Deck 12: Capital Budgeting Applications and Pitfalls

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/62

Play

Full screen (f)

Deck 12: Capital Budgeting Applications and Pitfalls

1

Boutique Booksellers is considering expanding each of its five shops to include a gourmet coffee shop. It has identified Javabean, a firm that is solely in the gourmet coffee shop business, as a possible acquisition. Javabean's market-beta is 1.25, and Boutique's market-beta is 1.60. The relevant risk-free rate is 3% and the risk premium is 7%. If Boutique decides to make the acquisition, 15% of its funds would be invested in gourmet coffee operations, and 85% would remain invested in its basic bookstore operation.

Refer to the information above. If Boutique expects the gourmet coffee shop to generate additional cash flows of $50,000 a year in perpetuity, what is the maximum amount it should

Be willing to pay for Javabean? Round your answer to the nearest dollar.

A)$361,011

B)$352,113

C)$545,672

D)$425,532

Refer to the information above. If Boutique expects the gourmet coffee shop to generate additional cash flows of $50,000 a year in perpetuity, what is the maximum amount it should

Be willing to pay for Javabean? Round your answer to the nearest dollar.

A)$361,011

B)$352,113

C)$545,672

D)$425,532

$425,532

2

Which of the following statements is true?

A)A firm that uses a single cost of capital as a required rate of return for all its projects will lose out because it may reject profitable projects that have a risk level that is greater than

The average-risk project of the firm.

B)It is better for a firm to use a single cost of capital as a required rate of return for all projects because it will then maintain a constant risk level for the firm.

C)A firm that uses a single cost of capital as a required rate of return for all its projects may end up accepting unprofitable projects that have a risk level that is below average for the

Firm.

D)A firm that uses a single cost of capital as a required rate of return for all its projects may end up rejecting profitable projects that have a risk level that is below average for the firm.

A)A firm that uses a single cost of capital as a required rate of return for all its projects will lose out because it may reject profitable projects that have a risk level that is greater than

The average-risk project of the firm.

B)It is better for a firm to use a single cost of capital as a required rate of return for all projects because it will then maintain a constant risk level for the firm.

C)A firm that uses a single cost of capital as a required rate of return for all its projects may end up accepting unprofitable projects that have a risk level that is below average for the

Firm.

D)A firm that uses a single cost of capital as a required rate of return for all its projects may end up rejecting profitable projects that have a risk level that is below average for the firm.

A firm that uses a single cost of capital as a required rate of return for all its projects may end up rejecting profitable projects that have a risk level that is below average for the firm.

3

A good manager should set the hurdle rate for a project

A)equal to the project's cost of capital.

B)equal to the project's IRR.

C)as low as possible.

D)as high as possible.

A)equal to the project's cost of capital.

B)equal to the project's IRR.

C)as low as possible.

D)as high as possible.

equal to the project's cost of capital.

4

A zero-coupon bond matures in one year and has a market-beta of 0.2. It has a 30% probability of defaulting, in which case investors will receive only 80% of the promised cash

Flow. The relevant risk-free rate is 4% and the risk premium is 6%. What is the maximum

Price at which this bond should sell (per $100 of par value)?

A)$89.35

B)$94.00

C)$66.54

D)This cannot be determined with the information provided.

Flow. The relevant risk-free rate is 4% and the risk premium is 6%. What is the maximum

Price at which this bond should sell (per $100 of par value)?

A)$89.35

B)$94.00

C)$66.54

D)This cannot be determined with the information provided.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

5

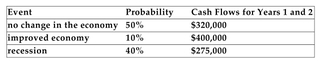

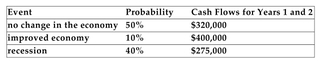

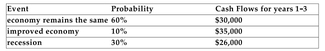

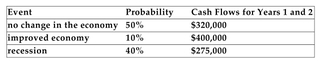

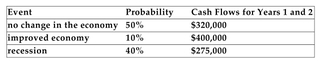

Project B is a 2-year project that will cost $550,000. You have estimated the following probability distribution for the project's future annual cash flows:

Refer to the information above. Project B's most likely future annual cash flow is

A)$320,000

B)$331,667

C)$310,000

D)$275,000

Refer to the information above. Project B's most likely future annual cash flow is

A)$320,000

B)$331,667

C)$310,000

D)$275,000

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

6

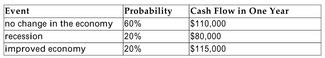

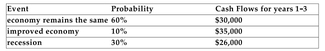

Project C is a one-year project that will cost $100,000. You have estimated the following probability distribution for the future cash flow of the project:  The project has a beta of 1.1. The relevant risk-free rate is 4%, and the risk premium is 5%.

The project has a beta of 1.1. The relevant risk-free rate is 4%, and the risk premium is 5%.

Calculate the NPV of Project C. Round your answer to the nearest dollar.

A)-$7,814

B)-$4,110

C)-$7,154

D)+$9,589

The project has a beta of 1.1. The relevant risk-free rate is 4%, and the risk premium is 5%.

The project has a beta of 1.1. The relevant risk-free rate is 4%, and the risk premium is 5%.Calculate the NPV of Project C. Round your answer to the nearest dollar.

A)-$7,814

B)-$4,110

C)-$7,154

D)+$9,589

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

7

Boutique Booksellers is considering expanding each of its five shops to include a gourmet coffee shop. It has identified Javabean, a firm that is solely in the gourmet coffee shop business, as a possible acquisition. Javabean's market-beta is 1.25, and Boutique's market-beta is 1.60. The relevant risk-free rate is 3% and the risk premium is 7%. If Boutique decides to make the acquisition, 15% of its funds would be invested in gourmet coffee operations, and 85% would remain invested in its basic bookstore operation.

Refer to the information above. All else equal, what will be Boutique's cost of capital if it makes this acquisition? Round your answer to the nearest tenth of a percent.

A)13.0%

B)13.8%

C)11.8%

D)14.2%

Refer to the information above. All else equal, what will be Boutique's cost of capital if it makes this acquisition? Round your answer to the nearest tenth of a percent.

A)13.0%

B)13.8%

C)11.8%

D)14.2%

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

8

Boutique Booksellers is considering expanding each of its five shops to include a gourmet coffee shop. It has identified Javabean, a firm that is solely in the gourmet coffee shop business, as a possible acquisition. Javabean's market-beta is 1.25, and Boutique's market-beta is 1.60. The relevant risk-free rate is 3% and the risk premium is 7%. If Boutique decides to make the acquisition, 15% of its funds would be invested in gourmet coffee operations, and 85% would remain invested in its basic bookstore operation.

Refer to the information above. If Boutique were to require projects coming out of the gourmet coffee shop division to earn a return based on Boutique's overall cost of capital after the

Acquisition, which of the following would occur?

A)Bad projects coming out of the gourmet coffee shop division would be accepted.

B)Management of the gourmet coffee shop division would be restricted to investing only in the least risky projects possible.

C)Good projects coming out of the gourmet coffee shop division would be rejected.

D)The discount rate used to evaluate projects submitted by the gourmet coffee shop division would be too low.

Refer to the information above. If Boutique were to require projects coming out of the gourmet coffee shop division to earn a return based on Boutique's overall cost of capital after the

Acquisition, which of the following would occur?

A)Bad projects coming out of the gourmet coffee shop division would be accepted.

B)Management of the gourmet coffee shop division would be restricted to investing only in the least risky projects possible.

C)Good projects coming out of the gourmet coffee shop division would be rejected.

D)The discount rate used to evaluate projects submitted by the gourmet coffee shop division would be too low.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements about using hedges to increase firm value is (are)true?

A)The management of a high-beta firm can increase firm value by selling P 500 Index futures contracts.

P 500 Index futures contracts.

B)The management of a construction company may be able to increase firm value by buying lumber futures contracts, but only if the market is imperfect.

C)In a perfect market, the management of a firm with global operations can increase firm value by using foreign currency futures contracts to hedge against adverse movements in

The currency.

D)All of the above statements are true.

A)The management of a high-beta firm can increase firm value by selling

P 500 Index futures contracts.

P 500 Index futures contracts.B)The management of a construction company may be able to increase firm value by buying lumber futures contracts, but only if the market is imperfect.

C)In a perfect market, the management of a firm with global operations can increase firm value by using foreign currency futures contracts to hedge against adverse movements in

The currency.

D)All of the above statements are true.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

10

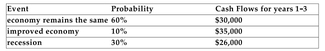

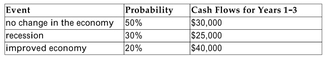

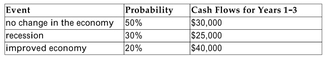

Project A is a 3-year project that will cost $50,000 today. You have estimated the following probability distribution for the future cash flows from the project:

Refer to the information above. Project A's most likely future annual cash flow is

A)$30,000

B)$26,000

C)$29,300

D)$30,333

Refer to the information above. Project A's most likely future annual cash flow is

A)$30,000

B)$26,000

C)$29,300

D)$30,333

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

11

Project A is a 3-year project that will cost $50,000 today. You have estimated the following probability distribution for the future cash flows from the project:

Refer to the information above. Assume the appropriate cost of capital is 15%. What is the NPV of Project A? Round your answer to the nearest dollar.

A)$19,257

B)-$23,623

C)$19,647

D)$16,898

Refer to the information above. Assume the appropriate cost of capital is 15%. What is the NPV of Project A? Round your answer to the nearest dollar.

A)$19,257

B)-$23,623

C)$19,647

D)$16,898

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements about mergers is true?

A)When deciding on a merger, the acquiring firm should use its own cost of capital to evaluate the value of the acquisition.

B)A merger will add value only if synergies exist, which is why most mergers take place.

C)Most mergers result in added value because the resultant firm is more diversified than the individual firms were before the merger.

D)None of the above is a true statement.

A)When deciding on a merger, the acquiring firm should use its own cost of capital to evaluate the value of the acquisition.

B)A merger will add value only if synergies exist, which is why most mergers take place.

C)Most mergers result in added value because the resultant firm is more diversified than the individual firms were before the merger.

D)None of the above is a true statement.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

13

When calculating the NPV of a project, you should use only

A)expected cash flows and promised rates of return

B)expected cash flows and expected rates of return

C)promised cash flows and expected rates of return

D)promised cash flows and promised rates of return

A)expected cash flows and promised rates of return

B)expected cash flows and expected rates of return

C)promised cash flows and expected rates of return

D)promised cash flows and promised rates of return

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

14

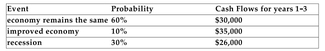

Project B is a 2-year project that will cost $550,000. You have estimated the following probability distribution for the project's future annual cash flows:

Refer to the information above. Assume the relevant cost of capital is 10%. What is Project B's NPV? Round your answer to the nearest dollar.

A)-$11,983

B)-$268,182

C)+$25,620

D)+$538,017

Refer to the information above. Assume the relevant cost of capital is 10%. What is Project B's NPV? Round your answer to the nearest dollar.

A)-$11,983

B)-$268,182

C)+$25,620

D)+$538,017

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

15

The rate of return that your investors could receive by investing in similar projects elsewhere is called the

A)hurdle rate

B)cost of capital

C)holding period return

D)internal rate of return

A)hurdle rate

B)cost of capital

C)holding period return

D)internal rate of return

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

16

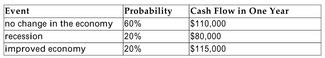

Project D is a three-year project that will cost $80,000. You have estimated the

following probability distribution for the future annual cash flows of the project: The project has a beta of 0.9. The relevant risk-free rate is 4%, and the risk premium is

The project has a beta of 0.9. The relevant risk-free rate is 4%, and the risk premium is

7%. Should this project be undertaken?

following probability distribution for the future annual cash flows of the project:

The project has a beta of 0.9. The relevant risk-free rate is 4%, and the risk premium is

The project has a beta of 0.9. The relevant risk-free rate is 4%, and the risk premium is7%. Should this project be undertaken?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

17

How is the hurdle rate for a project optimally determined?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

18

When a firm with a high market-beta merges with a firm with a lower market-beta,

A)the cost of capital of the combined firm will be a weighted average of the costs of capital for the individual firms.

B)investors will require a lower rate of return on the combined firm than they would have for each individual firm due to greater diversification.

C)the cost of capital of the combined firm will be lower due to greater diversification.

D)Both A and B are correct statements.

A)the cost of capital of the combined firm will be a weighted average of the costs of capital for the individual firms.

B)investors will require a lower rate of return on the combined firm than they would have for each individual firm due to greater diversification.

C)the cost of capital of the combined firm will be lower due to greater diversification.

D)Both A and B are correct statements.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

19

Boutique Booksellers is considering expanding each of its five shops to include a gourmet coffee shop. It has identified Javabean, a firm that is solely in the gourmet coffee shop business, as a possible acquisition. Javabean's market-beta is 1.25, and Boutique's market-beta is 1.60. The relevant risk-free rate is 3% and the risk premium is 7%. If Boutique decides to make the acquisition, 15% of its funds would be invested in gourmet coffee operations, and 85% would remain invested in its basic bookstore operation.

Refer to the information above. All else equal, if the acquisition occurs, what return should Boutique require on projects coming out of its gourmet coffee division?

A)14.20%

B)11.75%

C)13.85%

D)12.98%

Refer to the information above. All else equal, if the acquisition occurs, what return should Boutique require on projects coming out of its gourmet coffee division?

A)14.20%

B)11.75%

C)13.85%

D)12.98%

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

20

Assume a zero-coupon bond promises to pay $10,000 at the end of one year. The beta of the bond is 0.1, the relevant risk-free rate is 3%, and the equity premium is 6%. Assuming CAPM

Applies, what is the maximum price should you pay for this bond?

A)$9,174

B)$9,653

C)$10,000

D)This cannot be answered because you don't know the expected cash flow from the bond.

Applies, what is the maximum price should you pay for this bond?

A)$9,174

B)$9,653

C)$10,000

D)This cannot be answered because you don't know the expected cash flow from the bond.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

21

True, False, or Uncertain: "If a firm accepts only projects that are expected to return its

weighted average cost of capital or higher, the firm will become riskier over time."

Explain.

weighted average cost of capital or higher, the firm will become riskier over time."

Explain.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

22

The owner of The Haunted Bookshop, a retailer of used books, has determined that some of the hardback books he has in inventory will never be sold. He is considering using some of his

Creativity to convert these white elephants into items that might sell. He believes that with a

Few tools and some basic art supplies, he can create unique book ends and jewelry boxes from

These non-sellers during slow hours at the store. What are the relevant cash flows to be

Considered in deciding on this project?

A)the original cost of the books to him

B)the cost of the art supplies

C)the cost of the tools

D)both B and C

Creativity to convert these white elephants into items that might sell. He believes that with a

Few tools and some basic art supplies, he can create unique book ends and jewelry boxes from

These non-sellers during slow hours at the store. What are the relevant cash flows to be

Considered in deciding on this project?

A)the original cost of the books to him

B)the cost of the art supplies

C)the cost of the tools

D)both B and C

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

23

The IQ Corporation has two divisions. Division A does lobotomies and has an

estimated market beta of 0.80. Division B does brain transplants, and its beta is

estimated to be 1.50 (for obvious reasons.)Approximately 80% of the corporation's

total investment supports Division A; the remainder is invested in Division B. The

relevant risk-free rate is 5%, and the market equity premium is 8%. What is IQ's cost

of capital? What should it require as a minimum rate of return for projects undertaken

by the transplant division?

estimated market beta of 0.80. Division B does brain transplants, and its beta is

estimated to be 1.50 (for obvious reasons.)Approximately 80% of the corporation's

total investment supports Division A; the remainder is invested in Division B. The

relevant risk-free rate is 5%, and the market equity premium is 8%. What is IQ's cost

of capital? What should it require as a minimum rate of return for projects undertaken

by the transplant division?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

24

The Green Acres Lawn Company produces and sells lawn care products, such as fertilizers, seeds, and lawnmowers. Its market-beta is 1.30. It is considering diversifying into the manufacture of snowblowers to offset the seasonality of its current product lines. Management has estimated the market-beta for this new line of business to be 1.60. The relevant risk-free rate is 4%, and the market equity risk premium is 7%. Assume that 70% of the business will remain in lawn care products if the firm undertakes this project.

Refer to the information above. The snowblower project will cost $1.5 million. Management believes the project is equally likely to increase cash flows by $150,000 a year in perpetuity or

By $300,000 a year in perpetuity. What is the NPV of the snowblower project? Round your

Answer to the nearest dollar.

A)-$19,737

B)+$217,557

C)+$138,747

D)This cannot be determined with the information provided.

Refer to the information above. The snowblower project will cost $1.5 million. Management believes the project is equally likely to increase cash flows by $150,000 a year in perpetuity or

By $300,000 a year in perpetuity. What is the NPV of the snowblower project? Round your

Answer to the nearest dollar.

A)-$19,737

B)+$217,557

C)+$138,747

D)This cannot be determined with the information provided.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

25

Your firm produces its goods at an average unit production cost of  Currently, the firm sells 24 units at a price of $8 a unit. What is the marginal net benefit to the firm of selling

Currently, the firm sells 24 units at a price of $8 a unit. What is the marginal net benefit to the firm of selling

1 more unit, assuming the unit selling price remains unchanged? Round your answer to the

Nearest cent.

A)$8.00

B)$5.98

C)$5.60

D)$2.38

Currently, the firm sells 24 units at a price of $8 a unit. What is the marginal net benefit to the firm of selling

Currently, the firm sells 24 units at a price of $8 a unit. What is the marginal net benefit to the firm of selling1 more unit, assuming the unit selling price remains unchanged? Round your answer to the

Nearest cent.

A)$8.00

B)$5.98

C)$5.60

D)$2.38

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

26

Aspen Valley Storage has 1,800 units. Each unit is 100 square feet and rents for $100 a month. The firm is considering installing climate-control in 550 of the units, so that those units can be

Used to store items that would be damaged by excessive heat or cold, such as art work. The

Installation is expected to cost $500,000, and Aspen Valley's utility bill is expected to increase

By $3,750 if the conversion takes place. The climate-controlled units are expected to rent for

$130 a month. If the appropriate discount rate is 15%, what is the NPV of the project? Assume

All cash flows are perpetuities. (Note: Be careful to note whether the cash flow is monthly or

Annually when you work this one.)

A)+$4.92 million

B)+$1.02 million

C)+$0.52 million

D)-$0.48 million

Used to store items that would be damaged by excessive heat or cold, such as art work. The

Installation is expected to cost $500,000, and Aspen Valley's utility bill is expected to increase

By $3,750 if the conversion takes place. The climate-controlled units are expected to rent for

$130 a month. If the appropriate discount rate is 15%, what is the NPV of the project? Assume

All cash flows are perpetuities. (Note: Be careful to note whether the cash flow is monthly or

Annually when you work this one.)

A)+$4.92 million

B)+$1.02 million

C)+$0.52 million

D)-$0.48 million

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

27

The value of a "real option" is

A)the price at which an option to buy or sell an underlying asset trades on an exchange floor.

B)the value of having the flexibility to change course in the future.

C)indeterminable since it is a very nebulous concept.

D)infinite since it "keeps the door open" in the future.

A)the price at which an option to buy or sell an underlying asset trades on an exchange floor.

B)the value of having the flexibility to change course in the future.

C)indeterminable since it is a very nebulous concept.

D)infinite since it "keeps the door open" in the future.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

28

Colortex, Incorporated is considering the purchase of a new machine. The machine will cost $105,000. The firm currently generates an annual cash flow of $150,000 a year. It is expected

That the machine will increase annual cash flows to $170,000. The machine is expected to last 7

Years after which both its book value and market value will be zero. What is the NPV of the

New machine if Colortex requires a 14% return on this project?

A)-$19,234

B)+$174,909

C)+$37,857

D)+$624,012

That the machine will increase annual cash flows to $170,000. The machine is expected to last 7

Years after which both its book value and market value will be zero. What is the NPV of the

New machine if Colortex requires a 14% return on this project?

A)-$19,234

B)+$174,909

C)+$37,857

D)+$624,012

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

29

The Green Acres Lawn Company produces and sells lawn care products, such as fertilizers, seeds, and lawnmowers. Its market-beta is 1.30. It is considering diversifying into the manufacture of snowblowers to offset the seasonality of its current product lines. Management has estimated the market-beta for this new line of business to be 1.60. The relevant risk-free rate is 4%, and the market equity risk premium is 7%. Assume that 70% of the business will remain in lawn care products if the firm undertakes this project.

Refer to the information above. All else equal, what will Green Acres' new cost of equity be if they venture into the snowblower business?

A)13.73%

B)11.28%

C)15.20%

D)None of the above is correct.

Refer to the information above. All else equal, what will Green Acres' new cost of equity be if they venture into the snowblower business?

A)13.73%

B)11.28%

C)15.20%

D)None of the above is correct.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

30

The Carrolton Stein Corporation is considering replacing its existing decal printing

press with a larger one. The existing press can produce up to 10 decals at a time. The

larger press will be able to produce up to 20 decals. The existing press can be sold

today for $10,000, net of taxes. The new press will cost $75,000 and is expected to have

a 5-year economic life, at which time it is not expected to have any market value. (If

the larger press is not purchased, the existing press is not expected to have any market

value at that point either.)If the larger press is purchased, revenues are expected to

increase from $100,000 a year to $128,000 a year. Labor expenses are expected to

increase from $50,000 to $55,000 a year. If the appropriate cost of capital is 15%, should

Carrolton Stein Corporation invest in the larger press?

press with a larger one. The existing press can produce up to 10 decals at a time. The

larger press will be able to produce up to 20 decals. The existing press can be sold

today for $10,000, net of taxes. The new press will cost $75,000 and is expected to have

a 5-year economic life, at which time it is not expected to have any market value. (If

the larger press is not purchased, the existing press is not expected to have any market

value at that point either.)If the larger press is purchased, revenues are expected to

increase from $100,000 a year to $128,000 a year. Labor expenses are expected to

increase from $50,000 to $55,000 a year. If the appropriate cost of capital is 15%, should

Carrolton Stein Corporation invest in the larger press?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

31

A firm that produces Little O's cereal is considering coming out with Honey-Nut Little

O's cereal. The new cereal will most certainly reduce the sales of the original Little O's

cereal. When calculating the cash flows associated with the new project, should the

amount of the lost sales be considered a cash outflow? Why or why not?

O's cereal. The new cereal will most certainly reduce the sales of the original Little O's

cereal. When calculating the cash flows associated with the new project, should the

amount of the lost sales be considered a cash outflow? Why or why not?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following describes a cash flow that should always be included when evaluating a project?

A)any research and development expense that was incurred prior to the evaluation of this project if the R&D resulted in the consideration of this project today

B)lost sales incurred by another of the firm's products due to the introduction of the new product

C)the amount of attention that management may have to devote to the new project to the extent it might detract from their attention to existing projects

D)All of the above should always be included when evaluating a project.

A)any research and development expense that was incurred prior to the evaluation of this project if the R&D resulted in the consideration of this project today

B)lost sales incurred by another of the firm's products due to the introduction of the new product

C)the amount of attention that management may have to devote to the new project to the extent it might detract from their attention to existing projects

D)All of the above should always be included when evaluating a project.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

33

Chinook Resorts is considering building 10 new cabins. The cabins will cost $1,200,000 to build and furnishings for all 10 units are expected to cost about $82,500. Alternatively, Chinook

Could sell 40 acres of its land to a new developer for $12,000 an acre, in which case there would

Not be enough land to build any new cabins. Chinook paid $3,000 an acre for the land several

Years ago. Chinook pays taxes at a marginal rate of 34%. What is the net initial cash outflow to

Chinook if it undertakes the construction of the new cabins?

A)-$1,640,100

B)-$ 802,500

C)-$1,282,500

D)None of the above is correct.

Could sell 40 acres of its land to a new developer for $12,000 an acre, in which case there would

Not be enough land to build any new cabins. Chinook paid $3,000 an acre for the land several

Years ago. Chinook pays taxes at a marginal rate of 34%. What is the net initial cash outflow to

Chinook if it undertakes the construction of the new cabins?

A)-$1,640,100

B)-$ 802,500

C)-$1,282,500

D)None of the above is correct.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

34

A car dealership has both a used car and a new car division. A single service department serves both divisions. The service department performs the dealer prep work on the new cars

And installs any custom features that may be ordered by a customer. It also reconditions used

Cars acquired by the firm

To make them more salable. The dealership is considering expanding its new car division,

Which will involve a cost to the used car division since they will not be able to get as fast a

Turnover on their used cars. This is an example of a negative externality known as

A)pollution and congestion.

B)resource exhaustion.

C)bureaucratization and internal conflict.

D)cannibalization.

And installs any custom features that may be ordered by a customer. It also reconditions used

Cars acquired by the firm

To make them more salable. The dealership is considering expanding its new car division,

Which will involve a cost to the used car division since they will not be able to get as fast a

Turnover on their used cars. This is an example of a negative externality known as

A)pollution and congestion.

B)resource exhaustion.

C)bureaucratization and internal conflict.

D)cannibalization.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

35

When calculating the NPV of a project, which of the following should not be considered?

A)the cost of a new computer network that will be used by all the divisions of the firm.

B)the cost of an advertising campaign for a new project since the campaign should be evaluated as an independent project.

C)any cost that the project may impose on a division other than the division that will be undertaking the project.

D)All of the above should be considered when calculating the NPV of a project.

A)the cost of a new computer network that will be used by all the divisions of the firm.

B)the cost of an advertising campaign for a new project since the campaign should be evaluated as an independent project.

C)any cost that the project may impose on a division other than the division that will be undertaking the project.

D)All of the above should be considered when calculating the NPV of a project.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

36

The Green Acres Lawn Company produces and sells lawn care products, such as fertilizers, seeds, and lawnmowers. Its market-beta is 1.30. It is considering diversifying into the manufacture of snowblowers to offset the seasonality of its current product lines. Management has estimated the market-beta for this new line of business to be 1.60. The relevant risk-free rate is 4%, and the market equity risk premium is 7%. Assume that 70% of the business will remain in lawn care products if the firm undertakes this project.

Refer to the information above. If Green Acres were to require projects coming out of the snowblower division to earn a return based on Green Acres' overall cost of capital, which of

The following would occur?

A)Projects coming out of the snowblower division that would have subtracted value from the firm would be accepted.

B)The discount rate used to evaluate projects coming out of the snowblower division would be too high.

C)Projects coming out of the snowblower division that would have added value to the firm would be rejected.

D)Management of the snowblower division would have to submit projects that were above-average risk for the division in order to get them accepted.

Refer to the information above. If Green Acres were to require projects coming out of the snowblower division to earn a return based on Green Acres' overall cost of capital, which of

The following would occur?

A)Projects coming out of the snowblower division that would have subtracted value from the firm would be accepted.

B)The discount rate used to evaluate projects coming out of the snowblower division would be too high.

C)Projects coming out of the snowblower division that would have added value to the firm would be rejected.

D)Management of the snowblower division would have to submit projects that were above-average risk for the division in order to get them accepted.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

37

Your firm is considering replacing an existing machine with a newer model. Which of the following need not be considered when determining the incremental cash flows of the

Proposed project?

A)labor costs associated with the existing machine

B)selling price of the existing machine

C)cost of the new machine

D)All of the above costs need to be considered in determining the incremental cash flows of the new model.

Proposed project?

A)labor costs associated with the existing machine

B)selling price of the existing machine

C)cost of the new machine

D)All of the above costs need to be considered in determining the incremental cash flows of the new model.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

38

The Green Acres Lawn Company produces and sells lawn care products, such as fertilizers, seeds, and lawnmowers. Its market-beta is 1.30. It is considering diversifying into the manufacture of snowblowers to offset the seasonality of its current product lines. Management has estimated the market-beta for this new line of business to be 1.60. The relevant risk-free rate is 4%, and the market equity risk premium is 7%. Assume that 70% of the business will remain in lawn care products if the firm undertakes this project.

Refer to the information above. All else equal, what should Green Acres' require as a minimum rate of return on projects undertaken by the snowblower division?

A)7.00%

B)13.73%

C)11.28%

D)15.20%

Refer to the information above. All else equal, what should Green Acres' require as a minimum rate of return on projects undertaken by the snowblower division?

A)7.00%

B)13.73%

C)11.28%

D)15.20%

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements about applying the CAPM is true?

A)In reality, many knowlegable CFOs do not calculate project-specific costs of capital because it is often too difficult to obtain a good estimate for a project's beta.

B)Although a large number of CFOs do not calculate a specific cost of capital for each and every project, they typically do use different hurdle rates for different types of projects,

Rather than using only the firm's overall cost of capital to evaluate all projects regardless of

The risk.

C)A good CFO will calculate his or her own estimate of an appropriate market-beta for a project to use when applying CAPM.

D)All knowledgeable CFOs always use project-specific costs of capital in the CAPM when evaluating projects.

A)In reality, many knowlegable CFOs do not calculate project-specific costs of capital because it is often too difficult to obtain a good estimate for a project's beta.

B)Although a large number of CFOs do not calculate a specific cost of capital for each and every project, they typically do use different hurdle rates for different types of projects,

Rather than using only the firm's overall cost of capital to evaluate all projects regardless of

The risk.

C)A good CFO will calculate his or her own estimate of an appropriate market-beta for a project to use when applying CAPM.

D)All knowledgeable CFOs always use project-specific costs of capital in the CAPM when evaluating projects.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

40

If a manager is evaluating a project that will affect the cash flows of other projects, she should first calculate the NPV of the project as an independent project and

A)reject it if it has a negative NPV to avoid reducing firm value.

B)accept it if it has a positive NPV in order to increase firm value.

C)accept it if it has a zero NPV in order to increase firm value.

D)Both A and C are correct statements.

A)reject it if it has a negative NPV to avoid reducing firm value.

B)accept it if it has a positive NPV in order to increase firm value.

C)accept it if it has a zero NPV in order to increase firm value.

D)Both A and C are correct statements.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

41

Where are the risk premium and time premium associated with a project incorporated in the NPV analysis?

A)in both the expected future cash flows of the project and the cost of capital of the project

B)in the cost of capital, which is the discount rate used

C)in the expected future cash flows of the project

D)None of the above is correct.

A)in both the expected future cash flows of the project and the cost of capital of the project

B)in the cost of capital, which is the discount rate used

C)in the expected future cash flows of the project

D)None of the above is correct.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

42

Discuss the behavioral bias of "relativism." Give an example of how it can lead to a

wrong decision.

wrong decision.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

43

Where is the default risk associated with a project incorporated in the NPV analysis?

A)in the cost of capital, which is the discount rate used

B)in both the expected future cash flows of the project and the cost of capital for the project

C)in the expected future cash flows of the project

D)The default risk should never be considered in an NPV analysis since it cannot be known with certainty.

A)in the cost of capital, which is the discount rate used

B)in both the expected future cash flows of the project and the cost of capital for the project

C)in the expected future cash flows of the project

D)The default risk should never be considered in an NPV analysis since it cannot be known with certainty.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is not a "real option?"

A)the option to enter a new line of business based on a serendipitous discovery

B)the option to expand globally if a product is doing better than expected

C)the option to cease production if a product isn't selling

D)the option to sell your shares of a stock if its price decreases

A)the option to enter a new line of business based on a serendipitous discovery

B)the option to expand globally if a product is doing better than expected

C)the option to cease production if a product isn't selling

D)the option to sell your shares of a stock if its price decreases

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

45

In which of the following scenarios would you expect agency problems to be most prevalent?

A)in a firm that is transparent--i.e., the expected cash flows and costs of capital can easily be calculated even by outsiders.

B)in a small company with one owner and only a few employees

C)in a firm that relies heavily on research and development

D)when a firm's projects are short-term, and interim progress reports are forthcoming and deemed fairly accurate

A)in a firm that is transparent--i.e., the expected cash flows and costs of capital can easily be calculated even by outsiders.

B)in a small company with one owner and only a few employees

C)in a firm that relies heavily on research and development

D)when a firm's projects are short-term, and interim progress reports are forthcoming and deemed fairly accurate

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

46

You have analyzed the financial statements and other data associated with a firm, and you have compared this firm to other firms in the same industry. Based on your analysis, you are

Convinced that this firm will increase its profits by at least 20% next year. What behavioral bias

Is this?

A)overconfidence

B)relativism

C)narcissism

D)compartmentalization

Convinced that this firm will increase its profits by at least 20% next year. What behavioral bias

Is this?

A)overconfidence

B)relativism

C)narcissism

D)compartmentalization

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

47

In which of the following types of firms is an agency problem most likely to exist?

A)a private corporation that has only one owner and only a few employees

B)a partnership with several owners, but only a few employees

C)a sole proprietorship that has only one owner and one employee

D)a publicly-held corporation that has many owners and many employees

A)a private corporation that has only one owner and only a few employees

B)a partnership with several owners, but only a few employees

C)a sole proprietorship that has only one owner and one employee

D)a publicly-held corporation that has many owners and many employees

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following describes an agency bias?

A)John has been studying the telecommunications industry and a certain stock in particular. He sees no way that the stock price will not increase by 50% by the end of the year, and he

Invests his entire investment funds in it.

B)The CEO of a corporation requests her own private jet, separate from the private jet that flies other members of the executive team, arguing that it allows her to focus better when

Flying to a meeting.

C)A certain project will cost $500 and is expected to return $1,000 at the end of one year--a 100% return on the investment. A second project will cost $1,500 and is expected to return

$2,700 next year. Noting that the second project returns only 80%, a manager decides to

Undertake the first project since the projects are mutually exclusive.

D)Both B and C describe agency biases.

A)John has been studying the telecommunications industry and a certain stock in particular. He sees no way that the stock price will not increase by 50% by the end of the year, and he

Invests his entire investment funds in it.

B)The CEO of a corporation requests her own private jet, separate from the private jet that flies other members of the executive team, arguing that it allows her to focus better when

Flying to a meeting.

C)A certain project will cost $500 and is expected to return $1,000 at the end of one year--a 100% return on the investment. A second project will cost $1,500 and is expected to return

$2,700 next year. Noting that the second project returns only 80%, a manager decides to

Undertake the first project since the projects are mutually exclusive.

D)Both B and C describe agency biases.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements about "real options" is true?

A)The longer-term the project, the less important they are to consider.

B)Real options affect only expected cash flows, not the cost of capital associated with a project.

C)The shorter-term the project, the more important they are to consider.

D)The longer-term the project, the harder they are to value.

A)The longer-term the project, the less important they are to consider.

B)Real options affect only expected cash flows, not the cost of capital associated with a project.

C)The shorter-term the project, the more important they are to consider.

D)The longer-term the project, the harder they are to value.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is likely to result in agency issues?

A)Managers have a high probability of being fired if they undertake a project that loses money.

B)Employees are fearful of losing their jobs.

C)Management must compete for scarce resources.

D)All of the above are likely to result in agency issues.

A)Managers have a high probability of being fired if they undertake a project that loses money.

B)Employees are fearful of losing their jobs.

C)Management must compete for scarce resources.

D)All of the above are likely to result in agency issues.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

51

True, False, or Uncertain: "The existence of a real option influences not only expected

future cash flows, but it may also affect the cost of capital." Explain.

future cash flows, but it may also affect the cost of capital." Explain.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

52

A computer store that is 7 miles from your house is selling a laptop for $800. The same laptop is selling for $825 at a store that is only 5 miles from your home. You decide that it is not worth

Your time and effort to drive the extra 2 miles. On the other hand, you drive 2 miles out of

Your way to buy gas at a gas station for $2.60 a gallon because the gas stations within a mile of

Your home price their gas at $2.70 a gallon, and your SUV holds 30 gallons of gas. What

Behavioral bias does this describe?

A)compartmentalization

B)relativism

C)narcissism

D)overconfidence

Your time and effort to drive the extra 2 miles. On the other hand, you drive 2 miles out of

Your way to buy gas at a gas station for $2.60 a gallon because the gas stations within a mile of

Your home price their gas at $2.70 a gallon, and your SUV holds 30 gallons of gas. What

Behavioral bias does this describe?

A)compartmentalization

B)relativism

C)narcissism

D)overconfidence

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

53

Briefly discuss six items you should be certain to consider when doing an NPV

analysis that are presented in the chapter.

analysis that are presented in the chapter.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

54

A factory currently produces output that sells for $125 million. Production costs are $100 million. Each year it is equally likely that the selling price of the output will be 25% higher or

30% lower. Assume the cost of capital is zero and that it will cost nothing to close the plant or

To reopen it. What is the present value of this factory if it exists for 2 years?

A)$41.80

B)$56.64

C)$36.35

D)$57.73

30% lower. Assume the cost of capital is zero and that it will cost nothing to close the plant or

To reopen it. What is the present value of this factory if it exists for 2 years?

A)$41.80

B)$56.64

C)$36.35

D)$57.73

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

55

The CFO for a medical supplies company observed that an advertising campaign touting its wide range of available products resulted in the doubling of profits for the company. On the

Other hand, he observed that increasing the firm's customer service representatives during this

Same time frame increased the profits by only 5%. He thus concluded that the best use of the

Firm's funds is in advertising. What behavioral bias is this?

A)compartmentalization

B)overconfidence

C)narcissism

D)relativism

Other hand, he observed that increasing the firm's customer service representatives during this

Same time frame increased the profits by only 5%. He thus concluded that the best use of the

Firm's funds is in advertising. What behavioral bias is this?

A)compartmentalization

B)overconfidence

C)narcissism

D)relativism

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is a tool that may be used to minimize agency problems?

A)capital rationing

B)contingent compensation

C)audits

D)All of the above can be used to minimize agency problems.

A)capital rationing

B)contingent compensation

C)audits

D)All of the above can be used to minimize agency problems.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements about "real options" is true?

A)The existence of a real option may either increase or decrease the value of the project..

B)The existence of a real option can lower the cost of capital associated with a project.

C)Real options are very rare in practice.

D)The existence of a real option may change the magnitude, but not the uncertainty, underlying expected future cash flows from the project.

A)The existence of a real option may either increase or decrease the value of the project..

B)The existence of a real option can lower the cost of capital associated with a project.

C)Real options are very rare in practice.

D)The existence of a real option may change the magnitude, but not the uncertainty, underlying expected future cash flows from the project.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

58

Discuss the five tools available to help minimize agency problems that were presented

in the chapter.

in the chapter.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements is false regarding an NPV analysis?

A)The cash flows used in the NPV analysis should always be the expected cash flows rather than the promised cash flows.

B)If the discount rate being used is the weighted average cost of capital for the firm, then the expected cash flows should include any interest expense and other costs associated with

The debt financing.

C)The weighted average cost of capital that is used as a discount rate in evaluating the cash flows of a project should be based on the expected interest rate on the debt rather than the

Promised interest rate on the debt.

D)The cash flows used in the NPV analysis should incorporate the value of any real options associated with the project.

A)The cash flows used in the NPV analysis should always be the expected cash flows rather than the promised cash flows.

B)If the discount rate being used is the weighted average cost of capital for the firm, then the expected cash flows should include any interest expense and other costs associated with

The debt financing.

C)The weighted average cost of capital that is used as a discount rate in evaluating the cash flows of a project should be based on the expected interest rate on the debt rather than the

Promised interest rate on the debt.

D)The cash flows used in the NPV analysis should incorporate the value of any real options associated with the project.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements regarding an NPV analysis is true?

A)Expected future cash flows should be before-tax cash flows since no one really knows what future tax rates will be.

B)When using the weighted average cost of capital as a discount rate, the expected future cash flows should be estimated as if the project will be all equity financed.

C)In estimating future cash flows, the analyst should always be sure to include an allocation for any overhead expense that the project will be utilizing.

D)None of the above statements is true.

A)Expected future cash flows should be before-tax cash flows since no one really knows what future tax rates will be.

B)When using the weighted average cost of capital as a discount rate, the expected future cash flows should be estimated as if the project will be all equity financed.

C)In estimating future cash flows, the analyst should always be sure to include an allocation for any overhead expense that the project will be utilizing.

D)None of the above statements is true.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

61

A factory currently produces output that sells for $200 million. Production costs are

$150 million. Each year, it is equally likely that the selling price will be 20% higher or

30% lower. It will cost $5 million to close the factory, and it will cost $10 million to

open a closed plant. If the appropriate cost of capital is 10%, what is the present value

of the factory if it exists for 2 years?

$150 million. Each year, it is equally likely that the selling price will be 20% higher or

30% lower. It will cost $5 million to close the factory, and it will cost $10 million to

open a closed plant. If the appropriate cost of capital is 10%, what is the present value

of the factory if it exists for 2 years?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

62

A factory currently produces output that sells for $125 million. Production costs are $100 million. Each year it is equally likely that the selling price of the output will be 25% higher or

30% lower. Assume the cost of capital is 10%, and that it will cost nothing to close the plant or

To reopen it. What is the present value of this factory if it exists for 2 years?

A)$41.80

B)$50.04

C)$36.35

D)$57.73

30% lower. Assume the cost of capital is 10%, and that it will cost nothing to close the plant or

To reopen it. What is the present value of this factory if it exists for 2 years?

A)$41.80

B)$50.04

C)$36.35

D)$57.73

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck