Deck 8: Merchandising Companies: Sales Perpetual

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/122

Play

Full screen (f)

Deck 8: Merchandising Companies: Sales Perpetual

1

To grant a customer a sales return, the seller credits Sales Returns and Allowances.

False

2

Service charge expense on credit cards reduces the amount recorded as sales revenue.

False

3

Sales returns and allowances and sales discounts are subtracted from sales in reporting net sales in the income statement.

True

4

Sales Returns and Allowances is debited when the seller accepts a return of merchandise.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

5

Sales minus operating expenses equals gross profit.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

6

Net Sales is equal to Sales Revenue less Sales Discounts, Sales Returns and Allowances and Freight-Out.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

7

The retailer generally considers sales from the use of national credit cards as credit sales.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

8

Sales Returns and Allowances and Sales Discounts are both designed to encourage customers to pay their accounts promptly.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

9

The normal balance of Sales Returns and Allowances is a debit.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

10

The Sales Returns and Allowances account and the Sales Discounts account are both classified as expense accounts.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

11

Under a perpetual inventory system, the journal entries to record a cash sale increase the cash account, sales revenue and cost of goods sold.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

12

Under a perpetual inventory system, the cost of goods sold is determined each time a sale occurs.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

13

Sales revenues are earned during the period cash is collected from the buyer.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

14

If a customer does not take advantage of a sales discount, the Sales Discount account is credited instead of debited.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

15

The revenue recognition principle applies to merchandisers by recognizing sales revenues when the performance obligation is satisfied.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

16

Gross profit represents the merchandising profit of a company.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

17

Freight costs incurred by the seller on outgoing merchandise are an operating expense to the seller.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

18

In a Sales Allowance transaction, the goods are returned to the seller.

Prior question number: 7

Prior question number: 7

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

19

Under a perpetual inventory system, the inventory account is increased for freight costs paid by seller.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

20

A Sales Allowance requires two journal entries.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

21

Which is true concerning multiple sales accounts?

A) Companies may not use multiple sales accounts; all sales are recorded in one Sales Revenue account.

B) Companies may use multiple sales accounts; if they do they must report each sales account as a separate item in the income statement.

C) Companies may use multiple sales accounts; if they do they can report as a single Sales Revenue amount in the income statement, but must disclose the separate Sales Revenue amounts elsewhere.

D) Companies may use multiple sales accounts; if they do they generally report a single Sales Revenue amount in the income statement, and do not disclose the separate Sales Revenue amounts elsewhere.

A) Companies may not use multiple sales accounts; all sales are recorded in one Sales Revenue account.

B) Companies may use multiple sales accounts; if they do they must report each sales account as a separate item in the income statement.

C) Companies may use multiple sales accounts; if they do they can report as a single Sales Revenue amount in the income statement, but must disclose the separate Sales Revenue amounts elsewhere.

D) Companies may use multiple sales accounts; if they do they generally report a single Sales Revenue amount in the income statement, and do not disclose the separate Sales Revenue amounts elsewhere.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

22

Bennie's Polish Palace had credit card sales of $2,000 with cost of goods sold of $800, and cash sales of $1,000 with cost of goods sold of $400. Operating expenses were $1,000. What is Bennie's gross profit?

A) $600.

B) $800.

C) $1,200

D) $1,800

A) $600.

B) $800.

C) $1,200

D) $1,800

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

23

Sales revenue less cost of goods sold is called

A) gross profit.

B) net profit.

C) net income.

D) marginal income.

A) gross profit.

B) net profit.

C) net income.

D) marginal income.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

24

Driftless Market has total receipts of $53,000, which include sales tax of 6%. Driftless should record

A) Sales Taxes Payable of $3,000.

B) Sales Taxes Payable of $3,180.

C) Sales Taxes Expense of $3,000.

D) Sales Taxes Expense of $3,180.

A) Sales Taxes Payable of $3,000.

B) Sales Taxes Payable of $3,180.

C) Sales Taxes Expense of $3,000.

D) Sales Taxes Expense of $3,180.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

25

In a perpetual inventory system, cost of goods sold is recorded

A) on a daily basis.

B) on a monthly basis.

C) on an annual basis.

D) with each sale.

A) on a daily basis.

B) on a monthly basis.

C) on an annual basis.

D) with each sale.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

26

When the seller records a sales return, two journal entries are required.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

27

Which is true concerning recording cash sales and credit sales?

A) Recording a cash sale and a credit sale both require only one entry, and the only difference is which account is debited.

B) Recording a cash sale and a credit sale both require two entries, and the only difference is which account is debited in the Sales Revenue entry.

C) Recording a cash sale requires only one entry and recording a cash sale requires two entries.

D) Recording a cash sale requires only one entry and recording a credit sale requires two entries.

A) Recording a cash sale and a credit sale both require only one entry, and the only difference is which account is debited.

B) Recording a cash sale and a credit sale both require two entries, and the only difference is which account is debited in the Sales Revenue entry.

C) Recording a cash sale requires only one entry and recording a cash sale requires two entries.

D) Recording a cash sale requires only one entry and recording a credit sale requires two entries.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

28

Which is not one of the three parties involved when national credit cards are used in retail sales?

A) Supplier

B) Credit card issuer

C) Retailer

D) Customer

A) Supplier

B) Credit card issuer

C) Retailer

D) Customer

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

29

If both the seller uses a perpetual inventory systems, the seller credits Sales Discounts when payment is remitted within the discount period.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

30

When the seller grants a sales allowance, two journal entries are required.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

31

Sales Returns and Allowances is credited when the seller grants an allowance to a customer.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

32

A sales invoice provides evidence of

A) a cash collection from a customer.

B) a cash sale.

C) a credit sale.

D) any type of sale (cash or credit).

A) a cash collection from a customer.

B) a cash sale.

C) a credit sale.

D) any type of sale (cash or credit).

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

33

The seller credits Sales Discounts when the purchaser remits payment within the discount period.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

34

The purchaser of merchandise debits Sales Discounts when payment is remitted within the discount period.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

35

The entries to record a cash sale require all of the following except

A) a debit to Accounts Receivable.

B) a credit to Inventory.

C) a debit to Cash.

D) a debit to Cost of Goods Sold.

A) a debit to Accounts Receivable.

B) a credit to Inventory.

C) a debit to Cash.

D) a debit to Cost of Goods Sold.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

36

The entries to record a credit sale require all of the following except

A) a debit to Accounts Receivable.

B) a credit to Inventory.

C) a debit to Cash.

D) a debit to Cost of Goods Sold.

A) a debit to Accounts Receivable.

B) a credit to Inventory.

C) a debit to Cash.

D) a debit to Cost of Goods Sold.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

37

Josh Borke buys $700 of sports equipment from Get Moving Sports using his VISA Chase Credit Card. Chase charges a service fee of 3%. Get Moving Sports' journal entry includes a

A) debit to Cash of $700.

B) credit to Sales Revenue of $679.

C) debit to Accounts Receivable of $679.

D) debit to Service Charge Expense of $21.

A) debit to Cash of $700.

B) credit to Sales Revenue of $679.

C) debit to Accounts Receivable of $679.

D) debit to Service Charge Expense of $21.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

38

If the seller pays freight charges to have goods delivered to a customer, it would

A) debit the amount to Inventory.

B) credit the amount to Inventory.

C) debit the amount to Cost of Goods Sold.

D) debit the amount to Freight-Out or Delivery Expense.

A) debit the amount to Inventory.

B) credit the amount to Inventory.

C) debit the amount to Cost of Goods Sold.

D) debit the amount to Freight-Out or Delivery Expense.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

39

Recording a credit sale requires

A) only one entry that includes a debit to Accounts Receivable.

B) only one entry that includes a credit to Inventory.

C) two entries that include a debit to Cash.

D) two entries that include a debit to Cost of Goods Sold.

A) only one entry that includes a debit to Accounts Receivable.

B) only one entry that includes a credit to Inventory.

C) two entries that include a debit to Cash.

D) two entries that include a debit to Cost of Goods Sold.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

40

Recording a cash sale requires

A) only one entry that includes a debit to Cash.

B) only one entry that includes a credit to Inventory.

C) two entries, one of which includes a debit to Accounts Receivable.

D) two entries, one of which includes a debit to Cost of Goods Sold.

A) only one entry that includes a debit to Cash.

B) only one entry that includes a credit to Inventory.

C) two entries, one of which includes a debit to Accounts Receivable.

D) two entries, one of which includes a debit to Cost of Goods Sold.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

41

Sales revenue

A) may be recorded before cash is collected.

B) will always equal cash collections in a month.

C) only results from credit sales.

D) is only recorded after cash is collected.

A) may be recorded before cash is collected.

B) will always equal cash collections in a month.

C) only results from credit sales.

D) is only recorded after cash is collected.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

42

A sales invoice is a source document that

A) provides support for goods purchased for resale.

B) provides evidence of incurred operating expenses.

C) provides evidence of credit sales.

D) serves only as a customer receipt.

A) provides support for goods purchased for resale.

B) provides evidence of incurred operating expenses.

C) provides evidence of credit sales.

D) serves only as a customer receipt.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

43

The collection of a $6,000 account within the 3 percent discount period will result in a

A) debit to Sales Discounts for $180.

B) debit to Accounts Receivable for $5,820.

C) credit to Cash for $5,820.

D) credit to Accounts Receivable for $5,820.

A) debit to Sales Discounts for $180.

B) debit to Accounts Receivable for $5,820.

C) credit to Cash for $5,820.

D) credit to Accounts Receivable for $5,820.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

44

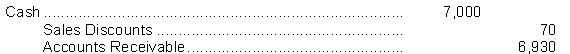

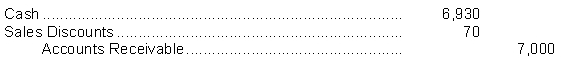

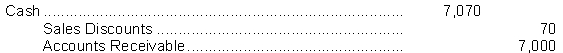

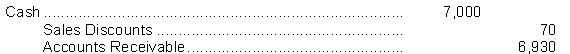

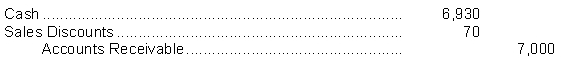

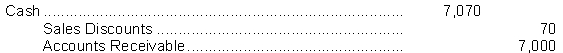

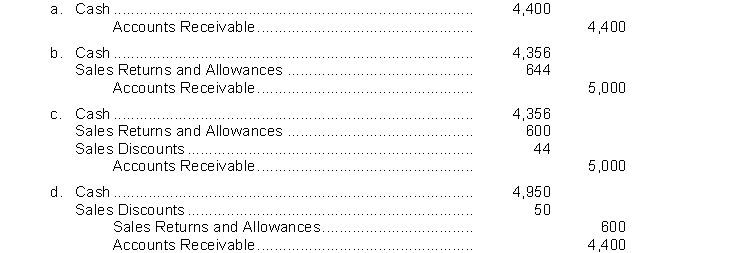

On July 9, Elijah Company sells goods on credit to Miley Company for $7,000, terms 1/10, n/60. Elijah receives payment on July 18. The entry by Elijah on July 18 is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

45

A credit sale of $4,000 is made on April 25, terms 3/10, n/30, on which a return of $300 is granted on April 28. What amount is received as payment in full on May 4?

A) $3,589

B) $3,700

C) $3,880 d $4,000

A) $3,589

B) $3,700

C) $3,880 d $4,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

46

Freight costs paid by a seller on merchandise sold to customers will cause an increase

A) in the selling expenses of the buyer.

B) in operating expenses for the seller.

C) to the cost of goods sold of the seller.

D) to a contra-revenue account of the seller.

A) in the selling expenses of the buyer.

B) in operating expenses for the seller.

C) to the cost of goods sold of the seller.

D) to a contra-revenue account of the seller.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

47

The journal entry to record a credit sale is

A)

B)

C)

D) Accounts Receivable

Sales Revenue

A)

B)

C)

D) Accounts Receivable

Sales Revenue

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

48

Financial information is presented below: Gross profit would be

A) $51,200.

B) $144,000.

C) $156,000.

D) $174,000.

A) $51,200.

B) $144,000.

C) $156,000.

D) $174,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

49

The entry to record the remittance of sales tax to the taxing authority includes a debit to

A) sales taxes payable.

B) sales tax expense.

C) accounts receivable.

D) sales revenue.

A) sales taxes payable.

B) sales tax expense.

C) accounts receivable.

D) sales revenue.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

50

Financial information is presented below:

Gross profit would be

A) $147,600

B) $57,600

C) $270,000

D) $187,600

Gross profit would be

A) $147,600

B) $57,600

C) $270,000

D) $187,600

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

51

The entry to record the receipt of payment within the discount period on a sale of $2,500 with terms of 2/10, n/30 will include a credit to

A) Sales Discounts for $50.

B) Cash for $2,450.

C) Accounts Receivable for $2,500.

D) Sales Revenue for $2,500.

A) Sales Discounts for $50.

B) Cash for $2,450.

C) Accounts Receivable for $2,500.

D) Sales Revenue for $2,500.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

52

The entry to record cash sales with sales tax includes

A) a debit to sales taxes payable.

B) a credit to sales discounts.

C) a debit to accounts receivable.

D) a credit to sales revenue.

A) a debit to sales taxes payable.

B) a credit to sales discounts.

C) a debit to accounts receivable.

D) a credit to sales revenue.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

53

Martin Company reported the following balances at June 30, 2020:

Net sales for the month is:

A) $7,300

B) $15,500

C) $15,700

D) $16,500

Net sales for the month is:

A) $7,300

B) $15,500

C) $15,700

D) $16,500

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

54

All of the following are have credit balances accounts except

A) sales revenue.

B) sales tax payable.

C) sales discounts.

D) All of these accounts have credit balances.

A) sales revenue.

B) sales tax payable.

C) sales discounts.

D) All of these accounts have credit balances.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

55

On November 2, 2020, Yakima Company has cash sales of $7,000 from merchandise having a cost of $3,900. The entries to record the day's cash sales will include a:

A) $3,900 credit to Cost of Goods Sold.

B) $7,000 credit to Cash.

C) $3,900 credit to Inventory. d $7,000 debit to Accounts Receivable.

A) $3,900 credit to Cost of Goods Sold.

B) $7,000 credit to Cash.

C) $3,900 credit to Inventory. d $7,000 debit to Accounts Receivable.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

56

Financial information is presented below: The amount of net sales on the income statement would be

A) $320,000.

B) $332,000.

C) $338,000.

D) $350,000.

A) $320,000.

B) $332,000.

C) $338,000.

D) $350,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

57

In a perpetual inventory system, the Cost of Goods Sold account is used

A) only when a cash sale of merchandise occurs.

B) only when a credit sale of merchandise occurs.

C) only when a sale of merchandise occurs.

D) whenever there is a sale of merchandise or a return of merchandise sold.

A) only when a cash sale of merchandise occurs.

B) only when a credit sale of merchandise occurs.

C) only when a sale of merchandise occurs.

D) whenever there is a sale of merchandise or a return of merchandise sold.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

58

On October 4, 2020, TJ Corporation had credit sales transactions of $4,800 from merchandise having cost $2,880. The entries to record the day's credit transactions include a

A) debit of $4,800 to Inventory.

B) credit of $4,800 to Sales Revenue.

C) debit of $2,880 to Inventory.

D) credit of $2,880 to Cost of Goods Sold.

A) debit of $4,800 to Inventory.

B) credit of $4,800 to Sales Revenue.

C) debit of $2,880 to Inventory.

D) credit of $2,880 to Cost of Goods Sold.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

59

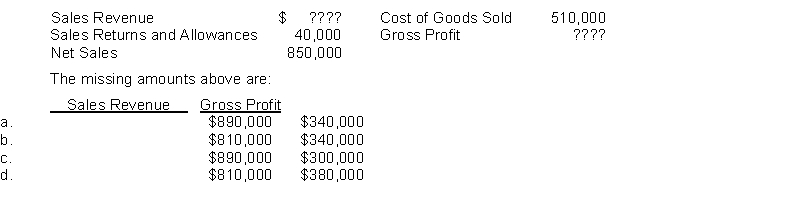

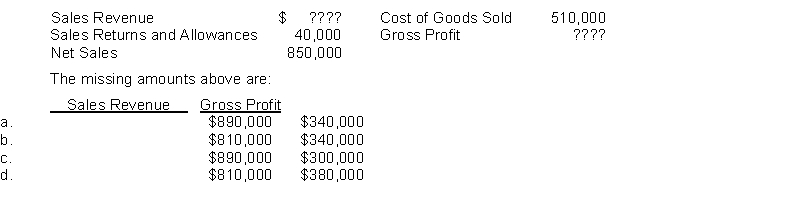

Chen Company's financial information is presented below.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

60

Sales revenues are usually considered earned when

A) cash is received from credit sales.

B) an order is received.

C) goods have been transferred from the seller to the buyer.

D) adjusting entries are made.

A) cash is received from credit sales.

B) an order is received.

C) goods have been transferred from the seller to the buyer.

D) adjusting entries are made.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

61

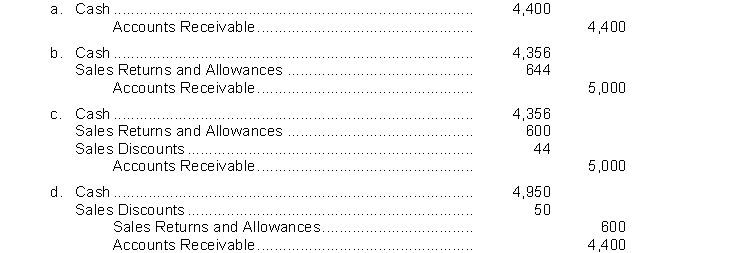

Baker Company sells merchandise on account for $5,000 to Helix Company with credit terms of 1/10, n/30. Helix Company returns $600 of merchandise that was damaged, along with a check to settle the account within the discount period. What entry does Baker Company make upon receipt of the check?

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

62

The collection of a $1,200 account after the 2 percent discount period will result in a

A) debit to Cash for $1,176.

B) credit to Accounts Receivable for $1,200.

C) credit to Cash for $1,200.

D) debit to Sales Discounts for $24.

A) debit to Cash for $1,176.

B) credit to Accounts Receivable for $1,200.

C) credit to Cash for $1,200.

D) debit to Sales Discounts for $24.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

63

Company P sells $3,000 of merchandise on account to Company Q with credit terms of 2/10, n/30. If Company Q remits a check taking advantage of the discount offered, what is the amount of Company Q's check?

A) $2,100

B) $2,400

C) $2,700

D) $2,940

A) $2,100

B) $2,400

C) $2,700

D) $2,940

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

64

The Sales Returns and Allowances account is classified as a(n)

A) asset account.

B) contra asset account.

C) expense account.

D) contra revenue account.

A) asset account.

B) contra asset account.

C) expense account.

D) contra revenue account.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

65

A credit sale of $3,600 is made on July 15, terms 3/10, n/30, on which a return of $100 is granted on July 18. What amount is received as payment in full on July 24?

A) $3,395

B) $3,492

C) $3,392 d $3,600

A) $3,395

B) $3,492

C) $3,392 d $3,600

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

66

Company M sells $900 of merchandise on account to Company N with credit terms of 1/15, n/30. If Company N remits a check taking advantage of the discount offered, what is the amount of Company N's check?

A) $774

B) $765

C) $810

D) $891

A) $774

B) $765

C) $810

D) $891

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following accounts has a normal credit balance?

A) Sales Returns and Allowances

B) Sales Discounts

C) Sales Revenue

D) Selling Expense

A) Sales Returns and Allowances

B) Sales Discounts

C) Sales Revenue

D) Selling Expense

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

68

Python Company sells merchandise on account for $5,000 to Monte Company with credit terms of 2/10, n/30. Monte Company returns $1,500 of merchandise that was damaged, along with a check to settle the account within the discount period. What is the amount of the check?

A) $3,430

B) $4,000

C) $4,900

D) $4,430

A) $3,430

B) $4,000

C) $4,900

D) $4,430

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

69

The Sales Returns and Allowances account is not debited if a customer

A) returns defective merchandise.

B) receives a credit for merchandise of inferior quality.

C) utilizes a prompt payment incentive.

D) returns goods that are not in accordance with specifications.

A) returns defective merchandise.

B) receives a credit for merchandise of inferior quality.

C) utilizes a prompt payment incentive.

D) returns goods that are not in accordance with specifications.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

70

A credit granted to a customer for returned goods requires a debit to

A) Sales Revenue and a credit to Cash.

B) Sales Returns and Allowances and a credit to Accounts Receivable.

C) Accounts Receivable and a credit to a contra-revenue account.

D) Cash and a credit to Sales Returns and Allowances.

A) Sales Revenue and a credit to Cash.

B) Sales Returns and Allowances and a credit to Accounts Receivable.

C) Accounts Receivable and a credit to a contra-revenue account.

D) Cash and a credit to Sales Returns and Allowances.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

71

If a customer agrees to retain merchandise that is defective because the seller is willing to reduce the selling price, this transaction is known as a sales

A) discount.

B) return.

C) contra asset.

D) allowance.

A) discount.

B) return.

C) contra asset.

D) allowance.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

72

When goods are returned that relate to a prior cash sale,

A) the Sales Returns and Allowances account should not be used.

B) the cash account will be credited.

C) Sales Returns and Allowances will be credited.

D) Accounts Receivable will be credited.

A) the Sales Returns and Allowances account should not be used.

B) the cash account will be credited.

C) Sales Returns and Allowances will be credited.

D) Accounts Receivable will be credited.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

73

As an incentive for customers to pay their accounts promptly, a business may offer its customers

A) a sales discount.

B) free delivery.

C) a sales allowance.

D) a sales return.

A) a sales discount.

B) free delivery.

C) a sales allowance.

D) a sales return.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

74

The Sales Returns and Allowances account does not provide information to management about

A) possible inferior merchandise.

B) the percentage of credit sales versus cash sales.

C) inefficiencies in filling orders.

D) errors in overbilling customers.

A) possible inferior merchandise.

B) the percentage of credit sales versus cash sales.

C) inefficiencies in filling orders.

D) errors in overbilling customers.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

75

Sales Returns and Allowances is increased when

A) an employee does a good job.

B) goods are sold on credit.

C) goods that were sold on credit are returned.

D) customers refuse to pay their accounts.

A) an employee does a good job.

B) goods are sold on credit.

C) goods that were sold on credit are returned.

D) customers refuse to pay their accounts.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

76

The collection of a $1,400 account after the 2 percent discount period will result in a

A) debit to Cash for $1,372.

B) debit to Accounts Receivable for $1,400.

C) debit to Cash for $1,400.

D) debit to Sales Discounts for $28.

A) debit to Cash for $1,372.

B) debit to Accounts Receivable for $1,400.

C) debit to Cash for $1,400.

D) debit to Sales Discounts for $28.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

77

The credit terms offered to a customer by a business firm are 3/10, n/30, which means that

A) the customer must pay the bill within 10 days.

B) the customer can deduct a 3% discount if the bill is paid between the 10th and 30th day from the invoice date.

C) the customer can deduct a 3% discount if the bill is paid within 10 days of the invoice date.

D) two sales returns can be made within 10 days of the invoice date and no returns thereafter.

A) the customer must pay the bill within 10 days.

B) the customer can deduct a 3% discount if the bill is paid between the 10th and 30th day from the invoice date.

C) the customer can deduct a 3% discount if the bill is paid within 10 days of the invoice date.

D) two sales returns can be made within 10 days of the invoice date and no returns thereafter.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

78

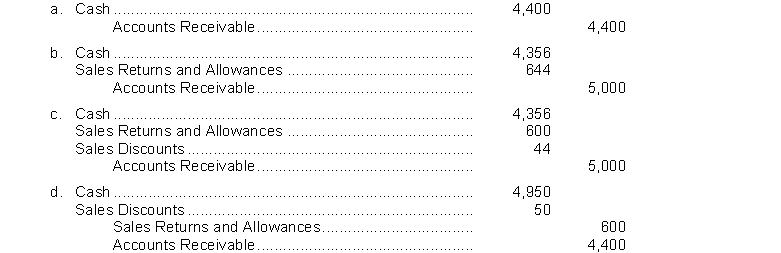

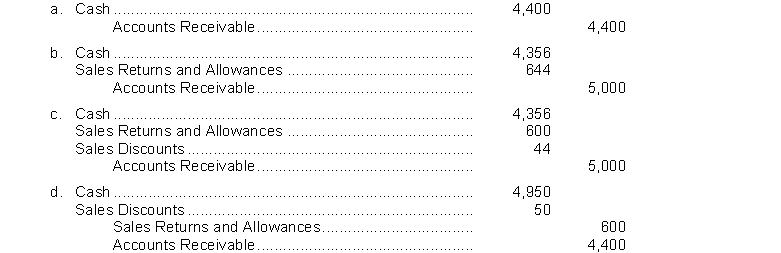

Bagley Company sells merchandise on account for $5,000 to Hoffman Company with credit terms of 1/10, n/30. Bagley grants Hoffman a $600 allowance because some of the merchandise did not conform to specifications. Hoffman settle the account within the discount period. What entry does Bagley make upon receipt of the check?

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

79

A sales discount does not

A) provide the purchaser with a cash saving.

B) reduce the amount of cash received from a credit sale.

C) increase a contra-revenue account.

D) increase an operating expense account.

A) provide the purchaser with a cash saving.

B) reduce the amount of cash received from a credit sale.

C) increase a contra-revenue account.

D) increase an operating expense account.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following would not be classified as a contra account?

A) Inventory

B) Sales Returns and Allowances

C) Accumulated Depreciation

D) Sales Discounts

A) Inventory

B) Sales Returns and Allowances

C) Accumulated Depreciation

D) Sales Discounts

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck