Deck 13: Investing in Mutual Funds, Etfs, and Real Estate

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/10

Play

Full screen (f)

Deck 13: Investing in Mutual Funds, Etfs, and Real Estate

1

Choosing between a mutual fund and an ETF. Serena Fairchild is considering whether she should invest some extra money in a mutual fund or an ETF. Explain the key factors that should influence her decision.

Mutual fund and ETF:

Mutual fund is a financial service organisation that receives money from its investors. The funds collected by the investors are invested in different portfolio to diversify risk and the share of profit is distributed among the investors. Exchange traded fund (ETF) is an investment company whose shares are traded on stock exchange and it can be bought and sold during the whole day.

Choosing between ETF and Mutual Fund:

The following points will help her to take decision on the selection of ETF or Mutual Fund:

Conclusion:

Conclusion:

The investor who prefers to take risk can invest in mutual fund. Higher the risk higher will be the return. The investor who does not want to take risk and not ready to pay more expenses should invest in exchange fund transfer.

Mutual fund is a financial service organisation that receives money from its investors. The funds collected by the investors are invested in different portfolio to diversify risk and the share of profit is distributed among the investors. Exchange traded fund (ETF) is an investment company whose shares are traded on stock exchange and it can be bought and sold during the whole day.

Choosing between ETF and Mutual Fund:

The following points will help her to take decision on the selection of ETF or Mutual Fund:

Conclusion:

Conclusion: The investor who prefers to take risk can invest in mutual fund. Higher the risk higher will be the return. The investor who does not want to take risk and not ready to pay more expenses should invest in exchange fund transfer.

2

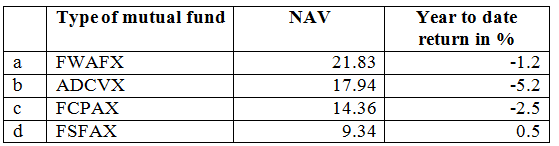

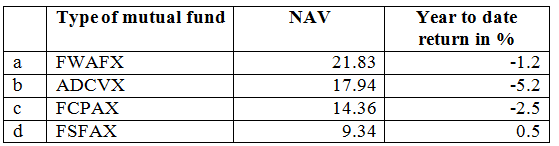

Estimating cost of mutual fund investments. Using the mutual fund quotes in exhibit 13.3, and assuming that you can buy these funds at their quoted NAVs, how much would you have to pay to buy each of the following funds?

a. FWAFX

b. ADCVX

c. FCPAX

d. FSFAX

According to the quotes, which of these four funds have 12b-1 fees? Which have redemption fees? Are any of them no-loads? Which fund has the highest year-to-date return? Which has the lowest?

a. FWAFX

b. ADCVX

c. FCPAX

d. FSFAX

According to the quotes, which of these four funds have 12b-1 fees? Which have redemption fees? Are any of them no-loads? Which fund has the highest year-to-date return? Which has the lowest?

Mutual fund:

Mutual fund is a financial service organisation that receives money from its investors. The funds collected by the investors are invested in different portfolio to diversify risk and the share of profit is distributed among the investors.

According to the quotes given in Exhibit 13.3 assuming that the mutual funds can be bought at their quoted NAV, the details of the different types of open end mutual fund are as follows:

12b-1 fees:

12b-1 fees:

12b-1 fee is an annual fee which is supposed to be payable to offset the selling and promotion expense. The mutual fund FCPAX carries 12b-1 fees.

Redemption fee:

Redemption fee is the amount of fee payable on the redemption of mutual fund. The mutual fund FSFAX carries the redemption fee.

No load fund:

When there is no charge payable to buy an open end mutual fund then there is no load fee associated with that mutual fund. The mutual fund FWAFX does not have load fund.

Highest and lowest yield:

The year to date return is highest for FSFAX (0.5%) and it is lowest for ADCVX (-5.2%).

Mutual fund is a financial service organisation that receives money from its investors. The funds collected by the investors are invested in different portfolio to diversify risk and the share of profit is distributed among the investors.

According to the quotes given in Exhibit 13.3 assuming that the mutual funds can be bought at their quoted NAV, the details of the different types of open end mutual fund are as follows:

12b-1 fees:

12b-1 fees: 12b-1 fee is an annual fee which is supposed to be payable to offset the selling and promotion expense. The mutual fund FCPAX carries 12b-1 fees.

Redemption fee:

Redemption fee is the amount of fee payable on the redemption of mutual fund. The mutual fund FSFAX carries the redemption fee.

No load fund:

When there is no charge payable to buy an open end mutual fund then there is no load fee associated with that mutual fund. The mutual fund FWAFX does not have load fund.

Highest and lowest yield:

The year to date return is highest for FSFAX (0.5%) and it is lowest for ADCVX (-5.2%).

3

Building a mutual fund portfolio. Imagine that you've just inherited $40,000 from a rich uncle. Now you're faced with the problem of deciding how to spend it. You could make a down payment on a condo-or better yet, on that BMw that you've always wanted. Or you could spend your windfall more profitably by building a mutual fund portfolio. Let's say that, after a lot of soul-searching, you decide to build a mutual fund portfolio. Your task is to develop a $40,000 mutual fund portfolio. Use actual funds and actual quoted prices, invest as much of the $40,000 as you possibly can, and be specific! Briefly describe the portfolio that you end up with, including the investment objectives that you're trying to achieve.

Mutual fund:

Mutual fund is a financial service organisation that receives money from its investors. The funds collected by the investors are invested in different portfolio to diversify risk and the share of profit is distributed among the investors.

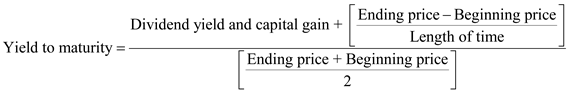

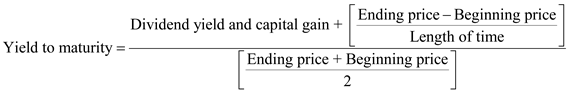

Approximate yield of mutual fund:

The approximate yield on the mutual fund will be computed in the following manner:

The objective of investment in the mutual fund is maximisation of profit and minimisation of risk. The risk can be minimised with diversification of portfolio. Investor should consider the following points to meet his objectives while investing in mutual fund:

The objective of investment in the mutual fund is maximisation of profit and minimisation of risk. The risk can be minimised with diversification of portfolio. Investor should consider the following points to meet his objectives while investing in mutual fund:

• Amount of in vestment : First of all decide how much amount will be invested in mutual fund. Here, the amount of investment is $40,000.

• Decide the allocation of asset : The common rule of thumb is that the percentage of investment in bonds should be equal to age of investor. If the investor is at the age of 25 then the investment in bonds should be 25 percent of investment amount and the rest should be invested in shares.

• Diversify investment with different types of mutual fund : Different types of mutual funds should be selected to minimise the risk.

• Comparison analysis : Compare the historical performance of mutual fund with the benchmark to analyse the best option.

Mutual fund is a financial service organisation that receives money from its investors. The funds collected by the investors are invested in different portfolio to diversify risk and the share of profit is distributed among the investors.

Approximate yield of mutual fund:

The approximate yield on the mutual fund will be computed in the following manner:

The objective of investment in the mutual fund is maximisation of profit and minimisation of risk. The risk can be minimised with diversification of portfolio. Investor should consider the following points to meet his objectives while investing in mutual fund:

The objective of investment in the mutual fund is maximisation of profit and minimisation of risk. The risk can be minimised with diversification of portfolio. Investor should consider the following points to meet his objectives while investing in mutual fund:• Amount of in vestment : First of all decide how much amount will be invested in mutual fund. Here, the amount of investment is $40,000.

• Decide the allocation of asset : The common rule of thumb is that the percentage of investment in bonds should be equal to age of investor. If the investor is at the age of 25 then the investment in bonds should be 25 percent of investment amount and the rest should be invested in shares.

• Diversify investment with different types of mutual fund : Different types of mutual funds should be selected to minimise the risk.

• Comparison analysis : Compare the historical performance of mutual fund with the benchmark to analyse the best option.

4

Describe an ETF and explain how these funds combine the characteristics of open- and closed-end funds. In the Vanguard family of funds, which would most closely resemble a "Spider" (SPDR)? In what respects are the Vanguard fund (that you selected) and SPDRs the same and how are they different? If you could invest in only one of them, which would it be? Explain.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

5

For each pair of funds listed below, select the fund that would be the least risky and briefly explain your answer.

a. Growth versus growth-and-income

b. Equity-income versus high-grade corporate bonds

c. Intermediate-term bonds versus high-yield municipals

d. International versus balanced

a. Growth versus growth-and-income

b. Equity-income versus high-grade corporate bonds

c. Intermediate-term bonds versus high-yield municipals

d. International versus balanced

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

6

Do an online search and see what information you can find on the PowerShares QQQ ETF. Discuss what information you need to evaluate the performance of the ETF, and use what you find to evaluate the QQQ ETF. What kind of investor should invest in this ETF?

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

7

Calculating approximate yield on mutual fund. About a year ago, Tyler Unger bought some shares in the Rising stars Fund. He bought the fund at $24.50 a share, and it now trades at $26.00. Last year, the fund paid dividends of 40 cents a share and had capital gains distributions of $1.83 a share. Using the approximate yield formula, what rate of return did Tyler earn on his investment? Repeat the calculation using a financial calculator. Would he have made a 20 percent rate of return if the stock had risen to $30 a share?

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

8

Calculating mutual fund approximate rate of return. A year ago, the early Growth Fund was being quoted at an NAV of $21.50 and an offer price of $23.35; today, it's being quoted at $23.04 (NAV) and $25.04 (offer). Use the approximate yield formula or a financial calculator to find the rate of return on this load fund; it was purchased a year ago, and its dividends and capital gains distributions over the year totaled $1.05 a share. ( Hint: As an investor, you buy fund shares at the offer price and sell at the NAV.)

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

9

Investing in residential income-producing property. Wendy Irving is thinking about investing in residential income-producing property that she can purchase for $200,000. Wendy can either pay cash for the full amount of the property or put up $50,000 of her own money and borrow the remaining $150,000 at 8 percent interest. The property is expected to generate $30,000 per year after all expenses but before interest and income taxes. Assume that wendy is in the 28 percent tax bracket. Calculate her annual profit and return on investment assuming that she (a) pays the full $200,000 from her own funds or (b) borrows $150,000 at 8 percent. Then discuss the effect, if any, of leverage on her rate of return. ( Hint: Earnings Before Interest Taxes minus Interest expenses (if any) equals Earnings Before Taxes minus Income Taxes (@28 percent) equals Profit After Taxes.)

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

10

Different ways to invest in real estate. Assume you've just inherited $100,000 and wish to use all or part of it to make a real estate investment.

a. Would you invest directly in real estate, or indirectly through something like a REIT? Explain.

b. Assuming that you decided to invest directly, would you invest in incomeproducing property or speculative property? Why? Describe the key characteristics of the types of income-producing or speculative property you would seek.

c. What financial and nonfinancial goals would you establish before beginning the search for suitable property?

d. If you decide to invest in real estate indirectly, which type(s) of securities would you buy, and why?

a. Would you invest directly in real estate, or indirectly through something like a REIT? Explain.

b. Assuming that you decided to invest directly, would you invest in incomeproducing property or speculative property? Why? Describe the key characteristics of the types of income-producing or speculative property you would seek.

c. What financial and nonfinancial goals would you establish before beginning the search for suitable property?

d. If you decide to invest in real estate indirectly, which type(s) of securities would you buy, and why?

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck