Deck 8: Capital Gains and Capital Losses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/104

Play

Full screen (f)

Deck 8: Capital Gains and Capital Losses

1

When a taxpayer disposes of a combination of land and buildings, ITA 13(21.1)(a)contains a special rule for determining the amount of proceeds to be allocated to the building. If applicable, this special rule increases the amount of the proceeds that will be allocated to the building. What is the tax policy objective of this special rule?

When a combination of land and buildings is sold, there will often be a capital gain on the land component, only one-half of which will be included in the selling taxpayer's Net Income For Tax Purposes. If the fair market value of the building is less than its UCC balance and the building is the last asset in its class, there will be a terminal loss on the building. This terminal loss will be 100 percent deductible and can be used to offset the one-half of the capital gain on the land that was included in the taxpayer's Net Income For Tax Purposes. This will, of course, tempt taxpayers to allocate a larger amount of the total proceeds to the land and a correspondingly smaller amount of the total proceeds to the building. The special rule in ITA 13(21.1)(a)increases the building proceeds to the point where any terminal loss will either be eliminated, or reduced to the point that it does not offset any capital gain on the land.

2

What is a superficial loss? What is the required tax treatment for such losses?

A superficial loss is one that results from the sale of a capital asset that is reacquired within 30 days before, or 30 days after, the disposition. Such losses cannot be deducted at the time of the disposition. However, they are added to the adjusted cost base of the reacquired asset, thereby reducing any future gain on the disposition of that asset.

3

Describe three different types of capital asset dispositions. In each case, indicate how the proceeds of disposition would be determined.

Possible answers here would include:

• Sale of the capital asset. The proceeds of disposition here would be the sales price.

• Expropriation by a government body. The proceeds of disposition here would be the amount of compensation paid by the government body.

• Destruction through fire, flood, or other natural disasters. The proceeds of disposition here would be any insurance payments received.

• Loss through theft. The proceeds of disposition here may be nil. However, if there is insurance coverage, any amount paid by the insurer would be the proceeds of disposition.

• Deemed dispositions. The deemed proceeds of disposition here would be the amount specified in the Income Tax Act.

• Sale of the capital asset. The proceeds of disposition here would be the sales price.

• Expropriation by a government body. The proceeds of disposition here would be the amount of compensation paid by the government body.

• Destruction through fire, flood, or other natural disasters. The proceeds of disposition here would be any insurance payments received.

• Loss through theft. The proceeds of disposition here may be nil. However, if there is insurance coverage, any amount paid by the insurer would be the proceeds of disposition.

• Deemed dispositions. The deemed proceeds of disposition here would be the amount specified in the Income Tax Act.

4

When a capital asset is sold and not all of the proceeds of disposition are received in the year of sale, the Income Tax Act allows a taxpayer to deduct a reserve. How is the maximum amount of this reserve determined?

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

5

When an enterprise sells a capital asset, it sometimes provides a warranty related to the performance of that asset. This may involve incurring warranty costs in periods subsequent to the period in which the asset is sold. How are such costs dealt with for income tax purposes? How does this differ from the accounting treatment of such costs?

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

6

When an individual converts his principal residence to a rental property, an election under ITA 45(2)is available to avoid having a deemed disposition based on a change in use. Briefly describe how this election works.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

7

The replacement property rules cover both voluntary dispositions and involuntary dispositions. However, they are applied differently to the two types of dispositions. Briefly describe the differences between the treatment for voluntary dispositions and involuntary dispositions.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

8

An enterprise buys €100,000 of merchandise in France, with the payable recorded in Euros. Between the time of the purchase and the payment of the account, the exchange rate for the Euro increases by $0.04. How will this increase be dealt with for tax purposes? Will this differ from the accounting treatment of the amount?

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

9

An individual purchases an option to acquire a tract of land at a later date. If the individual exercises the option, how will the cost of the option be dealt with? Alternatively, how would the cost be dealt with if the option expires without being exercised?

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

10

When an individual departs from Canada, there is a deemed disposition of most of his capital property. What major categories of property are the exceptions to this deemed disposition rule?

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

11

Describe how a taxpayer calculates a taxable capital gain or an allowable capital loss.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

12

When the use of a capital property is changed from personal use to business use, there is a deemed disposition/reacquisition of that property. If the original cost of the property is less than the fair market value of the property at the time of the change in use, the cost of the property for UCC purposes is limited to its cost, plus one-half of the difference between the cost and fair market value. What is the reason for this limitation?

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

13

Having business property destroyed in a natural disaster (e.g., flood or earthquake)would normally have very adverse tax consequences. Briefly describe the tax consequences of receiving insurance payments in this situation in the absence of special rules.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

14

Describe the tax treatment that will be given to personal use property dispositions. How does this treatment differ if the property is listed personal property?

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

15

The Income Tax Act contains a provision which allows an individual to defer the taxation on capital gains resulting from the sale of shares of an "eligible small business corporation". What is the definition of an eligible small business corporation?

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

16

It is not uncommon for a person, when moving out of a principal residence, to retain that property as a rental unit. If no election is made, this change in use will be treated as a deemed disposition, possibly resulting in capital gains being assessed. Explain how this result can be avoided, as well as the tax consequences of making the required election.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

17

A taxpayer may acquire a number of identical properties at different points in time at different costs. When there is a sale of part of a group of identical properties, how do you determine the adjusted cost base of the properties sold?

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

18

Capital gains have always been given very favourable tax treatment relative to interest income. What is the justification for this treatment?

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

19

In terms of tax planning, capital gains and losses have an advantage that is not available for other types of income. Briefly describe this advantage.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

20

How is government assistance for the purchase of capital assets dealt with in the Income Tax Act? How does this differ from the accounting treatment of government assistance for the purchase of capital assets?

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements about the tax treatment of gifts of capital assets is NOT correct?

A)The adjusted cost base to the recipient will be the fair market value of the asset gifted.

B)The tax treatment of gifts is different when the gift is made to a non-arm's length party rather than to an arm's length party.

C)The proceeds of disposition to the person giving the gift will be the fair market value of the asset gifted.

D)If the fair market value of the asset being given exceeds its tax cost to the person giving the gift, that person will have a capital gain.

A)The adjusted cost base to the recipient will be the fair market value of the asset gifted.

B)The tax treatment of gifts is different when the gift is made to a non-arm's length party rather than to an arm's length party.

C)The proceeds of disposition to the person giving the gift will be the fair market value of the asset gifted.

D)If the fair market value of the asset being given exceeds its tax cost to the person giving the gift, that person will have a capital gain.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

22

A dining room suite that had been purchased for $700 was sold during the year. The proceeds of disposition totalled $500. The allowable capital loss on the transaction is $100.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is NOT included in ITA 53 as an adjustment to the cost base of an asset?

A)Government assistance with the cost of acquisition.

B)CCA taken in previous years.

C)Superficial losses.

D)In the case of vacant land, interest and property taxes.

A)Government assistance with the cost of acquisition.

B)CCA taken in previous years.

C)Superficial losses.

D)In the case of vacant land, interest and property taxes.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

24

A dining room suite that had been purchased for $700 was sold during the year. The proceeds of disposition totalled $1,500. The taxable capital gain on the transaction is $250.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

25

When an individual emigrates from Canada, there is a deemed disposition of all of his capital property at fair market value.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements with respect to capital gains is NOT correct?

A)Insurance proceeds to compensate for a business building destroyed in a fire is a proceeds of disposition.

B)The adjusted cost base of capital assets is reduced by any government assistance received for their acquisition.

C)The lifetime capital gains deduction reduces the amount of capital gains included in Net Income For Tax Purposes.

D)The expropriation of a capital asset by a municipal government is considered to be a disposition.

A)Insurance proceeds to compensate for a business building destroyed in a fire is a proceeds of disposition.

B)The adjusted cost base of capital assets is reduced by any government assistance received for their acquisition.

C)The lifetime capital gains deduction reduces the amount of capital gains included in Net Income For Tax Purposes.

D)The expropriation of a capital asset by a municipal government is considered to be a disposition.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

27

Losses on the disposition of listed personal property can be deducted, but only against gains on the disposition of listed personal property.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

28

A dining room suite that had been purchased for $700 was sold during the year. The proceeds of disposition totalled $900. The capital gain on the transaction is $200.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements with respect to capital gains is correct?

A)The inclusion rate for taxable capital gains has always been one-half of the capital gain.

B)All gains on the sale of Canadian securities are treated as capital gains.

C)The favourable taxation of capital gains is designed to partially compensate businesses for the effects of inflation.

D)The lifetime capital gains deduction is no longer available to Canadian individuals.

A)The inclusion rate for taxable capital gains has always been one-half of the capital gain.

B)All gains on the sale of Canadian securities are treated as capital gains.

C)The favourable taxation of capital gains is designed to partially compensate businesses for the effects of inflation.

D)The lifetime capital gains deduction is no longer available to Canadian individuals.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

30

Capital gains on a principal residence are not taxable.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

31

On November 12, 2020, Hubert Robbins sells 100 shares of Loser Inc. for $120 per share. He had purchased these shares several years ago at $220 per share. On November 18, 2020, he acquires 80 shares of Loser Inc. for $100 per share. On December 22, 2020, he acquires 50 shares of Loser Inc. at $80 per share. What is the adjusted cost base of the 130 shares that he holds after the December 22, 2020 purchase?

A)$12,000.

B)$20,000.

C)$22,000.

D)$14,000.

A)$12,000.

B)$20,000.

C)$22,000.

D)$14,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

32

To be an eligible corporation for purposes of the deferral provisions on small business investments, more than 50 percent of the fair market value of its assets must be used to produce active business income in Canada.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

33

A superficial loss occurs when, in the 30 days following the disposition that resulted in the loss, an identical asset is acquired.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

34

Mr. Schmidt purchased 250 shares of Doss Limited on February 1 of the current year for $20 per share. On May 1 of the current year, he purchased 100 more shares for $25 per share. On June 20 of the current year, Mr. Schmidt sells 100 shares for $15 per share. His allowable capital loss on June 20 is $643.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

35

When there is a change in use, there will be a deemed disposition/reacquisition.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

36

When there is an involuntary disposition of a depreciable asset, any resulting capital gain can be eliminated if the asset is replaced by an asset of equal or greater value, no later than the end of the second taxation year following the disposition.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

37

One of the reasons for the favourable tax treatment of capital gains is that the amounts received often have to be reinvested in the business in order to maintain its productive capacity.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

38

When there is a disposition of a capital asset and not all of the proceeds of disposition are collected at the time of disposition, a reserve can be deducted. In the year of the disposition, the reserve cannot be less than 80 percent of the total gain.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

39

Carine purchased a piece of land with her inheritance. She was planning to open a mini-golf course and put in a zip-line course. Carine had been laid off for a year and could not find work as a golf pro. After spending some time researching mini-golf and zip line course designs, she received a job offer which she decided to take. She has received an offer to purchase the land at a significant gain. Which of the following statements is correct?

A)Since Carine's primary intent was to use the land in her business, the gain is business income.

B)Since Carine's primary intent was to use the land in her business, the property taxes on the land are deductible.

C)Since Carine's primary intent was to use the land in her business, the gain is a capital gain.

D)Since the gain relates to property, the gain is property income.

A)Since Carine's primary intent was to use the land in her business, the gain is business income.

B)Since Carine's primary intent was to use the land in her business, the property taxes on the land are deductible.

C)Since Carine's primary intent was to use the land in her business, the gain is a capital gain.

D)Since the gain relates to property, the gain is property income.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

40

The term proceeds of disposition can be used in a number of situations. Indicate which of the following would not be considered proceeds of disposition for the PD Company.

A)Amounts paid to PD Company under insurance policies for property that has been destroyed.

B)Amounts paid to PD Company under insurance policies for property unlawfully taken.

C)Amounts paid to PD Company by a municipal government for property that has been expropriated.

D)Amounts paid to PD Company on the sale of inventories.

E)Amounts paid to PD Company on the sale of a warehouse.

A)Amounts paid to PD Company under insurance policies for property that has been destroyed.

B)Amounts paid to PD Company under insurance policies for property unlawfully taken.

C)Amounts paid to PD Company by a municipal government for property that has been expropriated.

D)Amounts paid to PD Company on the sale of inventories.

E)Amounts paid to PD Company on the sale of a warehouse.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

41

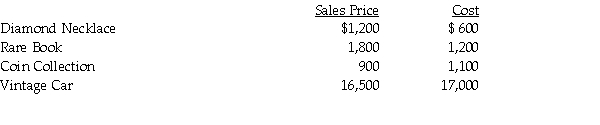

Song Ming sold the following assets during the current year:  Which one of the following amounts represents her taxable capital gain, net of allowable capital losses, for tax purposes during the current year?

Which one of the following amounts represents her taxable capital gain, net of allowable capital losses, for tax purposes during the current year?

A)$100

B)$250

C)$350

D)$500

Which one of the following amounts represents her taxable capital gain, net of allowable capital losses, for tax purposes during the current year?

Which one of the following amounts represents her taxable capital gain, net of allowable capital losses, for tax purposes during the current year?A)$100

B)$250

C)$350

D)$500

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements regarding the tax treatment of a principal residence is NOT correct?

A)If a taxpayer owns two residences, and both are sold in the same year, the principal residence formula will eliminate the capital gain on only one of the residences.

B)If a taxpayer owns two residences, the decision to designate a particular property as the principal residence must be made when the residence is sold.

C)If a taxpayer owns only one residence, the principal residence formula will eliminate any capital gain on the sale.

D)A capital loss cannot be realized on the sale of a principal residence.

A)If a taxpayer owns two residences, and both are sold in the same year, the principal residence formula will eliminate the capital gain on only one of the residences.

B)If a taxpayer owns two residences, the decision to designate a particular property as the principal residence must be made when the residence is sold.

C)If a taxpayer owns only one residence, the principal residence formula will eliminate any capital gain on the sale.

D)A capital loss cannot be realized on the sale of a principal residence.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements with respect to capital gains reserves is correct?

A)There is no limit on how many years a reserve can be deducted.

B)The maximum capital gains reserve is equal to the ratio between the proceeds not yet collected and the total proceeds, multiplied by the capital gain.

C)The maximum capital gains reserve is limited to 20 percent of the total capital gain in the first year after the sale.

D)Any capital gains reserve that is deducted in the current taxation year must be added back to income in the subsequent taxation year.

A)There is no limit on how many years a reserve can be deducted.

B)The maximum capital gains reserve is equal to the ratio between the proceeds not yet collected and the total proceeds, multiplied by the capital gain.

C)The maximum capital gains reserve is limited to 20 percent of the total capital gain in the first year after the sale.

D)Any capital gains reserve that is deducted in the current taxation year must be added back to income in the subsequent taxation year.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

44

Bob sold a capital property on December 31, 2020 for $300,000. $280,000 is payable on December 31, 2021, and the balance was paid immediately in cash. The adjusted cost base of the property was $170,000 and the selling costs totalled $10,000. Which one of the following amounts represents the minimum taxable capital gain in 2020?

A)$4,000.

B)$10,000.

C)$12,000.

D)$24,000.

A)$4,000.

B)$10,000.

C)$12,000.

D)$24,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

45

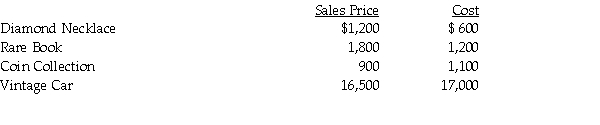

Mike sold the following assets during the current year:  Which one of the following amounts represents his taxable capital gain, net of allowable capital losses, for tax purposes during the current year?

Which one of the following amounts represents his taxable capital gain, net of allowable capital losses, for tax purposes during the current year?

A)$325.

B)$625.

C)$650.

D)$750.

Which one of the following amounts represents his taxable capital gain, net of allowable capital losses, for tax purposes during the current year?

Which one of the following amounts represents his taxable capital gain, net of allowable capital losses, for tax purposes during the current year?A)$325.

B)$625.

C)$650.

D)$750.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

46

Shun Li sold a capital property on July 31, 2020 for $400,000. She received $100,000 at the time of sale with the balance of $300,000 payable on July 31, 2023. The adjusted cost base of the property was $160,000. The minimum taxable capital gain that Shun Li can report in the 2020 taxation year is:

A)$30,000.

B)$60,000.

C)$120,000.

D)$180,000.

A)$30,000.

B)$60,000.

C)$120,000.

D)$180,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

47

Mr. Winestock owned two homes from 2017 to 2019. He had purchased Home A in 2005 for $60,000. In 2017, he purchased Home B for $180,000, with the intention of selling Home A immediately. Due to market conditions, mortgage rates, and the asking price, he was unable to sell Home A until 2019. The proceeds received on the sale of Home A were $150,000. In 2020, he was transferred to a different city and sold Home B. He designated 2017 and 2018 to Home A when it was sold. The proceeds received on the sale of Home B were $200,000. What is his taxable capital gain on Home B?

A)Nil.

B)$2,500.

C)$5,000.

D)$10,000.

E)$20,000.

A)Nil.

B)$2,500.

C)$5,000.

D)$10,000.

E)$20,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements related to the taxation of foreign currency transactions is correct?

A)All gains or losses that result from foreign currency transactions are treated as capital gains and losses.

B)When a Canadian corporation issues foreign currency debt, a gain or loss will only be recognized when the debt is repaid.

C)A foreign currency gain or loss will arise when Canadian dollars are converted to a different currency.

D)For individuals, the first $200 of foreign currency gains can always be excluded from income.

A)All gains or losses that result from foreign currency transactions are treated as capital gains and losses.

B)When a Canadian corporation issues foreign currency debt, a gain or loss will only be recognized when the debt is repaid.

C)A foreign currency gain or loss will arise when Canadian dollars are converted to a different currency.

D)For individuals, the first $200 of foreign currency gains can always be excluded from income.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

49

A business sells real property for $950,000, with $600,000 of this amount being allocated to the building and the remaining $350,000 allocated to the land. The building, the only asset in its Class, had a capital cost of $800,000 and a UCC of $650,000. The adjusted cost base of the land was $250,000. What are the tax consequences of this disposition?

A)A capital gain of $100,000 and a terminal loss of $50,000.

B)A capital gain of $50,000 and a terminal loss of nil.

C)A capital gain of $100,000 and a capital loss of $50,000.

D)A capital gain of $50,000 and a terminal loss of $50,000.

A)A capital gain of $100,000 and a terminal loss of $50,000.

B)A capital gain of $50,000 and a terminal loss of nil.

C)A capital gain of $100,000 and a capital loss of $50,000.

D)A capital gain of $50,000 and a terminal loss of $50,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements about personal use property is NOT correct?

A)Losses on the disposition of personal use property can be deducted to the extent of gains on the disposition of personal use property.

B)An antique chest would be classified as personal use property.

C)The minimum value for both the proceeds of disposition and the adjusted cost base of personal use property that is being sold is $1,000.

D)When losses on listed personal property are carried forward, they can be deducted to the extent of gains on the disposition of listed personal property.

A)Losses on the disposition of personal use property can be deducted to the extent of gains on the disposition of personal use property.

B)An antique chest would be classified as personal use property.

C)The minimum value for both the proceeds of disposition and the adjusted cost base of personal use property that is being sold is $1,000.

D)When losses on listed personal property are carried forward, they can be deducted to the extent of gains on the disposition of listed personal property.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

51

Indicate which of the following is NOT listed personal property.

A)A stamp.

B)A rare manuscript.

C)An antique chair.

D)A piece of jewelry.

E)A piece of sculpture.

A)A stamp.

B)A rare manuscript.

C)An antique chair.

D)A piece of jewelry.

E)A piece of sculpture.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

52

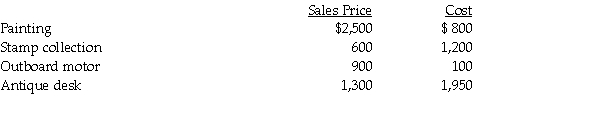

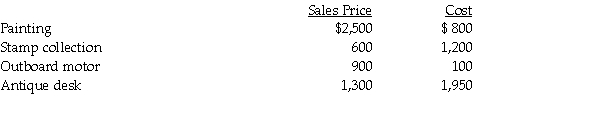

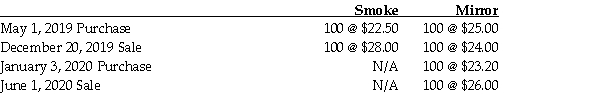

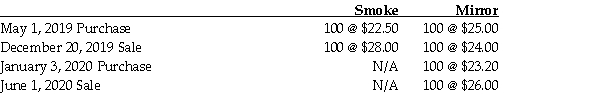

Chi has the following transactions in Smoke Corp. and Mirrors Corp. shares:  Chi's taxable capital gains for 2019 and 2020 are:

Chi's taxable capital gains for 2019 and 2020 are:

A)$225 for 2019, $90 for 2020.

B)$225 for 2019, $140 for 2020.

C)$275 for 2019, $90 for 2020.

D)$275 for 2019, $140 for 2020.

Chi's taxable capital gains for 2019 and 2020 are:

Chi's taxable capital gains for 2019 and 2020 are:A)$225 for 2019, $90 for 2020.

B)$225 for 2019, $140 for 2020.

C)$275 for 2019, $90 for 2020.

D)$275 for 2019, $140 for 2020.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

53

With respect to dispositions of capital assets, which of the following statements is correct?

A)The cost of providing a warranty on the sale of a capital asset cannot be deducted for tax purposes.

B)When identical properties are sold, the cost can be determined using either FIFO or Average Cost valuation.

C)The cost of providing a warranty on the sale of a capital asset can be deducted in full in the determination of business income.

D)If a portion of a property is sold, the adjusted cost base must be determined using the fair market value of the portion sold as a fraction of the total fair market value of the property.

A)The cost of providing a warranty on the sale of a capital asset cannot be deducted for tax purposes.

B)When identical properties are sold, the cost can be determined using either FIFO or Average Cost valuation.

C)The cost of providing a warranty on the sale of a capital asset can be deducted in full in the determination of business income.

D)If a portion of a property is sold, the adjusted cost base must be determined using the fair market value of the portion sold as a fraction of the total fair market value of the property.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

54

Heidi bought a mountain chalet in 2015 for $150,000 and sold it in 2020 for $180,000. She bought a lakeside cabin in 2016 for $100,000 and sold it in 2020 for $130,000. She lived full-time at the chalet in 2015 and spent an equal amount of time at the chalet and the cabin during the 5 years from 2016 to 2020. How should she allocate her principal residence gain reduction for the year 2016 to minimize her 2020 taxable capital gains?

A)2016 should be allocated to the cabin

B)2016 should be allocated to the chalet

C)2016 should be split between the cabin and the chalet

D)2016 cannot be allocated to either the cabin or the chalet

A)2016 should be allocated to the cabin

B)2016 should be allocated to the chalet

C)2016 should be split between the cabin and the chalet

D)2016 cannot be allocated to either the cabin or the chalet

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

55

On July 1, 2020, Chester Aguilar acquires 1,000 shares of a foreign company at 10 Foreign Currency units (FC, hereafter)per share. He acquired the funds for this purchase when FC1 = $1.48, a value that did not change prior to the date on which he purchased the shares. He sells the 1,000 shares December 1, 2020 for FC12 per share. On this date the exchange rate is FC1 = $1.46. What is the effect of the sale transaction on Chester's 2020 Net Income For Tax Purposes?

A)$2,720.

B)$1,160.

C)$2,520.

D)$1,360.

A)$2,720.

B)$1,160.

C)$2,520.

D)$1,360.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements with respect to the tax rules for principal residences is correct?

A)If a farmer's principal residence is on a farm, any capital gain on the disposition of the farm will be exempt.

B)If an individual and his spouse can each own real property in which they reside for a part of the year, they each can claim the principal residence exemption for that year on the property that they own.

C)If an individual sells a principal residence and buys another principal residence in a single year, he will not be able to completely eliminate any gain on the disposition of the second residence by using the principal residence exemption.

D)If an individual owns only one real property, it is not necessary to file the Form T2091, Designation Of A Property As A Principal Residence By An Individual, in order to claim the principal residence exemption.

A)If a farmer's principal residence is on a farm, any capital gain on the disposition of the farm will be exempt.

B)If an individual and his spouse can each own real property in which they reside for a part of the year, they each can claim the principal residence exemption for that year on the property that they own.

C)If an individual sells a principal residence and buys another principal residence in a single year, he will not be able to completely eliminate any gain on the disposition of the second residence by using the principal residence exemption.

D)If an individual owns only one real property, it is not necessary to file the Form T2091, Designation Of A Property As A Principal Residence By An Individual, in order to claim the principal residence exemption.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

57

The special rules for a disposition of property that includes land and buildings should be applied when:

A)there is a capital gain on the land and a capital loss on the building.

B)there is a capital gain on the building and a capital loss on the land.

C)there is a capital gain on the land and a terminal loss on the building.

D)there is a capital gain on the building and a terminal loss on the land.

A)there is a capital gain on the land and a capital loss on the building.

B)there is a capital gain on the building and a capital loss on the land.

C)there is a capital gain on the land and a terminal loss on the building.

D)there is a capital gain on the building and a terminal loss on the land.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements is NOT correct?

A)When there is a disposition of an identical property, the taxpayer must use the average cost of all such properties as the adjusted cost base.

B)When a taxpayer provides a warranty on the sale of a capital asset, the cost incurred to provide the warranty is treated as a capital loss.

C)When there is a partial disposition of land that is held as a capital asset, the adjusted cost base must be based on a proportionate share of the total area of the land.

D)When a bad debt arises from the sale of a capital asset, its writeoff must be treated as a capital loss.

A)When there is a disposition of an identical property, the taxpayer must use the average cost of all such properties as the adjusted cost base.

B)When a taxpayer provides a warranty on the sale of a capital asset, the cost incurred to provide the warranty is treated as a capital loss.

C)When there is a partial disposition of land that is held as a capital asset, the adjusted cost base must be based on a proportionate share of the total area of the land.

D)When a bad debt arises from the sale of a capital asset, its writeoff must be treated as a capital loss.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

59

The questions below are based on the following information:

BMP Products Ltd. (BMP)has been in operation for more than 20 years. Ten years ago, planning for future growth of its manufacturing facilities, BMP purchased a plot of land in an industrial area for $150,000. During the last couple of years, BMP has not met expectations. Business has fallen slightly and cash flows are tight. Due to the decrease in product demand, management does not believe that BMP will use this plot of land in the near future. As a result, during the taxation year ended March 31, 2020, BMP sold this land for $400,000. $150,000 was received in February, 2020, with the remainder to be paid in two equal instalments in February, 2021 and February, 2022. You have been advised that capital gains treatment is appropriate for this transaction.

BMP can claim a reserve on the above sale at March 31, 2021 of:

A)Nil.

B)$78,125.

C)$125,000.

D)$150,000.

BMP Products Ltd. (BMP)has been in operation for more than 20 years. Ten years ago, planning for future growth of its manufacturing facilities, BMP purchased a plot of land in an industrial area for $150,000. During the last couple of years, BMP has not met expectations. Business has fallen slightly and cash flows are tight. Due to the decrease in product demand, management does not believe that BMP will use this plot of land in the near future. As a result, during the taxation year ended March 31, 2020, BMP sold this land for $400,000. $150,000 was received in February, 2020, with the remainder to be paid in two equal instalments in February, 2021 and February, 2022. You have been advised that capital gains treatment is appropriate for this transaction.

BMP can claim a reserve on the above sale at March 31, 2021 of:

A)Nil.

B)$78,125.

C)$125,000.

D)$150,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

60

The questions below are based on the following information:

BMP Products Ltd. (BMP)has been in operation for more than 20 years. Ten years ago, planning for future growth of its manufacturing facilities, BMP purchased a plot of land in an industrial area for $150,000. During the last couple of years, BMP has not met expectations. Business has fallen slightly and cash flows are tight. Due to the decrease in product demand, management does not believe that BMP will use this plot of land in the near future. As a result, during the taxation year ended March 31, 2020, BMP sold this land for $400,000. $150,000 was received in February, 2020, with the remainder to be paid in two equal instalments in February, 2021 and February, 2022. You have been advised that capital gains treatment is appropriate for this transaction.

BMP can claim a reserve on the above sale at March 31, 2020 of:

A)Nil.

B)$156,250.

C)$200,000.

D)$250,000.

BMP Products Ltd. (BMP)has been in operation for more than 20 years. Ten years ago, planning for future growth of its manufacturing facilities, BMP purchased a plot of land in an industrial area for $150,000. During the last couple of years, BMP has not met expectations. Business has fallen slightly and cash flows are tight. Due to the decrease in product demand, management does not believe that BMP will use this plot of land in the near future. As a result, during the taxation year ended March 31, 2020, BMP sold this land for $400,000. $150,000 was received in February, 2020, with the remainder to be paid in two equal instalments in February, 2021 and February, 2022. You have been advised that capital gains treatment is appropriate for this transaction.

BMP can claim a reserve on the above sale at March 31, 2020 of:

A)Nil.

B)$156,250.

C)$200,000.

D)$250,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

61

Crystal Collins acquires an option to buy a piece of land at a price of $100,000. The land will be used to expand her greenhouse business. The cost of the option is $5,000. Which of the following statements is NOT correct?

A)If the option expires, Crystal will have a business loss of $5,000.

B)If Crystal exercises the option and acquires the land, the adjusted cost base of the land will be $105,000.

C)If the option expires, Crystal will have an allowable capital loss of $2,500.

D)If Crystal sells the option for $5,000, the transaction will have no effect on her Net Income For Tax Purposes.

A)If the option expires, Crystal will have a business loss of $5,000.

B)If Crystal exercises the option and acquires the land, the adjusted cost base of the land will be $105,000.

C)If the option expires, Crystal will have an allowable capital loss of $2,500.

D)If Crystal sells the option for $5,000, the transaction will have no effect on her Net Income For Tax Purposes.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

62

With respect to the deferral provisions for replacement property, which of the following statements is NOT correct?

A)In the case of involuntary dispositions, for the deferral provisions to apply, the replacement of the property must occur within 24 months after the end of the year in which the proceeds of disposition were received.

B)Provided the replacement cost of the property exceeds the proceeds of disposition, 100 percent of any capital gain that results from an involuntary disposition can be reversed.

C)When the disposition is voluntary, the deferral provisions only apply to former business properties.

D)Provided the replacement cost of the property is less than the proceeds of disposition, 100 percent of any recapture recognized as a result of an involuntary disposition can be reversed.

A)In the case of involuntary dispositions, for the deferral provisions to apply, the replacement of the property must occur within 24 months after the end of the year in which the proceeds of disposition were received.

B)Provided the replacement cost of the property exceeds the proceeds of disposition, 100 percent of any capital gain that results from an involuntary disposition can be reversed.

C)When the disposition is voluntary, the deferral provisions only apply to former business properties.

D)Provided the replacement cost of the property is less than the proceeds of disposition, 100 percent of any recapture recognized as a result of an involuntary disposition can be reversed.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

63

On January 1, 2020, Marcus Abbott permanently emigrates from Canada. At that time, his only property consists of his principal residence and a small apartment building. His principal residence was purchased several years ago at a cost of $650,000. Of this total $150,000 relates to the land. The current fair market value of his residence is $975,000. The value of the land is unchanged at the time of his departure. The apartment building had a capital cost of $870,000, with $170,000 of this total allocated to the land. The building had a January 1, 2020 UCC of $476,000. At the time of his departure, the apart- ment building has a fair market value of $1,200,000, with the value of the land remaining at $170,000. What is the minimum addition to Mr. Abbott's Net Income For Tax Purposes that results from his departure?

A)$655,000.

B)$724,000

C)$559,000

D)Nil

A)$655,000.

B)$724,000

C)$559,000

D)Nil

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

64

The questions below are based on the following information:

Ramon lives in Calgary. In 2017 he purchased a second house in Lethbridge for $180,000 (land $100,000; building $80,000). His grandmother lives in the house rent free and was the only occupant from 2017 to 2020. In March 2020, Ramon converted the house into a duplex. His grandmother lives in one unit rent free and the other unit is rented to tenants. The market value of the house in March 2020 was $215,000 (land $115,000; building $100,000).

What is Ramon's taxable capital gain for the 2020 change in use? He will not use his principal residence gain reduction for the Lethbridge house.

A)$5,000

B)$8,750

C)$10,000

D)$17,500

Ramon lives in Calgary. In 2017 he purchased a second house in Lethbridge for $180,000 (land $100,000; building $80,000). His grandmother lives in the house rent free and was the only occupant from 2017 to 2020. In March 2020, Ramon converted the house into a duplex. His grandmother lives in one unit rent free and the other unit is rented to tenants. The market value of the house in March 2020 was $215,000 (land $115,000; building $100,000).

What is Ramon's taxable capital gain for the 2020 change in use? He will not use his principal residence gain reduction for the Lethbridge house.

A)$5,000

B)$8,750

C)$10,000

D)$17,500

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

65

Equipment was stolen from Far East Corp. on May 1, 2020. The cost of the equipment was $10,000 and the UCC was $7,500. The insurance proceeds of $12,000 were received on September 15, 2020 and replacement equipment was purchased for $11,500 on September 30, 2020. Far East makes all elections to minimize the tax effect of replacing the equipment. Which of the following statements is correct?

A)The 2020 taxable capital gain is $250 and the deemed capital cost of the new equipment is $10,000

B)The 2020 taxable capital gain is $250 and the deemed capital cost of the new equipment is $11,500

C)The 2020 taxable capital gain is $250 and the deemed capital cost of the new equipment is $10,750

D)The 2020 taxable capital gain is $1,000 and the deemed capital cost of the new equipment is $12,000

A)The 2020 taxable capital gain is $250 and the deemed capital cost of the new equipment is $10,000

B)The 2020 taxable capital gain is $250 and the deemed capital cost of the new equipment is $11,500

C)The 2020 taxable capital gain is $250 and the deemed capital cost of the new equipment is $10,750

D)The 2020 taxable capital gain is $1,000 and the deemed capital cost of the new equipment is $12,000

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

66

When an individual departs from Canada, there is a deemed disposition of several types of property. Which of the following properties would NOT be subject to this deemed disposition rule?

A)A large painting by a well known Canadian artist.

B)Land and building that is being used as a rental property.

C)Shares in a CCPC involved in earning active business income.

D)Shares in a CCPC that is used to hold investments.

A)A large painting by a well known Canadian artist.

B)Land and building that is being used as a rental property.

C)Shares in a CCPC involved in earning active business income.

D)Shares in a CCPC that is used to hold investments.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

67

In 1997, Ms. Boisvert became a homeowner, acquiring a residence in Halifax at a cost of $135,000. In 2008, she was transferred by her employer to Winnipeg. She rented accommodations in Winnipeg and leased the Halifax residence. Ms. Boisvert elected to be deemed not to have converted the property to an income producing use. She did not take CCA on the property during the period that it was rented. In July, 2020, after 24 years of ownership, she sold the Halifax house for $207,000, netting a gain of $72,000. She had decided she would not return to Halifax. Which one of the following amounts represents the minimum capital gain that she may report in 2020?

A)Nil.

B)$21,000.

C)$33,000.

D)$36,000.

A)Nil.

B)$21,000.

C)$33,000.

D)$36,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

68

Nigel buys an option for $1,000 which allows him to purchase a block of shares for $40,000. Which of the following statements is NOT correct?

A)If Nigel allows the option to expire, he has an allowable capital loss of $500.

B)If Nigel sells the option for $700, he has an allowable capital loss of $350.

C)If Nigel purchases the shares, the adjusted cost base of the shares will be $41,000.

D)If Nigel allows the option to expire, the vendor has a taxable capital gain of $500.

A)If Nigel allows the option to expire, he has an allowable capital loss of $500.

B)If Nigel sells the option for $700, he has an allowable capital loss of $350.

C)If Nigel purchases the shares, the adjusted cost base of the shares will be $41,000.

D)If Nigel allows the option to expire, the vendor has a taxable capital gain of $500.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

69

Mamie Hanson converts her principal residence into a rental property. This property had cost $850,000 several years ago. It is converted on January 1, 2020 and, at that time, it is estimated that the value of the property has increased to $1,100,000. At this time the value of the land is unchanged at $400,000. Provided her rental income before CCA is more than this amount, what is the maximum CCA that Mamie can claim for 2020?

A)$16,000.

B)$32,000.

C)$46,000.

D)$23,000.

A)$16,000.

B)$32,000.

C)$46,000.

D)$23,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

70

Arnold Swartz converted his principal residence into a rental property after having lived in it for 5 years. He has not been able to find a tenant during the current year. The house had cost $1 million. At the time of conversion, the building had a fair market value of $1.4 million. What is the UCC balance in the rental property's Class 1 before any CCA is taken?

A)$1,000,000

B)$1,200,000

C)$1,400,000

D)Nil

A)$1,000,000

B)$1,200,000

C)$1,400,000

D)Nil

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

71

If a business asset with a capital cost of $100,000 and a UCC of $80,000 is converted to personal use at a time when its fair market value is $150,000, which of the following statements is NOT correct?

A)The deemed disposition will create recapture of $20,000.

B)The deemed disposition will create a taxable capital gain of $25,000.

C)The capital cost for CCA purposes will be $125,000.

D)The capital cost for capital gains purposes will be $150,000.

A)The deemed disposition will create recapture of $20,000.

B)The deemed disposition will create a taxable capital gain of $25,000.

C)The capital cost for CCA purposes will be $125,000.

D)The capital cost for capital gains purposes will be $150,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

72

In 2012, Rochelle Parsons acquired a home in Calgary, Alberta for $350,000, with $75,000 of this amount being the estimated value of the land. In 2014, she was required by her employer to move to London, Ontario. As she believed Calgary real estate was an outstanding investment, she decided to convert the home to a rental property, but would not be deducting CCA on it. Related to this decision was the fact that she decided to rent a home in London, rather than acquiring a second property in that city. In 2020, recognizing that she was unlikely to return to Calgary, she sold the Calgary home for $500,000, with $150,000 of this amount being the estimated value of the land. What is the minimum capital gain that Rochelle will have to recognize in 2020?

A)$33,333.

B)$16,667.

C)$50,000.

D)$150,000.

A)$33,333.

B)$16,667.

C)$50,000.

D)$150,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

73

Joel has lived in Canada his entire life. He is planning to depart permanently from Canada. The deemed disposition rules on departure would NOT apply to his:

A)shares in a Canadian public corporation.

B)shares in a Canadian private corporation.

C)coin collection.

D)house in Ontario.

A)shares in a Canadian public corporation.

B)shares in a Canadian private corporation.

C)coin collection.

D)house in Ontario.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

74

Jose Montana owns a cottage that he purchased in 2011 for $330,000, with $100,000 of this amount reflecting the value of the land. On January 1, 2020, this cottage is converted to a rental property. At the time of conversion, it is estimated that the cottage has a fair market value of $600,000, with $150,000 of this amount reflecting the value of the land. For 2020, rental income, net of all expenses except CCA equals $30,200. What is the maximum amount of CCA that Jose can deduct on this rental property for 2020?

A)$27,000.

B)$ 6,800.

C)$ 9,000.

D)$18,000.

A)$27,000.

B)$ 6,800.

C)$ 9,000.

D)$18,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

75

Assume that in all of the following situations the company's fiscal year is the calendar year and that recapture arose due to the disposition of the asset. In which situation would the company NOT be permitted to defer the recognition of the recapture?

A)A warehouse was destroyed in a fire in December, 2018. The insurance proceeds received were used to build a new warehouse that was finished in June, 2020.

B)A backhoe was stolen in December, 2018. The insurance proceeds received were used to buy a new backhoe in June, 2020.

C)A backhoe was destroyed in a fire in December, 2018. The insurance proceeds received were used to buy a new backhoe in June, 2020.

D)A warehouse was sold in December, 2018. A new warehouse was purchased in June, 2020.

A)A warehouse was destroyed in a fire in December, 2018. The insurance proceeds received were used to build a new warehouse that was finished in June, 2020.

B)A backhoe was stolen in December, 2018. The insurance proceeds received were used to buy a new backhoe in June, 2020.

C)A backhoe was destroyed in a fire in December, 2018. The insurance proceeds received were used to buy a new backhoe in June, 2020.

D)A warehouse was sold in December, 2018. A new warehouse was purchased in June, 2020.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

76

The questions below are based on the following information:

Ramon lives in Calgary. In 2017 he purchased a second house in Lethbridge for $180,000 (land $100,000; building $80,000). His grandmother lives in the house rent free and was the only occupant from 2017 to 2020. In March 2020, Ramon converted the house into a duplex. His grandmother lives in one unit rent free and the other unit is rented to tenants. The market value of the house in March 2020 was $215,000 (land $115,000; building $100,000).

What is Ramon's maximum 2020 CCA deduction for this rental property? The net rental income before CCA is $6,000.

A)$2,400

B)$900

C)$1,600

D)$1,800

Ramon lives in Calgary. In 2017 he purchased a second house in Lethbridge for $180,000 (land $100,000; building $80,000). His grandmother lives in the house rent free and was the only occupant from 2017 to 2020. In March 2020, Ramon converted the house into a duplex. His grandmother lives in one unit rent free and the other unit is rented to tenants. The market value of the house in March 2020 was $215,000 (land $115,000; building $100,000).

What is Ramon's maximum 2020 CCA deduction for this rental property? The net rental income before CCA is $6,000.

A)$2,400

B)$900

C)$1,600

D)$1,800

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

77

On November 25, 2019 Ervin sold 100 shares of Mighty Ltd., an eligible small business corporation, for $32 per share. He purchased the shares in 2018 for $28 per share. On December 15, 2019 he reinvested the proceeds by buying 80 shares of Mouse Ltd. for $40 per share. Mouse Ltd. is also an eligible small business corporation so he was able to use the ITA 44.1 election to defer the 2019 capital gains. Ervin sold all of the Mouse Ltd. shares on July 5, 2020 for $52 per share. His taxable capital gain for 2020 is:

A)$680.

B)$960.

C)$480.

D)$1,360.

A)$680.

B)$960.

C)$480.

D)$1,360.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following statements with respect to the ITA 44.1 deferral provisions on small business investments is NOT correct?

A)The replacement shares must be the common shares of an eligible small business corporation that are acquired within 120 days after the end of the year in which the qualifying disposition took place

B)The use of the deferral provision will not affect the adjusted cost base of the replacement shares.

C)The deferral is limited to a fraction of the capital gain resulting from the qualifying disposition.

D)The eligible small business corporation and corporations related to it cannot have assets with a carrying value in excess of $50 million.

A)The replacement shares must be the common shares of an eligible small business corporation that are acquired within 120 days after the end of the year in which the qualifying disposition took place

B)The use of the deferral provision will not affect the adjusted cost base of the replacement shares.

C)The deferral is limited to a fraction of the capital gain resulting from the qualifying disposition.

D)The eligible small business corporation and corporations related to it cannot have assets with a carrying value in excess of $50 million.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

79

Susan Cousins purchased a house in Oshawa in March, 2018, for $250,000 (land; $80,000, building; $170,000). Even though Susan would be unable to reside in the house immediately, she felt it was a very good price and did not want to miss the opportunity to own this house. She rented out the house as of April, 2018. Her tenants will move out in December, 2019, and she will move into her house in January, 2020. The fair market value of the house at January 1, 2020 was $300,000 (land; $130,000, building; $170,000). The UCC of the house on this date is $163,000. Which of the following is correct?

A)The capital cost of the house for CCA purposes at January 1, 2020 is $275,000.

B)Susan must recognize a capital gain for tax purposes of $50,000 at January 1, 2020.

C)Susan must recognize a capital gain for tax purposes of $25,000 at January 1, 2019.

D)Susan can elect to designate the house as her principal residence for the years 2018 and 2019 so there is no capital gain on the house.

E)None of the above.

A)The capital cost of the house for CCA purposes at January 1, 2020 is $275,000.

B)Susan must recognize a capital gain for tax purposes of $50,000 at January 1, 2020.

C)Susan must recognize a capital gain for tax purposes of $25,000 at January 1, 2019.

D)Susan can elect to designate the house as her principal residence for the years 2018 and 2019 so there is no capital gain on the house.

E)None of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

80

On July 1, 2019, the Flex Company's warehouse was completely destroyed in a fire. The capital cost of the warehouse was $1,500,000 and its January 1, 2019 UCC was $1,248,539. On December 1, 2019, the company received insurance proceeds of $1,650,000, an amount equal to the estimated fair market value of the building. On April 1, 2020, the Company acquires an existing warehouse building for $1,800,000. Provided the Company makes all possible elections to reduce Tax Payable, what amount will be added to the Class 1 UCC as the result of this acquisition?

A)$1,548,539.

B)$1,650,000

C)$1,398,539.

D)$1,248,539

A)$1,548,539.

B)$1,650,000

C)$1,398,539.

D)$1,248,539

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck