Deck 14: Valuation From Comparables and Some Financial Ratios

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/69

Play

Full screen (f)

Deck 14: Valuation From Comparables and Some Financial Ratios

1

Which of the following can be a potential problem when using comparables to value a firm?

A)estimating a good opportunity cost of capital to use

B)identifying a good value-relevant attribute

C)finding similar firms

D)Both B and C are correct.

A)estimating a good opportunity cost of capital to use

B)identifying a good value-relevant attribute

C)finding similar firms

D)Both B and C are correct.

Both B and C are correct.

2

On a certain day in February 2008, the Yahoo!Finance website indicated that Citicorp had a P/E ratio of 37.73. What was its implied earnings yield?

A)10.34%

B)37.73%

C)2.65%

D)None of the above is correct.

A)10.34%

B)37.73%

C)2.65%

D)None of the above is correct.

2.65%

3

An advantage of using comparables to value a firm is that

A)the inputs are more objective and more readily verifiable than those used in an NPV analysis.

B)there are always a large number of good value-relevant attributes that can be used.

C)if a firm is publicly traded, there are always a large number of similar firms that can be used for comparables

D)All of the above are advantages of using comparables to value a firm.

A)the inputs are more objective and more readily verifiable than those used in an NPV analysis.

B)there are always a large number of good value-relevant attributes that can be used.

C)if a firm is publicly traded, there are always a large number of similar firms that can be used for comparables

D)All of the above are advantages of using comparables to value a firm.

the inputs are more objective and more readily verifiable than those used in an NPV analysis.

4

For the P/E ratio to be a good predictor of stock price,

A)the "earnings" used in the denominator should be the average annual earnings of the firm over at least the past 10 years.

B)it must be computed on an aggregate (firm-wide)basis rather than on a per-share basis.

C)the firm's one-year annual earnings must be representative of its future annual earnings.

D)the annual earnings of the firm must be almost identical to its annual cash flow for the year.

A)the "earnings" used in the denominator should be the average annual earnings of the firm over at least the past 10 years.

B)it must be computed on an aggregate (firm-wide)basis rather than on a per-share basis.

C)the firm's one-year annual earnings must be representative of its future annual earnings.

D)the annual earnings of the firm must be almost identical to its annual cash flow for the year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

5

A good value-relevant attribute is

A)one that is pertinent to only the firm you are trying to value.

B)one such that the value of all firms with that attribute is the same.

C)one that is identical for all firms in the same industry.

D)one that is pertinent to only a few firms.

A)one that is pertinent to only the firm you are trying to value.

B)one such that the value of all firms with that attribute is the same.

C)one that is identical for all firms in the same industry.

D)one that is pertinent to only a few firms.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following can be a potential problem when using an NPV analysis to value a firm?

A)estimating a good opportunity cost of capital to use

B)finding similar firms

C)identifying a good value-relevant attribute

D)All of the above are potential problems when conducting an NPV analysis to value a firm.

A)estimating a good opportunity cost of capital to use

B)finding similar firms

C)identifying a good value-relevant attribute

D)All of the above are potential problems when conducting an NPV analysis to value a firm.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements comparing the use of NPV with the use of comparables to value a firm is true?

A)The use of NPV is always a better method than the use of comparables to determine a firm's value, and comparables should be used only as a last resort.

B)The use of comparables to value a firm is always a better method because it is both easier and is less subject to estimation error.

C)Comparables, like NPV, can be used to estimate a true net present value.

D)The assumptions that must be made when using comparables are much less stringent than the assumptions that must be made when conducting an NPV analysis.

A)The use of NPV is always a better method than the use of comparables to determine a firm's value, and comparables should be used only as a last resort.

B)The use of comparables to value a firm is always a better method because it is both easier and is less subject to estimation error.

C)Comparables, like NPV, can be used to estimate a true net present value.

D)The assumptions that must be made when using comparables are much less stringent than the assumptions that must be made when conducting an NPV analysis.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following might be expected to be the best value-relevant attribute in determining the yield-to-maturity on a firm's bond?

A)the book value of the firm's assets

B)the book value of the firm's equity

C)the bond rating

D)the earnings per share of the firm

A)the book value of the firm's assets

B)the book value of the firm's equity

C)the bond rating

D)the earnings per share of the firm

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is true?

A)The lower the P/E ratio of a firm, the higher its future growth prospects are.

B)The higher the future growth prospects of a firm, the higher its earnings yield will be.

C)The higher the P/E ratio of a firm, the higher its earnings yield will be.

D)The lower the earnings yield of a firm, the higher its future growth prospects are.

A)The lower the P/E ratio of a firm, the higher its future growth prospects are.

B)The higher the future growth prospects of a firm, the higher its earnings yield will be.

C)The higher the P/E ratio of a firm, the higher its earnings yield will be.

D)The lower the earnings yield of a firm, the higher its future growth prospects are.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

10

On a certain day in February 2008, the Yahoo!Finance website indicated that Gap, Inc. had a P/E ratio of 18.67. What was its implied earnings yield?

A)18.67%

B)5.1%

C)5.4%

D)This cannot be calculated without knowing Gap's opportunity cost of capital.

A)18.67%

B)5.1%

C)5.4%

D)This cannot be calculated without knowing Gap's opportunity cost of capital.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

11

An ideal value-relevant attribute is one for which the correlation coefficient of the values of the attribute and the stock prices is

A)+2.0

B)-1.0

C)+1.0

D)zero

A)+2.0

B)-1.0

C)+1.0

D)zero

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

12

Discuss the advantages and disadvantages of the NPV method of valuing a company

versus the comparables method.

versus the comparables method.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is not a necessary assumption to make in order to use comparables to value a firm?

A)A value-relevant measure can be identified.

B)The markets are both perfect and efficient.

C)The market values comparable projects similarly.

D)You can identify projects that are close comparables.

A)A value-relevant measure can be identified.

B)The markets are both perfect and efficient.

C)The market values comparable projects similarly.

D)You can identify projects that are close comparables.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following would likely be the best comparable to use to value an investment in the stock of General Motors Corporation?

A)an investment in a long-term U.S. government Treasury bond

B)an investment in a bond issue of General Motors Corporation

C)an investment in the stock of Ford Motor Company

D)an investment in an 500 index mutual fund

500 index mutual fund

A)an investment in a long-term U.S. government Treasury bond

B)an investment in a bond issue of General Motors Corporation

C)an investment in the stock of Ford Motor Company

D)an investment in an

500 index mutual fund

500 index mutual fund

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

15

What are the three assumptions on which the use of comparables is based?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

16

You note that on the Yahoo!Finance website, the AVC Corporation has a forward price/earnings ratio of 5 and its stock price closed at $20. Based on this, what are the expected

Earnings per share of AVC?

A)$1.00

B)$3.00

C)$5.00

D)$4.00

Earnings per share of AVC?

A)$1.00

B)$3.00

C)$5.00

D)$4.00

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

17

Assume you believe that the appropriate price/earnings ratio for a firm in one year is 18, and your estimate of future earnings at that time is $3 a share. Based on this, what price do you

Expect this firm to sell for in one year?

A)$16.67

B)$ 6.00

C)$54.00

D)None of the above is correct.

Expect this firm to sell for in one year?

A)$16.67

B)$ 6.00

C)$54.00

D)None of the above is correct.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

18

What does the "law of one price" stipulate?

A)Assets with the same attributes should sell for the same price in a perfect market.

B)Everyone should be able to borrow and lend at the same interest rate.

C)All investors must be price-takers.

D)A company must sell its products to everyone at the same price; that is, price discrimination is illegal.

A)Assets with the same attributes should sell for the same price in a perfect market.

B)Everyone should be able to borrow and lend at the same interest rate.

C)All investors must be price-takers.

D)A company must sell its products to everyone at the same price; that is, price discrimination is illegal.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following might be expected to be the best value-relevant attribute in determining the price of a share of a firm's stock?

A)market value of plant, property, and equipment

B)number of employees

C)earnings per share of the firm

D)book value of the firm's assets

A)market value of plant, property, and equipment

B)number of employees

C)earnings per share of the firm

D)book value of the firm's assets

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is most correct?

A)Current cash flows are usually better proxies for future cash flows than a firm's earnings are, so the Price/Cash Flow ratio is typically a more reliable predictor of price than the

Price/Earnings ratio.

B)Current cash flows are typically reliable predictors of future earnings, so the P/E ratio is often calculated using cash flows rather than earnings.

C)Current earnings and current cash flows are generally close enough in amount that the Price/Cash Flow ratio and the Price/Earnings ratio will be very similar.

D)Current earnings are often better representatives of future cash flows than are current cash flows, so the Price/Earnings ratio is often a better predictor of price than the Price/Cash

Flow ratio.

A)Current cash flows are usually better proxies for future cash flows than a firm's earnings are, so the Price/Cash Flow ratio is typically a more reliable predictor of price than the

Price/Earnings ratio.

B)Current cash flows are typically reliable predictors of future earnings, so the P/E ratio is often calculated using cash flows rather than earnings.

C)Current earnings and current cash flows are generally close enough in amount that the Price/Cash Flow ratio and the Price/Earnings ratio will be very similar.

D)Current earnings are often better representatives of future cash flows than are current cash flows, so the Price/Earnings ratio is often a better predictor of price than the Price/Cash

Flow ratio.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

21

A firm has a P/E ratio of 14, and investors are expecting a 10% return on the stock. What does this imply they expect the firm's eternal earnings growth rate to be?

A)2.9%

B)1.4%

C)17.1%

D)24.0%

A)2.9%

B)1.4%

C)17.1%

D)24.0%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements about a firm with declining growth is true?

A)Its cost of capital must equal its earnings-price yield.

B)Its cost of capital will be greater than its earnings-price yield.

C)Its cost of capital will be less than its earnings-price yield.

D)None of the above is true. There is no firm relationship between a firm's cost of capital and its earnings-price yield.

A)Its cost of capital must equal its earnings-price yield.

B)Its cost of capital will be greater than its earnings-price yield.

C)Its cost of capital will be less than its earnings-price yield.

D)None of the above is true. There is no firm relationship between a firm's cost of capital and its earnings-price yield.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

23

What causes one firm to have a higher (or lower)P/E ratio than another firm?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is a problem that exists when using the aggregate value of comparable firms and dividing by the aggregate earnings in order to determine a comparable P/E ratio?

A)One firm with negative earnings can skew the results such that the P/E ratio is not meaningful.

B)The P/E ratios of larger firms will have a greater effect on the average P/E than the P/E ratios of smaller firms.

C)The P/E ratio should use only firms of similar size to the firm being valued, and this method uses the prices and the earnings of all the firms in the industry.

D)The aggregate value of comparable firms is not a good substitute for prices.

A)One firm with negative earnings can skew the results such that the P/E ratio is not meaningful.

B)The P/E ratios of larger firms will have a greater effect on the average P/E than the P/E ratios of smaller firms.

C)The P/E ratio should use only firms of similar size to the firm being valued, and this method uses the prices and the earnings of all the firms in the industry.

D)The aggregate value of comparable firms is not a good substitute for prices.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

25

A firm with a P/E ratio of 15 wants to take over a firm that is 1/3 its size (in market capitalization)that has a P/E ratio of 20. What would be the P/E ratio of the merged firm?

A)16.0

B)16.7

C)16.3

D)17.5

A)16.0

B)16.7

C)16.3

D)17.5

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

26

A certain pharmaceutical company reported earnings of $3.3 billion this year. The

earnings have been growing at a constant rate of about 3% a year, and the firm has a

price/earnings ratio of 26. By how much would its price increase if it could increase its

perpetual growth rate to 5% a year?

earnings have been growing at a constant rate of about 3% a year, and the firm has a

price/earnings ratio of 26. By how much would its price increase if it could increase its

perpetual growth rate to 5% a year?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

27

A firm has a P/E ratio of 20 and an eternal earnings growth rate of 4%. What does this imply that investors are expecting as a rate of return on the stock?

A)5%

B)1%

C)24%

D)9%

A)5%

B)1%

C)24%

D)9%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

28

On a certain day in February 2008, Amazon.com's forward P/E was reported to be 32.31 and its beta was 3.04. The relevant risk-free rate at the time was 3%. Assume that 5% is a reasonable

Equity premium to use. What does this data suggest Amazon's expected eternal earnings

Growth rate was?

A)15.2%

B)35.9%

C)21.2%

D)13.8%

Equity premium to use. What does this data suggest Amazon's expected eternal earnings

Growth rate was?

A)15.2%

B)35.9%

C)21.2%

D)13.8%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

29

What is the 1/X problem as it applies to averaging P/E ratios?

A)It refers to the fact that a P/E ratio may not make sense when a firm's earnings are very small, and including such firms when calculating an industry average can result in an

Invalid comparison P/E.

B)It refers to the fact that it may be difficult to find a good comparable firm ("Firm X")in a single line of business.

C)It refers to the fact that there are a large number of firms in most industries, which results in an enormous amount of data collection when trying to determine an industry average

P/E ratio.

D)It refers to the fact that the expected eternal earnings growth rate ("X")is difficult to estimate.

A)It refers to the fact that a P/E ratio may not make sense when a firm's earnings are very small, and including such firms when calculating an industry average can result in an

Invalid comparison P/E.

B)It refers to the fact that it may be difficult to find a good comparable firm ("Firm X")in a single line of business.

C)It refers to the fact that there are a large number of firms in most industries, which results in an enormous amount of data collection when trying to determine an industry average

P/E ratio.

D)It refers to the fact that the expected eternal earnings growth rate ("X")is difficult to estimate.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

30

When attempting to value one firm using P/E comps from a few similar firms,

A)a value-weighted average of the comparable P/Es should be used.

B)it is better to use the median P/E ratio, not the mean P/E ratio of the comparable firms.

C)it is better to average the earnings yields, rather than the P/E ratios, and then invert the average earning yield back to a P/E ratio.

D)Both B and C are reasonable methods to use.

A)a value-weighted average of the comparable P/Es should be used.

B)it is better to use the median P/E ratio, not the mean P/E ratio of the comparable firms.

C)it is better to average the earnings yields, rather than the P/E ratios, and then invert the average earning yield back to a P/E ratio.

D)Both B and C are reasonable methods to use.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

31

Assume that a firm's earnings are expected to be $4 million next year and that this number is expected to grow by 10% a year indefinitely. If the appropriate cost of capital is 12%, what is

This firm's P/E ratio?

A)20

B)45

C)50

D)This cannot be determined because the market value of the firm has not been provided.

This firm's P/E ratio?

A)20

B)45

C)50

D)This cannot be determined because the market value of the firm has not been provided.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

32

Assume that a firm's earnings are expected to be $1 million next year, but that this number is expected to shrink by 2% a year indefinitely. If the appropriate cost of capital is 20%, what is

This firm's P/E ratio?

A)2.0

B)5.0

C)4.5

D)A meaningful P/E ratio cannot be calculated when a firm's expected growth rate is declining.

This firm's P/E ratio?

A)2.0

B)5.0

C)4.5

D)A meaningful P/E ratio cannot be calculated when a firm's expected growth rate is declining.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

33

On a certain day in February 2008, the Peabody Energy Corporation had a P/E ratio of 52.88. One of its competitors, Massey Energy Corporation, had a P/E ratio of 33.68. Which of the

Following is the most likely reason for this big difference?

A)Investors are expecting Massey's growth rate to exceed Peabody's growth rate in the future.

B)Peabody had a lower cost of capital relative to its expected earnings growth than did Massey.

C)Massey paid lower dividends in 2007 than did Peabody.

D)Massey reported higher earnings in 2007 than did Peabody, and this drove the P/E ratio down since earnings is in the denominator of the ratio.

Following is the most likely reason for this big difference?

A)Investors are expecting Massey's growth rate to exceed Peabody's growth rate in the future.

B)Peabody had a lower cost of capital relative to its expected earnings growth than did Massey.

C)Massey paid lower dividends in 2007 than did Peabody.

D)Massey reported higher earnings in 2007 than did Peabody, and this drove the P/E ratio down since earnings is in the denominator of the ratio.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

34

On a certain day in February 2008, Hasbro's forward P/E was reported to be 12.56 and its beta was 1.71. The relevant risk-free rate at the time was 3%. Assume that 5% is a reasonable

Equity premium to use. What does this data suggest Hasbro's expected eternal earnings

Growth rate was? Round your answer to the nearest tenth of a percent.

A)0.4%

B)11.6%

C)3.6%

D)19.6%

Equity premium to use. What does this data suggest Hasbro's expected eternal earnings

Growth rate was? Round your answer to the nearest tenth of a percent.

A)0.4%

B)11.6%

C)3.6%

D)19.6%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

35

A firm with a P/E ratio of 25 wants to take over a firm that is half its size (in market capitalization)that has a P/E ratio of 40. What would be the P/E ratio of the merged firm?

A)32.5

B)28.6

C)30.0

D)31.4

A)32.5

B)28.6

C)30.0

D)31.4

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

36

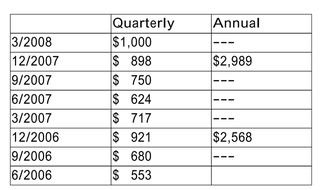

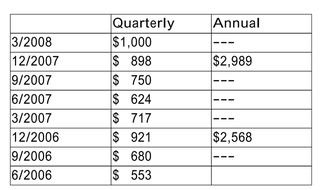

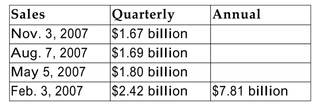

A firm reported the following earnings:  If it is now April 2008, what would be good earnings to use if you are using this firm's earnings for a comparable?

If it is now April 2008, what would be good earnings to use if you are using this firm's earnings for a comparable?

A)$3,272

B)$3,989

C)$2,779

D)$3,072

If it is now April 2008, what would be good earnings to use if you are using this firm's earnings for a comparable?

If it is now April 2008, what would be good earnings to use if you are using this firm's earnings for a comparable?A)$3,272

B)$3,989

C)$2,779

D)$3,072

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

37

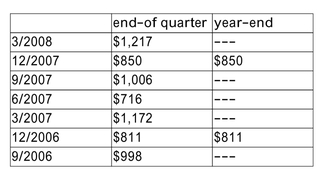

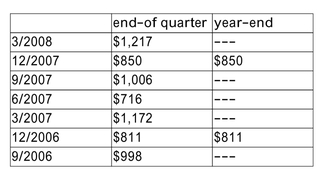

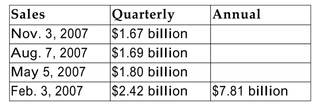

The following are the book values of a firm's debt as reported in its recent quarterly and annual reports:  If it is now April 2008, what would be a good debt number to use if you are using this firm's

If it is now April 2008, what would be a good debt number to use if you are using this firm's

Debt to calculate a comparable market-value-of-equity/book-value-of-debt ratio?

A)$3,869

B)$1,217

C)$924

D)$3,789

If it is now April 2008, what would be a good debt number to use if you are using this firm's

If it is now April 2008, what would be a good debt number to use if you are using this firm'sDebt to calculate a comparable market-value-of-equity/book-value-of-debt ratio?

A)$3,869

B)$1,217

C)$924

D)$3,789

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

38

A firm is currently selling for $50 a share and has a cost of capital of 12%. It has expected earnings of $1.50 a share. What is the present value of its growth opportunities?

A)$33.33

B)$35.00

C)$37.50

D)$12.50

A)$33.33

B)$35.00

C)$37.50

D)$12.50

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

39

A firm is currently selling for $90 a share and has a cost of capital of 12%. It has expected earnings of $3 a share. What percent of the firm's value is due to its future growth

Opportunities?

A)38.5%

B)26.0%

C)72.2%

D)27.8%

Opportunities?

A)38.5%

B)26.0%

C)72.2%

D)27.8%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is a problem that exists when using an industry median P/E ratio instead of an industry mean P/E ratio when trying to avoid the 1/X problem?

A)The P/E ratios of larger firms will have a greater effect on the median P/E than the P/E ratios of smaller firms.

B)It ignores the P/E ratios of all firms above or below those of the median firm.

C)One firm with negative earnings can skew the results such that the P/E ratio is not meaningful.

D)The P/E ratio should use only firms of similar size to the firm being valued, and the median P/E uses the P/Es of all firms in the industry.

A)The P/E ratios of larger firms will have a greater effect on the median P/E than the P/E ratios of smaller firms.

B)It ignores the P/E ratios of all firms above or below those of the median firm.

C)One firm with negative earnings can skew the results such that the P/E ratio is not meaningful.

D)The P/E ratio should use only firms of similar size to the firm being valued, and the median P/E uses the P/Es of all firms in the industry.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

41

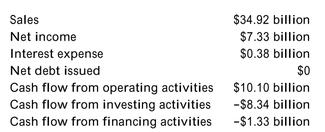

The following information was collected from Cisco Corporation's July 2007 annual report:  Cisco's close price on July 28, 2007 was $28.97, and there were 6.07 billion shares outstanding. What was Cisco's Price/Free Cash Flow ratio?

Cisco's close price on July 28, 2007 was $28.97, and there were 6.07 billion shares outstanding. What was Cisco's Price/Free Cash Flow ratio?

A)8.89

B)9.74

C)1.47

D)127.4

Cisco's close price on July 28, 2007 was $28.97, and there were 6.07 billion shares outstanding. What was Cisco's Price/Free Cash Flow ratio?

Cisco's close price on July 28, 2007 was $28.97, and there were 6.07 billion shares outstanding. What was Cisco's Price/Free Cash Flow ratio?A)8.89

B)9.74

C)1.47

D)127.4

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

42

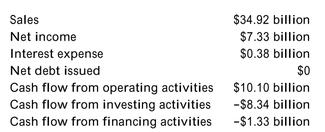

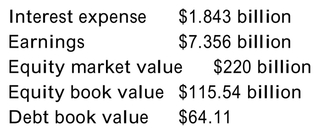

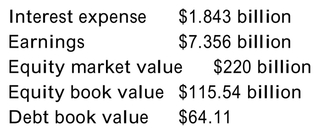

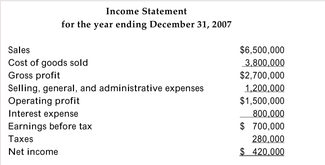

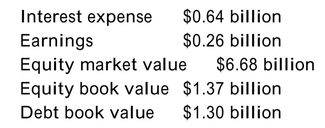

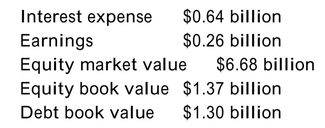

The following data were collected for AT&T in early 2008:  Calculate

Calculate  levered and unlevered P/E ratios.

levered and unlevered P/E ratios.

A)levered P/E = 15.7; unlevered P/E = 19.5

B)levered P/E = 29.9; unlevered P/E = 30.9

C)levered P/E = 30.9; unlevered P/E = 29.9

D)levered P/E = 19.5; unlevered P/E = 15.7

Calculate

Calculate  levered and unlevered P/E ratios.

levered and unlevered P/E ratios.A)levered P/E = 15.7; unlevered P/E = 19.5

B)levered P/E = 29.9; unlevered P/E = 30.9

C)levered P/E = 30.9; unlevered P/E = 29.9

D)levered P/E = 19.5; unlevered P/E = 15.7

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

43

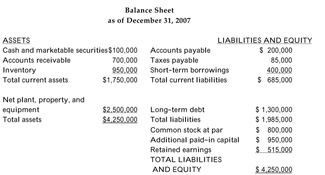

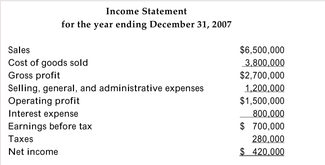

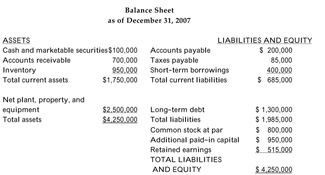

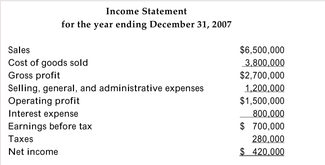

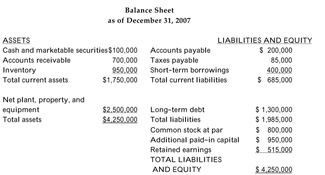

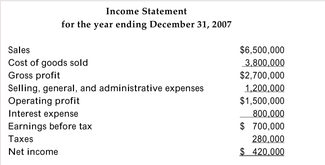

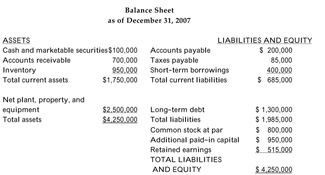

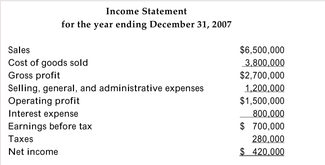

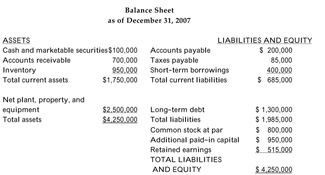

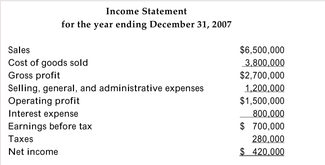

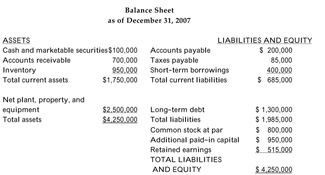

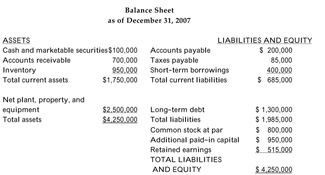

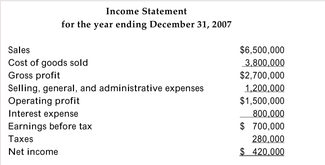

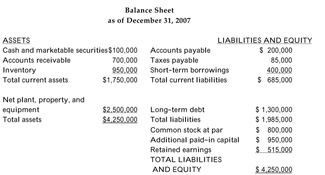

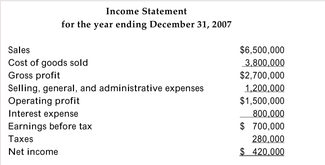

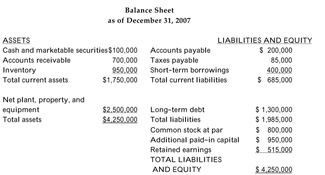

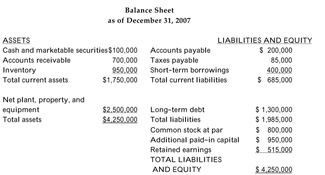

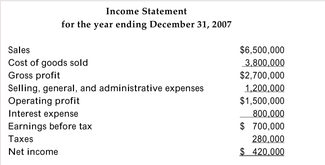

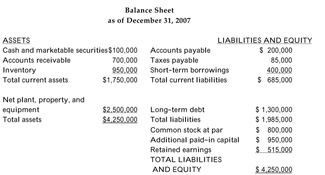

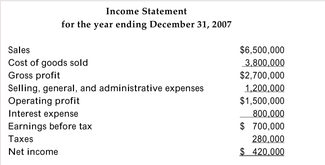

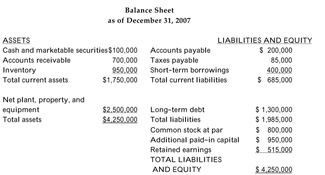

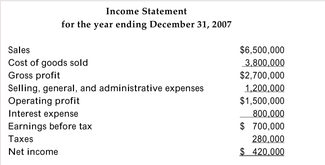

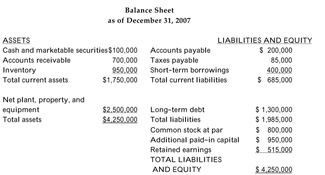

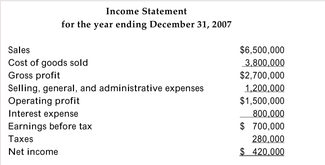

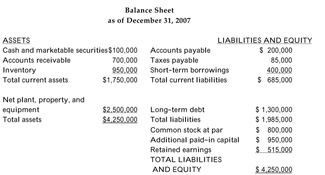

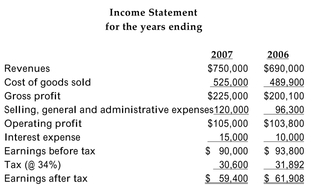

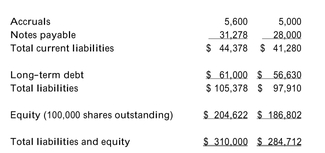

The balance sheet and income statement for Isnet Corporation are as follows:

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Refer to the information above. Calculate Isnet's 2007 dividend payout ratio.

A)23.8%

B)1.0%

C)76.2%

D)none of the above

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007Refer to the information above. Calculate Isnet's 2007 dividend payout ratio.

A)23.8%

B)1.0%

C)76.2%

D)none of the above

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

44

The following information was collected for Dillard's , Inc.:  Shares outstanding are 75.17 million and the close price per share on February 6, 2008 was $18.37. Calculate the appropriate Price/Sales ratio to use for Dillard's in February 2008.

Shares outstanding are 75.17 million and the close price per share on February 6, 2008 was $18.37. Calculate the appropriate Price/Sales ratio to use for Dillard's in February 2008.

A)1.77

B)3.25

C)5.49

D)0.18

Shares outstanding are 75.17 million and the close price per share on February 6, 2008 was $18.37. Calculate the appropriate Price/Sales ratio to use for Dillard's in February 2008.

Shares outstanding are 75.17 million and the close price per share on February 6, 2008 was $18.37. Calculate the appropriate Price/Sales ratio to use for Dillard's in February 2008.A)1.77

B)3.25

C)5.49

D)0.18

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

45

The balance sheet and income statement for Isnet Corporation are as follows:

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Refer to the information above. Calculate Isnet's financial debt-to-market value equity ratio for 2007.

A)19.9%

B)17%

C)13%

D)12.4%

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007Refer to the information above. Calculate Isnet's financial debt-to-market value equity ratio for 2007.

A)19.9%

B)17%

C)13%

D)12.4%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

46

The balance sheet and income statement for Isnet Corporation are as follows:

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Refer to the information above. Calculate Isnet's long-term debt-to-market value equity ratio for 2007.

A)13%

B)16.6%

C)17%

D)12.4%

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007Refer to the information above. Calculate Isnet's long-term debt-to-market value equity ratio for 2007.

A)13%

B)16.6%

C)17%

D)12.4%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

47

How and why might different analysts choose different companies to use as

comparables when estimating a value for a firm?

comparables when estimating a value for a firm?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements about the Price/Sales ratio is true?

A)All else equal, the higher the Price/Sales ratio the more attractive is the investment.

B)Like the Price/Earnings ratio, it is subject to the 1/X problem.

C)It can be misleading if you are valuing a firm within an industry that is using a different strategy from most other firms in the industry--e.g., a firm targeting low-volume, high

Profit margins in an industry that typically goes for high volume, lower margins.

D)All of the above are true statements.

A)All else equal, the higher the Price/Sales ratio the more attractive is the investment.

B)Like the Price/Earnings ratio, it is subject to the 1/X problem.

C)It can be misleading if you are valuing a firm within an industry that is using a different strategy from most other firms in the industry--e.g., a firm targeting low-volume, high

Profit margins in an industry that typically goes for high volume, lower margins.

D)All of the above are true statements.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

49

What must you be certain of when using the market-equity-to-book-equity ratio?

A)that both firms have approximately the same amount of depreciation and amortization expense

B)that both firms are approximately the same size and the same age

C)that both firms have approximately the same amount of interest expense

D)all of the above

A)that both firms have approximately the same amount of depreciation and amortization expense

B)that both firms are approximately the same size and the same age

C)that both firms have approximately the same amount of interest expense

D)all of the above

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

50

The following data was collected for Arch Coal, Inc. in early 2008:  Calculate Arch Coal's levered and unlevered P/E ratios. Round your answers to the nearest tenth.

Calculate Arch Coal's levered and unlevered P/E ratios. Round your answers to the nearest tenth.

A)levered P/E = 10.3; unlevered P/E = 5.3

B)levered P/E = 25.7; unlevered P/E = 11.3

C)levered P/E = 25.7; unlevered P/E = 8.9

D)levered P/E = 5.3; unlevered P/E = 10.3

Calculate Arch Coal's levered and unlevered P/E ratios. Round your answers to the nearest tenth.

Calculate Arch Coal's levered and unlevered P/E ratios. Round your answers to the nearest tenth.A)levered P/E = 10.3; unlevered P/E = 5.3

B)levered P/E = 25.7; unlevered P/E = 11.3

C)levered P/E = 25.7; unlevered P/E = 8.9

D)levered P/E = 5.3; unlevered P/E = 10.3

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

51

The balance sheet and income statement for Isnet Corporation are as follows:

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Refer to the information above. Approximately how many days are Isnet's customers taking to pay their bills? Assume a 365-day year.

A)28 days

B)39 days

C)43 days

D)30 days

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007Refer to the information above. Approximately how many days are Isnet's customers taking to pay their bills? Assume a 365-day year.

A)28 days

B)39 days

C)43 days

D)30 days

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

52

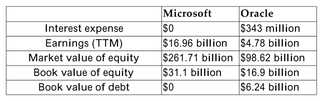

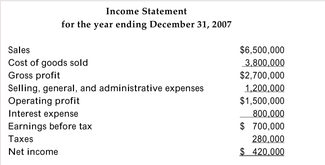

The following information was collected for Microsoft and for Oracle in February 2008:  Calculate the levered and unlevered P/E ratios for the two firms. Does it appear that

Calculate the levered and unlevered P/E ratios for the two firms. Does it appear that

either firm might serve as a good comparable by which to value the other firm?

Calculate the levered and unlevered P/E ratios for the two firms. Does it appear that

Calculate the levered and unlevered P/E ratios for the two firms. Does it appear thateither firm might serve as a good comparable by which to value the other firm?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

53

In this textbook, financial debt is defined as

A)long-term debt plus preferred stock.

B)total assets minus total equity.

C)long-term debt plus any interest-bearing debt included in current liabilities.

D)long-term debt only.

A)long-term debt plus preferred stock.

B)total assets minus total equity.

C)long-term debt plus any interest-bearing debt included in current liabilities.

D)long-term debt only.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

54

The balance sheet and income statement for Isnet Corporation are as follows:

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Refer to the information above. Calculate Isnet's dividend yield, based on the information provided.

A)76.2%

B)4.4%

C)23.8%

D)1.0%

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007Refer to the information above. Calculate Isnet's dividend yield, based on the information provided.

A)76.2%

B)4.4%

C)23.8%

D)1.0%

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

55

The balance sheet and income statement for Isnet Corporation are as follows:

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Refer to the information above. Calculate Isnet's Times Interest Earned ratio for 2007.

A)1.88

B)8.13

C)0.53

D)0.88

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007Refer to the information above. Calculate Isnet's Times Interest Earned ratio for 2007.

A)1.88

B)8.13

C)0.53

D)0.88

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

56

The balance sheet and income statement for Isnet Corporation are as follows:

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Refer to the information above. Calculate Isnet's Cash Conversion Cycle for 2007. Assume a 365-day year.

A)120 days

B)55 days

C)42 days

D)64 days

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007

Isnet's stock was selling for $10 a share at the end of 2007,and there were 1 million shares outstanding. Isnet paid dividends of $0.10 a share in 2007Refer to the information above. Calculate Isnet's Cash Conversion Cycle for 2007. Assume a 365-day year.

A)120 days

B)55 days

C)42 days

D)64 days

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

57

What are two problems that an analyst faces in trying to identify good comparable

firms?

firms?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

58

In which of the following situations might the Price/EBITDA ratio be more useful than the P/E ratio?

A)when comparing companies from different countries due to the different accounting rules that may apply

B)when valuing small companies with little or no debt

C)when valuing firms in an industry that is known to require a lot of upfront capital expenditures

D)Both B and C describe scenarios in which the Price/EBITDA ratio may be more useful.

A)when comparing companies from different countries due to the different accounting rules that may apply

B)when valuing small companies with little or no debt

C)when valuing firms in an industry that is known to require a lot of upfront capital expenditures

D)Both B and C describe scenarios in which the Price/EBITDA ratio may be more useful.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements is true?

A)The greater the use of debt, the higher the P/E ratio of a firm will be.

B)Debt has no effect on the P/E ratio of a firm.

C)Debt has an effect on the P/E ratio of a firm, but it may cause either an increase or a decrease in the ratio, depending on whether or not the firm is a growth firm.

D)The greater the use of debt, the lower the P/E ratio of a firm will be.

A)The greater the use of debt, the higher the P/E ratio of a firm will be.

B)Debt has no effect on the P/E ratio of a firm.

C)Debt has an effect on the P/E ratio of a firm, but it may cause either an increase or a decrease in the ratio, depending on whether or not the firm is a growth firm.

D)The greater the use of debt, the lower the P/E ratio of a firm will be.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

60

According to the textbook, a problem inherent in using a Price/Cash Flow ratio is that

A)debt repayments are included, and you are trying to value only the stock of the company.

B)cash flow is more difficult to calculate.

C)cash flows can vary widely from one year to the next.

D)depreciation and amortization expenses are not taken into account.

A)debt repayments are included, and you are trying to value only the stock of the company.

B)cash flow is more difficult to calculate.

C)cash flows can vary widely from one year to the next.

D)depreciation and amortization expenses are not taken into account.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

61

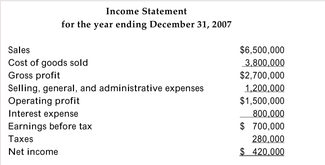

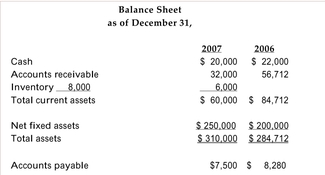

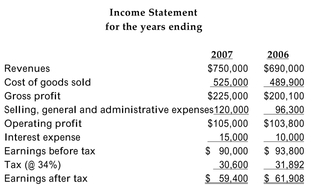

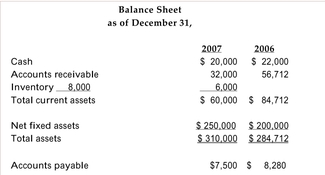

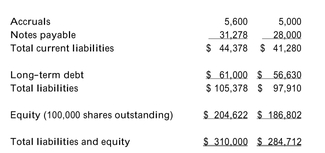

The income statement and balance sheet for the Chinook Sailing School for 2006 and 2007 are as follows:

Refer to the information above. Calculate the ratios necessary to analyze Chinook's

liquidity. Does it appear to have improved or deteriorated from 2006 to 2007?

Refer to the information above. Calculate the ratios necessary to analyze Chinook's

liquidity. Does it appear to have improved or deteriorated from 2006 to 2007?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

62

Assume that two firms have the same operating profit margin of 28%. Firm A has a net profit margin of 14%, however, while Firm B has a net profit margin of 18%. Which of the following

Is the probable reason for this?

A)Firm A has a higher cost of goods sold than Firm B.

B)Firm A has more interest expense than Firm B.

C)Firm A has more depreciation and amortization expense than Firm B.

D)All of the above are possible reasons for the stated results.

Is the probable reason for this?

A)Firm A has a higher cost of goods sold than Firm B.

B)Firm A has more interest expense than Firm B.

C)Firm A has more depreciation and amortization expense than Firm B.

D)All of the above are possible reasons for the stated results.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

63

Calculate Chinook's Cash Conversion Cycle for both years. Interpret your results.

(Assume a 365-day year.)

(Assume a 365-day year.)

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

64

If two firms have the same net profit margin and the same asset turnover ratio (i.e., the

same ROA), which one should have the higher ROE--the one that uses more or less

debt? Explain.

same ROA), which one should have the higher ROE--the one that uses more or less

debt? Explain.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

65

Calculate Chinook's Return on Equity. Did it increase or decrease from 2006 to 2007?

Use the DuPont analysis to determine why.

Use the DuPont analysis to determine why.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

66

If one firm has no debt and a second firm has high debt, is it possible for them to have

the same price/sales ratio? Is this a problem? Why or why not?

the same price/sales ratio? Is this a problem? Why or why not?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

67

A firm has a Days Receivables Outstanding (DRO)of 50 days. Its annual sales outstanding are $3.6 billion. If it could reduce its DRO to 36 days, how much cash could it free up for other

Investments? Assume a 360-day year.

A)$360,000,000

B)$370,400,000

C)$140,000,000

D)$222,220,000

Investments? Assume a 360-day year.

A)$360,000,000

B)$370,400,000

C)$140,000,000

D)$222,220,000

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

68

New Kid is a new firm in the biotech industry, having made its debut just twelve

months ago. The financial analyst for the firm has found that New Kid's total asst

turnover is very low relative to the industry average. Should this necessarily concern

New Kid's management?

months ago. The financial analyst for the firm has found that New Kid's total asst

turnover is very low relative to the industry average. Should this necessarily concern

New Kid's management?

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

69

A firm has a net profit margin of 4%, a total asset turnover ratio of 5 and an equity multiplier of 1.2. Its return on equity is

A)10.0%

B)24.0%.

C)16.7%.

D)none of the above.

A)10.0%

B)24.0%.

C)16.7%.

D)none of the above.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck