Deck 7: Shares Equity-Characteristics and Valuation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 7: Shares Equity-Characteristics and Valuation

1

Founders' shares is a type of classified share where the shares are owned by the firm's founders and they retain the sole voting rights to those shares but have restricted dividends for a specified time period.

True

2

When a firm issues new equity, market pressure applies first to the new shares issued and then to existing shares.Subsequent to the new issue, the value of the new shares will rise to the equilibrium price of the old shares.

False

3

When management controls more than 50% of the shares of the firm, they must be concerned with the potential of a proxy fights than can lead to takeovers of the firm and the replacement of management.

False

4

According to the basic share valuation model, the value an investor assigns to a share is dependent upon the length of time the investor plans to hold the share.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

One advantage of using ordinary shares as a source of funds is that ordinary shares does not legally obligate the firm to make payments to shareholders.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

A share's par value is equal to the market value of the share on the last day of the fiscal year for a firm.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

The book value per share is computed by taking the sum of ordinary shares, additional paid in capital, and retained earnings and dividing the number by the number of shares outstanding.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

A publicly owned corporation is simply a company whose shares are held by the investing public, which may include other corporations and institutions.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

The constant growth model used for evaluating the price of a share of ordinary shares and can also be used to find the price of perpetual preference shares or any other perpetuity.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

In international markets, excluding shares sold in South Africa, what is any share that is traded in a country other than the issuing company's home country called?

A) ADRs

B) Yankee shares

C) Euro shares

D) Class A shares

E) Preference shares

A) ADRs

B) Yankee shares

C) Euro shares

D) Class A shares

E) Preference shares

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

According to the textbook model, under conditions of non-constant growth, the discount rate utilized to find the present value of the expected cash flows will be the same for the initial growth period as for the normal growth period.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

12

The net income that firm earns can either be paid out to shareholders as __________ or can be reinvested in the company as __________.

A) interest; additional paid-in capital

B) dividends; retained earnings

C) shares; capital shares.

D) capital gains; additional paid-in capital

E) interest; retained earnings

A) interest; additional paid-in capital

B) dividends; retained earnings

C) shares; capital shares.

D) capital gains; additional paid-in capital

E) interest; retained earnings

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

13

A proxy fight is an attempt by a group to gain control of a firm by convincing its shareholders to give the group the authority to vote with their shares in order to elect a new management team.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

One advantage of ordinary shares as a source of funds is that the underwriting and distribution costs of ordinary shares are usually much lower than those for debt.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

After a new issue is brought to market it is the marginal investor who determines the price at which the share will trade.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

Preemptive rights are important to shareholders because they provide protection against a dilution of value when new shares are issued.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

From a social welfare perspective, ordinary shares are a desirable form of financing in part because it involves no fixed charge payments.Its inclusion in a firm's capital structure makes the firm less vulnerable to the consequences of unanticipated declines in sales and earnings than if only debt were available.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

Other things held constant, P/E ratios are higher for firms with high growth prospects.At the same time, P/E's are lower for riskier firms, other things held constant.These two factors, growth prospects and riskiness, may either be offsetting or reinforcing as P/E determinants.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

American depository receipts (ADRs) are foreign shares listed on a domestic exchange.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

A preemptive right is a provision in the corporate charter or by laws that gives ordinary shareholders the right to purchase on a pro rata basis new issues of ordinary shares.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

A share of preference shares pays a quarterly dividend of R2.50.If the price of this preference shares is currently R50, what is the simple annual rate of return?

A) 12%

B) 18%

C) 20%

D) 23%

E) 28%

A) 12%

B) 18%

C) 20%

D) 23%

E) 28%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

A share of perpetual preference shares pays an annual dividend of R6 per share.If investors require a 12 percent rate of return, what should be the price of this preference shares?

A) R57.25

B) R50.00

C) R62.38

D) R46.75

E) R41.64

A) R57.25

B) R50.00

C) R62.38

D) R46.75

E) R41.64

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

Nahanni Treasures Corporation is planning a new ordinary share issue of five million shares to fund a new project.The increase in shares will bring to 25 million the number of shares outstanding.Nahanni's long-term growth rate is 6 percent, and its current required rate of return is 12.6 percent.The firm just paid a R1.00 dividend and the shares sell for R16.06 in the market.On the announcement of the new equity issue, the firm's share price dropped.Nahanni estimates that the company's growth rate will increase to 6.5 percent with the new project, but since the project is riskier than average, the firm's cost of capital will increase to 13.5 percent.Using the DDM constant growth model, what is the change in the equilibrium share price?

A) -R1.77

B) -R1.06

C) -R0.85

D) -R0.66

E) -R0.08

A) -R1.77

B) -R1.06

C) -R0.85

D) -R0.66

E) -R0.08

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

Shares owned by the organisers of the firm who have sole voting rights is

A) preference shares.

B) ordinary equity.

C) founders' shares.

D) convertible equity.

E) retained earnings.

A) preference shares.

B) ordinary equity.

C) founders' shares.

D) convertible equity.

E) retained earnings.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

Shareholders exert control of the management of the firm by

A) electing board members who can replace management.

B) directly replacing management with themselves.

C) buying shares in an IPO at a discounted price.

D) running the daily operations of the firm.

E) None of the above.

A) electing board members who can replace management.

B) directly replacing management with themselves.

C) buying shares in an IPO at a discounted price.

D) running the daily operations of the firm.

E) None of the above.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

Scubapro Corporation currently has 500,000 shares outstanding and plans to issue 200,000 more shares in a seasoned equity offering.The current shareholders have preemptive rights on any new share issue by Scubapro Corporation.An investor with 20,000 shares who exercises his preemptive rights on the new share issue will have the right to buy how many shares?

A) 200,000 shares

B) 120,000 shares

C) 80,000 shares

D) 12,000 shares

E) 8,000 shares

A) 200,000 shares

B) 120,000 shares

C) 80,000 shares

D) 12,000 shares

E) 8,000 shares

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

Blow Glass Corporation has 100,000 shares outstanding, each with a par value of R2.50 per share.Blow Glass also has another 400,000 shares that are shelf registered.Blow Glass has retained earnings of R9,000,000 and additional paid-in capital of R1,000,000.What is Blow Glass's book value per share?

A) R90.00

B) R100.00

C) R27.50

D) R102.50

E) R92.50

A) R90.00

B) R100.00

C) R27.50

D) R102.50

E) R92.50

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

Assuming g will remain constant, the dividend yield is a good measure of the required return on an ordinary share under which of the following circumstances?

A) g = 0

B) g > 0

C) g < 0

D) Under no circumstances.

E) Answers a and b are both correct.

A) g = 0

B) g > 0

C) g < 0

D) Under no circumstances.

E) Answers a and b are both correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

29

The last dividend on Spirex Corporation's ordinary shares was R4.00, and the expected growth rate is 10 percent.If you require a rate of return of 20 percent, what is the highest price you should be willing to pay for this share?

A) R44.00

B) R38.50

C) R40.00

D) R45.69

E) R50.00

A) R44.00

B) R38.50

C) R40.00

D) R45.69

E) R50.00

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

You are trying to determine the appropriate price to pay for an ordinary share.If you purchase this share, you plan to hold it for 1 year.At the end of the year you expect to receive a dividend of R5.50 and to sell the share for R154.The appropriate rate of return for this share is 16 percent.What should be the current price of this share?

A) R137.50

B) R150.22

C) R162.18

D) R98.25

E) R175.83

A) R137.50

B) R150.22

C) R162.18

D) R98.25

E) R175.83

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

Velcraft Company has 20,000,000 shares of ordinary shares authorized, but to date, has only 12,000,000 shares outstanding, each with a R1.00 par value.The company has R24,000,000 in additional paid-in capital and retained earnings are R96,000,000.What is Velcraft's current book value per share?

A) R1.00

B) R3.00

C) R11.00

D) R6.60

E) R9.00

A) R1.00

B) R3.00

C) R11.00

D) R6.60

E) R9.00

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

A share of preference shares pays a dividend of R0.50 each quarter.If you are willing to pay R20.00 for this preference share, what is your simple (not effective) annual rate of return?

A) 10%

B) 8%

C) 6%

D) 12%

E) 14%

A) 10%

B) 8%

C) 6%

D) 12%

E) 14%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

An ordinary share has a current price of R82.50 and is expected to grow at a constant rate of 10 percent.If you require a 14 percent rate of return, what is the current dividend on this share?

A) R3.00

B) R3.81

C) R4.29

D) R4.75

E) R6.13

A) R3.00

B) R3.81

C) R4.29

D) R4.75

E) R6.13

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

Alpha's preference shares currently have a market price equal to R80 per share.If the dividend paid on this share is R6 per share, what is the required rate of return investors are demanding from Alpha's preference shares?

A) 7.5%

B) 13.3%

C) 6.0%

D) R6.00

E) None of the above is a correct answer.

A) 7.5%

B) 13.3%

C) 6.0%

D) R6.00

E) None of the above is a correct answer.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

Ms.Manners Catering (MMC) has paid a constant R1.50 per share dividend to its ordinary shareholders for the past 25 years.MMC expects to continue this policy for the next two years, and then begin to increase the dividend at a constant rate equal to 2 percent per year into perpetuity.Investors require a 12 percent rate of return to purchase MMC's ordinary shares.What is the market value of MMC's ordinary shares?

A) R14.73

B) R15.00

C) R15.58

D) R15.30

E) R12.20

A) R14.73

B) R15.00

C) R15.58

D) R15.30

E) R12.20

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

Mesmer Analytic, a biotechnology firm, floated an initial public offering of 2,000,000 shares at a price of R5.00 per share.The firm's owner/managers held 60 percent of the company's R1.00 par value authorized and issued shares following the public offering.One month after the IPO, the firm's board of directors declared a one-time dividend of R0.50 per share payable to all shareholders, meaning that the owner/managers would receive an immediate dividend, in part out of the pockets of the new public shareholders.What was the book value per share of the firm before and after the special dividend was paid?

A) R2.60; R2.10

B) R2.60; R2.60

C) R2.60; R2.30

D) R1.60; R1.10

E) R1.60; R1.00

A) R2.60; R2.10

B) R2.60; R2.60

C) R2.60; R2.30

D) R1.60; R1.10

E) R1.60; R1.00

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

Micromain Company has 10,000,000 shares of ordinary shares authorized and 8,000,000 shares outstanding, each with a R1.00 par value.The firm's additional paid-in capital account has a balance of R18,000,000.The previous year's retained earnings account was R124,000,000.In the year just ended, Micromain generated net income of R16,000,000 and the firm has a dividend payout ratio of 40 percent.What will Micromain's book value per share be when based on the final year-end balance sheet?

A) R20.75

B) R15.00

C) R15.96

D) R19.95

E) R18.75

A) R20.75

B) R15.00

C) R15.96

D) R19.95

E) R18.75

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

If the expected rate of return on a share exceeds the required rate,

A) The share is experiencing supernormal growth.

B) The share should be sold.

C) The company is probably not trying to maximise price per share.

D) The share is a good buy.

E) Dividends are not being declared.

A) The share is experiencing supernormal growth.

B) The share should be sold.

C) The company is probably not trying to maximise price per share.

D) The share is a good buy.

E) Dividends are not being declared.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

The last dividend paid by Klein Company was R1.00.Klein's growth rate is expected to be a constant 5 percent for 2 years, after which dividends are expected to grow at a rate of 10 percent forever.Klein's required rate of return on equity (rs) is 12 percent.What is the current price of Klein's ordinary shares?

A) R21.00

B) R33.33

C) R42.25

D) R50.16

E) R58.75

A) R21.00

B) R33.33

C) R42.25

D) R50.16

E) R58.75

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

Certificates representing ownership in shares of foreign companies, which are held in a trust bank located in the country the share is traded are called __________.

A) Certificates of Ownership

B) Foreign Share Funds

C) Mutual Funds

D) American Depository Receipts

E) Investment Bankers

A) Certificates of Ownership

B) Foreign Share Funds

C) Mutual Funds

D) American Depository Receipts

E) Investment Bankers

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

ABC Company has decided to make a major investment.The investment will require a substantial early cash outflow, and inflows will be relatively late.As a result, it is expected that the impact on the firm's earnings for the first 2 years will cause a negative growth of 5 percent annually.Further, it is anticipated that the firm will then experience 2 years of zero growth, after which it will begin a positive annual sustainable growth of 6 percent.If the firm's required return is 10 percent and its last dividend, D0, was R2 per share, what should be the current price per share?

A) R32.66

B) R47.83

C) R53.64

D) R38.47

E) R42.49

A) R32.66

B) R47.83

C) R53.64

D) R38.47

E) R42.49

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

Berg Inc.has just paid a dividend of R2.00.Its shares is now selling for R48 per share.The firm is half as risky as the market.The expected return on the market is 14 percent, and the yield on S.A.Treasury bonds is 11 percent.If the market is in equilibrium, what rate of growth is expected?

A) 13%

B) 10%

C) 4%

D) 8%

E) -2%

A) 13%

B) 10%

C) 4%

D) 8%

E) -2%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

Carlson Products, a constant growth company, has a current market (and equilibrium) share price of R20.00.Carlson's next dividend, D1, is forecasted to be R2.00, and Carlson is growing at an annual rate of 6 percent.Carlson has a beta coefficient of 1.2, and a required rate of return on the market is 15 percent.As Carlson's financial manager, you have access to insider information concerning a switch in product lines which would not change the growth rate, but would cut Carlson's beta which would not change the growth rate, but would cut Carlson's beta coefficient in half.If you buy the share at the current market price, what is your expected percentage capital gain?

A) 23%

B) 33%

C) 43%

D) 53%

E) There would be a capital loss.

A) 23%

B) 33%

C) 43%

D) 53%

E) There would be a capital loss.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

The Hart Mountain Company has recently discovered a new type of kitty litter which is extremely absorbent.It is expected that the firm will experience (beginning now) an unusually high growth rate (20 percent) during the period (3 years) it has exclusive rights to the property where the raw material used to make this kitty litter is found.However, beginning with the fourth year the firm's competition will have access to the material, and from that time on the firm will achieve a normal growth rate of 8 percent annually.During the rapid growth period, the firm's dividend payout ratio will be relatively low (20 percent) in order to conserve funds for reinvestment.However, the decrease in growth in the fourth year will be accompanied by an increase in dividend payout to 50 percent.Last year's earnings were E0 = R2.00 per share, and the firm's required return is 10 percent.What should be the current price of the ordinary shares?

A) R66.50

B) R87.96

C) R71.53

D) R61.78

E) R93.50

A) R66.50

B) R87.96

C) R71.53

D) R61.78

E) R93.50

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

Eastern Auto Parts' last dividend was D0 = R0.50, and the company expects to experience no growth for the next 2 years.However, Eastern will grow at an annual rate of 5 percent in the third and fourth years, and, beginning with the fifth year, it should attain a 10 percent growth rate which it should sustain thereafter.Eastern has a required rate of return of 12 percent.What should be the present price per share of Eastern ordinary shares?

A) R19.26

B) R31.87

C) R30.30

D) R20.83

E) R19.95

A) R19.26

B) R31.87

C) R30.30

D) R20.83

E) R19.95

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

Mpumalanga Corporation's shares recently paid a dividend of R2.00 per share (D0 = R2), and the share is in equilibrium.The company has a constant growth rate of 5 percent and a beta equal to 1.5.The required rate of return on the market is 15 percent, and the risk-free rate is 7 percent.Mpumalanga is considering a change in policy which will increase its beta coefficient to 1.75.If market conditions remain unchanged, what new constant growth rate will cause the ordinary share price of Mpumalanga to remain unchanged?

A) 8.85%

B) 18.53%

C) 6.77%

D) 5.88%

E) 13.52%

A) 8.85%

B) 18.53%

C) 6.77%

D) 5.88%

E) 13.52%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

Club Auto Parts' last dividend, D0, was R0.50, and the company expects to experience no growth for the next 2 years.However, Club will grow at an annual rate of 5 percent in the third and fourth years, and, beginning with the fifth year, it should attain a 10 percent growth rate which it will sustain thereafter.Club has a required rate of return of 12 percent.What should be the price per share of Club shares at the beginning of the third year, P2?

A) R19.98

B) R25.06

C) R31.21

D) R19.48

E) R27.55

A) R19.98

B) R25.06

C) R31.21

D) R19.48

E) R27.55

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

Hard Hat Construction's shares is currently selling at an equilibrium price of R30 per share.The firm has been experiencing a 6 percent annual growth rate.Last year's earnings per share, E0, were R4.00, and the dividend payout ratio is 40 percent.The risk-free rate is 8 percent, and the market risk premium is 5 percent.If systematic risk (beta) increases by 50 percent, and all other factors remain constant, by how much will the share price change? (Hint: Use four decimal places in your calculations.)

A) -R7.33

B) +R7.14

C) -R15.00

D) -R15.22

E) +R22.63

A) -R7.33

B) +R7.14

C) -R15.00

D) -R15.22

E) +R22.63

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

You are considering the purchase of an ordinary share that just paid a dividend of R2.00.You expect this share to have a growth rate of 30 percent for the next 3 years, then to have a long-run normal growth rate of 10 percent thereafter.If you require a 15 percent rate of return, how much should you be willing to pay for this share?

A) R71.26

B) R97.50

C) R82.46

D) R79.15

E) R62.68

A) R71.26

B) R97.50

C) R82.46

D) R79.15

E) R62.68

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

Yesterday BrandMart Supplies paid its ordinary shareholders a dividend equal to R3 per share.BrandMart expects to pay a R5 per share one year from today.After the R5 dividend is paid, the company expects its growth rate will remain constant at 4 percent per year forever.If BrandMart's investors demand a 12 percent rate of return, what should be the current market price of the company's shares?

A) R62.50

B) R65.00

C) R62.27

D) R37.50

E) None of the above is correct.

A) R62.50

B) R65.00

C) R62.27

D) R37.50

E) None of the above is correct.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

DAA's shares are selling for R15 per share.The firm's income, assets, and share price have been growing at an annual 15 percent rate and are expected to continue to grow at this rate for 3 more years.No dividends have been declared as yet, but the firm intends to declare a dividend of D3 = R2.00 at the end of the last year of its supernormal growth.After that, dividends are expected to grow at the firm's normal growth rate of 6 percent.The firm's required rate of return is 18 percent.The share is

A) Undervalued by R3.03.

B) Overvalued by R3.03.

C) Correctly valued.

D) Overvalued by R2.25.

E) Undervalued by R2.25.

A) Undervalued by R3.03.

B) Overvalued by R3.03.

C) Correctly valued.

D) Overvalued by R2.25.

E) Undervalued by R2.25.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

Suppose you are willing to pay R30 today for a share which you expect to sell at the end of one year for R32.If you require an annual rate of return of 12 percent, what must be the amount of the annual dividend which you expect to receive at the end of Year 1?

A) R2.25

B) R1.00

C) R1.60

D) R3.00

E) R1.95

A) R2.25

B) R1.00

C) R1.60

D) R3.00

E) R1.95

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

Modular Systems Inc.just paid dividend D0, and it is expecting both earnings and dividends to grow by 0 percent in Year 2, by 5 percent in Year 3, and at a rate of 10 percent in Year 4 and thereafter.The required return on Modular is 15 percent, and it sells at its equilibrium price, P0 = R49.87.What is the expected value of the next dividend? (Hint: Set up and solve an equation with the unknown.)

A) It cannot be estimated without more data.

B) R1.35

C) R1.85

D) R2.35

E) R2.85

A) It cannot be estimated without more data.

B) R1.35

C) R1.85

D) R2.35

E) R2.85

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

Over the past few years, Swanson Company has retained, on the average, 70 percent of its earnings in the business.The future retention rate is expected to remain at 70 percent of earnings, and long-run earnings growth is expected to be 10 percent.If the risk-free rate, rRF, is 8 percent, the expected return on the market, rM, is 12 percent, Swanson's beta is 2.0, and the most recent dividend, D0, was R1.50, what is the most likely market price and P/E ratio (P0/E1) for Swanson's shares today?

A) R27.50; 5.0x

B) R33.00; 6.0x

C) R25.00; 5.0x

D) R22.50; 4.5x

E) R45.00; 4.5x

A) R27.50; 5.0x

B) R33.00; 6.0x

C) R25.00; 5.0x

D) R22.50; 4.5x

E) R45.00; 4.5x

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

You have a chance to purchase a perpetual security that has a stated annual payment (cash flow) of R50.However, this is an unusual security in that the payment will increase at an annual rate of 5 percent per year; this increase is designed to help you keep up with inflation.The next payment to be received (your first payment, due in 1 year) will be R52.50.If your required rate of return is 15 percent, how much should you be willing to pay for this security?

A) R350

B) R482

C) R525

D) R556

E) R610

A) R350

B) R482

C) R525

D) R556

E) R610

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

A share has a dividend of D0 = R5.The dividend is expected to grow at a 20 percent annual rate for the next 10 years, then at a 15 percent rate for 10 more years, and then at a long-run normal growth rate of 10 percent forever.If investors require a 10 percent return on this share, what is its current price?

A) R100.00

B) R82.35

C) R195.50

D) R212.62

E) The data given in the problem are internally inconsistent, i.e., the situation described is impossible in that no equilibrium price can be produced.

A) R100.00

B) R82.35

C) R195.50

D) R212.62

E) The data given in the problem are internally inconsistent, i.e., the situation described is impossible in that no equilibrium price can be produced.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

57

The Satellite Building Company has fallen on hard times.Its management expects to pay no dividends for the next 2 years.However, the dividend for Year 3, D3, will be R1.00 per share, and the dividend is expected to grow at a rate of 3 percent in Year 4, 6 percent in Year 5, and 10 percent in Year 6 and thereafter.If the required return for Satellite is 20 percent, what is the current equilibrium price of the shares?

A) R0

B) R5.26

C) R6.34

D) R12.00

E) R13.09

A) R0

B) R5.26

C) R6.34

D) R12.00

E) R13.09

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58

A firm expects to pay dividends at the end of each of the next four years of R2.00, R1.50, R2.50, and R3.50.If growth is then expected to level off at 8 percent, and if you require a 14 percent rate of return, how much should you be willing to pay for this share?

A) R67.81

B) R22.49

C) R58.15

D) R31.00

E) R43.97

A) R67.81

B) R22.49

C) R58.15

D) R31.00

E) R43.97

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

59

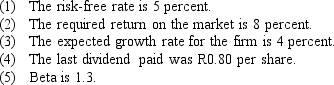

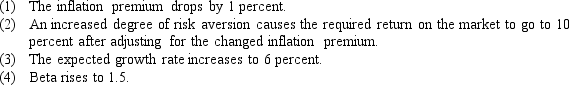

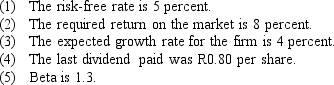

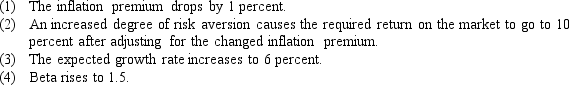

You are given the following data:  Now assume the following changes occur:

Now assume the following changes occur:

What will be the change in price per share, assuming the share was in equilibrium before the changes?

What will be the change in price per share, assuming the share was in equilibrium before the changes?

A) +R12.11

B) -R4.87

C) +R6.28

D) -R16.97

E) +R2.78

Now assume the following changes occur:

Now assume the following changes occur: What will be the change in price per share, assuming the share was in equilibrium before the changes?

What will be the change in price per share, assuming the share was in equilibrium before the changes?A) +R12.11

B) -R4.87

C) +R6.28

D) -R16.97

E) +R2.78

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

60

Given the following information, calculate the expected capital gains yield for Limpopo Pumas Inc.: beta = 0.6; rM = 15%; rRF = 8%; = R2.00; P0 = R25.00.Assume the share is in equilibrium and exhibits constant growth.

A) 3.8%

B) 0%

C) 8.0%

D) 4.2%

E) None of the above.

A) 3.8%

B) 0%

C) 8.0%

D) 4.2%

E) None of the above.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

61

Assume an all equity firm has been growing at a 15 percent annual rate and is expected to continue to do so for 3 more years.At that time, growth is expected to slow to a constant 4 percent rate.The firm maintains a 30 percent payout ratio, and this year's retained earnings net of dividends were R1.4 million.The firm's beta is 1.25, the risk-free rate is 8 percent, and the market risk premium is 4 percent.If the market is in equilibrium, what is the market value of the firm's ordinary equity (1 million shares outstanding)?

A) R6.41 million

B) R12.96 million

C) R9.18 million

D) R10.56 million

E) R7.32 million

A) R6.41 million

B) R12.96 million

C) R9.18 million

D) R10.56 million

E) R7.32 million

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

62

Assume that you would like to purchase 100 shares of preference shares that pays an annual dividend of R6 per share.However, you have limited resources now, so you cannot afford the purchase price.In fact, the best that you can do now is to invest your money in a bank account earning a simple interest rate of 6 percent, but where interest is compounded daily (assume a 365-day year).Because the preference shares are riskier, it has a required annual rate of return of 12 percent (assume that this rate will remain constant over the next 5 years).For you to be able to purchase this share at the end of 5 years, how much must you deposit in your bank account today, at t = 0?

A) R2,985.00

B) R4,291.23

C) R3,138.52

D) R3,704.18

E) R4,831.25

A) R2,985.00

B) R4,291.23

C) R3,138.52

D) R3,704.18

E) R4,831.25

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

63

Worldwide Inc., a large conglomerate, has decided to acquire another firm.Analysts are forecasting a period (2 years) of extraordinary growth (20 percent), followed by another 2 years of unusual growth (10 percent), and finally a normal (sustainable) growth rate of 6 percent annually.If the last dividend was D0 = R1.00 per share and the required return is 8 percent, what should the market price be today?

A) R93.70

B) R72.76

C) R99.66

D) R98.57

E) R68.87

A) R93.70

B) R72.76

C) R99.66

D) R98.57

E) R68.87

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

64

Garcia Inc.has a current dividend of R3.00 per share (D0 = R3.00).Analysts expect that the dividend will grow at a rate of 25 percent a year for the next three years, and thereafter it will grow at a constant rate of 10 percent a year.The company's cost of equity capital is estimated to be 15 percent.What is the current share price of Garcia Inc.?

A) R75.00

B) R88.55

C) R95.42

D) R103.25

E) R110.00

A) R75.00

B) R88.55

C) R95.42

D) R103.25

E) R110.00

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

65

Your company paid a dividend of R2.00 last year.The growth rate is expected to be 4 percent for 1 year, 5 percent the next year, then 6 percent for the following year, and then the growth rate is expected to be a constant 7 percent thereafter.The required rate of return on equity (ks) is 10 percent.What is the current price of the ordinary shares?

A) R53.45

B) R60.98

C) R64.49

D) R67.47

E) R69.21

A) R53.45

B) R60.98

C) R64.49

D) R67.47

E) R69.21

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

66

A financial analyst has been following Fast Start Inc., a new high-growth company.She estimates that the current risk-free rate is 6.25 percent, the market risk premium is 5 percent, and that Fast Start's beta is 1.75.The current earnings per share (EPS0) is R2.50.The company has a 40 percent payout ratio.The analyst estimates that the company's dividend will grow at a rate of 25 percent this year, 20 percent next year, and 15 percent the following year.After three years the dividend is expected to grow at a constant rate of 7 percent a year.The company is expected to maintain its current payout ratio.The analyst believes that the shares are fairly priced.What is the current price of the share?

A) R16.51

B) R17.33

C) R18.53

D) R19.25

E) R19.89

A) R16.51

B) R17.33

C) R18.53

D) R19.25

E) R19.89

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

67

Assume that the average firm in your company's industry is expected to grow at a constant rate of 5 percent, and its dividend yield is 4 percent.You company is about as risky as the average firm in the industry, but it has just developed a line of innovative new products which leads you to expect that its earnings and dividends will grow at a rate of 40 percent.( = D0 ((1 + g) = D0 (1.40)) this year and 25 percent the following year, after which growth should match the 5 percent industry average rate.The last dividend paid (D0) was R2.What is the value per share of your firm's shares?

A) R42.60

B) R82.84

C) R91.88

D) R101.15

E) R110.37

A) R42.60

B) R82.84

C) R91.88

D) R101.15

E) R110.37

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

68

Laserclock Corporation paid a dividend for 50 years until it experienced financial difficulty three years ago, at which time the dividend payment was suspended (that is, a dividend has not been paid during the past three years).The company is now much stronger financially, but Laserclock does not expect to pay a dividend for the next five years.Beginning six years from today, the company will pay a dividend equal to R2.10, which is 5 percent greater than the last dividend paid three years ago.After the dividend payments start again, Laserclock expects the dividend to continue to be paid and to grow at a constant rate of 5 percent.If the appropriate market rate for investments similar to Laserclock's shares is 15 percent, at what price should the shares currently be selling in the financial markets?

A) R21.00

B) R10.44

C) R14.00

D) There is not enough information to answer the question.

E) None of the above.

A) R21.00

B) R10.44

C) R14.00

D) There is not enough information to answer the question.

E) None of the above.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck