Deck 15: Corporate Claims

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/61

Play

Full screen (f)

Deck 15: Corporate Claims

1

At what level of firm value will equity begin to receive a payoff if the firm consists of equity and a single zero coupon bond with a promised payoff of $100 million?

A)when the value exceeds $50 million

B)when the value exceeds $100 million

C)when the value exceeds $10 million

D)This cannot be answered without knowing the relative percentages of debt and equity financing.

A)when the value exceeds $50 million

B)when the value exceeds $100 million

C)when the value exceeds $10 million

D)This cannot be answered without knowing the relative percentages of debt and equity financing.

when the value exceeds $100 million

2

Commercial paper is

A)a long-term debt instrument issued by commercial banks.

B)junior debt of a corporation.

C)long-term collateralized debt.

D)short-term debt of a corporation.

A)a long-term debt instrument issued by commercial banks.

B)junior debt of a corporation.

C)long-term collateralized debt.

D)short-term debt of a corporation.

short-term debt of a corporation.

3

The exercise of which of the following would cause dilution?

A)a bond's put feature

B)a bond's convertible feature

C)a bond's sinking fund feature

D)a bond's call feature

A)a bond's put feature

B)a bond's convertible feature

C)a bond's sinking fund feature

D)a bond's call feature

a bond's convertible feature

4

A bond feature that allows the bond issuer to buy back the debt from the bondholders at a pre-specified price is called a

A)callability feature.

B)warrant.

C)putability feature.

D)convertibility feature.

A)callability feature.

B)warrant.

C)putability feature.

D)convertibility feature.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

5

A firm can retire its debt by

A)exercising its call option on the bond.

B)forcing conversion of the bond.

C)exercising its put option on the bond.

D)Both A and B.

A)exercising its call option on the bond.

B)forcing conversion of the bond.

C)exercising its put option on the bond.

D)Both A and B.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

6

All else equal, which of the following bonds would provide the issuer with the lowest cost of debt

Capital?

A)convertible bonds

B)unsecured senior bonds

C)unsecured subordinated bonds

D)callable bonds

Capital?

A)convertible bonds

B)unsecured senior bonds

C)unsecured subordinated bonds

D)callable bonds

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following are non-financial claims?

A)pension obligations

B)taxes payable

C)notes payable

D)Both A and B are non-financial claims.

A)pension obligations

B)taxes payable

C)notes payable

D)Both A and B are non-financial claims.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is a control right?

A)the right of shareholders to elect the members of the board of directors

B)the right of bondholders to receive interest payments

C)the right of shareholders to receive the liquidated value of the assets of the firm after all prior claims are settled.

D)Both B and C are control rights.

A)the right of shareholders to elect the members of the board of directors

B)the right of bondholders to receive interest payments

C)the right of shareholders to receive the liquidated value of the assets of the firm after all prior claims are settled.

D)Both B and C are control rights.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is a cash flow right?

A)the right of bondholders to force a firm into bankruptcy if the firm isn't making the required payments on the bond

B)the right of shareholders to elect the members of the board of directors.

C)the right of shareholders to vote on a proposed merger

D)the right of bondholders to receive interest payments

A)the right of bondholders to force a firm into bankruptcy if the firm isn't making the required payments on the bond

B)the right of shareholders to elect the members of the board of directors.

C)the right of shareholders to vote on a proposed merger

D)the right of bondholders to receive interest payments

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

10

Provide a payoff table for a firm that is financed partly with a zero coupon bond issue

that has a promised payoff of $50 million and partly with common equity.

that has a promised payoff of $50 million and partly with common equity.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

11

A bond feature that allows the bondholder to sell the debt back to the issuing firm for a pre-specified price is called a

A)sinking fund.

B)callability feature.

C)warrant.

D)putability feature.

A)sinking fund.

B)callability feature.

C)warrant.

D)putability feature.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following are financial claims?

A)pension obligations

B)bonds

C)equity

D)Both B and C are financial claims.

A)pension obligations

B)bonds

C)equity

D)Both B and C are financial claims.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

13

The document that facilitates the creation of financial and non-financial claims for a corporation is called the

A)document of shareholder rights.

B)bond indenture.

C)10K.

D)corporate charter.

A)document of shareholder rights.

B)bond indenture.

C)10K.

D)corporate charter.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

14

In the event of insolvency, in which order are the following claims satisfied--from first to last?

A)preferred stockholders, common stockholders, senior bondholders, junior bondholders

B)senior bondholders, preferred stockholders, junior bondholders, common stockholders

C)preferred stockholders, senior bondholders, junior bondholders, common stockholders

D)senior bondholders, junior bondholders, preferred stockholders, common stockholders

A)preferred stockholders, common stockholders, senior bondholders, junior bondholders

B)senior bondholders, preferred stockholders, junior bondholders, common stockholders

C)preferred stockholders, senior bondholders, junior bondholders, common stockholders

D)senior bondholders, junior bondholders, preferred stockholders, common stockholders

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

15

All else equal, which of the following bonds would offer the highest expected rate of return?

A)collateralized straight bond

B)callable bond

C)convertible bond

D)putable bond

A)collateralized straight bond

B)callable bond

C)convertible bond

D)putable bond

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

16

A bond feature that allows an investor to exchange debt for shares of common stock is called a

A)sinking fund feature.

B)putability feature.

C)convertibility feature.

D)callability feature.

A)sinking fund feature.

B)putability feature.

C)convertibility feature.

D)callability feature.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

17

What is the corporate charter, and what types of information does it include?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

18

To what does the absolute priority rule refer?

A)It stipulates that the federal bankruptcy court will have full power to modify any decision handed down by a lower bankruptcy court.

B)It stipulates that common shareholders are the only category of a firm's investors that will have voting rights.

C)It stipulates that, in the event of liquidation, senior bondholders are paid first, then junior bondholders, then preferred shareholders, and finally common shareholders.

D)It stipulates that a firm must file for Chapter 11 bankruptcy prior to filing for Chapter 7 bankruptcy to ensure that the common shareholders rights don't get violated.

A)It stipulates that the federal bankruptcy court will have full power to modify any decision handed down by a lower bankruptcy court.

B)It stipulates that common shareholders are the only category of a firm's investors that will have voting rights.

C)It stipulates that, in the event of liquidation, senior bondholders are paid first, then junior bondholders, then preferred shareholders, and finally common shareholders.

D)It stipulates that a firm must file for Chapter 11 bankruptcy prior to filing for Chapter 7 bankruptcy to ensure that the common shareholders rights don't get violated.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

19

All else equal, which of the following bonds would be expected to sell for the lowest price?

A)putable bond

B)convertible bond

C)collateralized straight bond

D)callable bond

A)putable bond

B)convertible bond

C)collateralized straight bond

D)callable bond

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

20

A requirement that a firm retire a certain number of its bonds each year is called a

A)warrant requirement.

B)putability requirement.

C)sinking fund requirement.

D)convertibility requirement.

A)warrant requirement.

B)putability requirement.

C)sinking fund requirement.

D)convertibility requirement.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

21

A "unit" refers to

A)the number of bonds a firm is required to retire each year as stipulated in the bond covenants.

B)a bundle of multiple types of financial claims that are sold together.

C)each point above prime that a floating rate bond must pay.

D)a single bond in an entire bond issue.

A)the number of bonds a firm is required to retire each year as stipulated in the bond covenants.

B)a bundle of multiple types of financial claims that are sold together.

C)each point above prime that a floating rate bond must pay.

D)a single bond in an entire bond issue.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

22

Preferred equity differs from common equity in that

A)preferred stockholders have voting rights; common stockholders do not.

B)preferred stock dividends are legal obligations of the corporation while common stock dividends are not.

C)preferred stockholders usually have a prior claim over common shareholders if a firm is liquidated.

D)common shareholders receive a fixed dividend whereas the preferred stock dividends will increase with the earnings of the firm.

A)preferred stockholders have voting rights; common stockholders do not.

B)preferred stock dividends are legal obligations of the corporation while common stock dividends are not.

C)preferred stockholders usually have a prior claim over common shareholders if a firm is liquidated.

D)common shareholders receive a fixed dividend whereas the preferred stock dividends will increase with the earnings of the firm.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following does the CFO of a corporation have the least control over?

A)pension fund obligations

B)bank loans

C)treasury stock

D)commercial paper

A)pension fund obligations

B)bank loans

C)treasury stock

D)commercial paper

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

24

A zero-coupon, convertible bond promises to pay $1,000 upon maturity and can be converted into 40 shares of common stock at its maturity date. There are 1,000 of these bonds

Outstanding, and the firm has 120,000 shares of stock outstanding. At what level of firm value

Will the bondholders choose to convert?

A)when firm value exceeds $2,500,000

B)when firm value exceeds $4,000,000

C)when firm value exceeds $1,666,667

D)when firm value exceeds $1,000,000

Outstanding, and the firm has 120,000 shares of stock outstanding. At what level of firm value

Will the bondholders choose to convert?

A)when firm value exceeds $2,500,000

B)when firm value exceeds $4,000,000

C)when firm value exceeds $1,666,667

D)when firm value exceeds $1,000,000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

25

What are "non-financial" liabilities of a firm?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is a short-term liability of a corporation?

A)accounts payable

B)taxes payable

C)commercial paper

D)all of the above

A)accounts payable

B)taxes payable

C)commercial paper

D)all of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements regarding common stock dividends is true?

A)They provide a tax deduction for the corporation paying them, and they are not included in the taxable income of the recipients.

B)They are paid out of the after-tax income of the corporation paying them, and the recipients also pay taxes on this income.

C)They are paid out of the after-tax income of the corporation paying them, so the recipients do not have to pay taxes on the income.

D)They provide a tax deduction for the corporation paying them, but the recipients of the income must pay taxes on the income.

A)They provide a tax deduction for the corporation paying them, and they are not included in the taxable income of the recipients.

B)They are paid out of the after-tax income of the corporation paying them, and the recipients also pay taxes on this income.

C)They are paid out of the after-tax income of the corporation paying them, so the recipients do not have to pay taxes on the income.

D)They provide a tax deduction for the corporation paying them, but the recipients of the income must pay taxes on the income.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

28

A zero-coupon, convertible bond promises to pay $1,000 upon maturity and can be converted into 40 shares of common stock at its maturity date. There are 1,000 of these bonds

Outstanding, and the firm has 100,000 shares of stock outstanding. At what level of firm value

Will the firm's shareholders begin to receive a payoff?

A)when firm value exceeds $400,000

B)when firm value exceeds $40,000,000

C)when firm value exceeds $1,000,000

D)when firm value exceeds $2,500,000

Outstanding, and the firm has 100,000 shares of stock outstanding. At what level of firm value

Will the firm's shareholders begin to receive a payoff?

A)when firm value exceeds $400,000

B)when firm value exceeds $40,000,000

C)when firm value exceeds $1,000,000

D)when firm value exceeds $2,500,000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

29

Treasury stock refers to

A)stock that has been authorized, but has never been issued.

B)stock owned by preferred shareholders of a corporation.

C)stock that has been repurchased by the corporation.

D)debt of the U.S. government.

A)stock that has been authorized, but has never been issued.

B)stock owned by preferred shareholders of a corporation.

C)stock that has been repurchased by the corporation.

D)debt of the U.S. government.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements regarding the rights of common stockholders is true?

A)A firm's common stockholders collectively, albeit indirectly, own all the firm's assets.

B)A firm's common stockholders, along with the preferred shareholders (if any), elect the members of the board of directors.

C)A firm's common stockholders enjoy unlimited upside potential with limited liability.

D)A firm's common stockholders vote to establish the dividend payout ratio for the firm.

A)A firm's common stockholders collectively, albeit indirectly, own all the firm's assets.

B)A firm's common stockholders, along with the preferred shareholders (if any), elect the members of the board of directors.

C)A firm's common stockholders enjoy unlimited upside potential with limited liability.

D)A firm's common stockholders vote to establish the dividend payout ratio for the firm.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

31

A zero-coupon, convertible bond promises to pay $30,000 at maturity and can be converted into 250 shares of the firm's stock. There are 1,000 of these bonds outstanding, and the firm has

500,000 shares of stock outstanding. At what level of firm value will the firm's equity holders

Begin to receive a payout?

A)when firm value exceeds $60,000,000

B)when firm value exceeds $30,000,000

C)when firm value exceeds $7,500,000

D)when firm value exceeds $90,000,000

500,000 shares of stock outstanding. At what level of firm value will the firm's equity holders

Begin to receive a payout?

A)when firm value exceeds $60,000,000

B)when firm value exceeds $30,000,000

C)when firm value exceeds $7,500,000

D)when firm value exceeds $90,000,000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following current liability accounts would be considered financial debt?

A)taxes payable

B)notes payable

C)deferred income

D)accounts payable

A)taxes payable

B)notes payable

C)deferred income

D)accounts payable

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following long-term liability accounts would be considered financial debt?

A)mortgage bonds

B)foreign borrowings

C)pension obligations

D)both A and B

A)mortgage bonds

B)foreign borrowings

C)pension obligations

D)both A and B

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

34

Why is preferred stock used less often than debt or common equity as a source of

financing?

financing?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

35

Assume that a convertible bond has a coupon rate of 10% and a face value of $1,000

and is convertible into 40 shares of the firm's stock. Assume it is also callable at face

plus one year's interest. The current market price of the stock is $30 a share. If the firm

were to call these bonds under this condition, would you accept the call or exchange

your bond for common equity? Explain.

and is convertible into 40 shares of the firm's stock. Assume it is also callable at face

plus one year's interest. The current market price of the stock is $30 a share. If the firm

were to call these bonds under this condition, would you accept the call or exchange

your bond for common equity? Explain.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

36

A zero-coupon, convertible bond promises to pay $30,000 at maturity and can be converted into 250 shares of the firm's stock. There are 1,000 of these bonds outstanding, and the firm has

500,000 shares of stock outstanding. At what level of firm value will the bondholders choose

To convert?

A)when the firm value exceeds $60 million

B)when the firm value exceeds $90 million

C)when the firm value exceeds $30 million

D)when the firm value exceeds $7.5 million

500,000 shares of stock outstanding. At what level of firm value will the bondholders choose

To convert?

A)when the firm value exceeds $60 million

B)when the firm value exceeds $90 million

C)when the firm value exceeds $30 million

D)when the firm value exceeds $7.5 million

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

37

Preferred stock is like a bond in that

A)it has a fixed maturity date.

B)its dividend payments are typically fixed, like the interest payments on a bond.

C)its dividend payments are legal obligations of the corporation.

D)Both A and B are true statements.

A)it has a fixed maturity date.

B)its dividend payments are typically fixed, like the interest payments on a bond.

C)its dividend payments are legal obligations of the corporation.

D)Both A and B are true statements.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is classified as a long-term liability of a corporation?

A)income taxes payable

B)commercial paper

C)pension obligations

D)both B and C

A)income taxes payable

B)commercial paper

C)pension obligations

D)both B and C

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

39

What are the advantages and disadvantages associated with investing in common

stock?

stock?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements regarding preferred stock is false?

A)Preferred stock typically pays a fixed dividend.

B)Preferred stockholders typically have no voting rights.

C)Like debt, preferred stock may be convertible into shares of common stock.

D)Preferred stockholders can force a firm into bankruptcy if too many dividend payments are missed.

A)Preferred stock typically pays a fixed dividend.

B)Preferred stockholders typically have no voting rights.

C)Like debt, preferred stock may be convertible into shares of common stock.

D)Preferred stockholders can force a firm into bankruptcy if too many dividend payments are missed.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

41

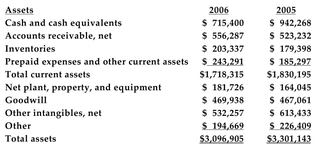

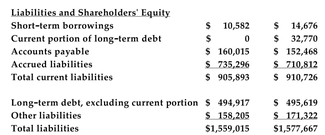

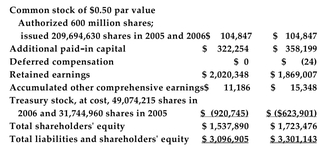

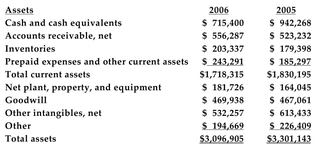

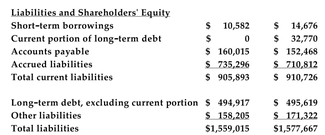

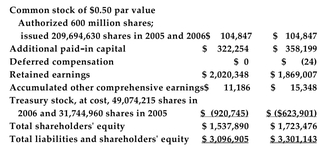

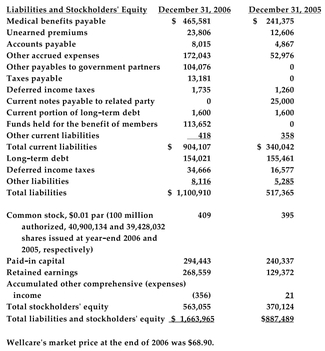

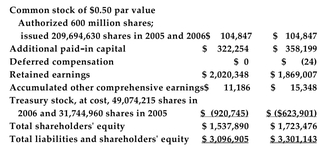

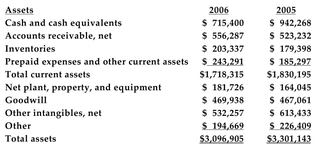

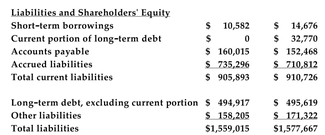

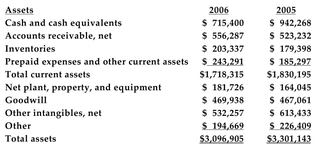

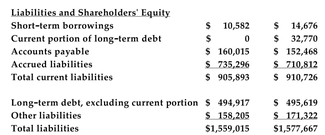

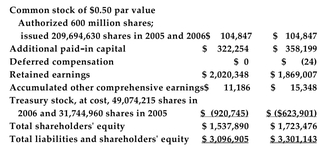

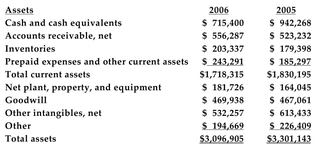

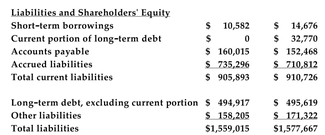

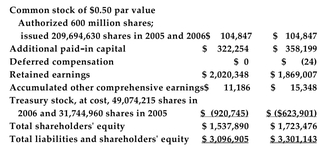

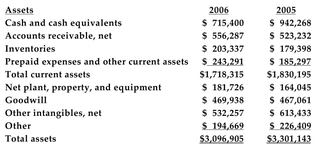

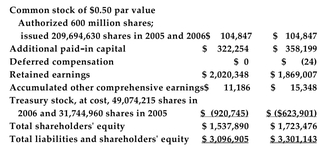

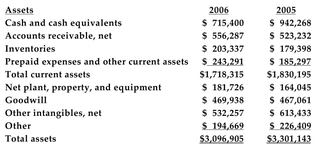

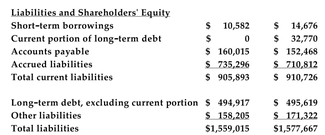

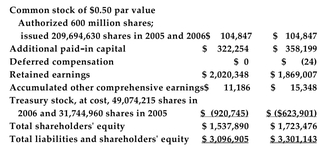

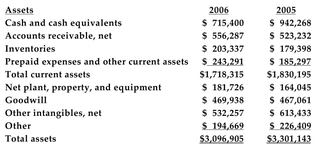

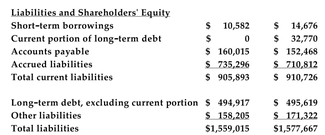

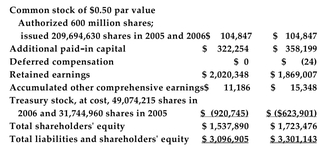

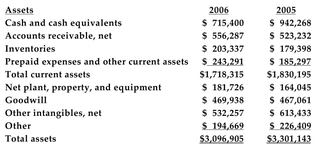

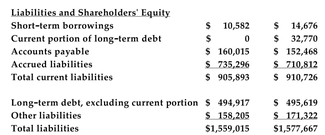

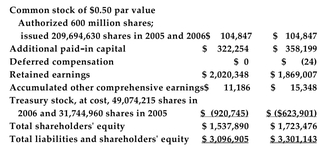

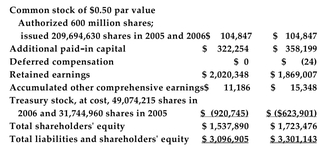

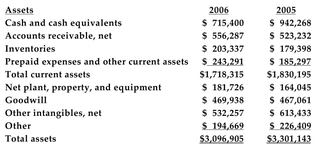

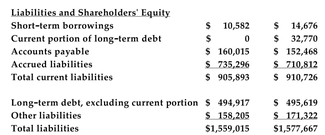

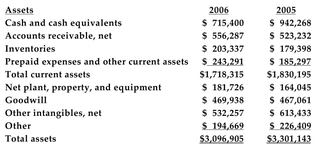

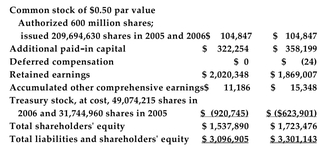

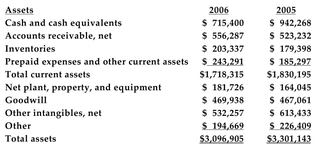

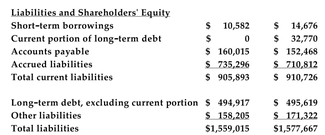

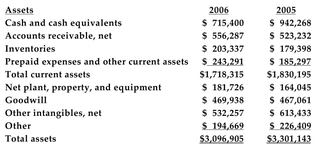

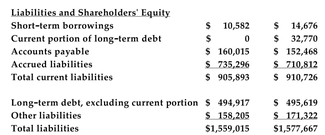

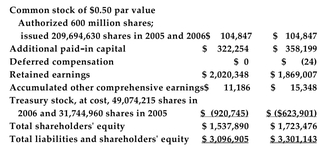

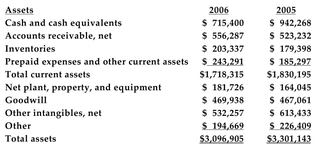

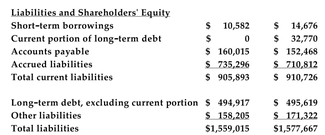

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars):

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

Refer to the information above. What was Hasbro's liabilities-to-assets ratio, based on market value of the assets in 2006?

A)55.3%

B)29.3%

C)50.3%

D)17.9%

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.Refer to the information above. What was Hasbro's liabilities-to-assets ratio, based on market value of the assets in 2006?

A)55.3%

B)29.3%

C)50.3%

D)17.9%

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

42

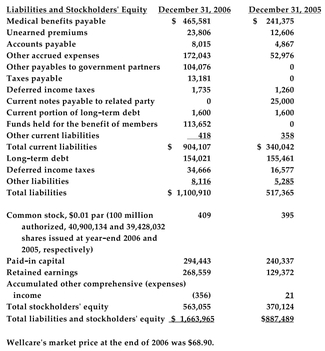

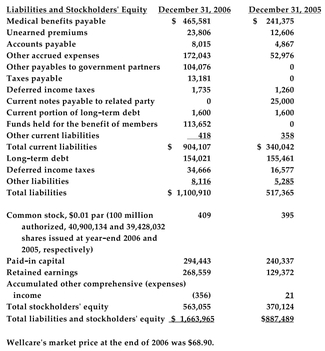

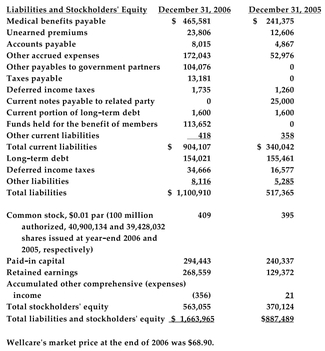

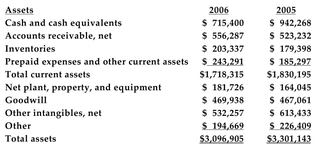

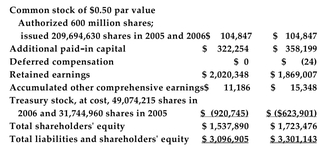

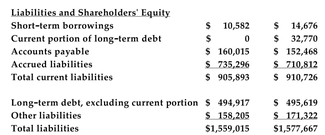

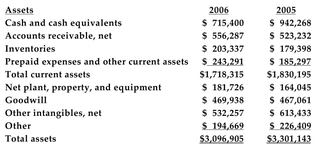

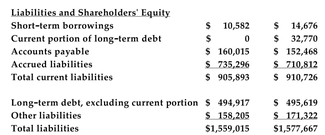

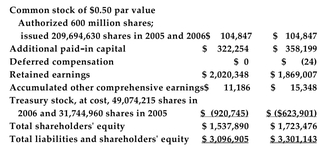

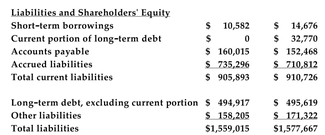

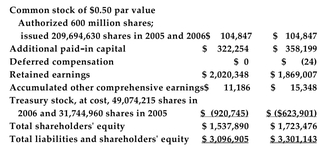

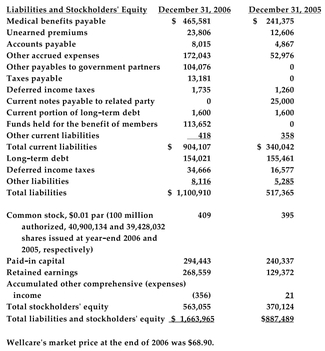

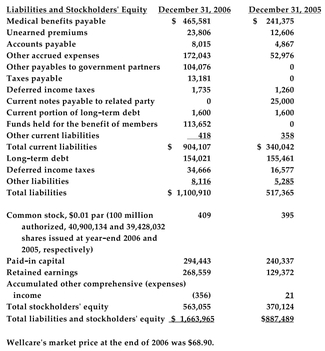

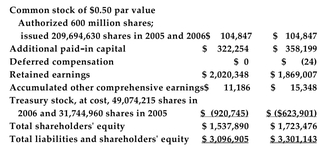

The following information has been collected from the 2006 and 2005 balance sheets of Wellcare Health Plans, Inc.

Refer to the information above What major changes have taken place in Wellcare's

capital structure between 2005 and 2006? Discuss.

Refer to the information above What major changes have taken place in Wellcare's

capital structure between 2005 and 2006? Discuss.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

43

The following information has been collected from the 2006 and 2005 balance sheets of Wellcare Health Plans, Inc.

Refer to the information above Calculate the 2006 liabilities-to-assets ratios for

Wellcare, based on both book value of assets and market value of assets.

Refer to the information above Calculate the 2006 liabilities-to-assets ratios for

Wellcare, based on both book value of assets and market value of assets.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

44

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars):

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

Refer to the information above. What was Hasbro's liabilities-to-assets ratio, based on the book value of the assets in 2006?

A)17.9%

B)55.3%

C)50.3%

D)29.3%

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.Refer to the information above. What was Hasbro's liabilities-to-assets ratio, based on the book value of the assets in 2006?

A)17.9%

B)55.3%

C)50.3%

D)29.3%

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

45

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars):

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

Refer to the information above. Which of the following statements regarding changes in Hasbro's capital structure from 2005 to 2006 is true?

A)Hasbro's use of short-term financial debt increased in 2006.

B)Hasbro has increased its overall use of debt financing in 2006.

C)Hasbro is using less financial debt and more non-financial debt in 2006.

D)None of the above is a true statement.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.Refer to the information above. Which of the following statements regarding changes in Hasbro's capital structure from 2005 to 2006 is true?

A)Hasbro's use of short-term financial debt increased in 2006.

B)Hasbro has increased its overall use of debt financing in 2006.

C)Hasbro is using less financial debt and more non-financial debt in 2006.

D)None of the above is a true statement.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

46

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars):

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

Refer to the information above. In 2006, the number of shares of Hasbro's stock that was publicly held was

A)519,180,825

B)128,875,455.

C)160,620,415.

D)550,925,785.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.Refer to the information above. In 2006, the number of shares of Hasbro's stock that was publicly held was

A)519,180,825

B)128,875,455.

C)160,620,415.

D)550,925,785.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

47

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars):

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

Refer to the information above. From 2005 to 2006, Hasbro's financial debt

A)decreased by $702.

B)decreased by $18,652.

C)decreased by $37,566.

D)decreased by $13,819.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.Refer to the information above. From 2005 to 2006, Hasbro's financial debt

A)decreased by $702.

B)decreased by $18,652.

C)decreased by $37,566.

D)decreased by $13,819.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

48

Pensions and other unspecified liabilities accounted for approximately what percentage of IBM's total liabilities from 2001 to 2003?

A)10%

B)33%

C)50%

D)25%

A)10%

B)33%

C)50%

D)25%

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

49

How much hybrid financing is Firm A using, if any?

A)$2,770

B)$ 300

C)$2,870

D)Firm A is not using any hybrid financing.

A)$2,770

B)$ 300

C)$2,870

D)Firm A is not using any hybrid financing.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

50

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars):

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

Refer to the information above. Hasbro's financial debt-to-capital market value ratio in 2006 was

A)10.4%.

B)24.7%.

C)24.3%.

D)none of the above.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.Refer to the information above. Hasbro's financial debt-to-capital market value ratio in 2006 was

A)10.4%.

B)24.7%.

C)24.3%.

D)none of the above.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

51

Calculate the 2006 financial debt-to-financial capital ratios for Wellcare, based on both

market values and book values.

market values and book values.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements about IBM's use of debt during the 2001 to 2003 period is true?

A)IBM had maxed out its use of credit lines during this period and had no unused credit lines left.

B)IBM began using more short-term debt and less long-term debt.

C)IBM began using more long-term debt and less short-term debt.

D)Both A and B are true statements.

A)IBM had maxed out its use of credit lines during this period and had no unused credit lines left.

B)IBM began using more short-term debt and less long-term debt.

C)IBM began using more long-term debt and less short-term debt.

D)Both A and B are true statements.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

53

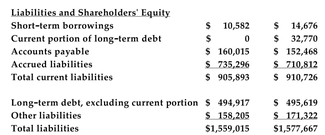

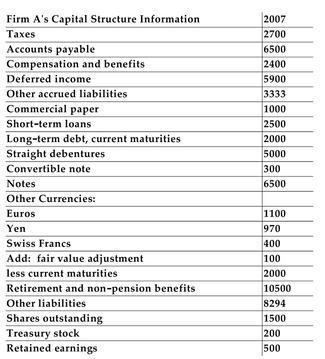

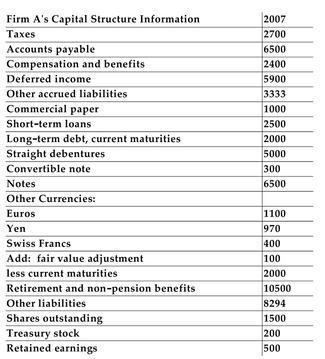

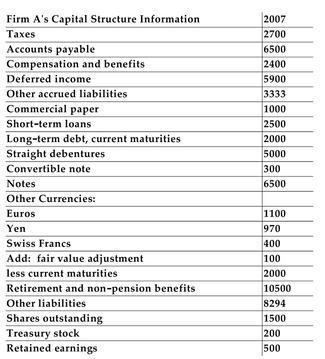

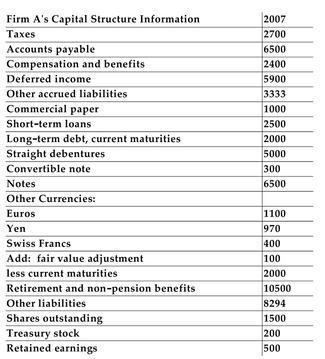

The following information has been collected from Firm A's 2007 annual report:

Refer to the information above. What is the value of Firm A's long-term financial debt?

A)$31,164

B)$12,370

C)$11,800

D)none of the above

Refer to the information above. What is the value of Firm A's long-term financial debt?

A)$31,164

B)$12,370

C)$11,800

D)none of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

54

A firm has 800 million authorized shares, 500 million issued shares, and 100 million in treasury stock. How many shares are in the public's hands?

A)700 million

B)400 million

C)300 million

D)none of the above

A)700 million

B)400 million

C)300 million

D)none of the above

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

55

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars):

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

Refer to the information above. In 2006, the number of shares of Hasbro's stock that were repurchased was

A)920,745.

B)160,620,415.

C)49,074,215.

D)none of the above.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.Refer to the information above. In 2006, the number of shares of Hasbro's stock that were repurchased was

A)920,745.

B)160,620,415.

C)49,074,215.

D)none of the above.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

56

The following information has been collected from Firm A's 2007 annual report:

Refer to the information above. What is the value of Firm A's short-term financial debt?

A)$9,500

B)$2,500

C)$3,500

D)$5,500

Refer to the information above. What is the value of Firm A's short-term financial debt?

A)$9,500

B)$2,500

C)$3,500

D)$5,500

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

57

The following information has been collected from the 2006 and 2005 balance sheets of Wellcare Health Plans, Inc.

Refer to the information above How many shares of Wellcare's stock were outstanding

at the end of 2006?

Refer to the information above How many shares of Wellcare's stock were outstanding

at the end of 2006?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

58

A firm has 500 million authorized shares, 300 million issued shares, and 180 million shares outstanding. How many shares does the firm hold in treasury?

A)120 million

B)320 million

C)200 million

D)20 million

A)120 million

B)320 million

C)200 million

D)20 million

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

59

Most of the change in IBM's capital structure during the 2001 to 2003 period was the result of

A)short-term debt issuance.

B)stock repurchases.

C)changes in the market value of IBM's equity.

D)long-term debt issuance.

A)short-term debt issuance.

B)stock repurchases.

C)changes in the market value of IBM's equity.

D)long-term debt issuance.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

60

Below are 2005 and 2006 balance sheets of Hasbro, Inc. (numbers are in thousands of dollars):

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

Refer to the information above. Hasbro's financial debt-to-capital book value ratio in 2006 was

A)24.3%.

B)24.7%.

C)50.3%.

D)none of the above.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.

The market value of Hasbro's shares was $27.25 a share at the end of 2006 and $20.18 a share at the end of 2005.Refer to the information above. Hasbro's financial debt-to-capital book value ratio in 2006 was

A)24.3%.

B)24.7%.

C)50.3%.

D)none of the above.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

61

How might the financial debt-to-assets ratio be misleading?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck