Deck 17: Rules for Monetary Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/18

Play

Full screen (f)

Deck 17: Rules for Monetary Policy

1

Why is the inflation report such an important part of an inflation-targeting system

Inflation report is important because it is the most important document regarding the issue of inflation targeting. This report carries forecast about inflation and other important quantitative predictions. However, the issue is these forecasts in most cases remain misleading due to the unavailability or imprecise data.

2

Why don't policymakers want to adopt rules for monetary policy

Policy makers do not want to follow rule based monetary policy because of mainly two reasons. One is that the rule based monetary policy makes policy inflexible. Hence, in the time of short run exigency it is not possible to react in this case. Also secondly, due to the political pressure on the policy makers it is difficult to follow rule based monetary policy. Every incumbent president wants a booming economy, a hunky-dory situation at the time around election. Hence, the incumbent president and his/her party put pressure and try to put 'yes men' in the positions of policymakers and that is how they manipulate things. Hence, it is mostly depend on the issue of autonomy of central bank rather than the will of the policy makers whether they follow rule based policies or discretion.

3

Suppose that the Fed's inflation target is 2 percent, potential output growth is 3.5 percent, and velocity is a function of how much the interest rate differs from 5 percent:

Suppose that a model of the economy suggests that the real interest rate is determined by the equation

where Y is the level of output, so % Y is the growth rate of output. Suppose that people expect the Fed to hit its inflation target.

a Calculate the optimal money growth rate needed for the Fed to hit its inflation target in the long run.

b In the short run, if output growth is just 2 percent for two years and the equation determining the real interest rate changes to r = 4.5 - % Y , what money growth rate should the Fed aim for to hit its inflation target in that period

c If the Fed instead maintained the money growth rate from part a, what is likely to happen to inflation

d Which policy do you think is better in the short run Which is better in the long run

Suppose that a model of the economy suggests that the real interest rate is determined by the equation

where Y is the level of output, so % Y is the growth rate of output. Suppose that people expect the Fed to hit its inflation target.

a Calculate the optimal money growth rate needed for the Fed to hit its inflation target in the long run.

b In the short run, if output growth is just 2 percent for two years and the equation determining the real interest rate changes to r = 4.5 - % Y , what money growth rate should the Fed aim for to hit its inflation target in that period

c If the Fed instead maintained the money growth rate from part a, what is likely to happen to inflation

d Which policy do you think is better in the short run Which is better in the long run

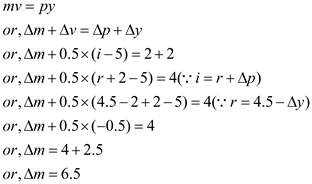

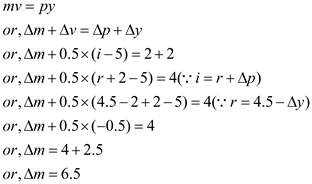

b)

In the changed circumstance the money growth will be as follows-

The money growth now will be 6.5%.

The money growth now will be 6.5%.

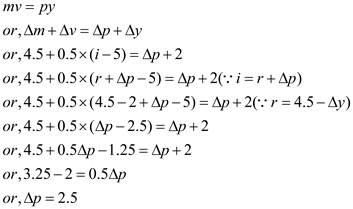

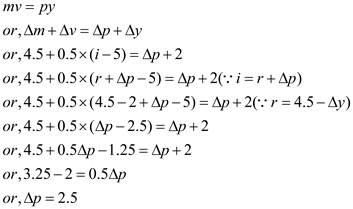

c)

In this case, inflation will be as follows-

In this case, inflation will rise to 2.5%.

In this case, inflation will rise to 2.5%.

d)

In the short run sometimes, discretionary monetary policy like increasing monetary growth is important. However, in the long run in most of the cases rule based moderate monetary growth is advisable.

In the changed circumstance the money growth will be as follows-

The money growth now will be 6.5%.

The money growth now will be 6.5%.c)

In this case, inflation will be as follows-

In this case, inflation will rise to 2.5%.

In this case, inflation will rise to 2.5%.d)

In the short run sometimes, discretionary monetary policy like increasing monetary growth is important. However, in the long run in most of the cases rule based moderate monetary growth is advisable.

4

Suppose that the economy is thought to be 3 percent below potential when potential output grows 3.5 percent per year. Suppose that the Fed is following the Taylor rule (with the equilibrium real federal funds rate assumed to be 2 percent and the weights on the inflation gap and output gap both equal to ½). The inflation rate was 3 percent over the past year. The federal funds rate is currently 4 percent.

a What is the Fed's target for the inflation rate

b Suppose that a year has gone by, output is now just 1 percent below potential, and the inflation rate was 2.5 percent over the year. What federal funds rate should the Fed now set (assuming that the inflation target does not change)

a What is the Fed's target for the inflation rate

b Suppose that a year has gone by, output is now just 1 percent below potential, and the inflation rate was 2.5 percent over the year. What federal funds rate should the Fed now set (assuming that the inflation target does not change)

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

5

Suppose that the economy is thought to be 2 percent above potential (that is, the output gap is 2 percent) when potential output grows 4 percent per year. Suppose also that the Fed is following the Taylor rule, with an inflation rate of 2 percent over the past year. The federal funds rate is currently 3 percent. The equilibrium real federal funds rate is 3 percent, and the weights on the output gap and inflation gap are 0.5 each. The inflation target is 1 percent.

a Is the federal funds rate currently too high or too low By how much Show your work.

b Suppose that a year has gone by, output is now just 1 percent above potential, and the inflation rate was 1.5 percent over the year. What federal funds rate should the Fed now set (assuming that the inflation target does not change)

a Is the federal funds rate currently too high or too low By how much Show your work.

b Suppose that a year has gone by, output is now just 1 percent above potential, and the inflation rate was 1.5 percent over the year. What federal funds rate should the Fed now set (assuming that the inflation target does not change)

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

6

a Write down the equation for the Taylor rule for monetary policy. Explain what each term in the equation means, in one sentence.

b Suppose the Fed is following the Taylor rule. Suppose the growth rate of potential output is 3 percent, the output gap is 26 percent, the weights on the output gap and inflation gap are each ½, the Fed's inflation target is 2 percent, the Fed believes the equilibrium real federal funds rate is 3 percent, and the inflation rate has been 2 percent over the past year. At what level does the Fed set the federal funds rate

c Suppose the Fed thinks that the equilibrium federal funds rate is 3 percent, as in part b above, but in fact the equilibrium real fed funds rate is 4 percent. What do you think will happen to the inflation rate in the long run

b Suppose the Fed is following the Taylor rule. Suppose the growth rate of potential output is 3 percent, the output gap is 26 percent, the weights on the output gap and inflation gap are each ½, the Fed's inflation target is 2 percent, the Fed believes the equilibrium real federal funds rate is 3 percent, and the inflation rate has been 2 percent over the past year. At what level does the Fed set the federal funds rate

c Suppose the Fed thinks that the equilibrium federal funds rate is 3 percent, as in part b above, but in fact the equilibrium real fed funds rate is 4 percent. What do you think will happen to the inflation rate in the long run

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

7

What would have happened to the money supply in the United States in the 1990s if the Federal Reserve had adhered to a policy of targeting monetary base growth of 3 percent each year regardless of the demand for currency Note that currency growth averaged 5 percent each year in that period largely owing to the demand from abroad.

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

8

Looking at the historical record for the Taylor rule, were there any periods when the rule gave bad advice That is, are there periods when the rule would have tightened policy in the face of weak economic growth or periods when the rule would have eased policy even though inflation was rising

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

9

What is an expectations trap If people thought that the central bank was likely to raise the infl ation rate to 3 percent from 2 percent, how might that lead to an expectations trap

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

10

In some macroeconomic models, the equilibrium real federal funds rate changes percentage point for percentage point with the growth rate of output. If the Fed believed such models and was following the Taylor rule, how would the Fed need to adjust its rule in the "new economy" of the second half of the 1990s as productivity growth increased

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

11

Describe the idea of time inconsistency in general terms. How can the problem be prevented

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

12

Would it make sense for a central bank to try inflation targeting by using the Taylor rule What problems might the central bank encounter in trying to do so

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

13

How can the central bank establish credibility for keeping inflation low

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

14

Why have rules for monetary policy based on money growth been unsuccessful in recent years

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

15

Describe how activist rules differ from nonactivist rules. Give an example of each

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

16

On average, would inflation over the last 45 years have been higher or lower if the Fed had followed the Taylor rule In what periods would monetary policy have been tighter When would it have been easier

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

17

Does an inflation-targeting country follow a particular rule for monetary policy, such as the Taylor rule

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck

18

Describe New Zealand's approach to inflation targeting. What are the advantages and disadvantages of that system

Unlock Deck

Unlock for access to all 18 flashcards in this deck.

Unlock Deck

k this deck