Deck 13: Advanced Topics in Business Strategy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/25

Play

Full screen (f)

Deck 13: Advanced Topics in Business Strategy

1

Between 1995 and 1997, American Airlines competed in the Dallas/Ft Worth Airport against several other low-cost carriers. In response to these low-cost carriers, American Airlines reduced its price and increased service on selected routes. As a result, one of the low-cost carriers stopped service, which led American Airlines to increase its price. Why do you think a lawsuit was filed against American Airlines? Why do you think American Airlines prevailed at trial?

It is given that in due course of competition with other low-cost carriers during the period from 1995 to 1997; AA reduced its price and increased its service on selected routes such that one of its low-cost carriers stopped service and that AA increased its price then after.

The pricing pattern followed by AA provides enough of evidence that AA was following predatory pricing where it priced for its flight service much below the marginal cost to drive away other low-cost carriers. Such kind of predatory pricing is illegal under the anti-trust act.

If AA were to keep its price reduced throughout to meet competition, it would have been termed as pricing practices consistent with the competitive behaviour. But, since AA has increased its price as soon as one of its low-cost carriers stopped service, AA was alleged to be practicing predatory pricing strategy. This may have resulted in a lawsuit against Aa.The AA prevailed at the trial, because it is generally difficult in case of airlines to establish that the airline is operating at a price less than marginal cost.

The pricing pattern followed by AA provides enough of evidence that AA was following predatory pricing where it priced for its flight service much below the marginal cost to drive away other low-cost carriers. Such kind of predatory pricing is illegal under the anti-trust act.

If AA were to keep its price reduced throughout to meet competition, it would have been termed as pricing practices consistent with the competitive behaviour. But, since AA has increased its price as soon as one of its low-cost carriers stopped service, AA was alleged to be practicing predatory pricing strategy. This may have resulted in a lawsuit against Aa.The AA prevailed at the trial, because it is generally difficult in case of airlines to establish that the airline is operating at a price less than marginal cost.

2

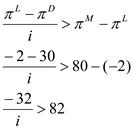

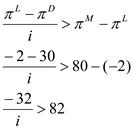

Suppose that, prior to other firms entering the market, the maker of a new smartphone (Way Cool, Inc.) earns $80 million per year. By reducing its price by 60 percent, Way Cool could discourage entry into "its" market, but doing so would cause its profits to sink to -$2 million. By pricing such that other firms would be able to enter the market, Way Cool's profits would drop to $30 million for the indefinite future. In light of these estimates, do you think it is profitable for Way Cool to engage in limit pricing? Is any additional information needed to formulate an answer to this question? Explain.

In the absence of any rival, WC's annual profit (

) is $80 million annually. If it deter any potential rivals from entering the market, the entry deterrent price will cost (

) is $80 million annually. If it deter any potential rivals from entering the market, the entry deterrent price will cost (

) the firm -$20 million indefinitely.

) the firm -$20 million indefinitely.

However, if it allow entry of potential rival firms, WC's profit in subsequent years (

) will fall to $30 million. Considering the facts, limit pricing is profitable for WC if:

) will fall to $30 million. Considering the facts, limit pricing is profitable for WC if:

Though the information about the interest rate is not given, in no circumstance this inequality can hold for the fact that the left hand side is negative. This implies that limiting the price will drive WC out of the market.

Though the information about the interest rate is not given, in no circumstance this inequality can hold for the fact that the left hand side is negative. This implies that limiting the price will drive WC out of the market.

Therefore, WC should not limit its prices.

) is $80 million annually. If it deter any potential rivals from entering the market, the entry deterrent price will cost (

) is $80 million annually. If it deter any potential rivals from entering the market, the entry deterrent price will cost ( ) the firm -$20 million indefinitely.

) the firm -$20 million indefinitely.However, if it allow entry of potential rival firms, WC's profit in subsequent years (

) will fall to $30 million. Considering the facts, limit pricing is profitable for WC if:

) will fall to $30 million. Considering the facts, limit pricing is profitable for WC if: Though the information about the interest rate is not given, in no circumstance this inequality can hold for the fact that the left hand side is negative. This implies that limiting the price will drive WC out of the market.

Though the information about the interest rate is not given, in no circumstance this inequality can hold for the fact that the left hand side is negative. This implies that limiting the price will drive WC out of the market.Therefore, WC should not limit its prices.

3

During the early days of the Internet, most dot-coms were driven by revenues rather than profits. A large number were even driven by "hits" to their site rather than revenues. This all changed in early 2000, however, when the prices of unprofitable dot-com stocks plummeted on Wall Street. Most analysts have attributed this to a return to rationality, with investors focusing once again on fundamentals like earnings growth. Does this mean that, during the 1990s, dot-coms that focused on "hits" rather than revenues or profits had bad business plans? Explain.

During 1990s, the dot-coms focus on "hits" does not mean that they did not focus on revenue profit.

Such focus actually has implication on its pricing strategy and its effects on revenue profitability of the firm on the long term basis.

During the early days of Internet, due to networking effect, the penetration pricing was optimal for dot-coms.

Most dot-coms focused on the number of "hits" their website obtained as it indicated the extent to which consumer lock-in has been realized. This business philosophy was thought to provide an estimate of the assured revenue profit that the firms could maintain in due course of time and during the course of raising price above the minimal penetration price with which they entered the industry.

During 2000s, the stock of some of the dot-com that focused on "hits" plummeted on Wall Street.

This perhaps may be more on account of the fact that the number of "hits" their website obtained did not translate into profits than the fact that the dot-coms focused more on hits rather than revenue profit, as the result of which the long term survival capability of the firms got challenged.Thus, it would not be right to say that during 1990s, dot-coms that focused on "hits" rather than revenues or profits had bad business plans.

Such focus actually has implication on its pricing strategy and its effects on revenue profitability of the firm on the long term basis.

During the early days of Internet, due to networking effect, the penetration pricing was optimal for dot-coms.

Most dot-coms focused on the number of "hits" their website obtained as it indicated the extent to which consumer lock-in has been realized. This business philosophy was thought to provide an estimate of the assured revenue profit that the firms could maintain in due course of time and during the course of raising price above the minimal penetration price with which they entered the industry.

During 2000s, the stock of some of the dot-com that focused on "hits" plummeted on Wall Street.

This perhaps may be more on account of the fact that the number of "hits" their website obtained did not translate into profits than the fact that the dot-coms focused more on hits rather than revenue profit, as the result of which the long term survival capability of the firms got challenged.Thus, it would not be right to say that during 1990s, dot-coms that focused on "hits" rather than revenues or profits had bad business plans.

4

Your instructor may assign additional problem-solving exercises (called memos) that require you to apply some of the tools you learned in this chapter to make a recommendation based on an actual business scenario. Some of these memos accompany the Time Warner case (pages 561-597 of your textbook). Additional memos, as well as data that may be useful for your analysis, are available online at www.mhhe.com/baye8e.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

5

A number of professional associations, such as the American Medical Association and the American Bar Association, support regulations that make it more costly for their members (for example, doctors and lawyers) to practice their services. While some of these regulations may stem from a genuine desire for higher- quality medical and legal services, self-interest may also play a role. Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

6

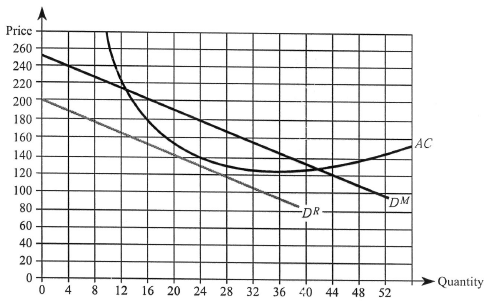

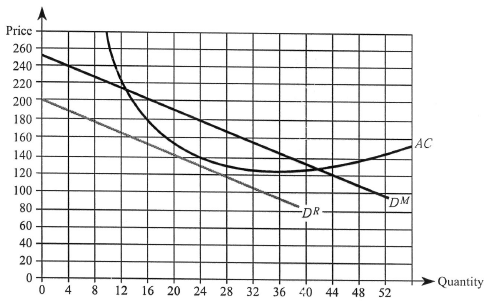

A potential entrant can produce at the same cost as the monopolist illustrated in the figure on the next page. The monopolist's demand curve is given by D M , and its average cost curve is AC.

a. What level of output does the monopolist have to produce in order for the entrant to face the residual demand curve, D R ?

b. How much profit will the monopolist earn if it commits to the output that generates the residual demand curve, D R ?

c. Can the monopolist profitably deter entry by committing to a different level of output? Explain.

a. What level of output does the monopolist have to produce in order for the entrant to face the residual demand curve, D R ?

b. How much profit will the monopolist earn if it commits to the output that generates the residual demand curve, D R ?

c. Can the monopolist profitably deter entry by committing to a different level of output? Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

7

Barnacle Industries was awarded a patent over 15 years ago for a unique industrial-strength cleaner that removes barnacles and other particles from the hulls of ships. Thanks to its monopoly position, Barnacle has earned more than $160 million over the past decade. Its customers-spanning the gamut from cruise lines to freighters-use the product because it reduces their fuel bills. The annual (inverse) demand function for Barnacle's product is given by P = 400 -.0005 Q, and Barnacle's cost function is given by C ( Q ) = 250 Q. Thanks to subsidies stemming from an energy bill passed by Congress nearly two decades ago, Barnacle does not have any fixed costs: The federal government essentially pays for the plant and capital equipment required to make this energy-saving product. Absent this subsidy, Barnacle's fixed costs would be about $4 million annually. Knowing that the company's patent will soon expire, Marge, Barnacle's manager, is concerned that entrants will qualify for the subsidy, enter the market, and produce a perfect substitute at an identical cost. With interest rates at 7 percent, Marge is considering a limit-pricing strategy. If you were Marge, what strategy would you pursue? Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

8

If your instructor has adopted Connect for the course and you are an active subscriber, you can practice with the questions presented above, along with many alternative versions of these questions. Your instructor may also assign a subset of these problems and/or their alternative versions as a homework assignment through Connect, allowing for immediate feedback of grades and correct answers.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

9

During the dot-com era, mergers among some brokerage houses resulted in the acquiring firm paying a premium on the order of $100 for each of the acquired firm's customers. Is there a business rationale for such a strategy? Do you think these circumstances are met in the brokerage business? Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

10

A monopolist earns $30 million annually and will maintain that level of profit indefinitely, provided that no other firm enters the market. However, if another firm enters the market, the monopolist will earn $30 million in the current period and $15 million annually thereafter. The opportunity cost of funds is 10 percent, and profits in each period are realized at the beginning of each period.

a. What is the present value of the monopolist's current and future earnings if entry occurs?

b. If the monopolist can earn $16 million indefinitely by limit pricing, should it do so? Explain.

a. What is the present value of the monopolist's current and future earnings if entry occurs?

b. If the monopolist can earn $16 million indefinitely by limit pricing, should it do so? Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

11

Argyle is a large, vertically integrated firm that manufactures sweaters from a rare type of wool produced on its sheep farms. Argyle has adopted a strategy of selling wool to companies that compete against it in the market for sweaters. Explain why this strategy may, in fact, be rational. Also, identify at least two other strategies that might permit Argyle to earn higher profits.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

12

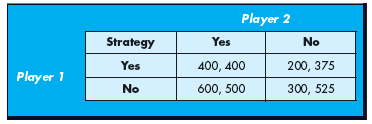

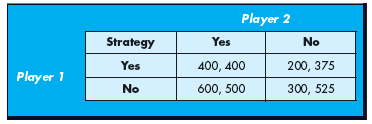

Consider the following simultaneous move game:

a. What is the maximum amount player 1 should be willing to pay for the opportunity to move first instead of moving at the same time as player 2? Explain carefully.

b. What is the maximum amount player 2 should be willing to spend to keep player 1 from getting to move first?

a. What is the maximum amount player 1 should be willing to pay for the opportunity to move first instead of moving at the same time as player 2? Explain carefully.

b. What is the maximum amount player 2 should be willing to spend to keep player 1 from getting to move first?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

13

You are the manager of 3D Designs-a large imaging company that does graphics and web design work for companies. You and your only competitor are contemplating the purchase of a new 3-D imaging device. If only one of you acquires the device, that firm will earn profits of $20 million and the other firm will lose $9 million. Unfortunately, there is only one 3-D imaging device in the world, and additional devices will not be available for the foreseeable future. Recognizing this fact, an opportunistic salesperson for the company that makes this device calls you. She indicates that, for an additional up-front payment of $23 million (not included in the above figures), her firm will deliver the device to your company's premises tomorrow. Otherwise, she'll call your competitor and offer it the same deal. Should you accept or decline her offer? Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

14

A firm is considering building a two-way network that links 12 users. The cost of building the network is $10,000.

a. How many potential connection services does this network provide?

b. If each user is willing to pay $150 to connect to the network, will the firm profit by building the network?

c. If each user is willing to pay an average of $12 for each potential connection service provided by the network, will the firm profit by building the network?

d. What happens to the number of potential connection services if one additional user joins the network?

a. How many potential connection services does this network provide?

b. If each user is willing to pay $150 to connect to the network, will the firm profit by building the network?

c. If each user is willing to pay an average of $12 for each potential connection service provided by the network, will the firm profit by building the network?

d. What happens to the number of potential connection services if one additional user joins the network?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

15

Bank 1 and Bank 2 are considering entering a compatibility agreement that would permit the users of each bank's ATMs access to the other bank's ATMs. Bank 1 has a network of branches and automated teller machines (ATMs) extending from Connecticut to Florida. Bank i's 12 million customers currently have access only to the 10,000 ATMs solely owned by the company on the East Coast. While Bank 2's core account holders are located on the West Coast and southwestern portion of the United States, the company is expanding to the East Coast. Bank 2 has 15 million customers who can use any of its 14,000 ATMs. Using the idea of network externalities, describe how such an agreement between Bank 1 and Bank 2 would benefit consumers.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

16

Two firms compete in a Cournot fashion. Firm 1 successfully engages in an activity that raises its rival's marginal cost of production.

a. Provide two examples of activities that might raise rivals' marginal costs.

b. In order for such strategies to be beneficial, is it necessary for the manager of firm 1 to enjoy hurting the rival? Explain.

a. Provide two examples of activities that might raise rivals' marginal costs.

b. In order for such strategies to be beneficial, is it necessary for the manager of firm 1 to enjoy hurting the rival? Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

17

By the end of 1995, Netscape's share of the browser market grew to 90 percent by continually upgrading its product to include new features such as e-mail and video capabilities. Shortly thereafter, Microsoft introduced and distributed a new version of its operating system that included its Internet Explorer browser at no cost. In addition, Microsoft allegedly imposed several restrictions on original equipment manufacturers (OEMs), Internet service providers (ISPs), and Internet content providers (ICPs) with the intention of (a) ensuring that almost every new computer had a version of Internet Explorer (IE) and (b) making it more difficult for consumers to get Netscape on new computers. On May 18, 1998, the government filed a complaint in District Court against Microsoft. Based on what you have learned in this chapter, briefly discuss the merits (if any) of the government's complaint against Microsoft.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

18

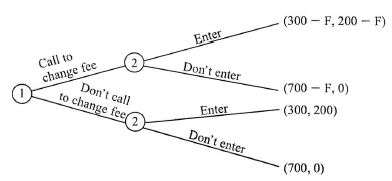

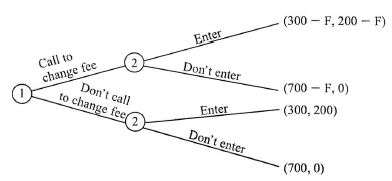

The market for taxi services in a Midwestern town is monopolized by firm 1. Currently, any taxi services firm must purchase a $40,000 "medallion" from the city in order to offer its services. A potential entrant (firm 2) is considering entering the market. Since entry would adversely affect firm l's profits, the owner of firm 1 is planning to call her friend (the mayor) to request that the city change the medallion fee by $ F thousand. The extensive form representation of the relevant issues is summarized in the accompanying graph (all payoffs are in thousands of dollars and include the current medallion fee of $40,000). Notice that when F 0, the medallion fee is increased and profits decline; when F 0, the fee is reduced and profits increase.

a.What are firm 1's profits if it does not call to change the fee (that is, if it opts for a strategy of maintaining the status quo)?

b. How much will firm 1 earn if it convinces the mayor to decrease the medallion fee by $40,000 ( F = ?$40) so that the medallion fee is entirely eliminated?

c. How much will firm 1 earn if it convinces the mayor to increase the medallion fee by $300,000 ( F = $300)?

d. Determine the change in the medallion fee that maximizes firm l's profits.

e. Do you think it will be politically feasible for the manager of firm 1 to implement the change in ( d )? Explain.

a.What are firm 1's profits if it does not call to change the fee (that is, if it opts for a strategy of maintaining the status quo)?

b. How much will firm 1 earn if it convinces the mayor to decrease the medallion fee by $40,000 ( F = ?$40) so that the medallion fee is entirely eliminated?

c. How much will firm 1 earn if it convinces the mayor to increase the medallion fee by $300,000 ( F = $300)?

d. Determine the change in the medallion fee that maximizes firm l's profits.

e. Do you think it will be politically feasible for the manager of firm 1 to implement the change in ( d )? Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

19

The CEO of a regional airline recently learned that its only competitor is suffering from a significant cash-flow constraint. The CEO realizes that its competitor's days are numbered, but has asked whether you would recommend the carrier significantly lower its airfares to "speed up the rival's exit from the market." Provide your recommendation.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

20

Two firms compete in a homogeneous product market where the inverse demand function is P = 20 - 5 Q (quantity is measured in millions). Firm 1 has been in business for one year, while firm 2 just recently entered the market. Each firm has a legal obligation to pay one year's rent of $2 million regardless of its production decision. Firm 1's marginal cost is $2, and firm 2's marginal cost is $10. The current market price is $15 and was set optimally last year when firm 1 was the only firm in the market. At present, each firm has a 50 percent share of the market.

a. Why do you think firm 1's marginal cost is lower than firm 2's marginal cost?

b. Determine the current profits of the two firms.

c. What would happen to each firm's current profits if firm 1 reduced its price to $10 while firm 2 continued to charge $15?

d. Suppose that, by cutting its price to $10, firm 1 is able to drive firm 2 completely out of the market. After firm 2 exits the market, does firm 1 have an incentive to raise its price? Explain.

e. Is firm 1 engaging in predatory pricing when it cuts its price from $15 to $10? Explain.

a. Why do you think firm 1's marginal cost is lower than firm 2's marginal cost?

b. Determine the current profits of the two firms.

c. What would happen to each firm's current profits if firm 1 reduced its price to $10 while firm 2 continued to charge $15?

d. Suppose that, by cutting its price to $10, firm 1 is able to drive firm 2 completely out of the market. After firm 2 exits the market, does firm 1 have an incentive to raise its price? Explain.

e. Is firm 1 engaging in predatory pricing when it cuts its price from $15 to $10? Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

21

Evaluate the following: "Since a rival's profit-maximizing price and output depend on its marginal cost and not its fixed costs, a firm cannot profitably lessen competition by implementing a strategy that raises its rival's fixed costs. "

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

22

In this chapter's Headline, we learned that Tom Jackson benefits by announcing well in advance his new marketing plan to target businesses. Suppose you are an executive at Morton's, and by lucky happenstance you learn of Tom's plans before he implements them. What plan of action should you take? Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

23

You are the manager of an international firm headquartered in Antarctica. You are contemplating a business tactic that will permit your firm to raise prices and increase profits in the long run by eliminating one of your competitors. Do you think it would make economic sense to expend resources on legal counsel before implementing your strategy? Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

24

In the following game, determine the maximum amount you would be willing to pay for the privilege of moving (a) first, (b) second, or (c) third: There are three players, you and two rivals. The player announcing the largest integer gets a payoff of $ 10, that announcing the second largest integer gets $0, and that announcing the third largest integer gets $5.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

25

UNIX is a powerful multiuser operating system designed for use with servers. UNIX's popularity has grown since it was developed by Bell Labs in 1969, as record numbers of users are logging onto the Internet. More recently, however, a branded version of another operating system has become available. This product, called Red Hat Linux, is a potential replacement for UNIX and other well-known operating systems. If you were in charge of pricing at Red Hat, what strategy would you pursue? Explain.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck