Deck 11: Integer Linear Optimization Models

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/26

Play

Full screen (f)

Deck 11: Integer Linear Optimization Models

1

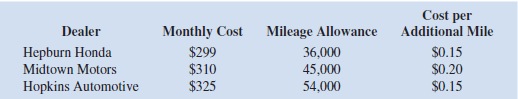

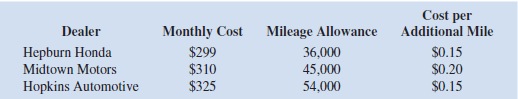

Amy Lloyd is interested in leasing a new Honda and has contacted three automobile dealers for pricing information. Each dealer offered Amy a closed-end 36-month lease with no down payment due at the time of signing. Each lease includes a monthly charge and a mileage allowance. Additional miles receive a surcharge on a per-mile basis. The monthly lease cost, the mileage allowance, and the cost for additional miles follow:

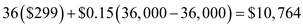

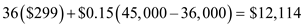

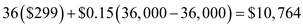

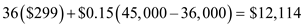

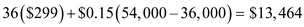

Amy decided to choose the lease option that will minimize her total 36-month cost. The difficulty is that Amy is not sure how many miles she will drive over the next three years. For purposes of this decision, she believes it is reasonable to assume that she will drive 12,000 miles per year, 15,000 miles per year, or 18,000 miles per year. With this assumption Amy estimated her total costs for the three lease options. For example, she figures that the Hepburn Honda lease will cost her 36($299) 1 $0.15(36,000 2 36,000) 5 $10,764 if she drives 12,000 miles per year, 36($299) 1 $0.15(45,000 2 36,000) 5 $12,114 if she

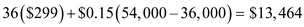

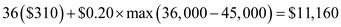

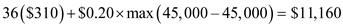

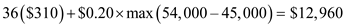

drives 15,000 miles per year, or 36($299) 1 $0.15(54,000 2 36,000) 5 $13,464 if she drives 18,000 miles per year.

a. What is the decision, and what is the chance event

b. Construct a payoff table for Amy's problem.

c. If Amy has no idea which of the three mileage assumptions is most appropriate, what is the recommended decision (leasing option) using the optimistic, conservative, and minimax regret approaches

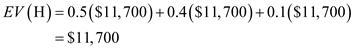

d. Suppose that the probabilities that Amy drives 12,000, 15,000, and 18,000 miles per year are 0.5, 0.4, and 0.1, respectively. What option should Amy choose using the expected value approach

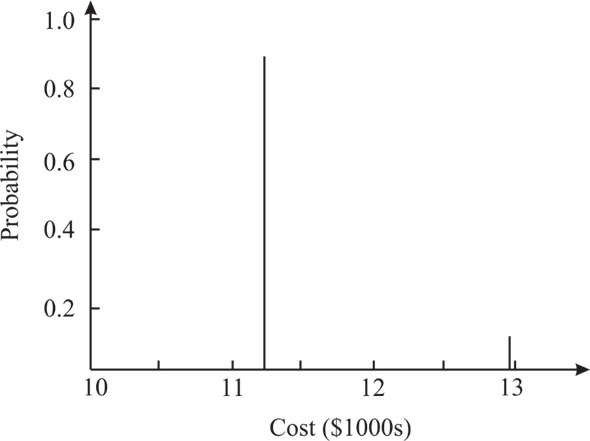

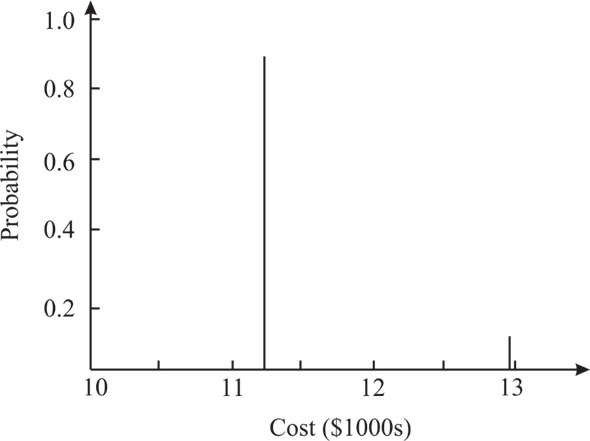

e. Develop a risk profile for the decision selected in part d. What is the most likely cost, and what is its probability

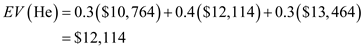

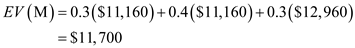

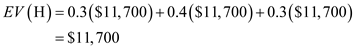

f. Suppose that, after further consideration, Amy concludes that the probabilities that she will drive 12,000, 15,000, and 18,000 miles per year are 0.3, 0.4, and 0.3, respectively. What decision should Amy make using the expected value approach

Amy decided to choose the lease option that will minimize her total 36-month cost. The difficulty is that Amy is not sure how many miles she will drive over the next three years. For purposes of this decision, she believes it is reasonable to assume that she will drive 12,000 miles per year, 15,000 miles per year, or 18,000 miles per year. With this assumption Amy estimated her total costs for the three lease options. For example, she figures that the Hepburn Honda lease will cost her 36($299) 1 $0.15(36,000 2 36,000) 5 $10,764 if she drives 12,000 miles per year, 36($299) 1 $0.15(45,000 2 36,000) 5 $12,114 if she

drives 15,000 miles per year, or 36($299) 1 $0.15(54,000 2 36,000) 5 $13,464 if she drives 18,000 miles per year.

a. What is the decision, and what is the chance event

b. Construct a payoff table for Amy's problem.

c. If Amy has no idea which of the three mileage assumptions is most appropriate, what is the recommended decision (leasing option) using the optimistic, conservative, and minimax regret approaches

d. Suppose that the probabilities that Amy drives 12,000, 15,000, and 18,000 miles per year are 0.5, 0.4, and 0.1, respectively. What option should Amy choose using the expected value approach

e. Develop a risk profile for the decision selected in part d. What is the most likely cost, and what is its probability

f. Suppose that, after further consideration, Amy concludes that the probabilities that she will drive 12,000, 15,000, and 18,000 miles per year are 0.3, 0.4, and 0.3, respectively. What decision should Amy make using the expected value approach

a.

Amy must make a decision regarding the dealer (dealer named He, dealer named M Motors, or the dealer named as H Automotive). Now, the decision to be made is the dealer. When the decision is implemented, the chance events are driving 12,000 miles per year, 15,000 miles per year or 18,000 miles per year.

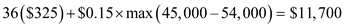

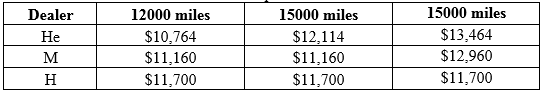

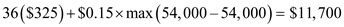

b.If it is assumed that she will be driving 12,000 miles per year, 15,000 miles per year or 18,000 miles per year, then this assumption will help to estimate the total cost for each of the three lease options.

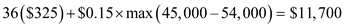

He:

If she drives 12,000 miles per year, that is, 36,000 miles for 3 years, then it will cost her

.

.

If she drives 15,000 miles per year, that is, 45,000 miles for 3 years, then it will cost her

.

.

If she drives 18,000 miles per year, that is, 54,000 miles for 3 years, then it will cost her

M:

M:

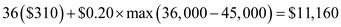

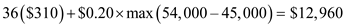

If she drives 12,000 miles per year, that is, 36,000 miles for 3 years, then it will cost her:

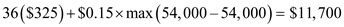

.

.

If she drives 15,000 miles per year, that is, 45,000 miles for 3 years, then it will cost her :

.

.

If she drives 18,000 miles per year, that is, 54,000 miles for 3 years, then it will cost her:

.

.

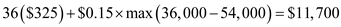

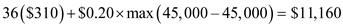

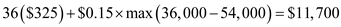

H Automotive:

If she drives 12,000 miles per year, that is, 36,000 miles for 3 years, then it will cost her:

.

.

If she drives 15,000 miles per year, that is, 45,000 miles for 3 years, then it will cost her :

.

.

If she drives 18,000 miles per year, that is, 54,000 miles for 3 years, then it will cost her:

.

.

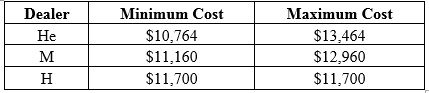

The payoff table for Amy's problem is given as follows:

Miles per Year

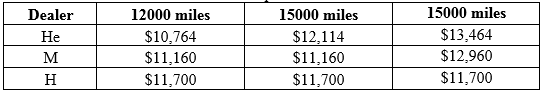

c.The minimum and maximum payoffs for each of Amy's three alternatives are:

c.The minimum and maximum payoffs for each of Amy's three alternatives are:

Thus, the optimistic approach is resulting in the assortment of the He Automotive lease option (which has the least minimum cost of the three alternatives, that is, $10,764).

Thus, the optimistic approach is resulting in the assortment of the He Automotive lease option (which has the least minimum cost of the three alternatives, that is, $10,764).

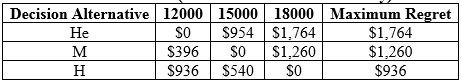

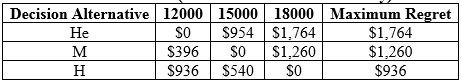

The conservative approach is resulting in the selection of the H Automotive lease option (which has the least maximum cost of the three alternatives, that is, $11,700). To find out the lease option in order to select under the approach named as minimax regret approach, firstly it is required to construct an opportunity loss (or regret) table. For each of the three chance events (that is, driving 12000 miles, driving 15000 miles, and driving 18000 miles) perform the subtraction of the minimum payoff from the payoff for each of the decision substitute (or alternative).

The regret table for this problem is shown below:

State of Nature (Actual Miles Driven Annually) Thus, from the above table, it is evident that the minimax regret approach is resulting in the selection of the lease option named as Hopkins Automotive lease option (which has the least regret of the three alternatives, that is, $936).

Thus, from the above table, it is evident that the minimax regret approach is resulting in the selection of the lease option named as Hopkins Automotive lease option (which has the least regret of the three alternatives, that is, $936).

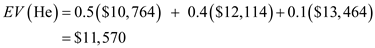

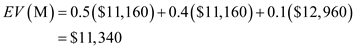

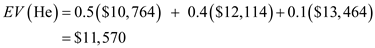

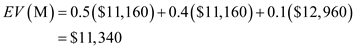

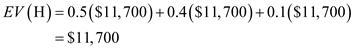

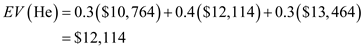

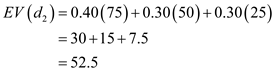

d.Here, firstly find the expected value for the payoffs associated with each of Amy's three alternatives as shown below:

Thus, the expected value approach is resulting in the selection of the Midtown Motors lease option (which has the smallest expected value of the three alternatives, that is, $11,340).

Thus, the expected value approach is resulting in the selection of the Midtown Motors lease option (which has the smallest expected value of the three alternatives, that is, $11,340).

e.The risk profile for the decision to lease from M is created below:

As shown in the risk profile, the best likely cost is $11,160 which is having a probability of 0.9. Note that although there are three chance outcomes (that is, drive 12000 miles annually, drive 15000 miles annually, and drive 18000 miles annually), there are two unique costs on the above graph. The reason for this is, because for this decision alternative, (lease from M Motors) there are only two unique payoffs related with the three chance outcomes. The payoff (cost) related with the Midtown Motors lease is the identical for two of the chance outcomes (whether Amy drives 12000 miles or 15000 miles annually, her payoff is $11,160).

As shown in the risk profile, the best likely cost is $11,160 which is having a probability of 0.9. Note that although there are three chance outcomes (that is, drive 12000 miles annually, drive 15000 miles annually, and drive 18000 miles annually), there are two unique costs on the above graph. The reason for this is, because for this decision alternative, (lease from M Motors) there are only two unique payoffs related with the three chance outcomes. The payoff (cost) related with the Midtown Motors lease is the identical for two of the chance outcomes (whether Amy drives 12000 miles or 15000 miles annually, her payoff is $11,160).

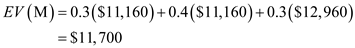

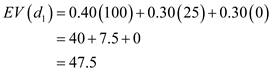

f.Here, firstly find the expected value for the payoffs associated with each of Amy's three alternatives:

Thus, the expected value approach is resulting in selection of either the M lease option or the H Automotive lease option (both of which have the smallest expected value of the three alternatives, that is, $11,700).

Thus, the expected value approach is resulting in selection of either the M lease option or the H Automotive lease option (both of which have the smallest expected value of the three alternatives, that is, $11,700).

Amy must make a decision regarding the dealer (dealer named He, dealer named M Motors, or the dealer named as H Automotive). Now, the decision to be made is the dealer. When the decision is implemented, the chance events are driving 12,000 miles per year, 15,000 miles per year or 18,000 miles per year.

b.If it is assumed that she will be driving 12,000 miles per year, 15,000 miles per year or 18,000 miles per year, then this assumption will help to estimate the total cost for each of the three lease options.

He:

If she drives 12,000 miles per year, that is, 36,000 miles for 3 years, then it will cost her

.

.If she drives 15,000 miles per year, that is, 45,000 miles for 3 years, then it will cost her

.

.If she drives 18,000 miles per year, that is, 54,000 miles for 3 years, then it will cost her

M:

M: If she drives 12,000 miles per year, that is, 36,000 miles for 3 years, then it will cost her:

.

.If she drives 15,000 miles per year, that is, 45,000 miles for 3 years, then it will cost her :

.

.If she drives 18,000 miles per year, that is, 54,000 miles for 3 years, then it will cost her:

.

.H Automotive:

If she drives 12,000 miles per year, that is, 36,000 miles for 3 years, then it will cost her:

.

.If she drives 15,000 miles per year, that is, 45,000 miles for 3 years, then it will cost her :

.

.If she drives 18,000 miles per year, that is, 54,000 miles for 3 years, then it will cost her:

.

.The payoff table for Amy's problem is given as follows:

Miles per Year

c.The minimum and maximum payoffs for each of Amy's three alternatives are:

c.The minimum and maximum payoffs for each of Amy's three alternatives are: Thus, the optimistic approach is resulting in the assortment of the He Automotive lease option (which has the least minimum cost of the three alternatives, that is, $10,764).

Thus, the optimistic approach is resulting in the assortment of the He Automotive lease option (which has the least minimum cost of the three alternatives, that is, $10,764).The conservative approach is resulting in the selection of the H Automotive lease option (which has the least maximum cost of the three alternatives, that is, $11,700). To find out the lease option in order to select under the approach named as minimax regret approach, firstly it is required to construct an opportunity loss (or regret) table. For each of the three chance events (that is, driving 12000 miles, driving 15000 miles, and driving 18000 miles) perform the subtraction of the minimum payoff from the payoff for each of the decision substitute (or alternative).

The regret table for this problem is shown below:

State of Nature (Actual Miles Driven Annually)

Thus, from the above table, it is evident that the minimax regret approach is resulting in the selection of the lease option named as Hopkins Automotive lease option (which has the least regret of the three alternatives, that is, $936).

Thus, from the above table, it is evident that the minimax regret approach is resulting in the selection of the lease option named as Hopkins Automotive lease option (which has the least regret of the three alternatives, that is, $936).d.Here, firstly find the expected value for the payoffs associated with each of Amy's three alternatives as shown below:

Thus, the expected value approach is resulting in the selection of the Midtown Motors lease option (which has the smallest expected value of the three alternatives, that is, $11,340).

Thus, the expected value approach is resulting in the selection of the Midtown Motors lease option (which has the smallest expected value of the three alternatives, that is, $11,340).e.The risk profile for the decision to lease from M is created below:

As shown in the risk profile, the best likely cost is $11,160 which is having a probability of 0.9. Note that although there are three chance outcomes (that is, drive 12000 miles annually, drive 15000 miles annually, and drive 18000 miles annually), there are two unique costs on the above graph. The reason for this is, because for this decision alternative, (lease from M Motors) there are only two unique payoffs related with the three chance outcomes. The payoff (cost) related with the Midtown Motors lease is the identical for two of the chance outcomes (whether Amy drives 12000 miles or 15000 miles annually, her payoff is $11,160).

As shown in the risk profile, the best likely cost is $11,160 which is having a probability of 0.9. Note that although there are three chance outcomes (that is, drive 12000 miles annually, drive 15000 miles annually, and drive 18000 miles annually), there are two unique costs on the above graph. The reason for this is, because for this decision alternative, (lease from M Motors) there are only two unique payoffs related with the three chance outcomes. The payoff (cost) related with the Midtown Motors lease is the identical for two of the chance outcomes (whether Amy drives 12000 miles or 15000 miles annually, her payoff is $11,160).f.Here, firstly find the expected value for the payoffs associated with each of Amy's three alternatives:

Thus, the expected value approach is resulting in selection of either the M lease option or the H Automotive lease option (both of which have the smallest expected value of the three alternatives, that is, $11,700).

Thus, the expected value approach is resulting in selection of either the M lease option or the H Automotive lease option (both of which have the smallest expected value of the three alternatives, that is, $11,700). 2

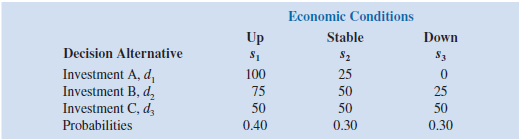

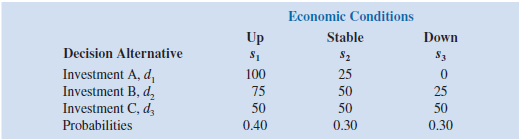

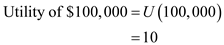

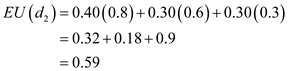

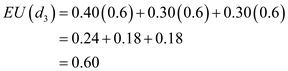

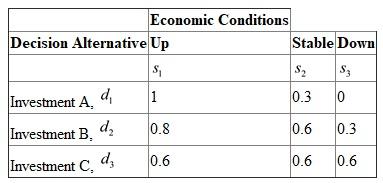

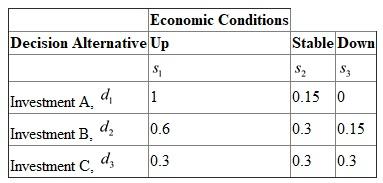

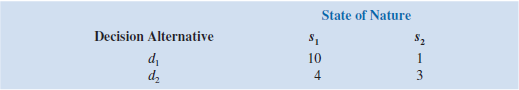

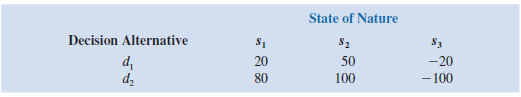

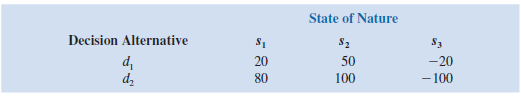

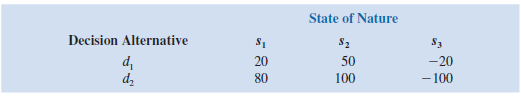

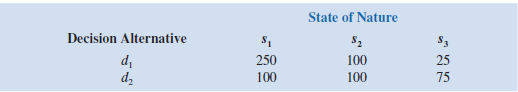

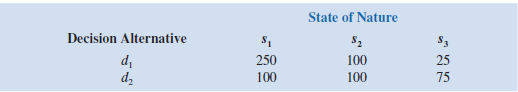

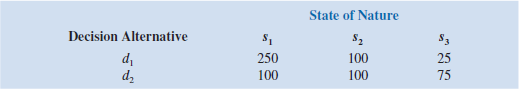

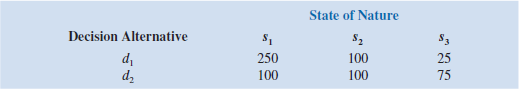

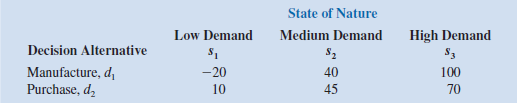

A firm has three investment alternatives. Payoffs are in thousands of dollars.

a. Using the expected value approach, which decision is preferred

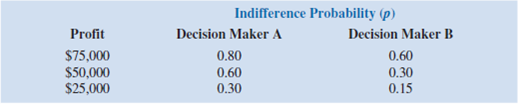

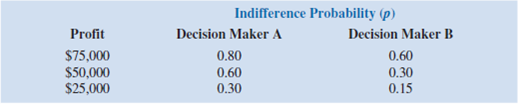

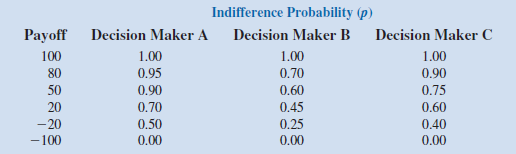

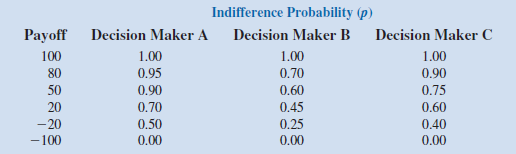

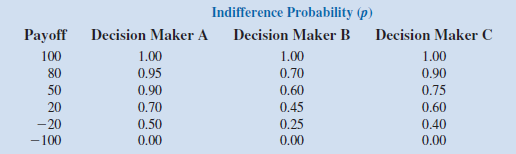

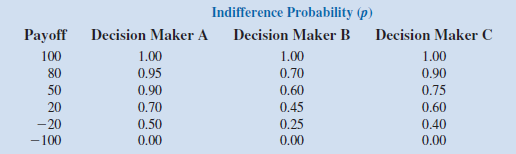

b. For the lottery having a payoff of $100,000 with probability p and $0 with probability (1 p ), two decision makers expressed the following indifference probabilities. Find the most preferred decision for each decision maker using the expected utility approach.

c. Why don't decision makers A and B select the same decision alternative

a. Using the expected value approach, which decision is preferred

b. For the lottery having a payoff of $100,000 with probability p and $0 with probability (1 p ), two decision makers expressed the following indifference probabilities. Find the most preferred decision for each decision maker using the expected utility approach.

c. Why don't decision makers A and B select the same decision alternative

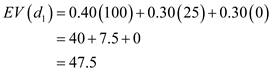

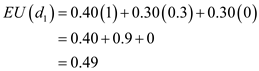

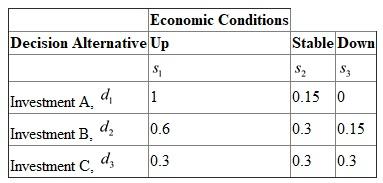

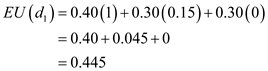

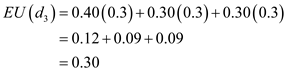

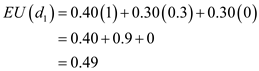

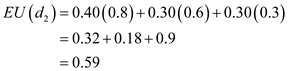

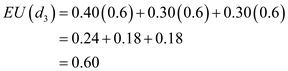

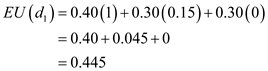

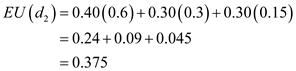

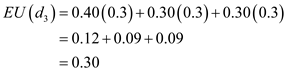

a. Since probabilities are available with the given payoff matrix, use the expected value approach to identify the best decision alternative. The expected value of a decision option is the summation of the weighted payoffs for the decision alternative. The weight for a payoff is nothing but the probability of the linked state of nature and therefore the occurrence of the probability that the payoff will occur.

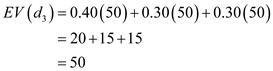

The expected values are calculated as follows:

Thus, using the expected value approach, d 2 is the preferred decision. The expected value is 52.5. The preferred decision is investment B using the expected value approach.

Thus, using the expected value approach, d 2 is the preferred decision. The expected value is 52.5. The preferred decision is investment B using the expected value approach.

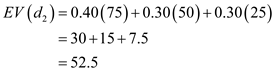

b.For either decision maker A or B , set

and

and

, then the indifference probabilities correspond to their utilities. First, construct the utility table for decision maker A.

, then the indifference probabilities correspond to their utilities. First, construct the utility table for decision maker A.

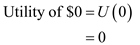

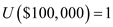

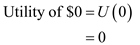

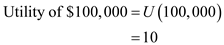

First assign a utility to the best and worst possible payoffs. Any values will work as long as the utility assigned to the best payoff is greater than the utility assigned to the worst payoff. In this case, $100,000 is the best payoff and $0 is the worst payoff. Arbitrarily make assignments to these two payoffs as follows:

And:

And:

Now determine the utility associated with each payoff.Consider the process of establishing the utility of a payoff of $100,000. The firm obtains a payoff of $100,000 with probability p and a payoff of $0 with probability

Now determine the utility associated with each payoff.Consider the process of establishing the utility of a payoff of $100,000. The firm obtains a payoff of $100,000 with probability p and a payoff of $0 with probability

.Substitute the corresponding indifference probability values of decision maker A for the values of the payoff table. So, the utility table for decision maker A is thus obtained as:

.Substitute the corresponding indifference probability values of decision maker A for the values of the payoff table. So, the utility table for decision maker A is thus obtained as:

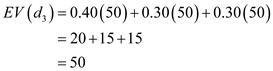

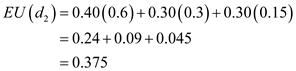

The expected utility for each alternative is obtained as:

The expected utility for each alternative is obtained as:

Thus, using the expected utility approach, d 3 is the preferred decision. Decision maker A chooses investment c.Similarly find the preferred decision of Decision Maker B. Substitute the corresponding indifference probability values of decision maker B for the values of the payoff table. The utility table for decision maker B is thus obtained as:

Thus, using the expected utility approach, d 3 is the preferred decision. Decision maker A chooses investment c.Similarly find the preferred decision of Decision Maker B. Substitute the corresponding indifference probability values of decision maker B for the values of the payoff table. The utility table for decision maker B is thus obtained as:

The expected utility for each alternative is obtained as:

The expected utility for each alternative is obtained as:

Thus, using the expected utility approach, d 1 is the preferred decision. Decision maker B chooses investment A.

Thus, using the expected utility approach, d 1 is the preferred decision. Decision maker B chooses investment A.

c.Decision maker A is fairly risk averse, chooses investment C with its guaranteed return. Decision maker B is less risk averse, chooses investment A as the expected payoff is much more than any other payoff. As there is difference in utilities, the decision makers A and B do not select the same decision alternative.

The expected values are calculated as follows:

Thus, using the expected value approach, d 2 is the preferred decision. The expected value is 52.5. The preferred decision is investment B using the expected value approach.

Thus, using the expected value approach, d 2 is the preferred decision. The expected value is 52.5. The preferred decision is investment B using the expected value approach.b.For either decision maker A or B , set

and

and , then the indifference probabilities correspond to their utilities. First, construct the utility table for decision maker A.

, then the indifference probabilities correspond to their utilities. First, construct the utility table for decision maker A. First assign a utility to the best and worst possible payoffs. Any values will work as long as the utility assigned to the best payoff is greater than the utility assigned to the worst payoff. In this case, $100,000 is the best payoff and $0 is the worst payoff. Arbitrarily make assignments to these two payoffs as follows:

And:

And: Now determine the utility associated with each payoff.Consider the process of establishing the utility of a payoff of $100,000. The firm obtains a payoff of $100,000 with probability p and a payoff of $0 with probability

Now determine the utility associated with each payoff.Consider the process of establishing the utility of a payoff of $100,000. The firm obtains a payoff of $100,000 with probability p and a payoff of $0 with probability .Substitute the corresponding indifference probability values of decision maker A for the values of the payoff table. So, the utility table for decision maker A is thus obtained as:

.Substitute the corresponding indifference probability values of decision maker A for the values of the payoff table. So, the utility table for decision maker A is thus obtained as: The expected utility for each alternative is obtained as:

The expected utility for each alternative is obtained as:

Thus, using the expected utility approach, d 3 is the preferred decision. Decision maker A chooses investment c.Similarly find the preferred decision of Decision Maker B. Substitute the corresponding indifference probability values of decision maker B for the values of the payoff table. The utility table for decision maker B is thus obtained as:

Thus, using the expected utility approach, d 3 is the preferred decision. Decision maker A chooses investment c.Similarly find the preferred decision of Decision Maker B. Substitute the corresponding indifference probability values of decision maker B for the values of the payoff table. The utility table for decision maker B is thus obtained as: The expected utility for each alternative is obtained as:

The expected utility for each alternative is obtained as:

Thus, using the expected utility approach, d 1 is the preferred decision. Decision maker B chooses investment A.

Thus, using the expected utility approach, d 1 is the preferred decision. Decision maker B chooses investment A. c.Decision maker A is fairly risk averse, chooses investment C with its guaranteed return. Decision maker B is less risk averse, chooses investment A as the expected payoff is much more than any other payoff. As there is difference in utilities, the decision makers A and B do not select the same decision alternative.

3

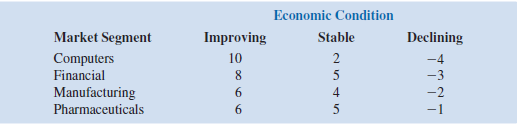

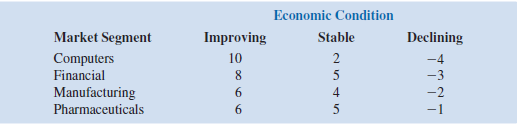

Investment advisors estimated the stock market returns for four market segments: computers, financial, manufacturing, and pharmaceuticals. Annual return projections vary depending on whether the general economic conditions are improving, stable, or declining. The anticipated annual return percentages for each market segment under each economic

condition are as follows:

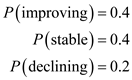

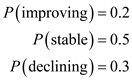

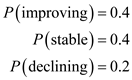

a. Assume that an individual investor wants to select one market segment for a new investment. A forecast shows improving to declining economic conditions with the following probabilities: improving (0.2), stable (0.5), and declining (0.3). What is the preferred market segment for the investor, and what is the expected return percentage

b. At a later date, a revised forecast shows a potential for an improvement in economic conditions. New probabilities are as follows: improving (0.4), stable (0.4), and declining (0.2). What is the preferred market segment for the investor based on these new probabilities What is the expected return percentage

condition are as follows:

a. Assume that an individual investor wants to select one market segment for a new investment. A forecast shows improving to declining economic conditions with the following probabilities: improving (0.2), stable (0.5), and declining (0.3). What is the preferred market segment for the investor, and what is the expected return percentage

b. At a later date, a revised forecast shows a potential for an improvement in economic conditions. New probabilities are as follows: improving (0.4), stable (0.4), and declining (0.2). What is the preferred market segment for the investor based on these new probabilities What is the expected return percentage

a.

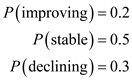

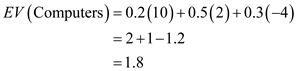

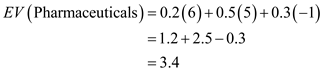

Suppose that an individual investor is interested in selecting one market segment for a new or fresh investment. A forecast shows improving the economic conditions with the following probabilities: improving (0.2), stable (0.5) and declining (0.3). Since probabilities are available, use the expected value approach in order to recognize the best decision alternative. The expected value of a decision alternative is the summation of the subjective (or weighted) payoffs for the decision option. The weight for a payoff is nothing but the probability of the connected state of nature. It thereby leads to consideration of the probability that the payoff will occur.

Given that:

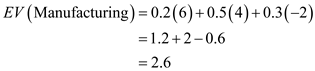

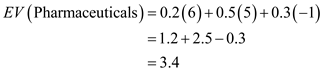

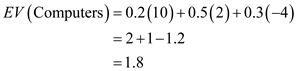

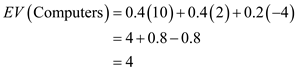

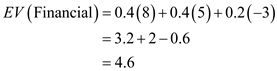

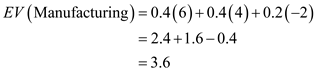

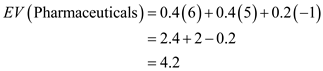

The expected values are calculated as follows:

The expected values are calculated as follows:

Thus, using the expected value approach, Pharmaceuticals segment is the ideal market segment for the investor. And so the expected return percentage is

Thus, using the expected value approach, Pharmaceuticals segment is the ideal market segment for the investor. And so the expected return percentage is

.

.

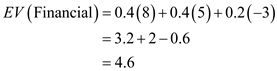

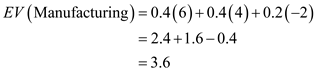

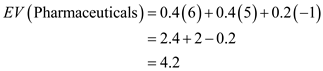

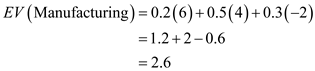

b.A revised forecast shows a potential for the development in economic conditions. New probabilities are given. Given that:

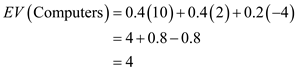

The expected values are calculated as follows:

The expected values are calculated as follows:

Thus, using the expected valued approach, the financial segment is the preferred market segment for the investor with the given probabilities. The expected return percentage is

Thus, using the expected valued approach, the financial segment is the preferred market segment for the investor with the given probabilities. The expected return percentage is

.

.

Suppose that an individual investor is interested in selecting one market segment for a new or fresh investment. A forecast shows improving the economic conditions with the following probabilities: improving (0.2), stable (0.5) and declining (0.3). Since probabilities are available, use the expected value approach in order to recognize the best decision alternative. The expected value of a decision alternative is the summation of the subjective (or weighted) payoffs for the decision option. The weight for a payoff is nothing but the probability of the connected state of nature. It thereby leads to consideration of the probability that the payoff will occur.

Given that:

The expected values are calculated as follows:

The expected values are calculated as follows:

Thus, using the expected value approach, Pharmaceuticals segment is the ideal market segment for the investor. And so the expected return percentage is

Thus, using the expected value approach, Pharmaceuticals segment is the ideal market segment for the investor. And so the expected return percentage is .

.b.A revised forecast shows a potential for the development in economic conditions. New probabilities are given. Given that:

The expected values are calculated as follows:

The expected values are calculated as follows:

Thus, using the expected valued approach, the financial segment is the preferred market segment for the investor with the given probabilities. The expected return percentage is

Thus, using the expected valued approach, the financial segment is the preferred market segment for the investor with the given probabilities. The expected return percentage is .

. 4

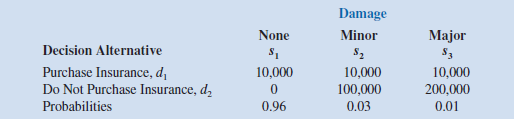

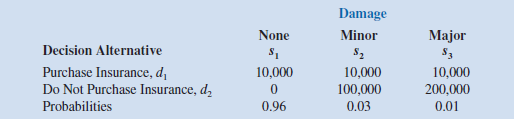

Alexander Industries is considering purchasing an insurance policy for its new office building in St. Louis, Missouri. The policy has an annual cost of $10,000. If Alexander Industries doesn't purchase the insurance and minor fire damage occurs, a cost of $100,000 is anticipated; the cost if major or total destruction occurs is $200,000. The costs, including the state-of-nature probabilities, are as follows:

a. Using the expected value approach, what decision do you recommend

b. What lottery would you use to assess utilities ( Note: Because the data are costs, the best payoff is $0.)

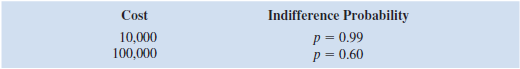

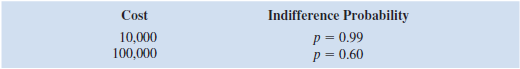

c. Assume that you found the following indifference probabilities for the lottery defined in part b. What decision would you recommend

d. Do you favor using expected value or expected utility for this decision problem Why

a. Using the expected value approach, what decision do you recommend

b. What lottery would you use to assess utilities ( Note: Because the data are costs, the best payoff is $0.)

c. Assume that you found the following indifference probabilities for the lottery defined in part b. What decision would you recommend

d. Do you favor using expected value or expected utility for this decision problem Why

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

5

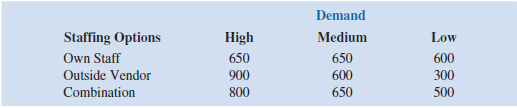

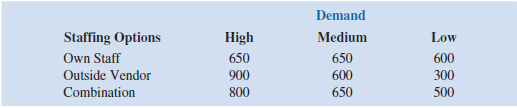

Hudson Corporation is considering three options for managing its data warehouse: continuing with its own staff, hiring an outside vendor to do the managing, or using a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows:

a. If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse What is the expected annual cost associated with that recommendation

b. Construct a risk profile for the optimal decision in part a. What is the probability of the cost exceeding $700,000

a. If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse What is the expected annual cost associated with that recommendation

b. Construct a risk profile for the optimal decision in part a. What is the probability of the cost exceeding $700,000

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

6

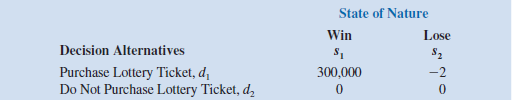

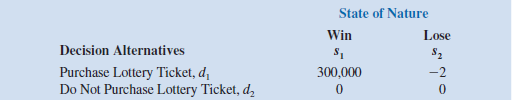

In a certain state lottery, a lottery ticket costs $2. In terms of the decision to purchase or not to purchase a lottery ticket, suppose that the following payoff table applies:

a. A realistic estimate of the chances of winning is 1 in 250,000. Use the expected value approach to recommend a decision.

b. If a particular decision maker assigns an indifference probability of 0.000001 to the $0 payoff, would this individual purchase a lottery ticket Use expected utility to justify your answer.

a. A realistic estimate of the chances of winning is 1 in 250,000. Use the expected value approach to recommend a decision.

b. If a particular decision maker assigns an indifference probability of 0.000001 to the $0 payoff, would this individual purchase a lottery ticket Use expected utility to justify your answer.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

7

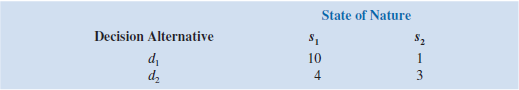

The following payoff table shows the profit for a decision problem with two states of nature and two decision alternatives:

a. Suppose P ( s 1 ) = 0.2 and P ( s 2 ) = 0.8. What is the best decision using the expectedvalue approach

b. Perform sensitivity analysis on the payoffs for decision alternative d 1. Assume the probabilities are as given in part a, and find the range of payoffs under states of nature s 1 and s 2 that will keep the solution found in part a optimal. Is the solution more sensitive to the payoff under state of nature s 1 or s 2

a. Suppose P ( s 1 ) = 0.2 and P ( s 2 ) = 0.8. What is the best decision using the expectedvalue approach

b. Perform sensitivity analysis on the payoffs for decision alternative d 1. Assume the probabilities are as given in part a, and find the range of payoffs under states of nature s 1 and s 2 that will keep the solution found in part a optimal. Is the solution more sensitive to the payoff under state of nature s 1 or s 2

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

8

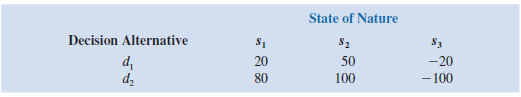

Three decision makers have assessed utilities for the following decision problem (payoff in dollars):

The indifference probabilities are as follows:

a. Plot the utility function for money for each decision maker.

b. Classify each decision maker as a risk avoider, a risk taker, or risk neutral.

c. For the payoff of 20, what is the premium that the risk avoider will pay to avoid risk What is the premium that the risk taker will pay to have the opportunity of the high payoff

The indifference probabilities are as follows:

a. Plot the utility function for money for each decision maker.

b. Classify each decision maker as a risk avoider, a risk taker, or risk neutral.

c. For the payoff of 20, what is the premium that the risk avoider will pay to avoid risk What is the premium that the risk taker will pay to have the opportunity of the high payoff

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

9

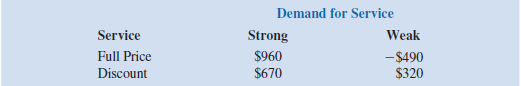

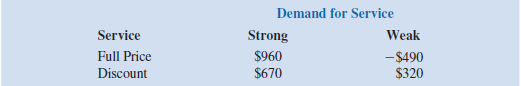

Myrtle Air Express decided to offer direct service from Cleveland to Myrtle Beach. Management must decide between a full-price service using the company's new fleet of jet aircraft and a discount service using smaller-capacity commuter planes. It is clear that the best choice depends on the market reaction to the service Myrtle Air offers. Management developed estimates of the contribution to profit for each type of service based on two possible levels of demand for service to Myrtle Beach: strong and weak. The following table shows the estimated quarterly profits (in thousands of dollars):

a. What is the decision to be made, what is the chance event, and what is the consequence for this problem How many decision alternatives are there How many outcomes are there for the chance event

b. If nothing is known about the probabilities of the chance outcomes, what is the recommended decision using the optimistic, conservative, and minimax regret approaches

c. Suppose that management of Myrtle Air Express believes that the probability of strong demand is 0.7 and the probability of weak demand is 0.3. Use the expected value approach to determine an optimal decision.

d. Suppose that the probability of strong demand is 0.8 and the probability of weak demand is 0.2. What is the optimal decision using the expected value approach

e. Use sensitivity analysis to determine the range of demand probabilities for which each of the decision alternatives has the largest expected value.

a. What is the decision to be made, what is the chance event, and what is the consequence for this problem How many decision alternatives are there How many outcomes are there for the chance event

b. If nothing is known about the probabilities of the chance outcomes, what is the recommended decision using the optimistic, conservative, and minimax regret approaches

c. Suppose that management of Myrtle Air Express believes that the probability of strong demand is 0.7 and the probability of weak demand is 0.3. Use the expected value approach to determine an optimal decision.

d. Suppose that the probability of strong demand is 0.8 and the probability of weak demand is 0.2. What is the optimal decision using the expected value approach

e. Use sensitivity analysis to determine the range of demand probabilities for which each of the decision alternatives has the largest expected value.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

10

In Problem, if P ( s 1 ) = 0.25, P ( s 2 ) = 0.50, and P ( s 3 ) = 0.25, find a recommended decision for each of the three decision makers. ( Note: For the same decision problem, different utilities can lead to different decisions.)

Problem

Three decision makers have assessed utilities for the following decision problem (payoff in dollars):

The indifference probabilities are as follows:

a. Plot the utility function for money for each decision maker.

b. Classify each decision maker as a risk avoider, a risk taker, or risk neutral.

c. For the payoff of 20, what is the premium that the risk avoider will pay to avoid risk What is the premium that the risk taker will pay to have the opportunity of the high payoff

Problem

Three decision makers have assessed utilities for the following decision problem (payoff in dollars):

The indifference probabilities are as follows:

a. Plot the utility function for money for each decision maker.

b. Classify each decision maker as a risk avoider, a risk taker, or risk neutral.

c. For the payoff of 20, what is the premium that the risk avoider will pay to avoid risk What is the premium that the risk taker will pay to have the opportunity of the high payoff

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

11

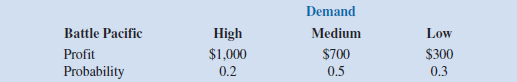

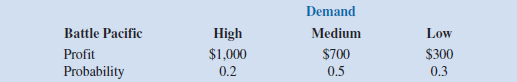

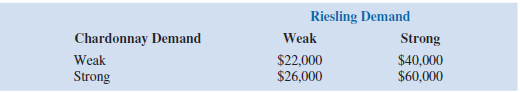

Video Tech is considering marketing one of two new video games for the coming holiday season: Battle Pacific or Space Pirates. Battle Pacific is a unique game and appears to have no competition. Estimated profits (in thousands of dollars) under high, medium, and low demand are as follows:

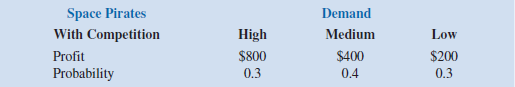

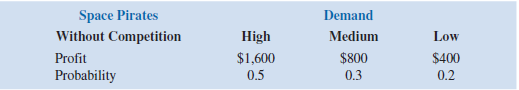

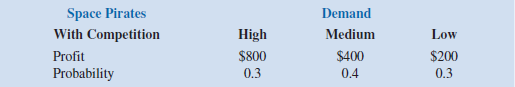

Video Tech is optimistic about its Space Pirates game. However, the concern is that profitability will be affected by a competitor's introduction of a video game viewed as similar to Space Pirates. Estimated profits (in thousands of dollars) with and without competition are as follows:

a. Develop a decision tree for the Video Tech problem.

b. For planning purposes, Video Tech believes there is a 0.6 probability that its competitor will produce a new game similar to Space Pirates. given this probability of competition, the director of planning recommends marketing the Battle Pacific video game. Using expected value, what is your recommended decision

c. Show a risk profile for your recommended decision.

d. Use sensitivity analysis to determine what the probability of competition for Space Pirates would have to be for you to change your recommended decision alternative

Video Tech is optimistic about its Space Pirates game. However, the concern is that profitability will be affected by a competitor's introduction of a video game viewed as similar to Space Pirates. Estimated profits (in thousands of dollars) with and without competition are as follows:

a. Develop a decision tree for the Video Tech problem.

b. For planning purposes, Video Tech believes there is a 0.6 probability that its competitor will produce a new game similar to Space Pirates. given this probability of competition, the director of planning recommends marketing the Battle Pacific video game. Using expected value, what is your recommended decision

c. Show a risk profile for your recommended decision.

d. Use sensitivity analysis to determine what the probability of competition for Space Pirates would have to be for you to change your recommended decision alternative

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

12

Translate the following monetary payoffs into utilities for a decision maker whose utility function is described by an exponential function with R = 250: $200, $100, $0, $100, $200, $300, $400, $500.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

13

Seneca Hill Winery recently purchased land for the purpose of establishing a new vineyard. Management is considering two varieties of white grapes for the new vineyard: Chardonnay and Riesling. The Chardonnay grapes would be used to produce a dry Chardonnay wine,

and the Riesling grapes would be used to produce a semidry Riesling wine. It takes approximately four years from the time of planting before new grapes can be harvested. This length of time creates a great deal of uncertainty concerning future demand and makes the decision about the type of grapes to plant difficult. Three possibilities are being considered:

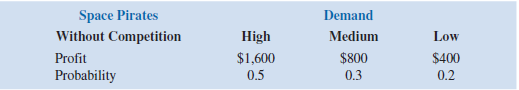

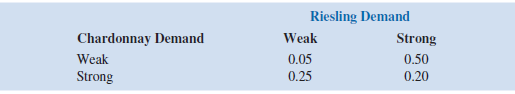

Chardonnay grapes only; Riesling grapes only; and both Chardonnay and Riesling grapes. Seneca management decided that for planning purposes it would be adequate to consider only two demand possibilities for each type of wine: strong or weak. With two possibilities for each type of wine, it was necessary to assess four probabilities. With the help of some forecasts in industry publications, management made the following probability assessments:

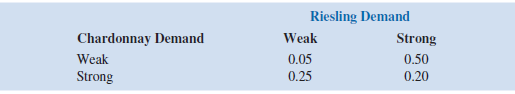

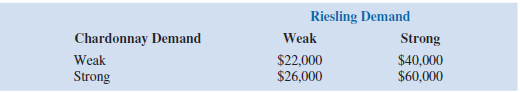

Revenue projections show an annual contribution to profit of $20,000 if Seneca Hill plants only Chardonnay grapes and demand is weak for Chardonnay wine, and $70,000 if Seneca plants only Chardonnay grapes and demand is strong for Chardonnay wine. If Seneca plants only Riesling grapes, the annual profit projection is $25,000 if demand is weak for Riesling grapes and $45,000 if demand is strong for Riesling grapes. If Seneca plants both types of grapes, the annual profit projections are shown in the following table:

a. What is the decision to be made, what is the chance event, and what is the consequence Identify the alternatives for the decisions and the possible outcomes for the chance events.

b. Develop a decision tree.

c. Use the expected value approach to recommend which alternative Seneca Hill Winery should follow in order to maximize expected annual profit.

d. Suppose management is concerned about the probability assessments when demand for Chardonnay wine is strong. Some believe it is likely for Riesling demand to also be strong in this case. Suppose the probability of strong demand for Chardonnay and weak demand for Riesling is 0.05 and that the probability of strong demand for

Chardonnay and strong demand for Riesling is 0.40. How does this change the recommended decision Assume that the probabilities when Chardonnay demand is weak are still 0.05 and 0.50.

e. Other members of the management team expect the Chardonnay market to become saturated at some point in the future, causing a fall in prices. Suppose that the annual profit projections fall to $50,000 when demand for Chardonnay is strong and only Chardonnay grapes are planted. Using the original probability assessments, determine how this change would affect the optimal decision

and the Riesling grapes would be used to produce a semidry Riesling wine. It takes approximately four years from the time of planting before new grapes can be harvested. This length of time creates a great deal of uncertainty concerning future demand and makes the decision about the type of grapes to plant difficult. Three possibilities are being considered:

Chardonnay grapes only; Riesling grapes only; and both Chardonnay and Riesling grapes. Seneca management decided that for planning purposes it would be adequate to consider only two demand possibilities for each type of wine: strong or weak. With two possibilities for each type of wine, it was necessary to assess four probabilities. With the help of some forecasts in industry publications, management made the following probability assessments:

Revenue projections show an annual contribution to profit of $20,000 if Seneca Hill plants only Chardonnay grapes and demand is weak for Chardonnay wine, and $70,000 if Seneca plants only Chardonnay grapes and demand is strong for Chardonnay wine. If Seneca plants only Riesling grapes, the annual profit projection is $25,000 if demand is weak for Riesling grapes and $45,000 if demand is strong for Riesling grapes. If Seneca plants both types of grapes, the annual profit projections are shown in the following table:

a. What is the decision to be made, what is the chance event, and what is the consequence Identify the alternatives for the decisions and the possible outcomes for the chance events.

b. Develop a decision tree.

c. Use the expected value approach to recommend which alternative Seneca Hill Winery should follow in order to maximize expected annual profit.

d. Suppose management is concerned about the probability assessments when demand for Chardonnay wine is strong. Some believe it is likely for Riesling demand to also be strong in this case. Suppose the probability of strong demand for Chardonnay and weak demand for Riesling is 0.05 and that the probability of strong demand for

Chardonnay and strong demand for Riesling is 0.40. How does this change the recommended decision Assume that the probabilities when Chardonnay demand is weak are still 0.05 and 0.50.

e. Other members of the management team expect the Chardonnay market to become saturated at some point in the future, causing a fall in prices. Suppose that the annual profit projections fall to $50,000 when demand for Chardonnay is strong and only Chardonnay grapes are planted. Using the original probability assessments, determine how this change would affect the optimal decision

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

14

Consider a decision maker who is comfortable with an investment decision that has a 50 percent chance of earning $25,000 and a 50 percent chance of losing $12,500, but not with any larger investments that have the same relative payoffs.

a. Write the equation for the exponential function that approximates this decision maker's utility function.

b. Plot the exponential utility function for this decision maker for x values between 20,000 and 35,000. Is this decision maker risk seeking, risk neutral, or risk averse

c. Suppose the decision maker decides that she would actually be willing to make an investment that has a 50 percent chance of earning $30,000 and a 50 percent chance of losing $15,000. Plot the exponential function that approximates this utility function and compare it to the utility function from part b. Is the decision maker becoming more risk seeking or more risk averse

a. Write the equation for the exponential function that approximates this decision maker's utility function.

b. Plot the exponential utility function for this decision maker for x values between 20,000 and 35,000. Is this decision maker risk seeking, risk neutral, or risk averse

c. Suppose the decision maker decides that she would actually be willing to make an investment that has a 50 percent chance of earning $30,000 and a 50 percent chance of losing $15,000. Plot the exponential function that approximates this utility function and compare it to the utility function from part b. Is the decision maker becoming more risk seeking or more risk averse

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

15

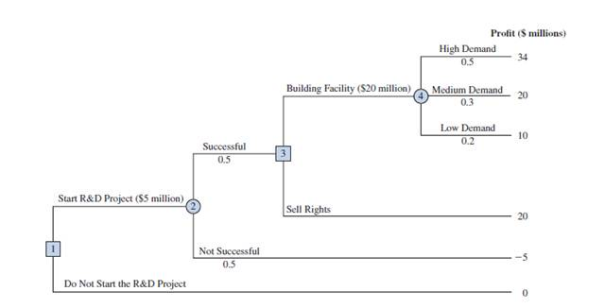

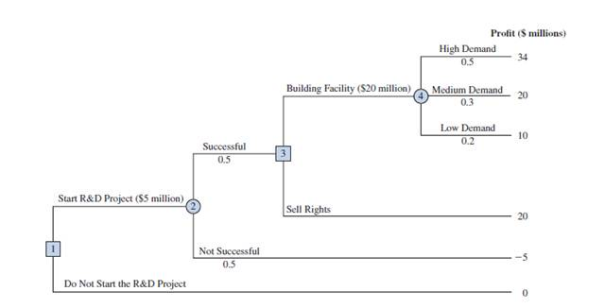

Hemmingway, Inc. is considering a $5 million research and development (R D) project. Profit projections appear promising, but Hemmingway's president is concerned because the probability that the RR D project will be successful is only 0.50. Furthermore, the president knows that even if the project is successful, it will require that the company build a new production facility at a cost of $20 million in order to manufacture the product. If the facility is built, uncertainty remains about the demand and thus uncertainty about the profit that will be realized. Another option is that if the R D project is successful, the company could sell the rights to the product for an estimated $25 million. Under this option, the company would not build the $20 million production facility.

The decision tree follows. The profit projection for each outcome is shown at the end of the branches. For example, the revenue projection for the high demand outcome is $59 million. However, the cost of the R D project ($5 million) and the cost of the production facility ($20 million) show the profit of this outcome to be $59 $5 $20 = $34 million. Branch probabilities are also shown for the chance events.

a. Analyze the decision tree to determine whether the company should undertake the R D project. If it does, and if the R D project is successful, what should the company do What is the expected value of your strategy

b. What must the selling price be for the company to consider selling the rights to the product

c. Develop a risk profile for the optimal strategy.

The decision tree follows. The profit projection for each outcome is shown at the end of the branches. For example, the revenue projection for the high demand outcome is $59 million. However, the cost of the R D project ($5 million) and the cost of the production facility ($20 million) show the profit of this outcome to be $59 $5 $20 = $34 million. Branch probabilities are also shown for the chance events.

a. Analyze the decision tree to determine whether the company should undertake the R D project. If it does, and if the R D project is successful, what should the company do What is the expected value of your strategy

b. What must the selling price be for the company to consider selling the rights to the product

c. Develop a risk profile for the optimal strategy.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

16

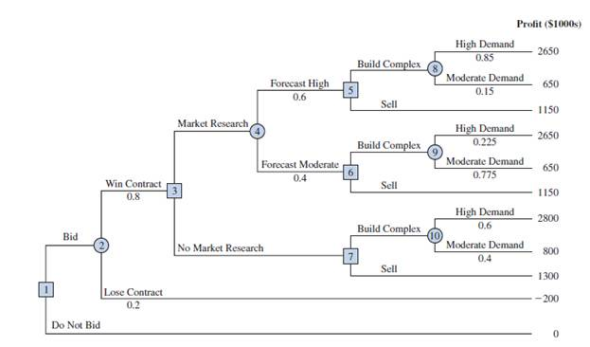

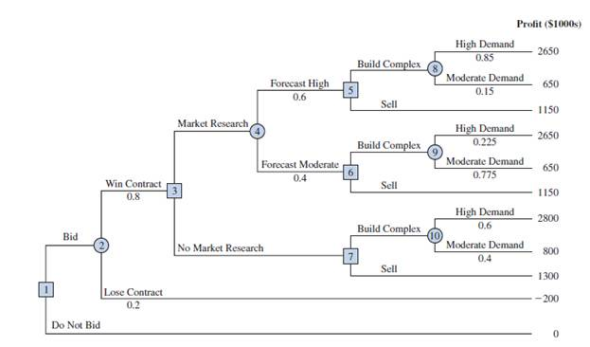

Dante Development Corporation is considering bidding on a contract for a new office building complex. The following figure shows the decision tree prepared by one of Dante's analysts. At node 1, the company must decide whether to bid on the contract. The cost of preparing the bid is $200,000. The upper branch from node 2 shows that the company

has a 0.8 probability of winning the contract if it submits a bid. If the company wins the bid, it will have to pay $2 million to become a partner in the project. Node 3 shows that the company will then consider doing a market research study to forecast demand for the office units prior to beginning construction. The cost of this study is $150,000. Node 4 is

a chance node showing the possible outcomes of the market research study.

Nodes 5, 6, and 7 are similar in that they are the decision nodes for Dante to either build the office complex or sell the rights in the project to another developer. The decision to build the complex will result in an income of $5 million if demand is high and $3 million if demand is moderate. If Dante chooses to sell its rights in the project to another developer, income from the sale is estimated to be $3.5 million. The probabilities shown at nodes 4, 8, and 9 are based on the projected outcomes of the market research study.

a. Verify Dante's profit projections shown at the ending branches of the decision tree by calculating the payoffs of $2,650,000 and $650,000 for first two outcomes.

b. What is the optimal decision strategy for Dante, and what is the expected profit for this project

c. What would the cost of the market research study have to be before Dante would change its decision about the market research study

d. Develop a risk profile for Dante.

has a 0.8 probability of winning the contract if it submits a bid. If the company wins the bid, it will have to pay $2 million to become a partner in the project. Node 3 shows that the company will then consider doing a market research study to forecast demand for the office units prior to beginning construction. The cost of this study is $150,000. Node 4 is

a chance node showing the possible outcomes of the market research study.

Nodes 5, 6, and 7 are similar in that they are the decision nodes for Dante to either build the office complex or sell the rights in the project to another developer. The decision to build the complex will result in an income of $5 million if demand is high and $3 million if demand is moderate. If Dante chooses to sell its rights in the project to another developer, income from the sale is estimated to be $3.5 million. The probabilities shown at nodes 4, 8, and 9 are based on the projected outcomes of the market research study.

a. Verify Dante's profit projections shown at the ending branches of the decision tree by calculating the payoffs of $2,650,000 and $650,000 for first two outcomes.

b. What is the optimal decision strategy for Dante, and what is the expected profit for this project

c. What would the cost of the market research study have to be before Dante would change its decision about the market research study

d. Develop a risk profile for Dante.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

17

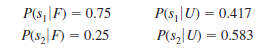

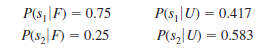

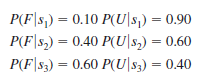

Embassy Publishing Company received a six-chapter manuscript for a new college textbook. The editor of the college division is familiar with the manuscript and estimated a 0.65 probability that the textbook will be successful. If successful, a profit of $750,000 will be realized. If the company decides to publish the textbook and it is unsuccessful, a loss of $250,000 will occur.

Before making the decision to accept or reject the manuscript, the editor is considering sending the manuscript out for review. A review process provides either a favorable ( F ) or unfavorable ( u ) evaluation of the manuscript. Past experience with the review process suggests that probabilities P ( F ) 5 0.7 and P ( u ) 5 0.3 apply. Let s 1 5 the textbook is successful, and s 2 5 the textbook is unsuccessful. The editor's initial probabilities of s 1 and s 2 will be revised based on whether the review is favorable or unfavorable. The revised probabilities are as follows:

a. Construct a decision tree assuming that the company will first make the decision as to whether to send the manuscript out for review and then make the decision to accept or reject the manuscript.

b. Analyze the decision tree to determine the optimal decision strategy for the publishing company.

c. If the manuscript review costs $5,000, what is your recommendation

d. What is the expected value of perfect information What does this EVPI suggest for the company

Before making the decision to accept or reject the manuscript, the editor is considering sending the manuscript out for review. A review process provides either a favorable ( F ) or unfavorable ( u ) evaluation of the manuscript. Past experience with the review process suggests that probabilities P ( F ) 5 0.7 and P ( u ) 5 0.3 apply. Let s 1 5 the textbook is successful, and s 2 5 the textbook is unsuccessful. The editor's initial probabilities of s 1 and s 2 will be revised based on whether the review is favorable or unfavorable. The revised probabilities are as follows:

a. Construct a decision tree assuming that the company will first make the decision as to whether to send the manuscript out for review and then make the decision to accept or reject the manuscript.

b. Analyze the decision tree to determine the optimal decision strategy for the publishing company.

c. If the manuscript review costs $5,000, what is your recommendation

d. What is the expected value of perfect information What does this EVPI suggest for the company

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

18

The following profit payoff table was presented in Problem 1:

The probabilities for the states of nature are P ( s 1 ) = 0.65, P ( s 2 ) = 0.15, and P ( s 3 ) = 0.20.

a. What is the optimal decision strategy if perfect information were available

b. What is the expected value for the decision strategy developed in part a

c. Using the expected value approach, what is the recommended decision without perfect information What is its expected value

d. What is the expected value of perfect information

The probabilities for the states of nature are P ( s 1 ) = 0.65, P ( s 2 ) = 0.15, and P ( s 3 ) = 0.20.

a. What is the optimal decision strategy if perfect information were available

b. What is the expected value for the decision strategy developed in part a

c. Using the expected value approach, what is the recommended decision without perfect information What is its expected value

d. What is the expected value of perfect information

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

19

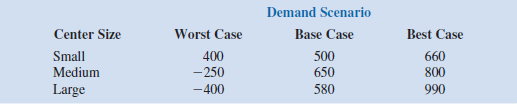

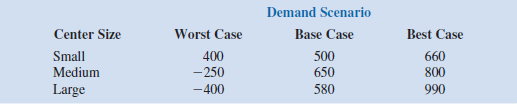

The Lake Placid Town Council decided to build a new community center to be used for conventions, concerts, and other public events, but considerable controversy surrounds the appropriate size. Many influential citizens want a large center that would be a showcase

for the area. But the mayor feels that if demand does not support such a center, the community will lose a large amount of money. To provide structure for the decision process, the council narrowed the building alternatives to three sizes: small, medium, andlarge. Everybody agreed that the critical factor in choosing the best size is the number of

people who will want to use the new facility. A regional planning consultant provided demand estimates under three scenarios: worst case, base case, and best case. The worst-case scenario corresponds to a situation in which tourism drops substantially; the base-case scenario corresponds to a situation in which Lake Placid continues to attract visitors at

current levels; and the best-case scenario corresponds to a substantial increase in tourism. The consultant has provided probability assessments of 0.10, 0.60, and 0.30 for the worstcase, base-case, and best-case scenarios, respectively.

The town council suggested using net cash flow over a 5-year planning horizon as the criterion for deciding on the best size. The following projections of net cash flow (in thousands of dollars) for a five-year planning horizon have been developed. All costs, including the consultant's fee, have been included.

a. What decision should Lake Placid make using the expected value approach

b. Construct risk profiles for the medium and large alternatives. given the mayor's concern over the possibility of losing money and the result of part a, which alternative would you recommend

c. Compute the expected value of perfect information. Do you think it would be worth trying to obtain additional information concerning which scenario is likely to occur

d. Suppose the probability of the worst-case scenario increases to 0.2, the probability of the base-case scenario decreases to 0.5, and the probability of the best-case scenario remains at 0.3. What effect, if any, would these changes have on the decision recommendation

e. The consultant has suggested that an expenditure of $150,000 on a promotional campaign over the planning horizon will effectively reduce the probability of the worstcase scenario to zero. If the campaign can be expected to also increase the probability of the best-case scenario to 0.4, is it a good investment

for the area. But the mayor feels that if demand does not support such a center, the community will lose a large amount of money. To provide structure for the decision process, the council narrowed the building alternatives to three sizes: small, medium, andlarge. Everybody agreed that the critical factor in choosing the best size is the number of

people who will want to use the new facility. A regional planning consultant provided demand estimates under three scenarios: worst case, base case, and best case. The worst-case scenario corresponds to a situation in which tourism drops substantially; the base-case scenario corresponds to a situation in which Lake Placid continues to attract visitors at

current levels; and the best-case scenario corresponds to a substantial increase in tourism. The consultant has provided probability assessments of 0.10, 0.60, and 0.30 for the worstcase, base-case, and best-case scenarios, respectively.

The town council suggested using net cash flow over a 5-year planning horizon as the criterion for deciding on the best size. The following projections of net cash flow (in thousands of dollars) for a five-year planning horizon have been developed. All costs, including the consultant's fee, have been included.

a. What decision should Lake Placid make using the expected value approach

b. Construct risk profiles for the medium and large alternatives. given the mayor's concern over the possibility of losing money and the result of part a, which alternative would you recommend

c. Compute the expected value of perfect information. Do you think it would be worth trying to obtain additional information concerning which scenario is likely to occur

d. Suppose the probability of the worst-case scenario increases to 0.2, the probability of the base-case scenario decreases to 0.5, and the probability of the best-case scenario remains at 0.3. What effect, if any, would these changes have on the decision recommendation

e. The consultant has suggested that an expenditure of $150,000 on a promotional campaign over the planning horizon will effectively reduce the probability of the worstcase scenario to zero. If the campaign can be expected to also increase the probability of the best-case scenario to 0.4, is it a good investment

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

20

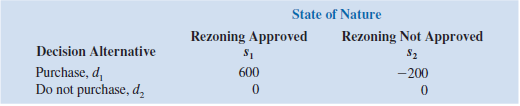

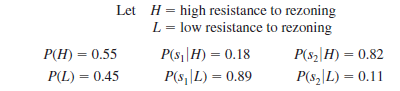

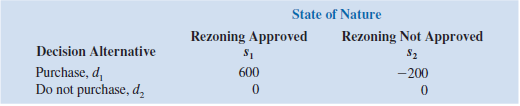

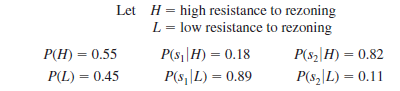

A real estate investor has the opportunity to purchase land currently zoned residential. If the county board approves a request to rezone the property as commercial within the next year, the investor will be able to lease the land to a large discount firm that wants to open a new store on the property. However, if the zoning change is not approved, the investor will have to sell the property at a loss. Profits (in thousands of dollars) are shown in the following payoff table:

a. If the probability that the rezoning will be approved is 0.5, what decision is recommended What is the expected profit

b. The investor can purchase an option to buy the land. Under the option, the investor maintains the rights to purchase the land anytime during the next three months while learning more about possible resistance to the rezoning proposal from area residents. Probabilities are as follows:

What is the optimal decision strategy if the investor uses the option period to learn more about the resistance from area residents before making the purchase decision

c. If the option will cost the investor an additional $10,000, should the investor purchase the option Why or why not What is the maximum that the investor should be willing to pay for the option

a. If the probability that the rezoning will be approved is 0.5, what decision is recommended What is the expected profit

b. The investor can purchase an option to buy the land. Under the option, the investor maintains the rights to purchase the land anytime during the next three months while learning more about possible resistance to the rezoning proposal from area residents. Probabilities are as follows:

What is the optimal decision strategy if the investor uses the option period to learn more about the resistance from area residents before making the purchase decision

c. If the option will cost the investor an additional $10,000, should the investor purchase the option Why or why not What is the maximum that the investor should be willing to pay for the option

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

21

Property purchase Strategy

Glenn Foreman, president of Oceanview Development Corporation, is considering submitting a bid to purchase property that will be sold by sealed bid auction at a county tax foreclosure. glenn's initial judgment is to submit a bid of $5 million. Based on his experience, glenn estimates that a bid of $5 million will have a 0.2 probability of being the highest

bid and securing the property for Oceanview. The current date is June 1. Sealed bids for the property must be submitted by August 15. The winning bid will be announced on September 1.

If Oceanview submits the highest bid and obtains the property, the firm plans to build and sell a complex of luxury condominiums. However, a complicating factor is that the property is currently zoned for single-family residences only. glenn believes that a referendum could be placed on the voting ballot in time for the November election. Passage

of the referendum would change the zoning of the property and permit construction of the condominiums.

The sealed-bid procedure requires the bid to be submitted with a certified check for 10 percent of the amount bid. If the bid is rejected, the deposit is refunded. If the bid is accepted, the deposit is the down payment for the property. However, if the bid is accepted and the bidder does not follow through with the purchase and meet the remainder of the

financial obligation within six months, the deposit will be forfeited. In this case, the county will offer the property to the next highest bidder.

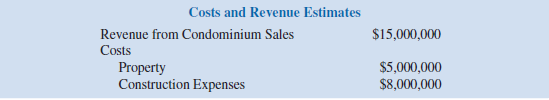

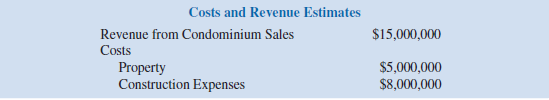

To determine whether Oceanview should submit the $5 million bid, glenn conducted some preliminary analysis. This preliminary work provided an assessment of 0.3 for the probability that the referendum for a zoning change will be approved and resulted in the following estimates of the costs and revenues that will be incurred if the condominiums

are built:

If Ocean view obtains the property and the zoning change is rejected in November, glenn believes that the best option would be for the firm not to complete the purchase of the property. In this case, Ocean view would forfeit the 10 percent deposit that accompanied the bid.

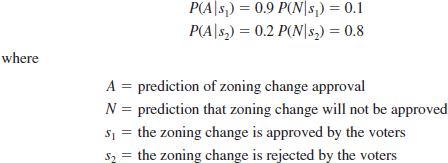

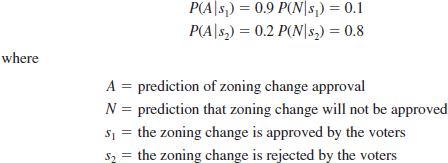

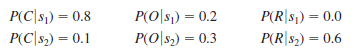

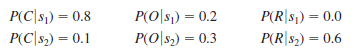

Because the likelihood that the zoning referendum will be approved is such an important factor in the decision process, glenn suggested that the firm hire a market research service to conduct a survey of voters. The survey would provide a better estimate of the likelihood that the referendum for a zoning change would be approved. The market research firm that Ocean view Development has worked with in the past has agreed to do the study for $15,000. The results of the study will be available August 1, so that Ocean view will have this information before the August 15 bid deadline. The results of the survey will be a prediction either that the zoning change will be approved or that the zoning change will be rejected. After considering the record of the market research service in previous studies conducted for Ocean view, glenn developed the following probability estimates concerning the accuracy of the market research information:

Managerial Report

Perform an analysis of the problem facing the Oceanview Development Corporation, and prepare a report that summarizes your findings and recommendations. Include the following items in your report:

1. A decision tree that shows the logical sequence of the decision problem

2. A recommendation regarding what Oceanview should do if the market research information is not available

3. A decision strategy that Oceanview should follow if the market research is conducted

4. A recommendation as to whether Oceanview should employ the market research firm, along with the value of the information provided by the market research firm

Include the details of your analysis as an appendix to your report.

Glenn Foreman, president of Oceanview Development Corporation, is considering submitting a bid to purchase property that will be sold by sealed bid auction at a county tax foreclosure. glenn's initial judgment is to submit a bid of $5 million. Based on his experience, glenn estimates that a bid of $5 million will have a 0.2 probability of being the highest

bid and securing the property for Oceanview. The current date is June 1. Sealed bids for the property must be submitted by August 15. The winning bid will be announced on September 1.

If Oceanview submits the highest bid and obtains the property, the firm plans to build and sell a complex of luxury condominiums. However, a complicating factor is that the property is currently zoned for single-family residences only. glenn believes that a referendum could be placed on the voting ballot in time for the November election. Passage

of the referendum would change the zoning of the property and permit construction of the condominiums.

The sealed-bid procedure requires the bid to be submitted with a certified check for 10 percent of the amount bid. If the bid is rejected, the deposit is refunded. If the bid is accepted, the deposit is the down payment for the property. However, if the bid is accepted and the bidder does not follow through with the purchase and meet the remainder of the

financial obligation within six months, the deposit will be forfeited. In this case, the county will offer the property to the next highest bidder.

To determine whether Oceanview should submit the $5 million bid, glenn conducted some preliminary analysis. This preliminary work provided an assessment of 0.3 for the probability that the referendum for a zoning change will be approved and resulted in the following estimates of the costs and revenues that will be incurred if the condominiums

are built:

If Ocean view obtains the property and the zoning change is rejected in November, glenn believes that the best option would be for the firm not to complete the purchase of the property. In this case, Ocean view would forfeit the 10 percent deposit that accompanied the bid.

Because the likelihood that the zoning referendum will be approved is such an important factor in the decision process, glenn suggested that the firm hire a market research service to conduct a survey of voters. The survey would provide a better estimate of the likelihood that the referendum for a zoning change would be approved. The market research firm that Ocean view Development has worked with in the past has agreed to do the study for $15,000. The results of the study will be available August 1, so that Ocean view will have this information before the August 15 bid deadline. The results of the survey will be a prediction either that the zoning change will be approved or that the zoning change will be rejected. After considering the record of the market research service in previous studies conducted for Ocean view, glenn developed the following probability estimates concerning the accuracy of the market research information:

Managerial Report

Perform an analysis of the problem facing the Oceanview Development Corporation, and prepare a report that summarizes your findings and recommendations. Include the following items in your report:

1. A decision tree that shows the logical sequence of the decision problem

2. A recommendation regarding what Oceanview should do if the market research information is not available

3. A decision strategy that Oceanview should follow if the market research is conducted

4. A recommendation as to whether Oceanview should employ the market research firm, along with the value of the information provided by the market research firm

Include the details of your analysis as an appendix to your report.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose that you are given a decision situation with three possible states of nature: s 1 , s 2 , and s 3. The prior probabilities are P ( s 1 ) = 0.2, P ( s 2 ) = 0.5, and P ( s 3 ) = 0.3. With sample information I , P ( I | s 1 ) = 0.1, P ( I | s 2 ) = 0.05, and P ( I = s 3 ) = 0.2. Compute the revised (or posterior) probabilities: P ( s 1 | I ), P ( s 2 | I ), and P ( s 3 | I ).

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

23

The following payoff table shows profit for a decision analysis problem with two decision alternatives and three states of nature:

a. Construct a decision tree for this problem.

b. If the decision maker knows nothing about the probabilities of the three states of nature, what is the recommended decision using the optimistic, conservative, and minimax regret approaches

a. Construct a decision tree for this problem.

b. If the decision maker knows nothing about the probabilities of the three states of nature, what is the recommended decision using the optimistic, conservative, and minimax regret approaches

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

24

To save on expenses, Rona and Jerry agreed to form a carpool for traveling to and from work. Rona prefers to use the somewhat longer but more consistent Queen City Avenue. Although Jerry prefers the quicker expressway, he agreed with Rona that they should take Queen City Avenue if the expressway has a traffic jam. The following payoff table provides the one-way time estimate in minutes for traveling to or from work: Based on their experience with traffic problems, Rona and Jerry agreed on a 0.15 probability that the expressway would be jammed.

In addition, they agreed that weather seemed to affect the traffic conditions on the expressway.

Let

The following conditional probabilities apply:

a. Use Bayes' theorem for probability revision to compute the probability of each weather condition and the conditional probability of the expressway being open, s 1, or jammed, s 2, given each weather condition.

b. Show the decision tree for this problem.

c. What is the optimal decision strategy, and what is the expected travel time

In addition, they agreed that weather seemed to affect the traffic conditions on the expressway.

Let

The following conditional probabilities apply:

a. Use Bayes' theorem for probability revision to compute the probability of each weather condition and the conditional probability of the expressway being open, s 1, or jammed, s 2, given each weather condition.

b. Show the decision tree for this problem.

c. What is the optimal decision strategy, and what is the expected travel time

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

25

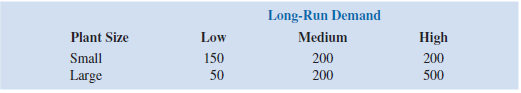

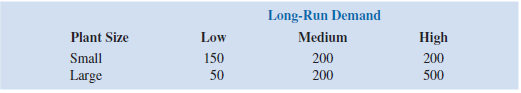

Southland Corporation's decision to produce a new line of recreational products resulted in the need to construct either a small plant or a large plant. The best selection of plant size depends on how the marketplace reacts to the new product line. To conduct an analysis, marketing management has decided to view the possible long-run demand as low, medium, or high. The following payoff table shows the projected profit in millions of dollars:

a. What is the decision to be made, and what is the chance event for Southland's problem

b. Construct a decision tree.

c. Recommend a decision based on the use of the optimistic, conservative, and minimax regret approaches.

a. What is the decision to be made, and what is the chance event for Southland's problem

b. Construct a decision tree.

c. Recommend a decision based on the use of the optimistic, conservative, and minimax regret approaches.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

26

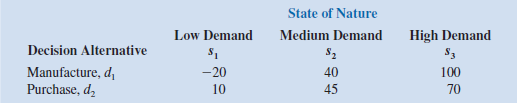

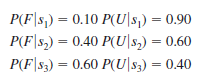

The Gorman Manufacturing Company must decide whether to manufacture a component part at its Milan, Michigan, plant or purchase the component part from a supplier. The resulting profit is dependent upon the demand for the product. The following payoff table shows the projected profit (in thousands of dollars):

The state-of-nature probabilities are P ( s 1 ) = 0.35, P ( s 2 ) = 0.35, and P ( s 3 ) = 0.30.

a. Use a decision tree to recommend a decision.

b. Use EVPI to determine whether gorman should attempt to obtain a better estimate of demand.

c. A test market study of the potential demand for the product is expected to report either a favorable ( F ) or unfavorable ( u ) condition. The relevant conditional probabilities are as follows:

What is the probability that the market research report will be favorable

d. What is gorman's optimal decision strategy

e. What is the expected value of the market research information

The state-of-nature probabilities are P ( s 1 ) = 0.35, P ( s 2 ) = 0.35, and P ( s 3 ) = 0.30.

a. Use a decision tree to recommend a decision.

b. Use EVPI to determine whether gorman should attempt to obtain a better estimate of demand.

c. A test market study of the potential demand for the product is expected to report either a favorable ( F ) or unfavorable ( u ) condition. The relevant conditional probabilities are as follows:

What is the probability that the market research report will be favorable

d. What is gorman's optimal decision strategy

e. What is the expected value of the market research information

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck