Deck 17: Financial Planning and Control

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

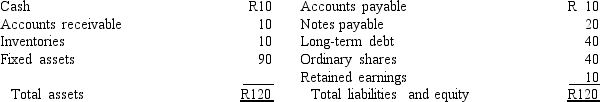

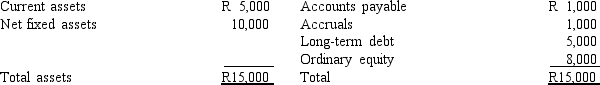

Question

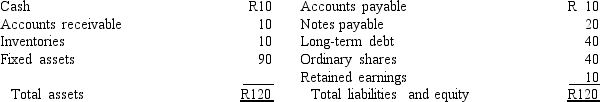

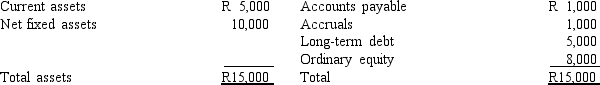

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/91

Play

Full screen (f)

Deck 17: Financial Planning and Control

1

The term "spontaneously generated funds" generally refers to increases in the cash account that result from growth in sales, assuming the firm is operating with a positive profit margin.

False

2

Two firms which have the same operating leverage must also have the same ROA, since operating leverage and ROA both measure the effective utilisation of assets by the firm.

False

3

Errors in the sales forecast can be offset by similar errors in costs and income forecasts.Thus, as long as the errors are not large, sales forecast accuracy is not critical to the firm.

False

4

Other things held constant, if a firm is operating at a profit and then sales increase, the degree of operating leverage will decline.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

5

Alternative methods for producing a given product often have different degrees of operating leverage and hence have different breakeven points and degrees of risk.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

6

The DOL is an index number that measures the effect of a change in sales price on the operating breakeven point.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

7

Two key objectives of financial planning and control are to avoid cash squeezes and to improve profitability.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

8

To determine the amount of additional funds needed, you may subtract the expected increase in liabilities (a source of funds) from the sum of the expected increases in retained earnings and assets (both uses of funds).

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

9

One limitation of operating breakeven analysis is that variable cost must be assumed constant throughout the analysis in order to completely analyse changes in fixed investment.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

10

The degree of financial leverage gives an indication of how a change in EBIT will affect EPS.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

11

Breakeven analysis can be used to determine how large sales of a new product must be for the firm to achieve profitability, but it is not useful in studying the effects of a general expansion in the firm's operations.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

12

The closer a firm is to its operating breakeven point, the greater is the absolute value of the degree of operating leverage.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

13

Operating costs include variable costs, depreciation, and interest charges.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

14

As a firm's sales grow its current asset accounts tend to increase.For instance, as sales increase the firm's purchases increase and its level of accounts payable will increase.Thus, spontaneously generated funds will arise from transaction accounts that increase as sales increase.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

15

Everything else equal, the higher the DFL is for a firm, the closer its operations are to its operating breakeven point.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

16

Today, computer simulation models can calculate multiple breakeven charts providing management with an idea of how the firm's breakeven point would change under different assumptions for key variables.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

17

The higher the percentage of a firm's total costs that are fixed, the higher the degree of operating leverage and the lower the operating breakeven point.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

18

Everything else equal, the higher the DFL is for a firm, the closer its operations are to its financial breakeven point.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

19

If a firm has no preferred stock, its financial breakeven point is the sales level that results in net income equal to zero.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

20

The purpose of financial breakeven analysis is to determine the level of sales a firm needs in order to cover the fixed and variable costs associated with producing and selling inventory items.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

21

Breakeven analysis can involve determining the magnitude of the firm's profit or losses at output levels on and around the point where revenues equal costs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

22

A firm whose degree of operating leverage (DOL) is equal to three means that a given percentage change in sales will change earnings per share by three times as much.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

23

In general, excess capacity means more external financing is required to support increases in operations than would be needed if the firm previously operated at full capacity.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

24

If any firm with a positive net worth is operating its fixed assets at full capacity, if its dividend payout ratio is 100 percent, and if it wants to hold all financial ratios constant, then for any positive growth rate in sales, the firm will require external financing.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

25

A firm that only utilises 40% of its fixed assets capacity to generate R1,000,000 in sales will be able to increase sales to R4,000,000 before full capacity is reached and plant and equipment would have to be increased.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

26

Other things held constant, a high degree of total leverage will mean that a relatively small change in sales will result in a large change in EPS.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

27

The operating breakeven volume in units can be found by dividing the firm's total fixed cost in rands by its profit margin per unit (i.e., price less variable cost).

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

28

Lumpy assets are assets that cannot be acquired in small increments; they must be obtained in large discrete amounts.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

29

The projected statement of financial position method assumes that the key ratios are constant, which means, for example, that if you plotted a graph of inventories versus sales, the regression line would be linear and would have a positive Y-intercept.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

30

Other things held constant, a high degree of operating leverage will mean that a relatively small change in sales will result in a large change in operating income.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

31

Financial planning involves implementing the financial plans, or forecasts, and dealing with the feedback and adjustment process that is necessary to ensure the goals of the firm are pursued appropriately.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

32

The degree of total leverage shows how a change in sales will affect operating income.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

33

One potential benefit of high operating leverage is that it can reduce the average cost per unit at high levels of output, thus generating a competitive cost advantage.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

34

The fact that long-term debt and equity funds are raised infrequently and in large amounts lessens the need for the firm to forecast them on a continual basis.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

35

The projected statement of financial position forecasting method would be appropriate if, in a regression of sales on each asset and spontaneous liability, the regression line was linear and passed through the origin.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

36

Financial planning involves the projection of sales, income, and assets as well as the determination of the resources needed to achieve these projections.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

37

Breakeven analysis is important in the planning and control process because the cost-volume-profit relationship can be influenced greatly by the proportion of the firm's assets that are fixed.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

38

Financial control involves the projection of sales, income, and assets as well as the determination of the resources needed to achieve these projections.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

39

The firm's cost-volume-profit relationship is most influenced by variable cost and, thus, the level of fixed or operating costs plays a relatively minor role.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

40

Two firms that have the same financial leverage must also have the same ROE, because both financial leverage and ROE measure the risk associated with equity financing.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is a key determinant of financial leverage?

A) Level of debt.

B) Technology.

C) Labor costs.

D) Amount of fixed assets used by the firm.

E) Variable cost of goods sold.

A) Level of debt.

B) Technology.

C) Labor costs.

D) Amount of fixed assets used by the firm.

E) Variable cost of goods sold.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

42

The decision of how to raise additional funds needed to support sales growth is based on several factors including

A) firm's ability to handle additional debt.

B) conditions in the equity markets.

C) firm's current capital structure.

D) existing debt covenants.

E) All of the above.

A) firm's ability to handle additional debt.

B) conditions in the equity markets.

C) firm's current capital structure.

D) existing debt covenants.

E) All of the above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

43

An advantage of breakeven analysis is that it can be applied with equal precision whether a firm's cost curve is linear or nonlinear.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

44

The projected statement of financial position forecasting method produces accurate results unless which of the following condition(s) is (are) present?

A) Fixes assets are "lumpy."

B) Strong economies of scale are present.

C) Excess capacity exists because of a temporary recession.

D) Answers a, b, and c all make the projected financial position method inaccurate.

E) Answers a and c make the projected statement of financial position method inaccurate, but as the text explains, the assumption of increasing economies of scale is built into the projected balance sheet method.

A) Fixes assets are "lumpy."

B) Strong economies of scale are present.

C) Excess capacity exists because of a temporary recession.

D) Answers a, b, and c all make the projected financial position method inaccurate.

E) Answers a and c make the projected statement of financial position method inaccurate, but as the text explains, the assumption of increasing economies of scale is built into the projected balance sheet method.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following liabilities is most likely to increase spontaneously with an increase in sales?

A) Notes payable

B) Long-term bonds

C) Preference shares

D) Accounts payable

E) Ordinary shares

A) Notes payable

B) Long-term bonds

C) Preference shares

D) Accounts payable

E) Ordinary shares

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

46

Once the "base case" forecasted financial statements have been prepared, top managers want to know

A) how realistic the results are.

B) how to attain the results.

C) what impact changes in operations would have on the forecasts.

D) All of the above.

E) None of the above.

A) how realistic the results are.

B) how to attain the results.

C) what impact changes in operations would have on the forecasts.

D) All of the above.

E) None of the above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

47

It is more difficult to estimate fixed and variable cost per unit for a project during planning than once the project is underway.This is because, once a project is operational, the firm has access to clearly reported and separated actual costs that the project incurs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

48

The degree of financial leverage for ABC Inc.is 2.5, and the degree of financial leverage for XYZ Corporation is 1.5.According to this information, which firm is considered to have greater financial risk?

A) ABC Inc.

B) XYZ Corporation.

C) The degree of financial leverage is not a measure of financial risk, so it is not possible to tell which firm has the greater financial risk given the above information.

D) To determine which firm has the greater financial risk, we need to know the operating income (NOI or EBIT) of each firm.XYZ Corporation would have less financial risk if its operating income is at least twice that of ABC Inc.

E) None of the above is a correct answer.

A) ABC Inc.

B) XYZ Corporation.

C) The degree of financial leverage is not a measure of financial risk, so it is not possible to tell which firm has the greater financial risk given the above information.

D) To determine which firm has the greater financial risk, we need to know the operating income (NOI or EBIT) of each firm.XYZ Corporation would have less financial risk if its operating income is at least twice that of ABC Inc.

E) None of the above is a correct answer.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

49

If a small change in sales results in a large change in EPS, then it must be caused by the financial leverage associated with the firm.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

50

Other things held constant, the greater the firm's use of debt, the greater the change in EPS that will result from a change in sales volume.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

51

If firm A uses more operating leverage than firm B, firm A will probably have a greater percentage profit margin per unit than firm B, if both firms are otherwise identical and operating above their respective operating breakeven levels.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

52

Suppose a firm uses a high degree of operating leverage and operates in an industry whose sales are greatly affected by changes in the overall level of economic activity.The riskiness of that firm's earnings stream will likely be greater than the earnings of a firm in the same industry which has a lower degree of operating leverage.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

53

Management need not consider economies of scale in operations when constructing pro forma financial statements since economies of scale do not impact the financial statements.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

54

The higher the DOL, the greater the firm's use of debt and the more earnings will change following a change in sales.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is correct?

A) One of the key steps in the development of pro forma financial statements is to identify those assets and liabilities which increase spontaneously with net income.

B) The first, and most critical, step in constructing a set of pro forma financial statements is establishing the sales forecast.

C) Pro forma financial statements as discussed in the text are used primarily to assess a firm's historical performance.

D) All else equal, if a firm operates at full capacity, the greater its payout ratio, the less additional funds that will be needed for a particular growth in sales.

E) The projected statement of financial position forecasting method produces accurate results when fixed assets are lumpy and when economies of scale are present.

A) One of the key steps in the development of pro forma financial statements is to identify those assets and liabilities which increase spontaneously with net income.

B) The first, and most critical, step in constructing a set of pro forma financial statements is establishing the sales forecast.

C) Pro forma financial statements as discussed in the text are used primarily to assess a firm's historical performance.

D) All else equal, if a firm operates at full capacity, the greater its payout ratio, the less additional funds that will be needed for a particular growth in sales.

E) The projected statement of financial position forecasting method produces accurate results when fixed assets are lumpy and when economies of scale are present.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

56

When constructing pro forma financial statements, which of the following steps should be completed first?

A) Forecast next period's statement of financial position.

B) Determine the additional funds needed, AFN, to support expected growth.

C) Forecast next period's statement of comprehensive income.

D) Consider the impact of external financing on the additional funds needed (AFN) to determine how much additional interest or dividends must be paid to support expected growth-that is, consider financing feedbacks.

E) Determine whether the firm is operating above or below its operating breakeven point.

A) Forecast next period's statement of financial position.

B) Determine the additional funds needed, AFN, to support expected growth.

C) Forecast next period's statement of comprehensive income.

D) Consider the impact of external financing on the additional funds needed (AFN) to determine how much additional interest or dividends must be paid to support expected growth-that is, consider financing feedbacks.

E) Determine whether the firm is operating above or below its operating breakeven point.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

57

A high degree of operating leverage, other things held constant, means that a relatively small change in unit sales will result in a large change in operating income.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

58

The projected statement of financial position method of forecasting is based on which of the following assumptions?

A) All financial position accounts are tied directly to sales.

B) Most financial position accounts are tied directly to sales.

C) The current level of total assets are optimal for the current sales level.

D) Answers a and c above.

E) Answers b and c above.

A) All financial position accounts are tied directly to sales.

B) Most financial position accounts are tied directly to sales.

C) The current level of total assets are optimal for the current sales level.

D) Answers a and c above.

E) Answers b and c above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following accounts will not rise spontaneously with an increase in sales?

A) Accounts payable

B) Accrued wages

C) Accrued taxes

D) Accounts receivable

E) Notes payable

A) Accounts payable

B) Accrued wages

C) Accrued taxes

D) Accounts receivable

E) Notes payable

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

60

Assume a portion of a firm's long-term funds includes either debt or preference shares.Which of the following statements is correct?

A) The firm must possess operating leverage, which means that a change in net income will result in a greater percentage change in earnings before interest and taxes (EBIT).

B) The firm has financial leverage, which means that a change in sales will result in a greater percentage change in EBIT.

C) The firm has financial leverage, which means that a change in EBIT will result in a greater percentage change in earnings per share (EPS).

D) The firm doesn't have leverage, because leverage is created through the use of ordinary equity financing only.

E) None of the above is a correct answer.

A) The firm must possess operating leverage, which means that a change in net income will result in a greater percentage change in earnings before interest and taxes (EBIT).

B) The firm has financial leverage, which means that a change in sales will result in a greater percentage change in EBIT.

C) The firm has financial leverage, which means that a change in EBIT will result in a greater percentage change in earnings per share (EPS).

D) The firm doesn't have leverage, because leverage is created through the use of ordinary equity financing only.

E) None of the above is a correct answer.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

61

Business risk is related with the operations of the firm.Which of the following is not directly associated with-that is, not a part of-business risk?

A) product demand variability

B) sales price variability

C) relative amount of fixed operating costs

D) degree of price flexibility with respect to changes in operating costs

E) changes in required returns due to financing decisions

A) product demand variability

B) sales price variability

C) relative amount of fixed operating costs

D) degree of price flexibility with respect to changes in operating costs

E) changes in required returns due to financing decisions

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

62

Everything else equal, a firm can reduce its operating breakeven point by

A) increasing its fixed costs.

B) decreasing the selling price of the product that is sold.

C) increasing the contribution margin, which is the product's selling price less its variable cost.

D) increasing the variable cost per unit.

E) None of the above is correct.

A) increasing its fixed costs.

B) decreasing the selling price of the product that is sold.

C) increasing the contribution margin, which is the product's selling price less its variable cost.

D) increasing the variable cost per unit.

E) None of the above is correct.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following factors might cause "spontaneous" assets and liabilities to change at a different rate than sales?

A) Lumpy assets

B) Economies of scale

C) Excess capacity

D) All of the above

E) Answers b and c above

A) Lumpy assets

B) Economies of scale

C) Excess capacity

D) All of the above

E) Answers b and c above

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

64

Compuvac Company has just completed its first pass forecast using the projected statement of financial position method.The firm has determined that it needs R4 million in new debt which can be sold at par with a 10% annual coupon.Additionally, the firm will sell 500,000 shares of new ordinary equity at R18.10 per share.Next year's expected dividend is R0.48 per share.The firm expects that taxes will be R160,000 less under the second pass than they were under the first pass based on a 40% tax rate.Given this information, what is the incremental change in AFN for Compuvac going from the first pass to the second pass?

A) R240,000

B) R0

C) R480,000

D) R160,000

E) R640,000

A) R240,000

B) R0

C) R480,000

D) R160,000

E) R640,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

65

If a firm has a degree of operating leverage (DOL) that is greater than 1.0, the we know that a 1.0 percent change in __________ will cause in a change in __________ that is __________ 1.0 percent.

A) EBIT; sales; greater than

B) EBIT; net income; greater than

C) sales; EBIT; less than

D) sales; EBIT; greater than

E) EBIT; net income; less than

A) EBIT; sales; greater than

B) EBIT; net income; greater than

C) sales; EBIT; less than

D) sales; EBIT; greater than

E) EBIT; net income; less than

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

66

All else equal, one firm will have a lower breakeven point than another firm if

A) its fixed costs are higher.

B) its selling price of the product is higher.

C) its variable operating cost per unit is higher.

D) All of the above.

E) None of the above.

A) its fixed costs are higher.

B) its selling price of the product is higher.

C) its variable operating cost per unit is higher.

D) All of the above.

E) None of the above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

67

For a particular product, Sandbarr Corporation has operating fixed costs of R30,000, of which depreciation of R15,000 is the only non-cash outlay.The unit sale price is R4.20 per unit and variable costs are R2.20 per unit.What is the operating cash breakeven point in units for Sandbarr?

A) 3,572 units

B) 6,818 units

C) 10,000 units

D) 15,000 units

E) 7,500 units

A) 3,572 units

B) 6,818 units

C) 10,000 units

D) 15,000 units

E) 7,500 units

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements is correct?

A) The first pass using the projected statement of financial position method determines the financing feedback effects and determines how much in additional funds are needed.The second pass completes the cycle, identifies the full financing need, and eliminates further feedback effects.

B) Interest expense on additional new debt is the only statement of comprehensive income account affected by financing feedback, and dividends payable to new ordinary shares is the only statement of financial position account affected.

C) The projected statement of financial position method is useful for determining additional funds needed, however, it cannot be used in evaluating dividend policy and capital structure decisions.

D) One reason a firm's managers may choose to meet additional funds needed requirements through ordinary shares is that it involves no financing feedback effects.Since no new debt is used, interest expense will be considered fully in the first pass, the statement of comprehensive income will remain unchanged, and no second pass is needed.

E) If new debt and new shares are used to meet new financing needs, net income will decrease from the first pass to the second pass even though taxes decrease.In addition, if dividends are to be paid on new shares, this will further decrease the amount of retained earnings available for financing needs.

A) The first pass using the projected statement of financial position method determines the financing feedback effects and determines how much in additional funds are needed.The second pass completes the cycle, identifies the full financing need, and eliminates further feedback effects.

B) Interest expense on additional new debt is the only statement of comprehensive income account affected by financing feedback, and dividends payable to new ordinary shares is the only statement of financial position account affected.

C) The projected statement of financial position method is useful for determining additional funds needed, however, it cannot be used in evaluating dividend policy and capital structure decisions.

D) One reason a firm's managers may choose to meet additional funds needed requirements through ordinary shares is that it involves no financing feedback effects.Since no new debt is used, interest expense will be considered fully in the first pass, the statement of comprehensive income will remain unchanged, and no second pass is needed.

E) If new debt and new shares are used to meet new financing needs, net income will decrease from the first pass to the second pass even though taxes decrease.In addition, if dividends are to be paid on new shares, this will further decrease the amount of retained earnings available for financing needs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

69

By definition, a firm's operating breakeven point represents the level of production and sales at which

A) additional funds needed equals zero.

B) variable costs equals operating revenue.

C) fixed variable costs equals operating revenue.

D) net operating income equals zero.

E) the cost of equity equals the cost of debt.

A) additional funds needed equals zero.

B) variable costs equals operating revenue.

C) fixed variable costs equals operating revenue.

D) net operating income equals zero.

E) the cost of equity equals the cost of debt.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

70

Everything else equal, if a firm shifts its capital structure to include more debt than before the shift, then the firm's business risk should

A) increase because the degree of financial leverage increases.

B) decrease because the degree of operating leverage decreases.

C) not change because capital structure decisions should affect the firm's financial risk, not its business risk.

D) not change because, although additional ordinary shares will increase financial risk, the business risk should decrease by the same amount.

A) increase because the degree of financial leverage increases.

B) decrease because the degree of operating leverage decreases.

C) not change because capital structure decisions should affect the firm's financial risk, not its business risk.

D) not change because, although additional ordinary shares will increase financial risk, the business risk should decrease by the same amount.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

71

The Price Company will produce 55,000 widgets next year.Variable costs will equal 40 percent of sales, while operating fixed costs will total R110,000.At what price must each widget be sold for the company to achieve an EBIT of R95,000?

A) R2.00

B) R4.45

C) R5.00

D) R5.37

E) R6.21

A) R2.00

B) R4.45

C) R5.00

D) R5.37

E) R6.21

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

72

Considering each action independently and holding other things constant, which of the following actions would reduce the firm's need for additional capital?

A) An increase in the dividend payout ratio.

B) A decrease in the profit margin.

C) A decrease in the days sales outstanding.

D) An increase in expected sales growth.

E) A decrease in the accrual accounts (accrued wages and taxes).

A) An increase in the dividend payout ratio.

B) A decrease in the profit margin.

C) A decrease in the days sales outstanding.

D) An increase in expected sales growth.

E) A decrease in the accrual accounts (accrued wages and taxes).

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

73

All else equal, which of the following activities should increase the financial risk of a firm?

A) decrease ordinary share dividends

B) issue new bonds

C) issue new ordinary shares

D) repurchase (pay off) outstanding debt

E) an increase in the fixed operating costs

A) decrease ordinary share dividends

B) issue new bonds

C) issue new ordinary shares

D) repurchase (pay off) outstanding debt

E) an increase in the fixed operating costs

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

74

If a firm's degree of total leverage (DTL) is 8.0, which of the following must be correct?

A) The firm must have fixed operating costs.

B) The firm must have fixed financial costs.

C) The firm must have both fixed operating costs and fixed financial costs.

D) The firm must have some fixed costs, but not enough information is given to determine whether the fixed costs are operating, financial, or both.

E) With the information given, we cannot tell whether the firm has any fixed costs (either operating or financial) at all.

A) The firm must have fixed operating costs.

B) The firm must have fixed financial costs.

C) The firm must have both fixed operating costs and fixed financial costs.

D) The firm must have some fixed costs, but not enough information is given to determine whether the fixed costs are operating, financial, or both.

E) With the information given, we cannot tell whether the firm has any fixed costs (either operating or financial) at all.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following statements is correct?

A) Any forecast of financial requirements involves determining how much money the firm will need and is obtained by adding together increases in assets and spontaneous liabilities and subtracting operating income.

B) The projected statement of financial position method of forecasting financial needs requires only a forecast of the firm's statement of financial position.Although a forecasted statement of comprehensive income helps clarify the financing needs, it is not essential to the statement of financial position method.

C) Because dividends are paid after taxes from retained earnings, dividends are not included in the projected statement of financial position method of forecasting.

D) The projected statement of financial position method forces recognition of the fact that new financing creates additional financial obligations.For instance, new financing can increase expenses which can actually decrease taxes but increase the projected financial need.

E) Financing feedback describes the effect on the firm's share price on the announcement that the firm will sell new equity or debt to raise needed capital.

A) Any forecast of financial requirements involves determining how much money the firm will need and is obtained by adding together increases in assets and spontaneous liabilities and subtracting operating income.

B) The projected statement of financial position method of forecasting financial needs requires only a forecast of the firm's statement of financial position.Although a forecasted statement of comprehensive income helps clarify the financing needs, it is not essential to the statement of financial position method.

C) Because dividends are paid after taxes from retained earnings, dividends are not included in the projected statement of financial position method of forecasting.

D) The projected statement of financial position method forces recognition of the fact that new financing creates additional financial obligations.For instance, new financing can increase expenses which can actually decrease taxes but increase the projected financial need.

E) Financing feedback describes the effect on the firm's share price on the announcement that the firm will sell new equity or debt to raise needed capital.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

76

The degree of operating leverage has which of the following characteristics?

A) The closer the firm is operating to breakeven quantity, the smaller the DOL.

B) A change in quantity demanded will produce the same percentage change in EBIT as an identical change in price per unit of output, other things held constant.

C) The DOL is not a fixed number for a given firm, but will depend upon the time zero values of the economic variables Q (Quantity), P (Price), and V (Volume).

D) The DOL relates the change in net income to the change in net operating income.

E) If the firm has no debt, the DOL will equal 1.

A) The closer the firm is operating to breakeven quantity, the smaller the DOL.

B) A change in quantity demanded will produce the same percentage change in EBIT as an identical change in price per unit of output, other things held constant.

C) The DOL is not a fixed number for a given firm, but will depend upon the time zero values of the economic variables Q (Quantity), P (Price), and V (Volume).

D) The DOL relates the change in net income to the change in net operating income.

E) If the firm has no debt, the DOL will equal 1.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

77

A firm has the following statement of financial position:  Fixed assets are being used at 80 percent of capacity; sales for the year just ended were R200; sales will increase R10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years, i.e., the total AFN for the 4-year period?

Fixed assets are being used at 80 percent of capacity; sales for the year just ended were R200; sales will increase R10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years, i.e., the total AFN for the 4-year period?

A) R4.00

B) R2.00

C) -R0.80 (Surplus)

D) -R14.00 (Surplus)

E) R0

Fixed assets are being used at 80 percent of capacity; sales for the year just ended were R200; sales will increase R10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years, i.e., the total AFN for the 4-year period?

Fixed assets are being used at 80 percent of capacity; sales for the year just ended were R200; sales will increase R10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years, i.e., the total AFN for the 4-year period?A) R4.00

B) R2.00

C) -R0.80 (Surplus)

D) -R14.00 (Surplus)

E) R0

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

78

You are the owner of a small business which has the following statement of financial position:  Fixed and current assets are fully utilised, and the sales/assets and sales/spontaneous liabilities ratios will remain constant.Next year you expect sales to increase by 50 percent.You also expect to retain R2,000 of next year's earnings within the firm.What is next year's additional external funding requirement, i.e., what is your firm's AFN?

Fixed and current assets are fully utilised, and the sales/assets and sales/spontaneous liabilities ratios will remain constant.Next year you expect sales to increase by 50 percent.You also expect to retain R2,000 of next year's earnings within the firm.What is next year's additional external funding requirement, i.e., what is your firm's AFN?

A) No additional funds are required.

B) R3,500

C) R4,500

D) R5,500

E) The answer depends on this year's sales level.

Fixed and current assets are fully utilised, and the sales/assets and sales/spontaneous liabilities ratios will remain constant.Next year you expect sales to increase by 50 percent.You also expect to retain R2,000 of next year's earnings within the firm.What is next year's additional external funding requirement, i.e., what is your firm's AFN?

Fixed and current assets are fully utilised, and the sales/assets and sales/spontaneous liabilities ratios will remain constant.Next year you expect sales to increase by 50 percent.You also expect to retain R2,000 of next year's earnings within the firm.What is next year's additional external funding requirement, i.e., what is your firm's AFN?A) No additional funds are required.

B) R3,500

C) R4,500

D) R5,500

E) The answer depends on this year's sales level.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

79

By definition, a firm's financial breakeven point is the level of operating income (NOI) where its

A) share value is maximised.

B) earnings before interest and taxes (EBIT) equal zero.

C) earnings per share equal zero.

D) taxes equal zero.

E) interest expense equal zero.

A) share value is maximised.

B) earnings before interest and taxes (EBIT) equal zero.

C) earnings per share equal zero.

D) taxes equal zero.

E) interest expense equal zero.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

80

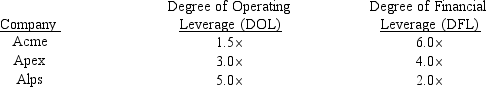

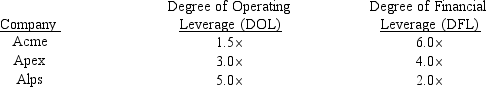

Expert Analysts Resources (EAR) has provided you with the following information about three companies you are currently evaluating:  According to this information, which firm would be considered riskiest?

According to this information, which firm would be considered riskiest?

A) Acme, because its DFL equals 6.0, which is the highest leverage associated with any of the three firms.

B) Acme, because its degree of total leverage (DTL) is almost equal to 10*.

C) Apex, because it has the highest degree of total (DTL).

D) Alps, because it has the highest DOL.

E) Acme, because is has the lowest DOL.

According to this information, which firm would be considered riskiest?

According to this information, which firm would be considered riskiest?A) Acme, because its DFL equals 6.0, which is the highest leverage associated with any of the three firms.

B) Acme, because its degree of total leverage (DTL) is almost equal to 10*.

C) Apex, because it has the highest degree of total (DTL).

D) Alps, because it has the highest DOL.

E) Acme, because is has the lowest DOL.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck