Deck 7: Financial Reporting by Limited Companies

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/30

Play

Full screen (f)

Deck 7: Financial Reporting by Limited Companies

1

Which one of the following statements about private limited companies is correct?

A)Private limited companies are required to issue a minimum of £50 000 in share capital.

B)A private limited company need have no more than one director.

C)Private limited companies are those defined by the Companies Act as 'small' companies.

D)Private limited companies are not required to file any financial information at Companies House.

A)Private limited companies are required to issue a minimum of £50 000 in share capital.

B)A private limited company need have no more than one director.

C)Private limited companies are those defined by the Companies Act as 'small' companies.

D)Private limited companies are not required to file any financial information at Companies House.

A private limited company need have no more than one director.

2

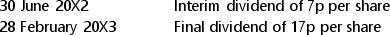

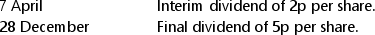

DXZ Limited has a share capital of 30 000 ordinary shares of 50p each.Dee owns 15% of the issued share capital.In the financial year ended 31 March 20X3, dividends were declared and paid as follows:  How much dividend did Dee receive in respect of her shareholding during the financial year ended 31 March 20X3?

How much dividend did Dee receive in respect of her shareholding during the financial year ended 31 March 20X3?

A)£540

B)£315

C)£765

D)£1080

How much dividend did Dee receive in respect of her shareholding during the financial year ended 31 March 20X3?

How much dividend did Dee receive in respect of her shareholding during the financial year ended 31 March 20X3?A)£540

B)£315

C)£765

D)£1080

£1080

3

Which one of the following statements is correct?

A)If a shareholder in a company wishes to receive a full set of its financial statements, he or she must apply to Companies House.

B)All limited companies are required by law to have an audit of their annual financial statements.

C)A company's directors take complete responsibility for the preparation of its annual financial statements.

D)All company directors in the UK are required to pass a test of basic competence in accountancy skills.

A)If a shareholder in a company wishes to receive a full set of its financial statements, he or she must apply to Companies House.

B)All limited companies are required by law to have an audit of their annual financial statements.

C)A company's directors take complete responsibility for the preparation of its annual financial statements.

D)All company directors in the UK are required to pass a test of basic competence in accountancy skills.

A company's directors take complete responsibility for the preparation of its annual financial statements.

4

The regulation of listed companies in the UK is handled by which of the following authorities?

A)DVLA

B)BIS

C)FCA

D)IASB

A)DVLA

B)BIS

C)FCA

D)IASB

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

5

Which one of the following statements about public limited companies (plcs) is correct?

A)plcs must have an issued share capital of at least £5 million.

B)plcs must have at least ten directors.

C)A plc must describe itself as such in its Memorandum of Association.

D)'Public limited company' is the legal term used to describe a company listed on the Stock Exchange.

A)plcs must have an issued share capital of at least £5 million.

B)plcs must have at least ten directors.

C)A plc must describe itself as such in its Memorandum of Association.

D)'Public limited company' is the legal term used to describe a company listed on the Stock Exchange.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

6

Which one of the following statements is correct? The Strategic Report:

A)is required by law to be filed at Companies House by all companies.

B)is a brief statement of a company's activities that is submitted to the government.

C)is disclosed voluntarily as part of the annual report of listed companies.

D)none of the above

A)is required by law to be filed at Companies House by all companies.

B)is a brief statement of a company's activities that is submitted to the government.

C)is disclosed voluntarily as part of the annual report of listed companies.

D)none of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

7

Which one of the following statements is correct? Under the Companies Act 2006, a small company is one that:

A)has a turnover of not more than £30.0 million.

B)employs not more than 10 employees

C)has a total of assets of not more than £316 000.

D)has a turnover of not more than £10.2 million.

A)has a turnover of not more than £30.0 million.

B)employs not more than 10 employees

C)has a total of assets of not more than £316 000.

D)has a turnover of not more than £10.2 million.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

8

At a recent staff seminar on accounting requirements, participants made several observations about international financial reporting standards (IFRS).Only one of the comments is correct.Which is it?

A)'IFRS are very restricted in the topics covered because the international standard setting body only started work in 2003'.

B)'Listed companies in the UK can choose to comply either with IFRS or with UK standards, but, having chosen, they must follow one set of rules consistently.

C)'UK accounting standards are a thing of the past because all businesses in the UK are now obliged to comply with IFRS'.

D)'Nowadays, listed companies in the European Union are required to comply with IFRS'.

A)'IFRS are very restricted in the topics covered because the international standard setting body only started work in 2003'.

B)'Listed companies in the UK can choose to comply either with IFRS or with UK standards, but, having chosen, they must follow one set of rules consistently.

C)'UK accounting standards are a thing of the past because all businesses in the UK are now obliged to comply with IFRS'.

D)'Nowadays, listed companies in the European Union are required to comply with IFRS'.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

9

Which one of the following items is not required by law to be included in a directors' report?

A)A note of political and charitable donations.

B)A description of the business's principal activities.

C)An explanation of the directors' remuneration policy.

D)A review of the development of the business.

A)A note of political and charitable donations.

B)A description of the business's principal activities.

C)An explanation of the directors' remuneration policy.

D)A review of the development of the business.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following financial statements is required by company law for all companies?

A)Statement of cash flows

B)Strategic report

C)Directors' report

D)Chairman's statement

A)Statement of cash flows

B)Strategic report

C)Directors' report

D)Chairman's statement

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

11

Which one of the following statements is correct?

A)The most common type of share capital is ordinary share capital.

B)The amount of dividend to be paid per share is decided at the company's annual general meeting by the shareholders.

C)Preference shares are those recommended by stockbrokers to their clients.

D)Ordinary shares carry a fixed rate of dividend.

A)The most common type of share capital is ordinary share capital.

B)The amount of dividend to be paid per share is decided at the company's annual general meeting by the shareholders.

C)Preference shares are those recommended by stockbrokers to their clients.

D)Ordinary shares carry a fixed rate of dividend.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

12

Which one of the following statements is correct?

A)Shareholders have unlimited liability for amounts owed by their company in respect of bank loans.

B)The directors of a limited company are immune from prosecution by the company or its shareholders.

C)A company is regarded in law as a 'person' and can be sued.

D)A company is required by law to have at least three directors.

A)Shareholders have unlimited liability for amounts owed by their company in respect of bank loans.

B)The directors of a limited company are immune from prosecution by the company or its shareholders.

C)A company is regarded in law as a 'person' and can be sued.

D)A company is required by law to have at least three directors.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

13

Which one of the following statements about the filing of information by small companies at Companies House is correct? Small companies:

A)are exempted from any requirement to file information at Companies House.

B)must file an abridged version of both statement of financial position and statement of profit or loss.

C)may choose to file an abridged statement of financial position.

D)must file a statement of profit or loss only.

A)are exempted from any requirement to file information at Companies House.

B)must file an abridged version of both statement of financial position and statement of profit or loss.

C)may choose to file an abridged statement of financial position.

D)must file a statement of profit or loss only.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

14

Which one of the following statements about audit reports is correct?

A)Auditors are required to report upon whether or not the financial statements present a 'true and fair view'.

B)All companies are required to include an auditor's report in their annual financial statements.

C)The audit report is addressed to the company's directors.

D)The auditor's report is addressed to the Registrar of Companies.

A)Auditors are required to report upon whether or not the financial statements present a 'true and fair view'.

B)All companies are required to include an auditor's report in their annual financial statements.

C)The audit report is addressed to the company's directors.

D)The auditor's report is addressed to the Registrar of Companies.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

15

XPN Limited has a share capital of £75 000, split into shares of 20p each.The company has just paid a dividend of £3750.What is the amount of share capital to be included in XPN's statement of financial position?

A)£15 000

B)£75 000

C)£375 000

D)£18 750

A)£15 000

B)£75 000

C)£375 000

D)£18 750

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

16

CBA Limited has a share capital of 25 000 £1 ordinary shares.Bill owns 10% of the company.In the financial year ended 31 December 20X8, a dividend of 12p per ordinary share was declared and paid. How much did Bill receive in respect of this dividend (to the nearest £)?

A)£2800

B)£300

C)£2200

D)Insufficient information available

A)£2800

B)£300

C)£2200

D)Insufficient information available

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

17

BBK Limited has share capital of 100 000 ordinary shares of 50p each, all of which have been issued to shareholders in exchange for cash.A dividend of 10p per share has been declared and is due for payment.What is the amount of share capital to be included in BBK's statement of financial position?

A)£100 000

B)£50 000

C)£55 000

D)£110 000

A)£100 000

B)£50 000

C)£55 000

D)£110 000

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

18

You are the company secretary of Annacone Belfort plc.The company has been making losses for several months in succession and is now on the brink of bankruptcy.You have just held a meeting with the four directors to discuss with them the implications for them personally if the company continues to trade while insolvent.During the meeting, each director made an assertion about the situation, only one of which was correct.Which of the following assertions was correct?

A)Director A: 'We can carry on trading until the annual accounts are drawn up - it's only then that we'll know whether the company's insolvent or not'.

B)Director B: 'We don't really have a choice here: it's our duty to the shareholders to continue trading.That's why the law protects us from any adverse consequences as individuals'.

C)Director C: 'If it is subsequently proved that we have defrauded the creditors, we could end up having to pay large fines personally, and we could even go to prison'.

D)Director D: 'The consequences of trading while insolvent are only really a problem for the finance director - he could go to prison, but the worst case scenario for the rest of us is a fine, which the company would be liable for in any case'.

A)Director A: 'We can carry on trading until the annual accounts are drawn up - it's only then that we'll know whether the company's insolvent or not'.

B)Director B: 'We don't really have a choice here: it's our duty to the shareholders to continue trading.That's why the law protects us from any adverse consequences as individuals'.

C)Director C: 'If it is subsequently proved that we have defrauded the creditors, we could end up having to pay large fines personally, and we could even go to prison'.

D)Director D: 'The consequences of trading while insolvent are only really a problem for the finance director - he could go to prison, but the worst case scenario for the rest of us is a fine, which the company would be liable for in any case'.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

19

Which one of the following statements about limited liability is correct? The liability of investors in a limited company is limited to:

A)The amount of their original investment plus £50 000.

B)An amount determined by the company's directors upon incorporation.

C)An amount determined by the Companies Act 2006.

D)The amount of their original investment.

A)The amount of their original investment plus £50 000.

B)An amount determined by the company's directors upon incorporation.

C)An amount determined by the Companies Act 2006.

D)The amount of their original investment.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

20

SBP Limited has share capital of 50 000 shares of 25p each, all of which have been issued to shareholders in exchange for cash.A dividend of 2p per share has been declared and is due for payment.What is the amount of share capital to be included in SBP's statement of financial position?

A)£50 000

B)£50 250

C)£12 500

D)£13 500

A)£50 000

B)£50 250

C)£12 500

D)£13 500

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

21

RRD Limited pays a dividend totaling £6000 to its shareholders on 31 December 20X4.What is the effect of this payment on the company's equity, assets and liabilities?

A)Decrease equity; decrease assets; no change to liabilities.

B)No change to equity; decrease assets; increase liabilities.

C)Decrease equity; no change to assets; increase liabilities.

D)Increase equity; increase assets; no change to liabilities.

A)Decrease equity; decrease assets; no change to liabilities.

B)No change to equity; decrease assets; increase liabilities.

C)Decrease equity; no change to assets; increase liabilities.

D)Increase equity; increase assets; no change to liabilities.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

22

Included in the share capital of NMO plc is an amount of £100 000 described as '7% preference shares of £1 each'.Which one of the following statements about these shares is correct?

A)The dividend per share is variable at the discretion of the directors, but it must be at least 7p per share each year.

B)If the market price of the preference share increases above £1 the preference dividend increases proportionately.

C)The dividend per share is fixed at exactly 7p each year.

D)None of the above.

A)The dividend per share is variable at the discretion of the directors, but it must be at least 7p per share each year.

B)If the market price of the preference share increases above £1 the preference dividend increases proportionately.

C)The dividend per share is fixed at exactly 7p each year.

D)None of the above.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

23

Sharp Motorhomes plc floated 90% of its ordinary share capital of £500 000 on the stock market on 15 January 20X6.The remainder was retained by the Sharp family.On 31 May 20X6 an interim dividend of 3% was paid followed by a final dividend of a further 3% on 30 November 20X6.What was the total dividend payment recorded by the company in the 20X6 calendar year?

A)£27 000

B)£30 000

C)£15 000

D)£33 333

A)£27 000

B)£30 000

C)£15 000

D)£33 333

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

24

Skapinker Fullworth plc (SF) had 150 000 shares of 50p each in issue at the beginning of its 20X6 financial year on 1 January 20X6.On 1 July 20X6 the company issued a further 50 000 shares for cash.At that date, Dan took the opportunity to increase his personal holding of shares in SF from 1000 to 3000.An interim dividend was paid on 1 May 20X6 of 5p per share and a final dividend of 10p per share was paid on 30 November 20X6. How much dividend did Dan receive from the company during the 20X6 financial year?

A)£300

B)£450

C)£350

D)£175

A)£300

B)£450

C)£350

D)£175

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

25

TTS Enterprises Limited has ordinary share capital of 40 000 shares of 12.5p each.In the year ended 31 May 20X7, an ordinary dividend of 4.5p per share was proposed and paid.Charles owns 10% of the issued share capital of the company.How much was his entitlement in respect of this dividend?

A)£1440.00

B)£22.50

C)£180.00

D)£2250.00

A)£1440.00

B)£22.50

C)£180.00

D)£2250.00

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

26

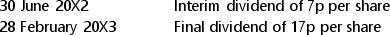

PCK Limited has the following share capital structure:  The company's directors declared and paid an ordinary dividend of 3% of nominal share value in the year ended 31 August 20X2.The preference dividend was also paid, in July 20X2.

The company's directors declared and paid an ordinary dividend of 3% of nominal share value in the year ended 31 August 20X2.The preference dividend was also paid, in July 20X2.

What was the total amount of dividend paid by PCK for the financial year ended 31 August 20X2?

A)£5925

B)£2925

C)£10 200

D)£5700

The company's directors declared and paid an ordinary dividend of 3% of nominal share value in the year ended 31 August 20X2.The preference dividend was also paid, in July 20X2.

The company's directors declared and paid an ordinary dividend of 3% of nominal share value in the year ended 31 August 20X2.The preference dividend was also paid, in July 20X2.What was the total amount of dividend paid by PCK for the financial year ended 31 August 20X2?

A)£5925

B)£2925

C)£10 200

D)£5700

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

27

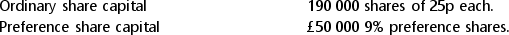

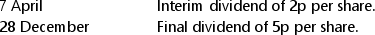

Liliana owned 6000 ordinary shares in BADC plc on 1 January 20X7.During its financial year ended 31 December 20X7, BADC paid the following dividends:  Having taken some tax advice, Liliana transferred ownership of 50% of her shareholding in BADC to her son, Freddie, on 30 November 20X7.How much dividend did Liliana receive from BADC in respect of the 20X7 financial year?

Having taken some tax advice, Liliana transferred ownership of 50% of her shareholding in BADC to her son, Freddie, on 30 November 20X7.How much dividend did Liliana receive from BADC in respect of the 20X7 financial year?

A)£420

B)£395

C)£385

D)£270

Having taken some tax advice, Liliana transferred ownership of 50% of her shareholding in BADC to her son, Freddie, on 30 November 20X7.How much dividend did Liliana receive from BADC in respect of the 20X7 financial year?

Having taken some tax advice, Liliana transferred ownership of 50% of her shareholding in BADC to her son, Freddie, on 30 November 20X7.How much dividend did Liliana receive from BADC in respect of the 20X7 financial year?A)£420

B)£395

C)£385

D)£270

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

28

XPP Limited has share capital of £22 000, split into 20p ordinary shares.Three-quarters of the way through the financial year ended 31 August 20X2 the company declared and paid a dividend of 40p per ordinary share. Pelham owns 1600 shares in XPP Limited.

What was the value of his dividend received from the company in the year ended 31 August 20X2?

A)£480

B)£3200

C)£640

D)£2400

What was the value of his dividend received from the company in the year ended 31 August 20X2?

A)£480

B)£3200

C)£640

D)£2400

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

29

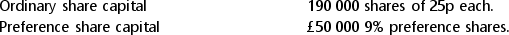

XLB plc has the following share capital details:  The directors of the company declare an ordinary dividend of 3% of nominal share value three-quarters of the way through the financial year ended 31 July 20X4.

The directors of the company declare an ordinary dividend of 3% of nominal share value three-quarters of the way through the financial year ended 31 July 20X4.

What is the amount of the ordinary dividend payable by the company in the financial year ended 31 July 20X4?

A)£1406

B)£3750

C)£2812

D)£1875

The directors of the company declare an ordinary dividend of 3% of nominal share value three-quarters of the way through the financial year ended 31 July 20X4.

The directors of the company declare an ordinary dividend of 3% of nominal share value three-quarters of the way through the financial year ended 31 July 20X4.What is the amount of the ordinary dividend payable by the company in the financial year ended 31 July 20X4?

A)£1406

B)£3750

C)£2812

D)£1875

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

30

SSPD Limited has 15 000 of ordinary share capital in £1 shares.Joan owns 6% of the shares.In addition, she owns 50% of the 8% cumulative preference share capital of £10 000 issued by the company several years ago.In the financial year ended 31 March 20X6 the company was unable to pay its preference dividend.However, it was able to meet its obligations in full in the financial year ended 31 March 20X7, in addition to paying an ordinary dividend of 10p per share.How much dividend did Joan receive in the financial year ended 31 March 20X7?

A)£1900

B)£490

C)£1700

D)£890

A)£1900

B)£490

C)£1700

D)£890

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck