Deck 15: Corporate Taxation and Management Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/85

Play

Full screen (f)

Deck 15: Corporate Taxation and Management Decisions

1

Varying provincial tax rates on corporations and varying provincial dividends tax credits for individuals can result in imperfections in the integration system. Briefly explain how these imperfections can influence the decision to use a corporation to earn business income.

The goal of integration is to ensure that, when a corporation is used, the combined corporate and individual taxes paid will be same as those paid by an individual receiving the same income directly. For eligible dividends, the enhanced gross up and tax credit procedures are based on the assumption of a combined federal/provincial corporate tax rate of 27.54 percent. For non-eligible dividends, the gross up and tax credit procedures are based on the assumption of a combined federal/provincial corporate tax rate of 13.04 percent. If the actual combined rate exceeds these rates, it will discourage the use of a corporation. If the actual combined rate is less than these rates, use of a corporation becomes more attractive.

The other assumption that is inherent in the integration system is that the combined federal/provincial dividend tax credit will be equal to the gross up. For eligible dividends, the federal credit is equal to 6/11 of the gross up. For the combined credit to equal the gross up, the provincial credit must be equal to 5/11 of the gross up. For non-eligible dividends, the federal credit is equal to 9/13 of the gross up. For the combined credit here to equal the gross up, the provincial credit must be equal to 4/13 of the gross up. If the provincial credit exceeds these values, the combined credit exceeds the notional corporate taxes and makes the use of a corporation more attractive. Alternatively, if the provincial credit is less than these values, the credit does not compensate for corporate taxes paid and this discourages the use of a corporation.

The other assumption that is inherent in the integration system is that the combined federal/provincial dividend tax credit will be equal to the gross up. For eligible dividends, the federal credit is equal to 6/11 of the gross up. For the combined credit to equal the gross up, the provincial credit must be equal to 5/11 of the gross up. For non-eligible dividends, the federal credit is equal to 9/13 of the gross up. For the combined credit here to equal the gross up, the provincial credit must be equal to 4/13 of the gross up. If the provincial credit exceeds these values, the combined credit exceeds the notional corporate taxes and makes the use of a corporation more attractive. Alternatively, if the provincial credit is less than these values, the credit does not compensate for corporate taxes paid and this discourages the use of a corporation.

2

Provide two examples of management compensation that can either reduce or defer the taxation applicable to a corporation and its shareholders. For each example, explain how the reduction or deferral occurs.

The required two examples can be selected from the following items listed in the text:

• Registered Pension Plans - Within prescribed limits, a corporation can deduct contributions to Registered Pension Plans in the year of contribution. These contributions will not become taxable to the employee until they are received as a pension benefit, resulting in an effective tax deferral arrangement.

• Deferred Profit Sharing Plans - In a fashion similar to Registered Pension Plans, amounts that are currently deductible to the corporation are deferred with respect to inclusion in the employee's Taxable Income.

• Provision Of Private Health Care Plans - The premiums paid by the corporation for such benefits as dental plans can be deducted in full by the corporation and will not be considered a taxable benefit to the employee. This can generate a significant tax savings.

• Stock Options - Stock options provide employees with an incentive to improve the performance of the enterprise. In addition, taxation of any benefits resulting from the options is deferred until they are exercised or sold. (For a full discussion of the deferral of stock option benefits, see Chapter 3.)Further, the value of the employment benefit received is enhanced by the fact that, in general, one-half of the amount can be deducted in the calculation of Taxable Income.

Other examples may be acceptable.

• Registered Pension Plans - Within prescribed limits, a corporation can deduct contributions to Registered Pension Plans in the year of contribution. These contributions will not become taxable to the employee until they are received as a pension benefit, resulting in an effective tax deferral arrangement.

• Deferred Profit Sharing Plans - In a fashion similar to Registered Pension Plans, amounts that are currently deductible to the corporation are deferred with respect to inclusion in the employee's Taxable Income.

• Provision Of Private Health Care Plans - The premiums paid by the corporation for such benefits as dental plans can be deducted in full by the corporation and will not be considered a taxable benefit to the employee. This can generate a significant tax savings.

• Stock Options - Stock options provide employees with an incentive to improve the performance of the enterprise. In addition, taxation of any benefits resulting from the options is deferred until they are exercised or sold. (For a full discussion of the deferral of stock option benefits, see Chapter 3.)Further, the value of the employment benefit received is enhanced by the fact that, in general, one-half of the amount can be deducted in the calculation of Taxable Income.

Other examples may be acceptable.

3

Provinces have sometimes declared a tax holiday (i.e., a period in which no provincial taxes will be assessed)for new Canadian controlled private corporations that start up business operations within their boundaries. The province's objective in granting this tax free period is to encourage economic growth and employment within the province. Describe the impact of such tax holidays on the type of compensation that will be used for the owner-manager of the business. Explain your conclusion.

The effect of a provincial tax holiday for a Canadian controlled private corporation is to reduce the overall tax rate on the first $500,000 of active business income to 9 percent (38% - 10% - 19% + 0%). This is 3.04 percent below the 13.04 percent rate that is assumed in the integration provisions and, as a consequence, the tax deduction associated with salary payments would be less significant. Without considering other factors, the presence of a provincial tax holiday would favour the use of dividend payments to the owner-manager over the use of salary compensation.

4

Frank Labelle has an unincorporated business that produces just enough income to meet his personal consumption needs. He anticipates that its income will exceed his consumption needs in the foreseeable future. Will he save taxes by incorporating? Will he defer taxes by incorporating? Explain your conclusions.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

5

An individual has started a new business. While he is confident that, in the long run, it will be very profitable, he expects the business to incur losses in the first 3 to 5 years of operation. Would you advise this person to operate this business as a proprietorship or, alternatively, incorporate the business?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

6

Jessica Simsung has 2 children over the age of 20. While Ms. Simsung has several million dollars invested in shares of public companies that earn a substantial rate of return through dividends, her children have no income of their own. Ms. Simsung has employment income which places her in the maximum tax bracket. Describe briefly how Ms. Simsung could use a corporation to split income with her children.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

7

In making management compensation decisions, how does the owner-manager environment differ from that of a publicly traded company?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

8

Under what circumstances would income splitting become an effective tax planning strategy? Explain your conclusion.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

9

If the owner-manager of a private corporation is provided with a loan by his corporation to assist in acquiring a residence, he will not have to include the principal amount in income if he can demonstrate that he received the loan in his capacity as an employee, rather than as a shareholder of the corporation. Explain why this may be difficult for him to do.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

10

An individual with no other source of income can receive almost $29,000 in non-eligible dividends without incurring any tax liability. In contrast, such an individual would start paying taxes after receiving only $13,229 in interest income. Explain this difference in treatment of the two types of income for 2020.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

11

What is "bonusing down"? What is the advantage that results from the use of this tax planning technique?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

12

One of the advantages that is cited for the use of a corporation is limited liability. Explain this concept and indicate whether you believe that it is an advantage for a small private corporation with a single shareholder.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

13

Indicate the conditions that are necessary for integration to work for income flowed through a large public company.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

14

Briefly describe the two basic types of tax benefits that can arise through the incorporation of a business.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

15

The general rule for shareholder loans is that they must be included in the shareholder's income when received. Indicate two exceptions to this general rule that are available to all shareholders, without regard to whether they are employees as well as shareholders.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

16

Ms. Copeland has invested in the common shares of a number of large Canadian public companies, all of which pay eligible dividends. She has no intention of selling the shares in the foreseeable future. She has asked your advice as to whether there would be either tax deferral or tax savings if she transferred these shares to a private company. She would be the only shareholder of this new company. Ms. Copeland has sufficient other sources of income that she is in the 29 percent federal tax bracket. She lives in a province where her marginal tax rate is 12 percent and the provincial dividend tax credit on both eligible and non-eligible dividends is equal to 25 percent of the dividend gross up.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

17

John Brothers is a shareholder of Brothers Ltd. He is also considered to be an employee. Brothers Ltd. provides John with an interest free loan to assist him in purchasing a home after being moved to a new work location. Explain why John would prefer to have his loan benefit assessed to him as an employee, rather than as a shareholder.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

18

For a CCPC paying eligible dividends, perfect integration occurs which the combined federal/provincial corporate tax rate is 27.54 percent and the combined federal/provincial dividend tax credit is equal to the dividend gross up. Briefly explain how rates that differ from these alter the desirability of using a corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

19

For an individual in the maximum tax bracket, channeling income through a corporation can result in tax deferral. Depending on corporate tax rates, this may or may not be beneficial to the individual. Explain this statement.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

20

One of your friends, who is the sole shareholder of a private corporation, has decided that it would be a good idea to have his company pay for a swimming pool at his personal residence. He has concluded that this would be better than paying himself sufficient salary to construct the pool with his own funds. Do you agree? Explain your conclusion.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

21

Even in situations where provincial tax and dividend tax credit rates favour the use of dividends, owner-managers may retain more after tax income if they receive some part of their compensation in the form of salary. Explain this statement.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

22

If an owner-manager wishes to make contributions to an RRSP, he will prefer to have dividend compensation, rather than salary compensation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

23

List and describe three factors, other than tax reduction and tax deferral, that should be considered by an owner-manager when choosing between salary compensation and the receipt of dividends.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

24

In cases where a corporation is subject to a low tax rate (e.g., a combined federal/provincial rate of 11 percent), charitable donations have less value to a corporation than they do to an individual.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

25

An advantage of incorporation is the ability to use business losses against an individual's other sources of income.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements about the use of a corporation is NOT correct?

A)The use of a corporation is more desirable in a province with a high dividend tax credit.

B)The use of a corporation will always result in deferral of taxes on income that is left in the corporation.

C)The use of a corporation is less desirable in a province with a low dividend tax credit.

D)The use of a corporation is more desirable in a province that has high tax rates on individuals.

A)The use of a corporation is more desirable in a province with a high dividend tax credit.

B)The use of a corporation will always result in deferral of taxes on income that is left in the corporation.

C)The use of a corporation is less desirable in a province with a low dividend tax credit.

D)The use of a corporation is more desirable in a province that has high tax rates on individuals.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

27

"Bonusing Down" is a procedure that owner-managers use to defer taxes on the salary amounts that they receive from their corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

28

Jo Beth Williams works for the Royal Bank and is also a shareholder of the company. The bank has extended her a $25,000 interest free loan that she can use for any purposes she chooses. Because she is a shareholder, she will have to include the $25,000 principal of the loan in her Net Income For Tax Purposes.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

29

If the owner/manager of a CCPC has a large Cumulative Net Investment Loss (CNIL)balance, he should pay himself dividends rather than salary.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

30

All other things being equal, a low provincial dividend tax credit favours the use of dividends to compensate the owner/manager of a CCPC.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

31

An owner-manager of a construction company would like to have a swimming pool installed at his personal residence. It doesn't really matter whether he has his corporation build it for him or, alternatively pay him sufficient salary to build the pool on his own.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

32

Any resident Canadian individual over the age of 17 can receive almost $29,000 in non-eligible dividends from a CCPC without paying any taxes.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

33

Individuals with no other source of income can receive a substantial amount of dividends on a tax free basis. This is because dividend income uses up an individual's tax credits at a lower rate than is the case with other sources of income.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

34

A shareholder loan that is for the purposes of acquiring a personal residence does not have to be included in the shareholder's Net Income For Tax Purposes, provided he has received the loan because he is an employee of the corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is NOT a possible advantage of incorporating a business?

A)The ability to defer taxes on income left in the business.

B)The ability to absorb business losses against employment income.

C)Limiting personal liability to the amount paid for shares.

D)The ability to use the lifetime capital gains deduction.

A)The ability to defer taxes on income left in the business.

B)The ability to absorb business losses against employment income.

C)Limiting personal liability to the amount paid for shares.

D)The ability to use the lifetime capital gains deduction.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

36

Any form of compensation that is deductible by the corporation in a fiscal year prior to the year it is included in the income of the shareholder involves tax deferral.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

37

For eligible dividends, perfect integration requires that the provincial dividend tax credit be equal to 5/11 of the dividend gross. If the provincial credit is larger than this, the use of a corporation will be less attractive.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

38

All other things being equal, higher provincial tax rates on corporations favour the use of a corporation to earn business income.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

39

The use of a corporation can facilitate splitting income with other members of an individual's family.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

40

Income splitting refers to procedures which are designed to spread an individual's Taxable Income over several taxation years.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following factors is NOT relevant in determining whether a corporation can be used to reduce taxes?

A)The combined federal/provincial tax rate on corporations.

B)The combined federal/provincial dividend tax credit.

C)The combined federal/provincial tax rate on individuals.

D)All of the above factors are relevant in determining whether a corporation can be used to reduce taxes.

A)The combined federal/provincial tax rate on corporations.

B)The combined federal/provincial dividend tax credit.

C)The combined federal/provincial tax rate on individuals.

D)All of the above factors are relevant in determining whether a corporation can be used to reduce taxes.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

42

The use of a corporation to provide tax deferral is most successful when:

A)the combined federal/provincial tax rate on corporations is greater than the combined federal/provincial tax rate on individuals.

B)the combined federal/provincial tax rate on corporations is less than the combined federal/provincial tax rate on individuals.

C)the combined federal/provincial tax rate on corporations is equal to the combined federal/provincial tax rate on individuals.

D)the combined federal/provincial dividend tax credit rates add up to 100% of the dividend gross up.

A)the combined federal/provincial tax rate on corporations is greater than the combined federal/provincial tax rate on individuals.

B)the combined federal/provincial tax rate on corporations is less than the combined federal/provincial tax rate on individuals.

C)the combined federal/provincial tax rate on corporations is equal to the combined federal/provincial tax rate on individuals.

D)the combined federal/provincial dividend tax credit rates add up to 100% of the dividend gross up.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

43

The general rule is that loans made to shareholders must be included in the shareholder's income in the year that the proceeds are received. There are, however, a number of exceptions to this rule. Which of the following is NOT an exception to the general rule?

A)A loan to an owner-manager to allow him to purchase a personal residence. The loan does not have a specific repayment date.

B)An interest free loan to a shareholder of a bank.

C)A loan to an owner-manager to acquire an automobile that he will use in working for the company. The company has no other employees.

D)A loan extended to an owner manager that must be repaid within two years. The company has a December 31 year end and the loan is extended on January 1 of the current year.

A)A loan to an owner-manager to allow him to purchase a personal residence. The loan does not have a specific repayment date.

B)An interest free loan to a shareholder of a bank.

C)A loan to an owner-manager to acquire an automobile that he will use in working for the company. The company has no other employees.

D)A loan extended to an owner manager that must be repaid within two years. The company has a December 31 year end and the loan is extended on January 1 of the current year.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

44

While of the following statement about income splitting is NOT correct?

A)For income splitting to be a useful tax planning tool, the related individuals must be in different tax brackets.

B)Income splitting can only be accomplished by using a corporation.

C)Income splitting may be accomplished by giving shares in an owner-managed corporation to adult children who are in a low tax bracket.

D)Income splitting can be accomplished by selling shares in an owner-managed corporation to the owner-manager's spouse.

A)For income splitting to be a useful tax planning tool, the related individuals must be in different tax brackets.

B)Income splitting can only be accomplished by using a corporation.

C)Income splitting may be accomplished by giving shares in an owner-managed corporation to adult children who are in a low tax bracket.

D)Income splitting can be accomplished by selling shares in an owner-managed corporation to the owner-manager's spouse.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following factors is NOT significant in contributing to imperfections in the integration system for corporate taxes?

A)Varying provincial rates for the dividend tax credit.

B)Varying provincial rates for corporate taxes on CCPCs.

C)Differing federal dividend tax rates for eligible and non-eligible dividends.

D)Varying provincial rates for corporate taxes on public companies.

A)Varying provincial rates for the dividend tax credit.

B)Varying provincial rates for corporate taxes on CCPCs.

C)Differing federal dividend tax rates for eligible and non-eligible dividends.

D)Varying provincial rates for corporate taxes on public companies.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

46

The use of a corporation is most likely to result in a reduction in total taxes if:

A)the corporation is a public company earning manufacturing income.

B)the corporation is a CCPC earning dividends.

C)the corporation is a CCPC earning investment income.

D)the corporation is a CCPC earning active business income.

A)the corporation is a public company earning manufacturing income.

B)the corporation is a CCPC earning dividends.

C)the corporation is a CCPC earning investment income.

D)the corporation is a CCPC earning active business income.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

47

With respect to the incorporation of a proprietorship earning less than $500,000 of active business income, which of the following statements is correct?

A)Incorporation will always result in an overall reduction in taxes because it combines the small business deduction with the dividend tax credit.

B)Incorporation will result in an overall reduction in taxes because corporations are able to deduct many items that cannot be deducted by an unincorporated business.

C)Incorporation will result in a deferral of taxes to the extent profits can be left in the corporation.

D)Incorporation will be beneficial because it will always limit the shareholders' obligations to creditors.

A)Incorporation will always result in an overall reduction in taxes because it combines the small business deduction with the dividend tax credit.

B)Incorporation will result in an overall reduction in taxes because corporations are able to deduct many items that cannot be deducted by an unincorporated business.

C)Incorporation will result in a deferral of taxes to the extent profits can be left in the corporation.

D)Incorporation will be beneficial because it will always limit the shareholders' obligations to creditors.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

48

Joan Farnun has employment income of about $100,000. This employment income is sufficient to cover her personal living expenses. In addition, she operates a consulting business which earns about $50,000 per year. She is considering the incorporation of the consulting business. With respect to the incorporation, which of the following statements is correct?

A)There will be an overall tax savings because of the small business deduction.

B)There will be an overall tax savings because of the dividend tax credit.

C)There will be tax deferral because of the small business deduction.

D)There will be no tax deferral because of the integration provisions in the Income Tax Act.

A)There will be an overall tax savings because of the small business deduction.

B)There will be an overall tax savings because of the dividend tax credit.

C)There will be tax deferral because of the small business deduction.

D)There will be no tax deferral because of the integration provisions in the Income Tax Act.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

49

An individual's only source of income is dividends from public companies. He is considering transferring the public company shares to a corporation. If he was to do so, which of the following statements is correct?

A)There would be a reduction in the total taxes paid.

B)There would always be deferral of taxes as long as the dividend income was left in the corporation.

C)All of the federal corporate taxes paid on the dividends would be refunded when all of the dividends received by the corporation are paid out to the individual.

D)The individual taxes on the dividends would be lower after they have passed through the corporation.

A)There would be a reduction in the total taxes paid.

B)There would always be deferral of taxes as long as the dividend income was left in the corporation.

C)All of the federal corporate taxes paid on the dividends would be refunded when all of the dividends received by the corporation are paid out to the individual.

D)The individual taxes on the dividends would be lower after they have passed through the corporation.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

50

There are several benefits to incorporating a business. Which of the following groups of statements about benefits is correct?

A)Investment income under $500,000 is eligible for a lower tax rate; dividend payments may be deferred until after a shareholder has retired; and a lifetime capital gains deduction may be available if conditions are met.

B)Active business income under $500,000 is eligible for a lower tax rate; taxable benefits may be provided to the shareholder if he is also an employee; and dividend payments may be deferred until after a shareholder has retired.

C)A lifetime capital gains deduction may be available if conditions are met; a tax deferral is available if the shareholder requires the corporation's profits for personal use in the year; and dividend payments may be deferred until after a shareholder has retired.

D)Dividend payments may be deferred until after a shareholder has retired; a lifetime capital gains deduction may be available if conditions are met; and active business income under $500,000 is eligible for a lower tax rate.

A)Investment income under $500,000 is eligible for a lower tax rate; dividend payments may be deferred until after a shareholder has retired; and a lifetime capital gains deduction may be available if conditions are met.

B)Active business income under $500,000 is eligible for a lower tax rate; taxable benefits may be provided to the shareholder if he is also an employee; and dividend payments may be deferred until after a shareholder has retired.

C)A lifetime capital gains deduction may be available if conditions are met; a tax deferral is available if the shareholder requires the corporation's profits for personal use in the year; and dividend payments may be deferred until after a shareholder has retired.

D)Dividend payments may be deferred until after a shareholder has retired; a lifetime capital gains deduction may be available if conditions are met; and active business income under $500,000 is eligible for a lower tax rate.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

51

GMR Inc is a corporation owned 100 percent by Ms. Rothstein. For the current year, the company accountant is predicting that taxable income will exceed $500,000. The accountant has suggested that Ms. Rothstein should consider paying herself an additional salary to ensure the taxable income of her CCPC will be less than $500,000. Why?

A)Because only income eligible for the small business deduction benefits from a modest tax deferral and significant tax savings.

B)Because the CRA will never challenge the reasonableness of remuneration to a shareholder, and the accountant must feel that Ms. Rothstein deserves a bonus this year.

C)Because if the income over $500,000 remains in the company it will not benefit from the small business deduction, and therefore after tax retention on this excess income in the company will be lower than it would be on paying a salary to Ms. Rothstein.

D)Because the case for "bonusing down" has gotten stronger in the past few years, and it is therefore more important than ever to take advantage of this possibility to save taxes.

A)Because only income eligible for the small business deduction benefits from a modest tax deferral and significant tax savings.

B)Because the CRA will never challenge the reasonableness of remuneration to a shareholder, and the accountant must feel that Ms. Rothstein deserves a bonus this year.

C)Because if the income over $500,000 remains in the company it will not benefit from the small business deduction, and therefore after tax retention on this excess income in the company will be lower than it would be on paying a salary to Ms. Rothstein.

D)Because the case for "bonusing down" has gotten stronger in the past few years, and it is therefore more important than ever to take advantage of this possibility to save taxes.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

52

Paul is one of six shareholders, but not an employee, of a Canadian controlled private corporation that manufactures doors. The corporation has a large amount of cash on hand and the other shareholders have agreed that the corporation can lend him $200,000 for a few years. To avoid having the principal included in his Taxable Income, the loan must meet which of the following conditions?

A)Interest must be made at the rate prescribed by the Regulations to the Income Tax Act.

B)It must be for the purchase of the company's shares.

C)It must be repaid within one year of the end of the fiscal year in which it was made.

D)It must have a specific repayment date.

A)Interest must be made at the rate prescribed by the Regulations to the Income Tax Act.

B)It must be for the purchase of the company's shares.

C)It must be repaid within one year of the end of the fiscal year in which it was made.

D)It must have a specific repayment date.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements with respect to tax free dividends is correct?

A)Any individual can receive a significant amount of eligible dividends without the payment of taxes on the amounts received.

B)For an individual in the lowest tax bracket, the dividend tax credit will be larger than the Tax Payable on the grossed up dividends.

C)To be received on a tax free basis, dividends must be designated as eligible.

D)For individuals in the lowest tax bracket, dividends always use up tax credits at a slower rate than other types of income.

A)Any individual can receive a significant amount of eligible dividends without the payment of taxes on the amounts received.

B)For an individual in the lowest tax bracket, the dividend tax credit will be larger than the Tax Payable on the grossed up dividends.

C)To be received on a tax free basis, dividends must be designated as eligible.

D)For individuals in the lowest tax bracket, dividends always use up tax credits at a slower rate than other types of income.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

54

Taxpayers decide to incorporate for many reasons. In which of the following situations would there be an advantage to a taxpayer in incorporating a business?

A)The taxpayer has significant personal losses and is looking for a way to utilize them.

B)The taxpayer has significant personal assets and investment income, and does not need all of the cash from her business in order to pay day to day living expenses.

C)The taxpayer has significant personal assets and investment income, and needs all of the cash from her business in order to pay day to day living expenses.

D)The taxpayer makes significant charitable donations each year and wants to use a corporation to maximize the tax savings from these donations.

A)The taxpayer has significant personal losses and is looking for a way to utilize them.

B)The taxpayer has significant personal assets and investment income, and does not need all of the cash from her business in order to pay day to day living expenses.

C)The taxpayer has significant personal assets and investment income, and needs all of the cash from her business in order to pay day to day living expenses.

D)The taxpayer makes significant charitable donations each year and wants to use a corporation to maximize the tax savings from these donations.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

55

Mr. Dawson is considering incorporating a company and transferring some of his assets into this company in order to take advantage of the possibility of some tax savings and deferral possibilities. Which of the following situations would provide the largest tax savings for Mr. Dawson?

A)Incorporating a CCPC earning only Active Business Income eligible for the small business deduction.

B)Incorporating a CCPC earning a 50/50 combination of Active Business Income eligible for the small business deduction and investment income.

C)Incorporating a CCPC earning only investment income.

D)Incorporating a CCPC earning only dividend income.

A)Incorporating a CCPC earning only Active Business Income eligible for the small business deduction.

B)Incorporating a CCPC earning a 50/50 combination of Active Business Income eligible for the small business deduction and investment income.

C)Incorporating a CCPC earning only investment income.

D)Incorporating a CCPC earning only dividend income.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

56

Jacquie is the sole shareholder of Holdings Ltd., which has a January 31 year end. On January 1, 2020, Jacquie borrowed $10,000 on an interest-free basis from Holdings Ltd. She used $8,000 of this amount to acquire shares of Arrow Inc. and the remaining $2,000 for personal purposes. Arrow Inc. is a small Canadian controlled private company that manufactures cross-bows. In March 2020, Arrow Inc. paid a non-eligible dividend of $1,100 to Jacquie. Jacquie repaid her $10,000 loan to Holdings Ltd. on June 30, 2020. Assume that these were her only transactions with Holdings Ltd. and the prescribed interest rate was 4 percent for the first quarter of 2020 and 3 percent for the second quarter. Which one of the following represents Jacquie's 2020 Taxable Income as a result of these transactions?

A)$1,100.00.

B)$1,265.00.

C)$1,299.68.

D)$1,438.42.

A)$1,100.00.

B)$1,265.00.

C)$1,299.68.

D)$1,438.42.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

57

Joan Barskey acquired 4,500 shares in Barskey Inc., a corporation that is controlled by her family. The cost of these shares was $900,000. In addition, she has personally guaranteed a bank loan for Barskey Inc. in the amount of $250,000. If Barskey Inc. goes bankrupt, which of the following statements is correct?

A)Joan's financial risk is limited to $1,150,000.

B)Joan's financial risk is limited to $900,000.

C)Joan's financial risk is limited to $250,000.

D)Joan's financial risk is unlimited.

A)Joan's financial risk is limited to $1,150,000.

B)Joan's financial risk is limited to $900,000.

C)Joan's financial risk is limited to $250,000.

D)Joan's financial risk is unlimited.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

58

Albert Jay is an employee and 15 percent shareholder of Rick's Welding Shop Ltd. (Rick's). During the 2020 calendar year, Albert Jay was having cash flow problems. Rick's gave Albert Jay a loan of $5,000 on May 1, 2020 to help him out. Rick's also gave Albert Jay's son, Jake, a loan of $2,000 on September 30, 2020 to help him meet expenses while at college. Rick's has said that Albert Jay and Jake can repay the loans whenever they can afford it. The loans remain outstanding as at January 31, 2021. Rick's year end for accounting and taxation purposes is December 31. How much, and in which taxation year, is Albert Jay required to include in his Taxable Income as a result of the above transactions?

A)$5,000 - 2020.

B)$5,000 - 2021.

C)$7,000 - 2020.

D)$7,000 - 2021.

E)None of the above.

A)$5,000 - 2020.

B)$5,000 - 2021.

C)$7,000 - 2020.

D)$7,000 - 2021.

E)None of the above.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

59

An individual owns a retail business that is unincorporated. The business earns about $150,000 per year, all of which is needed by the individual for his personal living expenses. The individual is considering incorporating this business. Which of the following statements is correct?

A)There can be a small tax advantage associated with incorporation.

B)The application of the small business deduction will result in a significant reduction in overall taxes.

C)The application of the small business deduction will result in a significant deferral of tax payments.

D)The application of the gross up and tax credit procedures for dividends will result in a significant reduction in overall taxes.

A)There can be a small tax advantage associated with incorporation.

B)The application of the small business deduction will result in a significant reduction in overall taxes.

C)The application of the small business deduction will result in a significant deferral of tax payments.

D)The application of the gross up and tax credit procedures for dividends will result in a significant reduction in overall taxes.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

60

John is thinking about incorporating his charter boat business. Which of the following describes an advantage that could be associated with incorporating the business as compared to running it as a proprietorship?

A)John could use any future business losses to offset his taxable employment income.

B)John could protect himself from being held personally liable if a client sustained injuries by falling overboard.

C)John could hire his brother to pilot the boat on days when he is not available. His brother's salary would be deductible in calculating the corporation's income.

D)John will not pay CPP on any salary paid to him by the corporation if he owns more than 40 percent of the voting shares.

A)John could use any future business losses to offset his taxable employment income.

B)John could protect himself from being held personally liable if a client sustained injuries by falling overboard.

C)John could hire his brother to pilot the boat on days when he is not available. His brother's salary would be deductible in calculating the corporation's income.

D)John will not pay CPP on any salary paid to him by the corporation if he owns more than 40 percent of the voting shares.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

61

Lisgar Ltd. is a CCPC with a December 31 year end. For the 2020 taxation year, it has Taxable Income, before consideration of dividends or salary paid to its sole shareholder, of $325,000. All of this income is from active business activities. Its available cash balance is also equal to $325,000.

Harry Lisgar is the only shareholder of Lisgar Ltd. His only income is either salary or dividends from Lisgar Ltd and he has tax credits of $4,550.

In his province of residence, assume:

• The corporate tax rate is 3 percent on income eligible for the small business deduction.

• The corporate tax rate is 13 percent on other income.

• Personal provincial Tax Payable on the first $214,368 is $27,000. The rate on additional amounts is 18 percent.

• The dividend tax credit is 25 percent of the dividend gross up for non-eligible dividends.

Determine the amount of after tax cash that Mr. Lisgar will retain if the maximum salary is paid by the corporation out of the available cash of $325,000. Ignore CPP contributions and the Canada employment tax credit.

Harry Lisgar is the only shareholder of Lisgar Ltd. His only income is either salary or dividends from Lisgar Ltd and he has tax credits of $4,550.

In his province of residence, assume:

• The corporate tax rate is 3 percent on income eligible for the small business deduction.

• The corporate tax rate is 13 percent on other income.

• Personal provincial Tax Payable on the first $214,368 is $27,000. The rate on additional amounts is 18 percent.

• The dividend tax credit is 25 percent of the dividend gross up for non-eligible dividends.

Determine the amount of after tax cash that Mr. Lisgar will retain if the maximum salary is paid by the corporation out of the available cash of $325,000. Ignore CPP contributions and the Canada employment tax credit.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

62

Martin Locks owns 100 percent of the shares of Locks Inc., a corporation with a December 31 year end. In January 2019, the corporation loans Martin $350,000 in order to assist him in acquiring a new principal residence. The loan is interest free and will be paid back on January 1, 2021. While small loans are made to other employees of the Company, a loan of this size is only available to Martin. Assume that the prescribed rate is 4 percent throughout 2019 and 5 percent throughout 2020. Which of the following statements is correct?

A)Martin will have to include $350,000 in his 2019 Net Income For Tax Purposes.

B)Martin will have to include $14,000 in his Net Income For Tax Purposes in both 2019 and 2020.

C)Martin will have to include $14,000 in his Net Income For Tax Purposes for 2019 and $17,500 in his Net Income For Tax Purposes for 2020.

D)Martin will have an inclusion in his 2019 Net Income For Tax Purposes, only if the loan is not repaid on December 30, 2020.

A)Martin will have to include $350,000 in his 2019 Net Income For Tax Purposes.

B)Martin will have to include $14,000 in his Net Income For Tax Purposes in both 2019 and 2020.

C)Martin will have to include $14,000 in his Net Income For Tax Purposes for 2019 and $17,500 in his Net Income For Tax Purposes for 2020.

D)Martin will have an inclusion in his 2019 Net Income For Tax Purposes, only if the loan is not repaid on December 30, 2020.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

63

Wanda Ho has employment income in excess of $300,000 per year. Because of this, any additional income that she receives will be subject to a combined federal/provincial tax rate of 51 percent. Several years ago, she established an unincorporated business that she anticipates will have active business income of $142,000 for the taxation year ending December 31, 2020.

In her province of residence:

• the corporate tax rate is 2.5 percent on income eligible for the small business deduction

• the corporate tax rate is 13 percent on other income

• the dividend tax credit is 20 percent of the dividend gross up for non-eligible dividends

• the dividend tax credit is 30 percent of the dividend gross up for eligible dividends

Ms. Ho has asked your advice as to whether she should incorporate this business. Advise her with respect to any tax deferral that will be available on income left in the corporation and on any tax savings that will be available if all of the income is paid out in dividends.

In her province of residence:

• the corporate tax rate is 2.5 percent on income eligible for the small business deduction

• the corporate tax rate is 13 percent on other income

• the dividend tax credit is 20 percent of the dividend gross up for non-eligible dividends

• the dividend tax credit is 30 percent of the dividend gross up for eligible dividends

Ms. Ho has asked your advice as to whether she should incorporate this business. Advise her with respect to any tax deferral that will be available on income left in the corporation and on any tax savings that will be available if all of the income is paid out in dividends.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

64

Cloister Inc. is a Canadian controlled private corporation with a December 31 year end. For the 2020 taxation year, Cloister Inc. has Taxable Income, before consideration of dividends or salary paid to its sole shareholder, of $197,000. All of its income has always been from active business activities. The cash balance of the Company, prior to any payments on the current year's taxes, is also equal to this amount.

Its only shareholder, Ms. Sally Cloister, has no income other than the dividends or salary paid by the corporation and has combined personal tax credits of $3,375.

In her province of residence, assume:

• The corporate tax rate is 3 percent on income eligible for the small business deduction.

• The corporate tax rate is 14 percent on other income.

• Personal provincial Tax Payable on the first $150,473 is $16,000. The rate on additional amounts is 12 percent.

• The dividend tax credit is 4/13 of the dividend gross up for non-eligible dividends.

Determine the amount of after tax cash that Ms. Cloister will retain if the maximum dividend is paid by the corporation out of the available cash of $197,000.

Its only shareholder, Ms. Sally Cloister, has no income other than the dividends or salary paid by the corporation and has combined personal tax credits of $3,375.

In her province of residence, assume:

• The corporate tax rate is 3 percent on income eligible for the small business deduction.

• The corporate tax rate is 14 percent on other income.

• Personal provincial Tax Payable on the first $150,473 is $16,000. The rate on additional amounts is 12 percent.

• The dividend tax credit is 4/13 of the dividend gross up for non-eligible dividends.

Determine the amount of after tax cash that Ms. Cloister will retain if the maximum dividend is paid by the corporation out of the available cash of $197,000.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

65

Victor Vice is a very conservative investor who only invests in fixed income securities. He anticipates that he will have interest income of $210,000 for the year ending December 31, 2020. As he has employment income of more than $400,000 per year, any additional income is taxed at a combined federal/provincial rate of 51 percent.

In his province of residence:

• the corporate tax rate is 3 percent on income eligible for the small business deduction

• the corporate tax rate is 13 percent on other income

• the dividend tax credit is 30 percent of the dividend gross up for non-eligible dividends

Mr. Vice has asked your advice as to whether he should transfer his interest bearing investments to a corporation in which he would own all of the shares. Advise him with respect to any tax deferral that could be available on income left in the corporation and on any tax savings that could be available if all of the income is paid out in dividends.

In his province of residence:

• the corporate tax rate is 3 percent on income eligible for the small business deduction

• the corporate tax rate is 13 percent on other income

• the dividend tax credit is 30 percent of the dividend gross up for non-eligible dividends

Mr. Vice has asked your advice as to whether he should transfer his interest bearing investments to a corporation in which he would own all of the shares. Advise him with respect to any tax deferral that could be available on income left in the corporation and on any tax savings that could be available if all of the income is paid out in dividends.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

66

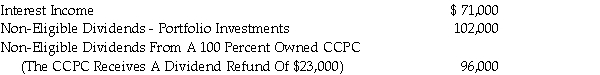

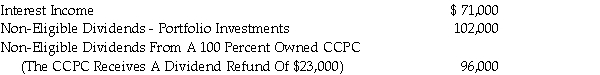

Maximilian Maximus has employment income in excess of $300,000. This means that any additional income will be taxed at a combined federal/provincial rate of 51 percent.

For the year ending December 31, 2020, in addition to his employment income, Max has the following amounts of investment income: Because of his extensive use of recreational drugs, Max requires all of the income that is produced by these investments (and then some).

Because of his extensive use of recreational drugs, Max requires all of the income that is produced by these investments (and then some).

In his province of residence:

• the corporate tax rate is 2.5 percent on income eligible for the small business deduction

• the corporate tax rate is 12 percent on other income

• the dividend tax credit is 4/13 percent of the dividend gross up for non-eligible dividends

Max has asked your advice as to whether there would be any tax benefits associated with transferring his investments to a corporation. Provide the requested advice, including an explanation of your conclusions.

For the year ending December 31, 2020, in addition to his employment income, Max has the following amounts of investment income:

Because of his extensive use of recreational drugs, Max requires all of the income that is produced by these investments (and then some).

Because of his extensive use of recreational drugs, Max requires all of the income that is produced by these investments (and then some).In his province of residence:

• the corporate tax rate is 2.5 percent on income eligible for the small business deduction

• the corporate tax rate is 12 percent on other income

• the dividend tax credit is 4/13 percent of the dividend gross up for non-eligible dividends

Max has asked your advice as to whether there would be any tax benefits associated with transferring his investments to a corporation. Provide the requested advice, including an explanation of your conclusions.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following types of owner-manager compensation is the least likely to provide either tax deferral or tax savings?

A)Contributions to a registered pension plan.

B)Contributions to a group disability plan

C)Granting options to acquire shares in the company.

D)Salary payments.

A)Contributions to a registered pension plan.

B)Contributions to a group disability plan

C)Granting options to acquire shares in the company.

D)Salary payments.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

68

Ms. Shauna MacDonald has investments that she anticipates will earn interest income of $143,000 for the year ending December 31, 2020. She has employment income in excess of $300,000 with additional amounts subject to a provincial tax rate of 18 percent.

In her province of residence:

• the corporate tax rate is 3 percent on income eligible for the small business deduction

• the corporate tax rate is 14 percent on other income

• the dividend tax credit is 25 percent of the dividend gross up for non-eligible dividends

Ms. MacDonald has asked your advice as to whether she should transfer these investments to a corporation in which she would own all of the shares. Advise her with respect to any tax deferral that could be available on income left in the corporation and on any tax savings that could be available if all of the income is paid out in dividends.

In her province of residence:

• the corporate tax rate is 3 percent on income eligible for the small business deduction

• the corporate tax rate is 14 percent on other income

• the dividend tax credit is 25 percent of the dividend gross up for non-eligible dividends

Ms. MacDonald has asked your advice as to whether she should transfer these investments to a corporation in which she would own all of the shares. Advise her with respect to any tax deferral that could be available on income left in the corporation and on any tax savings that could be available if all of the income is paid out in dividends.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

69

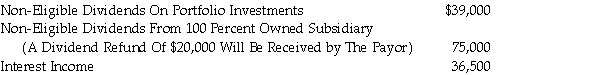

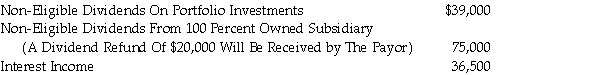

One of your clients has asked your advice on whether she should transfer a group of investments to a new corporation that can be established to hold them. The corporation will be a Canadian controlled private corporation and she anticipates that the transferred investments will have the following amounts of income for the year ending December 31, 2020:  Your client has business income of over $250,000. She needs all of the income that is produced by these investments to purchase art for her cherished collection. On additional amounts, your client is subject to a provincial tax rate of 18 percent.

Your client has business income of over $250,000. She needs all of the income that is produced by these investments to purchase art for her cherished collection. On additional amounts, your client is subject to a provincial tax rate of 18 percent.

In her province of residence:

• the corporate tax rate is 2.5 percent on income eligible for the small business deduction

• the corporate tax rate is 12 percent on other income

• the dividend tax credit is 25 percent of the dividend gross up for non-eligible dividends

Provide the requested advice, including an explanation of your conclusions.

Your client has business income of over $250,000. She needs all of the income that is produced by these investments to purchase art for her cherished collection. On additional amounts, your client is subject to a provincial tax rate of 18 percent.

Your client has business income of over $250,000. She needs all of the income that is produced by these investments to purchase art for her cherished collection. On additional amounts, your client is subject to a provincial tax rate of 18 percent.In her province of residence:

• the corporate tax rate is 2.5 percent on income eligible for the small business deduction

• the corporate tax rate is 12 percent on other income

• the dividend tax credit is 25 percent of the dividend gross up for non-eligible dividends

Provide the requested advice, including an explanation of your conclusions.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

70

Sharon Hartly is the owner-manager of a CCPC from which she receives an annual salary of $70,000 per year. For 2020, after deducting her salary, the CCPC will have additional income of $150,000. Sharon would like to take additional funds of $40,000 out of the corporation. Which of the following statements is correct?

A)The best solution is to take the funds out as salary as this will increase her pensionable earnings for CPP purposes.

B)The best solution is to take the funds out as a dividend as this will have the lowest tax cost.

C)The best solution is to take the funds out as salary because this will reduce her CNIL balance for purposes of the lifetime capital gains deduction.

D)The best solution is to take the funds out as salary so that she can maximize her contribution to her RRSP.

A)The best solution is to take the funds out as salary as this will increase her pensionable earnings for CPP purposes.

B)The best solution is to take the funds out as a dividend as this will have the lowest tax cost.

C)The best solution is to take the funds out as salary because this will reduce her CNIL balance for purposes of the lifetime capital gains deduction.

D)The best solution is to take the funds out as salary so that she can maximize her contribution to her RRSP.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

71

Joan Barts owns all of the outstanding shares of Barts Ltd., a CCPC that is carrying on an active business. She would prefer to pay herself salary instead of dividends if:

A)the corporation has a large RDTOH balance.

B)the corporation is located in a province with a low corporate tax rate.

C)the corporation has Taxable Income in excess of $500,000.

D)the corporation is located in a province with a high dividend tax credit.

A)the corporation has a large RDTOH balance.

B)the corporation is located in a province with a low corporate tax rate.

C)the corporation has Taxable Income in excess of $500,000.

D)the corporation is located in a province with a high dividend tax credit.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

72

Jonathan Baxter owns all of the shares of Baxter Ltd. The Company has a December 31 year end. He also works full time as an employee of the business. It is the policy of the Company to provide every employee an interest free loan of up to $30,000 to acquire a vehicle that will be used in their employment duties. The loan must be repaid 3 years after the date of borrowing.

On January 1, 2020, Jonathan borrows $30,000 on an interest free basis. The funds are used to acquire a vehicle to be used in his employment duties. In addition, on July 1, 2020, he borrows $250,000 on an interest free basis in order to assist in the purchase of a new and larger residence. The Company does not provide house acquisition loans to its other employees. The loan will be repaid in full on July 1, 2023. Assume that the prescribed rate for all of 2020 is 2 percent. What are the tax implications of these loans for Mr. Baxter for 2020?

On January 1, 2020, Jonathan borrows $30,000 on an interest free basis. The funds are used to acquire a vehicle to be used in his employment duties. In addition, on July 1, 2020, he borrows $250,000 on an interest free basis in order to assist in the purchase of a new and larger residence. The Company does not provide house acquisition loans to its other employees. The loan will be repaid in full on July 1, 2023. Assume that the prescribed rate for all of 2020 is 2 percent. What are the tax implications of these loans for Mr. Baxter for 2020?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

73

Larry Watts, a Canadian resident, owns 49 percent of the shares of Zatch Ltd., a Canadian corporation. Laura Marsh, who lives in England, owns the remaining 51 percent. For the current year, the corporation has $150,000 in income, all of which will be paid out as either salary or eligible dividends. Because of other sources of income, Larry is in the 29 percent federal tax bracket and an 18 percent provincial tax bracket. On both eligible and non-eligible dividends, the provincial dividend tax credit is equal to 30 percent of the gross up. Zatch Ltd. pays taxes at a combined federal/provincial rate of 31 percent. With respect to Larry's choice between receiving his share of the after tax corporate income in the form of salary or dividends, which of the following statements is correct?

A)It does not matter whether he receives salary or dividends as he would retain the same after tax amount with either alternative.

B)He should take the salary because he will have more left after tax.

C)He should take the dividends because he will have more left after tax.

D)In order to fully use his personal tax credits, he should receive a combination of salary and dividends.

A)It does not matter whether he receives salary or dividends as he would retain the same after tax amount with either alternative.

B)He should take the salary because he will have more left after tax.

C)He should take the dividends because he will have more left after tax.

D)In order to fully use his personal tax credits, he should receive a combination of salary and dividends.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

74

On January 1, 2020, Saul Barkin owns a group of shares with an adjusted cost base of $420,000. While these shares do not pay dividends, he expects that, during the coming year, their fair market value will increase to $640,000. At that point he expects to sell the securities in order to purchase a sailboat. None of these investments are eligible for the lifetime capital gains deduction.

Saul has employment income in excess of $250,000 and, given this, any additional income will be taxed at a combined federal/provincial rate of 52 percent.

He would like your advice on whether there would be any tax advantages associated with transferring these securities to a corporation.

In his province of residence:

• the corporate tax rate is 2.5 percent on income eligible for the small business deduction

• the corporate tax rate is 14 percent on other income

• the dividend tax credit is 25 percent of the dividend gross up for non-eligible dividends

Provide the requested advice, including an explanation of your conclusions.

Saul has employment income in excess of $250,000 and, given this, any additional income will be taxed at a combined federal/provincial rate of 52 percent.

He would like your advice on whether there would be any tax advantages associated with transferring these securities to a corporation.

In his province of residence:

• the corporate tax rate is 2.5 percent on income eligible for the small business deduction

• the corporate tax rate is 14 percent on other income

• the dividend tax credit is 25 percent of the dividend gross up for non-eligible dividends

Provide the requested advice, including an explanation of your conclusions.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

75

An owner-manager can generally choose whether he wishes to receive compensation in the form of dividends or, alternatively in the form of salary. All other things being equal which of the following would encourage the use of dividends?

A)A desire to make contributions to an RRSP.

B)A low provincial dividend tax credit.

C)A desire to eliminate a large CNIL balance.

D)A high provincial corporate tax rate.

A)A desire to make contributions to an RRSP.

B)A low provincial dividend tax credit.

C)A desire to eliminate a large CNIL balance.

D)A high provincial corporate tax rate.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

76

ITA 15(1)deals with situations where a corporation has provided a benefit to a shareholder that does not appear to have a business purpose. Which of the following events would NOT require the shareholder to include a benefit in his income?

A)The corporation provides an interest free loan to the shareholder to allow him to purchase a home suitable for entertaining business clients.

B)The shareholder purchases a vehicle that the corporation owns, but is not using, for 50 percent of fair market value.

C)The shareholder takes a two week, $12,000 vacation paid for by the corporation. During the vacation, the shareholder attends a 1 day session on tax issues related to the corporation's business.

D)The corporation purchases life insurance on the life of the shareholder in order to ensure that the company has the necessary funds to deal with a sudden, unexpected death of the shareholder.

A)The corporation provides an interest free loan to the shareholder to allow him to purchase a home suitable for entertaining business clients.

B)The shareholder purchases a vehicle that the corporation owns, but is not using, for 50 percent of fair market value.

C)The shareholder takes a two week, $12,000 vacation paid for by the corporation. During the vacation, the shareholder attends a 1 day session on tax issues related to the corporation's business.

D)The corporation purchases life insurance on the life of the shareholder in order to ensure that the company has the necessary funds to deal with a sudden, unexpected death of the shareholder.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

77

Cloister Inc. is a Canadian controlled private corporation with a December 31 year end. For the 2020 taxation year, Cloister Inc. has Taxable Income, before consideration of dividends or salary paid to its sole shareholder, of $197,000. All of its income has always been from active business activities. The cash balance of the Company, prior to any payments on the current year's taxes, is also equal to this amount.

Its only shareholder, Ms. Sally Cloister, has no income other than the dividends or salary paid by the corporation and has combined personal tax credits of $3,375.

In her province of residence, assume:

• The corporate tax rate is 3 percent on income eligible for the small business deduction.

• The corporate tax rate is 14 percent on other income.

• Personal provincial Tax Payable on the first $150,473 is $16,000. The rate on additional amounts is 12 percent.

• The dividend tax credit is 4/13 of the dividend gross up for non-eligible dividends.

Determine the amount of after tax cash that Ms. Cloister will retain if the maximum salary is paid by the corporation out of the available cash of $197,000. Ignore CPP contributions and the Canada employment tax credit.

Its only shareholder, Ms. Sally Cloister, has no income other than the dividends or salary paid by the corporation and has combined personal tax credits of $3,375.

In her province of residence, assume:

• The corporate tax rate is 3 percent on income eligible for the small business deduction.

• The corporate tax rate is 14 percent on other income.

• Personal provincial Tax Payable on the first $150,473 is $16,000. The rate on additional amounts is 12 percent.

• The dividend tax credit is 4/13 of the dividend gross up for non-eligible dividends.

Determine the amount of after tax cash that Ms. Cloister will retain if the maximum salary is paid by the corporation out of the available cash of $197,000. Ignore CPP contributions and the Canada employment tax credit.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

78

Ms. Janice Thiessen is an employee of Thiessen Ltd., a large company in which her husband owns 60 percent of the outstanding shares. Ms. Thiessen owns the remaining 40 percent of the shares. Thiessen Ltd. has a December 31 year end. It is the policy of the Company to provide an interest free loan of up to $25,000 to any employee who wishes to acquire a new home. They do not provide loans for home furnishings to employees.

On April 1 of the current year, Ms. Thiessen receives a $25,000 interest free loan from the Company to purchase a new home. On the same day, she receives an additional $15,000 interest free loan to purchase furnishings for the home. Both loans are to be repaid in four annual instalments to be made on March 31 of each year. Assume the prescribed rate for the current year is 2 percent. What are the current year tax implications of these loans for Ms. Thiessen?

On April 1 of the current year, Ms. Thiessen receives a $25,000 interest free loan from the Company to purchase a new home. On the same day, she receives an additional $15,000 interest free loan to purchase furnishings for the home. Both loans are to be repaid in four annual instalments to be made on March 31 of each year. Assume the prescribed rate for the current year is 2 percent. What are the current year tax implications of these loans for Ms. Thiessen?

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

79

Sandra Peterson has asked your advice on whether she should transfer a group of investments to a new corporation that can be established to hold them. The corporation will be a Canadian controlled private corporation and she anticipates that, during 2020, the market value of these investments will increase by $142,000. No other income will be generated by the investments. Sandra will sell these investments by the end of the year in order to purchase a condo. None of these investments are eligible for the lifetime capital gains deduction.

The corporation will be subject to a provincial tax rate of 3 percent on income eligible for the small business deduction and 16 percent on other income. Sandra has employment income in excess of $250,000 and, given this, any additional income will be taxed at a provincial tax rate of 18 percent. The provincial dividend tax credit is equal to 4/13 of the dividend gross up for non-eligible dividends. Provide the requested advice, including an explanation of your conclusions.

The corporation will be subject to a provincial tax rate of 3 percent on income eligible for the small business deduction and 16 percent on other income. Sandra has employment income in excess of $250,000 and, given this, any additional income will be taxed at a provincial tax rate of 18 percent. The provincial dividend tax credit is equal to 4/13 of the dividend gross up for non-eligible dividends. Provide the requested advice, including an explanation of your conclusions.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck

80

Stephen Lee has an unincorporated business that he anticipates will have active business income of $98,000 for the taxation year ending December 31, 2020. Mr. Lee has employment income in excess of $800,000 with additional amounts subject to a provincial tax rate of 16 percent. The provincial dividend tax credit is equal to 4/13 of the dividend gross up for non-eligible dividends. Also in this province, the corporate tax rate is 3 percent on income eligible for the small business deduction and 15 percent on other income.

Mr. Lee has asked your advice as to whether he should incorporate this business. Advise him with respect to any tax deferral that will be available on income left in the corporation and on any tax savings that will be available if all of the income is paid out in dividends.

Mr. Lee has asked your advice as to whether he should incorporate this business. Advise him with respect to any tax deferral that will be available on income left in the corporation and on any tax savings that will be available if all of the income is paid out in dividends.

Unlock Deck

Unlock for access to all 85 flashcards in this deck.

Unlock Deck

k this deck