Deck 12: Income Distribution Poverty and Discrimination

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/57

Play

Full screen (f)

Deck 12: Income Distribution Poverty and Discrimination

1

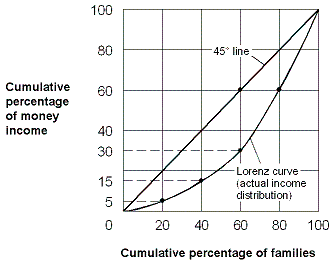

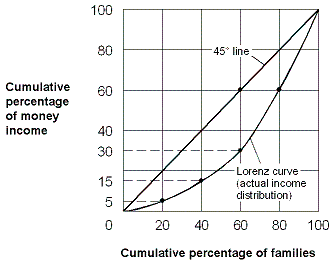

Using the Lorenz curve, the degree of income inequality is measured by the:

A) line connecting all points for which a given percentage of families receives exactly that cumulative percentage of income.

B) distance of the Lorenz curve from the line of perfect equality.

C) flat diagonal line that applies to a perfectly elastic demand curve.

D) number of times the Lorenz curve crosses the line of perfect equality.

A) line connecting all points for which a given percentage of families receives exactly that cumulative percentage of income.

B) distance of the Lorenz curve from the line of perfect equality.

C) flat diagonal line that applies to a perfectly elastic demand curve.

D) number of times the Lorenz curve crosses the line of perfect equality.

B

2

Make a case for income inequality.

First, by rewarding people for their productivity by paying them wages equal to their MRPs, people have the incentive to work and improve their skills. Since MRPs vary, people must receive different wage rates, even though this will lead to income inequality. Second, because the rich can afford to save a higher percentage of their income than can the poor, they tend to do the economy's investing, thus generating economic growth that benefits everyone.

3

Which of the following correctly describes the Lorenz curve?

A) The Lorenz curve shows that the increasing income inequality in the U.S. society is actually good for the economy.

B) The Lorenz curve shows the growth rate in real median family income over time.

C) The Lorenz curve shows the cumulative distribution of family income, ranked from the poorest to the richest families, and compares that curve with the straight line indicating perfectly equal income distribution.

D) The Lorenz curve shows the cumulative distribution of family income, ranked from the richest to the poorest families, and compares that curve with the ideal of having all income go to the richest 5 percent of society.

A) The Lorenz curve shows that the increasing income inequality in the U.S. society is actually good for the economy.

B) The Lorenz curve shows the growth rate in real median family income over time.

C) The Lorenz curve shows the cumulative distribution of family income, ranked from the poorest to the richest families, and compares that curve with the straight line indicating perfectly equal income distribution.

D) The Lorenz curve shows the cumulative distribution of family income, ranked from the richest to the poorest families, and compares that curve with the ideal of having all income go to the richest 5 percent of society.

C

4

Which of the following statements is true ?

A) Income distribution in the United States has gotten progressively more unequal since 1929.

B) The Lorenz curve indicates the degree of discrimination in an economy.

C) The Lorenz curve indicates the degree of income inequality in an economy.

D) The richest 5% of Americans earn approximately half of the nation's income.

A) Income distribution in the United States has gotten progressively more unequal since 1929.

B) The Lorenz curve indicates the degree of discrimination in an economy.

C) The Lorenz curve indicates the degree of income inequality in an economy.

D) The richest 5% of Americans earn approximately half of the nation's income.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

5

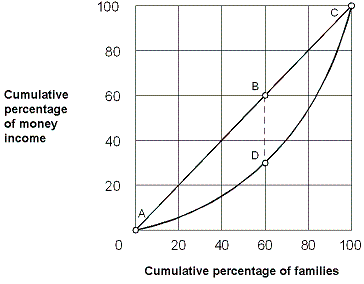

Exhibit 12-3 Lorenz curve for an economy

If this economy's distribution of income becomes more equal, then the Lorenz curve shown in Exhibit 12-3 will:

A) move closer to the 45 ° line.

B) become more bowed outward.

C) lie above the 45 ° line.

D) shift down and to the right.

If this economy's distribution of income becomes more equal, then the Lorenz curve shown in Exhibit 12-3 will:

A) move closer to the 45 ° line.

B) become more bowed outward.

C) lie above the 45 ° line.

D) shift down and to the right.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following are not counted when we compare a family's income to the poverty line?

A) food stamps

B) social security payments

C) unemployment compensation payments

D) Temporary Assistance for Needy Families (TANF)

A) food stamps

B) social security payments

C) unemployment compensation payments

D) Temporary Assistance for Needy Families (TANF)

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

7

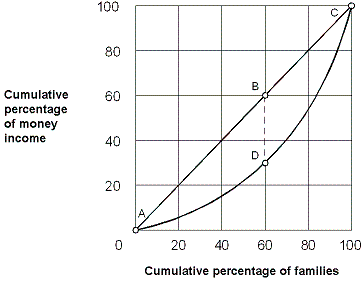

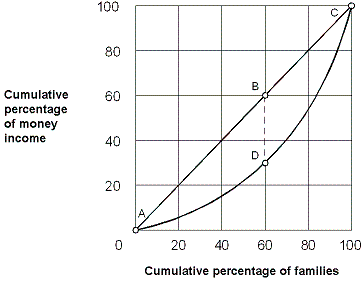

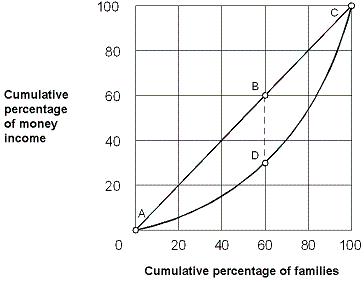

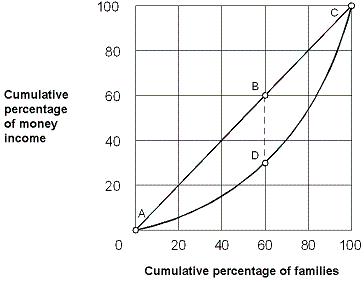

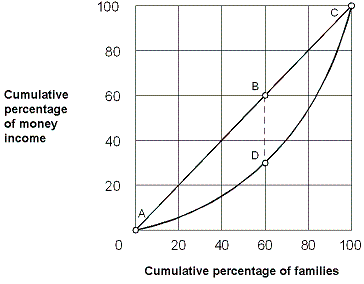

Exhibit 12-2 Lorenz curve

As shown in Exhibit 12-2, 60 percent of families earned a cumulative share of about ____ of income.

A) 5 percent

B) 15 percent

C) 30 percent

D) 50 percent

As shown in Exhibit 12-2, 60 percent of families earned a cumulative share of about ____ of income.

A) 5 percent

B) 15 percent

C) 30 percent

D) 50 percent

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

8

Exhibit 12-2 Lorenz curve

As shown in Exhibit 12-2, the perfect equality line is drawn between points:

A) A and B.

B) B and D.

C) A and C along the straight line.

D) A and C along the curve.

As shown in Exhibit 12-2, the perfect equality line is drawn between points:

A) A and B.

B) B and D.

C) A and C along the straight line.

D) A and C along the curve.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

9

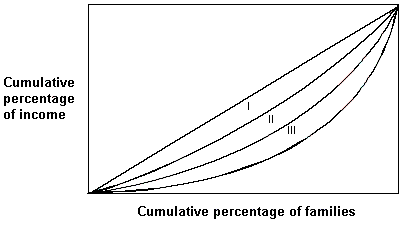

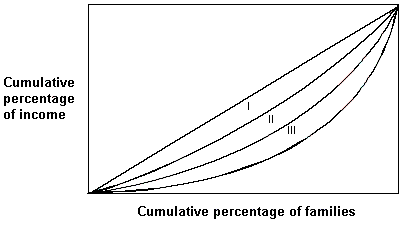

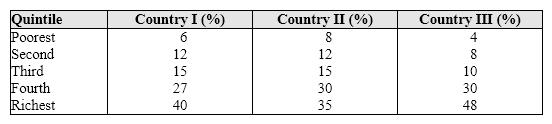

Exhibit 12-6 Lorenz curves

Exhibit 12-6 shows the Lorenz Curve for three countries, I, II, and III. Which of the following statements is true?

A) Country I has the most unequal income distribution.

B) Country II has the more equal income distribution than Country I.

C) Country I has the most equal income distribution.

D) Country III has the most equal income distribution.

Exhibit 12-6 shows the Lorenz Curve for three countries, I, II, and III. Which of the following statements is true?

A) Country I has the most unequal income distribution.

B) Country II has the more equal income distribution than Country I.

C) Country I has the most equal income distribution.

D) Country III has the most equal income distribution.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

10

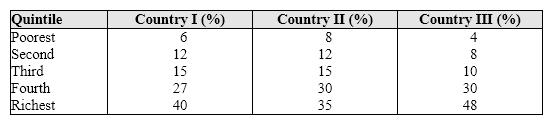

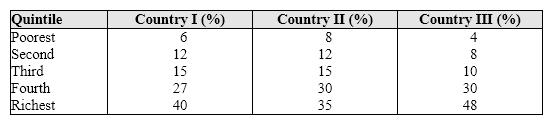

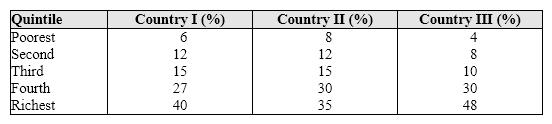

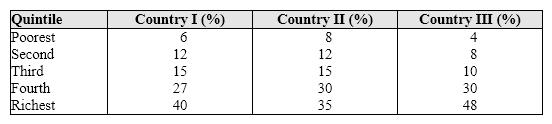

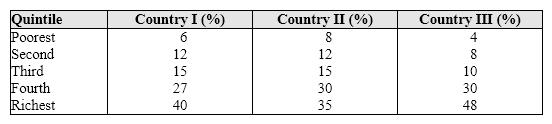

Exhibit 12-1 Income distribution for three countries

Exhibit 12-1 shows the percentage of income received by each population quintile. In Country II we can conclude that the:

A) least-wealthy 40 percent of the population received 20 percent of the economy's income.

B) least-wealthy 20 percent of the population received 25 percent of the economy's income.

C) richest 20 percent of the population received 20 percent of the economy's income.

D) richest 40 percent of the population received 35 percent of the economy's income.

Exhibit 12-1 shows the percentage of income received by each population quintile. In Country II we can conclude that the:

A) least-wealthy 40 percent of the population received 20 percent of the economy's income.

B) least-wealthy 20 percent of the population received 25 percent of the economy's income.

C) richest 20 percent of the population received 20 percent of the economy's income.

D) richest 40 percent of the population received 35 percent of the economy's income.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

11

If official U.S. poverty statistics included in-kind transfer payments the:

A) poverty rate would be close to zero.

B) poverty rate would be lower.

C) government deficit would be lower.

D) top 10 percent of those in the income distribution would be wealthier.

A) poverty rate would be close to zero.

B) poverty rate would be lower.

C) government deficit would be lower.

D) top 10 percent of those in the income distribution would be wealthier.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is an in-kind transfer payment?

A) Medicaid.

B) Social Security.

C) unemployment insurance.

D) Temporary Assistance to Needy Families.

A) Medicaid.

B) Social Security.

C) unemployment insurance.

D) Temporary Assistance to Needy Families.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

13

In a Lorenz curve diagram, the 45 ° line represents:

A) perfect income equality.

B) zero inflation.

C) a negative income tax.

D) an extremely unequal distribution of income.

A) perfect income equality.

B) zero inflation.

C) a negative income tax.

D) an extremely unequal distribution of income.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

14

If the poverty line in 2017 for a family of four was $24,600, which of the following is correct?

A) The cost of a minimal diet for a family of four was $4,100.

B) The cost of a minimal diet for a family of four was $6.150.

C) Unemployment benefits covered the first $24,600 of lost income.

D) Social security payments for the year totaled a minimum of $24,600 for a family of four.

A) The cost of a minimal diet for a family of four was $4,100.

B) The cost of a minimal diet for a family of four was $6.150.

C) Unemployment benefits covered the first $24,600 of lost income.

D) Social security payments for the year totaled a minimum of $24,600 for a family of four.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

15

"Dividing the economic pie more equally may reduce the size of the economic pie." This argument is characterized as:

A) a trade off between interest rates and unemployment.

B) a form of discrimination.

C) a conflict between equity and efficiency.

D) a conflict between full employment and economic growth.

A) a trade off between interest rates and unemployment.

B) a form of discrimination.

C) a conflict between equity and efficiency.

D) a conflict between full employment and economic growth.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

16

Exhibit 12-1 Income distribution for three countries

Exhibit 12-1 shows the percentage of income received by each population quintile. In Country I we can conclude that the:

A) richest 20 percent of the population received 25 percent of the economy's income.

B) richest 20 percent of the population received 40 percent of the economy's income.

C) richest 20 percent of the population received 80 percent of the economy's income.

D) least-wealthy 20 percent of the population received 40 percent of the economy's income.

Exhibit 12-1 shows the percentage of income received by each population quintile. In Country I we can conclude that the:

A) richest 20 percent of the population received 25 percent of the economy's income.

B) richest 20 percent of the population received 40 percent of the economy's income.

C) richest 20 percent of the population received 80 percent of the economy's income.

D) least-wealthy 20 percent of the population received 40 percent of the economy's income.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

17

Exhibit 12-2 Lorenz curve

As shown in Exhibit 12-2, the distance between points B and D means that 60 percent of families earn ____ less of total income than required for perfect equality.

A) 30 percent

B) 50 percent

C) 60 percent

D) 90 percent

As shown in Exhibit 12-2, the distance between points B and D means that 60 percent of families earn ____ less of total income than required for perfect equality.

A) 30 percent

B) 50 percent

C) 60 percent

D) 90 percent

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

18

The poverty line equals the:

A) average income of the bottom one-tenth of all income recipients.

B) cost of an economical and nutritional food plan for a family multiplied by six.

C) cost of an economical and nutritional food plan for a family multiplied by three.

D) average income of a family headed by a worker who has been unemployed for six months or more.

A) average income of the bottom one-tenth of all income recipients.

B) cost of an economical and nutritional food plan for a family multiplied by six.

C) cost of an economical and nutritional food plan for a family multiplied by three.

D) average income of a family headed by a worker who has been unemployed for six months or more.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

19

Of the following demographic groups, which has the lowest poverty rate in the U.S.?

A) Families headed by a female with no husband.

B) Families in which the "head of the household" has not attained a high-school education.

C) Families headed by a male with no wife

D) Families in which the "head of the household" has attained at least a bachelor's degree from a college or university.

A) Families headed by a female with no husband.

B) Families in which the "head of the household" has not attained a high-school education.

C) Families headed by a male with no wife

D) Families in which the "head of the household" has attained at least a bachelor's degree from a college or university.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

20

Exhibit 12-1 Income distribution for three countries

Exhibit 12-1 shows the percentage of income received by each population quintile. From this chart we can conclude:

A) Country I has the most unequal income distribution.

B) Country III has a more equal income distribution than Country II.

C) Country II has the most unequal income distribution.

D) Country II has the most equal income distribution.

Exhibit 12-1 shows the percentage of income received by each population quintile. From this chart we can conclude:

A) Country I has the most unequal income distribution.

B) Country III has a more equal income distribution than Country II.

C) Country II has the most unequal income distribution.

D) Country II has the most equal income distribution.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

21

Because the benefits distributed under TANF and Medicaid are essentially controlled by the states, critics argue that

A) recipients can receive benefits for a longer time period than if the programs were controlled by the federal government.

B) people receiving benefits have greater incentive to work more.

C) poor people with equal needs receive unequal benefits.

D) a negative income tax controlled by the federal government is less efficient.

A) recipients can receive benefits for a longer time period than if the programs were controlled by the federal government.

B) people receiving benefits have greater incentive to work more.

C) poor people with equal needs receive unequal benefits.

D) a negative income tax controlled by the federal government is less efficient.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

22

Which one of the following examples is a cash assistance program used to fight poverty in the United States?

A) Medicaid.

B) SNAP (food stamps).

C) Temporary Assistance to Needy Families (TANF)

D) Head Start.

A) Medicaid.

B) SNAP (food stamps).

C) Temporary Assistance to Needy Families (TANF)

D) Head Start.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

23

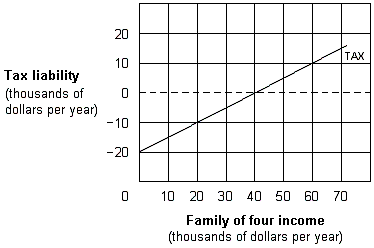

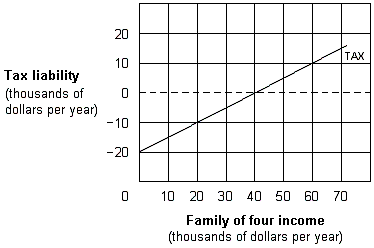

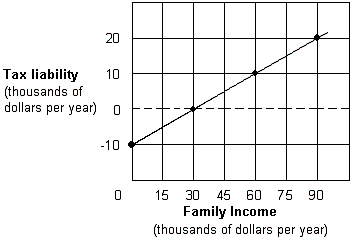

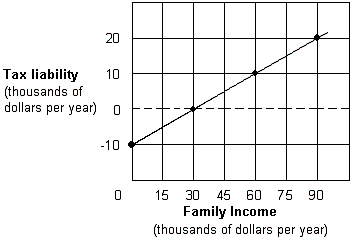

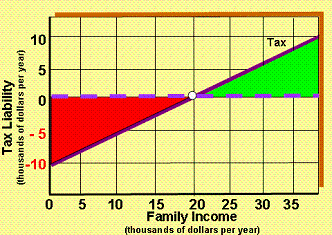

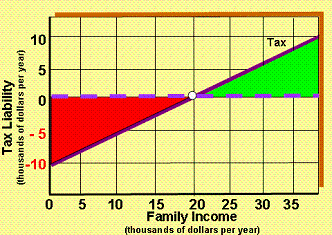

Exhibit 12-7 Negative income tax

As shown in Exhibit 12-7, a family of four with no earned income receives ____ from the government.

A) zero payment.

B) the break-even income of $40,000.

C) a $20,000 payment.

D) a $20,000 tax deferment.

As shown in Exhibit 12-7, a family of four with no earned income receives ____ from the government.

A) zero payment.

B) the break-even income of $40,000.

C) a $20,000 payment.

D) a $20,000 tax deferment.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

24

What is the official definition of the poverty line? What are some causes of poverty?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements is correct about Temporary Assistance to Needy Families (TANF)?

A) Families may not receive benefits for longer than 60 months.

B) The Federal program determines eligibility and benefit levels with no discretion left to the state.

C) Unwed teenage parents receiving benefits must live in public housing.

D) Parents with children under age one must work 20 hours per week to receive benefits.

A) Families may not receive benefits for longer than 60 months.

B) The Federal program determines eligibility and benefit levels with no discretion left to the state.

C) Unwed teenage parents receiving benefits must live in public housing.

D) Parents with children under age one must work 20 hours per week to receive benefits.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements is correct ?

A) About 25 percent of the U.S. population earns an income below the poverty line.

B) About 50 percent of blacks earn an income below the poverty line.

C) Since 1980 the fraction of persons below the poverty level has risen sharply.

D) The area of the United States with the highest percentage of the population below the poverty line is the south.

A) About 25 percent of the U.S. population earns an income below the poverty line.

B) About 50 percent of blacks earn an income below the poverty line.

C) Since 1980 the fraction of persons below the poverty level has risen sharply.

D) The area of the United States with the highest percentage of the population below the poverty line is the south.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

27

A requirement that a family's income not exceed a certain level to be eligible for public assistance is called

A) a welfare constraint.

B) an entitlement test.

C) a means test.

D) an earned income tax credit.

A) a welfare constraint.

B) an entitlement test.

C) a means test.

D) an earned income tax credit.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

28

Medicaid and SNAP (food stamps) are:

A) available only to families, not to individuals.

B) counterproductive.

C) forms of in-kind assistance.

D) forms of cash assistance.

A) available only to families, not to individuals.

B) counterproductive.

C) forms of in-kind assistance.

D) forms of cash assistance.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is true ?

A) All people in poverty are on welfare.

B) Unemployment compensation is an example of an in-kind transfer.

C) Temporary Assistance to Needy Families (TANF) is an example of a cash payment made by government to the impoverished.

D) After cash assistance and in-kind transfers are considered the distribution of income in the United States is more unequal.

A) All people in poverty are on welfare.

B) Unemployment compensation is an example of an in-kind transfer.

C) Temporary Assistance to Needy Families (TANF) is an example of a cash payment made by government to the impoverished.

D) After cash assistance and in-kind transfers are considered the distribution of income in the United States is more unequal.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

30

SNAP (food stamps) and Medicaid are examples of:

A) money transfers

B) resource earnings

C) in-kind transfers

D) tax expenditures

A) money transfers

B) resource earnings

C) in-kind transfers

D) tax expenditures

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

31

The revenue in the Social Security Trust Fund first fell below the benefits it paid out in 2010. If this trend continues, the Trust Fund will be depleted. What change(s) occurred to cause the revenue to fall below the benefits?

A) The U.S. Treasury Securities in which the Trust Fund is invested began paying out less interest.

B) Life expectancy is rising and a larger number of people are retiring.

C) The age at which retired individuals could start collecting benefits was lowered.

D) People were allowed to start privately investing some of their money in stocks and lost money through risky investments.

A) The U.S. Treasury Securities in which the Trust Fund is invested began paying out less interest.

B) Life expectancy is rising and a larger number of people are retiring.

C) The age at which retired individuals could start collecting benefits was lowered.

D) People were allowed to start privately investing some of their money in stocks and lost money through risky investments.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is not an in-kind subsidy?

A) unemployment compensation

B) low-cost rental housing

C) Medicare

D) Medicaid

A) unemployment compensation

B) low-cost rental housing

C) Medicare

D) Medicaid

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

33

The official poverty rate for all persons declined sharply between 1959 and:

A) the 2000s.

B) the 1970s.

C) the 1980s.

D) the 1990s.

A) the 2000s.

B) the 1970s.

C) the 1980s.

D) the 1990s.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

34

Exhibit 12-7 Negative income tax

As shown in Exhibit 12-7, a family of four pays income taxes at:

A) an income of $5,000.

B) any income between zero and $40,000.

C) all levels of income.

D) any income above $40,000.

As shown in Exhibit 12-7, a family of four pays income taxes at:

A) an income of $5,000.

B) any income between zero and $40,000.

C) all levels of income.

D) any income above $40,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

35

Statistics on families below the poverty line may be overstated because:

A) the poor are primarily children who soon will move out of poverty.

B) poverty in the United States is rich compared to poverty in other nations.

C) the income levels used to measure poverty do not include in-kind transfers.

D) unemployment compensation is a program closed to the poor.

A) the poor are primarily children who soon will move out of poverty.

B) poverty in the United States is rich compared to poverty in other nations.

C) the income levels used to measure poverty do not include in-kind transfers.

D) unemployment compensation is a program closed to the poor.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

36

Sort the following into cash transfer programs and in-kind transfers:

- social security

- SNAP

- TANF

- Medicare

- Medicaid

- housing assistance

- earned income tax credit (EITC)

A) cash transfers: social security, SNAP, TANF, and Medicare; in-kind transfers: Medicaid, housing assistance, EITC

B) cash tranfers: social security, housing assistance, Medicare, and Medicaid; in-kind transfers: EITC, SNAP, TANF

C) cash transfers: social security, EITC, TANF; in-kind transfers: Medicare, Medicaid, SNAP, housing assistance

D) cash transfers: EITC, TANF, SNAP; in-kind transfers: social security, Medicare, Medicaid, housing assistance

- social security

- SNAP

- TANF

- Medicare

- Medicaid

- housing assistance

- earned income tax credit (EITC)

A) cash transfers: social security, SNAP, TANF, and Medicare; in-kind transfers: Medicaid, housing assistance, EITC

B) cash tranfers: social security, housing assistance, Medicare, and Medicaid; in-kind transfers: EITC, SNAP, TANF

C) cash transfers: social security, EITC, TANF; in-kind transfers: Medicare, Medicaid, SNAP, housing assistance

D) cash transfers: EITC, TANF, SNAP; in-kind transfers: social security, Medicare, Medicaid, housing assistance

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

37

Exhibit 12-7 Negative income tax

Under the negative income tax scheme in Exhibit 12-7, families earning between $10,000 and $40,000 would:

A) receive the maximum negative income tax payment of $20,000.

B) receive payments under the negative income tax.

C) pay no income taxes, but receive no payments.

D) pay taxes of $5,000.

Under the negative income tax scheme in Exhibit 12-7, families earning between $10,000 and $40,000 would:

A) receive the maximum negative income tax payment of $20,000.

B) receive payments under the negative income tax.

C) pay no income taxes, but receive no payments.

D) pay taxes of $5,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

38

Why are government welfare programs often called entitlement programs?

A) Because every U.S. citizen, regardless of income, is entitled to receive benefits under these programs.

B) Because everyone living in the U.S., whether the person is a citizen or not, is entitled to a minimum level of income.

C) Because those who fail a means test are eligible for cash assistance but not in-kind transfers.

D) Because people whose income is below a certain level are entitled to government assistance.

A) Because every U.S. citizen, regardless of income, is entitled to receive benefits under these programs.

B) Because everyone living in the U.S., whether the person is a citizen or not, is entitled to a minimum level of income.

C) Because those who fail a means test are eligible for cash assistance but not in-kind transfers.

D) Because people whose income is below a certain level are entitled to government assistance.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following programs are in-kind assistance to fight poverty in the United States?

A) social security

B) Medicaid.

C) unemployment benefits

D) Temporary Assistance to Needy Families (TANF).

A) social security

B) Medicaid.

C) unemployment benefits

D) Temporary Assistance to Needy Families (TANF).

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is not one of the work disincentive criticisms of welfare programs?

A) Welfare provides income that is easier to obtain than by working, so poor are induced to reduce their work effort.

B) Because welfare benefits are paid for with money collected from taxes and these taxes reduce take home pay for those working, the reward for work is reduced.

C) Bureaucracy associated with welfare results in more money in the hands of bureaucrats than in the hands of the poor.

D) The more a welfare recipient earns from a job, the fewer the benefits he or she receives.

A) Welfare provides income that is easier to obtain than by working, so poor are induced to reduce their work effort.

B) Because welfare benefits are paid for with money collected from taxes and these taxes reduce take home pay for those working, the reward for work is reduced.

C) Bureaucracy associated with welfare results in more money in the hands of bureaucrats than in the hands of the poor.

D) The more a welfare recipient earns from a job, the fewer the benefits he or she receives.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

41

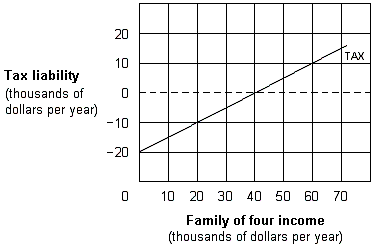

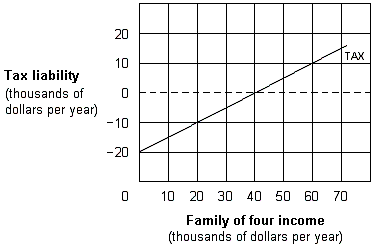

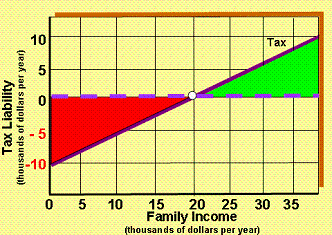

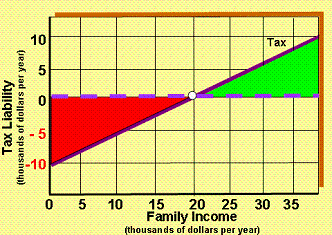

Exhibit 12-8 Negative income tax for a family

Under the negative income tax shown in Exhibit 12-8, what cash payment would a family with no earned income receive from the government?

A) $0.

B) $10,000.

C) $15,000.

D) $30,000.

Under the negative income tax shown in Exhibit 12-8, what cash payment would a family with no earned income receive from the government?

A) $0.

B) $10,000.

C) $15,000.

D) $30,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements is true ?

A) Discrimination against women and blacks reduces the demand for these workers resulting in lower wages paid these workers.

B) Discrimination is no longer a problem in the United States.

C) A negative income tax system is a plan where everyone pays the same percentage of their income as taxes.

D) A negative income tax system is a plan where those below a certain income receive a cash payment from government.

A) Discrimination against women and blacks reduces the demand for these workers resulting in lower wages paid these workers.

B) Discrimination is no longer a problem in the United States.

C) A negative income tax system is a plan where everyone pays the same percentage of their income as taxes.

D) A negative income tax system is a plan where those below a certain income receive a cash payment from government.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is a result of discrimination?

A) Two groups of workers earning different wages.

B) Two groups of workers paid the same wage, but proportionally fewer of one group are employed.

C) Equal pay and equal employment opportunities for two groups of workers with different productivities.

D) No workers from a particular group are employed.

A) Two groups of workers earning different wages.

B) Two groups of workers paid the same wage, but proportionally fewer of one group are employed.

C) Equal pay and equal employment opportunities for two groups of workers with different productivities.

D) No workers from a particular group are employed.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

44

Describe the advantages that a negative income tax has over other programs that have the same purpose.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

45

Consider a law that limits women's access to certain "dangerous" occupations like coal mining and military combat service. Such a law would likely reduce women's wages because:

A) women would be overqualified for "non-dangerous" jobs.

B) labor supply in female-intensive occupations would increase.

C) women would be less likely to obtain college degrees.

D) comparable worth would no longer exist between men's and women's occupations.

A) women would be overqualified for "non-dangerous" jobs.

B) labor supply in female-intensive occupations would increase.

C) women would be less likely to obtain college degrees.

D) comparable worth would no longer exist between men's and women's occupations.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

46

If there is employment discrimination against minorities, this will cause the:

A) supply of their services to increase, and their wages to fall.

B) demand for their services to decline, and their wages to fall.

C) supply of their services to decline, and their wages to rise.

D) demand for their services to decline, and their wages to rise.

A) supply of their services to increase, and their wages to fall.

B) demand for their services to decline, and their wages to fall.

C) supply of their services to decline, and their wages to rise.

D) demand for their services to decline, and their wages to rise.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

47

Comparable worth is the principle that:

A) goods and services priced the same have about the same worth.

B) the wage rate equals the value of productivity.

C) men and women should be paid comparably.

D) employees who perform comparable jobs should be paid the same wage.

A) goods and services priced the same have about the same worth.

B) the wage rate equals the value of productivity.

C) men and women should be paid comparably.

D) employees who perform comparable jobs should be paid the same wage.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

48

The incentive to work is an ingredient of the negative income tax because:

A) if families do work, they will be eliminated from the program.

B) if families don't work, they will be eliminated from the program.

C) the more income earned in the workplace, the higher the family's after-tax income.

D) the more income earned in the workplace, the higher the payment from the government.

A) if families do work, they will be eliminated from the program.

B) if families don't work, they will be eliminated from the program.

C) the more income earned in the workplace, the higher the family's after-tax income.

D) the more income earned in the workplace, the higher the payment from the government.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

49

Under a negative income tax program,

A) the government guarantees a minimum level of family income.

B) a family must pay income taxes on its welfare check.

C) a family receives a stated amount of money from the government plus its members can keep all income earned through work.

D) the government reduces the welfare payment by any income earned through work.

A) the government guarantees a minimum level of family income.

B) a family must pay income taxes on its welfare check.

C) a family receives a stated amount of money from the government plus its members can keep all income earned through work.

D) the government reduces the welfare payment by any income earned through work.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

50

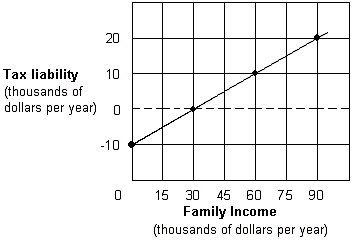

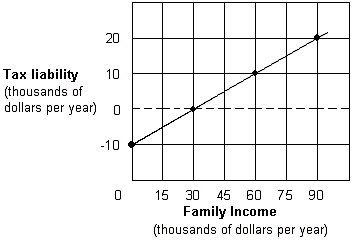

Exhibit 12-8 Negative income tax for a family

In Exhibit 12-8, consider a family that earns less than the break-even income level. For each $1 of earned income, this family's government payment will be reduced by:

A) $0.10.

B) $0.25.

C) $0.33.

D) $0.50.

In Exhibit 12-8, consider a family that earns less than the break-even income level. For each $1 of earned income, this family's government payment will be reduced by:

A) $0.10.

B) $0.25.

C) $0.33.

D) $0.50.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

51

Consider a labor market in which employers discriminate against African Americans. Comparing the labor market equilibrium with no discrimination to the equilibrium with discrimination,

A) The African American wage rate is higher without discrimination than with discrimination.

B) The number of African American workers hired is lower without discrimination than with discrimination.

C) The white wage rate is higher without discrimination than with discrimination.

D) The African American wage rate and the white wage rate are equal with and without discrimination; only the number of workers differs.

A) The African American wage rate is higher without discrimination than with discrimination.

B) The number of African American workers hired is lower without discrimination than with discrimination.

C) The white wage rate is higher without discrimination than with discrimination.

D) The African American wage rate and the white wage rate are equal with and without discrimination; only the number of workers differs.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

52

Some people believe that employees should be paid the same wages when their jobs, although different, require similar levels of education, training, experience, and responsibility. This principle is known as:

A) the equal-pay-for-equal work doctrine.

B) Lorenz equivalence.

C) marginal productivity theory.

D) comparable worth.

A) the equal-pay-for-equal work doctrine.

B) Lorenz equivalence.

C) marginal productivity theory.

D) comparable worth.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

53

Exhibit 12-9 Negative Income Tax

As shown in Exhibit 12-9, a family of four does not pay income taxes at:

A) an income of $25,000.

B) any income between zero and $20,000.

C) all levels of income.

D) any income above $20,000.

As shown in Exhibit 12-9, a family of four does not pay income taxes at:

A) an income of $25,000.

B) any income between zero and $20,000.

C) all levels of income.

D) any income above $20,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

54

Describe the comparable worth controversy?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following might decrease the supply curve of labor?

A) Elimination of discrimination against blacks.

B) Elimination of discrimination against females.

C) Easing licensing requirements.

D) Increasing discrimination against any group.

A) Elimination of discrimination against blacks.

B) Elimination of discrimination against females.

C) Easing licensing requirements.

D) Increasing discrimination against any group.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

56

Exhibit 12-9 Negative Income Tax

As shown in Exhibit 12-9, a family of four with an income of $20,000 receives ____ from the government:

A) zero payment

B) the break-even income of $20,000

C) a $10,000 payment

D) a $10,000 tax deferment

As shown in Exhibit 12-9, a family of four with an income of $20,000 receives ____ from the government:

A) zero payment

B) the break-even income of $20,000

C) a $10,000 payment

D) a $10,000 tax deferment

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

57

A negative income tax system would provide all households, including the poor, with:

A) cash payments.

B) incentives to earn income.

C) higher income levels.

D) medical assistance.

A) cash payments.

B) incentives to earn income.

C) higher income levels.

D) medical assistance.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck