Deck 13: Taxation of Corporate Investment Income

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Question

Question

Question

Question

Question

Match between columns

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/79

Play

Full screen (f)

Deck 13: Taxation of Corporate Investment Income

1

What is a connected corporation? Under what circumstances will Part IV tax be applicable to dividends received from such corporations?

A connected corporation is either:

• a controlled corporation, where control represents ownership of more than 50 percent of the voting shares by any combination of the other corporation and persons with whom it does not deal at arm's length, or

• a corporation in which the other corporation owns more than 10 percent of the voting shares, and more than 10 percent of the fair market value of all of the issued shares of the corporation.

Dividends from such corporations are subject to Part IV tax to the extent they are the basis for a dividend refund received by the paying corporation.

• a controlled corporation, where control represents ownership of more than 50 percent of the voting shares by any combination of the other corporation and persons with whom it does not deal at arm's length, or

• a corporation in which the other corporation owns more than 10 percent of the voting shares, and more than 10 percent of the fair market value of all of the issued shares of the corporation.

Dividends from such corporations are subject to Part IV tax to the extent they are the basis for a dividend refund received by the paying corporation.

2

Dividends declared by public companies will always be eligible dividends.

False

3

What are the components of "aggregate investment income" as described in ITA 129(4)?

As defined in ITA 129(4), aggregate investment income is made up of:

• Net taxable capital gains for the year, reduced by any net capital loss carry overs deducted during the year.

• Property income other than dividends that are deductible in determining the corporation's Taxable Income.

• Net taxable capital gains for the year, reduced by any net capital loss carry overs deducted during the year.

• Property income other than dividends that are deductible in determining the corporation's Taxable Income.

4

Briefly describe the calculation of the tax on excessive eligible dividend designations (EEDD)for a CCPC.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

5

The first component of the formula for determining the refundable portion of Part I tax, 30-2/3 percent of aggregate investment income, is reduced by the amount, if any, by which the foreign non-business income tax credit exceeds 8 percent of its foreign investment income for the year. What objective is achieved by subtracting this amount?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

6

For dividends received in a specific province, the after tax rates of return to investors are higher for eligible dividends received than for non-eligible dividends.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

7

What is the objective of the Part IV Refundable Tax on certain types of dividends received by a private company? Briefly explain your conclusion.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

8

Briefly describe the calculation of the tax on excessive eligible dividend designations (EEDD)for a public company.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

9

Explain, without using examples, how the dividend gross up and tax credit procedures assist in achieving the goal of the integration approach to taxing CCPCs and their shareholders. Assume any dividends paid are not designated eligible.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

10

A corporation can apply non-capital or farm losses to reduce the amount of Part IV tax payable. Would you recommend this procedure to a client?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

11

In the absence of the Part I refundable tax, the total personal and corporate taxes on investment income earned by, and flowed through, a CCPC could approach an unreasonably high 70 percent. While the Part I refundable tax reduces this combined rate to a more reasonable level, the same result could have been achieved by lowering the tax rate applicable to the investment income of a CCPC. Why did the government not adopt this less complex alternative?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

12

The concept of integration is central to the Canadian system of corporate taxation. Briefly explain the basic objective of integration as it is applied in the Canadian system of corporate taxation.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

13

With respect to Part IV tax rules, what is a "subject corporation"? How does the Part IV legislation classify such companies?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

14

Described the types of dividends on which Part IV tax is assessed.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

15

What would be one of the most common additions to a public corporation's LRIP balance?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

16

For a CCPC earning investment income, there may a refund of taxes paid when the company pays dividends. How is the amount of this refund determined?

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

17

What are the major differences between aggregate investment income as described in ITA 129(4), and property income as described in subdivision b of the Income Tax Act.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

18

A CCPC can only designate dividends as eligible to the extent that it has a GRIP balance. Indicate the two most common sources of additions to this balance.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

19

What is the objective of the Additional Refundable Tax (ART)that is assessed under ITA 123.3? Briefly explain your conclusion.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

20

The theories or perspectives of corporate taxation are referred to as the entity view and the integration view. Briefly describe these two views.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

21

For integration to work properly for a CCPC whose income qualifies for the small business deduction, the combined federal/provincial tax rate on corporations must be equal to 13.04 percent, while the combined federal/provincial dividend tax credit must be equal to 9/13 of the gross up.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

22

Integration works when the combined federal and provincial tax rate on corporate income is at a certain benchmark level for corporations paying eligible dividends and a different benchmark level for corporations paying non-eligible dividends. Applicable rates vary from province to province which affects the effectiveness of integration. If you assume that the combined federal/provincial dividend tax credit is equal to 100 percent of the gross up, which of the following statements is correct with respect to combined federal and provincial tax rates and the effectiveness of integration?

A)If the combined corporate tax rate exceeds the benchmark rate, then the use of a corporation will result in lower taxation.

B)If the combined corporate tax rate is equal to the benchmark rate, then the use of a corporation will result in the same amount of taxation.

C)If the combined corporate tax rate is less than the benchmark rate, then the use of a corporation will result in additional taxation.

D)The combined corporate tax rate for corporations paying non-eligible dividends must be greater than the combined corporate tax rate for corporations paying eligible dividends for integration to work for all dividends.

A)If the combined corporate tax rate exceeds the benchmark rate, then the use of a corporation will result in lower taxation.

B)If the combined corporate tax rate is equal to the benchmark rate, then the use of a corporation will result in the same amount of taxation.

C)If the combined corporate tax rate is less than the benchmark rate, then the use of a corporation will result in additional taxation.

D)The combined corporate tax rate for corporations paying non-eligible dividends must be greater than the combined corporate tax rate for corporations paying eligible dividends for integration to work for all dividends.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements with respect to non-eligible dividends paid in 2020 is NOT correct?

A)Taxable dividends will be equal to 115 percent of dividends received.

B)Non-eligible dividends can be designated by both public corporations and CCPCs.

C)The combined federal/provincial dividend tax credit will always be equal to the gross up.

D)The federal dividend tax credit on such dividends is always equal to 9/13 of the gross up.

A)Taxable dividends will be equal to 115 percent of dividends received.

B)Non-eligible dividends can be designated by both public corporations and CCPCs.

C)The combined federal/provincial dividend tax credit will always be equal to the gross up.

D)The federal dividend tax credit on such dividends is always equal to 9/13 of the gross up.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

24

With respect to integration, which of the following statements is correct for 2020?

A)For integration to be effective in situations where non-eligible dividends are paid, the combined federal/provincial tax rate on corporations must be equal to 27.54 percent.

B)For integration to be effective in situations where non-eligible dividends are paid, the provincial tax rate on individuals must be 14 percent.

C)For integration to be effective in situations where eligible dividends are paid, the provincial dividend tax credit must be equal to 9/13 of the dividend gross up.

D)For integration to be effective in situations where non-eligible dividends are paid, the combined federal/provincial tax rate on corporations must be equal to 13.04 percent.

A)For integration to be effective in situations where non-eligible dividends are paid, the combined federal/provincial tax rate on corporations must be equal to 27.54 percent.

B)For integration to be effective in situations where non-eligible dividends are paid, the provincial tax rate on individuals must be 14 percent.

C)For integration to be effective in situations where eligible dividends are paid, the provincial dividend tax credit must be equal to 9/13 of the dividend gross up.

D)For integration to be effective in situations where non-eligible dividends are paid, the combined federal/provincial tax rate on corporations must be equal to 13.04 percent.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

25

The total dividend refund for the current year cannot exceed the combined balance of the Eligible RDTOH and the Non-Eligible RDTOH.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

26

The Part IV tax is assessed on all of the dividends received from connected corporations.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

27

It is necessary for corporations to designate dividends that they pay as eligible dividends which are eligible for the enhanced gross up and dividend tax credit procedure because:

A)some CCPCs have some portion of their income taxed at full rates while some non-CCPCs will pay dividends out of income that has been taxed at lower rates.

B)most CCPCs have all of their income taxed at low rates, and some non-CCPCs have only income that is taxed at lower rates.

C)all companies always have some portion of their income taxed at full rates.

D)some non-CCPCs have income taxed at lower rates.

A)some CCPCs have some portion of their income taxed at full rates while some non-CCPCs will pay dividends out of income that has been taxed at lower rates.

B)most CCPCs have all of their income taxed at low rates, and some non-CCPCs have only income that is taxed at lower rates.

C)all companies always have some portion of their income taxed at full rates.

D)some non-CCPCs have income taxed at lower rates.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

28

The objective of the Additional Refundable Tax On Investment Income is to discourage the use of a Canadian controlled private corporation to defer taxes on investment income.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

29

For integration to work perfectly, two conditions must be met. For 2020, these two conditions are:

A)the combined federal/provincial tax rate on corporations must equal 13.04% for eligible dividends and 27.54% for non-eligible dividends, and the combined federal and provincial dividend tax credits must equal the gross up.

B)the federal and provincial tax and dividend tax credit rates must be equal.

C)the combined federal/provincial tax rate on corporations must equal 13.04% for non-eligible dividends and 27.54% for eligible dividends, and the combined federal and provincial dividend tax credits must equal the gross up.

D)both the corporate federal tax payable and the federal dividend tax credit must be equal to the gross up.

A)the combined federal/provincial tax rate on corporations must equal 13.04% for eligible dividends and 27.54% for non-eligible dividends, and the combined federal and provincial dividend tax credits must equal the gross up.

B)the federal and provincial tax and dividend tax credit rates must be equal.

C)the combined federal/provincial tax rate on corporations must equal 13.04% for non-eligible dividends and 27.54% for eligible dividends, and the combined federal and provincial dividend tax credits must equal the gross up.

D)both the corporate federal tax payable and the federal dividend tax credit must be equal to the gross up.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following types of dividends would not be subject to a gross up and would not generate a dividend tax credit to the individual shareholder who receives it?

A)A stock dividend.

B)A capital dividend.

C)A deemed dividend.

D)A dividend in kind.

A)A stock dividend.

B)A capital dividend.

C)A deemed dividend.

D)A dividend in kind.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

31

The major goal of integration is to ensure that, if an individual has a given income source, he will retain the same after tax amount of cash from that source, without regard to whether he receives the income directly or, alternatively, the income is routed through a corporation prior to his ultimate receipt of the after tax amount.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

32

As defined in ITA 129(4), aggregate investment income is reduced by any net capital losses that are deducted during the year.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

33

If a Canadian controlled private corporation has a GRIP balance, it must designate any dividend that is paid as eligible until that balance is eliminated.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

34

A CCPC's GRIP balance is increased by 72 percent of eligible dividends received during the year.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements with respect to eligible dividends paid in 2020 is NOT correct?

A)The recipient individual shareholder must gross them up by 38 percent.

B)They generate a federal tax credit equal to 6/11 of the gross up.

C)They can only be designated as eligible dividends by public companies.

D)They can be designated as eligible dividends by CCPCs with a positive GRIP balance.

A)The recipient individual shareholder must gross them up by 38 percent.

B)They generate a federal tax credit equal to 6/11 of the gross up.

C)They can only be designated as eligible dividends by public companies.

D)They can be designated as eligible dividends by CCPCs with a positive GRIP balance.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

36

An investee company can be designated as a connected company, even if the investor company does not have control.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

37

A Canadian controlled private corporation's GRIP balance is reduced by dividends that were designated as eligible in the preceding taxation year.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

38

A corporation's dividend refund for the year on eligible dividends will be the lesser of the balance in the Non-Eligible RDTOH account at the beginning of the year and 38-1/3 percent of the eligible dividends paid for the year.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

39

The refundable portion of a corporation's Part I Tax Payable for the year will be added to its Eligible RDTOH.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

40

Integration works when the combined federal and provincial dividend tax credit rate is at a certain benchmark level. Applicable dividend tax credit rates vary from province to province which affects the effectiveness of integration. If you assume that the combined federal/provincial corporate tax rate is at the benchmark rate for the type of dividend under consideration, which of the following statements is correct with respect to combined federal and provincial dividend tax credit rates and the use of a corporation?

A)If the combined dividend tax credit rate is less than 100 percent of the gross up, then the use of a corporation will result in additional taxation.

B)If the combined dividend tax credit rate is greater than 100 percent of the gross up, then the use of a corporation will result in additional taxation.

C)The provincial dividend tax rate must be greater than the federal dividend tax rate for integration to work.

D)The combined dividend tax rate on non-eligible dividends must be greater than the combined dividend tax rate on eligible dividends for integration to work for all dividends.

A)If the combined dividend tax credit rate is less than 100 percent of the gross up, then the use of a corporation will result in additional taxation.

B)If the combined dividend tax credit rate is greater than 100 percent of the gross up, then the use of a corporation will result in additional taxation.

C)The provincial dividend tax rate must be greater than the federal dividend tax rate for integration to work.

D)The combined dividend tax rate on non-eligible dividends must be greater than the combined dividend tax rate on eligible dividends for integration to work for all dividends.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

41

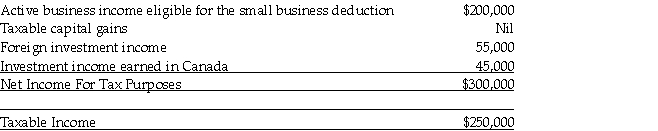

A Ltd. is a Canadian controlled private corporation that operates a chain of fast-food restaurants. In its most recent fiscal year, the Company had the following financial results:  The Company paid no foreign taxes on its foreign investment income. A Ltd. is not associated with any other corporations. Which one of the following amounts represents the refundable portion of Part I tax?

The Company paid no foreign taxes on its foreign investment income. A Ltd. is not associated with any other corporations. Which one of the following amounts represents the refundable portion of Part I tax?

A)$13,800.

B)$15,333.

C)$30,667.

D)$76,667.

The Company paid no foreign taxes on its foreign investment income. A Ltd. is not associated with any other corporations. Which one of the following amounts represents the refundable portion of Part I tax?

The Company paid no foreign taxes on its foreign investment income. A Ltd. is not associated with any other corporations. Which one of the following amounts represents the refundable portion of Part I tax?A)$13,800.

B)$15,333.

C)$30,667.

D)$76,667.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

42

Premier Investments Inc. (Premier)is a private corporation. Premier received $20,000 of dividends from its investments in publicly traded Canadian shares during its taxation year ended December 31, 2020. Premier has loss carry forwards as follows: non-capital losses of $3,000, net capital losses of $5,000, and farm losses of $7,000. All of these losses are available for application in Premier's 2020 taxation year. The non-capital and farm losses will expire if not used during 2020. Assuming Premier has no other income, what is Premier's minimum 2020 Part IV Tax Payable?

A)Nil.

B)$1,917.

C)$3,834.

D)$7,667.

A)Nil.

B)$1,917.

C)$3,834.

D)$7,667.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

43

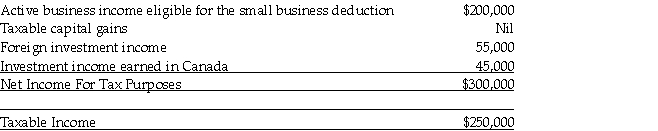

During the year, Makisha Fashions Inc has the following sources of income:  What is the total aggregate investment income?

What is the total aggregate investment income?

A)$6,000

B)$31,000

C)$48,000

D)$73,000

What is the total aggregate investment income?

What is the total aggregate investment income?A)$6,000

B)$31,000

C)$48,000

D)$73,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

44

The refundable Part IV tax on dividends received is required in order to:

A)prevent tax deferral in situations where there are multiple levels of corporations in a corporate group.

B)avoid double taxation of dividends paid to corporate shareholders.

C)ensure proper integration on investment income at the corporate level.

D)ensure that public companies pay out some dividends in every year they are profitable.

A)prevent tax deferral in situations where there are multiple levels of corporations in a corporate group.

B)avoid double taxation of dividends paid to corporate shareholders.

C)ensure proper integration on investment income at the corporate level.

D)ensure that public companies pay out some dividends in every year they are profitable.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

45

With respect to GRIP and LRIP balances, which of the following statements is NOT correct?

A)A CCPC's GRIP account is reduced by the amount of eligible dividends designated in the preceding taxation year.

B)A CCPC's GRIP account is increased by the amount of eligible dividends received during the current year.

C)A public company's LRIP account is increased by the amount of non-eligible dividends received.

D)A CCPC's GRIP account is increased by 72 percent of the company's Taxable Income.

A)A CCPC's GRIP account is reduced by the amount of eligible dividends designated in the preceding taxation year.

B)A CCPC's GRIP account is increased by the amount of eligible dividends received during the current year.

C)A public company's LRIP account is increased by the amount of non-eligible dividends received.

D)A CCPC's GRIP account is increased by 72 percent of the company's Taxable Income.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

46

With respect to Part I refundable taxes, which of the following statements is correct?

A)It is an additional tax which must be paid on aggregate investment income.

B)It is always refundable at the rate of 38-1/3 percent of dividends paid.

C)It is designed to prevent the deferral of taxes on investment income that is retained by a public company.

D)It is designed to prevent the deferral of taxes on investment income that is retained by a CCPC.

A)It is an additional tax which must be paid on aggregate investment income.

B)It is always refundable at the rate of 38-1/3 percent of dividends paid.

C)It is designed to prevent the deferral of taxes on investment income that is retained by a public company.

D)It is designed to prevent the deferral of taxes on investment income that is retained by a CCPC.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

47

A simple solution to the problem of high corporate tax rates on investment income would be to apply a different, lower corporate tax rate directly to this type of income. Instead, the Canadian tax system uses refundable taxes to lower the rate of taxation on investment income of CCPCs. Why?

A)Lower rates would create a situation where the payment of dividends to shareholders would result in double taxation.

B)Lower rates would provide a significant deferral of taxes on investment income.

C)Refundable taxes encourage early filing of corporate tax returns.

D)Refundable taxes provide a reason to retain funds in the corporation.

A)Lower rates would create a situation where the payment of dividends to shareholders would result in double taxation.

B)Lower rates would provide a significant deferral of taxes on investment income.

C)Refundable taxes encourage early filing of corporate tax returns.

D)Refundable taxes provide a reason to retain funds in the corporation.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

48

Mr. Patel is the sole owner of a holding company which owns 100 percent of the shares of his operating company that earns only active business income. Which of the following statements is correct?

A)The holding company will pay Part IV tax on dividends received from the operating company.

B)Mr. Patel will receive dividends from the holding company tax free.

C)Mr. Patel will receive dividends from the operating company tax free.

D)The holding company will receive dividends from the operating company tax free.

A)The holding company will pay Part IV tax on dividends received from the operating company.

B)Mr. Patel will receive dividends from the holding company tax free.

C)Mr. Patel will receive dividends from the operating company tax free.

D)The holding company will receive dividends from the operating company tax free.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements with respect to Part IV tax is NOT correct?

A)All dividends from subject companies will be assessed Part IV tax.

B)All dividends from portfolio investments will be assessed Part IV tax.

C)Dividends from a connected company will be assessed Part IV tax if the paying company received a dividend refund.

D)Part IV tax is assessed at a rate of 30-2/3 percent.

A)All dividends from subject companies will be assessed Part IV tax.

B)All dividends from portfolio investments will be assessed Part IV tax.

C)Dividends from a connected company will be assessed Part IV tax if the paying company received a dividend refund.

D)Part IV tax is assessed at a rate of 30-2/3 percent.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

50

With respect to the refundable Part I tax on investment income, which of the following statements is NOT correct?

A)It is always equal to 30-2/3 percent of aggregate investment income.

B)It is a designated portion of the regular Part I tax.

C)It is only applicable to Canadian controlled private corporations.

D)It only become refundable when dividends are paid.

A)It is always equal to 30-2/3 percent of aggregate investment income.

B)It is a designated portion of the regular Part I tax.

C)It is only applicable to Canadian controlled private corporations.

D)It only become refundable when dividends are paid.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

51

With respect to the Eligible RDTOH account, which of the following statements is correct?

A)The balance is reduced by any refund resulting from eligible dividends paid during the year.

B)The balance is increased by 38-1/3 percent of any eligible dividends received.

C)The total dividend refund for the current year cannot exceed the balance in this account.

D)The balance is increased by the amount of the refundable Part I tax for the year.

A)The balance is reduced by any refund resulting from eligible dividends paid during the year.

B)The balance is increased by 38-1/3 percent of any eligible dividends received.

C)The total dividend refund for the current year cannot exceed the balance in this account.

D)The balance is increased by the amount of the refundable Part I tax for the year.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

52

During the year, Makisha Fashions Inc has the following sources of income:  The company has taxable income of $495,000, of which $200,000 was eligible for the small business deduction. What is the total Additional Refundable Tax on Investment Income (ART)?

The company has taxable income of $495,000, of which $200,000 was eligible for the small business deduction. What is the total Additional Refundable Tax on Investment Income (ART)?

A)$ 640

B)$3,307

C)$5,120

D)$7,787

The company has taxable income of $495,000, of which $200,000 was eligible for the small business deduction. What is the total Additional Refundable Tax on Investment Income (ART)?

The company has taxable income of $495,000, of which $200,000 was eligible for the small business deduction. What is the total Additional Refundable Tax on Investment Income (ART)?A)$ 640

B)$3,307

C)$5,120

D)$7,787

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

53

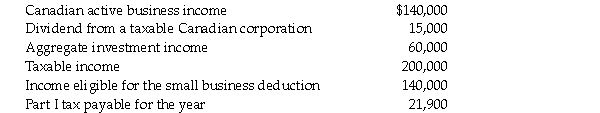

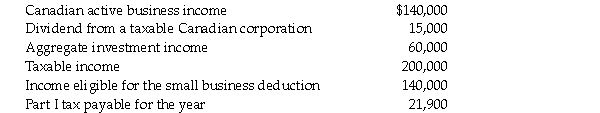

Schumann Inc. is a CCPC that has the following information for the current year:  The refundable portion of Part I tax for the year is equal to:

The refundable portion of Part I tax for the year is equal to:

A)$5,750.

B)$18,400.

C)$24,150.

D)$21,900.

The refundable portion of Part I tax for the year is equal to:

The refundable portion of Part I tax for the year is equal to:A)$5,750.

B)$18,400.

C)$24,150.

D)$21,900.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

54

A subject corporation for purposes of Part IV tax is defined as:

A)a resident private corporation that is controlled by an individual or for the benefit of an individual.

B)a resident public corporation that is controlled largely for the benefit of an individual or a related group of individuals.

C)a resident public corporation that is controlled, through trusts, largely for the benefit of an individual or related group of individuals.

D)a non-resident private corporation that is controlled largely for the benefit of a resident individual or related group of individuals.

A)a resident private corporation that is controlled by an individual or for the benefit of an individual.

B)a resident public corporation that is controlled largely for the benefit of an individual or a related group of individuals.

C)a resident public corporation that is controlled, through trusts, largely for the benefit of an individual or related group of individuals.

D)a non-resident private corporation that is controlled largely for the benefit of a resident individual or related group of individuals.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

55

CCPC Inc., a Canadian controlled private corporation, received a $10,000 dividend from a non-connected public corporation, Payor Inc. Which of the following statements is correct?

A)The dividends will be deductible by Payor Inc. from its Eligible RDTOH.

B)The dividend will be subject to a tax rate of 38-1/3%.

C)The dividend will be subject to Part I tax.

D)The dividend will be subject to Part IV tax if Payor Inc. received a dividend refund.

A)The dividends will be deductible by Payor Inc. from its Eligible RDTOH.

B)The dividend will be subject to a tax rate of 38-1/3%.

C)The dividend will be subject to Part I tax.

D)The dividend will be subject to Part IV tax if Payor Inc. received a dividend refund.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

56

As defined in ITA 129(4), aggregate investment income does NOT include:

A)foreign source property income.

B)net capital loss carry overs deducted in the current year.

C)net taxable capital gains.

D)dividends from taxable Canadian companies.

A)foreign source property income.

B)net capital loss carry overs deducted in the current year.

C)net taxable capital gains.

D)dividends from taxable Canadian companies.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

57

During the current year, Norton Tools Ltd. has net taxable capital gains of $45,000, receives dividends from taxable Canadian corporations of $34,000, and earns interest income of $21,000. Taxable Income for the year equals $280,000, of which $210,000 is eligible for the small business deduction. The Company's additional refundable tax for the year is equal to:

A)$ 7,467.

B)$10,667.

C)$ 7,040.

D)$ 8,427.

A)$ 7,467.

B)$10,667.

C)$ 7,040.

D)$ 8,427.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements best describes the purpose of the dividend refund?

A)The dividend refund allows corporations with a balance in their RDTOH accounts to reduce their tax payable by paying dividends.

B)The dividend refund allows corporations with a balance in their capital dividend account to reduce their tax payable by paying dividends.

C)The dividend refund reduces the effective tax rate on dividend income earned by corporations.

D)The dividend refund reduces the effective tax rate on dividend income earned by shareholders.

A)The dividend refund allows corporations with a balance in their RDTOH accounts to reduce their tax payable by paying dividends.

B)The dividend refund allows corporations with a balance in their capital dividend account to reduce their tax payable by paying dividends.

C)The dividend refund reduces the effective tax rate on dividend income earned by corporations.

D)The dividend refund reduces the effective tax rate on dividend income earned by shareholders.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following items would NOT influence the determination of aggregate investment income?

A)Canadian source rental income.

B)Foreign source dividend income.

C)Net capital losses deducted.

D)Dividends from taxable Canadian corporations.

A)Canadian source rental income.

B)Foreign source dividend income.

C)Net capital losses deducted.

D)Dividends from taxable Canadian corporations.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

60

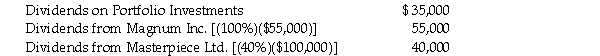

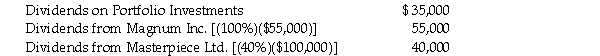

Opus Limited is a Canadian controlled private corporation. During 2020, the company received the following dividends:  Opus owns 100% of the shares of Magnum Inc. and 40% of the shares of Masterpiece Ltd. Masterpiece received a dividend refund of $10,000 on its dividend payment, while Magnum received a dividend refund of $15,000. Determine the amount of Part IV Tax payable by Opus Limited for the current year.

Opus owns 100% of the shares of Magnum Inc. and 40% of the shares of Masterpiece Ltd. Masterpiece received a dividend refund of $10,000 on its dividend payment, while Magnum received a dividend refund of $15,000. Determine the amount of Part IV Tax payable by Opus Limited for the current year.

A)$29,417.

B)$32,417.

C)$38,417.

D)$49,833.

Opus owns 100% of the shares of Magnum Inc. and 40% of the shares of Masterpiece Ltd. Masterpiece received a dividend refund of $10,000 on its dividend payment, while Magnum received a dividend refund of $15,000. Determine the amount of Part IV Tax payable by Opus Limited for the current year.

Opus owns 100% of the shares of Magnum Inc. and 40% of the shares of Masterpiece Ltd. Masterpiece received a dividend refund of $10,000 on its dividend payment, while Magnum received a dividend refund of $15,000. Determine the amount of Part IV Tax payable by Opus Limited for the current year.A)$29,417.

B)$32,417.

C)$38,417.

D)$49,833.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

61

With respect to GRIP and LRIP balances, which of the following statements is correct?

A)The GRIP account is used to track balances that can be used by a CCPC as the basis for designating eligible dividends.

B)The GRIP account is used to track balances that have not been subject to full corporate tax rates.

C)The LRIP account is used to track balances that can be used by any company as the basis for designating non-eligible dividends.

D)The LRIP account is used to track balances that can be used by non-CCPCs as the basis for designating eligible dividends.

A)The GRIP account is used to track balances that can be used by a CCPC as the basis for designating eligible dividends.

B)The GRIP account is used to track balances that have not been subject to full corporate tax rates.

C)The LRIP account is used to track balances that can be used by any company as the basis for designating non-eligible dividends.

D)The LRIP account is used to track balances that can be used by non-CCPCs as the basis for designating eligible dividends.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

62

Marion Fox has investments that generate interest income of $172,000 each year. She also has employment income in excess of $250,000 per year. This places her firmly in the top tax bracket, with a combined federal provincial rate of 53 percent.

She is considering transferring her interest bearing investments to a newly incorporated CCPC on January 1, 2020. In her province, the combined federal/provincial rate on the investment income of CCPCs is 50 percent. All of the corporation's income would be paid out as non-eligible dividends. The provincial dividend tax credit rate on non-eligible dividends is 35 percent of the gross up.

Advise Marion as to whether there would be any tax benefits associated with this transfer.

She is considering transferring her interest bearing investments to a newly incorporated CCPC on January 1, 2020. In her province, the combined federal/provincial rate on the investment income of CCPCs is 50 percent. All of the corporation's income would be paid out as non-eligible dividends. The provincial dividend tax credit rate on non-eligible dividends is 35 percent of the gross up.

Advise Marion as to whether there would be any tax benefits associated with this transfer.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

63

At the end of 2019, Gomez Inc., a CCPC, has a GRIP of $53,400. For 2020, the Company has Taxable Income of $143,000. This includes aggregate investment income of $19,000. In addition, the Company receives eligible dividends of $12,300. In calculating 2020 Tax Payable, the Company has a small business deduction of $16,150. During 2019, the company paid dividends of $42,000 with $13,700 of the dividends designated as eligible.

Dividends paid during 2020 total $51,000, with $18,400 of this amount being designated as eligible. What is the amount of the Company's GRIP at the end of the 2020 taxation year?

A)$80,080

B)$93,780

C)$67,780

D)$75,380

Dividends paid during 2020 total $51,000, with $18,400 of this amount being designated as eligible. What is the amount of the Company's GRIP at the end of the 2020 taxation year?

A)$80,080

B)$93,780

C)$67,780

D)$75,380

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

64

Starfare Ltd. is a Canadian controlled private corporation. During the taxation year ending December 31, 2020, the Company has the following amounts of property income: ![Starfare Ltd. is a Canadian controlled private corporation. During the taxation year ending December 31, 2020, the Company has the following amounts of property income: The Company's 2020 Net Income For Tax Purposes is $232,350. The Company has available a net capital loss carry forward of $24,000 [(1/2)($48,000)], which is deducted from Taxable Income. A $14,250 small business deduction and a foreign non-business tax credit of $1,600 served to reduce Tax Payable. Assume that the Company's Part I Tax Payable has been correctly determined to be $37,133. Determine the refundable amount of Part I tax for the year ending December 31, 2020.](https://d2lvgg3v3hfg70.cloudfront.net/TB8606/11eb9a05_65d2_318c_9571_ab9d4f05ebeb_TB8606_00.jpg) The Company's 2020 Net Income For Tax Purposes is $232,350. The Company has available a net capital loss carry forward of $24,000 [(1/2)($48,000)], which is deducted from Taxable Income. A $14,250 small business deduction and a foreign non-business tax credit of $1,600 served to reduce Tax Payable. Assume that the Company's Part I Tax Payable has been correctly determined to be $37,133. Determine the refundable amount of Part I tax for the year ending December 31, 2020.

The Company's 2020 Net Income For Tax Purposes is $232,350. The Company has available a net capital loss carry forward of $24,000 [(1/2)($48,000)], which is deducted from Taxable Income. A $14,250 small business deduction and a foreign non-business tax credit of $1,600 served to reduce Tax Payable. Assume that the Company's Part I Tax Payable has been correctly determined to be $37,133. Determine the refundable amount of Part I tax for the year ending December 31, 2020.

![Starfare Ltd. is a Canadian controlled private corporation. During the taxation year ending December 31, 2020, the Company has the following amounts of property income: The Company's 2020 Net Income For Tax Purposes is $232,350. The Company has available a net capital loss carry forward of $24,000 [(1/2)($48,000)], which is deducted from Taxable Income. A $14,250 small business deduction and a foreign non-business tax credit of $1,600 served to reduce Tax Payable. Assume that the Company's Part I Tax Payable has been correctly determined to be $37,133. Determine the refundable amount of Part I tax for the year ending December 31, 2020.](https://d2lvgg3v3hfg70.cloudfront.net/TB8606/11eb9a05_65d2_318c_9571_ab9d4f05ebeb_TB8606_00.jpg) The Company's 2020 Net Income For Tax Purposes is $232,350. The Company has available a net capital loss carry forward of $24,000 [(1/2)($48,000)], which is deducted from Taxable Income. A $14,250 small business deduction and a foreign non-business tax credit of $1,600 served to reduce Tax Payable. Assume that the Company's Part I Tax Payable has been correctly determined to be $37,133. Determine the refundable amount of Part I tax for the year ending December 31, 2020.

The Company's 2020 Net Income For Tax Purposes is $232,350. The Company has available a net capital loss carry forward of $24,000 [(1/2)($48,000)], which is deducted from Taxable Income. A $14,250 small business deduction and a foreign non-business tax credit of $1,600 served to reduce Tax Payable. Assume that the Company's Part I Tax Payable has been correctly determined to be $37,133. Determine the refundable amount of Part I tax for the year ending December 31, 2020.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

65

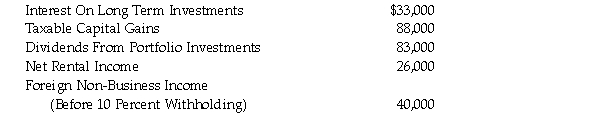

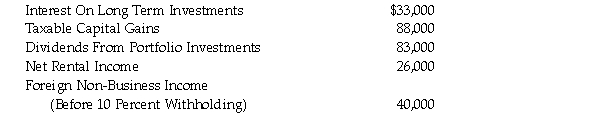

Elm Inc. is a Canadian controlled private corporation. During the taxation year ending December 31, 2020, the Company has the following amounts of property income:  The Company's 2020 Net Income For Tax Purposes is $458,000. In calculating Taxable Income, the Company deducted a $45,000 net capital loss carry forward.

The Company's 2020 Net Income For Tax Purposes is $458,000. In calculating Taxable Income, the Company deducted a $45,000 net capital loss carry forward.

In calculating Tax Payable, the Company deducted a small business deduction of $23,750 and a foreign non-business tax credit of $4,000. The Tax Payable has been correctly determined to be $71,607.

Determine the refundable amount of Part I tax for the year ending December 31, 2020.

The Company's 2020 Net Income For Tax Purposes is $458,000. In calculating Taxable Income, the Company deducted a $45,000 net capital loss carry forward.

The Company's 2020 Net Income For Tax Purposes is $458,000. In calculating Taxable Income, the Company deducted a $45,000 net capital loss carry forward.In calculating Tax Payable, the Company deducted a small business deduction of $23,750 and a foreign non-business tax credit of $4,000. The Tax Payable has been correctly determined to be $71,607.

Determine the refundable amount of Part I tax for the year ending December 31, 2020.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

66

Barnum Ltd. is a CCPC with a December 31 year end. For the 2020 taxation year, the Company has a Net Income For Tax Purposes of $436,000. This is made up of active business income of $256,000, dividends from taxable Canadian corporations of $61,000, taxable capital gains of $85,000, and interest income on long-term investments of $34,000. In filing its 2020 tax return, the company will deduct a non-capital loss carry forward of $163,000, and a net capital loss carry forward of $47,000. Barnum is associated with one other company and they have agreed to split the annual business limit on a 50/50 basis.

In 2019, Barnum's Taxable Capital Employed in Canada was less than $10 million, and its ADJUSTED Aggregate Investment Income was less than $50,000.

Determine Barnum's Taxable Income and its additional refundable tax on investment income for the 2020 taxation year.

In 2019, Barnum's Taxable Capital Employed in Canada was less than $10 million, and its ADJUSTED Aggregate Investment Income was less than $50,000.

Determine Barnum's Taxable Income and its additional refundable tax on investment income for the 2020 taxation year.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

67

Saxon Company is a CCPC that began operations on January 1, 2019. It has adopted a December 31 year end.

During 2019, the Company received eligible dividends of $45,000 and designated $40,000 of the dividends it paid as eligible. On December 31, 2019, the balance in the Company's GRIP account was $45,000.

For 2020, Saxon has Taxable Income of $726,000. Included in this amount is $18,000 of interest income, taxable capital gains of $22,000, and the deduction of a net capital loss of $18,000. Also during that year, the Company received eligible dividends of $36,000. In determining the 2020 Tax Payable, the Company has a small business deduction of $66,500. During 2020, Saxon pays dividends of $48,000, with $21,000 of this amount being designated as eligible.

Determine the Company's GRIP balance at the end of 2020.

During 2019, the Company received eligible dividends of $45,000 and designated $40,000 of the dividends it paid as eligible. On December 31, 2019, the balance in the Company's GRIP account was $45,000.

For 2020, Saxon has Taxable Income of $726,000. Included in this amount is $18,000 of interest income, taxable capital gains of $22,000, and the deduction of a net capital loss of $18,000. Also during that year, the Company received eligible dividends of $36,000. In determining the 2020 Tax Payable, the Company has a small business deduction of $66,500. During 2020, Saxon pays dividends of $48,000, with $21,000 of this amount being designated as eligible.

Determine the Company's GRIP balance at the end of 2020.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

68

Axco Inc. is a CCPC with a December 31 year end. Axco is not associated with any other company. For the 2020 taxation year, its Net Income For Tax Purposes is equal to $342,000. This is made up of active business income of $226,000, dividends from taxable Canadian corporations of $31,000, taxable capital gains of $51,000 and interest income on long-term investments of $34,000. The Company has available a net capital loss carry forward of $32,000 [(1/2)($64,000)] and a non-capital loss carry forward of $29,000. The Company intends to deduct both of these carry forwards in the 2020 taxation year.

In 2019, Axco's Taxable Capital Employed in Canada was less than $10 million, and its ADJUSTED Aggregate Investment Income was less than $50,000.

Determine Axco's Taxable Income and its additional refundable tax on investment income for the 2020 taxation year.

In 2019, Axco's Taxable Capital Employed in Canada was less than $10 million, and its ADJUSTED Aggregate Investment Income was less than $50,000.

Determine Axco's Taxable Income and its additional refundable tax on investment income for the 2020 taxation year.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

69

Patrick Innes has a business that he estimates will produce income of $130,000 per year. If he incorporates this business in 2020, all of the income would be eligible for the small business deduction and all dividends paid would be non-eligible. In the province where he lives, such corporate income is taxed at a combined federal/provincial rate of 14 percent. Mr. Innes has other income sources that place him in a combined federal/provincial tax bracket of 42 percent. In his province, the provincial dividend tax credit for non-eligible dividends is equal to 20 percent of the gross up.

Would Mr. Innes save taxes if he was to channel this source of income through a corporation? Explain your result.

Would Mr. Innes save taxes if he was to channel this source of income through a corporation? Explain your result.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

70

Blackwood Inc. is a Canadian controlled private company. It has two subsidiaries. Information related to these subsidiaries is as follows:

Whitewood Ltd. - Blackwood owns 65 percent of Whitewood Ltd. During 2020, Whitewood paid total dividends of $100,000. Whitewood received a dividend refund of $20,000 as a result of paying these dividends.

Redwood Inc. - Blackwood owns 100 percent of Redwood Inc. During 2020, Redwood paid total dividends of $72,000. No dividend refund was received as a result of paying these dividends

In addition to the dividends received from subsidiaries, Blackwood received $35,000 in dividends from various portfolio investments. Determine the amount of Part IV Tax Payable by Blackwood Inc. as a result of receiving these dividends.

Whitewood Ltd. - Blackwood owns 65 percent of Whitewood Ltd. During 2020, Whitewood paid total dividends of $100,000. Whitewood received a dividend refund of $20,000 as a result of paying these dividends.

Redwood Inc. - Blackwood owns 100 percent of Redwood Inc. During 2020, Redwood paid total dividends of $72,000. No dividend refund was received as a result of paying these dividends

In addition to the dividends received from subsidiaries, Blackwood received $35,000 in dividends from various portfolio investments. Determine the amount of Part IV Tax Payable by Blackwood Inc. as a result of receiving these dividends.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

71

Match between columns

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

72

Simard Ltd., a CCPC, had no GRIP balance at its year end on December 31, 2018. During 2019, the Company received eligible dividends of $37,000 and designated $23,000 of its dividends paid as eligible. At the end of 2019, Simard has a GRIP of $37,000.

For 2020, Simard has Taxable Income of $476,000. This amount includes taxable capital gains of $14,000, interest income on long-term bonds of $7,000, and a net capital loss deduction of $14,000. In addition, the Company receives eligible dividends during the year of $17,000. In determining 2020 Tax Payable, the Company has a small business deduction of $76,000. During 2020, Simard Ltd. pays dividends of $25,000, with $18,000 of this amount being designated as eligible.

Determine the Company's GRIP balance at the end of 2020.

For 2020, Simard has Taxable Income of $476,000. This amount includes taxable capital gains of $14,000, interest income on long-term bonds of $7,000, and a net capital loss deduction of $14,000. In addition, the Company receives eligible dividends during the year of $17,000. In determining 2020 Tax Payable, the Company has a small business deduction of $76,000. During 2020, Simard Ltd. pays dividends of $25,000, with $18,000 of this amount being designated as eligible.

Determine the Company's GRIP balance at the end of 2020.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

73

A non-CCPC has an LRIP balance of $78,000 at the end of the 2019 fiscal year. In 2020, the company wishes to pay a dividend of $250,000. During 2020, prior to the payment of the dividend, the company receives eligible dividends of $35,000 and non-eligible dividends of $85,000. How much of the $250,000 dividend must be paid as a non-eligible dividend before an eligible dividend can be designated?

A)$ 78,000

B)$ 113,000

C)$ 163,000

D)$ 250,000

A)$ 78,000

B)$ 113,000

C)$ 163,000

D)$ 250,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

74

Janice Huber has a business that she estimates will produce income of $75,000 per year. Because she controls another corporation that fully utilizes $500,000 of its small business deduction, if she incorporates this business, none of this income will be eligible for the small business deduction and any dividends paid would be designated eligible. In the province where she lives, such corporate income is taxed at a combined federal/provincial rate of 28 percent. Ms. Huber has other income sources that place her in a combined federal/provincial tax bracket of 46 percent. In her province, the provincial dividend tax credit for eligible dividends is equal to 32 percent of the gross up.

Would Ms. Huber save taxes if she was to channel this source of income through a corporation? Explain your result.

Would Ms. Huber save taxes if she was to channel this source of income through a corporation? Explain your result.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

75

Florence has a business that she estimates will produce income of $100,000. She is planning to incorporate this business in 2020, and if she does, none of the income will be eligible for the small business deduction because she controls a corporation that fully utilizes the $500,000 small business deduction. As a result, all dividends paid will be designated eligible. In her province, such corporate income is taxed at a combined federal/provincial rate of 29 percent. Florence has income from other sources that will result in any additional income being taxed at a combined federal/provincial rate of 43 percent. The provincial dividend tax credit rate on eligible dividends is equal to 29 percent of the gross up.

Would Florence save taxes if she was to channel this source of income through a corporation? Explain your result.

Would Florence save taxes if she was to channel this source of income through a corporation? Explain your result.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

76

Match between columns

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

77

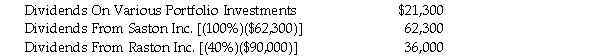

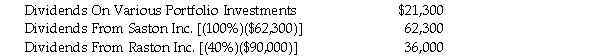

Overton Ltd. is a Canadian controlled private corporation. During 2020, the Company received the following amounts of dividends:  Overton Ltd. owns 100 percent of the voting shares of Saston Inc. and 40 percent of the voting shares of Raston Inc. The fair market value of the Raston Inc. shares equals 40 percent of the fair market value of all Raston Inc. shares. As a result of paying the $90,000 dividend, Raston Inc. received a dividend refund of $25,000. Saston Inc. received no dividend refund for its dividend payment.

Overton Ltd. owns 100 percent of the voting shares of Saston Inc. and 40 percent of the voting shares of Raston Inc. The fair market value of the Raston Inc. shares equals 40 percent of the fair market value of all Raston Inc. shares. As a result of paying the $90,000 dividend, Raston Inc. received a dividend refund of $25,000. Saston Inc. received no dividend refund for its dividend payment.

Determine the amount of Part IV Tax Payable by Overton Ltd. as a result of receiving these dividends.

Overton Ltd. owns 100 percent of the voting shares of Saston Inc. and 40 percent of the voting shares of Raston Inc. The fair market value of the Raston Inc. shares equals 40 percent of the fair market value of all Raston Inc. shares. As a result of paying the $90,000 dividend, Raston Inc. received a dividend refund of $25,000. Saston Inc. received no dividend refund for its dividend payment.

Overton Ltd. owns 100 percent of the voting shares of Saston Inc. and 40 percent of the voting shares of Raston Inc. The fair market value of the Raston Inc. shares equals 40 percent of the fair market value of all Raston Inc. shares. As a result of paying the $90,000 dividend, Raston Inc. received a dividend refund of $25,000. Saston Inc. received no dividend refund for its dividend payment.Determine the amount of Part IV Tax Payable by Overton Ltd. as a result of receiving these dividends.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

78

Mr. Marcus Fisher has investments that generate interest income of $94,000 per year. Because of his employment income, he is in the top tax bracket, with a combined federal/provincial rate of 52 percent. He is considering the transfer of these investments on January 1, 2020, to his CCPC which would be subject to a tax rate on investment income of 51 percent. The dividend tax credit in his province is equal to 30 percent of the gross up. Any dividends paid by the CCPC out of investment income will be non-eligible. Advise him as to whether there would be any tax benefits associated with this transfer.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

79

Nashwa has a business that she estimates will produce annual income of $100,000. She is planning to incorporate this business in 2020, and if she does, all of the income will be eligible for the small business deduction and all dividends paid will be non-eligible. In her province, such corporate income is taxed at a combined federal/provincial rate of 15 percent. Nashwa is taxed at a combined federal/provincial rate of 43 percent. The provincial dividend tax credit rate for non-eligible dividends is equal to 29 percent of the gross up.

Would Nashwa save taxes if she was to channel this source of income through a corporation? Explain your result.

Would Nashwa save taxes if she was to channel this source of income through a corporation? Explain your result.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck