Deck 14: Depreciation

Question

Question

Question

Question

Question

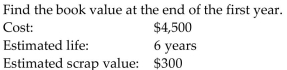

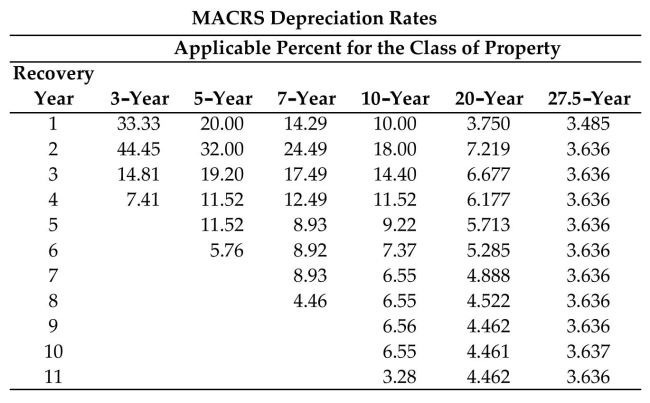

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

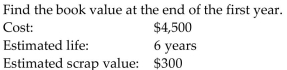

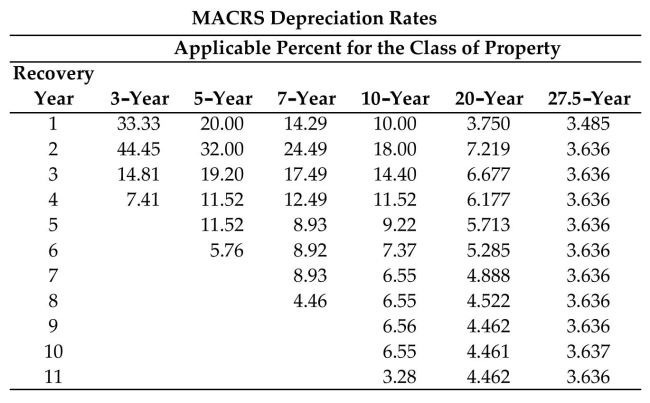

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 14: Depreciation

1

Provide an appropriate response.

Explain how the annual depreciation amount is found using the units-of-production method.

Explain how the annual depreciation amount is found using the units-of-production method.

Answers will vary.

2

Provide an appropriate response.

Describe in your own words the conditions under which the units-of-production method of depreciation is most applicable.

Describe in your own words the conditions under which the units-of-production method of depreciation is most applicable.

Answers will vary.

3

Find the annual amount of depreciation using the straight-line method. Round to the nearest dollar.

Cost: $4,100

Estimated life: 6 years

Estimated scrap value: $600

A)$683

B)$583

C)$600

D)$100

Cost: $4,100

Estimated life: 6 years

Estimated scrap value: $600

A)$683

B)$583

C)$600

D)$100

$583

4

Provide an appropriate response.

Describe three features that are unique to the Modified ACRS method of depreciation.

Describe three features that are unique to the Modified ACRS method of depreciation.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

Find the annual amount of depreciation using the units-of-production method. Round to the nearest dollar.

Depreciation per unit: $0.06

Units of production: 237,000

A)$14,220

B)$39,500

C)$1,422

D)$395,000

Depreciation per unit: $0.06

Units of production: 237,000

A)$14,220

B)$39,500

C)$1,422

D)$395,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

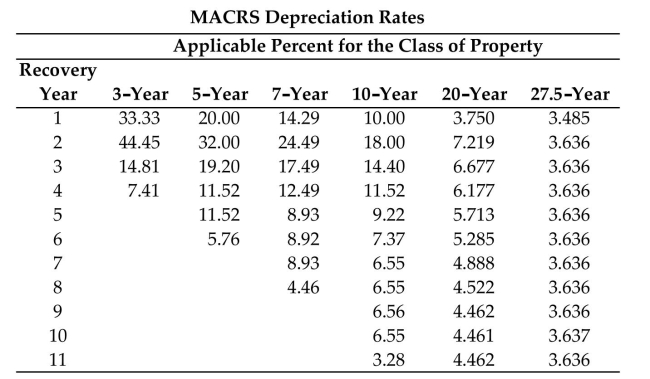

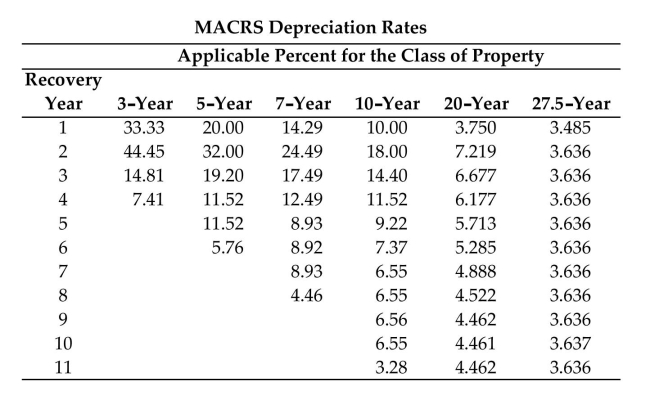

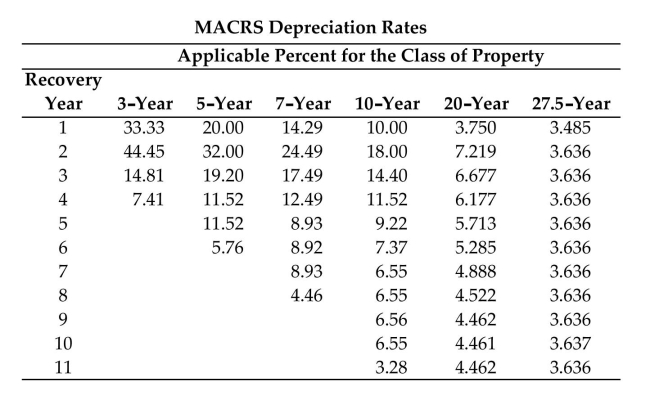

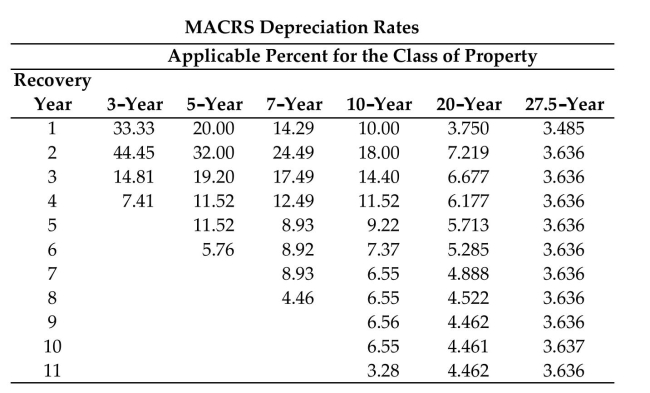

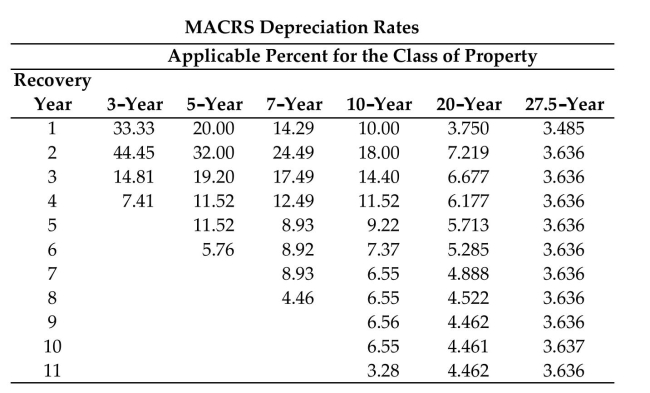

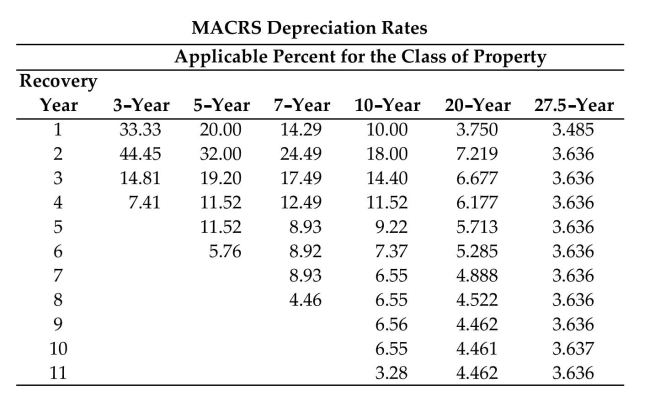

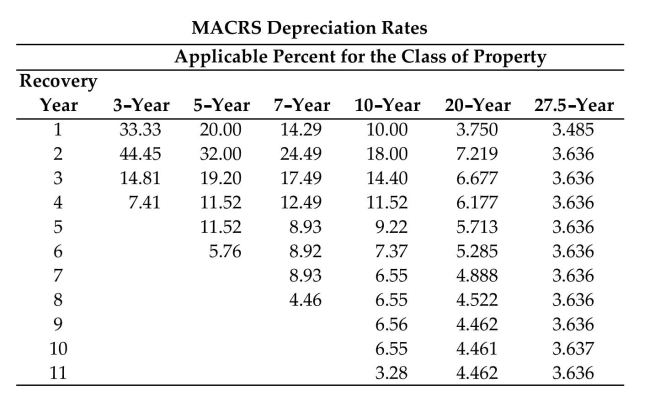

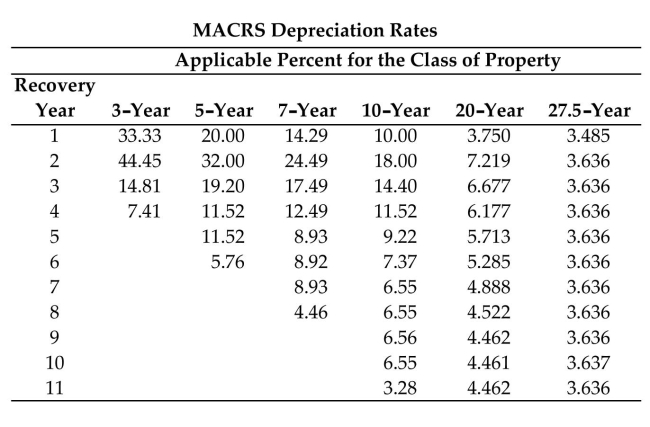

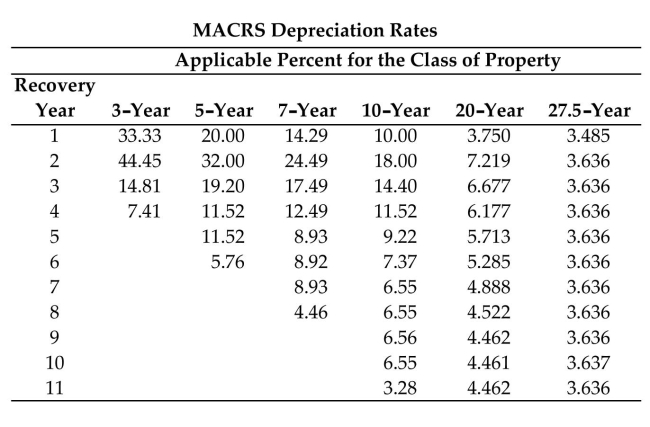

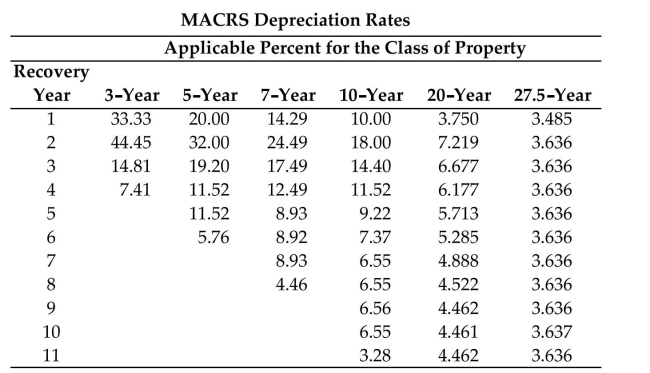

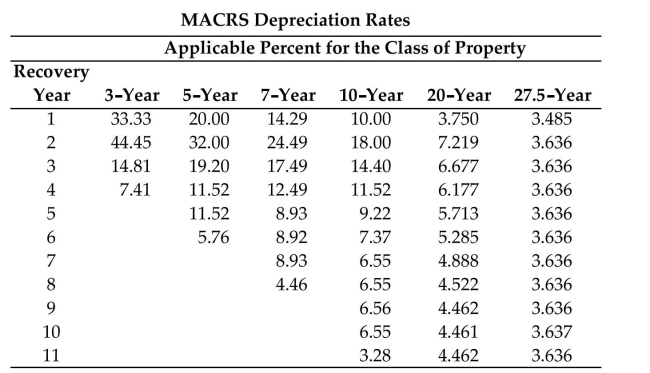

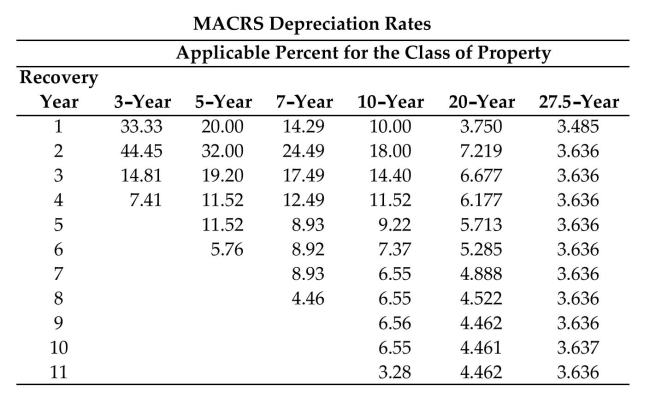

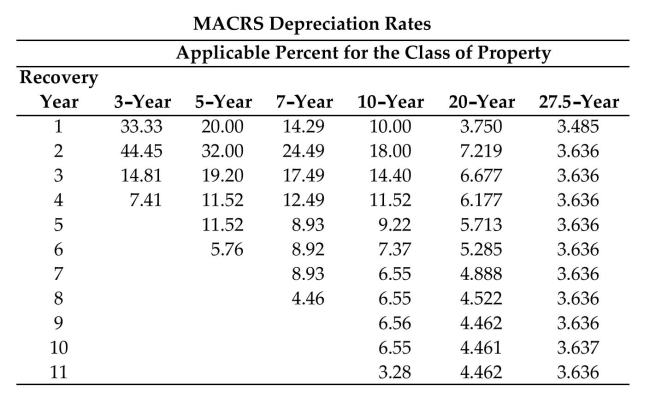

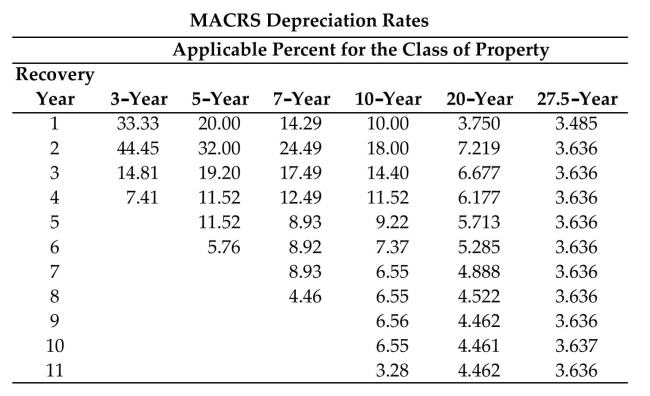

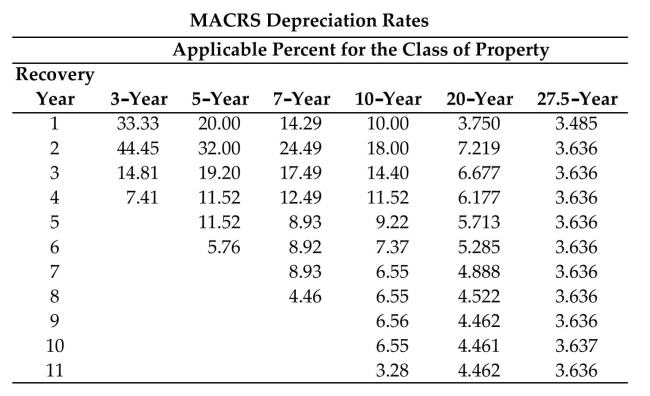

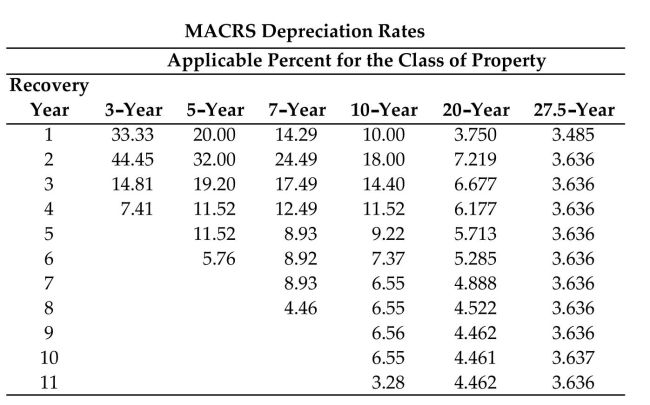

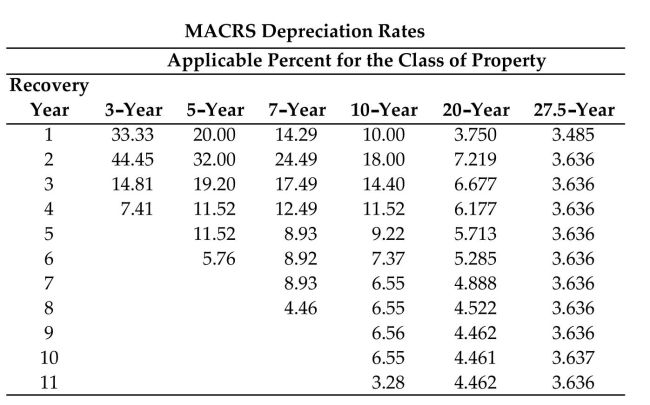

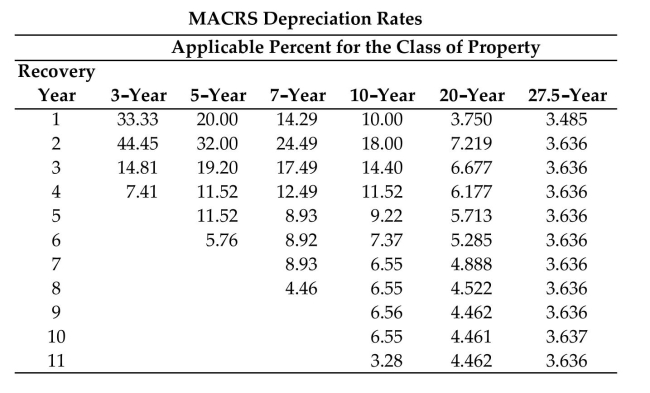

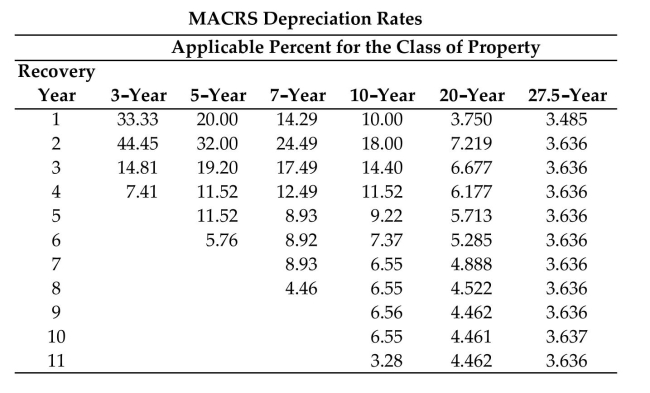

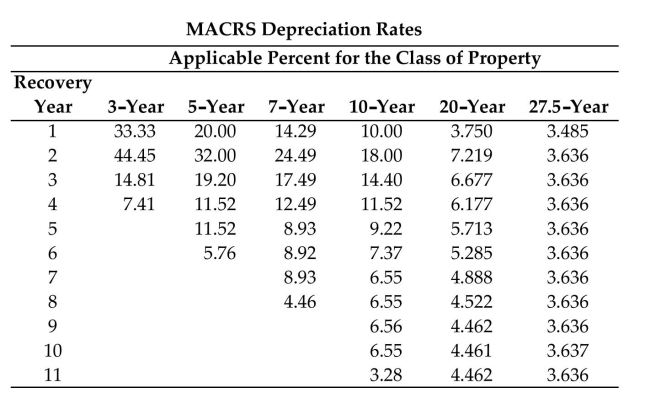

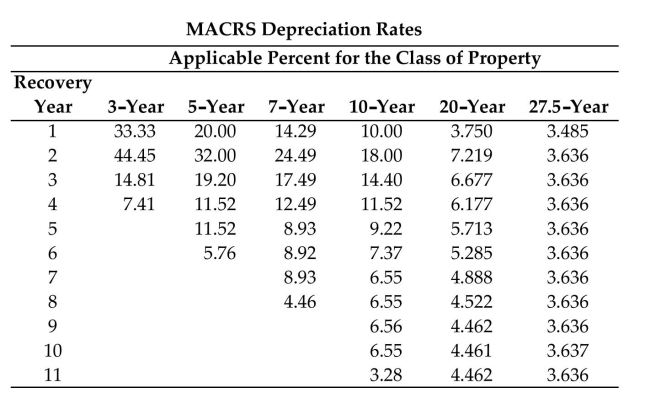

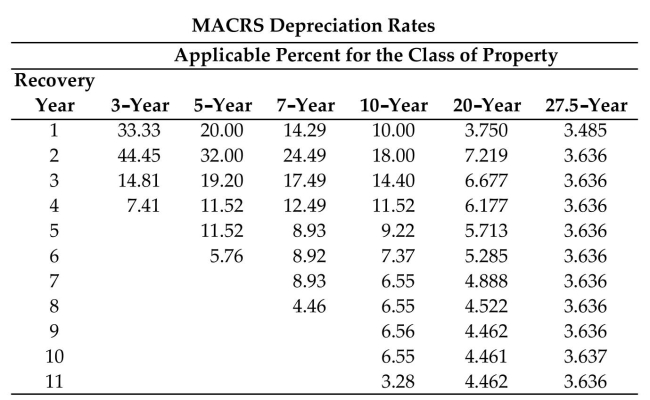

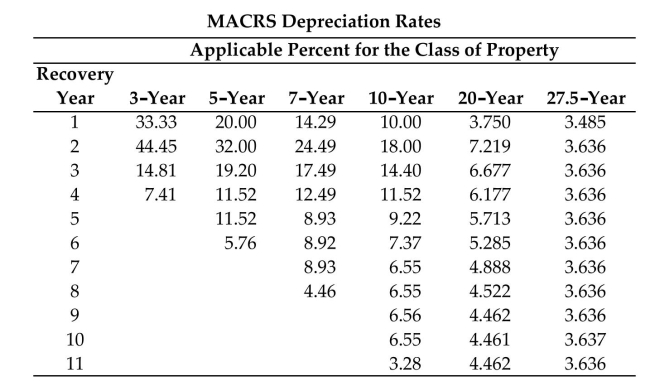

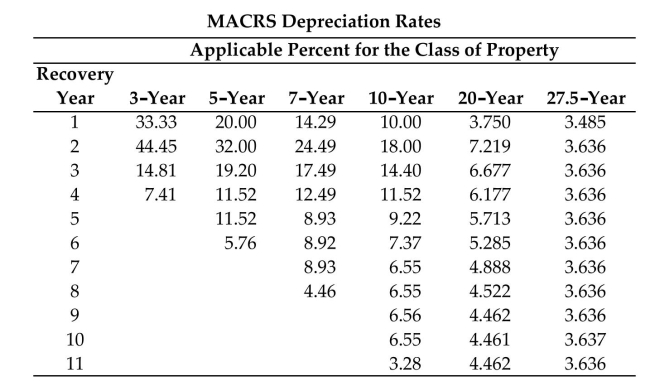

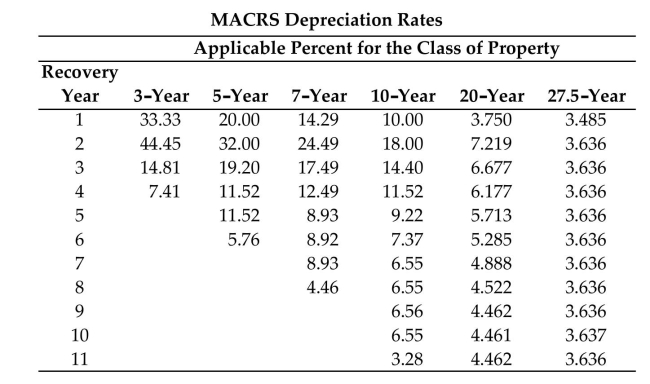

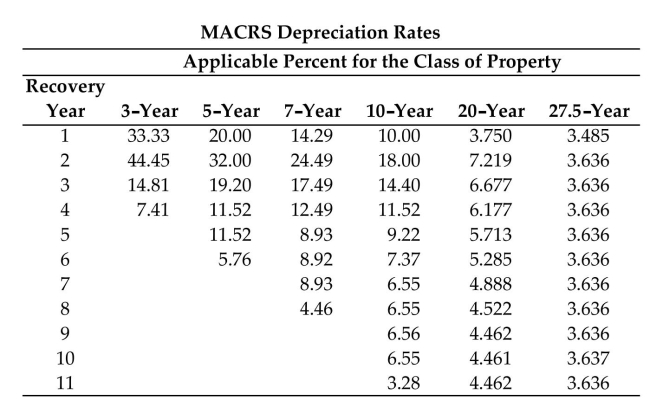

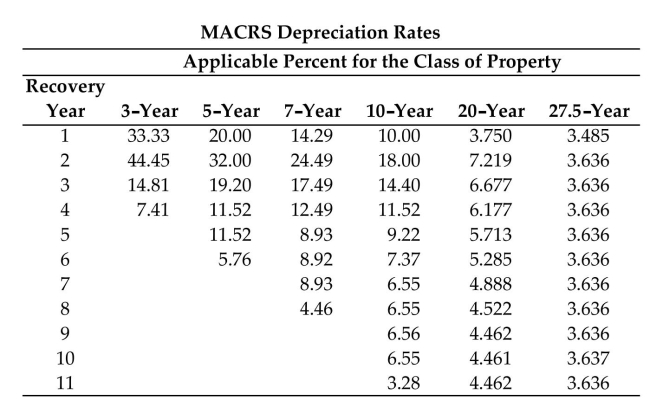

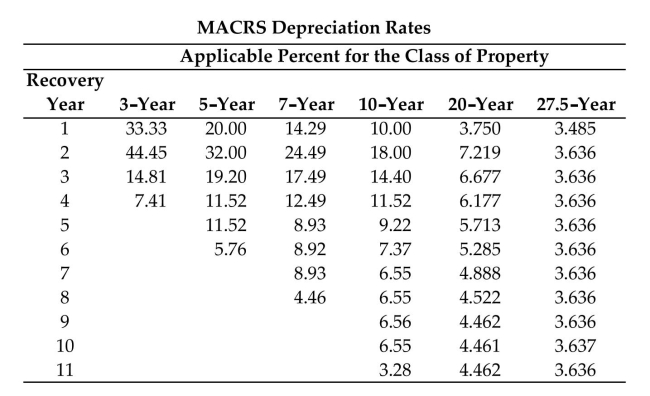

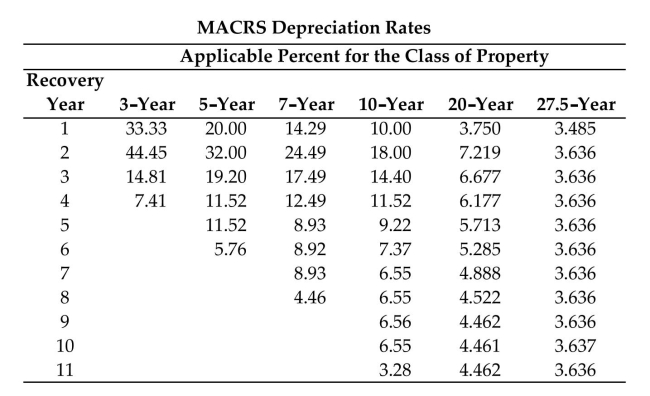

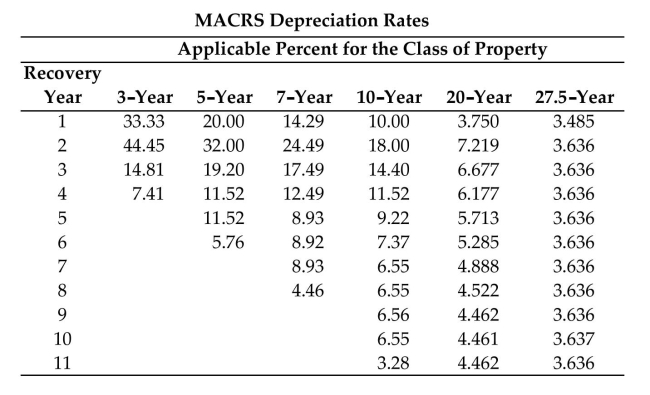

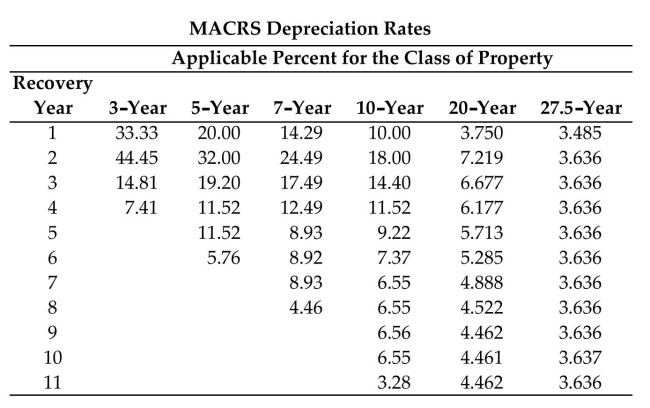

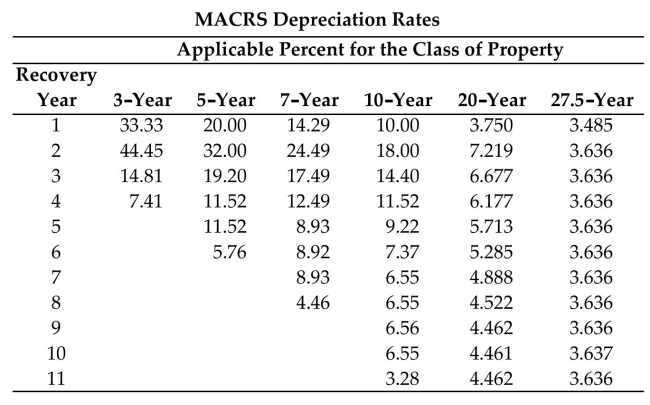

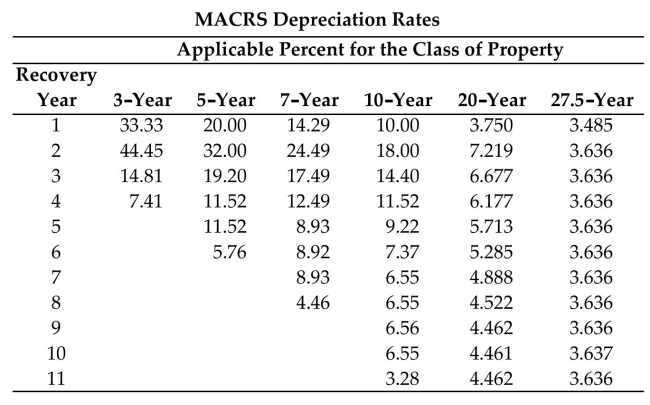

Use the MACRS depreciation rates table to find the recovery percent (rate), given the recovery year and recovery period.

Recovery year: 4

Recovery period: 3-year

A)11.52%

B)19.2%

C)14.81%

D)7.41%

Recovery year: 4

Recovery period: 3-year

A)11.52%

B)19.2%

C)14.81%

D)7.41%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

Provide an appropriate response.

Explain in your own words why the book values of an asset may never be less than the salvage value.

Explain in your own words why the book values of an asset may never be less than the salvage value.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

Provide an appropriate response.

Explain how to determine the depreciation fraction in any year of an asset's life when using the sum-of-the-years'-digits method of depreciation.

Explain how to determine the depreciation fraction in any year of an asset's life when using the sum-of-the-years'-digits method of depreciation.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

Provide an appropriate response.

Explain in your own words why the accumulated depreciation plus the book value equals the total cost in each year of an asset's life.

Explain in your own words why the accumulated depreciation plus the book value equals the total cost in each year of an asset's life.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

Provide an appropriate response.

Compare the three depreciation methods: straight-line, double-declining-balance, and sum-of-the-years'-digits.

Compare the three depreciation methods: straight-line, double-declining-balance, and sum-of-the-years'-digits.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

Find the annual straight-line rate of depreciation for the estimated life.

6 years

A)6%

B)8.3%

C)1.7%

D)16.7%

6 years

A)6%

B)8.3%

C)1.7%

D)16.7%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

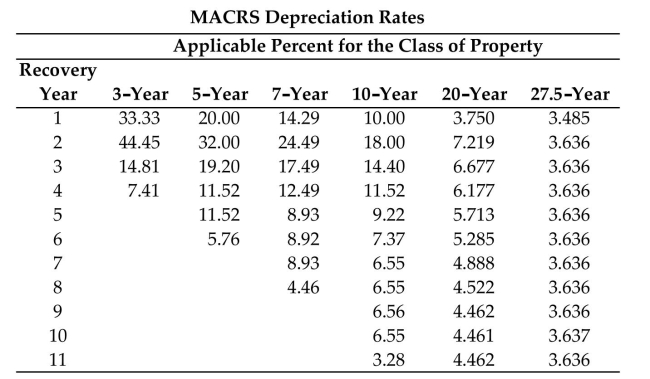

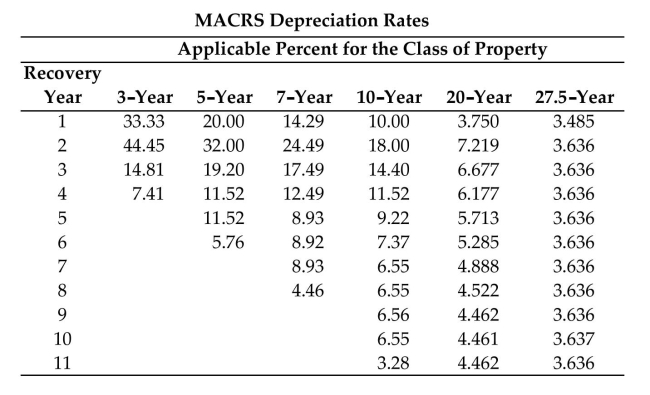

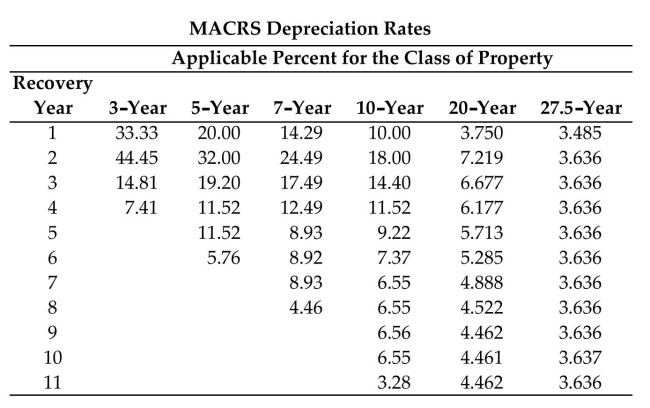

Find the book value using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $400,000

Recovery Period: 10-year

After: First Year

A)$360,000

B)$328,000

C)$302,040

D)$342,840

Cost: $400,000

Recovery Period: 10-year

After: First Year

A)$360,000

B)$328,000

C)$302,040

D)$342,840

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

Solve the problem.

A printing press cost $47,100 and has an estimated life of 11 years and a scrap value of $5,652. Find

The total depreciation at the end of 2 years using the straight-line method. Round to nearest dollar.

A)$43,332

B)$38,536

C)$39,564

D)$7,536

A printing press cost $47,100 and has an estimated life of 11 years and a scrap value of $5,652. Find

The total depreciation at the end of 2 years using the straight-line method. Round to nearest dollar.

A)$43,332

B)$38,536

C)$39,564

D)$7,536

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

Find the first year's depreciation using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $296,500

Period: 7-year

A)$42,370

B)$59,300

C)$72,613

D)$29,650

Cost: $296,500

Period: 7-year

A)$42,370

B)$59,300

C)$72,613

D)$29,650

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

Find the annual double-declining-balance (200% method) rate of depreciation.

30 years

A)300%

B)

C)

D)

30 years

A)300%

B)

C)

D)

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

Find the book value to the nearest dollar.

Cost $8,080, life 5 years, scrap value $808 at the end of 2 years using double-declining balance

Method

A)$3,426

B)$5,171

C)$5,462

D)$2,909

Cost $8,080, life 5 years, scrap value $808 at the end of 2 years using double-declining balance

Method

A)$3,426

B)$5,171

C)$5,462

D)$2,909

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

Use the MACRS depreciation rates table to find the recovery percent (rate), given the recovery year and recovery period.

Recovery year: 8

Recovery period: 27.5-year

A)3.636%

B)6.177%

C)3.637%

D)1.818%

Recovery year: 8

Recovery period: 27.5-year

A)3.636%

B)6.177%

C)3.637%

D)1.818%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

Provide an appropriate response.

Explain why a business asset may be depreciated using two or more different methods.

Explain why a business asset may be depreciated using two or more different methods.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

Find the annual amount of depreciation using the units-of-production method. Round to the nearest dollar.

Depreciation per unit: $0.09

Units of production: 214,000

A)$19,260

B)$237,778

C)$23,778

D)$1,926

Depreciation per unit: $0.09

Units of production: 214,000

A)$19,260

B)$237,778

C)$23,778

D)$1,926

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

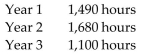

Solve the problem. Round to the nearest dollar.

SLM Instruments bought a metal punch machine at a cost of $8,700. The expected life is 5,000 hours

Of production with a salvage value of $870. Find the book value at the end of the third year. Use the

Units-of-production method of depreciation given the following production schedule.

Year 1 -1,150 hours

Year 2- 1,580 hours

Year 3- 1,280 hours

A)$1,534

B)$1,723

C)$2,404

D)$6,296

SLM Instruments bought a metal punch machine at a cost of $8,700. The expected life is 5,000 hours

Of production with a salvage value of $870. Find the book value at the end of the third year. Use the

Units-of-production method of depreciation given the following production schedule.

Year 1 -1,150 hours

Year 2- 1,580 hours

Year 3- 1,280 hours

A)$1,534

B)$1,723

C)$2,404

D)$6,296

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

Find the first year's depreciation, using the double-declining-balance method. Round to the nearest dollar.

Cost: $1,550

Est. life: 20 years

Est. scrap: $155

A)$155

B)$78

C)$140

D)$70

Cost: $1,550

Est. life: 20 years

Est. scrap: $155

A)$155

B)$78

C)$140

D)$70

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

22

Find the depreciation per unit. Round to the nearest cent.

Cost: $6,600

Salvage: $500

Est. Life: 21,000 units

A)$3.10

B)$2.90

C)$0.29

D)$0.31

Cost: $6,600

Salvage: $500

Est. Life: 21,000 units

A)$3.10

B)$2.90

C)$0.29

D)$0.31

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

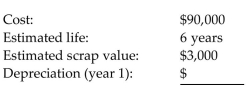

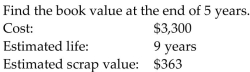

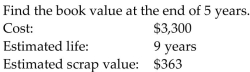

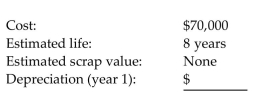

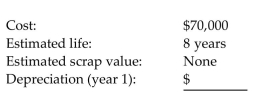

Find the book value after the given number of years, using the straight-line method. Round your answer to the nearest dollar.

A)$3,800

B)$700

C)$3,750

D)$3,100

A)$3,800

B)$700

C)$3,750

D)$3,100

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

Find the depreciation per unit. Round to the nearest cent.

Cost: $19,000

Salvage: $1,900

Est. Life: 220,000 miles

A)$0.90

B)$0.09

C)$0.80

D)$0.08

Cost: $19,000

Salvage: $1,900

Est. Life: 220,000 miles

A)$0.90

B)$0.09

C)$0.80

D)$0.08

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

Use the double-declining-balance method of depreciation. Round to the nearest dollar.

Metal Fabricators buys a milling machine for $3,500 and estimates its useful life at 4 years and its

Salvage value at $350. What is the amount of depreciation each year?

A)$1,750, $875, $438, $88

B)$1,575, $788, $788, $438

C)$788, $788, $788, $788

D)$875, $875, $875, $875

Metal Fabricators buys a milling machine for $3,500 and estimates its useful life at 4 years and its

Salvage value at $350. What is the amount of depreciation each year?

A)$1,750, $875, $438, $88

B)$1,575, $788, $788, $438

C)$788, $788, $788, $788

D)$875, $875, $875, $875

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

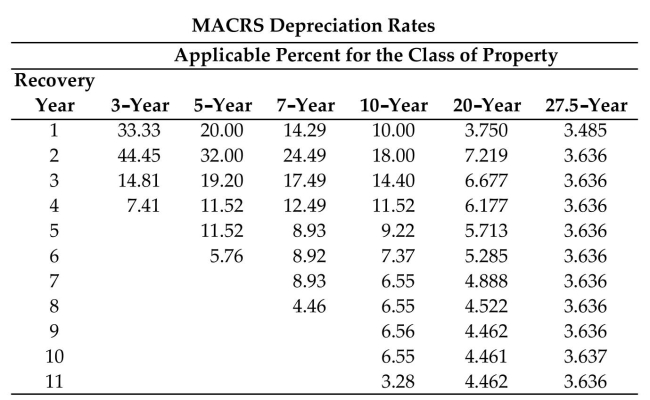

Use the MACRS depreciation rates table to solve the problem. Round to the nearest dollar.

Marcus McGuire purchased a rental duplex (27.5-year property)for $101,000. Find its book value

At the end of 5 years.

A)$71,169

B)$79,118

C)$82,791

D)$86,463

Marcus McGuire purchased a rental duplex (27.5-year property)for $101,000. Find its book value

At the end of 5 years.

A)$71,169

B)$79,118

C)$82,791

D)$86,463

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

Find the book value using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $120,500

Recovery Period: 27.5-year

After: Third Year

A)$99,237

B)$108,450

C)$107,538

D)$103,156

Cost: $120,500

Recovery Period: 27.5-year

After: Third Year

A)$99,237

B)$108,450

C)$107,538

D)$103,156

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

Find the depreciation per unit. Round to the nearest cent.

Cost: $655,000

Salvage: $65,500

Est. Life: 62,000 hours

A)$9.51

B)$105.60

C)$10.56

D)$95.10

Cost: $655,000

Salvage: $65,500

Est. Life: 62,000 hours

A)$9.51

B)$105.60

C)$10.56

D)$95.10

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

Find the book value after the given number of years, using the straight-line method. Round your answer to the nearest dollar.

Find the book value at the end of 4 years.

Cost: $39,000

Estimated life: 9 years

Estimated scrap value: $5,100

A)$15,067

B)$23,933

C)$31,467

D)$21,667

Find the book value at the end of 4 years.

Cost: $39,000

Estimated life: 9 years

Estimated scrap value: $5,100

A)$15,067

B)$23,933

C)$31,467

D)$21,667

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

Find the book value after the given number of years, using the straight-line method. Round your answer to the nearest dollar.

Find the book value at the end of 5 years.

Cost: $77,500

Estimated life: 50 years

Estimated scrap value: $4,650

A)$76,043

B)$7,285

C)$70,215

D)$69,750

Find the book value at the end of 5 years.

Cost: $77,500

Estimated life: 50 years

Estimated scrap value: $4,650

A)$76,043

B)$7,285

C)$70,215

D)$69,750

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

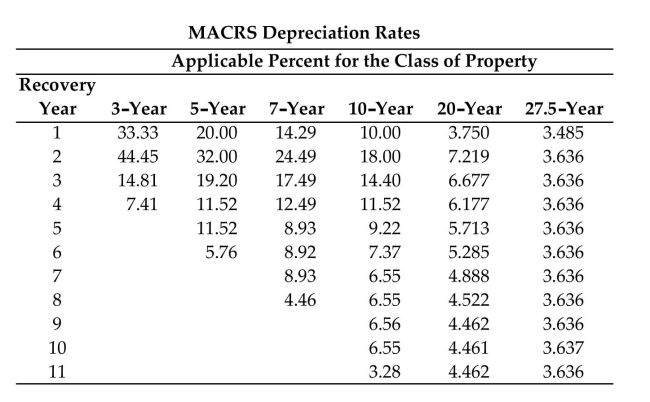

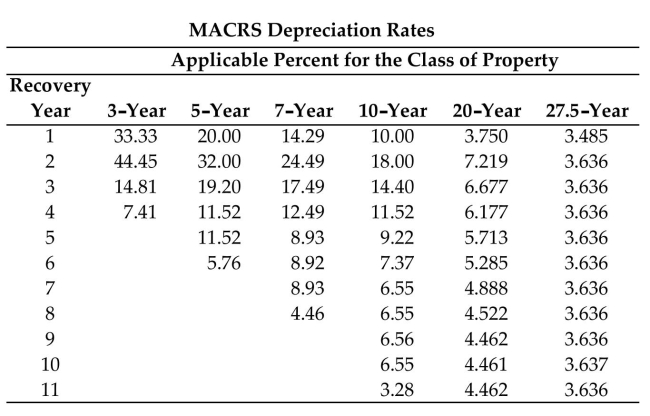

Find the book value using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $190,000

Recovery Period: 5-year

After: Third year

A)$153,520

B)$54,720

C)$36,480

D)$106,913

Cost: $190,000

Recovery Period: 5-year

After: Third year

A)$153,520

B)$54,720

C)$36,480

D)$106,913

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

Use the sum-of-the-years'-digits method of depreciation. Round to the nearest dollar.

Find the book value at the end of the third year for a service van which cost $16,000, has a life of 8

Years, and an estimated scrap value of $1,600.

A)$7,600

B)$10,000

C)$8,400

D)$6,000

Find the book value at the end of the third year for a service van which cost $16,000, has a life of 8

Years, and an estimated scrap value of $1,600.

A)$7,600

B)$10,000

C)$8,400

D)$6,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

Solve the problem.

A drill press cost $5,000 and has an estimated life of 8 years and a scrap value of $300. Find the

Book value at the end of 6 years using the straight-line method. Round to nearest dollar.

A)$4,413

B)$3,525

C)$1,250

D)$1,475

A drill press cost $5,000 and has an estimated life of 8 years and a scrap value of $300. Find the

Book value at the end of 6 years using the straight-line method. Round to nearest dollar.

A)$4,413

B)$3,525

C)$1,250

D)$1,475

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

Find the first year's depreciation using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $402,500

Period: 27.5-year

A)$15,094

B)$14,027

C)$1,402,713

D)$14,611

Cost: $402,500

Period: 27.5-year

A)$15,094

B)$14,027

C)$1,402,713

D)$14,611

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

Use the double-declining-balance method of depreciation. Round to the nearest dollar.

Royal Oaks Golf Course buys a tractor for $8,900 and estimates the life at 8 years with a scrap value

Of $890. What is its book value at the end of the fourth year?

A)$4,005

B)$2,816

C)$2,534

D)$890

Royal Oaks Golf Course buys a tractor for $8,900 and estimates the life at 8 years with a scrap value

Of $890. What is its book value at the end of the fourth year?

A)$4,005

B)$2,816

C)$2,534

D)$890

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

Find the book value to the nearest dollar.

Cost $7,090, life 6 years, scrap value $780 at the end of 3 years using double-declining balance

Method

A)$2,101

B)$4,103

C)$2,650

D)$4,432

Cost $7,090, life 6 years, scrap value $780 at the end of 3 years using double-declining balance

Method

A)$2,101

B)$4,103

C)$2,650

D)$4,432

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

Find the annual amount of depreciation using the straight-line method. Round to the nearest dollar.

Cost: $460

Estimated life: 8 years

Estimated scrap value: $92

A)$12

B)$92

C)$58

D)$46

Cost: $460

Estimated life: 8 years

Estimated scrap value: $92

A)$12

B)$92

C)$58

D)$46

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

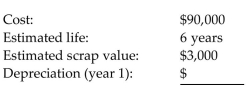

Find the first year's depreciation using the sum-of-the-years'-digits method of depreciation. Round to the nearest dollar.

A)$14,500

B)$24,857

C)$21,571

D)$65,143

A)$14,500

B)$24,857

C)$21,571

D)$65,143

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

Find the book value after the given number of years, using the straight-line method. Round your answer to the nearest dollar.

A)$2,974

B)$1,632

C)$1,668

D)$1,467

A)$2,974

B)$1,632

C)$1,668

D)$1,467

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

Find the book value to the nearest dollar.

Cost $2,890, life 7 years, scrap value $231 at the end of 1 year, sum-of-the-years'-digits method

A)$2,225

B)$2,510

C)$2,477

D)$2,064

Cost $2,890, life 7 years, scrap value $231 at the end of 1 year, sum-of-the-years'-digits method

A)$2,225

B)$2,510

C)$2,477

D)$2,064

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

Find the book value to the nearest dollar.

Cost $8,100, life 4 years, scrap value $405 at the end of 3 years, sum-of-the-years'-digits method

A)$1,175

B)$4,050

C)$2,025

D)$2,329

Cost $8,100, life 4 years, scrap value $405 at the end of 3 years, sum-of-the-years'-digits method

A)$1,175

B)$4,050

C)$2,025

D)$2,329

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

Find the annual amount of depreciation using the units-of-production method. Round to the nearest dollar.

Depreciation per unit: $0.36

Units of production: 23,000

A)$639

B)$8,280

C)$828

D)$6,389

Depreciation per unit: $0.36

Units of production: 23,000

A)$639

B)$8,280

C)$828

D)$6,389

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

Solve the problem. Round to the nearest dollar.

A construction company purchased a piece of equipment for $1,610. The expected life is 9,000

Hours, after which it will have a salvage value of $290. Find the amount of depreciation for the first

Year if the piece of equipment was used for 1,700 hours. Use the units-of-production method of

Depreciation.

A)$255

B)$149

C)$304

D)$177

A construction company purchased a piece of equipment for $1,610. The expected life is 9,000

Hours, after which it will have a salvage value of $290. Find the amount of depreciation for the first

Year if the piece of equipment was used for 1,700 hours. Use the units-of-production method of

Depreciation.

A)$255

B)$149

C)$304

D)$177

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

Find the first year's depreciation, using the double-declining-balance method. Round to the nearest dollar.

Cost: $3,400

Est. life: 6 years

Est. scrap: $800

A)$433

B)$867

C)$567

D)$1,133

Cost: $3,400

Est. life: 6 years

Est. scrap: $800

A)$433

B)$867

C)$567

D)$1,133

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

Use the double-declining-balance method of depreciation. Round to the nearest dollar.

New Town Deli buys refrigerated counters for $34,000 and estimates the life at 5 years with a scrap

Value of $3,400. What is the amount of depreciation for the third year?

A)$3,400

B)$6,120

C)$4,896

D)$4,406

New Town Deli buys refrigerated counters for $34,000 and estimates the life at 5 years with a scrap

Value of $3,400. What is the amount of depreciation for the third year?

A)$3,400

B)$6,120

C)$4,896

D)$4,406

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

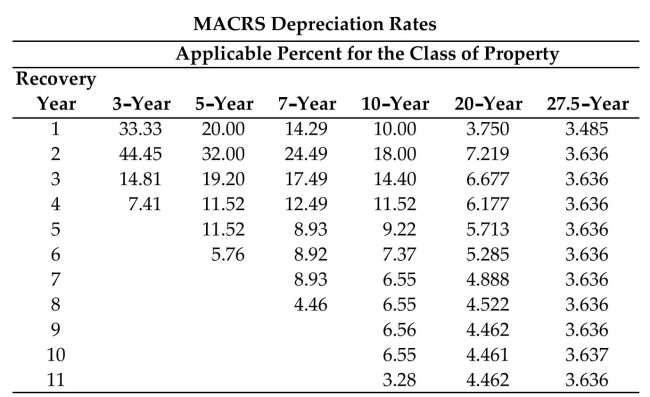

Find the first year's depreciation using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $8,760

Period: 5-year

A)$1,252

B)$1,752

C)$2,920

D)$3,894

Cost: $8,760

Period: 5-year

A)$1,252

B)$1,752

C)$2,920

D)$3,894

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

Find the annual straight-line rate of depreciation for the estimated life.

30 years

A)1.7%

B)30%

C)0.3%

D)3.3%

30 years

A)1.7%

B)30%

C)0.3%

D)3.3%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

Use the MACRS depreciation rates table to find the recovery percent (rate), given the recovery year and recovery period.

Recovery year: 9

Recovery period: 20-year

A)3.637%

B)4.461%

C)4.522%

D)4.462%

Recovery year: 9

Recovery period: 20-year

A)3.637%

B)4.461%

C)4.522%

D)4.462%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

Solve the problem.

The Windmill Harbour Marina purchased a boat hauling rig for $543,000. Its estimated life is 16

Years, at which time it will have a scrap value of $3,200. Use the straight-line method of

Depreciation to find the annual amount of depreciation. Find the book value at the end of 9 years.

A)$33,938, $846,642

B)$33,938, $305,442

C)$33,738, $239,358

D)$33,738, $303,642

The Windmill Harbour Marina purchased a boat hauling rig for $543,000. Its estimated life is 16

Years, at which time it will have a scrap value of $3,200. Use the straight-line method of

Depreciation to find the annual amount of depreciation. Find the book value at the end of 9 years.

A)$33,938, $846,642

B)$33,938, $305,442

C)$33,738, $239,358

D)$33,738, $303,642

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

Use the sum-of-the-years'-digits method of depreciation. Round to the nearest dollar.

Find the book value at the end of the second year for an air filtration system which cost $6,300, has

A life of 5 years, and an estimated scrap value of $630.

A)$4,032

B)$2,520

C)$2,898

D)$3,402

Find the book value at the end of the second year for an air filtration system which cost $6,300, has

A life of 5 years, and an estimated scrap value of $630.

A)$4,032

B)$2,520

C)$2,898

D)$3,402

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

Find the book value using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $35,000

Recovery Period: 5-year

After: First Year

A)$23,335

B)$23,800

C)$29,999

D)$28,000

Cost: $35,000

Recovery Period: 5-year

After: First Year

A)$23,335

B)$23,800

C)$29,999

D)$28,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

Solve the problem.

Tech Support Associates purchased a new computer network server and replaced all its terminals

For $29,600. Its estimated life is 4 years, at which time it will have a scrap value of $2,100. Use the

Straight-line method of depreciation to find the annual amount of depreciation. Find the book

Value at the end of 3 years.

A)$7,400, $7,400

B)$6,875, $20,625

C)$6,875, $8,975

D)$7,400, $22,200

Tech Support Associates purchased a new computer network server and replaced all its terminals

For $29,600. Its estimated life is 4 years, at which time it will have a scrap value of $2,100. Use the

Straight-line method of depreciation to find the annual amount of depreciation. Find the book

Value at the end of 3 years.

A)$7,400, $7,400

B)$6,875, $20,625

C)$6,875, $8,975

D)$7,400, $22,200

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

Use the MACRS depreciation rates table to find the recovery percent (rate), given the recovery year and recovery period.

Recovery year: 5

Recovery period: 10-year

A)11.52%

B)9.22%

C)5.713%

D)8.93%

Recovery year: 5

Recovery period: 10-year

A)11.52%

B)9.22%

C)5.713%

D)8.93%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

Find the annual double-declining-balance (200% method) rate of depreciation.

9 years

A)

B)

C)

D)90%

9 years

A)

B)

C)

D)90%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

Find the book value using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $167,000

Recovery Period: 7-year

After: Fourth year

A)$76,954

B)$48,096

C)$20,858

D)$52,171

Cost: $167,000

Recovery Period: 7-year

After: Fourth year

A)$76,954

B)$48,096

C)$20,858

D)$52,171

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

Solve the problem.

A drilling rig cost $20,600 and has an estimated life of 8 years and a scrap value of $1,030. Find the

Book value at the end of 5 years using the straight-line method. Round to nearest dollar.

A)$7,725

B)$8,369

C)$18,154

D)$12,231

A drilling rig cost $20,600 and has an estimated life of 8 years and a scrap value of $1,030. Find the

Book value at the end of 5 years using the straight-line method. Round to nearest dollar.

A)$7,725

B)$8,369

C)$18,154

D)$12,231

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

Use the MACRS depreciation rates table to find the recovery percent (rate), given the recovery year and recovery period.

Recovery year: 5

Recovery period: 5-year

A)8.93%

B)12.49%

C)7.41%

D)11.52%

Recovery year: 5

Recovery period: 5-year

A)8.93%

B)12.49%

C)7.41%

D)11.52%

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

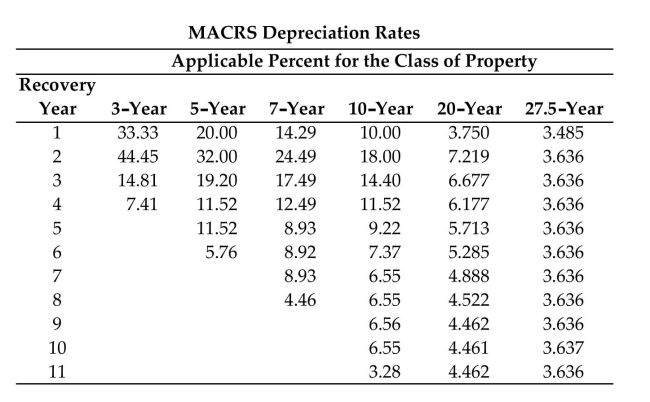

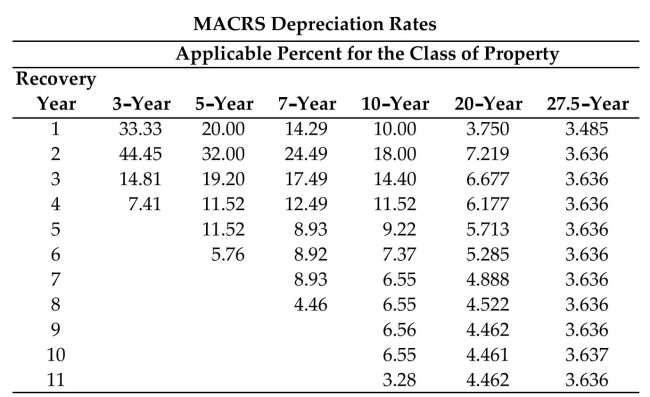

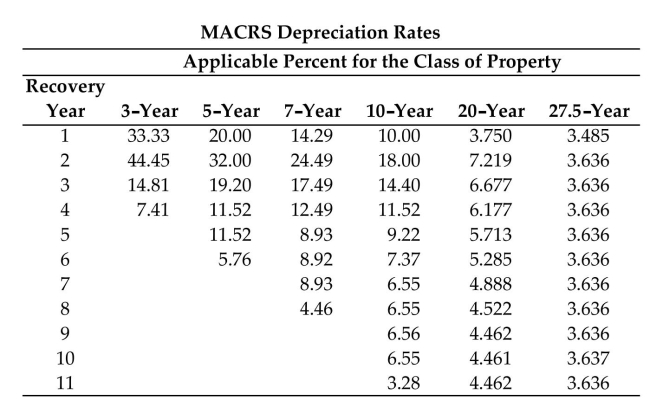

Find the book value using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $9,580

Recovery Period: 3-year

After: First Year

A)$8,161

B)$6,387

C)$7,664

D)$7,741

Cost: $9,580

Recovery Period: 3-year

After: First Year

A)$8,161

B)$6,387

C)$7,664

D)$7,741

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

Find the first year's depreciation, using the double-declining-balance method. Round to the nearest dollar.

Cost: $54,000

Est. life: 20 years

Est. scrap: $5,000

A)$2,700

B)$2,450

C)$4,900

D)$5,400

Cost: $54,000

Est. life: 20 years

Est. scrap: $5,000

A)$2,700

B)$2,450

C)$4,900

D)$5,400

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

Find the book value after the given number of years, using the straight-line method. Round your answer to the nearest dollar.

Find the book value at the end of 10 years.

Cost: $67,500

Estimated life: 12 years

Estimated scrap value: $4,050

A)$62,213

B)$11,250

C)$52,875

D)$14,625

Find the book value at the end of 10 years.

Cost: $67,500

Estimated life: 12 years

Estimated scrap value: $4,050

A)$62,213

B)$11,250

C)$52,875

D)$14,625

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

Use the double-declining-balance method of depreciation. Round to the nearest dollar.

Beta Graphics buys some CAD-CAM computer equipment at a cost of $8,350 and estimates the life

At 10 years with a scrap value of $835. What is its book value at the end of the fourth year?

A)$5,344

B)$3,420

C)$835

D)$3,078

Beta Graphics buys some CAD-CAM computer equipment at a cost of $8,350 and estimates the life

At 10 years with a scrap value of $835. What is its book value at the end of the fourth year?

A)$5,344

B)$3,420

C)$835

D)$3,078

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

Use the MACRS depreciation rates table to solve the problem. Round to the nearest dollar.

NewAge Consulting purchased a desktop publishing system (5-year property)at a cost of $9,600.

Find the accumulated depreciation at the end of 3 years.

A)$5,402

B)$7,941

C)$8,889

D)$6,835

NewAge Consulting purchased a desktop publishing system (5-year property)at a cost of $9,600.

Find the accumulated depreciation at the end of 3 years.

A)$5,402

B)$7,941

C)$8,889

D)$6,835

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

Find the sum-of-the-years'-digits depreciation fraction for the first year.

8 years

A)

B)

C)

D)

8 years

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

Find the first year's depreciation using the sum-of-the-years'-digits method of depreciation. Round to the nearest dollar.

A)$8,750

B)$54,444

C)$61,250

D)$15,556

A)$8,750

B)$54,444

C)$61,250

D)$15,556

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

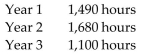

Solve the problem. Round to the nearest dollar.

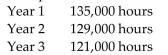

Rainbow Ice Cream bought a frozen custard maker that cost $9,400. The expected life is 5,000 hours

Of production with a salvage value of $940. Find the book value at the end of the third year. Use the

Units-of-production method of depreciation given the following production schedule.

A)$1,244

B)$1,372

C)$2,184

D)$7,216

Rainbow Ice Cream bought a frozen custard maker that cost $9,400. The expected life is 5,000 hours

Of production with a salvage value of $940. Find the book value at the end of the third year. Use the

Units-of-production method of depreciation given the following production schedule.

A)$1,244

B)$1,372

C)$2,184

D)$7,216

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

Find the book value to the nearest dollar.

Cost $7,030, life 2 years, scrap value $633 at the end of 1 year using double-declining balance

Method

A)$633

B)$0

C)$3,515

D)$3,832

Cost $7,030, life 2 years, scrap value $633 at the end of 1 year using double-declining balance

Method

A)$633

B)$0

C)$3,515

D)$3,832

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

Find the book value to the nearest dollar.

Cost $91,900, life 11 years, scrap value $8,271 at the end of 1 year, sum-of-the-years'-digits

Method

A)$84,297

B)$75,191

C)$83,545

D)$77,962

Cost $91,900, life 11 years, scrap value $8,271 at the end of 1 year, sum-of-the-years'-digits

Method

A)$84,297

B)$75,191

C)$83,545

D)$77,962

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

Find the sum-of-the-years'-digits depreciation fraction for the first year.

30 years

A)

B)

C)

D)

30 years

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

Use the MACRS depreciation rates table to solve the problem. Round to the nearest dollar.

Respiratory Care, Inc. purchased new packaging equipment (5-year property)at a cost of $8,150.

Find the book value at the end of 4 years.

A)$2,546

B)$2,556

C)$1,408

D)$2,347

Respiratory Care, Inc. purchased new packaging equipment (5-year property)at a cost of $8,150.

Find the book value at the end of 4 years.

A)$2,546

B)$2,556

C)$1,408

D)$2,347

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

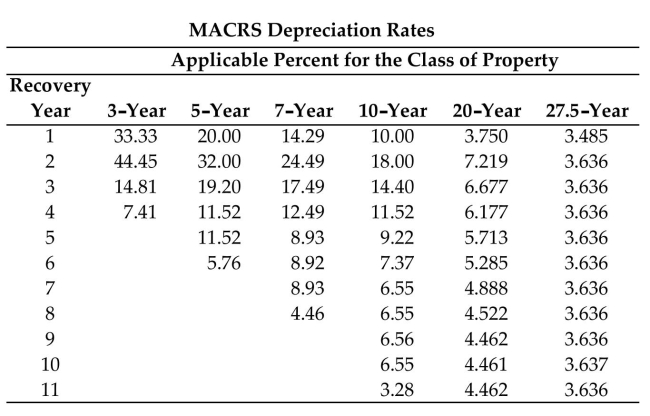

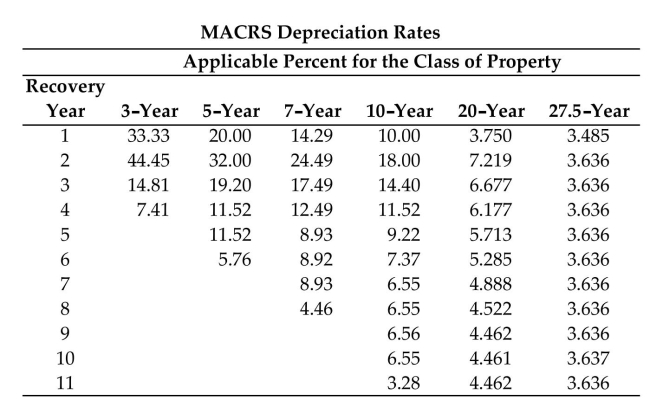

Find the first year's depreciation using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $425,000

Period: 10-year

A)$104,083

B)$60,733

C)$42,500

D)$76,500

Cost: $425,000

Period: 10-year

A)$104,083

B)$60,733

C)$42,500

D)$76,500

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

Use the sum-of-the-years'-digits method of depreciation. Round to the nearest dollar.

Scot Cleaners bought a new trouser press for $7,500 and estimates its life at 4 years at which time

The salvage value is expected to be $750. Find the amount of depreciation each year.

A)$3,750, $1,875, $938, $188

B)$2,700, $2,025, $1,350, $675

C)$3,000, $2,250, $1,500, $750

D)$1,688, $1,688, $1,688, $1,688

Scot Cleaners bought a new trouser press for $7,500 and estimates its life at 4 years at which time

The salvage value is expected to be $750. Find the amount of depreciation each year.

A)$3,750, $1,875, $938, $188

B)$2,700, $2,025, $1,350, $675

C)$3,000, $2,250, $1,500, $750

D)$1,688, $1,688, $1,688, $1,688

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

Find the first year's depreciation using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $34,800

Period: 5-year

A)$11,599

B)$6,960

C)$11,136

D)$4,973

Cost: $34,800

Period: 5-year

A)$11,599

B)$6,960

C)$11,136

D)$4,973

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

Find the depreciation per unit. Round to the nearest cent.

Cost: $7,000

Salvage: $350

Est. Life: 200,000 copies

A)$0.30

B)$0.03

C)$0.40

D)$0.04

Cost: $7,000

Salvage: $350

Est. Life: 200,000 copies

A)$0.30

B)$0.03

C)$0.40

D)$0.04

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

Use the sum-of-the-years'-digits method of depreciation. Round to the nearest dollar.

Find the depreciation in the third year for a power generator which costs $25,000, has a life of 12

Years, and an estimated scrap value of $2,500.

A)$961

B)$3,205

C)$962

D)$2,885

Find the depreciation in the third year for a power generator which costs $25,000, has a life of 12

Years, and an estimated scrap value of $2,500.

A)$961

B)$3,205

C)$962

D)$2,885

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

75

Find the book value using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $9,500

Recovery Period: 5-year

After: First Year

A)$6,334

B)$5,277

C)$8,142

D)$7,600

Cost: $9,500

Recovery Period: 5-year

After: First Year

A)$6,334

B)$5,277

C)$8,142

D)$7,600

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

76

Find the book value using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $309,500

Recovery Period: 7-year

After: First Year

A)$278,550

B)$247,600

C)$265,272

D)$233,703

Cost: $309,500

Recovery Period: 7-year

After: First Year

A)$278,550

B)$247,600

C)$265,272

D)$233,703

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

77

Find the first year's depreciation using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $9,040

Period: 3-year

A)$1,339

B)$3,013

C)$1,808

D)$1,736

Cost: $9,040

Period: 3-year

A)$1,339

B)$3,013

C)$1,808

D)$1,736

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

78

Find the first year's depreciation using the MACRS method of depreciation and the MACRS depreciation rates table. Round to the nearest dollar.

Cost: $90,500

Period: 20-year

A)$6,533

B)$1,645

C)$3,394

D)$9,050

Cost: $90,500

Period: 20-year

A)$6,533

B)$1,645

C)$3,394

D)$9,050

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

79

Use the MACRS depreciation rates table to solve the problem. Round to the nearest dollar.

Angelica Healthcare purchased new lab equipment (7-year property)for $138,000. Find the

Accumulated depreciation at the end of 5 years.

A)$114,154

B)$107,212

C)$119,522

D)$130,051

Angelica Healthcare purchased new lab equipment (7-year property)for $138,000. Find the

Accumulated depreciation at the end of 5 years.

A)$114,154

B)$107,212

C)$119,522

D)$130,051

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

80

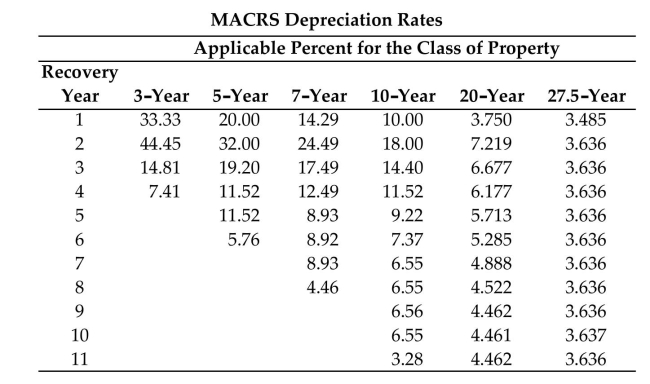

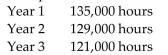

Solve the problem. Round to the nearest dollar.

Central Street bought a rolling machine that cost $58,000. The expected life is 600,000 hours of

Production with a salvage value of $5,800. Find the book value at the end of the third year. Use the

Units-of-production method of depreciation given the following production schedule.

A)$23,350

B)$34,650

C)$20,783

D)$17,550

Central Street bought a rolling machine that cost $58,000. The expected life is 600,000 hours of

Production with a salvage value of $5,800. Find the book value at the end of the third year. Use the

Units-of-production method of depreciation given the following production schedule.

A)$23,350

B)$34,650

C)$20,783

D)$17,550

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck