Deck 3: Stock and Bond Valuation: Annuities and Perpetuities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/61

Play

Full screen (f)

Deck 3: Stock and Bond Valuation: Annuities and Perpetuities

1

A financial advisor says she has an investment that will pay you $500 a month forever. It will cost you $25,000 today. What effective annual rate (EAR)will you earn on this investment?

Round your answer to the nearest tenth of a percent.

A)21.2%

B)20.0%

C)26.8%

D)24.0%

Round your answer to the nearest tenth of a percent.

A)21.2%

B)20.0%

C)26.8%

D)24.0%

26.8%

2

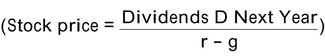

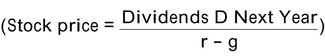

The Gordon growth model  assumes that

assumes that

A)dividends will grow at the constant rate of r forever.

B)dividends will grow at the constant rate of g forever.

C)dividends will remain at their current level indefinitely.

D)dividends will remain at next year's level indefinitely.

assumes that

assumes thatA)dividends will grow at the constant rate of r forever.

B)dividends will grow at the constant rate of g forever.

C)dividends will remain at their current level indefinitely.

D)dividends will remain at next year's level indefinitely.

dividends will grow at the constant rate of g forever.

3

A project is expected to produce a cash flow of $20,000 next year. The cash flow is expected to grow at a rate of 8% indefinitely. If the opportunity cost of capital is a constant 12%, what is

The maximum amount you should be willing to invest in the project?

A)$560,000

B)$540,000

C)$500,000

D)none of the above

The maximum amount you should be willing to invest in the project?

A)$560,000

B)$540,000

C)$500,000

D)none of the above

$500,000

4

All else equal, the price of a stock will increase if

A)the required rate of return on the stock increases.

B)the expected growth rate increases.

C)the expected future dividend payment increases.

D)Both B and C are correct.

A)the required rate of return on the stock increases.

B)the expected growth rate increases.

C)the expected future dividend payment increases.

D)Both B and C are correct.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

5

You would like to establish a fund that will be used to offer a scholarship each year to a worthy student at your alma mater. You would like the total annual award to be $5,000, with the first

Award to be presented next year. Your alma mater is able to invest the funds at a constant,

Annual, tax-free rate of 8%. How much must you donate today to fund this award? Round

Your answer to the nearest dollar.

A)$62,500

B)$51,296

C)$67,500

D)$46,296

Award to be presented next year. Your alma mater is able to invest the funds at a constant,

Annual, tax-free rate of 8%. How much must you donate today to fund this award? Round

Your answer to the nearest dollar.

A)$62,500

B)$51,296

C)$67,500

D)$46,296

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

6

What is the maximum you should be willing to pay for the right to receive $500 a month forever if the quoted annual interest rate (APR)is a constant 15%? Round your answer to the

Nearest dollar.

A)$49,383

B)$57,500

C)$40,000

D)none of the above

Nearest dollar.

A)$49,383

B)$57,500

C)$40,000

D)none of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following inputs is not needed when using the Gordon growth model to determine the market value of a share of stock?

A)the required rate of return for the stock

B)the number of years the investor expects to own the stock

C)the dollar amount of the dividend payment

D)the expected growth rate of the dividends

A)the required rate of return for the stock

B)the number of years the investor expects to own the stock

C)the dollar amount of the dividend payment

D)the expected growth rate of the dividends

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

8

An issue of preferred stock that pays an annual dividend of $6 is selling for $32 a share. The annual return on this investment is

A)18.75%.

B)5.33%.

C)4.33%.

D)8.75%.

A)18.75%.

B)5.33%.

C)4.33%.

D)8.75%.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

9

Decline, Inc. currently produces cash flows of $650,000 a year. However, these cash flows are expected to decline by 1% a year indefinitely. If Decline's cost of equity capital is 8%, what is

Its current market value?

A)$9,193,000

B)$9,286,000

C)$7,222,222

D)$7,150,000

Its current market value?

A)$9,193,000

B)$9,286,000

C)$7,222,222

D)$7,150,000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

10

The Sentinel Corporation has an issue of preferred stock that pays a dividend of $5.00 a share. If the appropriate cost of capital is 12%, what would you expect the market price of this stock

To be? Round you answer to the nearest cent.

A)$22.41

B)$41.67

C)$60.00

D)$24.00

To be? Round you answer to the nearest cent.

A)$22.41

B)$41.67

C)$60.00

D)$24.00

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

11

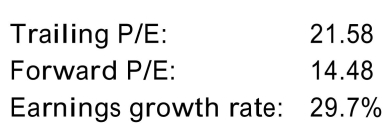

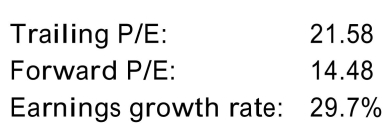

In May 2008, the Yahoo!Finance website provided the following information for the stock of Oracle:  If you assume that the earnings growth rate represents the long-run earnings growth rate for

If you assume that the earnings growth rate represents the long-run earnings growth rate for

The firm, what is the implied rate of return required by investors? Round your answer to the

Nearest tenth of a percent.

A)36.6%

B)44.2%

C)34.3%

D)51.3%

If you assume that the earnings growth rate represents the long-run earnings growth rate for

If you assume that the earnings growth rate represents the long-run earnings growth rate forThe firm, what is the implied rate of return required by investors? Round your answer to the

Nearest tenth of a percent.

A)36.6%

B)44.2%

C)34.3%

D)51.3%

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

12

The common stock of Average Corporation is selling for $10 a share and is expected to pay a dividend of $0.50 a share next year. If dividends are expected to grow at a constant rate of 4%

Indefinitely, what is the market requiring as a return on this company's stock?

A)5.0%

B)4.0%

C)9.0%

D)1.4%

Indefinitely, what is the market requiring as a return on this company's stock?

A)5.0%

B)4.0%

C)9.0%

D)1.4%

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

13

Stable Corporation currently pays a dividend of $0.50 a share. The firm's dividends are expected to grow at a constant rate of 10% indefinitely. If investors require a 15% return on

Stable's stock, at what price should it sell?

A)$5.00

B)$11.50

C)$11.00

D)$10.00

Stable's stock, at what price should it sell?

A)$5.00

B)$11.50

C)$11.00

D)$10.00

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is not a necessary assumption underlying the growing perpetuity formula?

A)The required rate of return is greater than the expected growth rate of the cash flows.

B)The investor will remain invested in the investment forever.

C)The cash flows will grow at a constant rate indefinitely.

D)All of the above are necessary assumptions underlying the growing perpetuity formula.

A)The required rate of return is greater than the expected growth rate of the cash flows.

B)The investor will remain invested in the investment forever.

C)The cash flows will grow at a constant rate indefinitely.

D)All of the above are necessary assumptions underlying the growing perpetuity formula.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

15

Nancy has built a very profitable business, and she credits the entrepreneurship program at her alma mater for a lot of her success. She would like to donate money to her old school to

Help one worthy graduate each year establish his or her own business. She will donate the

Money today, with the understanding that the first award will go to a graduate of this year's

Freshman class. (That is, the first award will be made four years from now.)Her alma mater is

Able to invest the funds at a constant, annual, tax-free rate of 12%. How much must her

Donation be if she would like for the annual award to be $10,000 a year and wants the program

To continue forever, even after she is no longer around? Round your answer to the nearest

Dollar.

A)$83,333

B)$59,315

C)$52,960

D)$93,333

Help one worthy graduate each year establish his or her own business. She will donate the

Money today, with the understanding that the first award will go to a graduate of this year's

Freshman class. (That is, the first award will be made four years from now.)Her alma mater is

Able to invest the funds at a constant, annual, tax-free rate of 12%. How much must her

Donation be if she would like for the annual award to be $10,000 a year and wants the program

To continue forever, even after she is no longer around? Round your answer to the nearest

Dollar.

A)$83,333

B)$59,315

C)$52,960

D)$93,333

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

16

What is the most you would be willing to pay for a promise to pay you $10 per year forever, beginning next year, if your opportunity cost of capital is a constant 10%?

A)$1,000

B)$10,000

C)$100

D)$10

A)$1,000

B)$10,000

C)$100

D)$10

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

17

A certain stock currently pays a dividend of $1.80 and is selling for $49.50. If the required rate of return on this stock is 14%, what is the implied expected dividend growth rate? Round your

Answer to the nearest tenth of a percent.

A)9.8%

B)8.2%

C)10.4%

D)none of the above

Answer to the nearest tenth of a percent.

A)9.8%

B)8.2%

C)10.4%

D)none of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

18

The cost of equity capital for the Houck Corporation is 18%. If the stock offers a dividend yield of 7%, what is the implied expected growth rate?

A)2.4%

B)25.0%

C)9.0%

D)none of the above

A)2.4%

B)25.0%

C)9.0%

D)none of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

19

You would like to establish a fund that will be used to offer a scholarship each year to a worthy student at

Your alma mater. You would like the total annual award to be $5,000, with the first award to

Be presented today. Your alma mater is able to invest the funds at a constant, annual, tax-free

Rate of 8%. How much must you donate today to fund this award? Round your answer to the

Nearest dollar.

A)$46,296

B)$67,500

C)$62,500

D)$51,296

Your alma mater. You would like the total annual award to be $5,000, with the first award to

Be presented today. Your alma mater is able to invest the funds at a constant, annual, tax-free

Rate of 8%. How much must you donate today to fund this award? Round your answer to the

Nearest dollar.

A)$46,296

B)$67,500

C)$62,500

D)$51,296

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

20

The stock of the Narnia Corporation is expected to pay a dividend of $1.50 next year. This dividend is expected to grow at a constant rate of 10% a year. If you require a 12% return on

The stock, what is the maximum price you should pay for a share of it?

A)$82.50

B)$84.00

C)$75.00

D)none of the above

The stock, what is the maximum price you should pay for a share of it?

A)$82.50

B)$84.00

C)$75.00

D)none of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

21

Maria has decided that she can live on $80,000 a year upon retirement, and she expects to live for thirty years after she has retired. If she can earn an average annual rate of return of 8% after

She retires, what minimum amount must she have accumulated in her retirement account one

Year before she makes her first withdrawal in order to meet her requirement? Round your

Answer to the nearest dollar.

A)$2,000,000

B)$900,623

C)$1,000,000

D)$833,910

She retires, what minimum amount must she have accumulated in her retirement account one

Year before she makes her first withdrawal in order to meet her requirement? Round your

Answer to the nearest dollar.

A)$2,000,000

B)$900,623

C)$1,000,000

D)$833,910

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

22

If you accumulate $600,000 in your retirement account and can earn a constant annual rate of 8% on this money after retirement, how much will you be able to live on each year if you

Expect to live for 30 years after retirement? Assume that you will make you first withdrawal

On the day your retire, and round your answer to the nearest dollar.

A)$26,107

B)$49,349

C)$44,148

D)$43,589

Expect to live for 30 years after retirement? Assume that you will make you first withdrawal

On the day your retire, and round your answer to the nearest dollar.

A)$26,107

B)$49,349

C)$44,148

D)$43,589

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

23

H&H Incorporated currently pays a dividend of $2.00 a share. These dividends are expected to grow at a rate of 5% for the next three years, after which the dividend is expected to remain

Constant. If investors require a 12% return, at what price should this stock sell? Round your

Answer to the nearest dollar.

A)$19

B)$5

C)$29

D)$24

Constant. If investors require a 12% return, at what price should this stock sell? Round your

Answer to the nearest dollar.

A)$19

B)$5

C)$29

D)$24

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

24

A bond that is selling for less than the final principal payment offered by the bond is said to be selling at a

A)premium.

B)discount.

C)par.

D)bargain.

A)premium.

B)discount.

C)par.

D)bargain.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

25

What is the value of an issue of preferred stock that pays an annual dividend of $4.00

if the prevailing interest rate is 7% a year?

if the prevailing interest rate is 7% a year?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

26

A financial planner has suggested you invest in a new insurance product he is selling that will pay you $20,000 a year for twenty years once you retire. If you plan to retire in 10 years and

Your opportunity cost of capital is a constant 6% a year, what is the most you should pay today

For this investment? Assume you will receive your first payment at the end of 10 years and

Round your answer to the nearest dollar.

A)$229,398

B)$147,202

C)$135,781

D)$128,095

Your opportunity cost of capital is a constant 6% a year, what is the most you should pay today

For this investment? Assume you will receive your first payment at the end of 10 years and

Round your answer to the nearest dollar.

A)$229,398

B)$147,202

C)$135,781

D)$128,095

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

27

Tommy's grandparents have left him a trust fund that will pay him $5,000 a year for twenty years once he turns twenty-one, which is four years from today. Tommy would prefer to have

The cash today for a new car, a new snowboard, a season's ski pass, and various other

Necessities of life. His uncle has offered to pay him a lump sum today in return for the rights to

The trust fund payments. If Tommy can earn an average annual return of 12% on his money,

What is the minimum amount he should expect to receive for the rights to the fund? Round

Your answer to the nearest dollar.

A)$63,552

B)$26,583

C)$23,735

D)$56,743

The cash today for a new car, a new snowboard, a season's ski pass, and various other

Necessities of life. His uncle has offered to pay him a lump sum today in return for the rights to

The trust fund payments. If Tommy can earn an average annual return of 12% on his money,

What is the minimum amount he should expect to receive for the rights to the fund? Round

Your answer to the nearest dollar.

A)$63,552

B)$26,583

C)$23,735

D)$56,743

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

28

An insurance agent has recommended you invest in a policy that promises to pay you $10,000 a year upon retirement. The payments will continue for 15 years after you retire. If you plan

To retire in 25 years and can earn a constant effective annual rate of 12% on similar

Investments, what is the maximum you should be willing to pay for this policy today? Assume

The first payment will be made at the end of the 25th year and round your answer to the

Nearest dollar.

A)$4,487

B)$76,282

C)$68,109

D)$4,006

To retire in 25 years and can earn a constant effective annual rate of 12% on similar

Investments, what is the maximum you should be willing to pay for this policy today? Assume

The first payment will be made at the end of the 25th year and round your answer to the

Nearest dollar.

A)$4,487

B)$76,282

C)$68,109

D)$4,006

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

29

A project is expected to produce a cash flow of $10,000 next year. This is expected to grow at a rate of 25% for the following two years before slowing down to an estimated eternal growth

Rate of 5% a year. If you require a 15% return on this project, what is the maximum amount

You should be willing to invest in it? Round your answer to the nearest dollar.

A)$143,750

B)$164,063

C)$182,224

D)$136,295

Rate of 5% a year. If you require a 15% return on this project, what is the maximum amount

You should be willing to invest in it? Round your answer to the nearest dollar.

A)$143,750

B)$164,063

C)$182,224

D)$136,295

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

30

A stock is expected to pay a dividend of $3.50 next year, and dividends are expected to

grow at the rate of 5% indefinitely. If the cost of capital is 15%, at what price should

this stock sell? How much value is the expected growth adding to the price?

grow at the rate of 5% indefinitely. If the cost of capital is 15%, at what price should

this stock sell? How much value is the expected growth adding to the price?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

31

A certain stock currently pays a dividend of $2.00 and is selling for $30.86. If the required rate of return on this stock is 15%, what is the implied expected dividend growth rate? Round your

Answer to the nearest tenth of a percent.

A)8.5%

B)8.0%

C)9.3%

D)15.4%

Answer to the nearest tenth of a percent.

A)8.5%

B)8.0%

C)9.3%

D)15.4%

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

32

Jolene has just become entitled to receive equal annual payments of $10,000 for ten years from a trust fund that her grandparents had set up for her. The payments will begin immediately.

Jolene has learned she can sell the rights to these payments for a lump sum today. If Jolene can

Earn 6% on her money, what is the minimum amount for which she should sell the fund?

Round your answer to the nearest dollar.

A)$73,601

B)$131,808

C)$78,017

D)$100,000

Jolene has learned she can sell the rights to these payments for a lump sum today. If Jolene can

Earn 6% on her money, what is the minimum amount for which she should sell the fund?

Round your answer to the nearest dollar.

A)$73,601

B)$131,808

C)$78,017

D)$100,000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

33

Freedom Enterprises is considering investing in a project that is expected to produce $12,000 in cash flows each year for five years. If Freedom Enterprises' cost of capital is 14%, what is the

Maximum the firm should be willing to invest in this project? Assume the first cash flow will

Occur one year after the investment is made, and round your answer to the nearest dollar.

A)$52,632

B)$41,197

C)$57,676

D)none of the above

Maximum the firm should be willing to invest in this project? Assume the first cash flow will

Occur one year after the investment is made, and round your answer to the nearest dollar.

A)$52,632

B)$41,197

C)$57,676

D)none of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

34

Jason wishes to be able to receive $50,000 a year upon retirement, and he expects to live for 25 years after retirement. If he can earn an average rate of return of 10% on his money after he

Retires, how much does he need to have accumulated at the time he retires? Assume he will

Make his first withdrawal one year after he retires, and round your answer to the nearest

Dollar.

A)$503,824

B)$453,852

C)$627,938

D)$1,250,000

Retires, how much does he need to have accumulated at the time he retires? Assume he will

Make his first withdrawal one year after he retires, and round your answer to the nearest

Dollar.

A)$503,824

B)$453,852

C)$627,938

D)$1,250,000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

35

If you accumulate $800,000 in your retirement account and can earn a constant annual rate of 5% on this money after retirement, how much will you be able to live on each year if you

Expect to live for 30 years after retirement? Assume that you will make your first withdrawal

At the end of one year, and round your answer to the nearest dollar.

A)$18,510

B)$52,041

C)$28,000

D)$27,922

Expect to live for 30 years after retirement? Assume that you will make your first withdrawal

At the end of one year, and round your answer to the nearest dollar.

A)$18,510

B)$52,041

C)$28,000

D)$27,922

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

36

Joe Cool plans to hit the campus scene. He expects his tuition for each of the next four years to be $2,000, payable at the end of each year. (He's cool, not smart.)At a 6% annual interest rate,

How much would have to be invested today to provide for all his future tuition payments?

Round your answer to the nearest dollar.

A)$2,525

B)$6,930

C)$8,000

D)$7,346

How much would have to be invested today to provide for all his future tuition payments?

Round your answer to the nearest dollar.

A)$2,525

B)$6,930

C)$8,000

D)$7,346

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

37

A certain stock paid a dividend of $2.00 a share this year and is selling for $52 a share.

Dividends are expected to grow at the rate of 8% indefinitely. If you require a 12%

return, should you purchase this stock at its current price? Explain your answer.

Dividends are expected to grow at the rate of 8% indefinitely. If you require a 12%

return, should you purchase this stock at its current price? Explain your answer.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

38

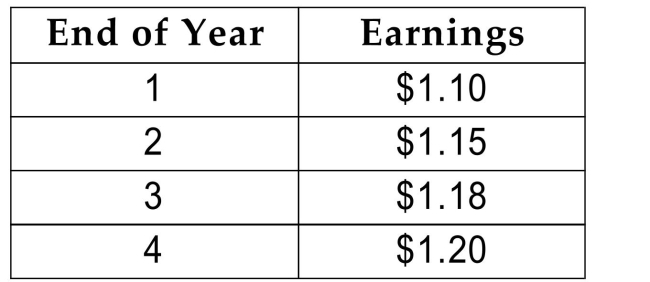

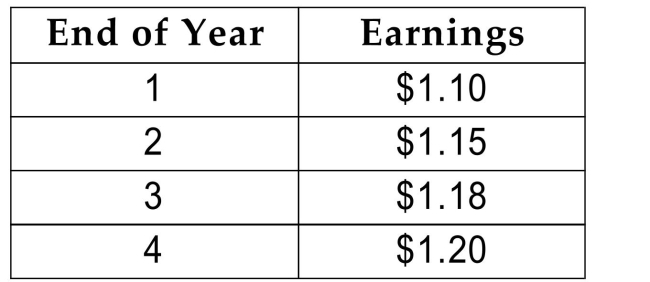

The earnings per share of Erratic Corporation are projected to be as follows:  After year 4, earnings are expected to grow at a constant rate of 6% indefinitely. If the required rate of return is 12%, what would you estimate the value of Erratic's stock to be? Round your

After year 4, earnings are expected to grow at a constant rate of 6% indefinitely. If the required rate of return is 12%, what would you estimate the value of Erratic's stock to be? Round your

Answer to the nearest dollar.

A)$16

B)$13

C)$17

D)$12

After year 4, earnings are expected to grow at a constant rate of 6% indefinitely. If the required rate of return is 12%, what would you estimate the value of Erratic's stock to be? Round your

After year 4, earnings are expected to grow at a constant rate of 6% indefinitely. If the required rate of return is 12%, what would you estimate the value of Erratic's stock to be? Round yourAnswer to the nearest dollar.

A)$16

B)$13

C)$17

D)$12

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

39

If the effective annual yield on a bond is equal to the bond's coupon rate, the bond will have a market value that is

A)above the principal value of the bond.

B)equal to the principal value of the bond.

C)below the principal value of the bond.

D)Either A or B may be true.

A)above the principal value of the bond.

B)equal to the principal value of the bond.

C)below the principal value of the bond.

D)Either A or B may be true.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

40

An issue of preferred stock pays an annual dividend of $5.00 and is selling for $75 a

share. What annual return would you earn if you purchased the stock for its current

price?

share. What annual return would you earn if you purchased the stock for its current

price?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

41

Assume the prevailing interest rate is 8% per annum. A 4-year lease agreement requires you to pay $2,000 up front , followed by annual payments of $1,800 a year for the first two years

And $1,500 a year in the last year. What would the payment on a 4-year lease with a constant

Annual payment, with the first payment due immediately, have to offer for you to be

Indifferent between the two lease options? Round your answer to the nearest dollar.

A)$1,063

B)$1,789

C)$3,568

D)$2,484

And $1,500 a year in the last year. What would the payment on a 4-year lease with a constant

Annual payment, with the first payment due immediately, have to offer for you to be

Indifferent between the two lease options? Round your answer to the nearest dollar.

A)$1,063

B)$1,789

C)$3,568

D)$2,484

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

42

When your firm hires a new employee this year, it is obligated to contribute $5,000 to a defined contribution plan for that employee, one year after the hire date. The contribution must be

Adjusted annually for inflation. Assume that inflation will be a constant 2.5% a year from this

Point forward. What is the cost to you of hiring a 30-year old who will be with the company

For 32 years if the appropriate discount rate is 10%? Round your answer to the nearest dollar.

A)$58,653

B)$66,667

C)$59,708

D)$68,333

Adjusted annually for inflation. Assume that inflation will be a constant 2.5% a year from this

Point forward. What is the cost to you of hiring a 30-year old who will be with the company

For 32 years if the appropriate discount rate is 10%? Round your answer to the nearest dollar.

A)$58,653

B)$66,667

C)$59,708

D)$68,333

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

43

A University of Colorado revenue bond pays an 8% level-coupon, matures in three years, and offers an effective annual yield (i.e., true yield)of 6%. The bond has a principal value of $1,000

And pays interest semiannually. What is the value of this bond, to the nearest dollar?

A)$1,056

B)$1,054

C)$1,021

D)$1,000

And pays interest semiannually. What is the value of this bond, to the nearest dollar?

A)$1,056

B)$1,054

C)$1,021

D)$1,000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

44

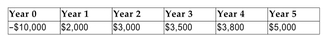

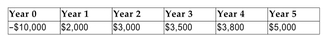

A certain project is expected to produce the following cash flows:  Assuming end-of year payments, this project's cash flows are equivalent to receiving what constant, annual payment for the next five years if the prevailing annual rate is 8%? Round

Assuming end-of year payments, this project's cash flows are equivalent to receiving what constant, annual payment for the next five years if the prevailing annual rate is 8%? Round

Your answer to the nearest dollar.

A)$851

B)$1,460

C)$2,313

D)$3,356

Assuming end-of year payments, this project's cash flows are equivalent to receiving what constant, annual payment for the next five years if the prevailing annual rate is 8%? Round

Assuming end-of year payments, this project's cash flows are equivalent to receiving what constant, annual payment for the next five years if the prevailing annual rate is 8%? RoundYour answer to the nearest dollar.

A)$851

B)$1,460

C)$2,313

D)$3,356

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

45

You have just won a lottery that will pay you $20,000 a year for the rest of your life.

The first payment will be made today. You expect to live for 40 more years, and you

believe you can average an annual risk-free return of 6% over the next 40 years. A

company calls you and offers to buy your ticket from you for a lump sum payment of

$325,000 today. Should you take their offer? Assume you will receive your last

payment at the end of the 40th year.

The first payment will be made today. You expect to live for 40 more years, and you

believe you can average an annual risk-free return of 6% over the next 40 years. A

company calls you and offers to buy your ticket from you for a lump sum payment of

$325,000 today. Should you take their offer? Assume you will receive your last

payment at the end of the 40th year.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

46

A stock currently pays a dividend of $0.10. This dividend is projected to grow at 40%

for the next five years, after which it is expected to grow at 5% indefinitely. If you

require a 20% return on this investment, what is the maximum price you should pay

for this stock?

for the next five years, after which it is expected to grow at 5% indefinitely. If you

require a 20% return on this investment, what is the maximum price you should pay

for this stock?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

47

Assume the prevailing interest rate is 12% per annum. A 4-year lease agreement requires you to pay $1,000 up front, followed by payments of $800, $600, and $500 at the end of each of the

Following three years, respectively. What would the payment on a 4-year lease with a constant

Annual payment have to offer for you to be indifferent between the two lease options? Assume

That the first payment on the constant annual payment lease will be made at the end of the first

Year, and round your answer to the nearest dollar.

A)$839

B)$1,061

C)$725

D)none of the above

Following three years, respectively. What would the payment on a 4-year lease with a constant

Annual payment have to offer for you to be indifferent between the two lease options? Assume

That the first payment on the constant annual payment lease will be made at the end of the first

Year, and round your answer to the nearest dollar.

A)$839

B)$1,061

C)$725

D)none of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

48

Newbie Business Center has borrowed $12,000 from its bank. The loan is for three years and requires the firm to make equal monthly payments of $398.57. Each payment is comprised of

Both interest and principal repayment, and the payments will begin one month after the loan

Agreement. What effective annual rate is the bank charging Newbie for this loan? Round your

Answer to the nearest tenth of a percent.

A)1.0%

B)12.0%

C)10.1%

D)12.7%

Both interest and principal repayment, and the payments will begin one month after the loan

Agreement. What effective annual rate is the bank charging Newbie for this loan? Round your

Answer to the nearest tenth of a percent.

A)1.0%

B)12.0%

C)10.1%

D)12.7%

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

49

Calculate the monthly payment due on a 30-year, fixed-rate, $80,000 mortgage if the quoted interest rate is 6%. Round your answer to the nearest cent.

A)$479.64

B)$287.83

C)$581.19

D)$133.31

A)$479.64

B)$287.83

C)$581.19

D)$133.31

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

50

A $50,000, level-coupon Eurobond has a 6% coupon and matures in ten years. At what price should the bond sell today if the prevailing interest rate is 8% per annum? Round your answer

To the nearest dollar.

A)$29,870

B)$43,290

C)$50,000

D)$57,360

To the nearest dollar.

A)$29,870

B)$43,290

C)$50,000

D)$57,360

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

51

A firm currently pays a dividend of $0.10 a share. The dividend is expected to grow at the rate of 16% for the next five years before slowing to a constant growth rate of 5% indefinitely. If

You require an 18% return on this firm's stock, what is the maximum price you would pay for

It?

A)$16.63

B)$0.48

C)$7.54

D)none of the above

You require an 18% return on this firm's stock, what is the maximum price you would pay for

It?

A)$16.63

B)$0.48

C)$7.54

D)none of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

52

Blake has borrowed $30,000 on a 3-year note to buy a car. The loan requires equal monthly payments of principal and interest, with the first payment due one month after the loan is

Signed. The quoted interest rate is 7%. What will Blake's monthly payments be? Round your

Answer to the nearest dollar.

A)$378

B)$926

C)$260

D)none of the above

Signed. The quoted interest rate is 7%. What will Blake's monthly payments be? Round your

Answer to the nearest dollar.

A)$378

B)$926

C)$260

D)none of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

53

Haluk has just retired. He may choose either to take a lump sum retirement benefit of

$750,000 today or elect to receive an annual annuity payment of $60,000 a year for 25

years, with the first payment to be made at the end of the year. If Haluk's opportunity

cost of capital is 6%, which option should he choose?

$750,000 today or elect to receive an annual annuity payment of $60,000 a year for 25

years, with the first payment to be made at the end of the year. If Haluk's opportunity

cost of capital is 6%, which option should he choose?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

54

Calculate the monthly payment due on a 30-year, fixed-rate, $250,000 mortgage if the quoted interest rate is 4.8%. Round your answer to the nearest cent.

A)$886.00

B)$1,200.00

C)$1,589.40

D)$1,311.66

A)$886.00

B)$1,200.00

C)$1,589.40

D)$1,311.66

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

55

A certain company's cash flows are expected to grow at a rate of 15% for the next eight years before tapering off to a constant growth rate of 6% forever. The current year's cash flow is

$50,000. If the firm's cost of capital is 20%, what should its fair market value be? Round your

Answer to the nearest dollar.

A)$888,126

B)$331,856

C)$641,583

D)$309,727

$50,000. If the firm's cost of capital is 20%, what should its fair market value be? Round your

Answer to the nearest dollar.

A)$888,126

B)$331,856

C)$641,583

D)$309,727

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

56

You are considering the purchase of one of two bonds. Both bonds have a principal

value of $1,000 and pay a 10% coupon, with annual interest payments. Bond S matures

in three years, however, while Bond L matures in 12 years. Both bonds are currently

selling for $1,000. You plan to hold whichever bond you purchase for only one year. If

you anticipate that the prevailing interest rate one year from now will be 8% per

annum, which bond should you purchase?

value of $1,000 and pay a 10% coupon, with annual interest payments. Bond S matures

in three years, however, while Bond L matures in 12 years. Both bonds are currently

selling for $1,000. You plan to hold whichever bond you purchase for only one year. If

you anticipate that the prevailing interest rate one year from now will be 8% per

annum, which bond should you purchase?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

57

Promises, Incorporated has issued a 10-year, semiannual, level-coupon bond that has a coupon rate of 18%. The bond is priced to offer an effective annual rate (i.e., true yield)of 14%

And sells for $1,212 per $1,000 of principal value. How much interest will this bond pay every

Six months (per $1,000 of principal value)?

A)$90.00

B)$70.00

C)$84.84

D)$109.08

And sells for $1,212 per $1,000 of principal value. How much interest will this bond pay every

Six months (per $1,000 of principal value)?

A)$90.00

B)$70.00

C)$84.84

D)$109.08

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

58

The Canton Corporation has a 10%, semiannual, level-coupon, $1,000 bond that matures in eight years. The prevailing effective interest rate is 12% per annum. What is the maximum

Price you would pay for this bond? Round your answer to the nearest dollar.

A)$915

B)$948

C)$938

D)$899

Price you would pay for this bond? Round your answer to the nearest dollar.

A)$915

B)$948

C)$938

D)$899

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

59

You have the choice between paying $95 for a 4-year magazine subscription today or

buying four 1-year subscriptions, which will cost $25, payable at the beginning of each

year. Assume that the price of the 1-year subscription will remain unchanged and

ignore any hassles involved with renewing each year. Which is the better choice if

your opportunity cost of funds is 4%?

buying four 1-year subscriptions, which will cost $25, payable at the beginning of each

year. Assume that the price of the 1-year subscription will remain unchanged and

ignore any hassles involved with renewing each year. Which is the better choice if

your opportunity cost of funds is 4%?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

60

At what price should a $1,000 , 8%, semiannual, level-coupon bond that matures in 12 years sell if the prevailing effective interest rate is 10% per annum? Round your answer to the

Nearest dollar.

A)$862

B)$911

C)$877

D)none of the above

Nearest dollar.

A)$862

B)$911

C)$877

D)none of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

61

A firm is considering the purchase of one of two machines to replace an existing one.

Machine A will cost $15,000 and has a three-year life. Annual net cash flows are

expected to be $7,000, beginning one year after the machine is purchased. Machine B

will cost $35,000 and has a seven-year life. Annual net cash flows are expected to be

$8,500, beginning one year after the machine is purchased. If the firm's cost of capital

is a constant 14% forever, which machine should it buy? Assume the expected future

cash flows for each machine will remain constant forever.

Machine A will cost $15,000 and has a three-year life. Annual net cash flows are

expected to be $7,000, beginning one year after the machine is purchased. Machine B

will cost $35,000 and has a seven-year life. Annual net cash flows are expected to be

$8,500, beginning one year after the machine is purchased. If the firm's cost of capital

is a constant 14% forever, which machine should it buy? Assume the expected future

cash flows for each machine will remain constant forever.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck