Deck 12: Environmental Protection and Negative Externalities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/24

Play

Full screen (f)

Deck 12: Environmental Protection and Negative Externalities

1

The elimination principle, a general feature of competitivemarkets, tells us that:

A)below-normal profits may be permanent.

B)above-normal profits may be permanent.

C)above-normal profits are temporary.(True Answer )Correct

D)above-normal profits result in firms exiting the industry.

A)below-normal profits may be permanent.

B)above-normal profits may be permanent.

C)above-normal profits are temporary.(True Answer )Correct

D)above-normal profits result in firms exiting the industry.

C

2

A competitive firm maximizes profit when marginal cost:

A)equals the price.

B)is less than the price.

C)is greater than the price.

D)is minimized.

A)equals the price.

B)is less than the price.

C)is greater than the price.

D)is minimized.

A

3

In a competitive industry:

A)all firms will earn above-normal profits if demand is high.

B)the opportunity cost of production is zero.

C)profits are only attainable in the long run to those firms able to innovate at the lowest cost.

D)resources move across firms in such a way that the total value of production is maximized.

A)all firms will earn above-normal profits if demand is high.

B)the opportunity cost of production is zero.

C)profits are only attainable in the long run to those firms able to innovate at the lowest cost.

D)resources move across firms in such a way that the total value of production is maximized.

D

4

When the size of the production is the most efficient:

A)total cost is at the minimum.

B)average cost is at the minimum.

C)marginal cost is at the minimum.

D)fixed cost is at the minimum.

A)total cost is at the minimum.

B)average cost is at the minimum.

C)marginal cost is at the minimum.

D)fixed cost is at the minimum.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

5

Suppose that you own two farms on which to grow corn. Inorder to lower the cost of production, you determine toincrease production on Farm 1 and reduce it on Farm 2. Thisimplies that the marginal cost of production on Farm 1 is:

A)greater than the marginal cost of production on Farm 2.

B)less than the marginal cost of production on Farm 2.(True Answer )Correct

C)equal to the marginal cost of production on Farm 2.

D)The difference of the marginal costs between the two farms cannot be determined.

A)greater than the marginal cost of production on Farm 2.

B)less than the marginal cost of production on Farm 2.(True Answer )Correct

C)equal to the marginal cost of production on Farm 2.

D)The difference of the marginal costs between the two farms cannot be determined.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

6

Since all competitive firms produce wherever marginal costequals the market price for the product, we can conclude that:

I) all competitive firms produce at the same marginal costlevel

II)all competitive firms produce the same quantity

III) all competitive firms make normal profit.

A)I only

B)I and II only

C)II and III only

D)All of the answers are correct.

I) all competitive firms produce at the same marginal costlevel

II)all competitive firms produce the same quantity

III) all competitive firms make normal profit.

A)I only

B)I and II only

C)II and III only

D)All of the answers are correct.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

7

In a competitive industry, entry and exit decisions:

A)allow some firms to earn above-normal profits in the long run.

B)ensure that labor and capital move across industries to optimally balance production.

C)rely on demand signals, not price signals.

D)move capital and labor away from profitable industries in order to maximize the total value of production.

A)allow some firms to earn above-normal profits in the long run.

B)ensure that labor and capital move across industries to optimally balance production.

C)rely on demand signals, not price signals.

D)move capital and labor away from profitable industries in order to maximize the total value of production.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements is TRUE regarding profitmaximization in competitive markets?

I) When all firms pursue profits, none of them achieve profits

II)When all firms pursue profits, only the most innovative willachieve profits

III) Production is divided in such a way that total costs ofproduction are minimized.

A)I only

B)II only

C)I and III only

D)II and III only

I) When all firms pursue profits, none of them achieve profits

II)When all firms pursue profits, only the most innovative willachieve profits

III) Production is divided in such a way that total costs ofproduction are minimized.

A)I only

B)II only

C)I and III only

D)II and III only

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

9

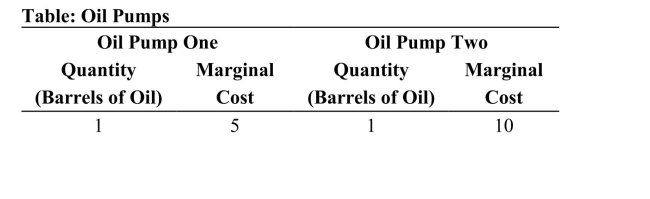

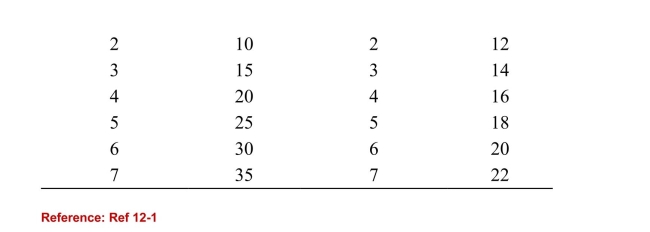

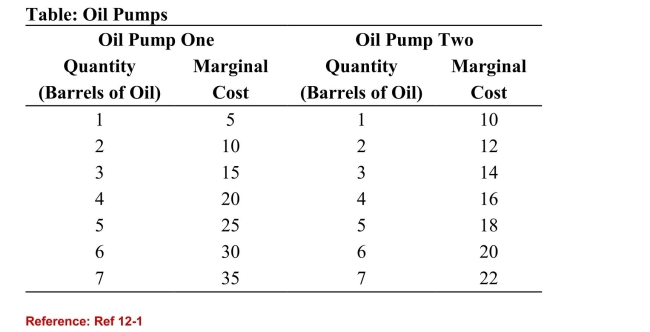

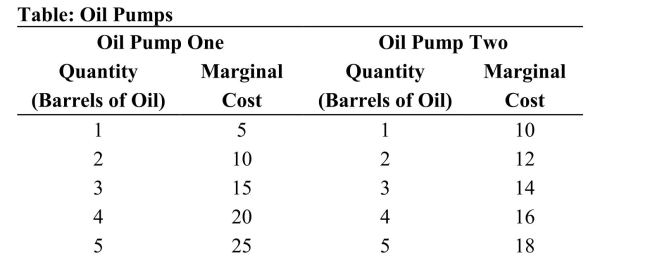

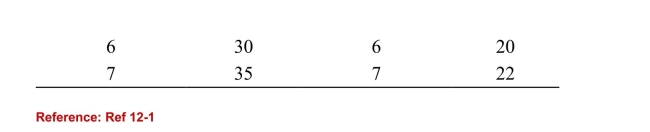

(Table: Oil Pumps) Refer to the table. Suppose that this marketis producing six barrels of oil from Oil Pump One and twobarrels of oil from Oil Pump Two. What happens to the totalcosts of production if we produce one less barrel of oil from OilPump One and one more barrel of oil from Oil Pump Two?

(Table: Oil Pumps) Refer to the table. Suppose that this marketis producing six barrels of oil from Oil Pump One and twobarrels of oil from Oil Pump Two. What happens to the totalcosts of production if we produce one less barrel of oil from OilPump One and one more barrel of oil from Oil Pump Two?A)The total costs of production fall by $16.00.(True Answer )Correct

B)The total costs of production rise by $7.00.

C)The total costs of production fall by $30.

D)The total costs of production rise by $14.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

10

(Table: Oil Pumps) Refer to the table. Suppose that we want toproduce seven barrels of oil. To minimize costs, we shouldproduce:

(Table: Oil Pumps) Refer to the table. Suppose that we want toproduce seven barrels of oil. To minimize costs, we shouldproduce:A)all seven barrels of oil from Oil Pump Two.

B)three barrels of oil from Oil Pump One and four barrels of oil from Oil Pump Two.

C)one barrel of oil from Oil Pump One and six barrels of oil from Oil Pump Two.

D)all seven barrels of oil from Oil Pump One.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

11

A free market can naturally allocate production across firmsin an industry to minimize total costs due to:

A)market power.

B)regulation.

C)the invisible hand.

D)externality.

A)market power.

B)regulation.

C)the invisible hand.

D)externality.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is TRUE?

I) A free market minimizes the total costs of producing output

II)In a free market, P = MC1 = MC2 = . . . MCN

III) Every firm faces the same price in a competitive market.

A)I and II only

B)III only

C)I and III only

D)I, II, and III

I) A free market minimizes the total costs of producing output

II)In a free market, P = MC1 = MC2 = . . . MCN

III) Every firm faces the same price in a competitive market.

A)I and II only

B)III only

C)I and III only

D)I, II, and III

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

13

The pursuit of profits in a competitive market:

A)minimizes total industry costs.

B)minimizes total value of production.

C)leads to higher prices.

D)maximizes producer surplus at the expense of consumer surplus.

A)minimizes total industry costs.

B)minimizes total value of production.

C)leads to higher prices.

D)maximizes producer surplus at the expense of consumer surplus.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

14

In a competitive market with four firms (indicated as Firm 1,Firm 2, Firm 3, and Firm 4), which of the following is thecondition that enables all sellers to maximize profit?

A)P = ATC for all firms

B)Profit = Total Revenue - Total Cost for all firms

C)P = MC1 = MC2 = MC3 = MC4

D)MC is minimized in all firms.

A)P = ATC for all firms

B)Profit = Total Revenue - Total Cost for all firms

C)P = MC1 = MC2 = MC3 = MC4

D)MC is minimized in all firms.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

15

Suppose that Sandy owns a farm in North Carolina and Patowns a farm in Iowa, and Sandy's farm is generally moreproductive than Pat's. If both Sandy and Pat sell their corn inthe same market, Sandy should produce the output at themarginal cost that is:

A)less than the marginal cost of Pat's production.

B)equal to the marginal cost of Pat's production.(True Answer )Correct

C)greater than the marginal cost of Pat's production.

D)equal to total revenue in the market.

A)less than the marginal cost of Pat's production.

B)equal to the marginal cost of Pat's production.(True Answer )Correct

C)greater than the marginal cost of Pat's production.

D)equal to total revenue in the market.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

16

The elimination principle illustrates the idea that:

A)above-normal profits will be eliminated by decreases in demand due to high prices.

B)losses will be eliminated by the innovation of new products.

C)above-normal profits will be eliminated by the entry of new firms into the industry.

D)losses will be eliminated by firms decreasing their costs.

A)above-normal profits will be eliminated by decreases in demand due to high prices.

B)losses will be eliminated by the innovation of new products.

C)above-normal profits will be eliminated by the entry of new firms into the industry.

D)losses will be eliminated by firms decreasing their costs.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

17

Since a competitive firm sets MR = P to determine allquantities in the short run, we can conclude that:

A)each firm in the industry faces very large fixed costs.

B)the demand curve faced by each individual competitive firm is perfectly elastic.

C)the demand curve faced by each individual competitive firm is downward sloping.

D)the industry demand curve is perfectly elastic.

A)each firm in the industry faces very large fixed costs.

B)the demand curve faced by each individual competitive firm is perfectly elastic.

C)the demand curve faced by each individual competitive firm is downward sloping.

D)the industry demand curve is perfectly elastic.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

18

(Table: Oil Pumps) Refer to the table. An oil producer ownstwo pumps: Oil Pump One and Oil Pump Two. If the marketprice of oil is $20 per barrel, how many barrels of oil getproduced?

(Table: Oil Pumps) Refer to the table. An oil producer ownstwo pumps: Oil Pump One and Oil Pump Two. If the marketprice of oil is $20 per barrel, how many barrels of oil getproduced?A)4

B)14

C)10

D)6

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

19

Consider industries X and Y. Industry X has total revenue of$100 million and total costs of $77 million. Industry Y has totalrevenue of $80 million and total costs of $40 million. Weshould expect that:

A)prices are higher in Industry X.

B)resources will move from Industry Y to Industry X.

C)labor and capital will move from Industry X to Industry Y.

D)firms in both industries will shut down operations.

A)prices are higher in Industry X.

B)resources will move from Industry Y to Industry X.

C)labor and capital will move from Industry X to Industry Y.

D)firms in both industries will shut down operations.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

20

For a competitive firm, which of the following conditionsdescribes the profit maximization condition?

I) P = MCII. MR = MCIII. TR = TC

A)II only

B)I and II only

C)II and III only

D)I, II, and III

I) P = MCII. MR = MCIII. TR = TC

A)II only

B)I and II only

C)II and III only

D)I, II, and III

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

21

According to the elimination principle:

A)above-normal profits are eliminated by exit.

B)below-normal profits are eliminated by entry.

C)there is a uniform rate of profit above the normal level in all competitive industries.

D)resources are always moving toward an increase in consumer welfare.

A)above-normal profits are eliminated by exit.

B)below-normal profits are eliminated by entry.

C)there is a uniform rate of profit above the normal level in all competitive industries.

D)resources are always moving toward an increase in consumer welfare.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

22

Stating that marginal revenue equals price is equivalent tosaying that marginal cost equals price for the profitmaximizing quantity.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

23

The elimination principle:

A)holds in all places and in all times.

B)says that below-normal profits may be eliminated by the entry of new firms.

C)depends on government protection.

D)says that above-normal profits are eliminated by entry and below-normal profits are eliminated by exit.(True Answer

)Correct

A)holds in all places and in all times.

B)says that below-normal profits may be eliminated by the entry of new firms.

C)depends on government protection.

D)says that above-normal profits are eliminated by entry and below-normal profits are eliminated by exit.(True Answer

)Correct

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

24

Stating that marginal revenue equals price is equivalent tosaying that marginal revenue equals marginal cost at all levelsof output.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck