Deck 12: Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/14

Play

Full screen (f)

Deck 12: Costing

1

BDA Fabrications Limited has three stages in its production process: machining, painting and finishing.Each of these stages is treated as a cost centre.The company employs two production supervisors.One spends her time entirely in the machining department, whereas the other divides his time equally between the three departments. Which one of the following statements is correct?

The process of identifying the indirect production overhead of supervisors' salaries with the individual cost centres is known as cost:

A)grouping

B)allocation

C)identification

D)apportionment

The process of identifying the indirect production overhead of supervisors' salaries with the individual cost centres is known as cost:

A)grouping

B)allocation

C)identification

D)apportionment

allocation

2

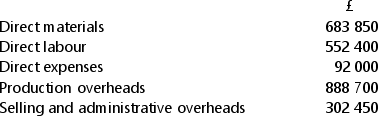

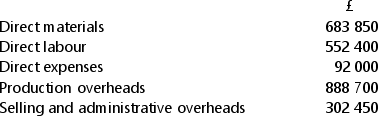

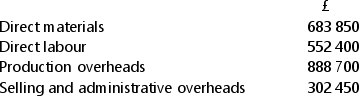

Nagri Machine Productions Limited produces a single product.The company's management accountant has budgeted the following totals in respect of the 20X7 financial year:  Machine hours for the year are estimated at 863 000.

Machine hours for the year are estimated at 863 000.

What is the estimated overhead absorption rate for 20X7, based on machine hours (to the nearest penny)?

A)£1.03

B)£1.14

C)£1.38

D)£1.49

Machine hours for the year are estimated at 863 000.

Machine hours for the year are estimated at 863 000.What is the estimated overhead absorption rate for 20X7, based on machine hours (to the nearest penny)?

A)£1.03

B)£1.14

C)£1.38

D)£1.49

£1.03

3

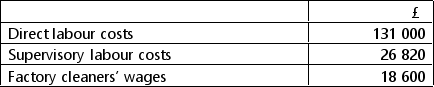

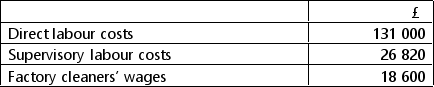

Hershall and Briggs Limited incurred the following labour costs in respect of its production process in the year ended 31 March 20X5:  The production process is split into two cost centres: machining and finishing.One third of the supervisory labour time is spent in the finishing department with the balance spent in machining.The finishing process is messy and 60% of the cleaners' hours are spent in this department.£101 000 of direct labour costs are incurred in the machining department and the remainder in the finishing department.

The production process is split into two cost centres: machining and finishing.One third of the supervisory labour time is spent in the finishing department with the balance spent in machining.The finishing process is messy and 60% of the cleaners' hours are spent in this department.£101 000 of direct labour costs are incurred in the machining department and the remainder in the finishing department.

What is the total amount of indirect labour cost allocated to the machining cost centre?

A)£17 880

B)£25 320

C)£126 320

D)£20 100

The production process is split into two cost centres: machining and finishing.One third of the supervisory labour time is spent in the finishing department with the balance spent in machining.The finishing process is messy and 60% of the cleaners' hours are spent in this department.£101 000 of direct labour costs are incurred in the machining department and the remainder in the finishing department.

The production process is split into two cost centres: machining and finishing.One third of the supervisory labour time is spent in the finishing department with the balance spent in machining.The finishing process is messy and 60% of the cleaners' hours are spent in this department.£101 000 of direct labour costs are incurred in the machining department and the remainder in the finishing department.What is the total amount of indirect labour cost allocated to the machining cost centre?

A)£17 880

B)£25 320

C)£126 320

D)£20 100

£25 320

4

The management accountant of Hepscott Iqbal Limited is currently considering the most appropriate basis for apportioning the company's indirect production overheads between its three principal production cost centres.Which one of the following is the most appropriate basis for apportioning the costs of running the factory canteen?

A)Factory floor area in square metres

B)Number of items produced

C)Machinery carrying amount

D)Number of factory employees

A)Factory floor area in square metres

B)Number of items produced

C)Machinery carrying amount

D)Number of factory employees

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

5

Which one of the following methods is not a valid approach to calculating overhead absorption rates?

A)Percentage of direct labour

B)Rate per labour hour

C)Percentage of production cost

D)Rate per machine hour

A)Percentage of direct labour

B)Rate per labour hour

C)Percentage of production cost

D)Rate per machine hour

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

6

Which one of the following statements is correct? In order to calculate a total production cost per unit, production overhead absorbed by each unit is added to:

A)direct expenses per unit

B)direct costs per unit

C)factory cost per unit

D)selling and administration costs per unit

A)direct expenses per unit

B)direct costs per unit

C)factory cost per unit

D)selling and administration costs per unit

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

7

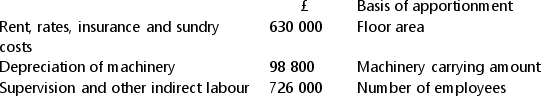

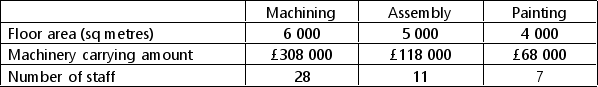

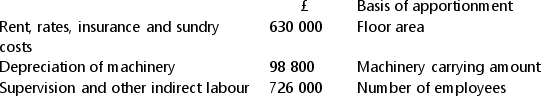

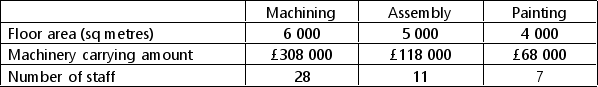

Hill and Breedon Limited has three departments in its production facility, each of which constitutes a cost centre.Production overheads in total are as follows:  Further relevant details are as follows:

Further relevant details are as follows:

How much production overhead will be apportioned to the assembly department (to the nearest £)?

How much production overhead will be apportioned to the assembly department (to the nearest £)?

A)£484 933

B)£210 000

C)£407 209

D)£383 609

Further relevant details are as follows:

Further relevant details are as follows: How much production overhead will be apportioned to the assembly department (to the nearest £)?

How much production overhead will be apportioned to the assembly department (to the nearest £)?A)£484 933

B)£210 000

C)£407 209

D)£383 609

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

8

Which one of the following statements about Activity Based Costing (ABC) is correct? ABC:

A)has the advantage of being much cheaper to implement than other costing systems

B)has been in use in advanced industrial economies for over a century

C)takes into account the effects of activities that actually occur during the production process

D)is a relatively old-fashioned system that is gradually being replaced by new methods of absorption costing

A)has the advantage of being much cheaper to implement than other costing systems

B)has been in use in advanced industrial economies for over a century

C)takes into account the effects of activities that actually occur during the production process

D)is a relatively old-fashioned system that is gradually being replaced by new methods of absorption costing

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

9

Which one of the following statements is correct? Overhead absorption is a way of:

A)allocating an appropriate portion of overhead costs to cost units

B)classifying costs as either direct or indirect

C)apportioning non-production overheads between service departments

D)apportioning overhead costs between cost centres

A)allocating an appropriate portion of overhead costs to cost units

B)classifying costs as either direct or indirect

C)apportioning non-production overheads between service departments

D)apportioning overhead costs between cost centres

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

10

Which one of the following statements is correct? The basic principle of Activity Based Costing is that:

A)costs are absorbed on the basis of labour productivity

B)costs are apportioned to cost units via direct labour hours

C)costs are incurred only in respect of the organization's principal activities

D)cost units should bear the cost of the activities they cause

A)costs are absorbed on the basis of labour productivity

B)costs are apportioned to cost units via direct labour hours

C)costs are incurred only in respect of the organization's principal activities

D)cost units should bear the cost of the activities they cause

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

11

The management accountant of Sutton Heath Engineering plc is currently apportioning production machinery overheads amongst the company's various cost centres. During 20X4 the cutting department made 22 service engineer call outs, out of the total of 43 for the factory as a whole.The total cost of all such call outs was £72 600.Factory machinery depreciation in total was £243 740.The cutting department's machinery at carrying amount constitutes 37% of the total.

Service costs are apportioned on the basis of numbers of call outs, and machinery depreciation is apportioned on the basis of carrying amount.

What is the total of production machinery overheads to be apportioned to the cutting department (to the nearest £)?

A)£117 046

B)£114 756

C)£127 328

D)£161 848

Service costs are apportioned on the basis of numbers of call outs, and machinery depreciation is apportioned on the basis of carrying amount.

What is the total of production machinery overheads to be apportioned to the cutting department (to the nearest £)?

A)£117 046

B)£114 756

C)£127 328

D)£161 848

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

12

Blisworth & Bexhill Limited produces a vacuum cleaner (its only product) that goes through three departments: moulding, assembly and finishing.The company's total production overheads for the 20X7 financial year are budgeted to be £1 860 420.Normally, the company apportions all its production overheads to the three departments in a 60:20:20 split (moulding: assembly: finishing) based on factory floor area.In order to make the information more useful, the company's management accountant has suggested that canteen and supervision overheads (which amount to £308 560 of the total overhead of £1 860 420) should be apportioned according to the number of direct labour employees.Moulding employs sixteen people, assembly eight, and finishing four (total = 28). If the proposed method of apportionment is adopted by what percentage will the finishing department's overhead be reduced, compared to the normal apportionment method (to one decimal place)?

A)28.6%

B)0% (i.e.no change)

C)16.6%

D)4.7%

A)28.6%

B)0% (i.e.no change)

C)16.6%

D)4.7%

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

13

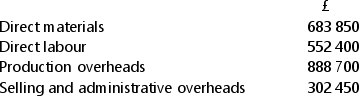

Narwhinder Design Fabrications Limited produces a single product.The company's management accountant has budgeted the following totals in respect of the 20X2 financial year:  Units of production are estimated at 658 000.

Units of production are estimated at 658 000.

What is the estimated overhead absorption rate for 20X2, based on units of production (to the nearest penny)?

A)£1.35

B)£1.81

C)£3.69

D)£0.74

Units of production are estimated at 658 000.

Units of production are estimated at 658 000.What is the estimated overhead absorption rate for 20X2, based on units of production (to the nearest penny)?

A)£1.35

B)£1.81

C)£3.69

D)£0.74

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck

14

Slimm Parsons Limited manufactures components for boat engines.The company's fabrications cost centre uses two grades of direct labour: grade X and grade Y.Grade X is to be paid at £8.20 per hour, and grade Y at £7.30 per hour.The budget for the 20X1 financial year requires 15 000 hours of grade X labour and 20 000 hours of grade Y labour. The apportionment of production overheads to the fabrications cost centre is budgeted at £883 000.

What is the overhead absorption rate for the fabrications department for 20X1 financial year, based on direct labour hours (to 1 decimal place)?

A)30.5%

B)328.3%

C)84.2%

D)143.8%

What is the overhead absorption rate for the fabrications department for 20X1 financial year, based on direct labour hours (to 1 decimal place)?

A)30.5%

B)328.3%

C)84.2%

D)143.8%

Unlock Deck

Unlock for access to all 14 flashcards in this deck.

Unlock Deck

k this deck