Deck 10: Market Imperfections

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/63

Play

Full screen (f)

Deck 10: Market Imperfections

1

Which of the following is a characteristic of a competitive market?

A)There are no transactions costs.

B)There are an infinite number of buyers and sellers, none of whom has any market power.

C)There are no taxes.

D)All of the above are characteristics of a competitive market.

A)There are no transactions costs.

B)There are an infinite number of buyers and sellers, none of whom has any market power.

C)There are no taxes.

D)All of the above are characteristics of a competitive market.

There are an infinite number of buyers and sellers, none of whom has any market power.

2

Which of the following industries is least representative of perfect market conditions?

A)mutual funds

B)cable companies

C)gas stations

D)supermarkets

A)mutual funds

B)cable companies

C)gas stations

D)supermarkets

cable companies

3

You can earn 4% on your bank deposits, but your bank charges you 9% to borrow

money. You are

considering a project that will cost $5,000 and will return 8% in one year. You have

$2,000 that you can invest. Should you undertake this project?

money. You are

considering a project that will cost $5,000 and will return 8% in one year. You have

$2,000 that you can invest. Should you undertake this project?

Yes. To undertake the project you must borrow $3,000 at 9%. You will owe $3,000(1.09)= $3,270 at the end of the year. You will have earned $5,000(1.08)= $5,400 on the project, so you will net $5,400 - $3,270 = $2,130. If, instead, you deposit your $2,000 in the bank at 4%, you will have only $2,000(1.04)= $2,080.

4

True, False, or Uncertain: "When the expected borrowing rate differs from the

promised borrowing rate,

the perfect market assumption is violated." Explain.

promised borrowing rate,

the perfect market assumption is violated." Explain.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

5

For which of the following types of assets is the market closest to perfect?

A)corporate bonds

B)municipal bonds

C)large company stocks

D)real estate

A)corporate bonds

B)municipal bonds

C)large company stocks

D)real estate

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

6

You can earn 3% on your bank deposits, but your bank will charge you 12% to borrow

money. You are considering a project that will cost $5,000 and will return 8% in one

year. You have $2,000 that you can invest. Should you undertake this project?

money. You are considering a project that will cost $5,000 and will return 8% in one

year. You have $2,000 that you can invest. Should you undertake this project?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

7

Assume risk-neutrality and that the appropriate interest rate is 8%. You believe your probability of

Defaulting on a loan and repaying nothing is only 5%, but your bank believes it is 20%. What

Rate will the bank quote you on a loan, and what does this make the expected borrowing rate

From your perspective?

A)bank rate = 28%; your expected borrowing rate = 35%

B)bank rate = 33.2%; your expected borrowing rate = 35%

C)bank rate =35%; your expected borrowing rate = 8%

D)bank rate = 35%; your expected borrowing rate =33.2%

Defaulting on a loan and repaying nothing is only 5%, but your bank believes it is 20%. What

Rate will the bank quote you on a loan, and what does this make the expected borrowing rate

From your perspective?

A)bank rate = 28%; your expected borrowing rate = 35%

B)bank rate = 33.2%; your expected borrowing rate = 35%

C)bank rate =35%; your expected borrowing rate = 8%

D)bank rate = 35%; your expected borrowing rate =33.2%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

8

The perfect market assumption that there is "no difference in opinion" among investors means that

A)everyone has the same information and is in perfect agreement regarding what return should be required for each given level of risk.

B)no single entity has any market power.

C)everyone faces the same tax rate and transaction costs, so there is perfect agreement regarding what an after-tax, after-transaction cost return should be for a given level of

Risk.

D)the risk and return of all investments is known with certainty.

A)everyone has the same information and is in perfect agreement regarding what return should be required for each given level of risk.

B)no single entity has any market power.

C)everyone faces the same tax rate and transaction costs, so there is perfect agreement regarding what an after-tax, after-transaction cost return should be for a given level of

Risk.

D)the risk and return of all investments is known with certainty.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is an example of an indirect transaction cost?

A)forgone rent

B)appraisal fees

C)the liquidity premium

D)advertising expenses

A)forgone rent

B)appraisal fees

C)the liquidity premium

D)advertising expenses

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

10

You can earn 4% on your bank deposits and are considering a project that will cost $8,000 and offers an 8% return in one year. You have $3,000 to invest. What is the maximum interest rate

You could pay on a loan that would make this project acceptable?

A)14.7%

B)8.0%

C)4.01%

D)10.4%

You could pay on a loan that would make this project acceptable?

A)14.7%

B)8.0%

C)4.01%

D)10.4%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is not considered to be a transaction cost?

A)the commission paid to a broker

B)a dealer's bid-ask spread

C)the time it takes you to research the asset you want to buy or sell

D)any taxes you must pay on the purchase or sale of the asset

A)the commission paid to a broker

B)a dealer's bid-ask spread

C)the time it takes you to research the asset you want to buy or sell

D)any taxes you must pay on the purchase or sale of the asset

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is not a perfect market assumption?

A)There is no uncertainty regarding expected returns.

B)There are no transaction costs.

C)There are an infinite number of buyers and sellers.

D)Everyone can borrow and lend at the same interest rate.

A)There is no uncertainty regarding expected returns.

B)There are no transaction costs.

C)There are an infinite number of buyers and sellers.

D)Everyone can borrow and lend at the same interest rate.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

13

The difference between what you personally value a good for and what you pay for it is called your

A)good luck.

B)overage.

C)indifference point.

D)surplus.

A)good luck.

B)overage.

C)indifference point.

D)surplus.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

14

You can earn 4% on your bank deposits, but your bank will charge you 8% to borrow money. You are considering a one-year project that will cost $10,000. You have $4,000 that you can

Invest. What minimum rate of return does this project have to offer before you should

Consider investing in it?

A)8.01%

B)5.6%

C)6.4%

D)4.0%

Invest. What minimum rate of return does this project have to offer before you should

Consider investing in it?

A)8.01%

B)5.6%

C)6.4%

D)4.0%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

15

Assume risk-neutrality and that the appropriate interest rate is 8%. You believe your probability of defaulting on a loan and repaying nothing is only 5%, but your bank believes it

Is 20%. What rate will the bank quote you on a loan?

A)64.0%

B)28.0%

C)35.0%

D)33.2%

Is 20%. What rate will the bank quote you on a loan?

A)64.0%

B)28.0%

C)35.0%

D)33.2%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

16

Assume that you and your bank agree that the probability that you will default on a loan and repay nothing is 15% and that the appropriate interest rate is 6%. What interest rate would

You have to promise to pay in order to get a loan, assuming risk-neutrality? What is your cost

Of capital?

A)loan rate = 24.7%; cost of capital = 6%

B)loan rate= 24.7%; cost of capital = 24.7%

C)loan rate = 10.5%; cost of capital = 6%

D)loan rate = 10.5%; cost of capital = 10.5%

You have to promise to pay in order to get a loan, assuming risk-neutrality? What is your cost

Of capital?

A)loan rate = 24.7%; cost of capital = 6%

B)loan rate= 24.7%; cost of capital = 24.7%

C)loan rate = 10.5%; cost of capital = 6%

D)loan rate = 10.5%; cost of capital = 10.5%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements is true?

A)A market imperfection exists if the expected borrowing rate from the lender's perspective differs from the expected borrowing rate from the borrower's perspective.

B)A market imperfection exists if the promised savings rate is higher than the promised borrowing rate.

C)A market imperfection exists if the promised borrowing rate is higher than the expected borrowing rate.

D)All of the above are market imperfections.

A)A market imperfection exists if the expected borrowing rate from the lender's perspective differs from the expected borrowing rate from the borrower's perspective.

B)A market imperfection exists if the promised savings rate is higher than the promised borrowing rate.

C)A market imperfection exists if the promised borrowing rate is higher than the expected borrowing rate.

D)All of the above are market imperfections.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

18

The "depth" of a market is defined by

A)how many different types of securities (e.g., stocks, bonds, options, etc.)are traded in that market.

B)the number of buyers and sellers participating in the market.

C)the number of securities traded on that specific exchange floor.

D)the degree to which the market is transparent.

A)how many different types of securities (e.g., stocks, bonds, options, etc.)are traded in that market.

B)the number of buyers and sellers participating in the market.

C)the number of securities traded on that specific exchange floor.

D)the degree to which the market is transparent.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

19

How perfect do you think the market for fine art is? Explain.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

20

Explain the following statement: "Although everyone is paying what a good is worth

in a perfect market, most buyers and sellers can come away being better off."

in a perfect market, most buyers and sellers can come away being better off."

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

21

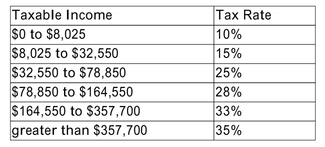

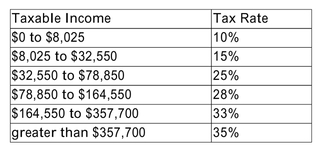

In 2008, the tax schedule for a single taxpayer is as follows:  What is the marginal tax rate and the average tax rate of a single taxpayer who has taxable income of $60,000?

What is the marginal tax rate and the average tax rate of a single taxpayer who has taxable income of $60,000?

A)marginal rate = 28%; average rate = 15.0%

B)marginal rate = 25%; average rate = 18.9%

C)marginal rate = 28%; average rate = 32.5%

D)marginal rate = 25%; average rate = 13.7%.

What is the marginal tax rate and the average tax rate of a single taxpayer who has taxable income of $60,000?

What is the marginal tax rate and the average tax rate of a single taxpayer who has taxable income of $60,000?A)marginal rate = 28%; average rate = 15.0%

B)marginal rate = 25%; average rate = 18.9%

C)marginal rate = 28%; average rate = 32.5%

D)marginal rate = 25%; average rate = 13.7%.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

22

The Calico Corporation pays taxes at the marginal rate of 34%. It recently purchased a new piece of equipment that allows the firm to deduct an annual depreciation expense $30,000.

What is the tax savings associated with this depreciation expense? (That is, how much does

Calico save in taxes because it can write off this expense and reduce its taxable income?)

A)$18,000

B)$19,800

C)$10,200

D)This can't be answered without knowing the firm's taxable revenues.

What is the tax savings associated with this depreciation expense? (That is, how much does

Calico save in taxes because it can write off this expense and reduce its taxable income?)

A)$18,000

B)$19,800

C)$10,200

D)This can't be answered without knowing the firm's taxable revenues.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

23

Is the market in which the utilities industry operates a "deep" market? Explain.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

24

Which is the correct statement regarding the taxation of income?

A)Interest income and dividend income are both at the same rate as ordinary income under current tax law.

B)Interest income is taxed at the same rate as ordinary income; dividend income is taxed preferentially under current tax law.

C)Interest income, dividend income, and long-term net capital gains are all taxed at lower rates than ordinary income under current tax law.

D)Interest income and long-term net capital gains are both taxed preferentially while dividend income is taxed at the same rate as ordinary income under current tax law.

A)Interest income and dividend income are both at the same rate as ordinary income under current tax law.

B)Interest income is taxed at the same rate as ordinary income; dividend income is taxed preferentially under current tax law.

C)Interest income, dividend income, and long-term net capital gains are all taxed at lower rates than ordinary income under current tax law.

D)Interest income and long-term net capital gains are both taxed preferentially while dividend income is taxed at the same rate as ordinary income under current tax law.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

25

If a municipal bond returns 6% and you pay taxes at the marginal rate of 35%, what rate would a taxable corporate bond of similar risk have to offer before you would consider investing in it?

A)8.1%

B)3.9%

C)9.2%

D)17.1%

A)8.1%

B)3.9%

C)9.2%

D)17.1%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

26

The bid price for Sun Microsystems (JAVA)is currently $16.22 and its ask price is $16.23. Your broker charges a commission of $13 per transaction. What are the total costs of buying and

Selling 1,000 shares of JAVA as a percentage of the invested dollars?

A)0.22%

B)0.43%

C)0.02%

D)0.18%

Selling 1,000 shares of JAVA as a percentage of the invested dollars?

A)0.22%

B)0.43%

C)0.02%

D)0.18%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

27

The more illiquid an investment is

A)the lower its expected rate of return, all else equal.

B)the worse the investment is.

C)the lower the price it should sell for, all else equal.

D)Both A and B are correct answers.

A)the lower its expected rate of return, all else equal.

B)the worse the investment is.

C)the lower the price it should sell for, all else equal.

D)Both A and B are correct answers.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

28

You bought a house for $250,000 and incurred additional transaction costs of $2,000 at the time of your purchase. You sold the house one year later for $325,000. The selling broker charged a

6% commission, and you incurred other costs associated with the sale, both direct and indirect,

Of $5,000. An alternative investment of similar risk offers a 10% annual return, but has a 60

Basis point transaction cost. What is the NPV of this investment?

A)$26,680

B)$22,680

C)$24,680

D)$36,942

6% commission, and you incurred other costs associated with the sale, both direct and indirect,

Of $5,000. An alternative investment of similar risk offers a 10% annual return, but has a 60

Basis point transaction cost. What is the NPV of this investment?

A)$26,680

B)$22,680

C)$24,680

D)$36,942

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

29

David invested $20,000 in the stock market. None of his stocks paid dividends, but after one year, his portfolio was worth $30,000. The relevant capital gains tax rate was 15%. What was

David's after-tax return on this investment, assuming he liquidated his portfolio?

A)27.5%

B)42.5%

C)22.8%

D)127.5%

David's after-tax return on this investment, assuming he liquidated his portfolio?

A)27.5%

B)42.5%

C)22.8%

D)127.5%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

30

An individual has earnings of $80,000 and deductible expenses of $15,000, and there is a single tax bracket of 35%. What is the after-tax income for this individual?

A)$35,750

B)$42,250

C)$22,750

D)$19,250

A)$35,750

B)$42,250

C)$22,750

D)$19,250

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

31

Hong Jun invested $10,000 in the stock market and earned a before-tax return of 30% on his investment. The relevant tax rate for his capital gain income was 15%. What was Hong Jun's

After-tax return?

A)22.5%

B)25.5%

C)4.5%

D)None of the above is a correct answer.

After-tax return?

A)22.5%

B)25.5%

C)4.5%

D)None of the above is a correct answer.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements about municipal bonds is true?

A)Investors in lower tax brackets are usually better off investing in a municipal bond than in a corporate bond.

B)An investment in a municipal bond is always preferable to investing in a corporate bond of the same risk because the municipal bond pays interest that is exempt from federal

Taxation.

C)Municipal bonds are similar in risk to Treasury bonds of the same maturity.

D)None of the above is a true statement.

A)Investors in lower tax brackets are usually better off investing in a municipal bond than in a corporate bond.

B)An investment in a municipal bond is always preferable to investing in a corporate bond of the same risk because the municipal bond pays interest that is exempt from federal

Taxation.

C)Municipal bonds are similar in risk to Treasury bonds of the same maturity.

D)None of the above is a true statement.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

33

You purchased a house for $450,000 and incurred additional costs of $4,000 at the time of the purchase. Because of a job transfer, you were forced to sell the house later for $400,000. The

Selling broker charged a 6% commission, and you estimated that other costs associated with

The sale, both direct and indirect, amounted to $10,000. What was your rate of return on this

Investment?

A)-19.4%

B)-21.3%

C)24.0%

D)17.9%

Selling broker charged a 6% commission, and you estimated that other costs associated with

The sale, both direct and indirect, amounted to $10,000. What was your rate of return on this

Investment?

A)-19.4%

B)-21.3%

C)24.0%

D)17.9%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

34

Assume you bought a $400,000 house, using an 80% interest-only mortgage. Transaction costs associated with the purchase amounted to $4,000. You estimate a net benefit of $2,000 per

Month from owning the home (e.g., the enjoyment of home ownership and the tax deductibility

Of the interest expense less the cash outflows associated with the mortgage payments, property

Taxes, etc.)At the end of a year, you receive a job transfer and are forced to sell your home.

Unfortunately, your employer doesn't provide any aid in this matter, and market values have

Declined. The real estate commission is 6% and other transaction costs associated with the sale

Amounted to about 1% of the selling price of $375,000. Assume the appropriate cost of capital

To use is 8% a year. What is your NPV on your investment?

A)-$36,360

B)-$120,178

C)+$261,909

D)-$108,462

Month from owning the home (e.g., the enjoyment of home ownership and the tax deductibility

Of the interest expense less the cash outflows associated with the mortgage payments, property

Taxes, etc.)At the end of a year, you receive a job transfer and are forced to sell your home.

Unfortunately, your employer doesn't provide any aid in this matter, and market values have

Declined. The real estate commission is 6% and other transaction costs associated with the sale

Amounted to about 1% of the selling price of $375,000. Assume the appropriate cost of capital

To use is 8% a year. What is your NPV on your investment?

A)-$36,360

B)-$120,178

C)+$261,909

D)-$108,462

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

35

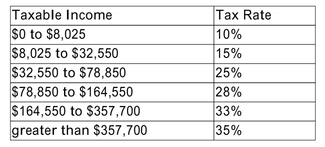

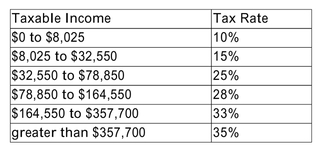

In 2008, the tax schedule for a single taxpayer is as follows:  The tax rate for capital gains and dividend income is 15% for investors in marginal tax brackets greater than 15%. Paul invested $10,000 in the stock market and $10,000 in bonds. During the

The tax rate for capital gains and dividend income is 15% for investors in marginal tax brackets greater than 15%. Paul invested $10,000 in the stock market and $10,000 in bonds. During the

Year Paul earned $1,000 in dividends and $900 in interest income from these investments. If

Paul is in the 28% marginal tax bracket, what was his tax obligation on the income from his

Portfolio?

A)$285

B)$532

C)$402

D)None of the above is a correct answer.

The tax rate for capital gains and dividend income is 15% for investors in marginal tax brackets greater than 15%. Paul invested $10,000 in the stock market and $10,000 in bonds. During the

The tax rate for capital gains and dividend income is 15% for investors in marginal tax brackets greater than 15%. Paul invested $10,000 in the stock market and $10,000 in bonds. During theYear Paul earned $1,000 in dividends and $900 in interest income from these investments. If

Paul is in the 28% marginal tax bracket, what was his tax obligation on the income from his

Portfolio?

A)$285

B)$532

C)$402

D)None of the above is a correct answer.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

36

Jackie earns $5,000 a month in taxable income. Her financial advisor is trying to talk her into contributing $500 a month into her 401K rather than putting the money into a regular account.

He explains to her that the contribution into the 401K is made with pre-tax dollars and would

Leave her with more spending money. Both investments are equally risky, and she can earn an

8% return on each. Her tax rate is 28%. If Jackie invests the money through her 401K rather

Than through a regular account , how much more would she have to spend each month in

After-tax dollars?

A)$360

B)$140

C)$900

D)None of the above is correct.

He explains to her that the contribution into the 401K is made with pre-tax dollars and would

Leave her with more spending money. Both investments are equally risky, and she can earn an

8% return on each. Her tax rate is 28%. If Jackie invests the money through her 401K rather

Than through a regular account , how much more would she have to spend each month in

After-tax dollars?

A)$360

B)$140

C)$900

D)None of the above is correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

37

An "on-the-run" Treasury security

A)will command a higher price than a nearly identical Treasury security with a maturity difference of only a few days.

B)has a higher bid-ask spread than an off-the-run bond.

C)is less liquid than an off-the-run bond and must therefore offer a higher yield-to-maturity.

D)All of the above are true statements.

A)will command a higher price than a nearly identical Treasury security with a maturity difference of only a few days.

B)has a higher bid-ask spread than an off-the-run bond.

C)is less liquid than an off-the-run bond and must therefore offer a higher yield-to-maturity.

D)All of the above are true statements.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

38

A taxable corporate bond is yielding 8% while a similar risk municipal bond is yielding 5.5%. At what marginal tax rate would you be indifferent between the two bonds?

A)28.00%

B)31.25%

C)35.25%

D)25.12%

A)28.00%

B)31.25%

C)35.25%

D)25.12%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

39

A municipal bond is yielding 7% and a similar-risk corporate bond is yielding 10%. If you are in the 35% marginal tax bracket, which investment is a better choice for you?

A)The municipal bond because it returns 7% and is risk-free.

B)The corporate bond because it returns 6.5% after taxes while the municipal bond returns only 4.6% after taxes.

C)The municipal bond because the corporate bond only returns 6.5% after taxes.

D)The municipal bond because the corporate bond only returns 3.5% after taxes.

A)The municipal bond because it returns 7% and is risk-free.

B)The corporate bond because it returns 6.5% after taxes while the municipal bond returns only 4.6% after taxes.

C)The municipal bond because the corporate bond only returns 6.5% after taxes.

D)The municipal bond because the corporate bond only returns 3.5% after taxes.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

40

You purchased 100 shares of Amazon.com (AMZN)for $50 a share and paid $20 in commissions and other transaction costs. You sold the stock a few months later for $88 a share,

Again incurring $20 in transaction costs. What was your rate of return?

A)76.3%

B)76.7%

C)75.3%

D)74.9%

Again incurring $20 in transaction costs. What was your rate of return?

A)76.3%

B)76.7%

C)75.3%

D)74.9%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

41

If the real rate of return is 2% (before taxes), the rate of inflation is 5%, and your marginal tax rate is 25%, what is your after-tax nominal return on a risk-free investment? Round your

Answer to the nearest tenth of a percent.

A)2.2%

B)5.3%

C)1.8%

D)7.3%

Answer to the nearest tenth of a percent.

A)2.2%

B)5.3%

C)1.8%

D)7.3%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

42

A project will cost $20,000 and is expected to return $22,000 next year. Your marginal tax rate is 30%. One-year taxable bonds that have similar risk to the project are yielding 9%.

Similar-risk municipal bonds are yielding 6%. What is the NPV of this project? Round your

Answer to the nearest dollar.

A)-$367

B)$132

C)$189

D)$183

Similar-risk municipal bonds are yielding 6%. What is the NPV of this project? Round your

Answer to the nearest dollar.

A)-$367

B)$132

C)$189

D)$183

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

43

Assume an investor invests $20,000 in Treasury securities that are expected to offer an average annual before-tax return of 4.5% over the next 3 years. Inflation is expected to average 4% a

Year during that same time period. If the investor pays taxes at a marginal rate of 30%, how

Much will the investor have in real, after-tax dollars at the end of the 3 years? Round your

Answer to the nearest dollar.

A)$19,512

B)$20,202

C)$20,289

D)$14,202

Year during that same time period. If the investor pays taxes at a marginal rate of 30%, how

Much will the investor have in real, after-tax dollars at the end of the 3 years? Round your

Answer to the nearest dollar.

A)$19,512

B)$20,202

C)$20,289

D)$14,202

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

44

When making a financial decision, should you focus on your marginal or your average

tax rate? Why?

tax rate? Why?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

45

What are three mechanisms an entrepreneur might employ to reduce his cost of

capital?

capital?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

46

According to the study by Frank de Jong, the market risk premium was highest for bonds rated

A)BBB.

B)AA.

C)AAA.

D)CCC.

A)BBB.

B)AA.

C)AAA.

D)CCC.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

47

Carol is considering the purchase of a new car. She can obtain a car loan from the

dealership at a rate of 6.5%. Alternatively, she can take out a home equity loan and use

the proceeds to buy the car. The rate on the home equity loan is 9%. Interest payments

would be tax deductible on the home equity loan, but not on the loan from the

dealership. If Carol is in the 30% marginal tax bracket, which financing choice should

she make? (Assume the transaction costs associated with the two loans are similar in

size.)

dealership at a rate of 6.5%. Alternatively, she can take out a home equity loan and use

the proceeds to buy the car. The rate on the home equity loan is 9%. Interest payments

would be tax deductible on the home equity loan, but not on the loan from the

dealership. If Carol is in the 30% marginal tax bracket, which financing choice should

she make? (Assume the transaction costs associated with the two loans are similar in

size.)

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

48

According to the Altman study, which premium is dominant in stated corporate bond yields?

A)tax premium

B)default premium

C)liquidity premium

D)market risk premium

A)tax premium

B)default premium

C)liquidity premium

D)market risk premium

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

49

You can invest in a fully taxable bond yielding 9% or in a municipal bond yielding 6%. Your marginal tax rate is 30%. In which bond should you invest, and what will be your real,

After-tax return on this investment if inflation is 3%?

A)Invest in the taxable bond for a real after-tax return of 3.2%.

B)Invest in the municipal bond for a real after-tax return of 1.2%

C)Invest in the taxable bond for a real after-tax return of 4.1%.

D)Invest in the municipal bond for a real after-tax return of 2.9%.

After-tax return on this investment if inflation is 3%?

A)Invest in the taxable bond for a real after-tax return of 3.2%.

B)Invest in the municipal bond for a real after-tax return of 1.2%

C)Invest in the taxable bond for a real after-tax return of 4.1%.

D)Invest in the municipal bond for a real after-tax return of 2.9%.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

50

If Congress were to eliminate the tax-exempt status of municipal bonds, which of the following would necessarily be true?

A)Municipal bonds would become riskier investments.

B)The yields on municipal bonds would have to increase to induce investors to invest in them.

C)The yields on municipal bonds would decrease since they would no long receive preferential tax treatment.

D)Both B and C are correct statements.

A)Municipal bonds would become riskier investments.

B)The yields on municipal bonds would have to increase to induce investors to invest in them.

C)The yields on municipal bonds would decrease since they would no long receive preferential tax treatment.

D)Both B and C are correct statements.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements is correct regarding NPV calculations?

A)When comparing projects on the basis of their NPVs, you should always discount pre-tax cash flows at the after-tax opportunity cost of capital or discount after-tax cash flows at

The pre-tax opportunity cost of capital. Otherwise, you are double-counting the tax

Effects.

B)When comparing projects on the basis of their NPVs, you can only use pre-tax cash flows and pre-tax opportunity costs of capital if the tax treatment is absolutely symmetric.

C)When comparing projects on the basis of their NPVs, you should either discount pre-tax cash flows at the pre-tax opportunity cost of capital or discount after-tax cash flows using

The after-tax opportunity cost of capital. Both methods will lead you to the correct

Financial decision.

D)Both B and C are correct statements.

A)When comparing projects on the basis of their NPVs, you should always discount pre-tax cash flows at the after-tax opportunity cost of capital or discount after-tax cash flows at

The pre-tax opportunity cost of capital. Otherwise, you are double-counting the tax

Effects.

B)When comparing projects on the basis of their NPVs, you can only use pre-tax cash flows and pre-tax opportunity costs of capital if the tax treatment is absolutely symmetric.

C)When comparing projects on the basis of their NPVs, you should either discount pre-tax cash flows at the pre-tax opportunity cost of capital or discount after-tax cash flows using

The after-tax opportunity cost of capital. Both methods will lead you to the correct

Financial decision.

D)Both B and C are correct statements.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

52

A project costs $30,000 and is expected to return $36,000 next year. One-year taxable bonds of similar risk are yielding 10% while similar-risk munis are yielding 8%. Your marginal tax rate

Is 30%. What is the NPV of this project? Round your answer to the nearest dollar

A)$1,091

B)$2,386

C)$1,963

D)$1,667

Is 30%. What is the NPV of this project? Round your answer to the nearest dollar

A)$1,091

B)$2,386

C)$1,963

D)$1,667

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

53

Justin invested $5,000 in Stock A. Although it did not pay any dividends, Stock A appreciated in value and Justin earned a 50% return on this investment in one year"s time. He sold the

Stock and invested his net proceeds in Stock B. Stock B returned 25% during the year, and

Justin sold the stock, considering himself smart because he discovered that Stock A had

Returned only 20% during this second year. If the capital gains tax rate is 15%, how much did

Justin gain (or lose)by following this strategy?

A)gain of $226

B)gain of $1,256

C)loss of $1,031

D)loss of $94

Stock and invested his net proceeds in Stock B. Stock B returned 25% during the year, and

Justin sold the stock, considering himself smart because he discovered that Stock A had

Returned only 20% during this second year. If the capital gains tax rate is 15%, how much did

Justin gain (or lose)by following this strategy?

A)gain of $226

B)gain of $1,256

C)loss of $1,031

D)loss of $94

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

54

Jake can invest in a fully taxable bond yielding 10% or in a municipal bond yielding 7%. His marginal tax rate is 35%. In which bond should Jake invest, and what would his real, after-tax

Return on this investment be if inflation is 4%?

A)Jake should invest in the municipal bond for a real after-tax return of 2.88%.

B)Jake should invest in the fully taxable bond for a real after-tax return of 6.25%.

C)Jake should invest in the fully taxable bond for a real after-tax return of 2.40%.

D)Jake should invest in the municipal bond for a real after-tax return of 5.29%.

Return on this investment be if inflation is 4%?

A)Jake should invest in the municipal bond for a real after-tax return of 2.88%.

B)Jake should invest in the fully taxable bond for a real after-tax return of 6.25%.

C)Jake should invest in the fully taxable bond for a real after-tax return of 2.40%.

D)Jake should invest in the municipal bond for a real after-tax return of 5.29%.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

55

True, False, or Uncertain: "Entrepreneurs have high expected borrowing costs."

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

56

In his study on bonds, Professor Frank de Jong found that junk-grade bonds require a

significantly higher liquidity premium than do investment grade bonds. What is a

possible reason for this?

significantly higher liquidity premium than do investment grade bonds. What is a

possible reason for this?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

57

A project costs $25,000 and will return $27,500 next year. Taxable bonds that are similar in risk to the project return 11% while similar-risk, tax-exempt bonds are yielding 8%. You pay taxes

At the marginal rate of 25%. What is the NPV of this project? Round your answer to the

Nearest dollar.

A)-$225

B)-$173

C)-$116

D)+$463

At the marginal rate of 25%. What is the NPV of this project? Round your answer to the

Nearest dollar.

A)-$225

B)-$173

C)-$116

D)+$463

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

58

According to the study by Frank de Jong, the liquidity premium was highest for bonds rated

A)B.

B)BBB.

C)AAA.

D)AA.

A)B.

B)BBB.

C)AAA.

D)AA.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements is true?

A)Although the expected borrowing rates and lending rates of large firms are different from those of small firms, both groups have borrowing rates that are very close to what they can

Earn if they lend their money.

B)Large firms' required expected borrowing costs are close to the expected returns they could earn by lending money to firms of similar risk to themselves.

C)In reality, there are large spreads between borrowing and lending rates for both large and small firms.

D)The net present value of a project should be independent of the firm undertaking the investment.

A)Although the expected borrowing rates and lending rates of large firms are different from those of small firms, both groups have borrowing rates that are very close to what they can

Earn if they lend their money.

B)Large firms' required expected borrowing costs are close to the expected returns they could earn by lending money to firms of similar risk to themselves.

C)In reality, there are large spreads between borrowing and lending rates for both large and small firms.

D)The net present value of a project should be independent of the firm undertaking the investment.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

60

You can invest in a corporate bond that offers an 8% rate of return. Your tax rate is 35% and inflation is 3%. What is your real, after-tax return on this investment? Round your answer to

The nearest hundredth of a percent.

A)3.15%.

B)3.25%.

C)2.14%

D)None of the above is a correct answer.

The nearest hundredth of a percent.

A)3.15%.

B)3.25%.

C)2.14%

D)None of the above is a correct answer.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

61

Assume that the rate of inflation is expected to increase from 3.5% to 5.5% next year. Is

it better to be a borrower or a lender in this case?

it better to be a borrower or a lender in this case?

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

62

Preetham is considering an investment that has a stated nominal return of 12%. There is a 1% probability of default, however, in which case Preetham would lose all his investment. The

Inflation rate is expected to be 4%, and Preetham's marginal tax rate is 25%. What is his real,

After-tax, post-default expected rate of return?

A)4.71%

B)2.62%

C)8.16%

D)4.00%

Inflation rate is expected to be 4%, and Preetham's marginal tax rate is 25%. What is his real,

After-tax, post-default expected rate of return?

A)4.71%

B)2.62%

C)8.16%

D)4.00%

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck

63

You are considering an investment that has a stated nominal return of 28% with a 10% probability of default, in which case you would lose all your money. The inflation rate is

Expected to be 4% and your marginal tax rate is 30%. What is your real, after-tax, post-default

Expected rate of return?

A)6.38%

B)13.1%

C)2.54%

D)None of the above is correct.

Expected to be 4% and your marginal tax rate is 30%. What is your real, after-tax, post-default

Expected rate of return?

A)6.38%

B)13.1%

C)2.54%

D)None of the above is correct.

Unlock Deck

Unlock for access to all 63 flashcards in this deck.

Unlock Deck

k this deck