Deck 5: Public Goods, Public Choice, and Government Failure

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/242

Play

Full screen (f)

Deck 5: Public Goods, Public Choice, and Government Failure

1

Nonrivalry and nonexcludability are the main characteristics of

A) consumption goods.

B) capital goods.

C) private goods.

D) public goods.

A) consumption goods.

B) capital goods.

C) private goods.

D) public goods.

public goods.

2

Which of the following is an example of a public good?

A) a weather warning system

B) a television

C) a sofa

D) a bottle of soda

A) a weather warning system

B) a television

C) a sofa

D) a bottle of soda

a weather warning system

3

When producers do not produce the efficient amount of a product because they are unable to charge consumers what they need to do so, then there exists a

A) demand-side market failure.

B) supply-side market failure.

C) competitive market.

D) monopolistic market.

A) demand-side market failure.

B) supply-side market failure.

C) competitive market.

D) monopolistic market.

demand-side market failure.

4

At the optimal quantity of a public good,

A) marginal benefit exceeds marginal cost by the greatest amount.

B) total benefit equals total cost.

C) marginal benefit equals marginal cost.

D) marginal benefit is zero.

A) marginal benefit exceeds marginal cost by the greatest amount.

B) total benefit equals total cost.

C) marginal benefit equals marginal cost.

D) marginal benefit is zero.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

5

Suppose that Mick and Cher are the only two members of society and are willing to pay $10 and $8, respectively, for the third unit of a public good. Also, assume that the marginal cost of the third unit is $17. We

Can conclude that

A) the third unit should not be produced.

B) the third unit should be produced.

C) zero units should be produced.

D) 4 units should be produced.

Can conclude that

A) the third unit should not be produced.

B) the third unit should be produced.

C) zero units should be produced.

D) 4 units should be produced.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

6

The two main characteristics of a public good are

A) production at constant marginal cost and rising demand.

B) nonexcludability and production at rising marginal cost.

C) nonrivalry and nonexcludability.

D) nonrivalry and large negative externalities.

A) production at constant marginal cost and rising demand.

B) nonexcludability and production at rising marginal cost.

C) nonrivalry and nonexcludability.

D) nonrivalry and large negative externalities.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

7

Demand-side market failures occur when

A) demand curves don't reflect consumers' full willingness to pay for a good or service.

B) demand curves don't reflect the full cost of producing a good or service.

C) government imposes a tax on a good or service.

D) a good or service is not produced because no one wants it.

A) demand curves don't reflect consumers' full willingness to pay for a good or service.

B) demand curves don't reflect the full cost of producing a good or service.

C) government imposes a tax on a good or service.

D) a good or service is not produced because no one wants it.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

8

The market system does not produce public goods because

A) there is no need or demand for such goods.

B) private firms cannot stop consumers who are unwilling to pay for such goods from benefiting from them.

C) public enterprises can produce such goods at lower cost than can private enterprises.

D) their production seriously distorts the distribution of income.

A) there is no need or demand for such goods.

B) private firms cannot stop consumers who are unwilling to pay for such goods from benefiting from them.

C) public enterprises can produce such goods at lower cost than can private enterprises.

D) their production seriously distorts the distribution of income.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

9

Unlike a private good, a public good

A) has no opportunity costs.

B) has benefits available to all, including nonpayers.

C) produces no positive or negative externalities.

D) is characterized by rivalry and excludability.

A) has no opportunity costs.

B) has benefits available to all, including nonpayers.

C) produces no positive or negative externalities.

D) is characterized by rivalry and excludability.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

10

A public good

A) can be profitably produced by private firms.

B) is characterized by rivalry and excludability.

C) produces no positive or negative externalities.

D) is available to all and cannot be denied to anyone.

A) can be profitably produced by private firms.

B) is characterized by rivalry and excludability.

C) produces no positive or negative externalities.

D) is available to all and cannot be denied to anyone.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

11

Esteban, Mariko, and Greta are the only three people in a community. Esteban is willing to pay $20 for the fifth unit of a public good; Mariko, $15; and Greta, $25. Government should produce the fifth unit of the public good

If the marginal cost is less than or equal to

A) $25.

B) $15.

C) $60.

D) $20.

If the marginal cost is less than or equal to

A) $25.

B) $15.

C) $60.

D) $20.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

12

Because of the free-rider problem,

A) the market demand for a public good is overstated.

B) the market demand for a public good is nonexistent or understated.

C) government has increasingly yielded to the private sector in producing public goods.

D) public goods often create serious negative externalities.

A) the market demand for a public good is overstated.

B) the market demand for a public good is nonexistent or understated.

C) government has increasingly yielded to the private sector in producing public goods.

D) public goods often create serious negative externalities.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

13

If many people in a community get flu shots, the whole community benefits, including those who did not get flu shots. Therefore, not enough people may decide to get the shots. This is one illustration of

A) the market allocating resources efficiently.

B) monopoly power due to lack of competition.

C) supply-side market failure.

D) demand-side market failure.

A) the market allocating resources efficiently.

B) monopoly power due to lack of competition.

C) supply-side market failure.

D) demand-side market failure.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

14

People enjoy outdoor holiday lighting displays and would be willing to pay to see them, but can't be made to pay. Because most people who put up lights are unable to charge others to view them, they don't put up as

Many lights as people would like. This is an example of a

A) negative externality.

B) supply-side market failure.

C) demand-side market failure.

D) government failure.

Many lights as people would like. This is an example of a

A) negative externality.

B) supply-side market failure.

C) demand-side market failure.

D) government failure.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

15

Nonexcludability describes a condition where

A) one person's consumption of a good does not prevent consumption of the good by others.

B) there is no effective way to keep people from using a good once it comes into being.

C) sellers can withhold the benefits of a good from those unwilling to pay for it.

D) there is no potential for free-riding behavior.

A) one person's consumption of a good does not prevent consumption of the good by others.

B) there is no effective way to keep people from using a good once it comes into being.

C) sellers can withhold the benefits of a good from those unwilling to pay for it.

D) there is no potential for free-riding behavior.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is not true?

A) Some public goods are paid for by private philanthropy.

B) Private provision of public goods is usually unprofitable.

C) The free-rider problem results from the characteristics of nonrivalry and nonexcludability.

D) Public goods are only provided by government.

A) Some public goods are paid for by private philanthropy.

B) Private provision of public goods is usually unprofitable.

C) The free-rider problem results from the characteristics of nonrivalry and nonexcludability.

D) Public goods are only provided by government.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

17

Public goods are those for which there

A) is no free-rider problem.

B) are not any externalities.

C) is nonrivalry and nonexcludability.

D) is rivalry and excludability.

A) is no free-rider problem.

B) are not any externalities.

C) is nonrivalry and nonexcludability.

D) is rivalry and excludability.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

18

If one person's consumption of a good does not preclude another's consumption, the good is said to be

A) nonrival in consumption.

B) rival in consumption.

C) nonexcludable.

D) excludable.

A) nonrival in consumption.

B) rival in consumption.

C) nonexcludable.

D) excludable.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

19

Toll-free roads sometimes get congested, such as during rush-hour traffic. During those times, we would say that these roads are

A) excludable and rival.

B) excludable and nonrival.

C) nonexcludable and nonrival.

D) nonexcludable and rival.

A) excludable and rival.

B) excludable and nonrival.

C) nonexcludable and nonrival.

D) nonexcludable and rival.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

20

A demand curve for a public good is determined by

A) summing vertically the individual demand curves for the public good.

B) summing horizontally the individual demand curves for the public good.

C) combining the amounts of the public good that the individual members of society demand at each price.

D) multiplying the per-unit cost of the public good by the quantity made available.

A) summing vertically the individual demand curves for the public good.

B) summing horizontally the individual demand curves for the public good.

C) combining the amounts of the public good that the individual members of society demand at each price.

D) multiplying the per-unit cost of the public good by the quantity made available.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

21

Private firms can hardly produce a public good profitably because of

A) liability rules and lawsuits.

B) the free-rider problem.

C) shortages and surpluses.

D) moral hazard and adverse selection.

A) liability rules and lawsuits.

B) the free-rider problem.

C) shortages and surpluses.

D) moral hazard and adverse selection.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

22

Assume there is no way to prevent someone from using an interstate highway, regardless of whether or not he or she helps pay for it. This characteristic is called

A) nonrivalry.

B) nonexcludability.

C) nontaxability.

D) nondiscrimination.

A) nonrivalry.

B) nonexcludability.

C) nontaxability.

D) nondiscrimination.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements concerning a public good is false?

A) It is impossible to exclude nontaxpayers from the enjoyment of the public good.

B) All benefits associated with the production and use of a public good are received by the government.

C) The availability of a public good to one person simultaneously makes it available to all members of society.

D) The private sector does not have an economic incentive to produce a socially optimal amount of a public good.

A) It is impossible to exclude nontaxpayers from the enjoyment of the public good.

B) All benefits associated with the production and use of a public good are received by the government.

C) The availability of a public good to one person simultaneously makes it available to all members of society.

D) The private sector does not have an economic incentive to produce a socially optimal amount of a public good.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

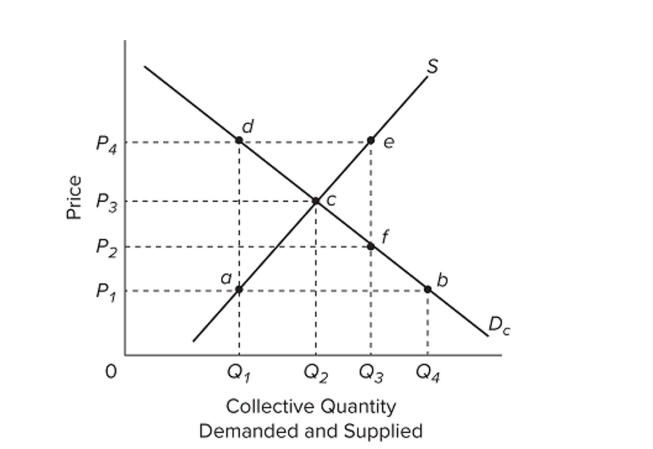

24

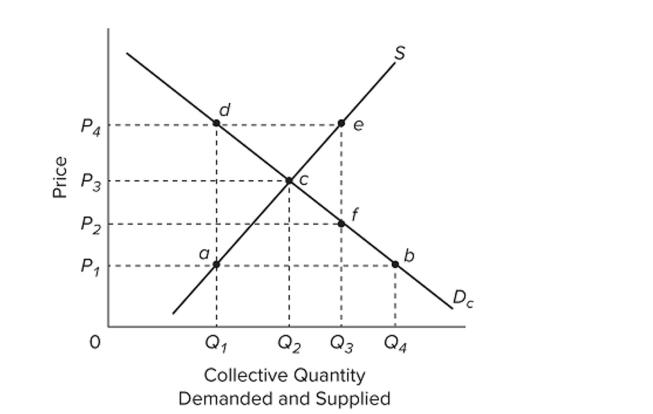

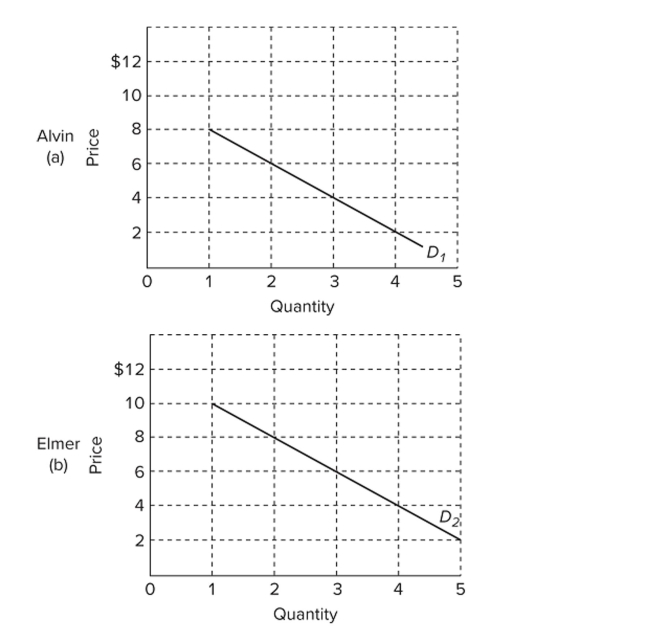

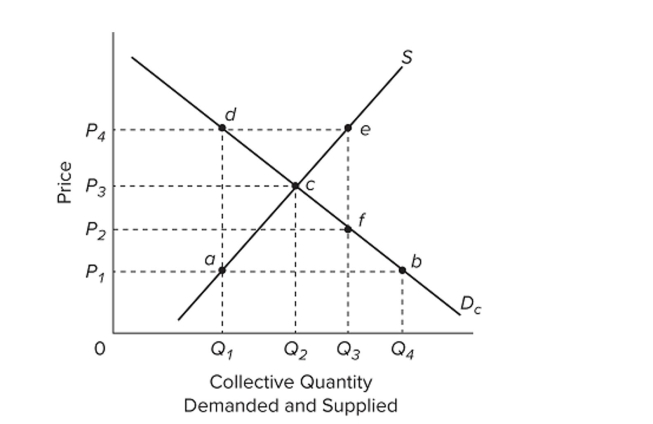

Refer to the provided supply and demand graph for a public good. Which line segment would indicate the amount by which the marginal benefit of this public good exceeds the marginal cost at a certain quantity?

A) de

B) da

C) ef

D) ab

A) de

B) da

C) ef

D) ab

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

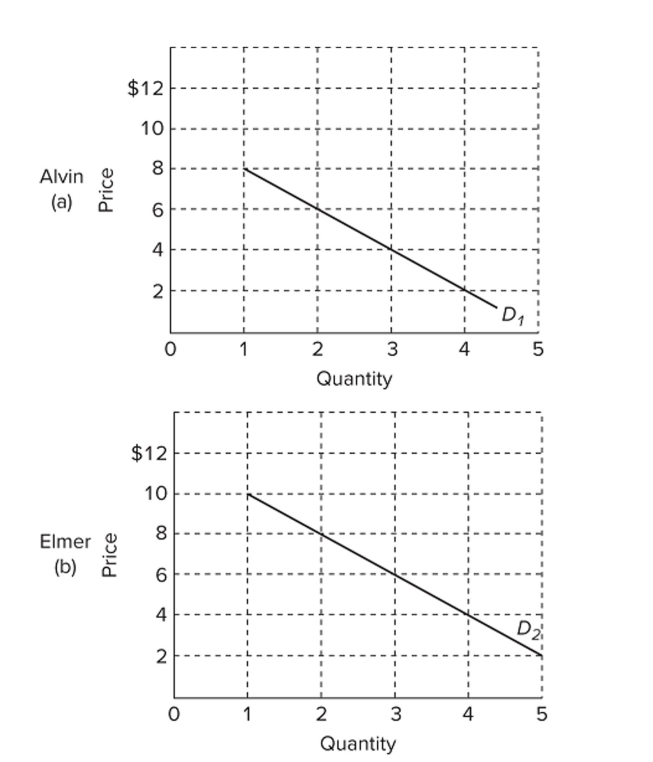

25

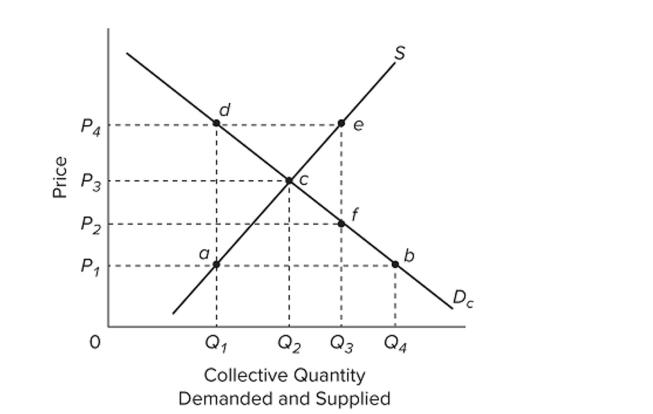

Refer to the graphs which show demand curves reflecting the prices Alvin and Elmer are willing to pay for a public good, rather than do without it. If the marginal cost of the optimal quantity of this public good is $10, the

Refer to the graphs which show demand curves reflecting the prices Alvin and Elmer are willing to pay for a public good, rather than do without it. If the marginal cost of the optimal quantity of this public good is $10, theOptimal quantity must be

A) 1 unit.

B) 2 units.

C) 3 units.

D) 4 units.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

26

The following data are for a series of increasingly extensive ?ood-control projects. For Plan D marginal costs and marginal bene?ts are

A) $72,000 and $64,000, respectively.

B) $28,000 and $12,000, respectively.

C) $24,000 and $18,000, respectively.

D) $16,000 and $28,000, respectively.

A) $72,000 and $64,000, respectively.

B) $28,000 and $12,000, respectively.

C) $24,000 and $18,000, respectively.

D) $16,000 and $28,000, respectively.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

27

Economists consider governments to be "wasteful"

A) whenever they over- or underallocate resources to a project.

B) only when they overallocate resources to a project.

C) only when they underallocate resources to a project.

D) whenever they attempt to correct a market failure.

A) whenever they over- or underallocate resources to a project.

B) only when they overallocate resources to a project.

C) only when they underallocate resources to a project.

D) whenever they attempt to correct a market failure.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

28

For which one of the following goods would we need to sum individual demand curves vertically to obtain the total demand curve?

A) frozen yogurt

B) bubble gum

C) microwave popcorn

D) courts of law

A) frozen yogurt

B) bubble gum

C) microwave popcorn

D) courts of law

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

29

A public good

A) generally results in substantial negative externalities.

B) can never be provided by a nongovernmental organization.

C) costs essentially nothing to produce and is thus provided by the government at a zero price.

D) can't be provided to one person without making it available to others as well.

A) generally results in substantial negative externalities.

B) can never be provided by a nongovernmental organization.

C) costs essentially nothing to produce and is thus provided by the government at a zero price.

D) can't be provided to one person without making it available to others as well.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

30

The market demand curve for a public good

A) is derived in the same manner as demand curves for private goods.

B) is derived by horizontally summing all individual demand curves.

C) shows the total value that all individuals place on each additional unit of the good.

D) shows the total number of units that would be produced by the public sector at each possible price.

A) is derived in the same manner as demand curves for private goods.

B) is derived by horizontally summing all individual demand curves.

C) shows the total value that all individuals place on each additional unit of the good.

D) shows the total number of units that would be produced by the public sector at each possible price.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

31

The following data are for a series of increasingly extensive ?ood-control projects. Plan C entails

A) marginal bene?ts in excess of marginal costs.

B) fewer spillovers than either Plan A or Plan B.

C) an overallocation of resources to ?ood control.

D) an underallocation of resources to ?ood control.

A) marginal bene?ts in excess of marginal costs.

B) fewer spillovers than either Plan A or Plan B.

C) an overallocation of resources to ?ood control.

D) an underallocation of resources to ?ood control.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

32

Alex, Kara, and Susie are the only three people in a community. Alex is willing to pay $40 for the third unit of a public good; Kara is willing to pay $25. If the marginal cost of producing the third unit is $100, what is the

Minimum amount that Susie must be willing to pay for it to be efficient for government to produce the third

Unit?

A) $35

B) $100

C) $65

D) The amount cannot be determined with the information provided.

Minimum amount that Susie must be willing to pay for it to be efficient for government to produce the third

Unit?

A) $35

B) $100

C) $65

D) The amount cannot be determined with the information provided.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

33

What are the two characteristics that differentiate private goods from public goods?

A) rivalry and excludability

B) negative externality and positive externality

C) marginal cost and marginal benefit

D) ownership and usage

A) rivalry and excludability

B) negative externality and positive externality

C) marginal cost and marginal benefit

D) ownership and usage

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

34

The following data are for a series of increasingly extensive ?ood-control projects. On the basis of cost-bene?t analysis, government should undertake

A) Plan D.

B) Plan C.

C) Plan B.

D) Plan A.

A) Plan D.

B) Plan C.

C) Plan B.

D) Plan A.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

35

Refer to the provided supply and demand graph for a public good. Point c on the graph shows where the

Refer to the provided supply and demand graph for a public good. Point c on the graph shows where theA) total benefit equals the total cost of the public good.

B) marginal benefit equals the marginal cost of the public good.

C) average benefit equals the average cost of the public good.

D) total benefit of the public good is at the maximum.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

36

Cost-benefit analysis attempts to

A) compare the real worth, rather than the market values, of various goods and services.

B) compare the relative desirability of alternative distributions of income.

C) determine whether it is better to cut government expenditures or reduce taxes.

D) compare the benefits and costs associated with any economic project or activity.

A) compare the real worth, rather than the market values, of various goods and services.

B) compare the relative desirability of alternative distributions of income.

C) determine whether it is better to cut government expenditures or reduce taxes.

D) compare the benefits and costs associated with any economic project or activity.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

37

Among the following examples, the one that best illustrates a public good is the

A) laptops used by students in a college or university.

B) movies produced by Hollywood companies.

C) bike paths around a city or town.

D) airline tickets bought by vacationers.

A) laptops used by students in a college or university.

B) movies produced by Hollywood companies.

C) bike paths around a city or town.

D) airline tickets bought by vacationers.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

38

According to the marginal-cost-marginal-benefit rule,

A) only government projects (as opposed to private projects) should be assessed by comparing marginal costs and marginal benefits.

B) the optimal project size is the one for which MB = MC.

C) the optimal project size is the one for which MB exceeds MC by the greatest amount.

D) project managers should attempt to minimize both MB and MC.

A) only government projects (as opposed to private projects) should be assessed by comparing marginal costs and marginal benefits.

B) the optimal project size is the one for which MB = MC.

C) the optimal project size is the one for which MB exceeds MC by the greatest amount.

D) project managers should attempt to minimize both MB and MC.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

39

Refer to the graphs which show demand curves reflecting the prices Alvin and Elmer are willing to pay for a public good, rather than do without it. The collective willingness to pay for the first unit of this public good is

Refer to the graphs which show demand curves reflecting the prices Alvin and Elmer are willing to pay for a public good, rather than do without it. The collective willingness to pay for the first unit of this public good isA) $18.

B) $14.

C) $10.

D) $6.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

40

Refer to the provided supply and demand graph for a public good. If Q1 units of the public good are produced, then

Refer to the provided supply and demand graph for a public good. If Q1 units of the public good are produced, thenA) users are willing to pay more for the public good than it costs to produce it.

B) users are willing to pay less for the public good than it costs to produce it.

C) there is an overallocation of resources toward producing this public good.

D) allocative efficiency is achieved in the market.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

41

New Normal University has found it necessary to institute a crime-control program on its campus to deal with the high costs of theft and vandalism. The university is now considering several alternative levels of crime

Control. This table shows the expected total annual costs and bene?ts of these alternatives.

The marginal bene?t of crime control for Level Two is

A) $ 90,000.

B) $40,000.

C) $ 60,000.

D) $200,000.

Control. This table shows the expected total annual costs and bene?ts of these alternatives.

The marginal bene?t of crime control for Level Two is

A) $ 90,000.

B) $40,000.

C) $ 60,000.

D) $200,000.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

42

The free-rider problem makes a good highly profitable for a private firm to provide.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

43

Rivalry means that when one person buys and consumes a product, it is not available for purchase and

consumption by another person.

consumption by another person.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

44

When a producer cannot get all consumers of their product to pay for enjoying it, such as in the case of a

fireworks display, then we have a demand-side market failure.

fireworks display, then we have a demand-side market failure.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

45

The government receives all of the benefits associated with the production of a public good.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

46

Government can reallocate resources away from private goods toward public goods, usually through

A) import tariffs and quotas.

B) the laws of supply and demand.

C) taxes and government spending.

D) positive and negative externalities.

A) import tariffs and quotas.

B) the laws of supply and demand.

C) taxes and government spending.

D) positive and negative externalities.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

47

(Consider This) Street entertainers face the free-rider problem when they perform because of the

A) law of demand.

B) diminishing marginal utility.

C) nonexcludability characteristic.

D) rivalry characteristic.

A) law of demand.

B) diminishing marginal utility.

C) nonexcludability characteristic.

D) rivalry characteristic.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

48

The free-rider problem refers to the local government's problem of finding funds to provide free bus rides in

the city.

the city.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

49

A government is considering undertaking a construction project of an increasing scale (ranging from 1, 2, 3, to 4). The estimated marginal costs and marginal bene?ts of each successive scale of the project are given in the

Table below.

What is the net bene?t of project scale 2?

A) $2 million

B) $3 million

C) $4 million

D) $5 million

Table below.

What is the net bene?t of project scale 2?

A) $2 million

B) $3 million

C) $4 million

D) $5 million

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

50

Assume that a government is considering a new social program and may choose to include in this program one of four progressively larger projects. The marginal cost and the marginal bene?ts of each of the four

Projects are given in the table below.

Refer to the provided table and information. What is the net bene?t of project D?

A) $1 billion

B) $15 billion

C) $5 billion

D) $20 billion

Projects are given in the table below.

Refer to the provided table and information. What is the net bene?t of project D?

A) $1 billion

B) $15 billion

C) $5 billion

D) $20 billion

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

51

Excludability means that when someone is consuming a good, then others are excluded from using the good

anymore.

anymore.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

52

Assume that a government is considering a new social program and may choose to include in this program one of four progressively larger projects. The marginal cost and the marginal bene?ts of each of the four

Projects are given in the table below.

Suppose that the government chooses to do project C. What is the total cost and total bene?t of doing project

C?

A) Total cost is $5 billion, and total bene?t is $7 billion.

B) Total cost is $4 billion, and total bene?t is $7 billion.

C) Total cost is $8 billion, and total bene?t is $12 billion.

D) Total cost is $15 billion, and total bene?t is $20 billion.

Projects are given in the table below.

Suppose that the government chooses to do project C. What is the total cost and total bene?t of doing project

C?

A) Total cost is $5 billion, and total bene?t is $7 billion.

B) Total cost is $4 billion, and total bene?t is $7 billion.

C) Total cost is $8 billion, and total bene?t is $12 billion.

D) Total cost is $15 billion, and total bene?t is $20 billion.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

53

Sometimes, public goods whose benefits are less than their costs still get produced because

A) the marginal benefit is still larger than the marginal cost.

B) of externalities in production.

C) the benefits accrue to politically powerful government officials and their constituents.

D) of market failures.

A) the marginal benefit is still larger than the marginal cost.

B) of externalities in production.

C) the benefits accrue to politically powerful government officials and their constituents.

D) of market failures.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

54

Assume that a government is considering a new social program and may choose to include in this program one of four progressively larger projects. The marginal cost and the marginal bene?ts of each of the four

Projects are given in the table below.

Which project should the government select to achieve the maximum net bene?t?

A) A

B) B

C) C

D) D

Projects are given in the table below.

Which project should the government select to achieve the maximum net bene?t?

A) A

B) B

C) C

D) D

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

55

Nonrivalry in the use or consumption of a good means that only one person is consuming the good without

any rivals.

any rivals.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

56

Demand-side market failures refer to those situations when there is a shortage in the market because buyers

want to buy more than what is available in the market.

want to buy more than what is available in the market.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

57

New Normal University has found it necessary to institute a crime-control program on its campus to deal with the high costs of theft and vandalism. The university is now considering several alternative levels of crime

Control. This table shows the expected total annual costs and bene?ts of these alternatives.

Based on cost-bene?t analysis, New Normal University should undertake Level

A) Two.

B) Three.

C) Four.

D) Five.

Control. This table shows the expected total annual costs and bene?ts of these alternatives.

Based on cost-bene?t analysis, New Normal University should undertake Level

A) Two.

B) Three.

C) Four.

D) Five.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

58

A government is considering undertaking a construction project of an increasing scale (ranging from 1, 2, 3, to 4). The estimated marginal costs and marginal bene?ts of each successive scale of the project are given in the

Table below.

What is the total amount that the government should spend on the construction project to attain maximum net

Bene?ts for the society?

A) $8 million

B) $14 million

C) $19 million

D) $37 million

Table below.

What is the total amount that the government should spend on the construction project to attain maximum net

Bene?ts for the society?

A) $8 million

B) $14 million

C) $19 million

D) $37 million

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

59

A government is considering undertaking a construction project of an increasing scale (ranging from 1, 2, 3, to 4). The estimated marginal costs and marginal bene?ts of each successive scale of the project are given in the

Table below.

What is the total cost and total bene?t of the scale-3 project?

A) Total cost is $18 million, and total bene?t is $19 million.

B) Total cost is $24 million, and total bene?t is $27 million.

C) Total cost is $37 million, and total bene?t is $41 million.

D) Total cost is $65 million, and total bene?t is $66 million.

Table below.

What is the total cost and total bene?t of the scale-3 project?

A) Total cost is $18 million, and total bene?t is $19 million.

B) Total cost is $24 million, and total bene?t is $27 million.

C) Total cost is $37 million, and total bene?t is $41 million.

D) Total cost is $65 million, and total bene?t is $66 million.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

60

New Normal University has found it necessary to institute a crime-control program on its campus to deal with the high costs of theft and vandalism. The university is now considering several alternative levels of crime

Control. This table shows the expected total annual costs and bene?ts of these alternatives.

If New Normal University undertakes program Level Three,

A) total bene?ts will be less than total costs.

B) marginal costs will exceed marginal bene?ts.

C) there would be an underallocation of resources to crime control.

D) there would be an overallocation of resources to crime control.

Control. This table shows the expected total annual costs and bene?ts of these alternatives.

If New Normal University undertakes program Level Three,

A) total bene?ts will be less than total costs.

B) marginal costs will exceed marginal bene?ts.

C) there would be an underallocation of resources to crime control.

D) there would be an overallocation of resources to crime control.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

61

Factors that impede the attainment of economic efficiency in the public sector are called

A) market failures.

B) externalities.

C) government failures.

D) voting irregularities.

A) market failures.

B) externalities.

C) government failures.

D) voting irregularities.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

62

The idea of government failure includes all of the following except

A) the special-interest effect.

B) bureaucratic inefficiency.

C) pressure by special-interest groups.

D) extensive positive externalities from public and quasi-public goods.

A) the special-interest effect.

B) bureaucratic inefficiency.

C) pressure by special-interest groups.

D) extensive positive externalities from public and quasi-public goods.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

63

Public choice theorists contend that

A) government can efficiently correct instances of market system failure.

B) the existence of cost-benefit analysis has brought about the efficient use of resources in the public sector.

C) public bureaucracies are inherently more efficient than private enterprises.

D) public bureaucracies are inherently less efficient than private enterprises.

A) government can efficiently correct instances of market system failure.

B) the existence of cost-benefit analysis has brought about the efficient use of resources in the public sector.

C) public bureaucracies are inherently more efficient than private enterprises.

D) public bureaucracies are inherently less efficient than private enterprises.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

64

Economists (particularly public choice theorists) point out that the political process

A) differs from the marketplace in that voters and congressional representatives often face limited and bundled choices.

B) is less prone to failure than is the marketplace.

C) is a much fairer way to allocate society's scarce resources than is the impersonal marketplace, which is dominated by high-income consumers.

D) involves logrolling, which is always inefficient.

A) differs from the marketplace in that voters and congressional representatives often face limited and bundled choices.

B) is less prone to failure than is the marketplace.

C) is a much fairer way to allocate society's scarce resources than is the impersonal marketplace, which is dominated by high-income consumers.

D) involves logrolling, which is always inefficient.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

65

In representative democracy, voters are ____________ and politicians are ______________.

A) agents; principals

B) logrollers; principals

C) agents; employees

D) principals; agents

A) agents; principals

B) logrollers; principals

C) agents; employees

D) principals; agents

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

66

Public choice economists contend public bureaucracies are inefficient primarily because

A) the value of public goods is more easily measured than is the value of private goods.

B) of the absence of competitive market pressures.

C) public sector workers are more security-conscious than are private sector workers.

D) relatively low pay in government attracts workers of lesser quality.

A) the value of public goods is more easily measured than is the value of private goods.

B) of the absence of competitive market pressures.

C) public sector workers are more security-conscious than are private sector workers.

D) relatively low pay in government attracts workers of lesser quality.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

67

As it relates to corporations, the principal-agent problem is that

A) the goals of the corporate managers (the principals) may not match the goals of the corporate owners (the agents).

B) the goals of the corporate managers (the agents) may not match the goals of the corporate owners (the principals).

C) the federal government (the agent) taxes both corporate profits and the dividends paid to stockholders (the principals).

D) it is costly for the corporate owners (the principals) to obtain a corporate charter from government (the agent).

A) the goals of the corporate managers (the principals) may not match the goals of the corporate owners (the agents).

B) the goals of the corporate managers (the agents) may not match the goals of the corporate owners (the principals).

C) the federal government (the agent) taxes both corporate profits and the dividends paid to stockholders (the principals).

D) it is costly for the corporate owners (the principals) to obtain a corporate charter from government (the agent).

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is related to the special-interest effect?

A) pork-barrel politics

B) earmarks

C) logrolling

D) all of these

A) pork-barrel politics

B) earmarks

C) logrolling

D) all of these

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

69

Economists call the pursuit of extra profit or income by influencing government policies,

A) the paradox of voting.

B) adverse selection.

C) rent-seeking behavior.

D) the benefits-received principle.

A) the paradox of voting.

B) adverse selection.

C) rent-seeking behavior.

D) the benefits-received principle.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

70

Suppose American winemakers convince the federal government to issue a directive to serve only domestically produced wine at government functions. This would be an example of

A) moral hazard.

B) the principal-agent problem.

C) logrolling.

D) rent-seeking behavior.

A) moral hazard.

B) the principal-agent problem.

C) logrolling.

D) rent-seeking behavior.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

71

The pursuit through government for special benefits at someone else's expense refers to

A) logrolling.

B) rent-seeking behavior.

C) the paradox of voting.

D) the median-voter model.

A) logrolling.

B) rent-seeking behavior.

C) the paradox of voting.

D) the median-voter model.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

72

"Vote for my special local project and I will vote for yours." This political technique

A) illustrates the paradox of voting.

B) is called "logrolling."

C) illustrates the median voter model.

D) undermines the benefits-received principle.

A) illustrates the paradox of voting.

B) is called "logrolling."

C) illustrates the median voter model.

D) undermines the benefits-received principle.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

73

Professional sports teams will sometimes seek public subsidies for stadium financing projects that produce large benefits for a relatively small number of fans and impose small costs on a relatively large number of

People. Sometimes these efforts to secure public funding are successful even though the decision is not

Efficient. This is an example of

A) log-rolling.

B) pork-barrel politics.

C) the special-interest effect.

D) market failure.

People. Sometimes these efforts to secure public funding are successful even though the decision is not

Efficient. This is an example of

A) log-rolling.

B) pork-barrel politics.

C) the special-interest effect.

D) market failure.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

74

The special-interest effect is one that yields

A) private benefits equal to external benefits.

B) large external benefits compared to private benefits.

C) small economic losses to a small number of people and large economic losses to a large number of people.

D) large economic gains to a small number of people and small economic losses to a large number of people.

A) private benefits equal to external benefits.

B) large external benefits compared to private benefits.

C) small economic losses to a small number of people and large economic losses to a large number of people.

D) large economic gains to a small number of people and small economic losses to a large number of people.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

75

In corporations, owners are __________________ and managers are ________________.

A) agents; principals

B) stockholders; bondholders

C) agents; employees

D) principals; agents

A) agents; principals

B) stockholders; bondholders

C) agents; employees

D) principals; agents

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

76

As it relates to the political process, the principal-agent problem results from the

A) negative externalities that are created by some policy actions.

B) political rules that encourage elected officials to engage in unethical and illegal behavior.

C) inconsistency between voters' interest in programs and politicians' interest in reelection.

D) paradox of voting.

A) negative externalities that are created by some policy actions.

B) political rules that encourage elected officials to engage in unethical and illegal behavior.

C) inconsistency between voters' interest in programs and politicians' interest in reelection.

D) paradox of voting.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

77

Suppose the U.S. House of Representatives is debating a bill to fund construction and maintenance for the nation's highway system. Representative Sandy Shady adds a provision to the bill that would fund a new public

Art museum in her district. The authorization of expenditure for the museum would be an example of

A) an earmark.

B) an unfunded liability.

C) a collective action problem.

D) a principal-agent problem.

Art museum in her district. The authorization of expenditure for the museum would be an example of

A) an earmark.

B) an unfunded liability.

C) a collective action problem.

D) a principal-agent problem.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is the best example of rent-seeking behavior?

A) Voters consider a ballot measure that would increase taxes to better fund schools.

B) Students at a university lobby the administration to improve dorms and reduce class sizes without increasing tuition.

C) Consumers try to get flying cars produced by telling automakers they are willing to pay for them.

D) Senators vote for what their constituents want so they can get reelected.

A) Voters consider a ballot measure that would increase taxes to better fund schools.

B) Students at a university lobby the administration to improve dorms and reduce class sizes without increasing tuition.

C) Consumers try to get flying cars produced by telling automakers they are willing to pay for them.

D) Senators vote for what their constituents want so they can get reelected.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

79

The optimal quantity of a public good is where the total benefits from it are equal to the total costs of

producing it.

producing it.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck

80

When congressional representatives vote on an appropriations bill, they must vote yea or nay, taking the bad with the good. This statement best reflects the

A) paradox of voting.

B) regulatory capture effect.

C) benefits-received principle.

D) concept of limited and bundled choices.

A) paradox of voting.

B) regulatory capture effect.

C) benefits-received principle.

D) concept of limited and bundled choices.

Unlock Deck

Unlock for access to all 242 flashcards in this deck.

Unlock Deck

k this deck