Deck 10: Retirement Savings and Other Special Income Arrangements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/95

Play

Full screen (f)

Deck 10: Retirement Savings and Other Special Income Arrangements

1

Tax advisors generally recommend making RRSP contributions as early in the year as possible. What is the basis for these recommendations?

The reason tax advisors make these recommendations is to extend the period of tax free compounding. A payment made on January 1 will benefit from a full extra year of tax free compounding, as compared to a payment made on December 31 of that year.

2

One of your clients is considering the withdrawal of a portion of his RRSP balance under the provisions of the Home Buyers' Plan. List and briefly explain any factors that should be considered before deciding to make this withdrawal.

The basic factors to consider would be as follows:

• Whether the required funds could be acquired through a conventional mortgage.

• What rate would be paid on conventional mortgage financing.

• What rate is being earned on the investments in the plan.

• The fact that the earnings lost while the funds are out of the plan can never be put back in the plan, resulting in a permanent loss of tax assisted savings.

• Whether the required funds could be acquired through a conventional mortgage.

• What rate would be paid on conventional mortgage financing.

• What rate is being earned on the investments in the plan.

• The fact that the earnings lost while the funds are out of the plan can never be put back in the plan, resulting in a permanent loss of tax assisted savings.

3

Describe the alternative tax situations that may arise when an individual dies as the registrant of an unmatured RRSP.

The general rule here is that the fair market value of the assets in the unmatured plan will be included as income in the decedent's final tax return. However, there are two exceptions to this general rule:

• If the beneficiary of the RRSP is the decedent's spouse, there is a rollover provision that allows the transfer of the balances in the plan to a spouse or common-law partner without tax consequences. In effect, the spouse becomes the new registrant of the plan and there are no tax consequences for the decedent.

• If the beneficiary of the RRSP is a financially dependent child or grandchild, the assets will be taxed as income to that dependent. In addition, if the child or grandchild has a physical or mental infirmity, the dependant can avoid current taxation by transferring the assets to an RRSP, RRIF, RDSP, or using them to purchase an annuity.

• If the beneficiary of the RRSP is the decedent's spouse, there is a rollover provision that allows the transfer of the balances in the plan to a spouse or common-law partner without tax consequences. In effect, the spouse becomes the new registrant of the plan and there are no tax consequences for the decedent.

• If the beneficiary of the RRSP is a financially dependent child or grandchild, the assets will be taxed as income to that dependent. In addition, if the child or grandchild has a physical or mental infirmity, the dependant can avoid current taxation by transferring the assets to an RRSP, RRIF, RDSP, or using them to purchase an annuity.

4

The RRSP Deduction Limit, as defined in ITA 146(1), is not a limit on RRSP contributions. Explain this statement.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

5

Briefly describe the options available to an individual in the year he reaches age 71 with respect to the assets in his RRSP. Also indicate the tax consequences of each alternative.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

6

In calculating an individual's Pension Adjustment, it is necessary to have a mechanism for equating contributions in defined contribution plans with benefits earned in defined benefit plans. How does the RRSP legislation deal with this issue? Would you consider this approach to be fair to all taxpayers? Explain your conclusion.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

7

What are the tax advantages associated with making contributions to an RPP or an RRSP?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

8

An individual's RRSP deduction room is reduced by past service pension adjustments. Describe two situations that would give rise to such adjustments.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

9

One of your friends, a very wealthy businessman, has indicated that he never makes contributions to his RRSP in excess of amounts that he can deduct. His reasoning is that this doesn't make sense because, even though the contributions cannot be deducted when they are made, they will be subject to tax when they are withdrawn. Do you agree with your friend? Explain your conclusion, indicating any assumptions that you have made.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

10

An individual is returning to university after several years of full time employment. He has a substantial RRSP balance and is considering withdrawing some of this balance under the lifelong learning plan provisions. What factors should he consider in choosing this method of financing his return to university studies?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

11

Under what circumstances would it be desirable for an individual to make contributions to an RRSP in favour of their spouse or common-law partner? What are the advantages of making such contributions?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

12

Many individuals do not have sufficient funds to maximize their contributions to both an RRSP and a TFSA. Briefly compare the tax features of these two alternative plans.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

13

An individual has shares that have declined in value since he acquired them several years ago. As he is short of cash, he would like to use these shares as a contribution to his RRSP. As his tax advisor, would you approve of this decision?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

14

In almost all cases, making contributions to an RRSP will provide for the deferral of income tax. In some cases, making such contributions may result in avoidance of tax. Explain these statements.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

15

Describe the circumstances that give rise to pension adjustment reversals.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

16

Describe the difference between a defined benefit pension plan and a money purchase pension plan.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

17

How is Earned Income defined for purposes of determining the RRSP Deduction Limit?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

18

If an individual wishes to terminate his RRSP, making a lump-sum withdrawal is generally not the best alternative. Describe the disadvantages of such withdrawals.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

19

In many cases, investors with various types of investments in their RRSPs also have a portfolio of investments that are held outside of their RRSPs. When this is the case, tax advisors will indicate that, to the degree possible, they should include their debt securities inside of their RRSP, while allocating equity securities to their non-RRSP investment portfolio. What is the basis for this advice?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

20

Explain the income attribution rule that applies to spousal RRSPs.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

21

An employer contributes $25,000 to a Registered Pension Plan on March 1, 2020. Each of the 15 employees in the plan has contributed $1,000 to the plan during 2020. The employer can deduct a maximum of $15,000 in contributions for the taxation year ending December 31, 2020.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

22

All RRSP contributions that cannot be deducted in the current year will be subject to a penalty of 1 percent per month.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

23

Employees are allocated a taxable benefit for all amounts that an employer contributes to a Deferred Profit Sharing Plan.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

24

Earned Income for RRSP purposes includes taxable spousal support received, business losses, and net rental income.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

25

Tax rules establish both the minimum and maximum withdrawal that can be made from a Registered Retirement Income Fund in a particular year.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

26

With respect to self-administered Registered Retirement Savings Plans, which of the following is NOT a qualified investment?

A)Shares in a publicly traded company.

B)A mortgage on the principal residence of the plan beneficiary.

C)Direct investments in rental properties.

D)A five-year guaranteed investment certificate.

A)Shares in a publicly traded company.

B)A mortgage on the principal residence of the plan beneficiary.

C)Direct investments in rental properties.

D)A five-year guaranteed investment certificate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

27

Profit Sharing Plans (PSPs)are not as effective as Deferred Profit Sharing Plans (DPSPs)in providing tax advantaged compensation to employees. Briefly explain this statement.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

28

In terms of tax planning, the use of Registered Retirement Savings Plans can provide for both tax deferral and tax avoidance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

29

Amounts withdrawn from a Registered Retirement Savings Plan under the provisions of the Home Buyers' Plan must be repaid over a period of 15 years, beginning in the second calendar year after the year of withdrawal.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

30

Describe the basic differences between an RRSP and a RRIF.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

31

Describe the tax features associated with retirement compensation arrangements.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

32

With respect to a defined benefit Registered Pension Plan, which of the following statements is correct?

A)The employer is required to make a specific contribution to the plan in each year.

B)The employer promises each employee a retirement benefit that is based on a contractually specified formula.

C)The Pension Adjustment that will be calculated for each employee is based on the amounts of contributions that have been made by the employer.

D)Employees cannot make contributions to this type of plan.

A)The employer is required to make a specific contribution to the plan in each year.

B)The employer promises each employee a retirement benefit that is based on a contractually specified formula.

C)The Pension Adjustment that will be calculated for each employee is based on the amounts of contributions that have been made by the employer.

D)Employees cannot make contributions to this type of plan.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

33

A Registered Retirement Savings Plan is considered to be a spousal Registered Retirement Savings Plan if a spouse or common-law partner has made any contributions to the plan at any time since its inception.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

34

Describe the types of individuals that can be members of a pooled registered pension plan.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

35

Amounts withdrawn from a Registered Retirement Savings Plan under the provisions of the Lifelong Learning Plan must be used to pay tuition fees for a qualifying educational program at a designated educational institution.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

36

What is a salary deferral arrangement?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements with respect to RRSP terminations is NOT correct?

A)All RRSPs must be terminated in the year an individual turns 71 years old.

B)A lump sum withdrawal from an RRSP is not eligible for pension income splitting.

C)If an individual has terminated his RRSP because he has turned 71, he can no longer make RRSP contributions, even if he has Earned Income.

D)If RRSP funds are used to purchase a life annuity, only the annuity payments would be subject to tax.

A)All RRSPs must be terminated in the year an individual turns 71 years old.

B)A lump sum withdrawal from an RRSP is not eligible for pension income splitting.

C)If an individual has terminated his RRSP because he has turned 71, he can no longer make RRSP contributions, even if he has Earned Income.

D)If RRSP funds are used to purchase a life annuity, only the annuity payments would be subject to tax.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

38

With respect to a defined contribution Registered Pension Plan, which of the following statements is NOT correct?

A)The employer agrees to make a specified contribution for each year of service.

B)The Pension Adjustment that will be calculated for each employee is based on the amounts of contributions that have been made by the employee and employer.

C)Both the employee and employer can make contributions to such plans.

D)The employee's pension benefit is not affected by rates of return on the pension plan assets.

A)The employer agrees to make a specified contribution for each year of service.

B)The Pension Adjustment that will be calculated for each employee is based on the amounts of contributions that have been made by the employee and employer.

C)Both the employee and employer can make contributions to such plans.

D)The employee's pension benefit is not affected by rates of return on the pension plan assets.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

39

A pension plan that provides for a pension equal to 3 percent of an employee's average annual salary for each year of service is a defined benefit plan.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements with respect to pension plan categories is correct?

A)Pension adjustment reversals can only arise when the plan is a defined contribution plan.

B)If the pension adjustment is based on the employer and employee contributions, it is a defined benefit plan.

C)A plan in which the benefit is based on employer contributions is a defined benefit plan.

D)Past Service Pension Adjustments can only arise when the plan is a defined benefit plan.

A)Pension adjustment reversals can only arise when the plan is a defined contribution plan.

B)If the pension adjustment is based on the employer and employee contributions, it is a defined benefit plan.

C)A plan in which the benefit is based on employer contributions is a defined benefit plan.

D)Past Service Pension Adjustments can only arise when the plan is a defined benefit plan.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is correct about the Lifelong Learning Plan?

A)The maximum tax-free withdrawal is $10,000 per year for up to four years.

B)A taxpayer cannot participate in a Home Buyers' Plan and a Lifelong Learning Plan in the same year.

C)Minimum repayments must be made over a period of ten years.

D)Tax-free withdrawals can be made by a part-time student as long as they are repaid within two years.

A)The maximum tax-free withdrawal is $10,000 per year for up to four years.

B)A taxpayer cannot participate in a Home Buyers' Plan and a Lifelong Learning Plan in the same year.

C)Minimum repayments must be made over a period of ten years.

D)Tax-free withdrawals can be made by a part-time student as long as they are repaid within two years.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

42

Parviz withdrew $15,000 from his RRSP under the Home Buyers' Plan in 2018 and used the funds for a down payment on a qualifying home. He made a repayment of $700 during 2020. Taking into consideration his repayment, his Home Buyers' Plan will have what effect on his 2020 taxable income?

A)An increase of $1,000.

B)An increase of $300.

C)A decrease of $700.

D)No effect.

A)An increase of $1,000.

B)An increase of $300.

C)A decrease of $700.

D)No effect.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

43

Harleen, who is 70 years old, requested a lump sum withdrawal of $10,000 from her RRSP on November 1, 2020. Which of the following statements is correct?

A)She will receive cash of $8,000 and her 2020 taxable income will increase by $10,000.

B)She will receive cash of $9,000 and her 2020 taxable income will increase by $9,000.

C)She will receive cash of $8,000 and her 2020 taxable income will increase by $8,000.

D)She will receive cash of $10,000 and her 2020 taxable income will increase by $10,000.

A)She will receive cash of $8,000 and her 2020 taxable income will increase by $10,000.

B)She will receive cash of $9,000 and her 2020 taxable income will increase by $9,000.

C)She will receive cash of $8,000 and her 2020 taxable income will increase by $8,000.

D)She will receive cash of $10,000 and her 2020 taxable income will increase by $10,000.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following statements with respect to Registered Pension Plans (RPPs)is NOT correct?

A)An employer can sponsor both an RPP and a Deferred Profit Sharing Plan.

B)Employee contributions provide the contributor with a credit against tax payable.

C)Employer contributions do not constitute a taxable benefit for the employee.

D)Employee options at retirement are determined by the terms of the plan.

A)An employer can sponsor both an RPP and a Deferred Profit Sharing Plan.

B)Employee contributions provide the contributor with a credit against tax payable.

C)Employer contributions do not constitute a taxable benefit for the employee.

D)Employee options at retirement are determined by the terms of the plan.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements about Home Buyers' Plans (HBPs)is correct?

A)If a withdrawal is made under the plan, any contributions made 90 days prior to the withdrawal cannot be deducted.

B)Any RRSP contribution made in a particular year will count first towards the HPB repayment requirement for that year.

C)Repayments in excess of an annual requirement will reduce future annual requirements.

D)When an individual dies with an outstanding Home Buyers' Plan balance, this balance will not be subject to tax.

A)If a withdrawal is made under the plan, any contributions made 90 days prior to the withdrawal cannot be deducted.

B)Any RRSP contribution made in a particular year will count first towards the HPB repayment requirement for that year.

C)Repayments in excess of an annual requirement will reduce future annual requirements.

D)When an individual dies with an outstanding Home Buyers' Plan balance, this balance will not be subject to tax.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

46

Jenelle was a full-time student in a four-year qualifying program from September 2016 to April 2020. She withdrew $5,000 from her RRSP each year on September 1 under the Lifelong Learning Plan to finance her education. Her first repayment is due on:

A)September 1, 2020.

B)March 1, 2021.

C)September 1, 2021.

D)March 1, 2022.

A)September 1, 2020.

B)March 1, 2021.

C)September 1, 2021.

D)March 1, 2022.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

47

Which one of the following lists describes items that are all included in the determination of Earned Income for RRSP purposes?

A)Author's royalties, net rental income or losses, and spousal support received/paid.

B)Auto standby charge, salesperson's expenses, and resource royalties.

C)Business income or losses, CPP retirement benefits, and research grants.

D)Rental income or losses, salaries, and scholarships.

A)Author's royalties, net rental income or losses, and spousal support received/paid.

B)Auto standby charge, salesperson's expenses, and resource royalties.

C)Business income or losses, CPP retirement benefits, and research grants.

D)Rental income or losses, salaries, and scholarships.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

48

With respect to RRSP contributions, which of the following statements is correct?

A)Contributions made during the current year and within 30 days of the end of the current year, must be deducted in the current year.

B)Contributions in excess of available deduction room cannot be deducted in the current year or in any subsequent year.

C)There is no penalty for making contributions that are in excess of available deduction room.

D)Contributions made during the current year can be deducted in any subsequent year.

A)Contributions made during the current year and within 30 days of the end of the current year, must be deducted in the current year.

B)Contributions in excess of available deduction room cannot be deducted in the current year or in any subsequent year.

C)There is no penalty for making contributions that are in excess of available deduction room.

D)Contributions made during the current year can be deducted in any subsequent year.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

49

Eileen is a member of her employer's Registered Pension Plan to which her employer contributed $3,500 and Eileen contributed $2,600 in the current year. Which of the following statements is correct?

A)Eileen can deduct her contribution from her Net Income For Tax Purposes and her employer's contribution is not considered a taxable benefit.

B)Eileen cannot deduct her contribution from her Net Income For Tax Purposes and her employer's contribution is not considered a taxable benefit.

C)Eileen can deduct her contribution from her Net Income For Tax Purposes and she must include her employer's contribution in her income.

D)Eileen cannot deduct her contribution from her Net Income For Tax Purposes and her employer's contribution is considered a taxable benefit.

A)Eileen can deduct her contribution from her Net Income For Tax Purposes and her employer's contribution is not considered a taxable benefit.

B)Eileen cannot deduct her contribution from her Net Income For Tax Purposes and her employer's contribution is not considered a taxable benefit.

C)Eileen can deduct her contribution from her Net Income For Tax Purposes and she must include her employer's contribution in her income.

D)Eileen cannot deduct her contribution from her Net Income For Tax Purposes and her employer's contribution is considered a taxable benefit.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

50

During the year ending December 31, 2019, Wilma Collins has employment income before the deduction of any RPP contributions of $40,000, a net rental loss of $16,000, dividends from taxable Canadian corporations with a total grossed up amount of $6,000, and income from royalties of $7,000. The royalties were on a book written by Ms. Collins in her undergraduate years at university. She has no Unused RRSP Deduction Room from previous years. She is not a member of a Registered Pension Plan or a Deferred Profit Sharing Plan during 2019. Her maximum deductible 2020 Registered Retirement Savings Plan contribution is:

A)$5,400.

B)$5,580.

C)$6,660.

D)$9,540.

A)$5,400.

B)$5,580.

C)$6,660.

D)$9,540.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

51

During the year ending December 31, 2019, Joyce Collins has employment income before the deduction of any RPP contributions of $40,000, a net rental loss of $16,000, interest income of $6,000, and income from royalties of $7,000. The royalties were on a book written by Ms. Collins in her undergraduate years at university. She has no Unused RRSP Deduction Room from previous years. She is not a member of a Registered Pension Plan during 2019. She has contributed $2,000 to her husband's Registered Retirement Savings Plan in 2020. The maximum deductible 2020 Registered Retirement Savings Plan contribution to a plan in her name is:

A)$3,580.

B)$5,580.

C)$4,660.

D)$6,660.

A)$3,580.

B)$5,580.

C)$4,660.

D)$6,660.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

52

Cecilia withdrew $24,000 from her RRSP under the Home Buyers' Plan in 2018 and used the funds for a down payment on a qualifying home. She made a repayment of $1,000 during 2020. Her minimum repayment for 2021 will be:

A)$1,493.33.

B)$1,533.33.

C)$1,600.00.

D)$1,642.86.

A)$1,493.33.

B)$1,533.33.

C)$1,600.00.

D)$1,642.86.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements about Lifelong Learning Plans (LLPs)is NOT correct?

A)The maximum withdrawal is $10,000 in any single year, to a cumulative total of $20,000 over four years.

B)An individual can only participate in this program once during his life.

C)Repayments must begin no later than the fifth year after the year of the first Lifelong Learning Plan withdrawal (actually the sixth year if payments are made within 60 days of the end of the fifth year).

D)If an individual ceases to be a resident of Canada, any unpaid balance under the LLP must be repaid before the date the tax return for the year of departure should be filed, or 60 days after becoming a non-resident, whichever date is earlier.

A)The maximum withdrawal is $10,000 in any single year, to a cumulative total of $20,000 over four years.

B)An individual can only participate in this program once during his life.

C)Repayments must begin no later than the fifth year after the year of the first Lifelong Learning Plan withdrawal (actually the sixth year if payments are made within 60 days of the end of the fifth year).

D)If an individual ceases to be a resident of Canada, any unpaid balance under the LLP must be repaid before the date the tax return for the year of departure should be filed, or 60 days after becoming a non-resident, whichever date is earlier.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

54

During the year ending December 31, 2019, Ramona Collins has employment income before the deduction of any RPP contributions of $40,000, a net business loss of $16,000, interest income of $6,000, and income from royalties of $7,000. The royalties were on a book written by Ms. Collins in her undergraduate years at university. She has no Unused RRSP Deduction Room from previous years. She is a member of a Deferred Profit Sharing Plan in which, during 2019, her employer has contributed $3,000 per employee. Her maximum deductible Registered Retirement Savings Plan contribution for 2020 is:

A)$3,660.

B)$1,320.

C)$5,580.

D)$2,580.

A)$3,660.

B)$1,320.

C)$5,580.

D)$2,580.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

55

On April 1, 2019 Mrs. Wu contributed $1,000 to her RRSP. On October 1, 2019 Mr. Wu contributed $1,000 to the same RRSP in his wife's name. On June 1, 2020 Mrs. Wu withdrew $1,600 from her RRSP. As a result of the withdrawal:

A)Mrs. Wu's 2020 taxable income increased by $1,600.

B)Mr. Wu's 2020 taxable income increased by $1,600.

C)Mrs. Wu's 2020 taxable income increased by $800 and Mr. Wu's increased by $800.

D)Mrs. Wu's 2020 taxable income increased by $600 and Mr. Wu's increased by $1,000.

A)Mrs. Wu's 2020 taxable income increased by $1,600.

B)Mr. Wu's 2020 taxable income increased by $1,600.

C)Mrs. Wu's 2020 taxable income increased by $800 and Mr. Wu's increased by $800.

D)Mrs. Wu's 2020 taxable income increased by $600 and Mr. Wu's increased by $1,000.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

56

During the year ending December 31, 2019, Donna Collins has employment income before the deduction of any RPP contributions of $40,000, a net rental loss of $16,000, interest income of $6,000, and income from royalties of $7,000. The royalties were on a book written by Ms. Collins in her undergraduate years at university. She has no Unused RRSP Deduction Room from previous years. Ms. Collins is a member of a money purchase Registered Pension Plan in which, during 2019, she has contributed $2,000 and her employer has contributed $3,000. Her maximum deductible Registered Retirement Savings Plan contribution for 2020 is:

A)$2,580.

B)$580.

C)$3,580.

D)$1,660.

A)$2,580.

B)$580.

C)$3,580.

D)$1,660.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

57

Yukie has net employment income of $35,000. During the year, she received spousal support payments of $8,000, child support payments for her 10 year old daughter of $12,000 and an inheritance consisting of a $50,000 term deposit that paid interest of $2,000 in the year. Her Earned Income for RRSP purposes is:

A)$35,000.

B)$43,000.

C)$45,000.

D)$55,000.

A)$35,000.

B)$43,000.

C)$45,000.

D)$55,000.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

58

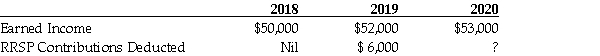

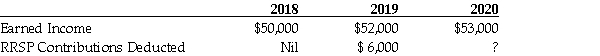

Mrs. Jacks is employed by RME Industries Ltd. RME Industries Ltd. does not offer a Registered Pension Plan or a Deferred Profit Sharing Plan to its employees. She has no Earned Income prior to 2018. Given the following, what is the maximum RRSP contribution that Mrs. Jacks can deduct for the 2020 taxation year?

A)$9,000.

B)$9,360.

C)$12,000.

D)$12,360.

E)None of the above.

A)$9,000.

B)$9,360.

C)$12,000.

D)$12,360.

E)None of the above.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

59

Mehrdad contributed $10,000 to an RRSP ten years ago. On May 1, 2020 the fair market value of the fund is $15,000 due solely to eligible dividends reinvested by the fund. On May 2, 2020 Mehrdad withdrew $2,000 from his RRSP. Which of the following statements is correct?

A)His tax payable will be reduced by the dividend tax credit on $2,000 of eligible dividends.

B)His taxable income will be increased by the sum of the $2,000 received plus the gross up on $2,000 of eligible dividends.

C)His tax payable will be reduced by the pension income credit on $2,000 of pension income.

D)His taxable income will be increased by $2,000.

A)His tax payable will be reduced by the dividend tax credit on $2,000 of eligible dividends.

B)His taxable income will be increased by the sum of the $2,000 received plus the gross up on $2,000 of eligible dividends.

C)His tax payable will be reduced by the pension income credit on $2,000 of pension income.

D)His taxable income will be increased by $2,000.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements with respect to the Home Buyers' Plan (HBP)is NOT correct?

A)All amounts withdrawn must be repaid within 10 years of the year of withdrawal.

B)Amounts withdrawn must be used to acquire a dwelling by October 1 of the year following withdrawal.

C)The maximum RRSP withdrawal is $25,000 per individual.

D)In the year an individual departs from Canada, any outstanding HBP balance must be repaid by the due date for his tax return for the year of departure.

A)All amounts withdrawn must be repaid within 10 years of the year of withdrawal.

B)Amounts withdrawn must be used to acquire a dwelling by October 1 of the year following withdrawal.

C)The maximum RRSP withdrawal is $25,000 per individual.

D)In the year an individual departs from Canada, any outstanding HBP balance must be repaid by the due date for his tax return for the year of departure.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

61

Mr. Marco Marconi has net employment income of $78,300, after the deduction of $2,400 in RPP contributions for the year. In addition, he has a business loss of $6,750, taxable dividends of $5,640, and pays $12,400 of deductible support to his former spouse. What is the amount of Mr. Marconi's Earned Income for RRSP purposes for the year?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

62

For 2019, Andrew Flack has Earned Income for RRSP purposes of $96,000. He is not a member of an RPP or a DPSP. While he had no undeducted contributions at the end of 2019, he had unused RRSP deduction room of $6,500. During 2020, he contributes $9,000 to his RRSP and make an RRSP deduction of $8,500. What is the amount of Mr. Flack's Unused RRSP Deduction Room and undeducted RRSP contributions at the end of 2020?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

63

On January 1, 2020 Mr. Yang celebrated his 65th birthday and transferred $85,000 from his RRSP into a RRIF. For what reason would he make this transfer?

A)He wants to split his RRIF withdrawal with his wife.

B)He wants to decrease his taxable income by transferring his high income investments from his RRSP.

C)He can no longer maintain an RRSP because of his age.

D)He is terminally ill and a RRIF will have more tax advantages to his wife on his death than his RRSP would have had.

A)He wants to split his RRIF withdrawal with his wife.

B)He wants to decrease his taxable income by transferring his high income investments from his RRSP.

C)He can no longer maintain an RRSP because of his age.

D)He is terminally ill and a RRIF will have more tax advantages to his wife on his death than his RRSP would have had.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

64

Mrs. Yus is 96 years old. She has a RRIF which was established in 1985. On January 1, 2020 the adjusted cost base of her RRIF is $50,000 and the fair market value is $62,000. Her minimum withdrawal for 2020 is:

A)$12,400.

B)$10,333.

C)$10,000.

D)$8,333.

A)$12,400.

B)$10,333.

C)$10,000.

D)$8,333.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

65

Mrs. Alison Lair has 2019 Earned Income for RRSP purposes of $43,500. She is not a member of an RPP or a DPSP. At the end of 2019, her Unused RRSP Deduction Room was $5,100 and she has no undeducted contributions. During 2020, she contributes $7,000 to her RRSP and makes an RRSP deduction of $5,200. What is the amount of Mrs. Lair's Unused RRSP Deduction Room and undeducted RRSP contributions at the end of 2020?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

66

Barry Notting has just received an inheritance of $50,000 in cash. As he is a very successful professional, he does not need the funds currently. Given this, he intends to invest the funds in preferred shares which pay an eligible dividend of 5.5 percent. As he intends to purchase a new home in five years, he plans to liquidate his investment at the end of that period. He is considering two alternatives:

Alternative 1 - Invest the $50,000 outside of his RRSP.

Alternative 2 - Invest the $50,000 in his RRSP (he has sufficient unused deduction room)and apply the deduction against his professional income. The tax savings resulting from the RRSP deduction would be invested outside of his RRSP in the 5.5 percent preferred shares.

Barry's marginal tax rate on ordinary income is 43 percent, while his marginal rate on eligible dividends is 26 percent. Ignoring the effect of any reinvestment of the dividends received, determine which alternative will provide more funds for Barry's home purchase.

Alternative 1 - Invest the $50,000 outside of his RRSP.

Alternative 2 - Invest the $50,000 in his RRSP (he has sufficient unused deduction room)and apply the deduction against his professional income. The tax savings resulting from the RRSP deduction would be invested outside of his RRSP in the 5.5 percent preferred shares.

Barry's marginal tax rate on ordinary income is 43 percent, while his marginal rate on eligible dividends is 26 percent. Ignoring the effect of any reinvestment of the dividends received, determine which alternative will provide more funds for Barry's home purchase.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements with respect to Deferred Profit Sharing Plans (DPSPs)is correct?

A)Both the employers and employees can make contributions to DPSPs.

B)Contributions to DPSPs are limited to one-half the money purchase limit for the year.

C)Employer contributions are treated as a taxable benefit to the employees.

D)Withdrawals from DPSPs are not taxable to the recipient.

A)Both the employers and employees can make contributions to DPSPs.

B)Contributions to DPSPs are limited to one-half the money purchase limit for the year.

C)Employer contributions are treated as a taxable benefit to the employees.

D)Withdrawals from DPSPs are not taxable to the recipient.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following would be eligible for the pension income tax credit?

A)a lump sum withdrawal from an RRSP

B)a lump sum withdrawal from a RRIF

C)a lump sum withdrawal from a spousal RRSP

D)all of the above

A)a lump sum withdrawal from an RRSP

B)a lump sum withdrawal from a RRIF

C)a lump sum withdrawal from a spousal RRSP

D)all of the above

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements with respect to profit sharing plans is correct?

A)Employer contributions are not taxable benefits to the employees.

B)Earnings within the plan accumulate on a tax free basis.

C)Employer contributions are limited to one-half of the money purchase limit for the year.

D)Withdrawals from the plan are received tax free by employee.

A)Employer contributions are not taxable benefits to the employees.

B)Earnings within the plan accumulate on a tax free basis.

C)Employer contributions are limited to one-half of the money purchase limit for the year.

D)Withdrawals from the plan are received tax free by employee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following statements with respect to Registered Retirement Income Funds (RRIFs)is NOT correct?

A)Withdrawals from a RRIF are not eligible for pension income splitting.

B)Withdrawals from a RRIF are eligible for the pension Income tax credit.

C)An individual can have multiple RRIFs.

D)Registered Pension Plan balances can be transferred to a RRIF on a tax free basis.

A)Withdrawals from a RRIF are not eligible for pension income splitting.

B)Withdrawals from a RRIF are eligible for the pension Income tax credit.

C)An individual can have multiple RRIFs.

D)Registered Pension Plan balances can be transferred to a RRIF on a tax free basis.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

71

The most common reason to transfer funds from a RRSP to a RRIF is:

A)the individual has officially retired.

B)the list of qualified investments is much longer for a RRIF.

C)the individual reaches age 65.

D)the individual reaches age 71.

A)the individual has officially retired.

B)the list of qualified investments is much longer for a RRIF.

C)the individual reaches age 65.

D)the individual reaches age 71.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

72

There are a number of tax free transfers of accumulated pension entitlements. Indicate the transfer that is NOT tax free.

A)Registered Pension Plan to Registered Retirement Savings Plan.

B)Registered Retirement Savings Plan to Registered Retirement Income Fund.

C)Profit Sharing Plan to Deferred Profit Sharing Plan.

D)Deferred Profit Sharing Plan to Registered Pension Plan.

E)Registered Pension Plan to different Registered Pension Plan.

A)Registered Pension Plan to Registered Retirement Savings Plan.

B)Registered Retirement Savings Plan to Registered Retirement Income Fund.

C)Profit Sharing Plan to Deferred Profit Sharing Plan.

D)Deferred Profit Sharing Plan to Registered Pension Plan.

E)Registered Pension Plan to different Registered Pension Plan.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

73

Ms. Calvin's employer sponsors both a money purchase RPP and a DPSP. During the current year, her employer contributes $2,600 to the RPP and $1,700 to the DPSP on behalf of Ms. Calvin. Ms. Calvin contributes $2,600 to the RPP. Calculate the amount of the Pension Adjustment that will be included on Ms. Calvin's T4 for the current year.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following statements with respect to Registered Retirement Income Funds (RRIFs)is correct?

A)An individual can make non-deductible contributions to a RRIF.

B)The minimum annual withdrawal from a RRIF is always determined by dividing the fair market value of the assets in the plan by 90, less the age of the beneficiary at the beginning of the year.

C)Earnings accumulate within the RRIF on a tax free basis.

D)A RRIF can only be established by individuals over the age of 71.

A)An individual can make non-deductible contributions to a RRIF.

B)The minimum annual withdrawal from a RRIF is always determined by dividing the fair market value of the assets in the plan by 90, less the age of the beneficiary at the beginning of the year.

C)Earnings accumulate within the RRIF on a tax free basis.

D)A RRIF can only be established by individuals over the age of 71.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

75

Susan Copley has net employment income of $56,200, after the deduction of $1,800 in RPP contributions. Her Net Income For Tax Purposes also includes $4,500 in taxable capital gains, a net rental loss of $2,300, spousal support payments received of $12,000, and eligible dividends received of $1,500. What is the amount of Susan's Earned Income for RRSP purposes for the year?

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following statements about Profit Sharing Plans is NOT correct?

A)The employer's contributions are taxable benefits.

B)Income earned within the plan is accumulated on a tax-free basis.

C)Lump sum withdrawals from the plan are not included in taxable income.

D)The employer's contribution can be higher than under a Deferred Profit Sharing Plan.

A)The employer's contributions are taxable benefits.

B)Income earned within the plan is accumulated on a tax-free basis.

C)Lump sum withdrawals from the plan are not included in taxable income.

D)The employer's contribution can be higher than under a Deferred Profit Sharing Plan.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

77

John Darby's employer sponsors both a money purchase RPP and a DPSP. During the current year, the employer contributes $2,500 to the RPP and $1,250 to the DPSP on behalf of Mr. Darby. Mr. Darby contributes $2,500 to the RPP. Calculate the amount of the Pension Adjustment that will be included on Mr. Darby's T4 for the current year.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

78

Mr. Smith, the sole shareholder and employee of Smithco Ltd. since its incorporation in 1976, has decided to sell the corporation and retire in 2020. He has never belonged to a pension plan, and wishes to maximize his RRSP. Which one of the following amounts represents the largest retiring allowance from Smithco that Mr. Smith can transfer to his RRSP in the year he retires?

A)$40,000.

B)$56,000.

C)$59,500.

D)$70,000.

A)$40,000.

B)$56,000.

C)$59,500.

D)$70,000.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements about a RPP is NOT correct?

A)Contributions can be made only by employers.

B)Pension adjustments reflect the benefits earned under both money purchase and defined benefit RPPs.

C)Contributions made by an employer to an unregistered pension plan are not deductible.

D)An RPP from a previous employer may be transferred into the new employer's plan.

A)Contributions can be made only by employers.

B)Pension adjustments reflect the benefits earned under both money purchase and defined benefit RPPs.

C)Contributions made by an employer to an unregistered pension plan are not deductible.

D)An RPP from a previous employer may be transferred into the new employer's plan.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following statements with respect to Retirement Compensation Arrangements (RCAs)is NOT correct?

A)Contributions to RCAs are fully deductible to the employer.

B)Contributions to RCAs are subject to a 50 percent, non-refundable tax.

C)Contributions can only be made by an employer, a former employer of a taxpayer, or by a person with whom the employer or former employer does not deal at arm's length.

D)Any taxes on contributions or earnings within the arrangement are refunded at the rate of 50 percent.

A)Contributions to RCAs are fully deductible to the employer.

B)Contributions to RCAs are subject to a 50 percent, non-refundable tax.

C)Contributions can only be made by an employer, a former employer of a taxpayer, or by a person with whom the employer or former employer does not deal at arm's length.

D)Any taxes on contributions or earnings within the arrangement are refunded at the rate of 50 percent.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck