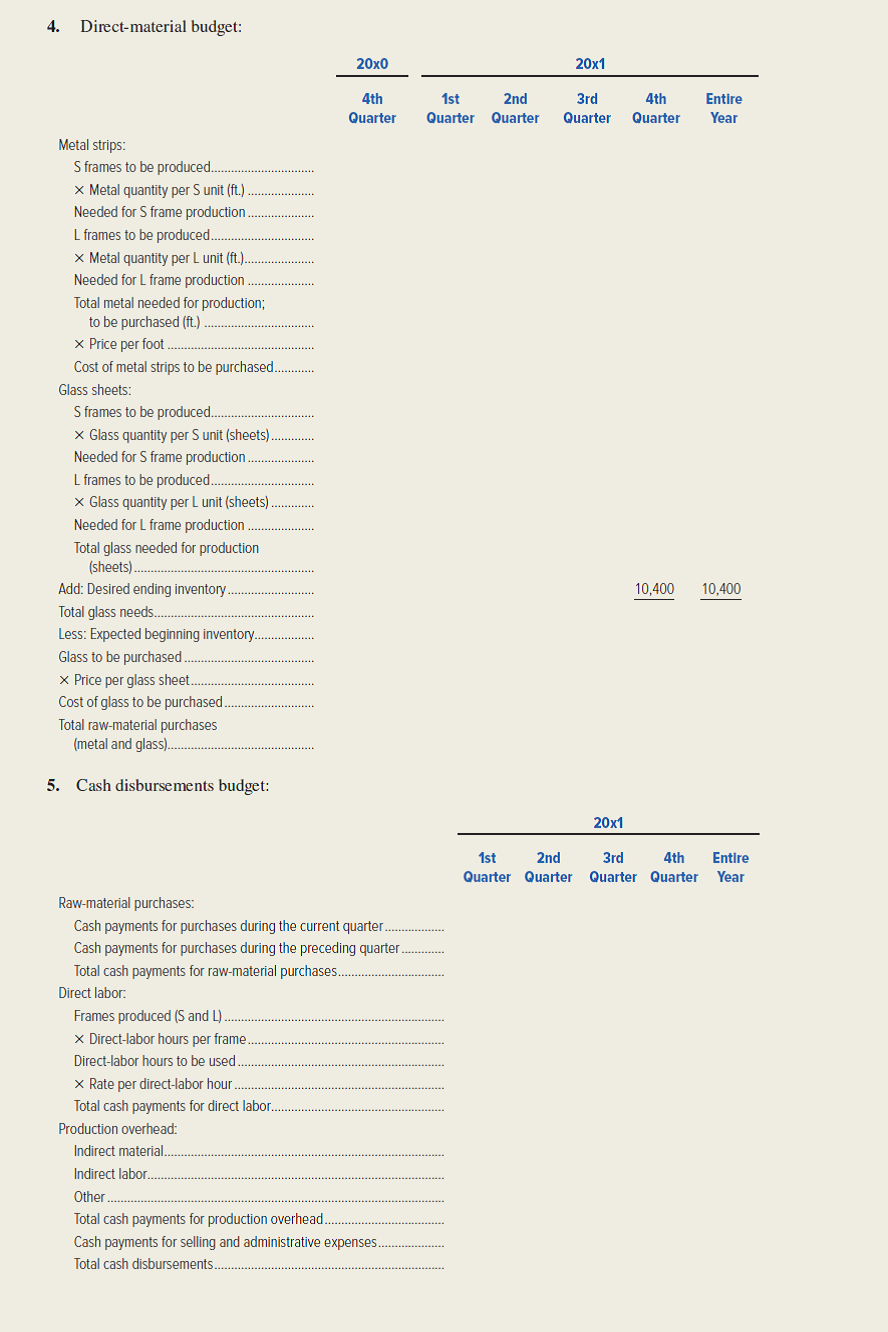

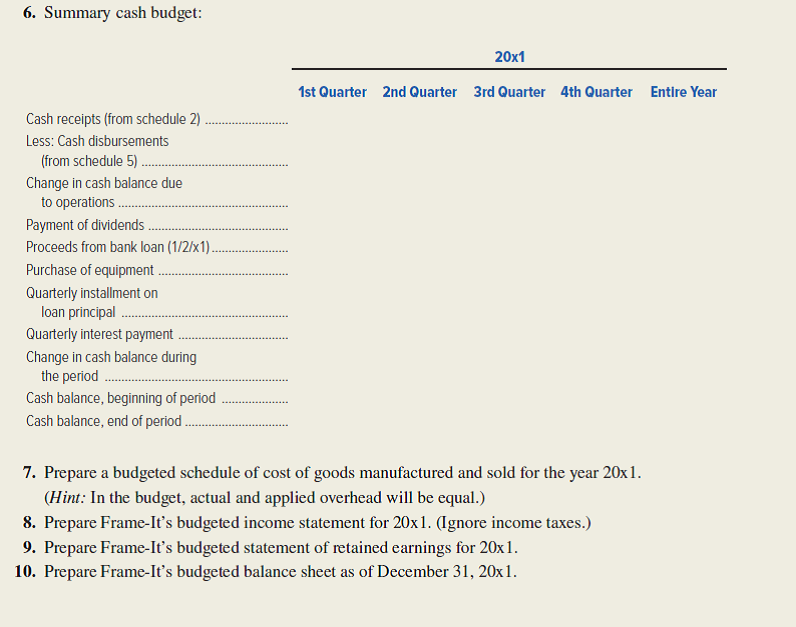

Jeffrey Vaughn, president of Frame-It Company, was just concluding a budget meeting with his senior staff. It was November of 20x0, and the group was discussing preparation of the firm's master budget for 20x1. "I've decided to go ahead and purchase the industrial robot we've been talking about. We'll make the acquisition on January 2 of next year, and I expect it will take most of the year to train the personnel and reorganize the production process to take full advantage of the new equipment."

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck