Deck 11: Taxable Income and Tax Payable for Individuals Revisited

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/106

Play

Full screen (f)

Deck 11: Taxable Income and Tax Payable for Individuals Revisited

1

List two types of income that would not be subject to the tax on split income (TOSI).

The two items that are specifically mentioned in the text are employment income and compound income resulting from the re-investment of split income amounts. Other items (e.g., dividends from publicly traded shares), could also be mentioned if they do not fall within the definition of split income.

2

If a taxpayer has both net capital and non-capital loss carry overs and does not have sufficient income in the current and previous years to deduct all of these amounts, which type of loss should be deducted first?

There is no clear cut answer to this question. Net capital losses have an unlimited life but can only be carried over to the extent of net taxable capital gains in the carry over year.

This would suggest that, if net taxable capital gains are present in the current year, the use of net capital losses should receive priority. This would be particularly true if additional net taxable capital gains are not expected in future years. In contrast, non-capital losses can be deducted against any type of income. However, the downside here is that their carry forward period is limited to 20 years. While no firm conclusion is available, in most cases the lengthy carry forward period for non-capital losses, would suggest using net capital losses first. However, this tentative conclusion would be altered if the taxpayer commonly has net taxable capital gains.

This would suggest that, if net taxable capital gains are present in the current year, the use of net capital losses should receive priority. This would be particularly true if additional net taxable capital gains are not expected in future years. In contrast, non-capital losses can be deducted against any type of income. However, the downside here is that their carry forward period is limited to 20 years. While no firm conclusion is available, in most cases the lengthy carry forward period for non-capital losses, would suggest using net capital losses first. However, this tentative conclusion would be altered if the taxpayer commonly has net taxable capital gains.

3

In computing Net Income For Tax Purposes, ITA 3 requires that subdivision e deductions be subtracted prior to deducting business or property losses. Explain why this rule is usually beneficial to a taxpayer.

Most subdivision e deductions such as child care expenses cannot be carried forward to other taxation years. This means that, if they are not deducted during the current taxation year, they are lost forever. In contrast, business and property losses can be both carried back to previous taxation years and forward to subsequent taxation years. In contrast to subdivision e deductions, business and property losses are not lost if they are not deducted during the current taxation year. This means that, in situations where there is not sufficient income to deduct all available amounts, it will generally be desirable to deduct any subdivision e deductions first. This prevents a permanent loss of these deductions.

4

What is a Small Business Corporation as defined in the Income Tax Act?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

5

Tax advisors will normally recommend that loss carry overs not be used to reduce Taxable Income to nil. What is the basis for this recommendation?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

6

The carry forward periods for losses varies with the type of loss. Briefly describe the carry forward periods that the Income Tax Act provides for the types of losses that it identifies.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

7

What types of current year losses are included in the definition of non-capital losses? What types of losses are not included?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

8

Under the TOSI legislation, what is the meaning of the term Excluded Shares?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

9

Describe the conditions under which the tax on split income (TOSI)can be applicable.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

10

The lifetime capital gains deduction is available when the taxpayer has a gain on the disposition of shares in a "qualified small business corporation". What are the conditions that must be met for an enterprise to be a qualified small business corporation?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

11

John Broley has a $50,000 non-capital loss carry forward and a $50,000 net capital loss carry forward. During the current year, his only income is a $50,000 taxable capital gain.

He has asked your advice as to which of the two loss carry forwards he should deduct. What advice would you give him?

He has asked your advice as to which of the two loss carry forwards he should deduct. What advice would you give him?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

12

With respect to the deductibility of their losses, farmers fall into three categories. What are these three categories and how are losses treated in each category?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

13

Under the TOSI legislation, what is the meaning of the term Excluded Business?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

14

What is an Allowable Business Investment Loss? What special tax provisions are associated with this type of loss?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

15

An individual has a capital gain on qualified farm property. He has no other capital gains during the year. Explain how the annual gains limit would be calculated in determining his lifetime capital gains deduction for the year.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

16

ITA 110.2 provides for a deduction of "lump-sum payments", for example a court ordered termination benefit. What tax policy objective is served by this provision?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

17

If an individual dies and has a net capital loss in that taxation year or unused net capital losses from previous years, these balances are subject to a different treatment than would be the case if the individual were still alive. Briefly describe how this treatment is different.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

18

Briefly describe the tax treatment of losses on listed personal property.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

19

When an enterprise has several types of loss carry forwards, why is it necessary to keep separate balances for each type?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

20

Under the TOSI legislation, in determining whether an amount of income represents a reasonable return, the test for individuals age 25 or over is different than the test for individuals between 18 and 24. Describe this difference.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

21

Briefly describe the four major categories of charitable donations.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

22

A corporation sold a long-term investment in common shares with an adjusted cost base of $25,000, for $10,000 during the current year. It also sold a parcel of land that is considered capital property with an adjusted cost base of $8,000, for $12,000. Its net allowable capital loss for the year is $11,000.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

23

Compare the tax treatment of foreign tax credits on foreign non-business income with the tax treatment of tax credits on foreign business income for individuals.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

24

Jennifer Nash is a plumber in Waterloo, Ontario, who spends all of her weekends and holidays operating a farm she purchased this year. She is confident that within two years her farm will be making a profit. In the current year, the farm had a loss of $18,000.

In the current year, she can deduct a maximum of $2,500 of the farm loss against other income.

In the current year, she can deduct a maximum of $2,500 of the farm loss against other income.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

25

When an individual makes a gift of publicly traded securities to a registered charity, any capital gain that results from the disposition is deemed to be nil.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

26

If an individual has no loss carry overs from other years, the current year Net Income For Tax Purposes will be equal to Taxable Income.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

27

The base for the charitable donations tax credit is always limited to 75 percent of the individual's Net Income For Tax Purposes.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

28

Jennifer Nash is a plumber in Waterloo, Ontario, who spends all of her weekends and holidays operating a farm she purchased this year. She is confident that within two years her farm will be making a profit. In the current year, the farm had a loss of $18,000.

Any loss that is not deductible in the current year can only be applied to the extent of farm income in the carry over year.

Any loss that is not deductible in the current year can only be applied to the extent of farm income in the carry over year.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

29

Capital gains resulting from donations of publicly traded shares are, in general, deemed to be nil. Why is an additional rule required to avoid taxing income resulting from gifts of publicly traded shares that have been acquired through stock options?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

30

Jennifer Nash is a plumber in Waterloo, Ontario, who spends all of her weekends and holidays operating a farm she purchased this year. She is confident that within two years her farm will be making a profit. In the current year, the farm had a loss of $18,000.

In the current year, she can deduct a maximum of $2,500 of the farm loss against other income.

In the current year, she can deduct a maximum of $2,500 of the farm loss against other income.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

31

If a 10 year old child receives dividends from a private company owned by his mother, it will always be taxed as Split Income.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

32

Under what circumstances can dividends be transferred from a spouse or common-law partner to a taxpayer?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

33

Net capital losses can be carried forward or back, but can only be deducted to the extent of net taxable capital gains in the carry back or carry forward year.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

34

If a taxpayer is donating a non-depreciable capital asset with a fair market value that exceeds its adjusted cost base, a taxpayer can elect any amount between those two values as the amount of his contribution. Why is it generally appropriate to elect the higher fair market value?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

35

An individual has a non-capital loss. It can be carried back three years and forward indefinitely.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

36

During 2020, an individual has taxable capital gains on the disposition of shares in a qualified small business corporation. The lifetime capital gains deduction can be used to eliminate up to $441,692 of the taxable capital gains on the disposition.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

37

Dividends received by the spouse of a taxpayer can be transferred to him and included in his Net Income For Tax Purposes and excluded from hers.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

38

If a 22 year old Specified Individual receives dividends from a private company in which he owns 20 percent of the fair market value of the company shares and 20 percent of the voting shares, the dividends will not be subject to the Tax On Split Income.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

39

An individual sells shares in a Canadian controlled private corporation that qualifies as a small business corporation to an arm's length party. The adjusted cost base of the shares is $50,000 and they are sold for $30,000. The $20,000 loss is an Allowable Business Investment Loss.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

40

The alternative minimum tax is an attempt to deal with a tax policy issue. What is this issue and, in general terms, how does the alternative minimum tax deal with this issue?

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

41

Martin is worried about how much tax he will have to pay this year and he is looking for anything that he might have missed that will decrease his Taxable Income. All of the following could decrease his Taxable Income, with the exception of:

A)a deduction for contributions to an RPP.

B)application of a net capital loss carryforward.

C)application of a non-capital loss carryforward.

D)a credit for a charitable donation.

A)a deduction for contributions to an RPP.

B)application of a net capital loss carryforward.

C)application of a non-capital loss carryforward.

D)a credit for a charitable donation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

42

An individual is holding bonds issued in a foreign country. Tax of $2,000 is withheld in that country from the gross interest of $10,000. The foreign tax credit deductible from federal Tax Payable cannot exceed $1,500.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

43

Individuals with Taxable Income in excess of $300,000 will always pay some amount of alternative minimum tax.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

44

As a part time employee, Derek earns $20,000 per year of employment income. He recently started up his own business as a sole proprietorship. For the current year, his business revenues were $12,000 and his business expenses were $28,000. Derek has some investments that resulted in taxable dividend income of $1,400 and incurred interest expense of $2,000. Assuming this accounts for all of Derek's sources of income, what is his non-capital loss carry forward for the year?

A)Nil.

B)$600.

C)$3,400.

D)$16,000.

A)Nil.

B)$600.

C)$3,400.

D)$16,000.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following would reduce an individual's Taxable Income?

A)A non-capital loss carried forward from a previous year.

B)A charitable donation carried forward from a previous year.

C)Adoption expenses.

D)Medical expenses.

A)A non-capital loss carried forward from a previous year.

B)A charitable donation carried forward from a previous year.

C)Adoption expenses.

D)Medical expenses.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements about Allowable Business Investment Losses is correct?

A)They are losses that result from the disposition of shares or debt in a Canadian controlled public corporation.

B)They can only be deducted against business income.

C)If they are not used during the current year, they are added to the net capital loss balance.

D)If they are not used during the current year, they are added to the non-capital loss balance.

A)They are losses that result from the disposition of shares or debt in a Canadian controlled public corporation.

B)They can only be deducted against business income.

C)If they are not used during the current year, they are added to the net capital loss balance.

D)If they are not used during the current year, they are added to the non-capital loss balance.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

47

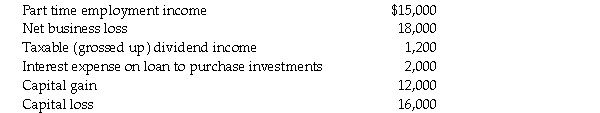

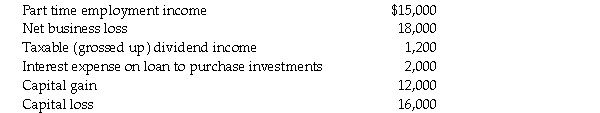

Daria is a part time employee who recently started up her own business as a sole proprietorship. For the current year, she had the following sources of income and loss:  What is her non-capital loss carry forward for the year?

What is her non-capital loss carry forward for the year?

A)$3,000.

B)$3,800.

C)$5,800.

D)$18,000.

What is her non-capital loss carry forward for the year?

What is her non-capital loss carry forward for the year?A)$3,000.

B)$3,800.

C)$5,800.

D)$18,000.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

48

Reuben Chechetto had to take his employer to court in 2020, to sue for wages owing to him over an 8 year period ending in 2020. In the 2020 taxation year, he receives a court settlement of $80,000, or $10,000 per year. In all years, Reuben had taxable income of $60,000. What will the tax consequences be with respect to the $80,000 in back wages received in 2020?

A)Mr. Chechetto will have to report the full $80,000 in additional wages in 2020.

B)As these funds were awarded through a court settlement, they are not taxable.

C)Mr. Chechetto can use a special relief mechanism in the Income Tax Act which will have the effect of spreading the lump-sum payment over a maximum period of 5 years.

D)Mr. Chechetto can use a special relief mechanism in the Income Tax Act which will have the effect of spreading the lump-sum payment over the 8 taxation years affected.

A)Mr. Chechetto will have to report the full $80,000 in additional wages in 2020.

B)As these funds were awarded through a court settlement, they are not taxable.

C)Mr. Chechetto can use a special relief mechanism in the Income Tax Act which will have the effect of spreading the lump-sum payment over a maximum period of 5 years.

D)Mr. Chechetto can use a special relief mechanism in the Income Tax Act which will have the effect of spreading the lump-sum payment over the 8 taxation years affected.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

49

Tabari has income from employment of $25,000 during the year. As well, he has a capital gain on Listed Personal Property of $8,000 on the sale of a stamp collection, and a capital gain from the sale of some shares of $6,000. Last year, he had a capital loss on Listed Personal Property of $10,000 that he was unable to use and carried forward to the current year. What is his net income for tax purposes for the year, assuming that this accounts for all of his income for the year?

A)$27,000.

B)$28,000.

C)$31,000.

D)$32,000.

A)$27,000.

B)$28,000.

C)$31,000.

D)$32,000.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements with respect to loss carry overs is NOT correct?

A)Losses on the disposition of listed personal property can be carried back 3 years and forward 7 years.

B)Restricted farm losses can only be carried over to years in which there is farm income.

C)Net capital loss carry overs cannot be deducted in years in which Net Income For Tax Purposes is nil, even if there are taxable capital gains in that year.

D)If an individual can deduct either a $10,000 non-capital loss carry over or a $10,000 net capital loss carry over, the effect on Taxable Income of deducting either is the same.

A)Losses on the disposition of listed personal property can be carried back 3 years and forward 7 years.

B)Restricted farm losses can only be carried over to years in which there is farm income.

C)Net capital loss carry overs cannot be deducted in years in which Net Income For Tax Purposes is nil, even if there are taxable capital gains in that year.

D)If an individual can deduct either a $10,000 non-capital loss carry over or a $10,000 net capital loss carry over, the effect on Taxable Income of deducting either is the same.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

51

Shelly is seeking your advice on how she can claim various deductions and credits. Which of the following items would reduce the amount of her Taxable Income? i. A net capital loss carried forward from a previous year.

Ii) A charitable donation.

Iii) Contributions to an RESP.

Iv) Childcare costs paid during the year.

A)i, ii, and iv

B)ii and iv

C)i and iv

D)i, iii, and iv

Ii) A charitable donation.

Iii) Contributions to an RESP.

Iv) Childcare costs paid during the year.

A)i, ii, and iv

B)ii and iv

C)i and iv

D)i, iii, and iv

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

52

Zina Chaburi has a full time job as a nurse in her local hospital. In her spare time she has a goat farming operation. The goat farm began in 2019, and resulted in a loss of $10,000. She deducted the maximum allowable amount against her 2019 income. In 2020, most of the problems had been worked out, and Zina had a profit from the farm operation of $5,000, as well as employment income of $90,000. Determine Ms. Chaburi's minimum taxable income for 2020.

A)$81,000.

B)$88,750.

C)$91,250.

D)$95,000.

A)$81,000.

B)$88,750.

C)$91,250.

D)$95,000.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

53

Under which set of circumstances would it be advisable to utilize a loss carry over to reduce taxable income to nil in the carry over year?

A)When the taxpayer is carrying a loss back to a prior year, taxable income can be reduced to nil without negative consequences.

B)When the taxpayer is carrying a loss forward, taxable income can be reduced to nil without negative consequences.

C)Net capital losses are the only type of loss that should be used to reduce taxable income to nil in the carry over year.

D)It is never advisable to use a loss carry over to reduce taxable income to nil in the carry over year.

A)When the taxpayer is carrying a loss back to a prior year, taxable income can be reduced to nil without negative consequences.

B)When the taxpayer is carrying a loss forward, taxable income can be reduced to nil without negative consequences.

C)Net capital losses are the only type of loss that should be used to reduce taxable income to nil in the carry over year.

D)It is never advisable to use a loss carry over to reduce taxable income to nil in the carry over year.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

54

An excess of alternative minimum tax over regular Tax Payable can be carried forward for up to 7 years to be applied against any future excess of regular Tax Payable over the alternative minimum tax.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

55

With respect to net capital loss balances, which of the following statements is NOT correct?

A)In the year of death when such balances are deducted, the amount deducted will be based on the capital gains inclusion rate which applied in the year in which the loss was realized.

B)When such balances are carried back, they can be deducted only to the extent of taxable capital gains arising in the carry back period.

C)Such balances can be carried back three years.

D)Such balances can be carried forward for a maximum of 20 years.

A)In the year of death when such balances are deducted, the amount deducted will be based on the capital gains inclusion rate which applied in the year in which the loss was realized.

B)When such balances are carried back, they can be deducted only to the extent of taxable capital gains arising in the carry back period.

C)Such balances can be carried back three years.

D)Such balances can be carried forward for a maximum of 20 years.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

56

With respect to an Allowable Business Investment Loss, which of the following statements is NOT correct?

A)An Allowable Business Investment loss can be deducted against any source of income.

B)If not used during the current year, an Allowable Business Investment Loss can only be applied against taxable capital gains in a carry forward or carry back period.

C)An Allowable Business Investment Loss results from the disposition of shares of a small business corporation.

D)An Allowable Business Investment Loss is the deductible portion of a Business Investment Loss.

A)An Allowable Business Investment loss can be deducted against any source of income.

B)If not used during the current year, an Allowable Business Investment Loss can only be applied against taxable capital gains in a carry forward or carry back period.

C)An Allowable Business Investment Loss results from the disposition of shares of a small business corporation.

D)An Allowable Business Investment Loss is the deductible portion of a Business Investment Loss.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

57

For which of the following types of losses is it not necessary to segregate the loss by type in order to track the balance carried forward as a separate balance?

A)Net capital losses.

B)Allowable Business Investment Losses.

C)Restricted farm losses

D)Business losses.

A)Net capital losses.

B)Allowable Business Investment Losses.

C)Restricted farm losses

D)Business losses.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following types of losses cannot be carried forward for at least 20 years?

A)Listed personal property losses.

B)Non-capital losses.

C)Net capital losses.

D)Restricted farm losses.

A)Listed personal property losses.

B)Non-capital losses.

C)Net capital losses.

D)Restricted farm losses.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

59

In 2017, Lorrie Meller use her lifetime capital gains deduction to eliminate a $10,000 taxable capital gain. During 2020, she had employment income of $50,000, a capital gain of $26,000, and a business investment loss of $30,000. What is the amount of Lorrie's Taxable Income for 2020?

A)$45,000

B)$58,000

C)$46,000

D)$48,000

A)$45,000

B)$58,000

C)$46,000

D)$48,000

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements is correct with respect to the disposition of a valuable coin collection?

A)If a loss occurs, it cannot be deducted against any source of income.

B)If a loss occurs, one-half of this amount can be applied against one-half of any capital gain.

C)If a gain occurs, one-half of this amount can be offset by allowable capital losses on any disposition of capital property.

D)If a gain occurs, it will not be taxed because this is personal use property.

A)If a loss occurs, it cannot be deducted against any source of income.

B)If a loss occurs, one-half of this amount can be applied against one-half of any capital gain.

C)If a gain occurs, one-half of this amount can be offset by allowable capital losses on any disposition of capital property.

D)If a gain occurs, it will not be taxed because this is personal use property.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements with respect to charitable donations is NOT correct?

A)Amounts of eligible donations that are not used during the current year can be carried forward for up to 5 years.

B)When making a gift of non-depreciable capital property with a fair market value in excess of its capital cost, it is always advisable to elect the fair market value amount for the gift.

C)The basis for a charitable donations tax credit for the current year can never exceed 75 percent on the individual's Net Income For Tax Purposes.

D)Any capital gain arising on gifts of ecologically sensitive land are deemed to be nil.

A)Amounts of eligible donations that are not used during the current year can be carried forward for up to 5 years.

B)When making a gift of non-depreciable capital property with a fair market value in excess of its capital cost, it is always advisable to elect the fair market value amount for the gift.

C)The basis for a charitable donations tax credit for the current year can never exceed 75 percent on the individual's Net Income For Tax Purposes.

D)Any capital gain arising on gifts of ecologically sensitive land are deemed to be nil.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

62

With respect to the lifetime capital gains deduction, which of the following statements is NOT correct?

A)The deduction is only available to individuals.

B)The Cumulative Gains Limit is reduced by any CNIL balance at the end of the year.

C)The Annual Gains Limit is reduced by Allowable Business Investment Losses realized during the year.

D)The deduction is available on any disposition of shares or debt of a qualified small business corporation.

A)The deduction is only available to individuals.

B)The Cumulative Gains Limit is reduced by any CNIL balance at the end of the year.

C)The Annual Gains Limit is reduced by Allowable Business Investment Losses realized during the year.

D)The deduction is available on any disposition of shares or debt of a qualified small business corporation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

63

With respect to the Foreign Non-Business Income Tax Credit and the Foreign Business Income Tax Credit for individuals, which of the following statements is correct?

A)The Foreign Business Income Tax Credit is limited to 15% of the foreign business income.

B)The Foreign Non-Business Income Tax Credit is limited to 15% of the foreign non-business income.

C)The Foreign Business Income Tax Credit cannot exceed tax otherwise payable for the year.

D)Any unused Foreign Non-Business Income Tax Credit can be carried forward for 10 years and carried back 3 years.

A)The Foreign Business Income Tax Credit is limited to 15% of the foreign business income.

B)The Foreign Non-Business Income Tax Credit is limited to 15% of the foreign non-business income.

C)The Foreign Business Income Tax Credit cannot exceed tax otherwise payable for the year.

D)Any unused Foreign Non-Business Income Tax Credit can be carried forward for 10 years and carried back 3 years.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

64

Mrs. Mantz receives eligible dividend income of $12,000 every year. Her spouse is unable to utilize the spousal credit because of the dividends received by Mrs. Mantz. She is considering transferring the dividends to her spouse which will then enable him to claim some or all of the spousal credit. Under what circumstances would this most likely be tax advantageous?

A)If Mrs. Mantz is receiving OAS.

B)If Mr. Mantz is in the 15 percent federal tax bracket.

C)If Mr. Mantz is in the 33 percent federal tax bracket.

D)If Mr. Mantz can claim the full spousal credit.

A)If Mrs. Mantz is receiving OAS.

B)If Mr. Mantz is in the 15 percent federal tax bracket.

C)If Mr. Mantz is in the 33 percent federal tax bracket.

D)If Mr. Mantz can claim the full spousal credit.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

65

Assume that any foreign income is taxed in the foreign jurisdiction. Which one of the following types of foreign income generates foreign tax credits that may be applied to other taxation years?

A)Business income only.

B)Capital gains only.

C)Employment income only.

D)Investment income only.

A)Business income only.

B)Capital gains only.

C)Employment income only.

D)Investment income only.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

66

For the year ending December 31, 2020, Liane Stanfield has Net Income For Tax Purposes of $102,000. This includes foreign non-business income of $30,000. This amount was before the withholding of taxes by the foreign government of $6,000. In calculating her 2020 Taxable Income, she intends to deduct a net capital loss carry forward of $10,000 and a $30,000 non-capital loss carry forward. After applying her basic personal credit, the tax otherwise payable is $8,056. What is the amount of Liane's foreign non-business tax credit?

A)$6,000

B)$2,628

C)$4,500

D)$3,898

A)$6,000

B)$2,628

C)$4,500

D)$3,898

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following transactions could result in the taxpayer being able to make a lifetime capital gains deduction?

A)An individual sells 100 percent of the shares of a CCPC that uses 85 percent of its assets in the operation of an active business.

B)An individual sells 15 percent of the shares of a CCPC that uses 95 percent of its assets in the operation of an active business.

C)A CCPC sells 100 percent of the shares of another CCPC that uses 100 percent of its assets in the operation of an active business.

D)An individual sells 25 percent of the shares of a CCPC that uses 30 percent of its assets to produce property income.

A)An individual sells 100 percent of the shares of a CCPC that uses 85 percent of its assets in the operation of an active business.

B)An individual sells 15 percent of the shares of a CCPC that uses 95 percent of its assets in the operation of an active business.

C)A CCPC sells 100 percent of the shares of another CCPC that uses 100 percent of its assets in the operation of an active business.

D)An individual sells 25 percent of the shares of a CCPC that uses 30 percent of its assets to produce property income.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

68

An individual has Net Income For Tax Purposes of $147,500. During the current year, the individual donates a depreciable capital asset with a fair market value of $300,000. The capital cost of this asset is $225,000 and it has a UCC $147,000. It is the only asset in its CCA class and no additions are made subsequent to the gift. If he elects to have the donation valued at its fair market value, what is the maximum amount that this individual can claim as the basis for his charitable donations tax credit for the current year?

A)$300,000

B)$110,625

C)$139,500

D)$148,875

A)$300,000

B)$110,625

C)$139,500

D)$148,875

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

69

With respect to the use of loss carryovers, which of the following statements is correct?

A)Net-capital losses must always be used before any other type of loss.

B)Non-capital losses must be used last if a taxpayer has several different types of loss carryovers to choose from.

C)Within a particular type of loss, the oldest losses must be utilized first.

D)Claiming a non-capital loss carry forward will reduce the amount of the lifetime capital gains deduction available in the year.

A)Net-capital losses must always be used before any other type of loss.

B)Non-capital losses must be used last if a taxpayer has several different types of loss carryovers to choose from.

C)Within a particular type of loss, the oldest losses must be utilized first.

D)Claiming a non-capital loss carry forward will reduce the amount of the lifetime capital gains deduction available in the year.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following statements with respect to the lifetime capital gains deduction is correct?

A)For purposes of calculating this deduction, the annual gains limit is reduced by the amount of the individual's CNIL.

B)It is always preferable to deduct net capital loss carry overs prior to making any use of the lifetime capital gains deduction

C)For 2020, the maximum deduction for qualified small business corporations is different than the maximum deduction for qualified family farm corporations.

D)The cumulative gains limit includes the annual gains limits for all previous years, but not for the current year.

A)For purposes of calculating this deduction, the annual gains limit is reduced by the amount of the individual's CNIL.

B)It is always preferable to deduct net capital loss carry overs prior to making any use of the lifetime capital gains deduction

C)For 2020, the maximum deduction for qualified small business corporations is different than the maximum deduction for qualified family farm corporations.

D)The cumulative gains limit includes the annual gains limits for all previous years, but not for the current year.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

71

Assuming that foreign income is taxed in the foreign jurisdiction, which of the following types of income results in foreign tax withholdings that could generate both a tax credit and a tax deduction for individuals?

A)Foreign business income.

B)Foreign employment income.

C)Foreign interest income.

D)All foreign income.

A)Foreign business income.

B)Foreign employment income.

C)Foreign interest income.

D)All foreign income.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following statements with respect to the Tax On Split Income (TOSI)is correct?

A)A Specified Individual's holding of private company shares will be classified as Excluded Shares if their fair market value is equal to or greater than 10 percent of the fair market value of all of the company's shares.

B)A Specified Individual can only claim that dividends are from an Excluded Business if they are actively engaged in the business during the current taxation year.

C)Specified Individuals under the age of 18 can never claim that income received is from an Excluded Business.

D)Potential Split Income received by any Specified Individual can be an Excluded Amount, provided it is reasonable in terms of the individual's labour, capital, or risk contribution to the source business.

A)A Specified Individual's holding of private company shares will be classified as Excluded Shares if their fair market value is equal to or greater than 10 percent of the fair market value of all of the company's shares.

B)A Specified Individual can only claim that dividends are from an Excluded Business if they are actively engaged in the business during the current taxation year.

C)Specified Individuals under the age of 18 can never claim that income received is from an Excluded Business.

D)Potential Split Income received by any Specified Individual can be an Excluded Amount, provided it is reasonable in terms of the individual's labour, capital, or risk contribution to the source business.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

73

Katrina is 27 years old. During 2020 she receives a non-eligible dividend of $12,000 from a private company controlled by her mother. Because she has never been actively engaged in the business, has assumed no risk or contributed capital to the corporation, holds only non-voting shares, these dividends are classified as Split Income. In addition to the dividends, she has interest income of $6,000 on funds that she inherited when her grandmother passed away. Her only tax credits are the basic personal credit and the dividend tax credit. How much is her federal tax payable for the year?

A)Nil

B)$1,324.

C)$2,224.

D)$3,308.

A)Nil

B)$1,324.

C)$2,224.

D)$3,308.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following amounts would NOT be considered to be a charitable donation for purposes of the charitable donations tax credit?

A)A donation to a charitable organization outside of Canada to which the taxpayer's province of residence has also made a donation.

B)A donation to her Majesty in right of Canada.

C)A gift of land to a Canadian municipality that has been certified by the Minister of the Environment to be ecologically sensitive land.

D)A gift to a registered Canadian athletic association.

A)A donation to a charitable organization outside of Canada to which the taxpayer's province of residence has also made a donation.

B)A donation to her Majesty in right of Canada.

C)A gift of land to a Canadian municipality that has been certified by the Minister of the Environment to be ecologically sensitive land.

D)A gift to a registered Canadian athletic association.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is NOT a requirement for a business to qualify as a qualified small business corporation?

A)At the time the shares are sold, the corporation must use all or substantially all of its assets for active business purposes in Canada.

B)More than 50 percent of the fair market value of the assets of the business must have been used for active business in the past 24 months.

C)The shares must not have been owned by a related individual in the past 24 months.

D)The shares must not have been owned by a non-related individual in the past 24 months.

A)At the time the shares are sold, the corporation must use all or substantially all of its assets for active business purposes in Canada.

B)More than 50 percent of the fair market value of the assets of the business must have been used for active business in the past 24 months.

C)The shares must not have been owned by a related individual in the past 24 months.

D)The shares must not have been owned by a non-related individual in the past 24 months.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

76

Under ITA 111.1, the order in which individuals must deduct Division C items is specifically listed. Assuming a taxpayer is eligible to deduct all of the following amounts in computing Taxable Income, which one would be deducted last?

A)Lifetime capital gains deduction.

B)Stock option deduction.

C)Loss carryovers.

D)Northern residents deduction.

A)Lifetime capital gains deduction.

B)Stock option deduction.

C)Loss carryovers.

D)Northern residents deduction.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

77

Mrs. Perry's total income consisted of $10,000 in eligible dividends received from taxable Canadian corporations. Mrs. Perry's basic personal tax credit and dividend tax credits are sufficient to eliminate all of her Tax Payable. Because she receives these dividends, Mr. Perry is not able to claim a spousal tax credit. Mr. Perry's income is such that any additional income from the transfer would be taxed at the federal rate of 20.5 percent. By what amount would Mr. Perry's Tax Payable increase or decrease if Mrs. Perry's dividends were transferred to him?

A)A decrease of $1,228.

B)An increase of $756.

C)An Increase of $845.

D)A decrease of $1,319.

A)A decrease of $1,228.

B)An increase of $756.

C)An Increase of $845.

D)A decrease of $1,319.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following amounts are not considered "split income" of an individual under 18 years of age?

A)Employment income from a private corporation.

B)Shareholder benefits received from a private corporation.

C)Eligible dividends received from a private corporation.

D)Non-eligible dividends received from a private corporation.

A)Employment income from a private corporation.

B)Shareholder benefits received from a private corporation.

C)Eligible dividends received from a private corporation.

D)Non-eligible dividends received from a private corporation.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

79

Elena is 12 years old. During 2020 she earns interest of $10,500 on funds she inherited when her maternal grandfather died, as well as non-eligible dividends of $15,300 received from a CCPC that is controlled by her father. Her only tax credits are the basic personal credit and the dividend tax credit. What is the amount of her federal Tax Payable for 2020?

A)$641.

B)$4,218.

C)$2,233.

D)$3,808.

A)$641.

B)$4,218.

C)$2,233.

D)$3,808.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following statements with respect to the Tax On Split Income (TOSI)is NOT correct?

A)For purposes of this tax, a Specified Individual is a resident of Canada, without regard to their age.

B)The federal tax is applied at a 33 percent rate to all of the income of a Specified Individual.

C)Split Income can include interest received from a private company.

D)The only tax credits that can be applied against the Tax On Split Income are dividend tax credits and foreign income tax credits that are related to the income.

A)For purposes of this tax, a Specified Individual is a resident of Canada, without regard to their age.

B)The federal tax is applied at a 33 percent rate to all of the income of a Specified Individual.

C)Split Income can include interest received from a private company.

D)The only tax credits that can be applied against the Tax On Split Income are dividend tax credits and foreign income tax credits that are related to the income.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck