Deck 2: Money, Money Supply and Interest

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 2: Money, Money Supply and Interest

1

Rosa goes to the grocery store to buy groceries, and at the checkout counter she pays cash. This is an example of money being used as

A)a store of value.

B)barter.

C)a medium of exchange.

D)a unit of account.

A)a store of value.

B)barter.

C)a medium of exchange.

D)a unit of account.

C

2

In sixteenth century Europe, commodity money was almost exclusively gold and silver coins. After the Spanish conquest of Latin America, there was a sudden influx of additional gold and silver. This resulted in which scenario?

A)The European economy of that day was greatly enhanced.

B)The European economy of that day remained fairly stable, as other factors offset the influx of new money.

C)The European economy of that day suffered from periods of horrible inflation.

D)The European economy of that day underwent periods of debasement.

A)The European economy of that day was greatly enhanced.

B)The European economy of that day remained fairly stable, as other factors offset the influx of new money.

C)The European economy of that day suffered from periods of horrible inflation.

D)The European economy of that day underwent periods of debasement.

C

3

Money is most accurately defined by which of the following statements?

A)Money is whatever a nation's government declares it to be.

B)Money is currency printed by the local government.

C)Money is a measure of the wealth of a nation.

D)Money is anything generally accepted in exchange for goods and services.

A)Money is whatever a nation's government declares it to be.

B)Money is currency printed by the local government.

C)Money is a measure of the wealth of a nation.

D)Money is anything generally accepted in exchange for goods and services.

D

4

If gold and silver became the primary types of commodity money in circulation, what would most likely be expected if there was a sudden and great amount of hoarding of these two items?

A)People would start to print and use various forms of currency.

B)Bartering would simply replace gold and silver.

C)There would likely not be enough money, and the economy could slide into an economic recession.

D)There would be too much money of other types, and the economy could endure rapid inflation.

A)People would start to print and use various forms of currency.

B)Bartering would simply replace gold and silver.

C)There would likely not be enough money, and the economy could slide into an economic recession.

D)There would be too much money of other types, and the economy could endure rapid inflation.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

In a barter economy, the number of prices necessary will

A)depend on the number of people in the economy.

B)depend on the number of goods exchanged in the economy.

C)be too many to be counted.

D)be fewer than the number of prices in an economy with money.

A)depend on the number of people in the economy.

B)depend on the number of goods exchanged in the economy.

C)be too many to be counted.

D)be fewer than the number of prices in an economy with money.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

When there is too much money chasing too few goods, the likely impact is

A)unemployment.

B)stagflation.

C)inflation.

D)deflation.

A)unemployment.

B)stagflation.

C)inflation.

D)deflation.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

In some cases, people use another country's currency in private transactions, but the local currency remains legal tender and continues to circulate. Which of these is one term for this unofficial change in currency used?

A)Currency substitution

B)Black market exchange

C)Illegal monetary substitution

D)Illegal buying and selling

A)Currency substitution

B)Black market exchange

C)Illegal monetary substitution

D)Illegal buying and selling

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

Assets accepted for repayment of debt to the government as well as private transactions are known as

A)dollarization.

B)fiat money.

C)money aggregates.

D)legal tender.

A)dollarization.

B)fiat money.

C)money aggregates.

D)legal tender.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

How many different prices would there be in a barter economy with 100 goods?

A)6,559

B)4,950

C)300

D)100

A)6,559

B)4,950

C)300

D)100

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

Following World War II, inflation became so bad that Germans stopped using Reichsmarks for transactions, and instead used cigarettes for small transactions and cognac for large transactions. Which of the following best describes this situation?

A)Reichsmarks were plentiful and valuable, but Germans preferred to barter.

B)Germans wanted to disassociate themselves from the Third Reich.

C)Cigarettes and cognac functioned as money in Germany in this period following World War II.

D)Cigarettes and cognac were more plentiful than Reichsmarks, so Germans found them more convenient to use for transactions than Reichsmarks.

A)Reichsmarks were plentiful and valuable, but Germans preferred to barter.

B)Germans wanted to disassociate themselves from the Third Reich.

C)Cigarettes and cognac functioned as money in Germany in this period following World War II.

D)Cigarettes and cognac were more plentiful than Reichsmarks, so Germans found them more convenient to use for transactions than Reichsmarks.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements most accurately describes the measurements of the money supply known as M1 and M2?

A)M1 was a measure of the money supply that worked until about the 1990s; then M2 became a more accurate measure and is still in use today.

B)M1 was a measure of the money supply that worked well until the Great Depression, M2 was used until the 1990s, and M3 is considered accurate today.

C)Neither M1 nor M2 worked very well after the 1970s.

D)M1 was a measure of the money supply that worked well until the mid-1970s; then M2 became a more accurate measure until the 1990s.

A)M1 was a measure of the money supply that worked until about the 1990s; then M2 became a more accurate measure and is still in use today.

B)M1 was a measure of the money supply that worked well until the Great Depression, M2 was used until the 1990s, and M3 is considered accurate today.

C)Neither M1 nor M2 worked very well after the 1970s.

D)M1 was a measure of the money supply that worked well until the mid-1970s; then M2 became a more accurate measure until the 1990s.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

Today, in the United States, several assets function as money. Which of the following would NOT be considered money?

A)Currency

B)Demand deposits

C)Checkable deposits

D)Credit cards

A)Currency

B)Demand deposits

C)Checkable deposits

D)Credit cards

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

Regulation Q, passed following the Great Depression, set a

A)maximum on the interest rates banks can charge.

B)maximum on the interest rate that banks can pay on deposits.

C)maximum on the quantity of money that the US Treasury can print.

D)floor on the interest rate that banks can pay on deposits.

A)maximum on the interest rates banks can charge.

B)maximum on the interest rate that banks can pay on deposits.

C)maximum on the quantity of money that the US Treasury can print.

D)floor on the interest rate that banks can pay on deposits.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

The term monetary aggregates refers to things like

A)M1 and M2.

B)interest rates.

C)the price of money.

D)the consumer price index.

A)M1 and M2.

B)interest rates.

C)the price of money.

D)the consumer price index.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

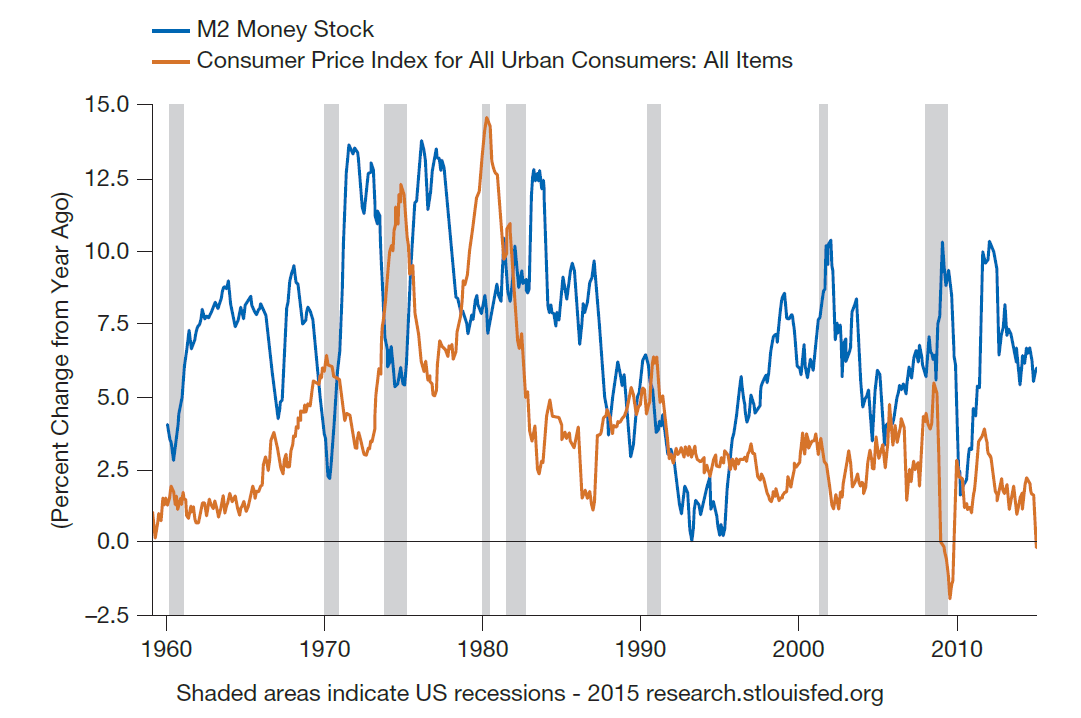

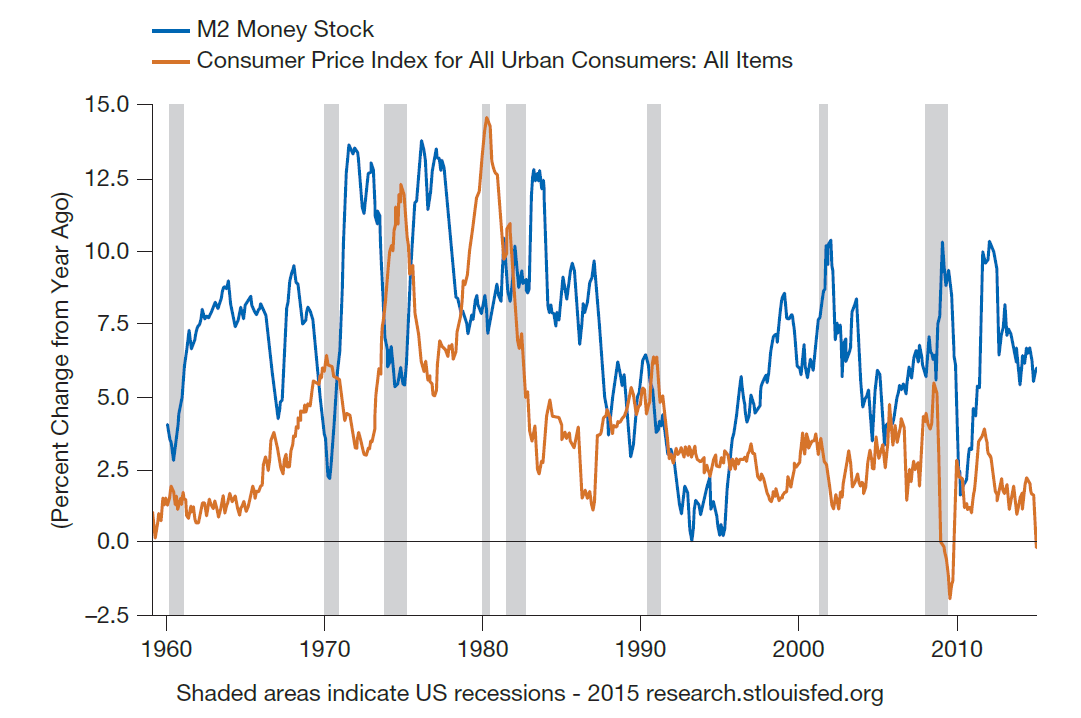

What concept does the following diagram illustrate?

A)Movements in the price level are unrelated to movements in the money supply.

B)The price level tends to move in the opposite direction of the money supply.

C)The price level is fairly constant over time.

D)The price level tends to move in the same direction as the money supply.

A)Movements in the price level are unrelated to movements in the money supply.

B)The price level tends to move in the opposite direction of the money supply.

C)The price level is fairly constant over time.

D)The price level tends to move in the same direction as the money supply.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

On payday you get paid in cash, so each week you put $10 into a shoebox in your closet so that you can buy a big-screen TV at the end of the year. In this situation, money is serving as a

A)unit of account.

B)medium of exchange.

C)store of value.

D)rainy day fund.

A)unit of account.

B)medium of exchange.

C)store of value.

D)rainy day fund.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

17

When a coffee shop lists a tall coffee on its menu at $2.95, the coffee shop is using money as a

A)unit of account.

B)medium of exchange.

C)store of value.

D)source of profit.

A)unit of account.

B)medium of exchange.

C)store of value.

D)source of profit.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following are included in the M1 definition of the money supply?

A)Currency, checkable deposits, and money market accounts

B)Small time deposits and currency

C)Currency, demand deposits, and other checkable deposits

D)Currency and money market deposit accounts

A)Currency, checkable deposits, and money market accounts

B)Small time deposits and currency

C)Currency, demand deposits, and other checkable deposits

D)Currency and money market deposit accounts

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

19

Commonly accepted and widely used money that has no intrinsic value is known as

A)commodity money.

B)fiat money.

C)disenfranchised money.

D)counterfeit money.

A)commodity money.

B)fiat money.

C)disenfranchised money.

D)counterfeit money.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

Imagine you live in a country suffering from extreme inflation of 20% per month. The money you earn, every single molino, is worth a little less each week, so you and many others around you begin to use the currency of a more prosperous neighboring country, the dolingo. What is the term for this practice of adopting another country's currency?

A)Disintermediation

B)Dolingization

C)Dollarization

D)Monetization

A)Disintermediation

B)Dolingization

C)Dollarization

D)Monetization

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

What is meant by the phrase "double coincidence of wants" in a barter economy?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

If the interest rate is 5%, the value of $1,000 at the end of 10 years is

A)$1,505.

B)$1,628.89.

C)$10,000.

D)$57,665.04.

A)$1,505.

B)$1,628.89.

C)$10,000.

D)$57,665.04.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

Edward would be equally happy with receiving $95 today or $100 one year from today. Edward's friend Bella would be just as happy receiving $90 today or $100 one year from today. Based on this information, which of the following best describes the difference between Edward and Bella?

A)Edward has a higher rate of time preference than Bella.

B)Bella has a higher rate of time preference than Edward.

C)Edward is in more urgent need of money today.

D)Bella is more easygoing about her finances.

A)Edward has a higher rate of time preference than Bella.

B)Bella has a higher rate of time preference than Edward.

C)Edward is in more urgent need of money today.

D)Bella is more easygoing about her finances.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

Sherry says that she requires a 3% rate of interest in order to lend you some money. This implies that for Sherry the present value of $100 to be received one year from today is

A)$97.09.

B)$97.

C)$100.03.

D)$103.

A)$97.09.

B)$97.

C)$100.03.

D)$103.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

For an asset to function as commodity money, it must be easily divisible, easily standardized, easy to carry around, physically attractive, and broadly demanded.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

With measurements of monetary aggregates such as M1 and M2, the money supply is relatively easy to measure.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

Joshua says that he would need 3% interest in order to lend you money which you will pay back in two years. This implies that for Joshua the present value of $100 to be received two years from today is what amount?

A)$97.09

B)$100.06

C)$94.26

D)$79.15

A)$97.09

B)$100.06

C)$94.26

D)$79.15

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

If you borrow $1,000 today to be paid back one year from today at 5% interest, the payment you will have to make in one year will be

A)$1,005.

B)$1,050.

C)$1,055.

D)$1,500.

A)$1,005.

B)$1,050.

C)$1,055.

D)$1,500.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

What are some of the challenges of using a commodity money in society?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

What is the term for removal of funds from a financial intermediary (e.g., a bank)to invest them directly, as through a mutual fund?

A)Disintermediation

B)Dollarization

C)Debanking

D)Allocation

A)Disintermediation

B)Dollarization

C)Debanking

D)Allocation

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is not true of cryptocurrency?

A)Cryptocurrency is only centralized by two banks worldwide.

B)Cryptocurrency uses codes to keep information secret.

C)Cryptocurrencies are decentralized, without any government oversight.

D)Cryptocurrencies are a medium of exchange, just as other forms of money.

A)Cryptocurrency is only centralized by two banks worldwide.

B)Cryptocurrency uses codes to keep information secret.

C)Cryptocurrencies are decentralized, without any government oversight.

D)Cryptocurrencies are a medium of exchange, just as other forms of money.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

What do we refer to when we talk about Becca's time preference?

A)The amount of time that Becca spends on financial transactions

B)The value of her time

C)The rate at which Becca prefers to consume today as opposed to consuming in the future

D)The rate of interest she is willing to pay for a loan

A)The amount of time that Becca spends on financial transactions

B)The value of her time

C)The rate at which Becca prefers to consume today as opposed to consuming in the future

D)The rate of interest she is willing to pay for a loan

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

For a social justice class, you take a field trip to a prison, where you notice prisoners exchanging cigarettes for other items, such as a candy bar, a magazine, a soft drink, and so on. In this circumstance, cigarettes could be considered money .

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

Explain why it is that money received today has greater value than money received in the future.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

35

The higher a person's rate of time preference, the lower the interest rate needed to get them to defer their consumption to the future.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck