Deck 6: Client Acceptance,Planning,and Materiality

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/73

Play

Full screen (f)

Deck 6: Client Acceptance,Planning,and Materiality

1

Simon owns a clothing store,Simonello.Simonello recently purchased a material amount of fabric from Simonique Inc. ,a textile company also owned by Simon.With regards to this transaction,the auditors should

A)request a confirmation from Simonique that the transaction took place.

B)inspect the textile received in the warehouse to ensure that the amount sent equals the amount ordered.

C)qualify the audit report,as this puts management's integrity into question.

D)verify that the business relationship is disclosed in the financial statements.

A)request a confirmation from Simonique that the transaction took place.

B)inspect the textile received in the warehouse to ensure that the amount sent equals the amount ordered.

C)qualify the audit report,as this puts management's integrity into question.

D)verify that the business relationship is disclosed in the financial statements.

D

2

When the auditor has properly planned and performed the audit to reduce risk to an acceptably low level that is consistent with the objective of the audit,this means that the auditor has conducted enough work to

A)reduce inherent risks to an acceptable level.

B)increase detection risk to a satisfactory level.

C)detect errors in internal controls so that control risk can be set higher.

D)detect material misstatements to the targeted level of assurance.

A)reduce inherent risks to an acceptable level.

B)increase detection risk to a satisfactory level.

C)detect errors in internal controls so that control risk can be set higher.

D)detect material misstatements to the targeted level of assurance.

D

3

One of the purposes of developing a client risk profile is to assist the auditor in

A)developing the pertinent audit procedures for tests of internal controls.

B)assessing the client's business risk.

C)locating related parties that need to be disclosed.

D)deciding whether fraud or illegal acts have taken place.

A)developing the pertinent audit procedures for tests of internal controls.

B)assessing the client's business risk.

C)locating related parties that need to be disclosed.

D)deciding whether fraud or illegal acts have taken place.

B

4

What are the three main factors that influence the organizational structure of all public accounting firms?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

5

How is lack of understanding of a client's knowledge and industry linked to the auditor's business risk?

A)sales and collection processes need to be carefully documented so that the auditor can assess the value of accounts receivable.

B)failure to fully understand the nature of the client's transactions could result in litigation should the client fail.

C)the auditor may not be adequately trained to understand the nature of the client's business and thus may conduct a poor quality audit.

D)there may not be sufficient expertise assigned to the audit engagement,resulting in a lack of understanding of complex issues.

A)sales and collection processes need to be carefully documented so that the auditor can assess the value of accounts receivable.

B)failure to fully understand the nature of the client's transactions could result in litigation should the client fail.

C)the auditor may not be adequately trained to understand the nature of the client's business and thus may conduct a poor quality audit.

D)there may not be sufficient expertise assigned to the audit engagement,resulting in a lack of understanding of complex issues.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

6

It is important for the auditor to obtain a good understanding of the client's industry to develop a client risk profile.If the auditor is looking at a client in the fashion clothing industry,a risk specific to the industry would be

A)the high risk of poor governance and management oversight.

B)the high risk of defective products.

C)the high risk of obsolescence of their inventory.

D)the volatility in the stock market with regards to common stock.

A)the high risk of poor governance and management oversight.

B)the high risk of defective products.

C)the high risk of obsolescence of their inventory.

D)the volatility in the stock market with regards to common stock.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

7

An important reason for adequately planning the audit engagement is to

A)help decide whether the engagement should be accepted.

B)enable the auditor to obtain sufficient appropriate audit evidence.

C)properly design the contents of the engagement letter.

D)keep audit risk as low as possible.

A)help decide whether the engagement should be accepted.

B)enable the auditor to obtain sufficient appropriate audit evidence.

C)properly design the contents of the engagement letter.

D)keep audit risk as low as possible.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

8

The audit plan includes the nature,timing,and extent of audit procedures for the purposes of risk assessment,including those that are linked to the individual audit assertions,as well as any other audit procedures that are considered necessary.At what point in the audit process is the audit plan finalized?

A)When the auditor has finished documenting internal controls.

B)When the client risk profile has been completed.

C)When risk assessments are complete.

D)When inherent risk information has been gathered.

A)When the auditor has finished documenting internal controls.

B)When the client risk profile has been completed.

C)When risk assessments are complete.

D)When inherent risk information has been gathered.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

9

Jibbery Company has numerous transactions with related parties.For example,it has borrowed money from shareholders,purchases raw materials from a subsidiary company,and sells finished goods to its parent company.Which of the following describes one of the impacts of these transactions on risk assessment ?

A)inherent risk would be set as low

B)inherent risk would be set as high

C)control risk would be set as low

D)audit risk would be decreased

A)inherent risk would be set as low

B)inherent risk would be set as high

C)control risk would be set as low

D)audit risk would be decreased

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

10

A measure of how willing the auditor is to accept that the financial statements may be materially misstated after the audit is completed and an unmodified opinion has been issued is the

A)inherent risk.

B)audit risk.

C)statistical risk.

D)financial risk.

A)inherent risk.

B)audit risk.

C)statistical risk.

D)financial risk.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

11

Risks associated with specific industries may affect the auditor's assessment of client business risk and acceptable audit risk,and even influence client acceptance decisions.Which of the following businesses would be the most risky for the auditor to accept as a new client?

A)a small manufacturer of metal and plastic parts that has steady profits and has been in business for 15 years

B)a client who is developing a computer game that is expected to be ready in three years and has no other products

C)a retail company in the clothing industry that has mid-range pricing and appeals to a large population sector

D)a firm consisting of a partnership of ten lawyers that operates out of three different cities in one province

A)a small manufacturer of metal and plastic parts that has steady profits and has been in business for 15 years

B)a client who is developing a computer game that is expected to be ready in three years and has no other products

C)a retail company in the clothing industry that has mid-range pricing and appeals to a large population sector

D)a firm consisting of a partnership of ten lawyers that operates out of three different cities in one province

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

12

Brandon is working on the audit of Michum Inc.In accordance with CAS 550 (related parties),Brandon had obtained a management confirmation of all related-party transactions.When auditing the purchasing cycle of Michum,Brandon found that the company had purchased over $500 000 of merchandise from Elite Crust Inc. ,a company that is owned by the CEO's brother.The $500 000 purchase is a material amount and it was not included in the confirmation provided by Michum.Brandon should

A)inform the audit committee.

B)qualify the audit report.

C)discuss this issue with the management of Michum.

D)reduce materiality to increase the likelihood of discovering other undisclosed related party transactions.

A)inform the audit committee.

B)qualify the audit report.

C)discuss this issue with the management of Michum.

D)reduce materiality to increase the likelihood of discovering other undisclosed related party transactions.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

13

What are the possible scope limitations that would cause the auditor to decline an audit engagement?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

14

What are the preliminary engagement activities performed by the auditor before planning the audit?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

15

An effective audit is one that

A)reduces the audit risk to the targeted level.

B)ensures that there are no errors contained in the financial statements.

C)does not contain errors of a dollar amount higher than 5% of the net income of the company.

D)is completed on time and within budget.

A)reduces the audit risk to the targeted level.

B)ensures that there are no errors contained in the financial statements.

C)does not contain errors of a dollar amount higher than 5% of the net income of the company.

D)is completed on time and within budget.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

16

Michum Inc.has related party transactions with a company owned by the CEO's brother totalling about $500 000.There are also related party transactions with the owner (about $250)and with two of the officers ($750 and $1000)respectively.Which related parties should be identified and included in audit documentation?

A)those with material transactions only

B)those that had transactions in the current year only

C)all related parties

D)only those that could lead to a conflict of interest

A)those with material transactions only

B)those that had transactions in the current year only

C)all related parties

D)only those that could lead to a conflict of interest

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

17

During the process of deciding to accept or continue an audit engagement,what indicators may raise doubts in the auditor's mind about management's integrity?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

18

What is the best description of the engagement letter?

A)a letter at the end of the audit engagement reviewing any concerns the auditors wish management to be aware of

B)a written agreement between the public accounting firm and the client as to the terms of the engagement for the conduct of the audit

C)a letter from a successor auditor to a predecessor auditor asking to review the working papers for the previous year

D)a letter soliciting a potential client

A)a letter at the end of the audit engagement reviewing any concerns the auditors wish management to be aware of

B)a written agreement between the public accounting firm and the client as to the terms of the engagement for the conduct of the audit

C)a letter from a successor auditor to a predecessor auditor asking to review the working papers for the previous year

D)a letter soliciting a potential client

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

19

The Canadian Auditing Standards state that the auditor must develop an audit plan.List and explain the components that must be included in the auditor's plan.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

20

An important reason for auditors to obtain good knowledge of a client's industry is that

A)payroll processing functions could differ from client to client.

B)control risks will vary from zero to 100% and can be better assessed in context.

C)detection risk must be set in accordance with the needs of the industry as well as of the individual client.

D)organizations like city governments have unique accounting requirements that could be complex.

A)payroll processing functions could differ from client to client.

B)control risks will vary from zero to 100% and can be better assessed in context.

C)detection risk must be set in accordance with the needs of the industry as well as of the individual client.

D)organizations like city governments have unique accounting requirements that could be complex.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

21

Vanovo Ltd.has purchased several companies in the retail sector.Recently,Vanovo purchased both a coffee and donut chain (that also owned bakeries)and a submarine sandwich chain.Unfortunately,the planned synergies between these two retail chains did not arise.What effect would this have on the financial statements of Vanovo Ltd. ,the parent company?

A)The financial statements will be incorrectly calculated and should be checked.

B)The fixed assets and goodwill recorded at acquisition could be impaired.

C)Risk of material misstatement for payroll expenses will increase.

D)Costs of goods sold will likely be overstated for both of the new chains.

A)The financial statements will be incorrectly calculated and should be checked.

B)The fixed assets and goodwill recorded at acquisition could be impaired.

C)Risk of material misstatement for payroll expenses will increase.

D)Costs of goods sold will likely be overstated for both of the new chains.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

22

When reading the corporate minutes,the auditor extracted the approved annual salary for the President,the Chief Executive Officer,and other senior executives.What audit step would the auditor likely conduct with this information?

A)trace the payroll amount to each individual officer's payroll record

B)check that the payroll has been recorded into the correct bank account

C)verify that payroll cheques have two signatures for all large amounts

D)ensure that all overtime is approved and adequately documented

A)trace the payroll amount to each individual officer's payroll record

B)check that the payroll has been recorded into the correct bank account

C)verify that payroll cheques have two signatures for all large amounts

D)ensure that all overtime is approved and adequately documented

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

23

Black Rock Limited is a marble and tile outlet that has a large outdoor area as well as an indoor showroom for a variety of stone,tile,and marble.It is July and your firm has just been appointed as the auditor for the September year-end audit.The previous auditing firm had conducted review engagements.The company's bank has asked for audited financial statements for the current year end.

Required:A)What is the purpose of obtaining knowledge of the client's industry and business environment? Identify at least three procedures that you could undertake in this area.B)What is the purpose of obtaining knowledge of the client's business? Identify at least three procedures that you could undertake in this area.

Required:A)What is the purpose of obtaining knowledge of the client's industry and business environment? Identify at least three procedures that you could undertake in this area.B)What is the purpose of obtaining knowledge of the client's business? Identify at least three procedures that you could undertake in this area.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

24

In addition to direct impacts on the financial statements,the auditor also needs to consider indirect effects.An assessment of client objectives and strategies can reveal issues that could lower income or cause contingent liabilities.Which of the following could cause lost sales,increases in warranty expenses,and product liability claims?

A)poor product quality

B)excessive advertising

C)ineffective projections

D)inaccurate budgets

A)poor product quality

B)excessive advertising

C)ineffective projections

D)inaccurate budgets

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

25

The official record of the meetings of the board of directors and shareholders is contained in the corporate

A)bylaws.

B)charter.

C)minutes.

D)license.

A)bylaws.

B)charter.

C)minutes.

D)license.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

26

During discussion and inquiry with management,the auditor determined that the company has started a new line of business that requires a substantial investment in manufacturing equipment.The company has also implemented wireless scanning for its warehouse and inventory.Which of the following techniques will the auditor likely use to corroborate these statements?

A)further inquiry of the accounting personnel

B)inspection of recent sales invoices for types of sales

C)use of analytical procedures,comparing last year to this year

D)observation during the plant tour

A)further inquiry of the accounting personnel

B)inspection of recent sales invoices for types of sales

C)use of analytical procedures,comparing last year to this year

D)observation during the plant tour

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is an important purpose of an organizational code of ethics and the associated processes to ensure adherence?

A)to ensure that there are no fraudulent or illegal transactions at the company

B)to train employees in acceptable conduct at the organization

C)to prevent unethical employees from acting in unacceptable ways

D)to provide a powerful signal of acceptable organizational conduct

A)to ensure that there are no fraudulent or illegal transactions at the company

B)to train employees in acceptable conduct at the organization

C)to prevent unethical employees from acting in unacceptable ways

D)to provide a powerful signal of acceptable organizational conduct

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

28

It is important that the policies,procedures,and key decisions of senior management,the board of directors,and the audit committee be considered when developing a client risk profile because

A)they have a pervasive effect on the company.

B)they influence the most important decisions for the company.

C)it is required by accounting and auditing standards.

D)they have the effect of increasing client business risks.

A)they have a pervasive effect on the company.

B)they influence the most important decisions for the company.

C)it is required by accounting and auditing standards.

D)they have the effect of increasing client business risks.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

29

If the client has set unreasonable objectives or if the performance measurement system encourages aggressive accounting,the auditor will

A)increase inherent risk of financial statement misstatements.

B)lower inherent risk of financial statement misstatements.

C)increase control risk of financial statement misstatements.

D)lower control risk of financial statement misstatements.

A)increase inherent risk of financial statement misstatements.

B)lower inherent risk of financial statement misstatements.

C)increase control risk of financial statement misstatements.

D)lower control risk of financial statement misstatements.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

30

What is the purpose of developing a client risk profile? List the steps involved in developing a client risk profile.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

31

Frontenac Construction,your audit client,is a construction company.In the initial planning phase of the audit,you identified that it has many contracts with severe non-performance clauses if any of the current constructions are not completed on the dates set in the contracts over the next three years.As the auditor,you would set the inherent risk for sales and penalties as

A)high.

B)moderate.

C)low.

D)unknown: this cannot be determined until more procedures are performed.

A)high.

B)moderate.

C)low.

D)unknown: this cannot be determined until more procedures are performed.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

32

Mario,the owner of Clayton's ice cream,is giving Steve,the manager of the audit,a private tour of the production facilities.By doing the tour,Steve will

A)be better able to identify control risks.

B)understand the client's business and operations better.

C)be able to gather audit evidence on operational efficiencies.

D)Steve should not be taking a tour alone with the owner as this could compromise his independence.

A)be better able to identify control risks.

B)understand the client's business and operations better.

C)be able to gather audit evidence on operational efficiencies.

D)Steve should not be taking a tour alone with the owner as this could compromise his independence.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

33

If management and salespeople are compensated on the basis of achieving high sales targets,there is increased incentive to record sales before they have been earned.In such a situation,the auditor will increase the extent of testing for which of the following transaction-related audit objectives for sales?

A)cut-off and classification

B)classification and occurrence

C)occurrence and cut-off

D)completeness and cut-off

A)cut-off and classification

B)classification and occurrence

C)occurrence and cut-off

D)completeness and cut-off

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

34

A client's performance measurement system includes key performance indicators that management uses to

A)measure its profitability.

B)compare its performance with prior periods.

C)prepare the financial statements.

D)measure progress toward its objectives.

A)measure its profitability.

B)compare its performance with prior periods.

C)prepare the financial statements.

D)measure progress toward its objectives.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

35

A code of ethics is an important document for organizational conduct.In response to the Sarbanes-Oxley Act in the United States,the SEC requires which of the following actions for organizations that have not adopted a code of ethics?

A)explanation of why it has not done so

B)disclosure of actions undertaken to prevent and detect fraud

C)disclosure of all related parties in management and discussion documents

D)a cost-benefit analysis for immediate implementation of one

A)explanation of why it has not done so

B)disclosure of actions undertaken to prevent and detect fraud

C)disclosure of all related parties in management and discussion documents

D)a cost-benefit analysis for immediate implementation of one

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

36

Organizations with a good control environment are able to document their positive "tone at the top" with a clear code of ethics.How would the auditor include the presence of such a code of ethics in the risk assessment process?

A)increase inherent risks associated with violations of laws and regulations

B)lower inherent risks associated with violations of laws and regulations

C)increase control risks associated with violations of laws and regulations

D)lower control risks associated with violations of laws and regulations

A)increase inherent risks associated with violations of laws and regulations

B)lower inherent risks associated with violations of laws and regulations

C)increase control risks associated with violations of laws and regulations

D)lower control risks associated with violations of laws and regulations

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

37

An effective board of directors helps ensure that the company takes only appropriate risks.The audit committee can

A)reduce the likelihood of fraud and financial statement errors through oversight of the entity-level controls.

B)reduce the likelihood of financial statement errors by helping management of the company with complex financial reporting issues.

C)reduce the likelihood of financial statement errors by helping management in the preparation of the financial statements and related notes.

D)reduce the likelihood of overly aggressive accounting through oversight of financial reporting.

A)reduce the likelihood of fraud and financial statement errors through oversight of the entity-level controls.

B)reduce the likelihood of financial statement errors by helping management of the company with complex financial reporting issues.

C)reduce the likelihood of financial statement errors by helping management in the preparation of the financial statements and related notes.

D)reduce the likelihood of overly aggressive accounting through oversight of financial reporting.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

38

With respect to clients,business risk increases when conditions,events,circumstances,or inactions

A)adversely affect the entity's ability to achieve its objectives.

B)cause employees to not do their job properly.

C)result in the company continuing profitable operations.

D)result in an assessment of poor internal controls.

A)adversely affect the entity's ability to achieve its objectives.

B)cause employees to not do their job properly.

C)result in the company continuing profitable operations.

D)result in an assessment of poor internal controls.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

39

During the course of an audit engagement,an auditor prepares and accumulates audit working papers.The primary purpose of the audit working papers is to

A)aid the auditor in adequately planning the work.

B)provide a point of reference for future audit engagements.

C)support the underlying concepts included in the preparation of the basic financial statements.

D)support the auditor's report.

A)aid the auditor in adequately planning the work.

B)provide a point of reference for future audit engagements.

C)support the underlying concepts included in the preparation of the basic financial statements.

D)support the auditor's report.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

40

When reading the corporate minutes,the auditor obtained information regarding loans that were authorized for borrowing.What audit step would the auditor likely conduct with this information?

A)trace the authorized amounts to the bank statements

B)verify that notes payable have been recorded

C)calculate interest payable as of the end of the year

D)contact a credit rating agency to determine the rating of the lender

A)trace the authorized amounts to the bank statements

B)verify that notes payable have been recorded

C)calculate interest payable as of the end of the year

D)contact a credit rating agency to determine the rating of the lender

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

41

If it is probable that the judgment of a reasonable person would have been changed or influenced by the omission or misstatement of information,then that information is considered to be

A)significant.

B)insignificant.

C)material.

D)relevant.

A)significant.

B)insignificant.

C)material.

D)relevant.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

42

There are many types of analytical procedures that the auditor can conduct during the planning stage of the financial statement audit.What is the purpose of comparing prepaid expenses and related expense accounts with those of prior years?

A)to understand the client's industry and business

B)to assess going concern

C)to identify possible misstatements

D)to reduce tests of controls

A)to understand the client's industry and business

B)to assess going concern

C)to identify possible misstatements

D)to reduce tests of controls

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

43

The overall audit strategy typically includes

A)specific procedures for determining audit risk.

B)the detailed audit plan.

C)audit evidence gathering procedures.

D)decisions about unusual client accounting principles.

A)specific procedures for determining audit risk.

B)the detailed audit plan.

C)audit evidence gathering procedures.

D)decisions about unusual client accounting principles.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

44

External auditor Mary Smith may not rely on the work of internal auditor Ray Jones unless

A)Jones is certified (CPA,CA;CPA,CGA;or CPA,CMA).

B)Jones is independent of the client.

C)Jones is supervised by Smith.

D)Smith obtains evidence that supports the competence,integrity,and objectivity of Jones.

A)Jones is certified (CPA,CA;CPA,CGA;or CPA,CMA).

B)Jones is independent of the client.

C)Jones is supervised by Smith.

D)Smith obtains evidence that supports the competence,integrity,and objectivity of Jones.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

45

Juniper Berry is a private company in the Niagara region that operates in the fruit and vegetable industry.In its main St.Catharines plant,it receives picked berries,and sorts and packages them.It also makes some related products such as jams,cookies,and pies.Your firm has recently been hired as the auditor of Juniper Berry.The partner in charge of the audit has asked you to write a memo explaining why it is important to gain understanding of the business operations and processes of Juniper Berry and also to list some suggested procedures to be performed in the process of understanding the business operations and processes.

To assist you with your memo,the partner provided you with some notes she took at a recent meeting with the management of Juniper Berry:

- Juniper Berry (JB)sells and manufactures a wide range of products,including fresh and frozen berries,jam,cookies,and pies.Fresh and frozen berries make up most of JB's revenues.

- JB sells mostly to grocery stores directly.However,its frozen berries are packaged with the Mondo Grocers logo as they have an exclusive contract to sell all of their frozen berry production to Mondo.

- In 2016,JB installed a new scale system to weigh berries when they are delivered from various farms.The amount to be paid to the farmer is then calculated and recorded immediately.The system automatically records the inventory and issues an electronic payment for the amount calculated by the scale.JB is proud to be technologically advanced,as it has allowed the company to cut some jobs and be more cost efficient.

- Given that most of the packaging and processing of berries into derived products is automated,capital assets represent a significant portion of the balance sheet and also required JB to obtain a large bank loan in 2016 when the plant upgrade took place.

To assist you with your memo,the partner provided you with some notes she took at a recent meeting with the management of Juniper Berry:

- Juniper Berry (JB)sells and manufactures a wide range of products,including fresh and frozen berries,jam,cookies,and pies.Fresh and frozen berries make up most of JB's revenues.

- JB sells mostly to grocery stores directly.However,its frozen berries are packaged with the Mondo Grocers logo as they have an exclusive contract to sell all of their frozen berry production to Mondo.

- In 2016,JB installed a new scale system to weigh berries when they are delivered from various farms.The amount to be paid to the farmer is then calculated and recorded immediately.The system automatically records the inventory and issues an electronic payment for the amount calculated by the scale.JB is proud to be technologically advanced,as it has allowed the company to cut some jobs and be more cost efficient.

- Given that most of the packaging and processing of berries into derived products is automated,capital assets represent a significant portion of the balance sheet and also required JB to obtain a large bank loan in 2016 when the plant upgrade took place.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

46

Distinguish horizontal and vertical analysis.Give an example of each.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

47

Silka is in the process of performing an audit.During the audit,Silka decided to change materiality.A valid reason for this would be

A)a new user of the financial statements was identified.

B)a fraud was discovered in the accounts payable section.

C)materiality required the auditors to perform too many tests.

D)too many errors were found during testing.

A)a new user of the financial statements was identified.

B)a fraud was discovered in the accounts payable section.

C)materiality required the auditors to perform too many tests.

D)too many errors were found during testing.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

48

In order to assess if a company is a going concern,the auditor can calculate which of the following ratios during the audit planning and compare with previous years and successful companies in the industry?

A)debt to equity ratio.

B)accounts receivable turnover ratio.

C)percent of interest expense to sales.

D)inventory turnover ratio.

A)debt to equity ratio.

B)accounts receivable turnover ratio.

C)percent of interest expense to sales.

D)inventory turnover ratio.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

49

Your preliminary discussion with European Real Estate Management (EREM)Corporation indicated that the company was owned by three Swedish individuals who sold limited liability partnerships of shopping malls,office buildings,and large residential apartment buildings to European investors.Often,a single shopping mall was broken up into several limited liability partnerships to make the ownership pieces small enough to sell easily.

In some cases these partnership units were sold to European companies,who diversified and bought units in several buildings.Other units were purchased by individuals.If a property looked particularly promising,the owners of EREM occasionally purchased units or advised their wives and family members to purchase units.

Required:

Explain why it is important for the auditor to identify related party transactions.Why are related party transactions a high-risk area for the EREM audit?

In some cases these partnership units were sold to European companies,who diversified and bought units in several buildings.Other units were purchased by individuals.If a property looked particularly promising,the owners of EREM occasionally purchased units or advised their wives and family members to purchase units.

Required:

Explain why it is important for the auditor to identify related party transactions.Why are related party transactions a high-risk area for the EREM audit?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

50

Your client,Macilbink Ltd. ,manufactures calendars,books,and magazines.The printing presses that they use are only three years old,yet new technology has been developed that would result in cuts in ink and electricity costs by over 20%,while simplifying the setup process,making smaller production runs more feasible.Macilbink Ltd.is facing lowered demand for its products and will need to change direction or innovate to stay in business.The effect of the new printing technology has resulted in which of the following risk assessment changes by Macilbink Ltd.'s auditors?

A)decreased control risk

B)increased control risk

C)decreased client business risk

D)increased client business risk

A)decreased control risk

B)increased control risk

C)decreased client business risk

D)increased client business risk

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

51

Anna performed a trend analysis of accounts receivable (AR)balances and computed the days to collect AR ratio.When she compared the results of her analysis with industry averages,she found the results were unusually low compared to the industry norm.Anna can conclude that

A)the accounts receivable balance is wrong.

B)the accounts receivable has an increased risk of misstatement.

C)the integrity of the company's management is questionable.

D)she will not be able to rely on internal controls for accounts receivable for audit purposes.

A)the accounts receivable balance is wrong.

B)the accounts receivable has an increased risk of misstatement.

C)the integrity of the company's management is questionable.

D)she will not be able to rely on internal controls for accounts receivable for audit purposes.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

52

There are many types of analytical procedures that the auditor can conduct during the planning stage of the financial statement audit.What is the purpose of calculating key ratios for the client's business and comparing them with industry averages?

A)to understand the client's industry and business

B)to assess going concern

C)to indicate possible misstatements

D)to reduce detailed tests

A)to understand the client's industry and business

B)to assess going concern

C)to indicate possible misstatements

D)to reduce detailed tests

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

53

White Top Telephones is the largest telephone distributor in the province,distributing wired and cordless phones as well as cell phones.Management always seems to be in a rush and is difficult to approach.Unfortunately,this attitude has permeated down to all of the staff.Everyone seems to be hurrying about,doing what needs to be done.Sometimes it seems as if they don't even have time for their customers.Yet,everything seems to get done.The company's website has a lengthy privacy policy statement indicating that customers are number one and that all data is kept secure.

Required:

Explain the importance of the control environment and corporate governance structure.During what phases of the risk assessment and planning process would the control environment and corporate governance structure be documented and assessed?

Required:

Explain the importance of the control environment and corporate governance structure.During what phases of the risk assessment and planning process would the control environment and corporate governance structure be documented and assessed?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

54

Knowledge of the client's industry and external environment can be obtained in different ways.Discuss some of the ways that this knowledge can be obtained.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

55

A)One step in the planning phase of an audit is to obtain information about the client's legal obligations.Identify the types of legal documents and records that auditors examine to obtain this information.B)Discuss the audit-relevant information contained in each of these types of documents that an auditor should be aware of early in the audit.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

56

Why might the decisions about materiality and risks be different for the internal auditor than for the external auditor when conducting an audit of a system?

A)The auditors are applying different skills during the conduct of the audit.

B)External auditors have different expectations with respect to quality control.

C)Internal auditors focus only on the potential for dollar errors internally.

D)External users may have different needs than management.

A)The auditors are applying different skills during the conduct of the audit.

B)External auditors have different expectations with respect to quality control.

C)Internal auditors focus only on the potential for dollar errors internally.

D)External users may have different needs than management.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

57

Analytical procedures are generally used to produce evidence from

A)physical observation of inventories.

B)relationships among current financial balances and prior balances,forecasts,and nonfinancial data.

C)detailed examination of external and internal documents.

D)confirmations mailed directly to the auditors by auditee customers.

A)physical observation of inventories.

B)relationships among current financial balances and prior balances,forecasts,and nonfinancial data.

C)detailed examination of external and internal documents.

D)confirmations mailed directly to the auditors by auditee customers.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

58

CAS 320 (materiality in planning and performing an audit)defines materiality in terms of three key concepts.The first and second concepts are that a material misstatement should be considered in the context of knowledgeable users and the effect on decision making;and that material is relative to circumstances surrounding the decision and nature of the information.The third concept is

A)that the auditor should consider users of financial statements as a group.

B)that the auditor should consider users of financial statements individually.

C)that the users should be informed and approve of the materiality used by the auditor.

D)that the auditor should be conservative in setting the materiality level.

A)that the auditor should consider users of financial statements as a group.

B)that the auditor should consider users of financial statements individually.

C)that the users should be informed and approve of the materiality used by the auditor.

D)that the auditor should be conservative in setting the materiality level.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

59

What are the responsibilities of an external auditor when a specialist is used in an audit?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

60

There are many types of analytical procedures that the auditor can conduct during the planning stage of the financial statement audit.What is the purpose of comparing the gross margin with prior years and looking for large fluctuations?

A)to understand the client's industry and business

B)to assess going concern

C)to identify possible misstatements

D)to reduce detailed tests

A)to understand the client's industry and business

B)to assess going concern

C)to identify possible misstatements

D)to reduce detailed tests

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

61

What is performance materiality?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

62

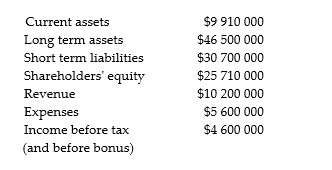

Mugsy Brights Limited (MBL)is a private company in Winnipeg that sells mugs,jars,and bottles in a variety of colours,sizes,and materials.MBL has been owned by four equal owners since its inception.The owners have different skills-creative design,marketing,finance,and information systems.The company attributes much of its success to the use of materials that can be easily shipped without breaking,and unique designs that appeal to a variety of buyers,particularly commercial buyers who purchase for restaurants,or for businesses who choose to advertise their business by giving away or selling regular or travel mugs.

The owners meet formally every month and have informal meetings two or three times per week to discuss particular clients or new approaches.About a quarter of the company's sales are completed via the company's secure website,while the remainder are by telephone or purchase order.MBL works with distributors of kitchenware,selling wholesale to hundreds of outlets in Canada.Most of these sales are done over the phone,although a salesperson does spend some time in major cities across the country visiting some of the large customers and helping with shelf layout and marketing to the ultimate consumers for larger distributors.These efforts have resulted in gradually increasing market share for the company.

All sales are recorded in the accounting software package used by the company.The accounting manager reports directly to one of the owners,and there are two other employees in the accounting department.Password controls are used to limit functions that are accessible by employees.For example,only the controller can implement wage rate increases or product price increases (which are reviewed and approved by the owner responsible for marketing).Two owners are required to sign cheques,and do so with source documents attached.Similarly,two owners are required to approve new employees.

All manufacturing is outsourced to local producers who work with different materials.For example,a different supplier handles steel mugs versus plastics or glass.Ceramics are rarely used as they are quite breakable,whereas some forms of glass are very durable.MBL does not hold any inventory,as manufacturing is all done to order.However,as there have been some collection problems from customers,the company has had to go to the maximum of its line of credit and has no additional borrowing capacity available.It is waiting for the results of the audited financial statements to approach its bank for an increase in its line of credit.

Internet sales are prepared (via credit card),while sales to distributors are net 30 days.The company has an April year end.Following are extracts from the annual financial statements.

![Mugsy Brights Limited (MBL)is a private company in Winnipeg that sells mugs,jars,and bottles in a variety of colours,sizes,and materials.MBL has been owned by four equal owners since its inception.The owners have different skills-creative design,marketing,finance,and information systems.The company attributes much of its success to the use of materials that can be easily shipped without breaking,and unique designs that appeal to a variety of buyers,particularly commercial buyers who purchase for restaurants,or for businesses who choose to advertise their business by giving away or selling regular or travel mugs. The owners meet formally every month and have informal meetings two or three times per week to discuss particular clients or new approaches.About a quarter of the company's sales are completed via the company's secure website,while the remainder are by telephone or purchase order.MBL works with distributors of kitchenware,selling wholesale to hundreds of outlets in Canada.Most of these sales are done over the phone,although a salesperson does spend some time in major cities across the country visiting some of the large customers and helping with shelf layout and marketing to the ultimate consumers for larger distributors.These efforts have resulted in gradually increasing market share for the company. All sales are recorded in the accounting software package used by the company.The accounting manager reports directly to one of the owners,and there are two other employees in the accounting department.Password controls are used to limit functions that are accessible by employees.For example,only the controller can implement wage rate increases or product price increases (which are reviewed and approved by the owner responsible for marketing).Two owners are required to sign cheques,and do so with source documents attached.Similarly,two owners are required to approve new employees. All manufacturing is outsourced to local producers who work with different materials.For example,a different supplier handles steel mugs versus plastics or glass.Ceramics are rarely used as they are quite breakable,whereas some forms of glass are very durable.MBL does not hold any inventory,as manufacturing is all done to order.However,as there have been some collection problems from customers,the company has had to go to the maximum of its line of credit and has no additional borrowing capacity available.It is waiting for the results of the audited financial statements to approach its bank for an increase in its line of credit. Internet sales are prepared (via credit card),while sales to distributors are net 30 days.The company has an April year end.Following are extracts from the annual financial statements. Required:A)What audit risk would you assign to the company? Why? [Tip: Do some calculations and consider client business risk.] B)Calculate preliminary materiality.Justify your decision of materiality base and choice of materiality.](https://d2lvgg3v3hfg70.cloudfront.net/TB1491/11ea2fda_7786_f305_b41d_6dee04476f8e_TB1491_00.jpg)

Required:A)What audit risk would you assign to the company? Why? [Tip: Do some calculations and consider client business risk.] B)Calculate preliminary materiality.Justify your decision of materiality base and choice of materiality.

The owners meet formally every month and have informal meetings two or three times per week to discuss particular clients or new approaches.About a quarter of the company's sales are completed via the company's secure website,while the remainder are by telephone or purchase order.MBL works with distributors of kitchenware,selling wholesale to hundreds of outlets in Canada.Most of these sales are done over the phone,although a salesperson does spend some time in major cities across the country visiting some of the large customers and helping with shelf layout and marketing to the ultimate consumers for larger distributors.These efforts have resulted in gradually increasing market share for the company.

All sales are recorded in the accounting software package used by the company.The accounting manager reports directly to one of the owners,and there are two other employees in the accounting department.Password controls are used to limit functions that are accessible by employees.For example,only the controller can implement wage rate increases or product price increases (which are reviewed and approved by the owner responsible for marketing).Two owners are required to sign cheques,and do so with source documents attached.Similarly,two owners are required to approve new employees.

All manufacturing is outsourced to local producers who work with different materials.For example,a different supplier handles steel mugs versus plastics or glass.Ceramics are rarely used as they are quite breakable,whereas some forms of glass are very durable.MBL does not hold any inventory,as manufacturing is all done to order.However,as there have been some collection problems from customers,the company has had to go to the maximum of its line of credit and has no additional borrowing capacity available.It is waiting for the results of the audited financial statements to approach its bank for an increase in its line of credit.

Internet sales are prepared (via credit card),while sales to distributors are net 30 days.The company has an April year end.Following are extracts from the annual financial statements.

![Mugsy Brights Limited (MBL)is a private company in Winnipeg that sells mugs,jars,and bottles in a variety of colours,sizes,and materials.MBL has been owned by four equal owners since its inception.The owners have different skills-creative design,marketing,finance,and information systems.The company attributes much of its success to the use of materials that can be easily shipped without breaking,and unique designs that appeal to a variety of buyers,particularly commercial buyers who purchase for restaurants,or for businesses who choose to advertise their business by giving away or selling regular or travel mugs. The owners meet formally every month and have informal meetings two or three times per week to discuss particular clients or new approaches.About a quarter of the company's sales are completed via the company's secure website,while the remainder are by telephone or purchase order.MBL works with distributors of kitchenware,selling wholesale to hundreds of outlets in Canada.Most of these sales are done over the phone,although a salesperson does spend some time in major cities across the country visiting some of the large customers and helping with shelf layout and marketing to the ultimate consumers for larger distributors.These efforts have resulted in gradually increasing market share for the company. All sales are recorded in the accounting software package used by the company.The accounting manager reports directly to one of the owners,and there are two other employees in the accounting department.Password controls are used to limit functions that are accessible by employees.For example,only the controller can implement wage rate increases or product price increases (which are reviewed and approved by the owner responsible for marketing).Two owners are required to sign cheques,and do so with source documents attached.Similarly,two owners are required to approve new employees. All manufacturing is outsourced to local producers who work with different materials.For example,a different supplier handles steel mugs versus plastics or glass.Ceramics are rarely used as they are quite breakable,whereas some forms of glass are very durable.MBL does not hold any inventory,as manufacturing is all done to order.However,as there have been some collection problems from customers,the company has had to go to the maximum of its line of credit and has no additional borrowing capacity available.It is waiting for the results of the audited financial statements to approach its bank for an increase in its line of credit. Internet sales are prepared (via credit card),while sales to distributors are net 30 days.The company has an April year end.Following are extracts from the annual financial statements. Required:A)What audit risk would you assign to the company? Why? [Tip: Do some calculations and consider client business risk.] B)Calculate preliminary materiality.Justify your decision of materiality base and choice of materiality.](https://d2lvgg3v3hfg70.cloudfront.net/TB1491/11ea2fda_7786_f305_b41d_6dee04476f8e_TB1491_00.jpg)

Required:A)What audit risk would you assign to the company? Why? [Tip: Do some calculations and consider client business risk.] B)Calculate preliminary materiality.Justify your decision of materiality base and choice of materiality.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

63

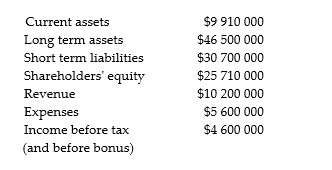

Lauralye Leasing Limited (LLL)provides lease financing to companies and individuals for equipment other than automobiles.Leases on commercial signs make up 50% of total leases;computer and telecommunications equipment are 30%;and restaurant equipment makes up most of the remainder.LLL's customers arrange to buy new equipment from equipment dealers,then contact LLL to arrange lease financing.

LLL was founded over thirty years ago by Laura and Al Ye.It is now run by Mr.and Mrs.Ye's daughter,Betsy,who is the President of LLL.LLL owns a small building downtown,where the offices of the business are located.Unused office space is rented out to other commercial tenants.

Betsy was a classmate of yours at in university and you have kept loosely in touch over the years.This year,she moved LLL's audit to your firm (a local firm with five partners),after deciding that the firm her parents had hired many years ago did not really understand her business needs.

LLL has a small loan that is used to cover blips in working capital.The company has two salespeople.Most loans are received from stores throughout the city with whom LLL has standing agreements.If customers require financing,they fill in an application and fax it to LLL for approval.LLL will reply within two business days.

The company has been profitable for many years.There are no extraordinary items in the current year's financial statements.

Selected financial information is as follows:

Required: A)Which base would you use to calculate materiality? Why? B)Calculate materiality.Choose a specific number and explain why you chose that amount.

LLL was founded over thirty years ago by Laura and Al Ye.It is now run by Mr.and Mrs.Ye's daughter,Betsy,who is the President of LLL.LLL owns a small building downtown,where the offices of the business are located.Unused office space is rented out to other commercial tenants.

Betsy was a classmate of yours at in university and you have kept loosely in touch over the years.This year,she moved LLL's audit to your firm (a local firm with five partners),after deciding that the firm her parents had hired many years ago did not really understand her business needs.

LLL has a small loan that is used to cover blips in working capital.The company has two salespeople.Most loans are received from stores throughout the city with whom LLL has standing agreements.If customers require financing,they fill in an application and fax it to LLL for approval.LLL will reply within two business days.

The company has been profitable for many years.There are no extraordinary items in the current year's financial statements.

Selected financial information is as follows:

Required: A)Which base would you use to calculate materiality? Why? B)Calculate materiality.Choose a specific number and explain why you chose that amount.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

64

What are the factors considered by an auditor while setting performance materiality?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following types of misstatements has the highest level of certainty?

A)identified misstatements

B)likely misstatements

C)likely aggregate misstatements

D)further possible misstatements

A)identified misstatements

B)likely misstatements

C)likely aggregate misstatements

D)further possible misstatements

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

66

If the auditor sets a low dollar amount as materiality,

A)more evidence is required than for a high amount.

B)less evidence is required than for a high amount.

C)the same amount of evidence is required as for a high dollar amount.

D)it has no effect on the amount of evidence required.

A)more evidence is required than for a high amount.

B)less evidence is required than for a high amount.

C)the same amount of evidence is required as for a high dollar amount.

D)it has no effect on the amount of evidence required.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

67

What is specific materiality?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

68

The first step in applying materiality is

A)estimating the misstatement in a segment for each functional cycle.

B)setting a judgment about materiality for the financial statements as a whole.

C)estimating the combined effects of errors.

D)comparing the error estimate with the materiality levels.

A)estimating the misstatement in a segment for each functional cycle.

B)setting a judgment about materiality for the financial statements as a whole.

C)estimating the combined effects of errors.

D)comparing the error estimate with the materiality levels.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

69

When an auditor allocates materiality to segments,then the materiality amount for different accounts under audit will

A)potentially differ from each other.

B)require the same level of unanticipated misstatements.

C)require the same amount of audit work.

D)be the same for each account audited.

A)potentially differ from each other.

B)require the same level of unanticipated misstatements.

C)require the same amount of audit work.

D)be the same for each account audited.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

70

The purpose of allocating planning materiality to balance sheet accounts is to

A)assess the appropriate evidence to accumulate for each account on the balance sheet.

B)assess the appropriate evidence to accumulate for each account on both the balance sheet and income statement.

C)reduce the amount of procedures done in the course of the audit.

D)increase the possibility that fraud or illegal activities would be detected by audit procedures.

A)assess the appropriate evidence to accumulate for each account on the balance sheet.

B)assess the appropriate evidence to accumulate for each account on both the balance sheet and income statement.

C)reduce the amount of procedures done in the course of the audit.

D)increase the possibility that fraud or illegal activities would be detected by audit procedures.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

71

Since materiality is relative,it is necessary to have benchmarks for establishing whether misstatements are material.Normally,the most important base for deciding what is material,because it is regarded as a critical item of current period information for users,is

A)total assets.

B)net income.

C)net working capital.

D)net income before taxes.

A)total assets.

B)net income.

C)net working capital.

D)net income before taxes.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

72

The auditors have decided upon a materiality level of $100 000 for their audit of ABC Manufacturing.Which one of the following errors would be considered more important by the auditors?

A)an error in accounts receivable cutoff of $50 000

B)an overstatement of accounts payable by $15 000

C)an error in allocation between accounts receivable and accounts payable by $75 000

D)an illegal payment of $15 000

A)an error in accounts receivable cutoff of $50 000

B)an overstatement of accounts payable by $15 000

C)an error in allocation between accounts receivable and accounts payable by $75 000

D)an illegal payment of $15 000

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

73

A)Discuss each of the six steps in applying materiality in an audit and identify the audit phase(s)in which each step is performed.B)Discuss the three main factors that affect an auditor's preliminary judgment about materiality.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck