Deck 13: Cash: Lifeblood of the Business

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/29

Play

Full screen (f)

Deck 13: Cash: Lifeblood of the Business

1

Choose a public business that is in the same industry as the business you would like to own. Go to the company's web site and find "investor relations." Download a copy of the business' most recent annual report. Examine the financial statements in the annual report. Make a list of the ways in which their content and format differ from the examples in this text.

Answers will vary.

2

PARKER MOUNTAIN PRODUCTS, INC.

COMPANY HISTORY

The New England region of the United States includes a beautiful coastal stretch that extends from Maine to Rhode Island, through the states of New Hampshire, Massachusetts, and Connecticut. The area is famous for its summer tourism, which includes beaches, quaint villages and towns, restaurants, shops, historic sites and landmarks, and lobsters. Tens of thousands of people from around the world vacation in the area each year, especially during the summer season, which extends from Memorial Day to Labor Day.

Shortly after World War II, Ernest Parker returned to his hometown of Rochester, New Hampshire, and built a small factory that produces low-end glass and ceramic regional souvenirs. These products include wine glasses, general glassware, ceramic cups and bowls, and small platters. Each of these is decorated with a variety of painted images and words related to the specific coastal tourist towns and markets, that is, pictures of lobsters, seagulls, ocean waves, famous towns, and famous sites.

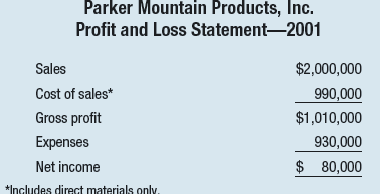

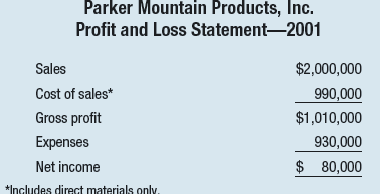

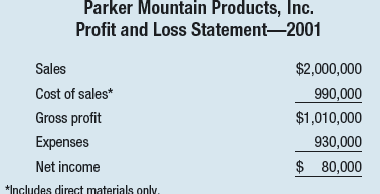

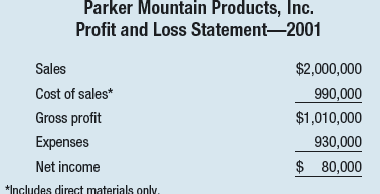

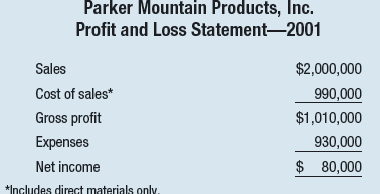

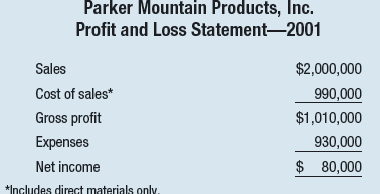

Ernest has provided steady employment for 35 production and support staff. The business has grown at a rate of about 5 percent per year (in sales). The most recent profit and loss statement is shown:

The entire production is sold through a small number of manufacturer's reps, wholesalers, and brokers. While the opportunity was always there to sell direct, Ernest chose to focus all his efforts on the production side of the business, allowing others to market, sell, and distribute the products to retail shops, hotels, and other vendors. The industry average or norm for profits is between 5 and 7 percent (net income to sales).

Chris and Ben are anxious to improve efficiency on the production side and to develop a variety of direct niche markets to complement their wholesale distribution on the marketing and sales side. The opportunity to add, drop, or shift the product mix, and to increase production and sales exists. In order to properly analyze and act on this, they have asked their bookkeeper to provide more specific production and cost data.

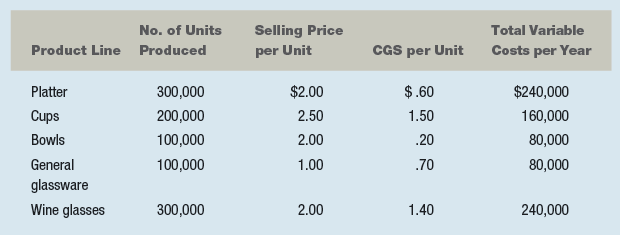

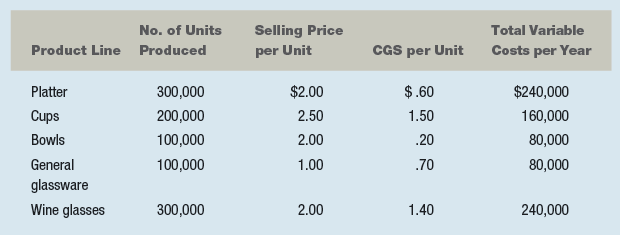

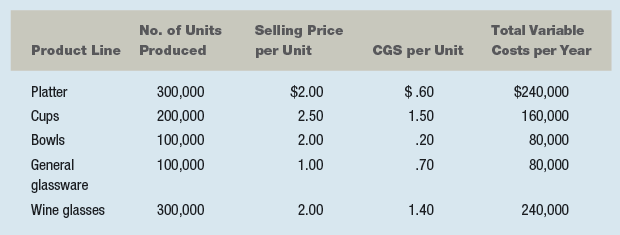

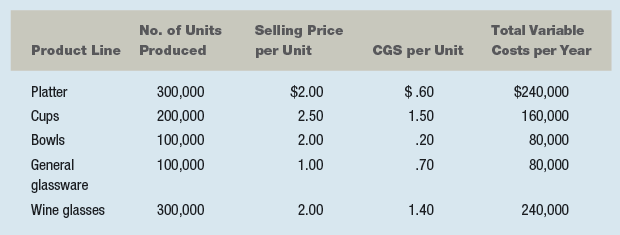

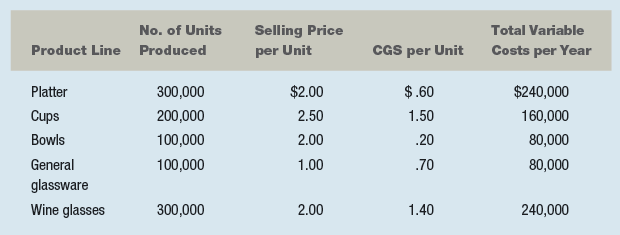

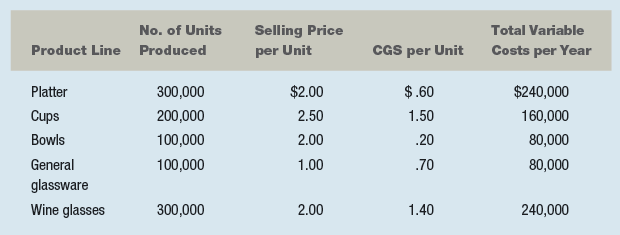

This information is presented below:

The total variable costs of $800,000 are assigned or charged to each product line based on the number of units produced. Total fixed costs for the factory are $80,000; selling and administrative costs for the total company are $50,000.

Chris and Ben have determined that the factory is now at 85 percent of capacity. They are certain that production can be increased without incurring any extra expense beyond direct materials.

They also know that the selling price could be increased by 15 percent as a result of a direct sales program. Their only uncertainty or fear is in disrupting the long-standing relationships that exist with the various manufacturers' reps, wholesalers, and brokers who have been able to sell all of the company's production for many years. They are afraid of "biting the hand that feeds them" by selling to an end user who currently buys from one of their own distributors.

Use the information provided along with any assumptions you wish to make and construct a balance sheet and cash flow statement. Analyze those data.

COMPANY HISTORY

The New England region of the United States includes a beautiful coastal stretch that extends from Maine to Rhode Island, through the states of New Hampshire, Massachusetts, and Connecticut. The area is famous for its summer tourism, which includes beaches, quaint villages and towns, restaurants, shops, historic sites and landmarks, and lobsters. Tens of thousands of people from around the world vacation in the area each year, especially during the summer season, which extends from Memorial Day to Labor Day.

Shortly after World War II, Ernest Parker returned to his hometown of Rochester, New Hampshire, and built a small factory that produces low-end glass and ceramic regional souvenirs. These products include wine glasses, general glassware, ceramic cups and bowls, and small platters. Each of these is decorated with a variety of painted images and words related to the specific coastal tourist towns and markets, that is, pictures of lobsters, seagulls, ocean waves, famous towns, and famous sites.

Ernest has provided steady employment for 35 production and support staff. The business has grown at a rate of about 5 percent per year (in sales). The most recent profit and loss statement is shown:

The entire production is sold through a small number of manufacturer's reps, wholesalers, and brokers. While the opportunity was always there to sell direct, Ernest chose to focus all his efforts on the production side of the business, allowing others to market, sell, and distribute the products to retail shops, hotels, and other vendors. The industry average or norm for profits is between 5 and 7 percent (net income to sales).

Chris and Ben are anxious to improve efficiency on the production side and to develop a variety of direct niche markets to complement their wholesale distribution on the marketing and sales side. The opportunity to add, drop, or shift the product mix, and to increase production and sales exists. In order to properly analyze and act on this, they have asked their bookkeeper to provide more specific production and cost data.

This information is presented below:

The total variable costs of $800,000 are assigned or charged to each product line based on the number of units produced. Total fixed costs for the factory are $80,000; selling and administrative costs for the total company are $50,000.

Chris and Ben have determined that the factory is now at 85 percent of capacity. They are certain that production can be increased without incurring any extra expense beyond direct materials.

They also know that the selling price could be increased by 15 percent as a result of a direct sales program. Their only uncertainty or fear is in disrupting the long-standing relationships that exist with the various manufacturers' reps, wholesalers, and brokers who have been able to sell all of the company's production for many years. They are afraid of "biting the hand that feeds them" by selling to an end user who currently buys from one of their own distributors.

Use the information provided along with any assumptions you wish to make and construct a balance sheet and cash flow statement. Analyze those data.

One major focus of this case is to teach and discuss the practice of converting the typical single-column total company income statement into the much more revealing profit center spreadsheet in contribution margin format. Just like magic, money-makers, money-losers, and marginal product lines "jump off the page" at the manager, who is now in a position to effect change (see attached Exhibit 1).

Students may now consider several options, which include: increasing production, increasing price through a direct sales program, and/or some combination of the two. Cost allocation techniques, finding new suppliers, and adding new product lines may also be considered, along with the possibility of dropping unprofitable existing lines. It is important to note that none of this would be possible without the revised profit and loss statement.

The creation of a computer spreadsheet will also allow students to run a series of "what-if scenarios" to support their recommendations to management.

While the obvious financial solution is to increase production to 100% and to sell direct, the instructor must discuss the trade-offs involved between direct and broker sales. This topic should create many opportunities for lively discussion about the world of wholesalers, brokers, warehousing/inventory management/insurance, cash flow, customer service, freight forwarders, and other distribution options.

The "right or actual answer" in this case was an increase to 100% production and a direct sales program that resulted in a 50-50 split between direct and wholesale sales. A new and less expensive supplier was found which along with an increase in pricing turned the wine and glassware lines into money-makers.

So while the main focus is financial, this case also integrates the marketing and sales arm opportunities of a manufacturing enterprise. Historically, many manufacturers chose not to participate in the marketing/selling/distribution end of the spectrum. These programs must be carefully developed over time in order to manage cash flow, customer service, wholesaler/broker relations, and ultimately, to move product.

Students may now consider several options, which include: increasing production, increasing price through a direct sales program, and/or some combination of the two. Cost allocation techniques, finding new suppliers, and adding new product lines may also be considered, along with the possibility of dropping unprofitable existing lines. It is important to note that none of this would be possible without the revised profit and loss statement.

The creation of a computer spreadsheet will also allow students to run a series of "what-if scenarios" to support their recommendations to management.

While the obvious financial solution is to increase production to 100% and to sell direct, the instructor must discuss the trade-offs involved between direct and broker sales. This topic should create many opportunities for lively discussion about the world of wholesalers, brokers, warehousing/inventory management/insurance, cash flow, customer service, freight forwarders, and other distribution options.

The "right or actual answer" in this case was an increase to 100% production and a direct sales program that resulted in a 50-50 split between direct and wholesale sales. A new and less expensive supplier was found which along with an increase in pricing turned the wine and glassware lines into money-makers.

So while the main focus is financial, this case also integrates the marketing and sales arm opportunities of a manufacturing enterprise. Historically, many manufacturers chose not to participate in the marketing/selling/distribution end of the spectrum. These programs must be carefully developed over time in order to manage cash flow, customer service, wholesaler/broker relations, and ultimately, to move product.

3

Focus on Small Business: Debbie Dusenberry and the Curious Sofa 1

The Curious Sofa was an off-beat but beautiful store, filled with one-of-a-kind items. The store was designed to look old with a black-and-white color scheme, columns made of used brick and distressed plaster, and a ceiling of antique tin tiles. All in all it was a for-real incarnation of Edwardian design. But then what would you expect of a store named after a novel by Edward Gorey, whose works (like the animation at the start of PBS's Mystery!) exemplify the Edwardian period 2

Debbie Dusenberry created the Curious Sofa just as we have encouraged our students not to do. She had no business plan, no specific measurable business goals, no regular reports of how the business was doing. In other words, she largely ignored the business aspects of her business.

That said, Debbie did do many other things right. She worked hard, spent long hours, and built on skills she had gained through years of designing sets for television commercials and working as an art director for movies. Her talent for choosing just the right antique (and sometimes just the right old thing) soon made Curious Sofa the go-to place for top designers. Debbie and the Curious Sofa were the topics of articles published in the New York Times, Forbes Small Business, Romantic Homes, Better Homes and Gardens, and incredibly, in The National-Dubai, a newspaper for expats in the Mideast.

So, it came as a shock when Debbie realized that her business was failing. Her first surprise came after she had moved into a location twice the size of the original shop. She wrote in her by-invitation-only blog, "If my sales were up 15 percent, why did I take a 20 percent salary cut three months ago when the rest of my staff got their raises " 3 The next shock came with the recession.

This year sales are down 28 percent, and it is killing me. I have laid off much-needed help, cut salaries, cut expenses, juggled the numbers so much I am OVER IT. I have laid my business out there naked to the landlord, my bank and advisers. 4

Debbie was at that crossroad where many entrepreneurs meet failure. She had run her business for eight years without ever having created a business plan, without ever having analyzed the economics of her business. She succeeded to this point by having phenomenal growth. But now the growth had stopped, even reversed. The only way to succeed from this point was to operate at a profit. Debbie not only had inadequate knowledge of accounting, no understanding of profit versus cash flow, inaccurate calculations of costs, and nonexistent internal controls, but she truly believed that she did not need it. "I'm an artist. I want somebody else to do that stuff," she said. 5

In what ways does an inadequate accounting system impede entrepreneurial success

The Curious Sofa was an off-beat but beautiful store, filled with one-of-a-kind items. The store was designed to look old with a black-and-white color scheme, columns made of used brick and distressed plaster, and a ceiling of antique tin tiles. All in all it was a for-real incarnation of Edwardian design. But then what would you expect of a store named after a novel by Edward Gorey, whose works (like the animation at the start of PBS's Mystery!) exemplify the Edwardian period 2

Debbie Dusenberry created the Curious Sofa just as we have encouraged our students not to do. She had no business plan, no specific measurable business goals, no regular reports of how the business was doing. In other words, she largely ignored the business aspects of her business.

That said, Debbie did do many other things right. She worked hard, spent long hours, and built on skills she had gained through years of designing sets for television commercials and working as an art director for movies. Her talent for choosing just the right antique (and sometimes just the right old thing) soon made Curious Sofa the go-to place for top designers. Debbie and the Curious Sofa were the topics of articles published in the New York Times, Forbes Small Business, Romantic Homes, Better Homes and Gardens, and incredibly, in The National-Dubai, a newspaper for expats in the Mideast.

So, it came as a shock when Debbie realized that her business was failing. Her first surprise came after she had moved into a location twice the size of the original shop. She wrote in her by-invitation-only blog, "If my sales were up 15 percent, why did I take a 20 percent salary cut three months ago when the rest of my staff got their raises " 3 The next shock came with the recession.

This year sales are down 28 percent, and it is killing me. I have laid off much-needed help, cut salaries, cut expenses, juggled the numbers so much I am OVER IT. I have laid my business out there naked to the landlord, my bank and advisers. 4

Debbie was at that crossroad where many entrepreneurs meet failure. She had run her business for eight years without ever having created a business plan, without ever having analyzed the economics of her business. She succeeded to this point by having phenomenal growth. But now the growth had stopped, even reversed. The only way to succeed from this point was to operate at a profit. Debbie not only had inadequate knowledge of accounting, no understanding of profit versus cash flow, inaccurate calculations of costs, and nonexistent internal controls, but she truly believed that she did not need it. "I'm an artist. I want somebody else to do that stuff," she said. 5

In what ways does an inadequate accounting system impede entrepreneurial success

Accounting system and finance planning take care of the most important part of the business which is 'money'. All businesses start with a goal to earn money. In this sense, the entrepreneurs keep accounting system up to date and up to the mark to avoid any issues or challenges which may turn out due to inadequate accounting system.

In a business if accounting system is not proper, it may lead to various financial disturbances. The records of cash flow and total earnings form a base for accounting. The actual earnings are calculated using the information recorded in accounts book. Either digitally or manually, record keeping is a sensitive process which should be done carefully and attentively.

An inadequate system impedes the success of a business in following ways:

• The entrepreneurs won't be able to calculate delayed payments and credits given to the customers.

• They won't be able to get the details of actual profit earned which may leads to financial imbalances.

• Tax planning and reports are affected by this approach in a negative way. The entrepreneurs may face legal problems because of that.

• Poor accounting system shows disastrous results in the long-run which at a point in time become irreversible.

In a business if accounting system is not proper, it may lead to various financial disturbances. The records of cash flow and total earnings form a base for accounting. The actual earnings are calculated using the information recorded in accounts book. Either digitally or manually, record keeping is a sensitive process which should be done carefully and attentively.

An inadequate system impedes the success of a business in following ways:

• The entrepreneurs won't be able to calculate delayed payments and credits given to the customers.

• They won't be able to get the details of actual profit earned which may leads to financial imbalances.

• Tax planning and reports are affected by this approach in a negative way. The entrepreneurs may face legal problems because of that.

• Poor accounting system shows disastrous results in the long-run which at a point in time become irreversible.

4

PARKER MOUNTAIN PRODUCTS, INC.

COMPANY HISTORY

The New England region of the United States includes a beautiful coastal stretch that extends from Maine to Rhode Island, through the states of New Hampshire, Massachusetts, and Connecticut. The area is famous for its summer tourism, which includes beaches, quaint villages and towns, restaurants, shops, historic sites and landmarks, and lobsters. Tens of thousands of people from around the world vacation in the area each year, especially during the summer season, which extends from Memorial Day to Labor Day.

Shortly after World War II, Ernest Parker returned to his hometown of Rochester, New Hampshire, and built a small factory that produces low-end glass and ceramic regional souvenirs. These products include wine glasses, general glassware, ceramic cups and bowls, and small platters. Each of these is decorated with a variety of painted images and words related to the specific coastal tourist towns and markets, that is, pictures of lobsters, seagulls, ocean waves, famous towns, and famous sites.

Ernest has provided steady employment for 35 production and support staff. The business has grown at a rate of about 5 percent per year (in sales). The most recent profit and loss statement is shown:

The entire production is sold through a small number of manufacturer's reps, wholesalers, and brokers. While the opportunity was always there to sell direct, Ernest chose to focus all his efforts on the production side of the business, allowing others to market, sell, and distribute the products to retail shops, hotels, and other vendors. The industry average or norm for profits is between 5 and 7 percent (net income to sales).

Chris and Ben are anxious to improve efficiency on the production side and to develop a variety of direct niche markets to complement their wholesale distribution on the marketing and sales side. The opportunity to add, drop, or shift the product mix, and to increase production and sales exists. In order to properly analyze and act on this, they have asked their bookkeeper to provide more specific production and cost data.

This information is presented below:

The total variable costs of $800,000 are assigned or charged to each product line based on the number of units produced. Total fixed costs for the factory are $80,000; selling and administrative costs for the total company are $50,000.

Chris and Ben have determined that the factory is now at 85 percent of capacity. They are certain that production can be increased without incurring any extra expense beyond direct materials.

They also know that the selling price could be increased by 15 percent as a result of a direct sales program. Their only uncertainty or fear is in disrupting the long-standing relationships that exist with the various manufacturers' reps, wholesalers, and brokers who have been able to sell all of the company's production for many years. They are afraid of "biting the hand that feeds them" by selling to an end user who currently buys from one of their own distributors.

What specific goals and standards of performance would you recommend for the new managers What control process or audit system would you include for follow-up purposes

COMPANY HISTORY

The New England region of the United States includes a beautiful coastal stretch that extends from Maine to Rhode Island, through the states of New Hampshire, Massachusetts, and Connecticut. The area is famous for its summer tourism, which includes beaches, quaint villages and towns, restaurants, shops, historic sites and landmarks, and lobsters. Tens of thousands of people from around the world vacation in the area each year, especially during the summer season, which extends from Memorial Day to Labor Day.

Shortly after World War II, Ernest Parker returned to his hometown of Rochester, New Hampshire, and built a small factory that produces low-end glass and ceramic regional souvenirs. These products include wine glasses, general glassware, ceramic cups and bowls, and small platters. Each of these is decorated with a variety of painted images and words related to the specific coastal tourist towns and markets, that is, pictures of lobsters, seagulls, ocean waves, famous towns, and famous sites.

Ernest has provided steady employment for 35 production and support staff. The business has grown at a rate of about 5 percent per year (in sales). The most recent profit and loss statement is shown:

The entire production is sold through a small number of manufacturer's reps, wholesalers, and brokers. While the opportunity was always there to sell direct, Ernest chose to focus all his efforts on the production side of the business, allowing others to market, sell, and distribute the products to retail shops, hotels, and other vendors. The industry average or norm for profits is between 5 and 7 percent (net income to sales).

Chris and Ben are anxious to improve efficiency on the production side and to develop a variety of direct niche markets to complement their wholesale distribution on the marketing and sales side. The opportunity to add, drop, or shift the product mix, and to increase production and sales exists. In order to properly analyze and act on this, they have asked their bookkeeper to provide more specific production and cost data.

This information is presented below:

The total variable costs of $800,000 are assigned or charged to each product line based on the number of units produced. Total fixed costs for the factory are $80,000; selling and administrative costs for the total company are $50,000.

Chris and Ben have determined that the factory is now at 85 percent of capacity. They are certain that production can be increased without incurring any extra expense beyond direct materials.

They also know that the selling price could be increased by 15 percent as a result of a direct sales program. Their only uncertainty or fear is in disrupting the long-standing relationships that exist with the various manufacturers' reps, wholesalers, and brokers who have been able to sell all of the company's production for many years. They are afraid of "biting the hand that feeds them" by selling to an end user who currently buys from one of their own distributors.

What specific goals and standards of performance would you recommend for the new managers What control process or audit system would you include for follow-up purposes

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

5

Why should you, as a business owner care about the distinction between costs and expenses

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

6

Either by yourself or in a group of your fellow students, select a business that you could reasonably expect to be able to start and run right now. (This could be as simple as a T-shirt company.) Using the techniques learned in exercises 2 and 3, above, develop a set of estimates of (1) sales, (2) variable cost of product or service and (3) the amount of other costs (rent, electricity, transportation, etc…) that you would expect to incur. Using these estimates, create a set of budget schedules through the schedule of Cost Of Goods Manufactured And Sold.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

7

Defend the statement, "the function of accounting is to produce information that is useful for decision making."

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

8

PHIONIA'S FINICKY FELINE GOURMET CAT DINNERS

Phionia Phelps has developed a gourmet cat food. Not only is this food eagerly eaten by the most finicky felines, but it is specially formulated to prevent the many health problems of aging cats. Phionia has been making the food on her kitchen range and selling it at $250 per case only to close acquaintances who are also cat lovers. One of her wealthy acquaintances has now offered to invest in her business if Phionia will begin selling the product through her website. However, the investor wants Phionia to produce a budget for the first six months of operation.

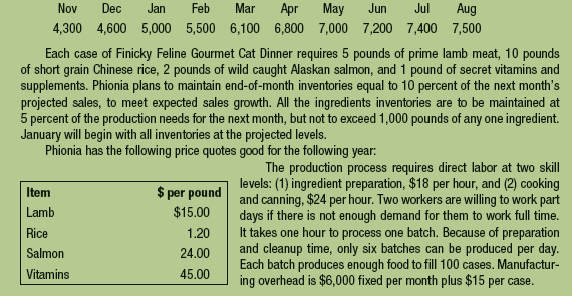

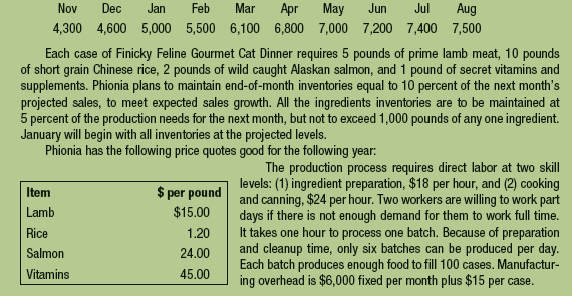

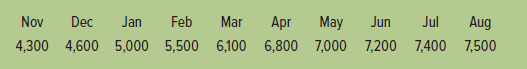

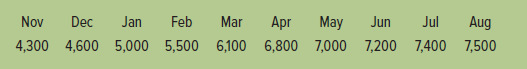

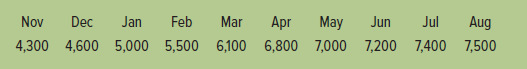

Based on her experience to date, Phionia predicts the following sales in cases:

CASE DISCUSSION QUESTIONS

1. Prepare the following budgets for the period, January through June:

a. Sales budget in dollars.

b. Production budget in units.

c. Direct materials purchases budget in pounds.

d. Direct materials purchases budget in dollars.

e. Direct manufacturing labor budget in dollars.

2. Comment on the viability of this business and the advisability of the investor making a $50,000 investment to get it started.

Phionia Phelps has developed a gourmet cat food. Not only is this food eagerly eaten by the most finicky felines, but it is specially formulated to prevent the many health problems of aging cats. Phionia has been making the food on her kitchen range and selling it at $250 per case only to close acquaintances who are also cat lovers. One of her wealthy acquaintances has now offered to invest in her business if Phionia will begin selling the product through her website. However, the investor wants Phionia to produce a budget for the first six months of operation.

Based on her experience to date, Phionia predicts the following sales in cases:

CASE DISCUSSION QUESTIONS

1. Prepare the following budgets for the period, January through June:

a. Sales budget in dollars.

b. Production budget in units.

c. Direct materials purchases budget in pounds.

d. Direct materials purchases budget in dollars.

e. Direct manufacturing labor budget in dollars.

2. Comment on the viability of this business and the advisability of the investor making a $50,000 investment to get it started.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

9

Go to either the QuickBooks or the Sage 50 Accounting website. Download and install a demonstration copy of its accounting program. Using either the budget schedules you developed in exercise 4, or the Red Jett Sweets, Inc. example from the text, set up the program to do accounting as if this were a real business.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

10

PHIONIA'S FINICKY FELINE GOURMET CAT DINNERS

Phionia Phelps has developed a gourmet cat food. Not only is this food eagerly eaten by the most finicky felines, but it is specially formulated to prevent the many health problems of aging cats. Phionia has been making the food on her kitchen range and selling it at $250 per case only to close acquaintances who are also cat lovers. One of her wealthy acquaintances has now offered to invest in her business if Phionia will begin selling the product through her website. However, the investor wants Phionia to produce a budget for the first six months of operation.

Based on her experience to date, Phionia predicts the following sales in cases:

Each case of Finicky Feline Gourmet Cat Dinner requires 5 pounds of prime lamb meat, 10 pounds of short-grain Chinese rice, 2 pounds of wild caught Alaskan salmon, and 1 pound of secret vitamins and supplements. Phionia plans to maintain end-of-month inventories equal to 10 percent of the next month's projected sales, to meet expected sales growth. All the ingredients inventories are to be maintained at 5 percent of the production needs for the next month, but not to exceed 1,000 pounds of any one ingredient. January will begin with all inventories at the projected levels.

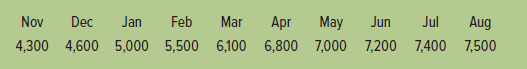

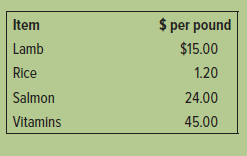

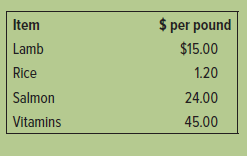

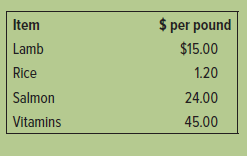

Phionia has the following price quotes good for the following year:

The production process requires direct labor at two skill levels: (1) ingredient preparation, $18 per hour; and (2) cooking and canning, $24 per hour. Two workers are willing to work part time if there is not enough demand for them to work full time. It takes one hour to process one batch. Because of preparation and cleanup time, only six batches can be produced per day. Each batch produces enough food to fill 100 cases. Manufacturing overhead is $6,000 fixed per month plus $15 per case.

Prepare the following budgets for the period January through June:

a. Sales budget in dollars.

b. Production budget in units.

c. Direct materials purchases budget in pounds.

d. Direct materials purchases budget in dollars.

e. Direct manufacturing labor budget in dollars.

Phionia Phelps has developed a gourmet cat food. Not only is this food eagerly eaten by the most finicky felines, but it is specially formulated to prevent the many health problems of aging cats. Phionia has been making the food on her kitchen range and selling it at $250 per case only to close acquaintances who are also cat lovers. One of her wealthy acquaintances has now offered to invest in her business if Phionia will begin selling the product through her website. However, the investor wants Phionia to produce a budget for the first six months of operation.

Based on her experience to date, Phionia predicts the following sales in cases:

Each case of Finicky Feline Gourmet Cat Dinner requires 5 pounds of prime lamb meat, 10 pounds of short-grain Chinese rice, 2 pounds of wild caught Alaskan salmon, and 1 pound of secret vitamins and supplements. Phionia plans to maintain end-of-month inventories equal to 10 percent of the next month's projected sales, to meet expected sales growth. All the ingredients inventories are to be maintained at 5 percent of the production needs for the next month, but not to exceed 1,000 pounds of any one ingredient. January will begin with all inventories at the projected levels.

Phionia has the following price quotes good for the following year:

The production process requires direct labor at two skill levels: (1) ingredient preparation, $18 per hour; and (2) cooking and canning, $24 per hour. Two workers are willing to work part time if there is not enough demand for them to work full time. It takes one hour to process one batch. Because of preparation and cleanup time, only six batches can be produced per day. Each batch produces enough food to fill 100 cases. Manufacturing overhead is $6,000 fixed per month plus $15 per case.

Prepare the following budgets for the period January through June:

a. Sales budget in dollars.

b. Production budget in units.

c. Direct materials purchases budget in pounds.

d. Direct materials purchases budget in dollars.

e. Direct manufacturing labor budget in dollars.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

11

What are the three most important characteristics of a small business computer accounting system Why do you think these are the most important

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

12

Focus on Small Business: Debbie Dusenberry and the Curious Sofa 1

The Curious Sofa was an off-beat but beautiful store, filled with one-of-a-kind items. The store was designed to look old with a black-and-white color scheme, columns made of used brick and distressed plaster, and a ceiling of antique tin tiles. All in all it was a for-real incarnation of Edwardian design. But then what would you expect of a store named after a novel by Edward Gorey, whose works (like the animation at the start of PBS's Mystery!) exemplify the Edwardian period 2

Debbie Dusenberry created the Curious Sofa just as we have encouraged our students not to do. She had no business plan, no specific measurable business goals, no regular reports of how the business was doing. In other words, she largely ignored the business aspects of her business.

That said, Debbie did do many other things right. She worked hard, spent long hours, and built on skills she had gained through years of designing sets for television commercials and working as an art director for movies. Her talent for choosing just the right antique (and sometimes just the right old thing) soon made Curious Sofa the go-to place for top designers. Debbie and the Curious Sofa were the topics of articles published in the New York Times, Forbes Small Business, Romantic Homes, Better Homes and Gardens, and incredibly, in The National-Dubai, a newspaper for expats in the Mideast.

So, it came as a shock when Debbie realized that her business was failing. Her first surprise came after she had moved into a location twice the size of the original shop. She wrote in her by-invitation-only blog, "If my sales were up 15 percent, why did I take a 20 percent salary cut three months ago when the rest of my staff got their raises " 3 The next shock came with the recession.

This year sales are down 28 percent, and it is killing me. I have laid off much-needed help, cut salaries, cut expenses, juggled the numbers so much I am OVER IT. I have laid my business out there naked to the landlord, my bank and advisers. 4

Debbie was at that crossroad where many entrepreneurs meet failure. She had run her business for eight years without ever having created a business plan, without ever having analyzed the economics of her business. She succeeded to this point by having phenomenal growth. But now the growth had stopped, even reversed. The only way to succeed from this point was to operate at a profit. Debbie not only had inadequate knowledge of accounting, no understanding of profit versus cash flow, inaccurate calculations of costs, and nonexistent internal controls, but she truly believed that she did not need it. "I'm an artist. I want somebody else to do that stuff," she said. 5

What is the difference between profit and cash flow

The Curious Sofa was an off-beat but beautiful store, filled with one-of-a-kind items. The store was designed to look old with a black-and-white color scheme, columns made of used brick and distressed plaster, and a ceiling of antique tin tiles. All in all it was a for-real incarnation of Edwardian design. But then what would you expect of a store named after a novel by Edward Gorey, whose works (like the animation at the start of PBS's Mystery!) exemplify the Edwardian period 2

Debbie Dusenberry created the Curious Sofa just as we have encouraged our students not to do. She had no business plan, no specific measurable business goals, no regular reports of how the business was doing. In other words, she largely ignored the business aspects of her business.

That said, Debbie did do many other things right. She worked hard, spent long hours, and built on skills she had gained through years of designing sets for television commercials and working as an art director for movies. Her talent for choosing just the right antique (and sometimes just the right old thing) soon made Curious Sofa the go-to place for top designers. Debbie and the Curious Sofa were the topics of articles published in the New York Times, Forbes Small Business, Romantic Homes, Better Homes and Gardens, and incredibly, in The National-Dubai, a newspaper for expats in the Mideast.

So, it came as a shock when Debbie realized that her business was failing. Her first surprise came after she had moved into a location twice the size of the original shop. She wrote in her by-invitation-only blog, "If my sales were up 15 percent, why did I take a 20 percent salary cut three months ago when the rest of my staff got their raises " 3 The next shock came with the recession.

This year sales are down 28 percent, and it is killing me. I have laid off much-needed help, cut salaries, cut expenses, juggled the numbers so much I am OVER IT. I have laid my business out there naked to the landlord, my bank and advisers. 4

Debbie was at that crossroad where many entrepreneurs meet failure. She had run her business for eight years without ever having created a business plan, without ever having analyzed the economics of her business. She succeeded to this point by having phenomenal growth. But now the growth had stopped, even reversed. The only way to succeed from this point was to operate at a profit. Debbie not only had inadequate knowledge of accounting, no understanding of profit versus cash flow, inaccurate calculations of costs, and nonexistent internal controls, but she truly believed that she did not need it. "I'm an artist. I want somebody else to do that stuff," she said. 5

What is the difference between profit and cash flow

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

13

Do a Google search on the terms "accounting system" and "small business." Follow the Google returns to the websites of the companies (other than the ones named in the text) that you can find that sell computerized accounting systems. Examine the site to determine if their program would be suitable under the criteria specified in the text.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the three types of accounting is most important to small business Which is the least Why do you think so

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

15

What are the three most important functions (think cash, accounts payable, owners' equity, etc.) that a computerized accounting system should have Why are they the most important

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

16

Assume that you have decided to purchase a computerized small business accounting system. Visit the web site of each of the accounting systems named in this chapter. From the information there determine:

a. The price of the accounting system.

b. The minimum computer requirements for the program.

c. The availability and cost of training to learn to use the program.

d. The availability of trained accountants and consultants in your geographic area who can be retained to assist you in setting up and using the program.

a. The price of the accounting system.

b. The minimum computer requirements for the program.

c. The availability and cost of training to learn to use the program.

d. The availability of trained accountants and consultants in your geographic area who can be retained to assist you in setting up and using the program.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

17

Which financial report is most important for managing a small business Why

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

18

PHIONIA'S FINICKY FELINE GOURMET CAT DINNERS

Phionia Phelps has developed a gourmet cat food. Not only is this food eagerly eaten by the most finicky felines, but it is specially formulated to prevent the many health problems of aging cats. Phionia has been making the food on her kitchen range and selling it at $250 per case only to close acquaintances who are also cat lovers. One of her wealthy acquaintances has now offered to invest in her business if Phionia will begin selling the product through her website. However, the investor wants Phionia to produce a budget for the first six months of operation.

Based on her experience to date, Phionia predicts the following sales in cases:

Each case of Finicky Feline Gourmet Cat Dinner requires 5 pounds of prime lamb meat, 10 pounds of short-grain Chinese rice, 2 pounds of wild caught Alaskan salmon, and 1 pound of secret vitamins and supplements. Phionia plans to maintain end-of-month inventories equal to 10 percent of the next month's projected sales, to meet expected sales growth. All the ingredients inventories are to be maintained at 5 percent of the production needs for the next month, but not to exceed 1,000 pounds of any one ingredient. January will begin with all inventories at the projected levels.

Phionia has the following price quotes good for the following year:

The production process requires direct labor at two skill levels: (1) ingredient preparation, $18 per hour; and (2) cooking and canning, $24 per hour. Two workers are willing to work part time if there is not enough demand for them to work full time. It takes one hour to process one batch. Because of preparation and cleanup time, only six batches can be produced per day. Each batch produces enough food to fill 100 cases. Manufacturing overhead is $6,000 fixed per month plus $15 per case.

Comment on the viability of this business and the advisability of the investor making a $50,000 investment to get it started.

Your instructor may provide you with a sample solution for this mini-case.

Phionia Phelps has developed a gourmet cat food. Not only is this food eagerly eaten by the most finicky felines, but it is specially formulated to prevent the many health problems of aging cats. Phionia has been making the food on her kitchen range and selling it at $250 per case only to close acquaintances who are also cat lovers. One of her wealthy acquaintances has now offered to invest in her business if Phionia will begin selling the product through her website. However, the investor wants Phionia to produce a budget for the first six months of operation.

Based on her experience to date, Phionia predicts the following sales in cases:

Each case of Finicky Feline Gourmet Cat Dinner requires 5 pounds of prime lamb meat, 10 pounds of short-grain Chinese rice, 2 pounds of wild caught Alaskan salmon, and 1 pound of secret vitamins and supplements. Phionia plans to maintain end-of-month inventories equal to 10 percent of the next month's projected sales, to meet expected sales growth. All the ingredients inventories are to be maintained at 5 percent of the production needs for the next month, but not to exceed 1,000 pounds of any one ingredient. January will begin with all inventories at the projected levels.

Phionia has the following price quotes good for the following year:

The production process requires direct labor at two skill levels: (1) ingredient preparation, $18 per hour; and (2) cooking and canning, $24 per hour. Two workers are willing to work part time if there is not enough demand for them to work full time. It takes one hour to process one batch. Because of preparation and cleanup time, only six batches can be produced per day. Each batch produces enough food to fill 100 cases. Manufacturing overhead is $6,000 fixed per month plus $15 per case.

Comment on the viability of this business and the advisability of the investor making a $50,000 investment to get it started.

Your instructor may provide you with a sample solution for this mini-case.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

19

You can sell your product (have revenues) without receiving any money. You can receive money (customer deposits) without having any revenue. Since revenue, expenses, and cash are so different, why should a small business owner care about the income statement

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

20

Focus on Small Business: Debbie Dusenberry and the Curious Sofa 1

The Curious Sofa was an off-beat but beautiful store, filled with one-of-a-kind items. The store was designed to look old with a black-and-white color scheme, columns made of used brick and distressed plaster, and a ceiling of antique tin tiles. All in all it was a for-real incarnation of Edwardian design. But then what would you expect of a store named after a novel by Edward Gorey, whose works (like the animation at the start of PBS's Mystery!) exemplify the Edwardian period 2

Debbie Dusenberry created the Curious Sofa just as we have encouraged our students not to do. She had no business plan, no specific measurable business goals, no regular reports of how the business was doing. In other words, she largely ignored the business aspects of her business.

That said, Debbie did do many other things right. She worked hard, spent long hours, and built on skills she had gained through years of designing sets for television commercials and working as an art director for movies. Her talent for choosing just the right antique (and sometimes just the right old thing) soon made Curious Sofa the go-to place for top designers. Debbie and the Curious Sofa were the topics of articles published in the New York Times, Forbes Small Business, Romantic Homes, Better Homes and Gardens, and incredibly, in The National-Dubai, a newspaper for expats in the Mideast.

So, it came as a shock when Debbie realized that her business was failing. Her first surprise came after she had moved into a location twice the size of the original shop. She wrote in her by-invitation-only blog, "If my sales were up 15 percent, why did I take a 20 percent salary cut three months ago when the rest of my staff got their raises " 3 The next shock came with the recession.

This year sales are down 28 percent, and it is killing me. I have laid off much-needed help, cut salaries, cut expenses, juggled the numbers so much I am OVER IT. I have laid my business out there naked to the landlord, my bank and advisers. 4

Debbie was at that crossroad where many entrepreneurs meet failure. She had run her business for eight years without ever having created a business plan, without ever having analyzed the economics of her business. She succeeded to this point by having phenomenal growth. But now the growth had stopped, even reversed. The only way to succeed from this point was to operate at a profit. Debbie not only had inadequate knowledge of accounting, no understanding of profit versus cash flow, inaccurate calculations of costs, and nonexistent internal controls, but she truly believed that she did not need it. "I'm an artist. I want somebody else to do that stuff," she said. 5

Where might Debbie Dusenberry find help to save her business

The Curious Sofa was an off-beat but beautiful store, filled with one-of-a-kind items. The store was designed to look old with a black-and-white color scheme, columns made of used brick and distressed plaster, and a ceiling of antique tin tiles. All in all it was a for-real incarnation of Edwardian design. But then what would you expect of a store named after a novel by Edward Gorey, whose works (like the animation at the start of PBS's Mystery!) exemplify the Edwardian period 2

Debbie Dusenberry created the Curious Sofa just as we have encouraged our students not to do. She had no business plan, no specific measurable business goals, no regular reports of how the business was doing. In other words, she largely ignored the business aspects of her business.

That said, Debbie did do many other things right. She worked hard, spent long hours, and built on skills she had gained through years of designing sets for television commercials and working as an art director for movies. Her talent for choosing just the right antique (and sometimes just the right old thing) soon made Curious Sofa the go-to place for top designers. Debbie and the Curious Sofa were the topics of articles published in the New York Times, Forbes Small Business, Romantic Homes, Better Homes and Gardens, and incredibly, in The National-Dubai, a newspaper for expats in the Mideast.

So, it came as a shock when Debbie realized that her business was failing. Her first surprise came after she had moved into a location twice the size of the original shop. She wrote in her by-invitation-only blog, "If my sales were up 15 percent, why did I take a 20 percent salary cut three months ago when the rest of my staff got their raises " 3 The next shock came with the recession.

This year sales are down 28 percent, and it is killing me. I have laid off much-needed help, cut salaries, cut expenses, juggled the numbers so much I am OVER IT. I have laid my business out there naked to the landlord, my bank and advisers. 4

Debbie was at that crossroad where many entrepreneurs meet failure. She had run her business for eight years without ever having created a business plan, without ever having analyzed the economics of her business. She succeeded to this point by having phenomenal growth. But now the growth had stopped, even reversed. The only way to succeed from this point was to operate at a profit. Debbie not only had inadequate knowledge of accounting, no understanding of profit versus cash flow, inaccurate calculations of costs, and nonexistent internal controls, but she truly believed that she did not need it. "I'm an artist. I want somebody else to do that stuff," she said. 5

Where might Debbie Dusenberry find help to save her business

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

21

Why would a small business ever need an accounting system more complicated than a simple checkbook register

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

22

How does the accounting equation relate to the balance sheet

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

23

A budget is a collection of estimates - a big word that means the same thing as "guess!" If you are guessing what future results will be, what value can a budget really have

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

24

Choose an industry in which you would like to own a small business. Use the Internet, the university library, and the public library to find the names and addresses of industry trade associations. Examine the web sites of the trade associations for availability of financial statistics of your industry. Examine governmental agency sites, such as those of the Department of Commerce, Department of the Treasury, Securities and Exchange Commission and the Small Business Administration for benchmark statistics.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

25

How are budgets related to business plans, as described in Chapter 8

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

26

Focus on Small Business: Debbie Dusenberry and the Curious Sofa 1

The Curious Sofa was an off-beat but beautiful store, filled with one-of-a-kind items. The store was designed to look old with a black-and-white color scheme, columns made of used brick and distressed plaster, and a ceiling of antique tin tiles. All in all it was a for-real incarnation of Edwardian design. But then what would you expect of a store named after a novel by Edward Gorey, whose works (like the animation at the start of PBS's Mystery!) exemplify the Edwardian period 2

Debbie Dusenberry created the Curious Sofa just as we have encouraged our students not to do. She had no business plan, no specific measurable business goals, no regular reports of how the business was doing. In other words, she largely ignored the business aspects of her business.

That said, Debbie did do many other things right. She worked hard, spent long hours, and built on skills she had gained through years of designing sets for television commercials and working as an art director for movies. Her talent for choosing just the right antique (and sometimes just the right old thing) soon made Curious Sofa the go-to place for top designers. Debbie and the Curious Sofa were the topics of articles published in the New York Times, Forbes Small Business, Romantic Homes, Better Homes and Gardens, and incredibly, in The National-Dubai, a newspaper for expats in the Mideast.

So, it came as a shock when Debbie realized that her business was failing. Her first surprise came after she had moved into a location twice the size of the original shop. She wrote in her by-invitation-only blog, "If my sales were up 15 percent, why did I take a 20 percent salary cut three months ago when the rest of my staff got their raises " 3 The next shock came with the recession.

This year sales are down 28 percent, and it is killing me. I have laid off much-needed help, cut salaries, cut expenses, juggled the numbers so much I am OVER IT. I have laid my business out there naked to the landlord, my bank and advisers. 4

Debbie was at that crossroad where many entrepreneurs meet failure. She had run her business for eight years without ever having created a business plan, without ever having analyzed the economics of her business. She succeeded to this point by having phenomenal growth. But now the growth had stopped, even reversed. The only way to succeed from this point was to operate at a profit. Debbie not only had inadequate knowledge of accounting, no understanding of profit versus cash flow, inaccurate calculations of costs, and nonexistent internal controls, but she truly believed that she did not need it. "I'm an artist. I want somebody else to do that stuff," she said. 5

Does a good accounting system guarantee entrepreneurial success

The Curious Sofa was an off-beat but beautiful store, filled with one-of-a-kind items. The store was designed to look old with a black-and-white color scheme, columns made of used brick and distressed plaster, and a ceiling of antique tin tiles. All in all it was a for-real incarnation of Edwardian design. But then what would you expect of a store named after a novel by Edward Gorey, whose works (like the animation at the start of PBS's Mystery!) exemplify the Edwardian period 2

Debbie Dusenberry created the Curious Sofa just as we have encouraged our students not to do. She had no business plan, no specific measurable business goals, no regular reports of how the business was doing. In other words, she largely ignored the business aspects of her business.

That said, Debbie did do many other things right. She worked hard, spent long hours, and built on skills she had gained through years of designing sets for television commercials and working as an art director for movies. Her talent for choosing just the right antique (and sometimes just the right old thing) soon made Curious Sofa the go-to place for top designers. Debbie and the Curious Sofa were the topics of articles published in the New York Times, Forbes Small Business, Romantic Homes, Better Homes and Gardens, and incredibly, in The National-Dubai, a newspaper for expats in the Mideast.

So, it came as a shock when Debbie realized that her business was failing. Her first surprise came after she had moved into a location twice the size of the original shop. She wrote in her by-invitation-only blog, "If my sales were up 15 percent, why did I take a 20 percent salary cut three months ago when the rest of my staff got their raises " 3 The next shock came with the recession.

This year sales are down 28 percent, and it is killing me. I have laid off much-needed help, cut salaries, cut expenses, juggled the numbers so much I am OVER IT. I have laid my business out there naked to the landlord, my bank and advisers. 4

Debbie was at that crossroad where many entrepreneurs meet failure. She had run her business for eight years without ever having created a business plan, without ever having analyzed the economics of her business. She succeeded to this point by having phenomenal growth. But now the growth had stopped, even reversed. The only way to succeed from this point was to operate at a profit. Debbie not only had inadequate knowledge of accounting, no understanding of profit versus cash flow, inaccurate calculations of costs, and nonexistent internal controls, but she truly believed that she did not need it. "I'm an artist. I want somebody else to do that stuff," she said. 5

Does a good accounting system guarantee entrepreneurial success

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

27

Is there any advantage to making a series of budget schedules, rather than just producing a pro forma income statement and balance sheet What are the advantages, if any

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

28

How are costs and expenses different

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

29

PARKER MOUNTAIN PRODUCTS, INC.

COMPANY HISTORY

The New England region of the United States includes a beautiful coastal stretch that extends from Maine to Rhode Island, through the states of New Hampshire, Massachusetts, and Connecticut. The area is famous for its summer tourism, which includes beaches, quaint villages and towns, restaurants, shops, historic sites and landmarks, and lobsters. Tens of thousands of people from around the world vacation in the area each year, especially during the summer season, which extends from Memorial Day to Labor Day.

Shortly after World War II, Ernest Parker returned to his hometown of Rochester, New Hampshire, and built a small factory that produces low-end glass and ceramic regional souvenirs. These products include wine glasses, general glassware, ceramic cups and bowls, and small platters. Each of these is decorated with a variety of painted images and words related to the specific coastal tourist towns and markets, that is, pictures of lobsters, seagulls, ocean waves, famous towns, and famous sites.

Ernest has provided steady employment for 35 production and support staff. The business has grown at a rate of about 5 percent per year (in sales). The most recent profit and loss statement is shown:

The entire production is sold through a small number of manufacturer's reps, wholesalers, and brokers. While the opportunity was always there to sell direct, Ernest chose to focus all his efforts on the production side of the business, allowing others to market, sell, and distribute the products to retail shops, hotels, and other vendors. The industry average or norm for profits is between 5 and 7 percent (net income to sales).

Chris and Ben are anxious to improve efficiency on the production side and to develop a variety of direct niche markets to complement their wholesale distribution on the marketing and sales side. The opportunity to add, drop, or shift the product mix, and to increase production and sales exists. In order to properly analyze and act on this, they have asked their bookkeeper to provide more specific production and cost data.

This information is presented below:

The total variable costs of $800,000 are assigned or charged to each product line based on the number of units produced. Total fixed costs for the factory are $80,000; selling and administrative costs for the total company are $50,000.

Chris and Ben have determined that the factory is now at 85 percent of capacity. They are certain that production can be increased without incurring any extra expense beyond direct materials.

They also know that the selling price could be increased by 15 percent as a result of a direct sales program. Their only uncertainty or fear is in disrupting the long-standing relationships that exist with the various manufacturers' reps, wholesalers, and brokers who have been able to sell all of the company's production for many years. They are afraid of "biting the hand that feeds them" by selling to an end user who currently buys from one of their own distributors.

As a first step, conduct a financial analysis of current operations by reformatting the income statement to include individual product lines as well as the total company. Analyze those data.

COMPANY HISTORY

The New England region of the United States includes a beautiful coastal stretch that extends from Maine to Rhode Island, through the states of New Hampshire, Massachusetts, and Connecticut. The area is famous for its summer tourism, which includes beaches, quaint villages and towns, restaurants, shops, historic sites and landmarks, and lobsters. Tens of thousands of people from around the world vacation in the area each year, especially during the summer season, which extends from Memorial Day to Labor Day.

Shortly after World War II, Ernest Parker returned to his hometown of Rochester, New Hampshire, and built a small factory that produces low-end glass and ceramic regional souvenirs. These products include wine glasses, general glassware, ceramic cups and bowls, and small platters. Each of these is decorated with a variety of painted images and words related to the specific coastal tourist towns and markets, that is, pictures of lobsters, seagulls, ocean waves, famous towns, and famous sites.

Ernest has provided steady employment for 35 production and support staff. The business has grown at a rate of about 5 percent per year (in sales). The most recent profit and loss statement is shown:

The entire production is sold through a small number of manufacturer's reps, wholesalers, and brokers. While the opportunity was always there to sell direct, Ernest chose to focus all his efforts on the production side of the business, allowing others to market, sell, and distribute the products to retail shops, hotels, and other vendors. The industry average or norm for profits is between 5 and 7 percent (net income to sales).

Chris and Ben are anxious to improve efficiency on the production side and to develop a variety of direct niche markets to complement their wholesale distribution on the marketing and sales side. The opportunity to add, drop, or shift the product mix, and to increase production and sales exists. In order to properly analyze and act on this, they have asked their bookkeeper to provide more specific production and cost data.

This information is presented below:

The total variable costs of $800,000 are assigned or charged to each product line based on the number of units produced. Total fixed costs for the factory are $80,000; selling and administrative costs for the total company are $50,000.

Chris and Ben have determined that the factory is now at 85 percent of capacity. They are certain that production can be increased without incurring any extra expense beyond direct materials.

They also know that the selling price could be increased by 15 percent as a result of a direct sales program. Their only uncertainty or fear is in disrupting the long-standing relationships that exist with the various manufacturers' reps, wholesalers, and brokers who have been able to sell all of the company's production for many years. They are afraid of "biting the hand that feeds them" by selling to an end user who currently buys from one of their own distributors.

As a first step, conduct a financial analysis of current operations by reformatting the income statement to include individual product lines as well as the total company. Analyze those data.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck