Deck 3: Bonds, Loanable Funds Interest Rates

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 3: Bonds, Loanable Funds Interest Rates

1

You own a 10-year, $10,000 US Treasury bond with a coupon rate of 2%. There are two years left to maturity, and you are planning to sell the bond in the secondary market. If the interest rate is 5%, how much can you expect to get for the bond?

A)$10,500

B)$10,000

C)$9,442

D)$9,628

A)$10,500

B)$10,000

C)$9,442

D)$9,628

C

2

Travis buys a 20-year, $10,000 US Treasury bond with a coupon rate of 5%. After three years, he has some unexpected expenses and decides to sell the bond. In which market will Travis sell his bond?

A)The primary bond market

B)The Treasury bond market

C)The T-bond market

D)The secondary bond market

A)The primary bond market

B)The Treasury bond market

C)The T-bond market

D)The secondary bond market

D

3

Three things fully describe the aspects of a bond. They are

A)the face value, the coupon rate, and the term to maturity.

B)the face value, the term to maturity, and the bond price.

C)the coupon rate, the term to maturity, and the issuer of the bond.

D)the face value, the coupon rate, and the bond price.

A)the face value, the coupon rate, and the term to maturity.

B)the face value, the term to maturity, and the bond price.

C)the coupon rate, the term to maturity, and the issuer of the bond.

D)the face value, the coupon rate, and the bond price.

A

4

What is the best description of the relationship between the price of bonds and the quantity of bonds demanded, all else equal?

A)Linear

B)Positive

C)Direct

D)Inverse

A)Linear

B)Positive

C)Direct

D)Inverse

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

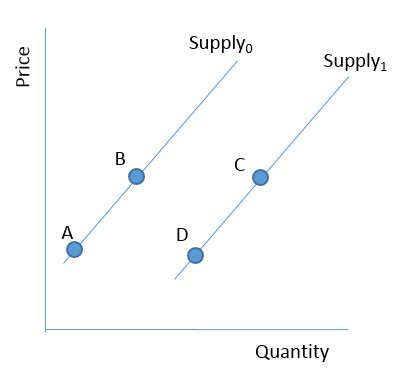

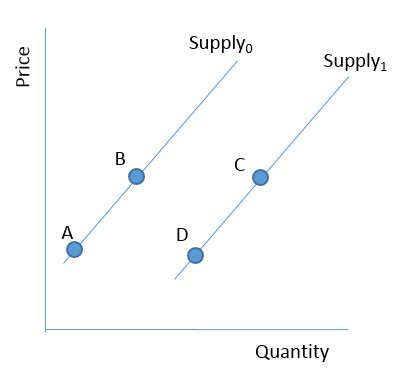

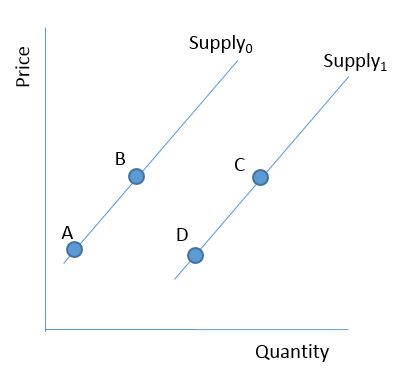

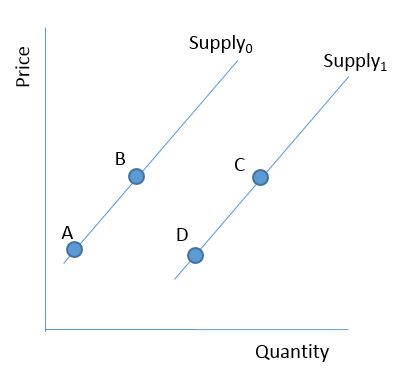

Consider the figure below. An increase in the quantity supplied is best illustrated by a movement from

A)A to B

B)A to C

C)B to D

D)C to D

A)A to B

B)A to C

C)B to D

D)C to D

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

A 10-year, $10,000 bond with a coupon rate of 5% is a promise by the issuer of the bond to

A)make a single payment to the bondholder of $10,500 in 10 years.

B)pay the bondholder $500 every year for the first nine years and also a $10,000 payment in 10 years.

C)make a payment to the bondholder of $500 in the first year and $10,000 in 10 years.

D)pay the bondholder $500 every year for 10 years and also a $10,000 payment in 10 years.

A)make a single payment to the bondholder of $10,500 in 10 years.

B)pay the bondholder $500 every year for the first nine years and also a $10,000 payment in 10 years.

C)make a payment to the bondholder of $500 in the first year and $10,000 in 10 years.

D)pay the bondholder $500 every year for 10 years and also a $10,000 payment in 10 years.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

If the market interest rate is the same as the coupon rate on a newly issued bond, then the bond will sell

A)at par.

B)above par.

C)below par.

D)at a discount.

A)at par.

B)above par.

C)below par.

D)at a discount.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

When a newly issued bond sells above its face value, it is said to sell

A)below par value.

B)at par value.

C)at a discount.

D)at a premium.

A)below par value.

B)at par value.

C)at a discount.

D)at a premium.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

Your good friend Megan is starting a new business and you decide to invest with $20,000. If you get back $2,000, what is your rate of return?

A)50%.

B)20%.

C)10%.

D)5%.

A)50%.

B)20%.

C)10%.

D)5%.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

What is the face value of a bond, also known as the bond principal?

A)The rate of interest to be paid to the holder of the bond

B)The original amount of money borrowed by the bond issuer

C)The final amount of money collected by the bondholder

D)The original amount of money borrowed by the bondholder plus the first year's interest

A)The rate of interest to be paid to the holder of the bond

B)The original amount of money borrowed by the bond issuer

C)The final amount of money collected by the bondholder

D)The original amount of money borrowed by the bondholder plus the first year's interest

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

11

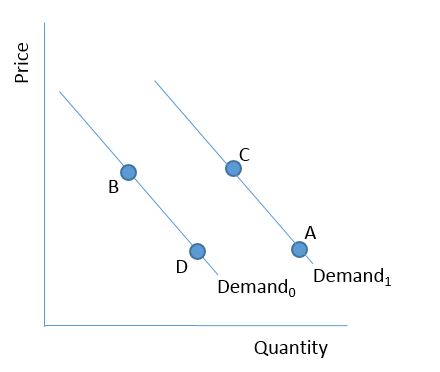

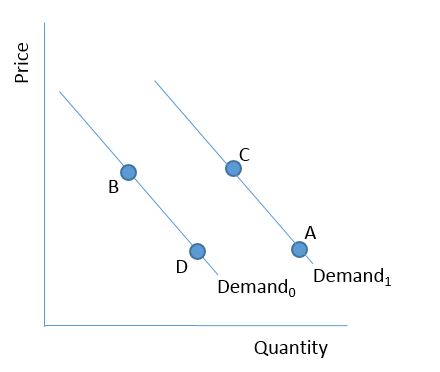

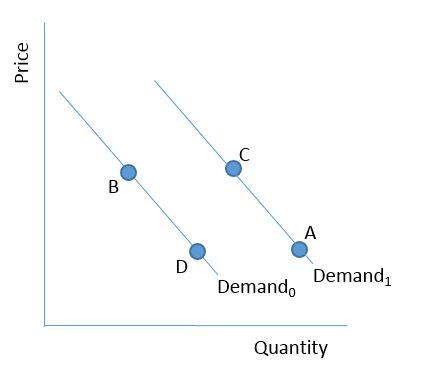

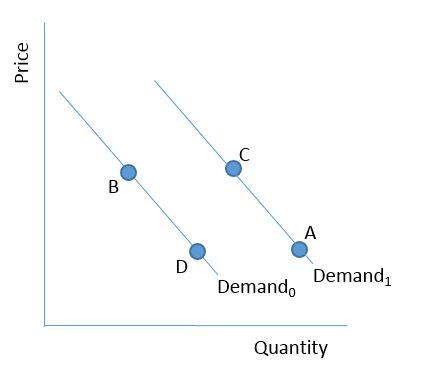

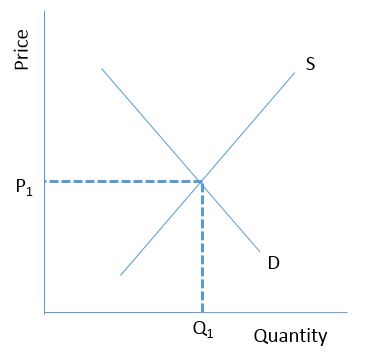

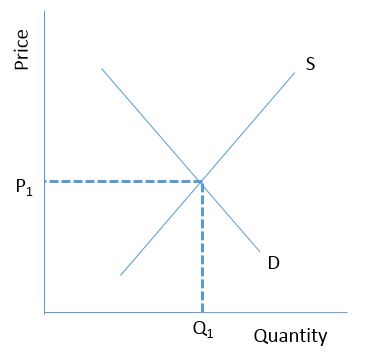

Consider the figure below. Which of the following is considered a decrease in the quantity demanded?

A)The movement from B to C

B)The movement from A to C

C)The movement from B to D

D)The movement from A to B

A)The movement from B to C

B)The movement from A to C

C)The movement from B to D

D)The movement from A to B

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

Which entities, by definition, issue the legal contracts known as bonds?

A)Corporations and government agencies

B)Governments and banks

C)Governments, corporations, and government agencies

D)Government agencies only

A)Corporations and government agencies

B)Governments and banks

C)Governments, corporations, and government agencies

D)Government agencies only

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

The coupon rate of a bond refers to the

A)original amount of money borrowed by the bond issuer.

B)number of years until repayment of the bond principal.

C)discount offered to the bond purchaser.

D)interest rate to be paid to the holder of the bond.

A)original amount of money borrowed by the bond issuer.

B)number of years until repayment of the bond principal.

C)discount offered to the bond purchaser.

D)interest rate to be paid to the holder of the bond.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

What is the best description of the relationship between the price of bonds and the quantity of bonds supplied, all else equal?

A)Inverse

B)Direct

C)Negative

D)Exponential

A)Inverse

B)Direct

C)Negative

D)Exponential

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

A bond's maturity refers to the

A)rate of interest to be paid to the holder of a bond.

B)amount that the bond issuer must repay.

C)period of time when the issuer of the bond makes repayment of the bond's principal.

D)issuer of the bond.

A)rate of interest to be paid to the holder of a bond.

B)amount that the bond issuer must repay.

C)period of time when the issuer of the bond makes repayment of the bond's principal.

D)issuer of the bond.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

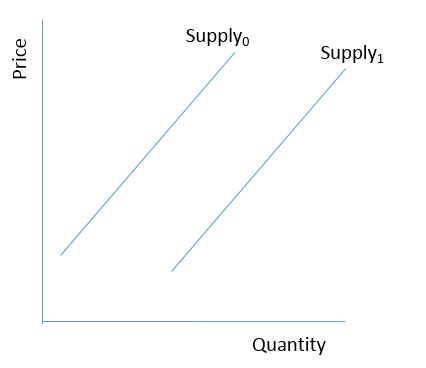

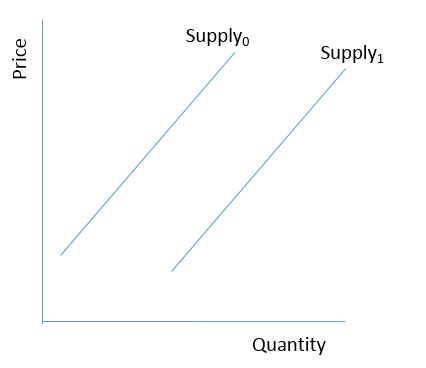

Consider the figure below. Which of the following best represents an increase in supply?

A)The movement from A to B

B)The movement from A to D

C)The movement from C to B

D)The movement from D to C

A)The movement from A to B

B)The movement from A to D

C)The movement from C to B

D)The movement from D to C

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

17

If the market interest rate is higher than the coupon rate on a newly issued bond, then the bond will sell

A)at par.

B)below par.

C)above par.

D)at a premium.

A)at par.

B)below par.

C)above par.

D)at a premium.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

18

Unlike older bonds, which were printed on paper with mail-in coupons used to trigger interest payments, bonds today are mostly recorded in a different way. Which statement best describes how bond details are recorded for most bonds today?

A)Bonds are recorded electronically.

B)Bonds are recorded electronically and on paper.

C)Bonds are recorded on paper, which both parties keep, and electronically.

D)Bonds are recorded electronically, but coupons are still used to collect interest.

A)Bonds are recorded electronically.

B)Bonds are recorded electronically and on paper.

C)Bonds are recorded on paper, which both parties keep, and electronically.

D)Bonds are recorded electronically, but coupons are still used to collect interest.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

19

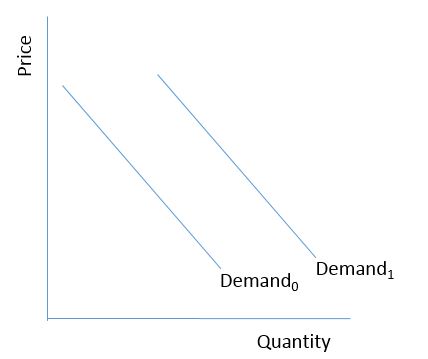

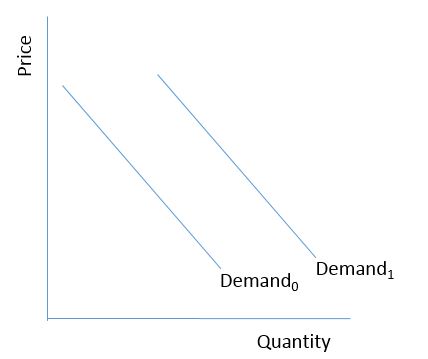

Imagine you live in a country experiencing a decrease in societal wealth, with a decline in expected returns to bonds relative to other assets, and an increase in the relative riskiness of bonds. Consider the figure below. Which of the following shows the change in demand for bonds?

A)The movement from B to C

B)The movement from A to C

C)The movement from B to D

D)The movement from A to B

A)The movement from B to C

B)The movement from A to C

C)The movement from B to D

D)The movement from A to B

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

Bond prices and interest rates are

A)directly related.

B)inversely related.

C)unrelated.

D)exponentially related.

A)directly related.

B)inversely related.

C)unrelated.

D)exponentially related.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

An increase in the price of bonds will cause a decrease in the demand for bonds.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

Explain how the market for loanable funds will adjust to the situation where the market interest rate is below the equilibrium rate.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following could cause an increase in the supply of loanable funds?

A)An increase in government deficits

B)A more optimistic outlook on the future by business

C)Expansionary monetary policy being followed by the Federal Reserve

D)Expectations of future inflation

A)An increase in government deficits

B)A more optimistic outlook on the future by business

C)Expansionary monetary policy being followed by the Federal Reserve

D)Expectations of future inflation

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

How would you distinguish between the market for bonds and the market for loanable funds?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

Consider the figure below. Which of the following would lead to a shift in the demand for bonds from Demand1 to Demand0?

A)A sudden and sustained decline in stock prices

B)A decrease in societal wealth

C)A decline in the cost of information about the bond market

D)A decrease in the default risk associated with bonds

A)A sudden and sustained decline in stock prices

B)A decrease in societal wealth

C)A decline in the cost of information about the bond market

D)A decrease in the default risk associated with bonds

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

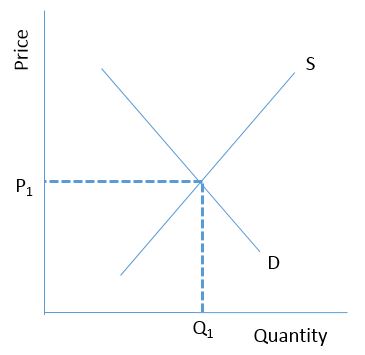

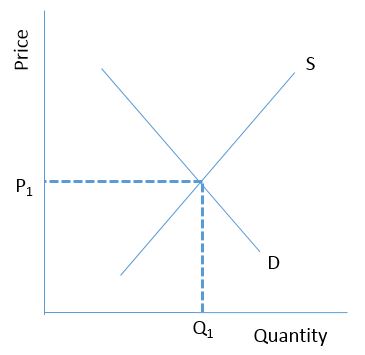

Consider the bond market illustrated in the figure below. If the current market price is lower than P1, which of the following statements is true?

A)There is a surplus of bonds in the market, and the market price will increase.

B)There is a surplus of bonds in the market, and the market price will fall toward P1.

C)There is a shortage of bonds in the market, and the market price will fall toward P1.

D)There is a shortage of bonds in the market, and the market price will increase.

A)There is a surplus of bonds in the market, and the market price will increase.

B)There is a surplus of bonds in the market, and the market price will fall toward P1.

C)There is a shortage of bonds in the market, and the market price will fall toward P1.

D)There is a shortage of bonds in the market, and the market price will increase.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

A 4%, $10,000, 30-year bond will produce for the owner a series of 30 annual payments of $400 from the issuer of the bond and a one-time payment of $9,600.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

Consider the bond market illustrated in the figure below. If the current market price is higher than P1, which of the following statements is true?

A)There is a surplus of bonds in the market, and the market price will increase.

B)There is a surplus of bonds in the market, and the market price will fall toward P1.

C)There is a shortage of bonds in the market, and the market price will fall toward P1.

D)There is a shortage of bonds in the market, and the price will increase.

A)There is a surplus of bonds in the market, and the market price will increase.

B)There is a surplus of bonds in the market, and the market price will fall toward P1.

C)There is a shortage of bonds in the market, and the market price will fall toward P1.

D)There is a shortage of bonds in the market, and the price will increase.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose the market for loanable funds is currently in equilibrium. Which of the following factors will cause an increase in the interest rate?

A)An increase in the household saving rate

B)A decrease in government budget deficits

C)An increase in business confidence

D)An expansionary monetary policy

A)An increase in the household saving rate

B)A decrease in government budget deficits

C)An increase in business confidence

D)An expansionary monetary policy

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

The quantity of loanable funds supplied is directly related to interest rates because as interest rates increase

A)the opportunity cost of household consumption increases, causing households to bring more of their after-tax income to the pool of loanable funds.

B)the opportunity cost to firms of funding projects with cash increases, causing firms to bring less of their cash to the pool of loanable funds.

C)the opportunity cost of government borrowing increases, causing government to run budget surpluses instead of deficits and therefore bring more cash to the pool of loanable funds.

D)in the United States, savers in the rest of the world will be more inclined to save in their domestic market, thereby bringing less of their saving to the US pool of loanable funds.

A)the opportunity cost of household consumption increases, causing households to bring more of their after-tax income to the pool of loanable funds.

B)the opportunity cost to firms of funding projects with cash increases, causing firms to bring less of their cash to the pool of loanable funds.

C)the opportunity cost of government borrowing increases, causing government to run budget surpluses instead of deficits and therefore bring more cash to the pool of loanable funds.

D)in the United States, savers in the rest of the world will be more inclined to save in their domestic market, thereby bringing less of their saving to the US pool of loanable funds.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

Consider the figure below. Which of the following occurrences will shift the supply of bonds from Supply0 to Supply1?

A)An expectation of deflation in the future

B)Federal government budget surpluses

C)A more optimistic outlook by business about the future

D)A reduction in investment tax credits available from government

A)An expectation of deflation in the future

B)Federal government budget surpluses

C)A more optimistic outlook by business about the future

D)A reduction in investment tax credits available from government

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

What determines the market price of a bond?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

The market for bonds is a subset of the market for loanable funds.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

Which of these could be a reason for a decrease in the demand for loanable funds?

A)Lower expected household income

B)A deterioration in business confidence

C)An increase in expectations about future inflation

D)A decrease in expectations about future inflation

A)Lower expected household income

B)A deterioration in business confidence

C)An increase in expectations about future inflation

D)A decrease in expectations about future inflation

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

35

If the market interest rate exceeds the coupon rate on a bond, the selling price of the bond will be greater than the bond's face value.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck