Deck 19: FX

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 19: FX

1

What is the meaning and purpose of a sterilized intervention?

A)A sterilized intervention happens when a more valuable currency is repeatedly traded to reduce a country's interest rates.

B)A sterilized intervention happens when a less valuable currency is repeatedly traded for currencies of increasing value.

C)A sterilized intervention happens when a central bank buys a foreign currency and also buys government securities to offset the decrease in the monetary base.

D)A sterilized intervention happens when a central bank buys its own country's currency and also buys government securities to offset the decrease in the monetary base.

A)A sterilized intervention happens when a more valuable currency is repeatedly traded to reduce a country's interest rates.

B)A sterilized intervention happens when a less valuable currency is repeatedly traded for currencies of increasing value.

C)A sterilized intervention happens when a central bank buys a foreign currency and also buys government securities to offset the decrease in the monetary base.

D)A sterilized intervention happens when a central bank buys its own country's currency and also buys government securities to offset the decrease in the monetary base.

D

2

An "unsterilized intervention" is when a country's __________ buy(s)the country's own currency in the foreign exchange market to __________ the currency's market price.

A)foreign investors; increase

B)central bank; increase

C)central bank; decrease

D)speculators; decrease

A)foreign investors; increase

B)central bank; increase

C)central bank; decrease

D)speculators; decrease

B

3

You own a local US company. In the past year, you successfully expanded your sales market into Europe, and you now have profits and cash denominated in euros. You want to convert the euros to dollars to repatriate the profits and pay taxes. Which of the following is true?

A)You are not required to convert the euros to the home currency to pay taxes.

B)You are a demander of the euro in the foreign exchange market.

C)You are a supplier of your home country's currency in the foreign exchange market.

D)You are a demander of dollars in the foreign exchange market.

A)You are not required to convert the euros to the home currency to pay taxes.

B)You are a demander of the euro in the foreign exchange market.

C)You are a supplier of your home country's currency in the foreign exchange market.

D)You are a demander of dollars in the foreign exchange market.

D

4

If the market price of a currency is above the equilibrium price, there is a __________ and __________ pressure on the price.

A)shortage; downward

B)shortage; upward

C)surplus; downward

D)surplus; upward

A)shortage; downward

B)shortage; upward

C)surplus; downward

D)surplus; upward

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

The European Central Bank (ECB), the central bank of the Eurozone, has determined that the euro is overvalued relative to various other important currencies around the world. In order to help stabilize the euro, which of these actions might the ECB take?

A)Sell euros in the foreign exchange market

B)Buy euros in the foreign exchange market

C)Sell most of the noneuro currencies it holds and keep the euros

D)Sell the currencies it holds that compete most directly with the euro

A)Sell euros in the foreign exchange market

B)Buy euros in the foreign exchange market

C)Sell most of the noneuro currencies it holds and keep the euros

D)Sell the currencies it holds that compete most directly with the euro

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

Roughly two-thirds of all foreign exchange transactions involve

A)brokers acting as intermediaries between banks.

B)central banks acting on behalf of their governments.

C)banks dealing directly with each other.

D)customers buying foreign exchange to make purchases in foreign countries.

A)brokers acting as intermediaries between banks.

B)central banks acting on behalf of their governments.

C)banks dealing directly with each other.

D)customers buying foreign exchange to make purchases in foreign countries.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

Exchange rates are simply another price of __________, similar to __________.

A)lending; interest rates

B)doing business; inventory costs

C)money; interest rates

D)borrowing; bond issue costs

A)lending; interest rates

B)doing business; inventory costs

C)money; interest rates

D)borrowing; bond issue costs

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

Between yesterday and today, the US dollar has appreciated against the yen. One of the impacts of this will be

A)US-made goods that sell in Japan will be more expensive.

B)US-made goods that sell in the United States will be more expensive.

C)Japanese-made goods that sell in the United States will be more expensive.

D)nothing; there will be no impact on goods flowing overseas between the United States and Japan.

A)US-made goods that sell in Japan will be more expensive.

B)US-made goods that sell in the United States will be more expensive.

C)Japanese-made goods that sell in the United States will be more expensive.

D)nothing; there will be no impact on goods flowing overseas between the United States and Japan.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

You are a manager of a hedge fund that has a trading strategy based on picking which currencies you believe will change in value in a significant way in a short period of time. If you believe that the value of the British pound will appreciate in the near future against the euro, you will

A)buy euros.

B)sell euros.

C)buy British pounds, and possibly sell euros.

D)sell British pounds, and buy euros with dollars.

A)buy euros.

B)sell euros.

C)buy British pounds, and possibly sell euros.

D)sell British pounds, and buy euros with dollars.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

A rapid depreciation of a country's home currency can lead-and has led-to serious consequences, including which of the following as a most serious consequence?

A)Imports will become more expensive.

B)Imports will become more scarce.

C)Cheap, imported goods will flood the home market.

D)Rapidly increasing costs for basic needs will lead to social unrest.

A)Imports will become more expensive.

B)Imports will become more scarce.

C)Cheap, imported goods will flood the home market.

D)Rapidly increasing costs for basic needs will lead to social unrest.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

11

The US dollar-to-euro exchange rate was $1 = 0.921384 euro yesterday. Today, the US dollar-to-euro exchange rate is $1 = 0.891560. This means that between yesterday and today, the

A)dollar has appreciated against the euro.

B)dollar has gained in value against the euro.

C)dollar has depreciated against the euro.

D)euro has weakened against the dollar.

A)dollar has appreciated against the euro.

B)dollar has gained in value against the euro.

C)dollar has depreciated against the euro.

D)euro has weakened against the dollar.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

The marginal propensity to import is defined in what way?

A)A change in the purchase of imports brought about by a change in disposable income; almost always defined as positive

B)A change in the purchase of imports brought about by a change in total income; may be positive or negative

C)A change in both the purchase of imports and the selling of exports brought about by a change in the GDP

D)A change in both the purchase of imports and the selling of exports brought about by a change in disposable income

A)A change in the purchase of imports brought about by a change in disposable income; almost always defined as positive

B)A change in the purchase of imports brought about by a change in total income; may be positive or negative

C)A change in both the purchase of imports and the selling of exports brought about by a change in the GDP

D)A change in both the purchase of imports and the selling of exports brought about by a change in disposable income

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

The four types of foreign exchange market participants are

A)buyers, sellers, traders, and manufacturing companies.

B)banks, brokers, customers, and central banks.

C)banks, brokers, traders, and financial companies.

D)banks, brokers, bond underwriters, and securities companies.

A)buyers, sellers, traders, and manufacturing companies.

B)banks, brokers, customers, and central banks.

C)banks, brokers, traders, and financial companies.

D)banks, brokers, bond underwriters, and securities companies.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

Which of these is a reason a central bank might sell its domestic currency?

A)To help lower the price of imports in the home country

B)To help exporters in their home country sell goods overseas

C)To speculate, using all available market information, to make a profit

D)To discourage excessive tourism in the home country

A)To help lower the price of imports in the home country

B)To help exporters in their home country sell goods overseas

C)To speculate, using all available market information, to make a profit

D)To discourage excessive tourism in the home country

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

Participants in the foreign exchange market trade for all of the following reasons EXCEPT

A)to earn short-term profits from fluctuations in exchange rates.

B)to protect themselves from loss resulting from changes in exchange rates.

C)to acquire the foreign currency necessary to buy goods and services from other countries.

D)to acquire the currency necessary to buy imports in their home country.

A)to earn short-term profits from fluctuations in exchange rates.

B)to protect themselves from loss resulting from changes in exchange rates.

C)to acquire the foreign currency necessary to buy goods and services from other countries.

D)to acquire the currency necessary to buy imports in their home country.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

A German automobile maker wants to buy land in China to build a manufacturing facility. This will most likely require the automaker to do what?

A)Exchange dollars for renminbi (Chinese currency)

B)Exchange euros (German currency)for renminbi

C)Exchange euros for dollars and exchange dollars for renminbi

D)Become a foreign tourist to acquire renminbi

A)Exchange dollars for renminbi (Chinese currency)

B)Exchange euros (German currency)for renminbi

C)Exchange euros for dollars and exchange dollars for renminbi

D)Become a foreign tourist to acquire renminbi

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

17

If you work for a company that __________, you do not want the home currency to __________.

A)depends on sales in foreign markets; depreciate

B)faces a lot of foreign competition in the local market; appreciate

C)faces a lot of foreign competition in the local market; depreciate

D)imports a lot of goods; appreciate

A)depends on sales in foreign markets; depreciate

B)faces a lot of foreign competition in the local market; appreciate

C)faces a lot of foreign competition in the local market; depreciate

D)imports a lot of goods; appreciate

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

18

You are a manager in a pharmaceutical company, and you oversee manufacturing operations in North America, Europe, and India. Under your careful management, the European operation becomes significantly more productive than either of the other two. This increase in productivity spreads to other manufacturers in Europe as well, and total factor productivity soars higher in Europe relative to other economies. Based on this information, which of the following statements is true?

A)The value of the euro will depreciate.

B)The value of the euro will appreciate.

C)The value of the euro will remain stable and not be affected by productivity increases.

D)The value of the dollar and rupee (currency in India)will appreciate.

A)The value of the euro will depreciate.

B)The value of the euro will appreciate.

C)The value of the euro will remain stable and not be affected by productivity increases.

D)The value of the dollar and rupee (currency in India)will appreciate.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

19

The supply side of the foreign exchange markets includes which of these groups?

A)Foreign consumers and foreign firms selling locally

B)Foreign tourists headed to local destinations and domestic consumers

C)Both domestic and foreign firms selling locally

D)Domestic consumers, domestic tourists headed abroad, and foreign firms selling locally

A)Foreign consumers and foreign firms selling locally

B)Foreign tourists headed to local destinations and domestic consumers

C)Both domestic and foreign firms selling locally

D)Domestic consumers, domestic tourists headed abroad, and foreign firms selling locally

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

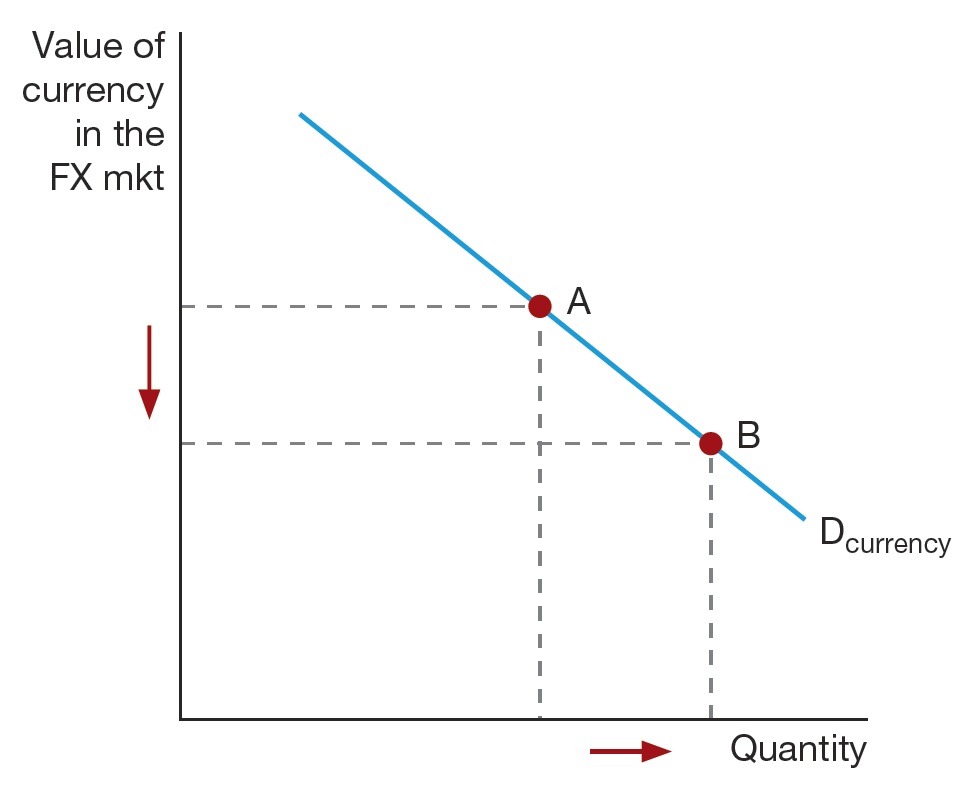

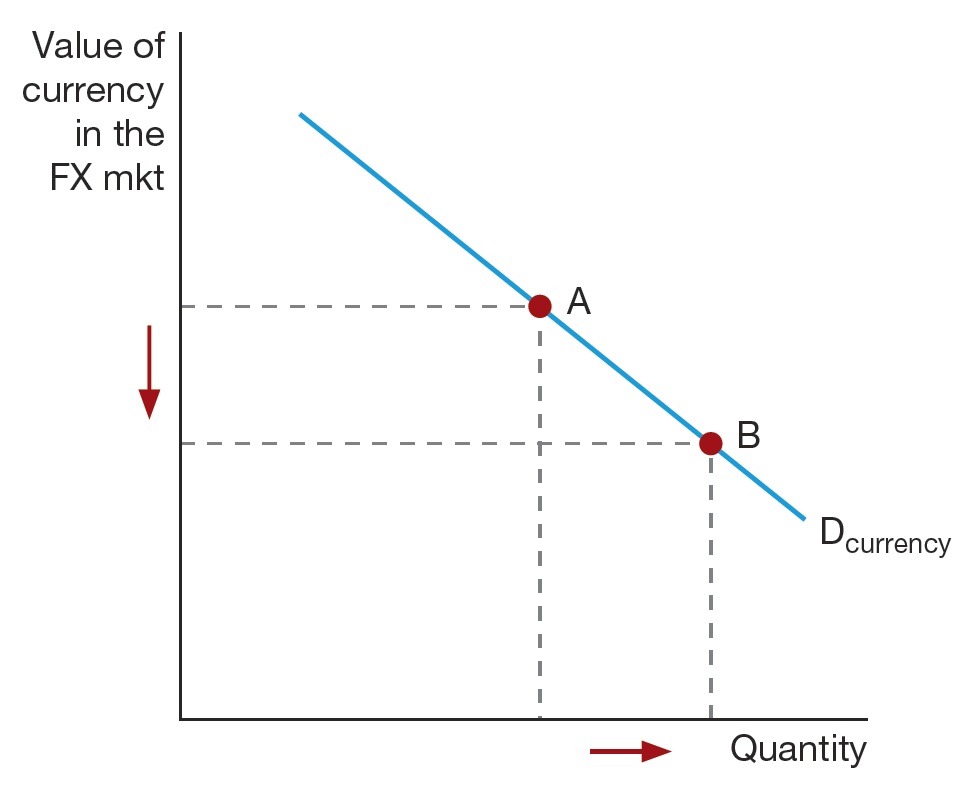

What concept does the following graph illustrate?

A)As the currency depreciates, the quantity of the currency demanded increases.

B)As the currency appreciates, the quantity of the currency supplied increases.

C)As the currency depreciates, the quantity of the currency demanded decreases.

D)As the currency appreciates, the quantity of the currency supplied decreases.

A)As the currency depreciates, the quantity of the currency demanded increases.

B)As the currency appreciates, the quantity of the currency supplied increases.

C)As the currency depreciates, the quantity of the currency demanded decreases.

D)As the currency appreciates, the quantity of the currency supplied decreases.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

Is a "strong" or appreciating currency a good thing, or is a "weak" or depreciating currency a good thing? Explain.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

The Bretton Woods Conference took place in 1944, with the leaders of forty-four countries in attendance. What was the central reason for this meeting?

A)To bring WWII to an immediate end, with the hopes of stabilizing many economies

B)To avoid another significant, global depression like the Great Depression

C)To argue either for or against a return to the gold standard

D)To create the International Monetary Fund

A)To bring WWII to an immediate end, with the hopes of stabilizing many economies

B)To avoid another significant, global depression like the Great Depression

C)To argue either for or against a return to the gold standard

D)To create the International Monetary Fund

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

When an economy sees higher real, risk-adjusted interest rates, it will most likely experience a(n)__________ in demand for its currency in the foreign exchange market, and the value of its currency will __________.

A)decrease; depreciate

B)decrease; appreciate

C)increase; depreciate

D)increase; appreciate

A)decrease; depreciate

B)decrease; appreciate

C)increase; depreciate

D)increase; appreciate

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

You work for a British company that is expanding its operations into continental Europe. In order to pay for the expenses of operations in Europe, your company will sell British pounds to purchase euros. Therefore, your company is a demander of pounds in the foreign exchange market.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

Graham has moved abroad to pursue his career after college. Unfortunately, the country where he is now living is experiencing a period of very high inflation. Graham can expect the currency of his newly adopted country to

A)decrease in value due to a decrease in demand as potential investors are no longer interested in investing in an inflationary economy.

B)increase in value due to a domestic increase in demand for more and more currency.

C)increase in value due to an increase in supply as investors who hold the country's currency rush to sell the currency as inflation fears grow.

D)either increase or decrease in value, depending on whether or not increased domestic demand is offset by decreased foreign demand.

A)decrease in value due to a decrease in demand as potential investors are no longer interested in investing in an inflationary economy.

B)increase in value due to a domestic increase in demand for more and more currency.

C)increase in value due to an increase in supply as investors who hold the country's currency rush to sell the currency as inflation fears grow.

D)either increase or decrease in value, depending on whether or not increased domestic demand is offset by decreased foreign demand.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

The anchor currency in the Bretton Woods System was the US dollar. What did this mean?

A)The dollar was convertible into any other currency at varying rates, but within a fixed range.

B)The dollar was fully convertible into gold at a fixed price, while other currencies in the system had a stable exchange rate with the dollar.

C)The dollar was fully convertible into gold at a fixed price, but other currencies in the system had variable exchange rates with the dollar.

D)The dollar was convertible into gold but at varying rates, depending on the state of the US economy.

A)The dollar was convertible into any other currency at varying rates, but within a fixed range.

B)The dollar was fully convertible into gold at a fixed price, while other currencies in the system had a stable exchange rate with the dollar.

C)The dollar was fully convertible into gold at a fixed price, but other currencies in the system had variable exchange rates with the dollar.

D)The dollar was convertible into gold but at varying rates, depending on the state of the US economy.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

Explain how central banks play a role in both demand and supply in foreign exchange markets.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

The current world system for ensuring stable yet flexible exchange rates is generally thought to be an improvement over the Bretton Woods System.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following events brought an end to the gold standard?

A)Industrial Revolution, as the value of gold in Europe has decreased as there was more gold than currency.

B)World War I, as borrowing needs of European governments increased greatly and there was not enough gold to fully back up all of the currency governments created.

C)1926 general strike, as the value of gold in Europe has decreased as there was more gold than currency.

D)World War II, as borrowing needs of European governments increased greatly and there was not enough gold to fully back up all of the currency governments created.

A)Industrial Revolution, as the value of gold in Europe has decreased as there was more gold than currency.

B)World War I, as borrowing needs of European governments increased greatly and there was not enough gold to fully back up all of the currency governments created.

C)1926 general strike, as the value of gold in Europe has decreased as there was more gold than currency.

D)World War II, as borrowing needs of European governments increased greatly and there was not enough gold to fully back up all of the currency governments created.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

Brokers earn profits by charging a commission on the transactions they arrange.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

From 1880 to 1914, the gold standard was maintained because the three major economic powers (the United Kingdom, the United States, and France)

A)allowed interest rates to change in response to flows of gold.

B)used their fiscal policy to maintain the gold standard.

C)used floating exchange rates.

D)increased their level of trade with each other.

A)allowed interest rates to change in response to flows of gold.

B)used their fiscal policy to maintain the gold standard.

C)used floating exchange rates.

D)increased their level of trade with each other.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

You work for a firm that exports toys to retail customers around the world. In fact, 75 percent of your sales revenue comes from exports. Because you work for a firm that relies heavily on exports, you want to see your home country currency strengthen or appreciate and gain value in the foreign exchange markets.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

Explain the gold standard. Discuss what it was and when and how it ended.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following demonstrates an arbitrage opportunity?

A)Buying and selling the same (or similar)goods until a profit is made

B)Buying a currency with the belief that its value will appreciate in the near future

C)Investing in an economy that is experiencing rapid economic growth

D)Buying a good in one market and selling the exact same good in another market at a higher price

A)Buying and selling the same (or similar)goods until a profit is made

B)Buying a currency with the belief that its value will appreciate in the near future

C)Investing in an economy that is experiencing rapid economic growth

D)Buying a good in one market and selling the exact same good in another market at a higher price

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

35

The concept of purchasing power parity refers to

A)the decrease in the market value of a currency relative to another currency.

B)consumers' preferences for imports over exports or goods produced at home.

C)the exchange rate between currencies that equalizes the purchasing power of each currency by eliminating the differences in price levels in each economy.

D)the exchange rate between currencies that equalizes the purchasing power of each currency by increasing the differences in price levels in each economy.

A)the decrease in the market value of a currency relative to another currency.

B)consumers' preferences for imports over exports or goods produced at home.

C)the exchange rate between currencies that equalizes the purchasing power of each currency by eliminating the differences in price levels in each economy.

D)the exchange rate between currencies that equalizes the purchasing power of each currency by increasing the differences in price levels in each economy.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck