Deck 12: Taxable Income and Tax Payable for Corporations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/89

Play

Full screen (f)

Deck 12: Taxable Income and Tax Payable for Corporations

1

Briefly explain why dividends received are included in the definition of a Non-Capital Loss for a corporation.

For corporations, dividends received are included in Net Income For Tax Purposes, but deducted in the determination of Taxable Income. If business or property losses are sufficient to reduce the amount of income recorded in ITA 3(a)and 3(b)to less than the amount of dividends included in Net Income For Tax Purposes, the result could be all or part of such dividends being subject to tax. This is avoided by defining Non-Capital Loss in a manner that includes any dividends received that cannot be deducted during the current year.

2

When a corporation receives eligible dividends, they do not gross them up by 38 percent and include the grossed up amount in Net Income For Tax Purposes.

True

3

Charitable contributions that are not used during the current year can be carried forward for five years, without regard to whether the taxpayer is an individual or a corporation.

True

4

With respect to both the small business deduction and the M&P deduction, the available amount is limited by the corporation's Taxable Income for the year. Why is this limitation included in the calculation of these tax credits?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

5

Non-capital loss carry overs must be deducted in the order in which they were incurred, the oldest one first, followed by amounts arising in later years.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

6

Under what circumstances can interest income qualify as active business income for the purposes of the small business deduction?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

7

List three items that would be added to accounting net income in order to arrive at Net Income For Tax Purposes.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

8

The federal tax abatement will sometimes be less than 10 percent of Taxable Income. Explain this statement.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

9

Compare the tax treatment of charitable donations for corporations with the treatment of charitable donations for individuals.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

10

A corporation has non-capital loss carry forwards and net capital loss carry forwards. How does management decide which of these carry forwards should be deducted first?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

11

How does a corporation determine the amount of Taxable Income that will be allocated to the various provinces?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

12

What are the general conditions that are required for the application of the small business deduction?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

13

What is the purpose of the stop loss rule applicable to shares that a corporation sells at a loss? When does this rule apply?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

14

The Canadian system of corporate taxation has goals other than raising revenue. Describe two of these other goals, including an example of a provision designed to achieve the goal described.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

15

What is a specified investment business? This definition represents a solution to an administrative problem that caused difficulties for the CRA for many years. What was this problem?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

16

While charitable donations cannot be deducted by a corporation, they can be used as the basis for a tax credit.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

17

Indicate three deductions that are available to individuals in determining their Taxable Income, but not available to corporations.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

18

One of your more socially conscious friends has just learned that dividends received by a Canadian corporation from other Canadian corporations are not subject to any form of taxation. In his view, this is additional evidence of how the government is allowing corporations to "rip-off" the Canadian public. Do you agree with the view being expressed by your friend? Explain your position.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

19

Because they expire after 20 years, non-capital losses should always be deducted prior to deducting net capital losses which have an unlimited carry forward period.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

20

For a corporation, dividends received from other taxable Canadian corporations are included in the determination of the non-capital loss for the current year.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

21

A Specified Investment Business is a business that primarily earns property income and employs in the business, throughout the year, more than 5 full-time employees.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

22

When dividends are paid by one taxable Canadian corporation to another taxable Canadian corporation, the recipient corporation will include the dividends in:

A)both Taxable Income and Net Income For Tax Purposes, but with an offsetting credit against Tax Payable.

B)both Taxable Income and Net Income For Tax Purposes, with no offsetting credit against Tax Payable.

C)neither Taxable Income nor Net Income For Tax Purposes.

D)net Income For Tax Purposes, but not Taxable Income.

E)taxable Income, but not Net Income For Tax Purposes.

A)both Taxable Income and Net Income For Tax Purposes, but with an offsetting credit against Tax Payable.

B)both Taxable Income and Net Income For Tax Purposes, with no offsetting credit against Tax Payable.

C)neither Taxable Income nor Net Income For Tax Purposes.

D)net Income For Tax Purposes, but not Taxable Income.

E)taxable Income, but not Net Income For Tax Purposes.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

23

Ottawa Corporation has accounting income for the year ended October 31, 2020 of $76,000. Included in this calculation are the following amounts:  You have correctly determined CCA to be $61,000. What are the correct amounts for first, Net Income for Tax Purposes, and second, Taxable Income?

You have correctly determined CCA to be $61,000. What are the correct amounts for first, Net Income for Tax Purposes, and second, Taxable Income?

A)Net Income for Tax Purposes - $105,500; Taxable Income - $51,000.

B)Net Income for Tax Purposes - $103,000; Taxable Income - $51,000.

C)Net Income for Tax Purposes - $73,500; Taxable Income - $19,000.

D)Net Income for Tax Purposes - $21,500; Taxable Income - $19,000.

You have correctly determined CCA to be $61,000. What are the correct amounts for first, Net Income for Tax Purposes, and second, Taxable Income?

You have correctly determined CCA to be $61,000. What are the correct amounts for first, Net Income for Tax Purposes, and second, Taxable Income?A)Net Income for Tax Purposes - $105,500; Taxable Income - $51,000.

B)Net Income for Tax Purposes - $103,000; Taxable Income - $51,000.

C)Net Income for Tax Purposes - $73,500; Taxable Income - $19,000.

D)Net Income for Tax Purposes - $21,500; Taxable Income - $19,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

24

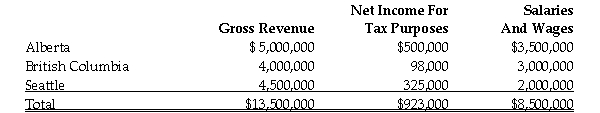

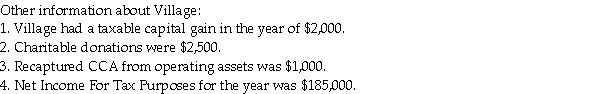

Calgary Corporation has permanent establishments in Alberta, British Columbia and Seattle in the United States. Gross revenues, Net Income and salaries and wages for each permanent establishment are:  For the purposes of calculating the federal tax abatement, the percentage of income allocated to a Canadian province would be:

For the purposes of calculating the federal tax abatement, the percentage of income allocated to a Canadian province would be:

A)64.79%.

B)65.72%.

C)70.63%.

D)71.57%.

For the purposes of calculating the federal tax abatement, the percentage of income allocated to a Canadian province would be:

For the purposes of calculating the federal tax abatement, the percentage of income allocated to a Canadian province would be:A)64.79%.

B)65.72%.

C)70.63%.

D)71.57%.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

25

If a corporation is classified as a Personal Services Business, the only deductions in the determination of its Net Income For Tax Purposes will be for salaries, wages, and other expenses that would normally be deductible against employment income.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

26

The two variables used to allocate income between permanent establishments when a corporation has permanent establishments in more than one province are:

A)gross salaries and net income for tax purposes of the establishment.

B)gross revenue and salaries and wages paid by the establishment.

C)gross revenue and net income for tax purposes of the establishment.

D)gross salaries and allocated revenue of the establishment.

A)gross salaries and net income for tax purposes of the establishment.

B)gross revenue and salaries and wages paid by the establishment.

C)gross revenue and net income for tax purposes of the establishment.

D)gross salaries and allocated revenue of the establishment.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

27

The base used for calculating the M&P deduction is reduced by the amount of the small business deduction.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

28

CCC Inc. is a Canadian controlled private corporation. During the year, CCC Inc. made charitable donations of $13,000. It has a charitable donation carry forward from the preceding year of $2,000. CCC Inc.'s Net Income For Tax Purposes for the current year consisted of $91,000 of active business income, $10,000 of dividends from taxable Canadian corporations and a net rental loss of $84,000. The maximum charitable donation deduction for CCC Inc. in the current year is:

A)$13,000.

B)$12,750.

C)$15,000.

D)$4,250.

A)$13,000.

B)$12,750.

C)$15,000.

D)$4,250.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

29

A corporation's Net Income For Tax Purposes includes the full amount of any foreign non-business income, without regard to the amount of taxes withheld in the foreign venue.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following items cannot be deducted in the determination of Taxable Income for a corporation?

A)Dividends from taxable Canadian corporations.

B)Charitable contributions.

C)The lifetime capital gains deduction.

D)Net capital losses.

A)Dividends from taxable Canadian corporations.

B)Charitable contributions.

C)The lifetime capital gains deduction.

D)Net capital losses.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

31

A corporation's non-business foreign income tax credit is limited to 15 percent of foreign non-business income earned.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

32

With respect to corporate Tax Payable, which of the following statements is NOT correct?

A)The effective federal tax rate on the active business income of a Canadian public company is 15 percent.

B)The federal tax abatement is always equal to 10 percent of corporate Tax Payable.

C)Canadian controlled private corporations may be eligible for the general rate reduction on some part of their income.

D)The manufacturing and processing deduction will not reduce the overall Tax Payable of a public company.

A)The effective federal tax rate on the active business income of a Canadian public company is 15 percent.

B)The federal tax abatement is always equal to 10 percent of corporate Tax Payable.

C)Canadian controlled private corporations may be eligible for the general rate reduction on some part of their income.

D)The manufacturing and processing deduction will not reduce the overall Tax Payable of a public company.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

33

Full Rate Taxable Income does not include income that is eligible for the small business deduction, but it does include income that is eligible for the manufacturing and processing deduction.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

34

On November 23, 2019, Victoria Ltd. acquired 20 percent of the 15,000 issued shares of Vancouver Ltd. at a cost of $32.50 per share. On December 20, 2019, these shares paid a dividend of $2.25 per share, and on August 15, 2020, Victoria sells the shares for $29 per share. What is the amount of the capital loss on the Vancouver Ltd. shares for Victoria Ltd. for the taxation year ended August 31, 2020?

A)Nil

B)$ 3,750

C)$ 10,500

D)$ 17,250

A)Nil

B)$ 3,750

C)$ 10,500

D)$ 17,250

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

35

If amounts of taxes paid on foreign source business income are not used as a credit during the current year, they can be carried back to the 3 preceding taxation years and forward to the 10 subsequent taxation years.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

36

During the 2020 taxation year, a corporation sells a depreciable asset with a capital cost of $130,000 for $140,000. The asset had a net book value in the accounting records of $112,000. It was not the last asset in Class 8 and, prior to the disposition, the UCC balance for Class 8 was $96,000. What is the amount of the adjustments that will be required in the conversion of the corporation's accounting Net Income to Net Income For Tax Purposes?

A)A deduction of $28,000, an addition of $5,000, and an addition of $34,000.

B)An addition of $5,000 and an addition of $34,000.

C)An addition of $44,000.

D)A deduction of $28,000 and an addition of $5,000.

A)A deduction of $28,000, an addition of $5,000, and an addition of $34,000.

B)An addition of $5,000 and an addition of $34,000.

C)An addition of $44,000.

D)A deduction of $28,000 and an addition of $5,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

37

During the 2020 taxation year, Brocko Ltd. has a business loss of $375,000, net taxable capital gains of $67,000, an Allowable Business Investment Loss of $23,000, and dividends from taxable Canadian corporations of $53,000. What is the amount of the non-capital loss for the year?

A)$384,000.

B)$398,000.

C)$322,000

D)$331,000.

A)$384,000.

B)$398,000.

C)$322,000

D)$331,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

38

In certain circumstances, rental income can be considered active business income.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

39

A Canadian controlled private company will never be able to use the General Rate Reduction provision.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

40

With respect to charitable donations made by a corporation, which of the following statements is correct?

A)They create a credit against Tax Payable, based on the corporation's tax rate prior to the deduction of the federal abatement.

B)If they cannot be used during the current year, they can be carried back three years.

C)They are a deduction in the determination of corporate Taxable Income but not corporate Net Income For Tax Purposes.

D)The amount of contributions that can be deducted is only limited by the corporation's Net Income For Tax Purposes for the year.

A)They create a credit against Tax Payable, based on the corporation's tax rate prior to the deduction of the federal abatement.

B)If they cannot be used during the current year, they can be carried back three years.

C)They are a deduction in the determination of corporate Taxable Income but not corporate Net Income For Tax Purposes.

D)The amount of contributions that can be deducted is only limited by the corporation's Net Income For Tax Purposes for the year.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

41

A CCPC has Taxable Capital Employed in Canada for the 2019 year of $14 million, and $13.5 million for the 2020 year. The company has Canadian active business income of $535,000, Taxable Income of $435,000, and no foreign income. It is not associated with any other CCPC. What is the 2020 annual business limit reduction for this company?

A)$304,500.

B)$350,000.

C)$348,000.

D)$400,000.

A)$304,500.

B)$350,000.

C)$348,000.

D)$400,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

42

With respect to the determination of Tax Payable for a corporation, which of the following statements is NOT correct?

A)The federal tax abatement percentage is reduced when less than 100 percent of the corporation's income is allocated to a province.

B)The basic tax rate applicable to corporations is 38 percent.

C)Provincial corporate taxes are based on a flat rate applied to a taxable income figure.

D)Full rate taxable income includes any income that is not eligible for the small business deduction.

A)The federal tax abatement percentage is reduced when less than 100 percent of the corporation's income is allocated to a province.

B)The basic tax rate applicable to corporations is 38 percent.

C)Provincial corporate taxes are based on a flat rate applied to a taxable income figure.

D)Full rate taxable income includes any income that is not eligible for the small business deduction.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

43

DDD Ltd. is a private corporation with a fiscal year ending on December 31. It is solely owned by Donald Darwin Dorsey who is a Canadian resident throughout 2020. During 2020, DDD Ltd. had the following:  What is the maximum small business deduction for DDD Ltd. for 2020?

What is the maximum small business deduction for DDD Ltd. for 2020?

A)Nil

B)$27,645

C)$34,903

D)$29,982

What is the maximum small business deduction for DDD Ltd. for 2020?

What is the maximum small business deduction for DDD Ltd. for 2020?A)Nil

B)$27,645

C)$34,903

D)$29,982

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements with respect to the general rate reduction for corporations is NOT correct?

A)The general rate reduction is 13 percent of full rate taxable income.

B)Full rate taxable income for a public company is reduced by the income eligible for the manufacturing and processing deduction.

C)The general rate reduction is not available to Canadian Controlled Private Corporations (CCPCs).

D)Full rate taxable income for a CCPC is reduced by the income eligible for the manufacturing and processing deduction.

A)The general rate reduction is 13 percent of full rate taxable income.

B)Full rate taxable income for a public company is reduced by the income eligible for the manufacturing and processing deduction.

C)The general rate reduction is not available to Canadian Controlled Private Corporations (CCPCs).

D)Full rate taxable income for a CCPC is reduced by the income eligible for the manufacturing and processing deduction.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is an example of a Canadian controlled private corporation?

A)A Canadian corporation in which 55 percent of the common shares are owned by Canadian residents and the remaining 45 percent of the common shares are owned by non-residents. The shares are all privately held.

B)A wholly-owned Canadian subsidiary of a public company.

C)A Canadian corporation in which Mr. Adams and Mr. Peters each own 50 percent of the shares. Both Mr. Adams and Mr. Peters are Canadian residents.

D)Both B and C.

E)Both A and C.

A)A Canadian corporation in which 55 percent of the common shares are owned by Canadian residents and the remaining 45 percent of the common shares are owned by non-residents. The shares are all privately held.

B)A wholly-owned Canadian subsidiary of a public company.

C)A Canadian corporation in which Mr. Adams and Mr. Peters each own 50 percent of the shares. Both Mr. Adams and Mr. Peters are Canadian residents.

D)Both B and C.

E)Both A and C.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

46

For 2020, Fosfo Inc., a Canadian controlled private company, has Taxable Income of $396,000. In calculating Tax Payable, the company received a small business deduction of $38,950 and a manufacturing and processing deduction of $6,500. What is the amount of Fosfo's 2020 general rate reduction?

A)Nil.

B)$18,330.

C)$45,572.

D)$51,480.

A)Nil.

B)$18,330.

C)$45,572.

D)$51,480.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

47

With respect to determining provincial tax payable for a corporation, which of the following statements is correct?

A)The provincial systems use a graduated rate structure similar to that used federally for individuals, and, except for Alberta and Quebec, the calculation of taxable income is the same as that used federally for corporations.

B)The provincial systems use a rate structure similar to the federal system for corporations, however, except for Alberta and Quebec, the calculation of taxable income is different from that used federally.

C)The provincial systems use a rate structure similar to the federal system for corporations and, except for Alberta and Quebec, the calculation of taxable income is the same as that used federally.

D)The provincial systems use a graduated rate structure similar to that used federally for individuals, however, except for Alberta and Quebec, the calculation of taxable income is different from that used federally.

A)The provincial systems use a graduated rate structure similar to that used federally for individuals, and, except for Alberta and Quebec, the calculation of taxable income is the same as that used federally for corporations.

B)The provincial systems use a rate structure similar to the federal system for corporations, however, except for Alberta and Quebec, the calculation of taxable income is different from that used federally.

C)The provincial systems use a rate structure similar to the federal system for corporations and, except for Alberta and Quebec, the calculation of taxable income is the same as that used federally.

D)The provincial systems use a graduated rate structure similar to that used federally for individuals, however, except for Alberta and Quebec, the calculation of taxable income is different from that used federally.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

48

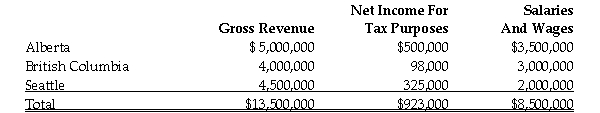

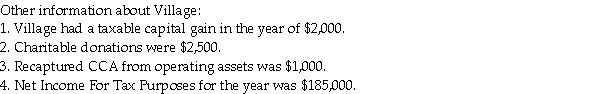

Village Concrete Inc. (Village)is a Canadian controlled private corporation (CCPC)with a year end of December 31, 2020. The owner of Village also controls Bob's Roofing Inc. (Bob's), another CCPC with active business income for the year ended December 31, 2020 of $116,500. The owner has agreed to allocate a sufficient amount of the small business deduction to Bob's to ensure that all of its active business income is taxed at the lower rate. Other than the income related items listed below, you may assume that Village's income is from active business in Canada.  What is the appropriate small business deduction for Village?

What is the appropriate small business deduction for Village?

A)$34,770.

B)$34,675.

C)$35,150.

D)$72,865.

What is the appropriate small business deduction for Village?

What is the appropriate small business deduction for Village?A)$34,770.

B)$34,675.

C)$35,150.

D)$72,865.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

49

Samson and Delilah are high fashion hair stylists who worked for Philistines Inc., a large chain of hair salons, for 6 years. They incorporated Haaiir Inc. 2 years ago and each own 50 percent of the shares. They are the only employees of Haaiir Inc. and the corporation's only revenues are from work done for Philistines Inc. What type of income is Haaiir Inc. earning?

A)Specified investment business income

B)Manufacturing and processing income

C)Personal services business income

D)Active business income

A)Specified investment business income

B)Manufacturing and processing income

C)Personal services business income

D)Active business income

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

50

A CCPC has Taxable Capital Employed in Canada for the 2019 year of $14 million, and $13 million for the 2020 year. The company has Canadian active business income of $420,000, Taxable Income of $385,000, and no foreign income. It is not associated with any other CCPC. What is the 2020 small business deduction for this company?

A)$14,630

B)$31,160.

C)$19,000.

D)$38,000.

A)$14,630

B)$31,160.

C)$19,000.

D)$38,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements with respect to the small business deduction is correct?

A)If the company has no associated companies, its annual business limit will always be $500,000.

B)A Specified Investment Company is a Canadian controlled private corporation whose primary purpose is earning property income and that has less than 5 full-time employees.

C)As long as the controlling shareholders of a corporation are residents of Canada for at least part of the year, the corporation will be considered a Canadian controlled private corporation.

D)Interest or rents earned by a Canadian controlled private company are not eligible for the small business deduction.

A)If the company has no associated companies, its annual business limit will always be $500,000.

B)A Specified Investment Company is a Canadian controlled private corporation whose primary purpose is earning property income and that has less than 5 full-time employees.

C)As long as the controlling shareholders of a corporation are residents of Canada for at least part of the year, the corporation will be considered a Canadian controlled private corporation.

D)Interest or rents earned by a Canadian controlled private company are not eligible for the small business deduction.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

52

Grande Ltd. is a Canadian controlled private company that is not associated with any other corporation. For 2020, it has active business income of $723,000, of which $617,000 involved manufacturing and processing activity. In addition, it has taxable capital gains on the disposition of assets used that were used in the business of $65,000. This results in a Net Income For Tax Purposes of $788,000. This is also the Company's Taxable Income. What is the amount of Grande's manufacturing and processing deduction for the year?

A)$80,210

B)$ 6,760

C)$15,210

D)$37,440

A)$80,210

B)$ 6,760

C)$15,210

D)$37,440

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements is correct?

A)Public and private corporations are eligible for the general rate reduction.

B)All private corporations are eligible for the small business deduction.

C)Canadian controlled public and private corporations are eligible for the small business deduction.

D)If a corporation claims the small business deduction, it cannot claim the general rate reduction.

A)Public and private corporations are eligible for the general rate reduction.

B)All private corporations are eligible for the small business deduction.

C)Canadian controlled public and private corporations are eligible for the small business deduction.

D)If a corporation claims the small business deduction, it cannot claim the general rate reduction.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

54

With respect to the manufacturing and processing deduction, which of the following statements is NOT correct?

A)The manufacturing and processing deduction is available to any corporation that has manufacturing and processing profits.

B)At the federal level, there is no tax advantage associated with the use of the manufacturing and processing deduction.

C)The amount of manufacturing and processing profits is determined by a formula that is found in the Income Tax Regulations.

D)The base for the manufacturing and processing deduction cannot exceed manufacturing and processing profits, reduced by the amount eligible for the small business deduction.

A)The manufacturing and processing deduction is available to any corporation that has manufacturing and processing profits.

B)At the federal level, there is no tax advantage associated with the use of the manufacturing and processing deduction.

C)The amount of manufacturing and processing profits is determined by a formula that is found in the Income Tax Regulations.

D)The base for the manufacturing and processing deduction cannot exceed manufacturing and processing profits, reduced by the amount eligible for the small business deduction.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

55

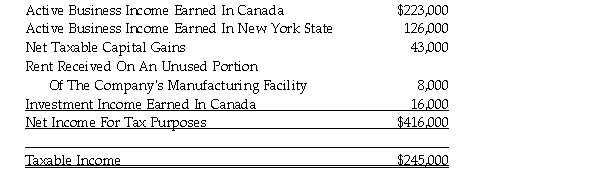

During the year ending December 31, 2020, Oxdor Ltd., a Canadian controlled private corporation had the following sources of income:  The Company paid no foreign taxes on its foreign operations. It is not associated with any other corporation. What is the maximum amount of income on which the Company can claim the small business deduction?

The Company paid no foreign taxes on its foreign operations. It is not associated with any other corporation. What is the maximum amount of income on which the Company can claim the small business deduction?

A)$223,000

B)$349,000

C)$231,000

D)$357,000

The Company paid no foreign taxes on its foreign operations. It is not associated with any other corporation. What is the maximum amount of income on which the Company can claim the small business deduction?

The Company paid no foreign taxes on its foreign operations. It is not associated with any other corporation. What is the maximum amount of income on which the Company can claim the small business deduction?A)$223,000

B)$349,000

C)$231,000

D)$357,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

56

Ammar Dayani is a senior executive in a large oil producing company in Canada. He has heard that it would be beneficial from a tax perspective if he resigned his position, established a company in which he would be the only shareholder and employee, and then have the new company sign a contract with his former employer to provide the same services he currently provides as an employee. If Ammar proceeds with this idea, what deductions would the company be able to take that he cannot take as an employee?

A)The company would be able to deduct all of the costs of operating the company, and would have the ability to pay a salary to Ammar and other family members to split income and reduce taxes.

B)The company would be able to deduct only the salary paid to Ammar.

C)The company would be able to deduct the salary paid to Ammar, any benefits paid on his behalf, and any other expenses that would normally be deductible against employment income.

D)The company would not be able to deduct any expenses as this would be a personal services corporation.

A)The company would be able to deduct all of the costs of operating the company, and would have the ability to pay a salary to Ammar and other family members to split income and reduce taxes.

B)The company would be able to deduct only the salary paid to Ammar.

C)The company would be able to deduct the salary paid to Ammar, any benefits paid on his behalf, and any other expenses that would normally be deductible against employment income.

D)The company would not be able to deduct any expenses as this would be a personal services corporation.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

57

In which of the following situations is a corporation earning incidental property income?

A)Regina Corporation has built up its cash reserves over several years, and its staff invests this surplus cash in a variety of publicly traded corporations, earning dividend income. This income is approximately 10 percent of corporate income on an annual basis.

B)A branch of Moose Jaw Corporation invests surplus cash for 2-3 months every year earning interest income which is less than 1 percent of corporate income.

C)Saskatoon Corporation has one rental property which is leased to a retail outlet. The net rental income from this property is 5 percent of corporate income.

D)Lethbridge Limited sells its factory building resulting in a capital gain which is about 10 percent of corporate income.

A)Regina Corporation has built up its cash reserves over several years, and its staff invests this surplus cash in a variety of publicly traded corporations, earning dividend income. This income is approximately 10 percent of corporate income on an annual basis.

B)A branch of Moose Jaw Corporation invests surplus cash for 2-3 months every year earning interest income which is less than 1 percent of corporate income.

C)Saskatoon Corporation has one rental property which is leased to a retail outlet. The net rental income from this property is 5 percent of corporate income.

D)Lethbridge Limited sells its factory building resulting in a capital gain which is about 10 percent of corporate income.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is a specified investment business?

A)A business which principally derives its income from rental property and has less than 5 full-time employees.

B)A business which principally derives its income from rental property and has more than 5 full-time employees.

C)A business which principally derives its income from rental property and has 5 or more full-time employees.

D)A business which actively derives its income from rental property and has more than 5 full-time employees.

A)A business which principally derives its income from rental property and has less than 5 full-time employees.

B)A business which principally derives its income from rental property and has more than 5 full-time employees.

C)A business which principally derives its income from rental property and has 5 or more full-time employees.

D)A business which actively derives its income from rental property and has more than 5 full-time employees.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

59

DDD Ltd. is a private corporation with a fiscal year ending on December 31. It is solely owned by Donald Darwin Dorsey who was a Canadian resident until November 1, 2020. On November 1 he left Canada permanently and became a resident of the U.S. During 2020, DDD Ltd. had the following:  What is the maximum small business deduction for DDD Ltd. for 2020?

What is the maximum small business deduction for DDD Ltd. for 2020?

A)Nil

B)$27,645

C)$34,903

D)$29,982

What is the maximum small business deduction for DDD Ltd. for 2020?

What is the maximum small business deduction for DDD Ltd. for 2020?A)Nil

B)$27,645

C)$34,903

D)$29,982

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

60

The small business deduction is only available on:

A)income earned in Canada by a resident corporation.

B)the first $500,000 in manufacturing and processing income earned by a Canadian controlled private corporation.

C)the active business income of a private corporation with no more than five full-time employees devoted to the production of property income.

D)all of the income earned in Canada by a Canadian controlled private corporation.

E)None of the above.

A)income earned in Canada by a resident corporation.

B)the first $500,000 in manufacturing and processing income earned by a Canadian controlled private corporation.

C)the active business income of a private corporation with no more than five full-time employees devoted to the production of property income.

D)all of the income earned in Canada by a Canadian controlled private corporation.

E)None of the above.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

61

For the taxation year ending December 31, 2020, Rude Ltd., a Canadian public company, recorded the following information: ![For the taxation year ending December 31, 2020, Rude Ltd., a Canadian public company, recorded the following information: At the beginning of 2020, the Company has a net capital loss carry forward available of $24,000 [(1/2)($48,000)]. Determine the maximum non-capital loss balance [ITA 111(8)(b)] for Rude Ltd. at the end of the 2020 taxation year and any available net capital loss carry forward.](https://d2lvgg3v3hfg70.cloudfront.net/TB8606/11eb9a05_65d7_13a0_9571_a78656a9aee9_TB8606_00.jpg) At the beginning of 2020, the Company has a net capital loss carry forward available of $24,000 [(1/2)($48,000)].

At the beginning of 2020, the Company has a net capital loss carry forward available of $24,000 [(1/2)($48,000)].

Determine the maximum non-capital loss balance [ITA 111(8)(b)] for Rude Ltd. at the end of the 2020 taxation year and any available net capital loss carry forward.

![For the taxation year ending December 31, 2020, Rude Ltd., a Canadian public company, recorded the following information: At the beginning of 2020, the Company has a net capital loss carry forward available of $24,000 [(1/2)($48,000)]. Determine the maximum non-capital loss balance [ITA 111(8)(b)] for Rude Ltd. at the end of the 2020 taxation year and any available net capital loss carry forward.](https://d2lvgg3v3hfg70.cloudfront.net/TB8606/11eb9a05_65d7_13a0_9571_a78656a9aee9_TB8606_00.jpg) At the beginning of 2020, the Company has a net capital loss carry forward available of $24,000 [(1/2)($48,000)].

At the beginning of 2020, the Company has a net capital loss carry forward available of $24,000 [(1/2)($48,000)].Determine the maximum non-capital loss balance [ITA 111(8)(b)] for Rude Ltd. at the end of the 2020 taxation year and any available net capital loss carry forward.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

62

Lax Inc. is a Canadian controlled private corporation. For the fiscal year ending December 31, 2020, its Net Income For Tax Purposes and Taxable Income is made up of active business income of $285,000, plus Adjusted Aggregate Investment Income of $95,000. For 2019, its Adjusted Aggregate Investment Income was $75,000. Its Taxable Capital Employed In Canada was $7 million for 2020 and $6 million for 2019. Because of its association with Slax Inc., its 2020 allocation of the annual business limit is $200,000. Slax's Taxable Capital Employed In Canada was $1,000,000 for 2020 and for 2019. It has no Adjusted Aggregate Investment Income in either year.

Determine the amount of the 2020 small business deduction for Lax Inc.

Determine the amount of the 2020 small business deduction for Lax Inc.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

63

The FG Company had Net Income For Tax Purposes for the year ending December 31, 2020 of $275,000. This amount included $13,720 in taxable capital gains, as well as $15,600 in dividends received from taxable Canadian corporations. Also during 2020, the Company made donations to registered charities of $9,100.

At the beginning of the year, the Company had available a non-capital loss carry forward of$74,000, as well as a net capital loss carry forward of $20,000 [(1/2)($40,000)].

Determine the Company's minimum Taxable Income for the year ending December 31, 2020 and the amount and type of any carry forwards available at the end of the year.

At the beginning of the year, the Company had available a non-capital loss carry forward of$74,000, as well as a net capital loss carry forward of $20,000 [(1/2)($40,000)].

Determine the Company's minimum Taxable Income for the year ending December 31, 2020 and the amount and type of any carry forwards available at the end of the year.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

64

With respect to foreign business tax credits for corporations, which of the following statements is NOT correct?

A)If the credit cannot be used during the current period, it can be carried back three years and forward ten years.

B)In the formula that limits this credit, the Tax Otherwise Payable is reduced by the federal tax abatement.

C)In the formula that limits this credit, the Tax Otherwise Payable is reduced by the general rate reduction.

D)In the formula that limits this credit, the Adjusted Division B Income is reduced by dividends that are deducted in the determination of Taxable Income.

A)If the credit cannot be used during the current period, it can be carried back three years and forward ten years.

B)In the formula that limits this credit, the Tax Otherwise Payable is reduced by the federal tax abatement.

C)In the formula that limits this credit, the Tax Otherwise Payable is reduced by the general rate reduction.

D)In the formula that limits this credit, the Adjusted Division B Income is reduced by dividends that are deducted in the determination of Taxable Income.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

65

With respect to the following statements about foreign source income and related tax credits for corporations, which one is NOT correct?

A)If a credit related to foreign business income cannot be used during the current period, it can be carried back 3 years and carried forward 10 years.

B)Any amount of a corporation's foreign non-business tax credit in excess of 15 percent of foreign non-business income must be deducted in determining Net Income For Tax Purposes.

C)The foreign non-business tax credit may be less than the amount of foreign taxes withheld.

D)The gross amount of foreign sources income, without the deduction of amounts withheld, must be included in Net Income For Tax Purposes.

A)If a credit related to foreign business income cannot be used during the current period, it can be carried back 3 years and carried forward 10 years.

B)Any amount of a corporation's foreign non-business tax credit in excess of 15 percent of foreign non-business income must be deducted in determining Net Income For Tax Purposes.

C)The foreign non-business tax credit may be less than the amount of foreign taxes withheld.

D)The gross amount of foreign sources income, without the deduction of amounts withheld, must be included in Net Income For Tax Purposes.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

66

Teeny Ltd. is a Canadian controlled private corporation. Its Net Income For Tax Purposes is $652,000 for the year ending December 31, 2020, all of which is active business income, except for $21,000 in foreign source non-business income. Ten percent of this amount was withheld in the foreign jurisdiction, and the corporation receives a foreign tax credit against federal Tax Payable that is equal to the amount withheld. The corporation's only deduction in the calculation of Taxable Income is for a non-capital loss carry forward of $415,000. The corporation had Taxable Capital Employed In Canada of $12,950,000 for 2019, and $13,100,000 for 2020. It is not associated with any other corporation.

Determine the amount of Teeny Ltd.'s small business deduction for the year ending December 31, 2020.

Determine the amount of Teeny Ltd.'s small business deduction for the year ending December 31, 2020.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

67

St. John Corporation, a Canadian controlled private corporation has Taxable Income of $250,000 in 2020, 87 percent of which is earned in a Canadian province. The company reported Canadian active business income of $235,000 for the year, and no foreign taxes were paid. The corporation has no M&P activity. It is associated with one other company, which received $200,000 of the annual business limit. What is the federal Tax Payable for St. John Corporation for the 2020 year?

A)$ Nil.

B)$23,400.

C)$26,650.

D)$29,975.

A)$ Nil.

B)$23,400.

C)$26,650.

D)$29,975.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

68

Badon Inc. is a Canadian public company. The following information is for its taxation year ending December 31, 2020: ![Badon Inc. is a Canadian public company. The following information is for its taxation year ending December 31, 2020: The Company also has available a net capital loss carry forward of $37,400 [(1/2)($74,800)]. It would like to deduct this loss during the current year. Determine the non-capital loss balance [ITA 111(8)(b)] for Badon Inc. at the end of the 2020 taxation year and any available net capital loss carry forward.](https://d2lvgg3v3hfg70.cloudfront.net/TB8606/11eb9a05_65d6_ec8e_9571_554104242484_TB8606_00.jpg) The Company also has available a net capital loss carry forward of $37,400 [(1/2)($74,800)]. It would like to deduct this loss during the current year.

The Company also has available a net capital loss carry forward of $37,400 [(1/2)($74,800)]. It would like to deduct this loss during the current year.

Determine the non-capital loss balance [ITA 111(8)(b)] for Badon Inc. at the end of the 2020 taxation year and any available net capital loss carry forward.

![Badon Inc. is a Canadian public company. The following information is for its taxation year ending December 31, 2020: The Company also has available a net capital loss carry forward of $37,400 [(1/2)($74,800)]. It would like to deduct this loss during the current year. Determine the non-capital loss balance [ITA 111(8)(b)] for Badon Inc. at the end of the 2020 taxation year and any available net capital loss carry forward.](https://d2lvgg3v3hfg70.cloudfront.net/TB8606/11eb9a05_65d6_ec8e_9571_554104242484_TB8606_00.jpg) The Company also has available a net capital loss carry forward of $37,400 [(1/2)($74,800)]. It would like to deduct this loss during the current year.

The Company also has available a net capital loss carry forward of $37,400 [(1/2)($74,800)]. It would like to deduct this loss during the current year.Determine the non-capital loss balance [ITA 111(8)(b)] for Badon Inc. at the end of the 2020 taxation year and any available net capital loss carry forward.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

69

The following items may involve an adjustment of a corporation's accounting Net Income in order to arrive at the Net Income For Tax Purposes figure.

1. Premium amortization on the company's bonds payable was $5,600 for the current year.

2. The company incurred landscaping costs of $16,000 during the current year. For accounting purposes, these costs are being amortized at the rate of $1,600 per year.

3. The company sold a depreciable asset during the year for $145,000. The asset had a capital cost of $120,000 and a net book value of $85,000. It was not the last asset in its CCA class and the UCC of this class was $105,000 before the disposition. There were no other additions or dispositions during the year.

4. For accounting purposes, the company deducted $4,500 of interest charged on late tax instalments.

Required: Determine the addition and/or deduction that would be made in Schedule 1 for each of the preceding items.

1. Premium amortization on the company's bonds payable was $5,600 for the current year.

2. The company incurred landscaping costs of $16,000 during the current year. For accounting purposes, these costs are being amortized at the rate of $1,600 per year.

3. The company sold a depreciable asset during the year for $145,000. The asset had a capital cost of $120,000 and a net book value of $85,000. It was not the last asset in its CCA class and the UCC of this class was $105,000 before the disposition. There were no other additions or dispositions during the year.

4. For accounting purposes, the company deducted $4,500 of interest charged on late tax instalments.

Required: Determine the addition and/or deduction that would be made in Schedule 1 for each of the preceding items.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

70

On February 21, 2020, Markham Inc. acquires 1,000 shares of Darcy Ltd., a widely held public company, at a cost of $27.60 per share. on March 1, 2020, these shares pay a dividend of $1.97 per share. Markham sells the shares on March 25, 2020 for $22.11 per share. Markham Inc. has taxable capital gains of $23,000 in the year.

What is the amount of the allowable capital loss, if any, that Markham Inc. will include in its tax return for the taxation year ending December 31, 2020?

What is the amount of the allowable capital loss, if any, that Markham Inc. will include in its tax return for the taxation year ending December 31, 2020?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

71

Ramsden Inc., a Canadian public company, has Taxable Income for the taxation year ending December 31, 2020 in the amount of $242,000. It has Canadian permanent establishments in Saskatchewan and Alberta. The Company's gross revenues for the 2020 taxation year are $3,013,000, with $1,520,000 of this accruing at the permanent establishment in Saskatchewan, and $912,000 accruing at the permanent establishment in Alberta. Wages and salaries total $192,000 for the year. Of this total, $63,000 is at the permanent establishment in Saskatchewan and $85,000 is at the permanent establishment in Alberta. Ramsden has sales to the U.S. through a U.S. permanent establishment.

Calculate federal Tax Payable for the taxation year ending December 31, 2020. Ignore any foreign tax implications.

Calculate federal Tax Payable for the taxation year ending December 31, 2020. Ignore any foreign tax implications.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

72

During the year ending December 31, 2019, Melanor Ltd. reported accounting Income Before Taxes of $225,000. This was followed in the year ending December 31, 2020, by an accounting Loss Before Taxes of $372,000. Both of these amounts were determined using generally accepted accounting principles. Included in the above income figures were the following amounts: ![During the year ending December 31, 2019, Melanor Ltd. reported accounting Income Before Taxes of $225,000. This was followed in the year ending December 31, 2020, by an accounting Loss Before Taxes of $372,000. Both of these amounts were determined using generally accepted accounting principles. Included in the above income figures were the following amounts: The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares. At the beginning of the 2019 taxation year, the Company has available a non-capital loss carry forward of $12,000 and a net capital loss carry forward of $10,000 [(1/2)($20,000)]. There has not been sufficient Net Income For Tax Purposes to deduct these amounts in any previous year. It is the policy of Melanor Ltd. to minimize non-capital loss carry overs. Required: Calculate the minimum Net Income For Tax Purposes and Taxable Income for each of the two years 2019 and 2020 and indicate the amount and type of any carry overs that are available at the end of each year.](https://d2lvgg3v3hfg70.cloudfront.net/TB8606/11eb9a05_65d7_61c2_9571_4b74105bad20_TB8606_00.jpg) The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares.

The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares.

At the beginning of the 2019 taxation year, the Company has available a non-capital loss carry forward of $12,000 and a net capital loss carry forward of $10,000 [(1/2)($20,000)]. There has not been sufficient Net Income For Tax Purposes to deduct these amounts in any previous year. It is the policy of Melanor Ltd. to minimize non-capital loss carry overs.

Required: Calculate the minimum Net Income For Tax Purposes and Taxable Income for each of the two years 2019 and 2020 and indicate the amount and type of any carry overs that are available at the end of each year.

![During the year ending December 31, 2019, Melanor Ltd. reported accounting Income Before Taxes of $225,000. This was followed in the year ending December 31, 2020, by an accounting Loss Before Taxes of $372,000. Both of these amounts were determined using generally accepted accounting principles. Included in the above income figures were the following amounts: The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares. At the beginning of the 2019 taxation year, the Company has available a non-capital loss carry forward of $12,000 and a net capital loss carry forward of $10,000 [(1/2)($20,000)]. There has not been sufficient Net Income For Tax Purposes to deduct these amounts in any previous year. It is the policy of Melanor Ltd. to minimize non-capital loss carry overs. Required: Calculate the minimum Net Income For Tax Purposes and Taxable Income for each of the two years 2019 and 2020 and indicate the amount and type of any carry overs that are available at the end of each year.](https://d2lvgg3v3hfg70.cloudfront.net/TB8606/11eb9a05_65d7_61c2_9571_4b74105bad20_TB8606_00.jpg) The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares.

The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares.At the beginning of the 2019 taxation year, the Company has available a non-capital loss carry forward of $12,000 and a net capital loss carry forward of $10,000 [(1/2)($20,000)]. There has not been sufficient Net Income For Tax Purposes to deduct these amounts in any previous year. It is the policy of Melanor Ltd. to minimize non-capital loss carry overs.

Required: Calculate the minimum Net Income For Tax Purposes and Taxable Income for each of the two years 2019 and 2020 and indicate the amount and type of any carry overs that are available at the end of each year.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

73

For the year ending December 31, 2020, Garba Inc. had Net Income For Tax Purposes of $472,000. This amount included $22,000 in dividends received from taxable Canadian companies, as well as $12,400 in net taxable capital gains. The Company also made charitable donations during 2020 of $14,500.

At the beginning of 2020, the Company had a non-capital loss carry forward of $102,000, as well as a net capital loss carry forward of $56,000.

Determine the Company's minimum Taxable Income for the year ending December 31, 2020 and the amount and type of any carry forwards available at the end of the year.

At the beginning of 2020, the Company had a non-capital loss carry forward of $102,000, as well as a net capital loss carry forward of $56,000.

Determine the Company's minimum Taxable Income for the year ending December 31, 2020 and the amount and type of any carry forwards available at the end of the year.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

74

During the year ending December 31, 2019, Durham Inc. had GAAP based accounting income before taxes of $427,000. The corresponding figure for 2020 was an accounting loss of $625,000. Included in these figures were the following amounts: ![During the year ending December 31, 2019, Durham Inc. had GAAP based accounting income before taxes of $427,000. The corresponding figure for 2020 was an accounting loss of $625,000. Included in these figures were the following amounts: The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares. At the beginning of 2019, Durham had available a non-capital loss carry forward of $26,000 and a net capital loss carry forward of $19,000 [(1/2)($38,000)]. It is the policy of Durham to minimize non-capital loss carry overs. Required: Calculate the minimum Net Income For Tax Purposes and Taxable Income for each of the two years 2019 and 2020 and indicate the amount and type of any carry overs that are available at the end of each year.](https://d2lvgg3v3hfg70.cloudfront.net/TB8606/11eb9a05_65d7_afe4_9571_b94107d73ef5_TB8606_00.jpg) The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares.

The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares.

At the beginning of 2019, Durham had available a non-capital loss carry forward of $26,000 and a net capital loss carry forward of $19,000 [(1/2)($38,000)]. It is the policy of Durham to minimize non-capital loss carry overs.

Required: Calculate the minimum Net Income For Tax Purposes and Taxable Income for each of the two years 2019 and 2020 and indicate the amount and type of any carry overs that are available at the end of each year.

![During the year ending December 31, 2019, Durham Inc. had GAAP based accounting income before taxes of $427,000. The corresponding figure for 2020 was an accounting loss of $625,000. Included in these figures were the following amounts: The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares. At the beginning of 2019, Durham had available a non-capital loss carry forward of $26,000 and a net capital loss carry forward of $19,000 [(1/2)($38,000)]. It is the policy of Durham to minimize non-capital loss carry overs. Required: Calculate the minimum Net Income For Tax Purposes and Taxable Income for each of the two years 2019 and 2020 and indicate the amount and type of any carry overs that are available at the end of each year.](https://d2lvgg3v3hfg70.cloudfront.net/TB8606/11eb9a05_65d7_afe4_9571_b94107d73ef5_TB8606_00.jpg) The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares.

The above accounting gains (losses)on the sale of shares are equal to the capital gains (losses)on the sale of the shares.At the beginning of 2019, Durham had available a non-capital loss carry forward of $26,000 and a net capital loss carry forward of $19,000 [(1/2)($38,000)]. It is the policy of Durham to minimize non-capital loss carry overs.

Required: Calculate the minimum Net Income For Tax Purposes and Taxable Income for each of the two years 2019 and 2020 and indicate the amount and type of any carry overs that are available at the end of each year.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

75

Meridian Inc. is a CCPC throughout the year and is not associated with any other corporation. For the year ending December 31, 2020, Meridian has Net Income For Tax Purposes of $422,000. This amount is made up of dividends from taxable Canadian corporations of $22,000, active business income of $380,000, and foreign non-business income of $20,000. The foreign income was subject to withholding in the foreign jurisdiction at a rate of 13 percent. Meridian receives a foreign tax credit against federal Tax Payable that is equal to the amount withheld. Meridian has a non-capital loss carry forward of $145,000 which it intends to deduct during 2020.

Determine Meridian's small business deduction for the year ending December 31, 2020.

Determine Meridian's small business deduction for the year ending December 31, 2020.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

76

You have been asked to prepare a Schedule 1 reconciliation of accounting Net Income and Net Income For Tax Purposes for the year ending December 31. Available information includes the following:

1. A capital asset was sold near the end of the year for $93,000. It had a cost of $89,300 and a net book value of $26,400. It was not the last asset in its CCA class and the UCC of this class was $263,000 before the disposition. There were no other additions or dispositions during the year.

2. During the year, the company has expensed estimated warranty costs of $22,000.

3. During the year, the Company acquired goodwill at a cost of $68,000. Since there was no impairment of the goodwill during the year, no write-down was required for accounting purposes.

4. Discount amortization on the company's bonds payable was $2,300 for the current year.

Required: Determine the addition and/or deduction that would be made in Schedule 1 for each of the preceding items.

1. A capital asset was sold near the end of the year for $93,000. It had a cost of $89,300 and a net book value of $26,400. It was not the last asset in its CCA class and the UCC of this class was $263,000 before the disposition. There were no other additions or dispositions during the year.

2. During the year, the company has expensed estimated warranty costs of $22,000.

3. During the year, the Company acquired goodwill at a cost of $68,000. Since there was no impairment of the goodwill during the year, no write-down was required for accounting purposes.

4. Discount amortization on the company's bonds payable was $2,300 for the current year.

Required: Determine the addition and/or deduction that would be made in Schedule 1 for each of the preceding items.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

77

Gander Limited is a Canadian controlled private corporation. In the current taxation year, the company has Taxable Income calculated as follows:  The company earned foreign non-business income of $25,000, from which tax of $2,500 was withheld by the foreign government. What is the Adjusted Division B Income for Gander Limited for the current taxation year?

The company earned foreign non-business income of $25,000, from which tax of $2,500 was withheld by the foreign government. What is the Adjusted Division B Income for Gander Limited for the current taxation year?

A)$166,000

B)$171,000

C)$191,000

D)$211,000

The company earned foreign non-business income of $25,000, from which tax of $2,500 was withheld by the foreign government. What is the Adjusted Division B Income for Gander Limited for the current taxation year?

The company earned foreign non-business income of $25,000, from which tax of $2,500 was withheld by the foreign government. What is the Adjusted Division B Income for Gander Limited for the current taxation year?A)$166,000

B)$171,000

C)$191,000

D)$211,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

78

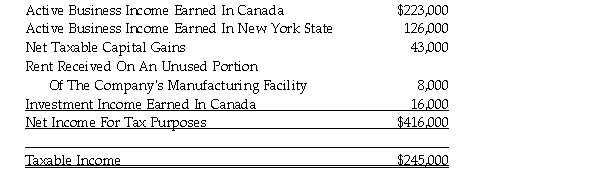

Sardo Ltd. is a CCPC through the 2020 taxation year. It has a December 31 year end and is not associated with any other companies. Its $422,000 Net Income For Tax Purposes is made up of the following components:  The foreign jurisdiction withheld $3,200 from the foreign non-business income. The Company receives a credit against federal Tax Payable for this amount.

The foreign jurisdiction withheld $3,200 from the foreign non-business income. The Company receives a credit against federal Tax Payable for this amount.

The Company has a non-capital loss carry over of $96,000 that it intends to deduct during 2020.

Determine Sardo's small business deduction for the year ending December 31, 2020.

The foreign jurisdiction withheld $3,200 from the foreign non-business income. The Company receives a credit against federal Tax Payable for this amount.

The foreign jurisdiction withheld $3,200 from the foreign non-business income. The Company receives a credit against federal Tax Payable for this amount.The Company has a non-capital loss carry over of $96,000 that it intends to deduct during 2020.

Determine Sardo's small business deduction for the year ending December 31, 2020.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

79

Fredericton Corp. earned $60,000 in foreign business income in the current fiscal year. Tax was paid to the foreign government in the amount of $7,500 on this income. Fredericton Corp. has correctly calculated its federal Tax Payable before the foreign business income tax credit as $15,250, calculated as follows:  What is the amount of Tax Otherwise Payable for purposes of the foreign business income tax credit calculation?

What is the amount of Tax Otherwise Payable for purposes of the foreign business income tax credit calculation?

A)$27,250.

B)$34,500.

C)$46,500.

D)$48,000.

What is the amount of Tax Otherwise Payable for purposes of the foreign business income tax credit calculation?

What is the amount of Tax Otherwise Payable for purposes of the foreign business income tax credit calculation?A)$27,250.

B)$34,500.

C)$46,500.

D)$48,000.

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

80

During March, 2020, Invest Inc. acquires 5,000 shares of Glee Ltd., a widely held public company for $18.95 per share. In May, 2020, the directors of Glee declare and pay a dividend of $1.50 per share. In September, 2020, Invest sells the 5,000 Glee shares for $16.75 per share. Invest Inc. has over $50,000 in 2020 taxable capital gains on other share transactions.

What is the amount of the allowable capital loss, if any, that Invest Inc. will include in its tax return for the taxation year ending December 31, 2020?

What is the amount of the allowable capital loss, if any, that Invest Inc. will include in its tax return for the taxation year ending December 31, 2020?

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck