Deck 7: Merchandising Companies: Purchases Perpetual

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

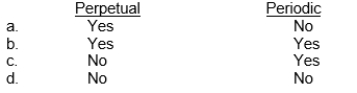

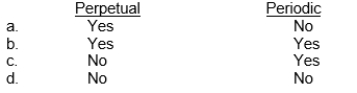

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/153

Play

Full screen (f)

Deck 7: Merchandising Companies: Purchases Perpetual

1

Sales revenues are earned when cash is collected from the buyer.

False

2

Retailers and wholesalers are both considered merchandisers.

True

3

In a periodic inventory system, cost of goods sold is determined by subtracting the cost of the ending inventory from the cost of goods available for sale.

True

4

A periodic inventory system requires a detailed inventory record of inventory items.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

5

Inventory is classified as a current asset on a classified balance sheet.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

6

Operating expenses are different for merchandising and service enterprises.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

7

The major difference between the balance sheet of a service company and that of a merchandising company is the presence of inventory.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

8

Sales revenue less cost of goods and operating expenses sold equals gross profit.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

9

Walgreens is an example of a merchandising company.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

10

If a company uses a periodic inventory system, cost of goods sold is determined each time a sale is made.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

11

Beginning inventory plus goods purchased equals goods available for sale.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

12

Gross profit represents the merchandising profit of a company.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

13

Sales minus operating expenses equals gross profit.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

14

Periodic inventory systems provide better control over inventories than perpetual inventory systems.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

15

Inventory is reported as a long-term asset on a classified balance sheet.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

16

Two categories of expenses for service companies are cost of goods sold and operating expenses.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

17

The operating cycle for a service business is generally longer than that of a merchandising business.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

18

A physical count of inventory is only needed if a periodic inventory system is used.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

19

Sales revenue minus cost of goods sold equals gross profit.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

20

Under a perpetual inventory system, the cost of goods sold is determined each time a sale occurs.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

21

When goods are shipped FOB Destination, the buyer debits the Freight-Out account.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

22

FOB Shipping Point means the buyer pays the freight costs.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

23

If the terms are FOB Shipping Point, the seller pays the freight costs and charges them to the Inventory account if a perpetual inventory system is used.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

24

The terms 2/10, n/30 state that a 2% discount is available if the invoice is paid within the first 10 days of the next month.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

25

The words "on account" or the presence of credit terms indicates that purchase or sale was made for cash.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

26

In a cash purchase of inventory, the inventory account is debited if a perpetual inventory system is used.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

27

When goods are shipped FOB Shipping Point, the seller records this cost as an operating expense.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

28

The seller's entry for a purchase return always includes a credit to Inventory.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

29

The seller's entry to record a purchase return under a perpetual inventory system includes a debit to Inventory and credit to Purchase Returns and Allowances.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

30

When goods are shipped FOB Shipping Point, this cost reduces the seller's net income but not gross profit.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

31

Most purchases are for cash.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

32

Under a perpetual inventory system, when a buyer pays within the discount period, the amount of the discount decreases the cost of its inventory.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

33

The entry to record a purchase return entry is the opposite of the entry to record a purchase.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

34

When a purchase allowance is granted, the buyer returns units of inventory.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

35

Every purchase should be supported by business documents.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

36

In a credit purchase of inventory, the cash account is credited.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

37

When goods are shipped FOB Destination, this cost reduces the buyer's net income but not gross profit.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

38

If the terms are FOB Shipping Point, the buyer pays the freight costs and charges them to the Inventory account if a perpetual inventory system is used.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

39

FOB Destination means the buyer pays the freight costs.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

40

If the terms are FOB Destination, the buyer debits Inventory for the amount of the freight costs if a perpetual inventory system is used.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

41

A merchandising company that sells directly to consumers is a

A) retailer.

B) wholesaler.

C) broker.

D) service company.

A) retailer.

B) wholesaler.

C) broker.

D) service company.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

42

An enterprise which sells goods to customers is known as a

A) proprietorship.

B) corporation.

C) retailer.

D) service firm.

A) proprietorship.

B) corporation.

C) retailer.

D) service firm.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

43

Net income is gross profit less

A) financing expenses.

B) operating expenses.

C) other expenses and losses.

D) other expenses.

A) financing expenses.

B) operating expenses.

C) other expenses and losses.

D) other expenses.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

44

Two categories of expenses for merchandising companies are

A) cost of goods sold and financing expenses.

B) operating expenses and financing expenses.

C) cost of goods sold and operating expenses.

D) sales and cost of goods sold.

A) cost of goods sold and financing expenses.

B) operating expenses and financing expenses.

C) cost of goods sold and operating expenses.

D) sales and cost of goods sold.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

45

Detailed records of goods held for resale are not maintained under a

A) perpetual inventory system.

B) periodic inventory system.

C) double entry accounting system.

D) single entry accounting system.

A) perpetual inventory system.

B) periodic inventory system.

C) double entry accounting system.

D) single entry accounting system.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

46

Cost of goods sold is determined only at the end of the accounting period in

A) a perpetual inventory system.

B) a periodic inventory system.

C) both a perpetual and a periodic inventory system.

D) neither a perpetual nor a periodic inventory system.

A) a perpetual inventory system.

B) a periodic inventory system.

C) both a perpetual and a periodic inventory system.

D) neither a perpetual nor a periodic inventory system.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

47

Maz-Ing Company had a beginning inventory with a cost of $1,000. During the period, the company purchased additional inventory at a cost of $12,000. A physical count of the inventory at the end of the period showed goods at a cost of $3,000 on hand. What was the company's cost of goods available for sale for the period?

A) $2,000

B) $3,000

C) $10,000

D) $13,000

A) $2,000

B) $3,000

C) $10,000

D) $13,000

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following would not be considered a merchandising company?

A) drugstore

B) law firm

C) bookstore

D) grocery store

A) drugstore

B) law firm

C) bookstore

D) grocery store

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following expressions is incorrect?

A) Gross profit - operating expenses = net income

B) Sales revenue - cost of goods sold - operating expenses = net income

C) Net income + operating expenses = gross profit

D) Operating expenses - cost of goods sold = gross profit

A) Gross profit - operating expenses = net income

B) Sales revenue - cost of goods sold - operating expenses = net income

C) Net income + operating expenses = gross profit

D) Operating expenses - cost of goods sold = gross profit

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following would not be considered a merchandising company?

A) Retailer

B) Wholesaler

C) Service firm

D) All of these are types of merchandising companies.

A) Retailer

B) Wholesaler

C) Service firm

D) All of these are types of merchandising companies.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

51

The terms 1/10, n/30 state that a 1% discount is available if the invoice is paid within 10 days of the purchase and the net amount is due in 30 days.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

52

After gross profit is calculated, operating expenses are deducted to determine

A) gross margin.

B) net income.

C) gross profit on sales.

D) net margin.

A) gross margin.

B) net income.

C) gross profit on sales.

D) net margin.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is a true statement about inventory systems?

A) Periodic inventory systems require more detailed inventory records.

B) Perpetual inventory systems require more detailed inventory records.

C) A periodic system requires cost of goods sold be determined after each sale.

D) A perpetual system determines cost of goods sold only at the end of the accounting period.

A) Periodic inventory systems require more detailed inventory records.

B) Perpetual inventory systems require more detailed inventory records.

C) A periodic system requires cost of goods sold be determined after each sale.

D) A perpetual system determines cost of goods sold only at the end of the accounting period.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

54

A perpetual inventory system would likely be used by a(n)

A) automobile dealership.

B) hardware store.

C) drugstore.

D) convenience store.

A) automobile dealership.

B) hardware store.

C) drugstore.

D) convenience store.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

55

Sales revenue less cost of goods sold is called

A) gross profit.

B) net profit.

C) net income.

D) marginal income.

A) gross profit.

B) net profit.

C) net income.

D) marginal income.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following would not be considered a merchandising company?

A) Home Depot

B) Barnes & Noble

C) Jones & Jones, CPAs

D) All of these are types of merchandising companies.

A) Home Depot

B) Barnes & Noble

C) Jones & Jones, CPAs

D) All of these are types of merchandising companies.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

57

In a perpetual inventory system, cost of goods sold is recorded

A) on a daily basis.

B) on a monthly basis.

C) on an annual basis.

D) with each sale.

A) on a daily basis.

B) on a monthly basis.

C) on an annual basis.

D) with each sale.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

58

Maz-Ing Company had a beginning inventory with a cost of $1,000. During the period, the company purchased additional inventory at a cost of $12,000. A physical count of the inventory at the end of the period showed goods at a cost of $3,000 on hand. What was the company's cost of goods sold for the period?

A) $10,000

B) $11,000

C) $13,000

D) $14,000

A) $10,000

B) $11,000

C) $13,000

D) $14,000

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

59

The primary source of revenue for a wholesaler is

A) investment income.

B) service fees.

C) the sale of merchandise.

D) the sale of fixed assets the company owns.

A) investment income.

B) service fees.

C) the sale of merchandise.

D) the sale of fixed assets the company owns.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

60

If a company determines cost of goods sold each time a sale occurs, it

A) must have a computer accounting system.

B) uses a combination of the perpetual and periodic inventory systems.

C) uses a periodic inventory system.

D) uses a perpetual inventory system.

A) must have a computer accounting system.

B) uses a combination of the perpetual and periodic inventory systems.

C) uses a periodic inventory system.

D) uses a perpetual inventory system.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

61

Sloan Enterprises had inventory on May 1 with a cost of $2,000. During May, the company purchased additional inventory at a cost of $8,000. Sloan uses a perpetual inventory system and recorded cost of goods sold of $7,000 for the month. What was Sloan's cost of goods available for sale during the period?

A) $1,000

B) $3,000

C) $9,000

D) $10,000

A) $1,000

B) $3,000

C) $9,000

D) $10,000

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

62

On a classified balance sheet, inventory is classified as

A) an intangible asset.

B) property, plant, and equipment.

C) a current asset.

D) a long-term investment.

A) an intangible asset.

B) property, plant, and equipment.

C) a current asset.

D) a long-term investment.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

63

Under a perpetual inventory system, cash purchases and credit purchases are debited to

A) inventory.

B) cash (for cash purchases) and inventory (for credit purchases).

C) inventory (for cash purchases) and accounts payable (for credit purchases).

D) accounts payable

A) inventory.

B) cash (for cash purchases) and inventory (for credit purchases).

C) inventory (for cash purchases) and accounts payable (for credit purchases).

D) accounts payable

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

64

Companies can choose to use which inventory system?

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

65

During August 2020, Shelby's Supply Store generated revenues of $65,000. The company's expenses were as follows: cost of goods sold of $33,000 and operating expenses of $7,000. Shelby's net income for August,2020 is

A) $25,000.

B) $27,000.

C) $24,000.

D) $32,000.

A) $25,000.

B) $27,000.

C) $24,000.

D) $32,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

66

When inventory is purchased, the purchase invoice

A) usually does not exist.

B) is prepared by the purchaser.

C) normally does not include the total purchase price.

D) is usually a copy of the sales invoice sent by the seller.

A) usually does not exist.

B) is prepared by the purchaser.

C) normally does not include the total purchase price.

D) is usually a copy of the sales invoice sent by the seller.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the terms below could be used when describing a cash purchase?

A) FOB destination.

B) On account.

C) 2/10, n/30.

D) Using credit.

A) FOB destination.

B) On account.

C) 2/10, n/30.

D) Using credit.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

68

Grey Enterprises had inventory on March 1 with a cost of $6,000. During March, the company purchased additional inventory at a cost of $22,000. A physical count of the inventory at March showed goods at a cost of $4,000 on hand. What was Grey Enterprises' cost of goods sold for March?

A) $16,000

B) $18,000

C) $23,000

D) $24,000

A) $16,000

B) $18,000

C) $23,000

D) $24,000

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

69

The entry for a cash purchase includes a credit to

A) inventory.

B) cash.

C) accounts payable,

D) sales.

A) inventory.

B) cash.

C) accounts payable,

D) sales.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

70

Under a perpetual inventory system, the acquisition of merchandise for resale is debited to the

A) Inventory account.

B) Purchases account.

C) Supplies account.

D) Cost of Goods Sold account.

A) Inventory account.

B) Purchases account.

C) Supplies account.

D) Cost of Goods Sold account.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

71

Gross profit for a merchandiser is sales revenue minus

A) operating expenses.

B) cost of goods sold.

C) sales discounts.

D) cost of goods available for sale.

A) operating expenses.

B) cost of goods sold.

C) sales discounts.

D) cost of goods available for sale.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

72

During August 2020, Shelby's Supply Store generated revenues of $65,000. The company's expenses were as follows: cost of goods sold of $33,000 and operating expenses of $7,000. Shelby's gross profit for August 2020 is

A) $25,000.

B) $27,000.

C) $24,000.

D) $32,000.

A) $25,000.

B) $27,000.

C) $24,000.

D) $32,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

73

Sloan Enterprises had inventory on May 1 with a cost of $2,000. During May, the company purchased additional inventory at a cost of $8,000. Sloan uses a perpetual inventory system and recorded cost of goods sold of $7,000 for the month. What should be the cost of inventory on hand at the end of May?

A) $1,000

B) $2,000

C) $3,000

D) $10,000

A) $1,000

B) $2,000

C) $3,000

D) $10,000

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

74

During 2020, Wu Han Co. generated revenues of $95,000. The company's expenses were as follows: cost of goods sold of $47,000, and operating expenses of $16,000. Wu Han's net income is

A) $27,000.

B) $32,000.

C) $48,000.

D) $95,000.

A) $27,000.

B) $32,000.

C) $48,000.

D) $95,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

75

Under a perpetual inventory system, the entry to record a credit purchase of inventory is

A) debit inventory, credit cash.

B) debit cash, credit. Inventory.

C) debit inventory, credit accounts payable.

D) debit accounts payable, credit inventory.

A) debit inventory, credit cash.

B) debit cash, credit. Inventory.

C) debit inventory, credit accounts payable.

D) debit accounts payable, credit inventory.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

76

During 2020, Wu Han Co. generated revenues of $95,000. The company's expenses were as follows: cost of goods sold of $47,000, and operating expenses of $16,000.Wu Han's gross profit is

A) $27,000.

B) $32,000.

C) $48,000.

D) $95,000.

A) $27,000.

B) $32,000.

C) $48,000.

D) $95,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

77

The operating cycle of a merchandiser is

A) always one year in length.

B) generally longer than it is for a service company.

C) about the same as for a service company.

D) generally shorter than it is for a service company.

A) always one year in length.

B) generally longer than it is for a service company.

C) about the same as for a service company.

D) generally shorter than it is for a service company.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

78

Grey Enterprises had inventory on March 1 with a cost of $6,000. During March, the company purchased additional inventory at a cost of $22,000. A physical count of the inventory at March showed goods at a cost of $4,000 on hand. What was Grey Enterprises' cost of goods available for sale for March?

A) $12,000

B) $22,000

C) $28,000

D) $32,000

A) $12,000

B) $22,000

C) $28,000

D) $32,000

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

79

Financial information is presented below: Operating Expenses $ 65,000

Sales Revenue 220,000

Cost of Goods Sold 138,000

Gross profit would be

A) $17,000.

B) $82,000.

C) $155,000.

D) $220,000.

Sales Revenue 220,000

Cost of Goods Sold 138,000

Gross profit would be

A) $17,000.

B) $82,000.

C) $155,000.

D) $220,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

80

Retailers generally purchase inventory

A) using cash only.

B) on account only.

C) using cash or on account.

D) from other retailers.

A) using cash only.

B) on account only.

C) using cash or on account.

D) from other retailers.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck