Deck 8: Investor Choice: Risk and Reward

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 8: Investor Choice: Risk and Reward

1

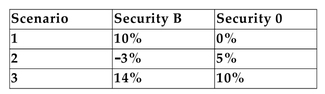

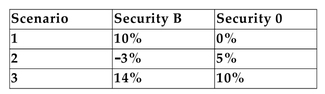

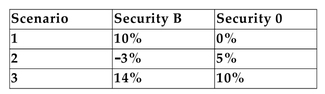

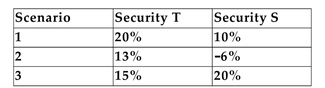

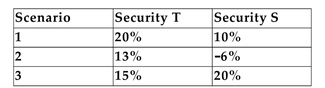

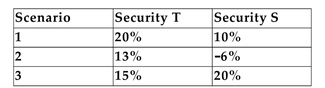

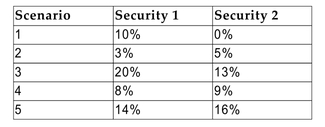

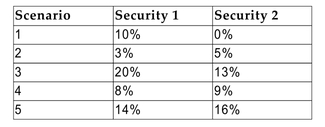

The following returns have been estimated for Security B and Security 0:  Each scenario is equally likely to occur, and you plan to invest 40% of your funds in Security B and 60% in Security O.

Each scenario is equally likely to occur, and you plan to invest 40% of your funds in Security B and 60% in Security O.

Refer to the information above. What is the standard deviation of the rate of return of your portfolio? Round your answer to the nearest tenth of a percent.

A)17.6%

B)4.2%

C)52.9%

D)0.0%

Each scenario is equally likely to occur, and you plan to invest 40% of your funds in Security B and 60% in Security O.

Each scenario is equally likely to occur, and you plan to invest 40% of your funds in Security B and 60% in Security O.Refer to the information above. What is the standard deviation of the rate of return of your portfolio? Round your answer to the nearest tenth of a percent.

A)17.6%

B)4.2%

C)52.9%

D)0.0%

4.2%

2

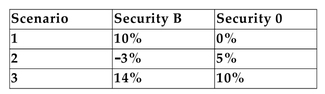

The following returns have been estimated for Security B and Security 0:  Each scenario is equally likely to occur, and you plan to invest 40% of your funds in Security B and 60% in Security O.

Each scenario is equally likely to occur, and you plan to invest 40% of your funds in Security B and 60% in Security O.

Refer to the information above. What is the expected return on your portfolio? Round your answer to the nearest tenth of a percent.

A)6.6%

B)6.0%

C)3.4%

D)5.8%

Each scenario is equally likely to occur, and you plan to invest 40% of your funds in Security B and 60% in Security O.

Each scenario is equally likely to occur, and you plan to invest 40% of your funds in Security B and 60% in Security O.Refer to the information above. What is the expected return on your portfolio? Round your answer to the nearest tenth of a percent.

A)6.6%

B)6.0%

C)3.4%

D)5.8%

5.8%

3

The investment portfolio of a large insurance company has the following three equally likely outcomes: 6%, 18%, and 33%. Calculate the expected return and the standard deviation of the

Rate of return for this portfolio. Round your answers to the nearest tenth of a percent.

A)

B)

C)

D)

Rate of return for this portfolio. Round your answers to the nearest tenth of a percent.

A)

B)

C)

D)

4

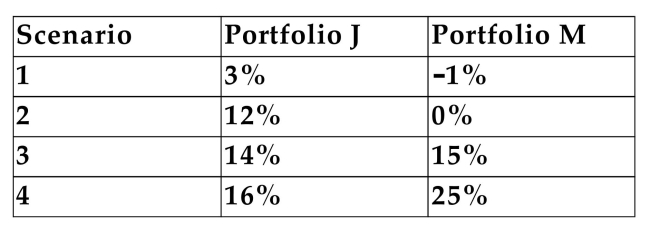

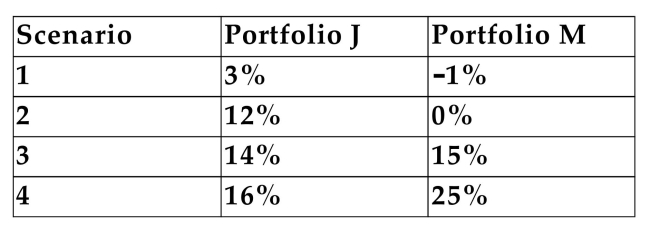

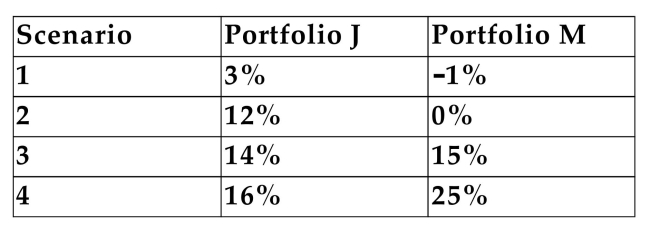

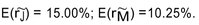

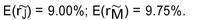

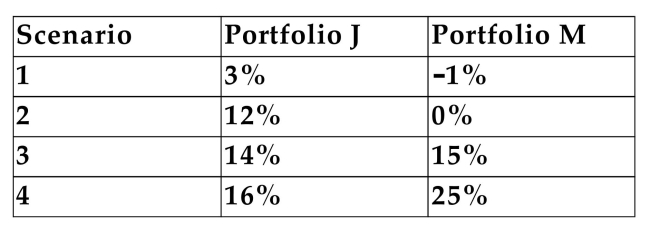

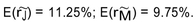

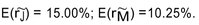

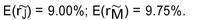

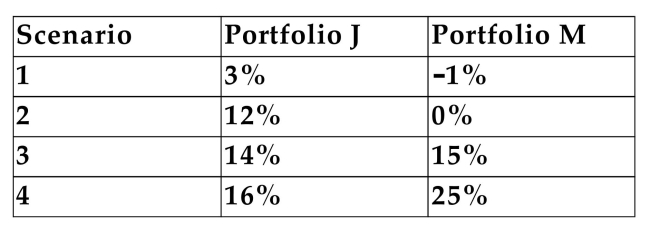

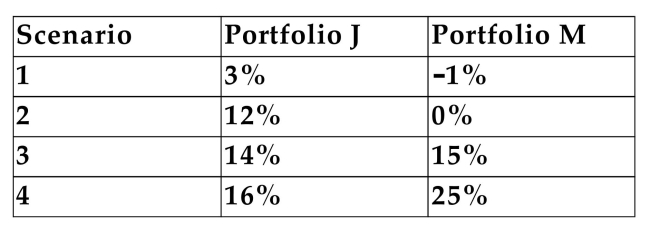

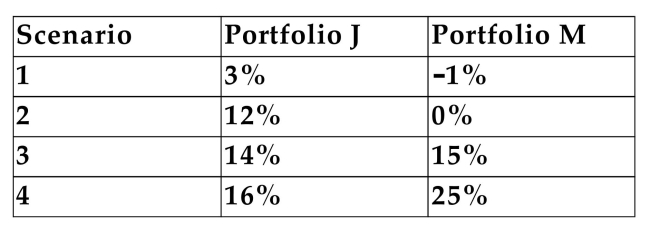

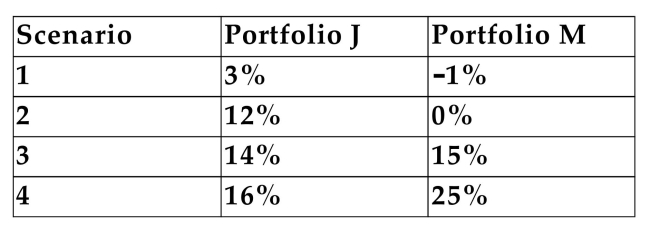

The following equally likely outcomes have been estimated for the returns on Portfolio J and Portfolio M:

Refer to the information above. Calculate the variances of the rate of return for the two portfolios. Round your answer to the nearest tenth of a percent.

A)

B)

C)

D)

Refer to the information above. Calculate the variances of the rate of return for the two portfolios. Round your answer to the nearest tenth of a percent.

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

Portfolio R offers an expected return of 12% with a standard deviation of 20%. Portfolio S has an expected return of 8% with a standard deviation of 10%. The correlation of the portfolios' returns is 0.5.

Refer to the information above. What is the expected return of a new portfolio that is

60% invested in Portfolio R and 40% in Portfolio S?

Refer to the information above. What is the expected return of a new portfolio that is

60% invested in Portfolio R and 40% in Portfolio S?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

A mutual fund has five equally likely outcomes: -5%, 8%, 12%, 15%, and 20%. Calculate the standard deviation of the rate of return. Round your answer to the nearest tenth of a percent.

A)18.9%

B)9.5%

C)0.0%

D)8.5%

A)18.9%

B)9.5%

C)0.0%

D)8.5%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is true?

A)Diversification serves to both increase your expected return and lower your risk.

B)By diversifying, you can have the same expected return with less risk exposure.

C)In a diversified portfolio, all the assets' returns are perfectly positively correlated.

D)Diversification reduces both your expected return and your risk.

A)Diversification serves to both increase your expected return and lower your risk.

B)By diversifying, you can have the same expected return with less risk exposure.

C)In a diversified portfolio, all the assets' returns are perfectly positively correlated.

D)Diversification reduces both your expected return and your risk.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

How does the correlation of the individual securities' returns affect the expected return

on a portfolio of securities?

on a portfolio of securities?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is not a determinant of the risk of a portfolio?

A)the amount of money invested in each asset in the portfolio

B)the expected returns on the individual assets in the portfolio

C)the number of assets in the portfolio

D)the degree to which the returns of the assets in the portfolio move together

A)the amount of money invested in each asset in the portfolio

B)the expected returns on the individual assets in the portfolio

C)the number of assets in the portfolio

D)the degree to which the returns of the assets in the portfolio move together

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

An investor invests $4,000 to buy 200 shares of Sand Corporation, which has an expected return of 24%; $2,000 to buy 100 shares of Water Corporation, with an expected return of 18%;

And $4,000 to buy 400 shares in Beach Corporation, with an expected return of 28%. What is

The expected return on this portfolio?

A)24.4%

B)17.8%

C)25.4%

D)23.3%

And $4,000 to buy 400 shares in Beach Corporation, with an expected return of 28%. What is

The expected return on this portfolio?

A)24.4%

B)17.8%

C)25.4%

D)23.3%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

An investor decides to split his money equally among four securities with the following expected returns: 10%, 15%, 23%, and 26%. The expected return on his portfolio is

A)18.5%.

B)15.2%.

C)14.8%.

D)This cannot be determined without knowing the weights invested in each security.

A)18.5%.

B)15.2%.

C)14.8%.

D)This cannot be determined without knowing the weights invested in each security.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

The following equally likely outcomes have been estimated for the returns on Portfolio J and Portfolio M:

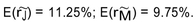

Refer to the information above. Calculate the expected returns for the two portfolios. Round your answer to the nearest hundredth of a percent.

A)

B)

C)

D)none of the above

Refer to the information above. Calculate the expected returns for the two portfolios. Round your answer to the nearest hundredth of a percent.

A)

B)

C)

D)none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

A mutual fund has five equally likely outcomes: -5%, 8%, 12%, 15%, and 20%. Calculate the expected return.

A)10.0%

B)12.5%

C)12.0%

D)15.0%

A)10.0%

B)12.5%

C)12.0%

D)15.0%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

The following equally likely outcomes have been estimated for the returns on Portfolio J and Portfolio M:

Refer to the information above. Calculate the standard deviations of the rate of return for the two portfolios. Round your answer to the nearest tenth of a percent.

A)

B)

C)

D)

Refer to the information above. Calculate the standard deviations of the rate of return for the two portfolios. Round your answer to the nearest tenth of a percent.

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

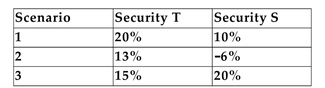

The following returns have been estimated for Security T and Security S:  Each scenario is equally likely to occur, and you plan to invest 70% in Security T and 30% in Security S.

Each scenario is equally likely to occur, and you plan to invest 70% in Security T and 30% in Security S.

Refer to the information above. What is the standard deviation of the rate of return of the portfolio? Round your answer to the nearest tenth of a percent.

A)0.0%

B)19.9%

C)4.5%

D)59.7%

Each scenario is equally likely to occur, and you plan to invest 70% in Security T and 30% in Security S.

Each scenario is equally likely to occur, and you plan to invest 70% in Security T and 30% in Security S.Refer to the information above. What is the standard deviation of the rate of return of the portfolio? Round your answer to the nearest tenth of a percent.

A)0.0%

B)19.9%

C)4.5%

D)59.7%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

The following equally likely outcomes have been estimated for the returns on Portfolio J and Portfolio M:

Refer to the information above. Which of the two portfolios is riskier?

A)Portfolio M since it has the possibility of a negative return

B)Portfolio M since its returns are more widely dispersed around the expected return

C)Portfolio J since it has the higher expected return

D)Both portfolios are equally risky since the possible returns of each are equally likely to occur.

Refer to the information above. Which of the two portfolios is riskier?

A)Portfolio M since it has the possibility of a negative return

B)Portfolio M since its returns are more widely dispersed around the expected return

C)Portfolio J since it has the higher expected return

D)Both portfolios are equally risky since the possible returns of each are equally likely to occur.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

The following returns have been estimated for Security T and Security S:  Each scenario is equally likely to occur, and you plan to invest 70% in Security T and 30% in Security S.

Each scenario is equally likely to occur, and you plan to invest 70% in Security T and 30% in Security S.

Refer to the information above. What is the expected return of the portfolio? Round your answer to the nearest tenth of a percent.

A)14.0%

B)11.7%

C)12.0%

D)13.6%

Each scenario is equally likely to occur, and you plan to invest 70% in Security T and 30% in Security S.

Each scenario is equally likely to occur, and you plan to invest 70% in Security T and 30% in Security S.Refer to the information above. What is the expected return of the portfolio? Round your answer to the nearest tenth of a percent.

A)14.0%

B)11.7%

C)12.0%

D)13.6%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is (are)a measure(s)of portfolio reward?

A)expected return

B)standard deviation

C)beta

D)both A and B

A)expected return

B)standard deviation

C)beta

D)both A and B

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

The following equally likely outcomes have been estimated for the returns on Security

K: Calculate the expected return and the standard deviation of the rate of return for

Calculate the expected return and the standard deviation of the rate of return for

Security K.

K:

Calculate the expected return and the standard deviation of the rate of return for

Calculate the expected return and the standard deviation of the rate of return forSecurity K.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

A mutual fund has five equally likely outcomes: -5%, 8%, 12%, 15%, and 20%. Calculate the variance of the rate of return. Round your answer to the nearest tenth of a percent.

A)89.5%%

B)71.6%%

C)358.0%%

D)0.0%%

A)89.5%%

B)71.6%%

C)358.0%%

D)0.0%%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

When computing a market beta using historical returns, the preferred returns to use are

A)quarterly returns.

B)monthly returns.

C)daily returns.

D)annual returns.

A)quarterly returns.

B)monthly returns.

C)daily returns.

D)annual returns.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

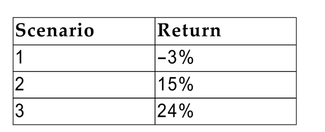

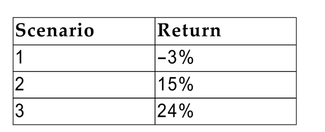

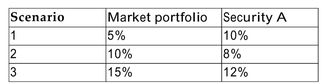

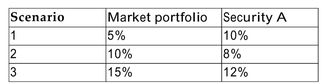

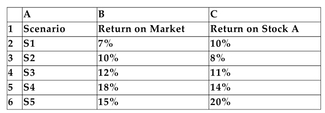

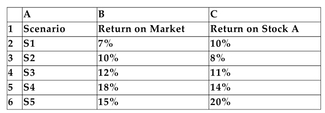

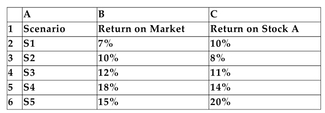

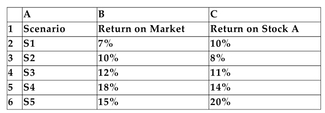

The following information has been estimated for the returns on the market portfolio

and the returns on Security A: The three scenarios are considered equally likely to occur. Calculate the market beta of

The three scenarios are considered equally likely to occur. Calculate the market beta of

Security A.

and the returns on Security A:

The three scenarios are considered equally likely to occur. Calculate the market beta of

The three scenarios are considered equally likely to occur. Calculate the market beta ofSecurity A.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

Portfolio R offers an expected return of 12% with a standard deviation of 20%. Portfolio S has an expected return of 8% with a standard deviation of 10%. The correlation of the portfolios' returns is 0.5.

Refer to the information above. Mr. Reliable says that it is obvious that everyone

should want to invest only in Portfolio R since it offers a higher rate of return than

investing in any combination of Portfolio R and Portfolio S. Respond to Mr. Reliable.

Refer to the information above. Mr. Reliable says that it is obvious that everyone

should want to invest only in Portfolio R since it offers a higher rate of return than

investing in any combination of Portfolio R and Portfolio S. Respond to Mr. Reliable.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

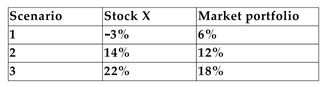

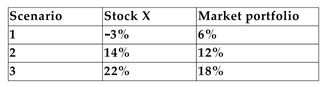

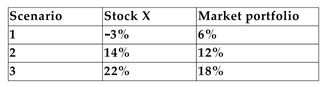

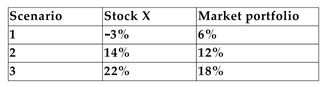

The possible outcomes for the returns on Stock X and the returns on the market portfolio have been estimated as follows:  Each scenario is considered to be equally likely to occur.

Each scenario is considered to be equally likely to occur.

Refer to the information above. Calculate the covariance of the returns of Stock X and the market portfolio.

A)12.2%%

B)150.0%%

C)61.7%%

D)50.0%%

Each scenario is considered to be equally likely to occur.

Each scenario is considered to be equally likely to occur.Refer to the information above. Calculate the covariance of the returns of Stock X and the market portfolio.

A)12.2%%

B)150.0%%

C)61.7%%

D)50.0%%

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

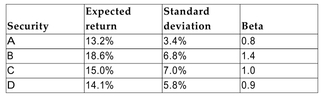

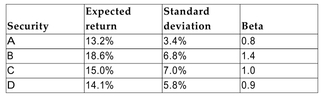

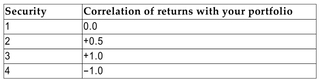

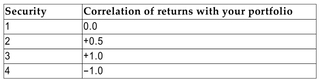

Assume investors hold the market portfolio. Rank the following four securities based on their relative risk contributions to the market portfolio, with the one that will contribute the least

Risk first.

A)C, B, A, D

B)A, D, B, C

C)D, A, B, C

D)A, D, C, B

Risk first.

A)C, B, A, D

B)A, D, B, C

C)D, A, B, C

D)A, D, C, B

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

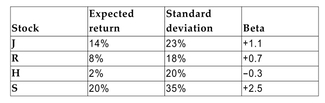

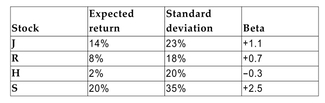

Assume you hold the market portfolio. Which of the following stocks would provide you with the greatest diversification benefit?

A)Stock R

B)Stock J

C)Stock H

D)Stock S

A)Stock R

B)Stock J

C)Stock H

D)Stock S

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

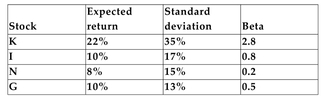

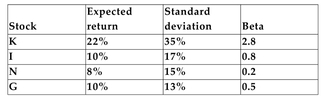

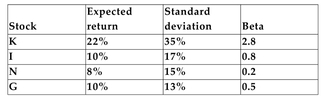

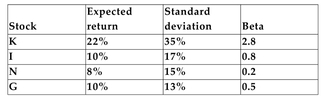

You have analyzed four stocks and obtained the following results:

Refer to the information above. A risk-averse investor, who will be invested in only a single stock, would choose to invest in Stock

A)N

B)I

C)G

D)K

Refer to the information above. A risk-averse investor, who will be invested in only a single stock, would choose to invest in Stock

A)N

B)I

C)G

D)K

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

You have analyzed four stocks and obtained the following results:

Refer to the information above. A risk-averse investor, who will be adding the stock to his already well-diversified portfolio, would choose to invest in Stock

A)K

B)N

C)G

D)I

Refer to the information above. A risk-averse investor, who will be adding the stock to his already well-diversified portfolio, would choose to invest in Stock

A)K

B)N

C)G

D)I

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

The possible outcomes for the returns on Stock X and the returns on the market portfolio have been estimated as follows:  Each scenario is considered to be equally likely to occur.

Each scenario is considered to be equally likely to occur.

Refer to the information above. Calculate the market beta for Stock X. Round your answer to the nearest tenth.

A)0.7

B)1.0

C)2.1

D)none of the above

Each scenario is considered to be equally likely to occur.

Each scenario is considered to be equally likely to occur.Refer to the information above. Calculate the market beta for Stock X. Round your answer to the nearest tenth.

A)0.7

B)1.0

C)2.1

D)none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

The stock of the Goldy Corporation has a beta of -0.25. If the expected return on the market decreases by 4%, then the expected return on Goldy should

A)decrease by 1%.

B)increase by 1%.

C)decrease by 1.6%.

D)increase by 1.6%.

A)decrease by 1%.

B)increase by 1%.

C)decrease by 1.6%.

D)increase by 1.6%.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

When the historical returns of an asset are plotted against the historical returns on the market portfolio and the line has a slope of zero, then

A)the returns on the asset are infinite relative to the market portfolio.

B)the returns on the asset tend to move in an opposite direction from the market portfolio.

C)the returns on the asset are independent of the returns on the market portfolio.

D)the returns on the asset tend to move in the same direction as the market portfolio.

A)the returns on the asset are infinite relative to the market portfolio.

B)the returns on the asset tend to move in an opposite direction from the market portfolio.

C)the returns on the asset are independent of the returns on the market portfolio.

D)the returns on the asset tend to move in the same direction as the market portfolio.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

The stock of Static Corporation has a beta of 0.7. If the expected return on the market increases by 6%, the expected return on Static Corporation should increase by

A)5.3%.

B)8.6%.

C)4.2%.

D)none of the above

A)5.3%.

B)8.6%.

C)4.2%.

D)none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

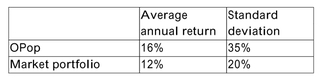

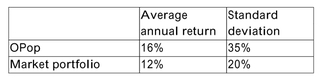

The following information has been collected for the returns of the OPop Corporation and the market portfolio:  The covariance of the returns is 567%%. Calculate OPop's market beta.

The covariance of the returns is 567%%. Calculate OPop's market beta.

A)0.5

B)1.4

C)2.2

D)3.9

The covariance of the returns is 567%%. Calculate OPop's market beta.

The covariance of the returns is 567%%. Calculate OPop's market beta.A)0.5

B)1.4

C)2.2

D)3.9

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

A security with a beta of 1.0 should offer a return

A)between the return on the market portfolio and the risk-free interest rate.

B)equal to the return on the market portfolio.

C)equal to the risk-free interest rate.

D)greater than the return on the market portfolio.

A)between the return on the market portfolio and the risk-free interest rate.

B)equal to the return on the market portfolio.

C)equal to the risk-free interest rate.

D)greater than the return on the market portfolio.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

The average annual return of Bram Corporation is 21%, with a standard deviation of 12.0%. The average annual return of the market portfolio is 12.5%, with a standard deviation of 4%.

The covariance of the returns is 28.8%%. What is Bram's market beta?

A)0.1

B)0.6

C)1.7

D)1.8

The covariance of the returns is 28.8%%. What is Bram's market beta?

A)0.1

B)0.6

C)1.7

D)1.8

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

A project returns 18% when the market returns 15% and 8% when the market returns 10%. Calculate the project's market beta.

A)0.7

B)0.5

C)1.5

D)2.0

A)0.7

B)0.5

C)1.5

D)2.0

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

When computing a market beta using historical returns, how many years of data are commonly used?

A)20-30 years

B)3-5 years

C)1-3 years

D)5-10 years

A)20-30 years

B)3-5 years

C)1-3 years

D)5-10 years

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following securities will provide the greatest diversification benefit for your portfolio?

A)Security 4

B)Security 2

C)Security 3

D)Security 1

A)Security 4

B)Security 2

C)Security 3

D)Security 1

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

A portfolio manager boasted that his portfolio earned a return of 28% while the general

market returned only 10% over that same period. He claims superior analytical

abilities and is requesting a raise from you, his supervisor. How should you respond?

market returned only 10% over that same period. He claims superior analytical

abilities and is requesting a raise from you, his supervisor. How should you respond?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

A project returns 15% when the market returns 10% and 8% when the market returns 15%. Calculate the project's market beta.

A)-1.4

B)-0.7

C)+0.7

D)0.0

A)-1.4

B)-0.7

C)+0.7

D)0.0

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

You have entered the following information on a spreadsheet:

Refer to the information above. Which of the following commands would you use to calculate the variance of the market returns?

A)=covar(b2:b6)

B)=varm(b2:b6)

C)=varp(b2:b6)

D)=var(b2:b6)

Refer to the information above. Which of the following commands would you use to calculate the variance of the market returns?

A)=covar(b2:b6)

B)=varm(b2:b6)

C)=varp(b2:b6)

D)=var(b2:b6)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

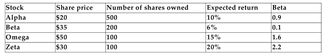

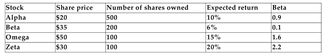

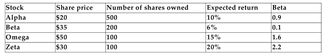

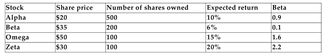

You have invested in a portfolio of four stocks:

Refer to the information above. Calculate the beta of the portfolio.

A)0.944

B)0.972

C)1.200

D)This cannot be calculated without having any data about the returns of the market portfolio.

Refer to the information above. Calculate the beta of the portfolio.

A)0.944

B)0.972

C)1.200

D)This cannot be calculated without having any data about the returns of the market portfolio.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

The capital market line depicts the relationship between

A)expected returns on a stock and expected returns on the market portfolio.

B)expected returns and the standard deviation of returns.

C)expected returns and betas.

D)none of the above

A)expected returns on a stock and expected returns on the market portfolio.

B)expected returns and the standard deviation of returns.

C)expected returns and betas.

D)none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

You have entered the following information on a spreadsheet:

Refer to the information above. Which of the following commands would you use to calculate the market beta of Stock A?

A)=intercept(b2:b6,c2:c6)

B)=covar(b2:b6,c2:c6)

C)=correlation(b2:b6,c2:c6)

D)=slope(b2:b6,c2:c6)

Refer to the information above. Which of the following commands would you use to calculate the market beta of Stock A?

A)=intercept(b2:b6,c2:c6)

B)=covar(b2:b6,c2:c6)

C)=correlation(b2:b6,c2:c6)

D)=slope(b2:b6,c2:c6)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

Your $500 million dollar firm is financed with $200 million debt and $300 million

equity. The beta of the debt is 0.2 and the equity beta is 1.0. If the firm retired all of its

debt and became 100% equity financed, what would the new equity beta be?

equity. The beta of the debt is 0.2 and the equity beta is 1.0. If the firm retired all of its

debt and became 100% equity financed, what would the new equity beta be?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

Your firm uses 30% debt financing and 70% equity financing. The beta of the debt is 0.1 and the beta of the equity is 1.4. What is your firm's asset beta?

A)1.01

B)1.30

C)0.49

D)none of the above

A)1.01

B)1.30

C)0.49

D)none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

What does the two-fund separation theorem state?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

If a firm is 100% equity-financed, then

A)the asset beta will be greater than it would have if the firm had used debt financing.

B)the asset beta will be greater than the market beta of the equity.

C)the asset beta will be less than the market beta of the equity.

D)the asset beta will equal the market beta of the equity.

A)the asset beta will be greater than it would have if the firm had used debt financing.

B)the asset beta will be greater than the market beta of the equity.

C)the asset beta will be less than the market beta of the equity.

D)the asset beta will equal the market beta of the equity.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

The expected return on the market portfolio is 15%, with a standard deviation of 17%. The risk-free rate of return is 6%. You want to design a portfolio with an expected return of 12%.

Calculate the weights that must be invested in the market portfolio and in the risk-free asset in

Order to accomplish this.

A)

B)

C)

D)

Calculate the weights that must be invested in the market portfolio and in the risk-free asset in

Order to accomplish this.

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

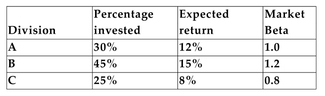

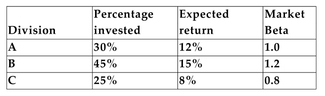

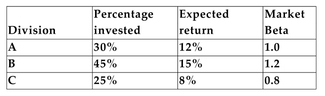

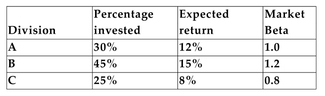

The Canton Corporation consists of three divisions:

Refer to the information above. Calculate the expected return of the Canton Corporation.

A)36.40%

B)11.67%

C)12.35%

D)none of the above

Refer to the information above. Calculate the expected return of the Canton Corporation.

A)36.40%

B)11.67%

C)12.35%

D)none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

You have divided your money equally between two stocks. Both have expected returns of 12%, standard deviations of 18%, and betas of 1.1. Assume the returns of the two stocks are

Not perfectly positively correlated. Which of the following statements is (are)necessarily true?

A)The beta of your portfolio is less than 1.1.

B)The expected return on your portfolio is 12%.

C)The standard deviation of the portfolio returns is 18%.

D)Both A and B are true statements.

Not perfectly positively correlated. Which of the following statements is (are)necessarily true?

A)The beta of your portfolio is less than 1.1.

B)The expected return on your portfolio is 12%.

C)The standard deviation of the portfolio returns is 18%.

D)Both A and B are true statements.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

You have invested in a portfolio of four stocks:

Refer to the information above. Calculate the expected return of the portfolio. Round your answer to the nearest hundredth of a percent.

A)11.08%

B)12.75%

C)10.78%

D)none of the above

Refer to the information above. Calculate the expected return of the portfolio. Round your answer to the nearest hundredth of a percent.

A)11.08%

B)12.75%

C)10.78%

D)none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following best defines the mean-variance efficient frontier?

A)It is the portfolio of all risky assets in existence.

B)It is the set of portfolios that provide the greatest reward for each unit of risk and the lowest risk for each level of reward.

C)It is the set of portfolios that offer the greatest return.

D)It is the set of portfolios that offer the lowest risk.

A)It is the portfolio of all risky assets in existence.

B)It is the set of portfolios that provide the greatest reward for each unit of risk and the lowest risk for each level of reward.

C)It is the set of portfolios that offer the greatest return.

D)It is the set of portfolios that offer the lowest risk.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

Write the general formula for the variance of a three-asset portfolio.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

Use a spreadsheet to calculate the variances and standard deviations of the expected

returns for the following two securities as well as the covariance of the two securities

returns: Assume all scenarios are equally likely to occur.

Assume all scenarios are equally likely to occur.

returns for the following two securities as well as the covariance of the two securities

returns:

Assume all scenarios are equally likely to occur.

Assume all scenarios are equally likely to occur.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

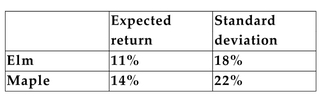

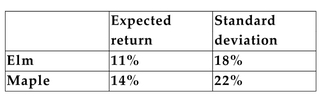

You have collected the following information for the returns of the Elm Corporation and the Maple Corporation:  The covariance of the returns of the two securities is 277.2%%.

The covariance of the returns of the two securities is 277.2%%.

Refer to the information above. If you invest 40% of your money in Elm and 60% in Maple, what is the standard deviation of the returns on your portfolio?

A)18.95%

B)8.16%

C)23.52%

D)none of the above

The covariance of the returns of the two securities is 277.2%%.

The covariance of the returns of the two securities is 277.2%%.Refer to the information above. If you invest 40% of your money in Elm and 60% in Maple, what is the standard deviation of the returns on your portfolio?

A)18.95%

B)8.16%

C)23.52%

D)none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

You have $5,000 cash to invest and borrow another $5,000 at the risk-free rate of 5%. You invest all of it in Portfolio Z, with an expected return of 15% and a standard deviation of 20%.

Refer to the information above. Calculate the standard deviation of the returns on this portfolio.

A)28.3%

B)40.0%

C)30.0%

D)This cannot be calculated without knowing the variance of the returns on the risk-free asset.

Refer to the information above. Calculate the standard deviation of the returns on this portfolio.

A)28.3%

B)40.0%

C)30.0%

D)This cannot be calculated without knowing the variance of the returns on the risk-free asset.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

You have $5,000 cash to invest and borrow another $5,000 at the risk-free rate of 5%. You invest all of it in Portfolio Z, with an expected return of 15% and a standard deviation of 20%.

Refer to the information above. Calculate the expected return on this portfolio.

A)17.5%

B)25.0%

C)12.5%

D)none of the above

Refer to the information above. Calculate the expected return on this portfolio.

A)17.5%

B)25.0%

C)12.5%

D)none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

The Canton Corporation consists of three divisions:

Refer to the information above. Calculate the market beta of the Canton Corporation.

A)1.00

B)0.36

C)1.04

D)none of the above

Refer to the information above. Calculate the market beta of the Canton Corporation.

A)1.00

B)0.36

C)1.04

D)none of the above

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

Your firm uses 50% debt financing and 50% equity financing. The beta of the debt is 0 since the firm has more than enough cash reserves to retire the debt completely. An identical firm that

Is entirely equity-financed has a market beta of 1.2. What is your firm's equity market beta?

A)0.6

B)2.4

C)0.7

D)1.8

Is entirely equity-financed has a market beta of 1.2. What is your firm's equity market beta?

A)0.6

B)2.4

C)0.7

D)1.8

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck