Deck 17: Stock Market Efficiency

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 17: Stock Market Efficiency

1

You have just read an article in today's Wall Street Journal that states that the US economy is growing at a healthy 3% per year, US interest rates are falling, and emerging economies around the world are growing at a healthy 7% per year. Based on this information, you predict that US stock prices will

A)remain relatively stable.

B)decline slightly.

C)decline significantly.

D)increase.

A)remain relatively stable.

B)decline slightly.

C)decline significantly.

D)increase.

D

2

Consider a share of stock in a company that will pay a dividend of $25 one year from today and immediately liquidate its assets. Your expected share of the liquidated assets is $5. Your time value of money is such that you consider $1.05 a year from today is equivalent to $1.00 today. What is the maximum you would be willing to pay for a share of stock in this company?

A)$23.81

B)$28.57

C)$30.06

D)$34.76

A)$23.81

B)$28.57

C)$30.06

D)$34.76

B

3

Consider a share of stock in a company that will pay a dividend of $20 one year from today and immediately liquidate its assets. Your expected share of the liquidated assets is $5. Your time value of money is such that you consider $1.05 a year from today is equivalent to $1.00 today. What is the maximum you would be willing to pay for a share of stock in this company?

A)$17.39

B)$20.00

C)$23.81

D)$25.00

A)$17.39

B)$20.00

C)$23.81

D)$25.00

C

4

Schneider Manufacturing Corporation has a PE ratio of $32.17. It has an expected earnings per share of $1.93. What is the current stock price for Schneider?

A)$16.67

B)$34.10

C)$62.09

D)$85.44

A)$16.67

B)$34.10

C)$62.09

D)$85.44

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

Stocks are riskier than bonds for which of the following reasons?

A)Unlike bonds, there is no buyback requirement, no requirement to make payments periodically, and the stock may lose a great deal of value.

B)Unlike bonds, there is no requirement that a corporation must buy back shares or pay dividends.

C)Unlike bonds, stocks can lose a great deal of value.

D)Unlike bonds, stocks can be common or preferred.

A)Unlike bonds, there is no buyback requirement, no requirement to make payments periodically, and the stock may lose a great deal of value.

B)Unlike bonds, there is no requirement that a corporation must buy back shares or pay dividends.

C)Unlike bonds, stocks can lose a great deal of value.

D)Unlike bonds, stocks can be common or preferred.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

History tells us that stock prices tend to be

A)seasonal.

B)counterseasonal.

C)procyclical.

D)countercyclical.

A)seasonal.

B)counterseasonal.

C)procyclical.

D)countercyclical.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

What is the difference between common and preferred stocks?

A)Unlike holders of common stock, those who own preferred stock usually do not get voting rights at the annual corporate meeting.

B)Those who hold common stocks are paid dividends before those who hold preferred stocks are paid.

C)Unlike preferred stock, the amount of the dividend paid to those who own common stock is fixed and never changes.

D)Unlike preferred stock, common stock is the least popular form of stock.

A)Unlike holders of common stock, those who own preferred stock usually do not get voting rights at the annual corporate meeting.

B)Those who hold common stocks are paid dividends before those who hold preferred stocks are paid.

C)Unlike preferred stock, the amount of the dividend paid to those who own common stock is fixed and never changes.

D)Unlike preferred stock, common stock is the least popular form of stock.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

You are interested in buying a share of stock in CAD Corporation. You expect a dividend payment of $0.50 next year and that the dividend will grow by 5% per year thereafter. You desire a 10% return on your purchase. According to the Gordon growth model, what is the maximum price you would pay for a share of this stock?

A)$10.00

B)$12.50

C)$15.00

D)$20.00

A)$10.00

B)$12.50

C)$15.00

D)$20.00

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is NOT true of stock dividends?

A)Stock dividends may be in the form of cash or additional shares of stock.

B)Stock dividends are typically paid out of long-term assets held for that purpose.

C)Stock dividends are typically paid out of current earnings.

D)Some well-established corporations pay out as much as 80% or more of their earnings in dividends.

A)Stock dividends may be in the form of cash or additional shares of stock.

B)Stock dividends are typically paid out of long-term assets held for that purpose.

C)Stock dividends are typically paid out of current earnings.

D)Some well-established corporations pay out as much as 80% or more of their earnings in dividends.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

One of the main reasons why savers wish to purchase stocks is because

A)they want to share in a corporation's future profits.

B)they want a safer investment than other assets.

C)stocks are a more liquid investment than other assets.

D)stocks are very profitable on a short time frame.

A)they want to share in a corporation's future profits.

B)they want a safer investment than other assets.

C)stocks are a more liquid investment than other assets.

D)stocks are very profitable on a short time frame.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

11

Interest rates and stock prices tend to be

A)unrelated.

B)inversely related.

C)directly related.

D)linearly related.

A)unrelated.

B)inversely related.

C)directly related.

D)linearly related.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

Since investors in the stock market are interested in owning part of the corporation, the stock market is also being referred to as

A)exchange market.

B)NASDAQ.

C)equity market.

D)debt market.

A)exchange market.

B)NASDAQ.

C)equity market.

D)debt market.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

If Mercury Corporation's stock is currently trading at $40.45 per share with an expected earnings per share of $1.67, Mercury's PE ratio would be

A)$20.01.

B)$24.22.

C)$38.78.

D)$67.55.

A)$20.01.

B)$24.22.

C)$38.78.

D)$67.55.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

Ryan owns 1,000 shares of preferred stock in Grant Corporation. This means that Ryan

A)will receive dividends after those who hold common stock are paid.

B)will receive a fixed dividend payment.

C)has voting rights at the annual corporate meeting.

D)purchased his stock in the secondary market.

A)will receive dividends after those who hold common stock are paid.

B)will receive a fixed dividend payment.

C)has voting rights at the annual corporate meeting.

D)purchased his stock in the secondary market.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

Which of these is true of the Dow Jones Industrial Average?

A)It tracks 100 stocks, including a wide variety of both small and large companies.

B)It tracks 500 stocks and uses a price-weighted index.

C)It tracks only thirty stocks and most of these are old, well-established companies.

D)It tracks 100 stocks, but very few growth stocks.

A)It tracks 100 stocks, including a wide variety of both small and large companies.

B)It tracks 500 stocks and uses a price-weighted index.

C)It tracks only thirty stocks and most of these are old, well-established companies.

D)It tracks 100 stocks, but very few growth stocks.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

Randolph & Chase Electronics has just declared an initial public offering (IPO). This means that

A)Randolph & Chase will be selling its shares in the primary market to the public for the first time.

B)Randolph & Chase's stock will be sold in the secondary market for the first time.

C)Randolph & Chase's stock will be listed on the S&P 500 stock market index.

D)Randolph & Chase will have a commercial bank sell its shares to the public.

A)Randolph & Chase will be selling its shares in the primary market to the public for the first time.

B)Randolph & Chase's stock will be sold in the secondary market for the first time.

C)Randolph & Chase's stock will be listed on the S&P 500 stock market index.

D)Randolph & Chase will have a commercial bank sell its shares to the public.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

17

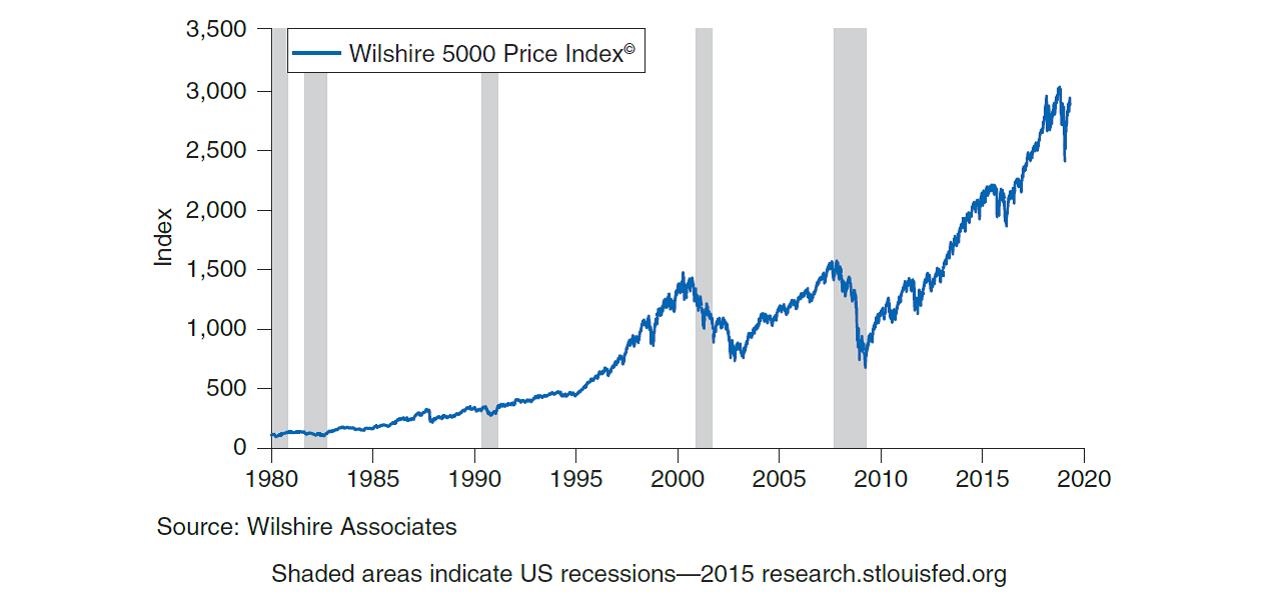

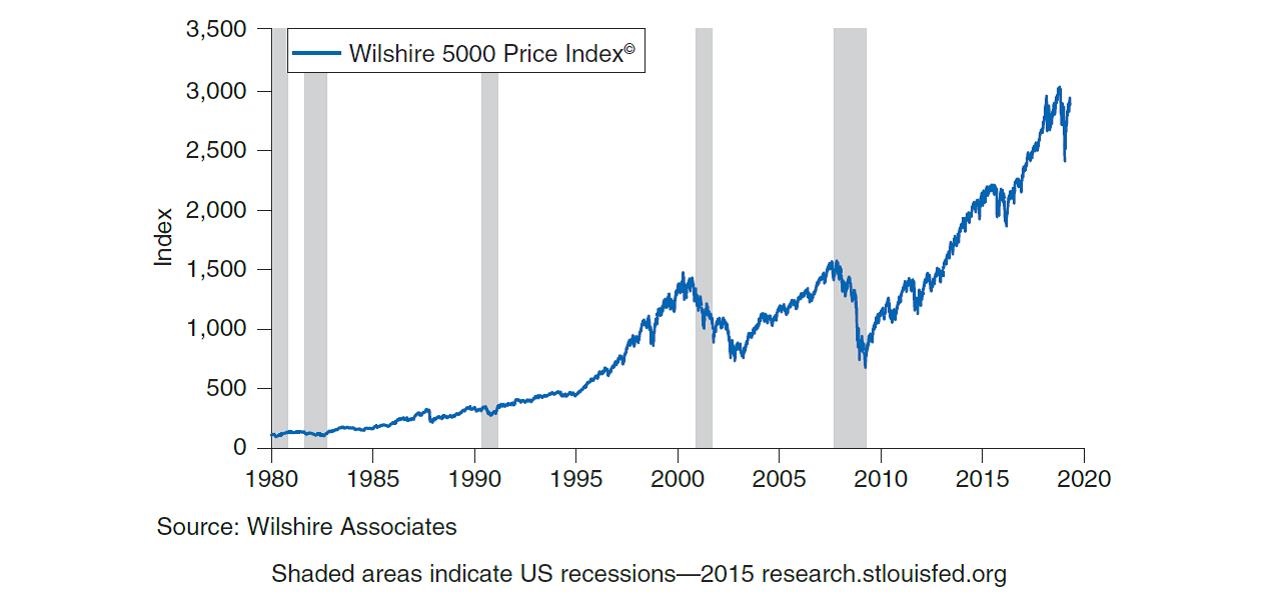

The following graph shows stock prices during the period 1980-2019.

Based on the information presented in the graph, which of the following statements is true?

A)There is no relation between the stock market and the business cycle.

B)The stock market typically declines during recessions.

C)The recession in the early 2000s had a bigger impact on the stock market than the recession in the late 2000s.

D)There is a nearly perfect correlation between the stock market and the business cycle.

Based on the information presented in the graph, which of the following statements is true?

A)There is no relation between the stock market and the business cycle.

B)The stock market typically declines during recessions.

C)The recession in the early 2000s had a bigger impact on the stock market than the recession in the late 2000s.

D)There is a nearly perfect correlation between the stock market and the business cycle.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

18

The amount that stockholders are paid at the liquidation of a corporation after taxes, debts, and other claims have been satisfied is called

A)the liquidation value.

B)a dividend payment.

C)a residual claim.

D)a share buyback.

A)the liquidation value.

B)a dividend payment.

C)a residual claim.

D)a share buyback.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

19

What is true of the secondary market for stocks?

A)Foreign-owned companies trade in the secondary market for stocks.

B)Previously owned stocks are sold in the secondary market but make up fewer than half of all stock market transactions.

C)Smaller, less well-established companies trade in the secondary market for stocks.

D)Previously owned stocks are sold in the secondary market and make up the majority of stock market transactions.

A)Foreign-owned companies trade in the secondary market for stocks.

B)Previously owned stocks are sold in the secondary market but make up fewer than half of all stock market transactions.

C)Smaller, less well-established companies trade in the secondary market for stocks.

D)Previously owned stocks are sold in the secondary market and make up the majority of stock market transactions.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

You are interested in buying a share of stock in LMU Company. You expect a dividend payment of $10 next year and that the dividend will grow by 6% per year thereafter. You desire an 8% return on your purchase. According to the Gordon growth model, what is the maximum price you would pay for a share of this stock?

A)$5

B)$25

C)$100

D)$500

A)$5

B)$25

C)$100

D)$500

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

The focus of the Securities and Exchange Commission (SEC)is on

A)ensuring the profitability of US companies that sell stock.

B)reducing the asymmetric information problem that may exist in the US equity market.

C)establishing fair market prices for stocks.

D)growing the wealth of the US economy.

A)ensuring the profitability of US companies that sell stock.

B)reducing the asymmetric information problem that may exist in the US equity market.

C)establishing fair market prices for stocks.

D)growing the wealth of the US economy.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

If a corporation issues stock, the major advantage of preferred stock over common stock is that preferred stockholders are paid dividends before those who hold common stock.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

Paul is an economist who believes the strong form of the efficient market hypothesis. Thus, Paul believes that the stock market is a good approximation of a(n)__________ market.

A)monopolistic

B)slightly irrational

C)oligopolistic

D)perfectly competitive

A)monopolistic

B)slightly irrational

C)oligopolistic

D)perfectly competitive

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

When people think their forecasts of future corporate earnings are more accurate than they actually are, they may be exhibiting which of the following behavioral maxims?

A)Overconfidence

B)Confirmation bias

C)The disposition effect

D)Heuristics

A)Overconfidence

B)Confirmation bias

C)The disposition effect

D)Heuristics

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

The theory of behavioral finance has replaced the efficient market hypothesis regarding behavior in the stock market.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

How does behavioral finance use the principles of psychology to explain stock market behavior? Give at least three specific examples of nonrational, yet common, thought processes that contribute to irrational fluctuations in the stock market, according to behavioral finance.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

There have been cases where people with inside information have illegally traded in the stock market, earning disproportionately high returns. What does this suggest?

A)The strong form of efficiency probably does not hold.

B)The semistrong form of efficiency does not hold.

C)The efficient market hypothesis is incorrect.

D)Behavioral finance cannot be used to explain these instances.

A)The strong form of efficiency probably does not hold.

B)The semistrong form of efficiency does not hold.

C)The efficient market hypothesis is incorrect.

D)Behavioral finance cannot be used to explain these instances.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

A flaw of the dividend discount model is that it assumes that a corporation's dividends will remain constant forever.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

Sonya is an economist who seeks to study noisy trader risk and confirmation bias. Which of these fields is Sonya in?

A)Classic economics

B)Psychological finance

C)Behavioral finance

D)Stock market economics

A)Classic economics

B)Psychological finance

C)Behavioral finance

D)Stock market economics

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

Consider the efficient market hypothesis as it relates to the stock market. If the weak form of efficiency holds, then which of these statements is true?

A)Insider trading may happen, but this is not reflected in stock prices.

B)Stock prices reflect all market information and most relevant private information.

C)Stock prices reflect all market information but cannot capture all private information.

D)Insider trading is necessarily an anomaly.

A)Insider trading may happen, but this is not reflected in stock prices.

B)Stock prices reflect all market information and most relevant private information.

C)Stock prices reflect all market information but cannot capture all private information.

D)Insider trading is necessarily an anomaly.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

The stocks that make up the S&P 500 are the stocks of the 500 biggest corporations in the United States.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

Keenan uses heuristics to make decisions about stocks. This means that Keenan relies on all of the following EXCEPT

A)mental shortcuts.

B)standard practices.

C)all relevant information.

D)rules of thumb.

A)mental shortcuts.

B)standard practices.

C)all relevant information.

D)rules of thumb.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

To be a part of the Wilshire 5000, all of the following criteria must be met EXCEPT

A)the stock must be actively traded on a US-based stock market.

B)there has to be widely available information on the stock price.

C)the stock must be issued by a corporation with headquarters in the United States.

D)the corporation must have net earnings of at least $50 million.

A)the stock must be actively traded on a US-based stock market.

B)there has to be widely available information on the stock price.

C)the stock must be issued by a corporation with headquarters in the United States.

D)the corporation must have net earnings of at least $50 million.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

Describe the securities exchange system, including the New York Stock Exchange (NYSE)and over the counter (OTC). How has each changed over the years?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

35

What is the PE ratio? Is a "high" PE ratio a good thing, or is a "low" PE ratio a good thing? Explain.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck