Deck 16: Pricing Concepts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 16: Pricing Concepts

1

List and explain a variety of pricing objectives. Establishing realistic and measurable pricing objectives is a critical part of any firm's marketing strategy. Pricing objectives are commonly classified into three categories: profit oriented, sales oriented, and status quo. Profit-oriented pricing is based on profit maximization, a satisfactory level of profit, or a target return on investment. The goal of profit maximization is to generate as much revenue as possible in relation to cost. Often, a more practical approach than profit maximization is setting prices to produce profits that will satisfy management and stockholders. The most common profit-oriented strategy is pricing for a specific return on investment relative to a firm's assets. The second type of pricing objective is sales oriented, and it focuses on either maintaining a percentage share of the market or maximizing dollar or unit sales. The third type of pricing objective aims to maintain the status quo by matching competitors' prices.

2.1 Give an example of each major type of pricing objective.

2.2 Why do many firms not maximize profits?

2.1 Give an example of each major type of pricing objective.

2.2 Why do many firms not maximize profits?

The pricing objective has to be realistic and specific.

The three categories of pricing objectives are as follows:

1. Profit-oriented objective: This objective aims at earning a target return on investment by maximizing the profits. This objective aims at setting the prices in such a way that the total revenue exceeds the total costs of the company. It does not necessarily mean setting unreasonable high prices.

This is attained by managers either by increasing the satisfaction of customers which will increase the revenue of the company. Another way is to reduce the costs of the company. Some managers use both the ways to maximize profit.

2. Sales- oriented objective: This objective aims at increasing the market share of the company's product. The market share can be increased in terms of revenue or units of product.

When the market share is increased, economies of scale takes place which means lower cost per unit and consequently higher profit for the company. Sometimes, companies aims at maximization of sales rather than striving for increasing market share.

3. Status-Quo objective: This objective aims at maintaining the existing prices in the target market. It sometimes also aims at setting prices in such a way that they are able to meet the prices of the competitors.

1.The profit maximization objective aims at earning a target return on investment. Return on investment (ROI) is net profit after taxes divided by total assets.

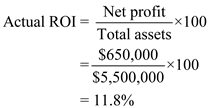

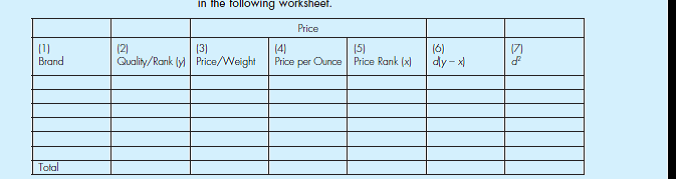

For example: If a company has assets of $5.5 million and net profits of $ 650,000. The target ROI is 11%. The actual ROI earned by the company can be computed as follows:

Thus, the actual ROI is 11.8% which is higher than 11% and thus the company is able to meet its target ROI.

Thus, the actual ROI is 11.8% which is higher than 11% and thus the company is able to meet its target ROI.

The sales maximization objective aims at increasing the market share in terms of units or revenue.

For example: Suppose there are two players in the market namely Company X and CompanyY. If Company X has sold 1,500 units at a unit price of $1.00, the total revenue generated by the company is $1,500 (

). If Company Y has sold 1,000 units at an average price of $2.00, then the total revenue generated by the company is $2,000(

). If Company Y has sold 1,000 units at an average price of $2.00, then the total revenue generated by the company is $2,000(

).

).

Then the market share of company X will be 60% (

) in terms of units and 42.8% (

) in terms of units and 42.8% (

) in terms of revenue.

) in terms of revenue.

And the remaining share of 40% (100 - 60) in terms of units and 57.2% (100 - 42.8) in terms of revenue will be that of company Y.

Thus, Company X has greater market share in terms of units and Company Y has greater market share in terms of revenue.

2.Some companies may not follow profit maximization objective as it sometimes becomes unclear and gives the impression to the managers that they can do anything to increase the profits of the company.

In an attempt to achieve profit maximization, managers sometimes reduce operating costs and thus may compromise on the quality of the product.

The three categories of pricing objectives are as follows:

1. Profit-oriented objective: This objective aims at earning a target return on investment by maximizing the profits. This objective aims at setting the prices in such a way that the total revenue exceeds the total costs of the company. It does not necessarily mean setting unreasonable high prices.

This is attained by managers either by increasing the satisfaction of customers which will increase the revenue of the company. Another way is to reduce the costs of the company. Some managers use both the ways to maximize profit.

2. Sales- oriented objective: This objective aims at increasing the market share of the company's product. The market share can be increased in terms of revenue or units of product.

When the market share is increased, economies of scale takes place which means lower cost per unit and consequently higher profit for the company. Sometimes, companies aims at maximization of sales rather than striving for increasing market share.

3. Status-Quo objective: This objective aims at maintaining the existing prices in the target market. It sometimes also aims at setting prices in such a way that they are able to meet the prices of the competitors.

1.The profit maximization objective aims at earning a target return on investment. Return on investment (ROI) is net profit after taxes divided by total assets.

For example: If a company has assets of $5.5 million and net profits of $ 650,000. The target ROI is 11%. The actual ROI earned by the company can be computed as follows:

Thus, the actual ROI is 11.8% which is higher than 11% and thus the company is able to meet its target ROI.

Thus, the actual ROI is 11.8% which is higher than 11% and thus the company is able to meet its target ROI.The sales maximization objective aims at increasing the market share in terms of units or revenue.

For example: Suppose there are two players in the market namely Company X and CompanyY. If Company X has sold 1,500 units at a unit price of $1.00, the total revenue generated by the company is $1,500 (

). If Company Y has sold 1,000 units at an average price of $2.00, then the total revenue generated by the company is $2,000(

). If Company Y has sold 1,000 units at an average price of $2.00, then the total revenue generated by the company is $2,000( ).

).Then the market share of company X will be 60% (

) in terms of units and 42.8% (

) in terms of units and 42.8% ( ) in terms of revenue.

) in terms of revenue.And the remaining share of 40% (100 - 60) in terms of units and 57.2% (100 - 42.8) in terms of revenue will be that of company Y.

Thus, Company X has greater market share in terms of units and Company Y has greater market share in terms of revenue.

2.Some companies may not follow profit maximization objective as it sometimes becomes unclear and gives the impression to the managers that they can do anything to increase the profits of the company.

In an attempt to achieve profit maximization, managers sometimes reduce operating costs and thus may compromise on the quality of the product.

2

As long as people have stomach aches, companies will sell remedies. Acid+All is banking that America will continue its love affair with bad food and has made an interesting move into the antacid market. The tiny pills come packaged in a tin priced at $3.89, which clearly sets the product apart from competitors like Rolaids, Tums, and others. The gambit of staking out a position as a prestige product is high. Watch the video to see what issues helped forge the $3.89 unit price and if the company has been successful at this price point.

What role do the product life cycle, competition, and perceptions of quality play in Acid+All's suggested retail price?

What role do the product life cycle, competition, and perceptions of quality play in Acid+All's suggested retail price?

Web Based Activity

Watch the video and determine the function product life cycle, completion from other brands, and opinion of quality performs in the antacid's recommended retail price.

A product life cycle is characterized by introduction, growth, maturity, and decline phases. Pricing for a product at the beginning can be higher to maximize profits and regain costs for the new product.

However, with each subsequent phase, the price must be adjusted to take into account decrease in demand and competition. A new product may be perceived to have a higher quality and thus customers may pay more.

However, a product that has been in the market for a long time may not have customers wanting to pay more for the same product.

Watch the video and determine the function product life cycle, completion from other brands, and opinion of quality performs in the antacid's recommended retail price.

A product life cycle is characterized by introduction, growth, maturity, and decline phases. Pricing for a product at the beginning can be higher to maximize profits and regain costs for the new product.

However, with each subsequent phase, the price must be adjusted to take into account decrease in demand and competition. A new product may be perceived to have a higher quality and thus customers may pay more.

However, a product that has been in the market for a long time may not have customers wanting to pay more for the same product.

3

Before Apple introduced the iPhone, it was hard for most people to imagine that they'd ever pay as much as $599 for a cell phone. But on June 29, 2007, customers stood in line for hours to do just that, eager to be among the first to get their hands on the sleek new device dubbed "the God machine." Newsweek columnist Steven Levy described how the proud new owners were "lofting their newly acquired iPhones in the air like they'd won the Stanley Cup." Within the first three days alone, Apple sold 270,000 iPhones at premium prices ($499 for a 4GB model, $599 for 8GB), and CEO Steve Jobs was predicting that they'd cross the 10-million mark by the end of 2008.

Industry analyst Lev Grossman says that Jobs, who had already revolutionized the portable music player market with the iPod, turned his attention to mobile phones because he believed they were "broken." And Jobs likes things that are broken, Grossman says. "It means he can make something that isn't and sell it to you for a premium price." And members of the "Apple Nation" have proved that they are willing to pay.

In a company of 20,000 employees, Apple has only one committee, and its job is to establish prices. In September of 2007, Jobs announced the decision to slash the price of the iPhone, even though it had only been 68 days since its launch. Company research had shown that it was priced too high for holiday shoppers. "If we don't take that chance, we wait a whole other year," Jobs explained. "We're willing to make less money to get more iPhones out there." The same iPhone that had sold for $599 would now cost $399. At the same press conference in San Francisco, Jobs introduced the new iPod nano, the iPod classic, and the iPod touch. The only thing that made headlines, however, was the unexpected iPhone price cut and stories of the consumer outrage that followed.

Elaine Soloway, a longtime Mac user, said, "Apple really infuriated their fans, the people who urge other people to buy Apple products. We are ambassadors for them." Like Soloway, thousands of iPhone early adopters expressed their disappointment.

"This is life in the technology lane," Jobs said in an attempt to defend the company's decision to drop the price so soon. "There is always something better and less expensive on the horizon." Some call it the curse of the early adopter. But usually they get bragging rights for more than two months before the masses can afford to buy the same product they paid a premium for. In an attempt to appease his angry customers, Jobs announced that those who paid the original price would now be eligible for a $100 refund in the form of store credit.

The store credit pleased some but wasn't enough for others. One customer, who bought his iPhone only weeks before the price drop, said the $100 was merely a pay-off for being a sucker. "Steve Jobs actually put a price tag on my suckerdom-$200-and now he's trying to drain off some of that embarrassment."

The price cut didn't just disappoint Apple's core customers. Investors were concerned, as well, suspecting that the iPhone wasn't selling as well as expected. Apple shares immediately fell $1.75 to $135.01 after the announcement. Industry analysts suggest that the price change could indicate that Apple, which has long been immune to the pricing wars among other personal computer companies, may have found the cell phone business more competitive than anticipated. Whatever the reasons, Jobs acknowledged, "We need to do a better job of taking care of our early iPhone customers as we aggressively go after new ones with a lower price."

The Cult of Mac shows no sign of waning in the aftermath of the company's rare misstep, however. Customers love their iPhones, they say, and remain devoted to Apple as the arbiter of cutting-edge technology that is intuitively and beautifully designed. Sure, admits one loyal customer, "It sucks. But if they had told me then they were going to drop the price in a few months, I still would have bought it. I was obsessed."

Discuss how the availability of substitutes affects elasticity of demand for Apple products such as the iPhone.

Industry analyst Lev Grossman says that Jobs, who had already revolutionized the portable music player market with the iPod, turned his attention to mobile phones because he believed they were "broken." And Jobs likes things that are broken, Grossman says. "It means he can make something that isn't and sell it to you for a premium price." And members of the "Apple Nation" have proved that they are willing to pay.

In a company of 20,000 employees, Apple has only one committee, and its job is to establish prices. In September of 2007, Jobs announced the decision to slash the price of the iPhone, even though it had only been 68 days since its launch. Company research had shown that it was priced too high for holiday shoppers. "If we don't take that chance, we wait a whole other year," Jobs explained. "We're willing to make less money to get more iPhones out there." The same iPhone that had sold for $599 would now cost $399. At the same press conference in San Francisco, Jobs introduced the new iPod nano, the iPod classic, and the iPod touch. The only thing that made headlines, however, was the unexpected iPhone price cut and stories of the consumer outrage that followed.

Elaine Soloway, a longtime Mac user, said, "Apple really infuriated their fans, the people who urge other people to buy Apple products. We are ambassadors for them." Like Soloway, thousands of iPhone early adopters expressed their disappointment.

"This is life in the technology lane," Jobs said in an attempt to defend the company's decision to drop the price so soon. "There is always something better and less expensive on the horizon." Some call it the curse of the early adopter. But usually they get bragging rights for more than two months before the masses can afford to buy the same product they paid a premium for. In an attempt to appease his angry customers, Jobs announced that those who paid the original price would now be eligible for a $100 refund in the form of store credit.

The store credit pleased some but wasn't enough for others. One customer, who bought his iPhone only weeks before the price drop, said the $100 was merely a pay-off for being a sucker. "Steve Jobs actually put a price tag on my suckerdom-$200-and now he's trying to drain off some of that embarrassment."

The price cut didn't just disappoint Apple's core customers. Investors were concerned, as well, suspecting that the iPhone wasn't selling as well as expected. Apple shares immediately fell $1.75 to $135.01 after the announcement. Industry analysts suggest that the price change could indicate that Apple, which has long been immune to the pricing wars among other personal computer companies, may have found the cell phone business more competitive than anticipated. Whatever the reasons, Jobs acknowledged, "We need to do a better job of taking care of our early iPhone customers as we aggressively go after new ones with a lower price."

The Cult of Mac shows no sign of waning in the aftermath of the company's rare misstep, however. Customers love their iPhones, they say, and remain devoted to Apple as the arbiter of cutting-edge technology that is intuitively and beautifully designed. Sure, admits one loyal customer, "It sucks. But if they had told me then they were going to drop the price in a few months, I still would have bought it. I was obsessed."

Discuss how the availability of substitutes affects elasticity of demand for Apple products such as the iPhone.

The substitute for any product affects the demand for the product to some degree. If the substitute is better and priced lower, then it will affect the demand for the original product more negatively. It is true that some customers develops loyalty to a brand and remain loyal, despite the availability of a better quality substitute at a lower price.

In case of Apple too, the availability of its quality substitute products will definitely affect the demand for its product. But, Apple is an iconic Brand and many customers feel proud to own it.

It is pertinent here to mention that when Apple launched its iPhone in June'2007, enthusiastic fans remain stood in line for long hours to own that device first. It depicts the huge popularity of apple's product in the market.

Again when Apple's iPhone price was slashed heavily two months later, many enthusiastic fans admitted that even if the company has made an announcement of this price cut earlier, they would still have bought it earlier at that high price. This again shows a very high rating for Apple's product in the eyes of its customer.

So, Apple is a brand which has many loyal customers who will remain stuck to it under any kind of market conditions. But, again there are a large number of customers who will go for substitutes if the quality is reasonably good and price is lower.

So, the availability of quality substitutes will certainly affect the elasticity of demand for Apple's product to some degree and it will be to such an extent that Apple can not ignore the pricing factor while formulating the sales strategy for its products.

In case of Apple too, the availability of its quality substitute products will definitely affect the demand for its product. But, Apple is an iconic Brand and many customers feel proud to own it.

It is pertinent here to mention that when Apple launched its iPhone in June'2007, enthusiastic fans remain stood in line for long hours to own that device first. It depicts the huge popularity of apple's product in the market.

Again when Apple's iPhone price was slashed heavily two months later, many enthusiastic fans admitted that even if the company has made an announcement of this price cut earlier, they would still have bought it earlier at that high price. This again shows a very high rating for Apple's product in the eyes of its customer.

So, Apple is a brand which has many loyal customers who will remain stuck to it under any kind of market conditions. But, again there are a large number of customers who will go for substitutes if the quality is reasonably good and price is lower.

So, the availability of quality substitutes will certainly affect the elasticity of demand for Apple's product to some degree and it will be to such an extent that Apple can not ignore the pricing factor while formulating the sales strategy for its products.

4

Explain the role of demand in price determination. Demand is a key determinant of price. When establishing prices, a firm must first determine demand for its product. A typical demand schedule shows an inverse relationship between quantity demanded and price: When price is lowered, sales increase; and when price is increased, the quantity demanded falls. For prestige products, however, there may be a direct relationship between demand and price: The quantity demanded will increase as price increases.

Marketing managers must also consider demand elasticity when setting prices. Elasticity of demand is the degree to which the quantity demanded fluctuates with changes in price. If consumers are sensitive to changes in price, demand is elastic; if they are insensitive to price changes, demand is inelastic. Thus, an increase in price will result in lower sales for an elastic product and little or no loss in salesfor an inelastic product. Inelastic demand creates pricing power.

3.1 Explain the role of supply and demand in determining price.

3.2 If a firm can increase its total revenue by raising its price, shouldn't it do so?

3.3 Explain the concepts of elastic and inelastic demand. Why should managers understand these concepts?

Marketing managers must also consider demand elasticity when setting prices. Elasticity of demand is the degree to which the quantity demanded fluctuates with changes in price. If consumers are sensitive to changes in price, demand is elastic; if they are insensitive to price changes, demand is inelastic. Thus, an increase in price will result in lower sales for an elastic product and little or no loss in salesfor an inelastic product. Inelastic demand creates pricing power.

3.1 Explain the role of supply and demand in determining price.

3.2 If a firm can increase its total revenue by raising its price, shouldn't it do so?

3.3 Explain the concepts of elastic and inelastic demand. Why should managers understand these concepts?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

As long as people have stomach aches, companies will sell remedies. Acid+All is banking that America will continue its love affair with bad food and has made an interesting move into the antacid market. The tiny pills come packaged in a tin priced at $3.89, which clearly sets the product apart from competitors like Rolaids, Tums, and others. The gambit of staking out a position as a prestige product is high. Watch the video to see what issues helped forge the $3.89 unit price and if the company has been successful at this price point.

Would you buy Acid+All for the $3.89 retail price? Why or why not?

Would you buy Acid+All for the $3.89 retail price? Why or why not?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Before Apple introduced the iPhone, it was hard for most people to imagine that they'd ever pay as much as $599 for a cell phone. But on June 29, 2007, customers stood in line for hours to do just that, eager to be among the first to get their hands on the sleek new device dubbed "the God machine." Newsweek columnist Steven Levy described how the proud new owners were "lofting their newly acquired iPhones in the air like they'd won the Stanley Cup." Within the first three days alone, Apple sold 270,000 iPhones at premium prices ($499 for a 4GB model, $599 for 8GB), and CEO Steve Jobs was predicting that they'd cross the 10-million mark by the end of 2008.

Industry analyst Lev Grossman says that Jobs, who had already revolutionized the portable music player market with the iPod, turned his attention to mobile phones because he believed they were "broken." And Jobs likes things that are broken, Grossman says. "It means he can make something that isn't and sell it to you for a premium price." And members of the "Apple Nation" have proved that they are willing to pay.

In a company of 20,000 employees, Apple has only one committee, and its job is to establish prices. In September of 2007, Jobs announced the decision to slash the price of the iPhone, even though it had only been 68 days since its launch. Company research had shown that it was priced too high for holiday shoppers. "If we don't take that chance, we wait a whole other year," Jobs explained. "We're willing to make less money to get more iPhones out there." The same iPhone that had sold for $599 would now cost $399. At the same press conference in San Francisco, Jobs introduced the new iPod nano, the iPod classic, and the iPod touch. The only thing that made headlines, however, was the unexpected iPhone price cut and stories of the consumer outrage that followed.

Elaine Soloway, a longtime Mac user, said, "Apple really infuriated their fans, the people who urge other people to buy Apple products. We are ambassadors for them." Like Soloway, thousands of iPhone early adopters expressed their disappointment.

"This is life in the technology lane," Jobs said in an attempt to defend the company's decision to drop the price so soon. "There is always something better and less expensive on the horizon." Some call it the curse of the early adopter. But usually they get bragging rights for more than two months before the masses can afford to buy the same product they paid a premium for. In an attempt to appease his angry customers, Jobs announced that those who paid the original price would now be eligible for a $100 refund in the form of store credit.

The store credit pleased some but wasn't enough for others. One customer, who bought his iPhone only weeks before the price drop, said the $100 was merely a pay-off for being a sucker. "Steve Jobs actually put a price tag on my suckerdom-$200-and now he's trying to drain off some of that embarrassment."

The price cut didn't just disappoint Apple's core customers. Investors were concerned, as well, suspecting that the iPhone wasn't selling as well as expected. Apple shares immediately fell $1.75 to $135.01 after the announcement. Industry analysts suggest that the price change could indicate that Apple, which has long been immune to the pricing wars among other personal computer companies, may have found the cell phone business more competitive than anticipated. Whatever the reasons, Jobs acknowledged, "We need to do a better job of taking care of our early iPhone customers as we aggressively go after new ones with a lower price."

The Cult of Mac shows no sign of waning in the aftermath of the company's rare misstep, however. Customers love their iPhones, they say, and remain devoted to Apple as the arbiter of cutting-edge technology that is intuitively and beautifully designed. Sure, admits one loyal customer, "It sucks. But if they had told me then they were going to drop the price in a few months, I still would have bought it. I was obsessed."

How do you think the relationship of price to quality affects how customers perceive Apple products?

Industry analyst Lev Grossman says that Jobs, who had already revolutionized the portable music player market with the iPod, turned his attention to mobile phones because he believed they were "broken." And Jobs likes things that are broken, Grossman says. "It means he can make something that isn't and sell it to you for a premium price." And members of the "Apple Nation" have proved that they are willing to pay.

In a company of 20,000 employees, Apple has only one committee, and its job is to establish prices. In September of 2007, Jobs announced the decision to slash the price of the iPhone, even though it had only been 68 days since its launch. Company research had shown that it was priced too high for holiday shoppers. "If we don't take that chance, we wait a whole other year," Jobs explained. "We're willing to make less money to get more iPhones out there." The same iPhone that had sold for $599 would now cost $399. At the same press conference in San Francisco, Jobs introduced the new iPod nano, the iPod classic, and the iPod touch. The only thing that made headlines, however, was the unexpected iPhone price cut and stories of the consumer outrage that followed.

Elaine Soloway, a longtime Mac user, said, "Apple really infuriated their fans, the people who urge other people to buy Apple products. We are ambassadors for them." Like Soloway, thousands of iPhone early adopters expressed their disappointment.

"This is life in the technology lane," Jobs said in an attempt to defend the company's decision to drop the price so soon. "There is always something better and less expensive on the horizon." Some call it the curse of the early adopter. But usually they get bragging rights for more than two months before the masses can afford to buy the same product they paid a premium for. In an attempt to appease his angry customers, Jobs announced that those who paid the original price would now be eligible for a $100 refund in the form of store credit.

The store credit pleased some but wasn't enough for others. One customer, who bought his iPhone only weeks before the price drop, said the $100 was merely a pay-off for being a sucker. "Steve Jobs actually put a price tag on my suckerdom-$200-and now he's trying to drain off some of that embarrassment."

The price cut didn't just disappoint Apple's core customers. Investors were concerned, as well, suspecting that the iPhone wasn't selling as well as expected. Apple shares immediately fell $1.75 to $135.01 after the announcement. Industry analysts suggest that the price change could indicate that Apple, which has long been immune to the pricing wars among other personal computer companies, may have found the cell phone business more competitive than anticipated. Whatever the reasons, Jobs acknowledged, "We need to do a better job of taking care of our early iPhone customers as we aggressively go after new ones with a lower price."

The Cult of Mac shows no sign of waning in the aftermath of the company's rare misstep, however. Customers love their iPhones, they say, and remain devoted to Apple as the arbiter of cutting-edge technology that is intuitively and beautifully designed. Sure, admits one loyal customer, "It sucks. But if they had told me then they were going to drop the price in a few months, I still would have bought it. I was obsessed."

How do you think the relationship of price to quality affects how customers perceive Apple products?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

Understand the concept of yield management systems. Yield management systems use complex mathematical software to profitably fill unused capacity. The software uses techniques such as discounting early purchases, limiting early sales at these discounted prices, and overbooking capacity. These systems are used in service and retail businesses and are substantially raising revenues. The use of Internet cookies and targeting software enables online retailers to offer different pricing and promotional offers to online buyers based upon their online shopping and browsing habits.

4.1 Why are so many companies adopting yield management systems?

4.2 Explain the relationship between supply and demand and yield management systems.

4.3 Why is targeting technology so effective?

4.1 Why are so many companies adopting yield management systems?

4.2 Explain the relationship between supply and demand and yield management systems.

4.3 Why is targeting technology so effective?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

As long as people have stomach aches, companies will sell remedies. Acid+All is banking that America will continue its love affair with bad food and has made an interesting move into the antacid market. The tiny pills come packaged in a tin priced at $3.89, which clearly sets the product apart from competitors like Rolaids, Tums, and others. The gambit of staking out a position as a prestige product is high. Watch the video to see what issues helped forge the $3.89 unit price and if the company has been successful at this price point.

How do the product, place, and promotion elements of Acid+All's marketing mix influence the pricing strategy the company has chosen?

How do the product, place, and promotion elements of Acid+All's marketing mix influence the pricing strategy the company has chosen?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Describe cost-oriented pricing strategies. The other major determinant of price is cost. Marketers use several cost-oriented pricing strategies. To cover their own expenses and obtain a profit, wholesalers and retailers commonly use markup pricing: They tack an extra amount onto the manufacturer's original price. Another pricing technique is to maximize profits by setting price where marginal revenue equals marginal cost. Still another pricing strategy determines how much a firm must sell to break even and uses this amount as a reference point for adjusting price.

5.1 Your firm has based its pricing strictly on cost in the past. As the newly hired marketing manager, you believe this policy should change. Write the president a memo explaining your reasons.

5.2 Why is it important for managers to understand the concept of break-even points? Are there any drawbacks?

5.1 Your firm has based its pricing strictly on cost in the past. As the newly hired marketing manager, you believe this policy should change. Write the president a memo explaining your reasons.

5.2 Why is it important for managers to understand the concept of break-even points? Are there any drawbacks?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

Before Apple introduced the iPhone, it was hard for most people to imagine that they'd ever pay as much as $599 for a cell phone. But on June 29, 2007, customers stood in line for hours to do just that, eager to be among the first to get their hands on the sleek new device dubbed "the God machine." Newsweek columnist Steven Levy described how the proud new owners were "lofting their newly acquired iPhones in the air like they'd won the Stanley Cup." Within the first three days alone, Apple sold 270,000 iPhones at premium prices ($499 for a 4GB model, $599 for 8GB), and CEO Steve Jobs was predicting that they'd cross the 10-million mark by the end of 2008.

Industry analyst Lev Grossman says that Jobs, who had already revolutionized the portable music player market with the iPod, turned his attention to mobile phones because he believed they were "broken." And Jobs likes things that are broken, Grossman says. "It means he can make something that isn't and sell it to you for a premium price." And members of the "Apple Nation" have proved that they are willing to pay.

In a company of 20,000 employees, Apple has only one committee, and its job is to establish prices. In September of 2007, Jobs announced the decision to slash the price of the iPhone, even though it had only been 68 days since its launch. Company research had shown that it was priced too high for holiday shoppers. "If we don't take that chance, we wait a whole other year," Jobs explained. "We're willing to make less money to get more iPhones out there." The same iPhone that had sold for $599 would now cost $399. At the same press conference in San Francisco, Jobs introduced the new iPod nano, the iPod classic, and the iPod touch. The only thing that made headlines, however, was the unexpected iPhone price cut and stories of the consumer outrage that followed.

Elaine Soloway, a longtime Mac user, said, "Apple really infuriated their fans, the people who urge other people to buy Apple products. We are ambassadors for them." Like Soloway, thousands of iPhone early adopters expressed their disappointment.

"This is life in the technology lane," Jobs said in an attempt to defend the company's decision to drop the price so soon. "There is always something better and less expensive on the horizon." Some call it the curse of the early adopter. But usually they get bragging rights for more than two months before the masses can afford to buy the same product they paid a premium for. In an attempt to appease his angry customers, Jobs announced that those who paid the original price would now be eligible for a $100 refund in the form of store credit.

The store credit pleased some but wasn't enough for others. One customer, who bought his iPhone only weeks before the price drop, said the $100 was merely a pay-off for being a sucker. "Steve Jobs actually put a price tag on my suckerdom-$200-and now he's trying to drain off some of that embarrassment."

The price cut didn't just disappoint Apple's core customers. Investors were concerned, as well, suspecting that the iPhone wasn't selling as well as expected. Apple shares immediately fell $1.75 to $135.01 after the announcement. Industry analysts suggest that the price change could indicate that Apple, which has long been immune to the pricing wars among other personal computer companies, may have found the cell phone business more competitive than anticipated. Whatever the reasons, Jobs acknowledged, "We need to do a better job of taking care of our early iPhone customers as we aggressively go after new ones with a lower price."

The Cult of Mac shows no sign of waning in the aftermath of the company's rare misstep, however. Customers love their iPhones, they say, and remain devoted to Apple as the arbiter of cutting-edge technology that is intuitively and beautifully designed. Sure, admits one loyal customer, "It sucks. But if they had told me then they were going to drop the price in a few months, I still would have bought it. I was obsessed."

Apple CEO Steve Jobs alluded to the price a customer may have to pay to own an iPhone when he said that the steep and sudden price change was simply part of "life in the technology lane." What did he mean? Beyond the simple exchange of money, what else might the price of such a product include?

Industry analyst Lev Grossman says that Jobs, who had already revolutionized the portable music player market with the iPod, turned his attention to mobile phones because he believed they were "broken." And Jobs likes things that are broken, Grossman says. "It means he can make something that isn't and sell it to you for a premium price." And members of the "Apple Nation" have proved that they are willing to pay.

In a company of 20,000 employees, Apple has only one committee, and its job is to establish prices. In September of 2007, Jobs announced the decision to slash the price of the iPhone, even though it had only been 68 days since its launch. Company research had shown that it was priced too high for holiday shoppers. "If we don't take that chance, we wait a whole other year," Jobs explained. "We're willing to make less money to get more iPhones out there." The same iPhone that had sold for $599 would now cost $399. At the same press conference in San Francisco, Jobs introduced the new iPod nano, the iPod classic, and the iPod touch. The only thing that made headlines, however, was the unexpected iPhone price cut and stories of the consumer outrage that followed.

Elaine Soloway, a longtime Mac user, said, "Apple really infuriated their fans, the people who urge other people to buy Apple products. We are ambassadors for them." Like Soloway, thousands of iPhone early adopters expressed their disappointment.

"This is life in the technology lane," Jobs said in an attempt to defend the company's decision to drop the price so soon. "There is always something better and less expensive on the horizon." Some call it the curse of the early adopter. But usually they get bragging rights for more than two months before the masses can afford to buy the same product they paid a premium for. In an attempt to appease his angry customers, Jobs announced that those who paid the original price would now be eligible for a $100 refund in the form of store credit.

The store credit pleased some but wasn't enough for others. One customer, who bought his iPhone only weeks before the price drop, said the $100 was merely a pay-off for being a sucker. "Steve Jobs actually put a price tag on my suckerdom-$200-and now he's trying to drain off some of that embarrassment."

The price cut didn't just disappoint Apple's core customers. Investors were concerned, as well, suspecting that the iPhone wasn't selling as well as expected. Apple shares immediately fell $1.75 to $135.01 after the announcement. Industry analysts suggest that the price change could indicate that Apple, which has long been immune to the pricing wars among other personal computer companies, may have found the cell phone business more competitive than anticipated. Whatever the reasons, Jobs acknowledged, "We need to do a better job of taking care of our early iPhone customers as we aggressively go after new ones with a lower price."

The Cult of Mac shows no sign of waning in the aftermath of the company's rare misstep, however. Customers love their iPhones, they say, and remain devoted to Apple as the arbiter of cutting-edge technology that is intuitively and beautifully designed. Sure, admits one loyal customer, "It sucks. But if they had told me then they were going to drop the price in a few months, I still would have bought it. I was obsessed."

Apple CEO Steve Jobs alluded to the price a customer may have to pay to own an iPhone when he said that the steep and sudden price change was simply part of "life in the technology lane." What did he mean? Beyond the simple exchange of money, what else might the price of such a product include?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

Demonstrate how the product life cycle, competition, distribution and promotion strategies, guaranteed price matching, customer demands, the Internet, and perceptions of quality can affect price. The price of a product normally changes as it moves through the life cycle and as demand for the product and competitive conditions change. Management often sets a high price at the introductory stage, and the high price tends to attract competition. The competition usually drives prices down because individual competitors lower prices to gain market share.

Adequate distribution for a new product can sometimes be obtained by offering a larger-than-usual profit margin to wholesalers and retailers. The Internet enables consumers to compare products and prices quickly and efficiently. Price is also used as a promotional tool to attract customers. Special low prices often attract new customers and entice existing customers to buy more. Price matching positions the retailer as a low-price vendor. Firms that don't match prices are perceived as offering a higher level of service. Large buyers can extract price concessions from vendors. Such demands can squeeze the profit margins of suppliers.

Perceptions of quality can also influence pricing strategies. A firm trying to project a prestigious image often charges a premium price for a product. Consumers tend to equate high prices with high quality.

6.1 Divide the class into teams of five. Each team will be assigned a different grocery store from a different chain. (An independent is fine.) Appoint a group leader. The group leaders should meet as a group and pick 15 nationally branded grocery items. Each item should be specifically described as to brand name and size of the package. Each team will then proceed to its assigned store and collect price data on the 15 items. The team should also gather price data on 15 similar store brands and 15 generics, if possible. Each team should present its results to the class and discuss why there are price variations between stores, national brands, store brands, and generics. As a next step, go back to your assigned store and share the overall results with the store manager. Bring back the manager's comments and share them with the class.

6.2 How does the stage of a product's life cycle affect price? Give some examples.

6.3 Go to Priceline.com. Can you research a ticket's price before purchasing it? What products and services are available for purchasing? How comfortable are you with naming your own price? Relate the supply and demand curves to customer-determined pricing.

Adequate distribution for a new product can sometimes be obtained by offering a larger-than-usual profit margin to wholesalers and retailers. The Internet enables consumers to compare products and prices quickly and efficiently. Price is also used as a promotional tool to attract customers. Special low prices often attract new customers and entice existing customers to buy more. Price matching positions the retailer as a low-price vendor. Firms that don't match prices are perceived as offering a higher level of service. Large buyers can extract price concessions from vendors. Such demands can squeeze the profit margins of suppliers.

Perceptions of quality can also influence pricing strategies. A firm trying to project a prestigious image often charges a premium price for a product. Consumers tend to equate high prices with high quality.

6.1 Divide the class into teams of five. Each team will be assigned a different grocery store from a different chain. (An independent is fine.) Appoint a group leader. The group leaders should meet as a group and pick 15 nationally branded grocery items. Each item should be specifically described as to brand name and size of the package. Each team will then proceed to its assigned store and collect price data on the 15 items. The team should also gather price data on 15 similar store brands and 15 generics, if possible. Each team should present its results to the class and discuss why there are price variations between stores, national brands, store brands, and generics. As a next step, go back to your assigned store and share the overall results with the store manager. Bring back the manager's comments and share them with the class.

6.2 How does the stage of a product's life cycle affect price? Give some examples.

6.3 Go to Priceline.com. Can you research a ticket's price before purchasing it? What products and services are available for purchasing? How comfortable are you with naming your own price? Relate the supply and demand curves to customer-determined pricing.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

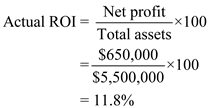

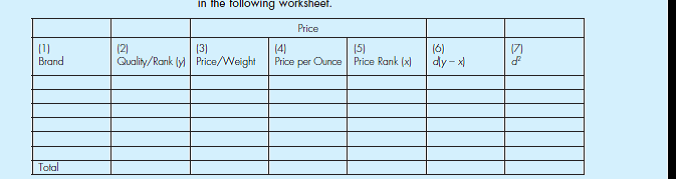

Reliance on price as a predictor of quality seems to occur for all products. Does this mean that high-priced products are superior? Well, sometimes. Price can be a good predictor of quality for some products, but for others, price is not always the best way to determine the quality of a product or service before buying it. This exercise (and worksheet) will help you examine the price-quality relationship for a simple product: canned goods.

Activities

1. Take a trip to a local supermarket where you are certain to find multiple brands of canned fruits and vegetables. Pick a single type of vegetable or fruit you like, such as cream corn or peach halves, and list five or six brands in the following worksheet.

2. Before going any further, rank the brands according to which you think is the highest quality (1) to the lowest quality (5 or 6, depending on how many brands you find). This ranking will be y.

3. Record the price and the volume of each brand. For example, if a 14-ounce can costs $.89, you would list $.89/14 oz.

4. Translate the price per volume into price per ounce. Our 14-ounce can costs $.064 per ounce.

5. Now rank the price per ounce (we'll call it x ) from the highest (1) to the lowest (5 or 6, again depending on how many brands you have).

6. We'll now begin calculating the coefficient of correlation between the price and quality rankings. The first step is to subtract x from y. Enter the result, d , in column 6.

7. Now calculate d 2 and enter the value in column 7. Write the sum of all the entries in column 7 in the final row.

8. The formula for calculating a price-quality coefficient r is as follows: In the formula, r s is the coefficient of correlation, 6 is a constant, and n is the number of items ranked.

9. What does the result of your calculation tell you about the correlation between the price and the quality of the canned vegetable or fruit you selected? Now that you know this, will it change your buying habits?

Activities

1. Take a trip to a local supermarket where you are certain to find multiple brands of canned fruits and vegetables. Pick a single type of vegetable or fruit you like, such as cream corn or peach halves, and list five or six brands in the following worksheet.

2. Before going any further, rank the brands according to which you think is the highest quality (1) to the lowest quality (5 or 6, depending on how many brands you find). This ranking will be y.

3. Record the price and the volume of each brand. For example, if a 14-ounce can costs $.89, you would list $.89/14 oz.

4. Translate the price per volume into price per ounce. Our 14-ounce can costs $.064 per ounce.

5. Now rank the price per ounce (we'll call it x ) from the highest (1) to the lowest (5 or 6, again depending on how many brands you have).

6. We'll now begin calculating the coefficient of correlation between the price and quality rankings. The first step is to subtract x from y. Enter the result, d , in column 6.

7. Now calculate d 2 and enter the value in column 7. Write the sum of all the entries in column 7 in the final row.

8. The formula for calculating a price-quality coefficient r is as follows: In the formula, r s is the coefficient of correlation, 6 is a constant, and n is the number of items ranked.

9. What does the result of your calculation tell you about the correlation between the price and the quality of the canned vegetable or fruit you selected? Now that you know this, will it change your buying habits?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

Describe the procedure for setting the right price. The process of setting the right price on a product involves four major steps: (1) establishing pricing goals; (2) estimating demand, costs, and profits; (3) choosing a price policy to help determine a base price; and (4) fine-tuning the base price with pricing tactics.

A price strategy establishes a long-term pricing framework for a good or service. The three main types of price policies are price skimming, penetration pricing, and status quo pricing. A price-skimming policy charges a high introductory price, often followed by a gradual reduction. Penetration pricing offers a low introductory price to capture a large market share and attain economies of scale. Finally, status quo pricing strives to match competitors' price.

7.1 A manufacturer of office furniture decides to produce antique-style rolltop desks reconfigured to accommodate personal computers. The desks will have built-in surge protectors, a platform for raising or lowering the monitor, and a number of other features. The high-quality, solid-oak desks will be priced far below comparable products. The marketing manager says, "We'll charge a low price and plan on a high volume to reduce our risks." Comment.

7.2 Janet Oliver, owner of a mid-priced dress shop, notes, "My pricing objectives are simple: I just charge what my competitors charge. I'm happy because I'm making money." React to Janet's statement.

7.3 What is the difference between a price policy and a price tactic? Give an example.

A price strategy establishes a long-term pricing framework for a good or service. The three main types of price policies are price skimming, penetration pricing, and status quo pricing. A price-skimming policy charges a high introductory price, often followed by a gradual reduction. Penetration pricing offers a low introductory price to capture a large market share and attain economies of scale. Finally, status quo pricing strives to match competitors' price.

7.1 A manufacturer of office furniture decides to produce antique-style rolltop desks reconfigured to accommodate personal computers. The desks will have built-in surge protectors, a platform for raising or lowering the monitor, and a number of other features. The high-quality, solid-oak desks will be priced far below comparable products. The marketing manager says, "We'll charge a low price and plan on a high volume to reduce our risks." Comment.

7.2 Janet Oliver, owner of a mid-priced dress shop, notes, "My pricing objectives are simple: I just charge what my competitors charge. I'm happy because I'm making money." React to Janet's statement.

7.3 What is the difference between a price policy and a price tactic? Give an example.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

Advanced Bio Medics (ABM) has invented a new stem-cell-based drug that will arrest even advanced forms of lung cancer. Development costs were actually quite low because the drug was an accidental discovery by scientists working on a different project. To stop the disease requires a regimen of one pill per week for 20 weeks. There is no substitute offered by competitors. ABM is thinking that it could maximize its profits by charging $10,000 per pill. Of course, many people will die because they can't afford the medicine at this price.

Questions

Should ABM maximize its profits?

Questions

Should ABM maximize its profits?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

Identify the legal and ethical constraints on pricing decisions. Government regulation helps monitor five major areas of pricing: unfair trade practices, price fixing, resales price maintenance, predatory pricing and predatory bidding, and price discrimination. Many states have enacted unfair trade practice acts that protect small businesses from large firms that operate efficiently on extremely thin profit margins; the acts prohibit charging below-cost prices. The Sherman Act and the Federal Trade Commission Act prohibit both price fixing, which is an agreement between two or more firms on a particular price, and predatory pricing, in which a firm undercuts its competitors with extremely low prices to drive them out of business. Finally, the Robinson-Patman Act makes it illegal for firms to discriminate between two or more buyers in terms of price.

8.1 What are the three basic defenses that a seller can use if accused under the Robinson-Patman Act?

8.1 What are the three basic defenses that a seller can use if accused under the Robinson-Patman Act?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

In the last part of your strategic marketing plan you began the process of defining the marketing mix, starting with the components of product, distribution, and promotion. The next stage of the strategic planning process-pricing-completes the elements of the marketing mix. In recent years, pricing has become a special challenge to the marketer because prices can be quickly and easily compared on the Internet.

In any case, your goal should be to make pricing competitive and value-driven, as well as cover costs. Other features and benefits of your offering are likely to be more important than price. Use the following exercises to guide you through the pricing part of your strategic marketing plan:

1. List possible pricing objectives for your chosen firm. How might adopting different pricing objectives change the behavior of the firm and its marketing plans?

2. Gather information on tactics you decided on for the first parts of your marketing plan. What costs are associated with those decisions? Will you incur more or fewer costs by selling online? Will your marketing costs increase or decrease? Why? Calculate the break-even point for selling your offering. Can you sell enough to cover your costs? Try the break-even calculator at http://connection.cwru.edu/mbac424/breakeven/BreakEven.html.

3. Pricing is an integral component of marketing strategy. Discuss how your firm's pricing can affect or be affected by competition, the economic environment, political regulations, product features, extra customer service, changes in distribution, or changes in promotion.

4. Is demand elastic or inelastic for your company's product or service? Why? What is the demand elasticity for your offering in an off-line world? Whatever the level, it is likely to be more elastic online. What tactics can you use to soften or reduce this online price sensitivity?

In any case, your goal should be to make pricing competitive and value-driven, as well as cover costs. Other features and benefits of your offering are likely to be more important than price. Use the following exercises to guide you through the pricing part of your strategic marketing plan:

1. List possible pricing objectives for your chosen firm. How might adopting different pricing objectives change the behavior of the firm and its marketing plans?

2. Gather information on tactics you decided on for the first parts of your marketing plan. What costs are associated with those decisions? Will you incur more or fewer costs by selling online? Will your marketing costs increase or decrease? Why? Calculate the break-even point for selling your offering. Can you sell enough to cover your costs? Try the break-even calculator at http://connection.cwru.edu/mbac424/breakeven/BreakEven.html.

3. Pricing is an integral component of marketing strategy. Discuss how your firm's pricing can affect or be affected by competition, the economic environment, political regulations, product features, extra customer service, changes in distribution, or changes in promotion.

4. Is demand elastic or inelastic for your company's product or service? Why? What is the demand elasticity for your offering in an off-line world? Whatever the level, it is likely to be more elastic online. What tactics can you use to soften or reduce this online price sensitivity?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

Discuss the importance of pricing decisions to the economy and to the individual firm. Pricing plays an integral role in the U.S. economy by allocating goods and services among consumers, governments, and businesses. Pricing is essential in business because it creates revenue, which is the basis of all business activity. In setting prices, marketing managers strive to find a level high enough to produce a satisfactory profit.

1.1 Why is pricing so important to the marketing manager?

1.2 How does price allocate goods and services?

1.1 Why is pricing so important to the marketing manager?

1.2 How does price allocate goods and services?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

As long as people have stomach aches, companies will sell remedies. Acid+All is banking that America will continue its love affair with bad food and has made an interesting move into the antacid market. The tiny pills come packaged in a tin priced at $3.89, which clearly sets the product apart from competitors like Rolaids, Tums, and others. The gambit of staking out a position as a prestige product is high. Watch the video to see what issues helped forge the $3.89 unit price and if the company has been successful at this price point.

Would you expect demand for Acid+All to be elastic? Why or why not?

Would you expect demand for Acid+All to be elastic? Why or why not?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

Before Apple introduced the iPhone, it was hard for most people to imagine that they'd ever pay as much as $599 for a cell phone. But on June 29, 2007, customers stood in line for hours to do just that, eager to be among the first to get their hands on the sleek new device dubbed "the God machine." Newsweek columnist Steven Levy described how the proud new owners were "lofting their newly acquired iPhones in the air like they'd won the Stanley Cup." Within the first three days alone, Apple sold 270,000 iPhones at premium prices ($499 for a 4GB model, $599 for 8GB), and CEO Steve Jobs was predicting that they'd cross the 10-million mark by the end of 2008.

Industry analyst Lev Grossman says that Jobs, who had already revolutionized the portable music player market with the iPod, turned his attention to mobile phones because he believed they were "broken." And Jobs likes things that are broken, Grossman says. "It means he can make something that isn't and sell it to you for a premium price." And members of the "Apple Nation" have proved that they are willing to pay.

In a company of 20,000 employees, Apple has only one committee, and its job is to establish prices. In September of 2007, Jobs announced the decision to slash the price of the iPhone, even though it had only been 68 days since its launch. Company research had shown that it was priced too high for holiday shoppers. "If we don't take that chance, we wait a whole other year," Jobs explained. "We're willing to make less money to get more iPhones out there." The same iPhone that had sold for $599 would now cost $399. At the same press conference in San Francisco, Jobs introduced the new iPod nano, the iPod classic, and the iPod touch. The only thing that made headlines, however, was the unexpected iPhone price cut and stories of the consumer outrage that followed.

Elaine Soloway, a longtime Mac user, said, "Apple really infuriated their fans, the people who urge other people to buy Apple products. We are ambassadors for them." Like Soloway, thousands of iPhone early adopters expressed their disappointment.

"This is life in the technology lane," Jobs said in an attempt to defend the company's decision to drop the price so soon. "There is always something better and less expensive on the horizon." Some call it the curse of the early adopter. But usually they get bragging rights for more than two months before the masses can afford to buy the same product they paid a premium for. In an attempt to appease his angry customers, Jobs announced that those who paid the original price would now be eligible for a $100 refund in the form of store credit.

The store credit pleased some but wasn't enough for others. One customer, who bought his iPhone only weeks before the price drop, said the $100 was merely a pay-off for being a sucker. "Steve Jobs actually put a price tag on my suckerdom-$200-and now he's trying to drain off some of that embarrassment."

The price cut didn't just disappoint Apple's core customers. Investors were concerned, as well, suspecting that the iPhone wasn't selling as well as expected. Apple shares immediately fell $1.75 to $135.01 after the announcement. Industry analysts suggest that the price change could indicate that Apple, which has long been immune to the pricing wars among other personal computer companies, may have found the cell phone business more competitive than anticipated. Whatever the reasons, Jobs acknowledged, "We need to do a better job of taking care of our early iPhone customers as we aggressively go after new ones with a lower price."

The Cult of Mac shows no sign of waning in the aftermath of the company's rare misstep, however. Customers love their iPhones, they say, and remain devoted to Apple as the arbiter of cutting-edge technology that is intuitively and beautifully designed. Sure, admits one loyal customer, "It sucks. But if they had told me then they were going to drop the price in a few months, I still would have bought it. I was obsessed."

Discuss the role that product demand played in pricing the iPhone. How did this demand influence Apple's decision to price it high in the beginning and then lower it two months later?

Industry analyst Lev Grossman says that Jobs, who had already revolutionized the portable music player market with the iPod, turned his attention to mobile phones because he believed they were "broken." And Jobs likes things that are broken, Grossman says. "It means he can make something that isn't and sell it to you for a premium price." And members of the "Apple Nation" have proved that they are willing to pay.

In a company of 20,000 employees, Apple has only one committee, and its job is to establish prices. In September of 2007, Jobs announced the decision to slash the price of the iPhone, even though it had only been 68 days since its launch. Company research had shown that it was priced too high for holiday shoppers. "If we don't take that chance, we wait a whole other year," Jobs explained. "We're willing to make less money to get more iPhones out there." The same iPhone that had sold for $599 would now cost $399. At the same press conference in San Francisco, Jobs introduced the new iPod nano, the iPod classic, and the iPod touch. The only thing that made headlines, however, was the unexpected iPhone price cut and stories of the consumer outrage that followed.

Elaine Soloway, a longtime Mac user, said, "Apple really infuriated their fans, the people who urge other people to buy Apple products. We are ambassadors for them." Like Soloway, thousands of iPhone early adopters expressed their disappointment.

"This is life in the technology lane," Jobs said in an attempt to defend the company's decision to drop the price so soon. "There is always something better and less expensive on the horizon." Some call it the curse of the early adopter. But usually they get bragging rights for more than two months before the masses can afford to buy the same product they paid a premium for. In an attempt to appease his angry customers, Jobs announced that those who paid the original price would now be eligible for a $100 refund in the form of store credit.

The store credit pleased some but wasn't enough for others. One customer, who bought his iPhone only weeks before the price drop, said the $100 was merely a pay-off for being a sucker. "Steve Jobs actually put a price tag on my suckerdom-$200-and now he's trying to drain off some of that embarrassment."

The price cut didn't just disappoint Apple's core customers. Investors were concerned, as well, suspecting that the iPhone wasn't selling as well as expected. Apple shares immediately fell $1.75 to $135.01 after the announcement. Industry analysts suggest that the price change could indicate that Apple, which has long been immune to the pricing wars among other personal computer companies, may have found the cell phone business more competitive than anticipated. Whatever the reasons, Jobs acknowledged, "We need to do a better job of taking care of our early iPhone customers as we aggressively go after new ones with a lower price."

The Cult of Mac shows no sign of waning in the aftermath of the company's rare misstep, however. Customers love their iPhones, they say, and remain devoted to Apple as the arbiter of cutting-edge technology that is intuitively and beautifully designed. Sure, admits one loyal customer, "It sucks. But if they had told me then they were going to drop the price in a few months, I still would have bought it. I was obsessed."

Discuss the role that product demand played in pricing the iPhone. How did this demand influence Apple's decision to price it high in the beginning and then lower it two months later?

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

Advanced Bio Medics (ABM) has invented a new stem-cell-based drug that will arrest even advanced forms of lung cancer. Development costs were actually quite low because the drug was an accidental discovery by scientists working on a different project. To stop the disease requires a regimen of one pill per week for 20 weeks. There is no substitute offered by competitors. ABM is thinking that it could maximize its profits by charging $10,000 per pill. Of course, many people will die because they can't afford the medicine at this price.

Questions

Does the AMA Statement of Ethics address this issue? Go to www.marketing power.com and review the code. Then, write a brief paragraph on what the AMA Statement of Ethics contains that relates to ABM's dilemma.

Questions

Does the AMA Statement of Ethics address this issue? Go to www.marketing power.com and review the code. Then, write a brief paragraph on what the AMA Statement of Ethics contains that relates to ABM's dilemma.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck