Deck 14: The Money Supply Process

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/28

Play

Full screen (f)

Deck 14: The Money Supply Process

1

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

"The money multiplier is necessarily greater than 1." Is this statement true, false, or uncertain? Explain your answer.

"The money multiplier is necessarily greater than 1." Is this statement true, false, or uncertain? Explain your answer.

It is given that the required reserve ratio is 10% and that banks do not hold any excess reserves. It is required to be answered whether the statement: "the money multiplier is necessarily greater than 1" is true, false, or certain.

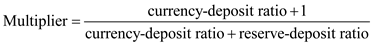

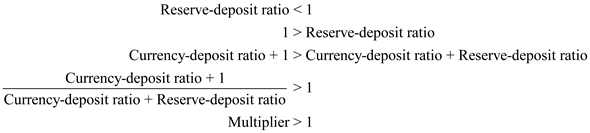

The formula for multiplier is as follows: It is given that banks do not hold any excess reserves, which means that the reserve-deposit ratio will equal required-reserve ratio. Therefore, reserve-deposit ratio is 10% (i.e. 0.10).

It is given that banks do not hold any excess reserves, which means that the reserve-deposit ratio will equal required-reserve ratio. Therefore, reserve-deposit ratio is 10% (i.e. 0.10).

The reserve-deposit ratio is 0.10, which is less that one. From this, the following can be deduced. Therefore, the given statement is true.

Therefore, the given statement is true.

The formula for multiplier is as follows:

It is given that banks do not hold any excess reserves, which means that the reserve-deposit ratio will equal required-reserve ratio. Therefore, reserve-deposit ratio is 10% (i.e. 0.10).

It is given that banks do not hold any excess reserves, which means that the reserve-deposit ratio will equal required-reserve ratio. Therefore, reserve-deposit ratio is 10% (i.e. 0.10).The reserve-deposit ratio is 0.10, which is less that one. From this, the following can be deduced.

Therefore, the given statement is true.

Therefore, the given statement is true. 2

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

What effect might a financial panic have on the money multiplier and the money supply? Why?

What effect might a financial panic have on the money multiplier and the money supply? Why?

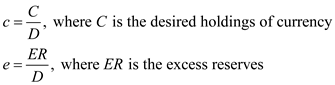

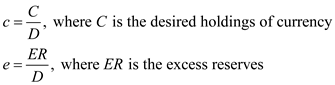

When there is a financial panic, the amount of deposits ( D ) decreases due to people's lack of confidence in the financial system and their decision to withdraw their funds from banks. Recall that the currency ratio ( c ) and excess reserves ratio ( e ) are calculated as follows:  A decrease in D would increase both c and e.

A decrease in D would increase both c and e.

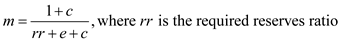

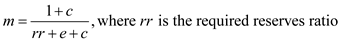

The money multiplier ( m ) indicates how much the money supply changes for a given change in the monetary base. It is calculated as: When e and c increase, m decreases because the denominator increases more than the numerator. Therefore,

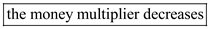

When e and c increase, m decreases because the denominator increases more than the numerator. Therefore,  .

.

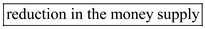

A financial panic can cause a substantial . Depositors shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. The money supply model predicts that when e and c increase, the money supply will contract because the rise in c results in a decline in the overall level of multiple deposit expansion. This leads to a smaller money multiplier and a decline in the money supply.

. Depositors shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. The money supply model predicts that when e and c increase, the money supply will contract because the rise in c results in a decline in the overall level of multiple deposit expansion. This leads to a smaller money multiplier and a decline in the money supply.

The rise in e reduces the amount of reserves available to support deposits, which also causes money supply to decrease.

A decrease in D would increase both c and e.

A decrease in D would increase both c and e.The money multiplier ( m ) indicates how much the money supply changes for a given change in the monetary base. It is calculated as:

When e and c increase, m decreases because the denominator increases more than the numerator. Therefore,

When e and c increase, m decreases because the denominator increases more than the numerator. Therefore,  .

.A financial panic can cause a substantial

. Depositors shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. The money supply model predicts that when e and c increase, the money supply will contract because the rise in c results in a decline in the overall level of multiple deposit expansion. This leads to a smaller money multiplier and a decline in the money supply.

. Depositors shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. The money supply model predicts that when e and c increase, the money supply will contract because the rise in c results in a decline in the overall level of multiple deposit expansion. This leads to a smaller money multiplier and a decline in the money supply.The rise in e reduces the amount of reserves available to support deposits, which also causes money supply to decrease.

3

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

During the Great Depression years from 1930-1933, both the currency ratio c and the excess reserves ratio e rose dramatically. What effect did these factors have on the money multiplier?

During the Great Depression years from 1930-1933, both the currency ratio c and the excess reserves ratio e rose dramatically. What effect did these factors have on the money multiplier?

The Great Depression years, 1930-1933, and currency ratio:

The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits.

[The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.]

Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose.

The Impact of the Rise of Currency Ratio on the Money Supply:

Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%.

By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply.

Why did money supply decrease due to a rise in the currency ratio

The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply.

But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply.

The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by:![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c6_f588_8df7_d94efc0297ba_SM3476_11.jpg) ...... (1)

...... (1)

Where,

m : money multiplier =![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c6_f589_8df7_97fc8ef0b212_SM3476_11.jpg) ......(2)

......(2)

c : currency ratio =![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c6_f58a_8df7_39b8b3ed6a68_SM3476_00.jpg) r : reserve ratio =

r : reserve ratio = ![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c6_f58b_8df7_9d78dc7e8a36_SM3476_00.jpg) e : excess reserves ratio =

e : excess reserves ratio = ![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c7_1c9c_8df7_8d760290553d_SM3476_00.jpg) M , Money Supply =

M , Money Supply = ![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c7_1c9d_8df7_5dbc6989fe72_SM3476_00.jpg) MB , Monetary Base =

MB , Monetary Base = ![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c7_1c9e_8df7_91b337ea4950_SM3476_00.jpg) ER : Excess reserves held by the banks.

ER : Excess reserves held by the banks.

D : Total checkable deposits

C : Currency in circulation

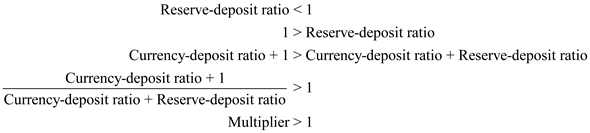

Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c7_1c9f_8df7_07b9b6c85967_SM3476_00.jpg)

The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits.

[The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.]

Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose.

The Impact of the Rise of Currency Ratio on the Money Supply:

Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%.

By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply.

Why did money supply decrease due to a rise in the currency ratio

The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply.

But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply.

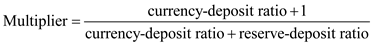

The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by:

![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c6_f588_8df7_d94efc0297ba_SM3476_11.jpg) ...... (1)

...... (1) Where,

m : money multiplier =

![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c6_f589_8df7_97fc8ef0b212_SM3476_11.jpg) ......(2)

......(2) c : currency ratio =

![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c6_f58a_8df7_39b8b3ed6a68_SM3476_00.jpg) r : reserve ratio =

r : reserve ratio = ![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c6_f58b_8df7_9d78dc7e8a36_SM3476_00.jpg) e : excess reserves ratio =

e : excess reserves ratio = ![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c7_1c9c_8df7_8d760290553d_SM3476_00.jpg) M , Money Supply =

M , Money Supply = ![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c7_1c9d_8df7_5dbc6989fe72_SM3476_00.jpg) MB , Monetary Base =

MB , Monetary Base = ![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c7_1c9e_8df7_91b337ea4950_SM3476_00.jpg) ER : Excess reserves held by the banks.

ER : Excess reserves held by the banks.D : Total checkable deposits

C : Currency in circulation

Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.

![The Great Depression years, 1930-1933, and currency ratio: The 1930s were a period of great economic uncertainty, during which there were many bank failures, wherein banks were unable to meet the demands of their depositors for cash. Further, because there was no deposit insurance at that time, so when a bank failed, depositors would only receive partial repayment of their deposits. [The first bank panic came around October 1930 to January 1931, during which, among others, there were 256 banks failures involving $180 million of deposits in November 1930, 532 failures involving $370 million of deposits in December and the most dramatic being the failure of the Bank of United States with over $200 million in deposits on 11 th December 1930.] Therefore, when banks were failing during bank panics, depositors knew that they would be likely to suffer substantial losses on deposits and thus the expected return on deposits would be negative. The theory of asset demand predicts that with the onset of the bank crisis, depositors would shift their holdings from checkable deposits to currency by withdrawing currency from their bank accounts. This prediction was borne out in reality and consequently, the currency ratio, c , rose. The Impact of the Rise of Currency Ratio on the Money Supply: Banking crises continued to occur from 1931 to 1933: Money stock fell rapidly in 1931 and 1932 and continued through April 1933. At the same time, the composition of the money stock changed. In March 1931, the currency ratio wAS₁8.5%; two years later it was 40.7%. By the end of the crises, the money supply had declined over 25% - by far the largest decline in the entire American history. Even more remarkable is that this decline continued despite a 20% rise in the monetary base - which illustrates how important the changes in the currency ratio can be in the determination of money supply. Why did money supply decrease due to a rise in the currency ratio The fall in the money supply was in part the result of large-scale bank failures. Banks failed because they did not have the reserves with which to meet the customers' cash withdrawals, and in failing they destroyed deposits and hence reduced the money supply. But the failures went further in reducing the money supply, because they led to a loss of confidence on the part of the depositors and hence to an even higher currency ratio. The rise in the currency ratio (and also the excess reserves ratio) reduced the money multiplier and hence sharply contracted the money supply. The relation between money supply ( M ), the money multiplier and the monetary base ( MB ) is given by: ...... (1) Where, m : money multiplier = ......(2) c : currency ratio = r : reserve ratio = e : excess reserves ratio = M , Money Supply = MB , Monetary Base = ER : Excess reserves held by the banks. D : Total checkable deposits C : Currency in circulation Keeping everything else constant, money supply, M , is negatively related to currency holdings and hence the currency reserve ratio. This is because, when c increases, more checkable deposits are converted into currency holdings and there is a switch from a component of money supply that undergoes multiple expansions to one that does not. Thus, the overall level of multiple expansion declines and the money supply falls.](https://d2lvgg3v3hfg70.cloudfront.net/SM3476/11eba290_28c7_1c9f_8df7_07b9b6c85967_SM3476_00.jpg)

4

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

Classify each of these transactions as an asset, a liability, or neither for each of the "players" in the money supply process-the Federal Reserve, banks, and depositors.

a. You get a $10,000 loan from the bank to buy an automobile.

b. You deposit $400 into your checking account at the local bank.

c. The Fed provides an emergency loan to a bank for $1,000,000.

d. A bank borrows $500,000 in overnight loans from another bank.

e. You use your debit card to purchase a meal at a restaurant for $100.

Classify each of these transactions as an asset, a liability, or neither for each of the "players" in the money supply process-the Federal Reserve, banks, and depositors.

a. You get a $10,000 loan from the bank to buy an automobile.

b. You deposit $400 into your checking account at the local bank.

c. The Fed provides an emergency loan to a bank for $1,000,000.

d. A bank borrows $500,000 in overnight loans from another bank.

e. You use your debit card to purchase a meal at a restaurant for $100.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

5

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

In October 2008, the Federal Reserve began paying interest on the amount of excess reserves held by banks. How, if at all, might this affect the multiplier process and the money supply?

In October 2008, the Federal Reserve began paying interest on the amount of excess reserves held by banks. How, if at all, might this affect the multiplier process and the money supply?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

6

Go to http://www.federalreserve.gov/boarddocs/hh/ and find the most recent annual report of the Federal Reserve. Read the first section of the annual report, which summarizes Monetary Policy and the Economic Outlook. Write a one-page summary of this section of the report.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

7

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

The money multiplier declined significantly during the period 1930-1933 and also during the recent financial crisis of 2008-2010. Yet the M1 money supply decreased by 25% in the Depression period but increased by more than 20% during the recent financial crisis. What explains the difference in outcomes?

The money multiplier declined significantly during the period 1930-1933 and also during the recent financial crisis of 2008-2010. Yet the M1 money supply decreased by 25% in the Depression period but increased by more than 20% during the recent financial crisis. What explains the difference in outcomes?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

8

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

The First National Bank receives an extra $100 of reserves but decides not to lend out any of these reserves. How much deposit creation takes place for the entire banking system?

The First National Bank receives an extra $100 of reserves but decides not to lend out any of these reserves. How much deposit creation takes place for the entire banking system?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

9

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

If the Fed sells $2 million of bonds to the First National Bank, what happens to reserves and the monetary base? Use T-accounts to explain your answer.

If the Fed sells $2 million of bonds to the First National Bank, what happens to reserves and the monetary base? Use T-accounts to explain your answer.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

10

Go to http://www.federalreserve.gov/releases/h6/hist/ and find the historical report of M1 and M2. Compute the growth rate of each aggregate over each of the past three years (it will be easier to do this if you move the data into Excel, as demonstrated in Chapter 1). Does it appear that the Fed has been increasing or decreasing the rate of growth of the money supply? Is this consistent with your understanding of the needs of the economy? Why?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

11

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

If the Fed sells $2 million of bonds to Irving the Investor, who pays for the bonds with a briefcase filled with currency, what happens to reserves and the monetary base? Use T-accounts to explain your answer.

If the Fed sells $2 million of bonds to Irving the Investor, who pays for the bonds with a briefcase filled with currency, what happens to reserves and the monetary base? Use T-accounts to explain your answer.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

12

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

Suppose the Fed buys $1 million of bonds from the First National Bank. If the First National Bank and all other banks use the resulting increase in reserves to purchase securities only and not to make loans, what will happen to checkable deposits?

Suppose the Fed buys $1 million of bonds from the First National Bank. If the First National Bank and all other banks use the resulting increase in reserves to purchase securities only and not to make loans, what will happen to checkable deposits?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

13

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

If the Fed lends five banks a total of $100 million but depositors withdraw $50 million and hold it as currency, what happens to reserves and the monetary base? Use T-accounts to explain your answer.

If the Fed lends five banks a total of $100 million but depositors withdraw $50 million and hold it as currency, what happens to reserves and the monetary base? Use T-accounts to explain your answer.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

14

An important aspect of the supply of money is reserve balances. Go to http://www.federalreserve.gov/Releases/h41/ and locate the most recent release. This site reports changes in factors that affect depository reserve balances.

a. What is the current reserve balance?

b. What is the change in reserve balances since a year ago?

c. Based on your results in parts (a) and (b), does it appear that the money supply should be increasing or decreasing?

a. What is the current reserve balance?

b. What is the change in reserve balances since a year ago?

c. Based on your results in parts (a) and (b), does it appear that the money supply should be increasing or decreasing?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

15

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

Using T-accounts, show what happens to checkable deposits in the banking system when the Fed lends $1 million to the First National Bank.

Using T-accounts, show what happens to checkable deposits in the banking system when the Fed lends $1 million to the First National Bank.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

16

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

If a bank depositor withdraws $1,000 of currency from an account, what happens to reserves, checkable deposits, and the monetary base?

If a bank depositor withdraws $1,000 of currency from an account, what happens to reserves, checkable deposits, and the monetary base?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

17

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

Using T-accounts, show what happens to checkable deposits in the banking system when the Fed sells $2 million of bonds to the First National Bank.

Using T-accounts, show what happens to checkable deposits in the banking system when the Fed sells $2 million of bonds to the First National Bank.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

18

Unless otherwise noted, the following assumptions are made in all questions: The required reserve ratio on checkable deposits is 10%, banks do not hold any excess reserves, and the public's holdings of currency do not change.

If a bank sells $10 million of bonds to the Fed to pay back $10 million on the loan it owes, what is the effect on the level of checkable deposits?

If a bank sells $10 million of bonds to the Fed to pay back $10 million on the loan it owes, what is the effect on the level of checkable deposits?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck